概率复习题2 西南财经大学天府学院

- 格式:doc

- 大小:181.00 KB

- 文档页数:6

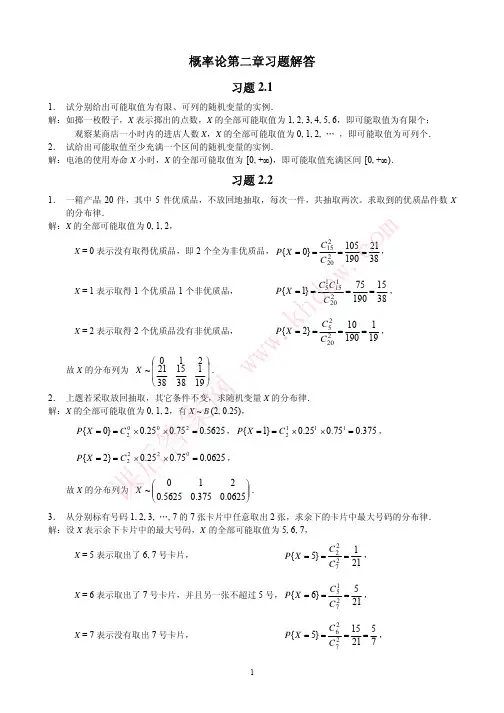

考试科目: 概率与数理统计 本一、单项选择(5*4=20分)1、设X 服从标准正态分布N (0,1),则D (X+3)=( ) A. 0 B.1 C.3 D.9分布律为:的元),统计表明,他们案的净利润(单位:万分别表示甲、乙投资方、分)二、(估计的无偏)为(的一个样本,下列各项为,,设总体)()()()),则有((,分布函数为的分布律为离散随机变量,,,已知)是统计量(下列四项中,哪一个不为未知,为已知,的一个样本,其中是来自总体,,设Y X X X D XX X C X B X X X A X X X X N X F D F C F B A x F X D C B A B A P A B P B P A P X X X D X X C XX X B X A N X X X 105.0.3321.2.32..321),2,((.57.02.8.02.12.7.0.3.01.0210.48.0.7.0.6.0.5.0.)()(8.06.0)(5.0)(.3)(21..3321.1.2)2,(321.232232123222132+++-+Θ====⎪⎪⎭⎫⎝⎛====++-+++μσμαασμσμσμ请选用适当的指标(即随机变量的数字特征),比较甲乙哪个方案更好? 三、(20分)假定创新科技产品产量与成本的资料如下表所示:创新科技产品产量与成本的资料表月份123456X 50 20 -100Y 60 10 -80 P 0.6 0.3 0.1P0.5 0.4 0.1产量x (千件) 2 2.5 3 5 4 4 单位成本Y (元/件) 757372686970对其进行回归分析结果如下:Coefficients 标准误差 T Stat P-value Intercept 79.10067114 0.832931603 94.96658653 7.37135 X V ariable 1 -2.322147650.2336496-9.938590320.000575565根据上述结果:1) 确定单位成本Y 对产量x 的回归方程;(小数点后保留两位有效数字) 2) 判断线性回归效果的显著性,并给出理由; 3) 产量为8千件时,预测相应的单位成本。

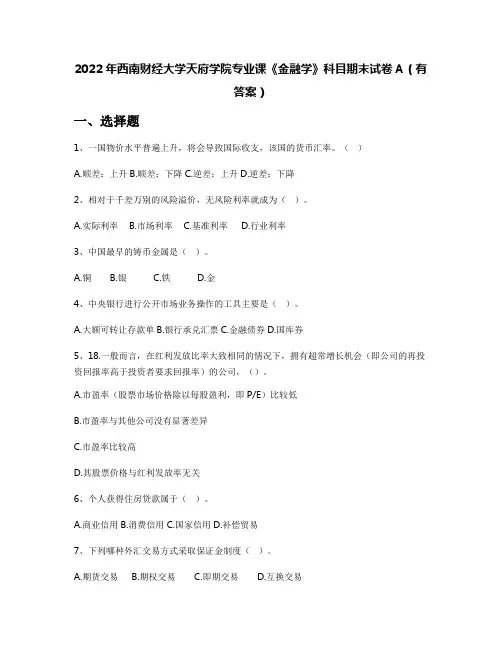

2022年西南财经大学天府学院专业课《金融学》科目期末试卷A(有答案)一、选择题1、一国物价水平普遍上升,将会导致国际收支,该国的货币汇率。

()A.顺差:上升B.顺差;下降C.逆差;上升D.逆差;下降2、相对于千差万别的风险溢价,无风险利率就成为()。

A.实际利率B.市场利率C.基准利率D.行业利率3、中国最早的铸币金属是()。

A.铜B.银C.铁D.金4、中央银行进行公开市场业务操作的工具主要是()。

A.大额可转让存款单B.银行承兑汇票C.金融债券D.国库券5、18.一般而言,在红利发放比率大致相同的情况下,拥有超常增长机会(即公司的再投资回报率高于投资者要求回报率)的公司,()。

A.市盈率(股票市场价格除以每股盈利,即P/E)比较低B.市盈率与其他公司没有显著差异C.市盈率比较高D.其股票价格与红利发放率无关6、个人获得住房贷款属于()。

A.商业信用B.消费信用C.国家信用D.补偿贸易7、下列哪种外汇交易方式采取保证金制度()。

A.期货交易B.期权交易C.即期交易D.互换交易8、剑桥方程式重视的是货币的()。

A.媒介功能B.交易功能C.避险功能D.资产功能9、个人获得住房贷款属于()。

A.商业信用B.消费信用C.国家信用D.补偿贸易10、资本流出是指本国资本流到外国,它表示()。

A.外国对本国的负债减少B.本国对外国的负债增加C.外国在本国的资产增加D.外国在本国的资产减少11、L公司刚支付了2.25元的股利,并预计股利会以5%每年的速度增长,该公司的风险水平对应的折现率为11%,该公司的股价应与以下哪个数值最接近?()A.20.45元B.21.48元C.37.50元D.39.38元12、关于马科维茨投资组合理论的假设条件,描述不正确的是()。

