怀尔德《会计学原理》19版答案 (6)

- 格式:pdf

- 大小:613.04 KB

- 文档页数:20

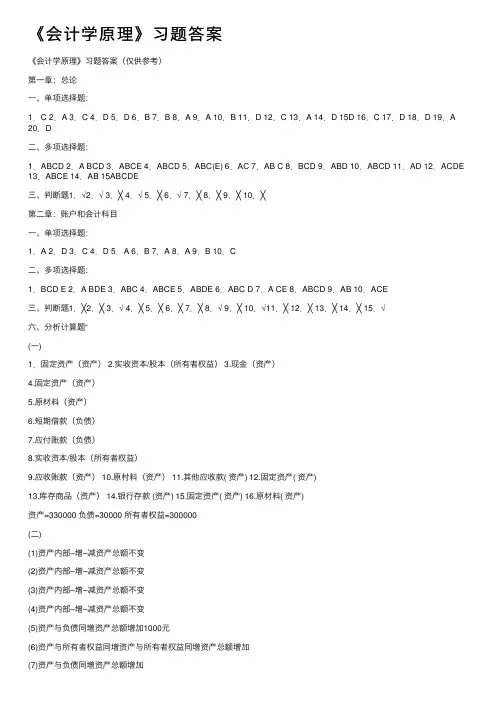

《会计学原理》习题答案《会计学原理》习题答案(仅供参考)第⼀章:总论⼀、单项选择题:1.C 2.A 3.C 4.D 5.D 6.B 7.B 8.A 9.A 10.B 11.D 12.C 13.A 14.D 15D 16.C 17.D 18.D 19.A 20.D⼆、多项选择题:1.ABCD 2.A BCD 3.ABCE 4.ABCD 5.ABC(E) 6.AC 7.AB C 8.BCD 9.ABD 10.ABCD 11.AD 12.ACDE 13.ABCE 14.AB 15ABCDE三、判断题1.√2.√ 3.╳ 4.√ 5.╳ 6.√ 7.╳ 8.╳ 9.╳ 10.╳第⼆章:账户和会计科⽬⼀、单项选择题:1.A 2.D 3.C 4.D 5.A 6.B 7.A 8.A 9.B 10.C⼆、多项选择题:1.BCD E 2.A BDE 3.ABC 4.ABCE 5.ABDE 6.ABC D 7.A CE 8.ABCD 9.AB 10.ACE三、判断题1.╳2.╳ 3.√ 4.╳ 5.╳ 6.╳ 7.╳ 8.√ 9.╳ 10.√11.╳ 12.╳ 13.╳ 14.╳ 15.√六、分析计算题“(⼀)1.固定资产(资产) 2.实收资本/股本(所有者权益) 3.现⾦(资产)4.固定资产(资产)5.原材料(资产)6.短期借款(负债)7.应付账款(负债)8.实收资本/股本(所有者权益)9.应收账款(资产) 10.原村料(资产) 11.其他应收款( 资产) 12.固定资产( 资产)13.库存商品(资产) 14.银⾏存款 (资产) 15.固定资产( 资产) 16.原材料( 资产)资产=330000 负债=30000 所有者权益=300000(⼆)(1)资产内部–增–减资产总额不变(2)资产内部–增–减资产总额不变(3)资产内部–增–减资产总额不变(4)资产内部–增–减资产总额不变(5)资产与负债同增资产总额增加1000元(6)资产与所有者权益同增资产与所有者权益同增资产总额增加(7)资产与负债同增资产总额增加(8)资产与负债同增资产总额增加(9)资产与负债同减资产总额减少业务发⽣后资产总额=14101,000(8000,000+1000+6000,000+100,000+200,000-200,000)(三)利润分别为(1)100,000元 (2)60,000 (3)130,000 (4)80,000第三章复式记账⼀、单项选择题:1.B 2.C 3.C 4.D 5.B 6.D 7.D 8.D 9.C 10.A 11.C⼆、多项选择题:1.ABCDE 2.A CD 3.BCE 4.ABC 5.BCE 6.ABC D 7.A CD 8.ABD 9.ABDE 10.BCD 11.ACD 12.AD 13.ABCD三、判断题1.╳2.√ 3.╳ 4.╳ 5.╳ 6.√ 7.╳ 8.√ 9.√ 10.╳11.√六(⼀)熟悉各类账户的结构:材料 34600 应收账款 1100 银⾏存款10,000 现⾦5255 固定资产176800预收账款 10,000 待摊费⽤1020 预收账款5000 预提费⽤4000 应付账款6995 短期借款 20,000(⼆)试算平衡表:现⾦ 3000 银⾏存款 80100,96600 原材料 39600 库存商品 10500应付账款 7600 短期借款 1000 16100 实收资本 30800 盈余公积100固定资产133600期初余额=245900 本期发⽣额=173200 期末余额=201000七、业务题:1、借:银⾏存款 150,0002、借:银⾏存款 30,000贷:实收资本(股本) 150,000 贷:应收账款30,0003、借:固定资产 50,0004、借:物资采购 8600贷:银⾏存款 50,000 应交税⾦- 应交增值税(进项)1462贷:银⾏存款 5000应付账款 50625、借:银⾏存款20006、借:其他应收款 2100贷:其他应付款 2000 贷:现⾦21007、借:银⾏存款 10,000 8、借:应付账款 10,000贷:短期借款 10,000 贷:银⾏存款 10,0009、借:固定资产 30,000 10、借:现⾦ 3000贷:待转资产价值 30,000 贷:银⾏存款 3000试算平衡表第四章:账户和复式记账的应⽤(答案)习题⼀:1、借:原材料 15,000元应交税⾦——应交增值税(进项税额) 2,550元银⾏存款 7,450元贷:实收资本 25,000元2、借:⽆形资产 20,000元贷:实收资本 20,000元3、借:固定资产 50,000元贷:实收资本 50,000元4、借:固定资产 5,000元贷:资本公积 5,000元5、借:银⾏存款 50,000元贷:短期借款 50,000元6、借:银⾏存款 100,000元贷:长期借款 100,000元习题⼆:1、借:固定资产 47,000元贷:应付账款 47,000元2、借:在建⼯程 35,700元贷:银⾏存款 35,700元3、(1)借:在建⼯程 317,元贷:应交税款—应交增值税(进项税额转出 17元原材料 100元现⾦ 200元(2)借:固定资产 36,017元贷:在建⼯程 36,017元4、(1)借:物资采购—甲20,200元应交税⾦—应交增值税(进项税额)3,400元贷:应付账款23,400元现⾦200元(2)借:原材料—甲20,200元贷:物资采购—甲20200元5、借:物资采购⼄10,30元应交税⾦—已交增值税(进项税制)1700元贷:银⾏存款12,000元6、借:原材料—⼄10,30元贷:物资采购—⼄10300元7、借:应付账款23,400元贷:银⾏存款23,400元8、借:预付账款15,000元贷:银⾏存款15,000元9、借:物资采购—丙20,000元应交税⾦—应交增值税(进项税额)3400元贷:预付账款15,000元银⾏存款84,00元10、借:原材料—丙20,000元贷:物资采购—丙20,000元习题三、1、借:物资采购—甲6,000元—⼄ 5,000元应交税⾦—应交增值税(进项税额)1,870元贷:银⾏存款12,870元2、借:物资采购—甲396元—⼄ 264元贷:现⾦ 600元660分配率=6+4=66甲材料应负担运费=6╳66=396元⼄材料应负担运费=5╳66=264元3、借:原材料—甲6,396元—⼄5,264元贷:物资采购—甲6,394元—⼄5,264元习题四:1、借:⽣产成本—A 25,000元—B 15,000元制造费⽤8,000元管理费⽤2,000元贷:原材料50,000元2、贷:⽣产成本—A 20,000元—B 10,000元制造费⽤3,000元管理费⽤7,000元贷:应付⼯资40,000元3、借:⽣产成本—A 2,800元—B 1400元制造费⽤420元管理费⽤980元贷:应付福利费5,600元4、借:制造费⽤ 200元管理费⽤ 800元贷:银⾏存款1,000元5、借:待摊费⽤——车间 3,600元——⼚部 1,200元贷:银⾏存款 4,800元6、借:制造费⽤ 200元管理费⽤ 100元贷:待摊费⽤——车间 200元——⼚部 100元7、借:财务费⽤ 500元贷:预提费⽤ 500元8、借:制造费⽤ 2,000元管理费⽤ 1,000元贷:累积折旧 3,000元9、借:预提费⽤ 1,200元短期借款 20,000元贷:银⾏存款 21,200元10、借:制造费⽤ 1,180元管理费⽤ 620元贷:应付账款 1,800元习题五:本⽉制造费⽤总额=8000元+3000元+420元+200元+200元+2000元+1180元=15000元制造费⽤分配率=15000/3000=0.5A产品应摊销制造费⽤=20000 × 0.5=10000元B产品应摊销制造费⽤=10000 × 0.5=5000元1、借:⽣产成本——A 10,000元——B 5,000元贷:制造费⽤ 15,000元2、A产品完⼯产品成本=2200+25000+20000+2800+10000=60000元借:库存商品——A 60,000元贷:⽣产成本——A 60,000元3、B产品完⼯产品成本=15000+10000+1400+5000=31400元借:库存商品——B 31,400元贷:⽣产成本——B 31,400元习题六:1、借:应收账款 23,400元贷:主营业务收⼊ 20,000元应交税⾦——应交增值税(销项税额) 3,400元2、借:银⾏存款 46,800元贷:主营业务收⼊ 40,000元应交税⾦——应交增值税(销项税额) 6,800元3、借:银⾏存款 20,000元贷:预收账款 20,000元4、借:预收账款 23,400元贷:主营业务收⼊ 20,000元应交税⾦——应交增值税(销项税额) 2,400元5、加权平均单价=(100×65.5+1000×60)/(100+1000)=60.5元本⽉销售成本=800×60.5=48,400元借:主营业务成本 48,400元贷:库存商品——甲 48,400元6、借:营业费⽤ 1,600元贷:银⾏存款 1,600元7、(1)借:主营业务税⾦及附加 4,000元贷:应交税⾦——应交消费税 4,000元(2)借:应交税⾦——应交消费税 4,000元贷:银⾏存款 4,000元本⽉主营业务利润=20000+40000+20000-48400--4000=27600元习题七:1、借:银⾏存款 2340贷:其他业务收⼊ 2000应交税⾦——应交增值税(销项税额) 3402、借:其他业务⽀出 1800贷:原材料 18003、借:应付账款 5000贷:资本公积 50004、借:待处理财产损溢 5000贷:营业外收⼊ 50005、借:营业外⽀出 4700贷:银⾏存款 4700其他业务利润=2000-1800=200(元)营业外收⽀净额=5000-4700=300(元)习题⼋:1、借:主营业务收⼊ 80000其他业务收⼊ 2000营业外收⼊ 5000贷:本年利润 870002、借:本年利润 73500贷:主营业务成本 48400主营业务税⾦及附加 4000营业费⽤ 1600管理费⽤ 12500财务费⽤ 500其他业务⽀出 1800营业外⽀出 47003、本⽉实现利润总额=87000-73500=13500元本⽉应交所得税=13500×33%=4455元借:所得税 4455贷:应交税⾦——应交所得税 44554、借:本年利润 4455贷:所得税 44555、净利润=13500-4455=9045元提取法定盈余公积=9045×10%=904.5元提取法定公益⾦=9045×5%=452.25元借:利润分配——提取法定公积⾦ 904.5——提取公益⾦ 452.25 贷:盈余公积 1356.75 6、借:利润分配—应付股利 3000贷:应付利润 3000 习题九1、借:银⾏存款 200000贷:短期借款 2000002、借:固定资产 120000贷:实收资本 1200003、借:财务费⽤ 2500贷:预提费⽤ 25004、借:应付账款 45000贷:银⾏存款 450005、借:其他应收款 1000贷:现⾦ 10006、借:短期借款 40000预提费⽤ 1800贷:银⾏存款 418007、借:固定资产 36000贷:银⾏存款 360008、借:预付账款 80000贷:银⾏存款 800009、借:物资采购——⼄材料 100000——丙材料 200000应交税⾦——应交增值税(进项税额) 51000贷:银⾏存款 300000应付账款 5100010、运杂费分配率=6000/(100000+200000)=0.02⼄材料分摊:100000×0.02=2000丙材料分摊:200000×0.02=4000借:物资采购——⼄材料 2000——丙材料 4000贷:银⾏存款 600011、借:原材料——⼄材料 102000——丙材料 204000贷:物资采购——⼄材料 102000——丙材料 20400012、借:物资采购——甲材料 102000应交税⾦——应交增值税(进项税额) 17000贷:预付账款 80000银⾏存款 3900013、借:现⾦ 30000贷:银⾏存款 30000借:应付⼯资 30000贷:现⾦ 3000014、借:⽣产成本——A产品 150000——B产品 60000制造费⽤ 20000管理费⽤ 10000贷:原材料——甲材料 150000——⼄材料 30000——丙材料 6000015、借:⽣产成本——A产品 15000——B产品 10000 制造费⽤ 3000管理费⽤ 2000 16、借:制造费⽤ 30000贷:应付⼯资 30000管理费⽤ 20000贷:累计折旧 5000017、借:待摊费⽤ 18000贷:银⾏存款 18000借:制造费⽤ 800管理费⽤ 400贷:待摊费⽤ 120018、借:制造费⽤ 2700贷:预提费⽤ 270019、借:管理费⽤ 1500贷:其他应收款 1000现⾦ 50020、借:制造费⽤ 1000管理费⽤ 2000贷:现⾦ 300021、借:营业费⽤ 10000贷:银⾏存款 1000022、借:银⾏存款 500000贷:预收账款 50000023、制造费⽤合计=20000+3000+30000+800+2700+1000=57500制造费⽤分配率=57500/(15000+10000)=2.3A产品分配:15000×2.3=34500B产品分配:10000×2.3=23000借:⽣产成本——A产品 34500——B产品 23000贷:制造费⽤ 5750024、A产品完⼯产品成本=10000+150000+15000+34500-20000=189500(元)B产品完⼯产品成本=60000+10000+23000-4000=89000(元)借:库存商品——A 189500——B 89000贷:⽣产成本——A 189500——B 89000(注意:⽉末在产品成本为4000元,练习册为40000元印刷有误)25、借:预收账款 702000贷:主营业务收⼊ 600000应交税⾦——应交增值税(销项税额) 10200026、借:应收票据 351000贷:主营业务收⼊ 300000应交税⾦——应交增值税(销项税额) 5100027、A产品销售成本=1500×94.75=142125(元)B产品销售成本=300×178=53400(元)借:营业务成本 195525贷:库存商品——A 142125——B 5340028、借:主营业务税⾦及附加 20000贷:应交税⾦——应交消费税 2000029(1)借;固定资产 8000贷:待处理财产损益 8000(2)借:待处理财产损益 8000贷:营业外收⼊ 800030、借:营业外⽀出 3000贷:银⾏存款 300031、借:银⾏存款 46800贷:其他业务收⼊ 40000应交税⾦——应交增值税(销项税额) 6800 借:其他业务⽀出 31000贷:原材料 3100032、借:主营业务收⼊ 900000其他业务收⼊ 40000营业外收⼊ 8000贷:本年利润 948000借:本年利润 297925贷:主营业务成本 195525主营业务税⾦及附加 20000营业费⽤ 10000管理费⽤ 35900财务费⽤ 2500其他业务⽀出 31000营业外⽀出 300033、应交所得税=(948000-297925)×33%=214524.75借:所得税 214524.75贷:应交税⾦——应交所得税 214524.75借:本年利润 214524.75贷:所得税 214524.7534、净利润=650075-214524.75=435550.25借:利润分配——提取法定公积⾦ 43555.30——提取公益⾦ 21777.51贷:盈余公积 65332.8135、借:利润分配——应付股利 217775.13贷:应付利润 217775.1336、借:本年利润 435550.25贷:利润分配——未分配利润 435550.2537、借:利润分配——未分配利润 283107.67贷:利润分配——提取法定公积⾦ 43555.03——提取公益⾦ 21777.51——应付股利 217775.13第五章:⼀、单选1、B2、A6、A7、C8、A9、A 10、C⼆、多选1、AE2、ABCD3、BC4、AD5、AB6、ACD7、BC8、BC9、AD 10、AD三、判断1、√2、×3、×4、×5、×6、×7、√8、√9、× 10、√11、√ 12、√ 13、× 14、√ 15、×第六章会计凭证习题答案⼀、单项选择题1、B2、C3、A4、D5、B9、C 10、C11、A 12、D 13、D 14、C 15、A 16、A 17、B 18、C⼆、多项选择题1、ACD2、BCD3、AB4、CD5、AC6、ABC7、ABCD8、BD9、BC10、CD 11、ACD 12、AC三、判断题1、F2、F3、F4、T5、T6、F7、T8、T9、T 10、T 11、T 12、T 13、F 14、F 15、T 第七章:⼀、单选1、A2、B3、D4、B5、B6、C7、D⼆、多选1、BCD2、BCD3、BC4、AD5、ABD6、ACD7、ACD8、ABC9、ABCD 10、ABCD三、判断1、×2、×3、×4、×5、×6、√7、√8、√9、× 10、×六、分析计算题银⾏存款⽇记账(三栏式)七、错账更正1、补充登记法(科⽬和⽅向⽆误),补做蓝字凭证。

