成本与管理会计亨格瑞第13版英文版CA16

- 格式:pptx

- 大小:3.48 MB

- 文档页数:34

亨格瑞成本与管理会计

亨格瑞(Hengrui)是一家知名的成本与管理会计公司。

他们专注于提供成本管理、绩效管理和策略管理等方面的解决方案和咨询服务。

成本管理是指通过对企业资源和活动的成本进行测算、分析和控制,来提高企业效益和降低成本的管理方法。

亨格瑞通过帮助企业建立

成本计划和预算、制定成本控制策略、优化成本结构等手段,帮助

企业降低成本、提高利润。

绩效管理是指通过设定绩效目标、制定绩效评价体系、实施绩效测

算和分析,来提高企业绩效和激励员工的管理方法。

亨格瑞通过设

计和实施绩效管理制度、开展绩效评估和考核、提供培训和改进方

案等手段,帮助企业优化绩效,实现战略目标。

策略管理是指通过对企业内外环境的分析和评估,制定和执行战略

计划,来提高企业竞争力和市场地位的管理方法。

亨格瑞通过帮助

企业制定战略目标、开展战略规划和执行、提供战略改善建议等手段,帮助企业提升竞争力,实现可持续发展。

亨格瑞拥有一支专业的团队,拥有丰富的成本与管理会计经验,能

够根据企业的实际情况,提供量身定制的解决方案,帮助企业提高

运营效率和盈利能力。

亨格瑞成本与管理会计引言亨格瑞成本与管理会计是一种用于帮助企业管理和控制成本的方法。

它通过收集、分类和分析成本数据,帮助企业制定决策并改善绩效。

本文将介绍亨格瑞成本与管理会计的背景、概念和应用。

背景亨格瑞成本与管理会计是由美国会计学家Dale F. Hengry 于20世纪60年代提出的。

在当时,传统的财务会计主要关注企业的财务报表,而忽视了管理层对成本的关注。

亨格瑞成本与管理会计的出现填补了这一空缺,为企业提供了更全面、准确、及时的成本信息。

概念成本成本是指企业为生产或提供产品或服务所支付的资源的衡量。

它包括直接成本和间接成本。

直接成本是直接与产品或服务相关的成本,如原材料、直接人工等。

间接成本是与产品或服务间接相关的成本,如企业管理费用、销售费用等。

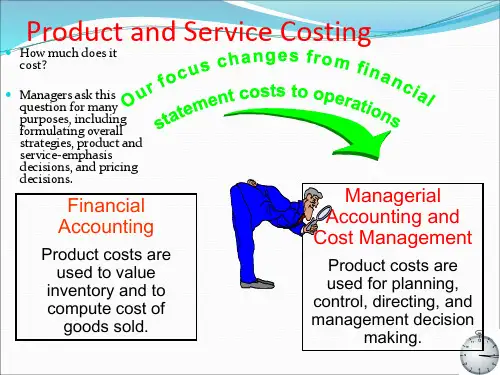

管理会计管理会计是一种专门用于管理决策和绩效评估的会计方法。

它与财务会计不同,会计师关注于为内部管理层提供更详细、实用的信息,以便他们做出决策和改进企业绩效。

管理会计强调成本控制、预算制定和业绩评估等方面。

亨格瑞成本法亨格瑞成本法是亨格瑞成本与管理会计的主要方法之一。

它通过以成本对象为基础,将企业的成本分为固定成本、可变成本和半固定成本,以帮助企业管理和控制成本。

固定成本是与产量无关的成本,如租金、折旧等。

可变成本是与产量成正比的成本,如直接材料、直接人工等。

半固定成本是与产量有部分相关的成本,如修理费用、研发费用等。

应用亨格瑞成本与管理会计广泛应用于各类企业中,帮助管理层制定决策、控制成本,提高企业绩效。

以下是亨格瑞成本与管理会计的几个常见应用:成本控制亨格瑞成本与管理会计为企业提供了更准确、详细的成本信息,帮助企业管理层控制成本。

通过对各类成本进行分类和分析,管理层可以识别哪些成本是可控的,从而采取相应的措施降低成本。

预算制定亨格瑞成本与管理会计可用于预算制定。

通过对成本进行分析,企业可以预测未来的成本,并制定相应的预算。

预算能够帮助企业管理层合理安排资源,控制成本。

Inventory Costing and CapacityAnalysisTRANSITION NOTESThis chapter now has a single comprehensive example that integrates the two parts of the chapter. This helps relate inventory costing to the capacity level issues and should make it easier for the student to relate the two concepts. The section on regulatory requirements is now entitled “Tax Requirements.” Many end-of-chapter problems have been revised and some new one introduced.PROBLEM MATERIALCORRELATION CHART13th Edition 12thEdition 13thEdition12thEdition16 16 30 3317 17 31 New18 18 32 34 Revised19 19 33 35 Revised20 20 34 36 Revised21 21 35 37 Revised22 22 Revised 36 38 Revised23 23 37 New24 24 38 New25 25 Revised 39 New26 26 Revised 40 40 Revised27 New 41 41 Revised28 30 42 New29 32I. LEARNING OBJECTIVES1.Identify what distinguishes variable costing from absorption costingpute income under absorption costing and variable costing, and explain thedifference in income3.Understand how absorption costing can provide undesirable incentives for managersto build up inventory4.Differentiate throughput costing from variable costing and absorption costing5.Describe the various capacity concepts that can be used in absorption costing6.Examine the key factors in choosing a capacity level to compute the budgeted fixedmanufacturing cost rate.7.Describe how attempts to recover fixed costs of capacity may lead to price increasesand lower demand9II. CHAPTER SYNOPSISThis chapter focuses on two related concepts: Variable costing, which is introduced andcompared with absorption costing; and throughput, or super-variable costing. In thesecond part of the chapter, capacity concepts that can be used in absorption costing arepresented. The use of these capacity concepts—theoretical, practical, normal, and master budget utilization—affect the cost per unit that is calculated for fixed costs.III. POINTS OF EMPHASIS1.Students may not have been introduced to the term absorption costing, even thoughthey have used it in previous courses. Help them understand how absorption costingand variable costing differ and why variable costing is preferable for decision-makingpurposes. Observe that a variable costing income statement classifies costs bybehavior; an absorption statement classifies costs by character.2.Emphasize that, although all variable costs are listed on the top portion of the incomestatement, only variable manufacturing costs are included in variable cost of goodssold.3.Students may react to the extreme nature of throughput costing. Emphasize that itdoes not have to be the only costing system employed, and is a useful short-termmanagement tool.4.Students may have trouble thinking “outside the box” on capacity concepts. The“teaching point” demonstration in the chapter outline will help them realize thatcapacity may have many definitions and meanings.IV. CHAPTER OUTLINE1Identify what distinguishes variable costing. . . fixed manufacturing costs excluded frominventoriable costsfrom absorption costing. . . fixed manufacturing costs included ininventoriable costs1.1Variable costing (also known as direct costing) is a method of inventory costingin which all variable manufacturing costs are included as inventoriable costs. Allfixed manufacturing costs are excluded from inventoriable costs and are treatedas costs of the period in which they are incurred.1.2Absorption costing