A.证券市场是有效的B.存在一种无风险资产,投资者可以不受限制地借入和贷出C.投资者都是风险规避的D.投资者在期望收益率和风险的基础上选择投资组合13、易受资本结构影响的财务指标有()。

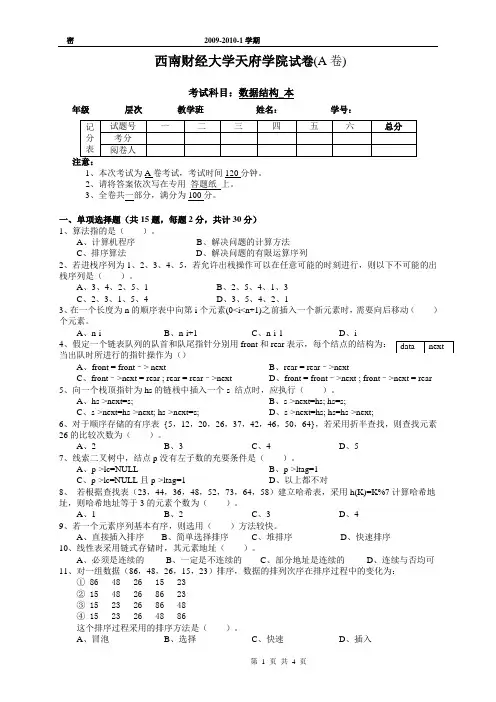

密 2009-2010-1学期西南财经大学天府学院试卷(A 卷)考试科目:数据结构_本年级 层次 教学班 姓名: 学号:1、本次考试为A 卷考试,考试时间120分钟。

2、请将答案依次写在专用 答题纸 上。

3、全卷共一部分,满分为100分。

一、单项选择题(共15题,每题2分,共计30分)1、算法指的是( )。

A 、计算机程序B 、解决问题的计算方法C 、排序算法D 、解决问题的有限运算序列2、若进栈序列为1、2、3、4、5,若允许出栈操作可以在任意可能的时刻进行,则以下不可能的出栈序列是( )。

A 、3、4、2、5、1B 、2、5、4、1、3C 、2、3、1、5、4D 、3、5、4、2、13、在一个长度为n 的顺序表中向第i 个元素(0<i<n+1)之前插入一个新元素时,需要向后移动( )个元素。

A 、n-iB 、n-i+1C 、n-i-1D 、i4、假定一个链表队列的队首和队尾指针分别用front 和rear 表示,每个结点的结构为:当出队时所进行的指针操作为()A 、front = front –> nextB 、rear = rear –>nextC 、front –>next = rear ; rear = rear –>nextD 、front = front –>next ; front –>next = rear5、向一个栈顶指针为hs 的链栈中插入一个s 结点时,应执行( )。

A 、hs->next=s;B 、s->next=hs; hs=s;C 、s->next=hs->next; hs->next=s;D 、s->next=hs; hs=hs->next;6、对于顺序存储的有序表 {5,12,20,26,37,42,46,50,64},若采用折半查找,则查找元素26的比较次数为( )。

A 、2B 、3C 、4D 、57、线索二叉树中,结点p 没有左子数的充要条件是( )。

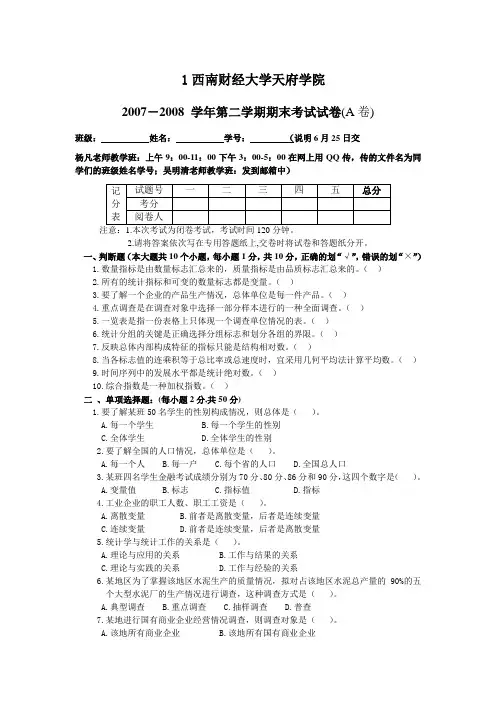

1西南财经大学天府学院2007-2008 学年第二学期期末考试试卷(A卷)班级:姓名:学号:(说明6月25日交杨凡老师教学班:上午9:00-11:00下午3:00-5:00在网上用QQ传,传的文件名为同学们的班级姓名学号;吴明清老师教学班:发到邮箱中)注意:1.本次考试为闭卷考试,考试时间120分钟。

2.请将答案依次写在专用答题纸上,交卷时将试卷和答题纸分开。

一、判断题(本大题共10个小题,每小题1分,共10分,正确的划“√”,错误的划“×”)1.数量指标是由数量标志汇总来的,质量指标是由品质标志汇总来的。

()2.所有的统计指标和可变的数量标志都是变量。

()3.要了解一个企业的产品生产情况,总体单位是每一件产品。

()4.重点调查是在调查对象中选择一部分样本进行的一种全面调查。

()5.一览表是指一份表格上只体现一个调查单位情况的表。

()6.统计分组的关键是正确选择分组标志和划分各组的界限。

()7.反映总体内部构成特征的指标只能是结构相对数。

()8.当各标志值的连乘积等于总比率或总速度时,宜采用几何平均法计算平均数。

()9.时间序列中的发展水平都是统计绝对数。

()10.综合指数是一种加权指数。

()二、单项选择题:(每小题2分,共50分)1.要了解某班50名学生的性别构成情况,则总体是()。

A.每一个学生B.每一个学生的性别C.全体学生D.全体学生的性别2.要了解全国的人口情况,总体单位是()。

A.每一个人B.每一户C.每个省的人口D.全国总人口3.某班四名学生金融考试成绩分别为70分、80分、86分和90分,这四个数字是()。

A.变量值B.标志C.指标值D.指标4.工业企业的职工人数、职工工资是()。

A.离散变量B.前者是离散变量,后者是连续变量C.连续变量D.前者是连续变量,后者是离散变量5.统计学与统计工作的关系是()。

A.理论与应用的关系B.工作与结果的关系C.理论与实践的关系D.工作与经验的关系6.某地区为了掌握该地区水泥生产的质量情况,拟对占该地区水泥总产量的90%的五个大型水泥厂的生产情况进行调查,这种调查方式是()。

