会计学原理Financial-Accounting-by-Robert-Libby第八版-第三章-答案

- 格式:docx

- 大小:162.76 KB

- 文档页数:76

会计学原理英文版Accounting Principles。

Accounting is the language of business. It is the process of recording, summarizing, analyzing, andinterpreting financial information. The principles of accounting provide the framework for the preparation and presentation of financial statements. These principles ensure that the financial information is relevant, reliable, and comparable.The basic principles of accounting include the following:1. Accrual Principle: This principle states thatrevenue and expenses should be recognized when they are incurred, regardless of when cash is received or paid. This means that revenue is recorded when it is earned, and expenses are recorded when they are incurred, regardless of when cash is exchanged.2. Matching Principle: This principle states that expenses should be matched with the revenues they help to generate. This ensures that the financial statements accurately reflect the results of operations for a specific period.3. Cost Principle: This principle states that assets should be recorded at their original cost, rather than at their current market value. This provides a reliable and objective basis for valuing assets.4. Full Disclosure Principle: This principle requires that all relevant information that could affect the decisions of financial statement users should be disclosed in the financial statements or in the accompanying notes.5. Going Concern Principle: This principle assumes thata business will continue to operate indefinitely. This allows for the use of historical cost in valuing assets and liabilities, as well as the use of the accrual basis of accounting.6. Materiality Principle: This principle states that information is material if its omission or misstatement could influence the economic decisions of users of financial statements. Materiality is based on the nature and size of the item.7. Conservatism Principle: This principle states that when in doubt, accountants should choose the method that will result in the least favorable financial statement. This helps to ensure that financial statements are not overstated.These principles form the foundation of accounting and are essential for the preparation of accurate and reliable financial statements. By adhering to these principles, accountants can ensure that the financial information they provide is useful for decision-making purposes.In addition to these basic principles, there are also specific accounting standards and regulations that must be followed, such as the Generally Accepted AccountingPrinciples (GAAP) and the International Financial Reporting Standards (IFRS). These standards and regulations provide further guidance on how to prepare and present financial statements in accordance with the principles of accounting.In conclusion, the principles of accounting areessential for the preparation and presentation of financial information. By following these principles, accountants can ensure that the financial statements are relevant, reliable, and comparable. This in turn provides valuable information for decision-making purposes and helps to maintain the integrity and transparency of the financial reporting process.。

会计学原理英文版第Principles of AccountingIntroductionAccounting, often referred to as the language of business, is a systematic process of recording, analyzing, and reporting financial transactions. It provides crucial information to businesses, investors, and other stakeholders about thefinancial health and performance of an organization. Accounting principles serve as the foundation for recording and reporting financial information accurately and consistently. This paper will explore the key principles of accounting and their importance in financial reporting.Accrual PrincipleThe accrual principle states that financial transactions should be recorded in the accounting period in which they occur, rather than when cash is received or paid. This principle ensures that revenues and expenses are recognized in the period in which they are earned or incurred. It enables businesses to present a more accurate and reliable picture of their financial performance.Principle of Historical CostThe historical cost principle states that assets should be recorded and reported at their original cost, which includesboth the purchase price and any other costs necessary to get the asset ready for use. This principle provides businesses with a reliable basis to measure and report their financial position. It also allows for consistent and objective valuation of assets, as opposed to subjective estimation.Matching PrincipleThe matching principle states that businesses should recognize expenses incurred in generating revenue in the same period as the revenue they help to generate. This principle ensures that financial statements accurately reflect the relationship between revenues and the expenses necessary to earn those revenues. By matching revenues and expenses, businesses can present a more accurate measure of their profitability.Conservatism PrincipleThe conservatism principle suggests that when there is uncertainty in accounting estimates, businesses should adopt a more conservative approach. This means that businesses shoulderr on the side of caution and recognize potential losses or expenses rather than potential gains. This principle helps to prevent overstatement of assets and revenues, and increases the reliability of financial statements.Consistency PrincipleMateriality PrincipleThe materiality principle states that businesses should only include information in financial statements if it is significant enough to influence the decision-making of users. This principle allows businesses to focus on the most relevant and important information, while avoiding excessive details that may distort the overall picture. Materiality is determined based on both quantitative and qualitative factors.Importance of Accounting PrinciplesConclusionAccounting principles serve as the foundation for recording, analyzing, and reporting financial transactions. They ensure accuracy, consistency, and reliability in financial reporting. The accrual principle, historical cost principle, matching principle, conservatism principle, consistency principle, and materiality principle are key principles that guide financial accounting practices. By adhering to these principles, businesses can present a more accurate and meaningful picture of their financial health and performance.。

financial accounting robert中文版-回复什么是财务会计?(What is financial accounting?)财务会计是一种会计学分支,主要关注企业的财务数据和信息处理。

