支付宝线下收单行业解决方案

- 格式:ppt

- 大小:32.60 MB

- 文档页数:119

支付渠道营销方案一、背景介绍随着电子商务的发展,支付渠道在商业营销中扮演着越来越重要的角色。

如何通过优化支付渠道来提升销售业绩,成为各行业企业亟需解决的问题。

本文将针对支付渠道营销方案展开讨论,旨在帮助企业更好地利用支付渠道来实现营销目标。

二、支付渠道分析1. 传统支付渠道传统支付渠道主要包括现金支付、银行转账、支票等方式,虽然安全性较高,但存在支付不便利、交易周期长等问题,不适应电商快节奏发展的需求。

2. 在线支付渠道随着互联网的普及,在线支付渠道包括支付宝、微信支付、信用卡支付等逐渐成为主流,便捷快速的支付方式受到广泛欢迎。

3. 移动支付渠道移动支付渠道以手机支付为主,如Apple Pay、Samsung Pay等,随着智能手机的普及,移动支付逐渐成为人们生活的一部分。

三、支付渠道营销策略1. 多渠道支付针对不同消费群体,企业可以选择多种支付渠道,比如在线支付、移动支付、银行卡支付等,以满足消费者的不同需求。

2. 优惠活动通过在特定支付渠道上推出优惠活动,如返现、打折等方式,吸引用户选择该渠道支付,提高支付渠道的活跃度。

3. 支付产品推广针对特定的支付产品,如某家银行推出的信用卡支付活动,企业可以与该银行合作,共同推广,提高消费者对该支付产品的认知度和使用率。

4. 数据分析与个性化推荐通过对用户支付数据的分析,可以根据用户的支付习惯和偏好进行个性化推荐,提高用户对支付渠道的粘性。

四、支付渠道营销效果评估为了确保支付渠道营销方案的有效性,企业可以通过以下指标进行评估: - 支付渠道使用率:统计不同支付渠道的使用比例,找出使用率较低的渠道进行优化。

- 转化率:分析支付渠道转化率,了解各渠道的营销效果,并及时调整方案。

- 客户满意度:通过用户问卷调查等方式收集用户反馈,了解用户对支付渠道的满意度,发现问题并改进。

五、总结通过对支付渠道营销方案的梳理和分析,企业可以更好地利用不同支付渠道推动销售增长,提高用户体验,从而实现营销目标。

pos全行业解决方案篇一:集中收银解决方案一、前期调查概述及分析调研对象概述深圳宝华白马服装批发城位于商业气氛活跃的东门商业步行街区内,东门建成最早、规模最大、地理位置最佳、品种最齐全、批发价格最便宜、人气最旺的服装批发市场。

宝华白马服装批发城经营着各类高、中、低档服装,品种齐全,各种规格服装日上市款式达10000款以上,日均人流量50万人次,其购销业务已经遍及国内、港澳台及海外市场。

各项指标显示,宝华白马已经成为目前深圳市规模最大的时装集散地。

本次调研对象为深圳宝华白马批发市场内商户的收款方式(特别是POS攵款的具体情况)和以此延展的网店信息、管理软件信息、供应渠道与分销方式等。

调研目的近年来,互联网技术的推动下,互联网业、金融业和电子商务业之间的界线日渐模糊,行业融合日渐深入,已经形成新的“互联网金融”蓝海。

随着互联网的发展,专业市场传统商业模式受互联网冲击,宝华白马批发市场也不例外。

为了在传统批发行业融入“互联网+”元素,将宝华白马批发市场中商户单独收银集成到市场统一收银,并进一步实现依托宝华白马实体市场打造的品牌网上商城、品牌金融超市、品牌联名信用卡等,特组织此次调研。

调研方法本次调研由博恩集团和华岸金控派员组成三人调研小组,采用实地走访抽样调查形式。

调研内容1.市场内POS安装基本情况市场内85%的商户已经安装了POS机,15%商户尚未安装现行POS终端布放分布图现行POS费率及到账时间备注:a、平安银行在市场中的政策为贷记卡T+0到账。

b、第三方支付公司,收取2%。

左右的额外费用后,可支持借记卡和贷记卡T+0到账。

c、T+0到账在本市场中大多数为实时逐笔,少数为当天。

办理条件及附加条件经核实商场中办理POS只需要营业执照、结算银行卡、结算人身份证即可,部分第三方支付公司需要商户缴纳少许机具押金。

主动上门收资料,到店安装,非常简便。

调研中还发现,部分银行在为商户提供0费率及T+0到账便利条件时,是对商户在该银行有日均不低于特定金额的存款要求的。

第三⽅⽹上跨境⽀付存在的问题与政策性建议lectronic Payment随着国内⽀付市场竞争⽇趋⽩热化,境外业务越来越受到⼤型第三⽅⽹上⽀付机构的重视。

以国内知名的第三⽅⽹上⽀付机构⽀付宝为例,其跨境⽀付业务的年增速超过100%。

为了满⾜境内个⼈通过⽹络购买境外商家物品的⼩额⽀付需求,⽀付宝与国内银⾏合作开展了境外收单业务。

在现⾏管理体制下,此项业务有其现实可⾏性和必要性,但同时也对当前的外汇管理⼯作提出了更⾼要求,对⽹络及电⼦商务快速发展中的外汇收⽀管理带来了挑战。

如何积极⽀持⽹上跨境⽀付,有序疏导外汇流出,值得我们作进⼀步的调查和思考。

⼀、境外收单的业务流程与可⾏性分析1.境外收单的业务流程通过与国内银⾏的合作,⽀付宝为境内的买家在境外购物提供便利的电⼦⽀付⼿段,境外商户可直接收到对应币种货款。

具体业务流程主要分为前台购物⽀付流程和后台购汇清算流程。

前台购物⽀付流程是境内买家拍下境外商家的货品后,按显⽰的⼈民币报价⽀付相应款项到⽀付宝,尔后境外商户向境内买家发货。

后台购汇清算流程主要发⽣在⽀付宝和境内合作银⾏之间,由⽀付宝向境内合作银⾏查询汇率并向境内买家显⽰⼈民币交易价格,同时根据交易情况通过银⾏进⾏批量购汇,在买家收到货物后向银⾏发送清算指令,通过SWIFT直接将外币货款打⼊境外商户开户银⾏,从⽽完成整个交易。

2.开展境外收单业务的可⾏性分析(1)便利⽹上跨境交易和⼩额汇兑⽀付交易。

第三⽅⽹上⽀付机构尚不能直接提供本外币转换⽀付服务,即境内客户如需⽹上购买境外商品,必须直接以外币⽀付或在⽹下通过银⾏⽀付,境外商家也⽆法实时向境内买家提供商品的⼈民币报价。

⽽⽀付宝境外收单业务却解决了这⼀交易瓶颈,境内买家可以实时获取境外商家的⼈民币报价并以⼈民币⽀付货款,境外商家也可以通过⽀付宝直接收到相应的外币货款,满⾜了⽹上跨境交易产⽣的汇兑和⽀付需求。

第三⽅⽹上跨境⽀付存在的问题与政策性建议中国⼈民银⾏太原中⼼⽀⾏郝建军国家外汇管理局⼭西省分局王⼤贤67E电⼦⽀付lectronic Payment(2)有利于⽹上个⼈跨境交易的规范管理。

