国际内部审计专业实务框架

- 格式:docx

- 大小:95.85 KB

- 文档页数:139

国际内部审计专业实务框架

国际内部审计专业实务框架是由国际内部审计协会(IIA)推出的一套标准,旨在帮助内部审计部门有效地管理和实施内部审计工作,提高内部审计的质量和效率。

该框架由两个部分组成:核心实践要素,以及一系列支持实践的支持资源。

核心实践要素包括十大主要领域:策略、规划、聚焦审计、评估及报告、持续支持、审计服务、项目管理、风险管理、人员及组织和沟通协调。

每个领域涵盖不同的实践方法以及有针对性的标准,要求审计机构确保内部审计能够有效地实施。

支持实践的支持资源包括三个主要方向:技术支持、制度支持和管理环境支持。

技术支持资源包括战略审计、人力资源审计、信息系统审计、绩效审计和财务审计等,制度支持可以帮助实施质量评估,以及编制内部审计规程、审计方案、审计程序、审计电子文件等,而管理环境支持则可以帮助建立内部审计机制,满足审计部门的报告组织、能力管理和认可等诉求。

国际内部审计专业实务框架的实施不仅提高审计机构的质量,而且还可以为企业审计机构提供重要的依据,使企业能够建立一套有效的内部审计管理制度。

它有助于保持内部控制固有的有效性,以及改善内部审计工作绩效,避免出现问题和争议,满足企业对可靠财务报告和整体风险管理的需求。

国际内部审计专业实务框架(2011年1月1日)银星集团审计部XXTEL:XX邮箱:459069297@2/28/2012 3:14 PM内部审计定义目职业道德规范录实务标准2/28/2012 3:14 PM国际内部审计师协会1987年11月,中国内部审计学会(2002年5月改名为中国内部审计协会)加入了国际内部审计师协会。

IIA网址:/2/28/2012 3:14 PM内部审计观念传统观念◆成本中心◆非增值部门非增值部◆负责「寻找麻烦」的工作,小事化大◆工作不受重视◆是一个可有可无的部门是个可有可无的部门后果◆内部控制缺乏客观性◆可能因其它工作压力而被忽视◆董事会得到的信心保证大减◆经营风险上升◆内部控制过程严重崩溃2/28/2012 3:14 PM世通公司内部审计师·CynthiaCooper)辛西娅库珀(Cynthia Cooper)2002年,揭发世通在以往年度隐瞒亏损,把应计当期费用资本化为固定资产,透过折旧把当期费用分年摊销入损益表。

调查结果,世通从2000和2001年度原审核净利润76亿美元和24 亿美元调整为净亏损489亿美元和92亿美元虚增资产少计费用及错计收入等共虚报利润高达亏损489亿美元和92 亿美元,虚增资产、少计费用及错计收入等共虚报利润高达740亿多美元。

公布利润需要作出调整之后,股价由最高64美元跌至最低0.9美元,裁减员工17,000人。

安然公司副总裁莎朗·沃特金斯(SherronWatkins)安然公司副总裁莎朗·沃特金斯(Sherron Watkins)2001年10月份,安然突然传出接近6亿美元亏损的季度财务报告。

调查结果,安然被迫承认做了假账,自1997年以来,虚报盈利大约6亿美元,并把即将到期的39亿美元的债务隐瞒了24亿美元。

2001年11月28日,曾高逾90美元的安然公司股票一天之内暴跌75%;两天后,又2001年11月28日,曾高逾90美元的安然公司股票天之内暴跌75%;两天后,又跌至每股0.26美元,股价缩水到不足高峰时期的0.3%。

国际内部审计专业实务框架试题(答案版)1.国际内部审计专业实务框架(IPPF)强制性指南包括:Ⅰ.内部审计定义Ⅱ.职业道德规范Ⅲ.实务公告Ⅳ.立场公告Ⅴ.实务指南Ⅵ.内部审计实务标准A.Ⅱ、Ⅲ、ⅥB.Ⅰ、Ⅱ、ⅥC.Ⅰ、Ⅱ、Ⅲ、ⅣD.Ⅱ、Ⅲ、Ⅴ、Ⅵ2.内部审计是一种独立、客观的和活动。

A.确认、咨询B.监督、评价C.监督、服务D.确认、评价3.《职业道德规范》要求内部审计师应当运用并信守以下原则:A.诚信、客观、独立、保密B.诚实、独立、保密、胜任C.诚实、客观、独立、胜任D.诚信、客观、保密、胜任4.以下关于内部审计章程的说法不正确的是:A.内部审计章程是确定内部审计活动宗旨、权利和职责的正式文件。

B.内部审计章程的最终审批权在董事会。

C.向组织提供的确认服务的性质必须在内部审计章程中规定。

D.咨询服务的性质可以不在内部审计章程中规定。

5.以下那种情况表明内部审计师的客观性受到损害:Ⅰ.内部审计师为其在上一年度内负责的业务提供确认服务。

Ⅱ.确认服务涉及首席审计执行官负责的职能领域时,由独立于内部审计部门的某一方进行监督。

Ⅲ.内部审计师对其以往负责的业务提供咨询服务。

Ⅳ.内部审计师可能会损害拟开展的咨询服务的独立性或客观性时,在接受该业务之后向客户进行披露。

A.Ⅰ、ⅢB.Ⅰ、ⅣC.Ⅰ、Ⅲ、ⅣD.Ⅰ、Ⅱ、Ⅲ、Ⅳ6.以下那几项是IPPF对专业能力的要求:Ⅰ.内部审计师缺乏完成全部或部分业务所需的知识、技能或其他能力时,首席审计执行官必须向他人寻求充分的专业建议和协助。

Ⅱ.内部审计师必须充分了解有关评估舞弊风险以及所在组织管理舞弊风险的知识,但不期望所有内部审计师掌握以发现和调查舞弊为首要职能的人员所具备的专门技能。

Ⅲ.所有内部审计师都必须熟练掌握信息技术审计的全部技能。

Ⅳ.当内部审计师缺乏完成全部或部分咨询业务所必需的知识、技能或其他能力时,首席审计执行官必须谢绝开展此项业务。

A.Ⅱ、Ⅲ、ⅣB.Ⅰ、ⅡC.Ⅱ、ⅣD.Ⅰ、Ⅱ、Ⅲ7.为保持应有的职业审慎,内部审计师必须考虑的因素包括:Ⅰ.为实现业务目标而需要开展工作的范围。

《内部审计实务框架》当前各国内部审计遵循的《内部审计实务框架》由三个层次组成:(一)第一个层次是强制性的,其核心内容有《内部审计定义》、《道德准则》、《内部审计实务准则》。

1 定义《内部审计定义》内部审计师协会在最新的《内部审计定义》中将内部审计定义为:“内部审计是一项独立、客观的鉴证和咨询服务,其目标在于增加价值并改进组织的经营.它通过一套系统、规范的方法评价和改进风险管理、控制和治理过程的效果,以帮助组织达到目标.”[1]2 道德准则。

