外文翻译:应收账款

- 格式:doc

- 大小:53.00 KB

- 文档页数:7

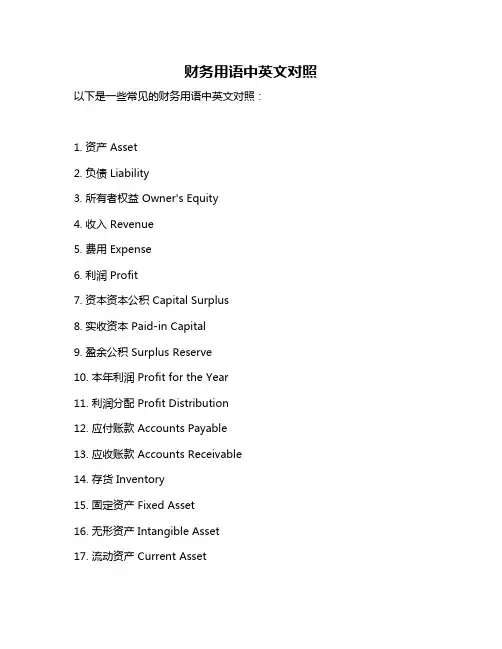

财务用语中英文对照以下是一些常见的财务用语中英文对照:1. 资产 Asset2. 负债 Liability3. 所有者权益 Owner's Equity4. 收入 Revenue5. 费用 Expense6. 利润 Profit7. 资本资本公积 Capital Surplus8. 实收资本 Paid-in Capital9. 盈余公积 Surplus Reserve10. 本年利润 Profit for the Year11. 利润分配 Profit Distribution12. 应付账款 Accounts Payable13. 应收账款 Accounts Receivable14. 存货 Inventory15. 固定资产 Fixed Asset16. 无形资产 Intangible Asset17. 流动资产 Current Asset18. 流动负债 Current Liability19. 长期负债 Long-term Liability20. 所有者权益合计 Total Owner's Equity21. 主营业务收入 Main Business Revenue22. 其他业务收入 Other Business Revenue23. 投资收益 Investment Income24. 营业外收入 Non-operating Income25. 营业成本 Operating Cost26. 营业税金及附加 Tax and Additional Expense27. 期间费用 Periodic Expense28. 管理费用 Administrative Expense29. 销售费用 Sales Expense30. 财务费用 Financial Expense31. 所得税费用 Income Tax Expense32. 其他业务支出 Other Business Expense33. 营业外支出 Non-operating Expense34. 利润总额 Total Profit35. 净利润 Net Profit36. 未分配利润 Undistributed Profit37. 外币报表折算差额 Translation Adjustment of Foreign Currency Statements38. 关联方交易 Related Party Transaction39. 非货币性交易 Non-monetary Transaction40. 或有事项 Contingencies41. 债务重组 Debt Restructuring42. 会计政策变更 Accounting Policy Change43. 会计估计变更 Accounting Estimate Change44. 前期差错更正 Correction of Prior Period Errors。