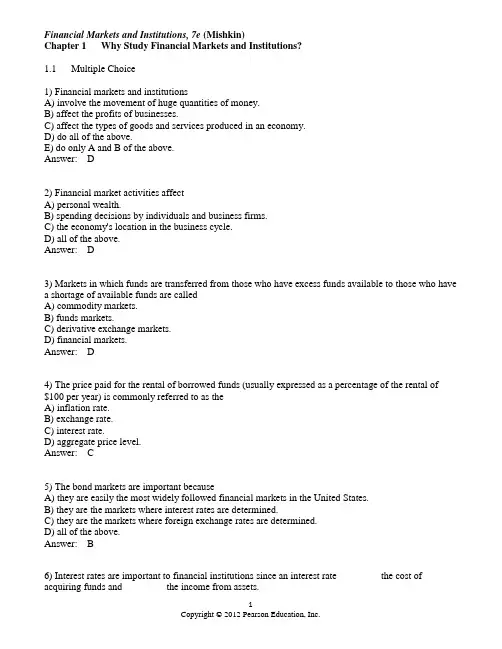

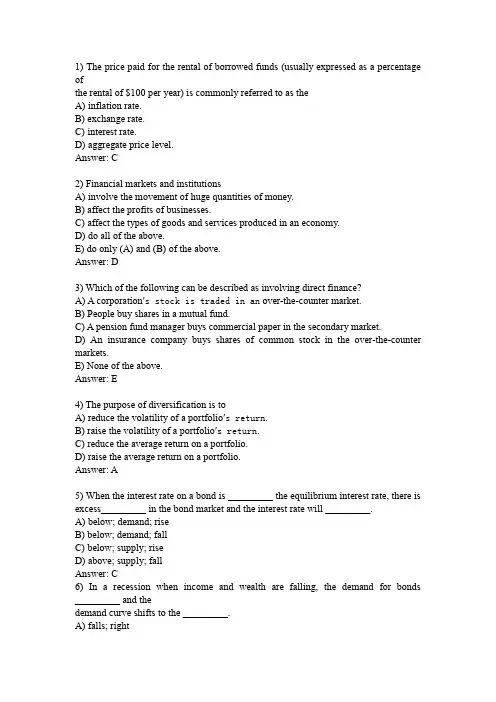

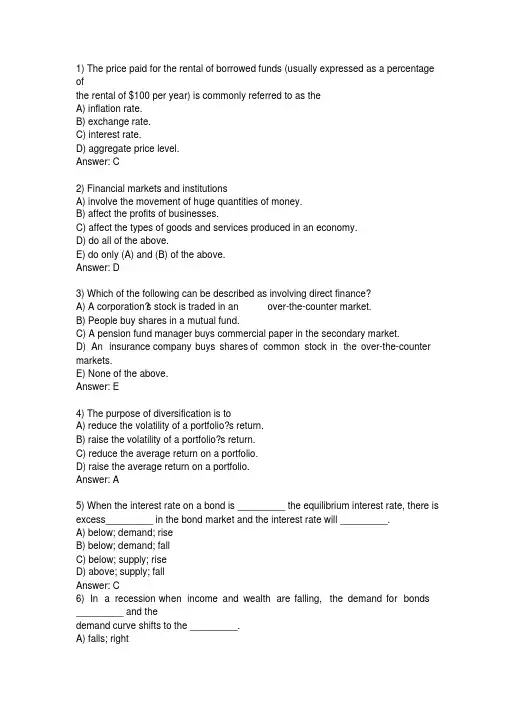

Financial Markets and Institutions, 7e (Mishkin)Chapter 1 Why Study Financial Markets and Institutions?1.1 Multiple Choice1) Financial markets and institutionsA) involve the movement of huge quantities of money.B) affect the profits of businesses.C) affect the types of goods and services produced in an economy.D) do all of the above.E) do only A and B of the above.Answer: D2) Financial market activities affectA) personal wealth.B) spending decisions by individuals and business firms.C) the economy's location in the business cycle.D) all of the above.Answer: D3) Markets in which funds are transferred from those who have excess funds available to those who havea shortage of available funds are calledA) commodity markets.B) funds markets.C) derivative exchange markets.D) financial markets.Answer: D4) The price paid for the rental of borrowed funds (usually expressed as a percentage of the rental of $100 per year) is commonly referred to as theA) inflation rate.B) exchange rate.C) interest rate.D) aggregate price level.Answer: C5) The bond markets are important becauseA) they are easily the most widely followed financial markets in the United States.B) they are the markets where interest rates are determined.C) they are the markets where foreign exchange rates are determined.D) all of the above.Answer: B6) Interest rates are important to financial institutions since an interest rate ________ the cost of acquiring funds and ________ the income from assets.A) decreases; decreasesB) increases; increasesC) decreases; increasesD) increases; decreasesAnswer: B7) Typically, increasing interest ratesA) discourages individuals from saving.B) discourages corporate investments.C) encourages corporate expansion.D) encourages corporate borrowing.E) none of the above.Answer: B8) Compared to interest rates on long-term U.S. government bonds, interest rates on ________ fluctuate more and are lower on average.A) medium-quality corporate bondsB) low-quality corporate bondsC) high-quality corporate bondsD) three-month Treasury billsE) none of the aboveAnswer: D9) Compared to interest rates on long-term U.S. government bonds, interest rates on three-month Treasury bills fluctuate ________ and are ________ on average.A) more; lowerB) less; lowerC) more; higherD) less; higherAnswer: A10) The stock market is important becauseA) it is where interest rates are determined.B) it is the most widely followed financial market in the United States.C) it is where foreign exchange rates are determined.D) all of the above.Answer: B11) Stock prices since the 1980s have beenA) relatively stable, trending upward at a steady pace.B) relatively stable, trending downward at a moderate rate.C) extremely volatile.D) unstable, trending downward at a moderate rate.Answer: C12) The largest one-day drop in the history of the American stock markets occurred inA) 1929.B) 1987.C) 2000.D) 2001.Answer: B13) A declining stock market index due to lower share pricesA) reduces people's wealth and as a result may reduce their willingness to spend.B) increases people's wealth and as a result may increase their willingness to spend.C) decreases the amount of funds that business firms can raise by selling newly issued stock.D) both A and C of the above.E) both B and C of the above.Answer: D14) Changes in stock pricesA) affect people's wealth and their willingness to spend.B) affect firms' decisions to sell stock to finance investment spending.C) are characterized by considerable fluctuations.D) all of the above.E) only A and B of the above.Answer: D15) (I) Debt markets are often referred to generically as the bond market.(II) A bond is a security that is a claim on the earnings and assets of a corporation.A) (I) is true, (II) false.B) (I) is false, (II) true.C) Both are true.D) Both are false.Answer: A16) (I) A bond is a debt security that promises to make payments periodically for a specified period of time.(II) A stock is a security that is a claim on the earnings and assets of a corporation.A) (I) is true, (II) false.B) (I) is false, (II) true.C) Both are true.D) Both are false.Answer: C17) The price of one country's currency in terms of another's is calledA) the foreign exchange rate.B) the interest rate.C) the Dow Jones industrial average.18) A stronger dollar benefits ________ and hurts ________A) American businesses; American consumers.B) American businesses; foreign businesses.C) American consumers; American businesses.D) foreign businesses; American consumers.Answer: C19) A weaker dollar benefits ________ and hurts ________A) American businesses; American consumers.B) American businesses; foreign consumers.C) American consumers; American businesses.D) foreign