投资学10~12课后习题

- 格式:docx

- 大小:23.37 KB

- 文档页数:7

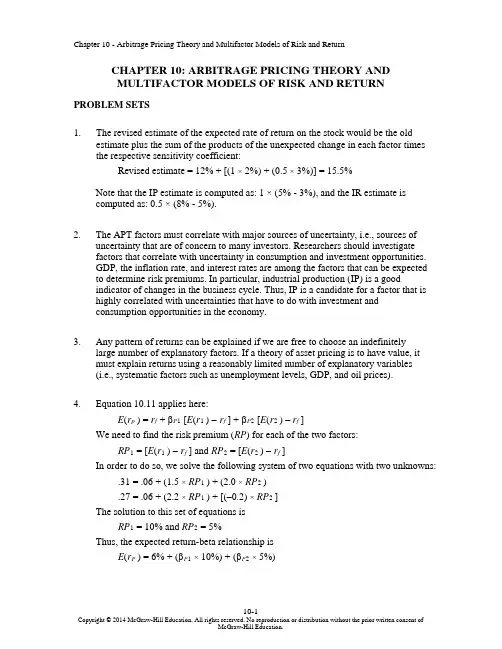

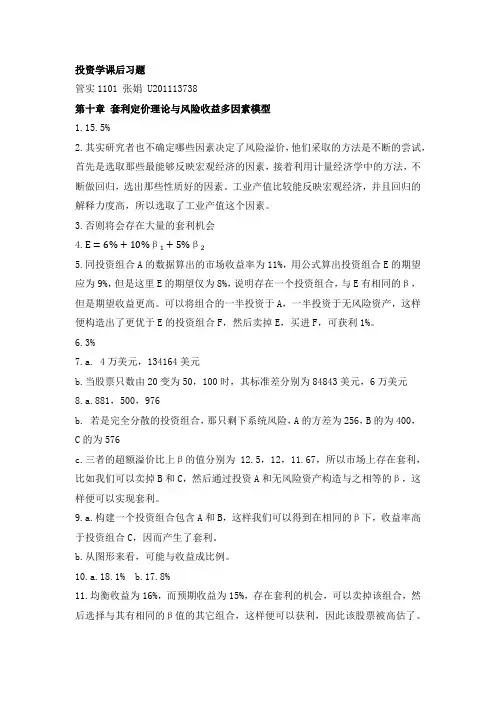

投资学(博迪)第10版课后习题答...CHAPTER 10: ARBITRAGE PRICING THEORY ANDMULTIFACTOR MODELS OF RISK AND RETURN PROBLEM SETS1. The revised estimate of the expected rate of return on the stock would be the oldestimate plus the sum of the products of the unexpected change in each factor times the respective sensitivity coefficient: Revised estimate = 12% + [(1 × 2%) + (0.5 × 3%)] = 15.5%Note that the IP estimate is computed as: 1 × (5% - 3%), and the IR estimate iscomputed as: 0.5 × (8% - 5%).2. The APT factors must correlate with major sources of uncertainty, i.e., sources ofuncertainty that are of concern to many investors. Researchers should investigatefactors that correlate with uncertainty in consumption and investment opportunities.GDP, the inflation rate, and interest rates are among the factors that can be expected to determine risk premiums. In particular, industrial production (IP) is a goodindicator of changes in the business cycle. Thus, IP is a candidate for a factor that is highly correlated with uncertainties that have to do with investment andconsumption opportunities in the economy.3. Any pattern of returns can be explained if we are free to choose an indefinitelylarge number of explanatory factors. If a theory of asset pricing is to have value, itmust explain returns using a reasonably limited number of explanatory variables(i.e., systematic factors such as unemployment levels, GDP, and oil prices).4. Equation 10.11 applies here:E(r p) = r f + βP1 [E(r1 ) ?r f ] + βP2 [E(r2 ) – r f]We need to find the risk premium (RP) for each of the two factors:RP1 = [E(r1 ) ?r f] and RP2 = [E(r2 ) ?r f]In order to do so, we solve the following system of two equations with two unknowns: .31 = .06 + (1.5 ×RP1 ) + (2.0 ×RP2 ).27 = .06 + (2.2 ×RP1 ) + [(–0.2) ×RP2 ]The solution to this set of equations isRP1 = 10% and RP2 = 5%Thus, the expected return-beta relationship isE(r P) = 6% + (βP1× 10%) + (βP2× 5%)5. The expected return for portfolio F equals the risk-free rate since its beta equals 0.For portfolio A, the ratio of risk premium to beta is (12 ?6)/1.2 = 5For portfolio E, the ratio is lower at (8 – 6)/0.6 = 3.33This implies that an arbitrage opportunity exists. For instance, you can create aportfolio G with beta equal to 0.6 (the same as E’s) by combining portfolio A and portfolio F in equal weights. The expected return and beta for portfolio G are then: E(r G) = (0.5 × 12%) + (0.5 × 6%) = 9%βG = (0.5 × 1.2) + (0.5 × 0%) = 0.6Comparing portfolio G to portfolio E, G has the same betaand higher return.Therefore, an arbitrage opportunity exists by buying portfolio G and selling anequal amount of portfolio E. The profit for this arbitrage will ber G –r E =[9% + (0.6 ×F)] ?[8% + (0.6 ×F)] = 1%That is, 1% of the funds (long or short) in each portfolio.6. Substituting the portfolio returns and betas in the expected return-beta relationship,we obtain two equations with two unknowns, the risk-free rate (r f) and the factor risk premium (RP):12% = r f + (1.2 ×RP)9% = r f + (0.8 ×RP)Solving these equations, we obtainr f = 3% and RP = 7.5%7. a. Shorting an equally weighted portfolio of the ten negative-alpha stocks andinvesting the proceeds in an equally-weighted portfolio of the 10 positive-alpha stocks eliminates the market exposure and creates a zero-investmentportfolio. Denoting the systematic market factor as R M, the expected dollarreturn is (noting that the expectation of nonsystematic risk, e, is zero):$1,000,000 × [0.02 + (1.0 ×R M)] ? $1,000,000 × [(–0.02) + (1.0 ×R M)]= $1,000,000 × 0.04 = $40,000The sensitivity of the payoff of this portfolio to the market factor is zerobecause the exposures of the positive alpha and negative alpha stocks cancelout. (Notice that the terms involving R M sum to zero.) Thus, the systematiccomponent of total risk is also zero. The variance of the analyst’s profit is notzero, however, since this portfolio is not well diversified.For n = 20 stocks (i.e., long 10 stocks and short 10 stocks) the investor willhave a $100,000 position (either long or short) in each stock. Net marketexposure is zero, but firm-specific risk has not been fully diversified. Thevariance of dollar returns from the positions in the 20 stocks is20 × [(100,000 × 0.30)2] = 18,000,000,000The standard deviation of dollar returns is $134,164.b. If n = 50 stocks (25 stocks long and 25 stocks short), the investor will have a$40,000 position in each stock, and the variance of dollar returns is50 × [(40,000 × 0.30)2] = 7,200,000,000The standard deviation of dollar returns is $84,853.Similarly, if n = 100 stocks (50 stocks long and 50 stocks short), the investorwill have a $20,000 position in each stock, and the variance of dollar returns is100 × [(20,000 × 0.30)2] = 3,600,000,000The standard deviation of dollar returns is $60,000.Notice that, when the number of stocks increases by a factorof 5 (i.e., from 20 to 100), standard deviation decreases by a factor of 5= 2.23607 (from$134,164 to $60,000).8. a. )(σσβσ2222e M +=88125)208.0(σ2222=+×=A50010)200.1(σ2222=+×=B97620)202.1(σ2222=+×=Cb. If there are an infinite number of assets with identical characteristics, then awell-diversified portfolio of each type will have only systematic risk since thenonsystematic risk will approach zero with large n. Each variance is simply β2 × market variance:222Well-diversified σ256Well-diversified σ400Well-diversified σ576A B C;;;The mean will equal that of the individual (identical) stocks.c. There is no arbitrage opportunity because the well-diversified portfolios allplot on the security market line (SML). Because they are fairly priced, there isno arbitrage.9. a. A long position in a portfolio (P) composed of portfoliosA andB will offer anexpected return-beta trade-off lying on a straight linebetween points A and B.Therefore, we can choose weights such that βP = βC but with expected returnhigher than that of portfolio C. Hence, combining P with a short position in Cwill create an arbitrage portfolio with zero investment, zero beta, and positiverate of return.b. The argument in part (a) leads to the proposition that the coefficient of β2must be zero in order to preclude arbitrage opportunities.10. a. E(r) = 6% + (1.2 × 6%) + (0.5 × 8%) + (0.3 × 3%) = 18.1%b.Surprises in the macroeconomic factors will result in surprises in the return ofthe stock:Unexpected return from macro factors =[1.2 × (4% –5%)] + [0.5 × (6% –3%)] + [0.3 × (0% – 2%)] = –0.3%E(r) =18.1% ? 0.3% = 17.8%11. The APT required (i.e., equilibrium) rate of return on the stock based on r f and thefactor betas isRequired E(r) = 6% + (1 × 6%) + (0.5 × 2%) + (0.75 × 4%) = 16% According to the equation for the return on the stock, the actually expected return on the stock is 15% (because the expected surprises on all factors are zero bydefinition). Because the actually expected return based on risk is less than theequilibrium return, we conclude that the stock is overpriced.12. The first two factors seem promising with respect to thelikely impact on the firm’scost of capital. Both are macro factors that would elicit hedging demands acrossbroad sectors of investors. The third factor, while important to Pork Products, is a poor choice for a multifactor SML because the price of hogs is of minor importance to most investors and is therefore highly unlikely to be a priced risk factor. Better choices would focus on variables that investors in aggregate might find moreimportant to their welfare. Examples include: inflation uncertainty, short-terminterest-rate risk, energy price risk, or exchange rate risk. The important point here is that, in specifying a multifactor SML, we not confuse risk factors that are important toa particular investor with factors that are important to investors in general; only the latter are likely to command a risk premium in the capital markets.13. The formula is ()0.04 1.250.08 1.50.02.1717%E r =+×+×==14. If 4%f r = and based on the sensitivities to real GDP (0.75) and inflation (1.25),McCracken would calculate the expected return for the Orb Large Cap Fund to be:()0.040.750.08 1.250.02.040.0858.5% above the risk free rate E r =+×+×=+=Therefore, Kwon’s fundamental analysis estimate is congruent with McCr acken’sAPT estimate. If we assume that both Kwon and McCracken’s estimates on the return of Orb’s Large Cap Fund are accurate, then no arbitrage profit is possible.15. In order to eliminate inflation, the following three equations must be solvedsimultaneously, where the GDP sensitivity will equal 1 in the first equation,inflation sensitivity will equal 0 in the second equation and the sum of the weights must equal 1 in the third equation.1.1.250.75 1.012.1.5 1.25 2.003.1wx wy wz wz wy wz wx wy wz ++=++=++=Here, x represents Orb’s High Growth Fund, y represents Large Cap Fund and z represents Utility Fund. Using algebraic manipulation will yield wx = wy = 1.6 and wz = -2.2.16. Since retirees living off a steady income would be hurt by inflation, this portfoliowould not be appropriate for them. Retirees would want a portfolio with a return positively correlated with inflation to preserve value, and less correlated with the variable growth of GDP. Thus, Stiles is wrong. McCracken is correct in that supply side macroeconomic policies are generally designed to increase output at aminimum of inflationary pressure. Increased output would mean higher GDP, which in turn would increase returns of a fund positively correlated with GDP.17. The maximum residual variance is tied to the number of securities (n ) in theportfolio because, as we increase the number of securities, we are more likely to encounter securities with larger residual variances. The starting point is todetermine the practical limit on the portfolio residualstandard deviation, σ(e P ), that still qualifies as a well-diversified portfolio. A reasonable approach is to compareσ2(e P) to the market variance, or equivalently, to compare σ(e P) to the market standard deviation. Suppose we do n ot allow σ(e P) to exceed pσM, where p is a small decimal fraction, for example, 0.05; then, the smaller the value we choose for p, the more stringent our criterion for defining how diversified a well-diversified portfolio must be.Now construct a portfolio of n securities with weights w1, w2,…,w n, so that Σw i =1. The portfolio residual variance is σ2(e P) = Σw12σ2(e i)To meet our practical definition of sufficiently diversified, we require this residual variance to be less than (pσM)2. A sure and simple way to proceed is to assume the worst, that is, assume that the residual variance of each security is the highest possible value allowed under the assumptions of the problem: σ2(e i) = nσ2MIn that case σ2(e P) = Σw i2 nσM2Now apply the constraint: Σw i2nσM2 ≤ (pσM)2This requires that: nΣw i2 ≤ p2Or, equivalently, that: Σw i2 ≤ p2/nA relatively easy way to generate a set of well-diversified portfolios is to use portfolio weights that follow a geometric progression, since the computations then become relatively straightforward. Choose w1 and a common factor q for the geometric progression such that q < 1. Therefore, the weight on each stock is a fraction q of the weight on the previous stock in the series. Then the sum of n terms is:Σw i= w1(1– q n)/(1– q) = 1or: w1 = (1– q)/(1– q n)The sum of the n squared weights is similarly obtained from w12 and a common geometric progression factor of q2. ThereforeΣw i2 = w12(1– q2n)/(1– q 2)Substituting for w1 from above, we obtainΣw i2 = [(1– q)2/(1– q n)2] × [(1– q2n)/(1– q 2)]For sufficient diversification, we choose q so that Σw i2 ≤ p2/nFor example, continue to assume that p = 0.05 and n = 1,000. If we chooseq = 0.9973, then we will satisfy the required condition. At this value for q w1 = 0.0029 and w n = 0.0029 × 0.99731,000 In this case, w1 is about 15 times w n. Despite this significant departure from equal weighting, this portfolio is nevertheless well diversified. Any value of q between0.9973 and 1.0 results in a well-diversified portfolio. As q gets closer to 1, theportfolio approaches equal weighting.18. a. Assume a single-factor economy, with a factor risk premium E M and a (large)set of well-diversified portfolios with beta βP. Suppose we create a portfolio Zby allocating the portion w to portfolio P and (1 – w) to the market portfolioM. The rate of return on portfolio Z is:R Z = (w × R P) + [(1 –w) × R M]Portfolio Z is riskless if we choose w so that βZ = 0. This requires that:βZ = (w × βP) + [(1 –w) × 1] = 0 ?w = 1/(1 –βP) and (1 – w) = –βP/(1 –βP)Substitute this value for w in the expression for R Z:R Z = {[1/(1 –βP)] × R P} –{[βP/(1 –βP)] × R M}Since βZ = 0, then, in order to avoid arbitrage, R Z must be zero.This implies that: R P = βP × R MTaking expectations we have:E P = βP × E MThis is the SML for well-diversified portfolios.b. The same argument can be used to show that, in a three-factor model withfactor risk premiums E M, E1 and E2, in order to avoid arbitrage, we must have:E P = (βPM × E M) + (βP1 × E1) + (βP2 × E2)This is the SML for a three-factor economy.19. a. The Fama-French (FF) three-factor model holds that one of the factors drivingreturns is firm size. An index with returns highly correlated with firm size (i.e.,firm capitalization) that captures this factor is SMB (small minus big), thereturn for a portfolio of small stocks in excess of the return for a portfolio oflarge stocks. The returns for a small firm will be positively correlated withSMB. Moreover, the smaller the firm, the greater its residual from the othertwo factors, the market portfolio and the HML portfolio, which is the returnfor a portfolio of high book-to-market stocks in excess of the return for aportfolio of low book-to-market stocks. Hence, the ratio of the variance of thisresidual to the variance of the return on SMB will be larger and, together withthe higher correlation, results in a high beta on the SMB factor.b.This question appears to point to a flaw in the FF model. The model predictsthat firm size affects average returns so that, if two firms merge into a largerfirm, then the FF model predicts lower average returns for the merged firm.However, there seems to be no reason for the merged firm to underperformthe returns of the component companies, assuming that the component firmswere unrelated and that they will now be operated independently. We mighttherefore expect that the performance of the merged firm would be the sameas the performance of a portfolio of the originally independent firms, but theFF model predicts that the increased firm size will result in lower averagereturns. Therefore, the question revolves around the behavior of returns for aportfolio of small firms, compared to the return for larger firms that resultfrom merging those small firms into larger ones. Had past mergers of smallfirms into larger firms resulted, on average, in no change in the resultantlarger firms’ stock return characteristics (compared to the portfolio of stocksof the merged firms), the size factor in the FF model would have failed.Perhaps the reason the size factor seems to help explain stock returns is that,when small firms become large, the characteristics of their fortunes (andhence their stock returns) change in a significant way. Put differently, stocksof large firms that result from a merger of smaller firms appear empirically tobehave differently from portfolios of the smaller component firms.Specifically, the FF model predicts that the large firm will have a smaller riskpremium. Notice that this development is not necessarily a bad thing for thestockholders of the smaller firms that merge. The lower risk premium may bedue, in part, to the increase in value of the larger firm relative to the mergedfirms.CFA PROBLEMS1. a. This statement is incorrect. The CAPM requires a mean-variance efficientmarket portfolio, but APT does not.b.This statement is incorrect. The CAPM assumes normallydistributed securityreturns, but APT does not.c. This statement is correct.2. b. Since portfolio X has β = 1.0, then X is the market portfolio and E(R M) =16%.Using E(R M ) = 16% and r f = 8%, the expected return for portfolio Y is notconsistent.3. d.4. c.5. d.6. c. Investors will take on as large a position as possible only if the mispricingopportunity is an arbitrage. Otherwise, considerations of risk anddiversification will limit the position they attempt to take in the mispricedsecurity.7. d.8. d.。

