债券定价和风险管理英文.pptx

- 格式:pptx

- 大小:570.64 KB

- 文档页数:8

债券定价与风险管理债券定价与风险管理债券定价是指确定债券的价格的过程,也是债券交易市场的核心内容。

债券市场是金融市场的重要组成部分,在现代经济中起到了重要的融资和投资作用。

债券的定价与风险管理是债券市场中的重要环节,对于投资者和发行人来说都具有重要的意义。

债券是一种固定收益的金融工具,是债务人向债权人发行的一种证券,债券持有人相当于债务人的债权人,可以获得固定的利息收入,并且在债券到期时可以收回本金。

债券定价是确定债券价格的过程,也就是确定债券的市场价格。

债券的价格受到多种因素的影响,包括债券期限、票面利率、市场利率、市场需求等。

债券的价格可以按照债券的收益率计算,也可以按照债券的现金流量计算。

债券的定价主要目的是确定债券的市场价值,为投资者和发行人提供一个交易的参考。

债券定价涉及到复杂的数学模型和经济理论,其中最基本的定价模型是利率期限结构模型。

利率期限结构理论是通过分析不同期限的利率水平和利率变动趋势,来解释不同期限债券价格之间的关系。

利率期限结构模型主要包括离散时间模型和连续时间模型。

离散时间模型是按照给定的时间点来计算债券价格,例如杨氏模型和赫尔金兹模型;连续时间模型是按照连续时间来计算债券价格,例如布莱克-斯科尔斯模型和考克斯-英格尔斯模型。

在债券定价的过程中,风险管理是一个重要的考虑因素。

债券市场存在着多种风险,包括市场风险、信用风险、流动性风险等。

市场风险是指债券价格因为市场变动而产生的风险,主要包括利率风险和汇率风险。

利率风险是指债券价格因为利率变动而产生的风险,当市场利率上升时,债券价格下跌,投资者可能蒙受损失;汇率风险是指债券价格因为汇率变动而产生的风险,当投资者持有的债券是外币债券时,债券价格会受到汇率变动的影响。

