多恩布什《宏观经济学》第10版 第9章 收入与支出

- 格式:ppt

- 大小:1.38 MB

- 文档页数:56

宏观经济学多恩布什第10版教材下载及考研视频网课多恩布什《宏观经济学》(第10版)网授精讲班【教材精讲+考研真题串讲】目录多恩布什《宏观经济学》(第10版)网授精讲班【郑炳老师讲授的完整课程】【共41课时】多恩布什《宏观经济学(第10版)》网授精讲班【王志伟老师讲授的部分课程】【共28课时】电子书(题库)•多恩布什《宏观经济学》(第10版)【教材精讲+考研真题解析】讲义与视频课程【39小时高清视频】•多恩布什《宏观经济学》(第10版)笔记和课后习题详解•试看部分内容导论与国民收入核算第1章导论1.1 复习笔记1宏观经济学宏观经济学主要讨论总体经济的运行,具体包括:经济增长问题——收入、就业机会的变化;经济波动问题——失业问题,通货膨胀问题;经济政策——政府能否、以及如何干预经济,改善经济的运行。

2.微观经济学与宏观经济学的关系(1)二者的联系第一,微观经济学和宏观经济学互为补充。

微观经济学是在资源总量既定的条件下,通过研究个体经济活动参与者的经济行为及其后果来说明市场机制如何实现各种资源的最优配置;宏观经济学则是在资源配置方式既定的条件下研究经济中各有关总量的决定及其变化。

第二,微观经济学是宏观经济学的基础。

这是因为任何总体总是由个体组成的,对总体行为的分析自然也离不开个体行为的分析。

第三,微观经济学和宏观经济学都采用了供求均衡分析的方法。

微观经济学通过需求曲线和供给曲线决定产品的均衡价格和产量,宏观经济学通过总需求曲线和总供给曲线研究社会的一般价格水平和产出水平。

(2)二者的区别第一,研究对象不同。

微观经济学研究的是个体经济活动参与者的行为及其后果,侧重讨论市场机制下各种资源的最优配置问题,而宏观经济学研究的是社会总体的经济行为及其后果,侧重讨论经济社会资源的充分利用问题。

第二,中心理论不同。

微观经济学的中心理论是价格理论,宏观经济学的中心理论是国民收入决定论。

第三,研究方法不同。

微观经济学的研究方法是个量分析,宏观经济学的研究方法是总量分析。

第3篇首要的几个模型第9章收入与支出9.1复习笔记一、总需求与均衡产出1.总需求概述(1)总需求的含义与构成总需求指整个经济社会在每一个价格水平下对产品和劳务的需求总量,它由消费需求、投资需求、政府支出和国外需求构成。

将商品需求区分为消费(C)、投资(I)、政府采购(G)、与净出口(NX)等需求,则总需求(AD)由下面的公式决定:=+++AD C I G NX(2)总需求与国民收入核算中总支出的区别①总需求指计划(意愿)支出量;国民收入中的总支出是指实际发生量;②一般而言在消费、政府采购、以及净出口方面两者不存在差异;③关键在于计划投资与实际投资之间的差别,在实际发生的投资中往往会出现非计划的存货投资。

2.均衡产出(1)均衡产出水平的含义均衡产出水平指总供给和总需求相一致时的产出水平。

经济社会的产量或者国民收入决定于总需求,均衡产出是和总需求相一致的产出,也就是经济社会的收入正好等于全体居民和企业想要有的产出。

当下式成立时,经济处于均衡产出水平状态:==+++Y AD C I G NX(2)非计划库存投资与产量调节机制当总需求即人们想要购买的量与产出不相等时,则存在非计划库存投资或负投资。

可将其概括为:IU Y AD=-,其中IU为非计划的库存投资。

图9-1产出调节机制①如果产出大于总需求,就有非计划库存投资0IU>,此时存在超额库存积累,企业会减少生产,直到产出与总需求再度均衡为止。

②如果产出低于总需求,0IU<,企业将增加生产直至均衡恢复为止。

③在均衡状态下,非计划存货投资为零,0IU=,企业没有增加或减少产出的激励。

以上论述的以存货调整为基础的产量调节机制如图9-1所示。

图9-1产出调节机制3.基本结论(1)总需求决定均衡产出(收入)水平(2)在均衡时,非计划库存投资等于零,而且消费者、政府以及外国居民都买到了他们想要购买的商品。

(3)以非计划库存变化为基础的产量调整将使经济达到均衡水平。

宏观经济学第二章概念题1.如果政府雇用失业工人,他们曾领取TR美元的失业救济金,现在他们作为政府雇员支取TR美元,不做任何工作,GDP会发生什么情况?请解释。

答:国内生产总值指一个国家(地区)领土范围,本国(地区)居民和外国居民在一定时期内所生产和提供的最终使用的产品和劳务的价值。

用支出法计算的国内生产总值等于消费C、投资I、政府支出G和净出口NX之和。

从支出法核算角度看:C、I、NX保持不变,由于转移支付TR美元变成了政府对劳务的购买即政府支出增加,使得G增加了TR美元,GDP会由于G的增加而增加。

2.GDP和GNP有什么区别?用于计算收入/产量是否一个比另一个更好呢?为什么?答:(1)GNP和GDP的区别GNP指在一定时期内一国或地区的国民所拥有的生产要素所生产的全部最终产品(物品和劳务)的市场价值的总和。

