国际结算英文版课后练习答案.doc

- 格式:doc

- 大小:169.50 KB

- 文档页数:15

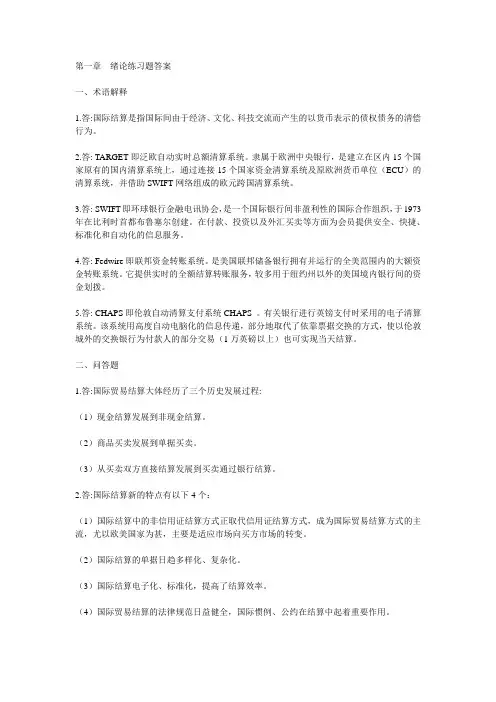

第一章绪论练习题答案一、术语解释1.答:国际结算是指国际间由于经济、文化、科技交流而产生的以货币表示的债权债务的清偿行为。

2.答: TARGET即泛欧自动实时总额清算系统。

隶属于欧洲中央银行,是建立在区内15个国家原有的国内清算系统上,通过连接15个国家资金清算系统及原欧洲货币单位(ECU)的清算系统,并借助SWIFT网络组成的欧元跨国清算系统。

3.答: SWIFT即环球银行金融电讯协会,是一个国际银行间非盈利性的国际合作组织,于1973年在比利时首都布鲁塞尔创建。

在付款、投资以及外汇买卖等方面为会员提供安全、快捷、标准化和自动化的信息服务。

4.答: Fedwire即联邦资金转账系统。

是美国联邦储备银行拥有并运行的全美范围内的大额资金转账系统。

它提供实时的全额结算转账服务,较多用于纽约州以外的美国境内银行间的资金划拨。

5.答: CHAPS即伦敦自动清算支付系统CHAPS 。

有关银行进行英镑支付时采用的电子清算系统。

该系统用高度自动电脑化的信息传递,部分地取代了依靠票据交换的方式,使以伦敦城外的交换银行为付款人的部分交易(1万英磅以上)也可实现当天结算。

二、问答题1.答:国际贸易结算大体经历了三个历史发展过程:(1)现金结算发展到非现金结算。

(2)商品买卖发展到单据买卖。

(3)从买卖双方直接结算发展到买卖通过银行结算。

2.答:国际结算新的特点有以下4个:(1)国际结算中的非信用证结算方式正取代信用证结算方式,成为国际贸易结算方式的主流,尤以欧美国家为甚,主要是适应市场向买方市场的转变。

(2)国际结算的单据日趋多样化、复杂化。

(3)国际结算电子化、标准化,提高了结算效率。

(4)国际贸易结算的法律规范日益健全,国际惯例、公约在结算中起着重要作用。

3、答:世界范围内有五大国际支付清算系统有:(1)美元支付清算系统。

包括CHIPS---纽约清算所同业支付系统和Fedwire--联邦资金转账系统。

CHIPS的特点是:①为实时的、大额的、多边的、终局性支付;②具有最大的流动性,1美元日周转500次;③免除了日透支费;④可以提供在线现金管理工具;⑤给公司客户传输汇款相关信息;⑥服务于国内和国际市场,可处理超过95%的美元跨境支付;⑦每日日终进行净额清算的资金转账。

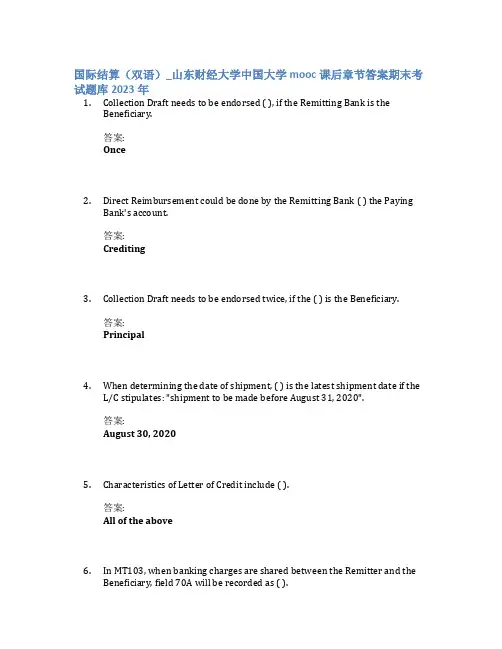

国际结算(双语)_山东财经大学中国大学mooc课后章节答案期末考试题库2023年1.Collection Draft needs to be endorsed ( ), if the Remitting Bank is theBeneficiary.答案:Once2.Direct Reimbursement could be done by the Remitting Bank ( ) the PayingBank's account.答案:Crediting3.Collection Draft needs to be endorsed twice, if the ( ) is the Beneficiary.答案:Principal4.When determining the date of shipment, ( ) is the latest shipment date if theL/C stipulates: "shipment to be made before August 31, 2020".答案:August 30, 20205.Characteristics of Letter of Credit include ( ).答案:All of the above6.In MT103, when banking charges are shared between the Remitter and theBeneficiary, field 70A will be recorded as ( ).答案:SHA7.Under Letter of Credit, ( )provides an additional payment guarantee that isseparated from the Issuing Bank's payment obligation.答案:Confirming Bank8.“Available with Issuing Bank by payment at sight” is a indication of ( ).答案:Sight Credit9.The ( ) will compensate the Guarantor when the Applicant fails to fulfill itsobligation.答案:Counter Guarantor10.When filling SWIFT message, March 20, 2019 should be recorded as ( ).答案:19032011.Insurance Policy should be dated ( ) the date of shipment.答案:on or before12.Main topics of International Settlement include the following, except ( ).答案:Risk Management13.Determine the LAST day of the bank's examination, based on the followinginformation.1.Date of Presentation:March 20(Friday)2.Date of Expiry:March 26(Thursday)答案:March 2714. A Promissory Note involves ( ) basic parties.答案:215.Which one among the following is the safest, from the standpoint of thePayee?答案:a Specially-crossed Cheque16.( ) is the sender of MT103.答案:17.The Exporter is the Applicant under the Payment Guarantee.答案:错误18.Characteristics of Standby Letter of Credit does not include ( ).答案:Demand payment19.If the payee is ( ), the Bill can not be endorsed.答案:Restrictive Order20.Which one/ones among the following is/are example(s)of DocumentaryCollection.答案:21.“Available with xxx bank by acceptance of Bill at xxx days after sight againstthe documents detailed herein and Beneficiary’s Bill drawn on us”is aindication of ( ).答案:22.Banks shall each have a maximum of ( ) banking days following the day ofpresentation to determine if a presentation is complying.答案:23.When determining the date of shipment, "on or about June 11th" refer to ( ).答案:June 6~1624.Under D/P, documents will be released against acceptance.答案:错误25.Under Letter of Credit, ( ) takes the primary liability to make payment.答案:26.Collection Draft needs to be endorsed ( ), if the Payee is the Principal.答案:Twice27.The ( ) will compensate the Beneficiary when the Guarantor fails to fulfill itsobligation.答案:Confirming Bank28.The most commonly used payment instrument is ( ).答案:29.( ) is commonly used in processing customs clearance.答案:30.Development of International Settlement does not include ( ).答案:31.The action of Drawing/Issuing a Bill of Exchange refers to ( ).答案:32.( ) is not transferable. The goods can only be taken by the Consignee.答案:33.Properties of Negotiable Instruments include ( ).答案:34.When a Cheque is crossed specially, the Holder ( ).答案:35.Crossed cheque can be used to ( ).答案:36."Presentation" means when the creditor exercises its right (i.e. asks theDrawee for acceptance or payment), there is no need to explain the reason.答案:错误37.The words “before” and “after” when used to determine a period of shipmentinclude the date mentioned.答案:错误38.Development of international settlement does not include ( ).答案:39.Which of the following is NOT a payment order?答案:Promissory Note40.If the Presenter fails to resubmit documents before the lastest presentingdate, the documents are deemed with discrepancies and can not be revised.答案:正确41.Under Letter of Credit, the Drawer of the Bill should be the ( ).答案:Beneficiary42.From the perspective of the Exporter, ( ) is the "safest" settlement method.答案:43.( ) becomes an Acceptor, when it accepts the Draft and signs on the Draft.答案:44.Banks takes responsibility to effect payment immediately by issuing ( ).答案:45.Under Letter of Credit, "Honor" does not include ( ).答案:46.The following are statements indicating Demand Bill, except ( ).答案:47.The payment date of a Draft stating "Payable at 1 month after February 28" is( ).答案:48.Main topics of International Settlement include the following, except ( ).答案:Risk Management49.( ) means that the acceptor is accepting the drawer's order withoutrestrictive statement.答案:50.Insurance Policy is the core documents based on which other documents areissued.答案:错误51.( ) does not state the name of the Consignee. Anyone who holds the B/L cantake goods from the Carrier.答案:52.( ) is the Drawee of the Draft under Letter of Credit.答案:53.( ) is not a document of title.答案:54.( ) is the fastest and safest way to transfer fund.答案:55.The following are commercial documents, except ( ).答案:56.The Correspondent Bank is an independent foreign bank.答案:正确57.( ) is the bank to which the Principal has entrusted the handling of aCollection.答案:58.Financial Documents including the following, except().答案:Invoice59.In Remittance, the Remitting Bank is also called the Exporter's Bank.答案:错误60.( ) is the core documents based on which other documents are issued.答案:61.( ) is the Drawer of the Draft under Collection.答案:62.Exporter will obtain banking credit in ( ).答案:。

