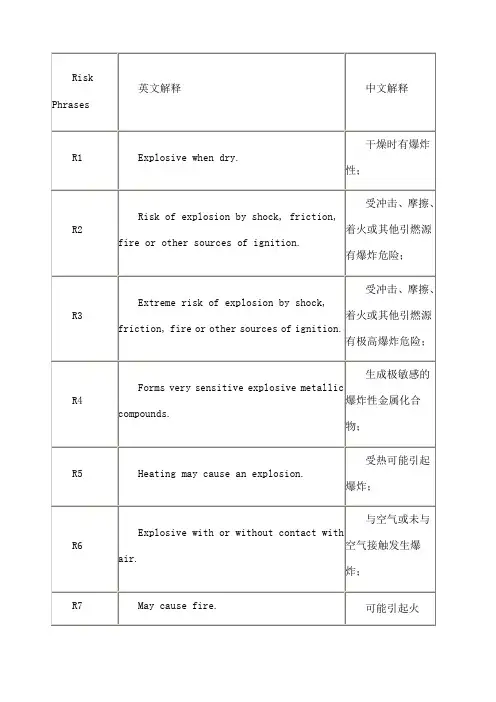

风险管理术语中英文对照

- 格式:xls

- 大小:62.00 KB

- 文档页数:1

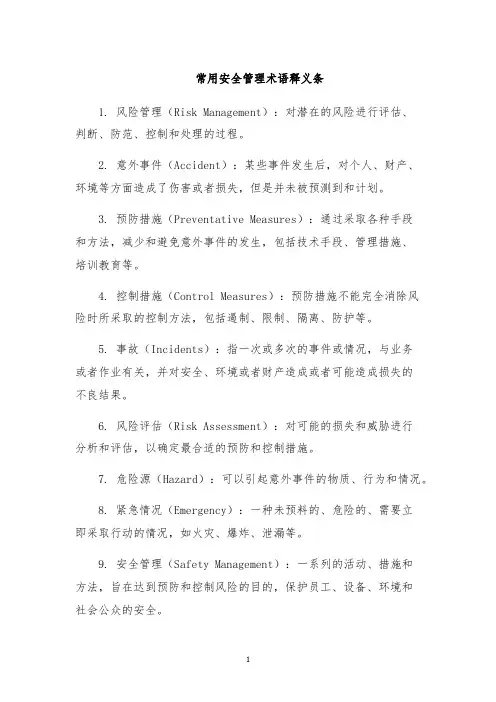

常用安全管理术语释义条1. 风险管理(Risk Management):对潜在的风险进行评估、判断、防范、控制和处理的过程。

2. 意外事件(Accident):某些事件发生后,对个人、财产、环境等方面造成了伤害或者损失,但是并未被预测到和计划。

3. 预防措施(Preventative Measures):通过采取各种手段和方法,减少和避免意外事件的发生,包括技术手段、管理措施、培训教育等。

4. 控制措施(Control Measures):预防措施不能完全消除风险时所采取的控制方法,包括遏制、限制、隔离、防护等。

5. 事故(Incidents):指一次或多次的事件或情况,与业务或者作业有关,并对安全、环境或者财产造成或者可能造成损失的不良结果。

6. 风险评估(Risk Assessment):对可能的损失和威胁进行分析和评估,以确定最合适的预防和控制措施。

7. 危险源(Hazard):可以引起意外事件的物质、行为和情况。

8. 紧急情况(Emergency):一种未预料的、危险的、需要立即采取行动的情况,如火灾、爆炸、泄漏等。

9. 安全管理(Safety Management):一系列的活动、措施和方法,旨在达到预防和控制风险的目的,保护员工、设备、环境和社会公众的安全。

10. 应急计划(Emergency Plan):一份详细的方案,规定在紧急情况下,如何处理事故或事件,避免或减少损失。

11. 健康管理(Health Management):一系列措施和方法,维护员工身心健康,提高工作效率和生产力。

12. 安全培训(Safety Trning):向员工和管理者提供必要的安全和健康方面的知识和技能,提高安全意识和法律意识,避免意外事件的发生。

13. 风险通报(Risk Notification):发生安全事件后及时向管理层、员工、相关部门等通报,以便采取必要的措施,避免事情恶化。

14. 安全检查(Safety Inspection):对工作场所、设备和操作流程进行检查,发现存在的安全隐患,及时采取措施解决。

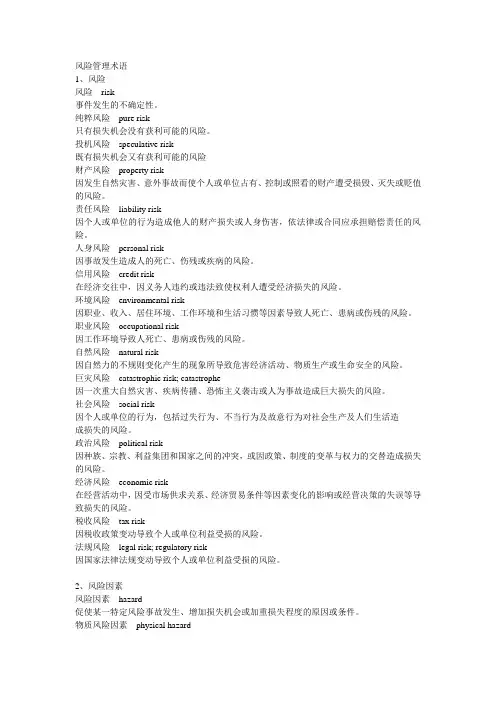

风险管理术语1、风险风险risk事件发生的不确定性。

纯粹风险pure risk只有损失机会没有获利可能的风险。

投机风险speculative risk既有损失机会又有获利可能的风险财产风险property risk因发生自然灾害、意外事故而使个人或单位占有、控制或照看的财产遭受损毁、灭失或贬值的风险。

