投资学课程练习题

- 格式:doc

- 大小:119.00 KB

- 文档页数:5

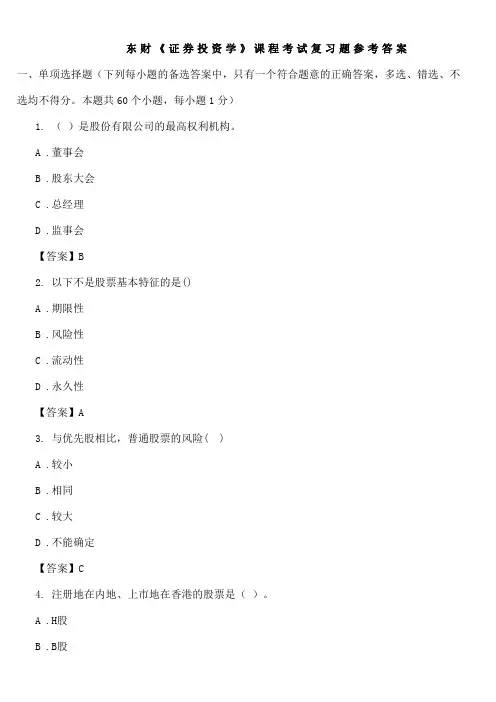

东财《证券投资学》课程考试复习题参考答案一、单项选择题(下列每小题的备选答案中,只有一个符合题意的正确答案,多选、错选、不选均不得分。

本题共60个小题,每小题1分)1. ()是股份有限公司的最高权利机构。

A .董事会B .股东大会C .总经理D .监事会【答案】B2. 以下不是股票基本特征的是()A .期限性B .风险性C .流动性D .永久性【答案】A3. 与优先股相比,普通股票的风险( )A .较小B .相同C .较大D .不能确定【答案】C4. 注册地在内地、上市地在香港的股票是()。

A .H股B .B股C .N股D .S股【答案】A5. 债券能为投资者带来一定收入,即债权投资的报酬是指债券的( )。

A .偿还性B .流动性C .安全性D .收益性【答案】D6. 下列债券中风险最小的是( )。

A .国债B .政府担保债券C .金融债券D .公司债券【答案】A7. 证券投资基金反映的是( )关系。

A .产权B .所有权C .债权债务D .委托代理【答案】D8. 开放式基金的交易价格取决于( )。

A .每一基金份额总资产值的大小B .市场供求C .每一基金份额净资产值的大小D .基金面值的大小【答案】C9. 积极成长型基金会将基金资产主要投资于()。

A .蓝筹股或者是具有长期升值潜力的普通股B .具有高成长潜力的小公司股票或者是具备良好前景的公司股票C .会把一半的资金投资于债券,另一半的资金投资于股票D .股息和红利水平较高的绩优股、资信度高的政府公债和公司债等【答案】B10. 依法持有并保管基金资产的是( )。

A .基金持有人B .基金管理人C .基金托管人D .证券交易所【答案】C11. 看涨期权的买方对标的金融资产具有( )的权利。

A .买入B .卖出C .持有D .以上都不是【答案】A12. 认沽权证实质上是一种普通股票的( )。

A .远期合约B .期货合约C .看跌期权D .看涨期权【答案】C13. 可转换证券实质上是一种普通股票的( )。

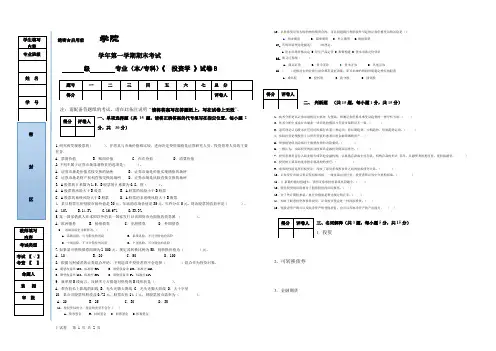

绝密★启用前学院学年第一学期期末考试级专业(本/专科)《投资学》试卷B注:需配备答题纸的考试,请在此备注说明“请将答案写在答题纸上,写在试卷上无效”。

一、单项选择题(共15 题,请将正确答案的代号填写在指定位置,每小题2分,共30分)1.研究和发现股票的( ),并将其与市场价格相比较,进而决定投资策略是证券研究人员、投资管理人员的主要任务。

A.票面价值B.账面价值 C.内在价值 D.清算价值2.下列不属于证券市场显著特征的选项是( )。

A.证券市场是价值直接交换的场所 B.证券市场是价值实现增值的场所C.证券市场是财产权利直接交换的场所 D.证券市场是风险直接交换的场所3. A股票的β系数为1.5,B股票的β系数为0.8,则()。

A.A股票的风险大于B股票 B.A股票的风险小于B股票C.A股票的系统风险大于B股票 D.A股票的非系统风险大于B股票4. 某只股票年初每股市场价值是30元,年底的市场价值是35元,年终分红5元,则该股票的收益率是()。

A.10% B.14.3% C.16.67% D.33.3%5.某一国家借款人在本国以外的某一国家发行以该国货币为面值的债券属()。

A.欧洲债券B.扬基债券 C.亚洲债券 D.外国债券6、市场风险也可解释为。

()A. 系统风险,可分散化的风险B. 系统风险,不可分散化的风险C. 个别风险,不可分散化的风险D. 个别风险,可分散化的风险7.如果某可转换债券面额为l 000元,规定其转换比例为50,则转换价格为()元。

A.10 B.20 C.50 D.1008. 根据马柯威茨的证券组合理论,下列选项中投资者将不会选择()组合作为投资对象。

A.期望收益率18%、标准差32% B.期望收益率12%、标准差16%C.期望收益率11%、标准差20% D.期望收益率8%、标准差11%9.就单根K线而言,反映多方占据绝对优势的K线形状是()。