线下收单市场分析报告1.引言1.1 概述概述线下收单市场是指在实体店铺、商场、餐饮等场所进行的支付收银服务。

随着移动支付、无现金支付等新型支付方式的兴起,线下收单市场正面临着巨大的变革和发展机遇。

本报告将对当前线下收单市场的状况进行分析,并探讨其发展趋势,以及对参与者提出建议与展望。

通过本报告的研究分析,可以为相关企业提供决策依据,帮助他们更好地把握市场机遇,提升竞争力。

1.2文章结构文章结构:本报告分为引言、正文和结论三部分。

在引言部分,将对文章的整体概况进行概述,介绍文章的结构和目的,并对整篇报告进行总结。

在正文部分,将深入分析当前线下收单市场的状况,分析市场主要参与者的情况,并对市场发展趋势进行预测。

在结论部分,对当前市场状况进行总结,展望未来市场的发展趋势,并提出相关的建议和展望。

整篇报告将全面、系统地分析线下收单市场的情况,并为市场参与者和决策者提供有益的参考和建议。

1.3 目的本报告旨在对当前线下收单市场进行深入分析,了解市场的整体状况、主要参与者的情况以及市场未来的发展趋势。

通过对市场的分析,我们希望能够为行业内企业提供有益的信息和建议,以便它们制定更好的市场战略和发展规划。

同时,我们也希望能够为政府部门和监管机构提供一些对行业发展有意义的参考,以促进行业健康有序的发展。

本报告的目的在于为行业内各方提供全面的市场分析和发展预测,为行业的未来发展提供参考和支持。

1.4 总结部分:本报告对线下收单市场进行了深入分析,从当前市场状况、主要参与者分析以及发展趋势预测等方面进行了全面的描述和评估。

通过对市场现状的梳理和主要参与者分析,我们可以看出线下收单市场正处于快速发展的阶段,市场竞争激烈,玩家众多。

在展望未来方面,随着科技的不断进步和消费者支付习惯的变化,线下收单市场将面临新的机遇和挑战,包括移动支付、智能终端设备等新技术的应用和普及,以及市场竞争加剧的局面。