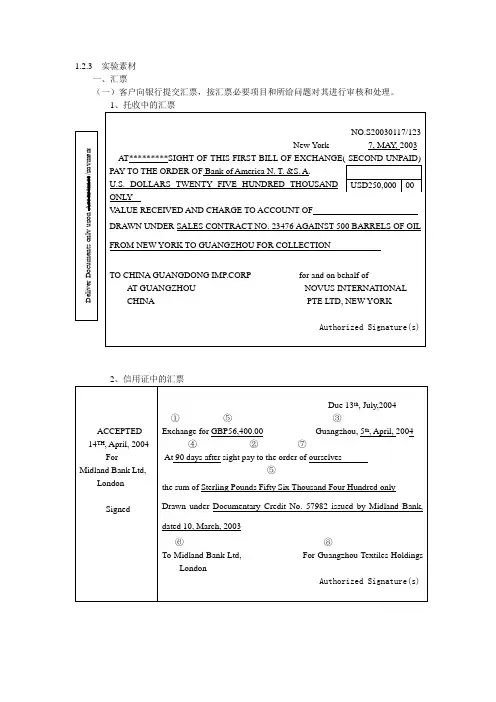

1.2.3 实验素材一、汇票(一)客户向银行提交汇票,按汇票必要项目和所给问题对其进行审核和处理。

(二)客户提交汇票委托银行收款,银行对汇票有效性进行判断并给予客户建议。

GUANGDONG IMP. & EXP. CORPORATION承兑汇票后在票面加盖承兑章。

根据所给汇票和条件在表格中计算并填写汇票到期日。

(五)根据条件进行汇票的转让并加注必要的背书。

1、收款人将汇票记名背书转让给D Company,D Company空白背书转让给E Company,E Company交付转让给F Company,F Company限制背书转让给G Company。

假设收款人公司有权签字人为李华,D Company有权签字人为John,E Company有权签字人为Mary,G2、一笔托收业务中,出口公司为广州市A公司,有权签字人为张品,托收行为中国工商银行广东省分行,有权签字人为李源,代收行为美国花旗银行,进口公司为美国B公司。

⑴开立己收汇票,收款公司空白背书转让给托收行,托收行记名背书给代收行。

汇票背面(六)汇票收款人A Company委托银行向汇票付款人B Company London提示汇票承兑时,付款人根据所给条件在汇票上进行承兑,银行审核承兑汇票。

1、付款人于3月26日在汇票左面作出普通承兑。

6、Standard Chartered Bank Ltd. Hong Kong于2003年11月26日承兑下面汇票后向Bank二、本票(一)客户向银行提交本票,按本票必要项目和所给问题对其进行审核和处理。

三、支票(三)根据所给条件在支票上划线。

出票人在支票上划线“Not Negotiable”;2、收款人在支票上特别划线,委托Bank of East Asia, Guangzhou做光票托收;3、Bank of East Asia,Guangzhou在支票上再特别划线,委托。

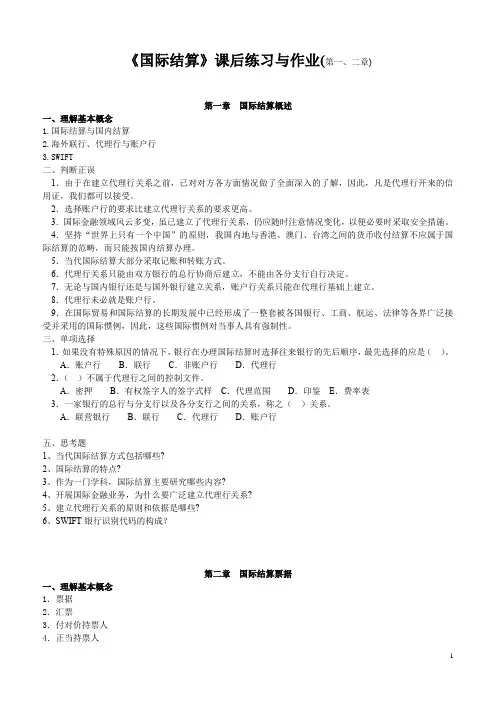

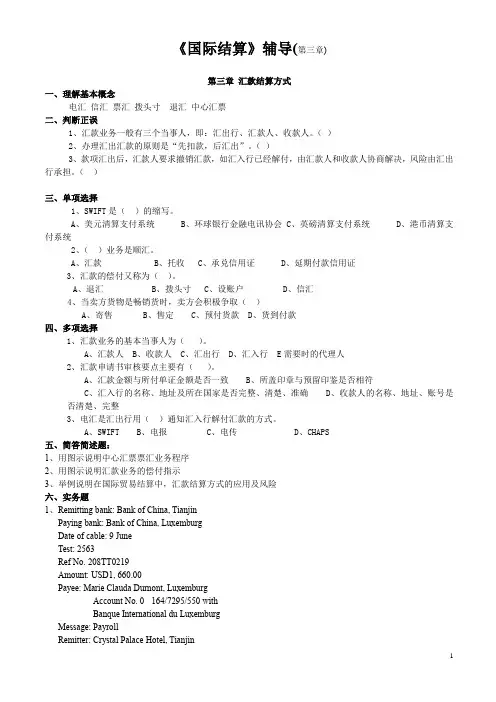

《国际结算》辅导(第三章)第三章汇款结算方式一、理解基本概念电汇信汇票汇拨头寸退汇中心汇票二、判断正误1、汇款业务一般有三个当事人,即:汇出行、汇款人、收款人。

()2、办理汇出汇款的原则是“先扣款,后汇出”。

()3、款项汇出后,汇款人要求撤销汇款,如汇入行已经解付,由汇款人和收款人协商解决,风险由汇出行承担。

()三、单项选择1、SWIFT是()的缩写。

A、美元清算支付系统B、环球银行金融电讯协会C、英磅清算支付系统D、港币清算支付系统2、()业务是顺汇。

A、汇款B、托收C、承兑信用证D、延期付款信用证3、汇款的偿付又称为()。

A、退汇B、拨头寸C、设账户D、信汇4、当卖方货物是畅销货时,卖方会积极争取()A、寄售B、售定C、预付货款D、货到付款四、多项选择1、汇款业务的基本当事人为()。

A、汇款人B、收款人C、汇出行D、汇入行 E需要时的代理人2、汇款申请书审核要点主要有()。

A、汇款金额与所付单证金额是否一致B、所盖印章与预留印鉴是否相符C、汇入行的名称、地址及所在国家是否完整、清楚、准确D、收款人的名称、地址、账号是否清楚、完整3、电汇是汇出行用()通知汇入行解付汇款的方式。

A、SWIFTB、电报C、电传D、CHAPS五、简答简述题:1、用图示说明中心汇票票汇业务程序2、用图示说明汇款业务的偿付指示3、举例说明在国际贸易结算中,汇款结算方式的应用及风险六、实务题1、Remitting bank: Bank of China, TianjinPaying bank: Bank of China, LuxemburgDate of cable: 9 JuneTest: 2563Ref No. 208TT0219Amount: USD1, 660.00Payee: Marie Clauda Durnont, LuxemburgAccount No. 0 - 164/7295/550 withBanque International du LuxemburgMessage: PayrollRemitter: Crystal Palace Hotel, TianjinCover: Debit our H. O. accountFM:TO:DATE:TEST OUR REFNOT ANY CHARGES FOR USPAYTOFOR CREDITING ACCOUNT NO.OFMESSAGEORDERCOVER2.请将下述的报文写成普通电报或者电传的汇款报文并用图示表示电汇路径。