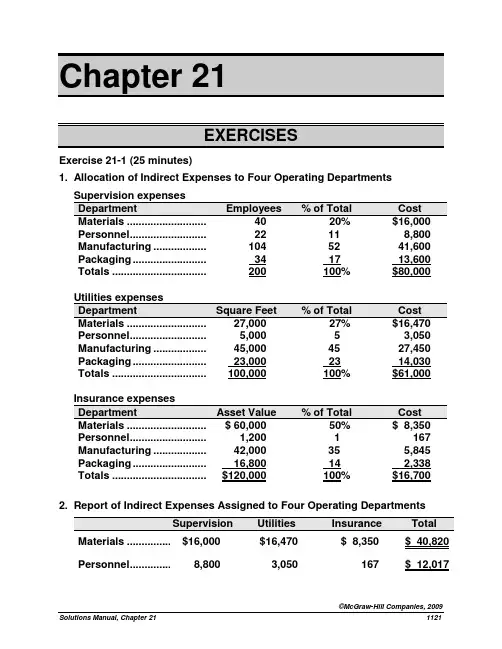

Chapter 21Exercise 21-1 (25 minutes)1. Allocation of Indirect Expenses to Four Operating DepartmentsPersonnel ..............................22 11 8,800 Manufacturing ......................104 52 41,600 Packaging ............................. 34 17 13,600 Totals ....................................200 100% $80,000Personnel ..............................5,000 5 3,050 Manufacturing ......................45,000 45 27,450 Packaging ............................. 23,000 23 14,030 Totals ....................................100,000 100% $61,000Personnel ..............................1,200 1 167 Manufacturing ......................42,000 35 5,845 Packaging ............................. 16,800 14 2,338 Totals ....................................$120,000 100% $16,700 2. Report of Indirect Expenses Assigned to Four Operating DepartmentsMaterials ...................$16,000 $16,470 $ 8,350 $ 40,820 Personnel ..................8,800 3,050 167 $ 12,017Manufacturing ..........41,600 27,450 5,845 $ 74,895 Packaging ................. 13,600 14,030 2,338 $ 29,968 Totals ........................$80,000 $61,000 $16,700 $157,700Exercise 21-2 (30 minutes)........................Depreciation ......................56,600 2,000 MH $28.30 per machine hour Line preparation ...............46,000250 setups $184.00 per setup1. Assignment of overhead costs to the two products using ABCMachinery depreciation ......... 500 hours $ 28.30 14,150 Line preparation ..................... 40 setups $184.00 7,360 Total overhead assigned ....... $23,340Machinery depreciation ......... 1,500 hours $ 28.3042,450 Line preparation ..................... 210 setups $184.00 38,640 Total overhead assigned ....... $84,660Direct labor .................................. 12,200 23,800 Overhead (using ABC) ................ 23,340 84,660 Total cost ..................................... $54,540 $151,660 Quantity produced ...................... 10,500 ft. 14,100 ft. Average cost per foot (ABC) ....... $5.19 $10.763. The average cost of rounded edge shelves declines and the average cost of squared edge shelves increases. Under the current allocation method, the rounded edge shelving was allocated 34% of all of the overhead cost ($12,200 direct labor/$36,000 total direct labor). However, it does not use 34% of all of the overhead resources. Specifically, it uses only 25% of machine hours (500 MH/2,000 MH), and 16% of the setups (40/250). Activity based costing allocated the individual overhead components in proportion to the resources used.Exercise 21-7 (15 minutes)(1) Items included in performance reportThe following items definitely should be included in the performance report for the auto service department manager because they are controlled or strongly influ enced by the manager’s decisions and activities:•Sales of parts•Sales of services•Cost of parts sold•Supplies•Wages (hourly)(2) Items excluded from performance reportThe following items definitely should be excluded from the performance report because the department manager cannot control or strongly influence them:•Building depreciation•Income taxes allocated to the department•Interest on long-term debt•Manager’s salary(3) Items that may or may not be included in performance reportThe following items cannot be definitely included or definitely excluded from the performance report because they may or may not be completely under the manager’s control or strong influence:•Payroll taxes Some portion of this expense relates to themanager’s salary and i s not controllable by themanager. The portion that relates to hourly wagesshould be treated as a controllable expense.•Utilities Whether this expense is controllable depends on thedesign of the auto dealership. If the auto servicedepartment is in a separate building or has separateutility meters, these expenses are subject to themanager’s control. Otherwise, the expense probablyis not controllable by the manager of the auto servicedepartment.Exercise 21-9 (20 minutes)(1)Electronics ...................$750,000 $3,750,000 20% Sporting Goods ...........800,000 5,000,000 16% Comment: Its Electronics division is the superior investment center on the basis of the investment center return on assets.Exercise 21-9 (continued)(2)Net income ...................$750,000 $800,000 Target net income$3,750,000 x 12% ...... 5,000,000 x 12% .......(450,000)(600,000)Residual income……. $300,000 $200,000Comment: Its Electronics division is the superior investment center on the basis of investment center residual income.(3) The Electronics division should accept the new opportunity, since it will generate residual income of 3% (15% - 12%) of the i nvestment’s invested assets.Exercise 21-10 (15 minutes)Electronics ...................$750,000 $10,000,000 7.50% Sporting Goods ...........800,000 8,000,000 10.0%Electronics ...................$10,000,000 $3,750,000 2.67 Sporting Goods ...........8,000,000 5,000,000 1.6 Comments: Its Sporting goods division generates the most net income per dollar of sales, as shown by its higher profit margin. The Electronics division however is more efficient at generating sales from invested assets, based on its higher investment turnover.Problem 21-1A (60 minutes)Part 1Average occupancy cost = $111,800 / 10,000 sq. ft. = $11.18 per sq. ft. Occupancy costs are assigned to the two departments as followsLanya’s Dept................. 1,000 $11.18 $11,180 Jimez’s Dept................. 1,700 $11.18 $19,006**A total of $30,186 ($11,180 + $19,006) in occupancy costs is charged to these departments. The company would follow a similar approach in allocating the remaining occupancy costs ($81,614, computed as $111,800 - $30,186) to its other departments (not shown in this problem).Part 2Market rates are used to allocate occupancy costs for depreciation, interest, and taxes. Heating, lighting, and maintenance costs are allocated to the departments on both floors at the average rate per square foot. These costs are separately assigned to each class as follows:Depreciation—Building .................$ 31,500 $31,500 Interest—Building mortgage .........47,000 47,000Taxes—Building and land .............14,000 14,000Gas (heating) expense ...................4,425 $ 4,425 Lighting expense ...........................5,250 5,250 Maintenance expense .................... 9,625 ______ 9,625 Total ................................................$111,800 $92,500 $19,300Value-based costs are allocated to departments in two stepsSecond floor ...................5,000 10 50,000Total market value .........$250,000Second floor ................... 50,000 20 18,500 3.70Totals ..............................$250,000 100% $92,500Usage-based costs allocation rate = $19,300 / 10,000 sq. ft.= $1.93 per sq. ft.We can then compute total allocation rates for the floors$16.73 Second floor ........................... 3.70 1.93 $ 5.63 These rates are applied to allocate occupancy costs to departmentsLanya’s Department......................... 1,000 $16.73 $16,730 Jimez’s Department......................... 1,700 5.63 $ 9,571Part 3A second-floor manager would prefer allocation based on market value. This is a reasonable and logical approach to allocation of occupancy costs. The current method assumes all square footage has equal value. This is not logical for this type of occupancy. It also means the second-floor space would be allocated a larger portion of costs under the current method, but less using an allocation based on market value.Part 1Professional salaries ..................$1,600,000 10,000 hours $160 per hour Patient services & supplies .......$ 27,000 600 patients $45 per patient Building cost ...............................$ 150,000 1,500 sq. ft. $100 per sq. ft. Total costs ...................................$1,777,000Part 2Allocation of cost to the surgical departments using ABCProfessional salaries ............. 2,500 hours $160 per hr. $400,000 Patient services & supplies ...... 400 patients $45 per patient 18,000 Building cost .......................... 600 sq. ft. $100 per sq. ft. 60,000 Total ...............................................................................................$478,000 Average cost per patient ...............................................................$ 1,195Professional salaries ............. 7,500 hours $160 per hr. $1,200,000 Patient services & supplies ...... 200 patients $45 per patient 9,000 Building cost .......................... 900 sq. ft. $100 per sq. ft 90,000 Total ................................................................................................$1,299,000 Average cost per patient ...............................................................$ 6,495[Note that the sum of the amounts allocated to General Surgery and Orthopedic Surgery ($478,000 + $1,299,000) equals the total amount of indirect costs ($1,777,000).] Part 3If all center costs were allocated on the number of patients, the average cost of general surgery would increase. Since general surgery sees 2/3 of all patients (400/600), it would get allocated 2/3 of all center costs. Orthopedic surgery is currently consuming more professional salaries and building space than general surgery, but has fewer patients.Problem 21-3A (70 minutes)Cost of goods sold ........................ 89,964 63,612 27,500 181,076 (2) Gross profit .................................... 93,636 38,988 22,500 155,124 Direct expensesSales salaries ............................... 21,000 7,100 8,500 36,600Advertising ................................... 2,100 700 1,100 3,900Store supplies used .................... 594 378 400 1,372 (3) Depreciation of equipment ......... 2,300 900 1,000 4,200Total direct expenses .................. 25,994 9,078 11,000 46,072 Allocated expensesRent expense ............................... 5,632 2,835 2,353 10,820 (4) Utilities expense .......................... 2,292 1,153 955 4,400 (4) Share of office dept. expenses ... 15,288 8,540 4,172 28,000 (5) Total allocated expenses ............ 23,212 12,528 7,480 43,220 Total expenses ............................... 49,206 21,606 18,480 89,292Net income ..................................... $ 44,430 $17,382 $ 4,020 $ 65,832 Supporting Computations—coded (1) through (5) in statement aboveGrowth rate (8% increase) ............... x 108% x 108%2010 sales ......................................... $183,600 $102,600 $ 50,000Growth rate (8% increase) ............... x 108% x 108% x 55%* 2010 cost of goods sold .................. $ 89,964 $ 63,612 $ 27,500 A LTERNATIVELY2009 cost of goods sold .................. $ 83,300 $ 58,9002009 sales ......................................... $170,000 $ 95,0002009 cost as % of sales ................... 49% 62%2010 sales ........................................ $183,600 $102,600 $ 50,000 2010 cost as % of sales .................. x 49% x 62% x 55%* 2010 cost of goods sold .................. $ 89,964 $ 63,612 $ 27,500 * T he 55% cost of goods sold percent is computed as 100% minus the predicted 45% gross profit margin.Growth rate (8% increase) ................x 108% x 108%2010 store supplies ..........................$ 594 $ 378 $ 400One-fifth from clock to paintings (1,408) $ 1,408 One-fourth from mirror topaintings ______ (945) 945 2010 allocation of $10,820 rent .........$ 5,632 $ 2,835 $ 2,353 Percent of total * ...............................2010 allocation of $4,400total utilities ....................................$ 2,292 $ 1,153 $ 955Percent of total sales * ......................54.6% 30.5% 14.9% 2010 allocation of $28,000total office departmentexpenses ($20,000 in 2009plus $8,000 increase) ......................$ 15,288 $ 8,540 $ 4,172 * Instructor note: If students round to something other than one-tenth of a percent, theirnumbers will slightly vary.Part 1a.Responsibility Accounting Performance ReportManager, Camper DepartmentFor the YearBudgeted Actual Over (Under)Amount Amount Budget Controllable CostsRaw materials .................................$195,900 $194,800 $ (1,100) Employee wages ............................104,200 107,200 3,000 Supplies used .................................34,000 32,900 (1,100) Depreciation—Equipment ............. 63,000 63,000 0 Totals ..............................................$397,100 $397,900 $ 800b.Responsibility Accounting Performance ReportManager, Trailer DepartmentFor the YearBudgeted Actual Over (Under)Amount Amount Budget Controllable CostsRaw materials .................................$276,200 $273,600 $ (2,600) Employee wages ............................205,200 208,000 2,800 Supplies used .................................92,200 91,300 (900) Depreciation—Equipment ............. 127,000 127,000 0 Totals ..............................................$700,600 $699,900 $ (700)c.Responsibility Accounting Performance ReportManager, Ohio PlantFor the YearBudgeted Actual Over (Under)Amount Amount Budget Controllable CostsDept. manager salaries ................. $ 97,000 $ 98,700 $ 1,700 Utilities ........................................... 8,800 9,200 400 Building rent .................................. 15,700 15,500 (200) Other office salaries ..................... 46,500 30,100 (16,400) Other office costs ......................... 22,000 21,000 (1,000) Camper department ...................... 397,100 397,900 800 Trailer department ........................ 700,600 699,900 (700) Total ............................................... $1,287,700 $1,272,300 $(15,400)Part 2The plant manager did a good job of controlling costs and meeting the budget. He came in under budget for the plant even though he paid the department managers more than budgeted and had to absorb the amounts over budget in their departments. This is because he spent less than the budget amount on building rent, other office salaries, and other office costs. The Trailer Department manager also came in under budget. The Camper Department manager came in over budget, and thus performed the worse of the three managers.Problem 21-1B (60 minutes)Part 1Average occupancy cost = $372,000 / 20,000 sq. ft. = $18.60 per sq. ft.Occu pancy costs are assigned to Miller’s department as followsMiller’s Dept.................. 2,000 $18.60 $37,200Part 2Market rates are used to allocate occupancy costs for the building rent. Lighting and cleaning costs are allocated to the departments on all three floors at the average rate per square foot. Costs assigned to each class are:Lighting expense ................... 20,000 $20,000 Cleaning expense .................. 32,000 _______ 32,000 Totals ...................................... $372,000 $320,000 $52,000Value-based costs are allocated in two steps(i) Compute market value of each floorSecond floor ...................7,500 24 180,000Basement floor ...............5,000 12 60,000Total market value .........$600,000Problem 21-1B (Continued)(ii) Allocate the $320,000 to each floor based on its percent of market valueSecond floor ...................180,000 30 96,000 12.80 Basement floor ............... 60,000 10 32,000 6.40$600,000 100% $320,000Usage-based costs allocation rate = $52,000 / 20,000 sq. ft.= $2.60 per sq. ft.Total allocation rates for the departments on all three floors areSecond floor .................12.80 2.60 15.40Basement floor ............. 6.40 2.60 9.00These rates are applied to alloc ate occupancy costs to Miller’s departmentMiller’s Department ................................2,000 $9.00 $18,000Part 3A basement manager would prefer the allocation based on market value. This is a reasonable and logical approach to allocation of occupancy costs. With a flat rate method, all square footage has equal value. This is not logical for this type of occupancy. Less cost would be allocated to the basement departments if the market value method were used.。

会计学原理课后习题答案目录第一章总论. ........................................................................ 错误! 未定义书签。

一、单项选择题. ............................................................. 错误! 未定义书签。

二、多项选择题. ............................................................. 错误! 未定义书签。

三、判断题...................................................................... 错误! 未定义书签。

第二章会计科目、会计账户和复式记账. .................................................. 错误! 未定义书签。

一、单项选择题. ............................................................. 错误! 未定义书签。

二、多项选择题. ............................................................. 错误! 未定义书签。

三、判断题...................................................................... 错误! 未定义书签。

四、业务题...................................................................... 错误! 未定义书签。

第三章工业企业主要生产经营过程核算和成本计算................................................. 错误! 未定义书签。

本文部分内容来自网络整理,本司不为其真实性负责,如有异议或侵权请及时联系,本司将立即删除!== 本文为word格式,下载后可方便编辑和修改! ==会计学原理课后答案篇一:会计学原理课后习题答案《会计学原理》课后题答案第一章总论第二章习题一:根据题设表格所示,库存现金、银行存款、应收账款、原材料属于流动资产,短期借款、应付账款、应交税费属于流动负债,因此:流动资产总额为:201X+27000+35000+5201X=116000;流动负债总额为:10000+3201X+9000=51000.1第二章会计科目和会计账户P61习题一:①=2201X0,计算过程如下:280000+3201X0=30000+(①-50000)+400000→①=280000+3201X0-30000-400000+50000=2201X0;②=80000;③=180000;④=570000.习题二:1、库存现金增加,银行存款减少;应在“库存现金”、“银行存款”账户中记录;“库存现金”、“银行存款”账户属于资产类;2、应付账款减少,银行存款减少;应在“银行存款”、“应付账款”账户中记录;“银行存款”账户属于资产类,“应付账款”账户属于负债类;3、营业外收入增加,固定资产增加;应在“营业外收入”、“ 固定资产”账户中记录;“营业外收入”账户属于损益类,“ 固定资产”账户属于资产类;4、短期借款增加,银行存款增加;应在“短期借款”、“ 银行存款”账户中记录;“短期借款”账户属于负债类,“ 银行存款”账户属于资产类;5、原材料增加,应付账款增加;应在“原材料”、“ 应付账款”账户中记录;原材料账户属于资产类,“ 应付账款”账户属于负债类;6、实收资本增加,银行存款增加;应在“实收资本”、“ 银行存款”账户中记录;“实收资本”账户属于所有者权益类,“ 银行存款”账户属于资产类;7、应付职工薪酬减少,库存现金减少;应在“应付职工薪酬”、“ 库存现金”账户中记录;“应付职工薪酬”账户属于负债类,“ 库存现金”账户属于资产类;8、预收账款增加,银行存款增加;应在“预收账款”、“ 银行存款”账户中记录;“预收账款”账户属于负债类,“ 银行存款”账户属于资产类。

第一章总论 (3)一、单项选择题 (3)二、多选题 (3)三、判断题 (3)四、简答题 (3)1、什么是会计?它有哪些职能和任务? (3)2、会计核算有哪些基本前提? (3)3、会计有哪些要素?它们各有哪些特征? (4)4.会计核算有哪些方法?会计信息的质量要求有哪些? (4)第二章账户和复式记账 (4)一、单项选择题 (4)二、多项选择题 (4)三、判断题 (4)四、简答题 (4)1.什么是会计科目,什么是账户?会计科目和账户有何联系和区别? (4)2.什么是会计恒等式?为什么一个会计主体的资产总额总是恒等于权益总额? (5)3.什么是借贷记账法,其优点是什么? (5)4.试述总分类账和明细分类账的关系。

(5)五、综合题 (5)第三章借贷记账法的应用 (7)一、单项选择题 (7)二、多项选择题 (7)三、判断题 (7)四、综合题 (7)3. (9)4. (11)5. (12)6. (13)7. (14)8. (15)9. (17)11. (21)第四章会计凭证的填制和审核 (24)一、单项选择题 (24)二、多项选择题 (24)三、判断题 (24)四、简答题 (24)1、简述原始凭证的基本要素。

(24)2、简述原始凭证的填制基本要求。

(24)3、简述原始凭证的审核内容。

(25)4、简述记账凭证的基本要素。

(25)5、简述凭证订角法的装订步骤。

(26)第五章会计账簿的设置和登记 (26)一、单项选择题 (26)二、多项选择题 (26)三、判断题 (26)第六章财产清查 (27)一、单项选择题 (27)二、多项选择题 (27)三、判断题 (27)四、简答题 (27)1.什么是财产清查?它有何重要作用? (27)2.引起财产物资账实不符的原因有哪些? (27)3.永续盘存制与实地盘存制的主要区别是什么?各有何优缺点? (28)4.何为未达账项?为什么会发生未达账项?如何编制银行余额调节表? (28)5.财产清查结果的处理步骤怎样?如何进行固定资产盘盈与盘亏的账务处理? (29)第七章账务处理程序 (29)一、单项选择题 (29)二、多项选择题 (30)三、判断题 (31)四、综合题 (32)1、按题号和日期分收、付、转记账凭证编制会计分录(验收入库材料实行逐笔结转)。