信用风险是指债券发行人违约或者无法偿付债券本息的风险,当发行人信用状况下降时,债券价格可能会大幅下跌。

流动性风险是指债券市场因为交易活跃度低、交易成本高等原因而导致的风险,当投资者急需变现时,可能会面临较高的成本。

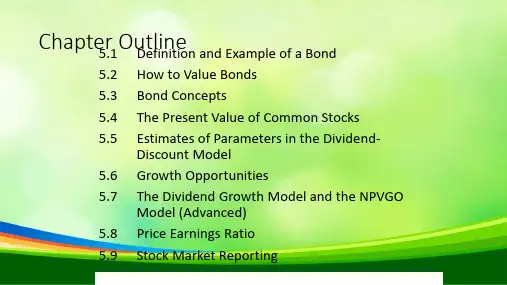

债券及股票的定价策略(英文版)In finance, pricing strategies for bonds and stocks are crucial for investors and financial institutions to determine the fair value of these financial securities. This helps in making informed investment decisions and managing investment portfolios effectively. Let's explore the pricing strategies for bonds and stocks.Bond Pricing Strategy:1. Discounted Cash Flow (DCF) Analysis: This strategy involves calculating the present value of future cash flows generated by the bond. The cash flows include periodic interest payments and the bond's face value at maturity. The present value is determined by discounting these cash flows using an appropriate discount rate, usually the bond's yield to maturity (YTM).2. Comparable Bond Analysis: This strategy relies on comparing the bond in question with similar bonds in the market. By analyzing similar bonds' yields and prices, investors can assess whether the bond is overvalued or undervalued. Factors considered in this analysis include credit rating, coupon rate, maturity, and market conditions.3. Yield Spread Analysis: This strategy involves analyzing the yield spread between a particular bond and a benchmark bond with similar characteristics but different credit ratings. If the yield spread is wider than historical levels, indicating higher risk, the bond may be priced at a discount. Conversely, a narrower yield spread implies a premium.Stock Pricing Strategy:1. Dividend Discount Model (DDM): This strategy focuses on estimating the intrinsic value of a stock based on its future dividends. The DDM involves discounting expected future dividends to the present value using an appropriate discount rate, such as the stock's required rate of return or the dividend growth rate.2. Price-to-Earnings (P/E) Ratio Analysis: This strategy evaluates a stock's value by comparing its market price to its earnings per share (EPS). A low P/E ratio may suggest an undervalued stock, while a high P/E ratio could indicate an overvalued stock. This analysis considers industry P/E ratios, earnings growth prospects, and other relevant factors.3. Comparable Company Analysis: This strategy involves comparing the valuation metrics of a company with its industry peers or similar companies. Parameters such as price-to-sales ratio, price-to-book ratio, or enterprise value-to-EBITDA ratio are compared to identify relative valuation. If a company's valuation is significantly lower than its peers with similar fundamentals, it may be considered undervalued.Both bond and stock pricing strategies require careful analysis of various quantitative and qualitative factors. It is crucial for investors to consider the fundamental characteristics of the security, market conditions, economic indicators, interest rates, and other relevant factors. Additionally, incorporating risk assessment and future market expectations into these pricing strategies enhances their accuracy.Bond Pricing Strategy (Continued):4. Term Structure of Interest Rates Analysis: This strategy takes into account the term structure of interest rates, which shows the relationship between the yields and maturity dates of bonds. By comparing the yields of bonds with different maturities, investors can assess the expectations of future interest rate movements. If the current bond's yield is higher than the expected future rates, it may be undervalued, and vice versa.5. Credit Rating Analysis: Credit ratings assigned by rating agencies provide an indication of a bond's creditworthiness. Higher-rated bonds typically have lower yields due to lower perceived risk. Investors can analyze the bond's credit rating and compare it to similar rated bonds to determine whether the bond is priced appropriately.Stock Pricing Strategy (Continued):4. Discounted Free Cash Flow (DCF) Analysis: This strategy estimates the intrinsic value of a stock by forecasting its future cash flows. The future cash flows are projected based on expected revenue, expenses, and capital expenditures. These cash flows are discounted to their present value using an appropriate discount rate, such as the company's cost of capital. The resulting value represents the fair value of the stock.5. Price-to-Book (P/B) Ratio Analysis: This strategy compares a company's market price per share to its book value per share. The book value represents the net assets of the company, calculated by subtracting liabilities from assets. A low P/B ratio may indicate anundervalued stock, suggesting that the market is not fully recognizing the company's tangible assets.6. Earnings Growth Analysis: This strategy looks at the growth potential of a company's earnings. Investors analyze historical earnings growth rates and projected future growth rates to assess the stock's value. A higher expected earnings growth rate may justify a higher valuation for the stock.7. Technical Analysis: This pricing strategy focuses on analyzing historical price and volume patterns of a stock to predict future price movements. Technical analysts use various tools and techniques such as charts, moving averages, and oscillators to identify trends, support and resistance levels, and other patterns that can guide investment decisions.It is important to note that these pricing strategies serve as a guide and should not be considered definitive methods of valuation. Market conditions, investor sentiment, and unforeseen events can impact the fair value of bonds and stocks. It is recommended to use a combination of these strategies and exercise caution while interpreting the results. Regular monitoring and reassessment of pricing strategies are necessary to adapt to changing market dynamics. Ultimately, investors should conduct thorough research and seek professional advice before making investment decisions.。