《道德准则》制定道德准则的目的是在内部审计职业内促进道德文化。

道德准则对于内部审计职业来说是必要和适当的,这是由于内部审计是建立在一种信任的基础上的,这种基础对风险管理、控制和治理提供了客观保证.道德准则在内部审计定义上加以扩展。

3 实务准则.《内部审计实务准则》《内部审计实务准则》由《属性准则》、《绩效准则》、《执行准则》组成。

《属性准则》论述从事内部审计活动的组织和个人的特性.《绩效准则》则论述内部审计活动的本质,并提供衡量内部审计绩效的质量标准。

《属性准则》和《绩效准则》适用于全部内部审计活动。

《执行准则》将《属性准则》和《绩效准则》运用于特定业务(如遵循性审计、舞弊调查、对控制的自我评估项目)。

《属性准则》和《绩效准则》只有一套,而《执行准则》可能有多套,每套对应内部审计活动的一种主要类型.(二)第二个层次是《实务建议》(即以前的指南),不是强制性的,但是也经过国际内部审计师协会批准并强烈推荐使用.它能够帮助解释内部审计实务准则,或将准则运用于特定的内部审计环境。

虽然有一些实务建议可能适用于所有内部审计师,但其他的主要用于特定的行业、特定的审计领域,或者特定的地域。

(三)第三个层次是《发展和实务指南》,包括了各类由国际内部审计师协会开发或者批准的材料,不具有强制性。

其中包括研究报告、书籍、讨论会以及其他还没有资格成为强制性准则的与内部审计实务有关的产品和服务,是审计实务框架中内容最多、最广泛的部分。

IIA International Professional Practice Framework(IPPF) 国际内部审计专业实务框架(国际内部审计师协会2009年1月修订)(红皮书)中国内部审计协会译★内部审计定义★职业道德规范★国际内部审计专业实务标准★实务公告修订说明作为整合IIA所发布标准的概念性框架,《国际内部审计专业实务框架》的范围缩减到只包括由IIA国际技术委员会按照适当程序制定的权威标准。

该权威标准由以下两部分构成:强制性指南。

遵循强制性指南的原则对于内部审计专业实务是必须且重要的。

强制性指南的制定遵循既定的尽职审查程序,包括公布征求意见稿,广泛听取各界的意见。

《国际内部审计专业实务框架》的三个强制部分为“内部审计定义”、《职业道德规范》和《国际内部审计专业实务标准》(以下简称《标准》)。

强力推荐的指南。

强力推荐的指南是IIA通过正式批准程序认可的,阐述有效执行“内部审计定义”、《职业道德规范》和《标准》的实务,包括立场公告、实务公告和实务指南。

↓新版IPPF所作的重大改变是:(1)程序改进。

加强了IPPF的各个部分,提高了透明度并确定了权威标准和修订周期。

标准的修订周期目前确定为三年,尽管并非每三年都需要进行修改,IIA 仍致力于确保对标准作全面的审核,并视需要进行修订。

(2)发展与实务帮助。

这一部分不再纳入柜架体系。

它曾经包含了内部审计师在工作过程中可能会用到的所有资源(例如培训、出版物和研究报告等)。

由于新版IPPF的范围只包括上述的权威标准,这项内容不再适合于新的框架。

(3)释义。

这是新增的对标准中的术语和短语作出的进一步阐释,置于需要加以解释的相关标准条款之下。

(4)实务公告。

这部分内容在范围上已经缩减为只包括用于实施“内部审计定义”,《职业道德规范》和《标准》的技术和方法。

原框架中涉及工具及技术方法的内容已经移至实务指南部分。

(5)实务指南的立场公告。

这是IPPF新增的内容,实务指南侧重于在工具和技术的具体运用方面提供指引,包括详细的流程、程序、方案和步骤(例如每一步所形成的结果的范例)。

1000-宗旨、权力和职责内部审计部门的宗旨、权力和职责必须在内部审计章程中按照内部审计定义、《职业道德规范》和《标准》的相关内容正式确定。

首席审计执行官必须定期审查内部审计章程,并提交高级管理层和董事会审批。

释义内部审计章程是确定内部审计活动宗旨、权力和职责的正式文件。

它确立了内部审计部门在组织内部的地位,授权内部审计部门接触与业务开展相关的记录、人员和实物资产,界定内部审计活动的范围。

内部审计章程的最终审批权在董事会。

1000.A1---向组织提供的确认服务的性质必须在内部审计章程中明确规定。

如果内部审计部门向组织外部的有关方面提供确认服务,则此类确认服务的性质也必须在内部审计章程中确定。

1000.C1---咨询服务的性质必须在内部审计章程中确定。

1010-在内部审计章程中确认“内部审计定义”、《职业道德规范》和《标准》“内部审计定义”、《职业道德规范》和《标准》的强制性质必须在内部审计章程中得到确认。

首席审计执行官应当向高级管理层和董事会解释并讨论“内部审计定义”、《职业道德规范》和《标准》。

1100-独立性和客观性内部审计部门必须保持其独立性,内部审计师必须客观地开展工作。

释义独立性指内部审计部门或首席审计执行官不偏不倚地履行职责,免受任何威胁其履职能力的情况影响。

要达到有效履行内部审计部门职责所必须的独立程度,首席审计执行官需要直接且无限制地与高级管理层和董事会接触。

这一要求可以通过建立双重报告关系来实现。

独立性所面临的各种威胁必须在审计师个人、具体业务、职能部门和整个组织等不同层面上得到解决。

客观性指不偏不倚的工作态度,保持客观性,内部审计师方可在开展业务时确信其工作成果,不做任何质量方面的妥协。

客观性要求内部审计师对于审计事项的判读不得屈服于他人。

客观性所面临的各种威胁必须在审计师个人、具体业务、职能部门和整个组织等不同层面上得到解决。

1110-组织的独立性首席审计执行官必须向组织内部能够确保内部审计部门履行职责的层级报告。

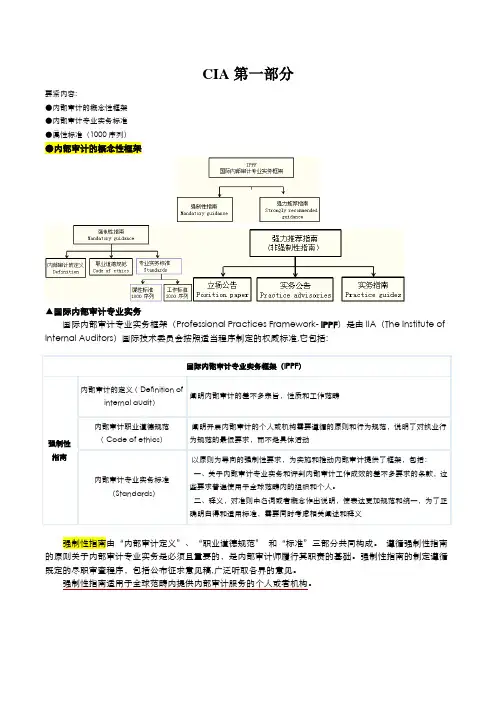

CIA第一部分要紧内容:●内部审计的概念性框架●内部审计专业实务标准●属性标准(1000序列)●内部审计的概念性框架▲国际内部审计专业实务国际内部审计专业实务框架(Professional Practices Framework- IPPF)是由IIA(The Institute of Internal Auditors)国际技术委员会按照适当程序制定的权威标准,它包括:国际内部审计专业实务框架(IPPF)强制性指南内部审计的定义( Definition ofinternal audit)阐明内部审计的差不多宗旨,性质和工作范畴内部审计职业道德规范( Code of ethics)阐明开展内部审计的个人或机构需要遵循的原则和行为规范,说明了对执业行为规范的最低要求,而不是具体活动内部审计专业实务标准(Standards)以原则为导向的强制性要求,为实施和推动内部审计提供了框架,包括:一、关于内部审计专业实务和评判内部审计工作成效的差不多要求的条款,这些要求普遍使用于全球范畴内的组织和个人。

