金融英语证书考试

- 格式:docx

- 大小:37.79 KB

- 文档页数:46

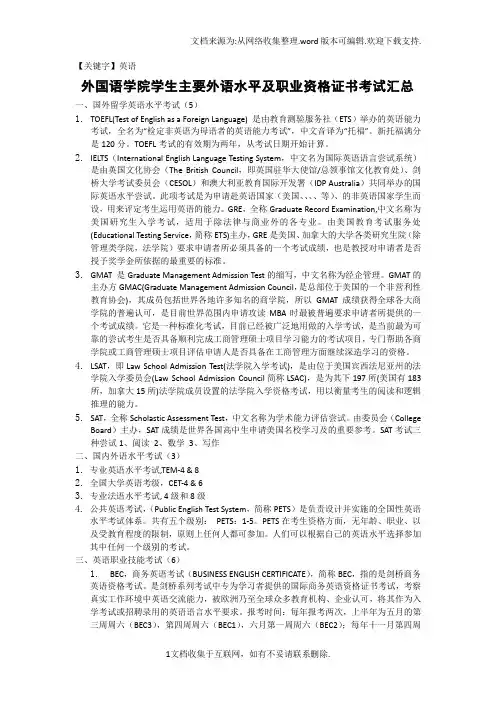

【关键字】英语外国语学院学生主要外语水平及职业资格证书考试汇总一、国外留学英语水平考试(5)1.TOEFL(Test of English as a Foreign Language) 是由教育测验服务社(ETS)举办的英语能力考试,全名为“检定非英语为母语者的英语能力考试”,中文音译为“托福”。

新托福满分是120分。

TOEFL考试的有效期为两年,从考试日期开始计算。

2.IELTS(International English Language Testing System,中文名为国际英语语言尝试系统)是由英国文化协会(The British Council,即英国驻华大使馆/总领事馆文化教育处)、剑桥大学考试委员会(CESOL)和澳大利亚教育国际开发署(IDP Australia)共同举办的国际英语水平尝试。

此项考试是为申请赴英语国家(美国、、、、等)、的非英语国家学生而设,用来评定考生运用英语的能力。

GRE,全称Graduate Record Examination,中文名称为美国研究生入学考试,适用于除法律与商业外的各专业。

由美国教育考试服务处(Educational Testing Service,简称ETS)主办,GRE是美国、加拿大的大学各类研究生院(除管理类学院,法学院)要求申请者所必须具备的一个考试成绩,也是教授对申请者是否授予奖学金所依据的最重要的标准。

3.GMAT 是Graduate Management Admission Test的缩写,中文名称为经企管理。

GMAT的主办方GMAC(Graduate Management Admission Council,是总部位于美国的一个非营利性教育协会),其成员包括世界各地许多知名的商学院,所以GMAT成绩获得全球各大商学院的普遍认可,是目前世界范围内申请攻读MBA时最被普遍要求申请者所提供的一个考试成绩。

它是一种标准化考试,目前已经被广泛地用做的入学考试,是当前最为可靠的尝试考生是否具备顺利完成工商管理硕士项目学习能力的考试项目,专门帮助各商学院或工商管理硕士项目评估申请人是否具备在工商管理方面继续深造学习的资格。

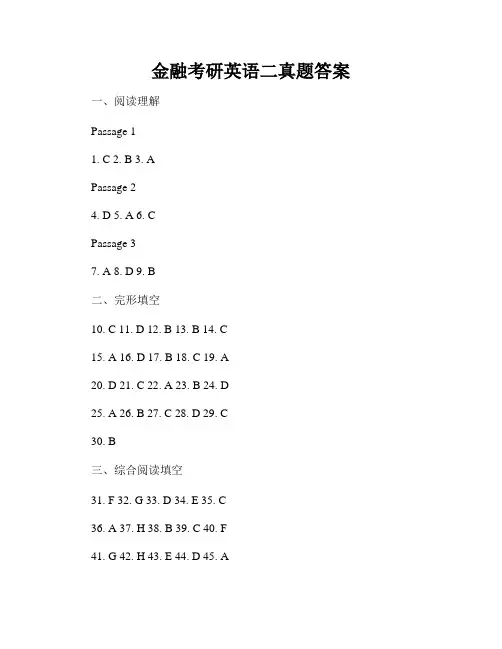

金融考研英语二真题答案一、阅读理解Passage 11. C2. B3. APassage 24. D5. A6. CPassage 37. A 8. D 9. B二、完形填空10. C 11. D 12. B 13. B 14. C15. A 16. D 17. B 18. C 19. A20. D 21. C 22. A 23. B 24. D25. A 26. B 27. C 28. D 29. C30. B三、综合阅读填空31. F 32. G 33. D 34. E 35. C36. A 37. H 38. B 39. C 40. F41. G 42. H 43. E 44. D 45. A四、翻译46. 参加这个考试的人数远远超过了预期。

47. 因为她的资历和经验,她被任命为部门经理。

48. 金融市场的波动可能会导致投资者的损失。

49. 这个项目在规定的时间内完成了,这是我们的重要成绩之一。

50. 自从经济危机以来,许多公司都采取了削减开支的措施。

五、作文题目:中国金融市场的发展与挑战随着中国经济的迅速崛起,中国金融市场也经历了快速发展。

然而,在这一过程中,金融市场也面临着一些挑战。

本文将探讨中国金融市场的发展现状以及所面临的主要挑战。

首先,中国金融市场的发展取得了显著的成就。

中国已成为全球第二大经济体,具有庞大的消费市场和潜力巨大的投资机会。

在金融领域,中国的股票市场、债券市场和期货市场迅速增长,并与国际市场融合。

同时,中国还积极推动金融创新,包括在线支付、数字货币等,为经济发展提供了新的动力。

然而,中国金融市场也面临着一些挑战。

首先,金融风险是发展中国金融市场的主要威胁之一。

目前,中国金融市场对外开放程度的提高使得外部冲击因素增加,金融市场波动性加大。

其次,市场监管和风险防范体系仍然不完善,监管能力、监管水平等需要进一步提升。

此外,金融市场的不均衡发展也是一个问题,一些地区和行业相对较弱,与一线城市相比,发展水平还有差距。

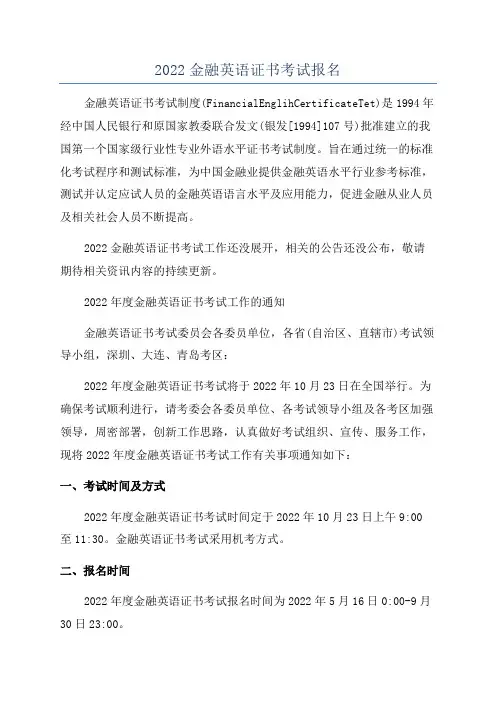

2022金融英语证书考试报名金融英语证书考试制度(FinancialEnglihCertificateTet)是1994年经中国人民银行和原国家教委联合发文(银发[1994]107号)批准建立的我国第一个国家级行业性专业外语水平证书考试制度。

旨在通过统一的标准化考试程序和测试标准,为中国金融业提供金融英语水平行业参考标准,测试并认定应试人员的金融英语语言水平及应用能力,促进金融从业人员及相关社会人员不断提高。

2022金融英语证书考试工作还没展开,相关的公告还没公布,敬请期待相关资讯内容的持续更新。

2022年度金融英语证书考试工作的通知金融英语证书考试委员会各委员单位,各省(自治区、直辖市)考试领导小组,深圳、大连、青岛考区:2022年度金融英语证书考试将于2022年10月23日在全国举行。

为确保考试顺利进行,请考委会各委员单位、各考试领导小组及各考区加强领导,周密部署,创新工作思路,认真做好考试组织、宣传、服务工作,现将2022年度金融英语证书考试工作有关事项通知如下:一、考试时间及方式2022年度金融英语证书考试时间定于2022年10月23日上午9:00至11:30。

