国际结算 英文版5.1-5.5 Letters of credit(1)

- 格式:pdf

- 大小:238.01 KB

- 文档页数:6

letter of credit翻译

信用证(letter of credit)是指由买方的银行以买方的名义,向卖

方的银行发出的一种有关国际贸易的支付方式。

它的原则是:买方的银行

承诺支付给卖方指定金额的钱,只要卖方能够提供指定的货品或服务证明,并满足其他条款。

信用证的出现有助于加强买卖双方的信任,确保交易的

安全性。

信用证是保证国际贸易支付的重要手段。

买卖双方中,买方希望确认

购买的货物是否满足约定标准,也希望卖方能够按时到货;而卖方希望保

证货款的安全,也希望能够与买方建立更长久的合作关系。

信用证能够双

方都满足其所需。

一般地,一个信用证包含了四方的信息,即卖方和买方,以及卖方和

买方的银行。

在贸易过程中,卖方向买方发货的时候,卖方的银行必须先

获得买方银行的确认,买方的银行才会向卖方支付货款。

卖方银行开出的

信用证是对卖方的一种担保,如果买方的银行没有严格按照信用证的条款

支付,卖方的银行有权要求买方支付损失。

所以,信用证是保障国际贸易

交易安全及双方利益的重要保证措施。

1、correspondent bank 代理银行2、clean collection 光票托收3、commitment fee 承诺费4、letter of credit 信用证5、letter of guarantee 担保书、保函6、single factoring (保理)7、Financial documents 金融单据8、reimbursement of remittance cover 汇款的偿付9、Accommodating draft 融通汇票10、expiry date 到期日11、Certificate of origin 原产地证书12、bill of lading 海运提单13、Promissory note 本票14、insurance policy 保险单15、Commercial check 商业汇票16、Credit is available for acceptance of your drafts at 90 days sight drawn on us本信用证可以凭你方对我方开立的90天期汇票承兑17、Beneficiary's drafts is negotiable at sight by the negotiating bank .受益人的汇票可由议付行见票即付18、Usance draft to be negotiated at sight basis远期汇票将即期议付19、Although drafts are drawn at 90 days sight ,they will receive payment at sight upon presentation of document in full compliance with l/c terms90天期远期汇票如单证相符可以即期付款20、Drawings against this credit are authorized only up to 97% of this face amount of the invoice submitted该信用证汇票金额应为所提交发票面值的97%。

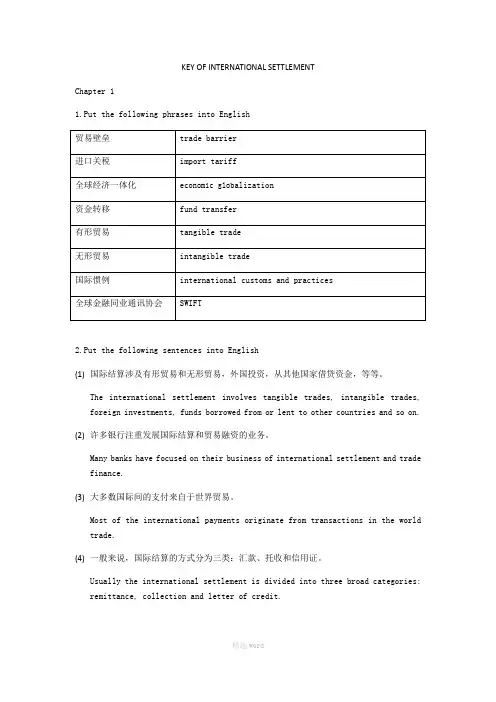

KEY OF INTERNATIONAL SETTLEMENTChapter 11.Put the following phrases into English2.Put the following sentences into English(1)国际结算涉及有形贸易和无形贸易,外国投资,从其他国家借贷资金,等等。

The international settlement involves tangible trades, intangible trades, foreign investments, funds borrowed from or lent to other countries and so on.(2)许多银行注重发展国际结算和贸易融资的业务。

Many banks have focused on their business of international settlement and trade finance.(3)大多数国际间的支付来自于世界贸易。

Most of the international payments originate from transactions in the world trade.(4)一般来说,国际结算的方式分为三类:汇款、托收和信用证。