责任风险liability risk因个人或单位的行为造成他人的财产损失或人身伤害,依法律或合同应承担赔偿责任的风险。

人身风险personal risk因事故发生造成人的死亡、伤残或疾病的风险。

信用风险credit risk在经济交往中,因义务人违约或违法致使权利人遭受经济损失的风险。

环境风险environmental risk因职业、收入、居住环境、工作环境和生活习惯等因素导致人死亡、患病或伤残的风险。

职业风险occupational risk因工作环境导致人死亡、患病或伤残的风险。

自然风险natural risk因自然力的不规则变化产生的现象所导致危害经济活动、物质生产或生命安全的风险。

巨灾风险catastrophic risk; catastrophe因一次重大自然灾害、疾病传播、恐怖主义袭击或人为事故造成巨大损失的风险。

社会风险social risk因个人或单位的行为,包括过失行为、不当行为及故意行为对社会生产及人们生活造成损失的风险。

政治风险political risk因种族、宗教、利益集团和国家之间的冲突,或因政策、制度的变革与权力的交替造成损失的风险。

经济风险economic risk在经营活动中,因受市场供求关系、经济贸易条件等因素变化的影响或经营决策的失误等导致损失的风险。

税收风险tax risk因税收政策变动导致个人或单位利益受损的风险。

法规风险legal risk; regulatory risk因国家法律法规变动导致个人或单位利益受损的风险。

2、风险因素风险因素hazard促使某一特定风险事故发生、增加损失机会或加重损失程度的原因或条件。

词汇表Aabstract 摘要:土地所有权的简要历史。

accelerated death benefit 提前给付:在某些情况下,人寿险保单面值的一部分,可以在被保险人身故前(须扣除利息)得到支付。

accidental death benefit 意外死亡额外给付:是一种两全保险。

若被保险人死于意外事故,则向受益人支付附加保险金。

accounts receivable insurance 应收账款保险:因被保险风险造成应收账款记录损毁,因而无法从记账赊销的债务人处收回应收账款,该损失可在应收账款保险项下得到补偿。

accumulation units 积累单位:用于已购买的变额年金。

积累单位的价值取决于投资组合的表现,所以每期保费能购买的积累单位数目是不同的。

activities of daily living 日常活动能力:诸如进食、洗浴、盥洗、换车、穿衣和节制等日常活动,当被保险人无法进行上述部分活动时,长期护理保险将予以给付。

acts of God 天灾:难以合理防范的危险,如洪水、地震。

acts of negligence of the shipper 托运人的疏忽或过失行为:如不当装货或包装缺陷,造成损失的原因不是承运人的责任的。

actual cash value(ACV)实际现金价值:财产的重置成本扣除折旧。

actual loss ratio 实际赔付率:某一险种在先前一个时期,赔付额与已收保费之间的实际比率。

Actual total loss 实际全损:财产完全损毁造成的损失。

actuarial cost assumption 精算成本假设:对投资收益率、死亡率、销售量、工资增长模式、可能的费用及员工实际退休年龄分布的假设。

精算成本方法的选择取决于这些假设。

actuarial cost methods 精算成本方法:计算为建立承诺的养老基金,每年必须缴纳多少金额的方法。

additional insureds 附加被保险人:对保单承保的财产或个人具有保险利益,而且能够根据保单条件得到损失补偿的人。

风险管理术语一、背景介绍风险管理是指在商业、金融、投资等领域中,为了降低或避免潜在的风险而采取的一系列措施。

在风险管理过程中,使用一些特定的术语来描述和评估风险,以便更好地理解和应对风险。

本文将介绍一些常见的风险管理术语。

二、1. 风险评估(Risk Assessment)风险评估是指对潜在风险进行系统的分析和评估,以确定其可能性和影响程度。

通过风险评估,可以确定哪些风险是最重要的,以便采取相应的措施来管理和控制风险。

2. 风险识别(Risk Identification)风险识别是指识别和确定可能对组织或项目造成负面影响的各种风险因素。

这包括内部和外部的风险因素,如市场风险、技术风险、法律风险等。

通过风险识别,可以及时发现潜在的风险,以便采取相应的措施来应对。

3. 风险分析(Risk Analysis)风险分析是指对已识别的风险进行深入分析,以确定其可能性、影响程度和相关因素。

通过风险分析,可以更全面地了解风险的本质和特点,为制定风险管理策略提供依据。

4. 风险评价(Risk Evaluation)风险评价是指对风险进行定量或定性的评估,以确定其对组织或项目的重要性和紧迫性。

通过风险评价,可以确定哪些风险需要优先处理,以及需要投入多少资源来管理和控制风险。

5. 风险控制(Risk Control)风险控制是指通过采取一系列措施来减少或消除风险的可能性和影响。

这包括风险预防、风险转移、风险减轻等。

通过风险控制,可以有效地管理和控制风险,降低组织或项目的潜在损失。

6. 风险监测(Risk Monitoring)风险监测是指对已采取的风险管理措施进行监测和评估,以确保其有效性和适用性。

通过风险监测,可以及时发现风险管理措施的不足之处,并及时调整和改进。

7. 风险传递(Risk Transfer)风险传递是指将风险转移给其他方,以降低自身承担风险的责任和损失。

常见的风险传递方式包括购买保险、签订合同等。

风险术语的英文对照1. Risk Assessment - 风险评估2. Risk Management - 风险管理3. Risk Mitigation - 风险缓解4. Risk Identification - 风险识别5. Risk Analysis - 风险分析6. Risk Control - 风险控制7. Risk Response - 风险应对8. Risk Avoidance - 风险避免9. Risk Transfer - 风险转移10. Risk Tolerance - 风险容忍度11. Risk Probability - 风险概率12. Risk Impact - 风险影响13. Risk Assessment Matrix - 风险评估矩阵14. Risk Register - 风险登记册15. Risk Treatment Plan - 风险处理计划16. Risk Exposure - 风险暴露度17. Risk Control Measures - 风险控制措施18. Risk Indicator - 风险指标19. Risk Communication - 风险沟通20. Risk Event - 风险事件请注意,上述术语仅提供参考,具体的风险管理术语可能根据行业和上下文有所不同。