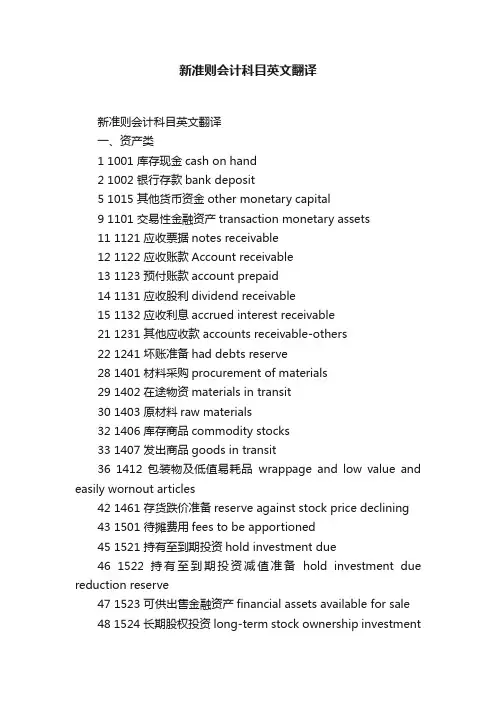

新准则会计科目英文翻译新准则会计科目英文翻译一、资产类1 1001 库存现金cash on hand2 1002 银行存款bank deposit5 1015 其他货币资金other monetary capital9 1101 交易性金融资产transaction monetary assets11 1121 应收票据notes receivable12 1122 应收账款Account receivable13 1123 预付账款account prepaid14 1131 应收股利dividend receivable15 1132 应收利息accrued interest receivable21 1231 其他应收款accounts receivable-others22 1241 坏账准备had debts reserve28 1401 材料采购procurement of materials29 1402 在途物资materials in transit30 1403 原材料raw materials32 1406 库存商品commodity stocks33 1407 发出商品goods in transit36 1412 包装物及低值易耗品wrappage and low value and easily wornout articles42 1461 存货跌价准备reserve against stock price declining43 1501 待摊费用fees to be apportioned45 1521 持有至到期投资hold investment due46 1522 持有至到期投资减值准备hold investment due reduction reserve47 1523 可供出售金融资产financial assets available for sale48 1524 长期股权投资long-term stock ownership investment49 1525 长期股权投资减值准备long-term stock ownership investment reduction reserve50 1526 投资性房地产investment real eastate51 1531 长期应收款long-term account receivable52 1541 未实现融资收益unrealized financing income54 1601 固定资产permanent assets55 1602 累计折旧accumulated depreciation56 1603 固定资产减值准备permanent assets reduction reserve57 1604 在建工程construction in process58 1605 工程物资engineer material59 1606 固定资产清理disposal of fixed assets60 1611 融资租赁资产租赁专用financial leasing assets exclusively for leasing61 1612 未担保余值租赁专用unguaranteed residual value exclusively for leasing62 1621 生产性生物资产农业专用productive living assets exclusively for agriculture63 1622 生产性生物资产累计折旧农业专用productive living assets accumulated depreciation exclusively for agriculture64 1623 公益性生物资产农业专用non-profit living assets exclusively for agriculture65 1631 油气资产石油天然气开采专用oil and gas assets exclusively for oil and gas exploitation66 1632 累计折耗石油天然气开采专用accumulated depletion exclusively for oil and gas exploitation67 1701 无形资产intangible assets68 1702 累计摊销accumulated amortization69 1703 无形资产减值准备intangible assets reduction reserve70 1711 商誉business reputation71 1801 长期待摊费用long-term deferred expenses72 1811 递延所得税资产deferred income tax assets73 1901 待处理财产损溢waiting assets profit and loss二、负债类debt group74 2001 短期借款short-term loan81 2101 交易性金融负债transaction financial liabilities83 2201 应付票据notes payable84 2202 应付账款account payable85 2205 预收账款item received in advance86 2211 应付职工薪酬employee pay payable87 2221 应交税费tax payable88 2231 应付股利dividend payable89 2232 应付利息interest payable90 2241 其他应付款other account payable97 2401 预提费用withholding expenses98 2411 预计负债estimated liabilities99 2501 递延收益deferred income100 2601 长期借款money borrowed for long term101 2602 长期债券long-term bond106 2801 长期应付款long-term account payable107 2802 未确认融资费用unacknowledged financial charges 108 2811 专项应付款special accounts payable109 2901 递延所得税负债deferred income tax liabilities 三、共同类112 3101 衍生工具derivative tool113 3201 套期工具arbitrage tool114 3202 被套期项目arbitrage project四、所有者权益类115 4001 实收资本paid-up capital116 4002 资本公积contributed surplus117 4101 盈余公积earned surplus119 4103 本年利润profit for the current year120 4104 利润分配allocation of profits121 4201 库存股treasury stock五、成本类122 5001 生产成本production cost123 5101 制造费用cost of production124 5201 劳务成本service cost125 5301 研发支出research and development expenditures 126 5401 工程施工建造承包商专用engineering construction exclusively for construction contractor127 5402 工程结算建造承包商专用engineering settlement exclusively for construction contractor 128 5403 机械作业建造承包商专用mechanical operation exclusively for construction contractor 六、损益类129 6001 主营业务收入main business income130 6011 利息收入金融共用 interest income financial sharing 135 6051 其他业务收入 other business income136 6061 汇兑损益金融专用 exchange gain or loss exclusively for finance137 6101 公允价值变动损益sound value flexible loss and profit138 6111 投资收益 income on investment142 6301 营业外收入 nonrevenue receipt143 6401 主营业务成本 main business cost144 6402 其他业务支出 other business expense145 6405 营业税金及附加 business tariff and annex146 6411 利息支出金融共用 interest expense financial sharing 155 6601 销售费用 marketing cost156 6602 管理费用 managing cost157 6603 财务费用 financial cost158 6604 勘探费用 exploration expense159 6701 资产减值损失 loss from asset devaluation160 6711 营业外支出 nonoperating expense161 6801 所得税 income tax162 6901 以前年度损益调整prior year profit and loss adjustment中英文对照最新会计科目北京市审计局发布顺序号编号会计科目名称适用范围英文表达法一、资产类1 1001 库存现金 Cash on Hand2 1002 银行存款 Bank Deposit3 1003 存放中央银行款项银行专用 Deposit in the Central Bank 4 1011 存放同业银行专用Due from Placements with Banks and Other Financial Institutions5 1015 其他货币资金 Other Monetary Capital6 1021 结算备付金证券专用 Deposit Reservation for Balance7 1031 存出保证金金融共用 Deposit for Recognizance8 1051 拆出资金金融共用Lendings to Banks and Other Financial Institutions9 1101 交易性金融资产Transactional Monetary Capital 10 1111 买入返售金融资产金融共用 Redemptory Monetary Capital for Sale 11 1121 应收票据 Notes Receivable12 1122 应收账款 Accounts Receivable131123 预付账款 Accounts Prepayment 141131 应收股利 Dividend Receivable 151132 应收利息 Accrued Interest Receivable 161211 应收保户储金保险专用Receivable Deposit from the Insured 171221 应收代位追偿款保险专用 Subrogation Receivables 181222 应收分保账款保险专用 Reinsurance Accounts Receivable 191223 应收分保未到期责任准备金保险专用 Receivable Deposit for Undue Duty of Reinsurance 201224 应收分保保险责任准备金保险专用 Receivable Deposit for Duty of Reinsurance 211231 其他应收款 Other Accounts Receivable 221241 坏账准备 Bad Debit Reserve 231251 贴现资产银行专用 Deposit of Capital Discounted 241301 贷款银行和保险共用 Loans 251302 贷款损失准备银行和保险共用 Loans Impairment Reserve 261311 代理兑付证券银行和证券共用Vicariously Cashed Securities 271321 代理业务资产 Capital in Vicarious Business 281401 材料采购 Procurement of Materials 291402 在途物资 Materials in Transit 301403 原材料 Raw Materials 311404 材料成本差异 Balance of Materials 321406 库存商品 Commodity Stocks 331407 发出商品 Goods in Transit 341410 商品进销差价 Difference between Purchase and Sales of Commodities 351411 委托加工物资 Materials for Consigned Processing 361412 包装物及低值易耗品Wrappage and Easily Wornout Inexpensive Articles 371421 消耗性生物资产农业专用 Consumptive Biological Assets 381431 周转材料建造承包商专用 Revolving Materials 391441 贵金属银行专用 Expensive Metals 40 1442 抵债资产金融共用 Capital for Debt Payment411451 损余物资保险专用 Salvage Value Of Insured Properties 421461 存货跌价准备 Reserve For Stock Depreciation 431501 待摊费用 Unamortized Expenditures 441511 独立账户资产保险专用 Capital in Independent Accounts 451521 持有至到期投资 Held-To-Maturity Investment 461522 持有至到期投资减值准备Reserve for Held-To-Maturity Investment Impairment 471523 可供出售金融资产 Financial Assets Available for Sale 48 1524 长期股权投资 Long-term Equity Investment 491525 长期股权投资减值准备Reserve for Long-term Equity Investment Impairment 501526 投资性房地产 Investment Real Estate 511531 长期应收款 Long-term Accounts Receivable 521541 未实现融资收益 Unrealized Financing Profits 531551 存出资本保证金保险专用Deposit for Capital Recognizance 541601 固定资产 Fixed Assets 551602 累计折旧 Accumulative Depreciation 561603 固定资产减值准备 Reserve for Fixed Assets Impairment 571604 在建工程 Construction in Process 581605 工程物资 Engineer Material 591606 固定资产清理 Disposal of Fixed Assets 601611 融资租赁资产租赁专用 Financial Leasing Assets 611612 未担保余值租赁专用 Unguaranteed Residual Value 62 1621 生产性生物资产农业专用 Productive Biological Assets 63 1622 生产性生物资产累计折旧农业专用Accumulative Depreciation of Productive Biological Assets 641623 公益性生物资产农业专用Biological Assets for Commonweal 651631 油气资产石油天然气开采专用 Oil and Gas Assets 66 1632 累计折耗石油天然气开采专用 Accumulated Depletion67 1701 无形资产Intangible Assets 68 1702 累计摊销Accumulated Amortization 69 1703 无形资产减值准备Reserve for Intangible Assets Impairment 70 1711 商誉Business Reputation 71 1801 长期待摊费用Long-term Deferred Expenses 72 1811 递延所得税资产Deferred Income T ax Assets 73 1901 待处理财产损溢Unsettled Assets Profit and Loss 二、负债类74 2001 短期借款 Short-term Borrowings 75 2002 存入保证金金融共用 Deposit Received for Recognizance 76 2003 拆入资金金融共用 Borrowings from Banks and Other Financial Institutions77 2004 向中央银行借款银行专用 Borrowings from the Central Bank 78 2011 同业存放银行专用Due to Placements with Banks and Other Financial Institutions79 2012 吸收存款银行专用 Savings Absorption80 2021 贴现负债银行专用 Liabilities of Capital Discounted81 2101 交易性金融负债Transactional Moneytary Liabilities 82 2111 卖出回购金融资产款金融共用 Financial Assets Sold for Repurchase 83 2201 应付票据 Notes Payable84 2202 应付账款 