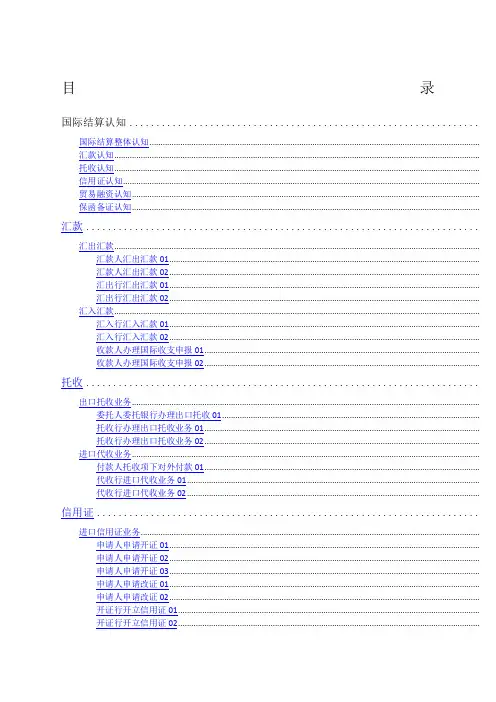

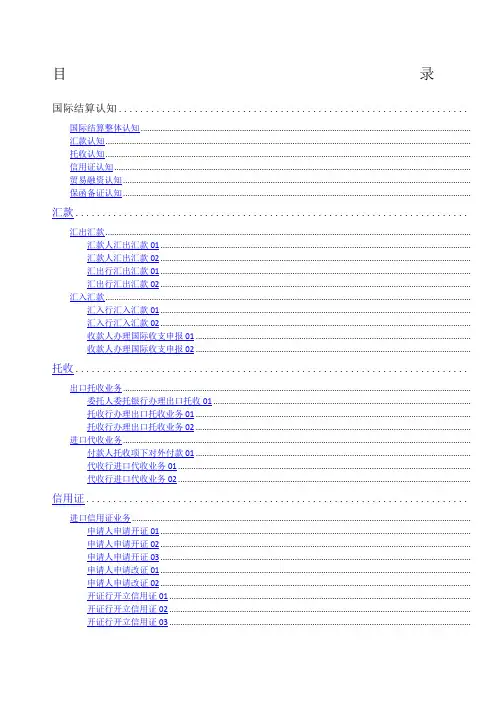

目录国际结算认知.................................................................国际结算整体认知......................................................................................................................................................汇款认知......................................................................................................................................................................托收认知......................................................................................................................................................................信用证认知..................................................................................................................................................................贸易融资认知..............................................................................................................................................................保函备证认知.............................................................................................................................................................. 汇款.........................................................................汇出汇款......................................................................................................................................................................汇款人汇出汇款01.............................................................................................................................................汇款人汇出汇款02.............................................................................................................................................汇出行汇出汇款01.............................................................................................................................................汇出行汇出汇款02.............................................................................................................................................汇入汇款......................................................................................................................................................................汇入行汇入汇款01.............................................................................................................................................汇入行汇入汇款02.............................................................................................................................................收款人办理国际收支申报01.............................................................................................................................收款人办理国际收支申报02 ............................................................................................................................. 托收.........................................................................出口托收业务..............................................................................................................................................................委托人委托银行办理出口托收01.....................................................................................................................托收行办理出口托收业务01.............................................................................................................................托收行办理出口托收业务02 .............................................................................................................................进口代收业务..............................................................................................................................................................付款人托收项下对外付款01.............................................................................................................................代收行进口代收业务01.....................................................................................................................................代收行进口代收业务02..................................................................................................................................... 信用证.......................................................................进口信用证业务..........................................................................................................................................................申请人申请开证01.............................................................................................................................................申请人申请开证02.............................................................................................................................................申请人申请开证03.............................................................................................................................................申请人申请改证01.............................................................................................................................................申请人申请改证02.............................................................................................................................................开证行开立信用证01.........................................................................................................................................开证行开立信用证02.........................................................................................................................................开证行开立信用证03.........................................................................................................................................开证行修改信用证01.........................................................................................................................................开证行修改信用证02.........................................................................................................................................付款行通知付款01.............................................................................................................................................付款行通知付款02.............................................................................................................................................出口信用证业务..........................................................................................................................................................通知行通知信用证01.........................................................................................................................................通知行通知信用证02.........................................................................................................................................通知行通知信用证03.........................................................................................................................................受益人审证交单01.............................................................................................................................................受益人审证交单02.............................................................................................................................................受益人审证交单03.............................................................................................................................................交单行审单01.....................................................................................................................................................交单行审单02.....................................................................................................................................................交单行审单03..................................................................................................................................................... 贸易融资.....................................................................出口融资案例01.........................................................................................................................................................出口融资案例02.........................................................................................................................................................进口融资案例..............................................................................................................................................................银行贸易融资操作...................................................................................................................................................... 银行保函及备用信用证.........................................................申请人申请开立保函..................................................................................................................................................担保人开立保函..........................................................................................................................................................通知行通知保函..........................................................................................................................................................受益人审核保函..........................................................................................................................................................申请人申请开立备证.................................................................................................................................................. 专项练习.....................................................................国际结算概述..............................................................................................................................................................国际结算中的票据......................................................................................................................................................汇款..............................................................................................................................................................................托收..............................................................................................................................................................................信用证..........................................................................................................................................................................国际贸易融资..............................................................................................................................................................银行保函及备用信用证..............................................................................................................................................国际结算中的单据......................................................................................................................................................国际贸易结算的风险及防范......................................................................................................................................国际结算认知国际结算整体认知P7内容4(录音听完,8分)P8内容5(6分)国际结算与国内结算的区别有哪些?(ABC)A、货币的活动范围不同B、使用的货币不同C、遵循的法律不同D、支付的工具不同P9内容6(录音听完,8分)P11内容9(6分)P14内容12(录音听完,8分)P15内容13(录音听完,8分)P16内容14(录音听完,8分)P17内容15(录音听完,8分)P18内容16(6分)国际结算的衍变历程经历哪些方面的变革?(ABCD)A、现金结算变为票据结算B、货物买卖变为单据买卖C、直接结算变为银行结算D、人工结算变为电子结算P21内容19(录音听完,8分)P22内容20(6分)国际贸易结算中的票据主要包括哪几种?(ABC)A、汇票B、本票C、支票D、发票P23内容21(6分)国际结算方式主要包括哪几种?(ABC)A、汇款B、托收C、信用证P25内容23(录音听完,8分)P31内容29(6分)下列选项中,哪些是属于国际结算中的货币清算系统?(ABCE)A、SWIFTB、CHIPSC、CHAPSD、EDIE、TATGET汇款认知P5内容2(录音听完,6分)P7内容4 (10分)在汇款的当事人中,汇款人和汇出行之间是哪种关系?(B)A、债权债务关系B、委托与被委托关系C、委托代理关系D、账户往来关系P10内容7(录音听完,6分)P11内容8(录音听完,6分)P12内容9(录音听完,6分)P14内容11(10分)汇款按照结算工具的不同,可以分为哪几种?(ABC)A、电汇B、信汇C、票汇P18内容15(录音听完,6分)P19内容16(录音听完,6分)P20内容17(录音听完,6分)P21内容18(10分)如果汇出行与汇入行之间没有帐户关系或没有所汇货币帐户关系,那么,头寸应该通过什么方式来完成转账?(B)A、账户行直接入账型B 、“碰头行”转帐型C、各自帐户行转帐型P26内容23(录音听完,6分)P27内容24(录音听完,6分)P28内容25(录音听完,6分)P29内容26(10分)在国际贸易中,汇款主要包括哪几种方式?(ABC)A、货到付款B、预付货款C、交单付现托收认知P5第2页(录音听完,7分)P8第5页(录音听完,7分)P9第6页(10分)托收的当事人中,代收行与付款人之间是什么关系?(C)A、债权债务关系B、委托代理关系C、无契约关系P11第8页(录音听完,7分)P14第11页(录音听完,7分)P18第15页(录音听完,7分)P19第16页(10分)P21第18页(录音听完,7分)P22第19页(录音听完,7分)P23第20页(录音听完,7分)P25第22页(录音听完,7分)P26第23页(录音听完,7分)P27第24页(10分)对出口商来说,风险最小的托收结算方式是哪一种?(A)A、即期付款交单B、远期付款交单C、承兑交单D、光票托收信用证认知P5内容2(录音听完,8分)P6内容3(录音听完,8分)P8内容5(录音听完,8分)P9内容6(7分)具备哪些要素的约定就可以称之为信用证?(ABC)A、信用证应当是开证行开出的确定承诺文件B、开证行承付的前提条件是相符交单C、开证行的承付承诺不可撤销P11内容8(录音听完,8分)P12内容9(录音听完,8分)P13内容10(录音听完,8分)P14内容11(录音听完,8分)P16内容24(7分)信开本信用证包括哪几种?(BCD)A、电开本信用证B、简电本信用证C、全电本信用证D、SWIFT开证P28内容24(7分)按照付款时间划分,信用证可以分为哪几种?(CDE)A、即期付款信用证B、延期付款信用证C、即期信用证D、远期信用证E、假远期信用证P31内容27(录音听完,8分)P32内容28(录音听完,8分)P35内容32(7分)银行应该对信用证的哪些方面进行审查?(ABCDE)A、审查开证行资信B、审查信用证的有效性C、审查信用证的责任条款D、索汇路线和索汇方式的审查E、信用证项下的费用问题贸易融资认知P6内容3(录音听完,5分)P8内容5(录音听完,5分)P11 内容8 (12分)在国际贸易中,进口商可以采用哪些结算方式来完成债权债务关系?(ABC)A、汇款B、托收C、信用证P15 内容12 (12分)进口商对贸易融资会有哪些需求呢?(ABC)A、进口货物的时候能否不占压资金或少占压资金B、可以在货物售出后再付款吗C、怎样在货先到而单据未到的情况下提货P16内容13(录音听完,5分)P18 内容15 (14分)出口商对贸易融资会有哪些需求呢?(ABCD)A、组织货流资金不够,银行能帮我吗?B、如何在出货后,立即获付?C、远期结算方式,可以立即收款吗?D、在托收或赊帐情况下,如何能够有保证地收回货款?P19内容16(录音听完,5分)P21 内容18 拖曳匹配题(16分)P25 内容22 (16分)国际贸易融资主要具有哪些特点?(ABCDE)A、具有自偿性B、单据通过银行传递C、期限较短D、综合收益高E、时效性强保函备证认知P5第2页(录音听完,10分)P6第3页(录音听完,10分)P9第6页(录音听完,10分)P10第7页(录音听完,10分)P12第9页(10分)银行保函的基本当事人是哪三个?(ADF)A、申请人B、转开行C、通知行D、受益人E、保兑行F、担保人G、反担保人P18第15页(10分)P20第17页(录音听完,10分)P23第20页(10分)备用信用证具有哪些性质?(ABCD)A、不可撤销性B、独立性C、跟单性D、强制性P25第22页(录音听完,10分)P26第23页(录音听完,10分)汇款汇出汇款汇款人汇出汇款01P12提问(6分)谢晓峰:“海运,从汉堡到广州航行时间大概30天左右。