上财投资学教程第二版课后练习第10章习题集(总18页)--本页仅作为文档封面,使用时请直接删除即可----内页可以根据需求调整合适字体及大小--习题集一、判断题(40题):1.股市的运行和发展植根于宏观经济环境,同时股市的活动又会对宏观经济产生影响。

因此,股市运行与宏观经济运行应当基本一致。

()2.宏观经济运行是一个动态的过程。

在这一过程中,一些经济变量会以周期性的方式变动。

()3.经济周期的平均长度为 40 个月的周期,一般被称为中周期。

()4.经济周期的长度为 50年左右的循环,被称为“康德拉耶夫”周期。

()5.银行提供的优惠利率属于先行指标。

()6.与经济周期的可预测性相比,股票市场的周期性涨跌的可预测性却较差。

()7.财政政策是指货币当局为实现既定的经济目标,运用各种工具调节货币供应和利率,进而影响宏观经济的运行状态的各类方针和措施的总和。

()8.扩张性货币政策是通过降低利率,扩大信贷以增加货币供应量,刺激社会总需求增长。

()9.紧缩性货币政策是通过降低利率,扩大信贷规模来增加货币供应量,以刺激总需求的增长。

()10.调整法定存款准备金率是实施财政政策所运用的工具之一。

()11.在经济过度扩张,社会需求过度膨胀,社会总需求大于社会总供给时,政府常常运用扩张性货币政策。

()12.紧缩性财政政策的目的在于,当经济增长强劲,价格水平持续上涨时,通过提高政府购买水平,提高转移支付水平,降低税率,以减少总需求,抑制通货膨胀。

()13.短期财政政策的目标一般是促进经济稳定增长,主要是通过发挥财政政策的“相机抉择”功能,调节宏观经济的运行,进而影响股票市场运行的。

()14.一般而言,利率与证券市场表现为正相关。

利率上升将对上市公司造成正面影响。

()15.温和、稳定的通货膨胀对证券价格上扬有推动作用。

()16.股票价格指数是滞后指标。

因为股价是对公司综合实力的后续体现。

()制度是一国在货币已实现完全可自由兑换、资本项目已开放的情况下,有限度地引进外资、进一步开放资本市场的一项过渡性的制度。

第6章风险厌恶与风险资产配置一、习题1.风险厌恶程度高的投资者会偏好哪种投资组合?a.更高风险溢价b.风险更高c.夏普比率更低d.夏普比率更高e.以上各项均不是答:e。

2.以下哪几个表述是正确的?a.风险组合的配置减少,夏普比率会降低b.借入利率越高,有杠杆时夏普比率越低c.无风险利率固定时,如果风险组合的期望收益率和标准差都翻倍,夏普比率也会翻倍d.风险组合风险溢价不变,无风险利率越高,夏普比率越高答:b项正确。

较高的借入利率是对借款人违约风险的补偿。

在没有额外的违约成本的完美市场中,这个增量值将与借款人违约选择权的价值相等。

然而,在现实中违约是有成本的,因此这部分的增量值会使夏普比率降低。

c项是不正确的,因为一个固定的无风险利率的预期回报增加一倍,风险溢价和夏普比率将增加一倍以上。

3.如果投资者预测股票市场波动性增大,股票期望收益如何变化?参考教材式(6-7)。

答:假设风险容忍度不变,即有一个不变的风险厌恶系数(A),则观察到的更大的波动会增加风险投资组合的最优投资方程(教材式6-7)的分母。

因此,投资于风险投资组合的比例将会下降。

4.考虑一个风险组合,年末现金流为70000美元或200000美元,两者概率相等。

短期国债利率为6%。

a.如果追求风险溢价为8%,你愿意投资多少钱?b.期望收益率是多少?c.追求风险溢价为12%呢?d.比较a和c的答案,关于投资所要求的风险溢价与售价之间的关系,投资者有什么结论?答:a.预期现金流入为(0.5×70000)+(0.5×200000)=135000(美元)。