它是本国国民生产的最终产品市场价值的总和,是一个国民概念,即无论劳动力和其他生产要素处于国内还是国外,只要本国国民生产的产品和劳务的价值都记入国民生产总值。

GDP指一定时期内一国或地区所拥有的生产要素所生产的全部最终产品(物品和劳务)的市场价值的总和。

它是一国范围内生产的最终产品,是一个地域概念。

两者的区别:在经济封闭的国家或地区,国民生产总值等于国内生产总值;在经济开放的国家或地区,国民生产总值等于国内生产总值加上国外净要素收入。

两者的关系可以表示为:GNP=GDP+[本国生产要素在其他国家获得的收入(投资利润、劳务收入)-外国生产要素从本国获得的收入]。

(2)使用GDP比使用GNP用于计量产出会更好一些,原因如下:1)从精确度角度看,GDP的精确度高;2)GDP衡量综合国力时,比GNP好;3)相对于GNP而言,GDP是对经济中就业潜力的一个较好的衡量指标。

由于美国经济中GDP和GNP的差异非常小,所以在分析美国经济时,使用这两种的任何一个指标,造成的差异都不会大。

但对于其他有些国家的经济来说明,这个差别是相当大的,因此,使用GDP作为衡量指标会更好。

第10章 收入与支出一、判断题 1.如果其他因素不变而边际消费倾向减小,国民收入将会增加。

( )【答案】F【解析】假设一个简单的两部门模型Y C I C cY I =+=++,得1Y C I c =+-,这里c 为边际消费倾向,当c 减小时,国民收入减少。

2.政府支出的变化直接影响总需求,但税收和转移支付则是通过它们对私人消费和投资的影响间接影响总需求。

( )【答案】T【解析】从三部门国民收入决定模型()Y C I G C c Y TA TR I G =++=+-+++可以看出,政府支出G 直接作用于国民收入,而税收和转移支付首先影响个人的可支配收入YD Y TA TR =-+,然后影响消费和投资决策,对国民收入产生间接影响。

3.在任何情况下,个人储蓄的增加都导致国民生产总值的减少。

( )【答案】F【解析】一方面,增加储蓄意味着相对来说消费者的消费支出减少,消费支出的减少会导致国民收入减少;另一方面,储蓄增加又会使得投资增加,进而使得国民收入增加。

所以很难说储蓄增加一定会使国民收入增加或是减少。

4.边际进口倾向越低,自发性投资变化对均衡产出的影响就越小。

( )【答案】F【解析】四部门模型中的投资乘数表达式为()111I c t αγ=--+。

γ的大小与投资乘数的大小呈反比,因此,边际进口倾向γ减小会使投资乘数增大。

5.考虑一个封闭经济,边际消费倾向为0.8,所得税税率为50%,假设投资I 为外生变量。

如果政府支出G 增加100,那么产出Y 的变化为50。

( )【答案】F【解析】封闭经济中政府购买乘数()15113G c t α==--,1005/3500/3G Y G α∆=⨯∆=⨯=。

6.在开放型经济中对外贸易乘数值大于三部门经济中的乘数值。

( )【答案】F【解析】在四部门经济中,由于引入外贸因素,在由外贸进出口因素的变化而引起的扩大的需求中,有一部分需求会因为购买进口商品而漏出,因此,开放经济中的外贸乘数小于三部门经济中的乘数值。

宏观经济学多恩布什第十版ppt课件contents •宏观经济学导论•国民收入核算与衡量•失业、通货膨胀与货币政策•长期经济增长与经济发展•总供给与总需求模型及其应用•国际经济关系与全球化进程中的挑战目录01宏观经济学导论研究对象宏观经济学以整个国民经济活动作为考察对象,研究社会总体经济问题以及相应的经济变量的总量是如何决定的及其相互关系。

研究任务宏观经济学的研究任务是揭示经济总体运行过程中的各种经济总量之间的关系和国民经济运行的一般规律,并对总体经济运行的趋势、波动及其形成原因进行解释,为政府制定宏观经济政策提供理论依据。