二、释义,对准则中名词或者概念作出说明,使表达更加规范和统一,为了正确明白得和适用标准,需要同时考虑相关阐述和释义强制性指南由“内部审计定义”、“职业道德规范” 和“标准”三部分共同构成。

遵循强制性指南的原则关于内部审计专业实务是必须且重要的,是内部审计师履行其职责的基础。

强制性指南的制定遵循既定的尽职审查程序,包括公布征求意见稿,广泛听取各界的意见。

强制性指南适用于全球范畴内提供内部审计服务的个人或者机构。

强力举荐的指南是IIA通过正式批准程序认可的,阐述有效执行内部审计定义, 职业道德规范和标准的实务, 包括立场公告、实务公告和实务指南三部分。

强力举荐的指南尽管不具有强制性, 但它有助于对标准进行说明, 或将标准应用于特定内部审计环境中。

强力举荐的指南能够由胜任的内部审计师凭借其专业判定加以运用。

【典型试题】1、内部审计专业界使用的标准,不包括以下哪项内容?a.用于评估和衡量内部审计部门运行情形的标准。

1000-宗旨、权力和职责内部审计部门的宗旨、权力和职责必须在内部审计章程中按照内部审计定义、《职业道德规范》和《标准》的相关内容正式确定。

首席审计执行官必须定期审查内部审计章程,并提交高级管理层和董事会审批。

释义内部审计章程是确定内部审计活动宗旨、权力和职责的正式文件。

它确立了内部审计部门在组织内部的地位,授权内部审计部门接触与业务开展相关的记录、人员和实物资产,界定内部审计活动的范围。

内部审计章程的最终审批权在董事会。

1000.A1---向组织提供的确认服务的性质必须在内部审计章程中明确规定。

如果内部审计部门向组织外部的有关方面提供确认服务,则此类确认服务的性质也必须在内部审计章程中确定。

1000.C1---咨询服务的性质必须在内部审计章程中确定。

1010-在内部审计章程中确认“内部审计定义”、《职业道德规范》和《标准》“内部审计定义”、《职业道德规范》和《标准》的强制性质必须在内部审计章程中得到确认。

首席审计执行官应当向高级管理层和董事会解释并讨论“内部审计定义”、《职业道德规范》和《标准》。

1100-独立性和客观性内部审计部门必须保持其独立性,内部审计师必须客观地开展工作。

释义独立性指内部审计部门或首席审计执行官不偏不倚地履行职责,免受任何威胁其履职能力的情况影响。

要达到有效履行内部审计部门职责所必须的独立程度,首席审计执行官需要直接且无限制地与高级管理层和董事会接触。

这一要求可以通过建立双重报告关系来实现。

独立性所面临的各种威胁必须在审计师个人、具体业务、职能部门和整个组织等不同层面上得到解决。

客观性指不偏不倚的工作态度,保持客观性,内部审计师方可在开展业务时确信其工作成果,不做任何质量方面的妥协。

客观性要求内部审计师对于审计事项的判读不得屈服于他人。

客观性所面临的各种威胁必须在审计师个人、具体业务、职能部门和整个组织等不同层面上得到解决。

1110-组织的独立性首席审计执行官必须向组织内部能够确保内部审计部门履行职责的层级报告。

国际内部审计专业实务框架国际内部审计专业实务框架修订说明鉴于全球内部审计职业的快速发展,2006年国际内部审计师协会(IIA)理事会组建了筹划指导委员会和专门小组,重新审视《内部审计专业实务框架》(PPF)及相关制定过程,重点是回顾该专业实务框架的范围,增加专业标准制定、复核及颁布过程的透明度和一贯性。