Usually the international settlement is divided into three broad categories: remittance, collection and letter of credit.3. True or False1)International payments and settlements are financial activities conducted inthe domestic country. (F)2)Fund transfers are processed and settled through certain clearing systems.(T)3)Using the SWIFT network, banks can communicate with both customers andcolleagues in a structured, secure, and timely manner.(T)4)SWIFT can achieve same day transfer.(T)4.Multiple Choice1)SWIFT is __B__A.in the united statesB. a kind of communications belonging to TT system for interbank’s fundtransferC.an institution of the United NationsD. a governmental organization2)SWIFT is an organization based in __A___A.BrusselsB.New YorkC.LondonD.Hong Kong3) A facility in fund arrangement for buyers or sellers is referred to __A___A.trade financeB.sale contractC.letter of creditD.bill of exchange4)Fund transfers are processed and settled through __C___A.banksB.SWIFTC.clearing systemD.telecommunication systems5)__C__is the reason why international trade first began.A.Uneven distribution of resourcesB.Patterns of demandC.Economic benefitsparative advantages5. Answer the following questions1)Where are the medium of exchange originated from?Tracing back the history of international settlement, the medium of exchange originated from coins to notes.2)What will inevitably lead to under the international political, economic andcultural exchanges?The international political, economic and cultural exchange inevitably leads to credits and debts owed by one country to another.3)Why do banks focus on the development of the businesses of internationalsettlement?Banks focus more and more on the development of the businesses because it isa major resource of profits.4)What will banks do to meet the higher and higher demand of the internationalmarket?Banks need to develop innovative products and deliver the best services possible in whatever way they can.Chapter 21.Put the following phrases into English2.Put the following sentences into English(1)用于国际结算的货币是可兑换的货币。

国际结算中英版国际结算1.1 The Concept of International Trade国际贸易的观念International trade is the exchange of goods and services produced in one country for those produced in another country. In most cases countries do not trade the actual the goods and services. Rather they use the income or money from the sale of their products to buy the products of another country.1.2 Introduction to International Payments and SettlementsInternational payments and settlements are financial activities conducted among different countries in which payments are effected or funds are transferred from one country to another in order to clear relations of debts.国际⽀付与结算是指为清偿国际间的债权债务关系或跨国转移资⾦⽽发⽣在不同国家之间的货币收付活动。

1.2 categories(分类)(1)、According to the cause of international settlementInternational trade settlement(国际贸易结算)International trade settlement is created on the basis of sales of commodities.国际贸易结算是指有形贸易活动(即由商品的进出⼝)引起的货币收付活动.(主要形式)International non-trade settlement (国际⾮贸易结算)invisible trade⽆形交易financial transaction⾦融业务payment between governments政府间的款项others 其他业务(2)、According to whether cash is usedCash settlement(现⾦结算)International payments is effected by shipping precious metals taking the form of coins, bars or bullions to or from the trading countries.Non-cash settlement(⾮现⾦结算)International payment is settled by way of transferring funds through the accounts opened in these banks.Four major clearing systems in the world(四⼤清算系统)2.1 SWIFT(Society for Worldwide Interbank Financial Telecommunication)SWIFT is a service organization established to meet a number of specialized service needs relating to interbank financial communications through a dedicated data processing and telecommunication system.Membership 会员制Low expenses 低费⽤Security 安全性Standardised 标准化2.2 CHIPS(The Clearing House Interbank Payment System).纽约清算所同业⽀付系统2.3 CHAPS(Clearing House Automated Payment System)伦敦银⾏同业⾃动⽀付系统2.4 TATGET(Trans-European Automated Real-Time Gross-Settlement Express Transfer)泛欧实时全额⾃动清算系统3.1 Correspondent Bank代理银⾏Correspondent banking is an arrangement under which one bank (correspondent) holds deposits owned by other banks (respondents) and provides payment and other services to those respondent banks. Such arrangements may also be known as agency relationships in somedomestic contexts.是接受其他国家或地区的银⾏委托,代办国际结算业务或提供其他服务,并建⽴相互代理业务关系的银⾏。