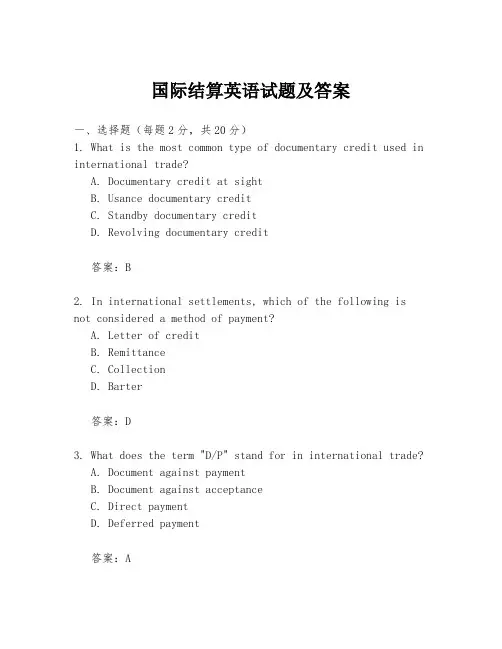

国际结算英语试题及答案一、选择题(每题2分,共20分)1. What is the most common type of documentary credit used in international trade?A. Documentary credit at sightB. Usance documentary creditC. Standby documentary creditD. Revolving documentary credit答案:B2. In international settlements, which of the following is not considered a method of payment?A. Letter of creditB. RemittanceC. CollectionD. Barter答案:D3. What does the term "D/P" stand for in international trade?A. Document against paymentB. Document against acceptanceC. Direct paymentD. Deferred payment答案:A4. Which of the following is a risk associated with documentary collections?A. Political riskB. Credit riskC. Exchange rate riskD. All of the above答案:B5. The term "usance" in the context of a usance documentary credit refers to:A. The time it takes for the documents to be presentedB. The time it takes for the payment to be madeC. The time it takes for the goods to be shippedD. The time it takes for the goods to be received答案:B6. What is the primary purpose of a documentary credit?A. To guarantee paymentB. To facilitate the transfer of documentsC. To provide a means of exchangeD. To finance the purchase of goods答案:A7. In international trade, what does "L/C" stand for?A. Letter of creditB. Letter of guaranteeC. Letter of indemnityD. Letter of intent答案:A8. Which of the following is not a document typically required in a documentary credit transaction?A. Commercial invoiceB. Bill of ladingC. Certificate of originD. Personal identification答案:D9. What is the meaning of "at sight" in the context of a documentary credit?A. Payment is made immediately upon presentation of documentsB. Payment is made after a specified periodC. Payment is made at the discretion of the bankD. Payment is made at the time of shipment答案:A10. Which of the following is a form of open account trade?A. Advance paymentB. ConsignmentC. CountertradeD. All of the above答案:A二、填空题(每题1分,共10分)11. The term "clean bill of exchange" refers to a bill of exchange that is _________.答案:unsecured12. The _________ is a document that provides evidence of the terms of a contract for the sale of goods.答案:sales contract13. In international trade, the term "forfaiting" refers to the sale of _________ at a discount.答案:usance bills of exchange14. The _________ is a document that certifies the quality, quantity, and description of the goods being shipped.答案:certificate of inspection15. A _________ is a type of documentary credit that can be drawn more than once within a specified period.答案:revolving documentary credit16. The _________ is a document that provides evidence of the insurance of goods during transit.答案:insurance policy17. The term "acceptance" in the context of a bill of exchange means that the _________ has agreed to pay the amount stated at a future date.答案:drawee18. The _________ is a document that provides evidence of the origin of the goods being shipped.答案:certificate of origin19. A _________ is a type of documentary credit that isissued by a bank at the request of the importer.答案: usance documentary credit20. The term "back-to-back" documentary credit refers to a situation where one documentary credit is _________ on the basis of another.答案:issued三、简答题(每题5分,共30分)21. Explain the difference between a documentary collection and a documentary credit.答案:A documentary collection involves the transfer of documents against payment or acceptance, without a bank guaranteeing payment. A documentary credit, on the other hand, is a commitment by a bank to pay a specified amount to the beneficiary upon fulfillment of the terms and conditionsstated in the credit.22. What are the advantages of using a documentary credit in international trade?答案:The advantages of using a documentary creditinclude providing a guarantee of payment, reducing the riskfor the exporter, ensuring that the terms of the contract are met,。