它提供了管理层、投资者、债权人和其他利益相关方所需的关于企业财务状况和业绩的可靠信息。

财务会计有几个主要目标。

首先,它旨在提供关于企业财务状况的准确和全面的信息。

该信息帮助各方了解企业的收入、支出、资产和负债等重要指标。

其次,财务会计还要提供有关企业经营业绩的信息,包括销售收入、利润和现金流量等。

最后,财务会计帮助检查企业的合规性,确保其遵守法律、法规和会计准则。

财务会计的核心概念是“会计周期”(accounting cycle)。

会计周期由一系列步骤组成,用于处理和报告企业的财务数据。

以下是财务会计的关键步骤:1. 识别和记录交易:首先,财务会计通过识别和记录企业的交易来开始。

这些交易可能包括销售产品、购买材料、支付工资等。

2. 准备原始账目:在这一步骤中,会计师将交易的细节记录在原始账目中。

原始账目包括会计方程中的资产、负债和所有者权益项。

3. 进行分类和分析:财务会计对原始账目进行分类和分析,将交易归类到不同的财务报表项目中。

这些项目包括资产、负债、所有者权益、收入和费用。

4. 编制财务报表:根据分类和分析的结果,财务会计编制企业的财务报表。

常见的财务报表包括资产负债表、利润表和现金流量表。

5. 审核财务报表:企业的财务报表需要经过外部会计师事务所的审计,以确保其准确性和可靠性。

审计过程包括对企业的账目、凭证和其他相关文件的审查。

6. 报告和分析:最后,财务会计将企业的财务报表通过适当的方式向利益相关方进行报告。

这些报告可以帮助投资者、债权人和管理人员评估企业的财务状况和业绩,并做出相应的决策。

财务会计是企业管理和决策的重要工具。

通过提供准确和可靠的财务信息,它帮助各方了解企业的财务状况和业绩情况,并帮助他们做出明智的决策。

会计学原理FinancialAccountingbyRobertLibby第八版第十一Chapter 11 - Reporting and Interpreting Owners’ EquityChapter 11Reporting and Interpreting Owners’ Equity__ TO __NS1. A corporation is a separate legal entity (authorized by law to operate as an individual).It is owned by a number of persons and/or entities whose ownership is evidenced by shares of capital stock. Its primary advantages are: (a) transferability of ownership, (b) limited liability to the owners, and (c) the ability to accumulate large amounts of resources. 2. The charter of a corporation is a legal document from the state that authorizes itscreation as a separate legal entity. The charter specifies the name of the entity, its purpose, and the kinds and number of shares of capital stock it can issue. 3. (a) Authorized capitalstock―the maximum number of shares of stock that can be sold and issued as specified in the charter of the corporation.(b) Issued capital stock―the total number of shares of capital stock that havebeen issued by the corporation at a particular date. (c) Outstanding capital stock―the number of shares currently owned by thestockholders.4. Common stock―the usual or normal stock of the corporation. It is the voting stockand generally ranks after the preferred stock for dividends and assets distributed upon dissolution. Often it is called the residual equity. Common stock may be either par value or no-par value.Preferred stock―when one or more additional classes of stock are issued, the additional classes are called preferred stock. Preferred stock has modifications that make it different fromcommon stock. Generally, preferred stock has both favorable and unfavorable features in comparison with common stock. Preferred stock usually is par value stock and usually specifies a dividend rate such as D6% preferred stock.‖Chapter 11 - Reporting and Interpreting Owners’ Equity5. Par value is a nominal per share amount established for the common stock and/orpreferred stock in the charter of the corporation, and is printed on the face of each stock certificate. The stock that is sold by a corporation to investors above par value is said to have sold at a premium, while stock that is sold below par is said to have sold at a discount. The laws of practically all states forbid the initial sale of stock by a corporation to investors below par value. No-par value stock does not have an amount per share specified in the charter. As a consequence, it may be issued at any price without involving a discount or a premium. It avoids giving the impression of a value that is not present. 6. The usual characteristics of preferred stock are: (1) dividend preferences, (2) conversion privileges, (3) asset preferences, and (4) nonvoting specifications. 7. The two basic sources of stockholders’ equity are:Contributed capital―the amount invested by stockholders by purchase from the corporation of shares of stock. It is comprised of two separate elements: (1) the par or stated amount derived from the sale of capital stock (common or preferred) and(2) the amount received in excess of par or stated value.Retained earnings―the accumulated amount of all ne t income since the organization of the corporation, less losses and less the accumulated amount of dividends paid by the corporation since organization.8. Stockholders’ equity is accounted for in terms of source. This means that severalaccounts are maintained for the various sources of stockholders’ equity, such as common stock, preferred stock, contributed capital in excess of par, and retained earnings. 9. Treasury stock is a corporation’s own capital stock that was sold (issued) andsubsequently reacquired by the corporation. Corporations frequently purchase shares of their own capital stock for sound business reasons, such as to obtain shares needed for employees’ bonus plans, to influence the market price of the stock, to increase earnings per share amounts, and to have shares on hand for use in the acquisition of other companies. Treasury stock, while held by the issuing corporation, confers no voting, dividend, or other stockholder rights. 10. Treasury stock is reported on the balance she et under stockholders’ equity as adeduction; that is, as contra stockholders’ equity. Any Dgain or loss‖ on treasury stock that has been sold is reported on the financial statements as an addition to contributed capital if a gain; if a loss, it is deducted from any previous contributed capital, or otherwise from retained earnings.Chapter 11 - Reporting and Interpreting Owners’ Equity11. The two basic requirements to support a cash dividend are: (1) cash on hand or theability to obtain cash sufficient to pay the dividend and (2) a sufficient balance in retained earnings, because the dividend represents a return of earnings to the stockholders. A cash dividend reduces both the assets of a corporation and stockholders’ equity by the amount o f the dividend. 12. Cumulative preferred stock has a dividend preference such that, should thedividends on the preferred stock for any year, or series of years, not be paid, dividends cannot be paid to the common stockholders until all such dividends in arrears are paid to the preferred stockholders. Noncumulative preferred stock does not have this preference; therefore, dividends not paid in past periods will never be paid to the preferred stockholders. 13. A stockdividend involves the issuance to the stockholders of a dividend in thecorporation’s own stock (rather than cash). A stock dividend is significantly different from a cash dividend in that the corporation does not disburse any assets, while in the case of a cash dividend, cash is decreased by the amount of the dividend.A cash dividend also reduces total stockholders’ equity by the amount of the dividend. In contrast, a stock dividend does not change total stockholders’ equity. 14. The primary purposes for issuing a stock dividend are: (1) to maintain dividendconsistency; that is, to pay dividends each year either in cash or in capital stock, and (2) to capitalize retained earnings; that is, a stock dividend requires a transfer from the Retained Earnings account to the permanent contributed capital accounts for the amount of the dividend. Although this transfer does not change stockholders’ equity in total, it does cause a shift from retained earnings to contributed capital. 15. When a dividend is declared and paid, the three important dates are:Declaration date―the date on which the board of directors votes the dividend. In the case of a cash dividend, a dividend liability comes into existence on this date and must be recordedas a debit to Retained Earnings and as a credit to Dividends Payable.Date of record―this date usually is about one month after the date of declaration. It is the date on which the corporation extracts from its stockholders’ records the list of individuals owning shares. The dividend is paid only to those names listed on the record date. No entry in the accounts is made on this date.Date of payment―the date on which the cash is disbursed to pay the dividend. It follows the date of record as specified in the dividend announcement. The entry to record the cash disbursement for the dividend is a debit to Dividends Payable and a credit to Cash.Chapter 11 - Reporting and Interpreting Owners’ Equity16. Retained earnings is the accumulated amount of all net income of the corporationless all losses and less the accumulated amount of all dividends declared to date. The primary components of retained earnings are: beginning balance, plus net income, less net losses, minus dividends declared, equals the ending balance.__ TO __E CHOICE1. c) 6. b)2. d) 7. c)3. b) 8. c)4. a) 9. d)5. c) 10. a)Chapter 11 - Reporting and Interpreting Owners’ EquityAuthors’ Recommended Solution Time(Time in minutes)students will need to complete the assignment. As with any open-ended project, it is possible for students to devote a large amount of time to these assignments. While students often benefit from the extra effort, we find that some become frustrated by the perceived difficulty of the task. You can reduce student frustration and anxiety by making your expectations clear. For example, when our goal is to sharpen research skills, we devote class time to discussing research strategies. When we want the students to focus on a real accounting issue, we offer suggestions about possible companies or industries.Chapter 11 - Reporting and Interpreting Owners’ EquityMINI- __ESM11C1.Stockholders may:a) Vote in the stockholders’ meeting (or by proxy) on major issues concerning management of the corporation. b) Participate proportionately with other stockholders in the distribution of the corporation’s profits. c) Share proportionately with other stockholders in the distribution of corporate assets upon liquidation.Being able to vote is the most important of the rights because this ensures that the owners have an input at the stockholders’ meeting and some control of the management of the corporation, thus enabling them to protect their rights as stockholders. M11C2.Unissued shares = 90,000 (268,000 C 178,000) M11C3.Cash (170,000 $21) (+A) ...........................................3,570,000Common Stock (170,000 $1) (+SE) ......................Capital in Excess of Par (+SE) .................................The journal entry would be different if the par value were $2: Cash (170,000 $21) (+A) ...........................................3,570,000Common Stock (170,000 $2) (+SE) ......................Capital in Excess of Par (+SE) .................................340,000 3,230,000170,000 3,400,000Chapter 11 - Reporting and Interpreting Owners’ EquityM11C4.Common stock is the basic voting stock issued by a corporation. It ranks after preferred stock for dividends and assets distributed upon liquidation of thecorporation. The dividend rate for common stock is determined by the board of directors, and is based on the company’s profitability. The dividend rate forpreferred stock is fixed by a contract. Common stock has more potential for growth than preferred stock if the company is profitable. On the other hand, the investor may lose more money with common stock than with preferred stock if the company is not profitable.Usually, It is advisable to invest in the common stock if you believe the company will be profitable. Common stock will receive a higher return on the $100,000 than preferred stock would.Chapter 11 - Reporting and Interpreting Owners’ EquityM11C7.April 15:Retained Earnings (-SE) .............................................. Dividends Payable (+L) ............................................June 14:Dividends Payable (-L) ................................................. Cash (-A) ..................................................................65,00065,00065,00065,000M11C10.Retained Earnings (-SE) .............................................. Common Stock (+SE) ..............................................800,000800,000Chapter 11 - Reporting and Interp reting Owners’ Equity__ESE11C1.Computation of End of Year Balance for Treasury Stock:Beginning balance Net increase307,532,841 383,407,665Ending balanceComputation of Shares Outstanding: E11C2.Req. 1 The number of authorized shares is specified in the corporate charter: 300,000. Req. 2 Issued shares are the sharessold to the public: 160,000 Req. 3Issued shares 160,000 Treasury stockIssued shares Treasury stock2,109,316,331 1,725,908,666Shares OutstandingOutstanding shares 135,000Chapter 11 - Reporting and Interpreting Owners’ EquityE11C3. Req. 1Stockholders’ EquityContributed capital: Preferred stock, authorized 4,000 shares, issued and outstanding, 3,000 shares ...................................................... $ 24,000 Common stock, authorized 103,000 shares,issued and outstanding, 20,000 shares .................................................... 200,000 Capital in excess of par, preferred .............................................................. 36,000 Capital in excess of stated value, no-par common ..................................... 120,000 Total contributed capital .......................................................................... 