风险溢价为8%,无风险利率为6%,则必要回报率为14%。

因此资产组合的现值为:135000/1.14=118421(美元)。

b.如果资产组合以118421美元买入,给定预期的收入为135000美元,则期望收益率E(r)满足:118421×[1+E(r)]=135000(美元)。

投资学第10版课后习题答案CHAPTER 2: ASSET CLASSES AND FINANCIALINSTRUMENTSPROBLEM SETS1. Preferred stock is like long-term debt in that it typicallypromises a fixed payment each year. In this way, it is aperpetuity. Preferred stock is also like long-term debt in that itdoes not give the holder voting rights in the firm.Preferred stock is like equity in that the firm is under nocontractual obligation to make the preferred stock dividend payments.Failure to make payments does not set off corporate bankruptcy. With respect to the priority of claims to the assets of the firm in theevent of corporate bankruptcy, preferred stock has a higher priority than common equity but a lower priority than bonds.2. Money market securities are called cash equivalents because oftheir high level of liquidity. The prices of money marketsecurities are very stable, and they can be converted to cash .,sold) on very short notice and with very low transaction costs.Examples of money market securities include Treasury bills,commercial paper, and banker's acceptances, each of which ishighly marketable and traded in the secondary market.3. (a) A repurchase agreement is an agreement whereby the seller ofa security agrees to “repurchase” it from the buyer on anagreed upon date at an agreed upon price. Repos are typicallyused by securities dealers as a means for obtaining funds topurchase securities.4. Spreads between risky commercial paper and risk-free governmentsecurities will widen. Deterioration of the economy increases thelikelihood of default on commercial paper, making them more risky.Investors will demand a greater premium on all risky debtsecurities, not just commercial paper.5.6. Municipal bond interest is tax-exempt at the federal level and possibly at the state level as well. When facing higher marginaltax rates, a high-income investor would be more inclined toinvest in tax-exempt securities.7. a. You would have to pay the ask price of:% of par value of $1,000 = $b. The coupon rate is % implying coupon payments of $ annually or, more precisely, $ semiannually.c. The yield to maturity on a fixed income security is also knownas its required return and is reported by The Wall StreetJournal and others in the financial press as the ask yield. Inthis case, the yield to maturity is %. An investor buying this security today and holding it until it matures will earn anannual return of %. Students will learn in a later chapter howto compute both the price and the yield to maturity with afinancial calculator.8. Treasury bills are discount securities that mature for $10,000. Therefore, a specific T-bill price is simply the maturity value divided by one plus the semi-annual return:P = $10,000/ = $9,9. The total before-tax income is $4. After the 70% exclusion for preferred stock dividends, the taxable income is: $4 = $ Therefore, taxes are: $ = $After-tax income is: $ – $ = $Rate of return is: $$ = %10. a. You could buy: $5,000/$ = shares. Since it is not possible to trade in fractions of shares, you could buy 77 shares of GD.b. Your annual dividend income would be: 77 $ = $c. The price-to-earnings ratio is and the price is $. Therefore: $Earnings per share = Earnings per share = $d. General Dynamics closed today at $, which was $ higher than yesterday’s price of $11. a. At t = 0, the value of the index is: (90 + 50 + 100)/3 = 80At t = 1, the value of the index is: (95 + 45 + 110)/3 =The rate of return is: 80) 1 = %b. In the absence of a split, Stock C would sell for 110, sothe value of the index would be: 250/3 = with a divisor of3.After the split, stock C sells for 55. Therefore, we needto find the divisor (d) such that: = (95 + 45 + 55)/dd = . The divisor fell, which is always the case after oneof the firms in an index splits its shares.c. The return is zero. The index remains unchanged because the return for each stock separately equals zero.12. a. Total market value at t = 0 is: ($9,000 + $10,000 + $20,000) = $39,000Total market value at t = 1 is: ($9,500 + $9,000 + $22,000) = $40,500 Rate of return = ($40,500/$39,000) – 1 = %b.The return on each stock is as follows:r= (95/90) – 1 =Ar= (45/50) – 1 = –Br= (110/100) – 1 =CThe equally weighted average is:[ + + ]/3 = = %13. The after-tax yield on the corporate bonds is: (1 – = = % Therefore, municipals must offer a yield to maturity of at least %.14. Equation shows that the equivalent taxable yield is: r = r m/(1 –t),so simply substitute each tax rate in the denominator to obtain thefollowing:a. %b. %c. %d. %15. In an equally weighted index fund, each stock is given equal weightregardless of its market capitalization. Smaller cap stocks will have the same weight as larger cap stocks. The challenges are as follows:Given equal weights placed to smaller cap and larger cap,equal-weighted indices (EWI) will tend to be more volatilethan their market-capitalization counterparts;It follows that EWIs are not good reflectors of the broadmarket that they represent; EWIs underplay the economicimportance of larger companies.Turnover rates will tend to be higher, as an EWI must berebalanced back to its original target. By design, many ofthe transactions would be among the smaller, less-liquidstocks.16. a. The ten-year Treasury bond with the higher coupon rate will sellfor a higher price because its bondholder receives higherinterest payments.b. The call option with the lower exercise price has more valuethan one with a higher exercise price.c. The put option written on the lower priced stock has more valuethan one written on a higher priced stock.17. a. You bought the contract when the futures price was $ (see Figureand remember that the number to the right of the apostropherepresents an eighth of a cent). The contract closes at a priceof $, which is $ more than the original futures price. Thecontract multiplier is 5000. Therefore, the gain will be: $5000 = $b. Open interest is 135,778 contracts.18. a. Owning the call option gives you the right, but not theobligation, to buy at $180, while the stock is trading in thesecondary market at $193. Since the stock price exceeds theexercise price, you exercise the call.The payoff on the option will be: $193 - $180 = $13The cost was originally $, so the profit is: $13 - $ = $b. Since the stock price is greater than the exercise price, youwill exercise the call. The payoff on the option will be: $193 -$185 = $8The option originally cost $, so the profit is $8 - $ = -$c. Owning the put option gives you the right, but not theobligation, to sell at $185, but you could sell in the secondarymarket for $193, so there is no value in exercising the option.Since the stock price is greater than the exercise price, youwill not exercise the put. The loss on the put will be theinitial cost of $.19. There is always a possibility that the option will be in-the-money atsome time prior to expiration. Investors will pay something for this possibility of a positive payoff.20.Value of Call atInitial Cost ProfitExpirationa.04-4b.04-4c.04-4d.541e.1046Value of Put atInitial Cost ProfitExpirationa.1064b.56-1c.06-6d.06-6e.06-621. A put option conveys the right to sell the underlying asset at theexercise price. A short position in a futures contract carries anobligation to sell the underlying asset at the futures price. Both positions, however, benefit if the price of the underlying asset falls.22. A call option conveys the right to buy the underlying asset at the exercise price. A long position in a futures contract carries an obligation to buy the underlying asset at the futures price. Both positions, however, benefit if the price of the underlying asset rises.CFA PROBLEMS1.(d) There are tax advantages for corporations that own preferred shares.2. The equivalent taxable yield is: %/(1 = %3. (a) Writing a call entails unlimited potential losses as the stock price rises.4. a. The taxable bond. With a zero tax bracket, the after-tax yield for thetaxable bond is the same as the before-tax yield (5%), which is greater than the yield on the municipal bond.b. The taxable bond. The after-tax yield for the taxable bond is:0.05 (1 – = %c. You are indifferent. The after-tax yield for the taxable bond is:(1 – = %The after-tax yield is the same as that of the municipal bond.d. The municipal bond offers the higher after-tax yield for investors in tax brackets above 20%.5.If the after-tax yields are equal, then: = × (1 –t)This implies that t = =30%.。

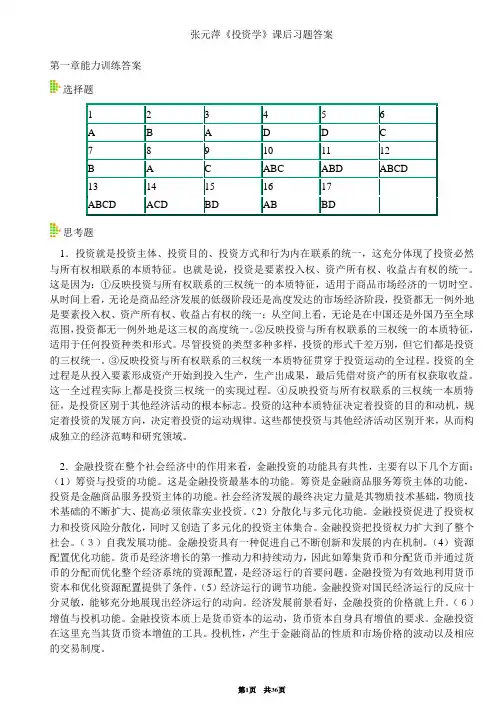

张元萍《投资学》课后习题答案第一章能力训练答案选择题思考题1.投资就是投资主体、投资目的、投资方式和行为内在联系的统一,这充分体现了投资必然与所有权相联系的本质特征。

也就是说,投资是要素投入权、资产所有权、收益占有权的统一。

这是因为:①反映投资与所有权联系的三权统一的本质特征,适用于商品市场经济的一切时空。

从时间上看,无论是商品经济发展的低级阶段还是高度发达的市场经济阶段,投资都无一例外地是要素投入权、资产所有权、收益占有权的统一;从空间上看,无论是在中国还是外国乃至全球范围,投资都无一例外地是这三权的高度统一。