Accounts Payable85 2205 预收账款 Accounts Received in Advance86 2211 应付职工薪酬 Payroll Payable87 2221 应交税费 T ax Payable88 2231 应付股利 Dividend Payable89 2232 应付利息 Accrued Interest Payable90 2241 其他应付款 Other Accounts Payable91 2251 应付保户红利保险专用Dividend Payable for The Insured 92 2261 应付分保账款保险专用Dividend Payable for Reinsurance93 2311 代理买卖证券款证券专用 Receivings from Vicariously Traded Securities94 2312 代理承销证券证券和银行Receivings from Vicariously Sold款共用 Securities95 2313 代理兑付证券款证券和银行共用Receivings from Vicariously Cashed Securities 96 2314 代理业务负债Liabilities from Vicarious Business 97 2401 预提费用 Withholding Expenses 98 2411 预计负债 Estimated Liabilities 99 2501 递延收益 Deferred Profits 100 2601 长期借款 Long-term Borrowings 101 2602 长期债券 Long-term Bonds 102 2701 未到期责任准备金保险专用Deposit for Undue Duty of Reinsurance 103 2702 保险责任准备金保险专用Deposit for Duty of Reinsurance 104 2711 保户储金保险专用Deposit of the Insured 105 2721 独立账户负债保险专用Liabilities of Independent Accounts 106 2801 长期应付款Long-term Accounts Payable 107 2802 未确认融资费用 Unsettled Financing Expenses 108 2811 专项应付款Special Accounts Payable 109 2901 递延所得税负债 Deferred Income Tax Liabilities三、共同类110 3001 清算资金往来银行专用Liquidation of Inter Bank Business 111 3002 外汇买卖金融共用Foreign Exchange Buy and Sale 112 3101 衍生工具 Derivative Tools 113 3201 套期工具Arbitrage T ools 114 3202 被套期项目Arbitraged Items 四、所有者权益类115 4001 实收资本 Paid-in Capital 116 4002 资本公积 Capital Surplus 117 4101 盈余公积 Earned Surplus 118 4102 一般风险准备金融共用Generic Risk Reserve 119 4103 本年利润 Full-year Profit 120 4104 利润分配Allocation of Profits 121 4201 库存股Treasury Share 五、成本类122 5001 生产成本Production Costs 123 5101 制造费用Manufacturing Expenditures124 5201 劳务成本Service Costs 125 5301 研发支出Research and Development Expenditures 126 5401 工程施工建造承包商专用 Engineering Constructon 127 5402 工程结算建造承包商专用 Engineering Settlement 128 5403 机械作业建造承包商专用 Mechanical Operations 六、损益类129 6001 主营业务收入 Prime Operating Revenue 130 6011 利息收入金融共用Interest Income 131 6021 手续费收入金融共用Commission Income 132 6031 保费收入保险专用Premium Income 133 6032 分保费收入保险专用Reinsurance Premium Income 134 6041 租赁收入租赁专用Leasehold Income 135 6051 其他业务收入Other Business Income 136 6061 汇兑损益金融专用Exchange Gain or Loss 137 6101 公允价值变动损益 Profit andLoss from Fair Value Changes 138 6111 投资收益Income on Investment 139 6201 摊回保险责任准备金保险专用Amortized Deposit for Duty 140 6202 摊回赔付支出保险专用Amortized Compensation Expenses 141 6203 摊回分保费用保险专用Amortized Reinsurance Expenditures 142 6301 营业外收入Nonrevenue Receipt 143 6401 主营业务成本Prime Operating Cost 144 6402 其他业务成本 Other Operating Cost 145 6405 营业税金及附加 Business Tax and Surcharges 146 6411 利息支出金融共用Interest Expenses 147 6421 手续费支出金融共用Commission Expenses 148 6501 提取未到期责任准备金保险专用Appropriation of Deposit for Undue Duty 149 6502 提取保险责任准备金保险专用Appropriation of Deposit for Duty 150 6511 赔付支出保险专用Compensation Expenses 151 6521 保户红利支出保险专用Dividend Expenses for The Insured 152 6531 退保金保险专用Loan Value1536541 分出保费保险专用 Reinsurance Premium 1546542 分保费用保险专用 Reinsurance Expenses 1556601 销售费用 Marketing Costs 1566602 管理费用 Managing Costs 1576603 财务费用 Financing Costs 1586604 勘探费用 Prospecting Costs 1596701 资产减值损失 Assets Devaluation 1606711 营业外支出Nonoperating Expenses 161 6801 所得税Income Tax162 6901 以前年度损益调整Profit and Loss Adjustment of Former Years**********************1 资产 assets11~ 12 流动资产 current assets111 现金及约当现金 cash and cash equivalents1111 库存现金 cash on hand1112 零用金/周转金 petty cash/revolving funds1113 银行存款 cash in banks1116 在途现金 cash in transit1117 约当现金 cash equivalents1118 其它现金及约当现金 other cash and cash equivalents112 短期投资 short-term investment1121 短期投资 -股票 short-term investments - stock1122 短期投资 -短期票券 short-term investments - short-term notes and bills 1123 短期投资 -政府债券 short-term investments - government bonds 1124 短期投资-受益凭证short-term investments - beneficiary certificates 1125 短期投资-公司债short-term investments - corporate bonds1128 短期投资 -其它 short-term investments - other1129 备抵短期投资跌价损失 allowance for reduction of short-term investment to market113 应收票据 notes receivable1131 应收票据 notes receivable1132 应收票据贴现 discounted notes receivable1137 应收票据 -关系人 notes receivable - related parties1138 其它应收票据 other notes receivable1139 备抵呆帐-应收票据allowance for uncollec- tible accounts- notes receivable114 应收帐款 accounts receivable1141 应收帐款accounts receivable1142 应收分期帐款installment accounts receivable1147 应收帐款-关系人accounts receivable - related parties1149 备抵呆帐-应收帐款allowance for uncollec- tible accounts - accounts receivable118 其它应收款other receivables1181 应收出售远汇款forward exchange contract receivable 1182 应收远汇款-外币forward exchange contract receivable - foreign currencies1183 买卖远汇折价discount on forward ex-change contract 1184 应收收益earned revenue receivable1185 应收退税款income tax refund receivable1187 其它应收款- 关系人other receivables - related parties 1188 其它应收款- 其它other receivables - other1189 备抵呆帐- 其它应收款allowance for uncollec- tible accounts - other receivables121~122 存货inventories1211 商品存货merchandise inventory1212 寄销商品consigned goods1213 在途商品goods in transit1219 备抵存货跌价损失allowance for reduction of inventory to market1221 制成品finished goods1222 寄销制成品consigned finished goods1223 副产品by-products1224 在制品work in process1225 委外加工work in process - outsourced1226 原料raw materials1227 物料supplies1228 在途原物料materials and supplies in transit1229 备抵存货跌价损失allowance for reduction of inventory to market125 预付费用prepaid expenses1251 预付薪资prepaid payroll1252 预付租金prepaid rents1253 预付保险费prepaid insurance1254 用品盘存office supplies1255 预付所得税prepaid income tax1258 其它预付费用other prepaid expenses126 预付款项prepayments1261 预付货款prepayment for purchases1268 其它预付款项other prepayments128~129 其它流动资产other current assets1281 进项税额VAT paid ( or input tax)1282 留抵税额excess VAT paid (or overpaid VAT)1283 暂付款temporary payments1284 代付款payment on behalf of others1285 员工借支advances to employees1286 存出保证金refundable deposits1287 受限制存款certificate of deposit-restricted1291 递延所得税资产deferred income tax assets1292 递延兑换损失deferred foreign exchange losses1293 业主(股东)往来owners'(stockholders') current account 1294 同业往来current account with others1298 其它流动资产-其它other current assets - other13 基金及长期投资funds and long-term investments131 基金funds1311 偿债基金redemption fund (or sinking fund)1312 改良及扩充基金fund for improvement and expansion 1313 意外损失准备基金contingency fund1314 退休基金pension fund1318 其它基金other funds132 长期投资long-term investments1321 长期股权投资long-term equity investments1322 长期债券投资long-term bond investments1323 长期不动产投资long-term real estate in-vestments1324 人寿保险现金解约价值cash surrender value of life insurance1328 其它长期投资other long-term investments1329 备抵长期投资跌价损失allowance for excess of cost over market value of long-term investments14~ 15 固定资产property , plant, and equipment141 土地land1411 土地land1418 土地-重估增值land - revaluation increments142 土地改良物land improvements1421 土地改良物land improvements1428 土地改良物-重估增值land improvements - revaluation increments 1429 累积折旧-土地改良物accumulated depreciation - land improvements 143 房屋及建物buildings1431 房屋及建物buildings1438 房屋及建物-重估增值buildings -revaluation increments 1439 累积折旧-房屋及建物accumulated depreciation - buildings144~146 机(器)具及设备machinery and equipment1441 机(器)具machinery1448 机(器)具-重估增值machinery - revaluation increments 1449 累积折旧-机(器)具accumulated depreciation - machinery151 租赁资产leased assets1511 租赁资产leased assets1519 累积折旧-租赁资产accumulated depreciation - leased assets152 租赁权益改良leasehold improvements1521 租赁权益改良leasehold improvements1529 累积折旧- 租赁权益改良accumulated depreciation - leasehold improvements156 未完工程及预付购置设备款construction in progress and prepayments for equipment1561 未完工程construction in progress1562 预付购置设备款prepayment for equipment158 杂项固定资产miscellaneous property, plant, and equipment1581 杂项固定资产miscellaneous property, plant, and equipment1588 杂项固定资产-重估增值miscellaneous property, plant, and equipment - revaluation increments1589 累积折旧- 杂项固定资产accumulated depreciation - miscellaneous property, plant, and equipment16 递耗资产depletable assets161 递耗资产depletable assets1611 天然资源natural resources1618 天然资源-重估增值natural resources -revaluation increments1619 累积折耗-天然资源accumulated depletion - natural resources17 无形资产intangible assets171 商标权trademarks1711 商标权trademarks172 专利权patents1721 专利权patents173 