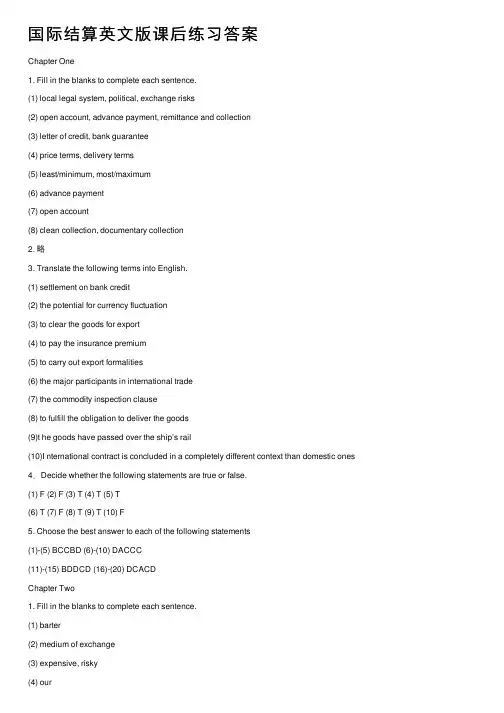

国际结算英⽂版课后练习答案Chapter One1. Fill in the blanks to complete each sentence.(1) local legal system, political, exchange risks(2) open account, advance payment, remittance and collection(3) letter of credit, bank guarantee(4) price terms, delivery terms(5) least/minimum, most/maximum(6) advance payment(7) open account(8) clean collection, documentary collection2. 略3. Translate the following terms into English.(1) settlement on bank credit(2) the potential for currency fluctuation(3) to clear the goods for export(4) to pay the insurance premium(5) to carry out export formalities(6) the major participants in international trade(7) the commodity inspection clause(8) to fulfill the obligation to deliver the goods(9)t he goods have passed over the ship’s rail(10)I nternational contract is concluded in a completely different context than domestic ones 4.Decide whether the following statements are true or false.(1) F (2) F (3) T (4) T (5) T(6) T (7) F (8) T (9) T (10) F5. Choose the best answer to each of the following statements(1)-(5) BCCBD (6)-(10) DACCC(11)-(15) BDDCD (16)-(20) DCACDChapter Two1. Fill in the blanks to complete each sentence.(1) barter(2) medium of exchange(3) expensive, risky(4) our(5) Vostro(6) vostro(7) nostro(8) specimen of authorized signatures, telegraphic test keys, terms and conditions, Swift authentic keys2. Define the following terms(1) Correspondent relationship 〖A bank having direct connection or friendly service relations with another bank.〗(2) International settlements〖International settlements are financial activities conducted among different countries in which payments are effected or funds are transferred from one country to another in order to settle accounts, debts, claims, etc. emerged in the course of political, economic or cultural contracts among them. 〗(3) Visible trade〖The exchange of goods and commodities between the buyer and the seller across borders.〗(4) Financial transaction〖International financial transaction covers foreign exchange market transactions, government supported export credits, syndicated loans, international bond issues, etc.〗(5). Vostro account〖Vostro account is an account held by a bank on behalf of a correspondent bank.〗3. Translate the following terms into English.(1) commercial credit(2) control documents(3) account relationship(4) cash settlement(5) financial intermediary(6) credit advice(7) agency arrangement(8) credit balance(9)reimbursement method(10) test key/code4.Decide whether the following statements are true or false.(1) T (2) F (3) F (4) T (5) F5. Choose the best answer to each of the following statements(1)-(5) BCDAD (6)-(10) BBDABChapter Three1. Define the following Terms:(1) Negotiable instrument〖“A negotiable instrument is a chose in action, the full and legal title to which is transferable by delivery of the instrument (po ssibly with the transferor’s endorsement) with the result that complete ownership of the instrument and all the property it represents passes free from equities to the transferee, providing the latter takes the instrument in good faith and for value.” 〗(2) Bill of exchange〖A bill of exchange is an unconditional order in writing, addressed by one person to another, signed by the person giving it, requiring the person to whom it is addressed to pay on demand, or at a fixed or determinable future time,a sum certain in money, to or to the order of a specified person, or to bearer. 〗(3) Check〖A check is an unconditional order in writing addressed by the customer to a bank signed by that customer authorizing the bank to pay on demand a specified sum of money to or to the order of a named person or to bearer. 〗(4) Documentary bill〖It is a bill with shipping documents attached thereto. 〗(5) Crossing〖A crossing is in effect an instruction to the paying bank from the drawer or holder to pay the fund to a bank only. 〗2. Translate the following terms into English.(1) ⼀般划线⽀票〖generally crossed check〗(2) 特殊划线⽀票〖specially crossed check〗(3) 过期⽀票〖a check that is out of date〗(4) 未到期⽀票〖post dated check〗(5) ⼤⼩写⾦额〖amount in words〗(6) ⽩背书〖blank endorsement〗(7) 特别背书〖special endorsement〗(8) 限制性背书〖restrictive endorsement〗(9) 跟单汇票〖documentary bill〗(10) 即期汇票〖sight draft〗(11) 远期汇票〖usance/term bill〗(12) 承兑汇票〖acceptance bill〗(13) 可确定的未来某⼀天〖determinable future date〗(14) 光票〖clean bill〗(15) 流通票据〖negotiable instrument〗(16) 贴现⾏〖discounting house 〗(17) 商⼈银⾏〖merchant bank〗(18) ⽆条件的付款承诺〖unconditional promise of payment〗(19) 负连带责任〖jointly and severally responsible〗(20) 出票后90天付款〖payable 90 days after date〗3. Decide whether the following statements are true or false.(1) T (2) F (3) T (4) T (5) T(6) F (7) T (8) T (9) T (10) T(11) F (12) T (13) T (14) F (15) T(16) T (17) T (18) F (19) F (20) F4. Choose the best answer to each of the following statements(1)-(5) CACBC (6)-(10) BACBB(11)-(15) BDCCC (16)-(20) BBAAC5-7 略Chapter Four1. Fill in the blanks to complete each sentence.(1) beneficiary(2) payment order / mail advice / debit advice(3) the remittance amount is large / the transfer of funds is subject to a time limit / test key(4) sell it to his own bank for crediting his account(5) debits / credits(6) demand draft(7) act of dishonor(8) swiftness / reliability / safety / inexpensiveness(9) debiting remitting bank’s nostro account(10) delivery of the goods2. Define the following Terms.(1) International remittance means a client (payer) asks his bank to send a sum of money to a beneficiary abroad by one of the transfer methods at his option while the beneficiary can be paid at the designated bank which is either the re mitting bank’s overseas branch or its correspondent with a nostro account.(2) Remitting bank is the bank transferring funds at the request of a remitter to its correspondent or its branch in another country and instructing the latter to pay a certain amount of money to a beneficiary.(3) A mail transfer is to transfer funds by means of a payment order or a mail advice, or sometimes a debit advice issued by a remitting bank, at the request of the remitter.(4) Demand draft transfer is a remittance method using a bank demand draft. It is a negotiable instrument drawn by one bank on its overseas branch or its correspondent abroad ordering the latter to pay on demand the stated amount to the holder of the draft.(5) Cancellation of the reimbursement under mail transfer or telegraphic transfer is usually done before its payment is made at the request of the remitter or the payee who refuses to receive the payment.3. Translate the following terms into English.(1) 汇款通知单remittance advice (2) 汇出汇款outward remittance(3) 国际汇款单international money order (4) 往来账户current account(5) ⾃动⽀付系统automated payment system (6) 作为偿付in cover(7) 赔偿保证书letter of indemnity (8) 信汇通知书 mail advice(9) 汇票的不可流通副本non-negotiable copy of draft (10) ⾸期付款down payment4. Choose the best answer to each of the following statements(1)-(5) BCABD (6)-(10) BBBAAChapter Five1. Fill in the blanks to complete each sentence.(1) presenting bank(2) title documents / pays the draft / accepts the obligation to do so(3) legal / the exchange control authorities(4) the payment is made(5) open account / advance payment(6) Inward collection(7). the remitting bank(8) trust receipt(9) D/P at sight(10) documents, draft, and collection order2. Define the following terms(1) Collection is an arrangement whereby the goods are shipped and a relevant bill of exchange is drawn by the seller on the buyer, and/or shipping documents are forwarded to the seller’s bank with clear instructions for collection through one of its correspondent banks located in the domicile of the buyer.(2) The case of need is the representative appointed by the principal to act as case of need in the event of non-acceptance and/or non-payment, whose power should be clearly and fully stated in the collection.(3) Documentary collection is a collection of financial instruments being accompanied by commercial documents or collection of commercial documents without being accompanied by financial instruments, that is, commercial documents without a bill of exchange. Alternatively, the documentary collection is a payment mechanism that allows the exporters to retain ownership of the goods until they receive payment or are reasonably certain that they will receive it.(4) Outward collection is a banking business in which a bank acting as the remitting bank sends the draft drawn against an export with or without shipping documents attached, to an appropriate overseas bank, namely, the collecting bank to get the payment or acceptance from the importer.(5) Collection bill purchased is a kind of financing by banks for exporters under documentary collection methods. It means that the remitting bank purchases the documentary bill drawn by the exporter on the importer. It involves great risk for the remitting bank due to lack of a guarantee.3. Translate the following terms into English.(1) 承兑交单acceptance against documents (2) 商业承兑汇票 trade acceptance(3) 需要时的代理⼈case of need (4) 出⼝押汇export bill purchased(5) 物权单据 title document (6) 以寄售⽅式on consignment(7) 直接托收direct collection (8) 货运单据shipping documents(9) 付款交单documents against payment (10) 远期汇票time/ tenor/term/ usance draft4. Choose the best answer to each of the following statements(1)-(5) ABCAB (6)-(10) ACAADChapter Six1. Define the following terms:(1) Letter of credit 〖The Documentary Credit or letter of credit is an undertaking issued by a bank for the account of the buyer (the applicant) or for its own account, to pay the beneficiary the value of the draft and/or documents provided that the terms and conditions of the documentary credit are complied with. 〗(2) Confirmed letter of credit 〖A credit that carries the commitment to pay by both the issuing bank and the advising bank. 〗(3) Revolving credit 〖A credit by which, under the terms and conditions thereof, the amount is renewed or reinstated without specific amendments to the documentary credit being required. 〗(4) Confirming bank 〖A bank, usually the advising bank, which adds its undertaking to those of the issuing bank and assumes liability under the credit.〗(5) Applicant of the credit〖The applicant is always an importer or a buyer, who fills out and signs an application form, requesting the bank to issue a credit in favor of an exporter or a seller abroad.〗2. Translate the following terms or sentences into English.(1) 未授权保兑〖silent confirmation 〗(2) 有效地点为开证⾏所在地的柜台〖to expire at the counters of the issuing bank 〗(3) 凭代表物权的单据付款〖to pay against documents representing the goods〗(4) 信⽤证以银⾏信⽤代替了商业信⽤。

