英文财产保险合同

- 格式:doc

- 大小:40.50 KB

- 文档页数:16

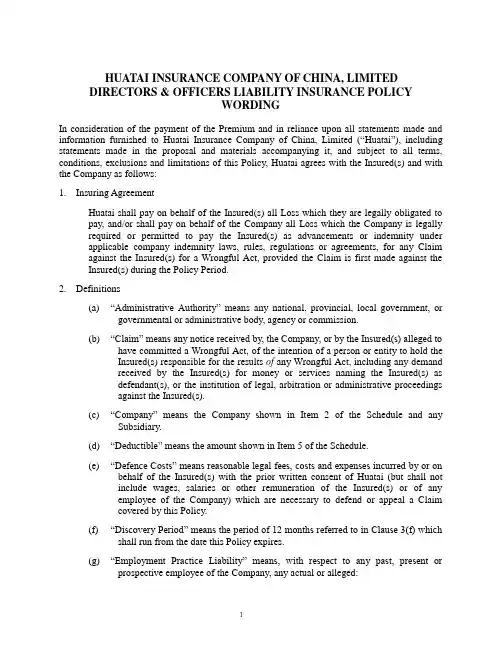

HUATAI INSURANCE COMPANY OF CHINA, LIMITED DIRECTORS & OFFICERS LIABILITY INSURANCE POLICYWORDINGIn consideration of the payment of the Premium and in reliance upon all statements made and information furnished to Huatai Insurance Company of China, Limited (“Huatai”), including statements made in the proposal and materials accompanying it, and subject to all terms, conditions, exclusions and limitations of this Policy, Huatai agrees with the Insured(s) and with the Company as follows:1. Insuring AgreementHuatai shall pay on behalf of the Insured(s) all Loss which they are legally obligated to pay, and/or shall pay on behalf of the Company all Loss which the Company is legally required or permitted to pay the Insured(s) as advancements or indemnity under applicable company indemnity laws, rules, regulations or agreements, for any Claim against the Insured(s) for a Wrongful Act, provided the Claim is first made against the Insured(s) during the Policy Period.2. Definitions(a)“Administrative Authority” mean s any national, provincial, local government, orgovernmental or administrative body, agency or commission.(b)“Claim” means any notice received by, the Company, or by the Insured(s) alleged tohave committed a Wrongful Act, of the intention of a person or entity to hold theInsured(s) responsible for the results of any Wrongful Act, including any demandreceived by the Insured(s) for money or services naming the Insured(s) asdefendant(s), or the institution of legal, arbitration or administrative proceedingsagainst the Insured(s).(c)“Company” means the Company shown in Item 2 of the Schedule and anySubsidiary.(d)“Deductible” means the amount shown in Item 5 of the Schedule.(e)“Defence Costs” means reasonable legal fees, costs and expenses incurred by or onbehalf of the Insured(s) with the prior written consent of Huatai (but shall notinclude wages, salaries or other remuneration of the Insured(s) or of anyemployee of the Company) which are necessary to defend or appeal a Claimcovered by this Policy.(f)“Discovery Period” means the period of 12 months referred to in Clause 3(f) whichshall run from the date this Policy expires.(g)“Employment Practice Liability” means, with respect to any past, present orprospective employee of the Company, any actual or alleged:(1)employment-related sexual or other unlawful harassment;(2)termination of employment which is against the law;(3)employment-related unlawful discrimination;(4)employment related denial of justice;(5)false or misleading advertising or representation involving terms orconditions of employment with the Company;(6)employment-related defamation;(7)failure to employ, promote or grant tenure;(8)unfair deprivation of career opportunity;(9)unfair discipline or evaluation of employment performance;(10)failure to provide or adhere to adequate employment policies orprocedures;(11)violation of any laws or regulations governing employment practices;(12)breach of employment contract;(13)employment-related invasion of privacy.(h)“Insured(s)” means all natural persons who were, now are or shall be director s,supervisors, officers, company secretaries or employees (but only where such employees are acting in a managerial capacity) of the Company.The term Insured(s) shall also include:(1)the lawful spouses of all directors, supervisors, officers, companysecretaries or employees (but only where such employees are acting in amanagerial capacity) of the Company;(2)the estates, heirs or legal representatives of deceased persons who weredirectors, supervisors, officers , company secretaries or employees (butonly where such employees are acting in a managerial capacity) of theCompany at the time of the Wrongful Act upon which the Claim is based;(3)the legal representatives of directors, supervisors, officers, companysecretaries or employees (but only where such employees are acting in amanagerial capacity) of the Company in the event of incompetency,insolvency or bankruptcy;The term Insured(s) shall not include:(1) a receiveror or a liquidator;(2)an official manager;(3)an external auditor;(4) a trustee or administrator of any occupational pension scheme oremployment benefit programmes.or any employee(s) of such person(s).(i)“Investigation” means any investigation, inquiry, public examination, commissionor prosecution, criminal or otherwise;(j)“Loss” means any da mages, judgments, settlements and Defence Costs. Loss shall not include fines or penalties imposed by law, punitive or exemplary damages, taxes, any amount for which the Insured(s) is not legally liable or any matter deemed uninsurable under the law. Damages, judgments, settlements and Defence Costs incurred with respect to more than one Claim against the Insured(s), but resulting from a single Wrongful Act shall constitute a single Loss.(k)“Non-Profit Organisation” means any corporation, institution, associ ation, trust, fund or foundation established for any social, community, charitable or industry purpose to provide services or benefits to its members and not for the purpose of making profits.(l)“Outside Directorship” means the position held by the Insured(s) in an Outside Organisation with the knowledge and consent and at the request of the Company.(m)“Outside Organisation” means any company or organisation, other than the Company, in which an Outside Directorship is held.(n)“Policy” means:(1)the Insuring Agreement, the Definitions, the Extensions, the Exclusions,the Conditions and all other terms contained herein;(2)the Proposal and any attachments thereto;(3)any Endorsement attaching to and forming part of this Policy either atcommencement of the Policy Period or during the Policy Period.(o)“Policy Period” means the period of time shown in Item 3 of the Schedule of this Policy.(p)“Premium” means the premium shown in Item 6 of the Schedule and any additional premium shown in any Endorsement attaching to and forming part of this Policy. (q)“Subsidiary” means any company, including any company held directly or indirectly through one or more Subsidiaries, in which, at the inception of the Policy Period:(1)the Company:(a)controls the composition of the Board of Directors; or(b)controls the voting power at any general meeting; or(c)holds more than 50% of the issued share capital; and(2)the accounts are consolidated with the accounts of the Company inaccordance with professionally accepted Accounting Standards for theconsolidation of accounts applicable in the country in which this Policywas issued.(r)“Wrongful Act” means any actual or alleged act, error, omission, breach of duty, misstatement or misleading statement by the Insured(s) while acting in theircapacity as Insured(s) of the Company or of any Outside Organisation to whichthe Outside Directorship Extension applies.3. ExtensionsThe following Extensions, which are automatically included in this Policy, are subject to all of the terms, conditions, exclusions and. limitations of this Policy. These Extensions do not increase the Limit of Liability unless Huatai otherwise agrees in writing.(a)Advancement of Defence CostsHuatai shall pay Defence Costs on behalf of the Insured(s) on an ongoing basisprior to the final payment or settlement of any Claim PROVIDED THAT:(1)such Defence Costs are incurred with the prior written consent of Huatai;(2)such advance payments by Huatai shall be repaid to Huatai in the eventthat the Insured(s) shall not be entitled to payment of any Loss or receiptof any benefit under this Policy.(b)Investigations, Inquiries, Prosecutions (Criminal Or Otherwise)Huatai shall pay on behalf of the Insured(s) on an ongoing basis prior to the finalpayment or settlement of any Claim all reasonable legal fees, costs and expensesincurred in being legally represented at any Investigation PROVIDED THAT:(1)the Investigation involves an allegation that the Insured(s) committed aWrongful Act;(2)the allegation is first made against the Insured(s) during the Policy Period;(3)such legal fees, costs and expenses are incurred with the prior writtenconsent of Huatai;(4)this Extension does not cover any fines or penalties imposed by law;(5)this Extension does not cover wages, salaries or other remuneration of theInsured(s) or of any employee of the Company;(6)such advance payments by Huatai shall be repaid to Huatai in the eventthat the Insured(s) shall not be entitled to payment of any Loss or receiptof any benefit under this Policy.(c)Acquisition Creation Sale or Dissolution of SubsidiariesIf during the Policy Period the Company acquires or creates a Subsidiary that:(1)increases the Company’s total assets by no greater than 10% based on theCompany’s latest annual report; and(2)is domiciled outside of the United States of America or Canada,then the Insured(s) of such Subsidiary shall be automatically covered by this Policy for Claims for Wrongful Acts committed or alleged to have been committed on or after the effective date of such acquisition or creation, and no notice needs to be given to Huatai relating to the acquisition or creation of such Subsidiary and no additional premium shall be paid relating to this extended cover.If during the Policy Period the Company acquires or creates a Subsidiary that either increases the Company’s assets by more than 10%, or is domiciled in the United States of America or Canada, and written notice of such acquisition or creation is given to Huatai as soon as practicable, and the Company agrees to pay any additional premium required and agrees to any amendments to the Policy required by Huatai relating to such Subsidiary, then the Insured(s) of such Subsidiary shall be covered by this Policy for Claims for Wrongful Acts committed or alleged to have been committed on or after the effective date of such acquisition or creation.If during the Policy Period the Company acquires or creates a Subsidiary, and if the Insured(s) require cover for Claims for Wrongful Acts committed or alleged to have been committed prior to the effective date of such acquisition or creation, Huatai may at its discretion, and subject to the payment of an appropriate additional premium, agree to provide such cover after presentation and consideration of a complete proposal and all necessary information.If the Company effects a sale or dissolution of a Subsidiary, cover under this Policy shall apply to any person who was an Insured(s) of that Subsidiary prior to the sale or dissolution PROVIDED THA T cover shall only apply for or in respect of Claims for Wrongful Acts committed or alleged to have been committed prior to the effective date of sale or dissolution.(d)Continuous CoverNotwithstanding Exclusions 4(b), (c) and (d), and in the absence of fraudulent non-disclosure, this Policy extends to cover the Insured(s) for any Claim, and for any Wrongful Act which may give rise to a Claim, which should or could have been notified to Huatai under any other preceding directors and officers liabilityinsurance policy issued by Huatai and which is notified during the Policy Period, PROVIDED THAT:(1)Huatai has been the insurer pursuant to any other preceding directors andofficers liability insurance policy continuously between the date whensuch notification should have been given and the date when notificationwas in fact given;(2)the terms, conditions and limits of this Policy shall not apply to thisExtension, which shall be subject to the terms, conditions and limits of thepreceding Huatai directors and officers liability insurance policy whichapplied at the date on which such notification should have been given. (e)Outside DirectorshipsFor the period during which the Outside Directorship is held this Policy covers:(1)Outside Directorships in any Outside Organisation listed in the Schedule ofOutside Directorships attached to this Policy; and(2)Outside Directorships in Non-Profit Organisations.Cover for any other Outside Directorships is subject to:(3)receipt of the most recent annual reports and audited financial statementsfor each Outside Organisation proposed;(4)receipt of details of any Directors and Officers Liability Insurance Policyheld by or on behalf of the Outside Organisation or its directors,supervisors, officers, company secretaries and employees;(5)receipt of any other information which Huatai may require;(6)acceptance by Huatai in writing of each Outside Directorship.If during the Policy Period the Insured(s) ceases to hold an Outside Directorship the cover provided by this Policy for such Outside Directorship shall continue, PROVIDED THAT the Claim for Loss arises from a Wrongful Act which occurred prior to the Outside Directorship ceasing.The cover provided by this Policy for Outside Directorships does not extend to cover:(7)any Outside Organisation in which the Outside Directorship is held or anyother director, supervisor, officer, company secretaries and employee ofsuch Outside Organisation;(8)any claim made against the Insured(s) the Outside Organisation or any ofits directors, supervisors, officers, company secretaries and employees;(9)Loss with respect to which insurance cover is available pursuant to anyunderlying policy listed in the Schedule of Outside Directorships attachedto this Policy.