财务管理chapter3习题

- 格式:doc

- 大小:221.50 KB

- 文档页数:46

财务管理第三章作业答案一、判断、选择题1、国库券是一种几乎没有风险的有价证券,其利率可以代表资金时间价值。

答案:×资金时间价值=国债利率-通货膨胀补偿率2、已知(F/A,10%,9)=13.579,(F/A,10%,11)=18.531。

则10年,10%的即付年金终值系数为()。

A.17.531B.15.937C.14.579D.12.579答案:A解析:10年,10%的即付年金终值系数=(F/A,10%,10)×(1+10%)=(F/A,10%,11)-1=18.531-1=17.531。

3、企业年初借得50000元贷款,10年期,年利率12%,每年末等额偿还。

已知年金现值系数(P/A,12%,10)=5.6502,则每年应付金额为()元。

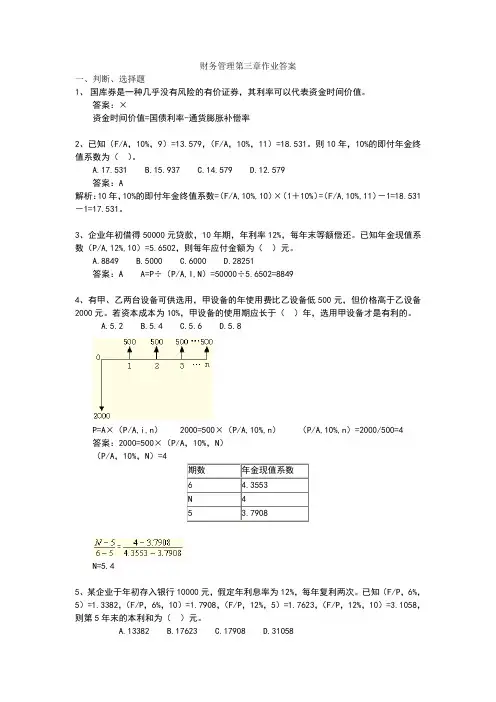

A.8849B.5000C.6000D.28251答案:A A=P÷(P/A,I,N)=50000÷5.6502=88494、有甲、乙两台设备可供选用,甲设备的年使用费比乙设备低500元,但价格高于乙设备2000元。

若资本成本为10%,甲设备的使用期应长于()年,选用甲设备才是有利的。

A.5.2B.5.4C.5.6D.5.8P=A×(P/A,i,n)2000=500×(P/A,10%,n)(P/A,10%,n)=2000/500=4答案:2000=500×(P/A,10%,N)(P/A,10%,N)=4N=5.45、某企业于年初存入银行10000元,假定年利息率为12%,每年复利两次。

已知(F/P,6%,5)=1.3382,(F/P,6%,10)=1.7908,(F/P,12%,5)=1.7623,(F/P,12%,10)=3.1058,则第5年末的本利和为()元。

A.13382B.17623C.17908D.31058答案:C解析:第5年末的本利和=10000×(F/P,6%,10)=17908(元)。

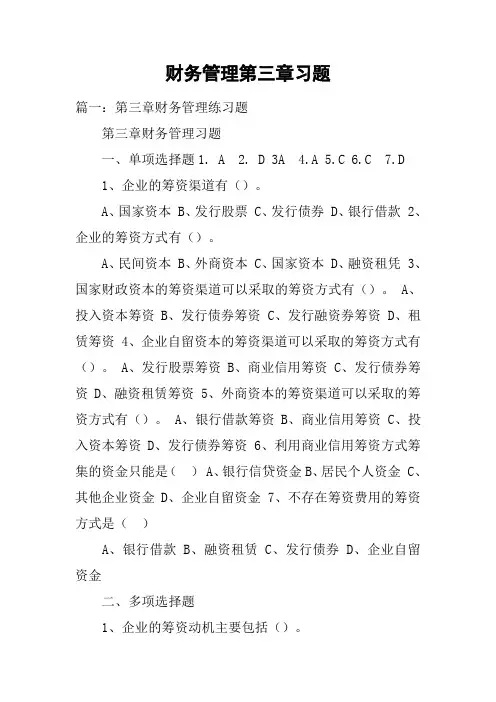

财务管理第三章习题财务管理第三章习题篇一:第三章财务管理练习题第三章财务管理习题一、单项选择题1. A 2. D 3A 4.A 5.C 6.C 7.D1、企业的筹资渠道有()。

A、国家资本B、发行股票C、发行债券D、银行借款 2、企业的筹资方式有()。

A、民间资本B、外商资本C、国家资本D、融资租凭 3、国家财政资本的筹资渠道可以采取的筹资方式有()。

A、投入资本筹资B、发行债券筹资 C、发行融资券筹资 D、租赁筹资 4、企业自留资本的筹资渠道可以采取的筹资方式有()。

A、发行股票筹资B、商业信用筹资 C、发行债券筹资D、融资租赁筹资 5、外商资本的筹资渠道可以采取的筹资方式有()。

A、银行借款筹资B、商业信用筹资 C、投入资本筹资D、发行债券筹资 6、利用商业信用筹资方式筹集的资金只能是() A、银行信贷资金B、居民个人资金 C、其他企业资金D、企业自留资金 7、不存在筹资费用的筹资方式是()A、银行借款B、融资租赁C、发行债券D、企业自留资金二、多项选择题1、企业的筹资动机主要包括()。

A、扩张筹资动机B、偿债动机C、对外投资动机D、混合动机E、经营管理动机2、企业的筹资渠道包括()。

A、国家资本B、银行资本C、民间资本D、外商资本3、非银行金融机构主要有()。

A、信托投资公司B、租赁公司C、保险公司D、证券公司E、企业集团的财务公司 4、企业筹资方式有()。

A、吸收投资B、发行股票C、发行公债D、内部资本E、长期借款5、国家财政资本渠道可以采用的筹资方式有()。

A、发行股票B、发行融资券C、吸收直接投资D、租凭筹资E、发行债券6、非银行金融机构资本渠道可以采取的筹资方式有()。

A、商业信用B、发行股票C、吸收直接投资D、租赁筹资E、发行融资券7、企业内部筹资的资本是()。

A、发行股票B、发行债券C、计提折旧D、留用利润E、银行借款8、长期资本通常采用()等方式来筹集。

A、长期借款 B、商业信用 C、融资租赁 D、发行债券 E、发行股票9、企业的短期资本一般是通过()等方式融通的。

财务管理练习题答案第三章一、选择题1. 以下哪项不是财务杠杆的作用?A. 增加企业收益B. 提高股东权益回报率C. 降低企业风险D. 增加企业价值答案:C2. 财务分析中,流动比率的计算公式是什么?A. 流动资产 / 总资产B. 流动资产 / 流动负债C. 总资产 / 总负债D. 总负债 / 股东权益答案:B3. 以下哪项不是资本预算的基本步骤?A. 确定项目现金流B. 评估项目风险C. 计算项目净现值D. 确定项目成本答案:D二、判断题1. 企业在进行资本结构调整时,应优先考虑权益融资而非债务融资,以降低财务风险。

(错误)2. 企业进行财务预测时,可以使用历史数据进行趋势分析,但不能使用比率分析。

(错误)3. 企业在进行现金流量管理时,应确保有足够的现金储备以应对突发事件。

(正确)三、简答题1. 简述财务杠杆对企业的影响。

答案:财务杠杆是指企业通过借债来增加投资,从而放大投资收益或亏损的能力。

它可以提高股东权益回报率,但同时也增加了企业的财务风险。

当企业的投资回报率高于债务成本时,财务杠杆可以增加企业价值;反之,则会减少企业价值。

2. 什么是现金流量表?它对企业财务管理有何重要性?答案:现金流量表是一份记录企业在一定时期内现金和现金等价物流入和流出情况的财务报表。

它对企业财务管理至关重要,因为它提供了企业现金流入和流出的详细信息,帮助管理层评估企业的流动性、偿债能力和财务健康状况。

四、计算题1. 假设某企业有流动资产200万元,流动负债100万元,计算该企业的流动比率。

答案:流动比率 = 流动资产 / 流动负债 = 200 / 100 = 22. 如果某企业计划投资一个项目,预计未来5年的净现金流分别为10万、15万、20万、25万和30万,假设折现率为10%,计算该项目的净现值。

答案:净现值 = 10 / (1+0.1)^1 + 15 / (1+0.1)^2 + 20 /(1+0.1)^3 + 25 / (1+0.1)^4 + 30 / (1+0.1)^5= 10 / 1.1 + 15 / 1.21 + 20 / 1.331 + 25 / 1.4641 + 30 / 1.6105= 9.09 + 12.39 + 15.02 + 17.08 + 18.63= 72.20万元五、案例分析题1. 某公司计划进行一项新的投资项目,预计初始投资为500万元,未来5年的预期现金流分别为100万、120万、140万、160万和180万。

第三章财务分析一、单项选择题1、下列经济业务会使企业的速动比率提高的是( )。

A、销售库存商品B、收回应收账款C、购买短期债券D、用固定资产对外进行长期投资2、下列财务比率中,可以反映企业偿债能力的是( )。

A、平均收款期B、销售利润率C、市盈率D、已获利息倍数3、下列不属于偿债能力分析指标的是()。

A、资产负债率B、现金比率C、产权比率D、安全边际4、下列财务比率中综合性最强、最具有代表性的指标是()。

A 、资产周转率B、净值报酬率C 、资产负债率D 、资产净利率5、流动比率小于1时,赊购原材料若干,将会( )。

A、增大流动比率B、降低流动比率C、降低营运资金D、增大营运资金6、在计算速动比率时,要把存货从流动资产中剔除的原因,不包括( )A、可能存在部分存货已经损坏但尚未处理的情况B、部分存货已抵押给债权人C、可能存在成本与合理市价相差悬殊的存货估价问题D、存货可能采用不同的计价方法7、不影响应收账款周转率指标利用价值的因素是( )。

A、销售折让与折扣的波动B、季节性经营引起的销售额波动C、大量使用分期付款结算方式D、大量使用现金结算的销售8、ABC公司无优先股,去年每股盈余为4元,每股发放股利2元,保留盈余在过去一年中增加了500万元。

年底每股账面价值为30元,负债总额为5000万元,则该公司的资产负债率为( )。

A、30%B、33%C、40%D、44%9、在杜邦财务体系中,假设其他情况相同,下列说法中错误的是( )A、权益乘数大则财务风险大B、权益乘数大则权益净利率大C、权益乘数等于资产权益率的倒数D、权益乘数大则资产净利率大10、下列公式中不正确的是( )。

A、股利支付率+留存盈利比率=1B、股利支付率×股利保障倍数=1C、变动成本率+边际贡献率=1D、资产负债率×产权比率=111、市净率指标的计算不涉及的参数是( )。