金融市场的风险管理(英文版)Risk Management in Financial MarketsIntroductionRisk management is a crucial aspect of the financial markets. It involves the identification, assessment, and mitigation of potential risks that may impact an organization's financial well-being. The dynamic nature of financial markets makes effective risk management imperative to ensure stability and sustainability. This article aims to explore the various aspects of risk management in financial markets.Types of RisksFinancial markets face various types of risks, each with its unique characteristics. The most common types of risks in financial markets include credit risk, market risk, liquidity risk, operational risk, and systemic risk.Credit risk refers to the potential loss arising from a borrower's inability to repay a loan or meet its contractual obligations. Financial institutions employ credit risk management techniques, such as credit scoring models and credit derivatives, to assess and mitigate this risk.Market risk encompasses the potential loss due to fluctuating market prices of financial instruments. It includes risks associated with interest rates, currencies, equities, commodities, and derivatives. Market risk management involves using techniques like portfolio diversification, hedging, and stress testing to mitigate potential losses.Liquidity risk arises when an institution is unable to fulfill its financial obligations due to an insufficient availability of liquid assets. Effective liquidity risk management involves maintaining adequate liquidity buffers, developing contingency funding plans, and regularly monitoring and stress testing liquidity positions.Operational risk involves the risk of financial loss due to inadequate or failed internal processes, systems, or human error. It includes risks associated with technology failures, fraud, legal and regulatory compliance, and vendor management. Operational risk management involves implementing robust internal controls, conducting regular audits, and training staff on risk awareness.Systemic risk refers to the risk of widespread disruptions or failures in the financial system that could have a significant impact on the overall economy. It can arise from interconnectedness and interdependencies among financial institutions, such as in the case of a financial crisis. Systemic risk management involves regulatory oversight, stress testing, and contingency planning at both the institutional and systemic levels.Risk Assessment and MitigationEffective risk management starts with a thorough and comprehensive risk assessment. This involves identifying and analyzing risks, including their potential impacts and likelihoods of occurrence. Risk assessment enables organizations to prioritize risks and allocate resources accordingly.Once risks are identified, appropriate risk mitigation strategies canbe implemented. These strategies may include risk avoidance, risk reduction, risk transfer, or risk acceptance. Risk avoidance involves refraining from activities that pose significant risks. Risk reduction involves implementing measures to minimize the likelihood or impact of risks. Risk transfer involves transferring risks to another party, such as through insurance or hedging. Risk acceptance involves acknowledging and accepting certain risks if their potential impact is deemed acceptable.Risk management frameworks and tools can also assist in the overall risk management process. These frameworks provide a structured approach to managing risks and can help organizations establish appropriate risk management policies, procedures, and controls. Examples of risk management tools include risk registers, risk appetite statements, risk and control self-assessment, and key risk indicators.Continual Monitoring and ReviewRisk management is an ongoing process that requires continuous monitoring and review. Financial institutions need to establish effective risk monitoring systems to detect and assess emerging risks promptly. Regular risk reporting and analysis help organizations stay informed about their risk profiles and take necessary actions.Risk management frameworks should also be periodically reviewed and updated to ensure their effectiveness in addressing evolving risks. As technology advances and market conditions change, risk management practices need to keep pace to effectively manage emerging risks.ConclusionRisk management is a critical component of the financial markets. The proper identification, assessment, and mitigation of risks are essential for maintaining stability and sustainability. By implementing robust risk management practices, financial institutions can navigate the challenges and uncertainties of financial markets effectively. Continued commitment to risk management ensures the soundness and integrity of the overall financial system.Sure, here's some additional content on the topic:Risk measurement and monitoring are key aspects of risk management in financial markets. Organizations use various metrics and tools to quantify and monitor risks. These include value-at-risk (VaR), stress testing, scenario analysis, and sensitivity analysis. VaR measures the potential loss in a portfolio or position under normal market conditions, with a specified confidence level. Stress testing, on the other hand, involves assessing the impact of extreme and hypothetical market scenarios on a portfolio's value. Scenario analysis involves analyzing the potential outcomes of specific events or market conditions. Sensitivity analysis assesses how changes in underlying factors, such as interest rates or exchange rates, affect the value of a portfolio.Risk management practices also extend to regulatory compliance. Financial institutions need to comply with various regulations and guidelines set by regulatory authorities. These regulations aim to safeguard the stability and integrity of the financial system and protect consumers. Risk management frameworks helporganizations ensure compliance by providing guidelines on risk assessment, reporting, and governance. Regulatory frameworks, such as Basel III, require banks to maintain adequate capital buffers to absorb potential losses and to have robust risk management systems in place.Technology plays a significant role in modern risk management. Advanced analytics tools and algorithms enable organizations to better analyze and understand risks. Artificial intelligence and machine learning can identify patterns and detect anomalies that may indicate potential risks. Risk management systems can also be automated to facilitate real-time monitoring and reporting. Technology-driven risk management helps organizations to improve risk assessment accuracy, increase efficiency, and enable faster decision-making.In addition to external risks, organizations also need to consider internal risks. Internal risks can arise from poor governance, inadequate internal controls, or unethical behaviors. Risk management frameworks often include internal control systems to ensure the effective mitigation of internal risks. These systems involve procedures and policies that promote transparency, accountability, and ethical behavior within the organization. Regular internal audits help assess the effectiveness of internal controls and identify areas for improvement.Risk management is a collective effort that involves all stakeholders in the financial markets. Regulators, financial institutions, investors, and market participants all play a role in identifying, assessing, and mitigating risks. Effective riskmanagement requires collaboration and information sharing among these stakeholders. Regulatory authorities set standards and guidelines, financial institutions implement risk management practices, investors conduct due diligence, and market participants adhere to market rules and regulations.In conclusion, risk management in financial markets is vital to ensure stability, sustainability, and trust in the financial system. It involves identifying, assessing, and mitigating various types of risks, including credit risk, market risk, liquidity risk, operational risk, and systemic risk. Risk assessment and mitigation strategies are informed by robust risk management frameworks and tools. Continual monitoring and review of risks help organizations stay informed and responsive to emerging risks. Technology and regulatory compliance also play significant roles in effective risk management. By prioritizing risk management, financial institutions can safeguard their financial well-being and contribute to the overall stability of the financial system.。