基于对市场的深入了解和未来趋势的预测,我们建议线下收单市场的主要参与者应加强技术创新,提高服务水平,不断提升用户体验,以应对市场竞争和满足消费者需求。

2024年线下收单市场需求分析引言随着电子支付的普及,线上交易逐渐成为人们的主要支付方式。

然而,在线上支付并不适用于所有场景,特别是在一些营业面积较小或是交易量较少的实体店。

对于这样的商户而言,线下收单成为一种常用的支付方式。

本文将对线下收单市场的需求进行分析。

1. 线下收单市场概述线下收单是指在实体店铺通过刷卡、扫码或现金等形式接收消费者支付的行为。

线下收单市场是指为商户提供相应收款服务的市场。

2. 2024年线下收单市场需求分析2024年线下收单市场需求分析主要从商户和消费者两个角度进行。

2.1 商户需求商户对线下收单市场有以下需求: - 简便易用:商户希望线下收单终端设备易于安装和使用,不需要过多的技术支持。

- 安全可靠:商户对交易安全和数据保护非常关注,希望线下收单系统具备安全防护能力,防止交易风险和数据泄露。

- 低成本:商户希望线下收单系统的使用和维护成本较低,以便他们能够提供更优惠的价格和服务给消费者。

- 多样化支付方式:商户希望线下收单系统支持多种支付方式,包括刷卡、扫码、现金等,以满足不同消费者的支付习惯和需求。

2.2 消费者需求消费者对线下收单市场有以下需求: - 便利快捷:消费者希望线下收单系统能够提供方便快捷的支付方式,减少支付过程中的等待时间。

- 安全可信:消费者对支付过程的安全性和可靠性有较高要求,需要线下收单系统具备防止交易欺诈和恶意攻击的能力。

- 多样化支付方式:消费者希望能够有多种支付方式选择,例如刷卡、扫码、现金等,以适应其个人支付习惯和需求。

- 付款记录:消费者希望能够方便地查询和管理自己的付款记录,以便进行对账和消费分析。

3. 市场发展趋势随着科技的不断进步和消费习惯的变化,线下收单市场的需求也在不断发展和变化。

以下是一些市场发展趋势: - 移动支付的兴起:随着智能手机的普及,移动支付正在成为主要的线下收单方式之一。

通过手机扫码支付或近场通信(NFC)技术感应支付,消费者可以实现方便快捷的支付。

支付宝的营销方案支付宝是中国领先的第三方电子支付平台,以其便捷、安全、快速的支付服务而深受用户的喜爱。

为了进一步提升支付宝的市场份额和用户粘性,支付宝可以采取以下营销方案:1. 用户激励活动:支付宝可以开展各种形式的用户激励活动,如优惠券、红包等。

通过在用户支付过程中赠送抵扣券或红包,可以吸引用户在支付宝上消费,提升用户对支付宝的黏性。

同时,支付宝可以与合作商户合作,推出联合品牌优惠活动,吸引用户持续在支付宝平台上进行消费。

2. 用户推荐奖励计划:支付宝可以通过用户推荐奖励计划来扩大用户群体。

用户只需要通过分享自己的推荐链接或邀请码,引导他人下载并注册支付宝账号,即可获得一定的奖励,如现金红包、积分等。

这样不仅可以提升用户活跃度,还能够扩大支付宝的用户基础。

3. 合作伙伴联合推广:支付宝可以与各类合作伙伴进行联合推广。

例如,与大型电商平台、线下零售商户达成合作,提供支付宝融合支付等服务,吸引商户和用户使用支付宝付款,同时通过联合推广和营销活动促进双方的双赢。

4. 定制化营销推广:支付宝可以针对不同用户群体,进行定制化的营销推广。

例如,通过用户数据分析,将用户分为不同的消费偏好群体,然后对不同群体推送个性化的营销活动,如购物返现、出行优惠等。

这样可以提高用户参与活动的积极性,增加用户使用支付宝的频率和黏性。

5. 社交媒体推广:支付宝可以利用社交媒体平台进行推广,通过创建和维护官方账号,发布有趣、有用的支付宝资讯和活动内容,吸引用户关注和参与。

同时,与大V、网红等合作,利用他们的影响力和粉丝基础,进行支付宝的宣传和推广,提升支付宝在年轻群体中的知名度和美誉度。

总之,支付宝可以通过丰富多样的营销方案,提升用户活跃度和粘性,扩大用户基础和市场份额。

通过与合作伙伴的联合推广合作、用户激励活动、定制化营销推广等手段,支付宝可以不断创新,满足用户需求,巩固其市场地位。

支付宝代运营解决方案

支付宝代运营是指将支付宝的相关业务代理给第三方机构或个人进行管理和运营。

以下是一些支付宝代运营的解决方案。

1. 代理商:作为代理商,你可以帮助商户创建支付宝账号、设置支付功能、管理收款信息等,从而为商户提供全面的支付解决方案。

2. 营销推广:作为支付宝代运营,你可以帮助商户制定并执行支付宝相关的营销活动,比如优惠券、满减活动等,提升商户的销售额。

3. 数据分析:通过对商户的支付数据进行分析,你可以帮助商户了解客户行为、支付趋势等,从而指导商户改进业务策略,并提供个性化的服务。

4. 客户服务:作为支付宝代运营,你可以代表商户处理支付过程中的问题和投诉,提供及时的客户服务,增加商户的用户满意度。

5. 财务管理:你可以帮助商户进行收款和结算,管理商户的财务数据,提供准确的财务报表,帮助商户掌握经营状况。

需要注意的是,作为支付宝代运营,你需要具备丰富的支付宝相关知识和经验,以及良好的沟通能力和服务意识,以确保为商户提供优质的代运营服务。

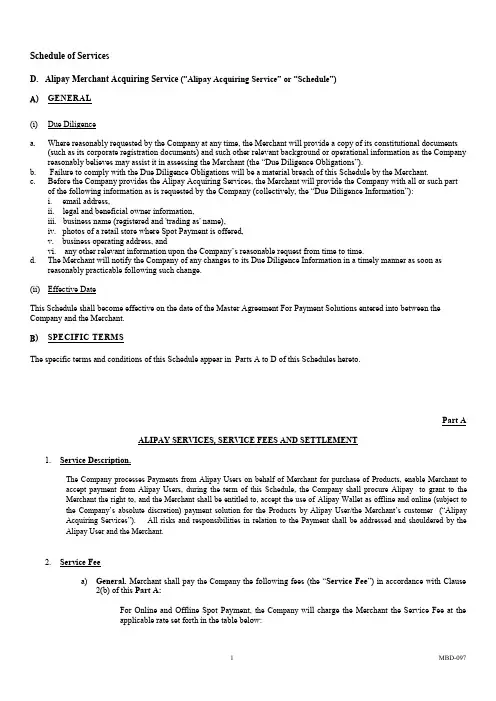

Schedule of ServicesD.Alipay Merchant Acquiring Service (“Alipay Acquiring Service” or “Schedule”)A) GENERAL(i) Due Diligencea. Where reasonably requested by the Company at any time, the Merchant will provide a copy of its constitutional documents(such as its corporate registration documents) and such other relevant background or operational information as the Company reasonably believes may assist it in assessing the Me rchant (the “Due Diligence Obligations”).b. Failure to comply with the Due Diligence Obligations will be a material breach of this Schedule by the Merchant.c. Before the Company provides the Alipay Acquiring Services, the Merchant will provide the Company with all or such partof the following information as is requested by the Company (collectively, the “Due Diligence Information”):i. email address,ii. legal and beneficial owner information,iii. business name (registered and 'trading as' name),iv. photos of a retail store where Spot Payment is offered,v. business operating address, andvi. any other relevant information upon the Company‟s reasonable request from time to time.d. The Merchant will notify the Company of any changes to its Due Diligence Information in a timely manner as soon asreasonably practicable following such change.(ii) Effective DateThis Schedule shall become effective on the date of the Master Agreement For Payment Solutions entered into between the Company and the Merchant.B) SPECIFIC TERMSThe specific terms and conditions of this Schedule appear in Parts A to D of this Schedules hereto.Part AALIPAY SERVICES, SERVICE FEES AND SETTLEMENT1.Service Description.The Company processes Payments from Alipay Users on behalf of Merchant for purchase of Products, enable Merchant to accept payment from Alipay Users,during the term of this Schedule, the Company shall procure Alipay to grant to the Merchant the right to, and the Merchant shall be entitled to, accept the use of Alipay Wallet as offline and online (subject to the Company‟s absolute discretion) payment solution for the Products by Alipay User/the Merchant‟s customer (“Alipay Acquiring Services”). All risks and responsibilities in relation to the Payment shall be addressed and shouldered by the Alipay User and the Merchant.2.Service Feea)General. Merchant shall pay the Company the following fees (the “Service Fee”) in accordance with Clause2(b) of this Part A:For Online and Offline Spot Payment, the Company will charge the Merchant the Service Fee at theapplicable rate set forth in the table below:For online Payment, the Company will charge the Merchant the Service Fee at [ ]%For offline transactions, the Company will charge the Merchant the Service Fee at [ ]% ().All payments of the Service Fee shall be exclusive of any Tax.b)Payment of Service Fee. The Merchant agrees that the Company may deduct, in whole or in part, any ServiceFee that is due and payable but have not otherwise been paid by the Merchant, from the relevant FundsAvailable for Settlement.c)Over/Under-Charges. If the Company charges the Merchant more than the Service Fee set forth in thisSchedule, the Company will return the additional Service Fee charged to the Merchant as soon as practicable.If the Company charges the Merchant less than the Service Fee set forth in this Schedule, then Merchant shallpay the amount of outstanding Service Fee to the Company as soon as practicable upon the Company‟s request.3.Alipay Settlement Processa)Bank Account. The Merchant will bear all losses arising from the incorrect information of its banking details asprovided to the Company in this Schedule.b)Funds Transfer. Subject to the Company exercising its rights to withhold, deduct or set off in accordance withthis Schedule, the Company will transfer to the Merchant an amount equal to the "Net Settlement Amount" inaccordance with the formula set out below:Net Settlement Amount= Settlement Funds –Refunds (if any, as specified under Clause 3(e) below) -Chargebacks (if any) - any other amount that the Company may deduct in accordance with its rights to withhold,deduct or set off under this Schedule; andWhere: Settlement Funds =Funds Available for Settlement – Service Fee.c)Settlement File.Following the transfer of any Net Settlement Amount to the Merchant‟s designated bankaccount, the Company will provide, on the same Working Day, a file containing the relevant settlementinformation (“Settlement File”) in relation to that Net Settlement Amount.d)Incidental Fee for Fund Transfer. In connection with transferring the Net Settlement Amount to the Merchantin accordance with this Part A, the Merchant will be solely responsible for bank charges (if any) imposed bybanks through which the Company initiates the transfer of such Net Settlement Amount. For any other fees orcharges imposed by beneficiary banks (where Merchant has a bank account), intermediary banks or otherpayment service providers passing or receiving such Net Settlement Amount on behalf of the Merchant, theMerchant shall be solely responsible for any such fees or charges.e)Refunds.(A)If an Alipay User requests and is due a Refund in accordance with a Merchant‟s after-sale servicepolicy or a Refund is required by Applicable Law, the Merchant (as appropriate) will instruct theCompany in a timely manner to make such Refund to the Alipay U ser‟s Alipay Account in accordancewith the Refund process to be agreed between the Company and the Merchant.(B)The Merchant hereby agrees to reimburse the Company for each such Refund and for that purposeauthorizes the Company to deduct the amount of each Refund from the Settlement Funds and returnsuch Refund to the relevant Alipay User in accordance with this Clause 3(e).(C)If the amount of the Settlement Funds is not sufficient to process the relevant Refund, the Company willbe entitled to process the Refund only after the amount of such Settlement Funds becomes sufficient topay the amount of such Refund or after the Company otherwise receives from the Merchant an amountsufficient to process the Refund. For the avoidance of doubt, the Company shall not be responsible forany claim or liability that the relevant Alipay User may seek Merchant in the event of any delay inprocessing such Refund.(D)Alipay will not charge any Service Fee in respect of any Refund from the relevant Settlement Fund.Any Service Fee related to a Payment that is subject to a Refund and which has already been deductedfrom the Funds Available for Settlement will be repaid to the merchant by the Company upon theRefund being paid to the Company.(E)the Company only accepts and processes Refund instructions from the Merchant if the request for theRefund is made within ninety (90) days from the date of the Transaction, except for Products relating toair travel that have been specifically agreed by both Parties which the Company will accept and processa request for any Refund up to three hundred and sixty five (365) days from the Transaction date.(F)The Merchant will ensure that any Refund is only effectuated through the system interface provided bythe Company. Any alternative methods for the Refund, including but not limited to bank remittance, aredisallowed.f)Settlement and Settlement Limit. T he Company will transfer the Net Settlement Amount in Hong Kong Dollarto the Merchant‟s designated bank account (as provided in the Agreement) within two (2) Working Days fromthe date of Transaction. T he Company reserves the right to adjust the Settlement Limit and charge a fee forSettlement during the Renewal Term(s).g)Enquiry Regarding Settlement. Any enquiry by the Merchant with respect to settlement shall be made inwriting and the Merchant shall provide any information reasonably required by the Company to assist with suchenquiry. T he Company will, acting in a commercially reasonable manner, assist the Merchant in resolving therelevant matter and provide a written response to the Merchant within seven (7) Working Days after receivingsuch written enquiry from Merchant.4.Rules for Risk Management.a)The Merchant agrees that, if the Company determines in its sole discretion that certain features of the AlipayAcquiring Services may be subject to high risk of Unauthorized Payment or fraudulent Transaction, theCompany may suspend or terminate, with reasonable notice, the provision of such part of the Alipay AcquiringServices, including but not limited to adjusting the types, issuing banks and payment limit (whether perTransaction or per day) of the credit card and/or debit card Alipay Users will be able to use to complete thePayment from time to time.b)The Merchant to use its best efforts to promptly answer Alipay U ser‟s enquiries and resolve any disputes inrelation to the goods and/or services provided by the Merchant.c)The Merchant shall be responsible for all costs and loss incurred by any disputes in relation to the goods and/orservices provided by the Merchant and any Unauthorized Payment if such Unauthorized Payment is caused byor due to the Merchant‟s default with respect to Transactions, including but not limited to Chargebacks andrelated costs, and the Merchant will comply with the following rules:(A)Transaction Evidence. The Merchant will ensure to provide the Transaction Evidence within three (3)Working Days upon the Company‟s request.