中职教育-国际金融英语课件:Unit 12 International Settlement (I).ppt

- 格式:ppt

- 大小:825.00 KB

- 文档页数:12

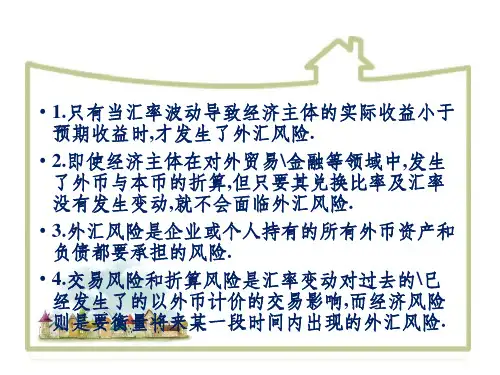

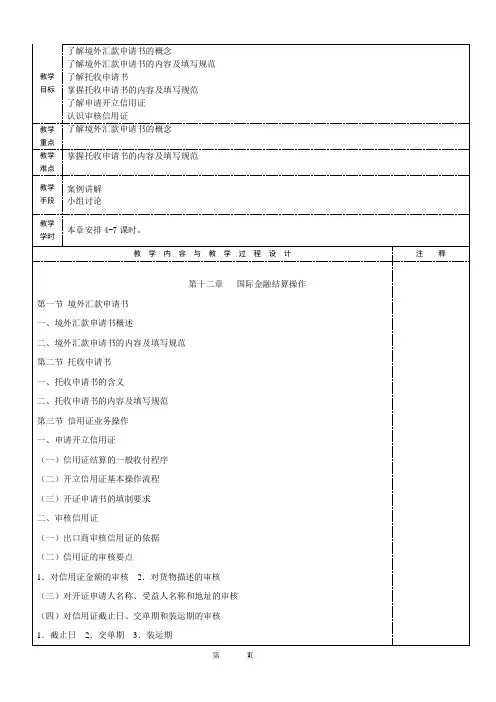

《国际金融电子教案》PPT课件第一章:国际金融概述1.1 教学目标了解国际金融的定义、功能和基本概念掌握国际金融市场的分类和主要参与者理解国际金融体系的基本框架1.2 教学内容国际金融的定义和功能国际金融市场的分类(如外汇市场、货币市场、资本市场等)国际金融体系的基本框架(如国际货币基金组织、世界银行等)1.3 教学方法采用PPT课件展示国际金融的基本概念和知识点通过案例分析和实例讲解,帮助学生理解国际金融市场的运作和参与者开展小组讨论,让学生分享对国际金融体系的理解和看法1.4 教学评估进行课堂提问,检查学生对国际金融基本概念的理解组织小组讨论,评估学生的参与和表达能力第二章:外汇市场2.1 教学目标理解外汇市场的定义、功能和主要参与者掌握外汇市场的交易工具和交易方式了解外汇市场的供求关系和汇率决定机制2.2 教学内容外汇市场的定义和功能外汇市场的交易工具(如外汇期货、外汇期权等)外汇市场的供求关系和汇率决定机制2.3 教学方法采用PPT课件展示外汇市场的基本概念和知识点通过案例分析和实例讲解,帮助学生理解外汇市场的交易工具和交易方式开展小组讨论,让学生分享对外汇市场的理解和看法2.4 教学评估进行课堂提问,检查学生对外汇市场的基本概念的理解布置课后作业,要求学生分析外汇市场的供求关系和汇率决定机制组织小组讨论,评估学生的参与和表达能力第三章:国际结算3.1 教学目标理解国际结算的定义、功能和基本流程掌握国际结算工具(如汇票、信用证等)的使用和操作了解国际结算的风险和管理方法3.2 教学内容国际结算的定义和功能国际结算工具的使用和操作(如汇票、信用证等)国际结算的风险和管理方法3.3 教学方法采用PPT课件展示国际结算的基本概念和知识点通过案例分析和实例讲解,帮助学生理解国际结算的工具和使用方法开展小组讨论,让学生分享对国际结算风险和管理方法的理解和看法3.4 教学评估进行课堂提问,检查学生对国际结算的基本概念的理解布置课后作业,要求学生分析国际结算的风险和管理方法组织小组讨论,评估学生的参与和表达能力第四章:国际金融市场4.1 教学目标理解国际金融市场的定义、功能和主要类型掌握国际金融市场的运作机制和参与者了解国际金融市场的发展趋势和挑战4.2 教学内容国际金融市场的定义和功能国际金融市场的运作机制和参与者国际金融市场的发展趋势和挑战4.3 教学方法采用PPT课件展示国际金融市场的基本概念和知识点通过案例分析和实例讲解,帮助学生理解国际金融市场的运作机制和参与者开展小组讨论,让学生分享对国际金融市场发展趋势和挑战的理解和看法4.4 教学评估进行课堂提问,检查学生对国际金融市场的基本概念的理解布置课后作业,要求学生分析国际金融市场的发展趋势和挑战组织小组讨论,评估学生的参与和表达能力第五章:国际金融衍生品市场5.1 教学目标理解国际金融衍生品市场的定义、功能和主要产品掌握国际金融衍生品市场的交易机制和风险管理了解国际金融衍生品市场的发展趋势和挑战5.2 教学内容国际金融衍生品市场的定义和功能国际金融衍生品市场的交易机制和风险管理国际金融衍生品市场的发展趋势和挑战5.3 教学方法采用PPT课件展示国际金融衍生品市场的基本概念和知识点通过案例分析和实例讲解,帮助学生理解国际金融衍生品市场的交易机制和风险管理开展小组讨论,让学生分享对国际金融衍生品市场发展趋势和挑战的理解和看法5.4 