(f)Discovery PeriodIf Huatai refuses to renew this Policy, the Company and/or the Insured(s) mayupon payment of an additional 50% of the full annual premium extend the coverunder this Policy for a period of 12 Months which shall run from the date thisPolicy expires, for any Claim first made against the Insured(s) during theDiscovery Period and notified in writing to Huatai during the Discovery Period,but only in respect of Wrongful Acts committed or alleged to have beencommitted before the date of expiration of the Policy Period.The right of the Company and/or the Insured(s) to exercise the Discovery Periodmust be by notice to Huatai in writing within 30 days of expiration of the PolicyPeriod and the Company shall elect equally to exercise its right (if any) to thisextension of cover under any directors and officers insurance policy issued inrespect of the same Policy Period.The right to exercise the Discovery Period does not apply in the event ofcancellation of this Policy. Huatai’s offer of renewal terms, conditions, limits ofliability or premium different from those of the expiring policy shall not constitutea refusal to renew.4. ExclusionsHuatai shall not be liable to make any payment for Loss in connection with any Claim made against the Insured(s) or any payment in connection with any Investigation involving an allegation made against the Insured(s), in either case based on, arising from or attributable to:(a)(1) fraudulent, dishonest or criminal acts of the Insured(s) if such acts arefound by any Court or Administrative Authority to be fraudulent,dishonest or criminal;(2) any personal profit or advantage gained in fact by the Insured(s) to whic hsuch Insured(s) was not legally entitled.(b)any litigation or other proceedings begun before the prior and pending litigationdate shown in Item 7 of this Policy or alleging the same or essentially the samefacts alleged in prior or pending litigation.(c)any fact, circumstance, act, omission. or claim of which notice has been given underany policy existing or expired before or on the inception date of this Policy.(d)any fact, circumstance, act or omission which may give rise to a claim and of whichthe Company or the Insured(s) are aware prior to the inception of this Policy.(e)any Claim brought by or on behalf of the Insured(s) or the Company other than anyClaim:(1)arising from an Employment Practice Liability;(2)instigated by a shareholder or group of shareholders of the Company in thename of the Company without the participation, solicitation or assistanceof any Insured(s) or the Company;(3)instigated by a receiver or a liquidator without the participation, solicitation,or assistance of the Insured(s) or the Company;(4)for contribution or indemnity, if the Claim for contribution or indemnitydirectly results from a Claim which is covered under this Policy.(f)any Claim brought against any person acting in the capacity:(1)as trustee or administrator of a superannuation scheme; or(2)as external auditor.(g)(1) any injury, damage, expense, cost, loss, liability or legal obligation in anyway related to pollution however caused including shareholder orderivative Claims arising from or attributable to such pollution. Pollutionincludes the actual, alleged or potential presence in or introduction into theenvironment of any substance, if such substance has, or is alleged to have,the effect of making the environment impure, harmful or dangerous.Environment includes any air, land, structure or the air therein,watercourse or water, including groundwater; or(2) the hazardous properties of nuclear or radioactive material.(h)any Claim for:(1)bodily injury, sickness, disease, death or emotional distress of any person,provided however that any Claim for emotional distress shall not beexcluded with respect to any actual or alleged Employment PracticeLiability; or(2) damage to or destruction of any tangible property including loss of use ofsuch property.5. Conditions(a)AllocationsIf a Claim against the Insured(s) includes causes of action against uninsureddefendants, allegations of uninsured damages, uninsured acts or other uninsuredmatters, Huatai, the Company and the Insured(s) agree to use their best efforts toagree upon a fair and proper allocation of defence costs, settlements and damagesbetween Huatai, the Company and the Insured(s).(b)AssignmentThis Policy and any rights hereunder may not be assigned without the written consent of Huatai.(c)Claims, Circumstances or Investigations - NotificationsThe Company and the Insured(s) shall give written notice to Huatai as soon as practicable of(1)any Claim first made during the Policy Period;(2)any facts or circumstances of which they shall first become aware duringthe Policy Period which may give rise to a Claim;(3)any notice first received during the Policy Period of any Investigation(s),but in no event later than 45 days after this Policy expires, or, in the case of Claims first made, facts and circumstances of which the Company and/or the Insured(s) shall first become aware and notice(s) of any Investigation(s) first received during the Discovery Period, if applicable, no later than 45 days after the Discovery Period expires. Notice and all information regarding a Claim, a circumstance that may result in a Claim or an Investigation shall be sent in writing to Huatai at [insert address] or by facsimile to [insert facsimile number].The Company and the Insured(s) shall give Huatai such information and cooperation as it may reasonably require to enable Huatai to investigate and determine both its liability under this Policy and the extent of the Insured(s’) actual or potential liability for any Claim or arising from any facts or circumstances which may give rise to a Claim.If during the Policy Period or Discovery Period, if applicable, the Insured(s) shall become aware of an actual or alleged Wrongful Act which may subsequently give rise to a Claim and during such period gives immediate notice to Huatai of such Wrongful Act, any Claim later made against the Insured(s) arising out of that Wrongful Act shall, for the purposes of this Policy, be treated as a Claim made during the Policy Period or Discovery Period, if applicable, in which such notice was first given. Notice of such Wrongful Act must contain a specific description of the actual or alleged Wrongful Act, state by whom it was committed or alleged to have been committed, and describe the material facts or circumstances which may give rise to a Claim.(d)Claims - Defence & SettlementNeither the Company nor the Insured(s) shall admit liability for or settle any Claim or incur Defence Costs without Huatai’s prior written consent, which consent shall not be unreasonably withheld.Huatai shall at all times have the right but not the duty to associa te in the investigation, defence or settlement of any Claim to which this Policy may apply.Huatai shall at all times have the right but not the duty to assume conduct in thename of the Insured(s) of the defence or settlement of any Claim or any claim for contribution or indemnity against any person or entity with respect to which the Insured(s) may have rights.Huatai and the Insured(s) shall not be required to contest any Claim unless a lawyer (to be mutually agreed upon by Huatai and the Insured(s)) shall advise that the Claim should be contested. The lawyer shall take into consideration the economics of the Claim, the damages and costs which are likely to be recovered by the plaintiff, the Defence Costs which will be incurred in contesting the Claim and the prospects of the Insured(s) successfully defending the Claim. The costs of obtaining such opinion from the lawyer shall be paid by Huatai as part of the Defence Costs. Should the lawyer advise that in all the circumstances the Claim should not be contested but should be settled Huatai and the Insured(s) shall not object to or oppose settlement of the Claim within the limits advised by the lawyer as being reasonable.(e)ConfidentialityThe Company or the Insured(s) may disclose that it has paid or agreed to pay a premium in respect of a contract insuring the Insured(s) against a liability.The Company or the Insured(s) shall not, without Huatai’s prior written consent, otherwise disclose the existence of or the terms of this Policy, including but not limited to the identity of Huatai, the limit of liability and the premium, unless required to do so by law.(f)DeductibleThe Company shall pay the Deductible for all Loss resulting from each Claim.Huatai shall have no obligation to pay Loss until the Insured(s) o r the Company have incurred Loss in the amount of the Deductible if applicable, except that, if the Company is unable to pay the amount of the Deductible due to insolvency then, subject to all other terms and conditions of this Policy, Huatai shall pay suc h Loss.If two or more Claims are made against any Insured(s) arising out of a single Wrongful Act, or out of a series of related Wrongful Acts, the Claims shall be treated as a single Claim for the purpose of applying the Deductible. This single Claim will be treated as if it was first made during the Policy Period at the earlier of:(1)when the earliest Claim was first made, or(2)when the earliest circumstance giving rise to a Claim was notified.The Deductible shall apply to all Loss for which advancement or indemnification by the Company is required or permissible under company indemnification laws, rules, regulations or agreements regardless of whether or not the Company actually advances or indemnifies the Insured(s) for such Loss.The amount of any Deductible payable will be calculated after deduction of any tax credit that is or may be available to the Company for payment of the Deductible.(g)Limit of LiabilityThe amount shown in Item 4 of the Schedule is Huatai’s maximum aggregate liability for all Loss including Defence Costs, arising from all Claims first made against the Insured(s) during the Policy Period and the Discovery Period if applicable.Two or more Claims arising out of a single Wrongful Act or a series of related Wrongful Acts shall be treated as a single Claim. All such Claims shall be treated as if first made during the Policy Period or Discovery Period at the earlier of:(1)when the earliest Claim was first made, or(2)when the earliest circumstance giving rise to a Claim was notified.(h)Loss MitigationThe Company and the Insured(s) shall, at their own cost, use due diligence and do and concur in doing all things reasonably practicable to avoid, or diminish any Loss under this Policy.(i)Non-Executive DirectorsIn the event that Huatai is entitled to avoid this Policy from inception, or from the time of any variation in cover, due to non-disclosure or misrepresentation by the Insured(s), Huatai shall maintain cover for non-executive directors who are Insured(s) under this Policy until the expiry date of the Policy Period. Provided that such non-executive directors are able to establish to the satisfaction of Huatai that they are innocent and free from all such fraudulent conduct, non disclosure, misrepresentation or intent to deceive. Any return of premium or amendment to the terms of this Policy shall be at the discretion of Huatai.(j)Other InsuranceUnless otherwise required by PRC laws, this Policy shall apply only as excess over any other valid and collectible insurance. However, if a Loss is not covered by the other insurance but would be covered under this Policy, this is hereby agreed that this Policy would drop down and serve as the primary policy.(k)Governing LawThis Policy shall be governed by and interpreted in accordance with the laws of the Peopl e’s Republic of China.The parties to this Policy shall choose one of the following methods to resolve any dispute in connection with this Policy:(1)Any dispute arising out of the performance of or in connection with thisPolicy shall be resolved through consultations in good faith. If thedispute cannot be resolved through such consultations, the dispute shall:(a)Where the party(ies) other than Huatai is a PRC citizen or entity, besubmitted to the China International Economic and Trade ArbitrationCommission in Beijing for arbitration in accordance with theFinancial Disputes Arbitration Rules administered by CIETAC at thetime of the arbitration; and(b)Where the party(ies) other than Huatai is not a PRC citizen or entity,be submitted to the Hong Kong International Arbitration Centre (the“HKIAC”) for arbitration in accordance with the UNCITRALArbitration Rules administered by the HKIAC at the time of thearbitration, or be submitted to the China International Economic andTrade Arbitration Commission in Beijing for arbitration inaccordance with the Financial Disputes Arbitration Rulesadministered by CIETAC at the time of the arbitration; or(2)Any dispute arising out of the performance of or in connection with thisPolicy shall be resolved through consultations in good faith. If thedispute cannot be resolved through such consultations, the dispute shall besubmitted to the PRC courts for litigation in accordance with relevant lawsand regulations.(l)Representation and SeverabilityHuatai has relied upon the statements made in the proposal, the supplementary proposal(s) if any, and materials accompanying them in granting cover under this Policy. All such statements and materials form the basis of the contract of insurance.The proposal(s) shall be construed as separate proposal(s) by each of the Insured(s) and, with respect to statements made and particulars provided in the proposal(s), no such statements or particulars, and no information possessed by the Insured(s), shall be imputed to any other Insured(s) to determine whether cover is available for any Claim against such other Insured(s).(m)SubrogationIn the event Huatai makes any payment under this Policy, Huatai shall be subrogated to all rights of recovery of all Insured(s), and the Insured(s) shall fully cooperate with Huatai in securing such rights, including but not limited to the execution of any documents necessary to enable Huatai to effectively bring suit in the name of the Company or the Insured(s).(n)Takeovers and MergersIf during the Policy Period the Company merges with or consolidates into another。