专门小组的工作结果形成了全新的《国际内部审计专业实务框架》(IPPF)和重新改组的专业实务委员会(PPC)。

根据IIA理事会2007年6月批准的使命声明,专业实务委员会目前负责协调《国际内部审计专业实务框架》的审核与发布工作。

作为整合IIA所发布标准的概念性框架,《国际内部审计专业实务框架》的范围缩减到只包括由IIA国际技术委员会按照适当程序制定的权威标准。

该权威标准由以下两部分构成:强制性指南。

遵循强制性指南的原则对于内部审计专业实务是必须且重要的。

强制性指南的制定遵循既定的尽职审查程序,包括公布征求意见稿,广泛听取各界的意见。

《国际内部审计专业实务框架》的三个强制部分为“内部审计定义”、《职业道德规范》和《国际内部审计专业实务框架》(以下简称《标准》)。

强力推荐的指南。

强力推荐的指南是IIA通过正式批准程序认可的,阐述有效执行“内部审计定义”、《职业道德规范》和《标准》的实务,包括立场公告、实务公告和实务指南。

新版IPPF所作的重大改变是:(l)程序改进。

加强了IPPF的各个部分,提高了透明度并确定了权威标准的修订周期。

标准的修订周期目前确定为三年,尽管并非每三年都需要进行修改,IIA仍致力于确保对标准作全面的审核,并视需要进行修订。

(2)发展与实务帮助。

这一部分不再纳入框架体系。

它曾经包含了内部审计师在工作过程中可能会用到的所有资源(例如培训、出版物和研究报告等)。

由于新版IPPF的范围只包括上述的权威标准,这项内容不再适合于新的框架。

(3)释义。

这是新增的对标准中的术语和短语作出的进一步阐释,置于需要加以解释的相关标准条款之下。

CIA红皮书-国际内部审计专业实务框架-2009年1月修订属性标准 (3)1000-宗旨、权力和职责 (3)1100-独立性和客观性 (3)1110-组织的独立性 (3)1130-对独立性或客观性的损害 (4)1200-专业能力与应有的职业审慎 (4)1210-专业能力 (4)1220-应有的职业审慎 (4)1230-持续职业发展 (5)1300-质量保证与改进程序 (5)1310-质量保证与改进程序的要求 (5)1311-内部评估 (5)1312-外部评估 (6)1320-对质量保证与改进程序的报告 (6)1321-对“遵循《标准》”的应用 (6)1322-对未遵循情况的披露 (6)工作标准 (6)2000-内部审计活动的管理 (6)2010-计划 (7)2020-沟通与批准 (7)2030-资源管理 (7)2040-政策与程序 (7)2050-协调 (7)2060-向高级管理层和董事会报告 (7)2100-工作性质 (8)2110-治理 (8)2120-风险管理 (8)2130-控制 (9)2200-业务计划 (9)2210-业务目标 (9)2220-业务范围 (10)2230-业务资源的分配 (10)2240-业务工作方案 (10)2300-业务的实施 (10)2310-识别信息 (10)2320-分析评价 (10)2330-记录信息 (10)2340-业务的督导 (11)2400-结果的报告 (11)2410-报告标准 (11)2420-报告的质量 (11)2421-错误与遗漏 (11)2430-对“遵循《标准》”的应用 (12)2431-对未遵循情况的披露 (12)2440-结果的发送 (12)2500-监督进展 (12)2600-高级管理层接受风险的决定 (12)实务公告 (16)实务公告1000-1 内部审计章程 (16)实务公告1110-1 组织的独立性 (16)实务公告1120-1 个人客观性 (17)实务公告1130-1 对独立性或客观性的损害 (18)实务公告1210-1 专业能力 (20)实物公告1220-1 应有的职业审慎 (22)实务公告1230-1 持续职业发展 (23)实务公告1312-1 外部评估 (25)实务公告1312-2 外部评估:独立审定的自我评估 (28)实务公告1321-1 对“遵循《标准》”的应用 (29)实务公告2010-1 审计计划对风险和风险暴露的关注 (29)实务公告2020-1 沟通与批准 (30)实务公告2030-1 资源管理 (30)实务公告2040-1 政策与程序 (31)实务公告2050-1 协调 (32)实务公告2060-1 向高级管理层和董事会报告 (32)实务公告2120-1 评估风险管理过程的适当性 (33)实务公告2130-1 评估控制程序的适当性 (34)实务公告2130-A1.1 信息的可靠性和完整性 (36)实务公告2130.A1-2 (36)实务公告2200-1 业务计划 (37)实务公告2210-1 业务目标 (38)实务公告2210.A1-1 业务计划中的风险评估 (38)实务公告2230-1 业务资源的分配 (39)实务公告2240-1 业务工作方案 (39)实务公告2230-1 记录信息 (39)实务公告2330.A1-1 对业务记录的控制 (40)实务公告2330.A2-1 保存记录 (40)实务公告2340-1 业务的督导 (40)实务公告2410-1 报告标准 (41)实务公告2420-1 报告的质量 (43)实务公告2440-1 结果的发放 (43)实务公告2500-1 监督进展 (44)实务公告2500.A1-1 后续程序 (44)属性标准1000-宗旨、权力和职责内部审计部门的宗旨、权力和职责必须在内部审计章程中按照内部审计定义、《职业道德规范》和《标准》的相关内容正式确定。