教学评估进行课堂提问,检查学生对国际金融衍生品市场的基本概念的理解布置课后作业,要求学生分析国际金融衍生品市场的发展趋势和挑战组织第六章:国际货币基金组织(IMF)6.1 教学目标了解国际货币基金组织的成立背景、宗旨和主要职责掌握国际货币基金组织的组织结构和工作机制理解国际货币基金组织在全球金融体系中的作用和影响6.2 教学内容国际货币基金组织的成立背景和历史发展国际货币基金组织的宗旨和主要职责国际货币基金组织的组织结构和工作机制国际货币基金组织在全球金融体系中的作用和影响6.3 教学方法采用PPT课件展示国际货币基金组织的基本概念和知识点通过案例分析和实例讲解,帮助学生理解国际货币基金组织的工作机制和作用开展小组讨论,让学生分享对国际货币基金组织的理解和看法6.4 教学评估进行课堂提问,检查学生对国际货币基金组织的基本概念的理解布置课后作业,要求学生分析国际货币基金组织在全球金融体系中的作用和影响组织小组讨论,评估学生的参与和表达能力第七章:世界银行集团7.1 教学目标了解世界银行集团的成立背景、宗旨和主要业务掌握世界银行集团的组织结构和运作机制理解世界银行集团在全球发展援助中的角色和贡献7.2 教学内容世界银行集团的成立背景和历史发展世界银行集团的宗旨和主要业务世界银行集团的组织结构和运作机制世界银行集团在全球发展援助中的角色和贡献7.3 教学方法采用PPT课件展示世界银行集团的基本概念和知识点通过案例分析和实例讲解,帮助学生理解世界银行集团的业务和运作开展小组讨论,让学生分享对世界银行集团的理解和看法7.4 教学评估进行课堂提问,检查学生对世界银行集团的基本概念的理解布置课后作业,要求学生分析世界银行集团在全球发展援助中的角色和贡献组织小组讨论,评估学生的参与和表达能力第八章:国际支付系统8.1 教学目标理解国际支付系统的定义、功能和重要性掌握国际支付系统的主要类型和运作机制了解国际支付系统的参与者及其角色和责任8.2 教学内容国际支付系统的定义和功能国际支付系统的主要类型(如电汇、信用证等)国际支付系统的运作机制和参与者国际支付系统的重要性和发展趋势8.3 教学方法采用PPT课件展示国际支付系统的基本概念和知识点通过案例分析和实例讲解,帮助学生理解国际支付系统的运作和参与者开展小组讨论,让学生分享对国际支付系统的理解和看法8.4 教学评估进行课堂提问,检查学生对国际支付系统的基本概念的理解布置课后作业,要求学生分析国际支付系统的重要性和发展趋势组织小组讨论,评估学生的参与和表达能力第九章:国际金融风险管理9.1 教学目标理解国际金融风险的概念、类型和影响掌握国际金融风险管理的基本原则和方法了解国际金融风险管理工具和市场的发展趋势9.2 教学内容国际金融风险的概念和类型(如市场风险、信用风险等)国际金融风险管理的基本原则和方法国际金融风险管理工具(如衍生品、保险等)国际金融风险管理市场的发展趋势9.3 教学方法采用PPT课件展示国际金融风险管理的基本概念和知识点通过案例分析和实例讲解,帮助学生理解国际金融风险的类型和管理方法开展小组讨论,让学生分享对国际金融风险管理工具和市场发展趋势的理解和看法9.4 教学评估进行课堂提问,检查学生对国际金融风险管理的基本概念的理解布置课后作业,要求学生分析国际金融风险管理工具的应用和市场发展趋势组织小组讨论,评估学生的参与和表达能力第十章:国际金融监管与合作10.1 教学目标理解国际金融监管的定义、功能和重要性掌握国际金融监管的主要机构和合作机制了解国际金融监管面临的主要挑战和应对策略10.2 教学内容国际金融监管的定义和功能国际金融监管的主要机构(如巴塞尔委员会、金融稳定论坛等)国际金融监管的合作机制和协调机制国际金融监管面临的主要挑战和应对策略10.3 教学方法采用PPT课件展示国际金融监管的基本概念和知识点通过案例分析和实例讲解,帮助学生理解国际金融监管第十一章:外汇交易市场11.1 