财产保险合同(英文) propertyinsuranceclauseswholedoc.i.thepropertyinsured thepropertyinsuredshallrefertoallpropertiesandexpensesspe- cifiedinthescheduleofthispolicy. unlessspecificallyagreeduponinwritingbetweentheinsuredandthecompanyandappraisedandvalue-establishedbyprofessionalsorassessors,thefollowingarticlesandtheexpensesrelevanttheretoshallnotbe coveredunderthispolicy:1.gold,silver,pearls,diamonds,preciousstonesandjades;2.antiques,articlesofvirtue,ancientcoins,ancientbooksand ancientpaintings;3.worksofartorpostagestamps;4.advertisements,aerials,neon,piecesofsolarenergyapparatusetc.onbuildings;putersystemrecordsoritsmakingandcopyingcosts. undernocircumstancesshallthefollowingarticlesrelevantthereto becoveredhereunder:1.guns,ammunitionorexplosives;2.banknotes,securities,bills,documents,files,accountbooksor drawings;3.animals,plantsandagriculturalcrops;4.mobilephones,portablecomputers,removablephotographapparatus orotherpreciousarticles;5.vehicleslicensedforgeneraltransportuse.ii.scopeofcover thecompanyshallindemnifytheinsuredinrespectofthephysical lossofordamagetotheinsuredpropertystatedinthescheduleduring theperiodofinsurancedirectlyarisingfromthefollowingperils: 1.fire;2.explosion; butnotincludingexplosionofaboilerorotherpressurerelief devices;3.lightning;4.hurricane,typhoonandtornado;5.storm,tempestandflood; butnotincludinglossordamagecausedbychangeinnormalwater levelorinundationfromseawaterorwaterescapeorleakagefromthe normalconfinesofanynaturalwatercourse,lakeorreservoir,canalor damaswellaslossofordamagetotheinsuredpropertycausedbystorm, tempestorfloodwhilebeingstoredintheopenorcoveredbyorundera shedthatchedwithreeds,tarpaulins,straw,asphaltfelt,plasticor nylonsheet;6.hailstorm;ndslide,rockslide,avalanche;8.volcanicexplosion;9.subsidenceofground;butnotincludinglossordamageresultingfrompiledriving, groundworkorexcavation;10.crashingaircraftandpartsorarticlesfallingfromaircraftand otherflyingobjects;11.burstingofwatertankorpipe; butnotincludingburstingofwatertankorpipeduetorust.iii.exclusionsthiscompanyshallnotbeliablefor:1.lossofordamagetotheinsuredpropertyorexpensescausedbyintentionalactorgrossnegligenceoftheinsuredorhisrepresentativ e;2.lossofordamagetotheinsuredpropertycausedandexpenses incurredbyearthquakeortsunami;3.depreciation,lossofmarket,lossofuseandotherconsequential lossesofanydescription;4.lossofordamagetotheinsuredpropertyorexpensesincurredarisingfromwar,warlikeoperation,hostilities,armedconflicts,terrorism,conspiracyinsurrection,coupdetat,strike,riot,andciv ilcommotion;5.confiscation,requisition,destructionordamagebyanyactionor orderofanygovernmentdejureordefactoorbyanypublicauthorities;6.lossofordamagetoinsuredpropertydirectlyorindirectlycausedorexpensesincurredbynuclearfission,nuclearfusion,nuclearweapo n,nuclearmaterial,nuclearradiationandradioactivecontamination;7.lossordamagecausedandexpensesincurredbypollutionofany kindordescriptionwhatsoeversuchasatmosphere,landandwater pollutionsbutthisdoesnotincludelossordamagecausedbypollution arisingfromperilsspecifiedinarticleiithepolicy;8.thedeductiblesstatedinthescheduletobebornebytheinsured;9.lossordamagearisingfromanyotherperilsnotlistedinarticle iiofthispolicy.iv.treatmentofclaim1.thecompanyshallatitsoption,indemnifytheinsuredinrespect oflossordamagefallingwithinthescopeofcoverofthepolicyby either:1.1payingtheamountoftheactualvalueofthepropertylostor damagedor;1.2payingthenecessarycostofrepairingorrestoringthedamaged propertytoitsnearestconditionimmediatelyprecedingthedamageor;1.3repairingorrestoringthedamagedpropertytoaconditionnearto otherpropertyoflikekindandquality.2.indemnityunderthispolicyshallbebaseduponthesoundmarket valueofthepropertyprevailingatthetimeofloss.ifthesoundmarket valueofthedamagedpropertyislowerthanthesuminsuredofsuch property,theclaimshallbesettledonitsmarketvalue;ifthesoundmarketvalueofthepropertyisinexcessofthesuminsured,thecompanyshallonlybeliableforsuchproportionoftheclaimasthesuminsured ofthedamagedpropertybearstoitssoundmarketvalue.iftheinsured propertyenumeratedinthescheduleismorethanoneitem,theprovision ofthisclauseshallapplytoeachthereof.3.ifaclaimforlossofordamagetotheinsureditemissettledon atotallossbasis,thesalvagevalueofsuchitemshallbedeductedfrom theindemnitypayablebythecompany.thecompanymay,atitsoption, declinetheabandonmentofanydamagedpropertybytheinsured.4.intheeventoflossofordamagetoanyequipmentiteminsured formingpartofapairorset,thecompanyshallnotbeliableinrespect ofeachofsuchitemlostordamagedformorethanitsproportionatepart ofthesuminsuredonthecompletepairorset.5.intheeventofanylossoccurrence,thecompanyshallalsopaytheinsuredfortheexpensesreasonablyincurredfortakingnecessarymeas urestominimizelossordamagetotheleastextent,butinnocaseshallsuchexpensesreferredheretoexceedthesuminsuredoftheinsuredproperty.6.uponsettlementofaclaim,anendorsementshallbeissuedbythe companytoreducethesuminsuredcorrespondingtothepropertylostor damagedbytheamountsosettledfromthedateofloss,andnopremium shallberefundedfortheamountsoreduced.ifreinstatementofthesum insuredisrequiredbytheinsureduponsettlementoftheclaim,anadditionalpremiumforthereinstatedamountshallbechargedatanagre edrate,andbecalculatedonproratadailybasisfromthedateoflossto theexpiryoftheinsurance.7.thetimeofvalidityofaclaimunderthisinsuranceshallnot exceedaperiodoftwoyearcountingfromthedateofloss.v.insuredsobligations thefollowingobligationsshallbestrictlyfulfilledbytheinsured andhisrepresentative:1.theinsuredandhisrepresentative,whenapplyingforinsuranceshallmaketrueanswersordescriptionstothequestionsintheproposal andquestionnaireortoanyotherquestionsraisedbythecompany.2.theinsuredandhisrepresentativeshallpaytothecompanyindue coursetheagreedpremiuminthemannerasprovidedinthescheduleand endorsements.3.duringtheperiodofthisinsurance,theinsuredshallathisown expensetakeallreasonableprecautions,includingpayingsufficientattentiontoandputtingintopracticethereasonablerecommendations ofthecompany,prudentlyselectingtheworkmenandemployeesandcomplyi ngwithallstatutoryregulationsandsafetyoperationprocedures.4.intheeventofanyoccurrencewhichgivesormightgiverisetoa claimunderthispolicy,theinsuredorhisrepresentativeshall:4.1notifythecompanyimmediatelyandwithinseven(7)daysoranyfurtherperiodasmaybeagreedbythecompanyinwriting,furnishawrittenreporttoindicatethecourse,probablereasonandextentoflos sordamage;4.2takeallnecessarymeasurestoavoidaggravationofthelossor damageandminimizeittotheleastextent;4.3preservethespotaffectedanddefectivepartsbeforean inspectioniscarriedoutbyarepresentativeorsurveyorfromthe company;4.4furnishallsuchinformationanddocumentaryevidenceasthe companymayrequireforsupportingtheclaim.vi.generalconditions1.policyeffect thedueobservanceandfulfilmentofthetermsandconditionsofthis policyinsofarastheyrelatetoanythingtobedoneorcompliedwithbytheinsuredshallbeaconditionprecedenttoanyliabilityofthecompan yunderthispolicy.2.policyvoidancethispolicyshallbevoidableintheeventofmisrepresentation,misdescriptionornon-disclosuremadebytheinsuredorhisrepresentativeinanymaterialparticularinrespectofthisinsurance.3.policyterminationunlessitscontinuancebeadmittedbythecompanyinwriting,thispolicyshallbeautomaticallyterminatedif:3.1theinsurableinterestoftheinsuredislost;3.2theriskoflossordamageisincreased.afterterminationofthepolicy,thepremiumshallberefundedtotheinsuredcalculatedonproratadailybasisfortheperiodfromthedateofterminationtothedateofexpiry.4.policycancellationthispolicymaybecanceledatanytimeattherequestoftheinsured inwritingorattheoptionofthecompanybygivingafifteen(15)days priornoticetotheinsured.intheformercasethecompanyshallretaina premiumcalculatedonshorttermratebasisforthetimethepolicyhas beeninforcewhileinthelattercasesuchpremiumshallbecalculatedon proratadailybasis.5.forfeitofbenefitiftheclaimisinanyrespectfraudulent,orifanyfraudulentmeans ordevicesareusedbytheinsuredorhisrepresentativetoobtainany benefitunderthispolicyorifanylossordamageisoccasionedbytheintentionalactorintheconnivanceoftheinsuredorhisrepresentativ e,theninanyofthesecases,alltherightsandbenefitsoftheinsured underthispolicyshallbeforfeited,andallconsequentlossesarising therefromincludingtheamountofclaimpaidbythecompanyshallbeindemnifiedbytheinsured.6.reasonableinspection therepresentativeofthecompanyshallatanysuitabletimebe entitledtoattendthesiteandinspectorexaminetheriskexplosureof thepropertyinsured.forthispurpose,theinsuredshallprovidefullassistanceandalldetailsandinformationrequiredbythecompanyasma ybenecessaryfortheassessmentoftherisk.theabovementioned inspectionorexaminationshallinnocircumstancesbeheldasany admissiontotheinsuredbythecompany.7.doubleinsuranceshouldanyloss,damage,expensesorliabilityrecoverableunderthe policybealsocoveredbyanyotherinsurance,thecompanyshallonlybeliabletopayorcontributehisproportionoftheclaimirrespectiveast owhethertheotherinsuranceisarrangedbytheinsuredorothersonhisbehalf,orwhetheranyindemnificationisobtainableundersuchotherinsurance.8.subrogation whereathirdpartyshallbeheldresponsibleforthelossordamagecoveredunderthispolicy,theinsuredshall,whetherbeingindemnifie dbythecompanyornot,takeallnecessarymeasurestoenforceorreservetherightofrecoveryagainstsuchthirdparty,anduponbeingindemnifiedb ythecompany,subrogatetothecompanyalltherightofrecovery,transfe rallnecessarydocumentstoandassistthecompanyinpursuingrecovery fromtheresponsibleparty.9.dispute alldisputesunderthisinsurancearisingbetweentheinsuredandthe companyshallbesettledthroughfriendlynegotiations.wherethetwopartiesfailtoreachanagreementafternegotiations,suchdisputesha llbesubmittedtoarbitrationortocourtforlegalactions.unlessotherwiseagreed,sucharbitrationorlegalactionshallbecarriedout intheplacewherethedefendantisdomiciled.vii.specialprovisionsthefollowingprovisionsshallbeappliedtoallpartsofthispolicyandshalloverridetheothertermsandconditionsofthispolicyifanyconflictarises.propertyinsurancepolicypolicyno.:whereastheinsurednamedinthescheduleheretohasmadetothe______insurancecompany(hereinaftercalled""thecompany"")awritt enproposalwhichtogetherwithanyotherstatementsmadebytheinsuredfo rthepurposeofthispolicyisdeemedtobeincorporatedhereinandhaspaidtothecompanythepremiumstatedintheschedule. nowthispolicyofinsurancewitnessesthatsubjecttothetermsandconditionscontainedhereinorendorsedhereonthecompanyshallindem nifytheinsuredforthelossordamagesustainedduringtheperiodof insurancestatedinthescheduleinthemannerandtotheextent hereinafterprovided.bythe________insurancecompany_________________________authorisedsignaturedateofissue:placeofissue:schedulepolicyno.:andaddressoftheinsured1.1theinsured:1.2address:2.locationofthepropertyinsured:3.natureoftrade:4.insureditemsandsumsinsured: insureditemssumsinsured4.1propertyinsured4.1.1building(s)(includingdecoration): 4.1.2machineryandequipment:4.1.3furnitureandfixture:(includingofficeequipmentandsupplies) 4.1.4stock:4.1.5others:4.2additionalexpenses:4.2.1removalofdebrisfees:4.2.2fireextinguishingexpenses:4.2.3professionalfees:4.2.4otherexpenses:totalsuminsured:5.deductible(anyoneaccident):6.periodofinsurance:___months.from00:00of_________to24:00hoursof______7.premiumrate:totalpremium:8.dateofpayment:9.jurisdiction: thispolicyisgovernedbylawofthepeoplesrepublicofchina.10.specialprovisions: propertyinsurancepolicysschedule_________insurancecompany。