Risk management is an essential component of any organization, as it involves the identification, assessment, and mitigation of potential risks that could impact the achievement of objectives. In order to effectively manage risks, itis crucial to have a clear understanding of various risk terminologies and their corresponding translations in English.Risk assessment, or 风险评估, is the process of identifying and evaluating potential risks to determine their likelihood and potential impact. This involves analyzing the probability of a risk occurring and assessing the potential consequences it could have on the organization. Risk assessments are typically conducted using various tools and techniques such as risk matrices, scenario analysis, and historical data.Once risks have been identified and assessed, the organization can proceed with risk management, or 风险管理. This involves developing strategies and action plans to minimize or eliminate the identified risks. Risk management aims to reduce the likelihood of a risk occurring or its potential impact if it does occur. It includes risk mitigation, or 风险缓解, which involves implementing measures to reduce the probability and/or severity of a risk.Risk identification, or 风险识别, is the process of identifying potential risks that could impact the organization's objectives. This includes analyzing internal and external factors that could lead to risks, such as changes in regulations, market volatility, or operational vulnerabilities. Risk analysis, or 风险分析, is the process of evaluating the identified risks to determine their potential impact and prioritize their treatment.Risk control, or 风险控制, involves implementing measures to reduce or manage the identified risks. This includes developingand implementing risk control measures, such as implementing safety protocols, conducting regular inspections, or implementing redundancy measures. Risk response, or 风险应对, refers to the actions taken by the organization to address identified risks. This could include accepting the risk, avoiding the risk, transferring the risk to a third party, or implementing measures to mitigate the risk.Risk avoidance, or 风险避免, refers to the strategy of completely eliminating the exposure to a particular risk. This could involve making changes to business processes, discontinuing certain activities, or avoiding certain markets or investments. Risk transfer, or 风险转移, involves transferring the responsibility and financial implications of a risk to another party, such as purchasing insurance coverage.Risk tolerance, or 风险容忍度, refers to the level of risk that an organization is willing to accept in order to achieve its objectives. This involves striking a balance between maximizing opportunities and minimizing potential risks. Risk probability, or 风险概率, refers to the likelihood or chance of a risk occurring. Risk impact, or 风险影响, refers to the magnitude of the consequences that would result if a risk were to occur.A risk assessment matrix, or 风险评估矩阵, is a tool used to evaluate and prioritize risks based on their likelihood and impact. It provides a visual representation of risks and helps in determining appropriate risk management strategies. A risk register, or 风险登记册, is a document that records all identified risks, along with their likelihood, potential impact, and mitigation measures.To implement effective risk management, organizations develop risk treatment plans, or 风险处理计划, which outline the specific actions to be taken to manage identified risks. These plans include a clear description of the risk, its potential impact, the desired risk treatment strategy, and the individuals responsible for its implementation.Risk exposure, or 风险暴露度, refers to the level of vulnerability or susceptibility of the organization to a particular risk. It considers the organization's potential financial, operational, and reputational losses resulting from a risk event. Risk control measures, or 风险控制措施, are actions implemented to mitigate or prevent identified risks. These measures may include implementing internal controls, conducting training programs, or investing in technologies to mitigate risks.Risk indicators, or 风险指标, are quantitative or qualitative measures used to monitor and assess risks. These indicators help in identifying early warning signs of emerging risks, enabling timely and proactive risk management. Risk communication, or 风险沟通, refers to the process of sharing information about risks within the organization or with external stakeholders. Effective risk communication is crucial for ensuring that everyone understands the risks, their potential impact, and the organization's strategiesfor managing them.Overall, understanding and utilizing risk terminologies in both English and their native language is vital for effective riskmanagement. It ensures clear communication, facilitates collaboration, and enhances the organization's ability to identify, assess, and mitigate risks. By effectively managing risks, organizations can safeguard their interests, minimize losses, and enhance their overall performance and resilience.。

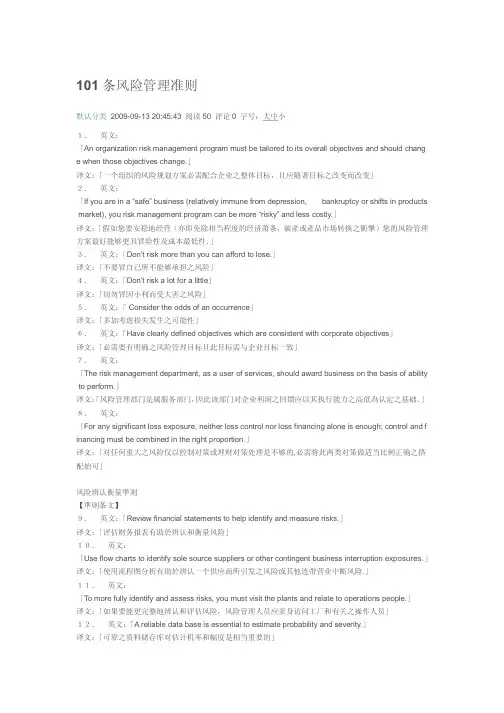

风险管理从十九世纪二三十年代开始,经历几十年的发展逐渐成为一门影响广泛的现代管理学科。

1983年在美国召开的风险和保险管理协会年会上,世界各国专家学者云集纽约,共同讨论并通过了“101条风险管理准则”,它标志着风险管理的发展已进入了一个新的发展阶段。