380,000 Retained earnings .......................................................................................... 60,000 Total Stockholders’ Equity .......................................................................Req. 2The answer would depend on the profitability of the company and the stability of its earnings. The preferred stock has a 9% dividend rate. If the company earns more than 9%, the additional earnings would accrue to the current stockholders. If the company earns less than 9%, it would pay a higher rate to the preferred stockholders. E11C4.Req. 1 ($30 x 90,000 shares) - $1,600,000 = $1,100,000 Req.2 $900,000 - $1,000,000 + $800,000 = $700,000 Req.3 90,000 shares C 80,000 shares = 10,000 shares Req.4 EPS = $1,000,000 80,000 = $12.50Chapter 11 - Reporting and Interpreting Owners’ EquityE11C5.Req. 1a. Cash (5,600 shares x $20) (+A) ............................................ 112,000 Common stock (5,600 shares x $10) (+SE) ...................... Capital in excess of par, common stock (+SE) .................. Sold common stock at a premium.b.Cash (1,000 shares x $25) (+A) ............................................ Common stock (1,000 shares x $10) (+SE) ...................... Capital in excess of par, common stock (+SE) .................. Sold common stockat a premium.25,00056,000 56,000 10,000 15,000Req. 2Stockholders’ EquityContributed capital: Common stock, par $10, authorized 11,500 shares, outstanding 6,600 shares .................................................................... $ 66,000 Contributed capital in excess of par ........................................................ 71,000 Total contributed capital .......................................................................... 137,000 Retained earnings ...................................................................................... 12,000 Stockholders’ equity ...................................................................................Chapter 11 - Report ing and Interpreting Owners’ EquityE11C6. Req. 1Req. 2(Note that this solution is based on the number of Class A common shares that areoutstanding. We elect not to include the Class B shares because they are owned by the Dillard family. Usually, students do not question this assumption but when they do, it permits usto discuss reasons for issuing different types of common stock. In this case, owners of Class B shares are permitted to elect two-thirds of the board of directors, effectively letting the founding family maintain control of a public company). Number of shares outstanding 2022年: 118,529,925 shares issued minus 73,099,319 Number of shares outstanding 2022年: 117,706,523 shares issued minus 61,740,439 Req. 3(In thousands) Retained earnings for 2022年: $3,107,344minusnet income for 2022年$463,909 plus dividends for 2022年$10,002 = $2,653,437 Req. 4(thousand). Req. 5Treasury stock transactions decreased stockholders’ equity by $490,786 (thousand) ($1,846,312 - $1,355,526). Req. 6 For 2022年, treasury stock cost per share: $1,846,312 (thousand) ÷ 73,099,319 shares =Chapter 11 - Reporting and Interpreting Owners’ EquityE11C7.Req. 1a. Cash (50,000 shares x $50) (+A) .......................................... 2,500,000 Common stock (50,000 shares x $2) (+SE) ...................... 100,000 Capital in excess of par, common stock (+SE) ..................2,400,000 Sold common stock at a premium. b.Treasury stock (2,000 shares x $52) (+XSE, -SE) ................ Cash (-A) ........................................................................... Bought treasury stock.104,000104,000Req. 2Stockholders’ EquityContributed capital: Common stock, par $2, authorized 80,000 shares, issued 50,000 shares .......................................................................... $ 100,000 Contributed capital in excess of par ........................................................ 2,400,000 Total contributed capital .......................................................................... 2,500,000 Treasury stock............................................................................................ (104,000 ) Stockholders’ equity ................................................................................... E11C8.Shareholders’ equity (deficit) in thousands:Common stock, par value $.01 per share; 100,000,000 shares authorized, 33,981,509 shares issued and outstanding at December 31, 2022年, 34,150,389 shares issued and outstandingat December 31, 2022年Additional paid-in capital Accumulated deficitTotal shareholders’ equity2022年2022年340 342 198,304 200,524 (118,282 ) (98,733 ) 80,362 102,133Chapter 11 - Reporting and Interpreting Owners’ EquityE11C9.Stockholders’ EquityContributed capital: Preferred stock, 8%, par $50, authorized 59,000 shares, issued and outstanding, 20,000 shares ............................................... $1,000,000 Common stock, par $10, authorized 98,000 shares, issued, 78,000 shares ......................................................................... 780,000 Capital in excess of par, preferred stock ................................................. 600,000 Capital in excess of par, common stock .................................................. 780,000 Treasury stock ..................................................................................... (80,000) Retained earnings* ......................................................................................... 160,000 Total stockholders’ equity........................................................................ *($210,000 C $50,000 = $160,000.) E11C10.a. Cash (20,000 shares x $20) (+A) .......................................... 400,000 Common stock, no-par (+SE) ............................................ .b. Cash (6,000 shares x $40) (+A) ............................................ 240,000 Common stock, no-par (+SE) ...........................................c.Cash (7,000 shares x $30) (+A) ............................................ 210,000 Preferred stock (7,000 shares x $10) (+SE) ...................... Capital in excess of par, preferred (+SE) ..........................400,000 240,000 70,000 140,000Req. 2Yes, it is ethical as long as there is a full disclosure of relevant information. In any arm’slength transaction, an informed buyer will pay the market value of the stock.Chapter 11 - Reporting and Interpreting Owners’ EquityE11C11. Req. 1Number of preferred shares issued: $100,000 Req. 2Number of preferred shares outstanding: 10,000 shares issued minus 500 shares held Req. 3Average sales price per share of preferred stock when issued: ($100,000 + $15,000) ÷ Req. 4Treasury stock transactions decreased stockholders’ equity by $8,000 (same as the decrease in corporate resources in 4 above). Req. 6Treasury stock cost per share: $9,500 ÷Req. 7Req. 8Issue price of common stock $600,000 ÷Chapter 11 - Reporting and Interpreting Owners’ EquityE11C12. Req. 1The number of shares that have been issuedis computed by dividing the common stock account ($4,008 million) by the par value of the shares ($1 per share) or approximately 4,008,000,000 shares. Req. 2Retained earnings end of 2022年 ............ $70,682,000,000 Net income for 2022年 ............................ 10,756,000,000 Dividends for 2022年 ............................... (5,811,600,000 ) Retained earnings end of 2022年 ............ $75,626,400,000The amount of retained earnings is an estimate because we do not know the exactnumber of shares outstanding (because we do not know the number of shares in treasury stock). This number is needed todetermine the amount of dividends paid during 2022年. We based the dividends on the estimate calculated in the previous requirement.E11C13.The treasury stock account is a contra equity account, meaning that it subtracts from the total stockholders’ equity. Cash also decreases on the balance sheet by the same amount.Req. 2Many companies repurchase common stock in order to develop an employee bonus plan that provides workers with shares of the company’s stock as part of their compensation. Because of SEC regulations concerning newly issued shares, companies find it cheaper to give their employees shares of stock that were purchased from stockholders than to issue new shares. In this case, the company mentions the goal of enhancing shareholders’ value. If the company main tains its current level of income, earnings per share will increase with fewer shares outstanding. Themanagement expects that the increase in EPS will be reflected in an increase in stock price. Req. 3Shares that are held in treasury stock do not participate individend payments. As a result, the purchase of treasury stock will reduce the amount of dividends that the company must pay in future years.Chapter 11 - Reporting and Interpreting Owners’ EquityE11C14. Req. 1Stockholders’ Eq uityContributed capital:Common stock, authorized 100,000 shares, issued 34,000 shares, ofwhich 2,000 shares are held as treasury stock .................................. Capital in excess of par ........................................................................ Total contributed capital .................................................................... Retained earnings ................................................................................... Total .................................................................................................. Less: Cost of treasury stock ................................................................. Total Stockholders’ Equity Req. 2The dividend yield ratio is 2.24% ([$16,000 32,000 shares] $22.29). While this yield seems small, it is a typical return on common stock. Investors receive a return from both dividends and stock price appreciation.Treasury stock does not receive dividends. As a result, dividends should be paid on 32,000 shares. E11C15.Req. 1a. Treasury stock (200 shares x $20) (+XSE, -SE) ................... Cash (-A) ........................................................................... Bought treasury stock.b.Cash (40 shares x $25) (+A) ................................................. Treasury stock(40 shares x $20) (-XSE, +SE) .................. Capital in excess of par (+SE) ........................................... Sold treasury stock.Capital in excess of par (-SE) ............................................... Treasury stock (30 shares x $20) (-XSE, +SE) ................ Sold treasury stock.4,0001,000450 1504,000800 200600$680,000 163,000 843,000 89,000 932,000 25,000 c. Cash (30 shares x $15) (+A) .................................................Req. 2It is not possible to make a Dprofit‖ or Dloss‖ on treasury stock transactions. Therefore, these transactions do not affect the income statement.Chapter 11 - Reporting and Interpreting Ow ners’ EquityE11C16.Req. 1 Feb. 1:Treasury stock, common (160 shares x $20) (+XSE, -SE) Cash (-A) ........................................................................July 15:Cash (80 shares x $21) (+A) ............................................. Treasury stock, common (-XSE, +SE) ........................... Capital in excess of par (+SE) .......................................Sept. 1:Cash (50 shares x $19) (+A) ............................................. Capital in excess of par (-SE) ............................................ Treasury stock, common (50 shares x $20) (-XSE, +SE) . Req. 2Dividends are not paid on treasury stock. Therefore, the amount of total cash dividends paid is reduced when treasury stock is purchased. Req. 3The sale of treasury stock for more or less than its original purchase price does not have an impact on net income. Thetransaction affects only balance sheet accounts. The cash received from the sale of treasury stock is a cash inflow which would affect the Statement of Cash Flows in the financing activities section.3,2001,680950 503,2001,600 80 1,000Chapter 11 - Reporting and Interpreting Owners’ EquityE11C17. Req. 1Case 1: When companies unexpectedly announce increases in dividends, stock prices typically increase. Depending on course objective, the instructor may want to discuss research in finance concerning dividend policy.Case 2: Stock price is based on expectations. If the increase in operatingperformance was not expected, the stock price should increase. It is not necessary to increase dividends to have a favorable stock price reaction.Case 3: Stock dividends do not provide any economic valuebut they may have a signal effect and are often associated with increases in cash dividends. As a result, stock dividends do not appear to directly cause an increase in stock price but are often associated with factors that do impact favorably on price.Req.2Stock prices react to underlying economic events and not changes in reporting methods, per se. Markets are relatively effective in recognizing the differencebetween profits generated by operations and profits generated by the use of liberal accounting policies.。