教学目标理解外汇市场的定义、功能和类型掌握外汇市场的交易机制和交易工具了解外汇市场的参与者及其角色和职责11.2 教学内容外汇市场的定义和功能外汇市场的交易机制(如现汇交易、现钞交易等)外汇市场的交易工具(如外汇期货、外汇期权等)外汇市场的参与者(如商业银行、投资者等)11.3 教学方法采用PPT课件展示外汇市场的基本概念和知识点通过案例分析和实例讲解,帮助学生理解外汇市场的交易机制和交易工具开展小组讨论,让学生分享对外汇市场参与者的理解和看法11.4 教学评估进行课堂提问,检查学生对外汇市场的基本概念的理解布置课后作业,要求学生分析外汇市场的交易工具和参与者组织小组讨论,评估学生的参与和表达能力第十二章:国际债券市场12.1 教学目标理解国际债券市场的定义、功能和类型掌握国际债券市场的交易机制和发行流程了解国际债券市场的参与者及其角色和职责12.2 教学内容国际债券市场的定义和功能国际债券市场的交易机制(如证券交易所交易、场外交易等)国际债券市场的发行流程(如筹备、发行、交易等)国际债券市场的参与者(如发行人、投资者等)12.3 教学方法采用PPT课件展示国际债券市场的基本概念和知识点通过案例分析和实例讲解,帮助学生理解国际债券市场的交易机制和发行流程开展小组讨论,让学生分享对国际债券市场参与者的理解和看法12.4 教学评估进行课堂提问,检查学生对国际债券市场的基本概念的理解布置课后作业,要求学生分析国际债券市场的交易机制和参与者组织小组讨论,评估学生的参与和表达能力第十三章:国际股票市场13.1 教学目标理解国际股票市场的定义、功能和类型掌握国际股票市场的交易机制和交易工具了解国际股票市场的参与者及其角色和职责13.2 教学内容国际股票市场的定义和功能国际股票市场的交易机制(如证券交易所交易、场外交易等)国际股票市场的交易工具(如股票、股票期权等)国际股票市场的参与者(如上市公司、投资者等)13.3 教学方法采用PPT课件展示国际股票市场的基本概念和知识点通过案例分析和实例讲解,帮助学生理解国际股票市场的交易机制和交易工具开展小组讨论,让学生分享对国际股票市场参与者的理解和看法13.4 教学评估进行课堂提问,检查学生对国际股票市场的基本概念的理解布置课后作业,要求学生分析国际股票市场的交易机制和参与者组织小组讨论,评估学生的参与和表达能力第十四章:国际金融衍生品市场14.1 教学目标理解国际金融衍生品市场的定义、功能和类型掌握国际金融衍生品市场的交易机制和风险管理了解国际金融衍生品市场的发展趋势和挑战14.2 教学内容国际金融衍生品市场的定义和功能国际金融衍生品市场的交易机制(如期货交易、期权交易等)国际金融衍生品市场的风险管理国际金融衍生品市场的发展趋势和挑战14.3 教学方法采用PPT课件展示国际金融衍生品市场的基本概念和知识点通过案例分析和实例讲解,帮助学生理解国际金融衍生品市场的交易机制和风险管理开展小组讨论,让学生分享对国际金融衍生品市场发展趋势和挑战的理解和看法14.4 教学评估进行课堂提问,检查学生对国际金融衍生品市场的基本概念的理解布置课后作业,要求学生分析国际金融衍生品市场的发展趋势和挑战组织小组讨论,评估学生的参与和表达能力第十五章:国际金融创新与发展15.1 教学目标理解国际金融创新的概念、动力和影响掌握国际金融创新的主要领域和产品了解国际金融创新与发展面临的挑战和机遇15.2 教学内容国际金融创新的概念和动力国际金融创新的主要领域(如金融科技、绿色金融等)国际金融创新的产品(如加密货币、绿色债券等)国际金融创新与发展面临的挑战和重点和难点解析本文主要介绍了《国际金融电子教案》PPT课件的十五个章节,涵盖了国际金融概述、外汇市场、国际结算、国际货币基金组织(IMF)、世界银行集团、国际支付系统、国际金融市场、国际金融衍生品市场、外汇交易市场、国际债券市场、国际股票市场、国际金融衍生品市场以及国际金融创新与发展等多个方面。