金融英语证书考试采用机考方式。

二、报名时间2022年度金融英语证书考试报名时间为2022年5月16日0:00-9月30日23:00。

三、报名及缴费方式四、考试地点2022年度金融英语证书考试在全国各省、自治区、直辖市等34个考区的44个省会城市、地级市和具备条件的县市设立预约机考考点(详见附件1),具体考点根据各考区报名情况进行配置(考区、考点设置及约考相关说明详见附件1)。

五、考试内容及相关教材2、考试内容以金融英语证书考试委员会2022年颁布的《金融英语证书考试大纲》为准。

3、考试涉及的金融理论与业务的内容参阅《金融英语证书考试要点汇总》(随考试教材赠阅)。

六、其他事项2、请考委会各委员单位、各考试领导小组及各考区认真学习《2022年金融英语证书考试公告》做好考试咨询服务工作。

1.adverse selection: The problem created by asymmetric information before a transactionoccurs : the people who are the most undesirable from the other party’s point of view are the ones who are most likely to want to engage in the financial transaction.逆向交易:在交易发生之前与信息不对称引起的问题:从交易对手的视角看最不受欢迎的人是最有可能积极参与金融交易的人。

2.asymmetric information : The inequality of knowledge that each party to a transaction has about the other party.信息不对称:交易各方对彼此情况的掌握程度存在不对等的现象。

3.behavioral finance : The field of study that applies concept from other social sciences,such as anthropology, sociology, and particularly psychology, to understand the behavior of securities prices.行为金融学:该项研究借用其他社会科学的概念,如人类学,社会学,特别是心理学的概念来解释证券价格的表现。

4.credit-rating agencies: Investment advisory firms that rate the quality of corporate and municipal bonds in terms of the probability of default.信用评级机构:一种根据违约概率来划分公司和市政债券质量等级的投资咨询公司。

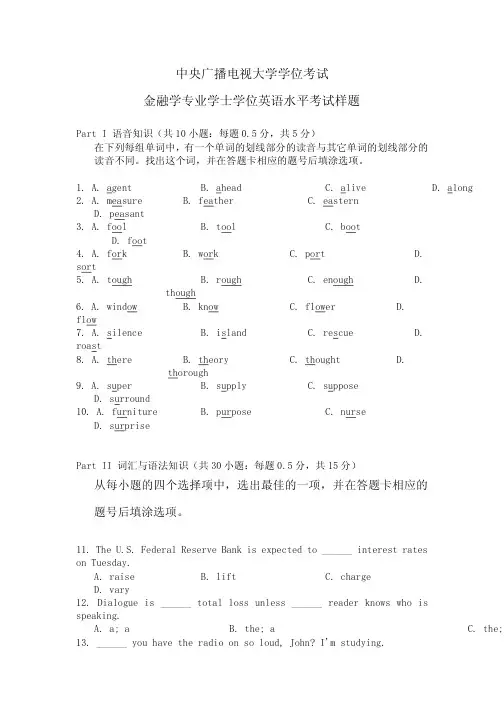

常熟理工学院2012〜2013学年第二学期20XX 级后续课《金融英语》考查试卷(I 卷)试题总分:Part I Listening Comprehension©' 25=50')Section A Short ConversationsListe n carefully and choose the best an swer to the questi on after each conv ersatio n.1. Which of the following is NOT among the four major commercial banks of China?A. Ba nk of China.B. China Co nstruction Ba nk.C. I ndustrial and Commercial Ba nk of Chi na.D. The People's Bank of Chi na.2. Which of the following is NOT mentioned in the dialog?A. China Mercha nts Ban k.B. I ndustrial Ba nk Co., Ltd.C. China Citic Bank.D. Chi na Min she ng Banking Corp. Ltd. 3. What is the man accord ing to the dialog?A. A bank man ager.B. A clerk of a foreig n bank.C. A uni versity stude nt.D. A teacher from a college.4. Which of the followi ng has the right to decide the preside nt of BOC?A. The shareholders.B. The shareholders' meet ing.C. The Board of Directors.D. The Preside nt Office.5. A. The man lost his checkbooks.B. The man lost his passport.C. The man lost his password.D. The man lost his passbook. 6. A. Hous ing loa n.B. Foreig n curre ncy loa n.C. Dollar loa n.D. Credit loa n. 7. A. Jan uary 24. B. February 31. C. Jan uary 25. D. February 26.8. A. Payme nt by dema nd drafts. B. Payme nt by collectio n.C. Payme nt by letters of credit.D. Payme nt by remitta nee. 9. A. To avoid problems aris ing from in flatio n.B. To preve nt possible fraud.C. To avoid problems aris ing from fluctuati ons of excha nge rate.D. To preve nt overdraw ing. 10. A. In spect ion certificate. B. Certificate of origi n. C. In sura nee policy. D. Bill of ladi ng.Section B Long ConversationListe n to the conv ersati on carefully and choose the best an swer to each of the questio ns below.11. Which of the following statements was mentioned in the magazine The Banker?A. BOC ranked the 9th amo ng the world's top 1,000 banks in 2007.B. BOC is one of the four big commercial banks of China.C. The developme nt of BOC is un believable.D. The top man ageme nt of BOC is young and effective. 12. What are the main sect ions un der the top man ageme nt of BOC?A. Corporate banking sect ion and retail banking sect ion.B. Security sect ion and supervisory sect ion.C. Operati onal sect ion and supervisory sect ion.D. Audit ing sect ion and in spect ion secti on. 13. Which do you think is NOT the duty of the supervisory section?A. Audit ing the ban k's acco un ts.B. Han dli ng gen eral affairs.C. Being resp on sible for the security of the ban k..D. Oversee ing the banking operati on. 14. What is the bus in ess scope of the operati onal secti on?A. Banking bus in ess.B. Gen eral bus in ess.C. Support ing bus in ess.D. All items men ti oned above.15. Which of the followi ng is NOT men ti oned among the bus in esses offered by BOC?A. Retail banking.B. Docume ntary letter of credit.C. On li ne banking or e-ba nking.D. Finan cial advisory service. Section C PassagesDirecti ons: In this sect ion, you will hear three short passages. At the end of each passage, you will hear some questi ons. The passages and the questions will be spoken only once. After you hear a question, you must choose the best answer from the four choices marked A, B, C and D. The n mark the corresp onding letter on the ANSWER SHEET with a si ngle line through the cen ter.Passage One16. A. 1992 B. 1993 C. 1994 D. 199517. A. The People's Bank of China. B. China Foreig n Excha nge Tradi ng Cen ter.C. I nter-ba nk Foreig n Excha nge Market.D. The State Admi nistratio n of Foreig n Excha nge.18. A. 1%0.3% C. 0.5% Passage Two19. A. High risk. B. A type of credit product. 20. A. Collateral loan. B. Educati on loa n.21. A.1952 B.1958 D. 0.4% C. High in terest. D . A ki nd of revolvi ng loa n C. Mortgage loa n. D . Commercial loa n. C.1962 D . 1968C. Public con fide nce in the in surers rema ined low.D. A rise in Tokyo stock helped improve the bala nce sheets of life in surers.Part II. Reading Comprehension (30 ')Section A (1 '*10=10 ')Directions: Each of the following sentences is provided with four choices. Choose the one that best completes the sentence.26. Although the compa ny showed a profit, the bala nce sheet looks in creas in gly .A. brightB. dimC. shallowD. fragile 27. _ money refers to curre ncy issued on the basis of ban k's credit in stead of gold reserve. A. Fair B. Fiduciary C. FixedD. Deposit 28. In creased flows of world capital inten sify finan cial competiti on among n ati ons. This trend places pressures on n ati onal gover nment to their domestic markets and liberalize intern ati onal capital moveme nts.A. removeB. settleC. deregulateD. con trol 29. Many finan cial tran sacti ons are _ sheet items such as in terest rate swaps and are not clearly ide ntified through the usual report ingcha nn els.A. zeroB. capitalC. off-bala nceD. major30. The ban kers _ the steel compa ny's new shares, which means the share issue will be sold to the ban kers in stead of the public directly. A. un derwrite B. un dercharge C. un dertakeD. un derestimate 31. With no in terest rate _ on deposits or restrict ions on maturities, banks can offer any deposit product customers dema nd. A. cutB. ceili ngsC. dema ndD. con tract 32. From ban k's perspective, liabilities have become more in terest elastic, so that small rate cha nges can produce large fluctuati ons in bala nces.A. outsta ndingB. outreach ingC. rema iningD. dema nding33. Checks are attractive because they are readily accepted and provide formal _______________ of payment. A. credit B. verificati onC. clarityD. collectio n 34. Normally, ____ capital loans are secured by accounts receivable or by pledges of inventory and carry a floating interest rate on theamounts actually borrowed aga inst the approved credit line.A. curre ntB. stockC. work ingD. Ion g-term35. Dealers in gover nment and private securities n eed short-term financing to purchase new securities and carry their exist ing portfolios ofsecurities un til those securities are sold to customers or reach ________ .A. bus in essB. marketsC. maturityD. objectiveSection B (2*10=20 * Directi ons: Read the passages and choose the right an swer for each questio n.Passage 1Text ?36. How many types of banks or banking in stitutio ns are men ti oned in the lecture?A. 5.B. 4.C. 52.D. 183.37. Which of the follow ing is NOT a join t-equity commercial bank? A. China Min she ng Ba nki ng Corp. Ltd. B. Bank of East Asia.C. China Citic Bank.D. Bank of Commun icati ons.38. How many bran ches and sub-bra nches have foreig n banks set up in China accord ing to the speaker?A. 264.B. 177.C. 183.D. 235. 39. Which of the follow ing was once ran ked amon gst the top three stron gest banks in Chin a's mainland?A. Chi na In dustrial Ba nk.B. Ba nk of East Asia.C. China Mercha nts Ba nk.D. Sha nghai Pudo ng Developme nt Ban k.40. Which of the following is a wholly foreign-owned bank?A. Chi na Min she ng Ba nki ng Corp., Ltd.B. Chi na Citic Bank.C. Hong Kong & Shan ghai Banking Corporati on Limited.D. China Export & Import Bank.Passage 2Liabilities are "outsider claims ” , whiche economic obligations, debts payable to outsiders. These outside parties are called creditors.Financial statement users such as creditors are interested in the due dates of an entity's liabilities. The sooner a liability must be paid, the more curre nt it is. Liabilities that must be paid on the earliest future date create the greatest stra in on cash. Therefore, the bala nce sheet lists liabilities in the order in which they are due. Knowing how many of a bus in ess's liabilities are curre nt and how many are Ion g-term helps creditors assess the likelihood of collecting from the entity. Balance sheets usually have at least two liability classifications: current liabilities and Iong-term liabilities.Current liabilities are debts that are due to be paid with in one year or with the en tity's operati ng cycle. Notes payable due with in one year, salary 22. A. It is a ki nd of short-term loa n.C. It is supposed to pay back at one time.Passage Three23. A. A rise in Tokyo stock.B. It is also called bridge loa n. D. Its maturity exceeds five years.C. Negative spread.24. A. Rise. B. Fall. 25. A. The value of outsta nding policies went dow n. B. Japa n's life in sura nee firms. D. Japa nese life in surers' difficult situati on.C. Rema in un cha nged.D. Not sure. B. Life in surers' n egative spreads ten ded to grow small.payable, unearned reve nue, and in terest payable owed on no tes payable are curre nt liabilities.Long-term liabilities are those liabilities other than current ones.41. The liabilities are classified as current or Iong-term liabilities according to _ .A. the liquidity of the liabilityB. the future date when the liability must be paidC. the operati ng cycleD. one year42. Liabilities are __ .A. money borrowed from banksB. money received from creditorsC. "outsider claims ” which are economic obligations, debts payable to outsidersD. notes receivable43. Which of the followi ng is current liability?A. cashB. inventoryC. salary payableD. money from the bank44. Which of the following is Iong-term liability?A. debt payable due with 10 yearsB. inven toryC. unearned revenueD. note payable due withi n 6 mon ths45. For a note payable to be paid in in stallme nts with in 5 years, which of the follow ing stateme nts is correct?A. The first installment due within one year is a current liability.B. The first installment due within one year is a Iong-term liability.C. All the in stallme nts due are Ion g-term liabilities.D. All the in stallme nts due are curre nt liabilities.Part ill. Translation (2‘ *=10')Part IV. Writing (10 ')Directions: You are asked to write a report on Bank of China with 120 words to make the brief introduction of BOC s orga ni zati ons and developme nt.。