A、年末普通股股数B、年末普通股权益C、年末普通股股本D、每股市价12、一般认为,流动比率保持在( )以上时,资产的流动性较好。

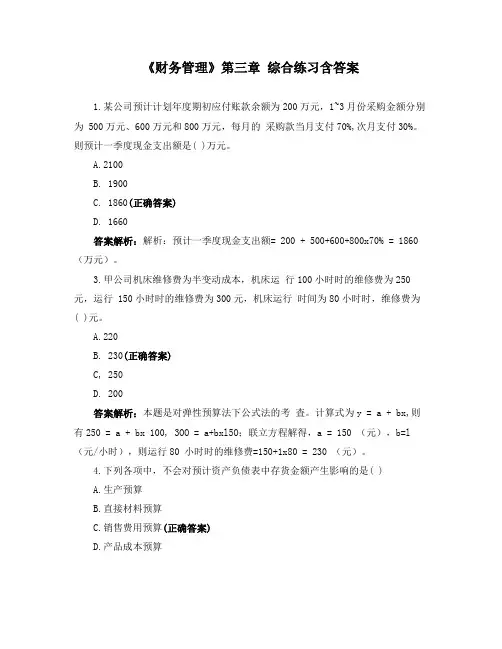

《财务管理》第三章综合练习含答案1.某公司预计计划年度期初应付账款余额为200万元,1~3月份采购金额分别为 500万元、600万元和800万元,每月的采购款当月支付70%,次月支付30%。

则预计一季度现金支出额是( )万元。

A.2100B. 1900C. 1860(正确答案)D. 1660答案解析:解析:预计一季度现金支出额= 200 + 500+600+800x70% = 1860 (万元)。

3.甲公司机床维修费为半变动成本,机床运行100小时时的维修费为250元,运行 150小时时的维修费为300元,机床运行时间为80小时时,维修费为( )元。

A.220B. 230(正确答案)C, 250D. 200答案解析:本题是对弹性预算法下公式法的考査。

计算式为y = a + bx,则有250 = a + bx 100, 3OO = a+bxl5O;联立方程解得,a = 150 (元),b=l (元/小时),则运行80 小时时的维修费=150+1x80 = 230 (元)。

4.下列各项中,不会对预计资产负债表中存货金额产生影响的是( )A.生产预算B.直接材料预算C.销售费用预算(正确答案)D.产品成本预算答案解析:销售费用预算只是影响利润表中数额,对存货项目没有影响。

选项C正确。

生产预算只涉及实物量指标,不涉及价值量指标,虽然它不会直接对预计资产负债表中存货金额产生影响,但是它对直接材料预算、产品成本预算有影响,从而间接影响预计资产负债表中存货金额,所以选项A错误。

5.下列有关预算作用的表述中,不正确的是 ( )。

A.通过规划、控制和引导经济活动,使企业经营达到预期目标B.是业绩考核的重要依据c.可以核算实际成本的执行结果(正确答案)D,可以实现企业内部各个部门之间的协调答案解析:本题的考点是预算的作用。

预算作为一种数量化的详细计划,它是对未来活动的细致、周密安排,是未来经营活动的依据,不是用来核算实际的执行结果。

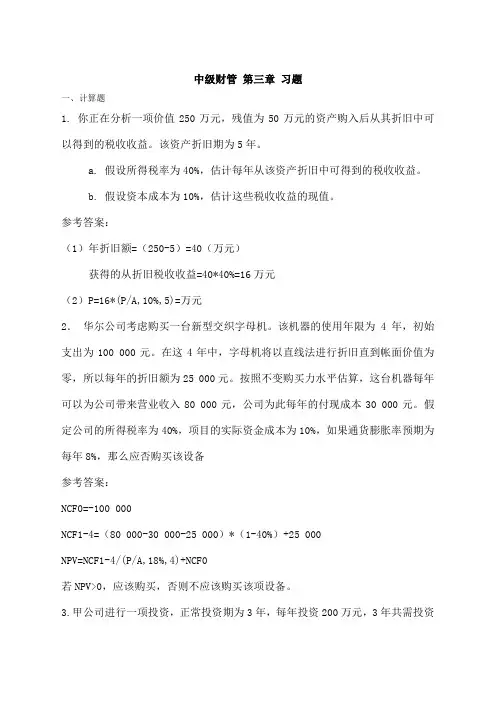

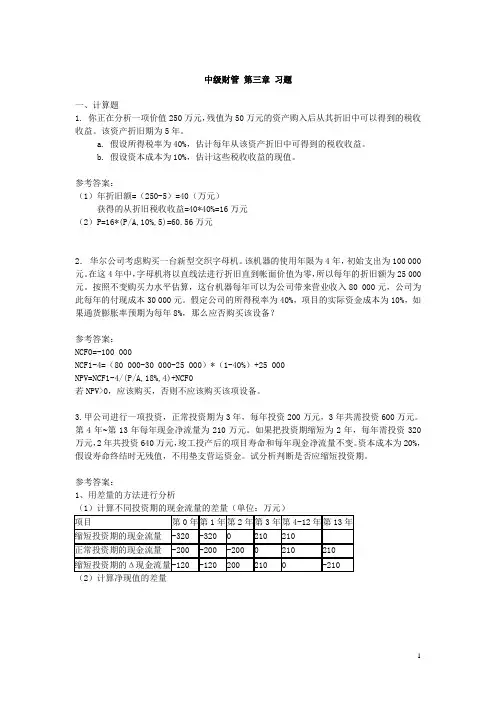

中级财管第三章习题一、计算题1. 你正在分析一项价值250万元,残值为50万元的资产购入后从其折旧中可以得到的税收收益。

该资产折旧期为5年。

a. 假设所得税率为40%,估计每年从该资产折旧中可得到的税收收益。

b. 假设资本成本为10%,估计这些税收收益的现值。

参考答案:(1)年折旧额=(250-5)=40(万元)获得的从折旧税收收益=40*40%=16万元(2)P=16*(P/A,10%,5)=万元2.华尔公司考虑购买一台新型交织字母机。

该机器的使用年限为4年,初始支出为100 000元。

在这4年中,字母机将以直线法进行折旧直到帐面价值为零,所以每年的折旧额为25 000元。

按照不变购买力水平估算,这台机器每年可以为公司带来营业收入80 000元,公司为此每年的付现成本30 000元。

假定公司的所得税率为40%,项目的实际资金成本为10%,如果通货膨胀率预期为每年8%,那么应否购买该设备参考答案:NCF0=-100 000NCF1-4=(80 000-30 000-25 000)*(1-40%)+25 000NPV=NCF1-4/(P/A,18%,4)+NCF0若NPV>0,应该购买,否则不应该购买该项设备。

3.甲公司进行一项投资,正常投资期为3年,每年投资200万元,3年共需投资600万元。

第4年~第13年每年现金净流量为210万元。

如果把投资期缩短为2年,每年需投资320万元,2年共投资640万元,竣工投产后的项目寿命和每年现金净流量不变。

资本成本为20%,假设寿命终结时无残值,不用垫支营运资金。

试分析判断是否应缩短投资期。

参考答案:1、用差量的方法进行分析(1)计算不同投资期的现金流量的差量(单位:万元)(2)计算净现值的差量2、分别计算两种方案的净现值进行比较(1)计算原定投资期的净现值(2)计算缩短投资期后的净现值(3)比较两种方案的净现值并得出结论:因为缩短投资期会比按照原投资期投资增加净现值()万元,所以应该采用缩短投资的方案。

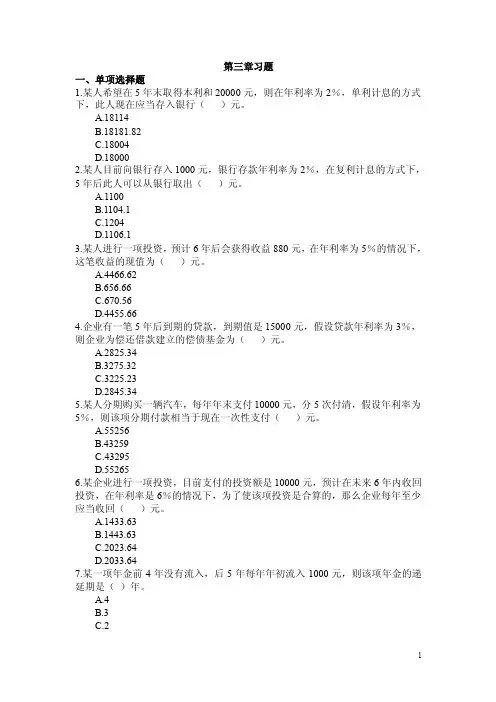

第三章习题一、单项选择题1.某人希望在5年末取得本利和20000元,则在年利率为2%,单利计息的方式下,此人现在应当存入银行()元。

A.18114B.18181.82C.18004D.180002.某人目前向银行存入1000元,银行存款年利率为2%,在复利计息的方式下,5年后此人可以从银行取出()元。

A.1100B.1104.1C.1204D.1106.13.某人进行一项投资,预计6年后会获得收益880元,在年利率为5%的情况下,这笔收益的现值为()元。

A.4466.62B.656.66C.670.56D.4455.664.企业有一笔5年后到期的贷款,到期值是15000元,假设贷款年利率为3%,则企业为偿还借款建立的偿债基金为()元。

A.2825.34B.3275.32C.3225.23D.2845.345.某人分期购买一辆汽车,每年年末支付10000元,分5次付清,假设年利率为5%,则该项分期付款相当于现在一次性支付()元。

A.55256B.43259C.43295D.552656.某企业进行一项投资,目前支付的投资额是10000元,预计在未来6年内收回投资,在年利率是6%的情况下,为了使该项投资是合算的,那么企业每年至少应当收回()元。

A.1433.63B.1443.63C.2023.64D.2033.647.某一项年金前4年没有流入,后5年每年年初流入1000元,则该项年金的递延期是()年。

A.4B.3C.2D.18.某人拟进行一项投资,希望进行该项投资后每半年都可以获得1000元的收入,年收益率为10%,则目前的投资额应是()元。

A.10000B.11000C.20000D.210009.某人在第一年、第二年、第三年年初分别存入1000元,年利率2%,单利计息的情况下,在第三年年末此人可以取出()元。

A.3120B.3060.4C.3121.6D.313010.已知利率为10%的一期、两期、三期的复利现值系数分别是0.9091、0.8264、0.7513,则可以判断利率为10%,3年期的年金现值系数为()。

财务管理第三章习题篇一:第三章财务管理练习题第三章财务管理习题一、单项选择题1. A 2. D 3A 4.A 5.C 6.C 7.D1、企业的筹资渠道有()。

A、国家资本B、发行股票C、发行债券D、银行借款 2、企业的筹资方式有()。

A、民间资本B、外商资本C、国家资本D、融资租凭 3、国家财政资本的筹资渠道可以采取的筹资方式有()。

A、投入资本筹资B、发行债券筹资 C、发行融资券筹资 D、租赁筹资 4、企业自留资本的筹资渠道可以采取的筹资方式有()。

A、发行股票筹资B、商业信用筹资 C、发行债券筹资D、融资租赁筹资 5、外商资本的筹资渠道可以采取的筹资方式有()。

A、银行借款筹资B、商业信用筹资 C、投入资本筹资D、发行债券筹资 6、利用商业信用筹资方式筹集的资金只能是() A、银行信贷资金B、居民个人资金 C、其他企业资金D、企业自留资金 7、不存在筹资费用的筹资方式是()A、银行借款B、融资租赁C、发行债券D、企业自留资金二、多项选择题1、企业的筹资动机主要包括()。