101条风险管理准则1.英文:「An organization risk management program must be tailored to its overall objectives and should change when those objectives change.」译文:「一个组织的风险规划方案必需配合企业之整体目标,且应随著目标之改变而改变」2.英文:「If you are in a “safe”business (relatively immune from depression, bankruptcy or shifts in products market), you risk management program can be more “risky”and less costly.」译文:「假如您要安稳地经营(亦即免除相当程度的经济萧条,破產或產品市场转换之衝撃)您的风险管理方案最好能够更具冒险性及成本最低性.」3.英文:「Don’t risk more than you can afford to lose.」译文:「不要冒自己所不能够承担之风险」4.英文:「Don’t risk a lot for a little」译文:「切勿冒因小利而受大害之风险」5.英文:「Consider the odds of an occurrence」译文:「多加考虑损失发生之可能性」6.英文:「Have clearly defined objectives which are consistent with corporate objectives」译文:「必需要有明确之风险管理目标且此目标需与企业目标一致」7.英文:「The risk management department, as a user of services, should award business on the basis of ability to perform.」译文:「风险管理部门是属服务部门,因此该部门对企业利润之回馈应以其执行能力之高低為认定之基础.」8.英文:「For any significant loss exposure, neither loss control nor loss financing alone is enough; control and financing must be combined in the right proportion.」译文:「对任何重大之风险仅以控制对策或理财对策处理是不够的,必需将此两类对策做适当比例正确之搭配始可」风险辨认衡量準则【準则条文】9.英文:「Review financial statements to help identify and measure risks.」译文:「评估财务报表有助於辨认和衡量风险」10.英文:「Use flow charts to identify sole source suppliers or other contingent business interruption exposures.」译文:「使用流程图分析有助於辨认一个供应商所引发之风险或其他连带营业中断风险.」11.英文:「To more fully identify and assess risks, you must visit the plants and relate to operations people.」译文:「如果要能更完整地辨认和评估风险,风险管理人员应亲身访问工厂和有关之操作人员」12.英文:「A reliable data base is essential to estimate probability and severity.」译文:「可靠之资料储存库对估计机率和幅度是相当重要的」13.英文:「Accurate and timely risk information reduces risk, in any of itself.」译文:「正确和及时之风险资讯有助於降低风险.」14.英文:「The risk manager should be involved in the purchase or design of any new operation to assure that there are no built-in risk management problems.」译文:「风险管理人员应涉及任何新计划之设计规划或任何新购置方案之工作,俾便事先能确保不產生风险管理上之问题.」15.英文:「Be certain environmental risks are evaluated in mergers, acquisitions and joint ventures.」译文:「企业在合併、购买和短期合营事业上应确定已完成环境风险之评估工作.」16.英文:「Select hazardous waste contractors on their risk control measures and their financial stability or insurance protection 」译文:「选择处理具有危险性之废弃物之厂商时应以该厂商在处理废弃物时所採取之风险控制手段是否良好,他们本身之财务结构是否稳定,或从事此危险工作所引发之责任或损失是否良好之保险保障為主要之考虑依据」17.英文:「Look for incidental involvement in critical risk areas, (ie. , aircraft and nuclear products, medical malpractice, engineering design, ect.)」译文:「在重要的风险区域范围内,积极寻求可能涉及的非所愿事件.(重要的风险区域范围指的是航空和核子科技產品,医疗作业失误、工程设计等工作而言.)」风险控制準则【準则条文】18.英文:「Risk control works, it is cost effective and helps control local operating costs.」译文:「风险控制是项积极改善风险单位本身性质之工作.它可使成本做最有效之运用同时亦有助单位或部门营运成本之控制.」19.英文:「The first ( and incontrovertible ) reason for risk control is the preservation of life.」译文:「风险控制首要的(和无可置疑的)理由乃是对人们生命的保护.」20.英文:「A property conservation program should be designed to protect corporate assets-not the underwriter.」译文:「财產保全维护计划是為了保护公司的资產而设计的──并非為了保全人而设计的.」21.英文:「Be mindful that key plants and sole source suppliers may need protection above and beyond normal HPR (highly protected risks)requirements.」译文:「对重要工厂和单一供应商应予留意也许它们需要超过HPR正常要求标準的防护措施.」22.英文:「Use the risk control services of your broker and insurer as anextension of your corporate program. Don’t let them go off on a tangent.」译文:「要把保险经纪人和保险人所提供之风险控制服务视為自己公司的风险控制规划方案延伸的一部份.不能让他们突然地改变既有之服务内容.」23.英文:「Quality control should not be substitute for a full product liability program. Quality control only assures the product is made according to specifications, whether good or bad.」译文:「品质控制不应视為全部產品责任损失控制方案之替代品.所谓品质控制仅是能确保產品是依据既定之规格製造,不管此一规格是好是坏.」24.英文:「Most of the safety-related “standards”of governmental agencies should be considered as minimum requirements.」译文:「政府机关所订有关的安全法规或标準应视為风险控制之最低要求.」25.英文:「Duplicate and separately store valuable papers and back-up data processing media.」译文:「复製并分开储存有价值之资料文件且储备许多电脑处理资料上需要的软硬体零件.」26.英文:「Avoid travel by multiple executives in a single aircraft.」译文:「避免安排许多重要主管同乘一架航空器从事旅游或考察」风险管理準则【準则条文】27.英文:「Risk manager. ent should focus on two separate zones of risk relative to the maximum dollar loss the company can survive form a single occurrence:. Below this level-optimize the use of insurance relative to current cost.. Above this level-transfer risk (usually insurance) to maximum extent possible-cost effectiveness is not a criterion in this zone; survival is.译文:「风险管理应著重一次损失之发生,企业能承受之最大损失能力之水準或范围下所分开的两个不同之风险范围..低於此一范围水準之风险-求取保险与非保险对策之适切成本组合..高於此一范围水準之风险-儘最大可能转移风险(通常利用保险)此时成本之有效性非决策标準而以存活之机会為决策标準.」28.英文:「An entity with an unlimited budget can benefit from adopting all risk management measures which have benefits to the entity with an expected present value greater than the expected present value of costs of those measures to that entity.」译文:「较少预算限制之经济个体只要对所有之风险管理方案採取预期收益现值大於预期成本现值之方案即可获益.」29.英文:「When, for budgetary or practical reasons, an entity must choose between mutually exclusive risk management measures, the entity should choose the measure that offers it the greatest excess of benefits over costs. When both benefits and costs are expressed as expected present values.」