businesses; American consumers.Answer: A20) From 1980 to early 1985 the dollar ________ in value, thereby benefiting American ________A) appreciated; businesses.B) appreciated; consumers.C) depreciated; businesses.D) depreciated; consumers.Answer: B21) Money is defined asA) anything that is generally accepted in payment for goods and services or in the repayment of debt.B) bills of exchange.C) a riskless repository of spending power.D) all of the above.E) only A and B of the above.Answer: A22) The organization responsible for the conduct of monetary policy in the United States is theA) Comptroller of the Currency.B) U.S. Treasury.C) Federal Reserve System.D) Bureau of Monetary Affairs.Answer: C23) The central bank of the United States isA) Citicorp.B) The Fed.C) Bank of America.D) The Treasury.24) Monetary policy is chiefly concerned withA) how much money businesses earn.B) the level of interest rates and the nation's money supply.C) how much money people pay in taxes.D) whether people have saved enough money for retirement.Answer: B25) Economists group commercial banks, savings and loan associations, credit unions, mutual funds, mutual savings banks, insurance companies, pension funds, and finance companies together under the heading financial intermediaries. Financial intermediariesA) act as middlemen, borrowing funds from those who have saved and lending these funds to others.B) produce nothing of value and are therefore a drain on society's resources.C) help promote a more efficient and dynamic economy.D) do all of the above.E) do only A and C of the above.Answer: E26) Economists group commercial banks, savings and loan associations, credit unions, mutual funds, mutual savings banks, insurance companies, pension funds, and finance companies together under the heading financial intermediaries. Financial intermediariesA) act as middlemen, borrowing funds from those who have saved and lending these funds to others.B) play an important role in determining the quantity of money in the economy.C) help promote a more efficient and dynamic economy.D) do all of the above.E) do only A and C of the above.Answer: D27) Banks are important to the study of money and the economy because theyA) provide a channel for linking those who want to save with those who want to invest.B) have been a source of financial innovation that is expanding the alternatives available to those wanting to invest their money.C) are the only financial institution to play a role in determining the quantity of money in the economy.D) do all of the above.E) do only A and B of the above.Answer: E28) Banks, savings and loan associations, mutual savings banks, and credit unionsA) are no longer important players in financial intermediation.B) have been providing services only to small depositors since deregulation.C) have been adept at innovating in response to changes in the regulatory environment.D) all of the above.E) only A and C of the above.29) (I) Banks are financial intermediaries that accept deposits and make loans.(II) The term "banks" includes firms such as commercial banks, savings and loan associations, mutual savings banks, credit unions, insurance companies, and pension funds.A) (I) is true, (II) false.B) (I) is false, (II) true.C) Both are true.D) Both are false.Answer: A30) ________ was the stock market's worst one-day drop in history in the 1980s.A) Black FridayB) Black MondayC) Blackout DayD) none of the aboveAnswer: B31) The largest financial intermediaries areA) insurance companies.B) finance companies.C) banks.D) all of the above.Answer: C32) In recent yearsA) interest rates have remained constant.B) the success of financial institutions has reached levels unprecedented since the Great Depression.C) stock markets have crashed.D) all of the above.Answer: C33) A securityA) is a claim or price of property that is subject to ownership.B) promises that payments will be made periodically for a specified period of time.C) is the price paid for the usage of funds.D) is a claim on the issuer's future income.Answer: D34) ________ are an example of a financial institution.A) BanksB) Insurance companiesC) Finance companiesD) All of the above35) Monetary policy affectsA) interest rates.B) inflation.C) business cycles.D) all of the above.Answer: D36) A rising stock market index due to higher share pricesA) increases people's wealth and as a result may increase their willingness to spend.B) increases the amount of funds that business firms can raise by selling newly issued stock.C) decreases the amount of funds that business firms can raise by selling newly issued stock.D) both A and B of the above.Answer: D37) From the peak of the high-tech bubble in 2000, the stock market ________ by over ________ by late 2002.A) collapsed; 75%B) rose; 35%C) collapsed; 30%D) rose; 50%Answer: C。