A.带有较长上影线的阳线 B.光头光脚大阴线 C.光头光脚大阳线 D.大十字星10.某公司股票每股收益0.72元,股票市价14.4元,则股票的市盈率为()。

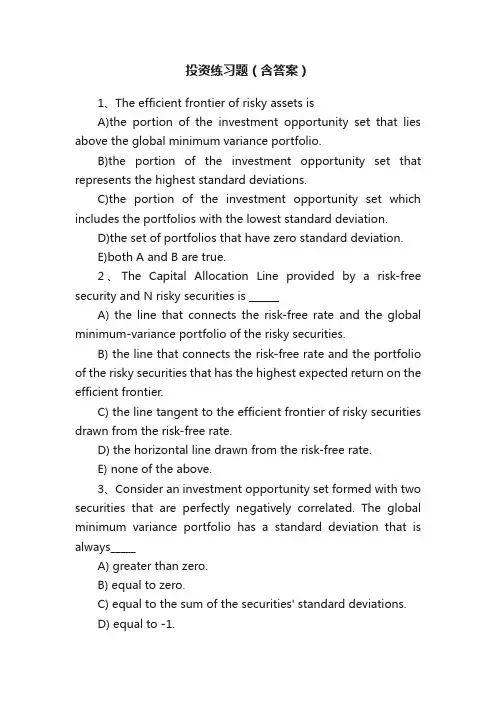

投资练习题(含答案)1、The efficient frontier of risky assets isA)the portion of the investment opportunity set that lies above the global minimum variance portfolio.B)the portion of the investment opportunity set that represents the highest standard deviations.C)the portion of the investment opportunity set which includes the portfolios with the lowest standard deviation.D)the set of portfolios that have zero standard deviation.E)both A and B are true.2、The Capital Allocation Line provided by a risk-free security and N risky securities is ______A) the line that connects the risk-free rate and the global minimum-variance portfolio of the risky securities.B) the line that connects the risk-free rate and the portfolio of the risky securities that has the highest expected return on the efficient frontier.C) the line tangent to the efficient frontier of risky securities drawn from the risk-free rate.D) the horizontal line drawn from the risk-free rate.E) none of the above.3、Consider an investment opportunity set formed with two securities that are perfectly negatively correlated. The global minimum variance portfolio has a standard deviation that is always_____A) greater than zero.B) equal to zero.C) equal to the sum of the securities' standard deviations.D) equal to -1.E) none of the above.4、Which of the following statements is (are) true regarding the variance of a portfolio of two risky securities?A) The higher the coefficient of correlation between securities, the greater the reduction in the portfolio variance.B) There is a linear relationship between the securities' coefficient of correlation and the portfolio variance.C) The degree to which the portfolio variance is reduced depends on the degree of correlation between securities.D) A and B.E) A and C.5、Efficient portfolios of N risky securities are portfolios thatA) are formed with the securities that have the highest rates of return regardless of their standard deviations.B) have the highest rates of return for a given level of risk.C) are selected from those securities with the lowest standard deviations regardless of their returns.D) have the highest risk and rates of return and the highest standard deviations.E) have the lowest standard deviations and the lowest rates of return.6、As diversification increases, the total variance of a portfolio approaches ____________.A) 0 B) 1 C) the variance of the market portfolioD) infinity E) none of the above7、The index model was first suggested by ____________.A) Graham B) Markowitz C) Miller D) SharpeE) none of the above8、.A single-index model uses __________ as a proxy for the systematic risk factor.A) a market index, such as the S&P 500B) the current account deficitC) the growth rate in GNPD) the unemployment rateE) none of the above9、According to the index model, covariances among security pairs areA) due to the influence of a single common factor represented by the market index returnB) extremely difficult to calculateC) related to industry-specific eventsD) usually positiveE) A and D10、In a factor model, the return on a stock in a particular period will be related to _________.A) firm-specific events B) macroeconomic events C) the error termD) both A and B E) neither A nor B11、Which of the following statement(s) is (are) true regarding the selection of a portfolio from those that lie on the Capital Allocation Line?A) Less risk-averse investors will invest more in the risk-free security and less in the optimal risky portfolio than more risk-averse investors.B) More risk-averse investors will invest less in the optimal risky portfolio and more in the risk-free security than less risk-averse investors.C) Investors choose the portfolio that maximizes their expected utility.D) A and C.E) B and C.12、An investor who wishes to form a portfolio that lies to the right of the optimal risky portfolio on the Capital Allocation Line must:A) lend some of her money at the risk-free rate and invest the remainder in the optimal risky portfolio.B) borrow some money at the risk-free rate and invest in the optimal risky portfolio.C) invest only in risky securities.D) such a portfolio cannot be formed.E) B and C13、Portfolio theory as described by Markowitz is most concerned with:A) the elimination of systematic risk.B) the effect of diversification on portfolio risk.C) the identification of unsystematic risk.D) active portfolio management to enhance returns.E) none of the above.14、The measure of risk in a Markowitz efficient frontier is:A) specific risk.B) standard deviation of returns.C) reinvestment risk.D) beta.E) none of the above.15、A statistic that measures how the returns of two risky assets move together is:A) variance. B) standard deviation. C) covariance. D) correlation.E) C and D.16、Rosenberg and Guy found that __________ helped topredict a firm's beta.A) the firm's financial characteristicsB) the firm's industry groupC) firm sizeD) both A and BE) A, B and C all helped to predict betas.17、If a firm's beta was calculated as 0.6 in a regression equation, Merrill Lynch would state the adjusted beta at a numberA) less than 0.6 but greater than zero.B) between 0.6 and 1.0.C) between 1.0 and 1.6.D) greater than 1.6.E) zero or less.18、The beta of Exxon stock has been estimated as 1.2 by Merrill Lynch using regression analysis on a sample of historical returns. The Merrill Lynch adjusted beta of Exxon stock would be ___________.A) 1.20 B) 1.32 C) 1.13 D) 1.0 E) none of the above19、Consider the single-index model. The alpha of a stock is 0%. The return on the market index is 16%. The risk-free rate of return is 5%. The stock earns a return that exceeds the risk-free rate by 11% and there are no firm-specific events affecting the stock performance. Theβ of the stock is _______.A) 0.67 B) 0.75 C) 1.0 D) 1.33 E) 1.5020、Suppose you forecast that the market index will earn a return of 15% in the coming year. Treasury bill s are yielding 6%. The unadjusted β of Mobil stock is 1.30. A reasonab le forecast of the return on Mobil stock for the coming year is _________ if youuse Merrill Lynch adjusted betas.A) 15.0% B) 15.5% C) 16.0% D) 16.8% E) none of the above21、The unsystematic risk of a specific securityA) is likely to be higher in an increasing market.B) results from factors unique to the firm.C) depends on market volatility.D) cannot be diversified away.E) none of the above.22、Which statement about portfolio diversification is correct?A) Proper diversification can reduce or eliminate systematic risk.B) The risk-reducing benefits of diversification do not occur meaningfully until at least 50-60 individual securities have been purchased.C) Because diversification reduces a portfolio's total risk, it necessarily reduces the portfolio's expected return.D) Typically, as more securities are added to a portfolio, total risk would be expected to decrease at a decreasing rate.E) None of the above statements is correct.23、Given an optimal risky portfolio with expected return of 12% and standard deviation of 23% and a risk free rate of 3%, what is the slope of the best feasible CAL?A) 0.64 B) 0.39 C) 0.08 D) 0.35 E) 0.3624、Given an optimal risky portfolio with expected return of 13% and standard deviation of 26% and a risk free rate of 5%, what is the slope of the best feasible CAL?A) 0.60 B) 0.14 C) 0.08 D) 0.36 E) 0.3125、The individual investor's optimal portfolio is designated by:A) The point of tangency with the indifference curve and the capital allocation line.B) The point of highest reward to variability ratio in the opportunity set.C) The point of tangency with the opportunity set and the capital allocation line.D) The point of the highest reward to variability ratio in the indifference curve.E) None of the above.26、The single-index modelA) greatly reduces the number of required calculations, relative to those required by the Markowitz model.B) enhances the understanding of systematic versus nonsystematic risk.C) greatly increases the number of required calculations, relative to those required by the Markowitz model.D) A and B. E) B and C.27、The Security Characteristic Line (SCL)A) plots the excess return on a security as a function of the excess return on the market.B) allows one to estimate the beta of the security.C) allows one to estimate the alpha of the security.D) all of the above. E) none of the above.28、The expected impact of unanticipated macroeconomic events on a security's return during the period isA) included in the security's expected return. B) zero.C) equal to the risk free rate. D) proportional to the firm's beta. E) infinite.29、Covariances between security returns tend to beA) positive because of SEC regulations.B) positive because of Exchange regulations.C) positive because of economic forces that affect many firms.D) negative because of SEC regulationsE) negative because of economic forces that affect many firms.30、One “cost” of the single-index model is that itA) is virtually impossible to apply.B) prohibits specialization of efforts within the security analysis industry.C) requires forecasts of the money supply.D) is legally prohibited by the SEC.E) allows for only two kinds of risk -- macro risk and micro risk.1 2 3 4 5 6 7 8 9 10A CBC B CD AE D11 12 13 14 15 16 17 18 19 20E E B B E E B C C D21 22 23 24 25 26 27 28 29 30B D B E A D D BC E。

