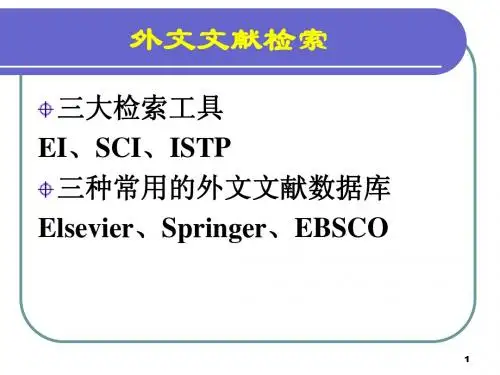

英文常用全文数据库的检索

- 格式:pptx

- 大小:4.70 MB

- 文档页数:42

英文文献检索的方法及全文数据库的应用Elseviver SDOS(SciebceDirect)全文数据库Elsevier科学出版公司是世界著名的出版公司,已有100多年的历史。

除了出版图书外,还是当今世界最大的学术期刊出版商,内容涉及生命科学,物理,医学,工程技术及社会科学,其中许多为核心期刊。

近年来,该公司又合并了一些出版社,如Academic Press的170多种学术期刊数据也已加入到国内的ScienceDirect镜像站。

现在可以访问到1995年至今超过2000种期刊。

主要包含如下学科:•ScienceDirect / •杂志数:1800•学科:23•SCI收录:1393•收录论文数:600万•Elsevier Science是一家设在荷兰的历史悠久的跨国科学出版公司,该公司出版的期刊是世界公认的高品位学术期刊,且大多数为核心期刊,被世界上许多著名的二次文献数据库所收录。

近年来,该公司收购了许多出版公司,包括美国的Ei公司, Harcourt 公司(包括Academic Press)等。

ScienceDirect全文数据库涵盖了数学、物理、化学、天文学、医学、生命科学、商业及经济管理、计算机科学、工程技术、能源科学、环境科学、材料科学、社会科学等众多学科,并通过网络提供服务Agricultural and Biological Sciences(138种) Biochemistry, Genetics, and Molecular Biology(156种) Business, Management and Accounting(84种) Chemistry(116种)Chemical Engineering(93种)Civil Engineering(58种)Computer Science(116种)Earth and Planetary Science(86种)Economics, Econometrics and Finance(66种)Energy and Power(53种)Engineering and Technology(184种)Environmental Science(74种)Materials Science(116种)Mathematics(60种)Medicine(270种)Physics and Astronomy(88种)Social Sciences (131种)德国施普林格(Springer-Verlag)世界上著名的科技出版集团, 通过Springer LINK 系统提供学术期刊及电子图书的在线服务。

一、常用文献检索数据库1、Springerlink数据库</>Springer是德国施普林格(Springer)出版公司出版的全文数据库数据库。

所提供的全文电子期刊共包含439种学术期刊(其中近400种为英文期刊),按学科分为以下11个“在线图书馆”:生命科学、医学、数学、化学、计算机科学、经济、法律、工程学、环境科学、地球科学、物理学与天文学,是科研人员的重要信息源。

2、HighWire Press数据库</>HighWire Press是提供免费全文的、全球最大的学术文献出版商之一,于1995年由美国斯坦福大学图书馆创立。

最初,仅出版著名的周刊“Journal of Biological Chemistry”,目前已收录电子期刊340多种,文章总数已达130多万篇,其中超过47万篇文章可免费获得全文;这些数据仍在不断增加。

通过该界面还可以检索Me564034381 19:25:58dline收录的4500余种期刊中的1200多万篇文章,可看到文摘题录。

HighWire Press收录的期刊覆盖以下学科:生命科学、医学、物理学、社会科学。

3、NCBI PUBMED数据库/pubmedPubMed系统是由NLM的国家生物技术信息中心(National Center for Biotechnology Information,NCBI)开发的用于检索MEDLINE、PreMEDLINE数据库的网上检索系统。

从1997年6月起,PubMed在网上免费向用户开放。

它具有收录范围广泛、更新速度快、检索系统完备、链接广泛的特点。

PubMed系统包含三个数据库:MEDLINE、PreMEDLINE和Record supplied by Publisher。

4、sciencedirect数据库</>SD是荷兰Elsevier公司的核心产品,是全学科的全文数据库,它拥有1263种科技和医学电子全文期刊数据库5、Blackwell数据库<http://564034381 19:25:59/>英国Blackwell出版公司是世界上最大的期刊出版商之一,出版期刊总数已超过700种,其中理科类期刊占54%左右,其余为人文社会科学类。