is a method of inventory costing in which all variablemanufacturing costs and all fixed manufacturing costs are included asinventoriable costs. Thus, inventory “absorbs” all manufacturing costs.Absorption costing is the method required for Generally Accepted AccountingPrinciples for external financial reporting.TEACHING POINT. Two observations can be made aboutvariable and absorption costing. A variable costing incomestatement classifies cost based on behavior. An absorptioncosting income statement classifies cost based on character(manufacturing, selling, administrative).Second, students frequently do not grasp the concept that not allvariable costs are inventoriable—only variable manufacturingcosts.1.3The main difference between the two is the treatment of fixed manufacturingcosts.TEACHING POINT. At this stage it is helpful to prepare incomestatements illustrating the two approaches. Before the studentscan understand why the differences arise between the two,they must have a concept of how an income statement isprepared under both methods. Exercise 9-16 can be used forthis purpose, saving the second part to explain why thedifferences arise.Refer to Quiz Question 1 Exercise 9-16 Part 12Compute income under absorption costing. . . using the gross-margin formatand variable costing,. . . using the contribution-margin formatand explain the difference in income. . . affected by the unit level of production andsales under absorption costing, but only the unitlevel of sales under variable costing(Exhibit 9-2 is an illustration comparing income statementsprepared under Variable Costing and Absorption Costing for athree-year period.)2.1In 2009, production exceeded sales. Since all fixed costs are expensed undervariable costing, absorption costing shows a higher operating income. Thedifference of $270,000 represents fixed costs that are included in endinginventory under absorption costing.2.2In 2010, sales exceed production, thus reducing inventory. Variable costingshows a higher operating income. The $202,500 difference represents the fixedcosts in the change of inventory level ($135 fixed cost per unit ⨯ 1,500 unitreduction in inventory).2.3In 2011, production exceeds sales with a corresponding increase in endinginventory. Once again, absorption costing shows a higher operating income, by$337,500. The difference is the fixed costs in the increased level of inventory($135 ⨯ 2500 = $337,500).TEACHING POINT. This concept is best covered throughillustration. The more students see these effects, the morelikely they are to grasp the concept.Refer to Quiz Questions 2, 3, and 4 Exercise 9-16 Part 2, 9-183Understand how absorption costing can provideundesirable incentives for mangers to build upinventory. . . producing more units for inventory absorbsfixed manufacturing costs and increases operatingincome3.1 As has been observed, absorption costing is the required inventory method forexternal reporting in the United States and most other countries. Most companiesalso use absorption costing for internal accounting as well. This includesperformance evaluation.3.2 Companies use one method because it is seen as cost effective and less confusingfor managers to deal with one common method for inventory reporting.3.3 This can lead to undesirable behavior on the part of managers seeking to enhancetheir performance evaluation, even to the detriment of the company.3.4 Companies that use both methods for internal reporting—variable costing forshort-run decisions and performance evaluation and absorption costing for long-run decisions—benefit from the advantages of both methods.3.5 One motivation for an undesirable buildup of inventories could be due to the factthat a manag er’s bonus is based on absorption-costing operating income.(Exhibit 9-4 illustrates the effect on absorption-costingoperating income at different levels of production.)TEACHING POINT. An extreme example will illustrate howproducing for inventory can result in higher profits underabsorption costing and a better performance evaluation for themanager. By over-producing, the manager increases hisincome, with no increase in the level of sales.Production Equals SalesSales $10/unit x 1000 10,000Cost of goods sold:VC (1000 ⨯ 4) 4,000FC 3,000Mfg costs 7,000Ending inventory -0-Cost of goods sold 7,000Gross profit 3,000=====Production Exceeds SalesSales $10/ units ⨯ 1,000 10,000Cost of goods sold:VC (2000 ⨯ 4) 8,000FC 3,000Mfg cost 11,000Ending inventory 5,500Cost of goods sold 5,500Gross profit 5,500=====3.6 Top management can take several steps to reduce the undesirable effects ofabsorption costing.•Focus on careful budgeting and inventory planning to reducemanagement’s freedom to build up excess inventory.•Incorporate a “carrying charge” for inventory in the internal accountingsystem.