研究方法宏观经济学采用实证分析和规范分析相结合的方法,既研究经济现象“是什么”的问题,也探讨经济运行“应该是什么”的问题。

研究工具宏观经济学运用大量的经济模型、图表和数学公式等分析工具,来研究和分析宏观经济现象及其运行规律。

宏观经济学发展历程及流派发展历程宏观经济学的发展经历了古典经济学、凯恩斯主义经济学、新古典综合派、新凯恩斯主义经济学等阶段。

主要流派古典经济学派、凯恩斯主义学派、货币主义学派、理性预期学派、供给学派、新制度学派等。

02国民收入核算与衡量GDP定义指一个国家或地区所有常住单位在一定时期内生产活动的最终成果。

包括生产法、收入法和支出法三种。

是从生产过程中生产的货物和服务总产品价值入手,剔除生产过程中投入的中间产品的价值,得到增加值的一种方法。

也称分配法,是按收入法计算的国内生产总值是从生产过程创造收入的角度,对常住单位的生产活动成果进行核算。

是从最终使用的角度反映国内生产总值最终使用去向的一种方法。

最终使用包括货物和服务的最终消费、资本形成总额和净出口三部分。

GDP核算方法收入法支出法生产法国内生产总值(GDP)概念及核算方法价格指数与通货膨胀率计算价格指数是反映不同时期一般价格水平的变化方向和变化程度的相对数。

常见的价格指数有消费物价指数(CPI)、批发物价指数(WPI)和GDP折算指数。

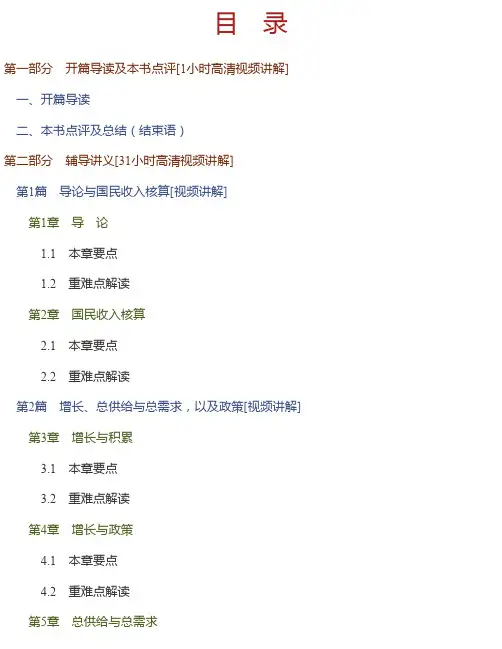

目 录第一部分 开篇导读及本书点评[1小时高清视频讲解]一、开篇导读二、本书点评及总结(结束语)第二部分 辅导讲义[31小时高清视频讲解]第1篇 导论与国民收入核算[视频讲解]第1章 导 论1.1 本章要点1.2 重难点解读第2章 国民收入核算2.1 本章要点2.2 重难点解读第2篇 增长、总供给与总需求,以及政策[视频讲解]第3章 增长与积累3.1 本章要点3.2 重难点解读第4章 增长与政策4.1 本章要点4.2 重难点解读第5章 总供给与总需求5.1 本章要点5.2 重难点解读第6章 总供给:工资、价格与失业6.1 本章要点6.2 重难点解读第7章 通货膨胀与失业的解剖7.1 本章要点7.2 重难点解读第8章 政策预览8.1 本章要点8.2 重难点解读第3篇 首要的几个模型[视频讲解]第9章 收入与支出9.1 本章要点9.2 重难点解读第10章 货币、利息与收入10.1 本章要点10.2 重难点解读第11章 货币政策与财政政策11.1 本章要点11.2 重难点解读第12章 国际联系12.1 本章要点12.2 重难点解读第4篇 行为的基础[视频讲解]第13章 消费与储蓄13.1 本章要点13.2 重难点解读第14章 投资支出14.1 本章要点14.2 重难点解读第15章 货币需求15.1 本章要点15.2 重难点解读第16章 联邦储备、货币与信用16.1 本章要点16.2 重难点解读第17章 政 策17.1 本章要点17.2 重难点解读第18章 金融市场与资产价格18.1 本章要点18.2 重难点解读第5篇 重大事件、国际调整和前沿课题[视频讲解]第19章 重大事件:萧条经济学、恶性通货膨胀和赤字19.1 本章要点19.2 重难点解读第20章 国际调整与相互依存20.1 本章要点20.2 重难点解读第21章 前沿课题21.1 本章要点21.2 重难点解读第三部分 名校考研真题名师精讲及点评[8小时高清视频讲解]一、名词解释二、简答题三、计算题四、论述题第一部分 开篇导读及本书点评[1小时高清视频讲解]一、开篇导读[0.5小时高清视频讲解]主讲老师:郑炳一、教材及教辅、课程、题库简介► 教材:多恩布什《宏观经济学》(第10版)(多恩布什、费希尔、斯塔兹著,王志伟译,中国人民大学出版社)► 教辅(两本,文库考研网主编,中国石化出版社出版)√网授精讲班【教材精讲+考研真题串讲】精讲教材章节内容,穿插经典考研真题,分析各章考点、重点和难点。

第九章 收入与支出宏观经济学的主要问题之一是产出为什么围绕其潜在水平波动。

本章提出了真实产出波动的初步理论——凯恩斯收入决定模型。

这个模型非常简单,假定价格完全没有变动,在既定价格水平,厂商愿意出售任何数量的产品,在这个假定前提下,支出决定了收入和产出。

一、总需求与均衡产出总需求是经济中商品和服务需求的总量(AD ):AD C I G NX ≡+++1、 当生产的数量等于需求的数量时,产出处于均衡水平。

Y AD C I G NX =≡+++2、 当总需求与产出不相等时,就出现了非计划库存投资或负的投资。

IU Y AD =-其中,IU 表示非计划库存。

有过量库存时,厂商将减少生产直到产出与总需求再度相等时为止;反之,如果产出低于总需求,库存减少直至均衡再度恢复为止。

二、消费函数与总需求消费是总需求中的主要组成部分,我们先来考虑消费的决定。

为了简化,我们略去政府领域和国际贸易,因此NX 和G 均为零。

(一)消费函数随着收入增加消费需求也会提高,收入和消费之间存在着正向的关系。

消费水平和收入水平之间究竟存在一种什么样的函数关系呢?不同的消费理论对此有不同的描述。

我们在此介绍的是凯恩斯的消费理论。

凯恩斯消费函数可以用下式来表示:C C cY =+ (C >0,01c <<) 变量C ,即函数的截距,表示收入为零时的消费水平;系数c ,即函数的斜率,有一个特别的名称,我们将其成为边际消费倾向。

边际消费倾向是指收入增加一个单位所增加的消费。

因为C Y S -≡ 所以,将cY C C += (C >0,1<<c o )代入上式得出Y c C cY C Y C Y S )1(-+-=--=-≡)1(c -为边际储蓄倾向,即c s -=1(二)总需求与自主支出现在,在消费需求的基础上,将政府支出、税收和对外贸易加入模型。

但暂时假定每类需求都是自主的,即在模型之外决定的,特别地不取决于收入。

第10章收入与支出10.1 复习笔记一、总需求与均衡产出1.总需求概述(1)总需求的含义与构成总需求指整个经济社会在每一个价格水平下对产品和劳务的需求总量,它由消费需求、投资需求、政府支出和国外需求构成。

将商品需求区分为消费()、投资()、政府采购()、与净出口()等需求,则总需求()由下面的公式决定:(2)总需求与国民收入核算中总支出的区别①总需求指计划(意愿)支出量;国民收入中的总支出是指实际发生量;②一般而言在消费、政府采购、以及净出口方面两者不存在差异;③关键在于计划投资与实际投资之间的差别,在实际发生的投资中往往会出现非计划的存货投资。