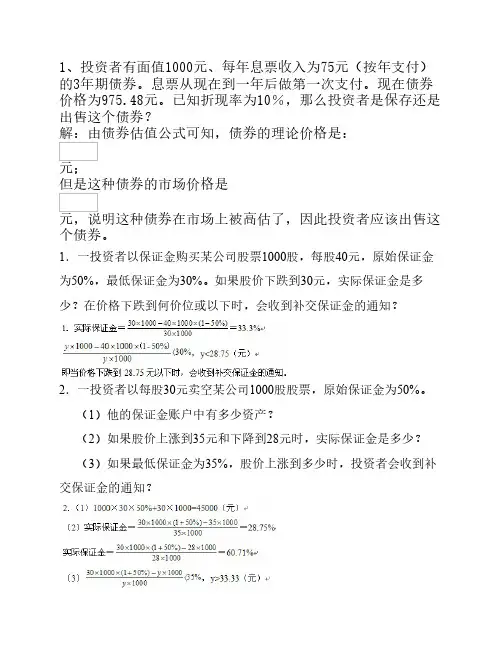

1、投资者有面值1000元、每年息票收入为75元(按年支付)的3年期债券。

息票从现在到一年后做第一次支付。

现在债券价格为975.48元。

已知折现率为10%,那么投资者是保存还是出售这个债券?

解:由债券估值公式可知,债券的理论价格是:

元;

但是这种债券的市场价格是

元,说明这种债券在市场上被高估了,因此投资者应该出售这个债券。

1.一投资者以保证金购买某公司股票1000股,每股40元,原始保证金为50%,最低保证金为30%。

如果股价下跌到30元,实际保证金是多少?在价格下跌到何价位或以下时,会收到补交保证金的通知?

2.一投资者以每股30元卖空某公司1000股股票,原始保证金为50%。

(1)他的保证金账户中有多少资产?

(2)如果股价上涨到35元和下降到28元时,实际保证金是多少?

(3)如果最低保证金为35%,股价上涨到多少时,投资者会收到补交保证金的通知?

3.如果股票的股息为5元,其预期年增长率为6%,而应得回报率

为14%,那么它的内在价值是多少?

4.某公司现时每股股息为2元,预期前3年股息年平均增长率为10%,3年后预期年平均增长率为4%,投资者的应得回报率为8%,那么股票的内在价值是多少?

5.某公司现在每股股息为3元,股息年平均增长率为6%,应得回报率为l0%,计算3年后的股价和现时的内在价值。

投资练习题1、The efficient frontier of risky assets isA)the portion of the investment opportunity set that lies above the global minimum variance portfolio.B)the portion of the investment opportunity set that represents the highest standard deviations.C)the portion of the investment opportunity set which includes the portfolios with the lowest standard deviation.D)the set of portfolios that have zero standard deviation.E)both A and B are true.2、The Capital Allocation Line provided by a risk-free security and N risky securities is ______A) the line that connects the risk-free rate and the global minimum-variance portfolio of the risky securities.B) the line that connects the risk-free rate and the portfolio of the risky securities that has the highest expected return on the efficient frontier.C) the line tangent to the efficient frontier of risky securities drawn from the risk-free rate.D) the horizontal line drawn from the risk-free rate.E) none of the above.3、Consider an investment opportunity set formed with two securities that are perfectly negatively correlated. The global minimum variance portfolio has a standard deviation that is always_____A) greater than zero.B) equal to zero.C) equal to the sum of the securities' standard deviations.D) equal to -1.E) none of the above.4、Which of the following statements is (are) true regarding the variance of a portfolio of two risky securitiesA) The higher the coefficient of correlation between securities, the greater the reduction in the portfolio variance.B) There is a linear relationship between the securities' coefficient of correlation and the portfolio variance.C) The degree to which the portfolio variance is reduced depends on the degree of correlation between securities.D) A and B.E) A and C.5、Efficient portfolios of N risky securities are portfolios thatA) are formed with the securities that have the highest rates of return regardless of their standard deviations.B) have the highest rates of return for a given level of risk.C) are selected from those securities with the lowest standard deviations regardless of their returns.D) have the highest risk and rates of return and the highest standard deviations.E) have the lowest standard deviations and the lowest rates of return.6、As diversification increases, the total variance of a portfolio approaches ____________.A) 0 B) 1 C) the variance of the market portfolioD) infinity E) none of the above7、The index model was first suggested by ____________.A) Graham B) Markowitz C) Miller D) SharpeE) none of the above8、.A single-index model uses __________ as a proxy for the systematic risk factor.A) a market index, such as the S&P 500B) the current account deficitC) the growth rate in GNPD) the unemployment rateE) none of the above9、According to the index model, covariances among security pairs areA) due to the influence of a single common factor represented by the market index returnB) extremely difficult to calculateC) related to industry-specific eventsD) usually positiveE) A and D10、In a factor model, the return on a stock in a particular period will be related to _________.A) firm-specific events B) macroeconomic events C) the error termD) both A and B E) neither A nor B11、Which of the following statement(s) is (are) true regarding the selection ofa portfolio from those that lie on the Capital Allocation LineA) Less risk-averse investors will invest more in the risk-free security and less in the optimal risky portfolio than more risk-averse investors.B) More risk-averse investors will invest less in the optimal risky portfolio and more in the risk-free security than less risk-averse investors.C) Investors choose the portfolio that maximizes their expected utility.D) A and C.E) B and C.12、An investor who wishes to form a portfolio that lies to the right of the optimal risky portfolio on the Capital Allocation Line must:A) lend some of her money at the risk-free rate and invest the remainder in the optimal risky portfolio.B) borrow some money at the risk-free rate and invest in the optimal risky portfolio.C) invest only in risky securities.D) such a portfolio cannot be formed.E) B and C13、Portfolio theory as described by Markowitz is most concerned with:A) the elimination of systematic risk.B) the effect of diversification on portfolio risk.C) the identification of unsystematic risk.D) active portfolio management to enhance returns.E) none of the above.14、The measure of risk in a Markowitz efficient frontier is:A) specific risk.B) standard deviation of returns.C) reinvestment risk.D) beta.E) none of the above.15、A statistic that measures how the returns of two risky assets move together is:A) variance. B) standard deviation. C) covariance. D)correlation.E) C and D.16、Rosenberg and Guy found that __________ helped topredict a firm's beta.A) the firm's financial characteristicsB) the firm's industry groupC) firm sizeD) both A and BE) A, B and C all helped to predict betas.17、If a firm's beta was calculated as 0.6 in a regression equation, Merrill Lynch would state the adjusted beta at a numberA) less than but greater than zero.B) between and .C) between and .D) greater than .E) zero or less.18、The beta of Exxon stock has been estimated as by Merrill Lynch using regression analysis on a sample of historical returns. The Merrill Lynch adjusted beta of Exxon stock would be ___________.A) B) 1.32 C) D) E) none of the above19、Consider the single-index model. The alpha of a stock is 0%. The return on the market index is 16%. The risk-free rate of return is 5%. The stock earns a return that exceeds the risk-free rate by 11% and there are no firm-specific events affecting the stock performance. The β of the stock is _______.A) B) 0.75 C) D) E)20、Suppose you forecast that the market index will earn a return of 15% in the coming year. Treasury bills are yielding 6%. The unadjusted β of Mobil stock is . A reasonable forecast of the return on Mobil stock for the coming year is _________ if you use Merrill Lynch adjusted betas.A) % B) % C) % D) % E) none of the above21、The unsystematic risk of a specific securityA) is likely to be higher in an increasing market.B) results from factors unique to the firm.C) depends on market volatility.D) cannot be diversified away.E) none of the above.22、Which statement about portfolio diversification is correctA) Proper diversification can reduce or eliminate systematic risk.B) The risk-reducing benefits of diversification do not occur meaningfully until at least 50-60 individual securities have been purchased.C) Because diversification reduces a portfolio's total risk, it necessarily reduces the portfolio's expected return.D) Typically, as more securities are added to a portfolio, total risk would be expected to decrease at a decreasing rate.E) None of the above statements is correct.23、Given an optimal risky portfolio with expected return of 12% and standard deviation of 23% and a risk free rate of 3%, what is the slope of the best feasible CALA) B) 0.39 C) D) E)24、Given an optimal risky portfolio with expected return of 13% and standard deviation of 26% and a risk free rate of 5%, what is the slope of the best feasible CALA) B) 0.14 C) D) E)25、The individual investor's optimal portfolio is designated by:A) The point of tangency with the indifference curve and thecapital allocation line.B) The point of highest reward to variability ratio in the opportunity set.C) The point of tangency with the opportunity set and the capital allocation line.D) The point of the highest reward to variability ratio in the indifference curve.E) None of the above.26、The single-index modelA) greatly reduces the number of required calculations, relative to those required by the Markowitz model.B) enhances the understanding of systematic versus nonsystematic risk.C) greatly increases the number of required calculations, relative to those required by the Markowitz model.D) A and B. E) B and C.27、The Security Characteristic Line (SCL)A) plots the excess return on a security as a function of the excess return on the market.B) allows one to estimate the beta of the security.C) allows one to estimate the alpha of the security.D) all of the above. E) none of the above.28、The expected impact of unanticipated macroeconomic events on a security's return during the period isA) included in the security's expected return. B) zero.C) equal to the risk free rate. D) proportional to the firm's beta.E) infinite.29、Covariances between security returns tend to beA) positive because of SEC regulations.B) positive because of Exchange regulations.C) positive because of economic forces that affect many firms.D) negative because of SEC regulationsE) negative because of economic forces that affect many firms.30、One “cost” of the single-index model is that itA) is virtually impossible to apply.B) prohibits specialization of efforts within the security analysis industry.C) requires forecasts of the money supply.D) is legally prohibited by the SEC.E) allows for only two kinds of risk -- macro risk and micro risk.。