国际结算英⽂版课后练习答案Chapter One1. Fill in the blanks to complete each sentence.(1) local legal system, political, exchange risks(2) open account, advance payment, remittance and collection(3) letter of credit, bank guarantee(4) price terms, delivery terms(5) least/minimum, most/maximum(6) advance payment(7) open account(8) clean collection, documentary collection2. 略3. Translate the following terms into English.(1) settlement on bank credit(2) the potential for currency fluctuation(3) to clear the goods for export(4) to pay the insurance premium(5) to carry out export formalities(6) the major participants in international trade(7) the commodity inspection clause(8) to fulfill the obligation to deliver the goods(9)t he goods have passed over the ship’s rail(10)I nternational contract is concluded in a completely different context than domestic ones 4.Decide whether the following statements are true or false.(1) F (2) F (3) T (4) T (5) T(6) T (7) F (8) T (9) T (10) F5. Choose the best answer to each of the following statements(1)-(5) BCCBD (6)-(10) DACCC(11)-(15) BDDCD (16)-(20) DCACDChapter Two1. Fill in the blanks to complete each sentence.(1) barter(2) medium of exchange(3) expensive, risky(4) our(5) Vostro(6) vostro(7) nostro(8) specimen of authorized signatures, telegraphic test keys, terms and conditions, Swift authentic keys2. Define the following terms(1) Correspondent relationship 〖A bank having direct connection or friendly service relations with another bank.〗(2) International settlements〖International settlements are financial activities conducted among different countries in which payments are effected or funds are transferred from one country to another in order to settle accounts, debts, claims, etc. emerged in the course of political, economic or cultural contracts among them. 〗(3) Visible trade〖The exchange of goods and commodities between the buyer and the seller across borders.〗(4) Financial transaction〖International financial transaction covers foreign exchange market transactions, government supported export credits, syndicated loans, international bond issues, etc.〗(5). Vostro account〖Vostro account is an account held by a bank on behalf of a correspondent bank.〗3. Translate the following terms into English.(1) commercial credit(2) control documents(3) account relationship(4) cash settlement(5) financial intermediary(6) credit advice(7) agency arrangement(8) credit balance(9)reimbursement method(10) test key/code4.Decide whether the following statements are true or false.(1) T (2) F (3) F (4) T (5) F5. Choose the best answer to each of the following statements(1)-(5) BCDAD (6)-(10) BBDABChapter Three1. Define the following Terms:(1) Negotiable instrument〖“A negotiable instrument is a chose in action, the full and legal title to which is transferable by delivery of the instrument (po ssibly with the transferor’s endorsement) with the result that complete ownership of the instrument and all the property it represents passes free from equities to the transferee, providing the latter takes the instrument in good faith and for value.” 〗(2) Bill of exchange〖A bill of exchange is an unconditional order in writing, addressed by one person to another, signed by the person giving it, requiring the person to whom it is addressed to pay on demand, or at a fixed or determinable future time,a sum certain in money, to or to the order of a specified person, or to bearer. 〗(3) Check〖A check is an unconditional order in writing addressed by the customer to a bank signed by that customer authorizing the bank to pay on demand a specified sum of money to or to the order of a named person or to bearer. 〗(4) Documentary bill〖It is a bill with shipping documents attached thereto. 〗(5) Crossing〖A crossing is in effect an instruction to the paying bank from the drawer or holder to pay the fund to a bank only. 〗2. Translate the following terms into English.(1) ⼀般划线⽀票〖generally crossed check〗(2) 特殊划线⽀票〖specially crossed check〗(3) 过期⽀票〖a check that is out of date〗(4) 未到期⽀票〖post dated check〗(5) ⼤⼩写⾦额〖amount in words〗(6) ⽩背书〖blank endorsement〗(7) 特别背书〖special endorsement〗(8) 限制性背书〖restrictive endorsement〗(9) 跟单汇票〖documentary bill〗(10) 即期汇票〖sight draft〗(11) 远期汇票〖usance/term bill〗(12) 承兑汇票〖acceptance bill〗(13) 可确定的未来某⼀天〖determinable future date〗(14) 光票〖clean bill〗(15) 流通票据〖negotiable instrument〗(16) 贴现⾏〖discounting house 〗(17) 商⼈银⾏〖merchant bank〗(18) ⽆条件的付款承诺〖unconditional promise of payment〗(19) 负连带责任〖jointly and severally responsible〗(20) 出票后90天付款〖payable 90 days after date〗3. Decide whether the following statements are true or false.(1) T (2) F (3) T (4) T (5) T(6) F (7) T (8) T (9) T (10) T(11) F (12) T (13) T (14) F (15) T(16) T (17) T (18) F (19) F (20) F4. Choose the best answer to each of the following statements(1)-(5) CACBC (6)-(10) BACBB(11)-(15) BDCCC (16)-(20) BBAAC5-7 略Chapter Four1. Fill in the blanks to complete each sentence.(1) beneficiary(2) payment order / mail advice / debit advice(3) the remittance amount is large / the transfer of funds is subject to a time limit / test key(4) sell it to his own bank for crediting his account(5) debits / credits(6) demand draft(7) act of dishonor(8) swiftness / reliability / safety / inexpensiveness(9) debiting remitting bank’s nostro account(10) delivery of the goods2. Define the following Terms.