(B)Reimbursement. If the Company does not receive the Transaction Evidence, or the Company deems theTransaction Evidence to be inadequate, or the Merchant accepts the Chargeback, or the arbitration orpre-arbitration result is not in favor of the Merchant, in the case that the Merchant elects to proceedwith the arbitration or the pre-arbitration (or equivalent procedure) to resolve the Chargeback and sucharbitration or pre-arbitration (or equivalent procedure) determines that there is a Chargeback, theChargeback amount regarding the Transaction in question will be deducted from the Settlement Fundsin the next settlement cycle in accordance with Clause 3 (b) of this Part A. .(C)Reimbursement Obligation. Provided Transaction Evidence has been requested, the Company may,having made due enquiry of the Alipay User, determine to reimburse an Alipay User in the event ofany Unauthorized Payment. The Merchant agrees to indemnify and hold harmless the Company for theamount to be agreed between the Merchant and the Company (each acting reasonably) reimbursed tothe Alipay User. In the event of any disputes in relation to the goods/services with card payments, theMerchant agrees to follow card association‟s rules.5.Payment Policiesa)Responsibilities for Service Fee. The Merchant will pay any Service Fee for using the Alipay Services and willnot, directly or indirectly, transfer any such Service Fee, that it may be charged, to the Alipay Users in addition to what a Merchant would charge a customer for the relevant Transaction in the normal course of business.b)Alipay Wallet as Payment Method. The Merchant will not restrict its customers in any way from using AlipayWallet as a Payment method at checkout at any sales channel, including but not limited to requiring a minimum or maximum purchase amount (except due to the transaction control required by Applicable Laws) from customers using Alipay Wallet to make Payments.c)Prohibited Products. The Merchant fully acknowledges that must not provide Alipay Acquiring Services withrespect to any Transaction which is prohibited by this Schedule (including Payments in relation to Prohibited Products), Applicable Law or violates the Company and Alipay‟s internal policies (as notified to the Merchant from time to time), or which will result in the Company being considered to have breached any Applicable Law.The Merchant will provide the Company information about its Merchant‟s Products as reasonably requested by the Company from time to time. The Merchants will not sell Products through Alipay‟s and the Company‟s Platform that contain articles prohibited or restricted from being sold to Alipay Users under any Applicable Law, including without limitation the products listed in Appendix I, which may be updated by the Company and/or Alipay and notified to the Merchant from time to time (together, “Prohibited Products”). The Merchant will ensure that no Transaction being submitted for the Company‟s processing involves or relates to any Prohibited Products (“Prohibited Transaction”). T he Company will have the right to refuse to provide any Alipay Acquiring Services with respect to any Prohibited Transaction and the Merchant will indemnify the Company for any damages, losses and liabilities that the Company may suffer arising from or in connection with such Prohibited Transactions.d)Products.The Merchant will use Alipay Acquiring Services only for the Products in connection withMerchant‟s principal business as notified by the Merchant to the Company in accordance with this Schedule. The Merchant shall not make a request for Payment or settlement for any Transaction unless the Merchant is in the course of conducting a sales and purchase transaction with respect to the provision of the Products to Alipay Users. Cash Advances by the Merchant or by Merchant to Alipay Users are not allowed in any circumstances.The Merchant hereby agrees, warrants and represents to the Company on each of its request for Payment that each relevant Transaction thereunder has been duly and properly authorized and completed according to the terms and conditions of this Schedule and that the details of the Transactions are true and correct.e)Storage of Transaction Information. The Merchant will, maintain the records for each Transaction to justifyits authenticity for a period of seven years after the completion of the Transaction and the Company shall be entitled to review or otherwise access such records. Subject to any legal restrictions under Applicable Law, The Merchant will ensure that the Company, Alipay, the relevant service providers of Alipay and the Company and/or regulatory or governmental authorities having jurisdiction over Alipay and the Company be provided with or granted access to, the relevant Transaction information including but not limited to information on each Merchant, Products, and the amount, currency, time and counterparties to each Transaction, within three (3) Working Days of the Company‟s request. Subject to any restriction under Applicable Laws, the Company will advise the Merchant of the names of such service providers or regulatory/governmental authorities and the subject matter to which such requests relate.f)Set off & Withholding. The Merchant agrees that the Company shall be entitled, at its sole discretion, to set off,withhold settlement of or deduct any sums payable and liability of any nature from time to time due, owing or incurred by the Merchants) to the Company(or any the Company Affiliate) under this Schedule against any monies and liabilities of any nature, including Payments, from time to time due, owing or incurred by the Company under this Schedule. The circumstances under which the Company may exercise its rights under this Clause include, but are not limited to,:(A)if the Merchant fails to comply with any term of this Schedule;(B)if the Company believes that the Merchant has or is likely to become subject to bankruptcy,insolvency, reorganization, winding up or similar dissolution procedures;(C)if the Company reasonably believes that there has been a material deterioration in the financialcondition of the Merchant; and(D)if the Company reasonably believes that any Transaction is a Prohibited Transaction.The Merchant shall not be entitled to retain or set-off any amount owed to it by the Company against any amountdue from the Merchant (or its Merchants) to the Company.6.Cooperation with the Company.a)In consideration of the mutual agreements and promises set forth in this Schedule, and for other good andvaluable consideration the receipt and sufficiency of which is hereby acknowledged, for the Term of thisSchedule, The Merchant, including its Affiliates, and its and their officers, shareholders, directors shall not inany way engage in any other payment acquiring service (other than the Service).b)The Merchant agrees that the limitations in this Clause are in the public interest by protecting the general publicfrom confusion and the passing off of other competing services and that the preferential rates as stipulated underthis Schedule adequately compensate it for these limitations.Part B ALIPAY ACQUIRING SERVICE TERMS AND CONDITIONS1.Definitions. Capitalized terms not defined in this Part B will have the meaning given to them in this Schedule includingthose set out in Part D, unless the context requires otherwise.2.Alipay Acquiring Services. T he Company will provide the Merchant certain service as described in Part A. Each of theCompany and the Merchant will perform and comply with its respective responsibilities set forth in this Schedule.3.Fees. In consideration for the Company providing the Alipay Acquiring Services to the Merchant in accordance with the termsof this Schedule, the Merchant will pay the Company the Service Fee and other fees or charges as set out in Part A. T he Company reserves the right to adjust such fees upon thirty (30) days prior written notice.4.Representations and Warranties. Each Party makes each of the following representations and warranties to the other Party,and acknowledges that such other Party is relying on these representations and warranties in entering into this Schedule.A.Authorization. The Party represents and warrants the following (collectively, the “Authorization Warranties”):(i)it is an independent corporation duly organized, validly existing and in good standing under the laws of jurisdictionof its incorporation;(ii)it is properly registered to do business in all jurisdictions in which it carries on business;(iii)it has all licenses, regulatory approvals, permits and powers legally required to conduct its business in each jurisdiction in which it carries on business; and(iv)it has the corporate power, authority and legal right to execute and perform this Schedule and to carry out the transactions and its obligations contemplated by this Schedule.B.Validity. Each Party represents and warrants that once duly executed by the Party this Schedule shall constitute valid andbinding obligations on the Party, enforceable in accordance with its terms. Except as otherwise stated in this Schedule, no approval or consent of any person or government department or agency is legally or contractually required to be obtained by the Party in order to enter into this Schedule and perform its obligations.C.No Conflicts. Each Party represents and warrants that (a) the execution of this Schedule, nor (b) the consummation bythe Party of this Schedule will (i) conflict with the certificate of incorporation or by-laws or any other corporate or constitutional document of the Party or (ii) breach any obligations of the Party under any contract to which it is a party or (ii) violate any Applicable Law.D.Litigation.Each Party represents and warrants that there is no litigation, proceeding or investigation of any naturepending or, to the Party‟s knowledge, threatened against or affecting the Party or any of its Affiliates, which woul d reasonably be expected to have a material adverse effect on its ability to perform its obligations under this Schedule.pliance with Law.A.General. Each of the Parties will comply with any Applicable Law in connection with the operation of its business andperformance of its obligations under this Schedule. Merchant will at its own cost, keep such records and do such things as are reasonably necessary to ensure that Alipay and the Company complies with any Applicable Law; provided always that Merchant shall not be required to do anything which is inconsistent with or in breach of any applicable laws.rmation Verification. In order for Alipay to satisfy its obligations and to comply with the relevant requirementsunder Applicable Law, upon reasonable request by Alipay, Merchants will share, records and information (including Transaction information and records with Alipay from time to time and the Company is authorized by Merchant to provide the relevant records and information to governmental agencies, regulatory authorities and third party service providers for examination and verification as necessary.C.AML Requirements. The Merchant shall comply with all Applicable Law on anti-money laundering, counter-terrorismfinancing and sanctions (together “AML”). The Merchant shall fully cooperate with the Company‟s reasonable due diligence (on site or in writing) of