A、扩张筹资动机B、偿债动机C、对外投资动机D、混合动机E、经营管理动机2、企业的筹资渠道包括()。

A、国家资本B、银行资本C、民间资本D、外商资本3、非银行金融机构主要有()。

A、信托投资公司B、租赁公司C、保险公司D、证券公司E、企业集团的财务公司 4、企业筹资方式有()。

A、吸收投资B、发行股票C、发行公债D、内部资本E、长期借款5、国家财政资本渠道可以采用的筹资方式有()。

A、发行股票 B、发行融资券 C、吸收直接投资 D、租凭筹资 E、发行债券6、非银行金融机构资本渠道可以采取的筹资方式有()。

A、商业信用B、发行股票C、吸收直接投资D、租赁筹资E、发行融资券7、企业内部筹资的资本是()。

A、发行股票B、发行债券C、计提折旧D、留用利润E、银行借款8、长期资本通常采用()等方式来筹集。

A、长期借款 B、商业信用 C、融资租赁 D、发行债券 E、发行股票9、企业的短期资本一般是通过()等方式融通的。

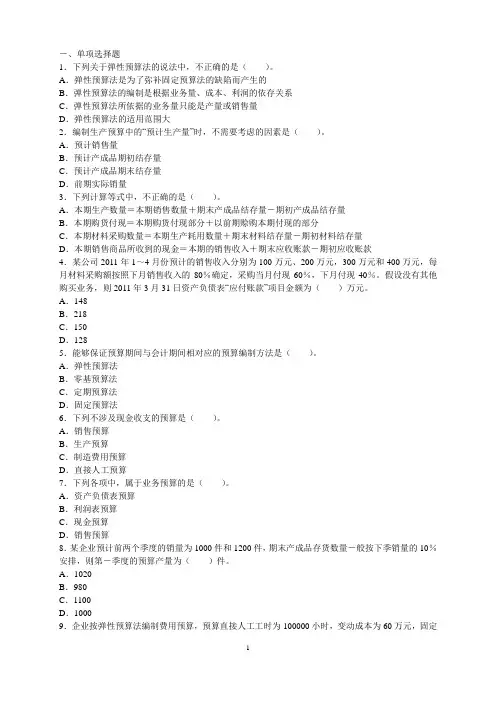

-、单项选择题1.下列关于弹性预算法的说法中,不正确的是()。

A.弹性预算法是为了弥补固定预算法的缺陷而产生的B.弹性预算法的编制是根据业务量、成本、利润的依存关系C.弹性预算法所依据的业务量只能是产量或销售量D.弹性预算法的适用范围大2.编制生产预算中的“预计生产量”时,不需要考虑的因素是()。

A.预计销售量B.预计产成品期初结存量C.预计产成品期末结存量D.前期实际销量3.下列计算等式中,不正确的是()。

A.本期生产数量=本期销售数量+期末产成品结存量-期初产成品结存量B.本期购货付现=本期购货付现部分+以前期赊购本期付现的部分C.本期材料采购数量=本期生产耗用数量+期末材料结存量-期初材料结存量D.本期销售商品所收到的现金=本期的销售收入+期末应收账款-期初应收账款4.某公司2011年1~4月份预计的销售收入分别为100万元、200万元,300万元和400万元,每月材料采购额按照下月销售收入的80%确定,采购当月付现60%,下月付现40%。

假设没有其他购买业务,则2011年3月31日资产负债表“应付账款”项目金额为()万元。

A.148B.218C.150D.1285.能够保证预算期间与会计期间相对应的预算编制方法是()。

A.弹性预算法B.零基预算法C.定期预算法D.固定预算法6.下列不涉及现金收支的预算是()。

A.销售预算B.生产预算C.制造费用预算D.直接人工预算7.下列各项中,属于业务预算的是()。

A.资产负债表预算B.利润表预算C.现金预算D.销售预算8.某企业预计前两个季度的销量为1000件和1200件,期末产成品存货数量-般按下季销量的10%安排,则第-季度的预算产量为()件。

A.1020B.980C.1100D.10009.企业按弹性预算法编制费用预算,预算直接人工工时为100000小时,变动成本为60万元,固定成本为30万元,总成本费用为90万元;如果预算直接人工工时达到120000小时,则总成本费用为()万元。

中级财管第三章习题一、计算题1. 你正在分析一项价值250万元,残值为50万元的资产购入后从其折旧中可以得到的税收收益。

该资产折旧期为5年。

a. 假设所得税率为40%,估计每年从该资产折旧中可得到的税收收益。

b. 假设资本成本为10%,估计这些税收收益的现值。

参考答案:(1)年折旧额=(250-5)=40(万元)获得的从折旧税收收益=40*40%=16万元(2)P=16*(P/A,10%,5)=60.56万元2.华尔公司考虑购买一台新型交织字母机。

该机器的使用年限为4年,初始支出为100 000元。

在这4年中,字母机将以直线法进行折旧直到帐面价值为零,所以每年的折旧额为25 000元。

按照不变购买力水平估算,这台机器每年可以为公司带来营业收入80 000元,公司为此每年的付现成本30 000元。

假定公司的所得税率为40%,项目的实际资金成本为10%,如果通货膨胀率预期为每年8%,那么应否购买该设备?参考答案:NCF0=-100 000NCF1-4=(80 000-30 000-25 000)*(1-40%)+25 000NPV=NCF1-4/(P/A,18%,4)+NCF0若NPV>0,应该购买,否则不应该购买该项设备。

3.甲公司进行一项投资,正常投资期为3年,每年投资200万元,3年共需投资600万元。

第4年~第13年每年现金净流量为210万元。

如果把投资期缩短为2年,每年需投资320万元,2年共投资640万元,竣工投产后的项目寿命和每年现金净流量不变。

资本成本为20%,假设寿命终结时无残值,不用垫支营运资金。

试分析判断是否应缩短投资期。

参考答案:1、用差量的方法进行分析(1)计算不同投资期的现金流量的差量(单位:万元)(2)计算净现值的差量2、分别计算两种方案的净现值进行比较 (1)计算原定投资期的净现值(2)计算缩短投资期后的净现值(3)比较两种方案的净现值并得出结论:因为缩短投资期会比按照原投资期投资增加净现值20.27(24.38-4.11)万元,所以应该采用缩短投资的方案。

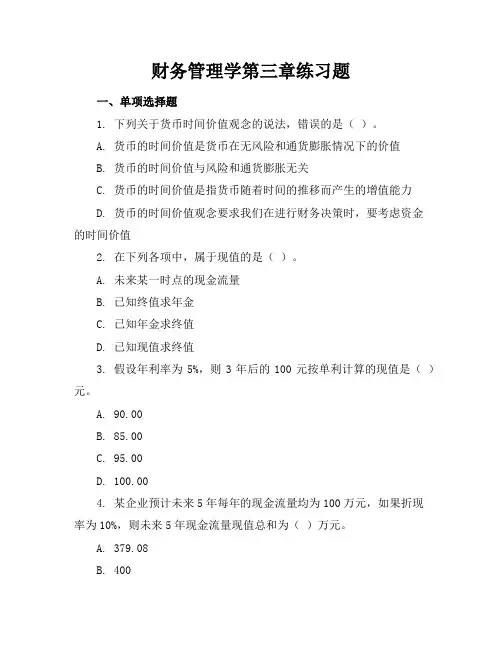

财务管理学第三章练习题一、单项选择题1. 下列关于货币时间价值观念的说法,错误的是()。

A. 货币的时间价值是货币在无风险和通货膨胀情况下的价值B. 货币的时间价值与风险和通货膨胀无关C. 货币的时间价值是指货币随着时间的推移而产生的增值能力D. 货币的时间价值观念要求我们在进行财务决策时,要考虑资金的时间价值2. 在下列各项中,属于现值的是()。

A. 未来某一时点的现金流量B. 已知终值求年金C. 已知年金求终值D. 已知现值求终值3. 假设年利率为5%,则3年后的100元按单利计算的现值是()元。

A. 90.00B. 85.00C. 95.00D. 100.004. 某企业预计未来5年每年的现金流量均为100万元,如果折现率为10%,则未来5年现金流量现值总和为()万元。

A. 379.08B. 400C. 375D. 5005. 下列关于永续年金的说法,正确的是()。

A. 永续年金没有终止时间B. 永续年金的现值与折现率无关C. 永续年金的现值计算公式为:P = A / rD. 永续年金终值等于年金乘以期限二、多项选择题1. 下列关于货币时间价值的说法,正确的是()。

A. 货币的时间价值是指货币随着时间的推移而产生的增值能力B. 货币的时间价值与风险和通货膨胀无关C. 货币的时间价值观念要求我们在进行财务决策时,要考虑资金的时间价值D. 货币的时间价值观念适用于所有类型的投资和融资活动2. 下列关于现值和终值的说法,正确的是()。

A. 现值是指未来某一时间点上的现金流量折现到当前时点的价值B. 终值是指当前时点的一笔现金流量在未来某一时间点上的价值C. 现值和终值的计算与折现率无关D. 现值和终值的计算方法相同3. 下列关于单利和复利的说法,正确的是()。

A. 单利是指利息不再产生利息B. 复利是指利息可以产生利息C. 在相同利率和期限下,单利和复利的终值相等D. 在相同利率和期限下,复利的终值大于单利的终值4. 下列关于年金的说法,正确的是()。

第三章财务分析一、单项选择题1、下列关于利润表的说法中,正确的是()。

A.利润表是反映公司在某一特定日期的财务状况的报表B.我国现行财务会计制度规定利润表采用多步式C.利润表是按照“利润=收入-费用”这一公式编制的静态报表D.利润表是以收付实现制为基础编制的【正确答案】:B【答案解析】:利润表是反映公司在一定会计期间经营成果的报表,选项A不正确;利润表是按照“利润=收入-费用”这一公式编制的动态报表,所以选项C不正确;利润表是以权责发生制为基础编制的,所以选项D不正确。

参见教材72页。

2、A企业的资产负债表中应收账款的年初数为360万元、年末数为400万元,应收票据的年初数为50万元,年末数为90万元,利润表中营业收入为4500万元,则应收账款周转天数为()天(一年按360天计算)。

A.36B.40C.36.5D.30.4【正确答案】:A【答案解析】:平均应收账款=(360+400)/2+(50+90)/2=450(万元),应收账款周转率=4500/450=10,应收账款周转天数=360/10=36(天)。