【思考与练习1】一、单项选择题1.D 2.A 3.B 4.C二、多项选择题1.CD 2.AD 3.BC 4.ABCD三、简答题1.简述企业的概念和作用。

企业是以盈利为目的,运用各种生产要素(土地、劳动、资本和企业家才能),向社会提供商品或服务,实行自主经营、自负盈亏、独立核算的具有法人资格的经济组织。

企业的作用主要表现在以下几个方面:(1)企业是市场经济活动的主要参加者,市场经济活动的顺利进行离不开企业的生产和销售活动。

(2)企业是社会生产和流通的直接承担者,离开了企业,社会经济活动就会中断或停止。

企业的生产和经营活动关系着整个社会经济的发展。

(3)企业是社会经济技术进步的主要力量。

(4)企业效益的增长与国家的经济实力、人民的生活水平息息相关,单个企业效益的增长可以在一定程度上带动地区经济的发展,而一个国家整体企业效益的增长则意味着国家经济的发展和人们生活水平的提高。

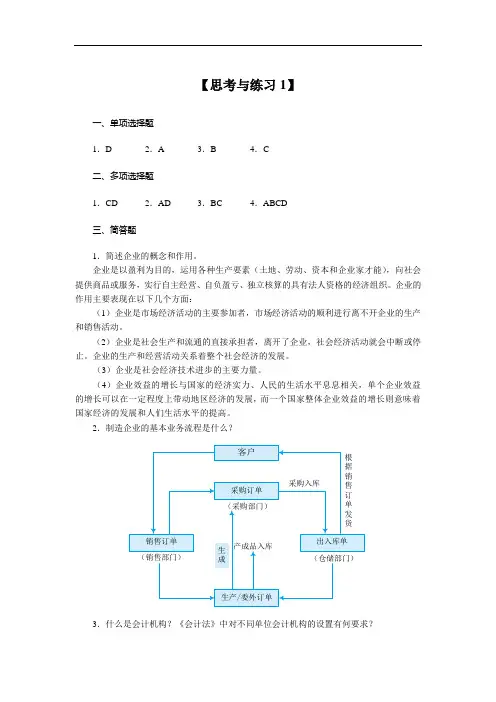

2.制造企业的基本业务流程是什么?3.什么是会计机构?《会计法》中对不同单位会计机构的设置有何要求?会计机构是指企业内部设置的办理会计事务和组织领导会计工作的职能部门。

会计机构和会计人员是会计工作的主要承担者。

《会计法》第三十六条明确规定:“各单位应当根据会计业务的需要,设置会计机构,或者在有关机构中设置会计人员并指定会计主管人员;不具备条件设置的,应当委托经批准设立从事会计代理记账业务的中介机构代理记账。

”需要注意的是,设置会计机构时,应至少设置两个会计岗位,即会计机构负责人(会计主管)岗位和出纳员岗位。

国有大中型企业(即国有资产占控股地位或主导地位的大中型企业)必须设置总会计师;事业单位和业务主管部门根据需要,经批准可以设置总会计师。

在有关机构中设置会计人员的,应当在专职会计人员中指定会计主管人员。

委托会计师事务所或其他机构代理记账的,企业至少应配备一名出纳员。

4.会计职业道德包括哪些内容?(1)爱岗敬业,其基本要求有:①正确认识会计职业,树立职业荣誉感;②热爱会计工作,敬重会计职业;③安心工作,任劳任怨;④严肃认真,一丝不苟;⑤忠于职守,尽职尽责。

会计学原理课后练习参考答案第一章总论【基础能力训练】一、单项选择题1、C2、C3、C4、C5、A6、B7、B8、D9、B 10、C11、D 12、C 13、B 14、B 15、A二、多项选择题1、ABC2、ABCD3、ABCDE4、ABD5、ABCD6、ACD7、ABCDE三、判断题1、√2、√3、×4、√5、×6、√7、√8、×9、×10、√【实践能力训练】一、掌握收付实现制和权责发生制业务号权责发生制收付实现制收入费用收入费用(1)70 000 0 50 000 0(2)0 1 300 0 7 800(3)0 1 000 0 0(4)0 0 7 000 0(5)0 0 10 000 0(6)0 8 000 0 0合计70 000 10 300 67 000 7 800第二章会计要素与与会计科目、会计账户【基础能力训练】一、单项选择题1、D2、D3、AD4、A5、A6、C7、D8、C9、C 10、C11、B 12、A 13、D 14、B 15、B二、多项选择题1、ADE2、ABC3、ACD4、ACD5、ABCD6、ACD7、ABD8、ABCD9、ABCDE 10、BD三、判断题1、×2、√3、√4、×5、×6、×7、√8、√9、√10、×【实践能力训练】一、掌握资产、负债、所有者权益的内容及划分(1)区分其属性是资产、负债还是所有者权益;项目金额(元)资产负债所有者权益1.存在银行的存款2.仓储产成品3.用作仓库的房屋4.仓储半成品5.运输设备6.出纳处的现金7.货运汽车一辆8.办公楼9.应收回的销售货款10.应付采购材料的货款11.国有投资12.外单位投资13.一年已实现利润14.尚未缴纳的税金15.以前年度的未分配利润16.向银行借入的资金48 00064 00065 00025 00020 0001 500280 000320 00040 00032 000300 00040 000101 0004 000168 00020 00048 00064 00065 00025 00020 0001 500280 000320 00040 00032 0004 00020 000300 00040 000101 000168 000合计863500 56 000 609 000(2)汇总各类要素,检验其平衡关系。

会计学原理课后题答案1. 描述并解释会计学原理中的货币计量原则。

货币计量原则是会计学原理中的基本原则之一。

它要求所有会计事项都必须以货币形式进行计量和记录。

这意味着所有的会计交易、资产和负债都必须以货币单位进行衡量,并以货币形式记录在财务报表中。

货币计量原则的目的是为了使不同时间发生的会计事项能够进行比较和分析,以提供决策者有关企业财务状况和业绩的有用信息。

2. 解释会计学原理中的权责发生制原则。

权责发生制原则是会计学原理中的另一个基本原则。

它规定会计交易和事件的确认应基于权利和义务是否发生,而不是实际的现金交换。

根据这一原则,收入应在权利和义务发生时确认,而不是在实际收到或支付现金时确认。

权责发生制原则的目的是确保会计信息能够及时和准确地反映企业的经济活动,以便决策者能够了解企业的真实财务状况和业绩。

3. 描述会计学原理中的会计等式。

会计等式是会计学原理中的基本概念之一。

它表达了企业财务状况的核心原理,即资产等于负债加所有者权益。

具体而言,会计等式可以表示为:资产 = 负债 + 所有者权益其中,资产是企业拥有的资源和对外借款的权益,负债是企业对外界的债务和支付义务,所有者权益代表了投资者对企业剩余资产的所有权。