(1) International remittance means a client (payer) asks his bank to send a sum of money to a beneficiary abroad by one of the transfer methods at his option while the beneficiary can be paid at the designated bank which is either the re mitting bank’s overseas branch or its correspondent with a nostro account.(2) Remitting bank is the bank transferring funds at the request of a remitter to its correspondent or its branch in another country and instructing the latter to pay a certain amount of money to a beneficiary.(3) A mail transfer is to transfer funds by means of a payment order or a mail advice, or sometimes a debit advice issued by a remitting bank, at the request of the remitter.(4) Demand draft transfer is a remittance method using a bank demand draft. It is a negotiable instrument drawn by one bank on its overseas branch or its correspondent abroad ordering the latter to pay on demand the stated amount to the holder of the draft.(5) Cancellation of the reimbursement under mail transfer or telegraphic transfer is usually done before its payment is made at the request of the remitter or the payee who refuses to receive the payment.3. Translate the following terms into English.(1) 汇款通知单remittance advice (2) 汇出汇款outward remittance(3) 国际汇款单international money order (4) 往来账户current account(5) ⾃动⽀付系统automated payment system (6) 作为偿付in cover(7) 赔偿保证书letter of indemnity (8) 信汇通知书 mail advice(9) 汇票的不可流通副本non-negotiable copy of draft (10) ⾸期付款down payment4. Choose the best answer to each of the following statements(1)-(5) BCABD (6)-(10) BBBAAChapter Five1. Fill in the blanks to complete each sentence.(1) presenting bank(2) title documents / pays the draft / accepts the obligation to do so(3) legal / the exchange control authorities(4) the payment is made(5) open account / advance payment(6) Inward collection(7). the remitting bank(8) trust receipt(9) D/P at sight(10) documents, draft, and collection order2. Define the following terms(1) Collection is an arrangement whereby the goods are shipped and a relevant bill of exchange is drawn by the seller on the buyer, and/or shipping documents are forwarded to the seller’s bank with clear instructions for collection through one of its correspondent banks located in the domicile of the buyer.(2) The case of need is the representative appointed by the principal to act as case of need in the event of non-acceptance and/or non-payment, whose power should be clearly and fully stated in the collection.(3) Documentary collection is a collection of financial instruments being accompanied by commercial documents or collection of commercial documents without being accompanied by financial instruments, that is, commercial documents without a bill of exchange. Alternatively, the documentary collection is a payment mechanism that allows the exporters to retain ownership of the goods until they receive payment or are reasonably certain that they will receive it.(4) Outward collection is a banking business in which a bank acting as the remitting bank sends the draft drawn against an export with or without shipping documents attached, to an appropriate overseas bank, namely, the collecting bank to get the payment or acceptance from the importer.(5) Collection bill purchased is a kind of financing by banks for exporters under documentary collection methods. It means that the remitting bank purchases the documentary bill drawn by the exporter on the importer. It involves great risk for the remitting bank due to lack of a guarantee.3. Translate the following terms into English.(1) 承兑交单acceptance against documents (2) 商业承兑汇票 trade acceptance(3) 需要时的代理⼈case of need (4) 出⼝押汇export bill purchased(5) 物权单据 title document (6) 以寄售⽅式on consignment(7) 直接托收direct collection (8) 货运单据shipping documents(9) 付款交单documents against payment (10) 远期汇票time/ tenor/term/ usance draft4. Choose the best answer to each of the following statements(1)-(5) ABCAB (6)-(10) ACAADChapter Six1. Define the following terms:(1) Letter of credit 〖The Documentary Credit or letter of credit is an undertaking issued by a bank for the account of the buyer (the applicant) or for its own account, to pay the beneficiary the value of the draft and/or documents provided that the terms and conditions of the documentary credit are complied with. 〗(2) Confirmed letter of credit 〖A credit that carries the commitment to pay by both the issuing bank and the advising bank. 〗(3) Revolving credit 〖A credit by which, under the terms and conditions thereof, the amount is renewed or reinstated without specific amendments to the documentary credit being required. 〗(4) Confirming bank 〖A bank, usually the advising bank, which adds its undertaking to those of the issuing bank and assumes liability under the credit.〗(5) Applicant of the credit〖The applicant is always an importer or a buyer, who fills out and signs an application form, requesting the bank to issue a credit in favor of an exporter or a seller abroad.〗2. Translate the following terms or sentences into English.(1) 未授权保兑〖silent confirmation 〗(2) 有效地点为开证⾏所在地的柜台〖to expire at the counters of the issuing bank 〗(3) 凭代表物权的单据付款〖to pay against documents representing the goods〗(4) 信⽤证以银⾏信⽤代替了商业信⽤。