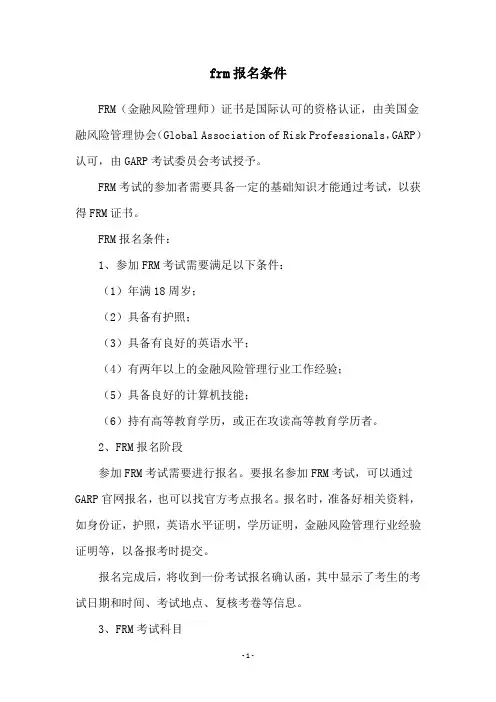

frm报名条件FRM(金融风险管理师)证书是国际认可的资格认证,由美国金融风险管理协会(Global Association of Risk Professionals,GARP)认可,由GARP考试委员会考试授予。

FRM考试的参加者需要具备一定的基础知识才能通过考试,以获得FRM证书。

FRM报名条件:1、参加FRM考试需要满足以下条件:(1)年满18周岁;(2)具备有护照;(3)具备有良好的英语水平;(4)有两年以上的金融风险管理行业工作经验;(5)具备良好的计算机技能;(6)持有高等教育学历,或正在攻读高等教育学历者。

2、FRM报名阶段参加FRM考试需要进行报名。

要报名参加FRM考试,可以通过GARP官网报名,也可以找官方考点报名。

报名时,准备好相关资料,如身份证,护照,英语水平证明,学历证明,金融风险管理行业经验证明等,以备报考时提交。

报名完成后,将收到一份考试报名确认函,其中显示了考生的考试日期和时间、考试地点、复核考卷等信息。

3、FRM考试科目FRM考试分为两部分,即FRM Part I考试和FRM Part II考试,分别包括FRM Part I考试中的Foundations of Risk Management,Quantitative Analysis,Financial Markets,andProducts以及FRM Part II考试中的Market Risk Measurement and Management,CreditRiskMeasurement and Management,Operational and Integrated Risk Management,Risk Management and Investment Management等。

考试形式以选择题为主,考试时间分别为Part I考试和Part II 考试2个小时。

4、FRM结束考试条件FRM考试结束条件有:(1)考生需要在规定时间完成考试;(2)按照考试要求完成所有题目;(3)达到考试分数线,即Part I考试最低分数线要达到60%,而Part II考试最低分数线要达到50%;(4)缴纳考试费,这笔费用分以上文提到的2个部分,即Part I考试费和Part II考试费;(5)等待FRM证书确认。

5金融英语证书综合考试正受到越来越多人的关注,其难度也让部分考生望而却步。

本文从金融术语、知识体系、听力、阅读理解、翻译写作等几方面梳理了金融英语证书综合考试的备考策略。

金融英语证书综合考试;备考策略金融英语证书制度的由来金融专业英语证书考试制度是1994年经中国人民银行和原国家教委联合发文批准建立的我国第一个国家级行业性外语证书考试制度。

为进一步完善金融专业英语证书考试制度,金融专业英语证书考试委员会经讨论决定,自2009年开始,金融专业英语证书考试结构进行适当调整。

调整后,原“金融专业英语证书考试”更名为“金融英语证书考试”。

金融英语证书考试共设两级,分别为金融英语证书综合考试和金融英语证书高级考试。

考试每年举办一次,考试成绩可用作金融系统员工录用、职称评定、职务晋升及出国培训人员或外派人员专业英语水平的参考证明(2013)。

金融英语证书考试制度自推行以来,吸引了越来越多的金融从业者和有志于从事金融业的学子。

报名考试的人数呈逐年递增的态势,金融英语证书业已成为颇受金融业界认可的行业英语等级证书。

在此,我们对金融英语证书综合考试的备考策略进行梳理。

金融英语证书综合考试题型及分值分布金融英语证书综合考试满分100分。

试卷分为三个部分。

第一部分听力30分;第二部分阅读45分,其中包括四项内容,传统的四选一的阅读理解文章,三篇15分;单项选择题10道题,10分;完型填空两篇10分;判断正误的阅读理解文章两篇或三篇,10分。