INTERNATIONAL STANDARDS FOR THE PROFESSIONALPRACTICE OFINTERNAL AUDITING (STANDARDS)Introduction to the International StandardsInternal auditing is conducted in diverse legal and cultural environments; within organizations that vary in purpose, size, complexity, and structure; and by persons within or outside the organization. While differences may affect the practice of internal auditing in each environment, conformance with The IIA’s International Standards for the Professional Practice of Internal Auditing (Standards) is essential in meeting the responsibilities of internal auditors and the internal audit activity.If internal auditors or the internal audit activity is prohibited by law or regulation from conformance with certain parts of the Standards, conformance with all other parts of the Standards and appropriate disclosures are needed.If the Standards are used in conjunction with standards issued by other authoritative bodies, internal audit communications may also cite the use of other standards, as appropriate. In such a case, if inconsistencies exist between the Standards and other standards, internal auditors and the internal audit activity must conform with the Standards, and may conform with the other standards if they are more restrictive.The purpose of the Standards is to:1. Delineate basic principles that represent the practice of internalauditing.2. Provide a framework for performing and promoting a broadrange of value-added internal auditing.Issued: October 2008 Page 1 of 353. Establish the basis for the evaluation of internal auditperformance.4. Foster improved organizational processes and operations.The Standards are principles-focused, mandatory requirements consisting of:∙Statements of basic requirements for the professional practice of internal auditing and for evaluating the effectiveness of performance, which are internationally applicable at organizational and individual levels.∙Interpretations, which clarify terms or concepts within the Statements.The Standards employ terms that have been given specific meanings that are included in the Glossary. Specifically, the Standards use the word ―must‖ to specify an unconditional requirement and the word ―should‖ where conformance is expected unless, when applying professional judgment, circumstances justify deviation.It is necessary to consider the Statements and their Interpretations as well as the specific meanings from the Glossary to understand and apply the Standards correctly.The structure of the Standards is divided between Attribute and Performance Standards. Attribute Standards address the attributes of organizations and individuals performing internal auditing. The Performance Standards describe the nature of internal auditing and provide quality criteria against which the performance of these services can be measured. The Attribute and Performance Standards are also provided to apply to all internal audit services. Implementation Standards are also provided to expand upon the Attribute and Performance standards, by providing the requirements applicable to assurance (A) or consulting (C) activities.Assurance services involve the internal auditor’s objective assessment of evidence to provide an independent opinion or conclusionsregarding an entity, operation, function, process, system, or other subject matter. The nature and scope of the assurance engagement are determined by the internal auditor. There are generally three parties involved in assurance services: (1) the person or group directly involved with the entity, operation, function, process, system, or other subject matter — the process owner, (2) the person or group making the assessment —the internal auditor, and (3) the person or group using the assessment — the user.Consulting services are advisory in nature, and are generally performed at the specific request of an engagement client. The nature and scope of the consulting engagement are subject to agreement with the engagement client. Consulting services generally involve two parties: (1) the person or group offering the advice —the internal auditor, and (2) the person or group seeking and receiving the advice —the engagement client. When performing consulting services the internal auditor should maintain objectivity and not assume management responsibility.The review and development of the Standards is an ongoing process. The Internal Audit Standards Board engages in extensive consultation and discussion prior to issuing the Standards. This includes worldwide solicitation for public comment through the exposure draft process. All exposure dr afts are posted on The IIA’s Web site as well as being distributed to all IIA institutes.Suggestions and comments regarding the Standards can be sent to:The Institute of Internal AuditorsStandards and Guidance247 Maitland AvenueAltamonte Springs, FL 32701-4201, USAE-mail: guidance@ Web: ***INTERNATIONAL STANDARDS FOR THE PROFESSIONALPRACTICEOF INTERNAL AUDITING (STANDARDS)Attribute Standards1000 – Purpose, Authority, and ResponsibilityThe purpose, authority, and responsibility of the internal audit activity must be formally defined in an internal audit charter, consistent with the Definition of Internal Auditing, the Code of Ethics, and the Standards. The chief audit executive must periodically review the internal audit charter and present it to senior management and the board for approval.Interpretation:The internal audit charter is a formal document that defines the internal audit activity's purpose, authority, and responsibility. The internal audit charter establishes the internal audit activity's position within the organization, including the nature of the chief audit executive’s functional reporting relationship with the board; authorizes access to records, personnel, and physical properties relevant to the performance of engagements; and defines the scope of internal audit activities. Final approval of the internal audit charter resides with the board.1000.A1 –The nature of assurance services provided to the organization must be defined in the internal audit charter. If assurances are to be provided to parties outside the organization, the nature of these assurances must also be defined in the internal audit charter.1000.C1 – The nature of consulting services must be defined in the internal audit charter.1010 –Recognition of the Definition of Internal Auditing, the Code of Ethics, and the Standards in the Internal Audit Charter The mandatory nature of the Definition of Internal Auditing, the Code of Ethics, and the Standards must be recognized in the internal audit charter. The chief audit executive should discuss the Definition of Internal Auditing, the Code of Ethics, and the Standards with senior management and the board.1100 – Independence and ObjectivityThe internal audit activity must be independent, and internal auditors must be objective in performing their work.Interpretation:Independence is the freedom from conditions that threaten the ability of the internal audit activity to carry out internal audit responsibilities in an unbiased manner. To achieve the degree of independence necessary to effectively carry out the responsibilities of the internal audit activity, the chief audit executive has direct and unrestricted access to senior management and the board. This can be achieved through a dual-reporting relationship. Threats to independence must be managed at the individual auditor, engagement, functional, and organizational levels.Objectivity is an unbiased mental attitude that allows internal auditors to perform engagements in such a manner that they believe in their work product and that no quality compromises are made. Objectivity requires that internal auditors do not subordinate their judgment on audit matters to others. Threats to objectivity must be managed at the individual auditor, engagement, functional, and organizational levels. 1110 – Organizational IndependenceThe chief audit executive must report to a level within the organization that allows the internal audit activity to fulfill its responsibilities. The chief audit executive must confirm to the board, at least annually, the organizational independence of the internal audit activity.Interpretation:Organizational independence is effectively achieved when the chief audit executive reports functionally to the board. Examples of functional reporting to the board involve the board:∙Approving the internal audit charter;∙Approving the risk based internal audit plan;∙Receiving communications from the chief audit executive on the internal audit activity’s performance relative to its plan and other matters;∙Approving decisions regarding the appointment and removal of the chief audit executive; and∙Making appropriate inquiries of management and the chief audit executive to determine whether there are inappropriate scope or resource limitations.1110.A1 –The internal audit activity must be free from interference in determining the scope of internal auditing, performing work, and communicating results.1111 – Direct Interaction with the BoardThe chief audit executive must communicate and interact directly with the board.1120 – Individual ObjectivityInternal auditors must have an impartial, unbiased attitude and avoid any conflict of interest.Interpretation:Conflict of interest is a situation in which an internal auditor, who is in a position of trust, has a competing professional or personal interest. Such competing interests can make it difficult to fulfill his or her duties impartially. A conflict of interest exists even if no unethical or improper act results. A conflict of interest can create an appearance of impropriety that can undermine confidence in the internal auditor, the internal audit activity, and the profession. A conflict of interest couldimpair an individual's ability to perform his or her duties and responsibilities objectively.1130 – Impairment to Independence or ObjectivityIf independence or objectivity is impaired in fact or appearance, the details of the impairment must be disclosed to appropriate parties. The nature of the disclosure will depend upon the impairment. Interpretation:Impairment to organizational independence and individual objectivity may include, but is not limited to, personal conflict of interest, scope limitations, restrictions on access to records, personnel, and properties, and resource limitations, such as funding.The determination of appropriate parties to which the details of an impairment to independence or objectivity must be disclosed is dependent upon the expectations of the internal audit activity’s and the chief audit executive’s responsibilities to senior managem ent and the board as described in the internal audit charter, as well as the nature of the impairment.1130.A1 – Internal auditors must refrain from assessing specificoperations for which they were previously responsible.Objectivity is presumed to be impaired if an internal auditorprovides assurance services for an activity for which the internalauditor had responsibility within the previous year.1130.A2 – Assurance engagements for functions over which thechief audit executive has responsibility must be overseen by aparty outside the internal audit activity.1130.C1–Internal auditors may provide consulting servicesrelating to operations for which they had previous responsibilities.1130.C2–If internal auditors have potential impairments toindependence or objectivity relating to proposed consultingservices, disclosure must be made to the engagement client prior to accepting the engagement.1200 – Proficiency and Due Professional CareEngagements must be performed with proficiency and due professional care.1210 – ProficiencyInternal auditors must possess the knowledge, skills, and other competencies needed to perform their individual responsibilities. The internal audit activity collectively must possess or obtain the knowledge, skills, and other competencies needed to perform its responsibilities.Interpretation:Knowledge, skills, and other competencies is a collective term that refers to the professional proficiency required of internal auditors to effectively carry out their professional responsibilities. Internal auditors are encouraged to demonstrate their proficiency by obtaining appropriate professional certifications and qualifications, such as the Certified Internal Auditor designation and other designations offered by The Institute of Internal Auditors and other appropriate professional organizations.1210.A1–The chief audit executive must obtain competent advice and assistance if the internal auditors lack the knowledge, skills, or other competencies needed to perform all or part of the engagement.1210.A2 – Internal auditors must have sufficient knowledge to evaluate the risk of fraud and the manner in which it is managed by the organization, but are not expected to have the expertise ofa person whose primary responsibility is detecting andinvestigating fraud.1210.A3–Internal auditors must have sufficient knowledge of key information technology risks and controls and available technology-based audit techniques to perform their assigned work. However, not all internal auditors are expected to have the expertise of an internal auditor whose primary responsibility is information technology auditing.1210.C1 – The chief audit executive must decline the consulting engagement or obtain competent advice and assistance if the internal auditors lack the knowledge, skills, or other competencies needed to perform all or part of the engagement.1220 – Due Professional CareInternal auditors must apply the care and skill expected of a reasonably prudent and competent internal auditor. Due professional care does not imply infallibility.1220.A1– Internal auditors must exercise due professional care by considering the:∙Extent of work