境外汇款常用英语银行汇款.Telegraphic Transfer (T/T):电汇,即由买方通过银行向卖方的银行账户付款。

.Letter of Credit (L/C):信用证,即由买方向卖方的银行开出的保证付款的文件。

.Bill of Exchange:汇票,即由卖方开出,要求买方在规定的期限内支付货款的票据。

.Bank Draft:银行汇票,即由银行出具的一个付款人向受益人的书面要求付款的文件。

.Remittance:汇款,一般指跨境汇款,包括电汇、汇票等。

线上支付.PayPal:一种在线支付方式,用户可以通过该平台向其他用户或商家付款。

.Alipay:中国的一种在线支付方式,既支持个人账户付款,也支持商家店铺收款。

.WeChat Pay:中国的一种线上支付方式,主要用于微信生态圈内的交易,支持个人和商家收款。

.Apple Pay:一种由苹果公司提供的移动支付服务,用户可以使用Apple设备完成线上或线下支付。

.Google Wallet:谷歌提供的一种在线支付方式,支持在谷歌商店中购物时使用,并可用于向其他用户转账等。

现金支付.Cash:现金,即纸币或硬币等形式的实体货币。

.Banknote:纸币,由国家或地区发行的具有法定货币地位的纸制品。

.Coin:硬币,一种小型、通常是圆形的实体货币,由铜、锌、镍和钢等材料制成。

.Counterfeit Money:假币,指伪造的与真币相似的货币。

信用卡支付.Credit Card:信用卡,一种信用工具,持卡人可以在确定的额度内消费,然后在规定的周期内还款。

.Debit Card:借记卡,与信用卡类似,但是其使用的是持卡人的存款而不是信用额度进行消费。

.Charge Card:充值卡,一种预付费方式的信用卡,持卡人需要提前充值才能使用。

.Prepaid Card:预付卡,一种先交付款项再使用的卡片,通常用于购买特定商品或服务。

第三方支付.Escrow Service:第三方担保服务,卖家将商品交给第三方机构保管,待买家确认收货后,第三方机构再将货款支付给卖家。

LetterofCredit(LC)的分类

Letter of Credit(L/C)的分类

Letter of Credit 即L/C, 为国际贸易中最常见的付款方式,它的分类很多,下面作了列举,供参考.