常用国外数据库详细介绍(按国家分类)一、美国(1) Wiley InterScience(英文文献期刊)主页:/简介:Wiley InterScience是John Wiely & Sons 公司创建的动态在线内容服务,1997年开始在网上开通。

通过InterScience,Wiley公司以许可协议形式向用户提供在线访问全文内容的服务。

Wiley InterScience收录了360多种科学、工程技术、医疗领域及相关专业期刊、30多种大型专业参考书、13种实验室手册的全文和500多个题目的Wiley学术图书的全文。

其中被SCI收录的核心期刊近200种。

期刊具体学科划分为:Business, Finance & Management (商业、金融和管理)、Chemistry (化学)、Computer Science (计算机科学)、Earth Science (地球科学)、Education (教育学)、Engineering (工程学)、Law (法律)、Life and Medical Sciences (生命科学与医学)、Mathematics and Statistics (数学统计学)、Physics (物理)、Psychology (心理学)。

(2)美国IEEE (英文文献期刊)主页:/简介:IEEE(Institute of Electrical & Electronics Engineers)是电子信息领域最著名的跨国性学术团体,其会员分布在世界150多个国家和地区。

据IEEE统计,IEEE会员总数2001年比2000年增加3.1%,达到377342人,其中学生会员为65669人,增长12.6%。

随着人们的信息越来越多地来自Internet,IEEE需要为会员提供更加完善和全面的电子信息产品和服务。

IEEE应成为IEEE会员获得信息的首选之地。

IEEE必须识别正确的信息,并提供对它们的访问方法。

简述文献检索过程中,英文的主要数据库以及使用方法摘要:一、英文主要数据库概述二、数据库使用方法1.文献检索策略2.检索技巧3.数据库特色及应用场景正文:【一、英文主要数据库概述】在学术研究和工作中,英文文献检索是不可或缺的一环。

以下是一些主要的英文数据库,它们涵盖了各个学科领域,为研究者提供了丰富的学术资源。

1.Web of Science(WOS):由美国汤姆逊路透公司开发,涵盖科学、社会科学、艺术等领域的学术文献。

2.PubMed:美国国家医学图书馆收录的生物医学领域的文献数据库。

3.Google Scholar:谷歌推出的学术搜索引擎,覆盖范围广泛,包括期刊论文、学位论文、会议论文等。

4.IEEE Xplore:电气和电子工程领域的文献数据库,提供全文检索。

5.ACM Digital Library:计算机科学领域的文献数据库,侧重于计算机技术和信息技术。

【二、数据库使用方法】1.文献检索策略:明确检索主题,选择合适的数据库,利用关键词、作者、机构等信息进行检索。

建议使用布尔运算(AND、OR、NOT)提高检索效果。

2.检索技巧:- 使用高级检索,设置检索字段,如标题、摘要、关键词等。

- 根据需求,限定文献类型、发表年份、期刊范围等。

- 关注数据库的特色功能,如引文检索、相似文献推荐等。

3.数据库特色及应用场景:- Web of Science:侧重于学术成果的质量和影响力,适用于评价学术水平。

- PubMed:生物医学领域研究者必备,提供丰富的医学文献和临床试验信息。

- Google Scholar:检索速度快,全文获取方便,适用于广泛的学术领域。

- IEEE Xplore:电气工程领域权威数据库,提供大量全文资源。

- ACM Digital Library:计算机科学领域研究者的首选,侧重于信息技术方面的文献。

掌握这些英文数据库的使用方法,将有助于您在学术研究和工作中更有效地获取所需信息。

常用免费外文全文数据库1.SpringerLINK数据库德国施普林格(Springer-Verlag)是世界上著名的科技出版集团, 通过SpringerLink系统提供其学术期刊及电子图书的在线服务。