会计等式的平衡反映了企业的财务状况的基本原则,即企业的资产来源于负债和所有者投入的权益。

只有在会计等式平衡的情况下,企业的财务报表才能提供准确和可靠的信息。

4. 解释会计学原理中的成本原则。

成本原则是会计学原理中的基本原则之一。

它规定企业在财务报表中应按照实际购买成本或制造成本记录和报告资产和负债。

根据成本原则,企业在购买或制造资产时,应将其记录为购买或制造成本,而不是目前的市场价值。

成本原则的目的是提供准确和可靠的信息,以衡量企业的财务状况和业绩。

通过将资产和负债的价值与其实际成本进行比较,决策者可以更好地判断企业的盈利能力和财务风险。

5. 描述会计学原理中的实体概念。

实体概念是会计学原理中的一个重要概念。

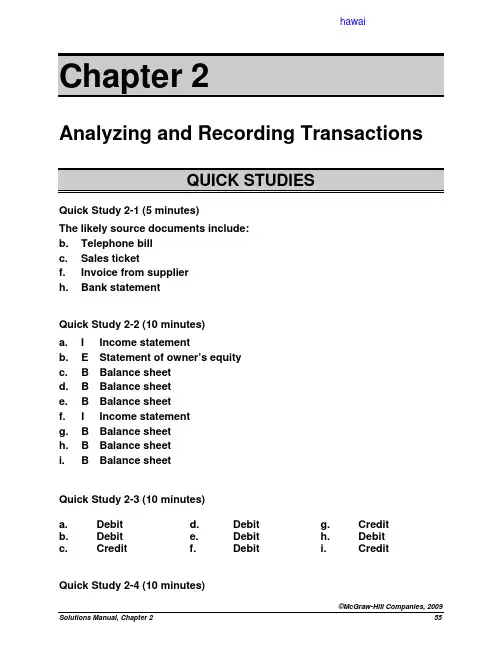

hawai Chapter 2Analyzing and Recording TransactionsQUICK STUDIESQ uick Study 2-1 (5 minutes)The likely source documents include:b. Telephone billc. Sales ticketf. Invoice from supplierh. Bank statementQ uick Study 2-2 (10 minutes)a. I Income statementb. E Statement of owner’s equityc. B Balance sheetd. B Balance sheete. B Balance sheetstatementf. I Incomeg. B Balance sheeth. B Balance sheeti. B BalancesheetQuick Study 2-3 (10 minutes)a. Debit d. Debit g. Creditb. Debit e. Debit h. Debitc. Credit f. Debit i. Credit Quick Study 2-4 (10 minutes)©McGraw-Hill Companies, 2009 Solutions Manual, Chapter 2 55a. Debit e. Debit i. Creditb. Debit f. Credit j. Debitc. Credit g. Credit k. Debitd. Credit h. Debit l. CreditQ uick Study 2-5 (10 minutes)a. Debit e. Debit i. Creditb. Credit f. Credit j. Debitc. Debit g. Creditd. Credit h. CreditQ uick Study 2-6 (15 minutes)Jan.13 Cash.......................................................................... 80,000Equipment...............................................................30,000Capital...............................................110,000 D.Tyler,Owner invests cash and equipment.21Supplies (820)OfficePayable (820)AccountsPurchased office supplies on credit.29Cash..........................................................................8,700Revenue....................8,700 LandscapingServicesReceived cash for landscaping services.30Cash..........................................................................4,000Services Revenue..4,000UnearnedLandscapingReceived cash in advance for landscaping services.Q uick Study 2-7 (10 minutes)The correct answer is c.Explanation: If a $2,250 debit to Rent Expense is incorrectly posted as a credit, the effect is to understate the Rent Expense debit balance by $4,500.This causes the Debit column total on the trial balance to be $4,500 lessthan the Credit column total.Q uick Study 2-8 (10 minutes)a. I e. B i. Bb. I f. I j. I©McG56c. I g. B k. Ed. B h. B l. B©McGraw-Hill Companies, 2009 Solutions Manual, Chapter 2 57EXERCISESE xercise 2-1 (15 minutes) Type of Increase Normal Account Account (Dr. or Cr.) Balancea. Owner Capital.............................equity credit creditb. Accounts Receivable.................asset debit debitc. Owner Withdrawals....................equity debit debitd. Cash............................................asset debit debite. Equipment..................................asset debit debitf. Fees Earned................................revenue credit creditg. Wages Expense..........................expense debit debith. Unearned Revenue....................liability credit crediti. Accounts Payable......................liability credit creditj. Postage Expense.......................expense debit debitk. Prepaid Insurance......................asset debit debitl. Land............................................asset debit debitE xercise 2-2 (15 minutes) a. Beginning cash balance (debit).............................................$ ?Cash received in October (debits)........................................104,750Cash disbursed in October (credits).....................................(101,607)Ending cash balance (debit)..................................................$ 17,069Beginning cash balance (debit).............................................$ 13,926b. Beginning accounts receivable (debit).................................$ 83,250Sales on account in October (debits)................................... ?Collections on account in October (credits)........................(75,924)Ending accounts receivable (debit)......................................$ 85,830Sales on account in October (debits)...................................$ 78,504c. Beginning accounts payable (credit)....................................$148,000Purchases on account in October (credits).........................271,876Payments on accounts in October (debits).......................... ( ?)Ending accounts payable (credit).........................................$137,492Payments on accounts in October (debits)..........................$282,384 ©McG58The company would make the following entry (not required for answer): Cash..................................................................12,000Equipment......................................90,000 ComputerNote Payable..............................................37,000Services Revenue......................................65,000 Accepted cash, equipment and note for services.Thus, of the a through f items listed, the following effects should be included:a. $37,000 increase in a liability account.b. $12,000 increase in the Cash account.e. $65,000 increase in a revenue account.Explanation: This transaction reflects $65,000 in revenue, which is the value of the service provided. Payment is received in the form of a $12,000 increase in cash, an $90,000 increase in computer equipment, and a $37,000 increase in its liabilities. The net value received by the company is $65,000.Exercise 2-4 (25 minutes)Aug.1Cash.................................................................. 14,250Photography Equipment.................................61,275M. Harris, Capital.......................................75,525Owner investment in business.2Prepaid Insurance............................................3,300Cash............................................................3,300Acquired 24 months of insurance coverage.5Office Supplies.................................................2,707Cash............................................................2,707Purchased office supplies.20Cash.................................................................. 3,250Photography Fees Earned........................3,250Collected photography fees.31 Utilities Expense (871)Cash (871)Paid for August utilities.©McGraw-Hill Companies, 2009 Solutions Manual, Chapter 2 59Cash Photography EquipmentAug. 1 14,250 Aug. 23,300Aug. 1 61,27520 3,250 52,70731871M. Harris, CapitalBalance 10,622 Aug. 1 75,525 Office Supplies Photography Fees Earned3,25020 Aug.52,707 Aug.Prepaid Insurance Utilities ExpenseAug.87131Aug.23,300SPECIAL PICSTrial BalanceAugust 31Debit Credit Cash...............................................................................$10,622Office supplies..............................................................2,707Prepaid insurance.........................................................3,300 Photography equipment...............................................61,275M. Harris, Capital...........................................................$75,525 Photography fees earned.............................................3,250 Utilities expense............................................................ 871_______ Totals..............................................................................$78,775 $78,775©McGraw-Hill Companies, 2009Fundamental Accounting Principles, 19th Edition 60Cash Accounts Payable(a) 14,000 (b) 406(e) 7,742 (c) 7,7427,742Balance(e)(d) 1,652510(h) 1,246(g)1,200(i)Balance 7,040 S. Amena, Capital(a) 14,00014,000Balance Accounts Receivable S. Amena, Withdrawals(f) 2,968 (h) 1,246(i) 1,200Balance 1,722 Balance 1,200Office Supplies Fees Earned1,652 (b) 406 (d) Balance 406 (f) 2,968Balance4,620 Office Equipment Rent Expense(c) 7,742 (g) 510Balance 7,742 Balance 510Exercise 2-7 (15 minutes)AMENA COMPANYTrial BalanceMay 31, 2009Debit Credit Cash.........................................................................................$ 7,040Accounts receivable...............................................................1,722Office supplies (406)Office equipment....................................................................7,742Accounts payable...................................................................$ 0S. Amena, Capital...................................................................14,000S. Amena, Withdrawals..........................................................1,200Fees earned.............................................................................4,620 Rent expense.......................................................................... 510______ Totals.......................................................................................$18,620 $18,620©McGraw-Hill Companies, 2009 Solutions Manual, Chapter 2 61Transactions that created expenses:b. Salaries Expense.........................................1,233Cash.......................................................1,233 Paid salary of receptionist.d. Utilities Expense (870)Cash (870)Paid utilities for the office.[Note: Expenses are outflows or using up of assets (or the creation ofliabilities) that occur in the process of providing goods or services tocustomers.]Transactions a, c, and e are not expenses for the following reasons:a. This transaction decreased assets in settlement of a previouslyexisting liability, and equity did not change. Cash payment does notmean the same as using up of assets (expense was recorded when thesupplies were used).c. This transaction involves the purchase of an asset. The form of thecompany’s assets changed, but total assets did not change, and theequity did not decrease.e. This transaction is a distribution of cash to the owner. Even thoughequity decreased, the decrease did not occur in the process ofproviding goods or services to customers.©McG62TECH TALKIncome StatementFor Month Ended October 31RevenuesConsulting fees earned......................... $25,620 ExpensesSalariesexpense................................... $12,405expense......................................... 6,859Rentexpense (560)TelephoneMiscellaneousexpenses (280)expenses...................................... 20,104 TotalNet income.................................................. $ 5,516Exercise 2-10 (15 minutes)TECH TALKStatement of Owner’s EquityFor Month Ended October 31D. Shabazz, Capital, October 1.................. $ 0Add: Investments by owner.................... 124,114income5,516 Net(from Exercise 2-10)......129,630 Less: Withdrawals by owner.................... 2,000D. Shabazz, Capital, October 31................ $127,630Exercise 2-11 (15 minutes)TECH TALKBalance SheetOctober 31Assets Liabilities Cash...............................$ 12,614 Accounts payable................$ 12,070 Accounts receivable.... 25,648Office supplies.............. 4,903 EquityOffice equipment.......... 27,147 D. Shabazz, Capital............. 127,630* Land............................... 69,388Total assets...................$139,700 Total liabilities & equity......$139,700 * Computation shown in Exercise 2-11.