最后是写作25分,涉及三项内容,填写流程图,5分;翻译英语句子,分;作文,分。

■王立莉/文金融英语证书综合考试备考策略21010金融英语证书综合考试的特点金融英语证书综合考试的特点是内容涉及广泛,知识比较庞杂。

其内容涉及银行中间业务、外汇、金融监管、银行信贷、证券、期货、会计、国际结算、保险以及金融函电写作。

眼花缭乱的内容常常让报考者望而生畏,因为即使是金融从业人员在日常工作中也不可能涉及如此广泛的领域。

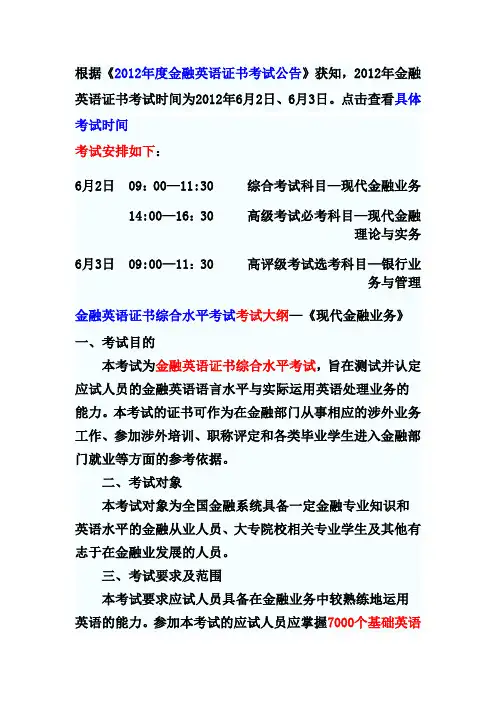

根据《2012年度金融英语证书考试公告》获知,2012年金融英语证书考试时间为2012年6月2日、6月3日。

点击查看具体考试时间考试安排如下:6月2日 09:00—11:30 综合考试科目—现代金融业务14:00—16:30 高级考试必考科目—现代金融理论与实务6月3日 09:00—11:30 高评级考试选考科目—银行业务与管理金融英语证书综合水平考试考试大纲—《现代金融业务》一、考试目的本考试为金融英语证书综合水平考试,旨在测试并认定应试人员的金融英语语言水平与实际运用英语处理业务的能力。

本考试的证书可作为在金融部门从事相应的涉外业务工作、参加涉外培训、职称评定和各类毕业学生进入金融部门就业等方面的参考依据。

二、考试对象本考试对象为全国金融系统具备一定金融专业知识和英语水平的金融从业人员、大专院校相关专业学生及其他有志于在金融业发展的人员。

三、考试要求及范围本考试要求应试人员具备在金融业务中较熟练地运用英语的能力。

参加本考试的应试人员应掌握7000个基础英语及金融专业英语词汇,熟悉基本的业务概念和术语及一般的业务程序和原理,能听懂日常会话和一般的业务交谈,具有在篇章水平上运用英语基本语法知识的能力。

能看懂与金融业务有关的一般文字材料,拟写一般的业务文件。

四、考试范围1、中国金融业概述1.1 银行业1.2 证券业1.3 保险业2、银行和金融机构监管2.1 银行业2.2 证券业2.3 保险业3、中国外汇体制3.1 概述3.2 外汇体系3.3 金融机构外汇业务3.4 对外汇账户的监管3.5 经常账户处理3.6 资本项目处理3.7 国际收支统计申报3.8 外汇业务4、会计4.1 财务会计4.2 管理会计4.3 银行会计5、银行中间业务5.1 中间业务5.2 金融市场5.3 投资银行业5.4 网上银行业6、银行信贷6.1 贷款种类6.2 信贷计划6.3 借款人的筛选6.4 信贷风险管理7、国际结算7.1 票据7.2 国际结算方式7.3 国际结算中使用的单据7.4 贸易融资7.5 《贸易术语通则2000》8、证券、期货市场8.1 概述8.2 证券市场8.3 期货市场8.4 法律体制9、保险基础9.1 保险原则和保险合约9.2 保险种类9.3 保险市场9.4 保险业务10、金融函电10.1 银行业务信函10.2 电传10.3 SWIFT10.4 备忘录10.5 电子邮件五、考试构成本考试包括听力和笔试两部分,主要从以下方面测试应试人员运用英语处理日常银行业务能力:听力部分(占30%):包括简短会话、报告、陈述、访谈、讨论、电话通讯对话、接待客户、介绍业务、提供服务等。

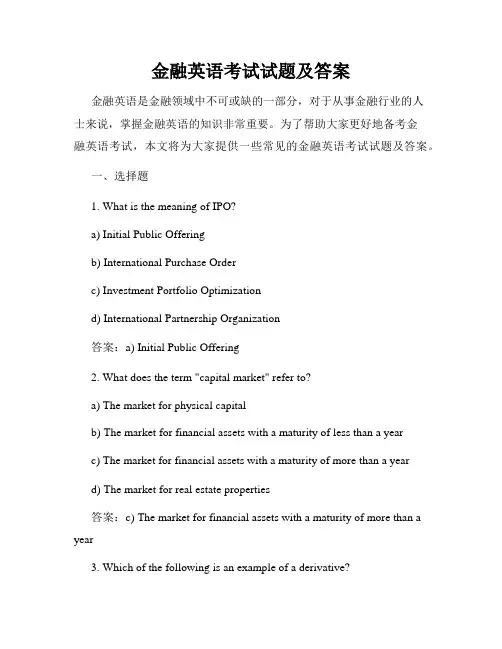

金融英语考试试题及答案金融英语是金融领域中不可或缺的一部分,对于从事金融行业的人士来说,掌握金融英语的知识非常重要。

为了帮助大家更好地备考金融英语考试,本文将为大家提供一些常见的金融英语考试试题及答案。

一、选择题1. What is the meaning of IPO?a) Initial Public Offeringb) International Purchase Orderc) Investment Portfolio Optimizationd) International Partnership Organization答案:a) Initial Public Offering2. What does the term "capital market" refer to?a) The market for physical capitalb) The market for financial assets with a maturity of less than a yearc) The market for financial assets with a maturity of more than a yeard) The market for real estate properties答案:c) The market for financial assets with a maturity of more than a year3. Which of the following is an example of a derivative?a) Stockb) Bondc) Optiond) Certificate of Deposit答案:c) Option4. What is the opposite of a deficit?a) Surplusb) Debtc) Liabilityd) Equity答案:a) Surplus5. What is the term for a loan that is secured by collateral?a) Unsecured loanb) Subordinated loanc) Secured loand) Revolving loan答案:c) Secured loan二、填空题1. The study of how individuals and institutions make financial decisions and how these decisions affect the allocation of resources is known as__________.答案:finance2. When a company issues shares for the first time and offers them to the public, it is called an ____________.答案:IPO (Initial Public Offering)3. The interest rate that a commercial bank charges its most creditworthy customers is known as the _________.答案:prime rate4. A financial instrument that represents ownership in a corporation is called a ___________.答案:stock5. The basic economic problem of having seemingly unlimited human wants in a world of limited resources is known as ________.答案:scarcity三、解答题1. Explain the concept of time value of money.答案:The time value of money refers to the idea that a dollar today is worth more than a dollar in the future. This is because money can be invested and earn interest over time. Therefore, receiving a dollar today ismore desirable than receiving the same amount in the future. The time value of money is an important concept in finance and is used to calculate the present value of future cash flows.2. What are the main functions of a central bank?答案:The main functions of a central bank include:- Monetary policy: Central banks are responsible for formulating and implementing monetary policy to control the money supply and interest rates in an economy. This is done to achieve specific macroeconomic objectives, such as price stability and economic growth.- Banker to the government: Central banks act as the government's bank and provide services such as managing the government's accounts, issuing government securities, and acting as a lender of last resort.- Banker to commercial banks: Central banks also provide banking services to commercial banks, including maintaining accounts, providing short-term loans, and overseeing the stability of the banking system.- Currency issuance: Central banks are responsible for issuing and circulating the national currency.- Financial stability: Central banks play a crucial role in maintaining financial stability and monitoring risks in the banking system.总结:本文为大家提供了一些常见的金融英语考试试题及答案。