特许权franchise1731 特许权franchise174 著作权copyright1741 著作权copyright175 计算机软件computer software1751 计算机软件computer software cost176 商誉goodwill1761 商誉goodwill177 开办费organization costs1771 开办费organization costs178 其它无形资产other intangibles1781 递延退休金成本deferred pension costs1782 租赁权益改良leasehold improvements1788 其它无形资产-其它other intangible assets - other18 其它资产other assets181 递延资产deferred assets1811 债券发行成本deferred bond issuance costs1812 长期预付租金long-term prepaid rent1813 长期预付保险费long-term prepaid insurance1814 递延所得税资产deferred income tax assets1815 预付退休金prepaid pension cost1818 其它递延资产other deferred assets182 闲置资产idle assets1821 闲置资产idle assets184 长期应收票据及款项与催收帐款long-term notes , accounts and overdue receivables1841 长期应收票据long-term notes receivable1842 长期应收帐款long-term accounts receivable1843 催收帐款overdue receivables1847 长期应收票据及款项与催收帐款-关系人long-term notes, accounts and overdue receivables- related parties1848 其它长期应收款项other long-term receivables1849 备抵呆帐-长期应收票据及款项与催收帐款allowance for uncollectible accounts - long-term notes, accounts and overdue receivables185 出租资产assets leased to others1851 出租资产assets leased to others1858 出租资产-重估增值assets leased to others - incremental value from revaluation1859 累积折旧-出租资产accumulated depreciation - assets leased to others 186 存出保证金refundable deposit1861 存出保证金refundable deposits188 杂项资产miscellaneous assets1881 受限制存款certificate of deposit - restricted1888 杂项资产-其它miscellaneous assets - other====================================== ==========================================2 负债liabilities21~ 22 流动负债current liabilities211 短期借款short-term borrowings(debt)2111 银行透支bank overdraft2112 银行借款bank loan2114 短期借款-业主short-term borrowings - owners2115 短期借款-员工short-term borrowings - employees2117 短期借款-关系人short-term borrowings- related parties 2118 短期借款-其它short-term borrowings - other212 应付短期票券short-term notes and bills payable2121 应付商业本票commercial paper payable2122 银行承兑汇票bank acceptance2128 其它应付短期票券other short-term notes and bills payable2129 应付短期票券折价discount on short-term notes and bills payable213 应付票据notes payable2131 应付票据notes payable2137 应付票据-关系人notes payable - related parties2138 其它应付票据other notes payable214 应付帐款accounts pay able2141 应付帐款accounts payable2147 应付帐款-关系人accounts payable - related parties216 应付所得税income taxes payable2161 应付所得税income tax payable217 应付费用accrued expenses2171 应付薪工accrued payroll2172 应付租金accrued rent payable2173 应付利息accrued interest payable2174 应付营业税accrued VAT payable2175 应付税捐-其它accrued taxes payable- other2178 其它应付费用other accrued expenses payable218~219 其它应付款other payables2181 应付购入远汇款forward exchange contract payable2182 应付远汇款-外币forward exchange contract payable - foreign currencies 2183 买卖远汇溢价premium on forward exchange contract2184 应付土地房屋款payables on land and building purchased2185 应付设备款Payables on equipment2187 其它应付款-关系人other payables - related parties2191 应付股利dividend payable2192 应付红利bonus payable2193 应付董监事酬劳compensation payable to directors and supervisors2198 其它应付款-其它other payables - other226 预收款项advance receipts2261 预收货款sales revenue received in advance2262 预收收入revenue received in advance2268 其它预收款other advance receipts227 一年或一营业周期内到期长期负债long-term liabilities -current portion 2271 一年或一营业周期内到期公司债corporate bonds payable - current portion 2272 一年或一营业周期内到期长期借款long-term loans payable - current portion2273 一年或一营业周期内到期长期应付票据及款项long-term notes and accounts payable due within one year or one operating cycle2277 一年或一营业周期内到期长期应付票据及款项-关系人long-term notes and accounts payables to related parties - current portion2278 其它一年或一营业周期内到期长期负债other long-term lia- bilities - current portion228~229 其它流动负债other current liabilities2281 销项税额VAT received(or output tax)2283 暂收款temporary receipts2284 代收款receipts under custody2285 估计售后服务/保固负债estimated warranty liabilities2291 递延所得税负债deferred income tax liabilities2292 递延兑换利益deferred foreign exchange gain2293 业主(股东)往来owners' current account2294 同业往来current account with others2298 其它流动负债-其它other current liabilities - others23 长期负债long-term liabilities231 应付公司债corporate bonds payable2311 应付公司债corporate bonds payable2319 应付公司债溢(折)价premium(discount) on corporate bonds payable232 长期借款long-term loans payable2321 长期银行借款long-term loans payable - bank2324 长期借款-业主long-term loans payable - owners2325 长期借款-员工long-term loans payable - employees2327 长期借款-关系人long-term loans payable - related parties2328 长期借款-其它long-term loans payable - other233 长期应付票据及款项long-term notes and accounts payable2331 长期应付票据long-term notes payable2332 长期应付帐款long-term accounts pay-able2333 长期应付租赁负债long-term capital lease liabilities2337 长期应付票据及款项-关系人Long-term notes and accounts payable - related parties2338 其它长期应付款项other long-term payables234 估计应付土地增值税accrued liabilities for land value increment tax2341 估计应付土地增值税estimated accrued land value incremental taxpay-able235 应计退休金负债accrued pension liabilities2351 应计退休金负债accrued pension liabilities238 其它长期负债other long-term liabilities2388 其它长期负债-其它other long-term liabilities - other28 其它负债other liabilities281 递延负债deferred liabilities2811 递延收入deferred revenue2814 递延所得税负债deferred income tax liabilities2818 其它递延负债other deferred liabilities286 存入保证金deposits received2861 存入保证金guarantee deposit received288 杂项负债miscellaneous liabilities2888 杂项负债-其它miscellaneous liabilities - other====================================== ==========================================3 所有者权益owners' equity31 资本capital311 资本(或股本)capital3111 普通股股本capital - common stock3112 特别股股本capital - preferred stock3113 预收股本capital collected in advance3114 待分配股票股利stock dividends to be distributed3115 资本capital32 资本公积additional paid-in capital321 股票溢价paid-in capital in excess of par3211 普通股股票溢价paid-in capital in excess of par- common stock3212 特别股股票溢价paid-in capital in excess of par- preferred stock323 资产重估增值准备capital surplus from assets revaluation 3231 资产重估增值准备capital surplus from assets revaluation 324 处分资产溢价公积capital surplus from gain on disposal of assets3241 处分资产溢价公积capital surplus from gain on disposal of assets325 合并公积capital surplus from business combination3251 合并公积capital surplus from business combination326 受赠公积donated surplus3261 受赠公积donated surplus328 其它资本公积other additional paid-in capital3281 权益法长期股权投资资本公积additional paid-in capital from investee under equity method3282 资本公积- 库藏股票交易additional paid-in capital - treasury stocktrans-actions33 保留盈余(或累积亏损) retained earnings (accumulated deficit)331 法定盈余公积legal reserve3311 法定盈余公积legal reserve332 特别盈余公积special reserve3321 意外损失准备contingency reserve3322 改良扩充准备improvement and expansion reserve3323 偿债准备special reserve for redemption of liabilities3328 其它特别盈余公积other special reserve335 未分配盈余(或累积亏损) retained earnings-unappropriated (or accumulated deficit)3351 累积盈亏accumulated profit or loss3352 前期损益调整prior period adjustments3353 本期损益net income or loss for current period34 权益调整equity adjustments341 长期股权投资未实现跌价损失unrealized loss on market value decline of long-term equity investments3411 长期股权投资未实现跌价损失unrealized loss on marketvalue decline of long-term equity investments342 累积换算调整数cumulative translation adjustment3421 累积换算调整数cumulative translation adjustments343 未认列为退休金成本之净损失net loss not recognized as pension cost 3431 未认列为退休金成本之净损失net loss not recognized as pension costs 35 库藏股treasury stock 351 库藏股treasury stock3511 库藏股treasury stock36 少数股权minority interest361 少数股权minority interest3611 少数股权minority interest====================================== ==========================================4 营业收入operating revenue41 销货收入sales revenue411 销货收入sales revenue4111 销货收入sales revenue4112 分期付款销货收入installment sales revenue417 销货退回sales return4171 销货退回sales return419 销货折让sales allowances4191 销货折让sales discounts and allowances46 劳务收入service revenue461 劳务收入service revenue4611 劳务收入service revenue47 业务收入agency revenue471 业务收入agency revenue4711 业务收入agency revenue48 其它营业收入other operating revenue488 其它营业收入-其它other operating revenue4888 其它营业收入-其它other operating revenue - other交易性金融资产:financial assets at fair value through profit or loss 持有至到期投资:held-to-maturity investments 公允价值变动损益:changes in fair value recognised in profit or loss。