②反映投资与所有权联系的三权统一的本质特征,适用于任何投资种类和形式。

尽管投资的类型多种多样,投资的形式千差万别,但它们都是投资的三权统一。

③反映投资与所有权联系的三权统一本质特征贯穿于投资运动的全过程。

投资的全过程是从投入要素形成资产开始到投入生产,生产出成果,最后凭借对资产的所有权获取收益。

这一全过程实际上都是投资三权统一的实现过程。

④反映投资与所有权联系的三权统一本质特征,是投资区别于其他经济活动的根本标志。

投资的这种本质特征决定着投资的目的和动机,规定着投资的发展方向,决定着投资的运动规律。

这些都使投资与其他经济活动区别开来,从而构成独立的经济范畴和研究领域。

2.金融投资在整个社会经济中的作用来看,金融投资的功能具有共性,主要有以下几个方面:(1)筹资与投资的功能。

这是金融投资最基本的功能。

筹资是金融商品服务筹资主体的功能,投资是金融商品服务投资主体的功能。

社会经济发展的最终决定力量是其物质技术基础,物质技术基础的不断扩大、提高必须依靠实业投资。

(2)分散化与多元化功能。

金融投资促进了投资权力和投资风险分散化,同时又创造了多元化的投资主体集合。

金融投资把投资权力扩大到了整个社会。

(3)自我发展功能。

金融投资具有一种促进自己不断创新和发展的内在机制。

(4)资源配置优化功能。

货币是经济增长的第一推动力和持续动力,因此如筹集货币和分配货币并通过货币的分配而优化整个经济系统的资源配置,是经济运行的首要问题。

CHAPTER 10: ARBITRAGE PRICING THEORY ANDMULTIFACTOR MODELS OF RISK AND RETURN PROBLEM SETS1. The revised estimate of the expected rate of return on the stock would be the oldestimate plus the sum of the products of the unexpected change in each factor times the respective sensitivity coefficient:Revised estimate = 12% + [(1 × 2%) + (0.5 × 3%)] = 15.5%Note that the IP estimate is computed as: 1 × (5% - 3%), and the IR estimate iscomputed as: 0.5 × (8% - 5%).2. The APT factors must correlate with major sources of uncertainty, i.e., sources ofuncertainty that are of concern to many investors. Researchers should investigatefactors that correlate with uncertainty in consumption and investment opportunities.GDP, the inflation rate, and interest rates are among the factors that can be expected to determine risk premiums. In particular, industrial production (IP) is a goodindicator of changes in the business cycle. Thus, IP is a candidate for a factor that is highly correlated with uncertainties that have to do with investment andconsumption opportunities in the economy.3. Any pattern of returns can be explained if we are free to choose an indefinitelylarge number of explanatory factors. If a theory of asset pricing is to have value, itmust explain returns using a reasonably limited number of explanatory variables(i.e., systematic factors such as unemployment levels, GDP, and oil prices).4. Equation 10.11 applies here:E(r p) = r f + βP1 [E(r1 ) −r f ] + βP2 [E(r2 ) – r f]We need to find the risk premium (RP) for each of the two factors:RP1 = [E(r1 ) −r f] and RP2 = [E(r2 ) −r f]In order to do so, we solve the following system of two equations with two unknowns: .31 = .06 + (1.5 ×RP1 ) + (2.0 ×RP2 ).27 = .06 + (2.2 ×RP1 ) + [(–0.2) ×RP2 ]The solution to this set of equations isRP1 = 10% and RP2 = 5%Thus, the expected return-beta relationship isE(r P) = 6% + (βP1× 10%) + (βP2× 5%)5. The expected return for portfolio F equals the risk-free rate since its beta equals 0.For portfolio A, the ratio of risk premium to beta is (12 − 6)/1.2 = 5For portfolio E, the ratio is lower at (8 – 6)/0.6 = 3.33This implies that an arbitrage opportunity exists. For instance, you can create aportfolio G with beta equal to 0.6 (the same as E’s) by combining portfolio A and portfolio F in equal weights. The expected return and beta for portfolio G are then: E(r G) = (0.5 × 12%) + (0.5 × 6%) = 9%βG = (0.5 × 1.2) + (0.5 × 0%) = 0.6Comparing portfolio G to portfolio E, G has the same beta and higher return.Therefore, an arbitrage opportunity exists by buying portfolio G and selling anequal amount of portfolio E. The profit for this arbitrage will ber G – r E =[9% + (0.6 ×F)] − [8% + (0.6 ×F)] = 1%That is, 1% of the funds (long or short) in each portfolio.6. Substituting the portfolio returns and betas in the expected return-beta relationship,we obtain two equations with two unknowns, the risk-free rate (r f) and the factor risk premium (RP):12% = r f + (1.2 ×RP)9% = r f + (0.8 ×RP)Solving these equations, we obtainr f = 3% and RP = 7.5%7. a. Shorting an equally weighted portfolio of the ten negative-alpha stocks andinvesting the proceeds in an equally-weighted portfolio of the 10 positive-alpha stocks eliminates the market exposure and creates a zero-investmentportfolio. Denoting the systematic market factor as R M, the expected dollarreturn is (noting that the expectation of nonsystematic risk, e, is zero):$1,000,000 × [0.02 + (1.0 ×R M)] − $1,000,000 × [(–0.02) + (1.0 ×R M)]= $1,000,000 × 0.04 = $40,000The sensitivity of the payoff of this portfolio to the market factor is zerobecause the exposures of the positive alpha and negative alpha stocks cancelout. (Notice that the terms involving R M sum to zero.) Thus, the systematiccomponent of total risk is also zero. The variance of the analyst’s profit is notzero, however, since this portfolio is not well diversified.For n = 20 stocks (i.e., long 10 stocks and short 10 stocks) the investor willhave a $100,000 position (either long or short) in each stock. Net marketexposure is zero, but firm-specific risk has not been fully diversified. Thevariance of dollar returns from the positions in the 20 stocks is20 × [(100,000 × 0.30)2] = 18,000,000,000The standard deviation of dollar returns is $134,164.b. If n = 50 stocks (25 stocks long and 25 stocks short), the investor will have a$40,000 position in each stock, and the variance of dollar returns is50 × [(40,000 × 0.30)2] = 7,200,000,000The standard deviation of dollar returns is $84,853.Similarly, if n = 100 stocks (50 stocks long and 50 stocks short), the investorwill have a $20,000 position in each stock, and the variance of dollar returns is100 × [(20,000 × 0.30)2] = 3,600,000,000The standard deviation of dollar returns is $60,000.Notice that, when the number of stocks increases by a factor of 5 (i.e., from 20 to 100), standard deviation decreases by a factor of 5= 2.23607 (from$134,164 to $60,000).8. a. )(σσβσ2222e M +=88125)208.0(σ2222=+×=A50010)200.1(σ2222=+×=B97620)202.1(σ2222=+×=Cb. If there are an infinite number of assets with identical characteristics, then awell-diversified portfolio of each type will have only systematic risk since thenonsystematic risk will approach zero with large n. Each variance is simply β2 × market variance:222Well-diversified σ256Well-diversified σ400Well-diversified σ576A B C;;;The mean will equal that of the individual (identical) stocks.c. There is no arbitrage opportunity because the well-diversified portfolios allplot on the security market line (SML). Because they are fairly priced, there isno arbitrage.9. a. A long position in a portfolio (P) composed of portfolios A and B will offer anexpected return-beta trade-off lying on a straight line between points A and B.Therefore, we can choose weights such that βP = βC but with expected returnhigher than that of portfolio C. Hence, combining P with a short position in Cwill create an arbitrage portfolio with zero investment, zero beta, and positiverate of return.b. The argument in part (a) leads to the proposition that the coefficient of β2must be zero in order to preclude arbitrage opportunities.10. a. E(r) = 6% + (1.2 × 6%) + (0.5 × 8%) + (0.3 × 3%) = 18.1%b.Surprises in the macroeconomic factors will result in surprises in the return ofthe stock:Unexpected return from macro factors =[1.2 × (4% – 5%)] + [0.5 × (6% – 3%)] + [0.3 × (0% – 2%)] = –0.3%E(r) =18.1% − 0.3% = 17.8%11. The APT required (i.e., equilibrium) rate of return on the stock based on r f and thefactor betas isRequired E(r) = 6% + (1 × 6%) + (0.5 × 2%) + (0.75 × 4%) = 16% According to the equation for the return on the stock, the actually expected return on the stock is 15% (because the expected surprises on all factors are zero bydefinition). Because the actually expected return based on risk is less than theequilibrium return, we conclude that the stock is overpriced.12. The first two factors seem promising with respect to the likely impact on the firm’scost of capital. Both are macro factors that would elicit hedging demands acrossbroad sectors of investors. The third factor, while important to Pork Products, is a poor choice for a multifactor SML because the price of hogs is of minor importance to most investors and is therefore highly unlikely to be a priced risk factor. Betterchoices would focus on variables that investors in aggregate might find moreimportant to their welfare. Examples include: inflation uncertainty, short-terminterest-rate risk, energy price risk, or exchange rate risk. The important point here is that, in specifying a multifactor SML, we not confuse risk factors that are important toa particular investor with factors that are important to investors in general; only the latter are likely to command a risk premium in the capital markets.13. The formula is ()0.04 1.250.08 1.50.02.1717%E r =+×+×==14. If 4%f r = and based on the sensitivities to real GDP (0.75) and inflation (1.25),McCracken would calculate the expected return for the Orb Large Cap Fund to be:()0.040.750.08 1.250.02.040.0858.5% above the risk free rate E r =+×+×=+=Therefore, Kwon’s fundamental analysis estimate is congruent with McCracken’sAPT estimate. If we assume that both Kwon and McCracken’s estimates on the return of Orb’s Large Cap Fund are accurate, then no arbitrage profit is possible.15. In order to eliminate inflation, the following three equations must be solvedsimultaneously, where the GDP sensitivity will equal 1 in the first equation,inflation sensitivity will equal 0 in the second equation and the sum of the weights must equal 1 in the third equation.1.1.250.75 1.012.1.5 1.25 2.003.1wx wy wz wz wy wz wx wy wz ++=++=++=Here, x represents Orb’s High Growth Fund, y represents Large Cap Fund and z represents Utility Fund. Using algebraic manipulation will yield wx = wy = 1.6 and wz = -2.2.16. Since retirees living off a steady income would be hurt by inflation, this portfoliowould not be appropriate for them. Retirees would want a portfolio with a return positively correlated with inflation to preserve value, and less correlated with the variable growth of GDP. Thus, Stiles is wrong. McCracken is correct in that supply side macroeconomic policies are generally designed to increase output at aminimum of inflationary pressure. Increased output would mean higher GDP, which in turn would increase returns of a fund positively correlated with GDP.17. The maximum residual variance is tied to the number of securities (n ) in theportfolio because, as we increase the number of securities, we are more likely to encounter securities with larger residual variances. The starting point is todetermine the practical limit on the portfolio residual standard deviation, σ(e P ), that still qualifies as a well-diversified portfolio. A reasonable approach is to compareσ2(e P) to the market variance, or equivalently, to compare σ(e P) to the market standard deviation. Suppose we do not allow σ(e P) to exceed pσM, where p is a small decimal fraction, for example, 0.05; then, the smaller the value we choose for p, the more stringent our criterion for defining how diversified a well-diversified portfolio must be.Now construct a portfolio of n securities with weights w1, w2,…,w n, so that Σw i =1. The portfolio residual variance is σ2(e P) = Σw12σ2(e i)To meet our practical definition of sufficiently diversified, we require this residual variance to be less than (pσM)2. A sure and simple way to proceed is to assume the worst, that is, assume that the residual variance of each security is the highest possible value allowed under the assumptions of the problem: σ2(e i) = nσ2MIn that case σ2(e P) = Σw i2 nσM2Now apply the constraint: Σw i2 nσM2 ≤ (pσM)2This requires that: nΣw i2 ≤ p2Or, equivalently, that: Σw i2 ≤ p2/nA relatively easy way to generate a set of well-diversified portfolios is to use portfolio weights that follow a geometric progression, since the computations then become relatively straightforward. Choose w1 and a common factor q for the geometric progression such that q < 1. Therefore, the weight on each stock is a fraction q of the weight on the previous stock in the series. Then the sum of n terms is:Σw i= w1(1– q n)/(1– q) = 1or: w1 = (1– q)/(1– q n)The sum of the n squared weights is similarly obtained from w12 and a common geometric progression factor of q2. ThereforeΣw i2 = w12(1– q2n)/(1– q 2)Substituting for w1 from above, we obtainΣw i2 = [(1– q)2/(1– q n)2] × [(1– q2n)/(1– q 2)]For sufficient diversification, we choose q so that Σw i2 ≤ p2/nFor example, continue to assume that p = 0.05 and n = 1,000. If we chooseq = 0.9973, then we will satisfy the required condition. At this value for q w1 = 0.0029 and w n = 0.0029 × 0.99731,000In this case, w1 is about 15 times w n. Despite this significant departure from equal weighting, this portfolio is nevertheless well diversified. Any value of q between0.9973 and 1.0 results in a well-diversified portfolio. As q gets closer to 1, theportfolio approaches equal weighting.18. a. Assume a single-factor economy, with a factor risk premium E M and a (large)set of well-diversified portfolios with beta βP. Suppose we create a portfolio Zby allocating the portion w to portfolio P and (1 – w) to the market portfolioM. The rate of return on portfolio Z is:R Z = (w × R P) + [(1 – w) × R M]Portfolio Z is riskless if we choose w so that βZ = 0. This requires that:βZ = (w × βP) + [(1 – w) × 1] = 0 ⇒w = 1/(1 – βP) and (1 – w) = –βP/(1 – βP)Substitute this value for w in the expression for R Z:R Z = {[1/(1 – βP)] × R P} – {[βP/(1 – βP)] × R M}Since βZ = 0, then, in order to avoid arbitrage, R Z must be zero.This implies that: R P = βP × R MTaking expectations we have:E P = βP × E MThis is the SML for well-diversified portfolios.b. The same argument can be used to show that, in a three-factor model withfactor risk premiums E M, E1 and E2, in order to avoid arbitrage, we must have:E P = (βPM × E M) + (βP1 × E1) + (βP2 × E2)This is the SML for a three-factor economy.19. a. The Fama-French (FF) three-factor model holds that one of the factors drivingreturns is firm size. An index with returns highly correlated with firm size (i.e.,firm capitalization) that captures this factor is SMB (small minus big), thereturn for a portfolio of small stocks in excess of the return for a portfolio oflarge stocks. The returns for a small firm will be positively correlated withSMB. Moreover, the smaller the firm, the greater its residual from the othertwo factors, the market portfolio and the HML portfolio, which is the returnfor a portfolio of high book-to-market stocks in excess of the return for aportfolio of low book-to-market stocks. Hence, the ratio of the variance of thisresidual to the variance of the return on SMB will be larger and, together withthe higher correlation, results in a high beta on the SMB factor.b.This question appears to point to a flaw in the FF model. The model predictsthat firm size affects average returns so that, if two firms merge into a largerfirm, then the FF model predicts lower average returns for the merged firm.However, there seems to be no reason for the merged firm to underperformthe returns of the component companies, assuming that the component firmswere unrelated and that they will now be operated independently. We mighttherefore expect that the performance of the merged firm would be the sameas the performance of a portfolio of the originally independent firms, but theFF model predicts that the increased firm size will result in lower averagereturns. Therefore, the question revolves around the behavior of returns for aportfolio of small firms, compared to the return for larger firms that resultfrom merging those small firms into larger ones. Had past mergers of smallfirms into larger firms resulted, on average, in no change in the resultantlarger firms’ stock return characteristics (compared to the portfolio of stocksof the merged firms), the size factor in the FF model would have failed.Perhaps the reason the size factor seems to help explain stock returns is that,when small firms become large, the characteristics of their fortunes (andhence their stock returns) change in a significant way. Put differently, stocksof large firms that result from a merger of smaller firms appear empirically tobehave differently from portfolios of the smaller component firms.Specifically, the FF model predicts that the large firm will have a smaller riskpremium. Notice that this development is not necessarily a bad thing for thestockholders of the smaller firms that merge. The lower risk premium may bedue, in part, to the increase in value of the larger firm relative to the mergedfirms.CFA PROBLEMS1. a. This statement is incorrect. The CAPM requires a mean-variance efficientmarket portfolio, but APT does not.b.This statement is incorrect. The CAPM assumes normally distributed securityreturns, but APT does not.c. This statement is correct.2. b. Since portfolio X has β = 1.0, then X is the market portfolio and E(R M) =16%.Using E(R M ) = 16% and r f = 8%, the expected return for portfolio Y is notconsistent.3. d.4. c.5. d.6. c. Investors will take on as large a position as possible only if the mispricingopportunity is an arbitrage. Otherwise, considerations of risk anddiversification will limit the position they attempt to take in the mispricedsecurity.7. d.8. d.。