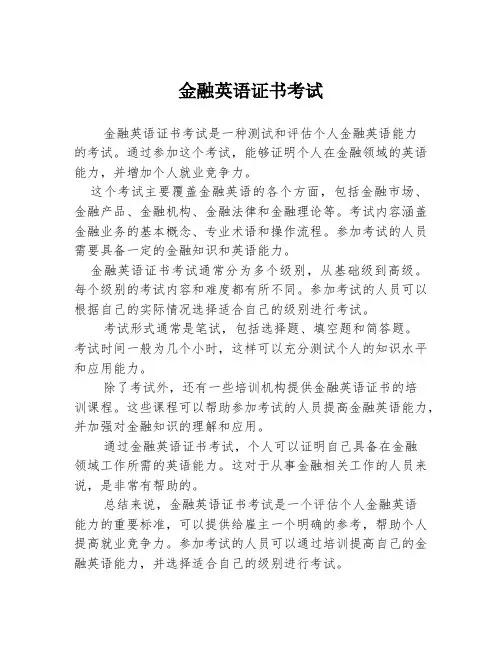

金融英语证书考试

金融英语证书考试是一种测试和评估个人金融英语能力

的考试。

通过参加这个考试,能够证明个人在金融领域的英语能力,并增加个人就业竞争力。

这个考试主要覆盖金融英语的各个方面,包括金融市场、金融产品、金融机构、金融法律和金融理论等。

考试内容涵盖金融业务的基本概念、专业术语和操作流程。

参加考试的人员需要具备一定的金融知识和英语能力。

金融英语证书考试通常分为多个级别,从基础级到高级。

每个级别的考试内容和难度都有所不同。

参加考试的人员可以根据自己的实际情况选择适合自己的级别进行考试。

考试形式通常是笔试,包括选择题、填空题和简答题。

考试时间一般为几个小时,这样可以充分测试个人的知识水平和应用能力。

除了考试外,还有一些培训机构提供金融英语证书的培

训课程。

这些课程可以帮助参加考试的人员提高金融英语能力,并加强对金融知识的理解和应用。

通过金融英语证书考试,个人可以证明自己具备在金融

领域工作所需的英语能力。

这对于从事金融相关工作的人员来说,是非常有帮助的。

总结来说,金融英语证书考试是一个评估个人金融英语

能力的重要标准,可以提供给雇主一个明确的参考,帮助个人提高就业竞争力。

参加考试的人员可以通过培训提高自己的金融英语能力,并选择适合自己的级别进行考试。

cfab报考条件全文共四篇示例,供读者参考第一篇示例:CFAB报考条件是指考生在申请参加CFAB(Chartered Financial Analyst)国际金融分析师认证考试时需要符合的一系列条件。

CFAB认证是全球金融领域最具权威的认证之一,对于想要在金融领域进一步发展的专业人士来说,具有非常重要的意义。

下面将详细介绍CFAB的报考条件。

CFAB是由国际著名的金融分析师协会(CFA Institute)颁发的资格认证,因此参加CFAB考试需要先注册成为CFA Institute的会员。

要成为CFA Institute会员,需要拥有学士学位或同等学历,并且至少有4年的金融领域相关工作经验。

如果考生是在校学生,也可以报考CFAB,但需要在毕业后完成相应的工作经验积累才能申请成为CFA Institute会员。

CFAB报考条件涉及到考试费用和时间安排。

CFAB考试每年分为6月和12月两次,考试具体时间由CFA Institute官方发布。

注册CFAB考试需要支付相应的报名费用,报名费用的金额随着报名日期不同而有所变化。

通常来说,提前报名可以享受到更低的报名费用。

考生在报名CFAB考试时,需要提供个人信息和相关学历、工作经历等证明材料,并且需要在考试前通过CFA Institute的道德自律考试。

CFAB报考条件还要求考生具备良好的英语水平。

CFAB考试的教材和考试全程都是用英文进行,因此参加CFAB考试的考生需要具备良好的英语听说读写能力。

对于非英语为母语的考生,还需要提供相关的英语水平证明,如托福、雅思成绩。

在考试过程中,如果发现考生的英语水平不符合要求,可能会影响考试的顺利进行。

CFAB报考条件还要求考生具备一定的财务知识和技能。

CFAB考试涵盖了众多金融领域的知识,包括财务报表分析、投资组合管理、伦理与职业标准等。

考生需要具备一定的财务知识基础和相关工作经验,才能更好地应对CFAB考试。

虽然CFAB考试没有硬性的财务知识要求,但是具备相关背景知识会对考试有所帮助。

金融英语证书考试(FECT)Exercises-1(1)来源:考试大 2010/11/26 【考试大:中国教育考试第一门户】模拟考场视频课程字号:T T金融英语证书考试(FECT)Exercises-1(1)。

密切关注考试大金融英语试题辅导中心,你将可以挖掘到更多实用更实惠的金融辅导资料。

1.Which of the following is not a function of money?______。

A.To act as a medium of exchangeB.To act as a unit of accountC.To act as a store of valueD.To provide a double coincidence of wantsE.To act as a means of payment2.The price in the foreign exchange market is called ______。

A.the trade surplusB.the exchange rateC.the money priceD.the currency rate3.Market risk refers to the risk of______。

A.financial prices fluctuationsB.defaultC.fraudD.deferred payments4.Which of the following is not among the generally accepted accounting principles?______。

A.Cash basisB.PrudenceC.ConsistencyD.Going concernE.Money measurement。

5.What is a documentary letter of credit?______。

金融英语方面的考试

金融英语方面的考试主要有以下几种:

1. 金融英语证书考试:这是由金融英语证书考试委员会组织的一项考试,旨在测试考生在金融英语方面的应用能力。

该考试分为初级、中级和高级三个级别,考试内容包括听力、阅读、写作和口语等方面。

2. 银行职业资格考试:这是由中国银行业协会组织的一项考试,旨在测试考生在银行业务方面的专业知识和技能。

该考试包括多个科目,如风险管理、个人理财、公司信贷等。

3. 特许金融分析师考试:这是由特许金融分析师协会组织的一项全球性考试,旨在测试考生在投资领域的知识和技能。

该考试分为三个级别,内容涵盖了投资分析、财务规划、风险控制等方面。

4. 注册会计师考试:这是由中国注册会计师协会组织的一项考试,旨在测试考生在会计、审计和税法等方面的专业知识和技能。

该考试分为多个科目,包括会计、审计、税法、财务管理等。

这些考试都是金融行业比较权威的考试,对于提高考生的金融英语水平、专业知识和技能都有很大的帮助。

金融英语证书考试FECT模拟试题-2(总分100, 考试时间90分钟)SECTION ONE (Compulsory):Answer all ten questions in this section. Each question carries 1 mark.Multiple-choice questions: from the following four options, select a correct and fill in its labeling the brackets.1.A production function for a firm describes: ()A What should be produced to maximize profit.B What is technologically feasible when the firm produces efficiently.C What revenue is earned from producing efficiently.D What the firm produces with given inputs.该题您未回答:х该问题分值: 2答案:B2.Which of the following is not a characteristic of a competitive industry? ()A There are many firms.B All firms produce homogeneous products, which are substitutable for each other.C There is a fierce price war among rivals.D Firms can enter and exit the industry freely.该题您未回答:х该问题分值: 2答案:C3.The Central Bank in the open market buying and selling of securities is designed to: ()A regulation bond pricesB achieve profit maximizationC regulate money supplyD adjust prices level该题您未回答:х该问题分值: 2答案:C4.What unemployment is formed because of the economic recession? ()A friction unemploymentB structural unemploymentC cyclical unemploymentD natural unemployment该题您未回答:х该问题分值: 2答案:C5.After a long race on a hot day, a runner enjoys her first drink a lot, the second she enjoys less and she declines a third drink. This illustrates the principle of: ()A Increasing marginal utility.B Decreasing marginal utility.C Increasing marginal cost.D Decreasing marginal cost.该题您未回答:х该问题分值: 2答案:B6.On a hot day, the price and the quantity sold of ice creams both increase. This can reflect a: ()A Shift in the demand curve to the right.B Move along the demand curve.C Shift in the demand curve to the left.D Shift in the supply curve to the right.该题您未回答:х该问题分值: 2答案:A7.When a country’s currency appreciates, the country’s goods abroad become ______ and foreign goods in that country become ______.A cheaper... more expensiveB more expensive... cheaperC cheaper...cheaperD more expensive... more expensive该题您未回答:х该问题分值: 2答案:B8.A US company is bidding for a contract in China. Its Chinese customer asks for a performance bond. What is the most likely course of action? ()A It asks its bank to issue a tender bond which can be converted into a performance bondB It gives up its bidC It consults its bank about issuing a standby letter of creditD It asks its bank to issue a performance bond该题您未回答:х该问题分值: 2答案:A9.There is a deficit in the federal budget when: ()A Federal government spending is greater than federal tax revenues.B U.S. imports are greater than U.S. exports.C The total demand for money is greater than the total supply of money.D U.S. imports are smaller than U.S. exports.该题您未回答:х该问题分值: 2答案:A10.Mrs. Jones purchased a 20-year Treasury bond bearing a 12% coupon rate. She purchased the bond at par ($1000). If rates fall to 9% what will be the new price of the bond? ()A $1333B $1500C $750D $900E There will be no change in the price of the bond.该题您未回答:х该问题分值: 2答案:DSECTION TWO(Compulsory):Answer the questions in this section.Reading Comprehension: (10 points)James Sigmund, CFA, is the Head of International Equity for Pell Global Advisors (PGA). Sigmund is considering investing in the country of Zuflak as part of an emerging market portfolio. Sigmund is aware of the risks in investing in emerging markets and is preparing a valuation report regarding this investment. He estimates that Zuflak government debt would be rated BB, and has gathered the following market information for use in analyzing Zuflak.Local Government Bond Yield = 11.50%U.S. 10 year Treasury Bond Yield = 4.50%U.S. BB rated Corporate Bond Yield = 7.75%Local Inflation Rate = 6.50%U.S. Inflation Rate = 3.00%To assist in his analysis of Zuflak, Sigmund has asked Stefano Testorf, CFA, to estimate a value for Kiani Corporation (Kiani), Oleg Industries (Oleg), and Malik Incorporated (Malik) - the three primary companies domiciled in Zuflak that Sigmund has determined to have adequate liquidity for inclusion in PGA’s client portfolios. Testorf gives Sigmund a rough draft of his report and tells Sigmund that in order to account for country specific emerging market risks; he used a probability-weighted scenarioanalysis to adjust cash flows. Sigmund asks him, “Why didn’t you s imply adjust the discount rate?” Testorf replies with three reasons: Reason 1: The country risk attributable to Zuflak can be diversified away according to modern finance theory, and should not be included in the cost of capital.Reason 2: Companies in emerging markets tend to exhibit wild price swings both up and down, therefore adjusting cash flows is the best way to account for these symmetrical country risks.Reason 3: Although Kiani, Oleg, and Malik are all domiciled in Zuflak, each of these companies will tend to respond differently to country risks. This makes it virtually impossible to adjust the discount rate for country specific risk and come up with an accurate valuation estimate.After careful analysis by Sigmund and his team, Sigmund decides that he wants to have exposure to Zuflak in his international portfolios. He is still unsure however, what the best way would be to establish the exposure. Sigmund discusses his concerns with Steve Solak, another portfolio manager with PGA. Solak suggests that Sigmund consider using a closed-end country fund to invest in Zuflak. Solak hands Sigmund a copy of a note that he had provided to a client listing facts about country-specific closed end funds. The note contained the following statements:Closed-end country funds provide an excellent means to access local foreign markets. Even nations that have restrictions on foreign investment are sometimes accessible using closed-end country funds.Closed-end country funds issue a fixed number of shares and are a great way to diversify a U.S.-dollar stock portfolio because of their low correlation with the U.S. stock market.Sigmund thanks Solak for the information and heads back to his office. As he is leaving, Solak asks him if he would have time later that afternoon to discuss the use of American Depository Receipts (ADRs).11.What is the best estimate of the country risk premium for Zuflak? ()A 0.25%.B 1.50%.C 2.75%.D 6.00%.该题您未回答:х该问题分值: 2答案:ABecause a U.S. denominated local government bond does not exist, the following formula must be used to calculate the country risk premium: Local government bond yield (non–US dollar denominated)- U.S. 10 year T-bond yield- Inflation differential between local country and U.S.- Yield spread between comparably rated U.S. corporate and U.S. T-bond yields= Country Risk PremiumCountry Risk Premium = 11.50 – 4.50 – (6.50-3.00) – (7.75-4.50) = 11.50 – 4.50 – 3.50 – 3.25= 0.25Note that if a U.S. denominated local government bond did exist, we would use that bond in our calculation and would not include the inflation differential.12.To determine a valuation estimate for Oleg, Testorf assumes that local investors require a 5 percent real rate of return on companies with similar risk to Oleg. What is Oleg’s price-to-earnings (P/E) ratio, if the company has an inflation flow-through rate of 65 percent? ()A 13.75.B 5.33.C 3.00.D 21.25该题您未回答:х该问题分值: 2答案:AP0/E1 = 1 / [real required return + (1 – inflation flow-through rate) × inflation rate]= 1 / [0.05 + (1-.65) × 0.065]= 1 / [0.05 + 0.02275]= 1 / 0.07275 = 13.7513.In regard to Testorf’s reasons for incorporating emerging market risk into the valuation of Zuflak by adjusting cash flows rather than adjusting the discount rate, which of the following is TRUE?()A Reasons 1 and 3 support Testorf’s cash flow adjustment, but reason2 does not.B All three of the reasons given support Testorf’s cash flowadjustment.C Reasons 2 and 3 su pport Testorf’s cash flow adjustment, but reason1 does not.D Reason 1 supports Testorf’s cash flow adjustment, but reasons 2and 3 do not.该题您未回答:х该问题分值: 2答案:AAlthough emerging market risk can be incorporated into the valuation process either by adjusting the discount rate (required return), or by adjusting cash flows in a scenario analysis, evidence suggests that country risks can be best captured through cash flow adjustment. The four arguments that support adjustments to cash flow rather than adjusting the discount rate are:Country risks are diversifiable. Modern finance theory states that country risks can be diversified away, and therefore should not be included in the cost of capital. Testorf’s first reason is correct.Companies respond differently to country risk. A general discount rate cannot be applied uniformly to every company valuation in the country because it would not capture the different operating characteristics of the company that could be captured by adjusting the cash flows. Testorf’s third reason is correct.Country risk is one-sided. Emerging markets have a tendency for companies to exhibit one-sided (down only) risk profiles. Therefore, the risks are asymmetrical and adjusting the cash flows best captures these asymmetrical risks. Testorf’s second reason is incorrect.Identifying cash flow effects aids risk management. Managers tend to identify specific factors affecting cash flow and plan to mitigate their risks by adjusting cash flows rather than adjusting the discount rate.14.Due to the high inflation rate of the local country, Testorf calculates the return on invested capital (ROIC) for Kiani by revaluing the company’s fixed assets. In comparing the performance of Z uflak to other local companies, the ROIC calculation should: ()A Exclude goodwill.B Exclude depreciation.C Not revalue fixed assets.D Exclude net operating profit adjusted for taxes.该题您未回答:х该问题分值: 2答案:AWhen calculating ROIC, excluding goodwill is useful for comparing different local companies and evaluating trends. Goodwill can distort the comparison when firms have differing levels of goodwill. ROIC that includes goodwill measures returns generated by the firm’s acquisitions based on the use of its investors’ capital, and is used for determining whether or not the company earned an acceptable rate of return over its cost of capital. Note that revaluation is also important here. ROIC including revaluation of fixed assets measures the company’s operating performance, and is also useful for comparing different companies and evaluating trends.15.With regard to Solak’s note concerning closed end-country funds: ()A Statement 1 is correct, statement 2 is correct.B Statement 1 is incorrect, statement 2 is incorrect.C Statement 1 is correct, statement 2 is incorrect.D Statement 1 is incorrect, statement 2 is correct.该题您未回答:х该问题分值: 2答案:CClosed-end country funds provide a simple way to access local foreign markets while achieving international diversification. One of the advantages of closed-end country funds is that investors often have greater access to emerging markets, even those from countries that tend to restrict foreign investment. This is due to the fact that redemptions are less of a concern to the emerging market government because the number of shares of the fund is fixed, and redemptions do not result in capital outflows. Statement 1 on Solak’s note is correct.One of the disadvantages of closed-end country funds is that they may trade at a significant discount premium or discount to their NAV. Although the actual performance of the stock within the closed end fund may have a low correlation with the U.S. market, the NAV of the fund may be highly correlated with the U.S. market, thus reducing the benefit of international diversification. Statement 2 on Solak’s note is incorrect. Explanations of terms16.Real interest rate该题您未回答:х该问题分值: 6答案:Real interest rate is the nominal rate you earn corrected for the change in the purchasing power of money or for the expected inflation. Roughly speaking, the real interest rate is the difference between the nominal interest rate and the inflation rate, or the nominal interest rate minus the inflation rate.17.Window instruction该题您未回答:х该问题分值: 6答案:It refers to the case in which a central bank sets the amount of loans to increase or decrease for each season for commercial banks and requires banks to obey the instruction. The measure is not formulated by the law, but it is only an instruction given by the central bank of a country.18.Special drawing rights该题您未回答:х该问题分值: 6答案:An international type of monetary reserve currency, created by the International Monetary Fund (IMF) in 1969, which operates as a supplement to the existing reserves of member countries.19.Money market mutual funds该题您未回答:х该问题分值: 6答案:Funds that issue shares to savers backed by holdings of high-quality short-term assets.20.Putable bonds该题您未回答:х该问题分值: 6答案:A putable bond grants the bondholder the right to sell the issue back to the issuer at par value on designated dates. The advantage to the bondholder is that if interest rates rise after the issue date, thereby reducing the market value of the bond, the bondholder can sell the bond back to the issuer at par.21.Please list some Capital Market Instruments.该题您未回答:х该问题分值: 10答案:The capital market is extremely important because it raises the funds needed by net borrowers to carry out their spending and investment plans.A smoothly functioning capital market influences how fast the economy grows.