参见教材79页。

3、流动资产占总资产的比重所形成的财务比率属于()。

A.动态比率B.定基比率C.结构比率D.环比比率【正确答案】:C【答案解析】:结构比率又称构成比率,用以计算某项财务指标的各构成部分分别占总体的百分比,反映部分与总体的关系,用以分析构成内容的变化以及对财务指标的影响程度。

所以本题流动资产占总资产的比重所形成的财务比率属于结构比率。

4、比较分析法中的比较会计要素的总量、比较结构百分比和比较财务比率的分类标准是()。

A.按比较对象分类B.按比较时间分类C.按比较指标分类D.按比较内容分类【正确答案】:D【答案解析】:比较分析法中:(1)按比较对象分类可以划分为:实际指标与计划指标比较;实际指标与本公司多期历史指标相比较;本公司指标与国内外同行业先进公司指标或同行业平均水平相比较;(2)按比较内容分类划分为:比较会计要素的总量、比较结构百分比和比较财务比率。

1、某人拟购房,开发商提出两个方案:方案一是现在一次性付80万元;方案二是5年后付100万元。

若目前银行贷款利率为7%(复利计息),要求计算比较哪个付款方案有利。

【解】方案一的终值=80×(F/P,7%,5)=112.208(万元)>100(万元)。

由于方案二的终值小于方案一的终值,所以应该选择方案二。

2、为实施某项计划,需要取得外商贷款1000万美元,经双方协商,贷款利率为8%,按复利计息,贷款分5年于每年年末等额偿还。

外商告知,他们已经算好,每年年末应归还本金200万美元,支付利息80万美元。

要求,核算外商的计算是否正确。

【解】贷款现值=1000(万美元)还款现值=280×(P/A,8%,5)=280×3.9927=1118(万美元)>1000万美元,由于还款现值大于贷款现值,所以外商计算错误。

3、某公司拟购置一处房产,房主提出三种付款方案:(1)从现在起,每年年初支付20万,连续支付10次,共200万元;(2)从第5年开始,每年末支付25万元,连续支付10次,共250万元;(3)从第5年开始,每年初支付24万元,连续支付10次,共240万元。

假设该公司的资金成本率(即最低报酬率)为10%,你认为该公司应选择哪个方案?【解】方案(1)P=20×(P/A,10%,10)×(1+10%)=135.18(万元)方案(2)(注意递延期为4年)P=25×(P/A,10%,10)×(P/F,10%,4)=104.93(万元)方案(3)(注意递延期为3年)P=24×(P/A,10%,10)×(P/F,10%,3)=110.78该公司应该选择第二方案。

4、现在向银行存入20000元,问年利率(i)为多少时,才能保证在以后9年中每年年末可以取出4000元?【答案】根据普通年金现值公式:20000=4000×(P/A,i,9)(P/A,i,9)=5查表并用内插法求解:查表找出期数为9,年金现值系数最接近5的一大一小两个系数。

企业财务学第三章习题及答案一、某企业于年初向银行借款50万元购买设备,第一年年末开始还款,每年还款一次,等额偿还,分5年还清,银行借款利率为12%。

要求:计算每年应还款额。

解:根据普通年金计算公式:(元)138696605.3500000*500000*5%,12,====A PVIFA A PVIFA A PVA ni n 由以上计算可知,每年还款138696元。

二、时代公司需要一台设备,买价为1600万元,可用10年。

如果租用,则每年年初需付租金200万元。

除此之外,买与租的其他情况相同。

假设利率为6%。

要求:用数据说明购买与租用何者为优。

解:利用先付年金现值计算公式计算出10年租金的现值。

(万元)32.156006.1*36.7*200%)61(**200)1(**10%,6,==+=+=PVIFA i PVIFA A XPVA n i n由以上计算可知,10年租金现值低于买价,因此租用较优。

三、某企业向银行借入一笔款项,银行贷款的年利率为10%,每年复利一次。

银行规定前10年不用还本付息,但从第11~20年每年年末偿还本息5000元。

要求:计算这笔借款的现值。

解:(元)11860386.0*145.6*5000**5000**10%,1010%,10,,0====PVIF PVIFA PVIF PVIFA A PV mi n i四、C 公司在2003年1月1日发行5年期债券,面值1000元,票面利率10%,于每年12月31日付息,到期一次还本。

要求解答一下问题:(1) 假定2003年1月1日金融市场上与该债券同类风险投资的利率是9%,该债券的发行价应定为多少?(2) 假定1年后该债券的市场价格为1049.06元,该债券于2004年1月1日的到期收益率是多少?(1) 解:元)债券的发行价格(1038.87 3.8897*10%*10000.6499*1000PVIFA *10%*1000PVIF 10009%,59%,5=+=+⨯=(2) 解:4,4,*%10*1000PVIF 10001049.06i i PVIFA +⨯=假设 i=9%,等式右边等于1032,假设i=8%,等式右边等于1066.2 利用插值法,%5.82.106610322.106606.1049%8%9%8=--=--i i。