Chapter 11 - Reporting and Interpreting Owners’ EquityChapter 11Reporting and Interpreting Owners’ EquityANSWERS TO QUESTIONS1. A corporation is a separate legal entity (authorized by law to operate as an individual).It is owned by a number of persons and/or entities whose ownership is evidenced by shares of capital stock. Its primary advantages are: (a) transferability of ownership, (b) limited liability to the owners, and (c) the ability to accumulate large amounts of resources.2. The charter of a corporation is a legal document from the state that authorizes itscreation as a separate legal entity. The charter specifies the name of the entity, its purpose, and the kinds and number of shares of capital stock it can issue.3. (a) Authorized capital stock—the maximum number of shares of stock that can besold and issued as specified in the charter of the corporation.(b) Issued capital stock—the total number of shares of capital stock that havebeen issued by the corporation at a particular date.(c) Outstanding capital stock—the number of shares currently owned by thestockholders.4. Common stock—the usual or normal stock of the corporation. It is the voting stockand generally ranks after the preferred stock for dividends and assets distributed upon dissolution. Often it is called the residual equity. Common stock may be either par value or no-par value.Preferred stock—when one or more additional classes of stock are issued, the additional classes are called preferred stock. Preferred stock has modifications that make it different fromcommon stock. Generally, preferred stock has both favorable and unfavorable features in comparison with common stock. Preferred stock usually is par value stock and usually specifies a dividend rate such as ―6% preferred stock.‖Chapter 11 - Reporting and Interpreting Owners’ Equity5. Par value is a nominal per share amount established for the common stock and/orpreferred stock in the charter of the corporation, and is printed on the face of each stock certificate. The stock that is sold by a corporation to investors above par value is said to have sold at a premium, while stock that is sold below par is said to have sold at a discount. The laws of practically all states forbid the initial sale of stock by a corporation to investors below par value. No-par value stock does not have an amount per share specified in the charter. As a consequence, it may be issued at any price without involving a discount or a premium. It avoids giving the impression of a value that is not present.6. The usual characteristics of preferred stock are: (1) dividend preferences, (2)conversion privileges, (3) asset preferences, and (4) nonvoting specifications.7. The two basic sources of stockholders’ equity are:Contributed capital—the amount invested by stockholders by purchase from the corporation of shares of stock. It is comprised of two separate elements: (1) the par or stated amount derived from the sale of capital stock (common or preferred) and(2) the amount received in excess of par or stated value.Retained earnings—the accumulated amount of all net income since the organization of the corporation, less losses and less the accumulated amount of dividends paid by the corporation since organization.8. Stockholders’ equity is accounted for in terms of source. This means that severalaccounts are maintained for the various sources of stockholders’equity, such as common stock, preferred stock, contributed capital in excess of par, and retained earnings.9. Treasury stock is a corporation’s own capital stock that was sold (issued) andsubsequently reacquired by the corporation. Corporations frequently purchase shares of their own capital stock for sound business reasons, such as to obtain shares needed for employees’ bonus plans, to influence the market price of the stock, to increase earnings per share amounts, and to have shares on hand for use in the acquisition of other companies. Treasury stock, while held by the issuing corporation, confers no voting, dividend, or other stockholder rights.10. Treasury stock is reported on the balance sheet under stockholders’equity as adeduction; that is, as contra stockholders’equity. Any ―gain or loss‖ on treasury stock that has been sold is reported on the financial statements as an addition to contributed capital if a gain; if a loss, it is deducted from any previous contributed capital, or otherwise from retained earnings.Chapter 11 - Reporting and Interpreting Owners’ Equity11. The two basic requirements to support a cash dividend are: (1) cash on hand or theability to obtain cash sufficient to pay the dividend and (2) a sufficient balance in retained earnings, because the dividend represents a return of earnings to the stockholders. A cash dividend reduces both the assets of a corporation and stockholders’ equity by the amount of the dividend.12. Cumulative preferred stock has a dividend preference such that, should thedividends on the preferred stock for any year, or series of years, not be paid, dividends cannot be paid to the common stockholders until all such dividends in arrears are paid to the preferred stockholders. Noncumulative preferred stock does not have this preference; therefore, dividends not paid in past periods will never be paid to the preferred stockholders.13. A stock dividend involves the issuance to the stockholders of a dividend in thecorporation’s own stock (rather than cash). A stock dividend is significantly diffe rent from a cash dividend in that the corporation does not disburse any assets, while in the case of a cash dividend, cash is decreased by the amount of the dividend. A cash dividend also reduces total stockholders’ equity by the amount of the dividend.In contrast, a stock dividend does not change total stockholders’ equity.14. The primary purposes for issuing a stock dividend are: (1) to maintain dividendconsistency; that is, to pay dividends each year either in cash or in capital stock, and (2) to capitalize retained earnings; that is, a stock dividend requires a transfer from the Retained Earnings account to the permanent contributed capital accounts for the amount of the dividend. Although this transfer does not change stockholders’ equity in total, it does cause a shift from retained earnings to contributed capital. 15. When a dividend is declared and paid, the three important dates are:Declaration date—the date on which the board of directors votes the dividend. In the case of a cash dividend, a dividend liability comes into existence on this date and must be recorded as a debit to Retained Earnings and as a credit to Dividends Payable.Date of record—this date usually is about one month after the date of declaration. It is the date on which the corporation extracts from its stockholders’ records the list of individuals owning shares. The dividend is paid only to those names listed on the record date. No entry in the accounts is made on this date.Date of payment—the date on which the cash is disbursed to pay the dividend. It follows the date of record as specified in the dividend announcement. The entry to record the cash disbursement for the dividend is a debit to Dividends Payable anda credit to Cash.Chapter 11 - Reporting and Interpreting Owners’ Equity16. Retained earnings is the accumulated amount of all net income of the corporationless all losses and less the accumulated amount of all dividends declared to date.The primary components of retained earnings are: beginning balance, plus net income, less net losses, minus dividends declared, equals the ending balance.ANSWERS TO MULTIPLE CHOICE1. c)2. d)3. b)4. a)5. c)6. b)7. c)8. c)9. d) 10. a)Chapter 11 - Reporting and Interpreting Owners’ EquityAuthors’ Recommended Solution Time(Time in minutes)students will need to complete the assignment. As with any open-ended project, it is possible for students to devote a large amount of time to these assignments. While students often benefit from the extra effort, we find that some become frustrated by the perceived difficulty of the task. You can reduce student frustration and anxiety by making your expectations clear. For example, when our goal is to sharpen research skills, we devote class time to discussing research strategies. When we want the students to focus on a real accounting issue, we offer suggestions about possible companies or industries.Chapter 11 - Reporting and Interpreting Owners’ EquityMINI- EXERCISESM11–1.Stockholders may:a) Vote in the stockholders’ meeting (or by proxy) on major issues concerningmanagement of the corporation.b) Participate proportionately with other stockholders in the distribution of thecorporation’s profits.c) Share proportionately with other stockholders in the distribution of corporateassets upon liquidation.Being able to vote is the most important of the rights because this ensures that the owners have an input at the stockholders’ meeting and some control of