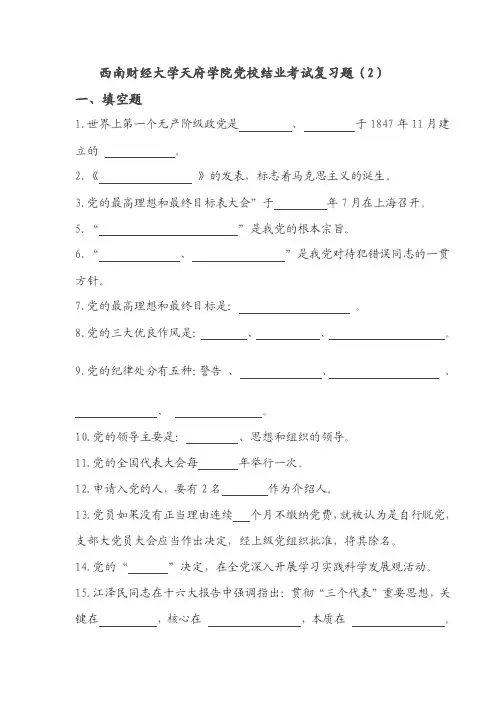

西南财经大学天府学院党校结业考试复习题(2)一、填空题1.世界上第一个无产阶级政党是、于1847年11月建立的。

2.《》的发表,标志着马克思主义的诞生。

3.党的最高理想和最终目标表大会”于年7月在上海召开。

5.“”是我党的根本宗旨。

6.“、”是我党对待犯错误同志的一贯方针。

7.党的最高理想和最终目标是:。

8.党的三大优良作风是:、、。

9.党的纪律处分有五种:警告、、、、。

10.党的领导主要是:、思想和组织的领导。

11.党的全国代表大会每年举行一次。

12.申请入党的人,要有2名作为介绍人。

13.党员如果没有正当理由连续个月不缴纳党费,就被认为是自行脱党,支部大党员大会应当作出决定,经上级党组织批准,将其除名。

14.党的“”决定,在全党深入开展学习实践科学发展观活动。

15.江泽民同志在十六大报告中强调指出:贯彻“三个代表”重要思想,关键在,核心在,本质在。

16.马克思主义有三个组成部分:马克思主义哲学、和。

17.年满岁的中国工人、农民、军人、知识分子和其他社会阶层的,承认党的纲领和章程,愿意参加党的一个组织并且在其中积极工作,和按期缴纳党费的,可以申请加入中国共产党。