•Change the period to evaluate performance. Instead of quarterly orannual horizon, evaluate the manager over a three-to-five year period.•Include nonfinancial as well as financial variables in the measures ofperformance evaluation.Refer to Quiz Question 5 Exercises 9-21 and 9-224Differentiate throughput costing. . . direct material costs inventoriedfrom variable costing. . . variable manufacturing costs inventoriedand absorption costing. . . variable and fixed manufacturing costsinventoried4.1 Some managers take the view that only direct materials are truly variable and arethe only costs that should be inventoried.4.2 This approach is known as throughput costing or super-variable costing. It isan inventory valuation method in which only direct material costs are included in inventoriable costs. All other costs are period costs and expensed in the periodincurred.TEACHING POINT. Students will be slow to accept such aseemingly radical departure from traditional costing methods.Illustrate that, in the very short run, many variable costs dobehave as though they were fixed. For example, consider arestaurant. When a server comes on duty, that server will likelywork until the end of the shift. Even though business mayfluctuate and the server may not stay busy the entire time, theemployer is on the hook for 8 hours pay. The employer cannot(from a practical standpoint) tell the employee to take an houroff because business is slow. Thus, the server’s wages for theday are in a very real sense, fixed.4.3 Throughput contribution is defined as revenues minus direct material cost ofgoods sold.4.4 Variable costing and absorption costing (as well as throughput costing) may becombined with actual, normal, or standard costing.(Exhibit 9-6 compares product costing under various inventorycosting systems.)TEACHING POINT. This is a good place to revisit thedefinitions of actual, normal, and standard costing. Althoughthese concepts are not difficult, they need to be brought intothe discussion on occasion to reinforce the differences amongthe three.4.5 Even though variable costing is not acceptable under GAAP, there are those whofeel that it should be acceptable for external reporting purposes. Their argumentis that fixed costs are more related to the capacity to produce rather than to actualproduction of specific units.4.6 Those arguing for the status quo, supporting absorption costing, maintain thatinventories should contain a fixed cost component because both fixed andvariable costs are necessary to produce goods.4.7 A key issue in absorption costing is the capacity level used to compute fixedcosts per unit produced.Refer to Quiz Question 6 Exercises 9-17 and 9-195Describe the various capacity concepts that can beused in absorption costing. . . theoretical capacity, practical capacity, normalcapacity utilization, and master-budget capacityutilization5.1 Determining the appropriate level of capacity is one of the most strategic anddifficult decisions managers face. Too much capacity means incurring costs ofunused capacity. Too little capacity means that demand may go unfilled.5.2 Four different capacity levels are used to compute the budgeted fixedmanufacturing cost rate. They are:•Theoretical capacity•Practical capacity•Normal capacity utilization•Master-budget capacity utilizationTEACHING POINT. To get students to “think outside the box”about capacity, perform the following demonstration. Get asmall glass jar. Ask a student to fill the jar with marbles. Whenthe student has done so, ask if the jar is full. Normally, you willget a “yes” for an answer. Then pull out a box of salt. Askanother student to pour as much salt into the jar with marbles.Then ask “Now is the jar full?” At this point, you will get someweak “ye s es” but the students don’t quite trust their answers.Then pull out a glass of water. Have a student pour water intothe marbles/salt. Emphasize that capacity is not a hard number,but depends on many factors.5.3 Theoretical capacity is the level of capacity based on producing at fullefficiency all the time. This measure of capacity does not allow for plantmaintenance, shutdowns, interruptions, or any other factors. Theoretical capacitymay be achieved for short periods of time, but it cannot be sustained. Theoreticalcapacity represents an ideal goal of capacity utilization.5.4 Practical capacity is the level of capacity that reduces theoretical capacity byconsidering unavoidable operating interruptions—scheduled maintenance orholidays, for example.5.5 Normal capacity is the level of capacity utilization that satisfies averagecustomer demand over a period of time—often two to three years.5.6 Master-budget capacity utilization is the level of capacity that managers expectfor the current time period, frequently one year.5.7 Theoretical and practical capacity measure capacity in