1.revocable L/C/irrevocable L/C可撤销信用证/不可撤销信用证

2.confirmed L/C/unconfirmed L/C 保兑信用证/不保兑信用证

3.sight L/C/usance L/C 即期信用证/远期信用证

4.transferable L/C(or)assignable L/C(or)transmissible L/C /untransferable L/C 可转让信用证/不可转让信用证

5.divisible L/C/indivisible L/C 可分割信用证/不可分割信用证

6.revolving L/C 循环信用证

7.L/C with T/T reimbursement clause 带电汇条款信用证

8.without recourse L/C/with recourse L/C 无追索权信用证/有追索权信用证

9.documentary L/C/clean L/C 跟单信用证/光票信用证

10.deferred payment L/C/anticipatory L/C延付信用证/预支信用证

11.back to back L/C reciprocal L/C对背信用证/对开信用证

12.traveller's L/C(or: circular L/C)旅行信用证。

Documentary Letter of Credit(L/C)---bank credit.--Ucp600Documentary Credit means an undertaking issued by a bank (“issuing bank”) at the request and on the instructions of a customer (the "applicant") to pay a determinable sum to the exporter (the “beneficiary”), provided the documents presented by the beneficiary are in compliance with the terms and conditions of the credit.Characteristics of a letter of credit: P71● The issuing bank takes primary liabilities for payment, provided the documents presented are in compliancewith the terms and conditions of the credit. 条件:出口商单证一致单单相符The L/C proves a relationship (a contract) between exporter and bank. L/C represents a bank’s credit .● L/C serves as self-sufficient instrument. A credit by its nature is a separate transaction from the sales contract orother contracts 与买卖合同相分离● L/C follows pure documents principle. The bank deals with only documents, but not the goods, services orperformance to which the documents may relate. 信用证各方处理单据非货物Functions of L/C P74● L/C minimizes the risks of defaults in foreign trade, providing more security for both parties. 风险最小● It achieves a commercially acceptable compromise between the conflicting interests of buyer and seller b ymatching time of payment for the goods with the time of their delivery.● L/C increase financing for both parties in foreign trade. 加强各方融资Parties to a L/C:● Applicant 申请人● Issuing bank 开证行● Beneficiary 受益人Amendment of L/C● Ad vising bank /Transmitting bank 通知行/转递行● Confirming bank保兑行Parties to a documentary credit:● Nominated bank 被指定银行---Pay, negotiate or accept the L/C as instructed by the issuing bank-- negotiating the documents with recourse to the beneficiary 被指定银行对受益人有追索权-- paying bank(honor)pays without recourse to the beneficiary● Reimbursing bank 偿付行--无审单责任流程:Process of a documentary credit:● Application for L/C---- Application form, Security● Issuance of L/C --- Credit risk● Advising/Transmitting L/C---Verification of authenticity 检查真实性● Review of L/C by the beneficiary ----Dispatching goods Preparing the full set of documents Presentation ofdocuments-- Soft Clause L/C cases (开证申请人(买方)通知船公司、日期、目的港、验货人等,受益人才能装船。

Copyright by Fei Zhonglin School of Economics and Management, NJUT15. Letters of credit5.1-5.5 General introduction5.1 Definition 5.2 Procedures 5.3 Characteristics5.4 Parties’ liabilities and rights5.5 contents5.6 Examination of a documentary credit5.7 Types of credit5.8 Financing provided by banksCopyright by Fei Zhonglin School of Economics and Management, NJUT2About UCPThe formal maturation of the letter of credit was in the 1920’s;ICC Uniform Customs and Practice for Documentary Credit (UCP)Versions of 1933,1951,1962, 1974,1983 and 1993(UCP500);The latest version is UCP600ISBP subject to UCP 600 (ICC Publication No. 681)Copyright by Fei Zhonglin School of Economics and Management, NJUT 35.1 What is a letter of creditAccording to UCP600 Article 2:Credit means any arrangement, however named or described, that is irrevocable and thereby constitutes a definite undertaking of the issuing bank to honour a complying presentation .信用证指一项不可撤销的安排,无论其名称或描述如何,该项安排构成开证行对相符交单予以承付的确定承诺。