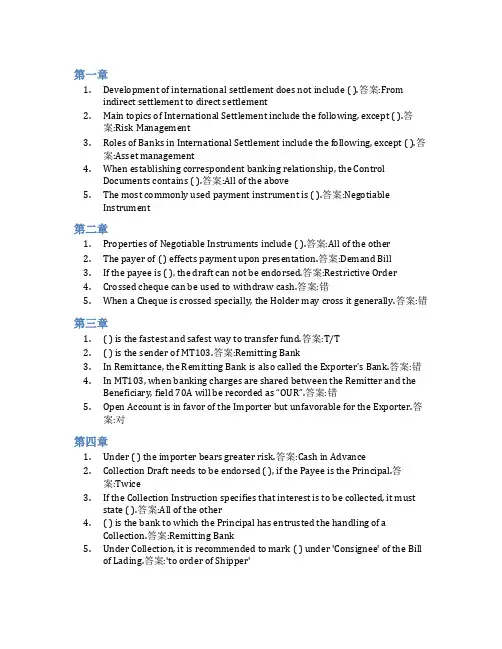

第一章1.Development of international settlement does not include ( ).答案:Fromindirect settlement to direct settlement2.Main topics of International Settlement include the following, except ( ).答案:Risk Management3.Roles of Banks in International Settlement include the following, except ( ).答案:Asset management4.When establishing correspondent banking relationship, the ControlDocuments contains ( ).答案:All of the above5.The most commonly used payment instrument is ( ).答案:NegotiableInstrument第二章1.Properties of Negotiable Instruments include ( ).答案:All of the other2.The payer of ( ) effects payment upon presentation.答案:Demand Bill3.If the payee is ( ), the draft can not be endorsed.答案:Restrictive Order4.Crossed cheque can be used to withdraw cash.答案:错5.When a Cheque is crossed specially, the Holder may cross it generally.答案:错第三章1.( ) is the fastest and safest way to transfer fund.答案:T/T2.( ) is the sender of MT103.答案:Remitting Bank3.In Remittance, the Remitting Bank is also call ed the Exporter’s Bank.答案:错4.In MT103, when banking charges are shared between the Remitter and theBeneficiary, field 70A will be recorded as “OUR”.答案:错5.Open Account is in favor of the Importer but unfavorable for the Exporter.答案:对第四章1.Under ( ) the importer bears greater risk.答案:Cash in Advance2.Collection Draft needs to be endorsed ( ), if the Payee is the Principal.答案:Twice3.If the Collection Instruction specifies that interest is to be collected, it muststate ( ).答案:All of the other4.( ) is the bank to which the Principal has entrusted the handling of aCollection.答案:Remitting Bank5.Under Collection, it is recommended to mark ( ) under 'Consignee' of the Billof Lading.答案:'to order of Shipper'第五章1.Banks takes responsibility to effect payment immediately by issuing ( ).答案:Sight Credit2.When determining the date of shipment, “on or about June 11th” refer to ( ).答案:June 6~163.The words “to”, “until”, “till”, “from” and “between” when used to determine aperiod of shipment include the date or dates mentioned答案:对4.The words “before” and “after” when used to determine a period of shipmentinclude the date mentioned.答案:错5.Partial acceptance of an amendment is not allowed and will be deemed to benotification of rejection of the amendment.答案:对第六章1.( ) will compensate the Beneficiary when the Guarantor fails to fulfill itsobligation.答案:Confirming Bank2.Under Letter of Guarantee, the liability undertaken by banks is definitive andprimary.答案:错3.Under Letter of Guarantee, Bank will effect payment only if the Beneficiaryfails to fulfill the obligations in the commercial contract.答案:错4.Under Letter of Guarantee, if the Beneficiary fails to fulfill its obligation, theApplicant has the right to make claim to the Guarantor and ask forcompensation.答案:错5.The Counter Guarantor will compensate the Beneficiary when the Guarantorfails to fulfill its obligation.答案:错第七章1.Financial documents including the following, except().答案:Invoice2.Basic documents include the following, except ( ).答案:Certificate of Origin3.( ) is not transferable. The goods can only be taken by the Consignee.答案:Straight B/L4.( ) does not state the name of the Consignee. Anyone who holds the B/L cantake goods from the Carrier.答案:Open B/L5.Bill of lading is a type of financial documents.答案:错第八章1.Place for presentation include the following, except ( ).答案:Remitting Bank2.The Notice of Refusal should include ( ).答案:All of the above3.Banks shall each have a maximum of ( ) banking days following the day ofpresentation to determine if a presentation is complying.答案:Five4.Under Letter of Credit, the Beneficiary should submit documents to theApplicant答案:错5.If presenter fails to resubmit before the lastest presenting date, thedocuments are deemed with discrepancies and can not be revised.答案:对。

目录国际结算认知.................................................................国际结算整体认知 ......................................................................................................................................................汇款认知 ......................................................................................................................................................................托收认知 ......................................................................................................................................................................信用证认知 ..................................................................................................................................................................贸易融资认知 ..............................................................................................................................................................保函备证认知 .............................................................................................................................................................. 汇款.........................................................................汇出汇款 ......................................................................................................................................................................汇款人汇出汇款01 .............................................................................................................................................汇款人汇出汇款02 .............................................................................................................................................汇出行汇出汇款01 .............................................................................................................................................汇出行汇出汇款02 .............................................................................................................................................汇入汇款 ......................................................................................................................................................................汇入行汇入汇款01 .............................................................................................................................................汇入行汇入汇款02 .............................................................................................................................................收款人办理国际收支申报01 .............................................................................................................................收款人办理国际收支申报02 ............................................................................................................................. 托收.........................................................................出口托收业务 ..............................................................................................................................................................委托人委托银行办理出口托收01 .....................................................................................................................托收行办理出口托收业务01 .............................................................................................................................托收行办理出口托收业务02 .............................................................................................................................进口代收业务 ..............................................................................................................................................................付款人托收项下对外付款01 .............................................................................................................................代收行进口代收业务01 .....................................................................................................................................代收行进口代收业务02 ..................................................................................................................................... 信用证.......................................................................进口信用证业务 ..........................................................................................................................................................申请人申请开证01 .............................................................................................................................................申请人申请开证02 .............................................................................................................................................申请人申请开证03 .............................................................................................................................................申请人申请改证01 .............................................................................................................................................申请人申请改证02 .............................................................................................................................................开证行开立信用证01 .........................................................................................................................................开证行开立信用证02 .........................................................................................................................................开证行开立信用证03 .........................................................................................................................................开证行修改信用证01 .........................................................................................................................................开证行修改信用证02 .........................................................................................................................................付款行通知付款01 .............................................................................................................................................付款行通知付款02 .............................................................................................................................................出口信用证业务 ..........................................................................................................................................................通知行通知信用证01 .........................................................................................................................................通知行通知信用证02 .........................................................................................................................................通知行通知信用证03 .........................................................................................................................................受益人审证交单01 .............................................................................................................................................受益人审证交单02 .............................................................................................................................................受益人审证交单03 .............................................................................................................................................交单行审单01 .....................................................................................................................................................交单行审单02 .....................................................................................................................................................交单行审单03 ..................................................................................................................................................... 贸易融资.....................................................................出口融资案例01 .........................................................................................................................................................出口融资案例02 .........................................................................................................................................................进口融资案例 ..............................................................................................................................................................银行贸易融资操作 ...................................................................................................................................................... 银行保函及备用信用证.........................................................申请人申请开立保函 ..................................................................................................................................................担保人开立保函 ..........................................................................................................................................................通知行通知保函 ..........................................................................................................................................................受益人审核保函 ..........................................................................................................................................................申请人申请开立备证 .................................................................................................................................................. 专项练习.....................................................................国际结算概述 ..............................................................................................................................................................国际结算中的票据 ......................................................................................................................................................汇款 ..............................................................................................................................................................................托收 ..............................................................................................................................................................................信用证 ..........................................................................................................................................................................国际贸易融资 ..............................................................................................................................................................银行保函及备用信用证 ..............................................................................................................................................国际结算中的单据 ......................................................................................................................................................国际贸易结算的风险及防范 ......................................................................................................................................国际结算认知国际结算整体认知P7内容4(录音听完,8分)P8内容5(6分)国际结算与国内结算的区别有哪些?(ABC)A、货币的活动范围不同B、使用的货币不同C、遵循的法律不同D、支付的工具不同P9内容6(录音听完,8分)P11内容9(6分)P14内容12(录音听完,8分)P15内容13(录音听完,8分)P16内容14(录音听完,8分)P17内容15(录音听完,8分)P18内容16(6分)国际结算的衍变历程经历哪些方面的变革?(ABCD)A、现金结算变为票据结算B、货物买卖变为单据买卖C、直接结算变为银行结算D、人工结算变为电子结算P21内容19(录音听完,8分)P22内容20(6分)国际贸易结算中的票据主要包括哪几种?(ABC)A、汇票B、本票C、支票D、发票P23内容21(6分)国际结算方式主要包括哪几种?(ABC)A、汇款B、托收C、信用证P25内容23(录音听完,8分)P31内容29(6分)下列选项中,哪些是属于国际结算中的货币清算系统?(ABCE)A、SWIFTB、CHIPSC、CHAPSD、EDIE、TATGET汇款认知P7内容4 (10分)在汇款的当事人中,汇款人和汇出行之间是哪种关系?(B)A、债权债务关系B、委托与被委托关系C、委托代理关系D、账户往来关系P10内容7(录音听完,6分)P11内容8(录音听完,6分)P12内容9(录音听完,6分)P14内容11(10分)汇款按照结算工具的不同,可以分为哪几种?(ABC)A、电汇B、信汇C、票汇P18内容15(录音听完,6分)P19内容16(录音听完,6分)P20内容17(录音听完,6分)P21内容18(10分)如果汇出行与汇入行之间没有帐户关系或没有所汇货币帐户关系,那么,头寸应该通过什么方式来完成转账?(B)A、账户行直接入账型B 、“碰头行”转帐型C、各自帐户行转帐型P26内容23(录音听完,6分)P27内容24(录音听完,6分)P28内容25(录音听完,6分)P29内容26(10分)在国际贸易中,汇款主要包括哪几种方式?(ABC)A、货到付款B、预付货款C、交单付现托收认知P5第2页(录音听完,7分)P8第5页(录音听完,7分)P9第6页(10分)托收的当事人中,代收行与付款人之间是什么关系?(C)A、债权债务关系B、委托代理关系C、无契约关系P11第8页(录音听完,7分)P14第11页(录音听完,7分)P18第15页(录音听完,7分)P19第16页(10分)P22第19页(录音听完,7分)P23第20页(录音听完,7分)P25第22页(录音听完,7分)P26第23页(录音听完,7分)P27第24页(10分)对出口商来说,风险最小的托收结算方式是哪一种?(A)A、即期付款交单B、远期付款交单C、承兑交单D、光票托收信用证认知P5内容2(录音听完,8分)P6内容3(录音听完,8分)P8内容5(录音听完,8分)P9内容6(7分)具备哪些要素的约定就可以称之为信用证?(ABC)A、信用证应当是开证行开出的确定承诺文件B、开证行承付的前提条件是相符交单C、开证行的承付承诺不可撤销P11内容8(录音听完,8分)P12内容9(录音听完,8分)P13内容10(录音听完,8分)P14内容11(录音听完,8分)P16内容24(7分)信开本信用证包括哪几种?(BCD)A、电开本信用证B、简电本信用证C、全电本信用证D、SWIFT开证P28内容24(7分)按照付款时间划分,信用证可以分为哪几种?(CDE)A、即期付款信用证B、延期付款信用证C、即期信用证D、远期信用证E、假远期信用证P31内容27(录音听完,8分)P32内容28(录音听完,8分)P35内容32(7分)银行应该对信用证的哪些方面进行审查?(ABCDE)A、审查开证行资信B、审查信用证的有效性C、审查信用证的责任条款D、索汇路线和索汇方式的审查E、信用证项下的费用问题贸易融资认知P6内容3(录音听完,5分)P8内容5(录音听完,5分)P11 内容8 (12分)在国际贸易中,进口商可以采用哪些结算方式来完成债权债务关系?(ABC)A、汇款B、托收C、信用证P15 内容12 (12分)进口商对贸易融资会有哪些需求呢?(ABC)A、进口货物的时候能否不占压资金或少占压资金B、可以在货物售出后再付款吗C、怎样在货先到而单据未到的情况下提货P16内容13(录音听完,5分)P18 内容15 (14分)出口商对贸易融资会有哪些需求呢?(ABCD)A、组织货流资金不够,银行能帮我吗?B、如何在出货后,立即获付?C、远期结算方式,可以立即收款吗?D、在托收或赊帐情况下,如何能够有保证地收回货款?P19内容16(录音听完,5分)P21 内容18 拖曳匹配题(16分)P25 内容22 (16分)国际贸易融资主要具有哪些特点?(ABCDE)A、具有自偿性B、单据通过银行传递C、期限较短D、综合收益高E、时效性强保函备证认知P5第2页(录音听完,10分)P6第3页(录音听完,10分)P9第6页(录音听完,10分)P10第7页(录音听完,10分)P12第9页(10分)银行保函的基本当事人是哪三个?(ADF)A、申请人B、转开行C、通知行D、受益人E、保兑行F、担保人G、反担保人P18第15页(10分)P20第17页(录音听完,10分)P23第20页(10分)备用信用证具有哪些性质?(ABCD)A、不可撤销性B、独立性C、跟单性D、强制性P25第22页(录音听完,10分)P26第23页(录音听完,10分)汇款汇出汇款汇款人汇出汇款01P12提问(6分)谢晓峰:“海运,从汉堡到广州航行时间大概30天左右。