Chapter 3—International Financial Markets1. Assume that a bank's bid rate on Swiss francs is $.45 and its ask rate is $.47. Its bid-ask percentagespread is:a. about 4.44%.b. about 4.26%.c. about 4.03%.d. about 4.17%.ANS: BSOLUTION: Bid-ask percentage spread = ($.47 − $.45)/$.47 = 4.26%PTS: 12. Assume that a bank's bid rate on Japanese yen is $.0041 and its ask rate is $.0043. Its bid-askpercentage spread is:a. about 4.99%.b. about 4.88%.c. about 4.65%.d. about 4.43%.ANS: CSOLUTION: Bid-ask percentage spread = ($.0043 − $.0041)/$.0043 = 4.65%PTS: 13. The bid/ask spread for small retail transactions is commonly in the range of ____ percent.a. 3 to 7b. .01 to .03c. 10 to 15d. .5 to 1ANS: A PTS: 14. ____ is not a factor that affects the bid/ask spread.a. Order costsb. Inventory costsc. Volumed. All of the above factors affect the bid/ask spreadANS: D PTS: 15. The forward rate is the exchange rate used for immediate exchange of currencies.a. Trueb. FalseANS: F PTS: 16. The ask quote is the price for which a bank offers to sell a currency.a. Trueb. FalseANS: T PTS: 17. According to the text, the forward rate is commonly used for:a. hedging.b. immediate transactions.c. previous transactions.d. bond transactions.ANS: A PTS: 18. If a U.S. firm desires to avoid the risk from exchange rate fluctuations, and it is receiving 100,000 in90 days, it could:a. obtain a 90-day forward purchase contract on euros.b. obtain a 90-day forward sale contract on euros.c. purchase euros 90 days from now at the spot rate.d. sell euros 90 days from now at the spot rate.ANS: B PTS: 19. If a U.S. firm desires to avoid the risk from exchange rate fluctuations, and it will need C$200,000 in90 days to make payment on imports from Canada, it could:a. obtain a 90-day forward purchase contract on Canadian dollars.b. obtain a 90-day forward sale contract on Canadian dollars.c. purchase Canadian dollars 90 days from now at the spot rate.d. sell Canadian dollars 90 days from now at the spot rate.ANS: A PTS: 110. Assume the Canadian dollar is equal to $.88 and the Peruvian Sol is equal to $.35. The value of thePeruvian Sol in Canadian dollars is:a. about .3621 Canadian dollars.b. about .3977 Canadian dollars.c. about 2.36 Canadian dollars.d. about 2.51 Canadian dollars.ANS: BSOLUTION: $.35/$.88 = .3977PTS: 111. Which of the following is not true with respect to spot market liquidity?a. The more willing buyers and sellers there are, the more liquid a market is.b. The spot markets for heavily traded currencies such as the Japanese yen are very liquid.c. A currency's liquidity affects the ease with which an MNC can obtain or sell that currency.d. If a currency is illiquid, an MNC is typically able to quickly purchase that currency at areasonable exchange rate.ANS: D PTS: 112. Forward markets for currencies of developing countries are:a. prohibited.b. less liquid than markets for developed countries.c. more liquid than markets for developed countries.d. only available for use by government agencies.ANS: B PTS: 113. A forward contract can be used to lock in the ____ of a specified currency for a future point in time.a. purchase priceb. sale pricec. A or Bd. none of the aboveANS: C PTS: 114. The forward market:a. for euros is very illiquid.b. for Eastern European countries is very liquid.c. does not exist for some currencies.d. none of the aboveANS: C PTS: 115. ____ is not a bank characteristic important to customers in need of foreign exchange.a. Quote competitivenessb. Speed of executionc. Forecasting adviced. Advice about current market conditionse. All of the above are important bank characteristics to customers in need of foreignexchange.ANS: E PTS: 116. The Basel II accord is focused on eliminating inconsistencies in ____ across countries.a. capital requirementsb. deposit ratesc. deposit insuranced. bank failure policiesANS: A PTS: 117. The international money market primarily concentrates on:a. short-term lending (one year or less).b. medium-term lending.c. long-term lending.d. placing bonds with investors.e. placing newly issued stock in foreign markets.ANS: A PTS: 118. The international credit market primarily concentrates on:a. short-term lending (less than one year).b. medium-term lending.c. long-term lending.d. providing an exchange of foreign currencies for firms who need them.e. placing newly issued stock in foreign markets.ANS: B PTS: 119. The main participants in the international money market are:a. consumers.b. small firms.c. large corporations.d. small European firms needing European currencies for international trade.ANS: C PTS: 120. LIBOR is:a. the interest rate commonly charged for loans between banks.b. the average inflation rate in European countries.c. the maximum loan rate ceiling on loans in the international money market.d. the maximum deposit rate ceiling on deposits in the international money market.e. the maximum interest rate offered on bonds that are issued in London.ANS: A PTS: 121. A syndicated loan:a. represents a loan by a single bank to a syndicate of corporations.b. represents a loan by a single bank to a syndicate of country governments.c. represents a direct loan by a syndicate of oil-producing exporters to a less developedcountry.d. represents a loan by a group of banks to a borrower.e. A and BANS: D PTS: 122. The international money market is primarily served by:a. the governments of European countries, which directly intervene in foreign currencymarkets.b. government agencies such as the International Monetary Fund that enhance developmentof countries.c. several large banks that accept deposits and provide loans in various currencies.d. small banks that convert foreign currency for tourists and business visitors.ANS: C PTS: 123. International money market transactions normally represent:a. the equivalent of $1 million or more.b. the equivalent of $1,000 to $10,000.c. the equivalent of between $10,000 and $100,000.d. the equivalent of between $100,000 and $200,000.ANS: A PTS: 124. A put option is the amount or percentage by which the existing spot rate exceeds the forward rate.a. Trueb. FalseANS: F PTS: 125. From 1944 to 1971, the exchange rate between any two currencies was typically:a. fixed within narrow boundaries.b. floating, but subject to central bank intervention.c. floating, and not subject to central bank intervention.d. nonexistent; that is currencies were not exchanged, but gold was used to pay for all foreigntransactions.ANS: A PTS: 126. As a result of the Smithsonian Agreement, the U.S. dollar was:a. the currency to be used by all countries as a medium of exchange for international trade.b. forced to be freely floating relative to all currencies without any boundaries.c. devalued relative to major currencies.d. revalued (upward) relative to major currencies.ANS: C PTS: 127. According to the text, the average foreign exchange trading around the world ____ per day.a. equals about $200 billionb. equals about $400 billionc. equals about $700 billiond. exceeds $1 trillionANS: D PTS: 128. Assume a Japanese firm invoices exports to the U.S. in U.S. dollars. Assume that the forward rate andspot rate of the Japanese yen are equal. If the Japanese firm expects the U.S. dollar to ____ against the yen, it would likely wish to hedge. It could hedge by ____ dollars forward.a. depreciate; buyingb. depreciate; sellingc. appreciate; sellingd. appreciate; buyingANS: B PTS: 129. The bid-ask spread on an exchange rate can be used to directly determine:a. how an exchange rate will change.b. the transaction cost of foreign exchange.c. the forward premium.d. the currency option premium.ANS: B PTS: 130. Futures contracts are typically ____; forward contracts are typically ____.a. sold on an exchange; sold on an exchangeb. offered by commercial banks; sold on an exchangec. sold on an exchange; offered by commercial banksd. offered by commercial banks; offered by commercial banksANS: C PTS: 131. Eurobonds:a. are usually issued in bearer form.b. typically carry several protective covenants.c. cannot contain call provisions.d. A and BANS: A PTS: 132. Which of the following is true?a. Non-U.S. firms may desire to issue bonds in the U.S. due to less regulations in the U.S.b. U.S. firms may desire to issue bonds in the U.S. due to less regulations in the U.S.c. U.S. firms may desire to issue bonds in the non-U.S. markets due to less regulations innon-U.S. countries.d. A and BANS: C PTS: 133. Eurobonds:a. can be issued only by European firms.b. can be sold only to European investors.c. A and Bd. none of the aboveANS: D PTS: 134. Which currency is used the most to denominate Eurobonds?a. the British pound.b. the Japanese yen.c. the U.S. dollar.d. the Swiss franc.ANS: C PTS: 135. When the foreign exchange market opens in the U.S. each morning, the opening exchange ratequotations will be based on the:a. closing prices in the U.S. during the previous day.b. closing prices in Canada during the previous day.c. prevailing prices in locations where the foreign exchange markets have been open.d. officially set by central banks before the U.S. market opens.ANS: C PTS: 136. The U.S. dollar is not ever used as a medium of exchange in:a. industrialized countries outside the U.S.b. in any Latin American countries.c. in Eastern European countries where foreign exchange restrictions exist.d. none of the aboveANS: D PTS: 137. Which of the following is not true regarding the Bretton Woods Agreement?a. It called for fixed exchange rates between currencies.b. Governments intervened to prevent exchange rates from moving more than 1 percentabove or below their initially established levels.c. The agreement lasted from 1944 until 1971.d. Each country used gold to back its currency.e. All of the above are true regarding the Bretton Woods Agreement.ANS: D PTS: 138. A Japanese yen is worth $.0080, and a Fijian dollar (F$) is worth $.5900. What is the value of the yenin Fijian dollars (i.e., how many Fijian dollars do you need to buy a yen)?a. 73.75.b. 125.c. 1.69.d. 0.014.e. none of the aboveANS: DSOLUTION: ($.008/$.59) = F$.014/¥PTS: 139. The existence of imperfect markets has prevented the internationalization of financial markets.a. Trueb. FalseANS: F PTS: 140. Under the gold standard, each currency was convertible into gold at a specified rate, and the exchangerate between two currencies was determined by their relative convertibility rates per ounce of gold.a. Trueb. FalseANS: T PTS: 141. An investor engaging in a transaction whereby he or she contracts to purchase British pounds one yearfrom now is an example of a spot market transaction.a. Trueb. FalseANS: F PTS: 142. The Single European Act prevented a trend toward increased globalization in the banking industry.a. Trueb. FalseANS: F PTS: 143. A cross exchange rate expresses the amount of one foreign currency per unit of another foreigncurrency.a. Trueb. FalseANS: T PTS: 144. A currency put option provides the right, but not the obligation, to buy a specific currency at a specificprice within a specific period of time.a. Trueb. FalseANS: F PTS: 145. The strike price is also known as the premium price.a. Trueb. FalseANS: F PTS: 146. The interest rate commonly charged for loans between banks is called the cross rate.a. Trueb. FalseANS: F PTS: 147. The Bretton Woods Agreement is an agreement to standardize banks' capital requirements acrosscountries; the resulting capital ratios are computed using risk-weighted assets.a. Trueb. FalseANS: F PTS: 148. The Basel Accord is an agreement among the major European countries to make regulations moreuniform across European countries and to reduce taxes on goods traded between these countries.a. Trueb. FalseANS: F PTS: 149. A futures contract is a contract specifying a standard volume of a particular currency to be exchangedon a specific settlement date.a. Trueb. FalseANS: T PTS: 150. Eurobonds are certificates representing bundles of stock.a. Trueb. FalseANS: F PTS: 151. A share of the ADR of a Dutch firm represents one share of that firm's stock that is traded on a Dutchstock exchange. The share price of the firm was 15 euros when the Dutch market closed. As the U.S.market opens, the euro is worth $1.10. Thus, the price of the ADR should be ____.a. $13.64b. $15.00c. $16.50d. 16.50 eurose. none of the aboveANS: CSOLUTION: 15 × $1.10 = $16.50PTS: 152. The ADR of a British firm is convertible into 3 shares of stock. The share price of the firm was 30pounds when the British market closed. When the U.S. market opens, the pound is worth $1.63. The price of this ADR should be $____.a. 48.90b. 146.70c. 55.21d. none of the aboveANS: BSOLUTION: 3 × 30 × $1.63 = $146.70PTS: 153. If there is a large supply of savings relative to the demand for short-term funds, the interest rate forthat country will be relatively low.a. Trueb. FalseANS: T PTS: 154. If there is a strong demand to borrow a currency, and a low supply of savings in that currency, theinterest rate will be relatively low.a. Trueb. FalseANS: F PTS: 155. The preferences of corporations and governments to borrow in foreign currencies and of investors tomake short-term investments in foreign currencies resulted in the creation of the international bond market.a. Trueb. FalseANS: F PTS: 156. Large commercial banks play a major role in the international money market by accepting short-termdeposits in large amounts (such as the equivalent of $1 million or more) and in various currencies, and channeling the money to corporations and government agencies that need to borrow those short-term funds in the desired currencies.a. Trueb. FalseANS: T PTS: 157. The term "eurobor" is widely used to reflect the interbank offer rate on euros.a. Trueb. FalseANS: T PTS: 158. The term "eurobor" is widely used to reflect the total amount of euros borrowed by the firms in Europeper month to finance their growth.a. Trueb. FalseANS: F PTS: 159. Institutional investors such as commercial banks, mutual funds, insurance companies, and pensionfunds from many countries are major participants in the international bond market.a. Trueb. FalseANS: T PTS: 160. In response to the Sarbanes-Oxley Act, the reporting costs were reduced, and many non-U.S. firms thatissued new shares of stock decided to place their stock in the United States.a. Trueb. FalseANS: F PTS: 161. Global regulations require that shareholders in all countries have the same rights wherever there arestock markets.a. Trueb. FalseANS: F PTS: 162. Shareholders have more voting power in some countries than others.a. Trueb. FalseANS: T PTS: 163. Shareholders can have influence on a wider variety of management issues in some countries.a. Trueb. FalseANS: T PTS: 164. The legal protection of shareholders is the same among countries.a. Trueb. FalseANS: F PTS: 165. Shareholders in some countries may have more power to effectively sue publicly-traded firms if theirexecutives or directors commit financial fraud.a. Trueb. FalseANS: T PTS: 166. In general, common law countries such as the U.S., Canada, and the United Kingdom allow for morelegal protection than French civil law countries such as France or Italy.a. Trueb. FalseANS: T PTS: 167. The government enforcement of securities laws varies among countries.a. Trueb. FalseANS: T PTS: 168. The degree of financial information that must be provided by public companies is the same amongcountries.a. Trueb. FalseANS: F PTS: 169. In general, stock markets allow for more price efficiency and attract more investors when they have allof the following except:a. more voting rights for shareholders.b. more legal protection.c. more enforcement of the laws.d. less stringent accounting requirements.ANS: D PTS: 170. In general, companies are attracted to the stock market in which there are very limited voting rights forshareholders.a. Trueb. FalseANS: F PTS: 171. If companies can rely on stock markets to obtain funds, they will have to rely more heavily on the____ market to raise long-term funds.a. derivativeb. long-term creditc. moneyd. foreign exchangeANS: B PTS: 172. The strike price on a currency option is also known as an exercise price.a. Trueb. FalseANS: T PTS: 173. Assume that the bank's bid quote of Mexican peso is $.126 and ask price is $.129. If you have Mexicanpesos, what is the amount of pesos that you need to purchase $100,000?a. 12,600b. 775,194c. 793,651d. 12,900ANS: C PTS: 174. When receiving quotations on a currency's exchange rate, the bank's bid quote is the rate at which thebank is willing to sell currency.a. Trueb. FalseANS: F PTS: 175. An obligation to purchase a specific amount of currency at a future point in time is called a:a. call optionb. spot contractc. put optiond. forward contracte. both B and D76. Which of the following is not a method that can be used to invest internationally?a. Investment in MNC stocksb. American depository receipts (ADRs)c. World Equity benchmark Shares (WEBS)d. International mutual fundse. All of the above are methods that can be used to invest internationally.ANS: E PTS: 177. The interest rate in developing countries is usually very low.a. Trueb. FalseANS: F PTS: 178. Assume that $1 is equal to .85 Euros and 98 yen. The value of yen in euros isa. .01b. 118c. 1.18d. .0087ANS: D PTS: 179. When obtaining a loan, the risk premium paid above LIBOR depends on the:a. risk-free interest rate of the borrower.b. credit risk of the borrower.c. borrower's stock price.d. lender's stock price.ANS: B PTS: 180. The largest global exchange is:a. NASDAQb. Tokyo Stock Exchangec. NYSE Euronextd. London Stock ExchangeANS: C PTS: 181. Which of the following is not true about syndicated loans?a. A borrower that receives a syndicated loan incurs various fees besides the interest rate.b. The loans are only denominated in U.S. dollars.c. The loans are provided by a group of banks to a borrower.d. The loans are usually formed in 6 weeks or less.ANS: B PTS: 182. The interest rate on the syndicated loan depends on the:a. currency denominating the loan.b. maturity of the loan.c. creditworthiness of the borrower.d. interbank lending rate.e. all of the above.83. Assume a U.S. firm has to pay for Korean imports in 60 days. It expects that Korean won willdepreciate, but it still wants to hedge its risk. What type of hedging is more appropriate in thissituation:a. Buy dollars forwardb. Sell dollars forwardc. Purchase call optiond. Purchase put optionANS: C PTS: 184. Certificates representing bundles of stock of non-U.S. firms are called:a. Eurobondsb. ADRsc. FRNsd. EuroborANS: B PTS: 185. Assume that the spot rate of the Singapore dollar is $.664. The ADR of a Singapore firm is convertibleinto 3 shares of stock. The price of an ADR is $20. What is the share price of the firm in Singapore dollars?a. 10b. 13.28c. 30.12d. 39.84ANS: A PTS: 186. Which of the following is not true regarding ADRs?a. ADRs are denominated in the currency of the stock's home country.b. ADRs enable U.S. investors to avoid cross-border transactionsc. ADRs allow non-U.S. firms to tap into U.S. market for funds.d. ADRs sometimes allow for arbitrage opportunities.ANS: A PTS: 187. The more intense the competition for the traded currency, the larger the bid/ask spread.a. Trueb. FalseANS: F PTS: 188. Banks charge larger bid/ask spreads than they would on less liquid, less traded currencies.a. Trueb. FalseANS: F PTS: 189. At any given point in time, a bank's bid quote will be greater than its ask quote.a. Trueb. FalseANS: F PTS: 190. An MNC with receivables in Japanese Yen purchases yen forward to hedge its exposure to exchangerate fluctuations.a. Trueb. FalseANS: F PTS: 191. A currency put option provides the right, but not the obligation, to buy a specific currency at a specificprice within a specific period of time.a. Trueb. FalseANS: F PTS: 192. The LIBOR varies among currencies because the market supply of and demand for funds vary amongcurrencies.a. Trueb. FalseANS: T PTS: 193. The international money market is frequently accessed by MNCs for short-term investment andfinancing decisions, while longer term financing decisions are made in the international credit market or the international bond market and in international stock markets.a. Trueb. FalseANS: T PTS: 194. Which of the following is not a possible bid/ask quotation for the Barbados dollar?a. $.50/$.51b. $.49/$.50c. $.52/$.51d. $.51/$.52e. All of the above are possible bid/ask quotations.ANS: C PTS: 195. Your company expects to receive 5,000,000 Japanese yen 60 days from now. You decide to hedgeyour position by selling Japanese yen forward. The current spot rate of the yen is $.0089, while the forward rate is $.0095. You expect the spot rate in 60 days to be $.0090. How many dollars will you receive for the 5,000,000 yen 60 days from now if you sell yen forward?a. $44,500b. $45,000c. $526 milliond. $47,500e. $556 millionANS: D PTS: 196. Which of the following is probably not an example of the use of forward contracts by an MNC?a. Hedging pound payables by selling pounds forwardb. Hedging peso receivables by selling pesos forwardc. Hedging yen payables by purchasing yen forwardd. Hedging peso payables by purchasing pesos forwarde. All of the above are examples of using forward contracts.ANS: A PTS: 197. A quotation representing the value of a foreign currency in dollars is referred to as a(n) ____ quotation;a quotation representing the number of units of a foreign currency per dollar is referred to as a(n) ____quotation.a. direct; indirectb. indirect; directc. direct; directd. indirect; indirecte. cannot be answered without more informationANS: A PTS: 198. You observe a quotation of the Japanese yen (¥) of $0.007. You are, however, interested in the numberof yen per dollar. Thus, you calculate the ____ quotation of ____ ¥/$.a. direct; 142.86b. indirect; 142.86c. indirect; 150d. direct; 150e. indirect; 0ANS: B PTS: 199. Which of the following is not true regarding electronic communications networks (ECNs)?a. They have a visible trading floor.b. Trades are executed by a computer network.c. They have been created in many countries to match orders between buyers and sellers.d. They allow investors to place orders on their computers.e. All of the above are true.ANS: A PTS: 1100. Which of the following is probably not appropriate for an MNC wishing to reduce its exposure to British pound payables?a. Purchase pounds forwardb. Buy a pound futures contractc. Buy a pound put optiond. Buy a pound call optionANS: C PTS: 1101. Futures contracts are sold on exchanges and are consequently ____ than forward contracts, which can be ____ to satisfy an MNC's needs.a. more standardized; standardizedb. more standardized; custom-tailoredc. more custom-tailored; standardizedd. more custom-tailored; custom-tailorede. less standardized; custom-tailoredANS: B PTS: 1102. An MNC's short-term financing decisions are satisfied in the ____ market, while its medium debt financing decisions are satisfied in the ____ market.a. international money; international creditb. international money; international bondc. international credit; international moneyd. international bond; international credite. international money; international stockANS: A PTS: 1。