terms of what a plant cansupply. Normal capacity and master-budget utilization measure capacity in termsof demand.5.8 The capacity level chosen will affect the budgeted fixed overhead cost rate. As alower capacity level is chosen, the fixed cost per unit increases.The Stassen Company illustration demonstrates the effect of different capacitylevel choices on the fixed overhead rate.Refer to Quiz Question 7 Exercise 9-266Examine the key factors in choosing a capacitylevel to compute the budgeted fixed manufacturingcost rate. . . managers must consider the effect a capacitylevel has on product costing capacity management,pricing decisions, and financial statements6.1 One of the principles of cost accounting covered in an earlier chapter was“different costs for different purposes.” That princi ple applies as we seek tochoose a capacity level for different purposes, including:•Product costing and capacity management•Pricing•Performance evaluation•External reporting•Regulatory requirements•Difficulties in forecasting6.2 Theoretical capacity is rarely used to calculate budgeted fixed manufacturing costper unit because it is significantly different from the “real” capacity available to acompany.6.3 Practical capacity is frequently used to calculate budgeted fixed manufacturingcost per unit. This approach sets the cost of capacity at the cost of supplying thecapacity regardless of demand.6.4 Practical capacity, then, highlights the cost of capacity acquired but not used andmay serve to direct managers’ attention toward more effective capacit ymanagement.6.5 In performance evaluation managers must guard against using a long-runmeasure such as normal capacity usage for a short-run purpose such as annualbonuses. Master-budget utilization would be more effective in this situation.6.6 For external reporting purposes, the choice of capacity measure will affect themagnitude of the production-volume variance. How this variance is disposed ofat the end of the year will impact the company’s operating income.•The adjusted allocation-rate approach restates all amounts in theledgers using actual rather than budgeted cost rates. This has the effect ofswitching to actual costing at the end of the year.•The proration approach spreads the balance over the accountscontaining overhead—Work-in-Process, Finished Goods, and Cost ofGoods Sold—in proportion to the balances in these accounts.•The write-off to cost of goods sold approach simply writes the balanceof the variance off to cost of goods sold. This can be utilized when thebalance is immaterial. This method also is the simplest to utilize.TEACHING POINT. A number of cost accountants use thewrite-off to cost of goods sold approach with the belief that thebalance to be written off must be very large before it becomesmaterial. In a normal operating situation, a very largepercentage of the balance will go to cost of goods sold, so itwould take a huge balance to make a material differencebetween methods.6.7 For tax reporting in the United States the IRS requires the use of practicalcapacity to calculate budgeted fixed overhead cost per unit.Refer to Quiz Questions 8, 9, and 10 Exercise 9-257Describe how attempts to recover fixed costs ofcapacity may lead to price increases and lowerdemand. . . this situation is the downward demand spiral,which explains why customers are unwilling to payfor a company’s unused capacity7.1 The downward demand spiral is the continuing reduction in demand thatoccurs when competitor prices are not met. As demand drops, unit costs becomeincreasingly higher resulting in an increased reluctance to meet competitors’prices.TEACHING POINT. The downward demand spiral and itseffect on profits is best illustrated through an example such asis included in the text.7.2 As the company increases prices to cover fixed costs, demand drops due to thehigher price, resulting in another price increase to cover still higher per-unit costs.7.3 Note that capacity costs also arise in nonmanufacturing parts of the value chainand must be appropriately dealt with by management. Failure to consider thesemay create unexpected losses.V. OTHER RESOURCESPlease visit the textbook companion website at . To download these and other resources,visit the Instructor’s Resource Center or access them on the Instructor’s Resource DVD(IR-DVD).The following exhibits were mentioned in this chapter of the Instructor’s Manual, andhave been included in the PowerPoint Lecture presentation created specifically for this chapter. You may use the PowerPoint Lecture presentations “as is”, or modify them tosuit your individual needs.Exhibit 9-2 is an illustration comparing income statements prepared under VariableCosting and Absorption Costing for a three-year period.Exhibit 9-4 illustrates the effect on absorption-costing operating income at