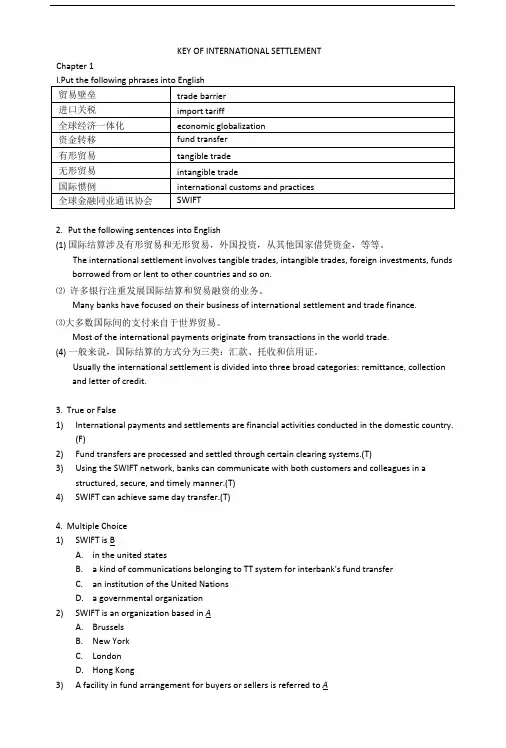

KEY OF INTERNATIONAL SETTLEMENTChapter 12.Put the following sentences into English(1)国际结算涉及有形贸易和无形贸易,外国投资,从其他国家借贷资金,等等。

The international settlement involves tangible trades, intangible trades, foreign investments, funds borrowed from or lent to other countries and so on.⑵ 许多银行注重发展国际结算和贸易融资的业务。

Many banks have focused on their business of international settlement and trade finance.⑶大多数国际间的支付来自于世界贸易。

Most of the international payments originate from transactions in the world trade.(4) 一般来说,国际结算的方式分为三类:汇款、托收和信用证。

Usually the international settlement is divided into three broad categories: remittance, collection and letter of credit.3.True or False1)International payments and settlements are financial activities conducted in the domestic country.(F)2)Fund transfers are processed and settled through certain clearing systems.(T)3)Using the SWIFT network, banks can communicate with both customers and colleagues in astructured, secure, and timely manner.(T)4)SWIFT can achieve same day transfer.(T)4.Multiple Choice1)SWIFT is BA.in the united statesB. a kind of communications belonging to TT system for interbank's fund transferC.an institution of the United NationsD. a governmental organization2)SWIFT is an organization based in AA.BrusselsB.New YorkC.LondonD.Hong Kong3) A facility in fund arrangement for buyers or sellers is referred to AA.trade financeB.sale contractC.letter of creditD.bill of exchange4)Fund transfers are processed and settled through CA.banksB.SWIFTC.clearing systemD.telecommunication systems5) C is the reason why international trade first began.A.Uneven distribution of resourcesB.Patterns of demandC.Economic benefitsparative advantages5.Answer the following questions1)Where are the medium of exchange originated from?Tracing back the history of international settlement, the medium of exchange originated from coins to notes.2)What will inevitably lead to under the international political, economic and cultural exchanges?The international political, economic and cultural exchange inevitably leads to credits and debts owed by one country to another.3)Why do banks focus on the development of the businesses of international settlement? Banksfocus more and more on the development of the businesses because it is a major resource ofprofits.4)What will banks do to meet the higher and higher demand of the international market? Banksneed to develop innovative products and deliver the best services possible in whatever way they can.Chapter 2(1)用于国际结算的货币是可兑换的货币。

《国际结算》辅导(第四章)第四章托收方式一、理解下列概念托收(URC522)、托收指示、承兑交单、付款交单、光票托收、跟单托收二、写出下列英文缩写的英文全称及中文意思1.D/P 2.D/A 3.URC 4.P.A.5.T/R 6.OC 7.IC三、将下列英文翻译成中文1.cover 2.reimbursement of remittance cover3.collection 4.principal5.remitting 6.collecting bank7.presenting bank 8.drawer9.financial documents 10.commercial documents11.consignor 12.clean collection13.documentary collection 14.documents against payment15.documents against acceptance16.documentary bill for collection17.drawee 18.collection instruction四、是非判断1.在托收业务中,只要委托银行可靠,收回货款就不成问题。

2.对于卖方来说,付款交单托收和承兑交单托收都有风险,而承兑交单托收容易被买方接受,有利于达成交易,因此,应多采用承兑交单托收方式。

3.托收业务中,银行负责查验所收到的单据的种类和各自份数,而不负责审查其具体内容和从单据中获得托收指示。

4.以信托收据提取的货物,其所有权并不随货物的转移而转移。

5.在托收业务中,未经代收行同意,委托人不能将海运提单做代收行抬头。

6.在当代国际托收业务中,托收指示中应注明受到国际商会的《托收统一规则》的约束。

7.在托收业务中,除非委托人另有授权,银行将只接受委托的当事人或银行的指示。

8.银行可以根据自己的判断,来决定是否接受委托办理托收业务。

9.通常情况下,由托收行根据自己的业务往来情况来选择代收行比较稳妥。

国际结算(英⽂版)清华⼤学出版社答案.docKEY OF INTERNATIONAL SETTLEMENTChapter 12.Put the following sentences into English(1)国际结算涉及有形贸易和⽆形贸易,外国投资,从其他国家借贷资⾦,等等。

The international settlement involves tangible trades, intangible trades, foreign investments, funds borrowed from or lent to other countries and so on.⑵许多银⾏注重发展国际结算和贸易融资的业务。

Many banks have focused on their business of international settlement and trade finance.⑶⼤多数国际间的⽀付来⾃于世界贸易。

Most of the international payments originate from transactions in the world trade.(4) ⼀般来说,国际结算的⽅式分为三类:汇款、托收和信⽤证。

Usually the international settlement is divided into three broad categories: remittance, collection and letter of credit.3.True or False1)International payments and settlements are financial activities conducted in the domestic country.(F)2)Fund transfers are processed and settled through certain clearing systems.(T)3)Using the SWIFT network, banks can communicate with both customers and colleagues in astructured, secure, and timely manner.(T)4)SWIFT can achieve same day transfer.(T)4.Multiple Choice1)SWIFT is BA.in the united statesB. a kind of communications belonging to TT system for interbank's fund transferC.an institution of the United NationsD. a governmental organization2)SWIFT is an organization based in AA.BrusselsB.New YorkC.LondonD.Hong Kong3) A facility in fund arrangement for buyers or sellers is referred to AA.trade financeB.sale contractC.letter of creditD.bill of exchange4)Fund transfers are processed and settled through CA.banksB.SWIFTC.clearing systemD.telecommunication systems5) C is the reason why international trade first began.A.Uneven distribution of resourcesB.Patterns of demandC.Economic benefits/doc/cded97ce27c52cc58bd63186bceb19e8b9f6ec66.html parative advantages5.Answer the following questions1)Where are the medium of exchange originated from?Tracing back the history of international settlement, the medium of exchange originated from coins to notes.2)What will inevitably lead to under the international political, economic and cultural exchanges?The international political, economic and cultural exchange inevitably leads to credits and debts owed by one country to another.3)Why do banks focus on the development of the businesses of international settlement? Banksfocus more and more on the development of the businesses because it is a major resource ofprofits.4)What will banks do to meet the higher and higher demand of the international market? Banksneed to develop innovative products and deliver the best services possible in whatever way they can.Chapter 2(1)⽤于国际结算的货币是可兑换的货币。