needed to achieve the engagement’s objectives;∙Relative complexity, materiality, or significance of matters to which assurance procedures are applied;∙Adequacy and effectiveness of governance, risk management, and control processes;∙Probability of significant errors, fraud, or noncompliance;and∙Cost of assurance in relation to potential benefits.1220.A2–In exercising due professional care internal auditors must consider the use of technology-based audit and other data analysis techniques.1220.A3– Internal auditors must be alert to the significant risks that might affect objectives, operations, or resources. However,assurance procedures alone, even when performed with due professional care, do not guarantee that all significant risks will be identified.1220.C1– Internal auditors must exercise due professional care during a consulting engagement by considering the:∙Needs and expectations of clients, including the nature, timing, and communication of engagement results;∙Relative complexity and extent of work needed to achieve the engagement’s objectives; and∙Cost of the consulting engagement in relation to potential benefits.1230 – Continuing Professional DevelopmentInternal auditors must enhance their knowledge, skills, and other competencies through continuing professional development.1300 – Quality Assurance and Improvement ProgramThe chief audit executive must develop and maintain a quality assurance and improvement program that covers all aspects of the internal audit activity.Interpretation:A quality assurance and improvement program is designed to enable an evaluation of the internal audit activity’s conformance with the Definition of Internal Auditing and the Standards and an evaluation of whether internal auditors apply the Code of Ethics. The program also assesses the efficiency and effectiveness of the internal audit activity and identifies opportunities for improvement.1310 – Requirements of the Quality Assurance and Improvement ProgramThe quality assurance and improvement program must include both internal and external assessments.1311 – Internal AssessmentsInternal assessments must include:∙Ongoing monitoring of the performance of the internal audit activity; and∙Periodic reviews performed through self-assessment or by other persons within the organization with sufficient knowledge of internal audit practices.Interpretation:Ongoing monitoring is an integral part of the day-to-day supervision, review, and measurement of the internal audit activity. Ongoing monitoring is incorporated into the routine policies and practices used to manage the internal audit activity and uses processes, tools, and information considered necessary to evaluate conformance with the Definition of Internal Auditing, the Code of Ethics, and the Standards. Periodic reviews are assessments conducted to evaluate conformance with the Definition of Internal Auditing, the Code of Ethics, and the Standards.Sufficient knowledge of internal audit practices requires at least an understanding of all elements of the International Professional Practices Framework.1312 – External AssessmentsExternal assessments must be conducted at least once every five years by a qualified, independent reviewer or review team from outside the organization. The chief audit executive must discuss with the board:∙The need for more frequent external assessments; and∙The qualifications and independence of the external reviewer or review team, including any potential conflict of interest. Interpretation:A qualified reviewer or review team demonstrates competence in two areas: the professional practice of internal auditing and the external assessment process. Competence can be demonstrated through a mixture of experience and theoretical learning. Experience gained in organizations of similar size, complexity, sector or industry, and technical issues is more valuable than less relevant experience. In the case of a review team, not all members of the team need to have all the competencies; it is the team as a whole that is qualified. The chief audit executive uses professional judgment when assessing whether a reviewer or review team demonstrates sufficient competence to be qualified.An independent reviewer or review team means not having either a real or an apparent conflict of interest and not being a part of, or under the control of, the organization to which the internal audit activity belongs.1320 –Reporting on the Quality Assurance and Improvement ProgramThe chief audit executive must communicate the results of the quality assurance and improvement program to senior management and the board.Interpretation:The form, content, and frequency of communicating the results of the quality assurance and improvement program is established through discussions with senior management and the board and considers the responsibilities of the internal audit activity and chief audit executive as contained in the internal audit charter. To demonstrate conformance with the Definition of Internal Auditing, the Code of Ethics, and the Standards, the results of external and periodic internal assessments are communicated upon completion of such assessments and the results of ongoing monitoring are communicated at least annually. The results include the reviewer’s or review team’s assessment with respect to the degree of conformance.1321 –Use of “Conforms with the International Standards for the Professional Practice of Internal Auditing”The chief audit executive may state that the internal audit activity conforms with the International Standards for the Professional Practice of Internal Auditing only if the results of the quality assurance and improvement program support this statement.Interpretation:The internal audit activity conforms with the Standards when it achieves the outcomes described in the Definition of Internal Auditing, Code of Ethics, and Standards. The results of the quality assurance and improvement program include the results of both internal and external assessments. All internal audit activities will have the results of internal assessments. Internal audit activities in existence for at least five years will also have the results of external assessments.1322 – Disclosure of NonconformanceWhen nonconformance with the Definition of Internal Auditing, the Code of Ethics, or the Standards impacts the overall scope or operation of the internal audit activity, the chief audit executive must disclose the nonconformance and the impact to senior management and the board.Performance Standards2000 – Managing the Internal Audit ActivityThe chief audit executive must effectively manage the internal audit activity to ensure it adds value to the organization.Interpretation:The internal audit activity is effectively managed when:∙The results of the internal audit activity’s work achieve the purpose and responsibility included in the internal audit charter;∙The internal audit activity conforms with the Definition of Internal Auditing and the Standards; and∙The individuals who are part of the internal audit activity demonstrate conformance with the Code of Ethics and the Standards.The internal audit activity adds value to the organization (and its stakeholders) when it provides objective and relevant assurance, and contributes to the effectiveness and efficiency of governance, risk management, and control processes.2010 – PlanningThe chief audit executive must establish risk-based plans to determine the priorities of the internal audit activity, consistent with the organization’s goals.Interpretation:The chief audit executive is responsible for developing a risk-based plan. The chief audit executive takes into account the organization’s risk management framework, including using risk appetite levels set by management for the different activities or parts of the organization. If a framework does not exist, the chief audit executive uses his/her own judgment of risks after consultation with senior management and the board.2010.A1–The internal audit activity’s plan of engagements must be based on a documented risk assessment, undertaken at least annually. The input of senior management and the board must be considered in this process.2010.A2– The chief audit executive must identify and consider the expectations of senior management, the board, and other stakeholders for internal audit opinions and other conclusions.2010.C1–The chief audit executive should consider accepting proposed consulting engagements based on the en gagement’s potential to improve management of risks, add value, and improve the organization’s operations. Accepted engagements must be included in the plan.2020 – Communication and ApprovalThe chief audit executive must communicate the internal audit activity’s plans and resource requirements, including significant interim changes, to senior management and the board for review and approval. The chief audit executive must also communicate the impact of resource limitations.2030 – Resource ManagementThe chief audit executive must ensure that internal audit resources are appropriate, sufficient, and effectively deployed to achieve the approved plan.Interpretation:Appropriate refers to the mix of knowledge, skills, and other competencies needed to perform the plan. Sufficient refers to the quantity of resources needed to accomplish the plan. Resources are effectively deployed when they are used in a way that optimizes the achievement of the approved plan.2040 – Policies and ProceduresThe chief audit executive must establish policies and procedures to guide the internal audit activity.Interpretation:The form and content of policies and procedures are dependent upon the size and structure of the internal audit activity and the complexity of its work.2050 – CoordinationThe chief audit executive should share information and coordinate activities with other internal and external providers of assurance and consulting services to ensure proper coverage and minimize duplication of efforts.2060 – Reporting to Senior Management and the BoardThe chief audit executive must report periodically to senior management and the board on the internal audit activity’s purpose, authority, responsibility, and performance relative to its plan. Reporting must also include significant risk exposures and control issues, including fraud risks, governance issues, and other matters needed or requested by senior management and the board. Interpretation:The frequency and content of reporting are determined in discussion with senior management and the board and depend on the importance of the information to be communicated and the urgency of the related actions to be taken by senior management or the board.2070 –External Service Provider and Organizational Responsibility for Internal AuditingWhen an external service provider serves as the internal audit activity, the provider must make the organization aware that the organization has the responsibility for maintaining an effective internal audit activity. InterpretationThis responsibility is demonstrated through the quality assurance and improvement program which assesses conformance with the Definition of Internal Auditing, the Code of Ethics, and the Standards. 2100 – Nature of WorkThe internal audit activity must evaluate and contribute to the improvement of governance, risk management, and control processes using a systematic and disciplined approach.2110 – GovernanceThe internal audit activity must assess and make appropriate recommendations for improving the governance process in its accomplishment of the following objectives:∙Promoting appropriate ethics and values within the organization;∙Ensuring effective organizational performance management and accountability;∙Communicating risk and control information to appropriate areas of the organization; and∙Coordinating the activities of and communicating information among the board, external and internal auditors, and management.2110.A1–The internal audit activity must evaluate the design, implementation, and effectiveness of the organization’s ethics-related objectives, programs, and activities.2110.A2 –The internal audit activity must assess whether the information technology governance of the organization supports the organization’s strategies and objectives.2120 – Risk ManagementThe internal audit activity must evaluate the effectiveness and contribute to the improvement of risk management processes.Interpretation:Determining whether risk management processes are effective is a judgment resulting from the internal auditor’s assessment that:∙Organizational objectives support and align with theorganization’s mission;∙Significant risks are identified and assessed;∙Appropriate risk responses are selected that align risks with the organization’s risk appetite; and∙ Relevant risk information is captured and communicated in a timely manner across the organization, enabling staff,management, and the board to carry out their responsibilities.The internal audit activity may gather the information to support this assessment during multiple engagements. The results of these engagements, when viewed together, provide an understanding of the organization’s risk management processes and their effectiveness.Risk management processes are monitored through ongoing management activities, separate evaluations, or both.2120.A1–The internal audit activity must evaluate risk exposures relating to the organization’s governance, operations, and information systems regarding the:∙Reliability and integrity of financial and operational information;∙Effectiveness and efficiency of operations and programs;∙Safeguarding of assets; and∙Compliance with laws, regulations, policies, procedures, and contracts.2120.A2 –The internal audit activity must evaluate the potential for the occurrence of fraud and how the organization manages fraud risk.。