differentlevels of production.Exhibit 9-6 compares product costing under various inventory costing systems.Download pdf images of textbook illustrations and exhibits from the Image Library oraccess them via your IR-DVD.Solutions to Select End-of-Chapter Problems mentioned in this chapter, which havebeen fully worked out in PowerPoint, are available for download and included on the IR-DVD.CHAPTER 9 QUIZ1.The main difference between variable costing and absorption costing isa.the treatment of nonmanufacturing costs.b.the accounting for variable manufacturing costs.c.the accounting for fixed manufacturing costs.d.their value for decision makers.The following data apply to questions 2 and 3.Alvin Inc. planned and actually manufactured 200,000 units of its single product in 2008, its first year of operations. Variable manufacturing costs were $30 per unit of product. Planned and actual fixed manufacturing costs were $600,000, and marketing and administrative costs totaled $400,000 in 2004. Alvin sold 120,000 units of product in 2008 at a selling price of $40 per unit.2.[CMA Adapted] Alvin’s 2008 operating income using variable costing isa. $800,000.b. $600,000.c. $440,000.d. $200,000.3.[CMA Adapted] Alvin’s 2008 operating income using absorption costing isa. $840,000.b. $800,000.c. $440,000.d. $200,000.4.[CPA Adapted] Operating income using variable costing as compared to absorptioncosting would be highera.when the quantity of beginning inventory equals the quantity of ending inventory.b.when the quantity of beginning inventory is more than the quantity of endinginventory.c.when the quantity of beginning inventory is less than the quantity of endinginventory.d.under no circumstances.5.Absorption costing enables managers to increase operating income in the short run bychanging production schedules. Which statement is true regarding such action?a.The reason for increased operating income is the deferral of fixed manufacturingoverhead contained in unsold inventory.b. A desirable effect of these changes in production is “cherry picking” theproduction line.c.This is done through decreases in the production schedule as customer demandfor product falls.d.None of the above statements are true regarding manager’s action to increaseoperating income through changes in the production schedule.6.The proponents of throughput costinga.maintain that variable costing undervalues inventories.b.maintain that it provides more incentive to produce for inventory than do eithervariable or absorption costing.c.argue that only direct materials and direct labor are “truly variable” and allindirect manufacturing costs be written off in the period in which they areincurred.d.treat all costs except those related to variable direct materials as costs of theperiod in which they are incurred.7.The absolute minimum absorption-inventory cost that would be reported under the bestconceivable operating conditions is a description of which type of denominator-levelconcept cost?a.Master-budget utilizationb.Practical capacityc.Theoretical capacityd.Normal utilizatione of capacity levels based on demanda.hides the amount of unused capacity.b.highlights the cost of capacity acquired but not used.c.yields a cost rate that does not include a charge for unused capacity.d.results in a price that covers the cost of capacity customers expect to pay.9. A company may experience the downward demand spiral whena.the use of theoretical capacity as a denominator level has contributed to budgetsthat project sales to be higher than actually attainable.b.spreading capacity costs over a small number of units and setting selling priceseven higher to recover those costs.c.engaged in a cyclical business and after experiencing an upturn.d.the production-volume variance is unfavorable each time period during a year.10.The manner in which a company deals with end-of-period variances will determine theeffect production-volume variances have on the company’s end-of-period operatingincome. When the chosen capacity level exceeds the actual production level, whichapproach to end-of-period variances results in an unfavorable production-volumevariance affect on that period’s operating income?a.Proration approachb.Adjusted allocation-rate approachc.Theoretical approachd.Write-off variances to cost of goods sold approachCHAPTER 9 QUIZ SOLUTIONS1. c2. d3. c4. b5. a6. d7. c8. a9. b10. dQuiz Question Calculations2. Sales 120,000 ⨯ $40/unit $4,800,000VC 120,000 ⨯ $30/unit 3,600,000Contribution margin $1,200,000Fixed costs ($600,000 + $400,000) 1,000,000Operating income 200,000========3. Sales 120,000 ⨯ $40 $4,800,000COGSVariable 3,600,000Fixed 360,000*3,960,000Gross profit 840,000Fixed costs 400,000Operating income 440,000=======Fixed manufacturing cost $600,000 / 200,000 units = $3 unit$3/unit ⨯ 120,000 units sold = $360,000。