(1)BondsBonds are long-term debt obligations issued by corporations and government units. Proceeds from a bond issue are used to raise funds to support long-term operations of the issuer (e.g., for capital expenditure projects). In return for the investor’s funds bond issuers promise to pay a specified amount in the future on the maturity of the bond (the face value) plus coupon interest on the borrowed funds (the coupon rate times the face value of the bond). If the terms of the repayment are not met by the bond issuer, the bond holder (investor) has a claim on the assets of the bond issuer. Bond markets are markets in which bonds are issued and traded. They are used to assist in the transfer of funds from individuals, corporations, and government units with excess funds to corporations and government units in need of long-term debt funding.(2) StocksStocks are equity claims representing ownership of the net income and assets of a corporation. The income that stockholders receive for their ownership is called dividends. There are two types of stocks, common and preferred. A share of common stock in a firm represents an ownership interest in that firm. Preferred stock is a form of equity from a legal and tax standpoint. Preferred stock pays a fixed dividend, and in the event of bankruptcy of the corporation, the owners of preferred stock are entitled to be paid first before the corporation’s other creditors. Common stock pays a variable dividend, depending on the profits that are left over after preferred stockholders have been paid and retained earnings set aside.(3) FundsIn a narrow sense, fund is a reserve of money set aside for some purpose. In general, fund means a financial institution that sells shares to individuals and invests in securities issued by other companies. As you probably know, mutual funds have become extremely popular over the last20 years. What was once just another obscure financial instrument is nowa part of our daily lives. More than 80 million people, or half of the households in America, invest in mutual funds. That means that, in the United States alone, trillions of dollars are invested in mutual funds. In fact, to many people, investing means buying mutual funds. After all, it’s common knowledge that investing in mut ual funds is (or at least should be) better than simply letting your cash waste away in a savings account, but, for most people, that’s where the understanding of funds ends. It doesn’t help that mutual fund salespeople speak a strange language that is int erspersed with jargon that many investors don’t understand. Originally, mutual funds were heralded as a way for the little guy to get a piece of the market. Instead of spending all your free time buried in the financial pages of the Wall Street Journal, all you had to do was buy a mutual fund and you’d be set on your way to financial freedom. As you might have guessed, it’s not that easy. Mutual funds are an excellent idea in theory, but, in reality, they haven’t always delivered. Not all mutual funds are c reated equal, and investing in mutuals isn’t as easy as throwing your money at the first salesperson who solicits your business.22.What kind of Economic Policy in an Open Economy该题您未回答:х该问题分值: 10答案:International economic policy refers to activities of national governments that affect the movement of trade and factor inputs among nations. Included are not only the obvious measures such as import tariffs and quotas, but also domestic measures such as monetary policy and fiscal policy. Policies that are undertaken to improve the conditions of one sector in a nation tend to have repercussions that spill over into other sectors. Since an economy’s internal (domestic) sector, one cannot designate economic policies as purely domestic or purely foreign. Rather, the effects of economic policy should be viewed as being located on a continuum between two poles—an internal-effects pole and anexternal-effects pole. Although the Primary impact of an import restriction is on a nation’s trade balance, for example, there are secondary effects on national output, employment, and income. Most economic polices are located between the external and internal poles rather than falling directly on either one.23.What is the Modern Quantity Theory of Money Demand?该题您未回答:х该问题分值: 10答案:(1) The modern quantity theory of money refers to the monetary theory developed by the Chicago School. From the late 1940s through the 1990s, a group of economists, associated in varying degrees with Chicago School, build upon the traditions of classical economics with the benefit of modern theoretical and statistical techniques. Represented by Milton Friedman, originally labeled the Chicago School, but currently referred to either as monetarists or new classical macroeconomists, this informal group has produced a set of ideas with important implications for the role of money in the economy. In 1956, Friedman published his paper " The Quantity Theory of Money Demand—A Restatement", which marked the emergence of the modern quantity theory of money. On one hand, Friedman accepted the Cambridge School and Keynes’s thought that money is an asset and the demand for money is people’s behavior of choosing assets; on the other hand, Friedman basically adopted the conclusion of the traditional quantity theory of money, i. e., the change of the quantity of money is the cause of the movement of price level.(2) In his design of the function of demand for money, Friedman took into consideration the two factors; first, the total wealth expressed with permanent income which is in a reverse ratio to the demand for money; second, the difference between expected rates of return of holding money and other assets. The higher the rate of return of other assets, the weaker people’s desire to hold money. Friedman did not analyze people’s motives of holding money like Keynes, but continued to study the causes of holding money and thought that there are many different factors affecting the demand for money. Friedman used a function to express the demand for money: Md / P =f (Yp, Rm, Rb, Rf, P, W, U )Md / P: the demand for real money balances,Yp; The real GDP, the index used to count wealth, called permanent income,Rm; The expected rate of return for money,Rb: The expected rate of return for bonds,Re: The expected rate of return for stocks (common stocks),P; The expected rate of return of goods or expected rate of inflation, W; The ratio of non-human wealth to human wealth,U; Other random variables, including preference, custom, technology, system, etc.(3) In Friedman’s view, the wealth affecting the money demand is permanent and the money demand will not fluctuate with ups and downs of business cycles because the permanent income fluctuates a little in shortrun. Generally speaking, the demand for an asset has a positive interrelation with the wealth people hold. Since money is an asset, the demand for money has a positive interrelation with wealth (Yp). Friedman held that factors affecting money demand are the expected rate of return of the assets that can substitute money. Besides holding wealth in the form of money, people can hold their wealth in other forms, say, bonds, stocks (common stocks) and goods. The opportunity cost of holding money is expressed by the expected rate of return of other assets compared with money. When the expected rates of return of bonds (Rb) and stocks (Re) rise the opportunity cost of holding money will increase which will result in less demand for money. The higher the expected rate of return of other assets, the less the demand for money. P is the expected rate of return of holding wealth in the form of goods compared with money. When the prices of goods rise, the rate of return of goods equals the rate of inflation rate. When the expected rate of return of goods is higher compared with that of holding money, people will do well to "beat the higher prices" by purchasing goods sooner than usual (this is the "expectations effect"). This will reduce the demand for money. W is the ratio of non-human wealth to human wealth. Non-human wealth refers to bonds, stocks and other real assets, while human wealth refers to individuals’ ability to make money. This ratio constrains people’s income, e. g.; human wealth can not beobtained when labor force is in a state of unemployment, which naturally reduces the demand for money. Given certain level of wealth, the larger the W, the smaller the money demand. U which refers to other random variables is in a negative correlation with the money demand.Monetarists adhere to virtually all the tenets of classical economists. However, they made some modifications. Some of them have used the quantity theory as a framework for describing the relationship between M and PY rather than just M and P and view the invisible hand as pushing the economy toward the full employment level of production. A second modification of classical thought occurred in Milton Friedman’s revival of the quantity theory is that Friedman replaced the idea of the stability of velocity with the less militant notion that it is predictable. Or, money demand may not be a fixed fraction of total spending; it is related to PY in a close and predictable way.Perhaps the most important classical tradition upheld by modern monetarists is the inherent stability of the economy at full employment. This explains the monetarist rejection of governmental attempts to fine-tune economic activity. A higher level of economic activity requires more capital and labor or technological improvements; more money only leads to inflation. The answer to cyclical downturns is to wait for the natural upturn. Government intervention is unnecessary and potentially damaging.24.If you are a policy maker, what are your Ultimate Targets of Monetary Policy?该题您未回答:х该问题分值: 10答案:The Four Ultimate Targets of Monetary PolicyThe four targets of monetary policy include:(1) Economic growth,(2) Price stability,(3) Full employment, and(4) Balance of payments equilibrium.(1) Economic growthEconomic growth refers to the growth of a nation’s GDP which is the total value of goods and services domestically produced. People’s living standard has increased dramatically over history as result of the growth of the economy and its productivity. But growth means more than merelyincreasing total output. It requires that output increase faster than the population so that the average output per person expands. Economic growth in every country is the first target of monetary policy. Without certain growth rate, national economy will be in a state of stop or shrinkage and it will be impossible to enhance a nation’s economic strength and raise people’s living standard.(2) Price stabilityPrice stability means the stability of currency value and control of inflation without great change of price level within certain period. The price stability reflects the general trend of price change or average level. In modern economic society, the general price level shows a rising trend in fact. Price stability is to limit the increase rate of the price level of a certain period within certain scope. As for the certain scope within which the increase rate of price level should be kept, there are different views among economists. Generally speaking, if the rising rate of price level is within 2%—3%, it can be called price stability. Consistently stable prices help create an environment in which the other economic targets are more easily reached.(3) Full employmentFull employment means the people who have ability to work and are willing to work can find suitable jobs at present wage level. Full employment is measured with the unemployment rate of labor force. The unemployment rate is the ratio of the number of the unemployed and the labor force willing to work. The unemployment rate represents the extent of full employment in a society. Unemployment means a loss of potential output and imposes costs on the entire economy.For many reasons, a high employment level is one of the paramount goals of monetary policy. Unemployment deprives families of their chief source of income, triggers a host of social problems such as increased incidence of crime and mental illness, and impacts most heavily on the disadvantaged and those at the lower end of the income scale. Collectively, increased unemployment reduces the nation’s level of output and income as well as tax revenues at all levels of government, thereby impairing such public services as roads, public security, and education.Monetary policy affects the unemployment rate by influencing aggregate expenditures on goods and services and the level of the nation’s gross domestic product (GDP). As monetary policy becomes more stimulative, aggregate expenditures and GDP increase and the unemployment rate falls, sometimes below the natural rate. The natural unemployment rate is defined as the lowest level at which the nation’s unemployment rate can be maintained without triggering an increase in the existing inflation rate. If monetary policy becomes too stimulative and the nation’s unemployment rate falls below the natural rate, inflation accelerates. Hence, a goal of central bank policy is to keep the nation’sunemployment rate as close as possible to the natural unemployment rate without going below it. Unfortunately, the natural unemployment rate changes over time and is uncertain at any point in time. Most economists believe it is currently somewhere in the 5 to 6 percent range.(4) Balance of payments equilibriumBalance of payments is the total record of a country’s (or region’s) economic transactions, including money receipts from and payments to abroad, the difference between receipts and payments forms the surplus or deficit. It also includes some economic transactions even if they will never give rise to monetary settlements. Balance of payments during certain period reflects the state of economic development of a country and the country’s external economy. To maintain balance of payments equilibrium and reasonable quantity of foreign exchange are important conditions of a country’s stable development of economy and international intercourse. So to maintain balance of payment equilibrium should be another important target of monetary policy.。