the management of the corporation, thus enabling them to protect their rights as stockholders.M11–2.Unissued shares = 90,000 (268,000 – 178,000)M11–3.Cash (170,000 ⨯ $21) (+A) ...........................................3,570,000Common Stock (170,000 ⨯ $1) (+SE) ......................170,000 Capital in Excess of Par (+SE) .................................3,400,000 The journal entry would be different if the par value were $2:Cash (170,000 ⨯ $21) (+A) ...........................................3,570,000Common Stock (170,000 ⨯ $2) (+SE) ......................340,000 Capital in Excess of Par (+SE) .................................3,230,000Chapter 11 - Reporting and Interpreting Owners’ EquityM11–4.Common stock is the basic voting stock issued by a corporation. It ranks afterpreferred stock for dividends and assets distributed upon liquidation of thecorporation. The dividend rate for common stock is determined by the board of directors, and is based on the company’s profitability. The dividend rate forpreferred stock is fixed by a contract. Common stock has more potential for growth than preferred stock if the company is profitable. On the other hand, the investor may lose more money with common stock than with preferred stock if the company is not profitable.Usually, It is advisable to invest in the common stock if you believe the company will be profitable. Common stock will receive a higher return on the $100,000 than preferred stock would.Chapter 11 - Reporting and Interpreting Owners’ EquityM11–7.April 15:Retained Earnings (-SE) ..............................................65,000Dividends Payable (+L) ............................................65,000 June 14:Dividends Payable (-L) .................................................65,000Cash (-A) ..................................................................65,000M11–10.Retained Earnings (-SE) ..............................................800,000Common Stock (+SE) ..............................................800,000Chapter 11 - Reporting and Interpreting Owners’ EquityEXERCISESE11–1.Computation of End of Year Balance for Treasury Stock:Beginning balance 307,532,841Net increase 75,874,824Ending balance 383,407,665Computation of Shares Outstanding:Issued shares 2,109,316,331Treasury stock ( 383,407,665)Shares Outstanding 1,725,908,666E11–2.Req. 1 The number of authorized shares is specified in the corporate charter: 300,000. Req. 2 Issued shares are the shares sold to the public: 160,000Req. 3 Issued shares 160,000Treasury stock (25,000)Outstanding shares 135,000Chapter 11 - Reporting and Interpreting Owners’ EquityE11–3.Req. 1Stockholders’ EquityContributed capital:Preferred stock, authorized 4,000 shares,issued and outstanding, 3,000 shares ...................................................... $ 24,000 Common stock, authorized 103,000 shares,issued and outstanding, 20,000 shares .................................................... 200,000 Capital in excess of par, preferred .............................................................. 36,000 Capital in excess of stated value, no-par common ..................................... 120,000 Total contributed capital .......................................................................... 380,000 Retained earnings .......................................................................................... 60,000 Total Stockholders’ Equity....................................................................... $440,000 Req. 2The answer would depend on the profitability of the company and the stability of its earnings. The preferred stock has a 9% dividend rate. If the company earns more than 9%, the additional earnings would accrue to the current stockholders. If the company earns less than 9%, it would pay a higher rate to the preferred stockholders.E11–4.Req. 1 ($30 x 90,000 shares) - $1,600,000 = $1,100,000Req. 2 $900,000 - $1,000,000 + $800,000 = $700,000Req. 3 90,000 shares – 80,000 shares = 10,000 sharesReq. 4 EPS = $1,000,000 80,000 = $12.50Chapter 11 - Reporting and Interpreting Owners’ EquityE11–5.Req. 1a. Cash (5,600 shares x $20) (+A) ............................................ 112,000Common stock (5,600 shares x $10) (+SE) ...................... 56,000 Capital in excess of par, common stock (+SE) .................. 56,000 Sold common stock at a premium.b. Cash (1,000 shares x $25) (+A) ............................................ 25,000Common stock (1,000 shares x $10) (+SE) ...................... 10,000 Capital in excess of par, common stock (+SE) .................. 15,000 Sold common stock at a premium.Req. 2Stockholders’ EquityContributed capital:Common stock, par $10, authorized 11,500 shares,outstanding 6,600 shares .................................................................... $ 66,000 Contributed capital in excess of par ........................................................ 71,000 Total contributed capital .......................................................................... 137,000 Retained earnings ...................................................................................... 12,000 Stockholders’ equity ................................................................................... $149,000Chapter 11 - Reporting and Interpreting Owners’ EquityE11–6.Req. 1Common stock, class A at par value: 118,529,925 X $0.01 = $1,185 (thousand)Req. 2(Note that this solution is based on the number of Class A common shares that are outstanding. We elect not to include the Class B shares because they are owned by the Dillard family. Usually, students do not question this assumption but when they do, it permits us to discuss reasons for issuing different types of common stock. In this case, owners of Class B shares are permitted to elect two-thirds of the board of directors, effectively letting the founding family maintain control of a public company).Number of shares outstanding 2012: 118,529,925 shares issued minus 73,099,319 shares held as treasury stock = 45,430,606.Number of shares outstanding 2011: 117,706,523 shares issued minus 61,740,439 shares held as treasury stock = 55,966,084.Req. 3(In thousands) Retained earnings for 2011: $3,107,344minusnet income for 2012 $463,909 plus dividends for 2012 $10,002 = $2,653,437Req. 4As of 2012, treasury stock had decreased corporate resources by $1,846,312 (thousand).Req. 5T reasury stock transactions decreased stockholders’ equity by $490,786 (thousand) ($1,846,312 - $1,355,526).Req. 6For 2012, treasury stock cost per share: $1,846,312 (thousand) ÷ 73,099,319 shares = $25.26.Chapter 11 - Reporting and Interpreting Owners’ EquityE11–7.Req. 1a. Cash (50,000 shares x $50) (+A) .......................................... 2,500,000Common stock (50,000 shares x $2) (+SE) ...................... 100,000 Capital in excess of par, common stock (+SE) .................. 2,400,000 Sold common stock at a premium.b. Treasury stock (2,000 shares x $52) (+XSE, -SE) ................ 104,000Cash (-A) ........................................................................... 104,000 Bought treasury stock.Req. 2Stockholders’ EquityContributed capital:Common stock, par $2, authorized 80,000 shares,issued 50,000 shares .......................................................................... $ 100,000 Contributed capital in excess of par ........................................................ 2,400,000 Total contributed capital .......................................................................... 2,500,000 Treasury stock............................................................................................ (104,000 ) Stockholders’ equity ................................................................................... $2,396,000 E11–8.Shareholders’ equity (deficit) in thousands: 2010 2011 Common stock, par value $.01 per share; 100,000,000 shares authorized,33,981,509 shares issued and outstanding at December 31, 2010,34,150,389 shares issued and outstanding at December 31, 2011 340 342 Additional paid-in capital 198,304 200,524 Accumulated deficit (118,282 ) (98,733 ) Total shareholders’ equity80,362 102,133Chapter 11 - Reporting and Interpreting Owners’ EquityE11–9.Stockholders’ EquityContributed capital:Preferred stock, 8%, par $50, authorized 59,000 shares,issued and outstanding, 20,000 shares ............................................... $1,000,000 Common stock, par $10, authorized 98,000 shares,issued, 78,000 shares ......................................................................... 780,000 Capital in excess of par, preferred stock ................................................. 600,000 Capital in excess of par, common stock .................................................. 780,000 Treasury stock ..................................................................................... (80,000) Retained earnings* ......................................................................................... 