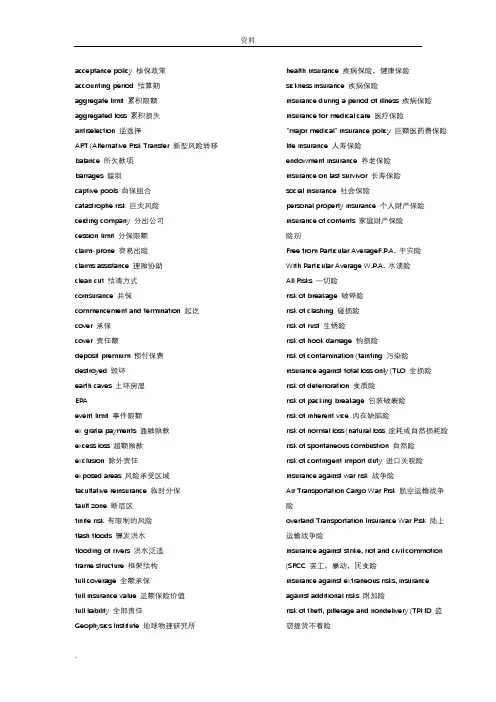

acceptance policy 核保政策accounting period 结算期aggregate limit 累积限额aggregated loss 累积损失antiselection 逆选择ART (Alternative Risk Transfer 新型风险转移balance 所欠款项barrages 堰坝captive pools 自保组合catastrophe risk 巨灾风险ceiding company 分出公司cession limit 分保限额claim-prone 容易出险claims assistance 理赔协助clean cut 结清方式coinsurance 共保commencement and termination 起讫cover 承保cover 责任额deposit premium 预付保费destroyed 毁坏earth caves 土坏房屋EPAevent limit 事件限额ex gratia payments 通融赔款excess loss 超额赔款exclusion 除外责任exposed areas 风险承受区域facultative reinsurance 临时分保fault zone 断层区finite risk 有限制的风险flash floods 骤发洪水flooding of rivers 洪水泛滥frame structure 框架结构full coverage 全额承保full insurance value 足额保险价值full liability 全部责任Geophysics Institute 地球物理研究所health insurance 疾病保险,健康保险sickness insurance 疾病保险insurance during a period of illness 疾病保险insurance for medical care 医疗保险"major medical" insurance policy 巨额医药费保险life insurance 人寿保险endowment insurance 养老保险insurance on last survivor 长寿保险social insurance 社会保险personal property insurance 个人财产保险insurance of contents 家庭财产保险险别Free from Particular AverageF.P.A. 平安险With Particular Average W.P.A. 水渍险All Risks 一切险risk of breakage 破碎险risk of clashing 碰损险risk of rust 生锈险risk of hook damage 钩损险risk of contamination (tainting 污染险insurance against total loss only (TLO 全损险risk of deterioration 变质险risk of packing breakage 包装破裂险risk of inherent vice 内在缺陷险risk of normal loss (natural loss 途耗或自然损耗险risk of spontaneous combustion 自然险risk of contingent import duty 进口关税险insurance against war risk 战争险Air Transportation Cargo War Risk 航空运输战争险overland Transportation Insurance War Risk 陆上运输战争险insurance against strike, riot and civil commotion (SRCC 罢工,暴动,民变险insurance against extraneous risks, insurance against additional risks 附加险risk of theft, pilferage and nondelivery (TPND 盗窃提货不着险GNPI 总净保费收入hailstorm 雹暴heavy damage 严重破坏hollow brick wall 空斗砖结构hour clause 小时条款hurricane 飓风individual losses 单一损失insurability 可保性insured losses 保险损失intensity 烈度layering 层次less exposed 损失可能性小liability 责任light damage 轻度破坏line slips 分保条loading 附加费loss occurrence 损失发生loss occurring basis 损失发生基础loss participation 分担损失loss settlement 损失赔付magnitude 震级malicious damage 恶意损害moderate damage 中度破坏multi-story building 多层建建筑Munich Re 慕尼黑再net retained lines 净自留额net retained losses 损失净自赔额no profit commission 无纯益风险non-proportional reinsurance 非比例再保险notification 告知object 标的obligatory reinsurance 固定分保original deductibles 原始免赔额original rate 原始费率paid-up capital 已付资本peak accelerator 峰值加速度peril 危险risk of fresh and/of rain water damage(wetting 淡水雨淋险risk of leakage 渗漏险risk of shortage in weight/quantity 短量险risk of sweating and/or heating 受潮受热险5保险英语翻译risk of bad odour(change of flavour 恶味险,变味险risk of mould 发霉险on deck risk 舱面险6保险英语翻译保险业词汇Terms used in insurance industryaccident意外事故险actuarial method精算法Advance Loss Profits (ALOP预期利润损失险,利损险Advance profit预期利润broker经纪人Business Interruption Insurance (BI营业中断险captive自保公司casualty意外伤害险catastrophe巨灾险ceding company分出公司claim索赔claim settlement理赔combined ratioPICC Re 中保再placement 安排PML 可能最大损失policyholder 保单持有者pool 共保组合portfolio entry 未满期责任的出帐portfolio outgo 未满期责任的入帐premium 保费previous losses 既往损失priority 分保自留额priority 自付责任3保险英语词汇表proportional reinsurance 比例再保险rainstorm 雨暴rating 费率reinforced concrete building 钢筋混凝土建筑reinstatement 恢复保额reinsured 分出公司reinsurer 再保险人retention 自留额retention areas 滞洪区return period 重现期revoke license 吊销营业执照seaquake 海震second event cover 第二事件承保securitization 证券化seismic demage 震害set-off 抵销shear wall structure 剪力墙结构single 险位超赔spread loss 分散风险stop loss 赔付率超赔storm surges 风暴潮susceptibility of goods to water 易受水浸性tarrif 费率表TG 拐点周期tidal wave 海啸topographic map 地形图综合赔付率Consequential Loss (CL7保险英语翻译,保险专业词汇。