投资学课后习题及答案投资学课后习题及答案投资学练习导论习题1证券投资是指投资者购买_______、________、________等有价证券以及这些有价证券的_______以获取________、_________及________的投资行为和投资过程,是直接投资的重要形式。

(填空)2 ____是投资者为实现投资目标所遵循的基本方针和基本准则。

(单选) A证券投资政策 B证券投资分析 C证券投组合 D评估证券投资组合的业绩3 一般来说,证券投资与投机的区别主要可以从________等不同角度进行分析。

(多选) A 动机 B对证券所作的分析方法 C投资期限 D投资对象E风险倾向4在证券市场中,难免出现投机行为,有投资就必然有投机。

适度的投机有利于证券市场发展(判断)第一至第四章习题1在股份有限公司利润增长时,参与优先股股东除了按固定股息率取得股息外,还可以分得___________。

(填空)2 累积优先股是一种常见的、发行很广泛的优先股股票。

其特点是股息率______,而且可以 ________计算。

(填空)3________不是优先股的特征之一。

(单选)A约定股息率 B股票可由公司赎回 C具有表决权 D优先分派股息和清偿剩余资产。

4 股份有限公司最初发行的大多是_____,通过这类股票所筹集的资金通常是股份有限公司股本的基础。

(单选) A特别股 B优先股 CB股 D普通股5 当公司前景和股市行情看好、盈利增加时,可转换优先股股东的最佳策略是_______ 。

(单选)A转换成参与优先股 B转换成公司债券 C转换成普通股 D转换成累积优先股6 下列外资股中,不属于境外上市外资股的是________。

(单选)A H股 BN股 CB股 DS股7 股份制就是以股份公司为核心,以股票发行为基础,以股票交易为依托。

(判断) 8 可赎回优先股是指允许拥有该股票的股东在一个合理的价格范围内将资金赎回。

(判断) 9________是指在管理层和股东之间发生冲突的可能性,它是由管理层在利益回报方面的控制以及管理人员的低效业绩所产生的问题。

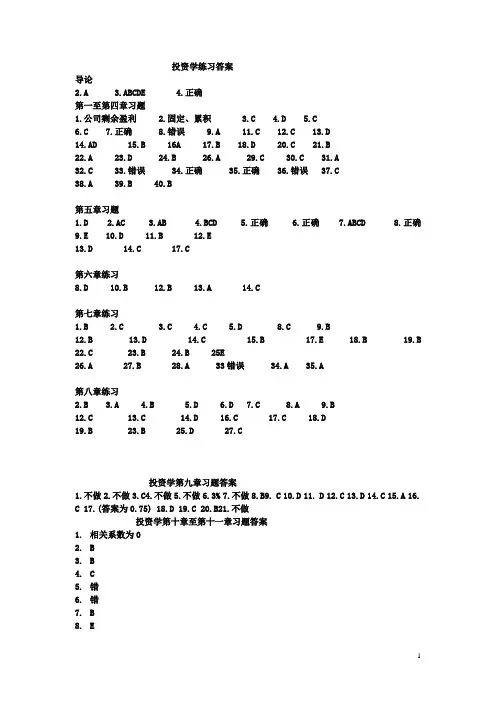

投资学练习答案导论2.A3.ABCDE4.正确第一至第四章习题1.公司剩余盈利2.固定、累积3.C4.D5.C6.C7.正确8.错误9.A 11.C 12.C 13.D14.AD 15.B 16A 17.B 18.D 20.C 21.B22.A 23.D 24.B 26.A 29.C 30.C 31.A32.C 33.错误 34.正确 35.正确 36.错误 37.C38.A 39.B 40.B第五章习题1.D2.AC3.AB4.BCD5.正确6.正确7.ABCD8.正确9.E 10.D 11.B 12.E13.D 14.C 17.C第六章练习8.D 10.B 12.B 13.A 14.C第七章练习1.B2.C3.C4.C5.D 8.C 9.B12.B 13.D 14.C 15.B 17.E 18.B 19.B 22.C 23.B 24.B 25E26.A 27.B 28.A 33错误 34.A 35.A第八章练习2.B3.A4.B5.D6.D7.C8.A9.B12.C 13.C 14.D 16.C 17.C 18.D19.B 23.B 25.D 27.C投资学第九章习题答案1.不做2.不做3.C4.不做5.不做6.3%7.不做8.B9. C 10.D 11. D 12.C 13.D 14.C 15.A 16.C 17.(答案为0.75) 18.D 19.C 20.B21.不做投资学第十章至第十一章习题答案1.相关系数为02. B3. B4. C5.错6.错7. B8. E9. A10.对11.D投资学第十二章至第十三章习题答案1.不做2.高于票面值因为10%大于8%3.具体看课本公式(老师只是讲公式没有给出确切得答案)4.贴现贴现率5.反方向6.C7.C8.对9.对10.不做11.折价平价溢价12.不做13.不做14.不做15.A16.C17.C18.具体看书本323页19.具体看课本325页20.看课本319至32021.不做22.不做第十四章至十五章习题答案1.先行同步滞后2.不做3.开拓拓展成熟衰落4.资产负责表损益表现金流量表5. C6.宏观分析行业分析公司分析7. A8. B9. A10.D11.D12.A13.A14.对15.对十七章注意事项: 注意技术分析得三大假设假设1. 市场行为涵盖一切信息假设2.价格沿趋势运动假设3.历史会重演。

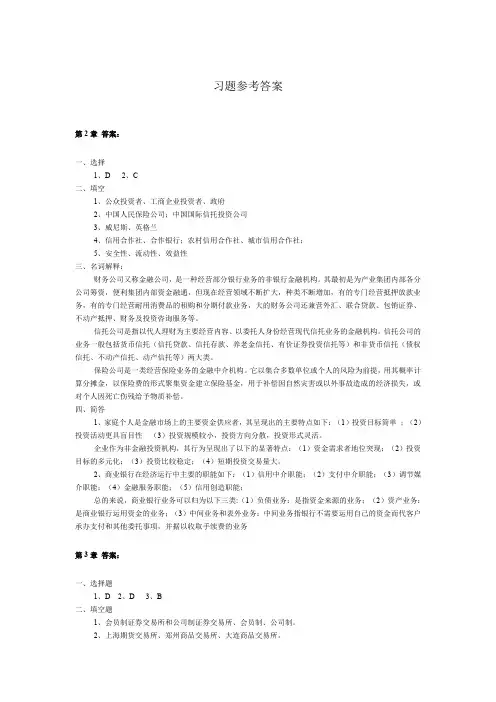

习题参考答案第2章答案:一、选择1、D2、C二、填空1、公众投资者、工商企业投资者、政府2、中国人民保险公司;中国国际信托投资公司3、威尼斯、英格兰4、信用合作社、合作银行;农村信用合作社、城市信用合作社;5、安全性、流动性、效益性三、名词解释:财务公司又称金融公司,是一种经营部分银行业务的非银行金融机构。

其最初是为产业集团内部各分公司筹资,便利集团内部资金融通,但现在经营领域不断扩大,种类不断增加,有的专门经营抵押放款业务,有的专门经营耐用消费品的租购和分期付款业务,大的财务公司还兼营外汇、联合贷款、包销证券、不动产抵押、财务及投资咨询服务等。

信托公司是指以代人理财为主要经营内容、以委托人身份经营现代信托业务的金融机构。

信托公司的业务一般包括货币信托(信托贷款、信托存款、养老金信托、有价证券投资信托等)和非货币信托(债权信托、不动产信托、动产信托等)两大类。

保险公司是一类经营保险业务的金融中介机构。

它以集合多数单位或个人的风险为前提,用其概率计算分摊金,以保险费的形式聚集资金建立保险基金,用于补偿因自然灾害或以外事故造成的经济损失,或对个人因死亡伤残给予物质补偿。

四、简答1、家庭个人是金融市场上的主要资金供应者,其呈现出的主要特点如下:(1)投资目标简单;(2)投资活动更具盲目性(3)投资规模较小,投资方向分散,投资形式灵活。

企业作为非金融投资机构,其行为呈现出了以下的显著特点:(1)资金需求者地位突现;(2)投资目标的多元化;(3)投资比较稳定;(4)短期投资交易量大。

2、商业银行在经济运行中主要的职能如下:(1)信用中介职能;(2)支付中介职能;(3)调节媒介职能;(4)金融服务职能;(5)信用创造职能;总的来说,商业银行业务可以归为以下三类:(1)负债业务:是指资金来源的业务;(2)资产业务:是商业银行运用资金的业务;(3)中间业务和表外业务:中间业务指银行不需要运用自己的资金而代客户承办支付和其他委托事项,并据以收取手续费的业务第3章答案:一、选择题1、D2、D3、B二、填空题1、会员制证券交易所和公司制证券交易所、会员制、公司制。