160,000 Total stockholders’ equity........................................................................ $3,240,000 *($210,000 – $50,000 = $160,000.)E11–10.Req. 1a. Cash (20,000 shares x $20) (+A) .......................................... 400,000Common stock, no-par (+SE) ............................................ 400,000 .b. Cash (6,000 shares x $40) (+A) ............................................ 240,000Common stock, no-par (+SE) ........................................... 240,000 c. Cash (7,000 shares x $30) (+A) ............................................ 210,000Preferred stock (7,000 shares x $10) (+SE) ...................... 70,000 Capital in excess of par, preferred (+SE) .......................... 140,000 Req. 2Yes, it is ethical as long as there is a fu ll disclosure of relevant information. In any arm’s length transaction, an informed buyer will pay the market value of the stock.Chapter 11 - Reporting and Interpreting Owners’ EquityE11–11.Req. 1Number of preferred shares issued: $100,000 $10 = 10,000Req. 2Number of preferred shares outstanding: 10,000 shares issued minus 500 shares held as treasury stock = 9,500.Req. 3Average sales price per share of preferred stock when issued: ($100,000 + $15,000) ÷10,000 shares = $11.50.Req. 4Decreased corporate resources by $9,500 - $1,500 = $8,000.Req. 5Treasury stock transactions decreased stockholders’ equity by $8,000 (same as the decrease in corporate resources in 4 above).Req. 6Treasury stock cost per share: $9,500 ÷ 500 shares = $19.00.Req. 7Total stockholders’ equity: $741,000.Req. 8Issue price of common stock $600,000 ÷ 8,000 shares = $75.00.Chapter 11 - Reporting and Interpreting Owners’ EquityE11–12.Req. 1The number of shares that have been issuedis computed by dividing the common stock account ($4,008 million) by the par value of the shares ($1 per share) or approximately 4,008,000,000 shares.Req. 2Retained earnings end of 2011 ............ $70,682,000,000Net income for 2012 ............................ 10,756,000,000Dividends for 2012 ............................... (5,811,600,000 )Retained earnings end of 2012 ............ $75,626,400,000The amount of retained earnings is an estimate because we do not know the exact number of shares outstanding (because we do not know the number of shares in treasury stock). This number is needed to determine the amount of dividends paid during 2012. We based the dividends on the estimate calculated in the previous requirement.E11–13.The treasury stock account is a contra equity account, meaning that it subtracts from the total stockholders’ equity. Cash also decreases on the balance sheet by the same amount.Req. 2Many companies repurchase common stock in order to develop an employee bonus plan that provides workers with shares of the company’s stock as part of their compensation. Because of SEC regulations concerning newly issued shares, companies find it cheaper to give their employees shares of stock that were purchased from stockholders than to issue new shares. In this case, the company mentions the goal of enhancing shareholder s’ value. If the company maintains its current level of income, earnings per share will increase with fewer shares outstanding. The management expects that the increase in EPS will be reflected in an increase in stock price.Req. 3Shares that are held in treasury stock do not participate in dividend payments. As a result, the purchase of treasury stock will reduce the amount of dividends that the company must pay in future years.Chapter 11 - Reporting and Interpreting Owners’ EquityE11–14.Req. 1Stockholders’ EquityContributed capital:Common stock, authorized 100,000 shares, issued 34,000 shares, ofwhich 2,000 shares are held as treasury stock .................................. $680,000 Capital in excess of par ........................................................................ 163,000 Total contributed capital .................................................................... 843,000 Retained earnings ................................................................................... 89,000 Total .................................................................................................. 932,000 Less: Cost of treasury stock ................................................................. 25,000 Total Stockholders’ Equity$907,000 Req. 2The dividend yield ratio is 2.24% ([$16,000 ÷ 32,000 shares] ÷ $22.29). While this yield seems small, it is a typical return on common stock. Investors receive a return from both dividends and stock price appreciation.Treasury stock does not receive dividends. As a result, dividends should be paid on 32,000 shares.E11–15.Req. 1a. Treasury stock (200 shares x $20) (+XSE, -SE) ................... 4,000Cash (-A) ........................................................................... 4,000 Bought treasury stock.b. Cash (40 shares x $25) (+A) ................................................. 1,000Treasury stock(40 shares x $20) (-XSE, +SE) (800)Capital in excess of par (+SE) (200)Sold treasury stock.c. Cash (30 shares x $15) (+A) (450)Capital in excess of par (-SE) (150)Treasury stock (30 shares x $20) (-XSE, +SE) (600)Sold treasury stock.Req. 2It is not possible to make a ―profit‖ o r ―loss‖ on treasury stock transactions. Therefore, these transactions do not affect the income statement.Chapter 11 - Reporting and Interpreting Owners’ EquityE11–16.Req. 1Feb. 1:Treasury stock, common (160 shares x $20) (+XSE, -SE) 3,200Cash (-A) ........................................................................ 3,200 July 15:Cash (80 shares x $21) (+A) ............................................. 1,680Treasury stock, common (-XSE, +SE) ........................... 1,600 Capital in excess of par (+SE) (80)Sept. 1:Cash (50 shares x $19) (+A) (950)Capital in excess of par (-SE) (50)Treasury stock, common (50 shares x $20) (-XSE, +SE) 1,000.Req. 2Dividends are not paid on treasury stock. Therefore, the amount of total cash dividends paid is reduced when treasury stock is purchased.Req. 3The sale of treasury stock for more or less than its original purchase price does not have an impact on net income. The transaction affects only balance sheet accounts. The cash received from the sale of treasury stock is a cash inflow which would affect the Statement of Cash Flows in the financing activities section.Chapter 11 - Reporting and Interpreting Owners’ EquityE11–17.Req. 1Case 1: When companies unexpectedly announce increases in dividends, stock prices typically increase. Depending on course objective, the instructor may want to discuss research in finance concerning dividend policy.Case 2: Stock price is based on expectations. If the increase in operatingperformance was not expected, the stock price should increase. It is not necessary to increase dividends to have a favorable stock price reaction.Case 3: Stock dividends do not provide any economic value but they may have a signal effect and are often associated with increases in cash dividends. As a result, stock dividends do not appear to directly cause an increase in stock price but are often associated with factors that do impact favorably on price.Req.2Stock prices react to underlying economic events and not changes in reportingmethods, per se. Markets are relatively effective in recognizing the differencebetween profits generated by operations and profits generated by the use of liberal accounting policies.Chapter 11 - Reporting and Interpreting Owners’ Equity E11–18.Req. 1 Preferred(5,000Shares)Common(50,000Shares) Totala) Noncumulative:Preferred ($50,000 x 10%) ...................................... $ 5,000 $ 5,000 Balance to common ($85,000 – $5,000) ................. $80,000 80,000$ 5,000 $80,000 $85,000 b) Cumulative:Preferred, arrears ($50,000 x 10% x 2 years) ......... $ 10,000 $ 10,000 Preferred, current year ($50,000 x 10%) ................. 5,000 5,000 Balance to common ($85,000 – $10,000 – $5,000) $70,000 70,000$15,000 $70,000 $85,000Req. 2The total dividend amount and dividends per share of common stock were less underthe second assumption because the preferred stock preferences increased while at the same time the total dividend amount remained stable.Req. 3Larger total dividend distributionsare more favorable for the common stockholders.E11–19.ItemEffect of Cash Dividend (Preferred) Effect of Stock Dividend (Common)Assets –No effect on declaration date.–Decreased by the amount of thedividend ($7,200) on paymentdate. No effect because no assets are disbursed.Liabilities –Increased on declaration date($7,200).–Decreased on payment date($7,200). No effect—no entry on declaration date because no contractual liability is created (no assets are disbursed).Stockholders’equity Decreased by the amount of thedividend (retained earningsdecreased by $7,200).–Total stockho lders’ equity notchanged.–Retained earnings reduced andcontributed capital increased bysame amount ($120,000).。