1、The efficient frontier of risky assets isA)the portion of the investment opportunity set that lies above the global minimum variance portfolio、B)the portion of the investment opportunity set that represents the highest standard deviations、C)the portion of the investment opportunity set which includes the portfolios with the lowest standard deviation、D)the set of portfolios that have zero standard deviation、E)both A and B are true、2、The Capital Allocation Line provided by a risk-free security and N risky securities is ______A) the line that connects the risk-free rate and the global minimum-variance portfolio of the risky securities、B) the line that connects the risk-free rate and the portfolio of the risky securities that has the highest expected return on the efficient frontier、C) the line tangent to the efficient frontier of risky securities drawn from the risk-free rate、D) the horizontal line drawn from the risk-free rate、E) none of the above、3、Consider an investment opportunity set formed with two securities that are perfectly negatively correlated、The global minimum variance portfolio has a standard deviation that is always_____A) greater than zero、B) equal to zero、C) equal to the sum of the securities' standard deviations、D) equal to -1、E) none of the above、4、Which of the following statements is (are) true regarding the variance of a portfolio of two risky securities?A) The higher the coefficient of correlation between securities, the greater the reduction in the portfolio variance、B) There is a linear relationship between the securities' coefficient of correlation and the portfolio variance、C) The degree to which the portfolio variance is reduced depends on the degree of correlation between securities、D) A and B、E) A and C、5、Efficient portfolios of N risky securities are portfolios thatA) are formed with the securities that have the highest rates of return regardless of their standard deviations、B) have the highest rates of return for a given level of risk、C) are selected from those securities with the lowest standard deviations regardless of their returns、D) have the highest risk and rates of return and the highest standard deviations、E) have the lowest standard deviations and the lowest rates of return、6、As diversification increases, the total variance of a portfolio approaches ____________、A) 0 B) 1 C) the variance of the market portfolioD) infinity E) none of the above7、The index model was first suggested by ____________、A) Graham B) Markowitz C) Miller D) SharpeE) none of the above8、、A single-index model uses __________ as a proxy for the systematic risk factor、A) a market index, such as the S&P 500B) the current account deficitC) the growth rate in GNPD) the unemployment rateE) none of the above9、According to the index model, covariances among security pairs areA) due to the influence of a single mon factor represented by the market index returnB) extremely difficult to calculateC) related to industry-specific eventsD) usually positiveE) A and D10、In a factor model, the return on a stock in a particular period will be related to _________、A) firm-specific events B) macroeconomic events C) the error termD) both A and B E) neither A nor B11、Which of the following statement(s) is (are) true regarding the selection of a portfolio from those that lie on the Capital Allocation Line?A) Less risk-averse investors will invest more in the risk-free security and less in the optimal risky portfolio than more risk-averse investors、B) More risk-averse investors will invest less in the optimal risky portfolio and more in the risk-free security than less risk-averse investors、C) Investors choose the portfolio that maximizes their expected utility、D) A and C、E) B and C、12、An investor who wishes to form a portfolio that lies to the right of the optimal risky portfolio on the Capital Allocation Line must:A) lend some of her money at the risk-free rate and invest the remainder in the optimal risky portfolio、B) borrow some money at the risk-free rate and invest in the optimal risky portfolio、C) invest only in risky securities、D) such a portfolio cannot be formed、E) B and C13、Portfolio theory as described by Markowitz is most concerned with:A) the elimination of systematic risk、B) the effect of diversification on portfolio risk、C) the identification of unsystematic risk、D) active portfolio management to enhance returns、E) none of the above、14、The measure of risk in a Markowitz efficient frontier is:A) specific risk、B) standard deviation of returns、C) reinvestment risk、D) beta、E) none of the above、15、A statistic that measures how the returns of two risky assets move together is:A) variance、B) standard deviation、C) covariance、D)correlation、E) C and D、16、Rosenberg and Guy found that __________ helped to predict a firm's beta、A) the firm's financial characteristicsB) the firm's industry groupC) firm sizeD) both A and BE) A, B and C all helped to predict betas、17、If a firm's beta was calculated as 0、6 in a regression equation, Merrill Lynch would state the adjusted beta at a numberA) less than 0、6 but greater than zero、B) between 0、6 and 1、0、C) between 1、0 and 1、6、D) greater than 1、6、E) zero or less、18、The beta of Exxon stock has been estimated as 1、2 by Merrill Lynch using regression analysis on a sample of historical returns、The Merrill Lynch adjusted beta of Exxon stock would be ___________、A) 1、20 B) 1、32 C) 1、13 D) 1、0 E) none of the above19、Consider the single-index model、The alpha of a stock is 0%、The return on the market index is 16%、The risk-free rate of return is 5%、The stock earns a return that exceeds the risk-free rate by 11% and there are no firm-specific events affecting the stock performance、The β of the stock is _______、A) 0、67 B) 0、75 C) 1、0 D) 1、33 E) 1、5020、Suppose you forecast that the market index will earn a return of 15% in the ing year、Treasury bills are yielding 6%、The unadjusted β of Mobil stock is 1、30、 A reasonable forecast of the return on Mobil stock for the ing year is _________ if you use Merrill Lynch adjusted betas、A) 15、0% B) 15、5% C) 16、0% D) 16、8% E) none of the above21、The unsystematic risk of a specific securityA) is likely to be higher in an increasing market、B) results from factors unique to the firm、C) depends on market volatility、D) cannot be diversified away、E) none of the above、22、Which statement about portfolio diversification is correct?A) Proper diversification can reduce or eliminate systematic risk、B) The risk-reducing benefits of diversification do not occur meaningfully until at least 50-60 individual securities have been purchased、C) Because diversification reduces a portfolio's total risk, it necessarily reduces the portfolio's expected return、D) Typically, as more securities are added to a portfolio, total risk would be expected to decrease at a decreasing rate、E) None of the above statements is correct、23、Given an optimal risky portfolio with expected return of 12% and standard deviation of 23% and a risk free rate of 3%, what is the slope of the best feasible CAL?A) 0、64 B) 0、39 C) 0、08 D) 0、35 E) 0、3624、Given an optimal risky portfolio with expected return of 13% and standard deviation of 26% and a risk free rate of 5%, what is the slope of the best feasible CAL?A) 0、60 B) 0、14 C) 0、08 D) 0、36 E) 0、3125、The individual investor's optimal portfolio is designated by:A) The point of tangency with the indifference curve and the capital allocation line、B) The point of highest reward to variability ratio in the opportunity set、C) The point of tangency with the opportunity set and the capital allocation line、D) The point of the highest reward to variability ratio in the indifference curve、E) None of the above、26、The single-index modelA) greatly reduces the number of required calculations, relative to those required by the Markowitz model、B) enhances the understanding of systematic versus nonsystematic risk、C) greatly increases the number of required calculations, relative to those required by the Markowitz model、D) A and B、E) B and C、27、The Security Characteristic Line (SCL)A) plots the excess return on a security as a function of the excess return on the market、B) allows one to estimate the beta of the security、C) allows one to estimate the alpha of the security、D) all of the above、 E) none of the above、28、The expected impact of unanticipated macroeconomic events on a security's return during the period isA) included in the security's expected return、B) zero、C) equal to the risk free rate、D) proportional to the firm's beta、E) infinite、29、Covariances between security returns tend to beA) positive because of SEC regulations、B) positive because of Exchange regulations、C) positive because of economic forces that affect many firms、D) negative because of SEC regulationsE) negative because of economic forces that affect many firms、30、One “cost” of the single-index model is that itA) is virtually impossible to apply、B) prohibits specialization of efforts within the security analysis industry、C) requires forecasts of the money supply、D) is legally prohibited by the SEC、E)。