2.均衡产出(1)均衡产出水平的含义均衡产出水平指总供给和总需求相一致时的产出水平。

经济社会的产量或者国民收入决定于总需求,均衡产出是和总需求相一致的产出,也就是经济社会的收入正好等于全体居民和企业想要有的产出。

当下式成立时,经济处于均衡产出水平状态:(2)非计划库存投资与产量调节机制当总需求即人们想要购买的量与产出不相等时,则存在非计划库存投资或负投资。

可将其概括为:,其中为非计划的库存投资。

①如果产出大于总需求,就有非计划库存投资,此时存在超额库存积累,企业会减少生产,直到产出与总需求再度均衡为止。

②如果产出低于总需求,,企业将增加生产直至均衡恢复为止。

③在均衡状态下,非计划存货投资为零,,企业没有增加或减少产出的激励。

以上论述的以存货调整为基础的产量调节机制如图10-1所示。

图10-1 产出调节机制3.基本结论(1)总需求决定均衡产出(收入)水平(2)在均衡时,非计划库存投资等于零,而且消费者、政府以及外国居民都买到了他们想要购买的商品。

(3)以非计划库存变化为基础的产量调整将使经济达到均衡水平。

二、消费函数与总需求1.消费函数(1)假定条件①不考虑政府部门和对外贸易的影响,即与;②消费需求随收入水平的提高而增加。

(2)消费函数消费函数是描述消费与诸种影响因素之间的数学关系的函数。

多恩布什宏观经济学第十版课后习题答案09CHAPTER 9INCOME AND SPENDINGSolutions to the Problems in the Textbook:Conceptual Problems:1. In the Keynesian model, the price level is assumed to be fixed, that is, the AS-curve is horizontal andthe level of output is determined solely by aggregate demand. The classical model, on the other hand, assumes that prices always fully adjust to maintain a full-employment level of output, that is, the AS-curve is vertical. Since the model of income determination in this chapter assumes that the price level is fixed, it is a Keynesian model.2. An autonomous variable’s value is determined outside ofa given model. In this chapter the followingcomponents of aggregate demand have been specified as being autonomous: autonomous consumption (C*) autonomous investment (I o), government purchases (G o), lump sum taxes (TA o), transfer payments (TR o), and net exports (NX o).3.Since it often takes a long time for policy makers to agree on a specific fiscal policy measure, it isquite possible that economic conditions may drastically change before a fiscal policy measure is implemented. In these circumstances a policy measure can actually be destabilizing. Maybe the economy has already begun to move out of a recession before policy makers have agreed to implement a tax cut. If the tax cut is enacted at a time when the economy is already beginning to experience strong growth, inflationary pressure can be created.While such internal lags are absent with automatic stabilizers (income taxes, unemployment benefits, welfare), these automatic stabilizers are not sufficient to replace active fiscal policy when the economy enters a deep recession.4. Income taxes, unemployment benefits, and the welfare system are often called automatic stabilizerssince they automatically reduce the amount by which output changes as a result of a change in aggregate demand. These stabilizers are a part of the economic mechanism and therefore work without any case-by-case government intervention. For example, when output declines and unemployment increases, there may be an increase in the number of people who fall below the poverty line. If we had no welfare system or unemployment benefits, then consumption would drop significantly. But since unemployed workers get unemployment compensation and people living in poverty are eligible for welfare payments, consumption will not decrease as much. Therefore, aggregate demand may not be reduced by as much as it would have without these automatic stabilizers.5. The full-employment budget surplus is the budget surplus that would exist if the economy were at thefull-employment level of output, given the current spending or tax structure. Since the size of the full-employment budget surplus does not depend on the position in the business cycle and only changes when the government implements a fiscal policy change, the full-employment budget surplus can be used as a measure of fiscal policy. Other names for the full-employment budget surplus are the structural budget surplus, the cyclically adjusted surplus, the high-employment surplus, and the standardized employment surplus. These names may bepreferable, since they do not suggest that there is a specific full-employment level of output that we were unable to maintain.Technical Problems:1.a. AD = C + I = 100 + (0.8)Y + 50 = 150 + (0.8)YThe equilibrium condition is Y = AD ==>12 Y = 150 + (0.8)Y ==> (0.2)Y = 150 ==> Y = 5*150 = 750.1.b. Since TA = TR = 0, it follows that S = YD - C = Y - C. ThereforeS = Y - [100 + (0.8)Y] = - 100 + (0.2)Y ==> S = - 100 +(0.2)750 = - 100 + 150 = 50.1.c. If the level of output is Y = 800, then AD = 150 + (0.8)800 = 150 + 640 = 790.Therefore the amount of involuntary inventory accumulation is UI = Y - AD = 800 - 790 = 10.1.d. AD' = C + I' = 100 + (0.8)Y + 100 = 200 + (0.8)YFrom Y = AD' ==> Y = 200 + (0.8)Y ==> (0.2)Y = 200 ==> Y = 5*200 = 1,000Note: This result can also be achieved by using the multiplier formula:Y = (multiplier)(?Sp) = (multiplier)(?I) ==> ?Y = 5*50 = 250, that is, output increases from Y o = 750 to Y 1 = 1,000.1.e. From 1.a. and 1.d. we can see that the multiplier is 5.1.f. Sp2001500 750 1,000 Y2.a. Since the mpc has increased from 0.8 to 0.9, the size of the multiplier is now larger and we shouldtherefore expect a higher equilibrium income level than in 1.a.AD = C + I = 100 + (0.9)Y + 50 = 150 + (0.9)Y ==>Y = AD ==> Y = 150 + (0.9)Y ==> (0.1)Y = 150 ==> Y = 10*150 = 1,500.2.b. From ?Y = (multiplier)(?I) = 10*50 = 500 ==> Y 1 = Y o + ?Y = 1,500 + 500 = 2,000.2.c. Since the size of the multiplier has doubled from 5 to 10, the change in output (Y) that results from achange in investment (I) now has also doubled from 250 to 500.2001503.a. AD = C + I + G + NX = 50 + (0.8)YD + 70 + 200 = 320 + (0.8)[Y - (0.2)Y + 100]= 