金融英语证书Part1 overview of the financial industry in China⏹They play a unique role in the economy throughmobilizing savings, allocating capital funds to financeproductive investment, transmitting monetary policy,providing a payment system and transforming risks.⏹The state council decided to make the PBC as a centralbank which was characterized by a mono-bank engaged in both policy and commercial bankingoperations.⏹The government introduced a comprehensive packageof measures aimed at restoring financial order as wellas addressing the inflationary pressure and signs ofoverheating, particularly in the real estate sector andthe stock markets.⏹The reform since then has been focused on developinga sound and robust financial system to guard againstand dissolve financial risks, cleaning up thebalance-sheets of the banks, improving their ownershipstructure, strengthening their corporate governance,developing market infrastructure, enhancing supervisory capacity, and further opening the banking sector to foreign participation.⏹The wholly state-owned commercial banks, namely,restructuring their balance sheets, establishing corporate governance, transforming their operational mechanisms, inviting strategic investors, listing them in stock markets.⏹Apart from the traditional deposit taking and lendingbusiness, commercial banks now offer a broad range of intermediary services such as international settlement, bankcards, personal banking, and financial consulting.As the economy becomes increasingly complex, there is an emerging need for developing universal banking.⏹Until recently, foreign banking institutions were onlyallowed to operate in the special economic zones and coastal cities. To encourage competition form foreign financial institutions, China has expanded the list of areas open to foreign banking establishments to include all large cities throughout the country. The banking institutions are now engaged in local currency business in 25 major cities.⏹Strengthening baking supervision has become auniversal task. Many countries including some advanced economies have been penalized for weak financial supervision. For china, this task is particularly relevant, as the authorities are well aware that the Chinese financial system is faced with risks associated with economic transition, in addition to credit and market risks common to all countries⏹Continued progress in structural reform in the financialsector will contribute to the viability of commercial banks. First, further interest rate liberalization will enhance banks’ capacity for risk pricing. Second, freer cross-border capital movement will allow them to seek high returns and diversify risks on a much broader horizon. Third, greater exchange rate flexibility will facilitate expansion of foreign exchange business and foster their ability to manage foreign exchange risks.⏹Shares are certificates or book entries representingownership in a corporation or similar entity.⏹Bonds are written evidences of debts.⏹The primary market is that part of the capital marketthat deals with the issuance of new securities. Thesecond market is the financial market for trading of securities that have already been issued in an initial private or public offering.⏹Bonds are forms of borrowing firms can undertake inthe form of medium or long-term security, which commits them to specific repayment dates, with fixed on variable interest.⏹Treasury bonds, also known as T-bonds, refer tocoupon bearing government securities with a relatively longer maturity.⏹In practice, not all risks can be insured, and theinsurability of a given risk depends on a number of factors:1. Losses are measurable in monetary terms.2. Only pure risks are insurable,3. The insurer must be able to collect together asufficiently large group of separate and independent exposure units which are subject to broadly similar risks. This is so that the Law of Large Numbers can operate effectively.4. Losses must be fortuitous.Part2 supervision of banking and financial institutions⏹First, the key objective of supervision is to maintainstability and public confidence in the financial system.⏹The second goal of bank supervision is to ensure thatbanks operate in a safe and sound manner and thatthey hold capital and reserves sufficient to cover therisks that may arise in their business.⏹Third, a related goal is to protect depositors’ funds andif any bank should fail, to minimize the losses to beabsorbed by the deposit insurance fund.⏹The fourth goal of bank supervision is to foster anefficient and competitive banking system that is responsive to the public’s need for high quality financialservices at reasonable cost.⏹The fifth and final goal of bank supervision is to ensurecompliance with banking laws and regulations.⏹Risks of bankCredit riskA major type of risk that banks face is credit risk or thefailure of a counterpart to perform according to a contractual arrangement.Two specific elements of market risk are foreign exchange risk and interest rate riskBanks face a risk of losses in on- and off-balance sheet positions arising from movements in exchange rates. Interest rate risk refers to the exposure of a bank’s financial condition to adverse movements in interest rates. Liquidity riskLiquidity risk arises from the inability of a bank to accommodate decreases in liabilities or to fund increases in assets.Operational riskThe most important types of operational risk involve breakdowns in internal controls and corporate governance.Legal riskBanks are subject to various forms of legal risk, including inadequate or incorrect legal advice or documentation that may result in unexpected decline in the value of assets or unexpected increase in the value of liabilities. Reputation riskReputation risk arises from operational failures, failure to comply with relevant laws and regulations, or othersources.⏹Prudential requirements cover a broad spectrumprocess. Of which, there are five key areas where the extensive prudential policies have been implemented by bank regulators of most countries; these are capital adequacy, risk concentration, asset quality, liquidity and internal controls.⏹Minimum capital adequacy ratios are necessary toreduce the risk of loss to depositors, creditors and other stakeholder of the bank and to help supervisors pursue the overall stability of the banking industry.⏹The 1988 Basel accordThe accord sets minimum capital ratio requirements for internationally active banks of 4% capital and 8%total capital in relation to risk-weighted assets.Tier 1 capital is core capital, that is, common shares, plus non-cumulative perpetual preferred shares, plus disclosed reserves, less goodwill.Tier 2 capital consists of undisclosed asset revaluation, and general provisions (general loan-loss) reserves, as well as hybrid debt capital instruments, and subordinated term debt.These limits are usually expressed in terms of a percentage of bank capital and, although they vary, 25% of capital is typically the most that a bank or banking group may extend to a private sector non-bank borrower or a group of closely related borrowers without specific supervisory approval.⏹Asset quality is the most important factor indetermining a bank’s creditworthiness.In addition to loans, balances due from banks, acceptances and bills of exchange held, as well as commitments liabilities which subject a bank to credit risk are also classified in the same way in order to give a better picture on asset quality.⏹LiquidityBanks need adequate liquidity to meet their obligations when they fall due, especially where the timing and amount of the commitment are uncertain, and to maintain confidence of depositors and shareholders. The major obligations in this context are demand for withdrawals from sight deposits, time deposits, and commitments to lend at a specific date, unutilized overdraft facilities and inter-bank settlements.After evaluating the six critical areas of the bank through the bank through separate ratings, a composite CAMELS rating ranging from 1 to 5 is established to provide an overall judgment of a bank’s financial condition and soundness, whereas “C” stands for Capital adequacy, “A”for Asset quality, “M”for Management, “E” for Earnings, “L” for Liquidity and “S”for Sensitivity to market risk.。