2021-5《投资学》A卷及答案上海金融学院2021--2021 学年度第二学期《投资学》课程A卷代码:23330295(集中考试考试形式:闭卷考试用时: 90 分钟)考试时只能使用简单计算器(无存储功能)试题纸一、单项选择题(每题1分,共10分;在答题纸上相应位置填入正确选项前的英文字母): 1、证券持有人面临预期收益不能实现,是证券的( )特征。

A、期限性B、收益性C、流通性D、风险性 2、证券交易所内证券交易的竞价原则是( )。

A、时间优先,客户优先B、价格优先,时间优先C、数量优先D、市价优先 3、以追求当期高收入为基本目标,以能带来稳定收入的证券为主要投资对象的证券投资基金是()。

A、指数基金B、成长型基金C、收入型基金D、平衡型基金4、企业对其产品的未来需求的预期相对悲观,于是决定减少投资。

这往往会造成实际利率()A、下降B、不变C、上升D、不确定 5、风险厌恶程度越强的投资者,其效用无差异曲线越()A、平缓B、陡峭C、水平D、下倾 6、零贝塔值证券的期望收益率为()。

A、市场收益率B、零收益率C、负收益率D、无风险收益率7、收益率曲线向右下方倾斜意味着在同一时点上,长期债券收益率( )短期债券收益率。

A、高于B、等于C、低于D、不能判断是否高于8、一张5年期零息票债券的久期是( )。

A、小于5年B、多于5年C、等于5年D、等同于一张5年期10%的息票债券9、考虑单指数模型,某只股票的阿尔法为0%。

市场指数的收益率为16%。

无风险收益率为5%。

尽管没有个别风险影响股票表现,这只股票的收益率仍超出无风险收益率11%。

那么这只股票的贝塔值是多少?()1A、0.67B、0.75C、1.0D、1.3310、已知一张3年期零息票债券的收益率是7.2%,第一年、第二年的远期利率分别为6.1%和6.9%,那么第三年的远期利率应为多少?( )A、7.2%B、8.6%C、6.1%D、6.9%二、多项选择题(每题1分,共10分;在答题纸上相应位置填入正确选项前的英文字母):1、( )是金融资产。

国本国际投资学题库————————————————————————————————作者:————————————————————————————————日期:10国本国际投资学习题库一、单项选择题1.下列国际投资方式中属于股权投资的是( C )。

A.技术授权B.管理合同C.合资经营D.合作经营2.下列关于证券组合有效集的条件正确的是( C )。

A. 在既定风险水平下取得最大收益并且在既定收益率水平下承担风险最大B. 在既定风险水平下取得最大收益或在既定收益率水平下承担风险最大C. 在既定风险水平下取得最大收益并且在既定收益率水平下承担风险最小D. 在既定风险水平下取得最大收益或在既定收益率水平下承担风险最小3.下列选项中不属于我国对外直接投资特点的是( B )A.我国对外投资规模总体规模偏小B.投资主体中大型国有企业占比逐渐上升C.我国的投资行业领域不断拓宽D.我国对外投资呈现向世界各地分散的趋势4.通过收购另一家已在海外证券市场上市的公司即空壳公司的全部或部分股份,取得上市公司的实际管理权,然后注入本国国内资产和业务,以达到海外间接上市目的的方式被称为( D )。

A.造壳上市B.换壳上市C.借壳上市D.买壳上市5.下列选项中不属于我国吸收外商直接投资特点的是( C )。

A.引资区域结构呈现“东重西轻”特点B.资金来源地日益多元化C.外资进入方式以跨国并购为主D.外商对华投资的独资化趋势日益明显6.将生产或经营过程中的某一个或几个环节交由其他实体完成的一种商业模式被称为( A )。

A.服务外包B.国际工程承包C.服务贸易D.产业转移7.下列选项中会增加国际投资风险的是( B )。

A.对东道国投资环境进行全面考察B.延长投资期限C.提高投资者的经营管理水平D.国际政治经济格局稳定8.外汇风险不包括( C )。

A.折算风险B.交易风险C. 技术风险D. 经济风险9.跨国公司规避国际业务中经营风险的方式不包括( D )。

《投资学》习题集第一部分导论第1章绪论一、思考题1、简述把对投资定义五消费的延迟的理解。

2、从追求效用最大化的经济人角度出发,分析如何安排当期消费与将来消费。

3、什么是对财富的时间偏好性?4、理解投资者偏好因素对投资行为的影响。

5、简述影响投资收益率的因素。

6、简述投资收益的来源及其之间的相互关系。

7、影响投资策略选择的因素有哪些?8、市场微观结构有哪些因素组成?9、如何进行投资的业绩评价?10、请对完整的投资过程作简要的概述。

第2章投资环境一、思考题1. 假设你发现一只装有100亿美元的宝箱。

a. 这是实物资产还是金融资产?b. 社会财富会因此而增加吗?c. 你会更富有吗?d. 你能解释你回答b、c时的矛盾吗?有没有人因为这个发现而受损呢?2. Lanni Products是一家新兴的计算机软件开发公司,它现有计算机设备价值30 000美元,以及由L a n n i的所有者提供的20 000美元现金。