金融市场的债券定价与风险管理债券是金融市场中的一种重要投资工具,它为债务人提供资金,同时为投资者提供一种固定利息和到期本金回收的债权。

债券的定价和风险管理是金融市场中的关键议题,本文将探讨债券定价和风险管理的基本原理和方法。

一、债券定价债券的定价是指确定其买卖价格的过程。

债券的价格主要由以下几个因素决定:1.到期收益率:到期收益率被认为是债券市场的基准利率,在市场上可以进行买卖的债券价格与其到期收益率呈反比关系。

当到期收益率上升时,债券价格下降;反之,当到期收益率下降时,债券价格上升。

2.利息支付周期:债券的利息支付周期也会影响其价格。

一般情况下,利息支付周期越短,债券价格越高。

3.剩余期限:债券的剩余期限也是决定其价格的重要因素。

一般情况下,剩余期限越长,债券价格越高。

4.信用风险:债券的信用风险是指发行人不能按时偿还本金和付息的风险。

在市场上,风险较高的债券价格会相应下降。

债券定价的基本原理是利用现金流的贴现来计算债券的价格。

根据债券的票面利率、到期时间、合理的风险溢价和市场利率等因素,可以通过贴现现金流的方法确定债券的价格。

二、债券风险管理在金融市场中,风险管理是投资者和发行人保持资金安全和稳定增长的重要手段。

对于债券投资者来说,风险管理主要包括以下几个方面:1.信用风险管理:在债券投资中,信用风险是最主要的风险之一。

投资者需要评估债券发行人的信用状况,选择信用良好的债券进行投资。

此外,投资者还可以通过购买信用担保债券或者使用信用违约掉期等金融衍生品进行风险对冲。

2.利率风险管理:利率风险是指市场利率的变动对债券价格的影响。

投资者可以通过构建合理的投资组合,包括购买不同到期时间和利率类型的债券,来降低利率风险。

此外,利率期货和利率互换等金融工具也可以用于对冲利率风险。

3.流动性风险管理:流动性风险是指在交易债券时,市场上没有足够的买家或卖家,导致价格无法顺利形成或者很难买卖的情况。

投资者可以通过选择具有较高流动性的债券,或者使用流动性风险对冲工具来管理流动性风险。