译文:「当為了有限之限算或实际之理由时,经济个体在选取互相衝突之风险管理方案时,经济个体应选择预期收益现值与预期成本现值差额最大的风险管理方案.」30.英文:「Competitive bidding which causes market disruption should be avoided.」译文:「公开竞标易引起市场崩溃应予避免」31.英文:「Never depend solely on someone else’s insurance .」译文:「不要单单依赖某一保险人提供之保险」32.英文:「Retrospective rating plans of more than one year hamper flexibility.」译文:「超过一年以上之追溯费率计划反而妨碍弹性程度.」33.英文:「A tax advantage should be considered a “plus”-not a principal reason for a risk financing decision.」译文:「税负减轻之优点仅能视為有利因子-它不是风险理财决策之主要理由」34.英文:「Risk taking presents an opportunity for economic gain.」译文:「冒风险意愿著在经济上获益之机会」索赔管理準则【準则条文】35.英文:「The risk manager should be notified immediately (with-in 24 hours)of any major loss or potential loss.」译文:「对任何重大或潜在之损失,风险经理应立即(24小时内)获得通知.」36.英文:「Major liability claims should be reviewed for adequacy of investigation and accuracy of reserve.」译文:「对於重大责任损失查勘之适当性和损失準备之正确性应特别注意评估.」37.英文:「Be careful of local plant involvement in property and liability claims. Local personnel may be too defensive to properly review a major claim.」译文:「特别留意涉及各地工厂部门之财產和责任索赔案件.因為各地工厂部门之人员容易為了减低其损失发失之责任而隐瞒实情以致重大之索赔关键无法正确评估.」38.英文:「Request early advance payments on large property and business interruption losses.」译文:「对於重大的财產和营业中断损失及早要求保险人预付部份赔款.」-39.英文:「Secure several estimates or an appraisal of self-insured vehicle physical damage losses.」译文:「对於自行承担之车辆实体毁损应儘可能获取数种之估价资料」40.英文:「Aggressive claims subrogation ( insured and self-insured) reduces costs.」译文:「主动积极运用代位求偿(不管是被保损失之索赔或未保损失之理贴)可降低理赔成本.」41.英文:「A claim and disability management program, directed toward getting the employee back to work as soon as possible can save money even though the employee cannot do all phases of the job. 」译文:「索赔和伤残管理规划中应儘可能使员工回復原有之工作,即使员工无法胜任原有所有之工作但可使企业组织节省金钱之花费.」42.英文:「Periodically audit claims reserves of insurers and self-insurance administrators.」译文:「定期审查保险人和自我保险人所设立的损失理赔準备」43.英文:「The best claim is a closed claim」译文:「最好的索赔就是结束索赔」员工福利準则【準则条文】44.英文:「The provisions and costs of employee benefit programs should be clearly and frequently communicated to employees」译文:「员工福利方案的成本和条款应该时常清楚地与员工沟通」45.英文:「When installing a new benefit plan, it is harder to reduce benefits than to improve them later on.」译文:「当设计一项新的福利项目时,要了解清楚的是将福利给付或项目缩减比事后改善福利项目和内容还难.」46.英文:「A poor employee benefit program can generate more employee relations problems than no plan at all .」译文:「一个差劲的员工福利计划会比不设立员工福利计划產生更多的人事关係纠纷之问题」47.英文:「Employee contributions, even small ones, can help you assess the real popularity of a benefit plan.」译文:「员工醵出额即使很小也能有助於评估员工福利方案真正被接受支持之普遍程度.」48.英文:「Know the benefit plans of the companies with whom you compete for labor.」译文:「应深切了解在人力市场上与自己公司互相竞争的同业公司之员工福利计划.」49.英文:「Benefit consultants and brokers are not efficiency replacements for in-house stall functions.」译文:「福利顾问和经纪人无法有效取代内部专业职员之功能」50.英文:「Collective bargaining of employee benefits should involve corporate benefit professionals.」译文:「员工福利在集体议商制定时,公司的福利专业人员应积极涉入参与.」51.英文:「Legislation and regulation are intensifying in the employee benefit field. Make your company’s opinions known to the government before legislation is enacted.」译文:「政府之立法和管理规定对员工福利具有重大实质之影响.故立法通过和执行前,自己企业公司之意见应让政府单位知道」退休年準则【準则条文】52.英文:「The ultimate cost of any pension plan is equal to the benefits paid, plus the cost of administration, less any investment earning of the fund.」译文:「任何退休计划终极本等於给付支出额加上行政处理费用扣除资金之投资收益.」53.英文:「For the most part different actuarial methods and/ or assumptions may alter the incidence of cost, but seldom alter the ultimate level of cost.」译文:「对於大部份不同的精算成本方法和(或)精算假设也许改变了每年退休成本的偶然不同性,但很少改变终极成本之水平.」54.英文:「Clearly identify your corporate objectives with respect to your retirement program.」译文:「明确确认公司目标与退休计划方案之关係」55.英文:「Recognize that retirement plans are long-term obligations which will span many political, economic and social environments.」译文:「确认退休计划是属长期之责任义务,这种计划涵盖了许多政治的、经济的和社会的层面环境」56.英文:「Identify the nature and extent of pension liability prior to any acquisition or divestiture.」译文:「做任何有关退休债务之取或捨之决定前,应认清该退休债务之性质和程度范围」57.英文:「Establish formal investment objectives with respect to your pension funds which define risk , diversification and absolute performance parameters.」译文:「应正式以书面建立与退休基金有关之投资目标,此目标应包括投资所可能產生风险之范围,投资项目之多元化之内容和肯定会影响投资绩效之因素有那些.」58.英文:「Monitor the performance of your pension fund in the context of your investment objectives」译文:「应以投资书面目标评估退休基金之投资绩效」59.英文:「Identify and monitor your corporate exposure as a result of participation in any industry wide multiemployer pension plans.」译文:「辨认和评估因参加任何同业之合同退休计划所可能產生之不利影响」国际性风险管理準则【準则条文】60.英文:「Multinational organizations should step up to their international risk management responsibilities.」译文:「多国籍企业应逐步提昇国际性风险管理之责任」61.英文:「Establish a worldwide risk and insurance management program; don’t rely totally on a difference-in-conditions approach.」译文:「多国籍企业应设立全球性风险和保险管理规划方案;不可完全抑赖条款差异保险」62.英文:「A combination of admitted and non-admitted insurance usually provides the best world wide insurance program.」