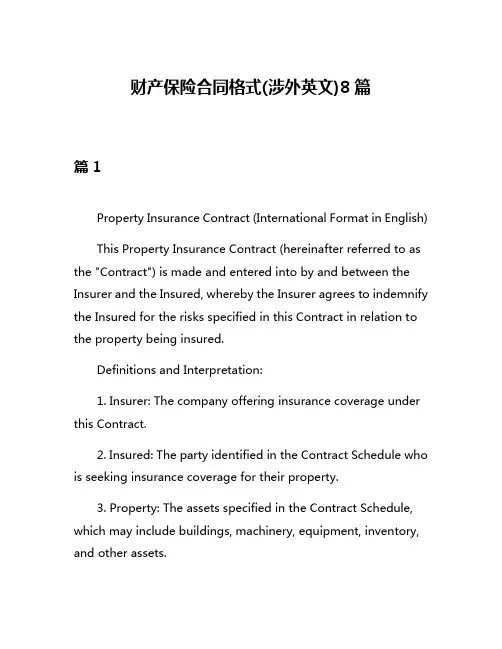

财产保险合同格式(涉外英文)8篇篇1Property Insurance Contract (International Format in English)This Property Insurance Contract (hereinafter referred to as the "Contract") is made and entered into by and between the Insurer and the Insured, whereby the Insurer agrees to indemnify the Insured for the risks specified in this Contract in relation to the property being insured.Definitions and Interpretation:1. Insurer: The company offering insurance coverage under this Contract.2. Insured: The party identified in the Contract Schedule who is seeking insurance coverage for their property.3. Property: The assets specified in the Contract Schedule, which may include buildings, machinery, equipment, inventory, and other assets.4. Risks: The potential losses covered by the insurance, such as fire, theft, natural disasters, etc.Contract Schedule:Both parties shall complete and agree to the following schedule:* Description of the property being insured.* Location of the property.* Risks covered by the insurance.* Total value of the property.* Premium amount and payment schedule.* Duration of the Contract.* Any special terms and conditions.Insurer's Obligations:The Insurer agrees to pay, in accordance with the terms of this Contract, any valid claim made by the Insured for losses incurred due to the risks specified in the Contract Schedule.Insured's Obligations:The Insured shall:* Pay the agreed premium on time.* Maintain accurate records of the property being insured.* Notify the Insurer immediately of any changes in the property or circumstances that may affect the insurance coverage.* Make a claim promptly after a loss occurs and provide necessary documents to support the claim.Exclusions:This Contract does not cover losses caused by wars, nuclear risks, or any other risks not specifically mentioned in the Contract Schedule. The Insurer shall not be liable for any consequential losses or indirect losses unless otherwise agreed in writing.Settlement of Claims:In case of a claim, the Insured shall submit necessary documents to prove the loss. The Insurer shall evaluate the claim and make payment promptly upon confirmation of the loss and validity of the claim.Termination:This Contract may be terminated by either party giving a written notice to the other party. The termination shall takeeffect from a date specified in the notice. Any premium for unused period shall be adjusted accordingly.Miscellaneous:篇2Property Insurance Contract (International Version)This Property Insurance Contract is entered into by and between the Insurance Company and the Insured, who agree to the terms and conditions set out below:Parties:Insurance Company: ________________Insured: ________________Contract Title: Property Insurance ContractArticle 1: Contract PurposeThe purpose of this Contract is to cover risks associated with property insurance of the Insured’s assets.Article 2: Contract TermThis Contract shall be effective from the date of issuance and shall continue for the agreed term unless terminated in accordance with the terms of this Contract.Article 3: Insured PropertyThe property covered by this Contract includes, but is not limited to, the following: ____________________. The specific details of the insured property shall be listed in the Schedule of Insurance.Article 4: CoverageThe Insurance Company shall cover losses or damages to the Insured Property caused by specified events, such as fire, explosion, lightning, windstorm, hail, earthquake, etc. The specific coverage shall be stated in the Schedule of Insurance.Article 5: ExclusionsThe following losses or damages shall not be covered by this Contract: ________________. (Insert specific exclusions relevant to the policy)Article 6: Premium PaymentThe Insured shall pay the premium specified in this Contract to the Insurance Company in a timely manner.Article 7: Claims SettlementIn case of any loss or damage to the Insured Property, the Insured shall promptly notify the Insurance Company and submit a claim in accordance with the procedures specified in this Contract. The Insurance Company shall investigate and settle the claim in a reasonable manner.Article 8: Settlement of DisputesAny dispute arising from or in connection with this Contract shall be settled through friendly negotiation. If no settlement can be reached, either Party may submit the dispute to a court of law with jurisdiction over the matter.Article 9: Misrepresentation and FraudAny misrepresentation or fraud by the Insured shall cause the nullity of this Contract from the beginning. Any claims arising from such misrepresentation or fraud shall not be paid by the Insurance Company.Article 10: Contract TerminationThis Contract may be terminated by either Party giving written notice to the other before the expiration date. Upon termination, all rights and obligations of both Parties shall be extinguished except for any claims arising prior to termination.Termination shall not affect any existing rights or obligations under this Contract.(Add any additional terms and conditions if necessary.)Signature:The Insurance Company: ________________ (Signature)Date: ________________The Insured: ________________ (Signature)Date: ________________Witness: ________________ (Signature)Date: ________________(Note: This contract must be signed by both parties and witnessed.)篇3Property Insurance Contract (International Version)This Property Insurance Contract is entered into by and between the Insurance Company and the Insured, who agree to the terms and conditions stated below:I. PartiesInsurance Company: _________________ (Name of the insurance company)Insured: _________________ (Name of the party seeking insurance)II. Insurance CoverageThe Insurance Company agrees to cover the property listed in the schedule attached hereto against risks specified in this Contract. The property insured includes, but may not be limited to, buildings, machinery, equipment, inventory, and other assets.III. Period of InsuranceThe Period of Insurance shall begin on ________________ (start date) and end on ________________ (end date).IV. Insurance Amount and PremiumThe total amount insured for the property is ________________ (amount) with a premium of ________________ (amount) payable by the Insured to the Insurance Company.V. Risks CoveredRisks covered under this Contract include, but are not limited to, fire, theft, natural disasters (e.g., earthquake, flood), and malicious damage.VI. ExclusionsThe following are excluded from this insurance coverage: wear and tear, deliberate damage by the Insured, nuclear risks, war risks, and any other risks not specifically mentioned in this Contract.VII. Claims SettlementIn case of any loss or damage to the insured property, the Insured shall promptly notify the Insurance Company in writing or by email with all necessary details and evidence of loss. The claim shall be settled in accordance with the terms and conditions of this Contract and the applicable laws.VIII. IndemnificationThe Insurance Company shall indemnify the Insured for any loss or damage to the insured property, provided that such loss or damage is due to a risk covered by this Contract and is supported by adequate evidence.IX. Default and TerminationIf the Insured fails to pay the premium on time or breaches any term of this Contract, the Insurance Company may terminate this Contract immediately and cancel the insurance coverage.X. Applicable Law and JurisdictionThis Contract shall be governed by the laws of________________ (country) and any dispute arising out of or in connection with this Contract shall be subject to the jurisdiction of ________________ (court/tribunal).XI. Miscellaneous1. Both parties shall maintain confidentiality regarding any information related to this Contract.2. This Contract may not be modified or amended except in writing signed by both parties.3. Failure by either party to exercise any right or remedy under this Contract shall not be a waiver of such right or remedy.4. If any provision of this Contract is invalid or unenforceable, it shall be deemed modified to the extent necessary to render it valid and enforceable, or if such modification is not possible, it shall be severed from this Contract without affecting the validity or enforceability of the remaining provisions.5. This Contract shall be binding on both parties and their respective successors and assigns.In conclusion, the parties hereby affirm their understanding of all terms and conditions stated in this Property Insurance Contract and agree to abide by them fully.Insurance Company: ________________ (Signature)Date: ________________ (Date)Insured: ________________ (Signature)Date: ________________ (Date)____________________________ (Place)篇4Property Insurance Contract (International Version)This Property Insurance Contract is entered into by and between the Insurance Company (hereinafter referred to as "the Company") and the Insured (hereinafter referred to as "the Client"), with respect to the insurance of property located at the specified address.I. Contracting PartiesThe Company: ________________ (Insurance Company Name)The Client: ________________ (Insured's Full Name)II. Insurance PropertyThe subject matter of this insurance is located at________________ (Address) and includes, but may not be limited to, the following property: ________________ (Description of property being insured, including buildings, machinery, equipment, inventory, etc.).III. Coverage PeriodThe insurance coverage shall be effective from________________ (Start Date) until ________________ (End Date).IV. Insurance CoverageThis contract covers risks including, but not limited to: fire, theft, natural disasters (e.g., earthquake, flood), and accidents involving property damage. Additional coverages may be included upon mutual agreement between the parties. Exclusions to the coverage shall be clearly stated in this contract.V. Premium and PaymentThe total insurance premium for the coverage specified in this contract is ________________ (Amount). The Client shall pay thepremium in full prior to the commencement of the coverage period. The Company shall issue a receipt for the premium paid.VI. Claims SettlementIn case of any damage to the insured property, the Client shall immediately notify the Company. The Company shall investigate and process the claim according to its procedures. The Client shall provide all necessary documents and information to facilitate the claims process. The Company shall make payment of the claim in accordance with the terms of this contract and its policies.VII. TerminationThis contract may be terminated by either party giving a written notice to the other party prior to the end of the coverage period. In case of termination, the Company shall refund the unearned premium based on the remaining period of coverage.VIII. MiscellaneousBoth parties shall perform their duties stipulated in this contract in good faith and in accordance with laws and regulations of both parties' jurisdictions. Any disputes arising from or in connection with this contract shall be resolved through friendly negotiation. If no settlement can be reached,such disputes shall be finally settled by ________________ (Method of dispute resolution, e.g., arbitration or litigation) in accordance with ________________ (Applicable laws or arbitration rules).This contract is made in duplicate, with each party holding one copy. This contract shall be valid from the date of signing by both parties and shall be binding on both parties. Any amendments or modifications to this contract must be made in writing and signed by both parties.Insurance Company:(Company Name)(Company Address)Date: ________________ (Date)Signed by: ____________________ (Authorized Representative)Title: ____________________ (Position)Insured:(Full Name)(Address)Date: ________________ (Date)Signed by: ____________________ (Insured)Title or Witness: ____________________ (If applicable)____________________________________________________________________ 注:该合同以中英文双语呈现,双方在签订合同时应确保对合同内容有充分理解。

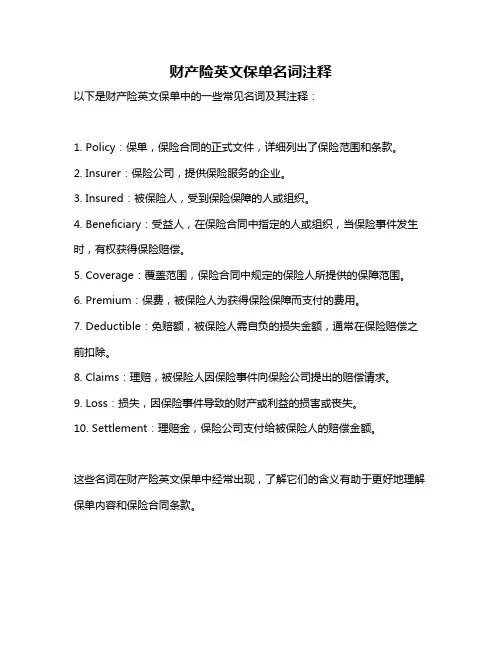

财产险英文保单名词注释

以下是财产险英文保单中的一些常见名词及其注释:

1. Policy:保单,保险合同的正式文件,详细列出了保险范围和条款。

2. Insurer:保险公司,提供保险服务的企业。

3. Insured:被保险人,受到保险保障的人或组织。

4. Beneficiary:受益人,在保险合同中指定的人或组织,当保险事件发生时,有权获得保险赔偿。

5. Coverage:覆盖范围,保险合同中规定的保险人所提供的保障范围。

6. Premium:保费,被保险人为获得保险保障而支付的费用。

7. Deductible:免赔额,被保险人需自负的损失金额,通常在保险赔偿之前扣除。

8. Claims:理赔,被保险人因保险事件向保险公司提出的赔偿请求。

9. Loss:损失,因保险事件导致的财产或利益的损害或丧失。

10. Settlement:理赔金,保险公司支付给被保险人的赔偿金额。

这些名词在财产险英文保单中经常出现,了解它们的含义有助于更好地理解保单内容和保险合同条款。

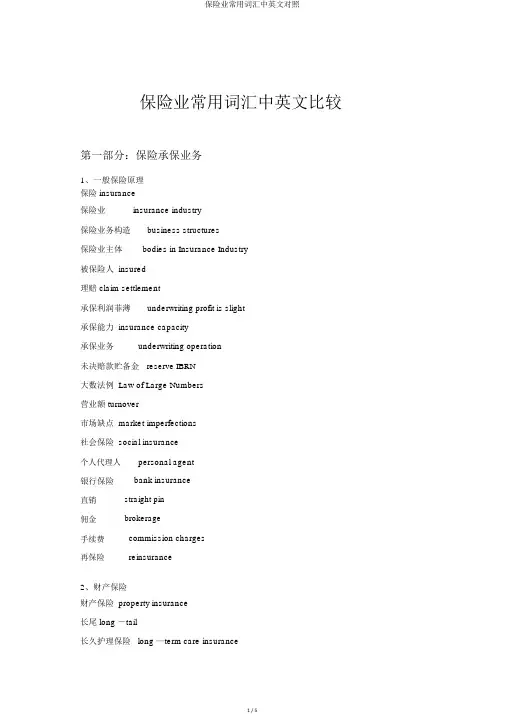

保险业常用词汇中英文比较第一部分:保险承保业务1、一般保险原理保险 insurance保险业insurance industry保险业务构造business structures保险业主体bodies in Insurance Industry被保险人 insured理赔 claim settlement承保利润菲薄underwriting profit is slight承保能力 insurance capacity承保业务underwriting operation未决赔款贮备金reserve IBRN大数法例 Law of Large Numbers营业额 turnover市场缺点 market imperfections社会保险 social insurance个人代理人银行保险personal agent bank insurance直销straight pin 佣金brokerage手续费再保险commission charges reinsurance2、财产保险财产保险 property insurance长尾 long -tail长久护理保险long —term care insurance短尾 short - tail综合赔付率 combined ratio自留 retention车险auto insurance财产保险property insurance责任保险liability insurance农业保险agricultural insurance巨灾保险catastrophe insurance不测损害保险casualty accident insurance3、寿险词汇变额寿险 variable life insurance长寿保险 insurance on last survivor按期寿险 term insurance合同积蓄机构contractual saving institutions盈利 dividend疾病保险 sickness insurance简略险 industrial insurance健康保险 health insurance巨额医药费保险major medical" insurance policy可变保费寿险flexible—premium life insurance利差损interest spread risk利率敏感型产品interest—sensitive whole life赔期 / 限时 indemnity period/limit一般寿险 ordinary life insurance人寿保险 life insurance预约利率市场化Market-based Assumed Interest Rate团险 group insurance限时缴费终生寿险 limited —payment whole life insurance 养老保险 endowment insurance医疗保险 insurance for medical care医疗花费保险medical expense insurance终生寿险 whole life insurance准备金 reserve伤残收入保险disability income insurance失能 incapacity可变全能寿险Variable-universal life insurance可变年金Variable annuity评估价值Appraisal Value内含价值Embeded Value新业务价值Value of New Business税收优惠tax break税收递延型养老保险Deferred tax endowment insurance 重病医疗保险Large quantity medical insurance分成保险Participating Insurance传统保险traditional insurance理财型保险financial planning oriented insurance投资连接寿险unit—linked life insurance4、保险偿付能力风险资本要求risk —based capital固定最低成本要求fixed minimum capital requirement 保险偿付能力看管insurance solvency regulation保险看管信息系统Insurance Regulatory Information System财务剖析追踪系统Financial Analysis Tracking System 偿付能力Solvency偿付能力不足insolvent认同财产admissible assets第二部分保险财产管理1、行业主体和看管保险财产管理insurance asset management保险法insurance law保险财产管理公司insurance asset management company中国人保公司People's Insurance Company of China(简称PICC)中国人保财产管理公司PICC Asset Management Company Limited慕尼黑再保险财产管理公司Munich ERGO Asset Management GmbH (简称MEAG)中国保监会China Insurance Regulatory Commission (简称CIRC)保险投资“新政”innovation policies in insurance investment可投资财产investable asset投资公司法案Investment Company Act2、拜托受托关系拜托人 client受托人 trustee拜托管理mandate绝对利润absolute return相对利润relative return3、组合管理大类财产配置assets allocation战略财产配置Strategic Assets Allocation (简称SAA)战术财产配置Tactic Assets Allocation (简称TAA)流动性管理liquidity management财产欠债管理Asset-Liability Management (简称ALM)久期般配duration matching现金流般配cash flow matching一般账户general account独立账户separate account4、类型投资固定利润投资fixed-income investment拥有到期类财产held-to-maturity asset交易类财产trading asset可供销售类财产asset available for sale股票投资equity investment基金投资fund investment另类投资alternative investment境外投资overseas investment基础设备债权计划infrastructure debt investment plan 未上市公司股权投资private equity investment不动产投资real estate investment利率交换Interest Rate Swap(简称IRS)均值一方差剖析the mean-variance method5、第三方业务财产管理wealth management第三方投资管理the third-party asset management 公司年金occupational annuity养老金 pension会合投财产品collective investment fund。

财产险常用附加条款中英对比财产险常用中英文附加条款汇编一般附加条款30天注销保单通知条款/30 Days Notice of Cancellation Clause30天注销保单通知条款被保险人可随时书面通知保险人注销本保险单,保险人将依照短期费率计收保险生效期间的保费。

保险人亦可提前三十天书面通知被保险人注销本保险单,保险人将退还被保险人从保险单取消之日起未满期限的按日比例计算的保险费。

30 Days Notice of Cancellation ClauseThe insurance may at any time be terminated at the option of the insurer, giving 30 days’ notic e to that effect being giving to the insured, in which case the Company shall be liable to repay on demand a ratable proportion of the premium for the unexpired terms from the date of the cancellation.The insurance may also at any time be terminated at the option of the insured, giving immediate notice to that effect being giving to the Insurer, in which case the insured shall be charged on a short period premium forthe expired terms from the date of inception.备注:天数可变动 30/60/9060天不续保通知条款/60 Days Non-Renewal Notice Clause60天不续保通知条款保险期限终止之前,本公司可提前60天书面通知被保险人本公司不虚报本保险单。

财产险常用中英文附加条款汇编目录一般附加条款 (6)30天注销保单通知条款/30 Days Notice of Cancellation Clause (6)60天不续保通知条款/60 Days Non-Renewal Notice Clause (6)理赔控制条款/Claims Control Clause (6)共同被保险人条款/Joint-Insured Clause (7)司法管辖权条款/Jurisdiction Clause (7)指定公估人条款/Loss Adjusters Clause (7)损失通知条款/Loss Notification Clause (8)不受控制条款/No Control Clause (8)不可注销保单条款/Non-Cancellation Clause (8)不使失效条款/Non-invalidation Clause (8)预付赔款条款A/Payment on Account Clause (9)预付赔款条款B (9)分期付费条款A/Premium Installment Clause (9)分期付费条款B (10)利益可分性条款/Severability of Interest Clause (10)放弃代位追偿扩展条款/Waiver of Subrogation Clause (10)财产险2000年问题除外责任条款/Year 2000 Problem Exclusion Clause (11)索赔单据条款 (12)财产险附加条款 (13)72小时条款/72 Hours Clause (13)50/50条款(50/50 Clause) (13)地面突然下陷下沉扩展条款/ Accidental Subsidence of Ground Extension Clause (14)定值保险条款/ Agreed Value Insurance Clause (14)空运费扩展条款/ Air Freight Fee Extension Clause (15)其他物品扩展条款/ All Other Contents Extension Clause (15)建筑物变动扩展条款/ Alteration of Building Clause (16)权益转让条款/Assignment Clause (16)自动承保条款/ Automatic Cover Clause (17)自动恢复保险金额条款/ Automatic Reinstatement of Sum Insured Clause (18)分摊豁免条款/ Average Relief Clause (20%) (18)锅炉、压力容器扩展条款/ Boilers and Pressure Vessels Extension Clause (19)商标条款/Brand & Trademark Clause (19)违反条件条款/ Breach of Conditions Clause (20)玻璃破碎扩展条款/ Breakage of Glass Extension Clause (20)玻璃破碎扩展条款(财产一切险)/ Breakage of Glass Clause (PAR) (21)玻璃破碎扩展条款(财产险)/ Breakage of Glass Clause (财产险) (21)盗窃险条款/ Burglary Insurance Clause (21)水箱、水管爆裂扩展条款/ Bursting of Water Tank or Water Pipe Extension Clause (22)增加资产扩展条款A/ Capital Additions Extension Clause (A) (23)增加资产扩展条款B/ Capital Additions Extension Clause (B) (23)85%扩展条款/ Co-Insurance Extension Clause (85%) (24)合同价格扩展条款/ Contract Price Extension Clause (24)复制费用扩展条款/ Cost of Duplication Extension Clause (25)清理残骸费用扩展条款/ Debris Removal Expenses Extension Clause (25)财物种别条款/ Designation of Property Clause (25)索赔单据条款/ Documents Clause (26)地震扩展条款/ Earthquake Extension Clause (26)紧急抢险条款/ Emergency Rescue Clause (27)错误和遗漏条款/ Error and Omissions Clause (27)自动升值扩展条款/ Escalation Extension Clause (28)特别费用扩展条款/ Extra Charges Extension Clause (28)飞行物体及其他空中运行物体坠落扩展条款/ Falling of Flying Objects Extension Clause (29)灭火费用扩展条款A/ Fire Fighting Cost Extension Clause (A) (29)灭火费用扩展条款B/ Fire Fighting Cost Extension Clause (B) (29)消防队灭火费用扩展条款/ Fire Fighting Brigade Charges Extension Clause (30)消防保证条款/ Fire Prevention Facilities Warranty Clause (30)洪水除外条款/ Flood and Inundation Exclusion Clause (31)洪水扩展条款/ Flood Extension Clause (31)防洪保证条款/ Flood Prevention Warranty Clause (32)地基除外条款/ Foundation Exclusion Clause (32)冰雹扩展条款/Hailstone Extension Clause (33)起重、运输机械扩展条款/ Hoisting and Transport Machinery Extension Clause (33)碰撞扩展条款/ Impact Damage Extension Clause (34)碰撞除外条款/ Impact damage Exclusion Clause (34)阻止条款/ Inhibition Clause (34)内陆运输扩展条款A/ Inland Transit Extension Clause (A) (35)内陆运输扩展条款B/ Inland Transit Extension Clause (B) (35)数据损失澄清条款/IT Clarification Clause (36)地崩及地陷条款/ Landslip & Subsidence Clause (36)遵守法律规定保证条款/ Legal Requirements Warranty (37)雷电扩展条款/ Lightning Extension Clause (37)车辆装载物扩展条款/Loaded Property Extension Clause (38)铁路机车车辆扩展条款/ Locomotive Extension Clause (38)赔款接受人条款/ Loss Payee Clause (39)抵押权条款/ Mortgage Clause (39)泥石流、崩塌、突发性滑坡扩展条款/ Mud-rock flow, Avalanche and Sudden Landslip Extension Clause (40)恶意破坏扩展条款/ Malicious Damage Extension Clause (40)不受控制条款/ No Control Clause (41)指定公估人条款/ Nomination of Loss Adjusters Clause (41)不使失效条款/ Non-invalidation Clause (41)非占用者业主条款/ Non Occupying Landlord Clause (42)场所外财产条款/ Off Premises Property Clause (42)油气管道损坏扩展条款/ Oil or Gas Pipeline Damage Extension Clause (43)建筑物外部附属设施扩展条款A/ Outside Ancillary Devices of Building Extension Clause (A) (43)建筑物外部附属设施扩展条款B/ Outside Ancillary Devices of Building Extension Clause (B) (44)委托加工扩展条款/ Out-sourcing Processing Extension Clause (44)成对或成套设备条款/ Pair & Set Clause (45)预付赔款条款A/ Payment on Account Clause (A) (45)预付赔款条款B/ Payment on Account Clause (B) (45)雇员个人物品扩展条款/ Personal Effects of Employees Extension Clause (46)便携式设备扩展条款/ Portable Devices on Premises Extension Clause (46)专业费用扩展条款/ Professional Fee Extension Clause (47)分期付费条款A/ Premium Instalment Clause (A) (47)分期付费条款B/ Premium Instalment Clause (B) (48)露天存放及简易建筑内财产扩展条款A/ Property in the Open or Simple Building Extension Clause (A) 48 露天存放及简易建筑内财产扩展条款B/ Property in the Open or Simple Building Extension Clause (B) 49 公共当局扩展条款/ Public Authority Extension Clause (49)冷库扩展条款/ Refrigerating Plants Extension Clause (50)重置价值条款(存货除外)/ Reinstatement Value Clause (not applicable to stock item) (51)清理残骸条款/ Removal of Debris Clause (52)沙尘暴除外条款/ Sandstorm Exclusion Clause (53)沙尘暴扩展条款/ Sandstorm Extension Clause (53)简易建筑除外条款/ Simple Building Exclusion (54)烟熏扩展条款/ Smoke Damage Extension Clause (54)暴雪、冰凌扩展条款/ Snowstorm and Icicle Extension Clause (55)自燃除外条款/ Spontaneous Combustion Exclusion Clause (55)自燃扩展条款/ Spontaneous Combustion Extension Clause (55)自动喷淋系统水损扩展条款/ Sprinkler Leakage Damage Extension Clause (56)仓储财产申报条款/ Stock Declaration and Adjustment Clause (56)暴风雨除外条款/ Storm and Tempest Exclusion Clause (57)暴风雨扩展条款/ Storm and Tempest Extension Clause (57)存放保证条款/ Storage Warranty (58)罢工、暴乱及民众骚乱扩展条款/ Strike Riot and/or Civil Commotions Extension Clause (58)供应中断扩展条款A/ Supply Failure Extension Clause (A) (59)供应中断扩展条款B/ Supply Suspension Extension Clause (B) (59)供应中断扩展条款C/ Supply Failure Extension Clause (C) (59)供应中断扩展条款D/ Supply Failure Extension Clause (D) (60)临时保护措施扩展条款/ Temporary Protection Extension Clause (60)厂区间临时移动扩展条款/Temporary Removal between Factories Extension Clause (61)临时移动扩展条款/ Temporary Removal Extension Clause (61)恐怖活动扩展条款/ Terrorism Extension Clause (62)盗窃、抢劫扩展条款/ Theft, Burglary and Robbery Extension Clause (62)龙卷风除外条款/ Tornado Exclusion Clause (63)龙卷风扩展条款/ Tornado Extension Clause (63)运输条款/ Transit Clause (64)台风、飓风除外条款/ Typhoon and Hurricane Exclusion Clause (64)台风、飓风扩展条款/ Typhoon and Hurricane Extension Clause (65)建筑物未受损部分额外费用扩展条款/ Undamaged Building Extra Charges Extension Clause (65)放弃代位追偿扩展条款/ Waiver of Subrogation Extension Clause (66)装修工人条款/ Workmen Clause (66)企财险附加条款1(仓储物扩展条款) (66)企财险附加条款2(洪水责任水位线条款) (67)企财险附加条款3(建筑物外部附属设施扩展条款) (67)企财险附加条款4(防洪保证条款) (67)企财险附加条款5(简易建筑物扩展条款) (67)一般附加条款30天注销保单通知条款/30 Days Notice of Cancellation Clause30天注销保单通知条款被保险人可随时书面通知保险人注销本保险单,保险人将依照短期费率计收保险生效期间的保费。