18.中国共产党党员永远是的普通一员。

19.党的根本组织原则是:。

20.预备党员的预备期,从之日算起,预备期为。

21.党员的党龄,从之日算起。

22.党的最高领导机关是和。

二.选择题1.把毛泽东思想确立为党的指导思想是在党的。

A、一大B、五大C、七大D、八大2.中共确定全面抗战路线的会议是。

A、洛川会议B、瓦窑堡会议C、遵义会议D、中共“七大”3.对党的决议和政策如有不同意见,在的前提条件下,可以声明保留。

A、向上级反映B、公开反对C、不公开反对D、坚决执行4.我党是最高纲领和阶段性纲领的。

A、过渡论者B、统一论者C、反对论者D、对立论者5.党在新世纪新阶段的奋斗目标是。

A.建设和谐社会 B、全面建设小康社会C、实现政治文明D、实现共产主义6.除了的个人利益与工作职权以外,所有共产党员不得谋求任何私利和特权。

1) The price paid for the rental of borrowed funds (usually expressed as a percentage ofthe rental of $100 per year) is commonly referred to as theA) inflation rate.B) exchange rate.C) interest rate.D) aggregate price level.Answer: C2) Financial markets and institutionsA) involve the movement of huge quantities of money.B) affect the profits of businesses.C) affect the types of goods and services produced in an economy.D) do all of the above.E) do only (A) and (B) of the above.Answer: D3) Which of the following can be described as involving direct finance?A) A corporationʹs stock is traded in an over-the-counter market.B) People buy shares in a mutual fund.C) A pension fund manager buys commercial paper in the secondary market.D) An insurance company buys shares of common stock in the over-the-counter markets.E) None of the above.Answer: E4) The purpose of diversification is toA) reduce the volatility of a portfolioʹs return.B) raise the volatility of a portfolioʹs return.C) reduce the average return on a portfolio.D) raise the average return on a portfolio.Answer: A5) When the interest rate on a bond is _________ the equilibrium interest rate, there is excess_________ in the bond market and the interest rate will _________.A) below; demand; riseB) below; demand; fallC) below; supply; riseD) above; supply; fallAnswer: C6) In a recession when income and wealth are falling, the demand for bonds _________ and thedemand curve shifts to the _________.A) falls; rightB) falls; leftC) rises; rightD) rises; leftAnswer: B7) When people begin to expect a large stock market decline, the demand curve for bonds shifts to the _________ and the interest rate _________.A) right; fallsB) right; risesC) left; fallsD) left; risesAnswer: A8) The spread between interest rates on low quality corporate bonds and U.S. government bonds_________ during the Great Depression.A) was reversedB) narrowed significantlyC) widened significantlyD) did not changeAnswer: C9) If income tax rates were lowered, thenA) the interest rate on municipal bonds would fall.B) the interest rate on Treasury bonds would rise.C) the interest rate on municipal bonds would rise.D) the price of Treasury bonds would fall.Answer: C10) According to the expectations theory of the term structure,A) yield curves should be equally likely to slope downward as to slope upward.B) when the yield curve is steeply upward-sloping, short-term interest rates are expected torise in the future.C) when the yield curve is downward-sloping, short-term interest rates are expected to remain relatively stable in the future.D) all of the above.E) only A and B of the above.Answer:E11) According to the efficient market hypothesisA) one cannot expect to earn an abnormally high return by purchasing a security.B) information in newspapers and in the published reports of financial analysts is alreadyreflected in market prices.C) unexploited profit opportunities abound, thereby explaining why so many people getrich by trading securities.D) all of the above are true.E) only A and B of the above are true.Answer: E12) To say that stock prices follow a ʺrandom walkʺ is to argue thatA) stock prices rise, then fall.B) stock prices rise, then fall in a predictable fashion.C) stock prices tend to follow trends.D) stock prices are, for all practical purposes, unpredictable.Answer:D13) The efficient market hypothesis suggests thatA) investors should purchase no-load mutual funds which have low management fees.B) investors can use the advice of technical analysts to outperform the market.C) investors let too many unexploited profit opportunities go by if they adopt a ʺbuy andholdʺ strategy.D) only A and B of the above are sensible strategies.Answer: A14) Which of the following is empirical evidence indicating that the efficient market hypothesismay not always be generally applicable?A) Small-firm effectB) January effectC) Market OverreactionD) All of the aboveAnswer: D15) An open market purchase of securities by the Fed willA) increase assets of the nonbank public and increase assets of the banking system.B) decrease assets of the nonbank public and increase assets of the Fed.C) decrease assets of the banking system and increase assets of the Fed.D) have no effect on assets of the nonbank public but increase assets of the Fed.E) increase assets of the banking system and decrease assets of the Fed.Answer: D16) Under usual circumstances, an increase in the discount rate causesA) the federal funds rate to fall.B) the federal funds rate to rise.C) no change in the federal funds rate.D) the supply of reserves to increase.E) the supply of reserves to decrease.Answer: C17) Which of the following is not an operating target?A) Nonborrowed reservesB) Monetary baseC) Federal funds interest rateD) Discount rateE) All are operating targets.Answer: D18) Money market instrumentsA) are usually sold in large denominations.B) have low default risk.C) mature in one year or less.D) are characterized by all of the above.E) are characterized by only A and B of the above.Answer: D19) If the Fed wants to lower the federal funds interest rate, it will _________ the banking system by _________ securities.A) add reserves to; sellingB) add reserves to; buyingC) remove reserves from; sellingD) remove reserves from; buyingAnswer: B20) Money market transactionsA) do not take place in any one particular location or building.B) are usually arranged purchases and sales between participants over the phone by tradersand completed electronically.C) both (a) and (b).D) none the the above.Answer: C21) The primary reason that individuals and firms choose to borrow long-term is to reduce the risk that interest rates will fall before they pay off their debt.Answer:False22) Typically, the interest rate on corporate bonds will be higher the more restrictions areplaced on management through restrictive covenants, because the bonds will beconsidered safer by bondholdersAnswer: False23) A change in the current yield always signals a change in the same direction of the yield tomaturity.Answer: True24) A bankʹs balance sheet indicates whether or not the bank is profitable. Answer: False25) Deposits that banks keep in accounts at the Federal Reserve less vault cash is called reserves.Answer: False26) Since a bankʹs assets exceed its equity capital, the return on assets always exceeds the return on equity.Answer: False27) Adverse selection refers to those most at risk being most aggressive in their search for funds.Answer: True28) Financial innovation has provided more options to both investors and borrowers. Answer: True28) When the federal governmentʹs budget deficit decreases, the demand curve for bonds shifts tothe right.Answer: False29) An increase in the inflation rate will cause the demand curve for bonds to shift to the right.Answer: False30) A positive liquidity premium indicates that investors prefer long-term bonds over short-termbonds.Answer: False31) When yield curves are downward sloping, long-term interest rates are above short-terminterest rates.Answer: False32) In an efficient market, abnormal returns are not possible even using inside information.Answer: False33) Technical analysis is a popular technique used to predict stock prices by studying past stock price data and search for patterns such as trends and regular cycles. Answer: True34) An open market sale leads to an expansion of reserves and deposits in the banking system and hence to a decline in the monetary base and the money supply.Answer: False35) Open market purchases by the Fed increase the supply of nonborrowed reserves. Answer: True36) In general, money market instruments are low risk, high yield securities. Answer: False37) Money markets are referred to as retail markets because small individual investors are theprimary buyers of money market securities.Answer: False38) Capital market securities are less liquid and have longer maturities than money marketsecurities.Answer: True39) The current yield on a bond is a good approximation of the bondʹs yield to maturity when the bond matures in five years or less and its price differs from its par value by a large amount.Answer: False40) A bankʹs largest source of funds is its borrowing from the Fed. Answer: False1.Consider a bond with a 7% annual coupon and a face value of $1,000. Completethe following table:Years to Maturity Discount Rate Current Price3 53 76 79 79 9What relationship do you observe between yield to maturity and the current market value?