译文:「被认可保险与不被认可保险之组合通常提供了最佳的全球性保险计划.」63.英文:「Avoid the use of long-term policies overseas.」译文:「避免使用海外之长期保单」64.英文:「Be sensitive to and don’t underestimate nationalism when implementing a worldwide risk management program.」译文:「在执行全球性风险管理方案时,尤需保持警觉,并且不能低估国家主义所致之严重问题.」65.英文:「Don’t ignore local objections to worldwide programs.」译文:「不要忽视海外当地对全球性计划方案之反对」风险管理行政準则【準则条文】66.英文:「Establish a level of authority via management policy statement.」译文:「透过一份管理策略说明书建立起不同的权责标準」67.英文:「Prepare and universally distribute a corporate risk managementmanual.」译文:「编製并普通分发公司的风险管理手册」68.英文:「Set up realistic annual objectives with your brokers, underwriters and vendors and measure their accomplishments and results.」译文:「与您的经纪人,保险人和厂商设立实际具体可完成之年度目标俾便评估其成效和结果」69.英文:「Verify the accuracy of all relevant information you receive.」译文:「应证实您所获取所有有关资讯之精确性」70.英文:「Read every insurance policy carefully」译文:「仔细阅读每一张保险单」71.英文:「Keep program design simple」译文:「应儘量保持风险管理方案设计之简明化」72.英文:「Consolidate-where it makes sense to do so」译文:「如果行政工作程序合併简化具积极意义时就该合併」73.英文:「Develop record retention procedures」译文:「应发展一套纪录保存之程序」74.英文:「Keep intercom any premium allocation confidential. 」译文:「公司单位部门间之保费分摊应使人信服」75.英文:「Establish administrative procedures in writing」译文:「应以书面建立行政处理程序」风险管理技巧準则【準则条文】76.英文:「Insurance policy provisions should be uniform as to named insured, notice and cancellation clauses, territory, etc.」译文:「保单条款中有关记名被保人、通知和註销条款、投保区域之规定等应求取一致.」77.英文:「The “notice ”provision in all insurance policies should be modified to mean notice to a specific individual」译文:「所有保单中之“通知”条款应被修订成通知特定单位或个人之通知条款」78.英文:「Primary policies with annual aggregates should have policy periods which coincide with excess policies」译文:「年度累积式基本保单之期间应与超额保单期间一致」79.英文:「Joint loss agreements should be obtained from fire and boiler and machinery insurers.」译文:「应取得火灾和锅炉机械保险之联合共同损失协议条款」80.英文:「Add “drive other car”protection to your corporate automobile insuracne」译文:「公司的汽车保险方案中应加入“驾驶他车”之保障条款」81.英文:「Eliminate coinsurance clauses.」译文:「应消除共保条款」82.英文:「Know the implications of and difference between “claims made”and “pay on behalf of”liability contracts.」译文:「应该认识清楚“请求索赔”责任保单和“代被保人赔偿”责任保单之涵义和其间之区别」83.英文:「Risks accepted under contracts are not necessarily covered under contractual liability coverage」译文:「透过契约而承受的风险不一定需由契约责任保险来承保」84.英文:「Add employees as insured’s to liability contracts. Use discretionary language to avoid defending hostile persons.」译文:「应将员工纳入责任保险之被保人中.并採用较為广义弹性之用语以避免并防范怀有恶意之他人.」风险管理沟通準则【準则条文】85.英文:「All communication providing or requesting information should be expressed in clear, objective language, leaving no room for individual interpretation.」译文:「沟通上所要提供之资讯或所需之资讯均应以明确且客观之用语显示,千万勿令人有两可解释之餘地.」86.英文:「All communications and relationships should be conducted with due consideration to proprietary information.」译文:「所有之沟通及工作关係应充份尊重考虑最高负责人意思后才予实施」87.英文:「Communicate effectively up and down and avoid management surprises」译文:「沟通应有效地做到上闻下达之地步并避免令管理人员闻讯后感到讶异.」88.英文:「Don’t tell senior management anything-ask them, counsel them, inform them.」译文:「对最高管理阶层人员千万勿用「告诉」字眼-而是用「请问」、「建议」、「通知」他们之字眼.」89.英文:「Communicate in business language, avoid insurance jargon.」译文:「应以一般商业用语沟通,避免用艰深之保险术语.」90.英文:「Obtain letters of intent or interpretations regarding agreements(coverage or administration) which are outside of and/or in addition to actual insurance or service contracts. Never rely on verbal agreements.」译文:「对於保险契约或服务契约本身外的协议或额外的协议(保障或行政事项),应确实获得有关解释说明之书面文件.絶对不可依赖口头上之协议来行事.」91.英文:「The immediate supervisor to the risk management function should be educated in principles of risk management.」译文:「对於直接执行风险管理职能之主管应受过风险管理专业教育训练始可.」92.英文:「Communicate every insurance exclusion and no insurance implication to your management . 」译文:「风险管理人员应就每一保险契约中之免责事项及其所显示之保险以外之涵义与管理阶层人员沟通」93.英文:「In competitive bidding situations, advise each competitor that the first bid is the only bid and stick to it.」译文:「在竞标中,应向每一位投标人建议每人的第一次标价就是唯一的标价并坚持此一原则.」94.英文:「Risk managers should meet with underwriters rather than relyingtotally on others for market communications」译文:「风险管理人员应经常主动拜访保险人,以便取得市场资讯而不应完全依赖其他的人和事来取得市场资讯.」风险管理哲学準则【準则条文】95.英文:「The risk manager ( and his corporation ) should avoid developing the reputation of a “shopper”or “market burner”. This reputation can be detrimental to the corporations best interests and the risk managers credibility」译文:「风险管理人员(或其公司)应避免建立起「购买者」或「市场交易带头者」之名声.此种名声能够阻碍公司最佳利益之获取和损及风险管理人员之信赖度.」96.英文:「Determine your personal level of risk aversion and temper intuitive judgments up or down accordingly.」译文:「确定自己的风险偏好之程度并据此调适主观直觉之判断」97.英文:「Program design will always be a function of current practicalities tempered by management’s level of risk aversion.」译文:「风险管理方案之规划常是管理决策者实际风险偏好程度之显示」98.英文:「Everyone is in business to make a fair profit」译文:「企业中每一个人均要有為公司赢得顾客满意,赚取合理利润之心志」99.英文:「Long term, good faith relationships are not obsolete.」译文:「长期且诚信的关係是絶不会过时的」100.英文:「Integrity is not out of style」译文:「诚篤正直的心絶不会落伍」101.英文:「Common sense is the most important ingredient in risk management.」译文:「普通常识是风险管理中最重之要素.」。