Copyright by Fei Zhonglin School of Economics and Management, NJUT 4“Provided that the stipulated documents are presented to the nominated bank or to the issuing bank and that they constitute a complying presentation, the issuing bank must honour...”In simple terms, a credit is a conditional bank undertaking of payment.In UCP600 Article 7 a.Copyright by Fei Zhonglin School of Economics and Management, NJUT5Irrevocable:“A credit is irrevocable even if there is no indication to that effect.”In 500, the Art 2 gave the meaning of credit and four types of L/C, and in Art 6 theirrevocable and revocable L/C were listed at the same time,The revocable L/C has been deleted and all L/Cs are irrevocable under UCP600.In UCP600 Article 3 InterpretationsCopyright by Fei Zhonglin School of Economics and Management, NJUT 6Undertakeing:to put oneself under obligation to perform; also to accept as a charge or responsibility该词在英美法中具有特定含义,专指行为人单方自行承担的一种义务,无须对价支持即具有可执行性,一般具有无因性、独立性,不受其可能基于的其他交易下的抗辩影响。

UCP600中译为“承诺”、“责任”、“承担……责任”Copyright by Fei Zhonglin School of Economics and Management, NJUT 7Issuing bank (开证行,opening bank) “means the bank that issues a credit at the request of an applicant or on its own behalf.”It is usually the bank located in the importer ’s place.In UCP600 Article 2 DefinitionCopyright by Fei Zhonglin School of Economics and Management, NJUT 8Honour (承付)means:a. to pay at sight if the credit is available by sight payment. (即期付款信用证)b. to incur a deferred payment undertaking and pay at maturity if the credit is available by deferred payment. (延期付款信用证)c. to accept a bill of exchange (“draft ”) drawn by the beneficiary and pay at maturity if the credit is available by acceptance. (承兑信用证)In UCP600 Article 2 DefinitionCopyright by Fei Zhonglin School of Economics and Management, NJUT9Complying presentation (相符交单)means a presentation that is in accordancewith the terms and conditions of the credit, the applicable provisions of these rules,and international standard banking practice.Compared with UCP500: “…against stipulated document(s), provided that the terms andconditions of the credit are complied with ”(单证相符)In UCP600 Article 2 DefinitionCopyright by Fei Zhonglin School of Economics and Management, NJUT105.2 Parties to a letter of creditBasic partiesApplicantBeneficiaryIssuing bankApplicationSales ContractL/CCopyright by Fei Zhonglin School of Economics and Management, NJUT 115.3 Procedures of a documentary credit operationCopyright by Fei Zhonglin School of Economics and Management, NJUT 12Copyright by Fei Zhonglin School of Economics and Management, NJUT 135.4 Characteristics of a creditA written undertaking on the part of the issuing bankArt. 7 b.An issuing bank is irrevocablybound to honour as of the time it issues the credit.Art. 6 c. A credit must not be issued available by a draft drawn on the applicant.Bank creditCopyright by Fei Zhonglin School of Economics and Management, NJUT14Independent of the sales contractArt 4 a.A credit by its nature is a separate transaction from the sale or other contract on which it may be based. Banks are in no way concerned with or bound by such contract, even if any reference whatsoever to it is included in the credit.The parties to a letter of credit are only bound by the terms and conditions of the credit itself.Copyright by Fei Zhonglin School of Economics and Management, NJUT 15Exclusively dealing with documentsArt 5 :Banks deal with documents and not with goods, services or performance to which the documents may relate.Under UCP500:The documents comply with the terms and conditions of the credit anddocuments are consistent with one another. (单单一致,单证相符)Copyright by Fei Zhonglin School of Economics and Management, NJUT 16Applicant (开证申请人)“means the party on whose request the credit is issued.”It isthe buyer under the sales contract account party (US)consignee (收货人)on the Bill of LadingIn UCP600 Article 2 DefinitionCopyright by Fei Zhonglin School of Economics and Management, NJUT 17Applicant ’s liability and rightsSubmit application for issuing a credit inaccordance with the stipulation of sales contract and pay a certain percentage of cash deposits;Make payment to the issuing bank if there ’s complying presentation;Examine the documents received from issuing bank and has the right to refuse payment if discrepancies (不符点)are found.Copyright by Fei Zhonglin School of Economics and Management, NJUT 18Beneficiary (受益人)“means the party in whose favour a credit is issued.”It isthe seller under the sales contractconsignor (发货人)on the Bill of LadingIn UCP600 Article 2 DefinitionCopyright by Fei Zhonglin School of Economics and Management, NJUT19Beneficiary ’s liabilities and rightsCarry out the contract and complete