《财务管理》第3章习题参考答案一、单选题1.C 2.D 3.A 4.C 5.B 6.B二、判断题1.×2.×3.×4.√5.√6.×7.√8.×9.√10.×三、计算题:(考核财务比率计算)(1)从DV公司2005年的财务报表可以获得以下信息:2005年资产总额期初值、期末值分别为2400万元、2560万元,负债总额期初值、期末值分别为980万元、1280万元;2005年度实现销售收入10000万元,净利润为600万元。

要求:分别计算销售净利率、资产周转率、权益乘数和净资产收益率。

[解析]:①销售净利率=净利润/销售收入净额×100%=600/10000×100%=6%②资产周转率=销售净收入/总资产平均占用额×100%=销售净收入/(期初+期末)÷2×100% =10000/(2400+2560)÷2×100%=4.03③年末资产负债率=1280/2560×100%=50%④权益乘数=1/(1-50%)=2⑤净资产收益率=主营业务净利率×总资产周转率×权益乘数=总资产净利率×权益乘数=净利润/平均资产×100%=6%×4.03×2=48.36%(2)A企业年末流动负债60万元,速动比率2.5,流动比率3.0,销货成本81万元。

已知年初和年末的存货相同。

要求:计算存货周转率。

[解析]:①流动比率-速动比率=平均存货/流动负债即:3-2.5=平均存货/60则:平均存货=30(万元)②存货周转率=主营业务成本/平均存货成本×100%=81/30×100%=2.7(3)B企业流动负债200万元,流动资产400万元,其中:应收票据50万元,存货90万元,待摊费用2万元,预付账款7万元,应收账款200万元(坏账损失率5‰)。

一:单项选择题4.下列财务比率反映企业短期偿债能力的有()A.现金流量比率B.资产负债率C.偿债保障比率D.利息保障倍数5.下列财务比率反映企业营运能力的有()A.资产负债率B.流动比率C.存货周转率D.资产报酬率6.下列经济业务会使企业的速动比率提高的是()A.销售产成品B.收回应收账款C.购买短期债券D.用固定资产对外进行长期投资7.下列各项经济业务不会影响流动比率的是()A.赊购原材料B.用现金购买短期债券C.用存货对外进行长期投资D.向银行借款8.下列各项经济业务会影响企业资产负债率的是()A.以固定资产的账面价值对外进行长期投资B.收回应收账款C.接受投资者以固定资产进行的投资D.用现金购买股票9.某企业2005年主营业务收入净额为36000万元,流动资产平均余额为4000万元,固定资产平均余额为8000万元,假定没有其他资产,则该企业2005年的总资产周转率为()次A.3.0B.3.4C.2.9D.3.210.企业的应收账款周转率高,说明()A.企业的信用政策比较宽松B.企业的盈利能力较强C.企业的应收账款周转率速度较快D企业的坏账损失较多11.影响速动比率可信性的最主要因素()A.存货的变现能力B.短期证劵的变现能力C.产品的变现能力D.应收账款的变现能力12.企业大量增加速动资产可能导致的结果是()A.减少资金的机会成本B.增加资产的机会成本C.增加财务风险D.提高流动资产的收益率13.某公司年末会计报表上部分数据为:流动负债60万元,流动比率为2,速动比率为1.2,销售成本100万元,年初存货为52万元,则本年度存货周转次数为()A,1.65 B.2 C.2.3 D.1.4514.股权报酬率是杜邦分析体系中综合性最强、最具有代表的指标,通过杜邦分析可知,提高股权报酬率的途径不包括()A.加强销售管理,提高销售净利率B.加强资产管理,提高总资产周转率C.加强负债管理,降低资产负债率D. 加强负债管理,提高产权比率15.其他条件不变的情况下,下列经济业务可能导致资产报酬率下降的是()A:用银行存款支付一笔销售费用 B.用银行存款购入一台设备C.将可转换债券转换为普通股D.用银行存款归还银行借款16.某企业去年的销售净利率为5.5%,资产周转率为2.5,今年的销售净利率为4.5%,资产周转率为2.4。