©McGraw-Hill Companies, 2009 Solutions Manual, Chapter 2 63a. Assets -Liabilities = EquityBeginning of the year..........$131,000 -$56,159 = $74,841End of the year.....................180,000 -72,900 = 107,100Net increase in equity..........$32,259Net Income............................$ ?Plus owner investments 0Less owner withdrawals 0Change in equity..................$32,259Therefore, income must equal $32,259.b. Netincome.........................................................................$ ?ownerinvestments 0PlusLess owner withdrawals ($650/mo. x 12 mo.)................. (7,800)Change in equity...............................................................$32,259Therefore, net income must equal ($32,259 + $7,800) = $40,059income.........................................................................$ ?c. Netinvestments................................................... 45,000ownerPlusLess owner withdrawals 0Change in equity...............................................................$32,259Therefore, the net loss must equal ($32,259 - $45,000) = $(12,741)income.........................................................................$ ?d. Netinvestments................................................... 25,000PlusownerLess owner withdrawals ($650/mo. x 12 mo.)................. (7,800)Change in equity...............................................................$32,259Therefore, income must equal ($32,259+$7,800-$25,000)= $15,059©McGraw-Hill Companies, 2009Fundamental Accounting Principles, 19th Edition64Exercise 2-13 (15 minutes)(d)(c)(b)(a)Answers $(45,000) $64,665 $71,347 $(47,000)Computations:Equity, Dec. 31, 2008.....$ 0 $ 0 $ 0 $ 0Owner investments.......112,500 64,665 85,347 201,871Owner withdrawals........(45,000) (51,000)(8,000) (53,000)Net income (loss).......... 27,000 78,000 (6,000) (47,000)Equity, Dec. 31, 2009.....$94,500 $91,665 $71,347 $101,871Exercise 2-14 (25 minutes)a. Belle created a new business and invested $12,000 cash, $15,200 ofequipment, and $24,000 in automobiles.b. Paid $4,800 cash in advance for insurance coverage.c. Paid $2,000 cash for office supplies.d. Purchased $300 of office supplies and $9,700 of equipment on credit.e. Received $9,000 cash for delivery services provided.f. Paid $4,600 cash towards accounts payable.g. Paid $820 cash for gas and oil expenses.Exercise 2-15 (30 minutes)a. Cash...........................................................................12,000Equipment.................................................................15,200Automobiles..............................................................24,000Capital.................................................51,200D.Belle,Owner invested in business.b. Prepaid Insurance.....................................................4,800Cash....................................................................4,800 Purchased insurance coverage.©McGraw-Hill Companies, 2009Solutions Manual, Chapter 2 65c. Office Supplies..........................................................2,000Cash....................................................................2,000 Purchased supplies with cash.d. Office Supplies (300)Equipment.................................................................9,700Payable.............................................10,000 AccountsPurchased supplies and equipment on credit.e. Cash...........................................................................9,000Revenue...............................9,000 ServicesDeliveryReceived cash from customer.Payable.....................................................4,600f. AccountsCash....................................................................4,600 Made payment on payables.g. Gas and Oil Expense (820)Cash (820)Paid for gas and oil.©McG66Exercise 2-16 (20 minutes)Description(1)DifferencebetweenDebit andCreditColumns(2)Columnwith theLargerTotal(3)Identifyaccount(s)incorrectlystated(4)Amount that account(s)is overstated orunderstateda. $1,870 debit to RentExpense is posted asa $1,780 debit. $90 credit Rent Expense Rent Expense isunderstated by $90b. $3,560 credit to Cashis posted twice as twocredits to Cash. $3,560 credit Cash Cash is understated by$3,560c. $7,120 debit to theWithdrawals account is debited to Owner’s Capital. $0 ––Owner,CapitalOwner,WithdrawalsOwner, Capital isunderstated by $7,120Owner, Withdrawals isunderstated by $7,120d. $1,630 debit toPrepaid Insurance isposted as a debit to Insurance Expense. $0 ––PrepaidInsuranceInsuranceExpensePrepaid Insurance isunderstated by $1,630Insurance Expense isoverstated by $1,630e. $31,150 debit toMachinery is posted as a debit to Accounts Payable. $0 ––MachineryAccountsPayableMachinery isunderstated by $31,150Accounts Payable isunderstated by $31,150f. $4,460 credit toServices Revenue isposted as a $446credit. $4,014 debit ServicesRevenueServices Revenue isunderstated by $4,014g. $820 debit to StoreSupplies is notposted. $820 credit StoreSuppliesStore Supplies isunderstated by $820©McGraw-Hill Companies, 2009Solutions Manual, Chapter 2 67PROBLEM SET AP roblem 2-1A (90 minutes) Part 1 a. Cash.............................................................101 195,000 Office Equipment........................................163 8,200 Drafting Equipment....................................164 80,000 J. Lancet, Capital................................301 283,200Owner invested cash and equipment.b. Land.............................................................172 52,000 Cash.....................................................101 8,900 Note Payable.......................................250 43,100Purchased land with cash and note payable.c. Building.......................................................170 55,000 Cash.....................................................101 55,000Purchased building.d. Prepaid Insurance......................................108 2,300 Cash.....................................................101 2,300Purchased 18-month insurance policy.e. Cash.............................................................101 6,600 Engineering Fees Earned ..................402 6,600Collected cash for completed work.f. Drafting Equipment....................................164 24,000 Cash.....................................................101 9,600 Note Payable.......................................250 14,400Purchased equipment with cash and notepayable.g. Accounts Receivable.................................106 14,500 Engineering Fees Earned ..................402 14,500Completed services for client.h. Office Equipment........................................163 1,100 Accounts Payable...............................201 1,100Purchased equipment on credit.©McG 68Problem 2-1A (Part 1 Continued)i. Accounts Receivable.................................106 23,000Engineering Fees Earned..................402 23,000 Billed client for completed work.j. Equipment Rental Expense.......................602 1,410Payable...............................201 1,410 AccountsIncurred equipment rental expense.Cash.............................................................101 8,000k.Receivable.........................106 8,000 AccountsCollected cash on account.Expense..........................................601 2,500Wagesl.Cash.....................................................101 2,500 Paid assistant’s wages.Payable......................................201 1,100m. AccountsCash..................................................101 1,100 Paid amount due on account.Expense........................................604 970n.RepairsCash..................................................101 970 Paid for repair of equipment.o. J. Lancet, Withdrawals...............................302 10,450Cash.....................................................101 10,450 Owner withdrew cash.Expense..........................................601 2,000Wagesp.Cash.....................................................101 2,000 Paid assistant’s wages.Expense..................................603 2,400Advertisingq.Cash.....................................................101 2,400 Paid for advertising expense.©McGraw-Hill Companies, 2009 Solutions Manual, Chapter 2 69Problem 2-1A (Continued)Part 2Cash No. 101Accounts Payable No. 201 Date PR Debit Credit Balance Date PR Debit Credit Balance(a) 195,000 195,000 (h)1,100 1,100(b) 8,900 186,100(j) 1,410 2,510(c) 55,000 131,100(m)1,1001,410(d) 2,300 128,800(e) 6,600 135,400Notes Payable No. 250(f) 9,600 125,800Date PR Debit Credit Balance (k) 8,000 133,800 (b)43,100 43,100 (l) 2,500 131,300 (f) 14,400 57,500 (m) 1,100 130,200(n) 970 129,230(o) 10,450 118,780J. Lancet, Capital No. 301 (p) 2,000 116,780Date PR Debit Credit Balance (q) 2,400 114,380 (a)283,200 283,200 Accounts Receivable No. 106J. Lancet, Withdrawals No. 302 Date PR Debit Credit Balance Date PR Debit Credit Balance (g) 14,500 14,500 (o)10,450 10,450 (i) 23,000 37,500(k) 8,000 29,500Engineering Fees Earned No. 402Date PR Debit Credit Balance Prepaid Insurance No. 108(e)6,600 6,600 Date PR Debit Credit Balance (g)14,500 21,100 (d) 2,300 2,300(i) 23,000 44,100 Office Equipment No. 163Wages Expense No. 601 Date PR Debit Credit Balance Date PR Debit Credit Balance (a) 8,200 8,200 (l) 2,5002,500 (h) 1,100 9,300 (p)2,0004,500 Drafting Equipment No. 164Equipment Rental Expense No. 602 Date PR Debit Credit Balance Date PR Debit Credit Balance (a) 80,000 80,000 (j) 1,4101,410 (f) 24,000 104,000Building No. 170Advertising Expense No. 603 Date PR Debit Credit Balance Date PR Debit Credit Balance (c) 55,000 55,000 (q)2,4002,400 Land No. 172Repairs Expense No. 604 Date PR Debit Credit Balance Date PR Debit Credit Balance (b) 52,000 52,000 (n)970970©McGraw-Hill Companies, 2009Fundamental Accounting Principles, 19th Edition 70Problem 2-1A (Concluded)Part 3LANCET ENGINEERINGTrial BalanceJune 30Debit CreditCash............................................................. $114,380Accounts receivable.................................. 29,500Prepaid insurance...................................... 2,300Office equipment........................................ 9,300Drafting equipment.................................... 104,000Building....................................................... 55,000Land............................................................. 52,000Accounts payable....................................... $ 1,410Notes payable............................................. 57,500J. Lancet, Capital........................................ 283,200J. Lancet, Withdrawals............................... 10,450Engineering fees earned............................ 44,100Wages expense.......................................... 4,500Equipment rental expense......................... 1,410Advertising expense.................................. 2,400Repairs expense (970)Totals........................................................... $386,210 $386,210©McGraw-Hill Companies, 2009 Solutions Manual, Chapter 2 71。