IIA International Professional Practice Framework(IPPF) 国际部审计专业实务框架(国际部审计师协会2009年1月修订)(红皮书)中国部审计协会译★部审计定义★职业道德规★国际部审计专业实务标准★实务公告修订说明作为整合IIA所发布标准的概念性框架,《国际部审计专业实务框架》的围缩减到只包括由IIA国际技术委员会按照适当程序制定的权威标准。

该权威标准由以下两部分构成:强制性指南。

遵循强制性指南的原则对于部审计专业实务是必须且重要的。

强制性指南的制定遵循既定的尽职审查程序,包括公布征求意见稿,广泛听取各界的意见。

《国际部审计专业实务框架》的三个强制部分为“部审计定义”、《职业道德规》和《国际部审计专业实务标准》(以下简称《标准》)。

强力推荐的指南。

强力推荐的指南是IIA通过正式批准程序认可的,阐述有效执行“部审计定义”、《职业道德规》和《标准》的实务,包括立场公告、实务公告和实务指南。

↓新版IPPF所作的重大改变是:(1)程序改进。

加强了IPPF的各个部分,提高了透明度并确定了权威标准和修订周期。

标准的修订周期目前确定为三年,尽管并非每三年都需要进行修改,IIA 仍致力于确保对标准作全面的审核,并视需要进行修订。

(2)发展与实务帮助。

这一部分不再纳入柜架体系。

它曾经包含了部审计师在工作过程中可能会用到的所有资源(例如培训、出版物和研究报告等)。

由于新版IPPF 的围只包括上述的权威标准,这项容不再适合于新的框架。

(3)释义。

这是新增的对标准中的术语和短语作出的进一步阐释,置于需要加以解释的相关标准条款之下。

(4)实务公告。

这部分容在围上已经缩减为只包括用于实施“部审计定义”,《职业道德规》和《标准》的技术和方法。

原框架中涉及工具及技术方法的容已经移至实务指南部分。

(5)实务指南的立场公告。

这是IPPF新增的容,实务指南侧重于在工具和技术的具体运用方面提供指引,包括详细的流程、程序、方案和步骤(例如每一步所形成的结果的例)。

CIA红皮书-国际内部审计专业实务框架-2009年1月修订属性标准 (3)1000-宗旨、权力和职责 (3)1100-独立性和客观性 (3)1110-组织的独立性 (3)1130-对独立性或客观性的损害 (4)1200-专业能力与应有的职业审慎 (4)1210-专业能力 (4)1220-应有的职业审慎 (4)1230-持续职业进展 (5)1300-质量保证与改进程序 (5)1310-质量保证与改进程序的要求 (5)1311-内部评估 (5)1312-外部评估 (6)1320-对质量保证与改进程序的报告 (6)1321-对“遵循《标准》”的应用 (6)1322-对未遵循情况的披露 (6)工作标准 (6)2000-内部审计活动的治理 (6)2010-打算 (7)2020-沟通与批准 (7)2030-资源治理 (7)2040-政策与程序 (7)2050-协调 (7)2060-向高级治理层和董事会报告 (7)2100-工作性质 (8)2110-治理 (8)2120-风险治理 (8)2130-操纵 (9)2200-业务打算 (9)2210-业务目标 (9)2220-业务范围 (10)2230-业务资源的分配 (10)2240-业务工作方案 (10)2300-业务的实施 (10)2310-识不信息 (10)2320-分析评价 (11)2330-记录信息 (11)2340-业务的督导 (11)2400-结果的报告 (11)2410-报告标准 (11)2420-报告的质量 (12)2421-错误与遗漏 (12)2430-对“遵循《标准》”的应用 (12)2431-对未遵循情况的披露 (12)2440-结果的发送 (12)2500-监督进展 (13)2600-高级治理层同意风险的决定 (13)实务公告 (16)实务公告1000-1 内部审计章程 (16)实务公告1110-1 组织的独立性 (17)实务公告1120-1 个人客观性 (18)实务公告1130-1 对独立性或客观性的损害 (18)实务公告1210-1 专业能力 (20)实物公告1220-1 应有的职业审慎 (23)实务公告1230-1 持续职业进展 (23)实务公告1312-1 外部评估 (26)实务公告1312-2 外部评估:独立审定的自我评估 (28)实务公告1321-1 对“遵循《标准》”的应用 (29)实务公告2010-1 审计打算对风险和风险暴露的关注 .. 30实务公告2020-1 沟通与批准 (31)实务公告2030-1 资源治理 (31)实务公告2040-1 政策与程序 (32)实务公告2050-1 协调 (32)实务公告2060-1 向高级治理层和董事会报告 (33)实务公告2120-1 评估风险治理过程的适当性 (33)实务公告2130-1 评估操纵程序的适当性 (35)实务公告2130-A1.1 信息的可靠性和完整性 (36)实务公告2130.A1-2 (37)实务公告2200-1 业务打算 (38)实务公告2210-1 业务目标 (38)实务公告2210.A1-1 业务打算中的风险评估 (39)实务公告2230-1 业务资源的分配 (39)实务公告2240-1 业务工作方案 (39)实务公告2230-1 记录信息 (40)实务公告2330.A1-1 对业务记录的操纵 (40)实务公告2330.A2-1 保存记录 (41)实务公告2340-1 业务的督导 (41)实务公告2410-1 报告标准 (42)实务公告2420-1 报告的质量 (43)实务公告2440-1 结果的发放 (44)实务公告2500-1 监督进展 (44)实务公告2500.A1-1 后续程序 (45)属性标准1000-宗旨、权力和职责内部审计部门的宗旨、权力和职责必须在内部审计章程中按照内部审计定义、《职业道德规范》和《标准》的相关内容正式确定。