企业风险管理中英文对照外文翻译文献(文档含英文原文和中文翻译)原文:Risk ManagementThis chapter reviews and discusses the basic issues and principles of risk management, including: risk acceptability (tolerability); risk reduction and the ALARP principle; cautionary and precautionary principles. And presents a case study showing the importance of these issues and principles in a practical management context. Before we take a closer look, let us briefly address some basic features of risk management.The purpose of risk management is to ensure that adequate measures are taken to protect people, the environment, and assets from possible harmful consequences of the activities being undertaken, as well as to balance different concerns, in particular risks and costs. Risk management includes measures both to avoid the hazards and toreduce their potential harm. Traditionally, in industries such as nuclear, oil, and gas, risk management was based on a prescriptive regulating regime, in which detailed requirements were set with regard to the design and operation of the arrangements. This regime has gradually been replaced by a more goal-oriented regime, putting emphasis on what to achieve rather than on the means of achieving it.Risk management is an integral aspect of a goal-oriented regime. It is acknowledged that risk cannot be eliminated but must be managed. There is nowadays an enormous drive and enthusiasm in various industries and in society as a whole to implement risk management in organizations. There are high expectations that risk management is the proper framework through which to achieve high levels of performance.Risk management involves achieving an appropriate balance between realizing opportunities for gain and minimizing losses. It is an integral part of good management practice and an essential element of good corporate governance. It is an iterative process consisting of steps that, when undertaken in sequence, can lead to a continuous improvement in decision-making and facilitate a continuous improvement in performance.To support decision-making regarding design and operation, risk analyses are carried out. They include the identification of hazards and threats, cause analyses, consequence analyses, and risk descriptions. The results are then evaluated. The totality of the analyses and the evaluations are referred to as risk assessments. Risk assessment is followed by risk treatment, which is a process involving the development and implementation of measures to modify the risk, including measures designed to avoid, reduce (“optimize”), transfer, or retain the risk. Risk transfer means sharing with another party the benefit or loss associated with a risk. It is typically affected through insurance. Risk management covers all coordinated activities in the direction and control of an organization with regard to risk.In many enterprises, the risk management tasks are divided into three main categories: strategic risk, financial risk, and operational risk. Strategic risk includes aspects and factors that are important for the e nterprise’s long-term strategy and plans,for example mergers and acquisitions, technology, competition, political conditions, legislation and regulations, and labor market. Financial risk includes the enterprise’s financial situation, and includes: Market risk, associated with the costs of goods and services, foreign exchange rates and securities (shares, bonds, etc.). Credit risk, associated with a debtor’s failure to meet its obligations in accordance with agreed terms. Liquidity risk, reflecting lack of access to cash; the difficulty of selling an asset in a timely manner. Operational risk is related to conditions affecting the normal operating situation: Accidental events, including failures and defects, quality deviations, natural disasters. Intended acts; sabotage, disgruntled employees, etc. Loss of competence, key personnel. Legal circumstances, associated for instance, with defective contracts and liability insurance.For an enterprise to become successful in its implementation of risk management, top management needs to be involved, and activities must be put into effect on many levels. Some important points to ensure success are: the establishment of a strategy for risk management, i.e., the principles of how the enterprise defines and implements risk management. Should one simply follow the regulatory requirements (minimal requirements), or should one be the “best in the class”? The establishment of a risk management process for the enterprise, i.e. formal processes and routines that the enterprise is to follow. The establishment of management structures, with roles and responsibilities, such that the risk analysis process becomes integrated into the organization. The implementation of analyses and support systems, such as risk analysis tools, recording systems for occurrences of various types of events, etc. The communication, training, and development of a risk management culture, so that the competence, understanding, and motivation level within the organization is enhanced. Given the above fundamentals of risk management, the next step is to develop principles and a methodology that can be used in practical decision-making. This is not, however, straightforward. There are a number of challenges and here we address some of these: establishing an informative risk picture for the various decision alternatives, using this risk picture in a decision-making context. Establishing an informative risk picture means identifying appropriate risk indices and assessments ofuncertainties. Using the risk picture in a decision making context means the definition and application of risk acceptance criteria, cost benefit analyses and the ALARP principle, which states that risk should be reduced to a level which is as low as is reasonably practicable.It is common to define and describe risks in terms of probabilities and expected values. This has, however, been challenged, since the probabilities and expected values can camouflage uncertainties; the assigned probabilities are conditional on a number of assumptions and suppositions, and they depend on the background knowledge. Uncertainties are often hidden in this background knowledge, and restricting attention to the assigned probabilities can camouflage factors that could produce surprising outcomes. By jumping directly into probabilities, important uncertainty aspects are easily truncated, and potential surprises may be left unconsidered.Let us, as an example, consider the risks, seen through the eyes of a risk analyst in the 1970s, associated with future health problems for divers working on offshore petroleum projects. The analyst assigns a value to the probability that a diver would experience health problems (properly defined) during the coming 30 years due to the diving activities. Let us assume that a value of 1 % was assigned, a number based on the knowledge available at that time. There are no strong indications that the divers will experience health problems, but we know today that these probabilities led to poor predictions. Many divers have experienced severe health problems (Avon and Vine, 2007). By restricting risk to the probability assignments alone, important aspects of uncertainty and risk are hidden. There is a lack of understanding about the underlying phenomena, but the probability assignments alone are not able to fully describe this status.Several risk perspectives and definitions have been proposed in line with this realization. For example, Avon (2007a, 2008a) defines risk as the two-dimensional combination of events/consequences and associated uncertainties (will the events occur, what the consequences will be). A closely related perspective is suggested by Avon and Renan (2008a), who define risk associated with an activity as uncertaintyabout and severity of the consequences of the activity, where severity refers to intensity, size, extension, scope and other potential measures of magnitude with respect to something that humans value (lives, the environment, money, etc.). Losses and gains, expressed for example in monetary terms or as the number of fatalities, are ways of defining the severity of the consequences. See also Avon and Christensen (2005).In the case of large uncertainties, risk assessments can support decision-making, but other principles, measures, and instruments are also required, such as the cautionary/precautionary principles as well as robustness and resilience strategies. An informative decision basis is needed, but it should be far more nuanced than can be obtained by a probabilistic analysis alone. This has been stressed by many researchers, e.g. Apostolicism (1990) and Apostolicism and Lemon (2005): qualitative risk analysis (QRA) results are never the sole basis for decision-making. Safety- and security-related decision-making is risk-informed, not risk-based. This conclusion is not, however, justified merely by referring to the need for addressing uncertainties beyond probabilities and expected values. The main issue here is the fact that risks need to be balanced with other concerns.When various solutions and measures are to be compared and a decision is to be made, the analysis and assessments that have been conducted provide a basis for such a decision. In many cases, established design principles and standards provide clear guidance. Compliance with such principles and standards must be among the first reference points when assessing risks. It is common thinking that risk management processes, and especially ALARP processes, require formal guidelines or criteria (e.g., risk acceptance criteria and cost-effectiveness indices) to simplify the decision-making. Care must; however, be shown when using this type of formal decision-making criteria, as they easily result in a mechanization of the decision-making process. Such mechanization is unfortunate because: Decision-making criteria based on risk-related numbers alone (probabilities and expected values) do not capture all the aspects of risk, costs, and benefits, no method has a precision that justifies a mechanical decision based on whether the result is overor below a numerical criterion. It is a managerial responsibility to make decisions under uncertainty, and management should be aware of the relevant risks and uncertainties.Apostolicism and Lemon (2005) adopt a pragmatic approach to risk analysis and risk management, acknowledging the difficulties of determining the probabilities of an attack. Ideally, they would like to implement a risk-informed procedure, based on expected values. However, since such an approach would require the use of probabilities that have not b een “rigorously derived”, they see themselves forced to resort to a more pragmatic approach.This is one possible approach when facing problems of large uncertainties. The risk analyses simply do not provide a sufficiently solid basis for the decision-making process. We argue along the same lines. There is a need for a management review and judgment process. It is necessary to see beyond the computed risk picture in the form of the probabilities and expected values. Traditional quantitative risk analyses fail in this respect. We acknowledge the need for analyzing risk, but question the value added by performing traditional quantitative risk analyses in the case of large uncertainties. The arbitrariness in the numbers produced can be significant, due to the uncertainties in the estimates or as a result of the uncertainty assessments being strongly dependent on the analysts.It should be acknowledged that risk cannot be accurately expressed using probabilities and expected values. A quantitative risk analysis is in many cases better replaced by a more qualitative approach, as shown in the examples above; an approach which may be referred to as a semi-quantitative approach. Quantifying risk using risk indices such as the expected number of fatalities gives an impression that risk can be expressed in a very precise way. However, in most cases, the arbitrariness is large. In a semi-quantitative approach this is acknowledged by providing a more nuanced risk picture, which includes factors that can cause “surprises” r elative to the probabilities and the expected values. Quantification often requires strong simplifications and assumptions and, as a result, important factors could be ignored or given too little (or too much) weight. In a qualitative or semi-quantitative analysis, amore comprehensive risk picture can be established, taking into account underlying factors influencing risk. In contrast to the prevailing use of quantitative risk analyses, the precision level of the risk description is in line with the accuracy of the risk analysis tools. In addition, risk quantification is very resource demanding. One needs to ask whether the resources are used in the best way. We conclude that in many cases more is gained by opening up the way to a broader, more qualitative approach, which allows for considerations beyond the probabilities and expected values.The traditional quantitative risk assessments as seen for example in the nuclear and the oil & gas industries provide a rather narrow risk picture, through calculated probabilities and expected values, and we conclude that this approach should be used with care for problems with large uncertainties. Alternative approaches highlighting the qualitative aspects are more appropriate in such cases. A broad risk description is required. This is also the case in the normative ambiguity situations, as the risk characterizations provide a basis for the risk evaluation processes. The main concern is the value judgments, but they should be supported by solid scientific assessments, showing a broad risk picture. If one tries to demonstrate that it is rational to accept risk, on a scientific basis, too narrow an approach to risk has been adopted. Recognizing uncertainty as a main component of risk is essential to successfully implement risk management, for cases of large uncertainties and normative ambiguity.A risk description should cover computed probabilities and expected values, as well as: Sensitivities showing how the risk indices depend on the background knowledge (assumptions and suppositions); Uncertainty assessments; Description of the background knowledge, including models and data used.The uncertainty assessments should not be restricted to standard probabilistic analysis, as this analysis could hide important uncertainty factors. The search for quantitative, explicit approaches for expressing the uncertainties, even beyond the subjective probabilities, may seem to be a possible way forward. However, such an approach is not recommended. Trying to be precise and to accurately express what is extremely uncertain does not make sense. Instead we recommend a more openqualitative approach to reveal such uncertainties. Some might consider this to be less attractive from a methodological and scientific point of view. Perhaps it is, but it would be more suited for solving the problem at hand, which is about the analysis and management of risk and uncertainties.Source: Terje Aven. 2010. “Risk Management”. Risk in Technological Systems, Oct, p175-198.译文:风险管理本章回顾和讨论风险管理的基本问题和原则,包括:风险可接受性(耐受性)、风险削减和安全风险管理原则、警示和预防原则,并提出了一个研究案例,说明在实际管理环境中这些问题和原则的重要性。