(10分)Solution:Years to Maturity Yield to Maturity Current Price3 5 $1,054.463 7 $1,000.006 7 $1,000.009 5 $1,142.169 9 $ 880.10When yield to maturity is above the coupon rate, the band’s current price is below its face value. The opposite holds true when yield to maturity is below the coupon rate. For a given maturity, the bond’s current price falls as yield to maturity rises.For a given yield to maturity, a bond’s value rises as its maturity increases. When yield to maturity equals the coupon rate, a bond’s current price equal s its facevalue regardless of years to maturity.2. At your favorite bond store, Bonds-R-Us, you see the following prices:1-year $100 zero selling for $90.193-year 10% coupon $1000 par bond selling for $10002-year 10% coupon $1000 par bond selling for $1000Assume that the pure expectations theory for the term structure of interest rates holds, no liquidity or maturity premium exists, and the bonds are equally risky. What is the implied 1-year rate two years from now? (10分)Solution:From (a), you know that the 1-year rate today is 10.877%.Using this information, (c) tells you that:2-year rate)^2+ 1100/(1 + 100/1.10877 =1000So, the 2-year rate today is 9.95%.Using these two rates, (b) tells you that:3-year rate)3+ 1100/(1 + 100/1.09952 + 100/1.10877 =1000So, the 3-year rate today is 9.97%⨯ 9.97% – 2 ⨯ (3 =year rate 2 years from now 10.01%=9.95%)3. A bank has two, 3-year commercial loans with a present value of $70 million. The first is a $30 million loan that requires a single payment of $37.8 million in 3 years, with no other payments until then. The second is for $40 million. It requires an annual interest payment of $3.6 million. The principal of$40 million is due in 3 years. (15分)What is the duration of the bank’s commercial loan portfolio?What will happen to the value of its portfolio if the general level of interest rates increased from 8% to 8.5%?Solution:The duration of the first loan is 3 years since it is a zero-coupon loan. The duration of the second loan is as follows:Year 1 2 3 SumPayment 3.60 3.60 43.60PV of Payments 3.33 3.09 34.61 41.03Time Weighted PV of Payments 3.33 6.18 103.83Time Weighted PV of PaymentsDivided by Price 0.08 0.15 2.53 2.76The duration of a portfolio is the weighted average duration of its individual securities.So, the portfolio’s 2.86= (2.76) ⨯ 4/7 + (3) ⨯ 3/ 7 =durationIf rates increased,4. According to the loanable funds frameworks, draw two figures to explain the changes of interest rates during expansion and recession. (5分)Problems1. The following table lists foreign exchange rates between US dollars and British pounds during April.Date US Dollars perGBP Date US Dollars perGBP4/1 1.9564 4/18 1.75044/4 1.9293 4/19 1.72554/5 1.914 4/20 1.69144/6 1.9374 4/21 1.6724/7 1.961 4/22 1.66844/8 1.8925 4/25 1.66744/11 1.8822 4/26 1.68574/12 1.8558 4/27 1.69254/13 1.796 4/28 1.72014/14 1.7902 4/29 1.75124/15 1.7785Which day would have been the best day to convert $200 into British pounds?Which day would have been the worst day? What would be the difference in pounds?2. Consider a bond with a 7% annual coupon and a face value of $1,000. Complete the following table:Years to Maturity Discount Rate CurrentPrice3 53 76 79 79 9What relationship do you observe between yield to maturity and the current market value?3. You are willing to pay $15,625 now to purchase a perpetuity which will pay you and your heirs $1,250 each year, forever, starting at the end of this year. If your required rate of return does not change, how much would you be willing to pay if this were a 20-year, annual payment, ordinary annuity instead of a perpetuity?4. A bank has two, 3-year commercial loans with a present value of $70 million. The first is a $30 million loan that requires a single payment of $37.8 million in 3 years, with no other payments until then. The second is for $40 million. It requires an annual interest payment of $3.6 million. The principal of$40 million is due in 3 years.a. What is th e duration of the bank’s commercial loan portfolio?b. What will happen to the value of its portfolio if the general level of interest rates increased from 8% to 8.5%?5. Consider a bond that promises the following cash flows. The required discount rate is 12%.Year 0 1 2 3 4Promised Payments 160 170 180 230You plan to buy this bond, hold it for 2½ years, and then sell the bond.a. What total cash will you receive from the bond after the 2½ years? Assume that periodic cash flows are reinvested at 12%.b. If immediately after buying this bond, all market interest rates drop to 11% (including your reinvestment rate), what will be the impact on your total cash flow after 2½ years? How doesthis compare to part (a)?c. Assuming all market interest rates are 12%, what is the duration of this bond?Solution:a. You will receive 160, reinvested that for 1.5 years, and 170 reinvested for 0.5 years. Then you will sell the remaining cash flows, discounted at 12%. This gives you:1.50.50.5 1.5180230160(1.12)170(1.12)$733.69.1.12 1.12⨯+⨯++= b. This is the same as part (a), but the rate is now 11%.1.50.50.5 1.5180230160(1.11)170(1.11)$733.74.1.11 1.11⨯+⨯++= Notice that this is only $0.05 different from part (a).6. You own a $1,000-par zero-coupon bond that has 5 years of remaining maturity. You plan on selling the bond in one year, and believe that the required yield next year will have the following probability distribution:Probability Required Yield0.1 6.60% 0.2 6.75% 0.4 7.00% 0.2 7.20% 0.17.45%a. What is your expected price when you sell the bond?b. What is the standard deviation?Multiple Choice1.When the inflation rate is expected to increase, the real cost of borrowing declines at any given interest rate; as a result, the _________ bonds increases and the _________ curve shifts to the right. A) demand for; demand B) demand for; supply C) supply of; demand D) supply of; supplyIn Figure 4.1, the most likely cause of the increasein the equilibrium interest rate from i1 to i2 isA)an increase in the price of bonds. B) a business cycle boom.C) an increase in the expected inflation rate. D) a decrease in the expected inflation rate.In Figure 4.2, one possible explanation for the increase in the interest rate from i1 to i2 is a(n) _________ in _________. A) increase; the expected inflation rateB) decrease; the expected inflation rateC) increase; economic growthD) decrease; economic growthSolution:Years to Maturity Yield to Maturity Current Price3 5 $1,054.463 7 $1,000.006 7 $1,000.009 5 $1,142.169 9 $ 880.10When yield to maturity is above the coupon rate, the band’s current price is below its facevalue. The opposite holds true when yield to maturity is below the coupon rate. For a givenmaturity, the bond’s current price falls as yield to maturity rises. For a given y ield to maturity, a bond’s value rises as its maturity increases. When yield to maturity equals thecoupon rate, a bond’s current price equals its face value regardless of years to maturity.Solution: To find your yield to maturity, Perpetuity value = PMT/I.So, 15625 = 1250/I. I = 0.08The answer to the final part, using a financial calculator:N = 20; I = 8; PMT = 1250; FV = 0Compute PV : PV = 12,272.69Solution:a. You will receive 160, reinvested that for 1.5 years, and 170 reinvested for 0.5 years. Then you will sell the remaining cash flows, discounted at 12%. This gives you:1.50.50.5 1.5180230160(1.12)170(1.12)$733.69.1.12 1.12⨯+⨯++= b. This is the same as part (a), but the rate is now 11%.1.50.50.5 1.5180230160(1.11)170(1.11)$733.74.1.11 1.11⨯+⨯++= Notice that this is only $0.05 different from part (a). c. The duration is calculated as follows:Year1 2 3 4 Sum Payments160.00 170.00 180.00 230.00 PV of Payments142.86 135.52 128.12 146.17 552.67Time Weighted PV of Payments142.86 271.05 384.36 584.68 Time Weighted PV of PaymentsDivided by Price0.260.490.701.062.50Since the duration and the holding period are the same, you are insulated from immediate changes in interest rates! It doesn’t always work out this perfectly, but the idea is important.Solution: The duration of the first loan is 3 years since it is a zero-coupon loan. The duration of the second loan is as follows:Year1 2 3 Sum Payment3.60 3.60 43.60PV of Payments3.33 3.09 34.61 41.03Time Weighted PV of Payments3.33 6.18 103.83 Time Weighted PV of PaymentsDivided by Price0.080.152.532.76The duration of a portfolio is the weighted average duration of its individual securities.So, the portfolio’s duration = 3/7 ⨯ (3) + 4/7 ⨯ (2.76) = 2.86If rates increased, 0.005DUR 2.8670,000,000926,852.1 1.08i P P i ∆∆=-⨯⨯=-⨯⨯=-+ ASMT 02_1112A1. Consider a bond with a 7% annual coupon and a face value of $1,000. Completethe following table:Years to Maturity Yield to MaturityCurrent Price3 5 3 7 6 7 9 7 9 9What relationship do you observe between yield to maturity and the current market value?2. You are willing to pay $15,625 now to purchase a perpetuity which will pay youand your heirs $1,250 each year, forever, starting at the end of this year. If your required rate of return does not change, how much would you be willing to pay if this were a 20-year, annual payment, ordinary annuity instead of a perpetuity? 3. Assume you just deposited $1,000 into a bank account. The current real interestrate is 2% and inflation is expected to be 6% over the next year. What nominal interest rate would you require from the bank over the next year? How much money will you have at the end of one year? If you are saving to buy a stereo that currently sells for $1,050, will you have enough to buy it? 4. A 10-year, 7% coupon bond with a face value of $1,000 is currently selling for$871.65. Compute your rate of return if you sell the bond next year for $880.10.。