在下面的交易中,指明交易涉及的实物资产或(和)金融资产。

在交易过程中有金融资产的产生或损失吗?a. Lanni 公司向银行贷款。

它共获得50 000美元的现金,并且签发了一张票据保证3年内还款。

b. Lanni 公司使用这笔现金和它自有的20 000美元为其一新的财务计划软件开发提供融资。

c. L a n n i公司将此软件产品卖给微软公司(Microsoft ),微软以它的品牌供应给公众,Lanni公司获得微软的股票1500股作为报酬。

d. Lanni公司以每股80美元的价格卖出微软的股票,并用所获部分资金偿还贷款。

3. 重新考虑第2题中的Lanni Products公司。

a. 在它刚获得贷款时处理其资产负债表,它的实物资产占总资产的比率为多少?b. 在L a n n i用70 000美元开发新产品后,处理资产负债表,实物资产占总资产比例又是多少?c. 在收到微软股票后的资产负债表中,实物资产占总资产的比例是多少?4. 检察金融机构的资产负债表,有形资产占总资产的比率为多少?对非金融公司这一比率又如何?为什么会有这样的差异?5. 20世纪6 0年代,美国政府对海外投资者所获得的在美国出售的债券的利息征收30%预扣税(这项税收现已被取消),这项措施和与此同时欧洲债券市场(美国公司在海外发行以美元计值的债券的市场)的成长有何关系?6. 见图1-7,它显示了美国黄金证券的发行。

投资学习题习题及答案教学内容投资学习题习题及答案第⼀章投资环境1.假设你发现⼀只装有100亿美元的宝箱。

a.这是实物资产还是⾦融资产?b.社会财富会因此⽽增加吗?c.你会更富有吗?d.你能解释你回答b、c时的⽭盾吗?有没有⼈因为这个发现⽽受损呢?a. 现⾦是⾦融资产,因为它是政府的债务。

b. 不对。

现⾦并不能直接增加经济的⽣产能⼒。

c. 是。

你可以⽐以前买⼊更多的产品和服务。

d. 如果经济已经是按其最⼤能⼒运⾏了,现在你要⽤这1 0 0亿美元使购买⼒有⼀额外增加,则你所增加的购买商品的能⼒必须以其他⼈购买⼒的下降为代价,因此,经济中其他⼈会因为你的发现⽽受损。

/doc/56efa6fdef06eff9aef8941ea76e58fafab045a2.html nni Products 是⼀家新兴的计算机软件开发公司,它现有计算机设备价值30000美元,以及由Lanni的所有者提供的20000美元现⾦。

在下⾯地交易中,指明交易涉及的实物资产或(和)⾦融资产。

在交易过程中有⾦融资产的产⽣或损失吗?/doc/56efa6fdef06eff9aef8941ea76e58fafab045a2.html nni公司向银⾏贷款。

它共获得50000美元的现⾦,并且签发了⼀张票据保证3年内还款。

/doc/56efa6fdef06eff9aef8941ea76e58fafab045a2.html nni公司使⽤这笔现⾦和它⾃有的20000美元为其⼀新的财务计划软件开发提供融资。

/doc/56efa6fdef06eff9aef8941ea76e58fafab045a2.html nni公司将此软件产品卖给微软公司(Microsoft),微软以它的品牌供应给公众,Lanni公司获得微软的股票1500股作为报酬。

/doc/56efa6fdef06eff9aef8941ea76e58fafab045a2.html nni公司以每股80元的价格卖出微软的股票,并⽤所获部分资⾦还贷款。

投资学考试试题及答案一、单项选择题(每题2分,共20分)1. 投资学中,以下哪项不是投资的基本要素?A. 投资主体B. 投资对象C. 投资时间D. 投资风险答案:D2. 根据现代投资组合理论,以下哪项不是投资组合的风险来源?A. 市场风险B. 非系统性风险C. 系统性风险D. 投资者情绪答案:D3. 在资本资产定价模型(CAPM)中,以下哪项不是模型的基本假设?A. 投资者都是理性的B. 市场是有效的C. 投资者可以无限制地借贷D. 投资者都是风险厌恶的答案:C4. 以下哪项不是金融市场的基本功能?A. 资本积累B. 风险管理C. 价格发现D. 商品交换答案:D5. 以下哪项不是债券的基本特征?A. 到期日B. 票面利率C. 面值D. 股息支付答案:D6. 以下哪项不是股票的基本特征?A. 股息B. 优先权C. 流通性D. 固定收益答案:D7. 以下哪项不是期货合约的基本要素?A. 合约规模B. 交割日期C. 交割地点D. 股息率答案:D8. 以下哪项不是期权合约的基本要素?A. 执行价格B. 到期日C. 期权类型D. 面值答案:D9. 在投资分析中,以下哪项不是财务分析的主要方法?A. 比率分析B. 趋势分析C. 现金流量分析D. 技术分析答案:D10. 以下哪项不是投资决策的主要步骤?A. 确定投资目标B. 收集投资信息C. 评估投资风险D. 选择投资工具答案:D二、多项选择题(每题3分,共15分)11. 以下哪些因素会影响股票价格?A. 公司盈利能力B. 利率水平C. 市场情绪D. 政治稳定性答案:ABCD12. 以下哪些因素会影响债券价格?A. 利率变化B. 信用评级C. 通货膨胀D. 经济周期答案:ABCD13. 以下哪些因素会影响期货价格?A. 供需关系B. 季节性因素C. 政策变动D. 国际市场影响答案:ABCD14. 以下哪些因素会影响期权价格?A. 标的资产价格B. 执行价格C. 波动率D. 到期时间答案:ABCD15. 以下哪些是投资组合管理的主要目标?A. 最大化收益B. 最小化风险C. 资产配置D. 风险调整后的收益最大化答案:ABCD三、判断题(每题2分,共10分)16. 投资组合的多样化可以完全消除非系统性风险。