Chapter 03 Financial Statements Analysis and Long-Term Planning Answer KeyMultiple Choice Questions1. One key reason a long-term financial plan is developed is because:A. the plan determines your financial policy.B. the plan determines your investment policy.C. there are direct connections between achievable corporate growth and the financial policy.D. there is unlimited growth possible in a well-developed financial plan.E. None of the above.Difficulty level: EasyTopic: LONG-TERM PLANNINGType: DEFINITIONSc2. Projected future financial statements are called:A. plug statements.B. pro forma statements.C. reconciled statements.D. aggregated statements.E. none of the above.Difficulty level: EasyTopic: PRO FORMA STATEMENTSType: DEFINITIONSB3. The percentage of sales method:A. requires that all accounts grow at the same rate.B. separates accounts that vary with sales and those that do not vary with sales.C. allows the analyst to calculate how much financing the firm will need to support the predicted sales level.D. Both A and B.E. Both B and C.Difficulty level: MediumTopic: PERCENTAGE OF SALESType: DEFINITIONSE4. A _____ standardizes items on the income statement and balance sheet as a percentage of total sales and total assets, respectively.A. tax reconciliation statementB. statement of standardizationC. statement of cash flowsD. common-base year statementE. common-size statementDifficulty level: EasyTopic: COMMON-SIZE STATEMENTSType: DEFINITIONSE5. Relationships determined from a firm's financial information and used for comparison purposes are known as:A. financial ratios.B. comparison statements.C. dimensional analysis.D. scenario analysis.E. solvency analysis.ADifficulty level: EasyTopic: FINANCIAL RATIOSType: DEFINITIONS6. Financial ratios that measure a firm's ability to pay its bills over the short run without undue stress are known as _____ ratios.A. asset managementB. long-term solvencyC. short-term solvencyD. profitabilityE. market valueDifficulty level: EasyTopic: SHORT-TERM SOLVENCY RATIOSType: DEFINITIONSC7. The current ratio is measured as:A. current assets minus current liabilities.B. current assets divided by current liabilities.C. current liabilities minus inventory, divided by current assets.D. cash on hand divided by current liabilities.E. current liabilities divided by current assets.Difficulty level: EasyTopic: CURRENT RATIOType: DEFINITIONSB8. The quick ratio is measured as:A. current assets divided by current liabilities.B. cash on hand plus current liabilities, divided by current assets.C. current liabilities divided by current assets, plus inventory.D. current assets minus inventory, divided by current liabilities.E. current assets minus inventory minus current liabilities.Difficulty level: EasyTopic: QUICK RATIOType: DEFINITIONSD9. The cash ratio is measured as:A. current assets divided by current liabilities.B. current assets minus cash on hand, divided by current liabilities.C. current liabilities plus current assets, divided by cash on hand.D. cash on hand plus inventory, divided by current liabilities.E. cash on hand divided by current liabilities.Difficulty level: MediumTopic: CASH RATIOType: DEFINITIONSE10. Ratios that measure a firm's financial leverage are known as _____ ratios.A. asset managementB. long-term solvencyC. short-term solvencyD. profitabilityE. market valueDifficulty level: EasyTopic: LONG-TERM SOLVENCY RATIOSType: DEFINITIONSB11. The financial ratio measured as total assets minus total equity, divided by total assets, is the:A. total debt ratio.B. equity multiplier.C. debt-equity ratio.D. current ratio.E. times interest earned ratio.Difficulty level: EasyTopic: TOTAL DEBT RATIOType: DEFINITIONSA12. The debt-equity ratio is measured as total:A. equity minus total debt.B. equity divided by total debt.C. debt divided by total equity.D. debt plus total equity.E. debt minus total assets, divided by total equity.Difficulty level: EasyTopic: DEBT-EQUITY RATIOType: DEFINITIONSC13. The equity multiplier ratio is measured as total:A. equity divided by total assets.B. equity plus total debt.C. assets minus total equity, divided by total assets.D. assets plus total equity, divided by total debt.E. assets divided by total equity.Difficulty level: MediumTopic: EQUITY MULTIPLIERType: DEFINITIONS14. The financial ratio measured as earnings before interest and taxes, divided by interest expense is the:A. cash coverage ratio.B. debt-equity ratio.C. times interest earned ratio.D. gross margin.E. total debt ratio.Difficulty level: MediumTopic: TIMES INTEREST EARNED RATIOType: DEFINITIONS15. The financial ratio measured as earnings before interest and taxes, plus depreciation, divided by interest expense, is the:A. cash coverage ratio.B. debt-equity ratio.C. times interest earned ratio.D. gross margin.E. total debt ratio.Difficulty level: MediumTopic: CASH COVERAGE RATIOType: DEFINITIONS16. Ratios that measure how efficiently a firm uses its assets to generate sales are known as _____ ratios.A. asset managementB. long-term solvencyC. short-term solvencyD. profitabilityE. market valueDifficulty level: EasyTopic: ASSET MANAGEMENT RATIOSType: DEFINITIONS17. The inventory turnover ratio is measured as:A. total sales minus inventory.B. inventory times total sales.C. cost of goods sold divided by inventory.D. inventory times cost of goods sold.E. inventory plus cost of goods sold.D ifficulty level: MediumTopic: INVENTORY TURNOVERType: DEFINITIONS18. The financial ratio days' sales in inventory is measured as:A. inventory turnover plus 365 days.B. inventory times 365 days.C. inventory plus cost of goods sold, divided by 365 days.D. 365 days divided by the inventory.E. 365 days divided by the inventory turnover.Difficulty level: MediumTopic: DAYS' SALES IN INVENTORYType: DEFINITIONS19. The receivables turnover ratio is measured as:A. sales plus accounts receivable.B. sales divided by accounts receivable.C. sales minus accounts receivable, divided by sales.D. accounts receivable times sales.E. accounts receivable divided by sales.Difficulty level: MediumTopic: RECEIVABLES TURNOVERType: DEFINITIONS20. The financial ratio days' sales in receivables is measured as:A. receivables turnover plus 365 days.B. accounts receivable times 365 days.C. accounts receivable plus sales, divided by 365 days.D. 365 days divided by the receivables turnover.E. 365 days divided by the accounts receivable.Difficulty level: MediumTopic: DAYS' SALES IN RECEIVABLESType: DEFINITIONS21. The total asset turnover ratio is measured as:A. sales minus total assets.B. sales divided by total assets.C. sales times total assets.D. total assets divided by sales.E. total assets plus sales.Difficulty level: EasyTopic: TOTAL ASSET TURNOVERType: DEFINITIONS22. Ratios that measure how efficiently a firm's management uses its assets and equity to generate bottom line net income are known as _____ ratios.A. asset managementB. long-term solvencyC. short-term solvencyD. profitabilityE. market valueDifficulty level: EasyTopic: PROFITABILITY RATIOSType: DEFINITIONS23. The financial ratio measured as net income divided by sales is known as the firm's:A. profit margin.B. return on assets.C. return on equity.D. asset turnover.E. earnings before interest and taxes.Difficulty level: EasyTopic: PROFIT MARGINType: DEFINITIONS24. The financial ratio measured as net income divided by total assets is known as the firm's:A. profit margin.B. return on assets.C. return on equity.D. asset turnover.E. earnings before interest and taxes.Difficulty level: EasyTopic: RETURN ON ASSETSType: DEFINITIONS25. The financial ratio measured as net income divided by total equity is known as the firm's:A. profit margin.B. return on assets.C. return on equity.D. asset turnover.E. earnings before interest and taxes.Difficulty level: EasyTopic: RETURN ON EQUITYType: DEFINITIONS26. The financial ratio measured as the price per share of stock divided by earnings per share is known as the:A. return on assets.B. return on equity.C. debt-equity ratio.D. price-earnings ratio.E. Du Pont identity.Difficulty level: EasyTopic: PRICE-EARNINGS RATIOType: DEFINITIONS27. The market-to-book ratio is measured as:A. total equity divided by total assets.B. net income times market price per share of stock.C. net income divided by market price per share of stock.D. market price per share of stock divided by earnings per share.E. market value of equity per share divided by book value of equity per share.Difficulty level: MediumTopic: MARKET-TO-BOOK RATIOType: DEFINITIONS28. The _____ breaks down return on equity into three component parts.A. Du Pont identityB. return on assetsC. statement of cash flowsD. asset turnover ratioE. equity multiplierDifficulty level: MediumTopic: DU PONT IDENTITYType: DEFINITIONS29. The External Funds Needed (EFN) equation does not measure the:A. additional asset requirements given a change in sales.B. additional total liabilities raised given the change in sales.C. rate of return to shareholders given the change in sales.D. net income expected to be earned given the change in sales.E. None of the above.Difficulty level: MediumTopic: EXTERNAL FUNDS NEEDEDType: DEFINITIONS30. To calculate sustainable growth rate without using return on equity, the analyst needs the:A. profit margin.B. payout ratio.C. debt-to-equity ratio.D. total asset turnover.E. All of the above.Difficulty level: MediumTopic: SUSTAINABLE GROWTH RATEType: DEFINITIONS31. Growth can be reconciled with the goal of maximizing firm value:A. because greater growth always adds to value.B. because growth must be an outcome of decisions that maximize NPV.C. because growth and wealth maximization are the same.D. because growth of any type cannot decrease value.E. None of the above.Difficulty level: MediumTopic: GROWTHType: DEFINITIONS32. Sustainable growth can be determined by the:A. profit margin, total asset turnover and the price to earnings ratio.B. profit margin, the payout ratio, the debt-to-equity ratio, and the asset requirement or asset turnover ratio.C. Total growth less capital gains growth.D. Either A or B.E. None of the above.Difficulty level: MediumTopic: SUSTAINABLE GROWTHType: DEFINITIONS33. Which of the following will increase sustainable growth?A. Buy back existing stockB. Decrease debtC. Increase profit marginD. Increase asset requirement or asset turnover ratioE. Increase dividend payout ratioDifficulty level: MediumTopic: SUSTAINABLE GROWTHType: DEFINITIONS34. The main objective of long-term financial planning models is to:A. determine the asset requirements given the investment activities of the firm.B. plan for contingencies or uncertain events.C. determine the external financing needs.D. All of the above.E. None of the above.Difficulty level: MediumTopic: LONG-TERM PLANNINGType: DEFINITIONS35. On a common-size balance sheet, all _____ accounts are shown as a percentage of _____.A. income; total assetsB. liability; net incomeC. asset; salesD. liability; total assetsE. equity; salesDifficulty level: MediumTopic: COMMON-SIZE BALANCE SHEETType: DEFINITIONS36. Which one of the following statements is correct concerning ratio analysis?A. A single ratio is often computed differently by different individuals.B. Ratios do not address the problem of size differences among firms.C. Only a very limited number of ratios can be used for analytical purposes.D. Each ratio has a specific formula that is used consistently by all analysts.E. Ratios can not be used for comparison purposes over periods of time.Difficulty level: MediumTopic: RATIO ANALYSISType: DEFINITIONS37. Which of the following are liquidity ratios?I. cash coverage ratioII. current ratioIII. quick ratioIV. inventory turnoverA. II and III onlyB. I and II onlyC. II, III, and IV onlyD. I, III, and IV onlyE. I, II, III, and IVDifficulty level: MediumTopic: LIQUIDITY RATIOSType: DEFINITIONS38. An increase in which one of the following accounts increases a firm's current ratio without affecting its quick ratio?A. accounts payableB. cashC. inventoryD. accounts receivableE. fixed assetsDifficulty level: MediumTopic: LIQUIDITY RATIOSType: DEFINITIONS39. A supplier, who requires payment within ten days, is most concerned with which one of the following ratios when granting credit?A. currentB. cashC. debt-equityD. quickE. total debtDifficulty level: MediumTopic: LIQUIDITY RATIOSType: DEFINITIONS40. A firm has a total debt ratio of .47. This means that that firm has 47 cents in debt for every:A. $1 in equity.B. $1 in total sales.C. $1 in current assets.D. $.53 in equity.E. $.53 in total assets.Difficulty level: MediumTopic: LONG-TERM SOLVENCY RATIOSType: DEFINITIONS41. The long-term debt ratio is probably of most interest to a firm's:A. credit customers.B. employees.C. suppliers.D. mortgage holder.E. shareholders.Difficulty level: MediumTopic: LONG-TERM SOLVENCY