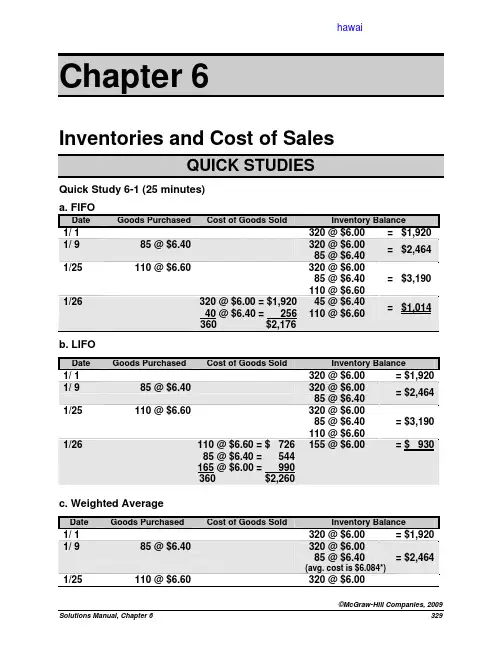

hawai Chapter 6Inventories and Cost of SalesQUICK STUDIESQ uick Study 6-1 (25 minutes)a. FIFODate Goods Purchased Cost of Goods Sold Inventory Balance1/ 1 320 @ $6.00 = $1,9201/ 9 85 @ $6.40 320 @ $6.00= $2,46485 @ $6.401/25 110 @ $6.60 320 @ $6.0085 @ $6.40 = $3,190110 @ $6.601/26 320 @ $6.00 = $1,92045 @ $6.40= $1,01440 @ $6.40 = 256110 @ $6.60360 $2,176b. LIFODate Goods Purchased Cost of Goods Sold Inventory Balance1/ 1 320 @ $6.00 = $1,9201/ 9 85 @ $6.40 320 @ $6.00= $2,46485 @ $6.401/25 110 @ $6.60 320 @ $6.0085 @ $6.40 = $3,190110 @ $6.601/26 110 @ $6.60 = $ 726155 @ $6.00 = $ 93085 @ $6.40 = 544165 @ $6.00 = 990360 $2,260c. Weighted AverageDate Goods Purchased Cost of Goods Sold Inventory Balance1/ 1 320 @ $6.00 = $1,920 1/ 9 85 @ $6.40 320 @ $6.0085 @ $6.40 = $2,464(avg. cost is $6.084*)1/25 110 @ $6.60 320 @ $6.00©McGraw-Hill Companies, 2009 Solutions Manual, Chapter 6 32985 @ $6.40 = $3,190110 @ $6.60(avg. cost is $6.194*)1/26 360 @ $6.194 = $2,230*155 @ $6.194 = $ 960* *roundedAlternate solution format(a) FIFO: 110 @ $6.60 = $ 72645@ $6.40 = 288155 $1,014Ending inventory cost(b) LIFO:155 @ $6.00 = $ 930Ending inventory cost(c) Weighted average:320 @ $6.00 = $1,92085 @ $6.40 = 544110@ $6.60 = 726515 $3,190Cost of goods available for sale$3,190/515 = $6.194 (rounded) weighted average cost per unit155 units @ $6.194 = $ 960 Ending inventory cost (rounded)©McG330Q uick Study 6-2 (10 minutes)Beginning inventory.....................................10 units @ $28 $ 280Plus 1st week purchase.......................................10 units @ $30 3002nd week purchase......................................10 units @ $31 3103rd week purchase.......................................10 units @ $32 3204th week purchase.......................................10 units @ $34 340Units Available for sale................................50 unitsCost of Goods Available for Sale................$1,550Q uick Study 6-3 (25 minutes)a. FIFODate Goods Purchased Cost of Goods Sold Inventory Balance12/ 7 10 @ $ 9 = $ 90 10 @ $ 9 = $ 9012/14 20 @ $10 = $200 10 @ $ 920 @ $10 = $29012/15 10 @ $ 9 12 @ $10 = $1208 @ $10 = $17012/21 15 @ $12 = $180 12 @ $10= $300____ 15 @ $12$170b. LIFODate Goods Purchased Cost of Goods Sold Inventory Balance12/ 7 10 @ $ 9 = $ 90 10 @ $ 9 = $ 9012/14 20 @ $10 = $200 10 @ $ 920 @ $10 = $29012/15 18 @ $10 = $180 10 @ $ 92 @ $10 = $11012/21 15 @ $12 = $180 10 @ $ 92 @ $10 = $290____ 15 @ $12$180©McGraw-Hill Companies, 2009 Solutions Manual, Chapter 6 331c. Weighted AverageDate Goods Purchased Cost of Goods Sold Inventory Balance12/ 7 10 @ $ 9 = $ 90 10 @ $ 9 = $ 9012/14 20 @ $10 = $200 10 @ $ 9= $29020 @ $ 10(avg cost is $9.667)12/15 18 @ $9.667 =$17412 @ $9.667 = $11612/21 15 @ $12 = $180 12 @ $9.667= $296____15 @ $ 12$174(avg cost is $10.963)d. Specific identification(3 units x $9) + (9 units x $10) + (15 units x $12) = $297.Quick Study 6-4 (10 minutes)1. FIFO2. Specific identification3. LIFO4. LIFO5. LIFOQ uick Study 6-5 (10 minutes)1. The consignor is Jabar Company. The consignee is Chi Company. Theconsignor, Jabar Company, should include any unsold and consigned goods in its inventory.2. Title will pass at “destination” which is Kwon Company’s receiving dock.Liu should show the $750 in its inventory at year-end as Liu retains title until the goods reach Kwon Company.©McG332Cost..............................................................................................$17,500PlusTransportation-in (300)Import duties.............................................................................1,000 Insurance.. (250)Inventory cost...........................................................................$19,050The $400 advertising cost and the $3,000 cost for sales staff salaries are included in operating expenses—not part of inventory costs. Those two costs are unnecessary to get the vehicle in a place and condition for sale.Q uick Study 6-7 (20 minutes)Per Unit Total Total LCM applied to Inventory Items Units Cost Market Cost Market Items Whole Mountain bikes 20 $650 $500$13,000$10,000$10,000 Skateboards 22 400 4508,8009,9008,800790 34,000 31,600 31,600_______850Gliders 40$55,800$51,500$50,400$51,500a. LCM for inventory as a whole...................................................$51,500b. LCM applied to each product ..................................................$50,400Q uick Study 6-8(15 minutes)a.Overstates 2009 cost of goods sold.b.Understates 2009 gross profit.c.Understates 2009 net income.d.Overstates 2010 net income.e.The understated 2009 net income and the overstated 2010 net incomecombine to yield a correct total income for the two-year period.f.The 2009 error will not affect years after 2010.©McGraw-Hill Companies, 2009 Solutions Manual, Chapter 6 333Quick Study 6-9A (15 minutes)ofCostEndingSold InventoryGoodsa. FIFO(45 x $6.40) + (110 x $6.60)................................. $1,014(320 x $6.00) + (40 x $6.40)................................. $2,176b. LIFO(155 x $6.00)......................................................... $ 930(110 x $6.60) + (85 x $6.40) + (165 x $6.00)....... $2,260c. Weighted Average ($3,190/ 515 = $6.194* cost per unit)(155 x $6.194)....................................................... $ 960*(360 x $6.194)....................................................... $2,230**rounded©McGraw-Hill Companies, 2009Fundamental Accounting Principles, 19th Edition334EXERCISESExercise 6-1 (30 minutes)a. Specific identificationEnding inventory—100 units from January 30, 80 units from January 20, and45 units from beginning inventoryEnding Cost of Computations Inventory Goods Sold (100 x $5.00) + (80 x $6.00) + (45 x $7.00).......$1,295$2,800 - $1,295..................................................$1,505b. Weighted average perpetualDate Goods Purchased Cost of Goods Sold Inventory Balance1/ 1 140 @ $7.000 = $ 980 1/10 90 @ $ 7.00 = $ 630 50 @ $7.000 = $ 350 1/20 220 @ $6.00 50 @ $7.000= $1,670220 @ $6.000(avg. cost is $6.185)1/25 145 @ $6.185 = $ 897*125 @ $6.185 = $ 773*1/30 100 @ $5.00 _____125 @ $6.185= $1,273$1,527100 @ $5.000(avg. cost is $5.658) *roundedc. FIFO PerpetualDate Goods Purchased Cost of Goods Sold Inventory Balance1/ 1 140 @ $7.00 = $ 980 1/10 90 @ $7.00 = $ 630 50 @ $7.00 = $ 350 1/20 220 @ $6.00 50 @ $7.00220 @ $6.00 = $1,670 1/25 50 @ $7.0095 @ $6.00 = $ 920 125 @ $6.00 = $ 750 1/30 100 @ $5.00 _____ 125 @ $6.00$1,550 100 @ $5.00 = $1,250, 2009335E xercise 6-1 (Continued)d. LIFO PerpetualDate Goods Purchased Cost of Goods Sold Inventory Balance1/ 1 140 @ $7.00 = $ 9801/10 90 @ $7.00 = $ 630 50 @ $7.00 = $ 3501/20 220 @ $6.00 50 @ $7.00220 @ $6.00 = $1,6701/25 145 @ $6.00 = $ 870 50 @ $7.0075 @ $6.00 = $ 8001/30 100 @ $5.00 _____ 50 @ $7.00$1,50075 @ $6.00 = $1,300100 @ $5.00Alternate Solution Format for FIFO and LIFO PerpetualEnding Cost ofComputations Inventory Goods Soldc. FIFO(125 x $6.00) + (100 x $5.00)............................................$1,250(90 x $7.00) + (50 x $7.00) + (95 x $6.00)........................$1,550d. LIFO(50 x $7.00) + (75 x $6.00) + (100 x $5.00)...................... $1,300(90 x $7.00) + (145 x $6.00)............................................. $1.500E xercise 6-2(20 minutes)LIBERTY COMPANYIncome StatementsFor Month Ended January 31Specific Identification WeightedAverage FIFO LIFOSales.................................$3,525 $3,525 $3,525 $3,525 (235 units x $15 price)Cost of goods sold......... 1,505 1,527 1,550 1,500 Gross profit.....................2,020 1,998 1,975 2,025 Expenses......................... 1,250 1,250 1,250 1,250 Income before taxes.......770 748 725 775 Income tax expense (30%).. 231 224* 218* 233* Net income......................$ 539 $ 524 $ 507 $ 542 * Rounded to nearest dollar.©McG336Exercise 6-2 (Concluded)1. LIFO method results in the highest net income of $542.2. Weighted average net income of $524 falls between the FIFO netincome of $507 and the LIFO net income of $542.3. If costs were rising instead of falling, then the FIFO method would yieldthe highest net income.Exercise 6-3 (30 minutes)a. FIFO PerpetualDate Goods Purchased Cost of Goods Sold Inventory Balance1/ 1 126 @ $ 8 = $1,008 1/10 113 @ $ 8 = $ 904 13 @ $ 8 = $ 104 3/14 315 @ $13 = $4,095 13 @ $ 8315 @ $13 = $4,199 3/15 13 @ $ 8 148 @ $13 = $1,924167 @ $13 = $ 2,2757/30 250 @ $18 = $4,500 148 @ $13250 @ $18 = $6,424 10/ 5 148 @ $13230 @ $18 = $ 6,064 20 @ $18 = $ 360 10/26 50 @ $23 = $1,150 20 @ $18______ 50 @ $23 = $1,510$9,243, 2009337E xercise 6-3 (Concluded)a. LIFO PerpetualDate Goods Purchased Cost of Goods Sold Inventory Balance1/ 1 126 @ $ 8 = $1,0081/10 113 @ $ 8 = $ 904 13 @ $ 8 = $ 1043/14 315 @ $13 = $4,095 13 @ $ 8315 @ $13 = $4,1993/15 13 @ $ 8180 @ $13 = $2,340135 @ $13 = $1,8597/30 250 @ $18 = $4,500 13 @ $ 8135 @ $13 = $6,359250 @ $1810/ 5 250 @ $18 = $4,500 13 @ $ 8128 @ $13 = 1,664 7 @ $13 = $ 195$6,16410/26 50 @ $23 = $1,150 13 @ $ 87 @ $13 = $1,345_____ 50 @ $23$9,408Alternate Solution FormatofCostEndingSold InventoryGoodsa. FIFO(20 x $18) + (50 x $23)...........................................................$1,510(113 x $8) + (13 x $8) + (167 x $13) + (148 x $13) +(230 x $18)............................................................................$9,243b. LIFO(13 x $8) + (7 x $13) + (50 x $23).......................................... $1,345(113 x $8) + (180 x $13) + (250 x $18) + (128 x $13)............. $9,408FIFO Gross MarginSales revenue (671 units sold x $40 selling price).................$26,840Less: FIFO cost of goods sold................................................ 9,243Gross profit................................................................................$17,597LIFO Gross MarginSales revenue (671 units sold x $40 selling price).................$26,840Less: LIFO cost of goods sold................................................ 9,408Gross profit................................................................................