习题参考答案第2章答案:一、选择1、D2、C二、填空1、公众投资者、工商企业投资者、政府2、中国人民保险公司;中国国际信托投资公司3、威尼斯、英格兰4、信用合作社、合作银行;农村信用合作社、城市信用合作社;5、安全性、流动性、效益性三、名词解释:财务公司又称金融公司,是一种经营部分银行业务的非银行金融机构。

其最初是为产业集团内部各分公司筹资,便利集团内部资金融通,但现在经营领域不断扩大,种类不断增加,有的专门经营抵押放款业务,有的专门经营耐用消费品的租购和分期付款业务,大的财务公司还兼营外汇、联合贷款、包销证券、不动产抵押、财务及投资咨询服务等。

信托公司是指以代人理财为主要经营内容、以委托人身份经营现代信托业务的金融机构。

信托公司的业务一般包括货币信托(信托贷款、信托存款、养老金信托、有价证券投资信托等)和非货币信托(债权信托、不动产信托、动产信托等)两大类。

保险公司是一类经营保险业务的金融中介机构。

它以集合多数单位或个人的风险为前提,用其概率计算分摊金,以保险费的形式聚集资金建立保险基金,用于补偿因自然灾害或以外事故造成的经济损失,或对个人因死亡伤残给予物质补偿。

四、简答1、家庭个人是金融市场上的主要资金供应者,其呈现出的主要特点如下:(1)投资目标简单;(2)投资活动更具盲目性(3)投资规模较小,投资方向分散,投资形式灵活。

企业作为非金融投资机构,其行为呈现出了以下的显著特点:(1)资金需求者地位突现;(2)投资目标的多元化;(3)投资比较稳定;(4)短期投资交易量大。

2、商业银行在经济运行中主要的职能如下:(1)信用中介职能;(2)支付中介职能;(3)调节媒介职能;(4)金融服务职能;(5)信用创造职能;总的来说,商业银行业务可以归为以下三类:(1)负债业务:是指资金来源的业务;(2)资产业务:是商业银行运用资金的业务;(3)中间业务和表外业务:中间业务指银行不需要运用自己的资金而代客户承办支付和其他委托事项,并据以收取手续费的业务第3章答案:一、选择题1、D2、D3、B二、填空题1、会员制证券交易所和公司制证券交易所、会员制、公司制。

第12章习题及答案1.权益证券估值内在价值估值方法都有哪些?这些估值方法具体有何特点?2.如何从企业现金流分配的角度理解现金流贴现模型的不同?3.如何计算公司的WACC?试选择我国A股市场一家上市公司进行计算?4.如何理解及经济附加值模型?试选择我国A股市场一家上市公司进行计算?5.市盈率模型与市净率模型有何不同?6.如何根据周期变化进行资产配置?7.价值型投资策略和增长型投资策略有何不同?参考答案:1.权益证券估值内在价值法主要有(1)股票贴现模型,包括零增长股息贴现模型、固定增长的股息贴现模型、三阶段股利增长模型,多元条件下的股利增长模型;其特点是假设投资者在正常条件下只获得股利这一现金流,通过对这些现金流进行贴现,从而计算公司内在价值;(2)自由现金流贴现法,它通过把公司未来所能产生的所有的现金流进行贴现求和得股票的内在价值的方法。

(3)超额收益贴现模型是刚刚流行不久的一种股价估值方法,主要包括经济附加值模型和剩余收益模型,主要他们都利用公司的税后利润来进行扣除资本成本等费用,最后得到股东权益的方法。

2.(1)公司自由现金流(free cash flow of firm,FCFF)是公司支付了所有营运费用、进行了必需的固定资产与营运资产投资后可以向所有的投资者分派的税后现金流。

它运用加权平均资本成本对公司自由现金流进行贴现来获得公司的价值,然后减去那时的债务来得到权益的价值。

FCFF贴现模型认为,公司的价值等于公司预期现金流按公司资本进行折现,将预期的未来自由现金流用加权平均资本成本折现到当前价值来假设公司价值,然后减去债券的价值进而得到股权的价值(2)股权自由现金流(free cash flow of equity,FCFE)是在公司扣除投资、营运资金和负债融资成本之后可以被股东利用的现金流,它是公司支付所有营运的费用、再投资支出、所得税和净债务支付(即利息、本金支付减去发行债务的净额)后可分配给公司股东的剩余现金流。

《证券投资学》课后练习题10《证券投资学》课后练习题第十章技术指标一、选择题1.下列对技术指标的说法不正确的是( C ) A.每种技术指标都有自己的适用范围 B.每种技术指标都有失效的时候 C.技术指标只重视股价D.应用技术指标时应多使用几个技术指标进行判断 2.移动平均线最常见的使用法则是( B ) A.威廉法则 B.格蓝碧法则 C.夏普法则D.艾略特法则3.技术分析指标MACD是由异同平均数和正负差两部分组成,其核心是( C )A.DEAB.EMAC.DIFD.EMA和DEA 4.下列对MACD的说法中正确的是( B ) A.MACD由MA和DIF两部分构成B.在市场没有明显趋势时,失误的几率更高C.计算是引入单日的开盘价和收盘价D.使用MACD指标时更多的是看柱状的颜色和长短 5.MACD指标出现顶背离时应( B ) A.买入 B.卖出C.观望D.无参考价值6.以一特定时期内股价的变动情况推测价格未来的变动方向,并根据股价涨跌幅度显示市场的涨跌波动强弱的指标是( C ) A.PSY B.BIASC.RSID.WMS%7.下列对相对强弱指标的说法中错误的是( D ) A.RSI可依形态理论作为买卖信号的判断标准B.通常RSI取值在80以上为超买而在20以下为超卖C.RSI与股价的背离情况是买卖信号的判断标准 D.短期RSI大于长期RSI属空头市场8.表示市场处于超买还是超卖状态的技术指标是( D ) A.PSY B.BIASC.RSID.WMS%9.若某股票三天内的股价情况如下表所示:(单位:元)星期一星期二星期三开盘价 11.35 11.20 11.50 最高价 12.45 12.0012.40 最低价 10.45 10.50 10.95 收盘价 11.20 11.50 12.05则星期三的3日WMS%值是:( C ) A.10% B.20% C.80%D.40%10.当WMS%高于80时,市场处于( A )状态 A.超买B.超卖C.公司盈利丰厚D.人气旺盛1《证券投资学》课后练习题11.KDJ指标的计算公式考虑了哪些因素( D ) A.开盘价,收盘价 B.最高价,最低价C.开盘价,最高价,最低价D.收盘价,最高价,最低价12.某股上升行情中,KD指标的快线倾斜度趋于平缓,出现这种情况,则股价( B ) A.需要调整B.是短期转势的警告信号C.要看慢线的位置D.不说明问题13.下面指标中,根据其计算方法,理论上所给出买、卖信号最可靠的是( D )A.MAB.MACDC.WMS%D.KDJ14.OBV线表明了量与价的关系,最好的买入机会是( A ) A.OBV线上升,此时股价下跌 B.OBV线下降,此时股价上升 C.OBV线从正的累积数转为负数D.OBV线与股价都急速上升15.一般地讲,在证券分析使用的技术指标中,OBV指标侧重反映( B ) A.股价变化 B.成交量变化 C.市场人气变化D.市场指数变化16.( A )是分析趋势的,它利用简单的加减法计算每天股票上涨家数和下降家数的累积结果,与综合指数相互对比,对大势的未来进行预测。