RATIOSType: DEFINITIONS42. A banker considering loaning a firm money for ten years would most likely prefer the firm have a debt ratio of _____ and a times interest earned ratio of _____.A. .75; .75B. .50; 1.00C. .45; 1.75D. .40; 2.50E. .35; 3.00Difficulty level: MediumTopic: LONG-TERM SOLVENCY RATIOSType: DEFINITIONS43. From a cash flow position, which one of the following ratios best measuresa firm's ability to pay the interest on its debts?A. times interest earned ratioB. cash coverage ratioC. cash ratioD. quick ratioE. Interval measureDifficulty level: MediumTopic: LONG-TERM SOLVENCY RATIOSType: DEFINITIONS44. The higher the inventory turnover measure, the:A. faster a firm sells its inventory.B. faster a firm collects payment on its sales.C. longer it takes a firm to sell its inventory.D. greater the amount of inventory held by a firm.E. lesser the amount of inventory held by a firm.Difficulty level: MediumTopic: ASSET MANAGEMENT RATIOSType: DEFINITIONS45. Which one of the following statements is correct if a firm has a receivables turnover measure of 10?A. It takes a firm 10 days to collect payment from its customers.B. It takes a firm 36.5 days to sell its inventory and collect the payment from the sale.C. It takes a firm 36.5 days to pay its creditors.D. The firm has an average collection period of 36.5 days.E. The firm has ten times more in accounts receivable than it does in cash.Difficulty level: MediumTopic: ASSET MANAGEMENT RATIOSType: DEFINITIONS46. A total asset turnover measure of 1.03 means that a firm has $1.03 in:A. total assets for every $1 in cash.B. total assets for every $1 in total debt.C. total assets for every $1 in equity.D. sales for every $1 in total assets.E. long-term assets for every $1 in short-term assets.Difficulty level: MediumTopic: ASSET MANAGEMENT RATIOSType: DEFINITIONS47. Puffy's Pastries generates five cents of net income for every $1 in sales. Thus, Puffy's has a _____ of 5%.A. return on assetsB. return on equityC. profit marginD. Du Pont measureE. total asset turnoverDifficulty level: MediumTopic: PROFITABILITY RATIOSType: DEFINITIONS48. If a firm produces a 10% return on assets and also a 10% return on equity, then the firm:A. has no debt of any kind.B. is using its assets as efficiently as possible.C. has no net working capital.D. also has a current ratio of 10.E. has an equity multiplier of 2.Difficulty level: MediumTopic: PROFITABILITY RATIOSType: DEFINITIONS49. If shareholders want to know how much profit a firm is making on their entire investment in the firm, the shareholders should look at the:A. profit margin.B. return on assets.C. return on equity.D. equity multiplier.E. earnings per share.Difficulty level: MediumTopic: PROFITABILITY RATIOSType: DEFINITIONS50. BGL Enterprises increases its operating efficiency such that costs decrease while sales remain constant. As a result, given all else constant, the:A. return on equity will increase.B. return on assets will decrease.C. profit margin will decline.D. equity multiplier will decrease.E. price-earnings ratio will increase.Difficulty level: MediumTopic: PROFITABILITY RATIOSType: DEFINITIONS51. The only difference between Joe's and Moe's is that Joe's has old, fully depreciated equipment. Moe's just purchased all new equipment which will be depreciated over eight years. Assuming all else equal:A. Joe's will have a lower profit margin.B. Joe's will have a lower return on equity.C. Moe's will have a higher net income.D. Moe's will have a lower profit margin.E. Moe's will have a higher return on assets.Difficulty level: MediumTopic: PROFITABILITY RATIOSType: DEFINITIONS52. Last year, Alfred's Automotive had a price-earnings ratio of 15. This year, the price earnings ratio is 18. Based on this information, it can be stated with certainty that:A. the price per share increased.B. the earnings per share decreased.C. investors are paying a higher price for each share of stock purchased.D. investors are receiving a higher rate of return this year.E. either the price per share, the earnings per share, or both changed.Difficulty level: MediumTopic: MARKET VALUE RATIOSType: DEFINITIONS53. Turner's Inc. has a price-earnings ratio of 16. Alfred's Co. has a price-earnings ratio of 19. Thus, you can state with certainty that one share of stock in Alfred's:A. has a higher market price than one share of stock in Turner's.B. has a higher market price per dollar of earnings than does one share of Turner's.C. sells at a lower price per share than one share of Turner's.D. represents a larger percentage of firm ownership than does one share of Turner's stock.E. earns a greater profit per share than does one share of Turner's stock.Difficulty level: MediumTopic: MARKET VALUE RATIOType: DEFINITIONS54. Which two of the following are most apt to cause a firm to have a higher price-earnings ratio?I. slow industry outlookII. high prospect of firm growthIII. very low current earningsIV. investors with a low opinion of the firmA. I and II onlyB. II and III onlyC. II and IV onlyD. I and III onlyE. III and IV onlyDifficulty level: MediumTopic: MARKET VALUE RATIOSType: DEFINITIONS55. Vinnie's Motors has a market-to-book ratio of 3. The book value per share is $4.00. Holding market-to-book constant, a $1 increase in the book value per share will:A. cause the accountants to increase the equity of the firm by an additional $2.B. increase the market price per share by $1.C. increase the market price per share by $12.D. tend to cause the market price per share to rise.E. only affect book values but not market values.Difficulty level: MediumTopic: MARKET VALUE RATIOSType: DEFINITIONS56. Which one of the following sets of ratios applies most directly to shareholders?A. return on assets and profit marginB. quick ratio and times interest earnedC. price-earnings ratio and debt-equity ratioD. market-to-book ratio and price-earnings ratioE. cash coverage ratio and times equity multiplierDifficulty level: MediumTopic: MARKET VALUE RATIOSType: DEFINITIONS57. The three parts of the Du Pont identity can be generally described as:I. operating efficiency, asset use efficiency and firm profitability.II. financial leverage, operating efficiency and asset use efficiency.III. the equity multiplier, the profit margin and the total asset turnover. IV. the debt-equity ratio, the capital intensity ratio and the profit margin.A. I and II onlyB. II and III onlyC. I and IV onlyD. I and III onlyE. III and IV onlyDifficulty level: MediumTopic: DU PONT IDENTITYType: DEFINITIONS58. If a firm decreases its operating costs, all else constant, then:A. the profit margin increases while the equity multiplier decreases.B. the return on assets increases while the return on equity decreases.C. the total asset turnover rate decreases while the profit margin increases.D. both the profit margin and the equity multiplier increase.E. both the return on assets and the return on equity increase.Difficulty level: MediumTopic: DU PONT IDENTITYType: DEFINITIONS59. Which one of the following statements is correct?A. Book values should always be given precedence over market values.B. Financial statements are frequently the basis used for performance evaluations.C. Historical information has no value when predicting the future.D. Potential lenders place little value on financial statement information.E. Reviewing financial information over time has very limited value.Difficulty level: MediumTopic: EVALUATING FINANCIAL STATEMENTSType: DEFINITIONS60. It is easier to evaluate a firm using its financial statements when the firm:A. is a conglomerate.B. is global in nature.C. uses the same accounting procedures as other firms in its industry.D. has a different fiscal year than other firms in its industry.E. tends to have one-time events such as asset sales and property acquisitions.Difficulty level: MediumTopic: EVALUATING FINANCIAL STATEMENTSType: DEFINITIONS61. Which two of the following represent the most effective methods of directly evaluating the financial performance of a firm?I. comparing the current financial ratios to those of the same firm from prior time periodsII. comparing a firm's financial ratios to those of other firms in the firm's peer group who have similar operationsIII. comparing the financial statements of the firm to the financial statements of similar firms operating in other countriesIV. comparing the financial ratios of the firm to the average ratios of all firms located in the same geographic areaA. I and II onlyB. II and III onlyC. III and IV onlyD. I and IV onlyE. I and III onlyDifficulty level: MediumTopic: EVALUATING FINANCIAL STATEMENTSType: DEFINITIONS62. In the financial planning model, external funds needed (EFN) is equal to changes inA. assets - (liabilities - equity).B. assets - (liabilities + equity).C. (assets + liabilities - equity).D. (assets + equity - liabilities).E. assets - equity.Difficulty level: MediumTopic: EXTERNAL FUNDS NEEDEDType: DEFINITIONS63. Which of the following represent problems encountered when comparing the financial statements of one firm with those of another firm?I. Either one, or both, of the firms may be conglomerates and thus have unrelated lines of business.II. The operations of the two firms may vary geographically.III. The firms may use differing accounting methods for inventory purposes. IV. The two firms may be seasonal in nature and have different fiscal year ends.A. I and II onlyB. II and III onlyC. I, III, and IV onlyD. I, II, and III onlyE. I, II, III, and IVDifficulty level: MediumTopic: EVALUATING FINANCIAL STATEMENTSType: DEFINITIONS64. A firm's sustainable growth rate in sales directly depends on its:A. debt to equity ratio.B. profit margin.C. dividend policy.D. asset efficiency.E. All of the above.Difficulty level: MediumTopic: SUSTAINABLE GROWTH RATEType: DEFINITIONS65. The sustainable growth rate will be equivalent to the internal growth rate when:A. a firm has no debt.B. the growth rate is positive.C. the plowback ratio is positive but less than 1.D. a firm has a debt-equity ratio exactly equal to 1.E. net income is greater than zero.Difficulty level: MediumTopic: SUSTAINABLE GROWTH RATEType: DEFINITIONS66. The sustainable growth rate:A. assumes there is no external financing of any kind.B. is normally higher than the internal growth rate.C. assumes the debt-equity ratio is variable.D. is based on receiving additional external debt and equity financing.E. assumes that 100% of all income is retained by the firm.Difficulty level: MediumTopic: SUSTAINABLE GROWTH RATEType: DEFINITIONS67. If a firm bases its growth projection on the rate of sustainable growth, and shows positive net income, then the:A. fixed assets will have to increase at the same rate, regardless of the current capacity level.B. number of common shares outstanding will increase at the same rate of growth.C. debt-equity ratio will have to increase.D. debt-equity ratio will remain constant while retained earnings increase.E. fixed assets, debt-equity ratio, and number of common shares outstanding will all increase.Difficulty level: MediumTopic: SUSTAINABLE GROWTH RATEType: DEFINITIONS68. Marcie's Mercantile wants to maintain its current dividend policy, which isa payout ratio of 40%. The firm does not want to increase its equity financing but is willing to maintain its current debt-equity ratio. Given these requirements, the maximum rate at which Marcie's can grow is equal to:A. 40% of the internal rate of growth.B. 60% of the internal rate of growth.C. the internal rate of growth.D. the sustainable rate of growth.E. 60% of the sustainable rate of growth.Difficulty level: MediumTopic: SUSTAINABLE GROWTH RATEType: DEFINITIONS69. One of the primary weaknesses of many financial planning models is that they:A. rely too much on financial relationships and too little on accounting relationships.B. are iterative in nature.C. ignore the goals and objectives of senior management.D. are based solely on best case assumptions.E. ignore the size, risk, and timing of cash flows.Difficulty level: MediumTopic: FINANCIAL PLANNING MODELSType: DEFINITIONS70. Financial planning, when properly executed:A. ignores the normal restraints encountered by a firm.B. ensures that the primary goals of senior management are fully achieved.C. reduces the necessity of daily management oversight of the business operations.D. helps ensure that proper financing is in place to support the desired level of growth.E. eliminates the need to plan more than one year in advance.Difficulty level: MediumTopic: FINANCIAL PLANNINGType: DEFINITIONS71. When examining the EBITDA ratio, lower numbers are:A. considered good.B. considered mediocre.C. considered poor.D. indifferent to higher numbers.E. it is impossible to garner information from this ratio.Difficulty level: MediumTopic: EBITDA RATIOType: DEFINITIONS。