An Introduction To Cost TermsAnd PurposesTRANSITION NOTESThis chapter has been rewritten to place more emphasis on the role of managerial decisions.Exhibits have been changed so the students can more easily follow the concepts. This chapter continues building on the framework begun in Chapter 1, emphasizing (1) calculating the cost of products or other cost objects, (2) obtaining information for planning and control as well as performance evaluation, and (3) identifying relevant information for decision making. It introduces concepts essential to topics covered in later chapters.PROBLEM MATERIALCORRELATION CHART13th Edition 12thEdition13thEdition12thEdition16 16 29 2817 New 30 2918 18 31 3019 19 32 3120 20 33 3221 Revised 34 3322 22 35 3423 New 36 New24 New 37 3625 Revised 38 3726 Revised 39 New27 New 40 3928 27I. LEARNING OBJECTIVES1.Define and illustrate a cost object2.Distinguish between direct costs and indirect costs3.Explain variable costs and fixed costs4.Interpret unit costs cautiously5.Distinguish among manufacturing companies, merchandising companies, andservice-sector companies6.Describe the three categories of inventories commonly found in manufacturingcompanies27.Distinguish inventoriable costs from period costs8.Explain why product costs are computed in different ways for different purposes9.Describe a framework for cost accounting and cost managementII. CHAPTER SYNOPSISChapter 2 defines and explains important cost accounting terms and concepts that will be discussed in the following chapters. Understanding the concepts and terms discussed inthis chapter is a prerequisite to successfully completing the remaining chapters of the text.One guiding principle is that the term cost is a relative term, dependent both on the “costobject” chosen and the purpose for which cost is being calculated and reported.Costs are a critical element in most business decisions. Students also need to recognizethat companies pay particular attention to costs because every dollar in cost reduction isone more dollar of operating income, whereas one more dollar of sales does notnecessarily result in the same impact due to the additional costs that may be incurred ingenerating those sales.“Cost” is often actually “estimated cost” due to difficulties involved in cost tracing andallocation, relevant range issues, which cost method is used, and the cost-benefitapproach to measuring costs. Although there are certain standard costing and reportingmethods followed by all, companies calculate and report the same types of datadifferently depending on their industry and sector. Companies commonly operate in themerchandising, manufacturing, and service sectors.III. POINTS OF EMPHASIS1.Although terminology can be boring, it is important that the students grasp andunderstand the terms introduced in this chapter. They will have some familiaritywith some of the terms; however, remind them that these words may havemeanings that are different in a cost accounting context.2.The distinction between inventoriable (or product) cost and period cost is animportant one that students may have some trouble grasping, as they areaccustomed to treating items such as wages, rent, utilities, and the like asexpenses of the period. Likewise, the term conversion cost is one that should bemastered early on.IV. CHAPTER OUTLINETEACHING POINT. The terminology in this chapter is importantfor the student to gain an understanding early in the course. Incovering the chapter, it is very beneficial to repeatedly askquestions such as: (1) What is the cost object in the situation? (2)What costs can be traced? and (3) Which costs are allocated?1Define and illustrate a cost object. . . examples of cost objects are products,services, activities, processes, and customers1.1Cost is a resource sacrificed or forgone to achieve a specific objective.1.2Actual cost is the historical amount, or cost incurred, as distinguished frombudgeted cost, which is the planned (or future) amount of cost.1.3Cost object is the purpose for which costs are being measured. Stated anotherway, the cost object is anything for which a measurement of costs is desired. For example, this can be a product, an assembly line, a product line, or a department.TEACHING POINT. Discuss with the students the concept ofcost object. Use different examples of cost objects. Help themrelate the concept to their own lives. The cost of taking a tripduring spring break, the cost of a date, the cost of a collegeeducation, and the cost of a single class—all make goodtalking points.(Exhibit 2-1 illustrates examples of cost objects at BMW.)1.4Cost Accumulation describes the process of accumulating costs in someorganized manner through the accounting system. Following accumulation, costs are assigned to the chosen cost object.1.5The process of cost assignment involves tracing and allocating costs,depending on the type of cost involved.Refer to Quiz Question 12Distinguish between direct costs and indirect costs. . . costs that are traced directly to the cost objectand indirect costs. . . costs that are allocated to the cost object2.1 Direct costs of a cost object are costs that are related to the cost object and canbe traced to it in an economically feasible manner. Many costs may be able to betraced to the cost object, but it is not always practical to do so from a cost-benefitperspective.2.2 Direct cost categories include direct materials and direct manufacturing labor.Direct materials are materials that go into the production of the product. Directlabor is the wages paid to workers who spend time working on the product.2.3 Indirect costs of a cost object are related to the cost object but cannot be tracedin an economically feasible manner. These costs are frequently referred to asfactory overhead, manufacturing overhead, or some similar term. These costsinclude supervisor salaries, supplies, or other costs incurred in the factory that arenot direct materials or direct labor.TEACHING POINT. Make the observation that the same costmay be direct or indirect depending on the cost object. Usesome illustrations. For example, a line supervisor in a factorycould be a direct cost if the cost object were the particularassembly line, but would be indirect if the finished product isthe cost object.2.4 There are several factors that affect the classification of costs as direct or indirect.Three of these factors include:•Materiality of the cost. The smaller the amount of the cost, the lesslikely that it is economically feasible to trace that cost to a particular costobject.•Ease of gathering the information. For example bar-code technologyhas made it possible to trace just about any material used in themanufacturing process.•Design of operations. A cost used exclusively for a specific cost objectcan be readily traced.