《投资学》练习题(二)一、选择题1.( )是金融资产。A.债券 B.机器 C.股票 D.a和c2.短期国库券在二级市场的出价是( )。A.交易商愿意出售的价格 B.交易商愿意购买的价格C.高于短期国库券的卖方报价 D.投资者的购买价格3.投资银行( )。A.是股票发行者和投资者之间的媒介B.是公司的顾问,帮助它们分析财务需求,为新发行的股票寻找买家C.接受储户的存款并把它们贷给公司D.a和b4.下列哪种是共同基金对于投资者的作用?( )A.保存和管理记录B.分散化和可分性C.专业管理D.上述各项均正确5.你以2 0美元购买了一股股票,一年以后你收到了1美元的红利,并以2 9美元卖出。你的持有期收益率是多少?( )A.45% B.50% C.5% D.40%6.在均值-标准差坐标系中,无差异曲线的斜率是( )。A.负 B.0 C.正 D.向东北7.投资者把他的财富的3 0%投资于一项预期收益为0.15、方差为0.04的风险资产,7 0%投资于收益为6%的国库券,他的资产组合的预期收益为( ),标准差为( )。A.0.114;0.12 B.0.087;0.06C.0.295;0.12 D.0.087;0.128.有风险资产组合的方差是( )。A.组合中各个证券方差的加权和B.组合中各个证券方差的和C.组合中各个证券方差和协方差的加权和D.组合中各个证券协方差的加权和9.无风险收益率和市场期望收益率分别是0.06和0.12。根据CAP M模型,贝塔值为1.2的证券X的期望收益率是( )。A.0.06 B.0.144 C.0.12 D.0.13210.美林公司出版的《证券风险评估》,用最近( )个月的数据来回归计算。A.12 B.36 C.60 D.12011.APT是1976年由( )提出的。A.林特纳 B.莫迪格利安尼和米勒 C.罗斯 D.夏普12.如果你相信逆转效应,( ) 。A.如果你在上一阶段持有股票,那么在这个阶段就买债券B.如果你在上一阶段持有债券,那么在这个阶段就买股票C.在该阶段买进在上一阶段表现较差的股票D.做空13.为了从债券信誉评级机构获得高信誉等级,企业应具有( )。A.较低倍数的获利额对利息比 B.低债务产权比C.高速动比率 D.b和c14.向上的收益率曲线是一种( )收益率曲线。A.正常的 B.隆起的C.反向的 D.平坦的15.欧式看涨期权可以如何执行?( )A.在未来的任何时刻 B.只能在到期日C.在标的资产的市值低于执行价格时 D.在红利分派之后1.衍生证券的一个例子是( )。A.通用汽车公司的普通股票 B.美孚股票的看涨期权C.商品的期货合约 D.b和c2.商业票据是由谁为筹资而发行的短期证券?( )A.联邦储备银行 B.商业银行C.大型著名公司 D.纽约证券交易所3.“证券代理”基于( )。A.投资银行从公司买入股票,然后卖给公众B.投资银行答应帮助公司以一个较好的价格销售股票C.投资银行为投资银行公司制定了最好的市场策略D.b、c4.共同基金的年终资产为457 000 000 美元,负债为17 000 000美元。如果基金在年终有24 300 000股,那么共同基金的净资产价值是多少?( )A.18.11美元 B.18.81美元 C.69.96美元 D.7.00美元5.下面哪一项决定了实际利率水平?( )I.公司和家庭储蓄的供给 II.对投资资金的需求III. 政府对资金的净供给或需求A.只有I B.只有II C.只有I、II D.I、II、III6.在均值-标准差坐标系中,有关风险厌恶者的无差异曲线哪一个是正确的?( )A.它是有相同预期收益率和不同标准差的投资组合轨迹B.它是有相同标准差和不同收益率的投资组合轨迹C.它是收益和标准差提供相同效用的投资组合轨迹D.它是收益和标准差提供了递增效用的投资组合轨迹7.考虑5%收益的国库券和下列风险证券:证券A:期望收益= 0.15;方差=0.04证券B:期望收益= 0.10;方差=0.0225证券C:期望收益= 0.12;方差=0.01证券D:期望收益= 0.13;方差=0.0625风险厌恶者将选择由国库券和上述风险证券之一组成的哪一个资产组合?( )A.国库券和证券A B.国库券和证券B C.国库券和证券C D.国库券和证券D8.当其他条件相同,分散化投资在那种情况下最有效?( )A.组成证券的收益不相关 B.组成证券的收益正相关C.组成证券的收益很高 D.组成证券的收益负相关9.对市场资产组合,哪种说法不正确? ( )A.它包括所有证券 B.它在有效边界上C.市场资产组合中所有证券所占比重与它们的市值成正比D.它是资本市场线和无差异曲线的切点10.美林公司出版的《证券风险评估》,用( )代替市场资产组合。A.道·琼斯工业平均指数B.道·琼斯运输业平均指数C.标准普尔500指数D.威尔希尔5000指数11.一个( )资产组合是完全分散化的,对一个因素的贝塔值为1,对另一个因素的贝塔值为0。A.因素 B.市场 C.指数 D.a和b12. ( )更关心公司股票在过去的市场表现,而不是其未来收益的潜在决定因素。A.信用分析家 B.基本面分析家C.系统分析家 D.技术分析者13.在发行时,息票债券通常都是( )。A.高于票面价值 B.接近或等于票面价值C.低于票面价值 D.与票面价值无关14.根据预期假说,正常的收益率曲线表示( )。A.利率在将来被认为是保持稳定的B.利率被认为将下降C.利率被认为将上升D.利率被认为先下降,再上升15.一张美国电话电报公司股票的当前市值是5 0美元。关于这种股票的一个看涨期权的执行价格是4 5美元,那么这个看涨期权( )。A.处于虚值状态B.处于实值状态C.与美国电话电报公司股票市价是4 0美元相比能获得更高的卖价D.b和c1.最先采用转手抵押证券的是( )。A.大通银行 B.花旗银行C.美国联邦国民抵押协会 D.政府国民抵押协会2.下面哪项内容最有效地阐述了欧洲美元的特点?( )A.存在欧洲银行的美元B.存在美国的外国银行分行的美元C.存在外国银行和在美国国土外的美国银行的美元D.存在美国的美国银行的美元3.二级市场包括( )。A.美国证券交易所中的交易 B.柜台交易C.与投资银行有关的交易 D.a、b4.分散化的组合有年终资产279 000 000美元,负债43 000 000美元。如果它的N AV (净资产价值)是42.13美元,基金有多少股? ( )A.43 000 000 B.6 488 372 C.5 601 709 D.1 182 2035.曾在经济衰退时表现良好的投资是( )。A.商品 B.国库券 C.股票和债券 D.黄金6.在收益-标准差坐标系中(纵坐标轴代表收益,横坐标轴代表标准差),下列哪一项是正确的?( )I. 投资者个人的无差异曲线可能相交II. 无差异曲线的斜率是负的III. 在一系列的无差异曲线中,最高的一条代表的效用最大I V. 两个投资者的无差异曲线可能相交A.只有I、I IB.只有I I、I I IC.只有I、I VD.只有I I I、I V7.酬报-波动性比率在下列哪一项中是有用的?( )A.测量收益的标准差 B.理解收益增加如何与风险增加相关C.分析不同利率债券的收益 D.评估通货膨胀的影响8.风险资产的有效边界是( )。A.在最小方差资产组合之上的投资机会 B.代表最高的收益/方差比的投资机会C.具有最小标准差的投资机会 D.a和b都正确9.关于资本市场线,哪种说法不正确?( )A.资本市场线通过无风险利率和市场资产组合两个点B.资本市场线是可达到的最好的市场配置线C.资本市场线也叫作证券市场线D.资本市场线斜率总为正10.根据指数模型,两个证券之间的协方差是( )。A.由同一个因素,即市场指数的收益率对它们的影响决定的B.非常难于计算C.与行业的特殊情况有关D.通常是负的11.利用证券定价错误获得无风险收益称作( )。A.套利 B.资本资产定价 C.因素 D.基本分析12.持续几个月甚至几年的价格长期波动,被称作( )。A.小走势 B.基本走势 C.中间走势 D.走势分析13.应计利息( )。A.在行情表中表现为债券价格B.必须由债券购买者支付并划拨到债券销售者的账户C.必须付给经纪人,为的是补偿他在到期日来临之前出售债券所造成的损失D.a和b14.下面哪一个不被认为是期限结构的解释( )。A.预期假定 B.流动偏好理论C.市场分割理论 D.现代资产组合理论15.一个看跌期权在下面哪种情况下被叫做处于虚值状态?( )A.执行价格比股票价格高 B.执行价格比股票价格低C.执行价格与股票价格相等 D.看跌期权的价格高于看涨期权的价格二、计算题1.假定某一股票年预期收益率为16%,标准差为15%,另一股票年预期收益率为14%,标准差为12%,两种股票的相关系数为0.4,每种股票投资的金额各占一半,求证券组合的预期收益率、方差和协方差。2.假设对3只股票进行定价分析。其中E(rA)=0.15;βA=2;残差的方差=0.1;需2A