CHAPTER 12: BEHAVIORAL FINANCEAND TECHNICAL ANALYSISPROBLEM SETS1. Technical analysis can generally be viewed as a search for trendsor patterns in market prices. Technical analysts tend to viewthese trends as momentum, or gradual adjustments to ‘correct’prices, or, alternatively, reversals of trends. A number of thebehavioral biases discussed in the chapter might contribute tosuch trends and patterns. For example, a conservatism bias mightcontribute to a trend in prices as investors gradually take newinformation into account, resulting in gradual adjustment ofprices towards their fundamental values. Another example derivesfrom the concept of representativeness, which leads investors toinappropriately conclude, on the basis of a small sample of data, that a pattern has been established that will continue well intothe future. When investors subsequently become aware of the factthat prices have overreacted, corrections reverse the initialerroneous trend.2. Even if many investors exhibit behavioral biases, security pricesmight still be set efficiently if the actions of arbitrageurs move prices to their intrinsic values. Arbitrageurs who observemispricing in the securities markets would buy underpricedsecurities (or possibly sell short overpriced securities) in order to profit from the anticipated subsequent changes as prices move to their intrinsic values. Consequently, securities prices would still exhibit the characteristics of an efficient market.3. One of the major factors limiting the ability of rational investorsto take advantage of any ‘pricing errors’ that result from theactions of behavioral investors is the fact that a mispricing can get worse over time. An example of this fundamental risk is theapparent ongoing overpricing of the NASDAQ index in the late 1990s.Related factors are the inherent costs and limits related to short selling, which restrict the extent to which arbitrage can forceoverpriced securities (or indexes) to move towards their fair values. Rational investors must also be aware of the risk that an apparent mispricing is, in fact, a consequence of model risk; that is, the perceived mispricing may not be real because the investor has used a faulty model to value the security.4. There are two reasons why behavioral biases might not affectequilibrium asset prices: first, behavioral biases might contribute to the success of technical trading rules as prices graduallyadjust towards their intrinsic values, and second, the actions of arbitrageurs might move security prices towards their intrinsicvalues. It might be important for investors to be aware of thesebiases because either of these scenarios might create the potential for excess profits even if behavioral biases do not affectequilibrium prices.In addition, an investor should be aware of his personal behavioral biases, even if those biases do not affect equilibrium prices, to help avoid some of these information processing errors (e.g.overconfidence or representativeness).5. Efficient market advocates believe that publicly availableinformation (and, for advocates of strong-form efficiency, eveninsider information) is, at any point in time, reflected insecurities prices, and that price adjustments to new informationoccur very quickly. Consequently, prices are at fair levels so that active management is very unlikely to improve performance abovethat of a broadly diversified index portfolio. In contrast,advocates of behavioral finance identify a number of investorerrors in information processing and decision making that couldresult in mispricing of securities. However, the behavioral finance literature generally does not provide guidance as to how theseinvestor errors can be exploited to generate excess profits.Therefore, in the absence of any profitable alternatives, even if securities markets are not efficient, the optimal strategy mightstill be a passive indexing strategy.6. a. Davis uses loss aversion as the basis for her decision making.She holds on to stocks that are down from the purchase price in the hopes that they will recover. She is reluctant to accept a loss.7. a. Shrum refuses to follow a stock after she sells it because shedoes not want to experience the regret of seeing it rise. Thebehavioral characteristic used for the basis for her decisionmaking is the fear of regret.8. a. Investors attempt to avoid regret by holding on to losers hopingthe stocks will rebound. If the stock rebounds to its originalpurchase price, the stock can be sold with no regret. Investorsalso may try to avoid regret by distancing themselves from theirdecisions by hiring a full-service broker.9. a. ivb. iiic. vd. ie. ii10. Underlying risks still exist even during a mispricing event. Themarket mispricing could get worse before it gets better. Otheradverse effects could occur before the price corrects itself (e.g., loss of clients with no understanding or appetite for mispricing opportunities).11. Data mining is the process by which patterns are pulled from data.Technical analysts must be careful not to engage in data mining as great is the human capacity to discern patterns where no patterns exist. Technical analysts must avoid mining data to support atheory rather than using data to test a theory.12. Even if prices follow a random walk, the existence of irrationalinvestors combined with the limits to arbitrage by arbitrageurs may allow persistent mispricings to be present. This implies thatcapital will not be allocated efficiently —capital does notimmediately flow from relatively unproductive firms to relatively productive firms.13. Trin =advancing Num ber /advancing V olum e declining Num ber /declining V olum e =This trin ratio, which is above 1.0, would be taken as a bearish signal.14. Breadth:Breadth is negative —bearish signal (no one would actually use a one-day measure).15. This exercise is left to the student; answers will vary, butsuccessful students should be able to identify time periods when upward or downward trends are obvious. This exercise also shows the benefit of hindsight, which investors do not possess whenmaking current decisions.16. The confidence index increases from (5%/6%) = 0.833 to (6%/7%)= 0.857.This indicates slightly higher confidence which would beinterpreted by technicians as a bullish signal. But the realreason for the increase in the index is the expectation ofhigher inflation, not higher confidence about the economy.17. At the beginning of the period, the price of Computers, Inc.divided by the industry index was 0.39; by the end of the period, the ratio had increased to 0.50. As the ratio increased over the period, it appears that Computers, Inc. outperformed other firms in its industry. The overall trend, therefore, indicates relativestrength, although some fluctuation existed during the period, with the ratio falling to a low point of 0.33 on day 19.18. Five day moving averages:Days 1 – 5: (19.63 + 20 + 20.5 + 22 + 21.13) / 5 = 20.65Days 2 – 6 = 21.13Days 3 – 7 = 21.50Days 4 – 8 = 21.90Days 5 – 9 = 22.13Days 6 – 10 = 22.68Days 7 – 11 = 23.18Days 8 – 12 = 23.45 Sell signal (day 12 price < movingaverage)Days 9 – 13 = 23.38Days 10 – 14 = 23.15AdvancesDeclinesNet Advances 1,455 1,553 -98Days 11 – 15 = 22.50Days 12 – 16 = 21.65Days 13 – 17 = 20.95Days 14 – 18 = 20.28Days 15 – 19 = 19.38Days 16 – 20 = 19.05Days 17 – 21 = 18.93Buy signal (day 21 price > movingaverage)Days 18 – 22 = 19.28Days 19 – 23 = 19.93Days 20 – 24 = 21.05Days 21 – 25 = 22.05Days 22 – 26 = 23.18Days 23 – 27 = 24.13Days 24 – 28 = 25.13Days 25 – 29 = 26.00Days 26 – 30 = 26.80Days 27 – 31 = 27.45Days 28 – 32 = 27.80Days 29 – 33 = 27.90Sell signal (day 33 price < movingaverage)Days 30 – 34 = 28.20Days 31 – 35 = 28.45Days 32 – 36 = 28.65Days 33 – 37 = 29.05Days 34 – 38 = 29.25Days 35 – 39 = 29.00Days 36 – 40 = 28.7519. This pattern shows a lack of breadth. Even though the index is up,more stocks declined than advanced, which indicates a “lack ofbroad-based support” for the rise in the index.20.Day Advances DeclinesNetAdvancesCumulativeBreadth1 906 704 202 2022 653 986 -333 -1313 721 789 - 68 -1994 503 968 -465 -6645 497 1,095 -598 -1,2626970 702 268 -994 71,002 609 393 -601 8903 722 181 -420 9850 748 102 -318 10 766 766 0 -318The signal is bearish as cumulative breadth is negative; however, the negative number is declining in magnitude, indicative of improvement. Perhaps the worst of the bear market has passed.21. Trin =936.0906/m illion 330704/m illion 240advancing Num ber /advancing V olum e declining Num ber /declining V olum e == This is a slightly bullish indicator, with average volume in advancing issues a bit greater than average volume in declining issues.22. Confidence Index =bonds corporate grade -te intermedia on Y ield bonds corporate rated -on top Y ield This year: Confidence index = (8%/10.5%) = 0.762Last year: Confidence index = (8.5%/10%) = 0.850Thus, the confidence index is decreasing.23. Note: In order to create the 26-week moving average for the S&P 500,we converted the weekly returns to weekly index values, with a base of 100 for the week prior to the first week of the data set. Thefollowing graph shows the S&P 500 values and the 26-week movingaverage, beginning with the 26th week of the data set.a. The graph summarizes the data for the 26-week moving average.The graph also shows the values of the S&P 500 index.b. The S&P 500 crosses through its moving average from below 14times, as indicated in the table below. The index increasesseven times in weeks following a cross-through and decreasesseven times.Date of Cross-ThroughDirection of S&P 500 in SubsequentWeek05/18/01 Decrease 06/08/01 Decrease 12/07/01 Decrease 12/21/01 Increase 03/01/02 Increase 11/22/02 Increase 01/03/03 Increase03/21/03 Decrease 04/17/03 Increase 06/10/04 Decrease 09/03/04 Increase 10/01/04 Decrease 10/29/04 Increase04/08/05 Decreasec. The S&P 500 crosses through its moving average from above 14times, as indicated in the table below. The index increases nine times in weeks following a cross-through and decreases five times.Date of Cross-Through Direction of S&P500 inSubsequent WeekDate ofCross-ThroughDirection of S&P500 in SubsequentWeek06/01/01 Increase 03/28/03 Increase06/15/01 Increase 04/30/04 Decrease12/14/01 Increase 07/02/04 Decrease02/08/02 Increase 09/24/04 Increase04/05/02 Decrease 10/15/04 Decrease12/13/02 Increase 03/24/05 Increase01/24/03 Decrease 04/15/05 Increased. When the index crosses through its moving average from below,as in part (b), this is regarded as a bullish signal. In oursample, the index is as likely to increase as it is todecrease following such a signal. When the index crossesthrough its moving average from above, as in part (c), this isregarded as a bearish signal. In our sample, contrary to thebearish signal, the index is actually more likely to increasethan it is to decrease following such a signal.24. In order to create the relative strength measure, we converted theweekly returns for the Fidelity Banking Fund and for the S&P 500 to weekly index values, using a base of 100 for the week prior to the first week of the data set. The first graph shows the resultingvalues, along with the relative strength measure (× 100). Thesecond graph shows the percentage change in the relative strength measure over five-week intervals.a. The following graph summarizes the relative strength data forthe fund.b. Over five-week intervals, relative strength increased by morethan 5% 29 times, as indicated in the table and graph below.The Fidelity Banking Fund underperformed the S&P 500 index 18 times and outperformed the S&P 500 index 11 times in weeksfollowing an increase of more than 5%.Date of IncreasePerformance ofBanking Fund inSubsequent WeekDate ofIncreasePerformance ofBanking Fund inSubsequent Week07/21/00 Outperformed 03/09/01 Outperformed 08/04/00 Outperformed 03/16/01 Underperformed 08/11/00 Underperformed 03/30/01 Underperformed 08/18/00 Outperformed 06/22/01 Underperformed 09/22/00 Outperformed 08/17/01 Underperformed 09/29/00 Underperformed 03/15/02 Outperformed 10/06/00 Underperformed 03/22/02 Underperformed 12/01/00 Underperformed 03/28/02 Outperformed 12/22/00 Underperformed 04/05/02 Outperformed 12/29/00 Outperformed 04/12/02 Underperformed 01/05/01 Underperformed 04/26/02 Outperformed 01/12/01 Underperformed 05/03/02 Underperformed 02/16/01 Underperformed 05/10/02 Underperformed 02/23/01 Outperformed 06/28/02 Underperformed 03/02/01 Underperformedc. Over five-week intervals, relative strength decreases by morethan 5% 15 times, as indicated in the graph above and table below. The Fidelity Banking Fund underperformed the S&P 500 index six times and outperformed the S&P 500 index nine times in weeks following a decrease of more than 5%.Date of DecreasePerformance ofBanking Fund inSubsequent WeekDate ofDecreasePerformance ofBanking Fund inSubsequent Week07/07/00 Underperformed 04/16/04 Underperformed07/14/00 Outperformed 04/23/04 Outperformed05/04/01 Underperformed 12/03/04 Outperformed05/11/01 Outperformed 12/10/04 Underperformed10/12/01 Outperformed 12/17/04 Outperformed11/02/01 Outperformed 12/23/04 Underperformed10/04/02 Outperformed 12/31/04 Underperformed10/11/02 Outperformedd. An increase in relative strength, as in part (b) above, isregarded as a bullish signal. However, in our sample, theFidelity Banking Fund is more likely to underperform the S&P 500 index than it is to outperform the index following such a signal.A decrease in relative strength, as in part (c), is regarded asa bearish signal. In our sample, contrary to the bearish signal,the Fidelity Banking Fund is actually more likely to outperformthe index increase than it is to underperform following such asignal.25. It has been shown that discrepancies of price from net asset value inclosed-end funds tend to be higher in funds that are more difficult to arbitrage such as less-diversified funds.CFA PROBLEMS1. i. Mental accounting is best illustrated by Statement #3.Sampson’s requirement that his income needs be met viainterest income and stock dividends is an example of mentalaccounting. Mental accounting holds that investors segregatefunds into mental accounts (e.g., dividends and capital gains),maintain a set of separate mental accounts, and do not combineoutcomes; a loss in one account is treated separately from aloss in another account. Mental accounting leads to an investorpreference for dividends over capital gains and to an inabilityor failure to consider total return.ii. Overconfidence(illusion of control) is best illustrated by Statement #6. Sampson’s desire to select investments that areinconsistent with his overall strategy indicatesoverconfidence. Overconfident individuals often exhibit risk-seeking behavior. People are also more confident in thevalidity of their conclusions than is justified by theirsuccess rate. Causes of overconfidence include the illusion ofcontrol, self-enhancement tendencies, insensitivity topredictive accuracy, and misconceptions of chance processes.iii. Reference dependence is best illustrated by Statement #5.Sampson’s desire to retain poor-performing investments and totake quick profits on successful investments suggests referencedependence. Reference dependence holds that investmentdecisions are critically dependent on the decision-maker’sreference point. In this case, the reference point is theoriginal purchase price. Alternatives are evaluated not interms of final outcomes but rather in terms of gains and lossesrelative to this reference point. Thus, preferences aresusceptible to manipulation simply by changing the referencepoint.2. a. Frost's statement is an example of reference dependence. Hisinclination to sell the international investments once pricesreturn to the original cost depends not only on the terminalwealth value, but also on where he is now, that is, hisreference point. This reference point, which is below theoriginal cost, has become a critical factor in Frost’sdecision.In standard finance, alternatives are evaluated in terms ofterminal wealth values or final outcomes, not in terms of gainsand losses relative to some reference point such as original cost.b. Frost’s statement is an example of susceptibility to cognitiveerror, in at least two ways. First, he is displaying thebehavioral flaw of overconfidence. He likely is more confidentabout the validity of his conclusion than is justified by hisrate of success. He is very confident that the past performanceof Country XYZ indicates future performance. Behavioralinvestors could, and often do, conclude that a five-year recordis ample evidence to suggest future performance. Second, bychoosing to invest in the securities of only Country XYZ, Frostis also exemplifying the behavioral finance phenomenon of assetsegregation. That is, he is evaluating Country XYZ investmentin terms of its anticipated gains or losses viewed in isolation.Individuals are typically more confident about the validity oftheir conclusions than is justified by their success rate or bythe principles of standard finance, especially with regard torelevant time horizons. In standard finance, investors knowthat five years of returns on Country XYZ securities relativeto all other markets provide little information about futureperformance. A standard finance investor would not be fooled bythis “law of small numbers.” In standard finance, investorsevaluate performance in portfolio terms, in this case definedby combining the Country XYZ holding with all other securitiesheld. Investments in Country XYZ, like all other potentialinvestments, should be evaluated in terms of the anticipatedcontribution to the risk–reward profile of the entireportfolio.c. Frost’s statement is an example of mental accounting. Mentalaccounting holds that investors segregate money into mentalaccounts (e.g., safe versus speculative), maintain a set ofseparate mental accounts, and do not combine outcomes; a lossin one account is treated separately from a loss in anotheraccount. One manifestation of mental accounting, in which Frostis engaging, is building a portfolio as a pyramid of assets,layer by layer, with the retirement account representing alayer separate from the speculative fund. Each layer isassociated with different goals and attitudes toward risk. Heis more risk averse with respect to the retirement account thanhe is with respect to the speculative fund account. The moneyin the retirement account is a downside protection layer,designed to avoid future poverty. The money in the speculativefund account is the upside potential layer, designed for achance at being rich.In standard finance, decisions consider the risk and returnprofile of the entire portfolio rather than anticipated gainsor losses on any particular account, investment, or class ofinvestments. Alternatives should be considered in terms offinal outcomes in a total portfolio context rather than interms of contributions to a safe or a speculative account.Standard finance investors seek to maximize the mean-variancestructure of the portfolio as a whole and consider covariancesbetween assets as they construct their portfolios. Standardfinance investors have consistent attitudes toward risk acrosstheir entire portfolio.3. a. Illusion of knowledge: Maclin believes he is an expert on, andcan make accurate forecasts about, the real estate marketsolely because he has studied housing market data on theInternet. He may have access to a large amount of real estate-related information, but he may not understand how to analyzethe information nor have the ability to apply it to a proposedinvestment.Overconfidence: Overconfidence causes us to misinterpret theaccuracy of our information and our skill in analyzing it. Maclinhas assumed that the information he collected on the Internet isaccurate without attempting to verify it or consult other sources.He also assumes he has skill in evaluating and analyzing the realestate-related information he has collected, although there is noinformation in the question that suggests he possesses suchability.b. Reference point: Maclin’s reference point for his bondposition is the purchase price, as evidenced by the fact that hewill not sell a position for less than he paid for it. Thisfixation on a reference point, and the subsequent waiting forthe price of the security to move above that reference pointbefore selling the security, prevents Maclin from undertaking arisk/return-based analysis of his portfolio position.c. Familiarity: Maclin is evaluating his holding of company stockbased on his familiarity with the company rather than on soundinvestment and portfolio principles. Company employees, becauseof this familiarity, may have a distorted perception of theirown company, assuming a “good company” will also be a goodinvestment. Irrational investors believe an investment in acompany with which they are familiar will produce higher returnsand have less risk than nonfamiliar investments.Representativeness: Maclin is confusing his company (which maywell be a good company) with the company’s stock (which may ormay not be an appropriate holding for his portfolio and/or a goodinvestment) and its future performance. This can result inemployees’ overweighting their company stock, thereby holding anunderdiversified portfolio.4. a. The behavioral finance principle of biasedexpectations/overconfidence is most consistent with the inve stor’sfirst statement. Petrie stock provides a level of confidence andcomfort for the investor because of the circumstances in which sheacquired the stock and her recent history with the returns andincome from the stock. However, the investor exhibitsoverconfidence in the stock given the needs of her portfolio (sheis retired) and the brevity of the recent performance history.b. The behavioral finance principle of mental accounting is mostconsistent with the investor’s second statement. The investorhas segregated the monies distributed from her portfolio into two “accounts”: the returns her portfolio receives on the Petrie stock and the returns on the rest of her portfolio. She is maintaining a separate set of mental accounts with regard to the total funds distributed. The investor’s specific uses should be viewed in the overall context of her spending needs and she should consider the risk and return profile of the entire portfolio.5. i. Overconfidence (Biased Expectations and Illusion of Control):Pierce is basing her investment strategy for supporting herparents on her confidence in the economic forecasts. This is acognitive error reflecting overconfidence in the form of bothbiased expectations and an illusion of control. Pierce is likelymore confident in the validity of those forecasts than isjustified by the accuracy of prior forecasts. Analysts’ consensusforecasts have proven routinely and widely inaccurate. Pierce alsoappears to be overly confident that the recent performance of thePogo Island economy is a good indicator of future performance.Behavioral investors often conclude that a short track record isample evidence to suggest future performance.Standard finance investors understand that individuals typicallyhave greater confidence in the validity of their conclusions thanis justified by their success rate. The calibration paradigm,which compares confidence to predictive ability, suggests thatthere is significantly lower probability of success than theconfidence levels reported by individuals. In addition, standardfinance investors know that recent performance provides littleinformation about future performance and are not deceived by this“law of small numbers.”ii. Loss Aversion (Risk Seeking): Pierce is exhibiting risk aversion in deciding to sell the Core Bond Fund despite its gains andfavorable prospects. She prefers a certain gain over a possiblylarger gain coupled with a smaller chance of a loss. Pierce isexhibiting loss aversion (risk seeking) by holding the High YieldBond Fund despite its uncertain prospects. She prefers the modestpossibility of recovery coupled with the chance of a larger lossover a certain loss. People tend to exhibit risk seeking, ratherthan risk aversion, behavior when the probability of loss is large.There is considerable evidence indicating that risk aversion holdsfor gains and risk seeking behavior holds for losses, and thatattitudes toward risk vary depending on particular goals andcircumstances.Standard finance investors are consistently risk averse andsystematically prefer a certain outcome over a gamble with the sameexpected value. Such investors also take a symmetrical view ofgains and losses of the same magnitude, and their sensitivity(aversion) to changes in value is not a function of a specified value reference point.iii. Reference Dependence: Pierce’s inclination to sell her Small Company Fund once it returns to her original cost is anexample of reference dependence. This is predicated on thecurrent value as related to original cost, her reference point.Her decision ignores any analysis of expected terminal valueor the impact of this sale on her total portfolio. Thisreference point of original cost has become a critical butinappropriate factor in Pierce’s dec ision.In standard finance, alternatives are evaluated in terms ofterminal wealth values or final outcomes, not in terms of gains and losses relative to a reference point such as original cost.Standard finance investors also consider the risk and returnprofile of the entire portfolio rather than anticipated gains or losses on any particular investment or asset class.。