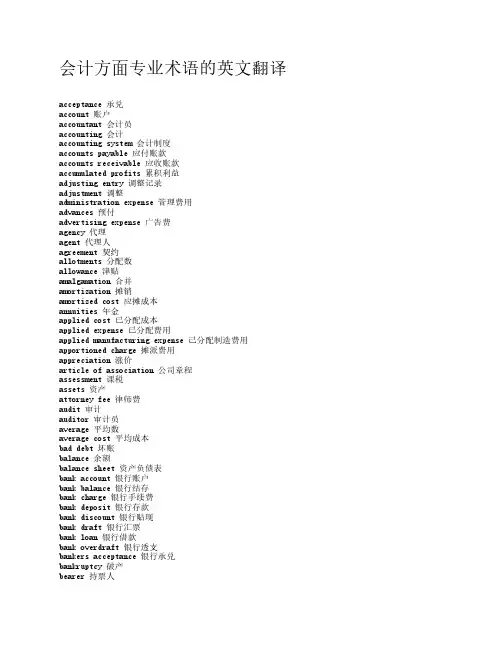

会计方面专业术语的英文翻译acceptance 承兑account 账户accountant 会计员accounting 会计accounting system 会计制度accounts payable 应付账款accounts receivable 应收账款accumulated profits 累积利益adjusting entry 调整记录adjustment 调整administration expense 管理费用advances 预付advertising expense 广告费agency 代理agent 代理人agreement 契约allotments 分配数allowance 津贴amalgamation 合并amortization 摊销amortized cost 应摊成本annuities 年金applied cost 已分配成本applied expense 已分配费用applied manufacturing expense 己分配制造费用 apportioned charge 摊派费用appreciation 涨价article of association 公司章程assessment 课税assets 资产attorney fee 律师费audit 审计auditor 审计员average 平均数average cost 平均成本bad debt 坏账balance 余额balance sheet 资产负债表bank account 银行账户bank balance 银行结存bank charge 银行手续费bank deposit 银行存款bank discount 银行贴现bank draft 银行汇票bank loan 银行借款bank overdraft 银行透支bankers acceptance 银行承兑bankruptcy 破产bearer 持票人beneficiary 受益人bequest 遗产bill 票据bill of exchange 汇票bill of lading 提单bills discounted 贴现票据bills payable 应付票据bills receivable 应收票据board of directors 董事会bonds 债券bonus 红利book value 账面价值bookkeeper 簿记员bookkeeping 簿记branch office general ledger 支店往来账户 broker 经纪人brought down 接前brought forward 接上页budget 预算by-product 副产品by-product sales 副产品销售capital 股本capital income 资本收益capital outlay 资本支出capital stock 股本capital stock certificate 股票carried down 移后carried forward 移下页cash 现金cash account 现金账户cash in bank 存银行现金cash on delivery 交货收款cash on hand 库存现金cash payment 现金支付cash purchase 现购cash sale 现沽cashier 出纳员cashiers check 本票certificate of deposit 存款单折certificate of indebtedness 借据certified check 保付支票certified public accountant 会计师 charges 费用charge for remittances 汇水手续费charter 营业执照chartered accountant 会计师chattles 动产check 支票checkbook stub 支票存根closed account 己结清账户closing 结算closing entries 结账纪录closing stock 期末存货closing the book 结账columnar journal 多栏日记账combination 联合commission 佣金commodity 商品common stock 普通股company 公司compensation 赔偿compound interest 复利consignee 承销人consignment 寄销consignor 寄销人consolidated balance sheet 合并资产负债表 consolidated profit and loss account 合并损益表 consolidation 合并construction cost 营建成本construction revenue 营建收入contract 合同control account 统制账户copyright 版权corporation 公司cost 成本cost accounting 成本会计cost of labour 劳工成本cost of production 生产成本cost of manufacture 制造成本cost of sales 销货成本cost price 成本价格credit 贷方credit note 收款通知单creditor 债权人crossed check 横线支票current account 往来活期账户current asset 流动资产current liability 流动负债current profit and loss 本期损益debit 借方debt 债务debtor 债务人deed 契据deferred assets 递延资产deferred liabilities 递延负债delivery 交货delivery expense 送货费delivery order 出货单demand draft 即期汇票demand note 即期票据demurrage charge 延期费deposit 存款deposit slip 存款单depreciation 折旧direct cost 直接成本direct labour 直接人工director 董事discount 折扣discount on purchase 进货折扣 discount on sale 销货折扣 dishonoured check 退票dissolution 解散dividend 股利dividend payable 应付股利 documentary bill 押汇汇票 documents 单据double entry bookkeeping 复式簿记 draft 汇票drawee 付款人drawer 出票人drawing 提款duplicate 副本duties and taxes 税捐earnings 业务收益endorser 背书人entertainment 交际费enterprise 企业equipment 设备estate 财产estimated cost 估计成本estimates 概算exchange 兑换exchange loss 兑换损失 expenditure 经费expense 费用extension 延期face value 票面价值factor 代理商fair value 公平价值financial statement 财务报表 financial year 财政年度finished goods 制成品finished parts 制成零件fixed asset 固定资产fixed cost 固定成本fixed deposit 定期存款fixed expense 固定费用foreman 工头franchise 专营权freight 运费funds 资金furniture and fixture 家俬及器具 gain 利益general expense 总务费用general ledger 总分类账goods 货物goods in transit 在运货物 goodwill 商誉government bonds 政府债券gross profit 毛利guarantee 保证guarantor 保证人idle time 停工时间import duty 进口税income 收入income tax 所得税income from joint venture 合营收益 income from sale of assets 出售资产收入 indirect cost 间接成本indirect expense 间接费用indirect labour 间接人工indorsement 背书installment 分期付款insurance 保险intangible asset 无形资产interest 利息interest rate 利率interest received 利息收入inter office account 内部往来intrinsic value 内在价值inventory 存货investment 投资investment income 投资收益invoice 发票item 项目job 工作job cost 工程成本joint venture 短期合伙journal 日记账labour 人工labour cost 人工成本land 土地lease 租约leasehold 租约ledger 分类账legal expense 律师费letter of credit 信用状liability 负债limited company 有限公司limited liability 有限负债limited partnership 有限合夥liquidation 清盘loan 借款long term liability 长期负债loss 损失loss on exchange 兑换损失machinery equipment 机器设备 manufacturing expense 制造费用 manufacturing cost 制造成本market price 市价materials 原村料material requisition 领料单medical fee 医药费merchandise 商品miscellaneous expense 杂项费用 mortgage 抵押mortgagee 承押人movable property 动产net amount 净额net asset 资产净额net income 净收入net loss 净亏损net profit 纯利net value 净值notes 票据notes payable 应付票据 notes receivable 应收票据 opening stock 期初存货 operating expense 营业费用 order 订单organization expense 开办费 original document 原始单据 outlay 支出output 产量overdraft 透支opening stock 期初存货 operating expense 营业费用 order 订单organization expense 开办费 original document 原始单据 outlay 支出output 产量overdraft 透支quotation 报价rate 比率raw material 原料rebate 回扣receipt 收据receivable 应收款recoup 补偿redemption 偿还refund 退款remittance 汇款rent 租金repair 修理费reserve 准备residual value 剩余价值 retailer 零售商returns 退货revenue 收入salary 薪金sales 销货sale return 销货退回sale discount 销货折扣 salvage 残值sample fee 样品scrap 废料scrap value 残余价值 securities 证券selling commission 销货佣金 selling expense 销货费用selling price 售价share capital 股份share certificate 股票 shareholder 股东short term loan 短期借款sole proprietorship 独资spare parts 配件standard cost 标准成本stock 存货stocktake 盘点stock sheet 存货表subsidies 补助金sundry expense 杂项费用 supporting document 附表surplus 盈余suspense account 暂记账户taxable profit 可徵税利润tax 税捐temporary payment 暂付款 temporary receipt 暂收款time deposit 定期存款total 合计total cost 总成本trade creditor 进货客户trade debtor 销货客户trademark 商标transaction 交易transfer 转账transfer voucher 转账传票 transportation 运输费travelling 差旅费trial balance 试算表trust 信托turnover 营业额unappropriated surplus 未分配盈余 unit cost 单位成本unlimited company 无限公司 unlimited liability 无限责任 unpaid dividend 未付股利 valuation 估价value 价值vendor 卖主voucher 传票wage rate 工资率wage 工资wage allocation sheet 工资分配表 warehouse receipt 仓库收据 welfare expense 褔利费wear and tear 秏损work order 工作通知单year end 年结Account 帐户Accounting system 会计系统American Accounting Association 美国会计协会American Institute of CPAs 美国注册会计师协会Audit 审计Balance sheet 资产负债表Bookkeepking 簿记Cash flow prospects 现金流量预测Certificate in Internal Auditing 内部审计证书 Certificate in Management Accounting 管理会计证书 Certificate Public Accountant注册会计师Cost accounting 成本会计External users 外部使用者Financial accounting 财务会计Financial Accounting Standards Board 财务会计准则委员会 Financial forecast 财务预测Generally accepted accounting principles 公认会计原则 General-purpose information 通用目的信息Government Accounting Office 政府会计办公室Income statement 损益表Institute of Internal Auditors 内部审计师协会Institute of Management Accountants 管理会计师协会 Integrity 整合性Internal auditing 内部审计Internal control structure 内部控制结构Internal Revenue Service 国内收入署Internal users 内部使用者Management accounting 管理会计Return of investment 投资回报Return on investment 投资报酬Securities and Exchange Commission 证券交易委员会 Statement of cash flow 现金流量表Statement of financial position 财务状况表Tax accounting 税务会计Accounting equation 会计等式Articulation 勾稽关系Assets 资产Business entity 企业个体Capital stock 股本Corporation 公司Cost principle 成本原则Creditor 债权人Deflation 通货紧缩Disclosure 批露Expenses 费用Financial statement 财务报表Financial activities 筹资活动Going-concern assumption 持续经营假设Inflation 通货膨涨Investing activities 投资活动Liabilities 负债Negative cash flow 负现金流量 Operating activities 经营活动Owner's equity 所有者权益Partnership 合伙企业Positive cash flow 正现金流量 Retained earning 留存利润Revenue 收入Sole proprietorship 独资企业 Solvency 清偿能力Stable-dollar assumption 稳定货币假设 Stockholders 股东Stockholders' equity 股东权益 Window dressing 门面粉饰。

Accounts ReceivableOne of the key factors underlying the growth of the American economy is the trend toward selling goods and services on credit. Accounts receivable comprise the largest financial asset of many merchandising companies.Accounts receivable are relatively liquid assets, usually converting into cash within a period of 30 to 60 days. Therefore, accounts receivable from customers usually appear in the balance sheet immediately after cash and short-term investments in marketable securities.UNCOLLECTIBLE ACCOUNTSAccounts receivable are shown in the balance sheet at the estimated collectible amount—called net realizable value. No business wants to sell merchandise on account to customers who will be able to pay. Many companies maintain their own credit departments that investigate the creditworthiness of each prospective customer. Nonetheless, if a company makes credit sales to hundreds—perhaps thousands—of customers, some accounts inevitably will turn out to be uncollectible.A limited amount of uncollectible accounts is not only expected—it is evidence of a sound credit policy. If the credit department is overly cautious, the business may lose many sales opportunities by rejecting customers who should have been considered acceptable credit risks.THE ALLOWANCE FOR DOUBTFUL ACCOUNTSThere is no way of telling in advance which accounts receivable will prove to be uncollectible. It is therefore not possible to credit the accounts of specific customers for our estimate of probable uncollectible accounts. Neither should we credit the Accounts Receivable control account in the general ledger. If the Accounts Receivable control accounts were to be credited with the estimated amount of doubtful accounts, this control account would no longer be in balance with the total of the numerous customers’accounts in the subsidiary ledger. A practical alternative therefore is to credit a separate account called Allowance for Doubtful Accounts with the amount estimated to be uncollectible.The Allowance for Doubtful Accounts often is described as a contra-asset account or a valuation account. Both of these terms indicate that the Allowance for Doubtful Accounts has a credit balance, which is offset against the asset Accounts Receivable to produce a more useful and reliable measure of a company’s liquidity. Because the Allowance for Doubtful Accounts is merely an estimate and not a precise calculation, professional judgment plays a considerable role in determining the size of this valuation account.Monthly Adjustment of the Allowance Account In the adjusting entry made by World Famous Toy Co. at January 31, the amount of the adjustment ($10,000) was equal to the estimated amount of uncollectible accounts. This is true only because January was the first month of operations and this was the company’s first estimate of its uncollectible accounts. In future months, the amount of the adjusting entry will depend on two factors: (1) the estimate of uncollectible accounts and (2) the current balance in the Allowance for Doubtful Accounts. Before we illustrate the adjusting entry for a future month, let us see why the balance in the allowance account maychange during the accounting period.WRITING OFF AN UNCOLLECTIBLE ACCOUNT RECEIV ABLEWhenever an account receivable from a specific customer is determined to be uncollectible, it no longer qualifies as an asset and should be written off. To write off an account receivable is to reduce the balance of the customer’s account to zero. The journal entry to accomplish this consists of a credit to the Accounts Receivable control account in the general ledger (and to the customer’s account in the subsidiary ledger) and an offsetting debit to the Allowance for Doubtful Accounts.To illustrate, assume that, early in February, World Famous Toy Co. learns that Discount Stores has gone out of business and that the $4,000 account receivable from this customer is now worthless. The entry to write off this uncollectible account receivable is:Allowance for Doubtful Accounts………………… 4,000Accounts Receivable (Discount Stores)…………………… 4,000To write off the account receivable from Discount Stores as uncollectible.The important thing to note in this entry is that the debit is made to the Allowance for Doubtful Accounts and not to the Uncollectible Accounts Expense account. The estimated expense of credit losses is charged to the Uncollectible Accounts Expense account at the end of each accounting period. When a specific account receivable is later determined to be worthless and is written off, this action does not represent an additional expense but merely confirms our previous estimate of the expense. If the Uncollectible Accounts Expense account was first charged with estimated credit losses and then later charged with proven credit losses, we would be double-counting the actual uncollectible accounts expense.Notice also that the entry to write off an uncollectible account receivable reduces both the asset account and the contra-asset account by the same amount. Thus writing off an uncollectible account does not change the net realizable value of accounts receivable in the balance sheet.INTERNAL CONTROLS FOR RECEIV ABLESOne of the most important principles of internal control is that employees who have custody of cash or other negotiable assets must not maintain accounting records. In a small business, one employee often is responsible for handing cash receipts, maintaining accounts receivable records, issuing credit memoranda, and writing off uncollectible accounts. Such a combination of duties is an invitation to fraud. The employee in this situation is able to remove the cash collected from a customer without making any record of the collection. The next step is to dispose of the balance in the customer’s account. This can be done by issuing a credit memo indicating that the customer has returned merchandise, or by writing off the customer’s account as uncollectible. Thus the employee has the cash, the customer’s account shows a zero balance due, and the books are in balance.In summary, employees who maintain the accounts receivable subsidiary ledger should not have access to cash receipts. The employees who maintain accounts receivable or handle cash receipts should not have authority to issue credit memoranda or to authorize the write-off of receivables as uncollectible. These areclassic examples of incompatible duties.MANAGEMENT OF ACCOUNTS RECEIV ABLEManagement has two conflicting objectives with respect to the accounts receivable. On the one hand, management wants to generate as much sales revenue as possible. Offering customers lengthy credit terms, with little or no interest, has proven to be an effective means of generating sales revenue.Every business, however, would rather sell for cash than on account. Unless receivables earn interest, which usually is not the case, they are nonproductive assets that produce no revenue as they await collection. Therefore, another objective of cash management is to minimize the amount of money tied up in the form of accounts receivable.Several tools are available to a management that must offer credit terms to its customers yet wants to minimize the company’s investment in accounts receivable. We have already discussed offering credit customers cash discounts (such as 2/10, n/30) to encourage early payment. Other tools include factoring accounts receivable and selling to customers who use national credit cards.应收账款一个关键因素的增长,美国经济正走向销售商品和服务的信贷。