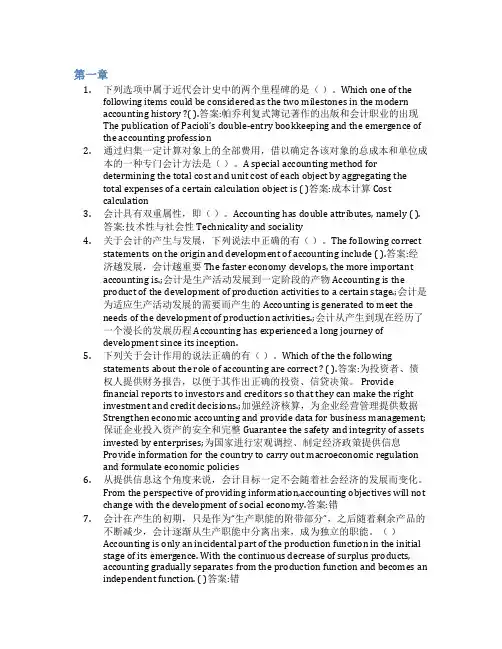

第一章1.下列选项中属于近代会计史中的两个里程碑的是()。

Which one of thefollowing items could be considered as the two milestones in the modernaccounting history ?( ).答案:帕乔利复式簿记著作的出版和会计职业的出现The publication of Pacioli’s double-entry bookkeeping and the emergence of the accounting profession2.通过归集一定计算对象上的全部费用,借以确定各该对象的总成本和单位成本的一种专门会计方法是()。

A special accounting method fordetermining the total cost and unit cost of each object by aggregating thetotal expenses of a certain calculation object is ( )答案:成本计算Costcalculation3.会计具有双重属性,即()。

Accounting has double attributes, namely ( ).答案:技术性与社会性Technicality and sociality4.关于会计的产生与发展,下列说法中正确的有()。