400 + (0.8)(0.8)Y = 400 + (0.64)YFrom Y = AD ==> Y = 400 + (0.64)Y ==> (0.36)Y = 400==> Y = (1/0.36)400 = (2.78)400 = 1,111.11The size of the multiplier is (1/0.36) = 2.78.3.b. BS = tY - TR - G = (0.2)(1,111.11) - 100 - 200 = 222.22 - 300 = - 77.783.c. AD' = 320 + (0.8)[Y - (0.25)Y + 100] = 400 + (0.8)(0.75)Y = 400 + (0.6)YFrom Y = AD' ==> Y = 400 + (0.6)Y ==> (0.4)Y = 400 ==> Y = (2.5)400 = 1,000The size of the multiplier is now reduced to 2.5.3.d. BS' = (0.25)(1,000) - 100 - 200 = - 50BS' - BS = - 50 - (-77.78) = + 27.78The size of the multiplier and equilibrium output will both increase with an increase in the marginal propensity to consume.Therefore income tax revenue will also go up and the budget surplus should increase.3.e. If the income tax rate is t = 1, then all income is taxed. There is no induced spending and equilibriumincome only increases by the change in autonomous spending, that is, the size of the multiplier is 1.From Y = C + I + G ==> Y = C o + c(Y - 1Y + TR o) + I o + G o==> Y = C o + cTR o + I o + G o = A o4. In Problem 3.d. we had a situation where the following was given:Y = 1,000, t = 0.25, G = 200 and BS = - 50.Assume now that t = 0.3 and G = 250 ==>AD' = 50 + (0.8)[Y - (0.3)Y + 100] + 70 + 250 = 370 + (0.8)(0.7)Y + 80 = 450 + (0.56)Y.From Y = AD' ==> Y = 450 + (0.56)Y ==> (0.44)Y = 450==> Y = (1/0.44)450 = 1,022.73BS' = (0.3)(1,022.73) - 100 - 250 = 306.82 - 350 = - 43.18BS' - BS = -43.18 - (-50) = + 6.82The budget surplus has increased, since the increase in tax revenue is larger than the increase in government purchases.5.a. While an increase in government purchases by ?G = 10 will change intended spending by ?Sp = 10,a decrease in government transfers by ?TR = -10 will change intended spending by a smaller amount,that is, by only ?Sp = c(?TR) = c(-10). The change in intended spending equals ?Sp = (1 - c)(10) and equilibrium income should therefore increase byY = (multiplier)(1 - c)10.5.b. If c = 0.8 and t = 0.25, then the size of the multiplier isα = 1/[1 - c(1 - t)] = 1/[1 - (0.8)(1 - 0.25)] = 1/[1 - (0.6)] = 1/(0.4) = 2.5.The change in equilibrium income isY = α(?A o) = α[?G + c(?TR)] = (2.5)[10 + (0.8)(-10)] = (2.5)2 = 55.c. ?BS = t(?Y) - ?TR - ?G = (0.25)(5) - (-10) - 10 = 1.25Additional Problems:1. "An increase in the marginal propensity to save increases the impact of one additional dollar inincome on consumption." Comment on this statement. In your answer discuss the effect of sucha change in the mps on the size of the expenditure multiplier.The fact that the marginal propensity to save (1 - c) has risen implies that the marginal propensity to consume (c) has fallen. This means that now one extra dollar in income earned will affect consumption by3less than before the reduction in the mpc. When the mpc is high, one extra dollar in income raises consumption by more than when the mpc is low. If the mps is larger, then the expenditure multiplier will be larger, since the expenditure multiplier is defined as 1/(1-c).2. Using a simple model of the expenditure sector without any government involvement, explainthe paradox of thrift that asserts that a desire to save may not lead to an increase in actual saving.The paradox of thrift occurs because the desire to increase saving leads to a lower consumption level. But a lower level of spending sends the economy into a recession and we get a new equilibrium at a lower level of output. In the end, the increase inautonomous saving is exactly offset by the decrease in induced saving due to the lower income level. In other words, the economy is in equilibrium when S = I o. Since the level of autonomous investment (I o) has not changed, the level of saving at the new equilibrium income level must also equal I o.This can also be derived mathematically. Since an increase in desired saving is equivalent to a decrease in desired consumption, that is, ?C o = -?S o, the effect on equilibrium income is ?Y = [1/(1 - c)](?C o) = [1/(1 - c)](-?S o).Therefore the overall effect on total saving isS = s(?Y) + ?S o = [s/(1 - c)](-?S o) + ?S o = 0, since s = 1 - c.3. "When aggregate demand falls below the current output level, an unintended inventoryaccumulation occurs and the economy is no longer in an equilibrium." Comment on this statement.If aggregate demand falls below the equilibrium output level, production exceeds desired spending. When firms see an unwanted accumulation in their inventories, they respond by reducing production. The level of output falls and eventually reaches a level at which total output equals desired spending. In other words, the economy eventually reaches a new equilibrium at a lower value of output.4. For a simple model of the expenditure sector without any government involvement, derive themultiplier in terms of the marginal propensity to save (s) rather than the marginal propensity to consume (c). Does this formula still hold when the government enters the picture and levies an income tax?In the text, the expenditure multiplier for a model without any government involvement was derived as α = 1/(1 - c).But since the marginal propensity to save is s = 1 - c, the multiplier now becomes α = 1/s = 1/(1-c).In the text, we have also seen that if the government enters the picture and levies an income tax, then the simple expenditure multiplier changes toα = 1/[1 - c(1 - t)] = 1/(1 - c').By substituting s = 1 - c, this equation can be easily manipulated, to getα’ = 1/[1 - c + ct] = 1/[s + (1 - s)t] = 1/s'.Just as s = 1 – c, we can say that s' = 1 - c', sinces' = 1 - c' = 1 - c(1 - t) = 1 - c + ct = s + (1 - s)t.This can also be derived in another way:S = YD - C = YD - (C* + cYD) = - C* + (1 - c)YD = - C* + sYD If we assume for simplicity that TR = 0 and NX = 0, thenS + TA = I + G ==> - C* + sYD + TA = I* + G* ==>s(Y - tY - TA*) + tY + TA* = C* + I* + G* ==>4[s + (1 - s)t]Y = C* + I* + G* - (1 - s)TA* = A* ==>Y = (1/[s + (1 - s)t])A* = (1/s')A*.5. The balanced budget theorem states that the government can stimulate the economy withoutincreasing the budget deficit if an increase in government purchases (G) is financed by an equivalent increase in taxes (TA). Show that this is true for a simple model of the expenditure sector without any income taxes.If taxes and government purchases are increased by the same amount, then the change in the budget surplus can be calculated asBS = ?TA o - ?G = 0, since ?TA o = ?G.The resulting change in national income isY = ?C + ?G = c(?YD) + ?G = c(?Y - ?TA o) + ?G= c(?Y) - c(?TA o) + ?G = c(?Y) + (1 - c)(?G) since ?TA o = ?G.==> (1 - c)(?Y) = (1 - c)(?G) ==> ?Y = ?GIn this case, the increase in output (Y) is exactly of the same magnitude as the increase in government purchases (G). This occurs since the decrease in the level of consumption due to the higher lump sum tax has exactly been offset by the increase in the level of consumption caused by the increase in income.6. Assume a model without income taxes and in which the only two components of aggregatedemand are consumption and investment. Show that, in this case, the two equilibrium conditions Y = C + I and S = I are equivalent.We can derive the equilibrium value of output by setting actual income equal to intended spending, that is, Y = C + I ==> Y = C* + cY + I* ==> (1 - c)Y = C* + I* ==> Y = [1/(1 - c)](C* + I*) = [1/(1 - c)]A*.But since S = YD - C = Y - [C* + cY] = - C* + (1 - c)Y,we can derive the same result fromS = I* ==> S = - C* + (1 - c)Y = I*==> (1 - c)Y = C* + I* ==> Y = [1/(1 - c)](C* + I*) = [1/(1 -c)]A* .7. In an effort to stimulate the economy in 1976, President Ford asked Congress for a $20 billiontax cut in combination with a $20 billion cut in government purchases. Do you consider this a good policy proposal? Why or why not?This is not a good policy proposal. According to the balanced budget theorem, equal decreases in government purchases and taxes will decrease rather than increase income. Therefore theintended result would not be achieved.8. Assume the following model of the expenditure sector:Sp = C + I + G + NX C = 420 + (4/5)YD YD = Y - TA + TR TA = (1/6)YTR o = 180 I o = 160 G o = 100 NX o = - 40(a) Assume the government would like to increase the equilibrium level of income (Y) to thefull-employment level Y*= 2,700. By how much should government purchases (G) be changed?(b) Assume we want to reach Y*= 2,700 by changing government transfer payments (TR)instead. By how much should TR be changed?(c) Assume you increase both government purchases (G) and taxes (TA) by the same lump sumof ?G = ?TA o= + 300. Would this change in fiscal policy be sufficient to reach the full-employment level of output at Y* = 2,700? Why or why not?(d) Briefly explain how a decrease in the marginal propensity to save would affect the size of theexpenditure multiplier.5a. Sp = C + I + G + NX = 420 + (4/5)[Y - (1/6)Y + 100] + 160 + 180 - 40= 720 + (4/5)(5/6)Y + 80 = 800 + (2/3)YFrom Y = Sp ==> Y = 800 + (2/3)Y ==> (1/3)Y = 800 ==>Y = 3*800 = 2,400==> the expenditure multiplier is α = 3From ?Y = α(?A o) ==> 300 = 3(?A o) ==> (?A o) = 100Thus government purchases should be changed by ?G = ?A o = 100.b. Since ?A o = 100 and ?A o = c(?TR o) ==>100 = (4/5)(?TR o) ==> ?TR o = 125.c. This is a model with income taxes, so the balanced budget theorem does not apply in its strictest form,which states that an increase in government purchases and taxes by a certain amount increases national income by that same amount, leaving the budget surplus unchanged. Here total tax revenue actually increases by more than 100, since taxes are initially increased by a lump sum of 100, but then income taxes also change due to the change in income. Thus income does not increase by ?Y = 300, as we can see below.Y = α(?G) + α[(-c)(αTA o) = 3*300 + 3*[-(4/5)300] = 900 - 720 = 180This change in fiscal policy will increase income by only ?Y = 180, from Y0 = 2,400 to Y1 = 2,580, and we will be unable to reach Y* = 2,700.d. If the marginal propensity to save decreases, people spend a larger portion of their additionaldisposable income, that is, the mpc and the slope of the [C+I+G+NX]-line increase. This will lead to an increase in the expenditure multiplier and equilibrium income.9. Assume a model with income taxes similar to the model in Problem 9 above. This time, however,you have only limited information about the model, that is, you only know that the marginal propensity to consume out of disposable income is c = 0.75, and that total autonomous spending is A o = 900, such that Sp = A o + c'Y = 900 + c'Y. You also know that you can reach the full-employment level of output at Y* = 3,150 by increasing government transfers by a lump sum of ?TR = 200.(a) What is your current equilibrium level?(b) Is it possible to determine the size of the expenditure multiplier with the information youhave?