the Merchant‟s AML policies and procedures, including but not limited to merchantmanagement, sanctions and political exposed people review, suspicious transactions monitoring and reporting. In accordance with its AML, anti-fraud, and other compliance and security policies and procedures, the Company may impose reasonable limitations and controls on Merchant‟s ability to utilize the Alipay acquiring Services. Such limitations may include but are not limited to rejecting Payments and/or or suspending/restricting any Alipay Acquiring Service with respect to certain Transactions.6.Disclaimer.TO THE EXTENT PERMITTED BY APPLICABLE LAW AND EXCEPT AS OTHERWISE EXPRESSLYSTATED, ALIPAY DISCLAIMS ANY WARRANTY OR CONDITION OF ANY KIND, EXPRESS, IMPLIED, COMMON LAW OR STATUTORY INCLUDING, WITHOUT LIMITATION, ANY IMPLIED WARRANTY OF TITLE, LICENSEABILITY, DATA ACCURACY, NON-INFRINGEMENT, MERCHANTABILITY, SATISFACTORY QUALITY, FITNESS FOR A PARTICULAR PURPOSE AND USE OF REASONABLE SKILL AND CARE OR THAT THE ALIPAY SERVICES, THE ALIPAY PLATFORM OR ANY APPLICATION, WEBSITE, PRODUCT PROVIDED OR USED IN CONNECTION WITH THE ALIPAY SERVICES WILL BE ERROR FREE OR OPERATE WITHOUT INTERRUPTION.7.Indemnification.A.General Indemnity.Subject to Clause 8 below, each Party (the “indemnifying Party”) will indemnify the other Party(the “indemnified Party”) from and a gainst all actions, claims, demands, liabilities, obligations, losses, costs (including, but not limited to legal fees, expenses and penalties) and interest suffered, incurred or sustained by or threatened against the indemnified Party arising out of any breach or violation of this Schedule by the indemnifying Party or any gross neglect, willful misconduct, fraud or dishonesty by the indemnifying Party or any of its employees or agents.B.Third party IP Indemnity for Alipay. The Merchant shall indemnify and defend Alipay and its Affiliates from andagainst any claim that any license the Merchant and/or its Affiliates granted under Clause 9 of Part B or the exercise thereof in accordance with this Schedule constitutes an unauthorized use or infringement of any Intellectual Property rights of a third party (“IP Claim against Alipay”).C.Notwithstanding anything to the contrary, nothing under this Schedule shall be construed to exclude or limit Merchant‟sliability in connection with its obligations under Clause 3 of this Part B.8.Limitation of Liability. To the extent permitted under Applicable Law, under no circumstances will Alipay and theCompany or its Affiliates be liable under any theory of tort, contract, strict liability or other legal or equitable theory for lost profits (whether direct or indirect), indirect, incidental, special, consequential or exemplary loss or punitive damages, each of which is excluded by agreement of the Parties regardless of whether such losses and/or damages were foreseeable or whether Merchant had been advised of the possibility of such damages. Notwithstanding anything in this Schedule to the contrary, othe r than Alipay‟s settlement obligations under Clause 3 of Part A, The Company‟s aggregate liability, including for claims, expenses, damages or indemnity obligations under or in connection with this Schedule or the Alipay Services, will not exceed the lesser of (a) USD$500,000 and (b) the total fees payable by Merchant to the Company for the Alipay Services provided in the Twelve (12) complete calendar months preceding the date of the first event giving rise to a claim upon which liability is based.9.Intellectual Property.A.The Company’s License to the Merchant. T he Company owns all rights, title or interests in and to the IntellectualProperty associated with the provision of the Alipay Acquiring Services, or has otherwise been granted the appropriate licenses by the relevant owner with respect to such Intellectual Property. Subject to the terms of this Schedule and, as the case may be, any agreement between the Company and the owner of the relevant Intellectual Property, the Company hereby grants Merchant during the term of this Schedule, a license to use the relevant Intellectual Property in the Alipay Acquiring Services, the Alipay Acquiring Platform and the Alipay branding and logo (it owns or is entitled to use) solely for the purpose of using the Alipay Acquiring Services in accordance with this Schedule. Such license to use the relevant Intellectual Property granted in favor of Merchant is non-exclusive, non-sublicensable (other than to Merchants as permitted by and in accordance with Clause 4 of Part C) and non-transferrable, and may be modified or revoked by the Company in writing at any time during the term of this Schedule. The Merchant shall be permitted to use Alipay's branding and logo solely as required for the purpose of using the Alipay Acquiring Services and strictly in accordance with the provisions of Clause 4 of Part C. T he Merchant agrees that the licenses granted under this Clause 9 and the Merchant's use of such Intellectual Property under this Schedule will not confer any proprietary right, and the Merchant agrees to take reasonable care to protect all such Intellectual Property from infringement or damage and cease all use of such Intellectual Property immediately upon termination of this Schedule.B.The Merchant’s License to the Company. During the term of this Schedule for the limited purposes of performing theobligations set forth in this Schedule and subject to the terms of this Schedule, the Merchant grants to the Company a non-exclusive, non-transferable, royalty-free license to use, reproduce, publish, distribute and transmit any of the Merchant ‟smarketing materials, proprietary indicia or other similar items containing the Intellectual Property of the Merchant ("Merchant IP") necessary for the Company to perform its obligations contemplated by this Schedule and to refer to the name of the Merchant in the public announcement as one of the partners using the Alipay Acquiring Services. The Merchant represents and warrants to the Company that it has obtained all necessary authorities, permissions, approvals and licenses to license the Merchant IP to the Company and that the Merchant IP does not infringe the Intellectual Property of any third party.10.Data privacy. Each Party will take all commercially reasonable endeavours to ensure that the Personal Information isprotected against misuse and loss, or unauthorized access, modification or disclosure and will promptly notify the other Party of any loss of, or any unauthorized disclosure of or access to, the Personal Information. Each Party may retain records of Payments for complying with Applica ble Law and internal compliance requirements. “Personal Information” means personal information or data, whether true or not, and whether recorded in a material form or not, about an individual whose identity is apparent, or can reasonably be ascertained, from the information or data, processed by either Party in connection with this Schedule. T he Company may transfer Transaction data, including Personal Information, to any of its Affiliates that have been delegated any of its obligations under this Schedule.11.Taxes.A.To the extent permitted by Applicable Law, all Taxes arising from or in connection with all payments between theCompany and the Merchant under this Schedule shall be for the account of and liability of Merchant, unless agreed otherwise in writing by the Parties.B.For the avoidance of doubt, (i) all amounts payable by the Merchant to the Company under this Schedule are exclusive ofany Taxes imposed by the relevant taxation authority of applicable jurisdictions to which the Merchant is subject which shall be for the account of the Company; and (ii) any Taxes imposed by the relevant taxation authority of applicable jurisdictions to which the Merchant is subject, including without limitation value added tax or other Taxes of similar nature, arising out of or in connection with any Transaction or this Schedule, shall be for the account of the Merchant.C.Each Party shall be responsible for any and all Excluded Taxes that it is liable for under Applicable Law.D.Where a Party is required under Applicable Law relating to tax to fulfil its tax obligations, including but not limited tocommon reporting standard, imposed by any taxation authority, the other Party shall promptly provide information and documents as requested by that Party to the extent permitted by Applicable Law.E.Nothing contained in this Schedule is intended to result in one Party assisting the other Party to evade any Taxes in theapplicable jurisdictions to which the other Party is subject.12.Confidential Information.Each Party acknowledges that the Confidential Information of the other is valuable to it andagrees to treat all Confidential Information received from the other Party in connection this Schedule as confidential. Neither Party will disclose such Confidential Information to any third party except to perform its obligations under this Schedule or as required by Applicable Law or government authorities, and in each case, the disclosing Party will, to the extent permitted under Applicable Law, give the other Party prior notice of such disclosure. Upon termination of this Schedule or at the written request of the other Party, each Party will promptly return or destroy all material embodying Confidential Information of the other. Notwithstanding the foregoing, each Party may retain reasonable copies of the other Party's Confidential Information to comply with Applicable Laws or in order to exercise its rights under this Schedule, provided that such retained Confidential Information will not be disclosed or used for any other purposes. “Confidential Information” means all non-public, proprietary or other confidential information, whether in oral, written or other form, including but not limited to: the content and performance of this Schedule, business plans, capitalization tables, budgets, financial statements; costs, prices, and marketing plans, contracts and licenses, employee, customer, supplier, shareholder, partner or investor lists, technology, know-how, business processes, trade secrets and business models, notes, sketches, flow charts, formulas, blueprints, and elements thereof, and source code, object code, graphical design, user interfaces and other Intellectual Property, including that of any customer, supplier or other third party (including, in the case of the Company, the interface technologies, security protocol and certificate to any other website or enterprise provided by the Company) .13.Publicity. Neither Party will issue any press release or make any public announcement pertaining to this Schedule without theprior written consent of the other Party unless required by Applicable Law binding the Party. However, the preceding limitation will not be interpreted to prevent Alipay from making general statements about Alipay‟s business or about services similar to the Alipay Services in or outside of the jurisdiction where Merchant is located.14.Notice.All business correspondence in relation to the business as usual operation of the Alipay Acquiring Services andamendment of any matters in relation to this Schedule (other than in respect of notification of a change of Company legal name) will: all notices and other communications given in connection with this Schedule (including changing any terms of。