2002年7月开始,Springer公司和EBSCO/Metapress 公司在国内开通了SpringerLink服务。

访问方式:镜像服务器(本校读者无需登录)、国外站点(用户需登录出国并自付国际网络通信费)。

访问权限:校园网IP地址范围。

访问全文:(PDF格式)需要使用Acrobat Reader软件,如需安装,可由此下载Acrobat Reader。

2.EBSCOhost数据库EBSCO公司通过国际专线提供检索服务,校园网的用户检索、下载无需支付国际网络通信费。

采用IP控制访问权限,不需要帐号和口令。

3.WorldSciNet数据库WorldSciNet为新加坡世界科学出版社(World Scientific Publishing Co.)电子期刊发行网站,该出版社委托EBSCO / MetaPress 公司在清华大学图书馆建立了世界科学出版社全文电子期刊镜像站.4.Ptics ExpressOptics Express由美国光学学会创办,刊登光学技术领域方面的报告和新进展。

提供1997年创刊以来的全部文献,以平均49天一期的速度出版,并支持彩色图像和多媒体文件。

网站地址:/创建者:Optical Society 0f America5.New Journal 0f PhysicsNew Journal 0fPhysics由英国皇家物理学会和德国物理学会出版,提供1998年创刊以来的全部文献。

所有用户可免费获取电子版文章。

网站地址:创建者:Institute of Physics & German Physical Society6.The Journal of Machine Learning ResearchThe Journal of Machine Learning Research由麻省理工学院出版,是机械研究领域的优质学术性论文的平台,用户可下载2000年创刊以来的全部文章。

(四)利用英文全文数据库——Elsevier进行文献信息检索示例1、检索课题名称:货币需求对利率的影响2、课题分析:中文关键词为:货币需求、利率英文关键词为::Currency demand 、 interest rate3、选择检索工具:Elsevier数据库4、构建检索策略:Currency demand AND interest rate5、简述检索过程:选定在Elsevier中期刊、图书、文摘数据库等全部文献资源中检索2002年以后的关于货币需求对利率影响的相关文献。

利用确定的检索策略(Currency demand AND interest rate),文献全文(含文献题目、摘要、关键词)中检索,检到19040 篇相关文献;在文献题目、摘要和关键词中检索,检索到 47篇相关文献;在文献关键词中检索到0篇相关文献;在文献题目中检索到0 相关文献。