(c)Assume you want to change the income tax rate (t) in order to reach the full-employmentlevel of income Y* = 3,150. How would this change in the income tax rate affect the size of the expenditure multiplier?a. Since ?A = c(?TR) = (0.75)200 = 150,the new [C+I+G+NX]-line is of the form Sp1 = 1,050 + c1Y.For each model of the expenditure sector we can derive the equilibrium level of income by using the following equation: Y* = αA o = 1/(1-c’) ==> 3,150 = α1,050 ==> the expend iture multiplier is α = 3.If we now change autonomous spending by ?A = 150, then income will have to change by ?Y = α(?A) ==> ?Y = 3*150 = 450.Therefore the old equilibrium level of income must have been Y = 3,150 - 450 = 2,700.b. From our work above we can see that the size of the multiplier is α = 3.c. The new [C+I+G+NX]-line is of the form Sp2 = 900 + c2Y. This new intended spending line intersectsthe 45-degree line at Y = 3,150. Thus the slope of the new intended spending line can be derived as c2= (3,150 - 900)/(3,150) = 5/7.From Y = Sp2 ==> Y = 900 + (5/7)Y ==> (2/7)Y = 900 ==> Y = (7/2)900 = (3.5)900 = 3,150.6The new value of the multiplier is 3.5Sp3,1509002,700 3,150 Y10. Assume you have the following model of the expenditure sector:Sp = C + I + G + NX C = 400 + (0.8)YD I o = 200 G o = 300 + (0.1)(Y* - Y) YD = Y - TA + TR NX o = - 40 TA = (0.25)Y TR o =50(a) What is the size of the output gap if potential output is at Y* = 3,000?(b) By how much would investment (I) have to change to reach equilibrium at Y* = 3,000, andhow does this change affect the budget surplus?(c) From the model above you can see that government purchases (G) are counter-cyclical, thatis they are increased as national income decreases. If youcompare this specification of G with a constant level of G, how is the value of the expenditure multiplier affected?(d) Assume the equation for net exports is changes such that NX o = - 40 is now NX1 = - 40 - mY,with 0 < m < 1. How would this affect expenditure multiplier?a. Sp = 400 + (0.8)YD + 200 + 300 + (0.1)(3,000 - Y) - 40= 1,160 + (0.8)(Y - (0.25)Y + 50) - (0.1)Y = 1,200 + [(0.8)(0.75) - (0.1)]Y = 1,200 + (0.5)Y Y = Sp ==> Y = 1,200 + (0.5)Y ==> (0.5)Y = 1,200 ==>Y = 2*1,200 = 2,400The output gap is Y* - Y = 3,000 - 2,400 = 600.b. From ?Y = (mult.)(?A) ==> 600 = 2(?I) ==> ?I = 300BuS = TA - TR - G = (0.25)(2,400) - 50 - [300 + (0.1)(600)] = 600 - 50 - 300 - 60 = 190BuS* = (0.25)(3,000) - 50 - 300 = 400, so the budget surplus increases by ?BuS = 210.c. If government purchases are used as a stabilization tool, the size of the multiplier should be lower thanif the level of government spending is fixed. In the model of the expenditure sector above, the slope of the [C+I+G+NX]-line is c' = 0.5 compared to c" = 0.6, when government purchases were defined as G = 300.d.With this change, net exports decrease as national income increases. This additional leakage impliesthat the size of the multiplier will decrease. In the model above, the slope of the [C+I+G+NX]-line decreases from c' = (0.5) to c" = (0.5) - m. Therefore the expenditure multiplier will decrease from 1/[1 - (0.5)] to 1/[1 - (0.5) + m].711. Assume you have the following model of the expenditure sector:Sp = C + I + G + NX C = C o + cYD YD = Y - TA + TR TA = TA oTR = TR o I = I o G = G o NX = NX o(a) If a decrease in income (Y) by 800 leads to a decrease in savings (S) by 160, what is the sizeof the expenditure multiplier?(b) If a decrease in taxes (TA) by 400 leads to an increase in income (Y) by 1,200, how large isthe marginal propensity to save?(c) If an increase in imports by 200 (?NX = - 200) leads to a decrease in consumption (C) by800, what is the size of the expenditure multiplier?Recall that the expenditure multiplier for such a simple model can be calculated as:α = 1/(1 - c)a. (?S)/(?Y) = 1 - c = (-160)/(-800) = .2 ==> 1/(1 - c) = 1/(.2) = 5 ==> the multiplier is α = 5.b. From (?Y) = α[-c(?TA o)] ==> (?Y)/(?TA o) = (-c)α = (-c)/(1 - c) ==>(1,200)/(-400) = - 3 = (-c)/(1 - c) ==> -3(1 - c) = -c ==> c = 3/4==> mps = 1 - c = 1/4 = 0.25.c. ?Y = ?C + ?NX = -800 + (-200) = - 1,000==> c = (?C)/(?Y) = (-800)/(-1,000) = .8 ==> multiplier = α = 1/(1 - c) = 1/(.2) = 512. Explain why income taxation, the Social Security system, and unemployment insurance areconsidered automatic stabilizers.Income taxes, unemployment benefits, and the Social Security system are often called automatic stabilizers becausethey reduce the amount by which output changes as a result of a change in aggregate demand. These stabilizers are a part of the structure of the economy and therefore work without any actual government intervention. For example, when output declines and unemployment increases. If we had no unemployment insurance, people out of work would not receive any disposable income and then consumption would drop significantly. But since unemployed workers get unemployment compensation, consumption will not decrease as much. Therefore, aggregate demand may not be reduced by as much as it would have without these automatic stabilizers.13. Assume a simple model of the expenditure sector with a positive income tax rate (t). Showmathematically how an increase in lump sum taxes (TA o ) would affect the budget surplus. From BS = TA - G - TR = tY + TA o - G – TR==> ?BS = t(?Y) + ?TA o = t(mult.)