投资学答案(贺显南)课后答案《投资学》部分习题答案导论1.交易实际上是有人买有人卖,两者的判断是相反的;买者往往要判断市场卖者的意图,卖者同样要判断买者的想法。

6.①7.①②③④⑤8.正确第一章3.委托代理关系由于信息不对称,使得代理人实施损害委托人利益的投机行为有了客观条件。

4.企业发展越来越受到周围环境的影响,必须适应这种变化,与企业的周围环境协调发展。

5.③6.④7.③8.错误9.①10.①④第二章3.①4.③5.错误6.对7.对8.④第三章3.③4.①5.④6.②7.③8.①9.②10.②11.对12.基金分散投资、专家管理等13-15题需要利用公式:资产净值=发行价格(1-前端费用)13.11.38元14.11.685元15.大约是10.4925元。

第四章2.机构投资者具有五大优势4.杠杆功能,以小搏大5.除权表面上使得股价下跌,导致价格重新上涨。

有一些道理,但不完全是。

6.可能是大多数股票在下跌,也可能是权重股票下跌而其他大多数股票上涨。

7.④8.①③9.①②③10.正确11.正确12.①②③④13.正确14.⑤15.④16.②17.⑤18.④19.③20.②21.②22.②23.①24.21.8元25.大约是20.19元第五章1.不同时点的同样数额的货币的价值是不同的,前面时间的货币价值要大于后面时间出现的货币的价值。

2.10.25%,10.38%,10.43%,10.47%3.对4.59.22元5.大约是108.775万元。

6.大约是4793.26元7.25某12=300个月,每月利率是7.25%/12,每月支付650.53元8.等同的每月支付一次的年利率水平是11.39%,每季度支付一次的年利率水平是11.49%([(10.12)1/41]4)。

9.1072508.18元,7.2508%。

10.32088.29元11.六个月的等同利率是4.88%([(10.1)1/2,27.95元。

目 录第一部分 绪论第1章 投资环境1.1 复习笔记1.2 课后习题详解第2章 资产类别与金融工具2.1 复习笔记2.2 课后习题详解第3章 证券是如何交易的3.1 复习笔记3.2 课后习题详解第4章 共同基金与其他投资公司4.1 复习笔记4.2 课后习题详解第二部分 资产组合理论与实践第5章 风险与收益入门及历史回顾5.1 复习笔记5.2 课后习题详解第6章 风险资产配置6.1 复习笔记6.2 课后习题详解第7章 最优风险资产组合7.1 复习笔记7.2 课后习题详解第8章 指数模型8.1 复习笔记8.2 课后习题详解第三部分 资本市场均衡第9章 资本资产定价模型9.1 复习笔记9.2 课后习题详解第10章 套利定价理论与风险收益多因素模型10.1 复习笔记10.2 课后习题详解第11章 有效市场假说11.1 复习笔记11.2 课后习题详解第12章 行为金融与技术分析12.1 复习笔记12.2 课后习题详解第13章 证券收益的实证证据13.1 复习笔记13.2 课后习题详解第四部分 固定收益证券第14章 债券的价格与收益14.1 复习笔记14.2 课后习题详解第15章 利率的期限结构15.1 复习笔记15.2 课后习题详解第16章 债券资产组合管理16.1 复习笔记16.2 课后习题详解第五部分 证券分析第17章 宏观经济分析与行业分析17.1 复习笔记17.2 课后习题详解第18章 权益估值模型18.1 复习笔记18.2 课后习题详解第19章 财务报表分析19.1 复习笔记19.2 课后习题详解第六部分 期权、期货与其他衍生证券第20章 期权市场介绍20.1 复习笔记20.2 课后习题详解第21章 期权定价21.1 复习笔记21.2 课后习题详解第22章 期货市场22.1 复习笔记22.2 课后习题详解第23章 期货、互换与风险管理23.1 复习笔记23.2 课后习题详解第七部分 应用投资组合管理第24章 投资组合业绩评价24.1 复习笔记24.2 课后习题详解第25章 投资的国际分散化25.1 复习笔记25.2 课后习题详解第26章 对冲基金26.1 复习笔记26.2 课后习题详解第27章 积极型投资组合管理理论27.1 复习笔记27.2 课后习题详解第28章 投资政策与特许金融分析师协会结构28.1 复习笔记28.2 课后习题详解第一部分 绪论第1章 投资环境1.1 复习笔记1实物资产与金融资产(1)概念实物资产指经济活动中所创造的用于生产商品和提供服务的资产。