首席审计执行官必须定期审查内部审计章程,并提交高级治理层和董事会审批。

释义内部审计章程是确定内部审计活动宗旨、权力和职责的正式文件。

它确立了内部审计部门在组织内部的地位,授权内部审计部门接触与业务开展相关的记录、人员和实物资产,界定内部审计活动的范围。

内部审计章程的最终审批权在董事会。

1000.A1---向组织提供的确认服务的性质必须在内部审计章程中明确规定。

假如内部审计部门向组织外部的有关方面提供确认服务,则此类确认服务的性质也必须在内部审计章程中确定。

1000.C1---咨询服务的性质必须在内部审计章程中确定。

1010-在内部审计章程中确认“内部审计定义”、《职业道德规范》和《标准》“内部审计定义”、《职业道德规范》和《标准》的强制性质必须在内部审计章程中得到确认。

首席审计执行官应当向高级治理层和董事会解释并讨论“内部审计定义”、《职业道德规范》和《标准》。

1100-独立性和客观性内部审计部门必须保持其独立性,内部审计师必须客观地开展工作。

释义独立性指内部审计部门或首席审计执行官不偏不倚地履行职责,免受任何威胁其履职能力的情况阻碍。

要达到有效履行内部审计部门职责所必须的独立程度,首席审计执行官需要直接且无限制地与高级治理层和董事会接触。

这一要求能够通过建立双重报告关系来实现。

独立性所面临的各种威胁必须在审计师个人、具体业务、职能部门和整个组织等不同层面上得到解决。

客观性指不偏不倚的工作态度,保持客观性,内部审计师方可在开展业务时确信其工作成果,不做任何质量方面的妥协。

客观性要求内部审计师关于审计事项的判读不得屈服于他人。

客观性所面临的各种威胁必须在审计师个人、具体业务、职能部门和整个组织等不同层面上得到解决。

1110-组织的独立性首席审计执行官必须向组织内部能够确保内部审计部门履行职责的层级报告。

首席审计执行官必须至少每年一次向董事会确认内部审计部门在组织中的独立性。

1110.A1---内部审计部门在确定内部审计范围、开展工作和报告结果时,必须免受干扰。

1111-与董事会的直接互动首席审计执行官必须与董事会直接沟通和互动。

1120-个人的客观性内部审计师必须有公正、不偏不倚的态度,幸免任何利益冲突。

释义利益冲突时备受信赖的内部审计师面临与其职责相冲突的职业或个人利益的情况。

这些职业或个人利益会阻碍内部审计师公正地履行职责。

在不产生不道德或不恰当行为后果的情形下也会发生利益冲突。

利益冲突可造成不当表象,削弱人们对内部审计师、内部审计活动以及整个内部审计职业的信心。

利益冲突更可损害内部审计师个人客观履行其职责的能力。

1130-对独立性或客观性的损害假如独立性或客观性受到实质上或形式上的损害,必须向适当的对象披露损害的具体情况。

披露的性质视受损情况而定。

释义对组织独立性和个人客观性的损害可能包括但不限于:个人利益冲突,工作范围限制,接触记录、个人和实物资产的限制,在经费等资源方面受到约束等。

独立性或客观性受损的细节必须披露的适当对象,取决于内部审计章程所记载的内部审计部门和首席执行官应当对高级治理层和董事会承担的责任,以及损害的性质。

1130.A1---内部审计师必须幸免评价其以往负责的特定业务。

假如内部审计师为其在上一年度内负责的业务提供确认服务,则其客观性视为受到损害。

1130.A2---确认服务涉及首席审计执行官负责的职能领域时,必须由独立于内部审计部门的某一方面进行监督。

1130.C1 内部审计师能够对其以往负责的业务提供咨询服务。

1130.C2 若内部审计师可能会损害拟开展的咨询服务的独立性或客观性时,必须在同意该业务之前向客户披露。

1200-专业能力与应有的职业审慎内部审计师在开展业务时,必须具备专业能力和应有的职业审慎。

1210-专业能力内部审计师必须具备履行其职责所必须的知识、技能和其他能力。

内部审计部门整体必须具备或获得履行其职责所必须的知识、技能和其他能力。

释义“知识、技能和其他能力”是一个集合术语,是内部审计师有效履行其职责所必须的专业水平。

鼓舞内部审计师通过确定适当的专业资格证书和认证,例如国际内部审计协会和其他相关专业组织提供的“注册内部审计师”和其他认证,以证明其专业能力。

1210.A1---当内部审计师缺乏完成全部或部分业务所必须的知识、技能或其他能力时,首席审计执行官必须向他人寻求充分的专业建议和协助。

1210.A2---内部审计师必须充分了解有关评估舞弊风险以及所在组织治理舞弊风险的知识,但不期望内部审计师掌握以发觉和调查舞弊为首要职责的人员所具备的专业技能。

1210.A3---内部审计师缺乏完成全部或部分咨询业务所必须的知识、技能或其他能力时,首席审计执行官必须谢绝开展此项业务或寻求充分的建议和协助。

1220-应有的职业审慎内部审计师必须具备并保持合理的审慎水平和胜任能力所要求的慎重和技能。

然而,应有的职业审慎并不意味着永不犯错。

1220.A1---内部审计师必须通过考虑以下因素,履行其应有的职业审慎:为实现业务目标而需要开展工作的范围;所要确认事项的相对复杂性、重要性或严峻性;治理、风险治理和操纵过程的适当性和有效性;发生重大错误、舞弊或不合法的可能性;与潜在效益相对的确认成本。

1220.A2---在履行应有的职业审慎时,内部审计师必须考虑利用技术的审计方法和其他数据分析技术。

1220.A3---内部审计师必须警惕可能阻碍目标、运营或资源的重大风险。

然而,即使是应有的职业审慎开展工作,确认程序本身并不能保证发觉所有的重大风险。

1220.C1---开展咨询业务时,内部审计师必须考虑以下因素,履行其应有的职业审慎:客户的需要与愿望,包括咨询结果的性质、时刻安排与结果沟通;实现咨询业务目标所需开展工作的相对复杂性和范围;与潜在效益相对的咨询业务成本。

1230-持续职业进展内部审计师必须通过持续职业进展来增加知识、提高技能和其他能力。

1300-质量保证与改进程序内部审计执行官必须建立并维护涵盖内部审计活动所有方面的质量保证与改进程序。

释义质量保证与改进程序旨在对内部审计活动是否遵循“内部审计定义”和《标准》以及内部审计师是否遵守《职业道德规范》进行评估,还能够用来评价内部审计活动的效果和效率,并识不改进的机会。

1310-质量保证与改进程序的要求质量保证与改进程序必须包括内部评估和外部评估。

1311-内部评估内部评估必须包括:对内部审计活动执行情况的持续监督;通过自我评估或由组织内部其他充分了解内部审计实务的人员进行定期检查。

释义持续监督包含在对内部审计活动进行日常监督、检查和测试的过程中。

持续监督应纳入治理内部审计活动的日常政策和实践,运用不要的流程、工具和信息对内部审计活动是否遵循“内部审计定义”、《职业道德规范》和《标准》作出评估。