AccountingBasics英语会计基础教学课件期末复习

- 格式:pptx

- 大小:239.89 KB

- 文档页数:20

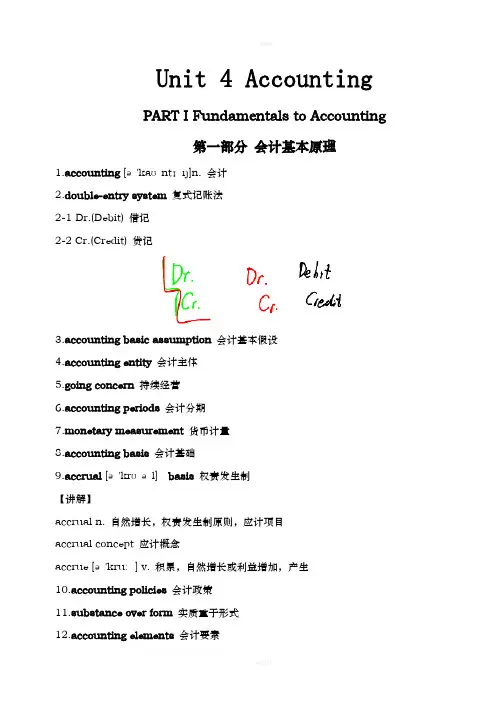

Unit 4 AccountingPART I Fundamentals to Accounting第一部分会计基本原理1.accounting [ə'kaʊntɪŋ]n. 会计2.double-entry system复式记账法2-1 Dr.(Debit) 借记2-2 Cr.(Credit) 贷记3.accounting basic assumption会计基本假设4.accounting entity会计主体5.going concern持续经营6.accounting periods会计分期7.monetary measurement货币计量8.accounting basis会计基础9.accrual [ə'krʊəl] basis权责发生制【讲解】accrual n. 自然增长,权责发生制原则,应计项目accrual concept 应计概念accrue [ə'kruː] v. 积累,自然增长或利益增加,产生10.accounting policies会计政策11.substance over form实质重于形式12.accounting elements会计要素13.recognition [rekəg'nɪʃ(ə)n] n. 确认13-1 initial recognition [rekəg'nɪʃ(ə)n] 初始确认【讲解】recognize ['rɛkəg'naɪz] v. 确认14.measurement ['meʒəm(ə)nt] n. 计量14-1 subsequent ['sʌbsɪkw(ə)nt] measurement 后续计量15.asset['æset] n. 资产16.liability [laɪə'bɪlɪtɪ] n. 负债17.owners’ equity所有者权益18.shareholder’s equity股东权益19.expense [ɪk'spens; ek-] n. 费用20.profit ['prɒfɪt] n. 利润21.residual [rɪ'zɪdjʊəl] equity剩余权益22.residual claim剩余索取权23.capital['kæpɪt(ə)l] n. 资本24.gains [ɡeinz] n. 利得25.loss [lɒs] n. 损失26.Retained earnings留存收益27.Share premium股本溢价28.historical cost历史成本【讲解】historical [hɪ'stɒrɪk(ə)l] adj. 历史的,历史上的historic [hɪ'stɒrɪk] adj. 有历史意义的,历史上著名的28-1 replacement [rɪ'pleɪsm(ə)nt] cost 重置成本29.Balance Sheet/Statement of Financial Position资产负债表29-1 Income Statement 利润表29-2 Cash Flow Statement 现金流量表29-3 Statement of changes in owners’equity (or shareholders’equity) 所有者权益(股东权益)变动表29-4 notes [nəʊts] n. 附注PART II Financial Assets*第二部分金融资产*30.financial assets金融资产e.g. A financial instrument is any contract that gives rise to a financial asset of one enterprise and a financial liability or equity instrument of another enterprise.【讲解】give rise to 引起,导致31.cash on hand 库存现金32.bank deposits [dɪ'pɒzɪt] 银行存款33.A/R, account receivable应收账款34.notes receivable应收票据35.others receivable其他应收款项36.equity investment股权投资37.bond investment债券投资38.derivative financial instrument衍生金融工具39.active market活跃市场40.quotation [kwə(ʊ)'teɪʃ(ə)n]n. 报价41.financial assets at fair value through profit or loss以公允价值计量且其变动计入当期损益的金融资产41-1 those designated as at fair value through profit or loss 指定为以公允价值计量且其变动计入当期损益的金融资产41-2 financial assets held for trading 交易性金融资产42.financial liability金融负债43.transaction costs交易费用43-1 incremental external cost 新增的外部费用【讲解】incremental [ɪnkrə'məntl] adj. 增量的,增值的44.cash dividend declared but not distributed 已宣告但尚未发放的现金股利投资收益45.profit and loss arising from fair value changes公允价值变动损益46.Held-to-maturity investments持有至到期投资47.amortized cost摊余成本【讲解】amortized [ə'mɔ:taizd]adj. 分期偿还的,已摊销的48.effective interest rate实际利率49.loan [ləʊn] n. 贷款50.receivables [ri'si:vəblz] n. 应收账款51.available-for-sale financial assets可供出售金融资产52.impairment of financial assets金融资产减值52-1 impairment loss of financial assets 金融资产减值损失53.transfer of financial assets金融资产转移53-1 transfer of the financial asset in its entirety 金融资产整体转移53-2 transfer of a part of the financial asset 金融资产部分转移54.derecognition [diː'rekəg'nɪʃən] n. 终止确认,撤销承认54-1 derecognize [diː'rekəgnaɪz] v. 撤销承认e.g. An enterprise shall derecognize a financial liability (or part of it) only when the underlying present obligation (or part of it) is discharged/cancelled.【译】金融负债的现时义务全部或部分已经解除的,才能终止确认该金融负债或其一部分。