$17,432©McG338a. Specific identification method—Cost of goods soldCost of goods available for sale.......................................$10,753 Ending inventory under specific identification3/14 purchase ( 5 @ $13) ........................................$ 657/30 purchase ( 15 @ $18) (270)10/26 purchase ( 50 @ $23)......................................... 1,150Total ending inventory under specific identification.... 1,485 Cost of goods sold under specific identification..........$ 9,268b. Specific identification method—Gross marginSales revenue (671 units sold x $40 selling price)..........$26,840 Less: Specific identification cost of goods sold............ 9,268 Gross profit.........................................................................$17,572E xercise 6-5 (15 minutes)Per Unit Total Total LCM applied to Inventory Items Units Cost Market Cost Market Products Whole Helmets.........19 $45 $49$ 855$ 931$ 855 Bats...............12 73 67876804804 Shoes............33 90 862,9702,8382,838 Uniforms.......37 31 31 1,147 1,147 1,147$5,848$5,720$5,644 $5,720a. Lower of cost or market of inventory as a whole = $5,720b. Lower of cost or market of inventory by product = $5,644©McGraw-Hill Companies, 2009 Solutions Manual, Chapter 6 3391. Correct gross profit = $1,100,000 - $700,000 = $400,000 (for each year)2. Reported income figuresYear 2008 Year 2009 Year 2010 Sales.....................................$1,100,000$1,100,000$1,100,000Cost of goods soldBeginning inventory........$280,000$262,000$280,000Cost of purchases............ 700,000 700,000 700,000Good available for sale...980,000962,000980,000Ending inventory.............. 262,000 280,000 280,000Cost of goods sold.......... 718,000 682,000 700,000Gross profit.........................$ 382,000$ 418,000$ 400,000E xercise 6-7A (20 minutes)CostofEndingGoodsSold Inventorya. Specific Identification(100 x $5.00) + (80 x $6.00) + (45 x $7)........................ $1,295$2,800 - $1,295.............................................................. $1,505b. Weighted Average($2,800 / 460 units = $6.087* average cost per unit)225 x $6.087.................................................................. $1,370*235 x $6.087.................................................................. $1,430*c. FIFO(100 x $5.00) + (125 x $6.00)........................................ $1,250(140 x $7.00) + (95 x $6.00).........................................$1,550©McG340d. LIFO(140 x $7.00) + (85 x $6.00).......................................... $1,490(100 x $5.00) + (135 x $6.00)........................................ $1,310 *roundedExercise 6-8A (20 minutes)Ending InventoryCost of Goods Solda. Specific identification(135 x $2.70) + (135 x $2.60) + (135 x $2.30).......$1,026$8,976 - $1,026.......................................................$7,950 b. Weighted average ($8,976/3,780 = $2.375*)405 x $2.375...........................................................962*$8,976 - $962..........................................................8,014* c. FIFO(390 x $2.70) + (15 x $2.60) ..................................1,092(270 x $1.90) + (540 x $2.05) + (1,350 x $2.30) +(1,215 x $2.60)..................................................7,884 d. LIFO(270 x $1.90) + (135 x $2.05).................................790*(390 x $2.70) + (1,230 x $2.60) + (1,350 x $2.30)+ (405 x $2.05).....................................................8,186* *RoundedIncome effect: FIFO provides the lowest cost of goods sold, thehighest gross profit, and the highest net income.©McGraw-Hill Companies, 2009 Solutions Manual, Chapter 6 341PROBLEM SET AProblem 6-1A (40 minutes)Instructor note: In the first printing, Requirement 3 in the book for specific identification reads “—units sold consist of…,” which should read “—ending inventory consists of…”1. Compute cost of goods available for sale and units available for saleBeginning inventory......................... 770 units @ $50$38,500 Feb. 10............................................... 420 units @ $4117,220 Mar. 13............................................... 260 units @ $256,500 Aug. 21............................................... 180 units @ $498,820 Sept. 5............................................... 585 units @ $42 24,570 Units available................................... 2,215 unitsCost of goods available for sale $95,6102. Units in ending inventoryUnits available (from part 1).............2,2151,420Less: Units sold (770 + 650).............Ending Inventory (units) (795)©McG3423a. FIFO perpetualDate Goods Purchased Cost of Goods Sold Inventory Balance1/ 1 770 @ $50 = $38,5002/10 420 @ $41 = $17,220 770 @ $50420 @ $41 = $55,720 3/13 260 @ $25 = $ 6,500 770 @ $50420 @ $41 = $62,220260 @ $253/15 770 @ $50 = $38,500 420 @ $41260 @ $25 = $23,7208/21 180 @ $49 = $ 8,820 420 @ $41260 @ $25 = $32,540180 @ $499/ 5 585 @ $42 = $24,570 420 @ $41260 @ $25 = $57,110180 @ $49585 @ $429/10 420 @ $41230 @ $25 = $22,970_______ 30 @ $25180 @ $49585 @ $42 = $34,140$61,470FIFO Alternate Solution FormatCost of goods available for sale $95,610 Less: Cost of sales 770 @ $50 $38,500420 @ $41 17,220230 @ $25 5,75061,470 Total cost of goods soldEndingInventory $34,140 Proof of Ending Inventory30 @ $25 180 @ $49 $ 7508,820585 @ $42 24,570EndingInventory............... 795 units $34,140©McGraw-Hill Companies, 2009 Solutions Manual, Chapter 6 3433b. LIFO perpetualDate Goods Purchased Cost of Goods Sold Inventory Balance1/ 1 770 @ $50 = $38,500 2/10 420 @ $41 = $17,220 770 @ $50420 @ $41 = $55,720 3/13 260 @ $25 = $ 6,500 770 @ $50420 @ $41 = $62,220260 @ $253/15 260 @ $25420 @ $41 = $28,22090 @ $50680 @ $50 = $34,0008/21 180 @ $49 = $ 8,820 680 @ $50180 @ $49 = $42,820 9/ 5 585 @ $42 = $24,570 680 @ $50180 @ $49 = $67,390585 @ $429/10 585 @ $4265 @ $49 = $27,755_______680 @ $50115 @ $49 = $39,635$55,975LIFO alternate solution formatCost of goods available for sale $95,610Less: Cost of sales 260 @ $25 $ 6,500420 @ 41 17,22090 @ 50 4,500585 @ 42 24,57065 @ 49 3,18555,975 Cost of Goods SoldEndingInventory $39,635 Proof of Ending Inventory680 @ $50 $34,0005,635115 @ 49EndingInventory………..795 units $39,635©McGraw-Hill Companies, 2009Fundamental Accounting Principles, 19th Edition 3443c. Specific IdentificationCost of goods available for sale...........$95,610Less: Cost of Goods Sold675 @ $50..................................$33,750245 @ $41.................................. 10,045190 @ $25..................................4,750180 @ $49..................................8,820130 @ $42.................................. 5,460Total cost of goods sold........................ 62,825Ending Inventory....................................$32,785Proof of Ending Inventory95 @ $50 $ 4,750175 @ $41 7,17570 @ $25 1,750455 @ $42 19,110Ending Inventory…………. 795 units $32,785, 2009345P roblem 6-1A (Continued)3d. Weighted AverageDate Goods Purchased Cost of Goods Sold Inventory Balance1/ 1 770 @ $50.00 = $38,500 2/10 420 @ $41 = $17,220 770 @ $50.00420 @ $41.00 = $55,720(avg. cost is $46.824*)3/13 260 @ $25 = $ 6,500 770 @ $50.00420 @ $41.00 = $62,220260 @ $25.00(avg. cost is $42.910*)3/15 770 @ $42.910* = $33,041**680 @ $42.910* = $29,179** 8/21 180 @ $49 = $ 8,820 680 @ $42.910*180 @ $49.000 = $37,999(avg. cost is $44.185*)9/ 5 585 @ $42 = $24,570 680 @ $42.910*180 @ $49.000585 @ $42.000 = $62,569(avg. cost is $43.300*)9/10 650 @ $43.300 = $28,145**795 @ $43.300 = $34,424$61,186* rounded to three decimals** rounded to nearest dollar4.FIFO LIFO SpecificIdentifi-cationWeightedAverageSales (1,420 x $75)................$106,500$106,500$106,500 $106,500 Less: Cost of goods sold..... 61,470 55,975 62,825 61,186 Gross profit............................$ 45,030$ 50,525$ 43,675 $ 45,3145. The manager would likely prefer the LIFO method since this method’sgross profit is the largest at $50,525. This would give the manager the highest bonus based on gross profit.©McG346a. Lower of cost or market for the inventory as a whole = $275,948b. Lower of cost or market for the inventory by major category =$95,011 + $148,699 + $27,752 = $271,462 c. Lower of cost or market for inventory applied separately = $264,007, 2009347P art 1(a)Cost of goods sold 2008 2009 2010 Reported......................................$ 623,000$ 955,000 $ 780,000 Adjustments: 12/31/2008 error.....- 56,000+ 56,00012/31/2009 error..... + 25,000 - 25,000 Corrected....................................$ 567,000$1,036,000 $ 755,000 (b)Net income 2008 2009 2010 Reported......................................$ 230,000$ 275,000 $ 250,000 Adjustments: 12/31/2008 error.....+ 56,000- 56,00012/31/2009 error..... - 25,000 + 25,000 Corrected....................................$ 286,000$ 194,000 $ 275,000 (c)Total current assets 2008 2009 2010 Reported......................................$1,247,000$1,360,000 $1,230,000 Adjustments: 12/31/2008 error.....+ 56,00012/31/2009 error..... - 25,000 Corrected....................................$1,303,000$1,335,000 $1,230,000 (d)Equity 2008 2009 2010 Reported......................................$1,387,000$1,580,000 $1,245,000 Adjustments: 12/31/2008 error.....+ 56,00012/31/2009 error....._________ - 25,000 Corrected....................................$1,443,000$1,555,000 $1,245,000 P art 2Total net income for the combined three-year period ($755,000) is not affected by the errors. This is because these errors are "self-correcting"—that is, each overstatement (or understatement) of net income is offset by a matching understatement (or overstatement) in the following year.P art 3The understatement of inventory by $56,000 results in an overstatement of cost of goods sold by that same amount. The $56,000 overstatement of cost of goods sold results in an understatement of gross profit by the same amount. This understatement of gross profit carries through to an understatement of net income. Since the understated net income is closed to equity, the final equity figure is understated by the amount of the inventory understatement.©McG348。