the export documents;Examine the L/C to see whether the terms and conditions on the credit comply with those in the sales contract;Obtain the payment if no discrepancy among above documents;Refuse the L/C and ask for amendment if there ’s any discrepancy.Copyright by Fei Zhonglin School of Economics and Management, NJUT20UCP600 Article 7 Issuing Bank undertakinga . Provided that the stipulated documents are presented to the nominated bank or to theissuing bank and that they constitute a complying presentation, the issuing bank must honour, if the credit is available by ……b. An issuing bank is irrevocably bound to honour as of the time it issues the credit.c. An issuing bank undertakes to reimburse a nominated bank that has honoured or negotiated a complying presentation and forwarded the documents to the issuing bank ……Copyright by Fei Zhonglin School of Economics and Management, NJUT 21Open L/C according to the instruction of the application and get the deposits from the applicant;Refuse to pay if there ’s any discrepancy with the documents submitted.Issuing bank ’s liability and rightCopyright by Fei Zhonglin School of Economics and Management, NJUT 22In UCP600 Article 2 DefinitionNominated bank (指定银行)means the bank with which the credit is available or any bank in the case of a credit available with any bank.Copyright by Fei Zhonglin School of Economics and Management, NJUT 23In UCP600 Article 2 DefinitionNegotiation 议付means the purchase by the nominated bank of drafts (drawn on a bank other than thenominated bank ) and/or documents under a complying presentation , by advancing or agreeing to advance funds to the beneficiary on or before the banking day on whichreimbursement is due to the nominated bank.Copyright by Fei Zhonglin School of Economics and Management, NJUT 24Other partiesAdvising bank/ Transmitting bank 通知行/转递行 Confirming bank 保兑行Paying bank/ Accepting bank 付款行/承兑行Negotiating bank 议付行Copyright by Fei Zhonglin School of Economics and Management, NJUT25Advising bank/ Transmitting bankA bank in the seller ’s country that receives the credit from the issuing bank.To check the apparent authenticity of the credit; to inform or advise the seller (beneficiary) that the credit is available.“An advising bank …advises the credit and any amendment without any undertaking to honour or negotiate .”(Art. 9 a)Copyright by Fei Zhonglin School of Economics and Management, NJUT 26Usually selected by the issuing bank.An advising bank may utilize the services ofanother bank (“second advising bank ”), the latter has the same right with the former.Note that unless the credit specifies otherwise, the beneficiary is not required to present documents to or through the advising bank.Copyright by Fei Zhonglin School of Economics and Management, NJUT27Confirming bank (UCP600 Art.2)Confirming bank means the bank that adds its confirmation to a credit upon the issuing bank ’s authorization or request.Confirmation means a definite undertaking of the confirming bank, in addition to that of the issuing bank, to honour or negotiate a complying presentation.a Confirming Bank acts the role of second Issuing Bank, therefore it should undertake the same responsibility as the Issuing Bank.Copyright by Fei Zhonglin School of Economics and Management, NJUT28The Paying Bank/Accepting BankThe bank nominated by the issuing bank, to which the beneficiary is directed to present documents for payment, acceptance, or a deferred payment.To claim reimbursement from the Issuing Bank after payment.Lose its right of recourse to the beneficiary after payment.The Paying Bank is the drawee bank of the draft drawn by the Beneficiary, and the payment of the drawee will discharge the draft.Copyright by Fei Zhonglin School of Economics and Management, NJUT 29The Negotiating BankDifference from the paying bank:Has the right of recourse to the beneficiary.Copyright by Fei Zhonglin School of Economics and Management, NJUT30Benefits for the exporterBank credit is better than trade credit.The payment commitment is made by a third party —a bank.Most banks, in most countries, are responsible and reliable, and generally believed to adhere to ethical business practices and to exercise prudence in their commercial dealings.The precondition for obtaining payment is to provide the correct documents to the issuing bank at the right place on time.Benefits for the importerThe Issuing Bank provides credit to him once issuing the credit.The ability to obtain a letter of credit expands the buyers purchasing power.Only creditworthy buyers can obtain an L/Cfrom the issuing bank.Cash deposits will be required for those whoare not creditworthy.Copyright by Fei Zhonglin School of Economics and Management, NJUT31。