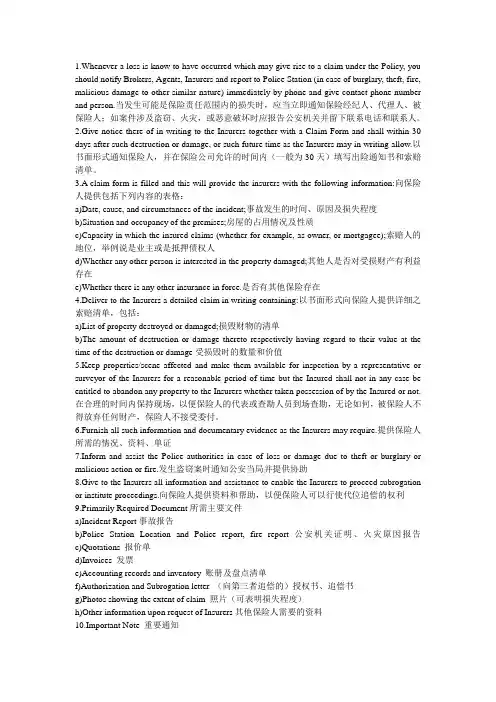

1.Whenever a loss is know to have occurred which may give rise to a claim under the Policy, you should notify Brokers, Agents, Insurers and report to Police Station (in case of burglary, theft, fire, malicious damage to other similar nature) immediately by phone and give contact phone number and person.当发生可能是保险责任范围内的损失时,应当立即通知保险经纪人、代理人、被保险人;如案件涉及盗窃、火灾,或恶意破坏时应报告公安机关并留下联系电话和联系人。

2.Give notice there of in writing to the Insurers together with a Claim Form and shall within 30 days after such destruction or damage, or such future time as the Insurers may in writing allow.以书面形式通知保险人,并在保险公司允许的时间内(一般为30天)填写出险通知书和索赔清单。

3.A claim form is filled and this will provide the insurers with the following information:向保险人提供包括下列内容的表格:a)Date, cause, and circumstances of the incident;事故发生的时间、原因及损失程度b)Situation and occupancy of the premises;房屋的占用情况及性质c)Capacity in which the insured claims (whether for example, as owner, or mortgagee);索赔人的地位,举例说是业主或是抵押债权人d)Whether any other person is interested in the property damaged;其他人是否对受损财产有利益存在e)Whether there is any other insurance in force.是否有其他保险存在4.Deliver to the Insurers a detailed claim in writing containing:以书面形式向保险人提供详细之索赔清单,包括:a)List of property destroyed or damaged;损毁财物的清单b)The amount of destruction or damage thereto respectively having regard to their value at the time of the destruction or damage受损毁时的数量和价值5.Keep properties/scene affected and make them available for inspection by a representative or surveyor of the Insurers for a reasonable period of time but the Insured shall not in any case be entitled to abandon any property to the Insurers whether taken possession of by the Insured or not.在合理的时间内保持现场,以便保险人的代表或查勘人员到场查勘,无论如何,被保险人不得放弃任何财产,保险人不接受委付。

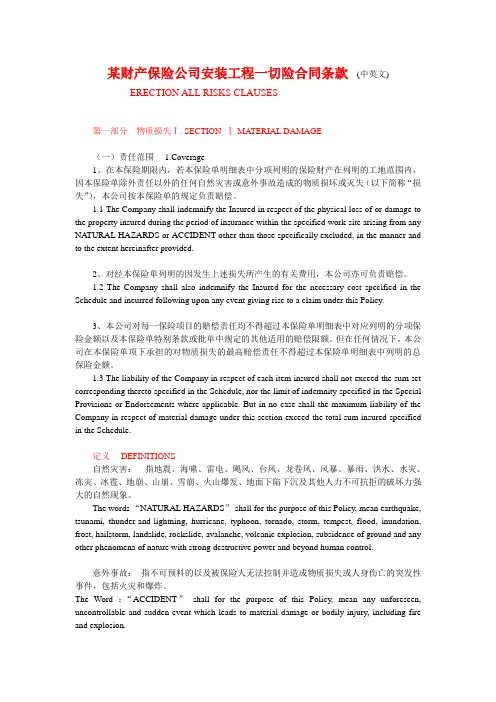

某财产保险公司安装工程一切险合同条款(中英文)ERECTION ALL RISKS CLAUSES第一部分物质损失Ⅰ. SECTION Ⅰ-MATERIAL DAMAGE(一)责任范围 1.Coverage1、在本保险期限内,若本保险单明细表中分项列明的保险财产在列明的工地范围内,因本保险单除外责任以外的任何自然灾害或意外事故造成的物质损坏或灭失(以下简称“损失”),本公司按本保险单的规定负责赔偿。

1.1 The Company shall indemnify the Insured in respect of the physical loss of or damage to the property insured during the period of insurance within the specified work-site arising from any NA TURAL HAZARDS or ACCIDENT other than those specifically excluded, in the manner and to the extent hereinafter provided.2、对经本保险单列明的因发生上述损失所产生的有关费用,本公司亦可负责赔偿。

1.2 The Company shall also indemnify the Insured for the necessary cost specified in the Schedule and incurred following upon any event giving rise to a claim under this Policy.3、本公司对每一保险项目的赔偿责任均不得超过本保险单明细表中对应列明的分项保险金额以及本保险单特别条款或批单中规定的其他适用的赔偿限额。