6、整理检索结果:从以上文献中选择出3条切题文献1. Currency demand by federal reserve cash office: what do we know? Original Research ArticleJournal of Economics and Business, Volume 56, Issue 4, July–August 2004, Pages 273-285Ruth A Judson, Richard D PorterAbstract:We evaluate US regional currencydemands using a panel dataset covering the 37 Federal Reserve Cash Offices over 25 years from 1974 to 1998. We find strong support for the transaction specification, in which currency depends on a transaction measure and nominal interestrate for all denominations, large denominations, and US $20. This result is generally robust to the inclusion of wide variety of additional economic and demographic variables. Beyond the traditional transaction terms, seven other variables stand out in the specifications we entertain: the age distribution of the population, bankruptcies, crime, employment, housing permits and starts, and transfer payments. Finally, we show that international currencydemand was generally an important influence during the period; when its influence is disregarded, the findings are muddied considerably.The following tests were made:– Combined wet–dry cycles using fresh water, seawater and water containing 5% sulphates– Accelerated ageing in an autoclave– Accelerated carbonationThe performance of the concrete containing sludge was acceptable and comparable to the results obtained for the reference concrete not containing sludge.Keywords: Currency; Domestic; International; Money demand; Panel2. Black market exchange rate, currency substitution and the demand for money in LDCs Original Research ArticleEconomic Systems, Volume 30, Issue 3, October 2006, Pages 249-263 Mohsen Bahmani-Oskooee, Altin TankuAbstract:Mundell's conjecture in 1963 that the demand for money could depend on the exchange rate in addition to income and interestrate has received some attention in the literature by including the official exchange rate and estimating the money demand in a few developed countries. In less developed countries, since there is a black market for foreign exchange, it has been suggested that the black market exchange rate rather than the official rate should be the determinant of the demand for money in LDCs. This proposition is tested by estimating the demand for money for 25 LDCs using the bounds testing approach to cointegration. The main conclusion is that while in some LDCs, the black market rate enters into the formulation of the demand for money, in some others the official rate is the determinant. The black market premium also played a role in some countries.JEL classification• E41;• F31Keywords: Money demand; Black market exchange rate; Bounds testing3. An oil demand and supply model incorporating monetary policy Original Research ArticleEnergy, Volume 35, Issue 5, May 2010, Pages 2013-2021Hossein Askari, Noureddine KricheneAbstract:Oil price inflation may have had a significant role in pushing the world economy into its worst post-war recession during 2008–2009. Reserve currency central banks pursued an overly expansionary monetary policy during 2001–2009, in the form of low or negative real interestrates and accompanied by a rapidly falling US dollar, while paying inadequate attention to the destabilizing effects on oil markets. In this paper, we show that monetary policy variables, namely key interestrates and the US dollar exchange rate, had a powerful effect on oil markets. World oil demand was significantly influenced by interest and dollar exchangerates, while oil supply was rigid. Oil demand and supply have very low price elasticity and this characteristic makes oil prices highly volatile and subject to wider fluctuations than the prices of other commodities. Aggressive monetary policy would stimulate oil demand, however, it would be met with rigid oil supply and would turn inflationary and disruptive to economic growth if there was little excess capacity in oil output. We argue that a measure of stability in oil markets cannot be achieved unless monetary policy is restrained and real interestrates become significantly positive. Monetary tightening during 1979–1982 might implythat monetary policy has to be restrained for a long period and with high interestrates in order to bring stability back to oil markets. Keywords:Crude oil; Demand and supply; Elasticity; Exchange rate; Interestrates6、全文摘录选择一篇:1An oil demand and supply model incorporating monetary policy一、篇名An oil demand and supply model incorporating monetary policy二、著者Hossein Askari,Noureddine Krichene三、著者机构George Washington University, 17795 Canby Road, Leesburg, VA 20175, USA International Monetary Fund, 700 19th Street, NW, Washington DC 20431, USAReceived 1 October 2009. Accepted 15 January 2010. Available online 3 March 2010./10.1016/j.energy.2010.01.017, How to Cite or Link UsingDOI四、文摘 AbstractOil price inflation may have had a significant role in pushing the world economy into its worst post-war recession during 2008–2009. Reserve currency central banks pursued an overly expansionary monetary policy during 2001–2009, in the form of low or negative real interestrates and accompanied by a rapidly falling US dollar, while paying inadequate attention to the destabilizing effects on oil markets. In this paper, we show that monetary policy variables, namely key interestrates and the US dollar exchange rate, had a powerful effect on oil markets. World oil demand was significantly influenced by interest and dollar exchange rates, while oil supply was rigid. Oil demand and supply have very low price elasticity and this characteristic makes oil prices highly volatile and subject to wider fluctuations than the prices of other commodities. Aggressive monetary policy would stimulate oil demand, however, it wouldbe met with rigid oil supply and would turn inflationary and disruptive to economic growth if there was little excess capacity in oil output. We argue that a measure of stability in oil markets cannot be achieved unless monetary policy is restrained and real interestrates become significantly positive. Monetary tightening during 1979–1982 might implythat monetary policy has to be restrained for a long period and with high interestrates in order to bring stability back to oil markets.