阿里巴巴系列研究之支付宝2011年7月29日,阿里巴巴集团、雅虎、软银三方就支付宝股权转让事件签署协议,根据协议规定,阿里巴巴集团将获得支付宝变现时股权价值的37.5%,且不低于20亿美元不超过60亿美元,另外在变现发生之前阿里巴巴集团将获得支付宝49. 9%的税前利润,作为相关知识产权许可费和软件技术服务费,Jefferies 据此对支付宝估值53-160亿美元。

这份协议也宣告支付宝自2003年10月上线后正式“脱离”阿里巴巴集团,截止20 10年12月,支付宝用户数突破5.5亿,日交易额25亿人民币,日交易笔数达到8 50万笔,本文将根据相关公开资料对支付宝的发展历程,商业模式、行业状况、发展前景及风险做一解读。

一、发展历程:“植根淘宝”到“独立支付平台”支付宝发展历程大体上经历两个阶段,从最初的“植根淘宝”到“独立支付平台”,与同时期诞生的其他第三方支付平台不同,支付宝一开始只面向淘宝,即与淘宝网购物的应用场景相结合,服务于淘宝交易。

而后面支付宝独立发展,向独立支付平台转型,支付宝成为电子商务的一项基础服务,担当着“电子钱包”的角色。

植根淘宝(2003-2004)支付宝2003年最初上线主要针对淘宝上购物的信用问题,即解决网购用户的需求,推出“担保交易”模式,让买家在确认满意所购的产品后才将款项发放给卖家,降低网上购物的交易风险,支付宝植根于淘宝网购需求,充当淘宝网资金流工具角色。

当时支付宝(淘宝旗下的一个部门)并没有什么长远发展目标,只是一款专为淘宝网的发展需要打造的支付工具,主要面向淘宝网提供担保交易,解决淘宝网发展的支付瓶颈问题。

后面有评论认为淘宝能够在短时间超越易趣,不仅仅是免费模式,支付宝对买卖双方信用的建立不可或缺。

反过来淘宝网的发展为支付宝带来源源不断的用户,2004年,阿里巴巴管理层认识到支付宝在初步解决淘宝信用瓶颈后,不应该只是淘宝网的一个应用工具,即“支付宝或许可以是个独立的产品,成为所有电子商务网站一个非常基础的服务”。