(Exhibit 2-2 illustrates the assignment of direct and indirectcosts at BMW.)TEACHING POINT. Use an object in the classroom, such as astool or chair. Place it on a desk or somewhere the students caneasily see it. Ask: “W hat are the materials used in manufacturingthe object?” Once a list of materials is compiled, then have thestudents determine which are direct material costs and whichare indirect costs.Refer to Quiz Question 2 Exercise 2-17only ID as Direct or IndirectExplain variable costs and fixed costs. . . the two basic ways in which costs behave3.1 In order to adequately predict costs, their behavior must be understood. From abehavioral view, costs are classified as fixed or variable.3.2 A variable cost changes in proportion with changes in the activity level. Forexample, if the number of units produced doubles, direct materials (a variablecost) would double in total. Note, however, that the variable cost per unit staysthe same.3.3 Fixed costs do not change due to changes in the activity level. If units produceddoubles, fixed costs remain the same in total. However, when expressed on a per-unit basis, fixed costs would decline with an increase in activity.(Exhibit 2-3 displays the cost behavior of variable and fixedcosts in total.)3.4 Costs are not inherently fixed or variable; it depends on the defined cost object.They may be variable with respect to level of activity and fixed for another.3.5 A cost driver is what causes a cost to be incurred. Stated another way there is acause-and-effect relationship between the level of activity of the cost driver andthe cost incurred.TEACHING POINT. Use several examples that will help thestudents grasp this concept. For example, their cost ofgasoline is determined largely by the number of miles driven.This can also be used to illustrate that most costs, in realityhave multiple drivers. Gas cost is also affected by type ofdriving, the horsepower of the engine, and other factors.3.6 Relevant range is the range of activity within which costs behave as predicted.Outside this level of activity, costs behave differently. This is not a concept thatcan be determined from a textbook; observation of the actual costs must be donein order to determine this range.(Exhibit 2-4 illustrates the relevant range of fixed costs atThomas Transport Company.)3.7 In dealing with costs, it is important to distinguish between behaviors of costswhen expressed as unit costs and when dealing with total costs. Generally,decision makers should think in terms of total cost. However, in many decisionanalysis situations, calculating unit costs is essential.Refer to Quiz Question 3 Exercises 2-17 (fixed and variable) and 2-23Interpret unit costs cautiously. . . for many decisions, managers should use totalcosts, not unit costs4.1 Unit costs (also called average costs) are normally used in making decisions suchas product mix and pricing. However, managers should usually think in terms oftotal costs for most decisions.4.2 Fixed costs, when expressed on a unit basis can be misleading. For example, iffixed costs are $25,000 and you manufacture 5.000 units, fixed costs are $5 perunit. When production increases to 6,250 units, total fixed costs remain at$25,000, but the unit cost declines to $4. Avoid using the higher unit cost whenproduction level changes.Refer to Quiz Question 4 Exercise 2-275Distinguish among manufacturing companies,merchandising companies, and service-sectorcompanies. . . different types of companies face differentaccounting issues5.1 Manufacturing-sector companies purchase materials and components andconvert them into finished products.5.2 Merchandising-sector companies purchase and sell tangible products withoutchanging their basis form. These companies are known as retailers.5.3 Service-sector companies provide services (intangibles). However, there isfrequently a tangible aspect to the service.TEACHING POINT. Have the students name companies thatare representative of each sector. Likely, they will correctlyidentify the proper sector for each company. Point out,however, that a service company may have a tangible aspect,such as the tax return as the end product of a tax preparationservice. Conversely, a merchandising company mayemphasize the intangibles. As the saying goes, “sell the sizzle,not the steak.”Refer to Quiz Question 56Describe the three categories of inventoriescommonly found in manufacturing companies. . . the categories are direct materials, work inprocess, and finished goods6.1 The accounting system of a manufacturing company is more complex than for amerchandising or service company. The main reason for this complexity is in theinventories held by a manufacturer. These companies will have three types ofinventory.•Direct Materials Inventory, or simply Materials Inventory, consists of materials being held by the company, ready to begin the conversionprocess into a finished product.•Work-in-Process Inventory represents product partially worked on but not yet completed. WIP is a representation of what is on the factory floor.•Finished Goods Inventory is product that has been completed and has not yet been sold.6.2 Merchandising companies purchase products in their completed form and do notmake changes in their basic form. An inventory account for a merchandisingcompany is called Merchandise Inventory, or simply Inventory.6.3 The Work-in-Process account will have three debits, representing the three typesof manufacturing costs.•Direct material costs are the costs of materials that become part of the cost object and can be traced to the cost object in an economicallyfeasible manner.•Direct manufacturing labor costs include compensation ofmanufacturing labor that can be traced to the cost object in aneconomically feasible manner. This includes labor of workers who workdirectly on the product.•Indirect manufacturing costs are all manufacturing costs that are not direct materials or direct labor. These costs are allocated rather thantraced. Other terms for this category include manufacturing overhead orfactory overhead costs.Refer to Quiz Question 67Differentiate inventoriable costs. . . assets when incurred, then cost of goods soldfrom period costs. . . expenses of the period when incurred7.1 Inventoriable costs are all costs of a product that are considered assets on thebalance sheet. These costs are direct materials, direct labor, and factory overhead.They become a part of the cost of the product and are assets until sold, when they become cost of goods sold. These are also known as product costs.7.2 Period costs are all costs on the income statement other than cost of goods sold.Period costs are treated as expenses of the period in which they are incurred.7.3 Prime cost is a term used to describe all direct costs or direct materials plusdirect labor.7.4 Conversion cost is direct materials plus factory overhead. It is the cost ofconverting the materials into a finished product.TEACHING POINT. Many companies with highly automatedmanufacturing operations have little or no direct labor. Thesecompanies often only use two categories of manufacturingcosts—direct materials and conversion cost.7.5 Costs can be measured in different ways. The management accountant shoulddefine and understand the ways costs are measured in a particular company orsituation.TEACHING POINT. Labor costs can include only the wagepaid to the workers or it can be broadened to include the costof that labor to the employer—the wage rate plus the cost ofbenefits the employee receives. Overtime premium can betreated as direct labor or as overhead.(Exhibit 2-6 illustrates examples of period costs in a bank.)(Exhibit 2-7 shows the flow of costs through the three differenttypes of manufacturing inventory.)