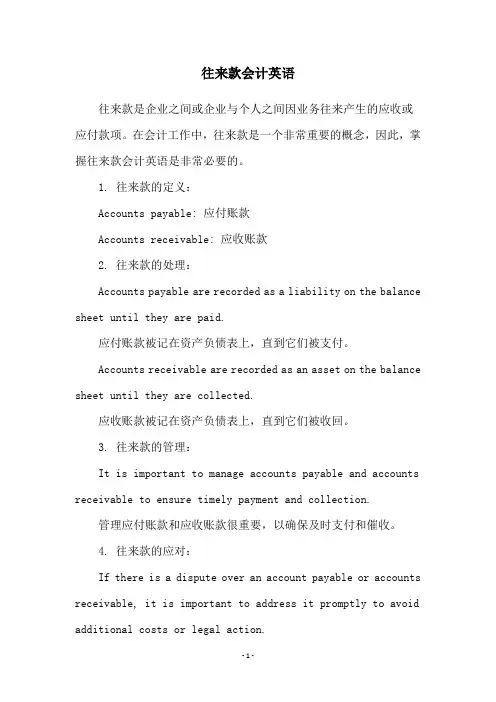

往来款会计英语往来款是企业之间或企业与个人之间因业务往来产生的应收或应付款项。

在会计工作中,往来款是一个非常重要的概念,因此,掌握往来款会计英语是非常必要的。

1. 往来款的定义:Accounts payable: 应付账款Accounts receivable: 应收账款2. 往来款的处理:Accounts payable are recorded as a liability on the balance sheet until they are paid.应付账款被记在资产负债表上,直到它们被支付。

Accounts receivable are recorded as an asset on the balance sheet until they are collected.应收账款被记在资产负债表上,直到它们被收回。

3. 往来款的管理:It is important to manage accounts payable and accounts receivable to ensure timely payment and collection.管理应付账款和应收账款很重要,以确保及时支付和催收。

4. 往来款的应对:If there is a dispute over an account payable or accounts receivable, it is important to address it promptly to avoid additional costs or legal action.如果有关于应付账款或应收账款的争议,及时解决是很重要的,以避免额外的成本或法律行动。

以上是关于往来款会计英语的简单介绍,希望对会计工作者有所帮助。

Accounts ReceivableOne of the key factors underlying the growth of the American economy is the trend toward selling goods and services on credit. Accounts receivable comprise the largest financial asset of many merchandising companies.Accounts receivable are relatively liquid assets, usually converting into cash within a period of 30 to 60 days. Therefore, accounts receivable from customers usually appear in the balance sheet immediately after cash and short-term investments in marketable securities.UNCOLLECTIBLE ACCOUNTSAccounts receivable are shown in the balance sheet at the estimated collectible amount—called net realizable value. No business wants to sell merchandise on account to customers who will be able to pay. Many companies maintain their own credit departments that investigate the creditworthiness of each prospective customer. Nonetheless, if a company makes credit sales to hundreds—perhaps thousands—of customers, some accounts inevitably will turn out to be uncollectible.A limited amount of uncollectible accounts is not only expected—it is evidence of a sound credit policy. If the credit department is overly cautious, the business may lose many sales opportunities by rejecting customers who should have been considered acceptable credit risks.THE ALLOWANCE FOR DOUBTFUL ACCOUNTSThere is no way of telling in advance which accounts receivable will prove to be uncollectible. It is therefore not possible to credit the accounts of specific customers for our estimate of probable uncollectible accounts. Neither should we credit the Accounts Receivable control account in the general ledger. If the Accounts Receivable control accounts were to be credited with the estimated amount of doubtful accounts, this control account would no longer be in balance with the total of the numerous customers’accounts in the subsidiary ledger. A practical alternative therefore is to credit a separate account called Allowance for Doubtful Accounts with the amount estimated to be uncollectible.The Allowance for Doubtful Accounts often is described as a contra-asset account or a valuation account. Both of these terms indicate that the Allowance for Doubtful Accounts has a credit balance, which is offset against the asset Accounts Receivable to produce a more useful and reliable measure of a company’s liquidity. Because the Allowance for Doubtful Accounts is merely an estimate and not a precise calculation, professional judgment plays a considerable role in determining the size of this valuation account.Monthly Adjustment of the Allowance Account In the adjusting entry made by World Famous Toy Co. at January 31, the amount of the adjustment ($10,000) was equal to the estimated amount of uncollectible accounts. This is true only because January was the first month of operations and this was the company’s first estimate of its uncollectible accounts. In future months, the amount of the adjusting entry will depend on two factors: (1) the estimate of uncollectible accounts and (2) the current balance in the Allowance for Doubtful Accounts. Before we illustrate the adjusting entry for a future month, let us see why the balance in the allowance account maychange during the accounting period.WRITING OFF AN UNCOLLECTIBLE ACCOUNT RECEIV ABLEWhenever an account receivable from a specific customer is determined to be uncollectible, it no longer qualifies as an asset and should be written off. To write off an account receivable is to reduce the balance of the customer’s account to zero. The journal entry to accomplish this consists of a credit to the Accounts Receivable control account in the general ledger (and to the customer’s account in the subsidiary ledger) and an offsetting debit to the Allowance for Doubtful Accounts.To illustrate, assume that, early in February, World Famous Toy Co. learns that Discount Stores has gone out of business and that the $4,000 account receivable from this customer is now worthless. The entry to write off this uncollectible account receivable is:Allowance for Doubtful Accounts………………… 4,000Accounts Receivable (Discount Stores)…………………… 4,000To write off the account receivable from Discount Stores as uncollectible.The important thing to note in this entry is that the debit is made to the Allowance for Doubtful Accounts and not to the Uncollectible Accounts Expense account. The estimated expense of credit losses is charged to the Uncollectible Accounts Expense account at the end of each accounting period. When a specific account receivable is later determined to be worthless and is written off, this action does not represent an additional expense but merely confirms our previous estimate of the expense. If the Uncollectible Accounts Expense account was first charged with estimated credit losses and then later charged with proven credit losses, we would be double-counting the actual uncollectible accounts expense.Notice also that the entry to write off an uncollectible account receivable reduces both the asset account and the contra-asset account by the same amount. Thus writing off an uncollectible account does not change the net realizable value of accounts receivable in the balance sheet.INTERNAL CONTROLS FOR RECEIV ABLESOne of the most important principles of internal control is that employees who have custody of cash or other negotiable assets must not maintain accounting records. In a small business, one employee often is responsible for handing cash receipts, maintaining accounts receivable records, issuing credit memoranda, and writing off uncollectible accounts. Such a combination of duties is an invitation to fraud. The employee in this situation is able to remove the cash collected from a customer without making any record of the collection. The next step is to dispose of the balance in the customer’s account. This can be done by issuing a credit memo indicating that the customer has returned merchandise, or by writing off the customer’s account as uncollectible. Thus the employee has the cash, the customer’s account shows a zero balance due, and the books are in balance.In summary, employees who maintain the accounts receivable subsidiary ledger should not have access to cash receipts. The employees who maintain accounts receivable or handle cash receipts should not have authority to issue credit memoranda or to authorize the write-off of receivables as uncollectible. These areclassic examples of incompatible duties.MANAGEMENT OF ACCOUNTS RECEIV ABLEManagement has two conflicting objectives with respect to the accounts receivable. On the one hand, management wants to generate as much sales revenue as possible. Offering customers lengthy credit terms, with little or no interest, has proven to be an effective means of generating sales revenue.Every business, however, would rather sell for cash than on account. Unless receivables earn interest, which usually is not the case, they are nonproductive assets that produce no revenue as they await collection. Therefore, another objective of cash management is to minimize the amount of money tied up in the form of accounts receivable.Several tools are available to a management that must offer credit terms to its customers yet wants to minimize the company’s investment in accounts receivable. We have already discussed offering credit customers cash discounts (such as 2/10, n/30) to encourage early payment. Other tools include factoring accounts receivable and selling to customers who use national credit cards.。