五、关键词 Keywords:Crude oil; Demand and supply; Elasticity; Exchange rate; Interestrates六、正文1. Introduction(首段)The world economy experienced its worst post-WWII recession during 2008–2009 as oil prices raced from $20/barrel in 2001 to over $147/barrel in July 2008.1 Left unchecked and largely ignored by reserve currency central bankers, high fuel prices diverted large quantities of grains to the production of ethanol, putting pressure on corn and soybean markets; disrupted agriculture, airlines, auto industry; set off food riots in vulnerable countries; led to oil protests in major industrial countries; and aggravated poverty and unemployment around the world.(末段)During 2001–2008, major reserve currency central banks followed a highly expansionary monetary policy that ignited rapid commodity price inflation. Food and oil prices rose at unprecedented pace and reached levels that triggered riots and protests. Such a policy disrupted vital food and energy markets, and was a factoring the ensuing economic recession and high unemployment. In response to the recession during 2008–2009, reserve central banks decided to keep key money market rates near zero bounds and to expand the supply of money. This policy could encourage more speculation in commodity markets, especially in markets that face rigid demand and supply, such as oil. The data for 1976–1986 shows that monetary policy may have to be tightened significantly in order to reduce commodity price inflation and that money market interest rates, such as the LIBOR or the federal funds rate, may have to be maintained on average at levels similar to those during 1986–2001 in order to restore long-term stability in oil markets. Based on monetary tightening during 1979–1982, the period of monetary restraint may have to be extended over many years and interest rates may have to rise significantly before long-term oil market stability can be restored.七、参考文献 References1.[1]J.D. HamiltonOil and the macroeconomy since world war IIJournal of Political Economy, 91 (2) (1983), pp. 228–248View Record in Scopus|Full Text via CrossRef| Cited By in Scopus (288)2.[2]J.D. HamiltonWhat is an oil shockJournal of Econometrics, 113 (2) (2003), pp. 363–398Article | PDF (481 K) |View Record in Scopus|Full Text via CrossRef| Cited By in Scopus (223)3.[3]N.S. Balke, S.P.A. Brown, M. YucelOil price shocks and the U.S. economy: where does the asymmetry originate?The Energy Journal, 3 (2002), pp. 27–52View Record in Scopus|Full Text via CrossRef| Cited By in Scopus (48)4.[4]D.W. Jones, P.N. Leiby, I.K. PaikOil price shocks and the macroeconomy: what have we learned since 1996?The Energy Journal, 2 (2004), pp. 1–32View Record in Scopus|Full Text via CrossRef| Cited By in Scopus (82)5.[5]B.S. Bernanke, M. Gertler, M. WatsonSystematic monetary policy and the effects of oil shocksBrookings Papers on Economic Activity, 1 (1997), pp. 91–157View Record in Scopus|Full Text via CrossRef| Cited By in Scopus (156)6.[6]J.J. Rotemberg, M. WoodfordImperfect competition and the effects of energy price increases on the economic activityJournal of Money, Credit and Banking, 28 (1996), pp. 549–577Full Text via CrossRef7.[7]H. ThorntonF.R.A.v. Hayek (Ed.), An inquiry into the nature and effects of the paper credit of Great Britain, Rinehart, New York (1802) 19398.[8]D. RicardoOn the principles of political economy and taxationJohn Muray, London, UK (1817)9.[9]Tooke, T, The history of prices. 1838.10.[10]K. WicksellInterest and pricesMacMillan and Co, London, UK (1898)11.[11]J.M. KeynesThe general theory of employment, interest and moneyMacmillan (reprinted 2007), London, UK (1936)12.[12]M. FriedmanA program for monetary stabilityFordham University Press, New York, NY (1959)13.[13]B. McCallum, W. NelsonPerformance of operational policy rules in an estimated semi- classical structural modelJohn Taylor (Ed.), Monetary policy rules, University of Chicago Press, Chicago, IL (2000), pp. 15–4514.[14]J. WilliamsonThe open economy and the world economyBasic Books, New York, NY (1983)15.[15]E.W. Erickson, R.M. SpannSupply response in a regulated industry: the case of natural gasThe Bell Journal of Economics and Management Science, 1 (1971), pp. 94–121Full Text via CrossRef16.[16]J.H. EyssellThe supply response of crude petroleum – new and optimistic resultsBusiness Economics, 13 (3) (1978), pp. 338–34617.[17]R.S. PindyckThe structure of world energy demandMIT Press, Cambridge, MA (1979)18.[18]M.H. Pesaran, R.P. Smith, T. AkiyamaEnergy demand in Asian developing economiesOxford University Press/World Bank, New York, NY (1998)19.[19]D. Gately, H.G. HuntingtonThe asymmetric effects of changes in price and income on energy and oil demandThe Energy Journal, 1 (2002), pp. 19–55View Record in Scopus|Full Text via CrossRef| Cited By in Scopus (42)20.[20]J. Griffin, G. SchulmanPrice asymmetry in energy demand models: a proxy for energy- saving technical change?The Energy Journal, 2 (2005), pp. 1–21View Record in Scopus|Full Text via CrossRef| Cited By in Scopus (17)21.[21]F.M. FisherSupply costs in the United States petroleum industryJohn Hopkins University Press, Baltimore, MD (1964)22.[22]C. Dhal, T.E. DugganSurvey of price elasticities from economic exploration models of US oil and gas supplyJournal Energy Finance and Development, 2 (1998), pp. 129–16923.[23]K. Lee, S. Ni, R.A. RattiOil shocks and the macroeconomy: the role of price variabilityThe Energy Journal, 4 (1995), pp. 39–56View Record in Scopus|Full Text via CrossRef| Cited By in Scopus (165)24.[24]B.S. Bernanke, A.S. Blinder"The federal funds rate and the channels of monetary transmissionsAmerican Economic Review, 4 (1992), pp. 901–921View Record in Scopus。