《证券投资学》课程习题集【说明】:本课程《证券投资学》共有单选题,多项选择题,论述题,计算题,简答题,判断题等多种试题类型.一、单选题1.收入型证券组合是一种特殊类型的证券组合,它追求( )A、资本利得B、资本收益C、资本升值D、基本收益2。

以未来价格上升带来的价差收益为投资目标的证券组合属于( )A、收入型证券组合B、平衡型证券组合C、避税型证券组合D、增长型证券组合3.一般地讲,认为证券市场是有效市场的机构投资者倾向于选择( )A、市场指数型证券组合B、收入型证券组合C、平衡型证券组合D、有效型证券组合4.《证券组合的选择》一文被认为是投资组合理论的奠基之作,它的作者是( )A、马柯威茨B、索罗斯C、艾略特D、凯恩斯5。

股东有权参加公司经营管理的股票属于()A、成长股B、蓝筹股C、普通股D、累积优先股6。

普通股具有如下基本特点()A、优先认股权B、优先清偿C、股息优先D、有限表决权7。

投资基金的单位资产净值是()A、经常发生变化的B、不断上升的C、不断减少的D、一直不变的8.下述对股票特征的表述哪一个是错误的( )A、高风险性B、可流通性C、潜在高收益性D、返还性9。

投资基金的单位资产净值是()A、经常发生变化的B、不断上升的C、不断减少的D、一直不变的10.在深交所上市的用港币购买的人民币特种股票是()A、A股B、B股C、H股D、N股11.在上交所上市的用美元购买的人民币特种股票是( )A、A股B、B股C、H股D、N股12.公用事业、药品等行业的股票属于()A、周期性股票B、防御性股票C、投机性股票D、蓝筹股票13。

按股东的权利和义务,可将股票分为( )A、普通股和优先股B、A股和B股C、H股和N股D、记名股票和无记名股票14.在我国,B股的转让是在哪里进行的()A、香港证交所B、台湾证交所C、国内的证交所D、纽约证交所15。

甲股票的每股收益为1元,市盈率水平为15,估算该股票的价格()A、15元B、13元C、20元D、25元16。

《投资学》课程练习题

一、选择题范例

1. 市场委托指令具有()

A 价格的不确定性,执行的确定性

B 价格和执行的不确定性

C 执行的不确定性和价格的确定性

二、计算分析题(每题10分)

1. 假定你以保证金贷款的方式借入20000美元购买迪士尼公司的股票,该股票当前的市场价格为每股40美元,账户初始保证金比率要求为50%,维持保证金比率要求为35%,两天后该股票的价格跌至35美元。

(1)此时你会收到保证金催缴通知吗

(2)股价下跌至多少时,你会收到保证金催缴通知

2. 假定你拥有的风险资产组合的基本信息如下:

,。

(1)你的客户想要投资一定比例于你的风险资产组合,以获得8%的期望收益,那么他的投资比例需是多少

(2)他的组合标准差是多少

(3)另一个客户在标准差不超过12%的情况下最大化收益水平,他投资的比例是多少

3. 假定借款利率为9%,标普500指数的期望收益率为13%,标准差为25%,无风险利率为5%。

你的投资组合的期望收益为11%,标准

差为15%。

(1)考虑到更高的借款利率时画出你的客户的资本市场线,叠加两个无差异曲线,一是当客户借入资金时的;二是投资于市场指数基金和货币市场基金时的。

(2)在投资者选择既不借入资金也不贷出资金时其风险厌恶系数的范围是多少,即当y=1时的情形。

(3)贷出资金和借入资金的投资者分别最多愿意支付多少管理费4. 可行证券包括股票基金A、B和短期国库券,数据如下表所示。

期望收益(%)标准差(%)

A 10 20

B 30 60

短期国库券 5 0

假定A和B的相关系数为

(1)画出A和B构成的可行集

(2)找出最优风险组合P,计算期望收益和标准差。

(3)计算资本配置线斜率。

(4)风险厌恶系数A=5的投资者应如何投资

5. A、B、C三只股票的统计数据如下表所示:

股票 A B C

A

B

C

结合表中信息,请在等权重A和B的投资组合,与等权重B和C 的投资组合中做出选择,并说明理由。

6. 下表给出了一个由三只股票组成的金融市场,满足单指数模型。

股票市值(美元)平均超额收益率标准差(%)

A 3000 10 40

B 1940 2 30

C 1360 17 50

假定市场组合的标准差为25%,请问:

(1)市场指数投资组合的平均超额收益率为多少

(2)股票A和股票B之间的协方差是多少

(3)股票B与指数之间的协方差是多少

(4)将股票B的方差分解为市场和公司两个部分。

7. 假定无风险收益率为6%,市场的期望收益率为16%。

(1)一只股票今日的售价为50美元。

每年末将会支付每股股息6美元,值为,那么投资者预期年末该股的售价为多少

(2)你正准备买入一只股票,该股票预期的永久现金流为1000美元,但风险不能确定。

如果我认为该企业的值为,那么当实际值为1时,我实际支付的比该股票的真实价值高多少

(3)一只股票的期望收益率为4%,那么它的值为多少

8. 假定证券收益由单因素模型确定,即:

其中,表示证券的超额收益,表示市场超额收益。

无风险收益率为2%。

同样假设证券A、B和C,其数据如下表所示:

证券

A 10 25

B 12 10

C 14 20

(1)如果,计算证券A、B和C收益的方差。

(2)现在假定资产的种类无限多,并且与证券A、B和C具有相同的收益特征。

如果证券A是一个充分分散的投资组合,则该投资组合的超额收益方差的均值是多少那么只有B或C组成的投资组合呢(3)承接第(2)问,市场中是否存在套利机会如果存在套利机会,请用图表描述这一套利机会,并简要介绍如何实现这一套利机会。

9. 在未来两年年底,你要支付10000美元的学费,且债券当期的收益率为8%。

(1)你的债务的现值和久期分别是多少

(2)什么样期限的零息债券可以使你的债务免疫

(3)假设你购买一种零息债券,其价值和久期与你的债务相同。

现在假设市场利率立即上升到9%,则你的净头寸将会发生什么变化换句话说,你的学费债务和债券价值之间的差异会有什么变化如果市场

利率下降至7%,又会如何最后,请解释为什么学费债务和债券价值会存在差异

10. 假设你正在管理100万美元的资产组合,你的目标久期是10年,你可以从以下两种债券中做出选择:5年期的零息债券和终身年金,当期收益率都为5%。

(1)在你的资产组合中,你将持有两种债券各多少

(2)如果你现在的目标久期是9年,明年持有比例会发生什么变化

三、简答题范例

1. 什么是信用违约掉期(credit default swap, CDS)请简要回顾CDS 在2008年美国金融危机中扮演的角色

2. 有效市场假说中的半强势有效市场认为所有公共可得的信息都会迅速且准确地在证券价格上反映出来。

这表明投资者在信息公布出来之后不可能从购买证券中获得超额利润,因为证券价格已经完全反映了信息的全部效应。

(1)试找出两个现实中的例子以支持上述有效市场假说并给出说明。

(2)试找出两个现实中的例子驳斥上述有效市场假说并给出说明。

(3)简要说明投资者在半强势有效市场上仍然不能进行指数化投资的原因。