支付宝线下收单行业解决方案背景目前,随着科技的进步和移动支付的普及,越来越多的消费者选择用手机付款。

支付宝线上支付已经得到广泛应用,然而,线上支付只能在互联网上进行交易,无法满足线下商家的支付需求。

为此,支付宝推出了线下收单的解决方案,为商家和消费者提供了更便捷、更安全的支付方式。

方案介绍支付宝线下收单解决方案分为三个环节:商家入驻、支付交易和结算。

商家入驻商家可以通过支付宝的商家入驻平台,上传商户信息和证件资料,完成商家入驻。

商户需要提供的资料包括商家名称、开户银行信息、经营范围、法人身份证号码等,以便支付宝对商家进行认证审查,并确保商家与法律法规的合规要求。

支付交易在商家完成入驻后,可以使用支付宝扫码枪或收款码收取顾客的支付宝账户资金。

顾客选择使用支付宝付款时,扫描商家的收款码或让商家使用支付宝扫码枪扫描其支付宝账户中的付款二维码。

支付宝系统会将用户的付款金额扣除,并转移到商家的支付宝账户中,完成交易。

结算商家可以随时将支付宝收到的资金提现到指定的银行卡或支付宝账户中。

商家在提现时需要提供提现金额和账户信息,支付宝会按照约定时间和方式将资金提现到商家提供的账户。

优势和应用场景优势1.便捷:商家只需要一个扫码枪或一个二维码就能轻松完成交易。

2.安全:支付过程中,支付宝提供严格的身份验证、资金监管和防欺诈服务,确保商家的资金安全。

3.易于管理:商家可以通过支付宝钱包实时查看交易记录,轻松管理交易流程。

应用场景支付宝线下收单解决方案适用于各种场景,包括:1.餐饮、零售等各类实体店铺;2.便利店、超市、加油站等大型连锁店;3.运营商、物业公司等服务类行业;4.各类展览、演艺、赛事等活动现场。

使用方法和费用介绍商家可以通过支付宝官网,下载支付宝收款码或者扫码枪,申请商家入驻。

商家入驻以后,使用支付宝扫码枪或收款码收取顾客的支付宝账户资金时,不需要支付任何费用。

商家提现需要支付提现手续费用,手续费用以及提现周期视商家的具体情况而定。

收单交易场景分析报告一、社交电商交易场景分析社交电商是指通过社交媒体平台进行商品展示、推广和销售的电子商务模式。

在社交电商交易场景中,买家通过社交媒体平台浏览商品信息并与卖家进行互动交流,最终完成线上下单和线下交付的交易过程。

1. 用户需求分析买家使用社交电商平台的主要目的是购买自己需要的商品。

用户在平台上可以浏览和搜索各种商品,根据个人偏好和需求进行筛选与比较。

他们还可以通过分享商品和评论来获取其他用户的反馈和建议,进而决定是否购买。

2. 商品展示策略在社交电商平台上,商品的图文信息展示是非常重要的。

卖家需要精心设计商品展示页面,包括商品主图、多角度展示图片、详细描述、价格信息等。

同时,卖家还可以通过发布商品视频、搭配推荐、用户评价等方式来增加商品的吸引力。

3. 互动交流机制社交电商平台注重用户之间的互动交流,买家可以与卖家进行实时的在线聊天和咨询。

卖家需要及时回复买家的问题,并提供专业的售前咨询服务,以便促成买家的购买决策。

4. 下单与支付买家通过社交电商平台选择心仪的商品后,可以将商品加入购物车进行集中管理,最后生成订单并选择支付方式。

社交电商平台通常提供多种支付方式,如支付宝、微信支付等,以方便买家进行付款。

5. 物流与配送在交易完成后,卖家需要及时安排商品的发货和物流配送工作。

他们可以选择与物流合作伙伴合作,提供快速、安全的配送服务。

同时,平台也会提供订单跟踪功能,方便买家随时了解物流情况。

6. 售后服务社交电商平台非常注重售后服务,包括退换货、维修及售后咨询等。

买家在购买过程中遇到任何问题,都可以跟卖家进行沟通,并获得相应的解决方案。

卖家需要负责解答买家的疑问,解决售后问题,以提高用户的满意度和信任度。

二、线上支付交易场景分析线上支付是指通过互联网平台完成资金转移和支付的交易方式。

在线上支付交易场景中,买家通过互联网平台将商品加入购物车并生成订单,然后选择支付方式进行付款,最后完成交易。

XXX商户收单拓展和业务发展方案一、商户收单业务发展背景和现状当前,利率市场化改革的持续推进,宏观经济金融形势日趋复杂,银行存贷款息差进一步缩小,存贷利差“躺赢”的时代一去不复返了,息差收窄和收益下滑的困难和问题已经摆在我们眼前。

因此,只有通过不断拓展负债成本下行空间,才能为我行提升利润打下坚实基础,从而推动XXX各项业务的高质量赶超发展。

商户收单业务同时连接B端和C端,使得资金流、信息流、数据流“三流合一”,是我行服务实体经济和转型发展的重要着力点。

随着我行商户收单业务管理系统的建成,使我行具备了从传统收单逐渐向综合性收单服务转型的基础和能力,实现了我行自有清算渠道畅通,打通了云闪付、微信,支付宝等扫码交易及银行卡收单支付通道链路,实现主流支付通道的聚合,可满足了不同商户收单支付通道需求。

基于目前现状,我行商户收单业务拓展应基于快速拥抱支付接口模式的接入以及移动支付受理,提供多元化商户支付服务,为商户解决综合支付方案,从而提升我行收单业务拓展能力及综合盈利水平。

二、商户收单营业发展的总体方针商户收单拓展的总体方针是在联合我行整体发展和总体经营目标的基础上,采用“客户思维”形式来促进收单营业发展。

即以商户需求为导向,根据商户侧实际经营需求,充裕联合场景应用,依托满足客户需求为内涵的营业产品,来为客户提供包括一点式接入的支付办理方案、一站式资金结算、清算对账效劳、其他增值效劳等一体化办理方案,从而促进商户收单营业长期地优质地可持续地发展。