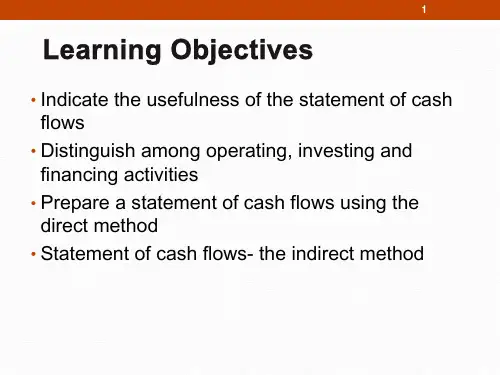

会计英语期末知识点总结1. Basic Concepts of Accounting1.1. Financial AccountingFinancial accounting is the process of recording, summarizing, and reporting financial transactions of a business to external parties such as investors, creditors, and regulators. It provides a comprehensive view of the financial performance and position of a company.1.2. Managerial AccountingManagerial accounting is the process of providing financial and non-financial information to internal management for decision making, planning, and control. It focuses on providing relevant and timely information to support the management in making informed decisions.1.3. Accounting PrinciplesGenerally Accepted Accounting Principles (GAAP) are a set of guidelines and rules that govern the accounting practices and procedures in the United States. These principles ensure consistency and comparability in financial reporting.1.4. Double-Entry AccountingDouble-entry accounting is a system in which every financial transaction has equal and opposite effects on at least two different accounts. This system ensures accuracy and completeness in recording financial transactions.1.5. Accrual Basis vs. Cash Basis AccountingAccrual basis accounting recognizes revenues when earned and expenses when incurred, regardless of when cash is received or paid. Cash basis accounting, on the other hand, recognizes revenues and expenses only when cash is received or paid.2. Financial Statements2.1. Balance SheetA balance sheet is a financial statement that shows the financial position of a company at a specific point in time. It presents the assets, liabilities, and equity of the business, providinga snapshot of its financial health.2.2. Income StatementAn income statement, also known as a profit and loss statement, shows the revenues, expenses, and profits (or losses) of a company over a specific period of time. It provides a summary of the company's financial performance.2.3. Statement of Cash FlowsThe statement of cash flows shows the sources and uses of cash in a company's operating, investing, and financing activities. It provides insights into the cash flow dynamics of a business.2.4. Statement of Retained EarningsThe statement of retained earnings shows the changes in a company's retained earnings over a specific period, including net income, dividends, and other adjustments. It reconciles the beginning and ending balances of retained earnings.3. Key Principles in Accounting3.1. Historical Cost PrincipleThe historical cost principle requires assets to be recorded at their original cost, rather than their current market value. This principle ensures reliability and objectivity in financial reporting.3.2. Revenue Recognition PrincipleThe revenue recognition principle states that revenues should be recognized when earned, regardless of when cash is received. This principle ensures that revenues are matched with the expenses incurred to generate them.3.3. Matching PrincipleThe matching principle requires expenses to be recognized in the same period as the revenues they help generate. This principle ensures that the income statement accurately reflects the profitability of a company.3.4. Full Disclosure PrincipleThe full disclosure principle requires companies to disclose all relevant information in their financial statements and footnotes, providing a complete and transparent view of their financial position and performance.3.5. Consistency PrincipleThe consistency principle requires companies to use the same accounting methods and techniques from one period to the next, providing consistent and comparable financial information.In conclusion, accounting is a vital function in any business organization. It provides crucial information that helps in decision-making, planning, and control. By understanding the basic concepts, financial statements, and key principles in accounting, stakeholders can make informed judgments about the financial health and performance of a company.。