The following correctstatements on the origin and development of accounting include ( ).答案:经济越发展,会计越重要The faster economy develops, the more importantaccounting is.;会计是生产活动发展到一定阶段的产物Accounting is theproduct of the development of production activities to a certain stage.;会计是为适应生产活动发展的需要而产生的Accounting is generated to meet theneeds of the development of production activities.;会计从产生到现在经历了一个漫长的发展历程 Accounting has experienced a long journey ofdevelopment since its inception.5.下列关于会计作用的说法正确的有()。

《会计学原理(英文)》教学大纲王燕祥编写工商管理专业课程教学大纲610 目录Chapter 1 Accounting in Action 第一章会计实践活动 (613)学习目标 (613)Teaching and homework hours 教学与作业时间 (613)Reading and References 学生必读和参考书目 (613)Chapter 2 The Recording Process 第二章记录过程 (615)学习目标 (615)Teaching and homework hours 教学与作业时间 (615)Reading and References 学生必读和参考书目 (615)Chapter 3 Adjusting the Accounts 第三章调整账户 (617)学习目标 (617)Teaching and homework hours 教学与作业时间 (617)Reading and References 学生必读和参考书目 (617)Chapter 4 Completion of the Accounting Cycle 第四章完成会计循环 (619)学习目标 (619)Teaching and homework hours 教学与作业时间 (619)Reading and References 学生必读和参考书目 (619)Chapter 5 Accounting for Merchandising Operations 第五章商品经营活动的会计核算 (621)学习目标 (621)Teaching and homework hours 教学与作业时间 (621)Reading and References 学生必读和参考书目 (621)Chapter 6 Inventories 第六章存货 (623)学习目标 (623)Teaching and homework hours 教学与作业时间 (624)Reading and References 学生必读和参考书目 (624)Chapter 7 Accounting Information Systems 第七章会计信息系统 (626)学习目标 (626)Teaching and homework hours 教学与作业时间 (626)Reading and References 学生必读和参考书目 (626)Chapter 8 Internal Control and Cash 第八章内部控制和现金 (628)学习目标 (628)Teaching and homework hours 教学与作业时间 (628)Reading and References 学生必读和参考书目 (628)Chapter 9 Accounting for Receivables 第九章应收款项的会计核算 (630)学习目标 (630)Teaching and homework hours 教学与作业时间 (630)Reading and References 学生必读和参考书目 (630)Chapter 10 Plant Assets, Natural Resources, and Intangible Assets 第十章厂场资产、自然资源和无形资产 (632)会计学原理(英文)学习目标 (632)Teaching and homework hours 教学与作业时间 (632)Reading and References 学生必读和参考书目 (633)Chapter 11 Current Liabilities and Payroll Accounting 第十一章流动负债和工资的核算 (634)学习目标 (634)Teaching and homework hours 教学与作业时间 (634)Reading and References 学生必读和参考书目 (634)Chapter 12 Accounting Principles 第十二章会计原则 (636)学习目标 (636)Teaching and homework hours 教学与作业时间 (636)Reading and References 学生必读和参考书目 (636)Chapter 13 Accounting for Partnerships 第十三章合伙企业的会计核算 (638)学习目标 (638)Teaching and homework hours 教学与作业时间 (638)Reading and References 学生必读和参考书目 (638)Chapter 14 Corporations: Organization and Capital Stock Transactions 第十四章公司:组织和股本交易 (640)学习目标 (640)Teaching and homework hours 教学与作业时间 (640)Reading and References 学生必读和参考书目 (640)Chapter 15 Corporations: Dividends, Retained Earnings, and Income Reporting 第十五章股利、保留盈余和收益报告 (642)学习目标 (642)Teaching and homework hours 教学与作业时间 (642)Reading and References 学生必读和参考书目 (642)Chapter 16 Long-Term Liabilities 第十六章长期负债 (644)学习目标 (644)Teaching and homework hours 教学与作业时间 (644)Reading and References 学生必读和参考书目 (644)Chapter 17 Investments 第十七章投资 (646)学习目标 (646)Teaching and homework hours 教学与作业时间 (646)Reading and References 学生必读和参考书目 (646)Chapter 18 The Statement of Cash Flows 第十八章现金流量表 (648)学习目标 (648)Teaching and homework hours 教学与作业时间 (648)Reading and References 学生必读和参考书目 (648)Chapter 19 Financial Statement Analysis 第十九章财务报表分析 (650)学习目标 (650)Teaching and homework hours 教学与作业时间 (650)Reading and References 学生必读和参考书目 (650)Chapter 20 Managerial Accounting 第二十章管理会计 (652)611工商管理专业课程教学大纲612 学习目标 (652)Teaching and homework hours 教学与作业时间 (652)Reading and References 学生必读和参考书目 (652)Chapter 21 Job Order Cost Accounting 第二十一章分批成本法 (654)学习目标 (654)Teaching and homework hours 教学与作业时间 (654)Reading and References 学生必读和参考书目 (654)Chapter 22 Process Cost Accounting 第二十二章分步成本法 (656)学习目标 (656)Teaching and homework hours 教学与作业时间 (656)Reading and References 学生必读和参考书目 (657)Chapter 23 Cost-V olume-Profit Relationships 第二十三章本量利分析 (658)学习目标 (658)Teaching and homework hours 教学与作业时间 (658)Reading and References 学生必读和参考书目 (659)Chapter 24 Budgetary Planning 第二十四章编制预算 (660)学习目标 (660)Teaching and homework hours 教学与作业时间 (660)Reading and References 学生必读和参考书目 (660)Chapter 25 Budgetary Control and Responsibility Accounting 第二十五章预算控制和责任会计 662 学习目标 (662)Teaching and homework hours 教学与作业时间 (662)Reading and References 学生必读和参考书目 (662)Chapter 26 Performance Evaluation through Standard Costs 第二十六章利用标准成本进行业绩评价 (664)学习目标 (664)Teaching and homework hours 教学与作业时间 (664)Reading and References 学生必读和参考书目 (664)Chapter 27 Incremental Analysis and Capital Budgeting 第二十七章增量分析和资本预算 (666)学习目标 (666)Teaching and homework hours 教学与作业时间 (667)Reading and References 学生必读和参考书目 (667)会计学原理(英文)Chapter 1 Accounting in Action第一章会计实践活动STUDY OBJECTIVESAfter studying this chapter you should be able to:1.Explain what accounting is.2.IDENTIFY THE USERS AND USES OF ACCOUNTING.3.UNDERSTAND WHY ETHICS IS A FUNDAMENTAL BUSINESS CONCEPT.4.EXPLAIN THE MEANING OF GENERALLY ACCEPTED ACCOUNTING PRINCIPLESAND THE COST PRINCIPLE.5.EXPLAIN THE MEANING OF THE MONETARY UNIT ASSUMPTION AND THE ECONOMIC ENTITY ASSUMPTION.6.STATE THE BASIC ACCOUNTING EQUATION AND EXPLAIN THE MEANING OF ASSETS, LIABILITIES, AND OWNER’S EQUITY.7.ANALYZE THE EFFECT OF BUSINESS TRANSACTIONS ON THE BASIC ACCOUNTING EQUATION.8.Understand what the four financial statements are and how they are prepared.学习目标学完本章之后,学生应该能够达到以下目标:1.解释什么是会计。