三、商户收单业务发展的主要基础一)完善的系统和丰富产品目前我行已初步建立了自有的商户收单营业管理系统。

在此基础之上,应不断完善系统应用,优化客户体验,并持续丰富产品线和对外提供的效劳。

二)有竞争力的费率价格我行自立收单相较于委托第三方支付机构收单,因节省了支付给第三方支付机构的手续费差价,故通过自有收单系统收单具有手续费扣率优势。

如能通过运作,争取到支付宝或者微信端赐与我行更优惠的商户扣率(零扣率),那就能为我行推进商户收单营业提供更有竞争力的费率代价优势。

收单业务总结收单业务总结篇1收单业务总结:探索、挑战与未来随着科技的发展和互联网的普及,收单业务在我们的日常生活中变得越来越普遍。

收单业务是指为商户提供收款的渠道,将客户的支付信息转化为电子支付,以实现快速、便捷的支付体验。

*将对收单业务进行总结,并提出相应的建议。

一、收单业务的概念和背景收单业务起源于20世纪70年代,当时信用卡开始在欧美国家普及。

为了方便商户快速、安全地处理客户支付,诞生了收单业务。

商户通过收单业务,可以获得多种支付方式,如现金、信用卡、移动支付等,以满足不同客户的需求。

二、收单业务的主要流程1.商户提交订单:商户通过收单系统提交订单,并填写相关信息,如商品名称、数量、金额等。

2.客户支付:客户通过收单系统完成支付,将支付信息发送给商户。

3.商户处理支付:商户根据收单系统的指令,对客户的支付信息进行确认和处理。

4.资金结算:商户和收单机构之间进行结算,将结算金额发送给双方。

三、收单业务的挑战1.安全性问题:支付信息在传输过程中可能被黑客攻击,导致支付信息泄露。

2.支付效率问题:由于网络延迟或系统故障,支付处理时间过长,影响客户体验。

3.支付合规问题:各国对于支付方式的合规要求不同,商户需遵守相关法规,避免违规操作。

四、未来展望随着科技的进步,未来收单业务将更加便捷、安全和高效。

例如,生物识别技术(如指纹、面部识别等)和区块链技术有望进一步提高支付安全。

同时,智能合约和自动化支付处理将减少支付处理时间,提升客户体验。

五、总结收单业务作为连接客户和商户的重要桥梁,在互联网时代发挥了至关重要的作用。

通过提供多种支付方式,收单业务使商户能够满足不同客户的需求,提高了支付效率。

然而,随着业务的发展,安全性、支付效率和合规要求等问题也日益突出。

为应对这些挑战,收单机构需要不断改进和创新,提高业务的安全性和效率,同时遵守相关法规,避免违规操作。

未来,随着科技的进步,收单业务有望实现更大的创新和发展。

商户收款营销推广方案一、前言在支付领域,商户作为支付宝等支付平台的主体,其收款渠道重要性不言而喻。

商家应该善于利用现代科技手段,结合市场特点和用户需求,打造一系列适宜的营销和推广方案。

本文将从几个方面进行探讨。

二、基础环节2.1 产品定位和营销策略(1)产品定位:商户的产品定位应该具有特色,突出优势,以满足用户需求为目标。

商家可以从价格、功能特性、服务质量、品牌形象等几个方面入手。

即使是同一类别产品,也要有区分度。

(2)营销策略:商家的营销策略必须有巨大的创新性,要细腻且个性化,能够引起消费者共鸣。

商家可以采用促销、满减、团购、会员价、积分换礼等方式,营造消费氛围、提高用户黏性。

2.2 数据分析商户需要及时了解消费者的喜好和需求,以便针对性的推出产品和服务。

通过数据分析,商户可以挖掘自己的优势、保持稳定的收益,降低风险。

2.3 用户体验商户周到的用户体验和优质的服务不仅仅能够提升用户满意度,同时也能促进用户的口碑传播,为商家带来更好的业绩。

因此,商家应该关注用户各个阶段及时识别用户需求并进行优化。

例如,完善交易流程,提升支付体验等。

三、渠道资源3.1 对渠道资源的分析商户应该对渠道资源进行分析,找到自己的优势。

根据自身情况进行内外兼修,寻找更好的传播方式。

要加强关系网络建设,对内寻求资源共享,对外扩大渠道拓展。

3.2 合作推广当商家资源不足时,可以考虑利用第三方合作渠道来获得用户支持。

合作方式不仅能够减低商家开支,同时也能拥有更大的用户接触面,进一步提高商户收益。

四、市场推广市场推广是商家最重要、最基础的推广方式。

商家可以通过优质的产品和营销策略、广告宣传,提升品牌知名度和美誉度,进而吸引更多的用户。

4.1 品牌宣传商家需要突出自己的品牌理念,增强品牌影响力和知名度,提高品牌价值。

品牌宣传可以通过品牌广告、文化活动、公益事业等多种方式进行,不断提高品牌美誉度。

4.2 广告投放广告投放是商家常见的营销手段。

第三方支付的解决方案—以支付宝为例篇一:第三方支付会计处理网络购物等电子商务的发展,带动了电子交易量的不断攀升,使得第三方支付平台被广泛地应用。

但会计准则并未针对该业务领域制定会计处理方法,这成了会计准则的空白区。

本文以支付宝为例,进行第三方支付平台相关业务账务处理的探讨。

之所以选择支付宝,是因为它是目前我国交易规模最大的、最具代表性的独立第三方支付平台,并且其交易流程是人们最熟悉的。

一、第三方支付平台的运营模式第三方支付平台是独立于消费者和商家的营运商,也是交易资金代收代付的中介。

它与各大银行签约,建立深入的战略合作关系,并与银行支付结算系统对接,为电子交易中的买卖双方提供资金支付的中转站。

在一个理想的支付系统里,资金的支付转移与相应的账务处理是同步的,即从付款方的贷方转入收款方的借方。

但是在第三方支付系统中,由于存在延时交付或延时清算,资金的支付和账务处理是不同步的。

买方先将货款支付到第三方支付平台,卖方发货并且由买方确认收货后,第三方支付平台再将货款汇转到卖方的账户。

在这个过程中,资金不能及时地由买方账户流转到卖方账户,因此出现了资金在第三方支付平台的沉淀。

下面以支付宝的交易流程为例,简要描述独立第三方支付平台的运营模式。

首先,买方在淘宝网上购买商品,并通过网上银行等方式向支付宝公司的账户支付相应的的款项,交易由此产生。

其次,卖方收到订单后,一般在1 ~ 3天内向买方发货。

最后,买方收到商品并在淘宝网上点击“确认收货”后,支付宝会将款项支付给卖方,此时交易结束。

二、虚拟账户概述在第三方支付平台,进行资金流转的载体是虚拟账户?它是第三方支付平台提供给买卖双方的交易账户。

虚拟账户分为两类。

一类存在于企业集团内部,以集团的银行账户为依托,将企业内部的网络平台与银行提供的系统相对接,企业集团为子公司、内部部门或项目设立子虚拟账户,并可通过网上银行对这些子虚拟账户进行转账、查询等操作。

还有一类是第三方支付虚拟账户,是第三方支付平台为客户提供的网上交易账户。

移动支付发展中存在的问题及建议当前以二维码扫码支付、近场支付为主导的移动支付市场发展迅速,但面临着监管机制滞后、安全防范薄弱等问题,应予关注解决。

一、存在的主要问题和风险(一)移动支付监管机制不健全。

一是监管制度不完善且层级不高。

我国目前适用于移动支付领域的监管制度主要有《电子支付指引(第一号)》《非金融机构支付服务管理办法》《银行卡收单业务管理办法》及《非银行支付机构网络支付管理办法》等,但对移动支付业务标准等情况尚未做出具体规定,且以上规定多为部门规章或规范性文件,法律效力较低。

二是监管主体不明确。

目前,我国移动支付监管主体涉及人民银行、银监会、工信部三个部门,缺乏明确的监管框架和体系,易出现多头规划和监管盲区。

三是监管手段和监管人员素质有待提高。

移动支付方式不断创新,且会产生大量交易信息,目前缺乏有效的监管技术手段和系统支持,监管人员的业务能力也有待提高。

四是网络舆情带来新的监管风险。

与传统支付服务相比,移动支付的用户基础更加广泛,当市场误读监管政策时,往往会通过舆论放大影响,带来的新的监管风险。

(二)支付机构承担跨行资金清算增加了支付和金融风险。

由于支付机构搭建的清算体系较好地满足了移动支付交易实时化、去中心化和网络化等新要求,支付机构逐渐主导了移动支付跨行资金清算,传统由央行支付系统处理的跨行资金清算转换为由支付机构业务系统处理的各银行备付金账户资金头寸调整,从而替代央行完成移动支付跨行资金清算。

这种情况会带来以下弊端:一是我国银行卡清算市场刚刚放开,支付机构尚未获得行政许可,既办理结算又办理清算缺少法律依据。

二是支付机构系统与银行机构系统直接对接,技术和设备投入成本高,会造成系统重复建设和资源浪费。

三是支付机构取代人民银行在跨行清算中的地位,导致支付业务信息的完整性和可追溯性大大降低,央行监控跨行资金清算的难度加大,及时阻断系统性支付风险的能力减弱。

四是支付机构搭建的跨行清算系统,在系统建设和运行维护上的投入受企业效益等多因素制约,安全性稳定性难以保证,增加了金融体系风险。