词汇表Aabstract 摘要:土地所有权的简要历史。

accelerated death benefit 提前给付:在某些情况下,人寿险保单面值的一部分,可以在被保险人身故前(须扣除利息)得到支付。

accidental death benefit 意外死亡额外给付:是一种两全保险。

若被保险人死于意外事故,则向受益人支付附加保险金。

accounts receivable insurance 应收账款保险:因被保险风险造成应收账款记录损毁,因而无法从记账赊销的债务人处收回应收账款,该损失可在应收账款保险项下得到补偿。

accumulation units 积累单位:用于已购买的变额年金。

积累单位的价值取决于投资组合的表现,所以每期保费能购买的积累单位数目是不同的。

activities of daily living 日常活动能力:诸如进食、洗浴、盥洗、换车、穿衣和节制等日常活动,当被保险人无法进行上述部分活动时,长期护理保险将予以给付。

acts of God 天灾:难以合理防范的危险,如洪水、地震。

acts of negligence of the shipper 托运人的疏忽或过失行为:如不当装货或包装缺陷,造成损失的原因不是承运人的责任的。

actual cash value(ACV)实际现金价值:财产的重置成本扣除折旧。

actual loss ratio 实际赔付率:某一险种在先前一个时期,赔付额与已收保费之间的实际比率。

Actual total loss 实际全损:财产完全损毁造成的损失。

actuarial cost assumption 精算成本假设:对投资收益率、死亡率、销售量、工资增长模式、可能的费用及员工实际退休年龄分布的假设。

精算成本方法的选择取决于这些假设。

actuarial cost methods 精算成本方法:计算为建立承诺的养老基金,每年必须缴纳多少金额的方法。

additional insureds 附加被保险人:对保单承保的财产或个人具有保险利益,而且能够根据保单条件得到损失补偿的人。