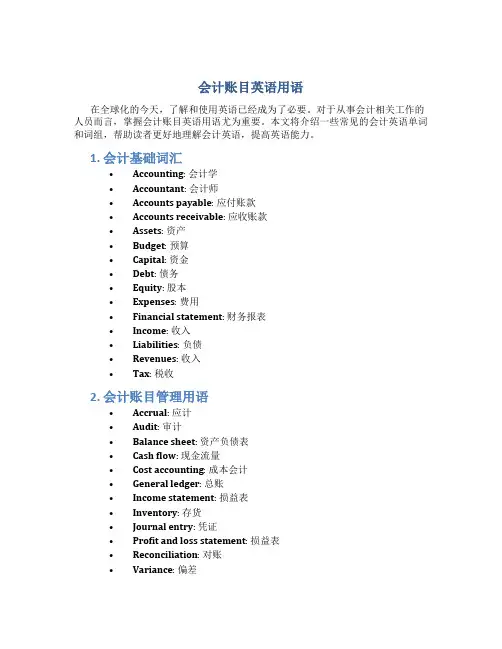

会计账目英语用语在全球化的今天,了解和使用英语已经成为了必要。

对于从事会计相关工作的人员而言,掌握会计账目英语用语尤为重要。

本文将介绍一些常见的会计英语单词和词组,帮助读者更好地理解会计英语,提高英语能力。

1. 会计基础词汇•Accounting: 会计学•Accountant: 会计师•Accounts payable: 应付账款•Accounts receivable: 应收账款•Assets: 资产•Budget: 预算•Capital: 资金•Debt: 债务•Equity: 股本•Expenses: 费用•Financial statement: 财务报表•Income: 收入•Liabilities: 负债•Revenues: 收入•Tax: 税收2. 会计账目管理用语•Accrual: 应计•Audit: 审计•Balance sheet: 资产负债表•Cash flow: 现金流量•Cost accounting: 成本会计•General ledger: 总账•Income statement: 损益表•Inventory: 存货•Journal entry: 凭证•Profit and loss statement: 损益表•Reconciliation: 对账•Variance: 偏差3. 会计法律用语•Amortization: 摊销•Auditing standards: 审计标准•Capital gain: 资本收益•Capital loss: 资本损失•Depreciation: 折旧•Financial accounting: 财务会计•Fiscal year: 财政年度•Generally accepted accounting principles (GAAP): 公认会计原则•Internal controls: 内部控制•Tax evasion: 逃税•Tax liability: 税收负担•Tax refund: 税收退款•Taxable income: 应纳税所得额4. 会计英语常用词组•Accounts payable turnover: 应付账款周转率•Accounts receivable turnover: 应收账款周转率•Book value: 资产账面价值•Cash basis: 现金基础•Current assets: 流动资产•Current liabilities: 流动负债•Financial year-end: 年度财政结算日•Fixed assets: 固定资产•Gross profit: 毛利润•Net income: 净收入•Operating expenses: 营业费用•Operating income: 营业收入•Revenue recognition: 收入确认•Trial balance: 试算平衡5. 会计英语学习资源推荐•ACCA: 国际会计师公会协会,提供一系列的英语培训和考试•Investopedia: 专门介绍金融、投资、股票等相关英语词汇和术语的网站•Wall Street English: 提供专门的商务英语培训课程结论以上介绍的会计账目英语用语只是一个小部分,掌握会计英语还需要在实践中不断积累。

上海财经大学浙江学院毕业设计(论文)外文翻译译文:会计帐户应收账款(AR)侯赛因·Pashang瑞典延雪平大学文摘:治理工商管理财务报表的质量是一个关键问题.经过痛苦的经验与实践的表外会计、应收账款(AR)的概念越来越多地得到了管理层的注意。

这种关注的原因之一是,可以使用基于“增大化现实”的技术,高度灵活的方式,来影响底线和债务/股本比例。

本研究的目的是,通过必要的信息披露和其他一些会计原则和客观性等思想, 重要性、匹配和公允价值批判分析中使用的技术评估和测量的基于“增大化现实”技术。

关键词:会计确认、会计应收账款、会计披露。

1.介绍账户操作的概念,包括“收益管理”,主要是附加的损益表的项目。

例如,科普兰(1968)集中在收入报表和观察到管理影响净利润的大小有目的地.按照构建三个“否则"不利于收入的概念,“收益极大化者"和“收入smoothers”他把收入作为管理中心的研究重点。

值得注意的是,盈余管理的概念,表示一个特定类型的会计实践,把注意力只在损益表。

然而,账户操作可能分类上的实践,这些相关的平衡负债表和损益表分类。

这些类型的操作不是文学中描述。

也许,这个缺点的原因应该与复杂的会计技术有关,应用于促进盈余管理。

一项研究由理查森et al 。

(2002)表明,盈余管理主要是根据收入确认,包括基于“增大化现实”技术。

他没有表明,使用基于“增大化现实"技术的方式来操纵帐户。

观察的会计违规和会计错误当局要求重述或修正的年度报告.AR—related重述的原因应该与所需的“盈余管理”,包括操作的资产负债表和损益表。

看起来,“收益管理”是在路上被安放“管理帐户"的概念.新概念建构的旧概念收入管理和沟通管理更中性时尚的观点影响会计(见,例如。

金融时报》6月8日,2009年).根据定义,收益管理一组通信方式管理人为管理以满足一些预先设定的预期收益水平,如,分析师预期.跟上一些收入趋势,据分析师估计,它是先验假定可以影响投资者对风险的看法(Riahi—Belkaoui 2005;马修斯和佩雷拉1996)。