会计学原理课后习题答案1. 会计基本假设:- 会计实体:假设企业是一个独立的经济实体,其财务状况应独立于所有者或其他企业。

- 持续经营:假设企业将无限期地继续其经营活动。

- 货币计量:假设所有交易和事项都以货币单位来计量和表达。

2. 会计原则:- 会计信息应具有可靠性、相关性、可理解性、可比性。

- 遵循历史成本原则,即在会计记录中使用交易发生时的成本。

3. 会计等式:- 资产(A) = 负债(L) + 所有者权益(E)。

- 收入(R) - 费用(E) = 净利润。

4. 会计循环:- 识别和记录交易。

- 调整账户以反映期末事项。

- 准备财务报表。

5. 财务报表:- 资产负债表:反映企业在特定日期的财务状况。

- 利润表:显示企业在一定会计期间的经营成果。

- 现金流量表:显示企业在一定会计期间的现金收入和支出。

6. 会计估计:- 需要对不确定的未来事件进行估计,如坏账准备、存货评估等。

7. 会计政策和变更:- 企业应选择并一致应用会计政策。

- 会计政策变更应按照相关准则进行处理。

8. 内部控制:- 内部控制系统是确保财务报告准确性和防止欺诈的重要机制。

9. 会计职业道德:- 会计师应遵守职业道德规范,保证会计信息的真实性和公正性。

10. 会计信息系统:- 会计信息系统是企业内部用于收集、处理、存储和报告财务信息的系统。

请注意,这些答案只是对会计学原理的一些基本概念的简要说明,并不代表具体的习题答案。

实际的习题答案应详细分析习题的具体要求,并应用相应的会计原则和方法来解答。

在准备答案时,务必参考相关的会计准则和实际案例。

一、多选题(共3题,15分)1、属于损益类账户的有( )。

A、主营业务收入B、制造费用C、所得税费用D、管理费用E、本年利润正确答案: ACD完整题库答案看我百度文库名字查找我,我发给你,所有科目均有。

2、账户的结构,一般包括( )。

A、账户借方核算的内容B、账户贷方核算的内容C、账户期末余额的方向D、账户余额所表示的内容E、账户的作用正确答案: ABCD3、属于债权结算类账户的有( )。

A、应收账款B、销售费用C、预收账款D、盈余公积E、预付账款正确答案: AE一、多选题(共1题,25分)1、XBRL可以在()等经济活动中发挥重要应用。

A、企业管理领域B、审计领域C、企业信用等级评估领域D、贸易与纳税领域正确答案: ABCD二、多选题(共1题,25分)1、XBRL基本框架主要主要包括()。

A、技术规范(Specifications)B、分类标准(Taxonomy)C、实例文档(Instance Documents)D、会计准则(Accounting Standard)E、会计制度正确答案: ABC三、单选题(共1题,25分)1、最有利于开展个性化财务分析的电子文件格式是()。

A、 WordB、 PDFC、 HTMLD、 XBRL正确答案: D一、多选题(共1题,40分)1、属于损益类账户的是()A、主营业务收入B、制造费用C、所得税费用D、管理费用E、本年利润正确答案: ACD二、单选题(共1题,20分)1、按照经济内容分类属于成本类账户的有()。

A、“管理费用”账户B、“应付账款”账户C、“短期借款”账户D、“制造费用”账户正确答案: D三、单选题(共1题,20分)1、“应付利息”账户按经济内容分类属于()。

A、资产类账户B、负债类账户C、费用类账户D、利润类账户正确答案: B、多选题(共1题,3分)1、权益包括()。

A、资产B、预收账款C、累计折旧D、资本公积E、应付账款正确答案: BDE二、其它(共1题,11分)1、6、某公司20×6年12月31日有关账户的余额如下:某公司20×6年12月31日有关账户余额账户名称借方余额账户名称贷方余额现金17 00坏账准备2 000银行存款72 000存货跌价准备38 000应收账款52 000累计折旧67 000其他应收款 4 000应付账款31 000预付账款38 000应付职工薪酬57 000生产成本87 000应付利息7 000原材料76 000应付股利8 000库存商品108 000预收账款24 000固定资产820 000长期借款12 000其中,其中有关账户的明细账户余额如下:“应收账款”明细账户余额:A公司:71 000元(借方)B公司:19 000元(贷方)“预收账款”明细账户余额:C公司:19 000元(借方)D公司:43 000元(贷方)“应付账款”明细账户余额:E公司:29 000元(借方)F公司:60 000元(贷方)“预付账款”明细账户余额:G公司:70 000元(借方)H公司:32 000元(贷方)长期借款中有7 000元须在6个月内偿还。

会计学原理课后习题答案1. 会计学原理概述。

会计学原理是会计学的基础,它是会计学的理论基础和规范。

会计学原理是会计工作的指导思想和方法论,是会计实践的规范和准则。

会计学原理包括会计的计量原则、会计的确认原则、会计的实体原则、会计的持续经营原则等。

会计学原理的正确运用对于保证会计信息的真实性、可靠性和比较性具有重要意义。

2. 会计等式与会计核算。

会计等式是会计核算的基础,它包括资产等于负债加所有者权益。

会计等式的核算是指根据会计等式的基本关系进行会计核算,确保会计等式始终成立。

会计等式的核算是会计核算的基础,它是会计核算的逻辑基础和方法论。

3. 会计科目与会计账户。

会计科目是会计核算的基本单位,它包括资产、负债、所有者权益、成本、损益等。

会计科目是会计账户的基础,它是会计账户的逻辑基础和方法论。

会计科目的正确设置对于保证会计信息的真实性、可靠性和比较性具有重要意义。

4. 会计凭证与会计账簿。

会计凭证是会计核算的依据,它包括原始凭证和复制凭证。

会计凭证的正确填制对于保证会计信息的真实性、可靠性和比较性具有重要意义。

会计账簿是会计核算的载体,它包括日记账、总账、明细账等。

会计账簿的正确设置对于保证会计信息的真实性、可靠性和比较性具有重要意义。

5. 会计报表与财务分析。

会计报表是会计核算的结果,它包括资产负债表、利润表、现金流量表等。

会计报表的正确编制对于保证会计信息的真实性、可靠性和比较性具有重要意义。

财务分析是会计核算的应用,它包括比较分析、趋势分析、比率分析等。

财务分析的正确运用对于保证会计信息的真实性、可靠性和比较性具有重要意义。

6. 会计学原理课后习题答案。

1) 会计学原理的基本内容是什么?会计学原理的基本内容包括会计的计量原则、会计的确认原则、会计的实体原则、会计的持续经营原则等。

2) 会计等式的基本关系是什么?会计等式的基本关系是资产等于负债加所有者权益。

3) 会计科目的基本分类有哪些?会计科目的基本分类包括资产、负债、所有者权益、成本、损益等。

会计学原理课后答案1. 简介本文档为《会计学原理》课程的课后答案,旨在帮助学生巩固和理解课堂所学的会计学原理知识。

通过仔细阅读并尝试解答下面的问题,您将能够提高对会计学原理的理解,并准备好应对考试和实践中的各种问题。

2. 问题与答案2.1 会计基础2.1.1 什么是会计?答:会计是一门通过记录、分析和总结经济交易和业务活动的科学与艺术。

2.1.2 会计的目的是什么?答:会计的目的是为了提供决策依据、提供财务信息、评估和监测企业的财务状况。

2.2 会计原则2.2.1 什么是会计原则?列举几个常见的会计原则。

答:会计原则是会计处理和报告财务信息时需要遵循的规则和规范。

常见的会计原则包括货币计量原则、收入确认原则、费用匹配原则、历史成本原则等。

2.2.2 什么是货币计量原则?答:货币计量原则要求所有财务信息必须以货币单位进行记录和报告。

2.3 会计方程2.3.1 什么是会计方程?答:会计方程是会计中最基本的概念,用于描述企业财务状况的等式关系。

会计方程的公式为:资产 = 负债 + 所有者权益。

2.3.2 举例说明资产、负债和所有者权益的概念。

答:资产包括现金、存货、设备等企业拥有的有形和无形的资源。

负债是企业欠他人的债务,比如应付款项、借款等。

所有者权益是指企业所有者对企业的所有权和权益,包括资本、盈余等。

2.4 会计记录2.4.1 什么是会计记录?答:会计记录是指通过账簿和账户等方式,把经济交易和业务活动的信息记录下来,并以一定的格式和规范进行展示和存档。

2.4.2 举例说明常见的会计记录方式。

答:常见的会计记录方式包括账户余额表、现金流量表、损益表等。

账户余额表用于记录和总结各项财务信息,现金流量表用于展示企业的现金流动情况,损益表用于展示企业的盈利和损失情况。

2.5 会计报告2.5.1 什么是会计报告?答:会计报告是指企业通过财务报表等形式,向内外部利益相关者提供财务信息的过程和结果。

2.5.2 举例说明常见的会计报告。

《会计学原理》课后习题答案第一章练习权责发生制确认收入、费用和利润第二章习2-1:练习经济业务发生对会计等式的影响第二章2-2:练习运用会计科目及其归属的会计要素一、目的:练习运用会让科目及其归属的会计要素。

二、资料:某工业企业有下列资产和权益内容:(1)存放在出纳处的现金;(2)存放在银行的款项;(3)收到购货单位开来并承兑的商业汇票;(4)借入偿还期在1年内的借款;(5)借入偿还期在1年以上的借款;(6)生产部门使用的各种机器设备;(7)厂部使用的办公人楼;(8)库存的原料及其他材料;(9)库存的完工产品;(10)生产部门正在加工中的在产品;(11)所有者投入的资本;(12)出租出借包装物所收取的押金;(13)采购员预借的差旅费;(14)应收购买单位的货款;(15)应付给供应单位的货款;(16)尚未缴纳的税金;(17)本年实现的利润;(18)以前年度积累的未分配利润;(19)企业外购准备长期持有的股票;(20)企业提存的盈余公积;(21)预付的卜•个季度的财产保险费;(22)接受外单位描赠的非现金资产。

费用耍索:四要点1>费用是经济利益的总流出2、费用是获取收入的樂支3、费用是日常活动中发生的4、费用将引起所有者权益变化生产成本是市对象化的牛产费用形成(人力(体力脑力劳动),物力(原材料等)消耗),它并不会导致所冇者权益减少,也不是经济利益的流出,而是资产形态的的转化,是继续由企业拥有和控制的一种资源。

因此生产成木属于资产要素而不是费用要素。

当产品完工•旦对外销售(判断标准),这时牛产成本转化为营业成本,从而得到价值补偿,这时候才会导致所有者权益减少,属于费用耍素。

本年利润:按照会计要素划分为利润要素,按会计科目划分属于所有者权益类科目营业外收入:非流动资产处置利得、非货币性资产交换利得、出售无形资产收益、债务重组利得、企业合并损益、盘盈利得、因债权人原因确实无法支付的应付款项、政府补助、教育费附加返还第二章2-3:练习账户的结构及四项金额之间的关系第二章2-4:练习区分经济业务类型及对会计等式的影响资产二权益会计基本等式:资产二负债+所有者权益会计扩展等式:资产二负债+所有者权益+(收入■费用)二负债+所有者权益+利润■一、目的:练习经济业务的分类和经济业务发生后对账户余额的影响以及试算平衡。