但在任何情况下,本公司在本保险单项下承担的对物质损失的最高赔偿责任不得超过本保险单明细表中列明的总保险金额。

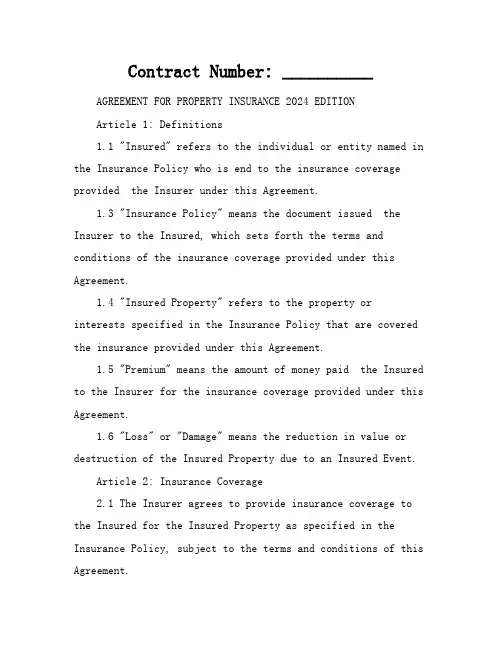

Contract Number: __________ AGREEMENT FOR PROPERTY INSURANCE 2024 EDITIONArticle 1: Definitions1.1 "Insured" refers to the individual or entity named in the Insurance Policy who is end to the insurance coverage provided the Insurer under this Agreement.1.3 "Insurance Policy" means the document issued the Insurer to the Insured, which sets forth the terms and conditions of the insurance coverage provided under this Agreement.1.4 "Insured Property" refers to the property orinterests specified in the Insurance Policy that are covered the insurance provided under this Agreement.1.5 "Premium" means the amount of money paid the Insured to the Insurer for the insurance coverage provided under this Agreement.1.6 "Loss" or "Damage" means the reduction in value or destruction of the Insured Property due to an Insured Event.Article 2: Insurance Coverage2.1 The Insurer agrees to provide insurance coverage to the Insured for the Insured Property as specified in the Insurance Policy, subject to the terms and conditions of this Agreement.Article 3: Premium Payment3.1 The Insured shall pay the Premium to the Insurer in accordance with the payment schedule and amount specified in the Insurance Policy.3.2 In the event of nonpayment of the Premium the Insured, the Insurer may, at its discretion, terminate this Agreement in accordance with the provisions of the Insurance Policy.Article 4: Duty to Disclose4.1 The Insured shall disclose to the Insurer all material facts that are known or ought to be known the Insured, which may affect the Insurer's decision to provide insurance coverage under this Agreement.4.2 The Insurer may void this Agreement or refuse to paya claim if the Insured fails to disclose any material fact as required under this Article.Article 5: Claims Procedure5.1 In the event of a Loss or Damage to the Insured Property, the Insured shall promptly notify the Insurer in writing and provide all necessary information and documentation to support the claim.5.2 The Insurer shall, upon receipt of the claim, conducta reasonable investigation and assess the Loss or Damage in accordance with the terms and conditions of this Agreement.Article 6: Termination6.1 This Agreement may be terminated either party upon written notice to the other party, subject to the provisions of the Insurance Policy.6.2 The Insurer shall refund the unearned Premium to the Insured, if any, in accordance with the provisions of the Insurance Policy upon termination of this Agreement.Article 7: Governing Law and Jurisdiction7.1 This Agreement shall be governed and construed in accordance with the laws of [Jurisdiction].7.2 Any dispute arising out of or in connection with this Agreement shall be subject to the exclusive jurisdiction of the courts of [Jurisdiction].IN WITNESS WHEREOF, the parties hereto have executed this Agreement as of the date first above written.Insured: ______________________By: __________________________Name: ________________________Title: ________________________Insurer: ______________________By: __________________________Name: ________________________Title: ________________________[Signature Page Follows]执行中遇到的问题及解决办法:1. 保险覆盖范围不明确解决办法:在签订合同前,双方应详细讨论并明确保险覆盖的具体范围,必要时可在保险单中列举具体保险项目。

财产保险合同(英文)Property Insurance ContractThis Property Insurance Contract is made and effective as of the date of signing between the Insurer and the Insured, under the terms and conditions set out below.Insured Party: [Name of the Insured]Insurer: [Name of the Insurer]1. Insurance CoverageThe Insurer agrees to provide insurance coverage for the property specified in this Contract against risks specified in Clause 2, in accordance with the terms and conditions stated herein.2. Property InsuredThe property insured under this Contract includes [describe the property and its value, e.g., buildings, machinery, equipment, stock, etc.] with a total insured value of [specify the total insured value].3. Risks CoveredThe Insurer shall cover risks such as fire, explosion, lightning, earthquake, windstorm, flood, theft, malicious damage, and other risks agreed upon by both parties.4. ExclusionsThis insurance does not cover [specify the exclusions such as war risks, nuclear accidents, wear and tear, etc.] and other risks not specifically included in this Contract.5. Period of InsuranceThe insurance coverage shall be effective from [start date] to [end date] both dates inclusive.6. PremiumThe Insured shall pay the premium specified in the Schedule of this Contract. The premium is non-refundable unless otherwise agreed by both parties.7. ClaimsIn case of any loss or damage to the property insured, the Insured shall immediately notify the Insurer and submit a claim in accordance with the procedures specified in this Contract. The Insurer shall investigate and settle the claim in a timely manner.8. Settlement of ClaimsIn case of loss or damage, the settlement of claims shall be based on the actual cash value of the property at the time of loss or damage. Any depreciation or deduction due to wear and tear shall be taken into account.9. Policy CancellationEither party may cancel this Contract by giving a written notice to the other party. The cancellation shall be effective from the date specified in the notice. The premium shall be adjusted accordingly.10. Misrepresentation and FraudIf any misrepresentation or fraud is detected in connection with this Contract, the Insurer shall have the right to cancel this Contract and reject any claim made under it. The Insured shall refund any premium received in connection with such misrepresentation or fraud.11. General ProvisionsSigned by: ______________________ (Insurer) and______________________ (Insured)Date: ______________________(This is a sample contract and should be used for reference only. It is advisable to consult a legal expert for professional advice before signing any contract.)。

财产保险合同(英文)7篇篇1Property Insurance ContractThis Property Insurance Contract is made and effective as of the date of signing between the Insurer and the Insured, with the terms and conditions agreed upon as follows:1. DEFINITIONS(a) "Insurer" refers to the insurance company or itsbranch/subsidiary that issues the insurance policy.(b) "Insured" refers to the person or entity purchasing the insurance policy from the Insurer.(c) "Property" refers to the assets specified in this Contract, for which the Insured has requested insurance coverage.2. SCOPE OF INSURANCEThe Insurer agrees to compensate the Insured for loss or damage to the Property, as specified in this Contract, due tocauses specified in the policy, including but not limited to fire, theft, natural disasters, and malicious damage.3. INSURANCE PREMIUMSThe Insured shall pay the insurance premium as specified in the insurance policy, and the amount of insurance shall be determined based on the value of the Property and the risks associated with it.4. PROPERTY COVEREDThe Property insured under this Contract includes (list specific items and their values), as agreed upon by both parties.5. EXCLUSIONSThis insurance does not cover loss or damage caused by war, nuclear reactions, radioactive contamination, earthquakes, floods, or any other risks specifically excluded in this Contract. Both parties shall specify such exclusions in detail.6. CLAIMS PROCEDUREIn case of loss or damage to the Property, the Insured shall immediately notify the Insurer and provide necessary documents and evidence to support the claim. The Insurer shall investigatethe claim and provide compensation in accordance with this Contract.7. POLICY CONDITIONS(a) The Insured shall provide accurate information and truthfully represent all facts related to the insurance application.(b) The Insurer shall not be responsible for any loss or damage not specified in this Contract or resulting from fraudulent acts by the Insured.(c) Any alteration or amendment to this Contract must be agreed upon by both parties in writing.(d) Neither party may terminate this Contract except as stipulated in the Contract or under applicable laws.(e) All disputes arising from this Contract shall be settled through friendly negotiation or legal means.8. MISCELLANEOUS(a) This Contract is governed by the laws of the country where it is executed.(b) This Contract constitutes the entire agreement between the parties and no modification shall be made except in writing and signed by both parties.(c) If any term or condition of this Contract is invalid or unenforceable under applicable law, such invalidity or unenforceability shall not affect the validity or enforceability of any other term or condition of this Contract.(d) This Contract is effective from the date of signing and shall remain in force until expired or terminated in accordance with its terms.In conclusion, this Property Insurance Contract is made and shall be binding upon both parties, with each party agreeing to adhere to its terms and conditions. This Contract represents a mutual understanding and agreement between the Insurer and the Insured on matters pertaining to property insurance.签名:________________________ 日期:______________保险公司(盖章):______________ 负责人签名:______________ 日期:______________投保人(盖章):______________ 代表签名:______________ 日期:______________(注:本合同为样例,具体条款需根据实际情况进行调整和完善。

中保财产保险有限公司The People’s Insurance (Property) Company of China,Ltd发票号码保险单号次Invoice No. Policy No.保险单INSURANCE POLICY被保险人:Insured:中保财产保险有限公司(以下简称本公司)根据被保险人的要求,及其所缴付约定的保险费,按照本保险单承担险别和背面所栽条款与下列特别条款承保下列货物运输保险,特签发本保险单。

This policy of Insurance witnesses that the People’s Insurance (Property) Company of China, Ltd. (hereinafter called“The Company”), at the request of the Insured and in consideration of the agreed premium paid by the Insured, undertakesto insure the undermentioned goods in transportation subject to conditions of the Policy as per the Clauses printed overleaf and other special clauses attached hereon.保险货物项目Descriptions of Goods包装单位数量Packing Unit Quantity保险金额Amount Insured承保险别货物标记Conditions Marks of Goods总保险金额:Total Amount Insured:_____________________________保费载运输工具Premium________________________________Per conveyance S.S______________________开航日期Slg. on or abt_____________________________起运港目的港Form__________________________To___________________所保货物,如发生本保险单项下可能引起索赔的损失或损坏,应立即通知本公司下述代理人查勘。

== 本文为word格式,下载后可方便编辑和修改! ==财产保险合同范本格式(涉外)(附英文)一、保险财产保险财产指在本保险单明细表中列明的财产及费用。

经被保险人特别申请,并经本公司书面同意,下列物品及费用经专业人员或公估部门鉴定并确定价值后,亦可作为保险财产:(一)金银、珠宝、钻石、玉器;(二)古玩、古币、古书、古画;(三)艺术作品、邮票;(四)建筑物上的广告、天线、霓虹灯、太阳能装置等;(五)计算机资料及其制作、复制费用。

下列物品一律不得作为保险财产:(一)枪支弹药、爆炸物品;(二)现钞、有价证券、票据、文件、档案、帐册、图纸;(三)动物、植物、农作物;(四)便携式通讯装置、电脑设备、照相摄像器材及其他贵重物品;(五)用于公共交通的车辆。

二、责任范围在本保险期限内,若本保险单明细表中列明的保险财产因以下列明的风险造成的直接物质损坏或灭失(以下简称“损失”),本公司同意按照本保险单的规定负责赔偿。

(一)火灾;(二)爆炸,但不包括锅炉爆炸;(三)雷电;(四)飓风、台风、龙卷风;(五)风暴、暴雨、洪水但不包括正常水位变化、海水倒灌及水库、运河、堤坝在正常水位线以下的排水和渗漏,亦不包括由于风暴、暴雨或洪水造成存放在露天或使用芦席、蓬布、茅草、油毛毡、塑料膜或尼龙等作罩棚或覆盖的保险财产的损失;(六)冰雹;(七)地崩、山崩、雪崩;(八)火山爆发;(九)地面下陷下沉,但不包括由于打桩、地下作业及挖掘作业引起的地面下陷下沉;(十)飞机坠毁、飞机部件或飞行物体坠落;(十一)水箱、水管爆裂,但不包括由于锈蚀引起水箱、水管爆裂。

三、除外责任本公司对下列各项不负责赔偿:(一)被保险人及其代表的故意行为或重大过失引起的任何损失和费用;(二)地震、海啸引起的损失和费用;(三)贬值、丧失市场或使用价值等其他后果损失;(四)战争、类似战争行为、敌对行为、武装冲突、恐怖活动、谋反、政变、罢工、暴动、民众骚乱引起的损失和费用;(五)政府命令或任何公共当局的没收、征用、销毁或毁坏;(六)核裂变、核聚变、核武器、核材料、核幅射以及放射性污染引起的任何损失和费用;(七)大气、土地、水污染及其他各种污染引起的任何损失和费用,但不包括由于本保险单第二条责任范围列明的风险造成的污染引起的损失;(八)本保险单明细表或有关条款中规定的应由被保险人自行负担的免赔额;。