附录原文Receivable managementWith the development of enterprises, a gradual increase in accounts receivable, the rising cost of funds, and enterprises to increase their market share, reducing the provision of goods or services on credit services, credit rating, to obtain more business channels and expand sales. In this case enterprises can not be sufficient liquidity to pay day-to-day management activities and related taxes and fees, they need to rely on bank loans to solve this problem. However, the heavy interest, but also further increase the cost of the enterprise, and with the growth of accounts receivable aging, and its loss of the possibility of bad debts have also increased, so that the cost of capital rise. Some enterprises also exist as a result of malicious arrears accounts, and accounts receivable collection enterprises basically rely on their own collection, resulting in the recovery of accounts receivable due to unnecessary cost increases can not be transferred, the cost of capital increase, increasing accounts receivable risk recovery section.1 Accounts receivable risk causesFirst, the causes of accounts recevableTo promote the sale of enterprises and accelerate the collection, to pay a certain cost to provide customers with a certain degree of credit terms. In determining the customer's credit terms, the enterprise must ensure that customer credit terms to provide the benefits to the enterprise greater than the cost of credit. If the credit period is too long, the blind implementation of the cash discount, or discount rate determined unreasonable, all the credit companies will only increase costs and increase the recovery of accounts receivable risks and cost recovery is not conducive to the development of enterprises. The lack of a number of small and medium enterprisesengaged in full-time accounts receivable risk management, the lack of a sound and effective customer profiles and professional credit rating, credit limits and credit control, there is no risk of bad debts in advance, a matter of prevention and control.Many enterprises, wages and benefits linked to the operating mode, the operator simply allows the pursuit of high-margin, commodity or the provision of credit blind services, to create indicators met or surpassed the illusion, do not consider value for money and recyclability, and increase business accounts receivable risk. Enterprise internal control system in a large number of claims for clean-up funds, poor collection, resulting in financial losses. Corporate accounting departments should timely accounting, accounts receivable reflect the situationcorrectly. However, the prevalence of accounting in debt, debt accounts do not wither in time the entire problem of cleaning up failed to claim the funds, check, and many of the business of money is unknown, the possibility of increased bad debts. In order to inflated corporate profits, capital losses and the current cost of long-term hanging on subjects dealing with accounts receivable, resulting in actual loss virtual surplus. The existence of these issues to cover up the of business losses, is not conducive to strengthening the management of enterprises easily create the illusion of false claims, resulting in distortion of accounting information, serious impact on information usersmake the right decisions.Second, accounts receivable management and prevent risks(A) receivables in advance of risk controlBad debt risk is an objective existence, as long as there is likely to have bad credit. Not all accounts receivable can be passed on, all can be avoided, so must be provision for bad debts. Enterprises should be fully estimated bad debt losses that may occur will be the impact of gains and losses, bad debts on schedule extract prepared to break down the risk of bad debt losses. Their provision is based on sound principles and the principle of proportion. Accounting system of China's enterprises, enterprises can only account for bad debt allowance for loss method. Allowance for bad debts is estimated that loss of time, the formation of bad debts. Have to guard against the risk of bad debts, to resist the loss of identity, is to guard against the risk of accounts receivable of the first barrier. Accounts receivable as a bad loss does not mean thatcompanies give up to obtain the right to accounts receivable, business units should continue to pay attention to the debt situation, as far as possible to recover the receivable. Clear job responsibilities, the establishment of system of personal responsibility. ShouldAccounts receivable management is a system, in accordance with the relevant provisions of enterprises, improve the sales management system, a clear job responsibilities and business processes for the refinement of management; to negotiate the contract, opening, distribution and delivery, to go out and receivables and other business-related departments and staff to ensure that the mutual separation of incompatible duties. The various departments to carry out their duties, fulfill their duties, responsible, responsibility to the people, to maximize the recovery of accounts receivable, to shorten the accounts receivable collection period,To reduce the bad debt losses. Enterprises in the sales process, should be granted in strict accordance with the customer's credit trading volume control, and in accordance with the principle of limited authorization in the enterprise at all levels within the respective provisions of the credit limit may be granted. Hierarchical management system that is conducive to business at a reasonable credit limits, credit limits businesses to deal with the implementation of regular inspection and analysis, to ensure that the credit limit of safety and reasonable. Credit standards in the process, through comprehensive analysis, to find out will not affect the sales will not increase the risk of the optimal point of balance. Credit terms including credit terms and cash discounts, to extend the credit period to be appropriate to expand sales, but it can also result in accounts receivable to increase the opportunity cost of occupancy, at the same time increase the risk of bad debt losses. Enterprises to deal with different clients in credit and making necessary adjustments so that it has always been able to keep the scope of enterpriseInside. Business units in determining the credit terms and credit limit of credit before the credit must be made to understand and carry out the assessment, given the appropriate credit standards, thus the effective control of accounts receivable. Credit analysis from the quality of enterprises, capital, capacity, collateral and credit situation in these five cases are analyzed.(B)Accounts receivable risk control thingsFinancial sector client money received should be recorded or made such an inquiry procedure, it is necessary to control the contract and customer requirements to issue bills of lading, and sent to transport personnel or customer receipt, the transport sector should be organized according to the bill of lading shipments, and to ensure that the specifications of the goods, model, the number is correct, should be based on bills of lading after delivery to customers, such as timely invoicing, payment settlement process. Contracts should be standardized, in line with the requirements of contract law, the subject of the contract, the quantity, quality, delivery time, delivery location, payment method and careful assessment of liability for breach of contract and decide whether to accept the orders, thereby enabling business conduct standardized and refinement. As far as possible, enterprises should use their own settlement in a favorable settlement and advanced means to return the funds to accelerate and shorten the time in-transit funds.(C) the risk of accounts receivable after the controlControl of accounts receivable, including credit contract after the expiration of the recovery of funds control and funds due to various reasons could not be recovered due to the formation of bad debts and losses. Business enterprises through the establishment of accounts receivable management information system, credit process from beginning to the accounts receivable due date ofFollow-up supervision of clients to ensure that customers normally pay the purchase price, minimizing the incidence of overdue accounts. Accounts receivable tracking service, to maintain good relations with customers, but also allows customers to feel the pressure of creditors, greatly improve the recovery of accounts receivable. Maintained through regular contact with customers to remind them of their payment due date can also be found in the packaging of goods, quality, transport, and billing problems and disputes in a timely manner to make the appropriate decision-making.Arising from the sale of customer accounts receivable management has become a fund management business, money management, an important part. For enterprises to implement high-quality accounts receivable asset securitization, the lack of liquidity of enterprises, but can produce a stable predictable cash flows of assets, assetstructure through the integration and separation of the assets of credit in order to guarantee some assets, controlled by the trustee issued a special ad hoc bodies, in the capital market. The use of legal means to defend corporate interests. Enterprise can be entrusted to professional accounts receivable accounts receivable recovery companies, large and medium-sized enterprises, if a larger amount of accounts receivable, accounts receivable can be entrusted to the company for recycling. Professional callable receivables in the amount of comparative advantage, to a certain extent, reduce accounts receivable to invest in financial译文应收账款管理随着企业的发展,应收账款逐渐增多,资金成本不断上升,而企业为扩大市场占有率,降低了赊销商品或提供劳务服务的信用评定,以获取更多的商业渠道、扩大销售份额。

应收账款外文文献-CAL-FENGHAI.-(YICAI)-Company One11.Accounts ReceivableOne of the key factors underlying the growth of the American economy is the trend toward selling goods and services on credit. Accounts receivable comprise the largest financial asset of many merchandising companies.Accounts receivable are relatively liquid assets, usually converting into cash within a period of 30 to 60 days. Therefore, accounts receivable from customers usually appear in the balance sheet immediately after cash and short-term investments in marketable securities.2.UNCOLLECTIBLE ACCOUNTSAccounts receivable are shown in the balance sheet at the estimated collectible amount—called net realizable value. No business wants to sell merchandise on account to customers who will be able to pay. Many companies maintain their own credit departments that investigate the creditworthiness of each prospective customer. Nonetheless, if a company makes credit sales to hundreds—perhaps thousands—of customers, some accounts inevitably will turn out to be uncollectible.A limited amount of uncollectible accounts is not only expected—it is evidence of a sound credit policy. If the credit department is overly cautious, the business may lose many sales opportunities by rejecting customers who should have been considered acceptable credit risks.3.THE ALLOWANCE FOR DOUBTFUL ACCOUNTSThere is no way of telling in advance which accounts receivable will prove to be uncollectible. It is therefore not possible to credit the accounts of specific customers for our estimate of probable uncollectible accounts. Neither should we credit the Accounts Receivable control account in the general ledger. If the Accounts Receivable control accounts were to be credited with the estimated amount of doubtful accounts, this control account would no longer be in balance with the total of the numerous customers’ accounts in the subsidiary ledger. A practical alternative therefore is to credit a separate account called Allowance for Doubtful Accounts with the amount estimated to be uncollectible.The Allowance for Doubtful Accounts often is described as a contra-asset account or a valuation account. Both of these terms indicate that the Allowance for Doubtful Accounts has a credit balance, which is offset against the asset Accounts Receivable to produce a more useful and reliable measure of a company’s liquidity. Because the Allowance for Doubtful Accounts is merely an estimate and not a precise calculation, professional judgment plays a considerable role in determining the size of this valuation account.Monthly Adjustment of the Allowance Account In the adjusting entry made by World Famous Toy Co. at January 31, the amount of the adjustment ($10,000) was equal to the estimated amount of uncollectible accounts. This is true only because January was the first month of operations and this was the company’s first estimate of its uncollectible accounts. In future months, the amount of the adjusting entry will depend on two factors: (1) the estimate of uncollectible accounts and (2) the current balance in the Allowance for Doubtful Accounts. Before we illustrate the adjustingentry for a future month, let us see why the balance in the allowance account may change during the accounting period.WRITING OFF AN UNCOLLECTIBLE ACCOUNT RECEIVABLEWhenever an account receivable from a specific customer is determined to be uncollectible, it no longer qualifies as an asset and should be written off. To write off an account receivable is to reduce the balance of the customer’s account to zero. The journal entry to accomplish this consists of a credit to the Accounts Receivable control account in the general ledger (and to the customer’s account in the subsidiary ledger) and an offsetting debit to the Allowance for Doubtful Accounts.To illustrate, assume that, early in February, World Famous Toy Co. learns that Discount Stores has gone out of business and that the $4,000 account receivable from this customer is now worthless. The entry to write off this uncollectible account receivable is:Allowance for Doubtful Accounts………………… 4,000Accounts Receivable (Discount Stores)…………………… 4,000To write off the account receivable from Discount Stores as uncollectible.The important thing to note in this entry is that the debit is made to the Allowance for Doubtful Accounts and not to the Uncollectible Accounts Expense account. The estimated expense of credit losses is charged to the Uncollectible Accounts Expense account at the end of each accounting period. When a specific account receivable is later determined to be worthless and is written off, this action does not represent an additional expense but merely confirms our previous estimate of the expense. If the Uncollectible Accounts Expense account was first charged with estimated credit losses and then later charged with proven credit losses, we would be double-counting the actual uncollectible accounts expense.Notice also that the entry to write off an uncollectible account receivable reduces both the asset account and the contra-asset account by the same amount. Thus writing off an uncollectible account does not change the net realizable value of accounts receivable in the balance sheet.INTERNAL CONTROLS FOR RECEIVABLESOne of the most important principles of internal control is that employees who have custody of cash or other negotiable assets must not maintain accounting records. In a small business, one employee often is responsible for handing cash receipts, maintaining accounts receivable records, issuing credit memoranda, and writing off uncollectible accounts. Such a combination of duties is an invitation to fraud. The employee in this situation is able to remove the cash collected from a customer without making any record of the collection. The next step is to dispose of the balance in the customer’s account. This can be done by issuing a credit memo indicating that the customer has returned merchandise, or by writing off the customer’s account as uncollectible. Thus the employee has the cash, the customer’s account shows a zero balance due, and the books are in balance.In summary, employees who maintain the accounts receivable subsidiary ledger should not have access to cash receipts. The employees who maintain accounts receivable or handle cash receipts should not have authority to issue creditmemoranda or to authorize the write-off of receivables as uncollectible. These are classic examples of incompatible duties.MANAGEMENT OF ACCOUNTS RECEIVABLEManagement has two conflicting objectives with respect to the accounts receivable. On the one hand, management wants to generate as much sales revenue as possible. Offering customers lengthy credit terms, with little or no interest, has proven to be an effective means of generating sales revenue.Every business, however, would rather sell for cash than on account. Unless receivables earn interest, which usually is not the case, they are nonproductive assets that produce no revenue as they await collection. Therefore, another objective of cash management is to minimize the amount of money tied up in the form of accounts receivable.Several tools are available to a management that must offer credit terms to its customers yet wants to minimize the company’s investment in accounts receivable. We have already discussed offering credit customers cash discounts (such as 2/10,n/30) to encourage early payment. Other tools include factoring accounts receivable and selling to customers who use national credit cards.。