目录国际结算认知.................................................................国际结算整体认知 ......................................................................................................................................................汇款认知 ......................................................................................................................................................................托收认知 ......................................................................................................................................................................信用证认知 ..................................................................................................................................................................贸易融资认知 ..............................................................................................................................................................保函备证认知 .............................................................................................................................................................. 汇款.........................................................................汇出汇款 ......................................................................................................................................................................汇款人汇出汇款01 .............................................................................................................................................汇款人汇出汇款02 .............................................................................................................................................汇出行汇出汇款01 .............................................................................................................................................汇出行汇出汇款02 .............................................................................................................................................汇入汇款 ......................................................................................................................................................................汇入行汇入汇款01 .............................................................................................................................................汇入行汇入汇款02 .............................................................................................................................................收款人办理国际收支申报01 .............................................................................................................................收款人办理国际收支申报02 ............................................................................................................................. 托收.........................................................................出口托收业务 ..............................................................................................................................................................委托人委托银行办理出口托收01 .....................................................................................................................托收行办理出口托收业务01 .............................................................................................................................托收行办理出口托收业务02 .............................................................................................................................进口代收业务 ..............................................................................................................................................................付款人托收项下对外付款01 .............................................................................................................................代收行进口代收业务01 .....................................................................................................................................代收行进口代收业务02 ..................................................................................................................................... 信用证.......................................................................进口信用证业务 ..........................................................................................................................................................申请人申请开证01 .............................................................................................................................................申请人申请开证02 .............................................................................................................................................申请人申请开证03 .............................................................................................................................................申请人申请改证01 .............................................................................................................................................申请人申请改证02 .............................................................................................................................................开证行开立信用证01 .........................................................................................................................................开证行开立信用证02 .........................................................................................................................................开证行开立信用证03 .........................................................................................................................................开证行修改信用证01 .........................................................................................................................................开证行修改信用证02 .........................................................................................................................................付款行通知付款01 .............................................................................................................................................付款行通知付款02 .............................................................................................................................................出口信用证业务 ..........................................................................................................................................................通知行通知信用证01 .........................................................................................................................................通知行通知信用证02 .........................................................................................................................................通知行通知信用证03 .........................................................................................................................................受益人审证交单01 .............................................................................................................................................受益人审证交单02 .............................................................................................................................................受益人审证交单03 .............................................................................................................................................交单行审单01 .....................................................................................................................................................交单行审单02 .....................................................................................................................................................交单行审单03 ..................................................................................................................................................... 贸易融资.....................................................................出口融资案例01 .........................................................................................................................................................出口融资案例02 .........................................................................................................................................................进口融资案例 ..............................................................................................................................................................银行贸易融资操作 ...................................................................................................................................................... 银行保函及备用信用证.........................................................申请人申请开立保函 ..................................................................................................................................................担保人开立保函 ..........................................................................................................................................................通知行通知保函 ..........................................................................................................................................................受益人审核保函 ..........................................................................................................................................................申请人申请开立备证 .................................................................................................................................................. 专项练习.....................................................................国际结算概述 ..............................................................................................................................................................国际结算中的票据 ......................................................................................................................................................汇款 ..............................................................................................................................................................................托收 ..............................................................................................................................................................................信用证 ..........................................................................................................................................................................国际贸易融资 ..............................................................................................................................................................银行保函及备用信用证 ..............................................................................................................................................国际结算中的单据 ......................................................................................................................................................国际贸易结算的风险及防范 ......................................................................................................................................国际结算认知国际结算整体认知P7内容4(录音听完,8分)P8内容5(6分)国际结算与国内结算的区别有哪些?(ABC)A、货币的活动范围不同B、使用的货币不同C、遵循的法律不同D、支付的工具不同P9内容6(录音听完,8分)P11内容9(6分)P14内容12(录音听完,8分)P15内容13(录音听完,8分)P16内容14(录音听完,8分)P17内容15(录音听完,8分)P18内容16(6分)国际结算的衍变历程经历哪些方面的变革?(ABCD)A、现金结算变为票据结算B、货物买卖变为单据买卖C、直接结算变为银行结算D、人工结算变为电子结算P21内容19(录音听完,8分)P22内容20(6分)国际贸易结算中的票据主要包括哪几种?(ABC)A、汇票B、本票C、支票D、发票P23内容21(6分)国际结算方式主要包括哪几种?(ABC)A、汇款B、托收C、信用证P25内容23(录音听完,8分)P31内容29(6分)下列选项中,哪些是属于国际结算中的货币清算系统?(ABCE)A、SWIFTB、CHIPSC、CHAPSD、EDIE、TATGET汇款认知P7内容4 (10分)在汇款的当事人中,汇款人和汇出行之间是哪种关系?(B)A、债权债务关系B、委托与被委托关系C、委托代理关系D、账户往来关系P10内容7(录音听完,6分)P11内容8(录音听完,6分)P12内容9(录音听完,6分)P14内容11(10分)汇款按照结算工具的不同,可以分为哪几种?(ABC)A、电汇B、信汇C、票汇P18内容15(录音听完,6分)P19内容16(录音听完,6分)P20内容17(录音听完,6分)P21内容18(10分)如果汇出行与汇入行之间没有帐户关系或没有所汇货币帐户关系,那么,头寸应该通过什么方式来完成转账?(B)A、账户行直接入账型B 、“碰头行”转帐型C、各自帐户行转帐型P26内容23(录音听完,6分)P27内容24(录音听完,6分)P28内容25(录音听完,6分)P29内容26(10分)在国际贸易中,汇款主要包括哪几种方式?(ABC)A、货到付款B、预付货款C、交单付现托收认知P5第2页(录音听完,7分)P8第5页(录音听完,7分)P9第6页(10分)托收的当事人中,代收行与付款人之间是什么关系?(C)A、债权债务关系B、委托代理关系C、无契约关系P11第8页(录音听完,7分)P14第11页(录音听完,7分)P18第15页(录音听完,7分)P19第16页(10分)P22第19页(录音听完,7分)P23第20页(录音听完,7分)P25第22页(录音听完,7分)P26第23页(录音听完,7分)P27第24页(10分)对出口商来说,风险最小的托收结算方式是哪一种?(A)A、即期付款交单B、远期付款交单C、承兑交单D、光票托收信用证认知P5内容2(录音听完,8分)P6内容3(录音听完,8分)P8内容5(录音听完,8分)P9内容6(7分)具备哪些要素的约定就可以称之为信用证?(ABC)A、信用证应当是开证行开出的确定承诺文件B、开证行承付的前提条件是相符交单C、开证行的承付承诺不可撤销P11内容8(录音听完,8分)P12内容9(录音听完,8分)P13内容10(录音听完,8分)P14内容11(录音听完,8分)P16内容24(7分)信开本信用证包括哪几种?(BCD)A、电开本信用证B、简电本信用证C、全电本信用证D、SWIFT开证P28内容24(7分)按照付款时间划分,信用证可以分为哪几种?(CDE)A、即期付款信用证B、延期付款信用证C、即期信用证D、远期信用证E、假远期信用证P31内容27(录音听完,8分)P32内容28(录音听完,8分)P35内容32(7分)银行应该对信用证的哪些方面进行审查?(ABCDE)A、审查开证行资信B、审查信用证的有效性C、审查信用证的责任条款D、索汇路线和索汇方式的审查E、信用证项下的费用问题贸易融资认知P6内容3(录音听完,5分)P8内容5(录音听完,5分)P11 内容8 (12分)在国际贸易中,进口商可以采用哪些结算方式来完成债权债务关系?(ABC)A、汇款B、托收C、信用证P15 内容12 (12分)进口商对贸易融资会有哪些需求呢?(ABC)A、进口货物的时候能否不占压资金或少占压资金B、可以在货物售出后再付款吗C、怎样在货先到而单据未到的情况下提货P16内容13(录音听完,5分)P18 内容15 (14分)出口商对贸易融资会有哪些需求呢?(ABCD)A、组织货流资金不够,银行能帮我吗?B、如何在出货后,立即获付?C、远期结算方式,可以立即收款吗?D、在托收或赊帐情况下,如何能够有保证地收回货款?P19内容16(录音听完,5分)P21 内容18 拖曳匹配题(16分)P25 内容22 (16分)国际贸易融资主要具有哪些特点?(ABCDE)A、具有自偿性B、单据通过银行传递C、期限较短D、综合收益高E、时效性强保函备证认知P5第2页(录音听完,10分)P6第3页(录音听完,10分)P9第6页(录音听完,10分)P10第7页(录音听完,10分)P12第9页(10分)银行保函的基本当事人是哪三个?(ADF)A、申请人B、转开行C、通知行D、受益人E、保兑行F、担保人G、反担保人P18第15页(10分)P20第17页(录音听完,10分)P23第20页(10分)备用信用证具有哪些性质?(ABCD)A、不可撤销性B、独立性C、跟单性D、强制性P25第22页(录音听完,10分)P26第23页(录音听完,10分)汇款汇出汇款汇款人汇出汇款01P12提问(6分)谢晓峰:“海运,从汉堡到广州航行时间大概30天左右。