常用国外数据库详细介绍(按国家分类)一、美国(1) Wiley InterScience(英文文献期刊)主页:/简介:Wiley InterScience是John Wiely & Sons 公司创建的动态在线内容服务,1997年开始在网上开通。

通过InterScience,Wiley公司以许可协议形式向用户提供在线访问全文内容的服务。

Wiley InterScience收录了360多种科学、工程技术、医疗领域及相关专业期刊、30多种大型专业参考书、13种实验室手册的全文和500多个题目的Wiley学术图书的全文。

其中被SCI收录的核心期刊近200种。

期刊具体学科划分为:Business, Finance & Management (商业、金融和管理)、Chemistry (化学)、Computer Science (计算机科学)、Earth Science (地球科学)、Education (教育学)、Engineering (工程学)、Law (法律)、Life and Medical Sciences (生命科学与医学)、Mathematics and Statistics (数学统计学)、Physics (物理)、Psychology (心理学)。

(2)美国IEEE (英文文献期刊)主页:/简介:IEEE(Institute of Electrical & Electronics Engineers)是电子信息领域最著名的跨国性学术团体,其会员分布在世界150多个国家和地区。

据IEEE统计,IEEE会员总数2001年比2000年增加3.1%,达到377342人,其中学生会员为65669人,增长12.6%。

随着人们的信息越来越多地来自Internet,IEEE需要为会员提供更加完善和全面的电子信息产品和服务。

IEEE应成为IEEE会员获得信息的首选之地。

IEEE必须识别正确的信息,并提供对它们的访问方法。

EBSCO外文全文数据库检索使用方法浙江财经学院图书馆数字资源介绍之二EBSCO外文全文数据库检索使用方法进入方法:图书馆主页一数字资源一远程站点一EBSCO英文全文专业数据库1、数据库选择:进入数据库首页,可以看到一个子数据库的列表,每个子数据库都有内容介绍,可以选择某一个子数据库,也可以同时选择多个子数据库。

选择检索续”进入检索界面也可直接点击子数据库名称进入检索界面通过“题名列表”可浏览该子数据库资源2、检索:选择一个或多个子数据库后,进入具体的检索界面,输入具体的检索要求,同时可以设定一些限制条件,缩小检索范圉,精确检索结果。

界面的语言种mosanassacB选择子数据库,点击“继类,便于使用数据库选择检索字段输入检索词可设定一些限制条件,精确检索结果浙江财经学院图书馆数字资源介绍之二3、检索结果:可以选择需要的文献查看全文,也可以将需要的文献存放在“我的EBSCOhost”文件夹里,以后再次需要时可直接到文件夹中查看,无须再次检索。

需要说明的是该数据库不是所有文献都有全文,如在文献列表中没有“PDF全文”字样就表示该文献没有全文,因此建议在检索时设定附加检索条件为“全文”。

该数据库文献釆用PDF格式,在浏览全文前请先下载安装PDF阅读器。

注册或登陆我的文件夹,可存放检索到的文献点击打开已经存入文件夹的检索结果检索结果按文献类型分类检索结果列表,点击“PDF全文”可查看全文将该文献添加至我的文件夹点击添加到“我的文件夹检索结果按主题分类4、“我的文件夹”管理:先注册一个“我的EBSCO”,将检索结果进行添加,添加后将显示“我的文件夹中有对象”,下次需要利用这些检索结果时,不用重新检索,直接打开“我的EBSCO”或点击“我的文件夹中有内容”即可。

AW* taer - L "r T IN o 眄9f I •■ -TW点击查看以前添加的检索结果浙江财经学院图书馆数字资源介绍之二.• w・* fl・ 6 ) • I r ・■!«・■ >•・h ET・r,・・—r・・IXlAMUk VM33"L—WL LfT ,Eh ■ ■■■■U iMLiffrii •tiTWkvvMwSuCuotMtJ 2?S*。