(-c)(?TA o) + ?TA o= t[1/(1 - c + ct)](-c)(?TA o) + ?TA o = ([ -(ct) + 1 - c + (ct)]/[1 - c + (ct)])(?TA o)= (1 - c) /[1 - c + (ct)])(?TA o) > 0, since c < 1In other words, a lump sum tax increase would increase the budget surplus.14. True or false? Why?"A tax cut will increase national income and will therefore always increase the budget surplus." False. Although a tax cut raises national income, not all of the increase in income is spent, nor is it completely taxed away. Income tax revenues fall and the budget deficit rises. Assume the following model of the expenditure sector:Sp = C + I + G + NX I = I oC = C o + cYD G = G oYD = Y - TA +TR NX = NX oTA = TA o + tY BS = TA - G - TRTR = TR o8From Y = Sp ==> Y = C o + c(Y - TA o - tY + TR o) + I o + G o + NX o ==>Y = C o - cTA o + cTR o + I o + G o + NX o + c(1 - t)Y = A o + c'Y ==>Y = [1/(1 - c')]A o with c' = c (1- t)Thus ?Y = [1/(1 - c')][(-c)(?TA o)]and ?BS = t(?Y) + (?TA o) = {[t(-c)]/(1 - c') + 1}(?TA o) ==> = {[-(ct) + 1 - c + (ct)]/[1 - c + (ct)]}(?TA o) = {(1 - c)/[1 - c + (ct)]}(?TA o) > 0 if ?TA > 0. Therefore, if taxes fall, that is, if ?TA < 0, the budget surplus decreases.15. Assume a simple model of the expenditure sector with a positive income tax rate (t). Showmathematically how a decrease in autonomous investment (I o ) would affect the budget surplus.A decrease in autonomous investment (I o) will have a multiplier effect and will therefore decrease national income and tax revenue. The budget surplus will decrease as shown below: ?BS = t(?Y) = tα(?I o) < 016. "An increase in government purchases will always pay for itself, as it raises national income andhence the government's tax revenues." Comment on this statement.An increase in government purchases will increase the budget deficit. If we assume a model of the expenditure sectorwith income taxes, then the multiplier equals [1/(1 - c')] with c' = c (1- t). The change in the budget surplus that arises from a change in government purchases can be calculated as ?BS = t(?Y) - ?G = t[1/(1 - c')](?G) - ?G = {[t - 1 + c - (ct)]/[1 - c + (ct)]}(?G) = - {[(1 - c)(1 - t)]/(1 - c + (ct)]}(?G) < 0, sine ?G > 0.Therefore, if government purchases are increased, the budget surplus will decrease.17. Is the size of the actual budget surplus always a good measure for determining fiscal policy?What about the size of the full-employment budget surplus?The actual budget surplus has a cyclical and a structural component. The cyclical component of the budget surplus changes with changes in the level of income whether or not any fiscal policy measure has been implemented. This implies that the actual budget surplus also changes with changes in income and is therefore not a very good measure for assessing fiscal policy. The structural (full-employment) budget surplus is calculated under the assumption that the economy is at full-employment. It therefore changes only with a change in fiscal policy and is a much better measure for fiscal policy than the actual budget surplus. One should keep in mind, however, that the balanced budget theorem implies that the government can stimulate national income by an equivalent and simultaneous increase in taxes and government purchases, thereby affecting the actual or the full-employment budget surplus.18. Assume a model of the expenditure sector with income taxes, in which people who pay taxes,have a higher marginal propensity to consume than people who receive government transfers, and the consumption function is of the following form: C = C o + c(Y - TA) + dTR, withc < d.(a) What will happen to the equilibrium level of income and the budget surplus if governmentpurchases are reduced by the same lump sum amount as taxes?(b) W hat will happen to the equilibrium level of income and the budget surplus if governmenttransfers are reduced by the same lump sum amount as taxes?a. Assume that ?TA o = ?G = - 100 ==>Y = [(-c)/(1 - c')(?TA o) + [1/(1 - c')](?G) = [(1 - c)/(1 - c')](-100) < 0 c' = c(1 - t)National income would decrease.BS = t(?Y) + ?TA o - ?G = t(?Y) < 09The budget surplus would decrease by the loss in income tax revenue.b. Assume that ?TA o = ?TR o = - 100 ==>Y = [(-c)/(1 - c')](?TA o) + [d/(1 - c')](?TR o) = [(d - c)/(1 - c')](-100) < 0 c' = c(1 - t)National income would increase.BS = t(?Y) + ?TA o - ?TR o = t(?Y) < 0The budget surplus would decrease.19. True or false? Why?"The higher the marginal propensity to import, the lower the size of the multiplier."True. Imports represent a leakage out of the income flow. An increase in autonomous spending will raise income and we will see the usual multiplier effect. However, if imports are positively related to income, this effect is reduced since higher imports reduce the level of domestic demand.Closed Economy Model Open Economy ModelSp = C + I + G Sp = C + I + G + NXC = C o + cY C = C o + cYG = G o G = G oI = I o I = I oNX = NX o - mY with m > 0From Y = Sp ==>Y = (C o + I o + G o) + cY Y = (C o + I o + G o + NX o) + (c - m)YY = A o + cY Y = A o + (c - m)YY = [1/(1 - c)]A o Y = [1/(1 - c + m)]A oTherefore the multiplier is defined as[1/(1 - c)] [1/(1 - c + m)]Clearly the open economy multiplier falls short of the closed economy multiplier. This is because leakages reduce demand. If income taxes were included in these models, they too would reduce the multipliers, as income taxes represent another leakage from the income flow.10。