(Exhibit 2-8 uses a sample Cost of Goods Manufacturedschedule and a sample Income Statement to illustrate thecalculation and reporting of Cost of Goods Sold.)7.6 Two issues in cost measurement that require special attention are idle time andovertime premium. Idle time is wage paid for unproductive time caused by lackof orders, machine breakdowns, or other reasons. Overtime premium is the wagerate paid to workers in excess of their regular straight-time wage rate. Both ofthese are considered as overhead rather than direct labor costs.Refer to Quiz Questions 7 and 8 Assign Exercises 2-26 and 2-288Explain why product costs are computed indifferent ways for different purposes. . . examples are pricing and product-mixdecisions, government contracts, and financialstatements8.1 Product cost is a term with an ambiguous meaning because there are differentdefinitions of product cost depending on the purpose for measuring that cost.8.2 Pricing and product decisions require an emphasis on the total profitability ofdifferent products and would assign costs incurred in all business functions to theproduct.8.3 Contracting with government agenc ies is frequently done on the “product cost”plus a specified mark up. This is known as cost plus pricing. Governmentagencies frequently have detailed specifications about what costs can be includedin the cost base.8.4 Reporting product cost for financial statement purposes requires adherence toGAAP guidelines for costing.(Exhibit 2-11 illustrates how product costs can vary dependingon the purpose for which product cost is being calculated.)(Exhibit 2-12 lists alternative classifications of costs.)Refer to Quiz Question 99Describe a framework for cost accounting and costmanagement. . . three features that help managers makedecisions9.1 This chapter deals with a number of cost terms and purposes. These concepts canbe expressed in three features of cost accounting that have a wide range of usesin business applications.•Calculating the cost of products, services, and other cost objects.Managers use this information in a variety of ways to formulate strategyand make various decisions.•Obtaining information for planning and control and forperformance evaluation. Budgeting is the most commonly used tool forplanning and control and forces managers to:o Look aheado Translate strategy into planso Coordinate and communicate within the organizationo Provide a benchmark for evaluating performance•Analyzing the relevant information for making decisions. Managers must understand which revenues to consider and which to ignore in thedecision-making process. Management accounting can assist managers indetermining which costs are relevant.Refer to Quiz Question 10V. OTHER RESOURCESPlease visit the textbook companion website at . To download these and other resources, visit the Instructor’s Resource Center or access them on the Instructor’s Resource DVD (IR-DVD).The following exhibits were mentioned in this chapter of the Instructor’s Manual, and havebeen included in the PowerPoint Lecture presentation created specifically for this chapter.You may use the PowerPoint Lecture presentations “as is”, or modify them to suit yourindividual needs.Exhibit 2-1 illustrates examples of cost objects at BMW.Exhibit 2-2 illustrates the assignment of direct and indirect costs at BMW.Exhibit 2-3 displays the cost behavior of variable and fixed costs in total.Exhibit 2-4 illustrates the relevant range of fixed costs at Thomas Transport CompanyExhibit 2-6 illustrates examples of period costs in a bank.Exhibit 2-7 shows the flow of costs through the three different types of manufacturinginventory.Exhibit 2-8 uses a sample Cost of Goods Manufactured schedule and a sample IncomeStatement to illustrate the calculation and reporting of Cost of Goods Sold.Exhibit 2-11 illustrates how product costs can vary depending on the purpose for whichproduct cost is being calculated.Exhibit 2-12 lists alternative classifications of costs.Download pdf images of textbook illustrations and exhibits from the Image Library oraccess them via your IR-DVD.Solutions to Select End-of-Chapter Problems mentioned in this chapter, which have been fully worked out in PowerPoint, are available for download and included on the IR-DVD.CHAPTER 2 QUIZ1.Tanner Co. management desires cost information regarding their Rawhide brand. TheRawhide brand is a(n)a.cost object.b.cost driver.c.cost assignment.d.actual cost.2.The cost of replacement light bulbs on campus would be a direct cost to a college butwould need to be allocated as an indirect cost toa.departments.b.buildings.c.schools.d.individual student instruction.3.What is the total fixed cost of the shipping department of EZ-Mail Clothing Co. if it hasthe following information for 2002?Salaries $800,000 75% of employees on guaranteed contractsPackaging $400,000 depending on size of item(s) shippedPostage $500,000 depending on weight of item(s) shippedRent of warehouse space $250,000 annual leasea. $850,000b. $900,000c. $1,050,000d. $1,950,0004.Morton Graphics successfully bid on a job printing standard notebook covers during theyear using last year’s price of $0.27 per cover. This amount was calculated from prioryear costs, noting that no changes in any costs had occurred from the past year to thecurrent year. At the end of the year, the company manager was shocked to discover that the company had suffered a loss. “How could this be?” she exclaimed. “We had noincreases in cost and our price was the same as last year. Last year we had a healthyincome.” What could explain the company’s loss in income this current year?a.Their costs were all variable costs and the amount produced and sold increased.b.Their costs were mostly fixed costs and the amount produced this year was lessthan last year.c.They used a different cost object this year than the previous year.d.Their costs last year were actual costs but they used budgeted costs to make theirbids.5.Which type of company converts materials into finished products?a.Not-for-profitb.Servicec.Merchandisingd.Manufacturing6.The three categories of inventories commonly found in many manufacturing companiesare:a.Direct materials, direct labor, and indirect manufacturing costs.b.Purchased goods, period costs, and cost of goods sold.c.Direct materials, work in process, and finished goods.d.LIFO, FIFO, and weighted average.7.Inventoriable costs area.only purchased goods for resale.b. a category of costs used only for manufacturing companies.c.recorded as expenses when incurred and later reclassified as assets.d.recorded as assets when incurred.8.Period costs area.all costs in the income statement other than cost of goods sold.b.defined as manufacturing costs incurred this period on the schedule of cost ofgoods manufactured.c.always recorded as assets when first incurred.d.those costs that benefit future periods.9.The cost of a product can be measured as any of the following except as costa.gathered from all areas of the value chain.b.identified as period cost.c.designated as manufacturing cost only.d.explicitly defined by contract.10.The primary focus of cost management is toa.help managers make different decisions.b.calculate product costs.c.aid managers in budgeting.d.distinguish between relevant and irrelevant information.CHAPTER 2 QUIZ SOLUTIONS1. a2. d3. a4. b5. c6. c7. d8. a9. b10. aQuiz Question Calculations3. Fixed costs = (800,000) 75% + 250,000 = $850,000。