![统计学复习题[2] 西南财经大学天府学院](https://uimg.taocdn.com/65f6696dddccda38376bafe7.webp)

第九章练习题1.10位学生的数学和统计学两们课程的考试成绩如下:965.0)725(5462510.)809(66859107258096029910)()())((222222=-⨯-⨯⨯-⨯=∑∑-⋅∑∑-∑∑∑-=y y n x x n y x xy n r计算结果表明,数学和统计学之间是高度正相关关系。

2.生产同种产品的六个企业的生产量和单位成本资料如下:要求根据表中资料(1)计算相关系数并指出其相关的方向和程度(2)求出直线回归方程并说明回归系数b的含义(3)计算估计标准误差(4)假定产量为5500件时,单位成本为多少?(1)82158 .0)300(150486.)24(106 63002411826)()())((2 22222-=-⨯-⨯⨯-⨯=∑∑-⋅∑∑-∑∑∑-=yynxxnyxxynr计算结果表明,产量与单位成本之间是高度的负相关关系。

(2)xy x b y a x x n y x xy n b n x x n y y c8.12.572.574)8.1(508.1)24(10663002411826)(4624,506300222-==⨯--=-=-=-⨯⨯-⨯=∑∑-∑∑∑-===∑===∑=回归系数b=-1.8说明产量每增加1千件,单位成本降低1.8元。

(3)217.69261182)8.1(3002.571504822=-⨯--⨯-=-∑∑∑--=n xyb y a y s y(4)当产量为5500件(5.5千件)时,单位成本为: 57.2-1.8×5.5=47.3(元)3.销售收入x 与销售成本y 之间存在相关关系。

现根据某百货公司12个月的有关资料计算出以下数据:(单位:万元)2()425053.73x x -=∑ 2()262855.25y y -=∑ 647.88x =549.8y = ()()334229.09x x y y --=∑要求根据以上资料:(1)计算销售收入与销售成本之间的相关系数并指出其相关的方向和程度。

1) The price paid for the rental of borrowed funds (usually expressed as a percentage ofthe rental of $100 per year) is commonly referred to as theA) inflation rate.B) exchange rate.C) interest rate.D) aggregate price level.Answer: C2) Financial markets and institutionsA) involve the movement of huge quantities of money.B) affect the profits of businesses.C) affect the types of goods and services produced in an economy.D) do all of the above.E) do only (A) and (B) of the above.Answer: D3) Which of the following can be described as involving direct finance?A) A corporation?s stock is traded in an over-the-counter market.B) People buy shares in a mutual fund.C) A pension fund manager buys commercial paper in the secondary market.D) An insurance company buys shares of common stock in the over-the-counter markets.E) None of the above.Answer: E4) The purpose of diversification is toA) reduce the volatility of a portfolio?s return.B) raise the volatility of a portfolio?s return.C) reduce the average return on a portfolio.D) raise the average return on a portfolio.Answer: A5) When the interest rate on a bond is _________ the equilibrium interest rate, there is excess_________ in the bond market and the interest rate will _________.A) below; demand; riseB) below; demand; fallC) below; supply; riseD) above; supply; fallAnswer: C6) In a recession when income and wealth are falling, the demand for bonds _________ and thedemand curve shifts to the _________.A) falls; rightB) falls; leftC) rises; rightD) rises; leftAnswer: B7) When people begin to expect a large stock market decline, the demand curve for bonds shifts to the _________ and the interest rate _________.A) right; fallsB) right; risesC) left; fallsD) left; risesAnswer: A8) The spread between interest rates on low quality corporate bonds and U.S. government bonds_________ during the Great Depression.A) was reversedB) narrowed significantlyC) widened significantlyD) did not changeAnswer: C9) If income tax rates were lowered, thenA) the interest rate on municipal bonds would fall.B) the interest rate on Treasury bonds would rise.C) the interest rate on municipal bonds would rise.D) the price of Treasury bonds would fall.Answer: C10) According to the expectations theory of the term structure,A) yield curves should be equally likely to slope downward as to slope upward.B) when the yield curve is steeply upward-sloping, short-term interest rates are expected torise in the future.C) when the yield curve is downward-sloping, short-term interest rates are expected to remain relatively stable in the future.D) all of the above.E) only A and B of the above.Answer:E11) According to the efficient market hypothesisA) one cannot expect to earn an abnormally high return by purchasing a security.B) information in newspapers a nd in the published reports of financial analysts is alreadyreflected in market prices.C) unexploited profit opportunities abound, thereby explaining why so many people getrich by trading securities.D) all of the above are true.E) only A and B of the above are true.Answer: E12) To say that stock prices follow a ?r andom walk? is to argue thatA) stock prices rise, then fall.B) stock prices rise, then fall in a predictable fashion.C) stock prices tend to follow trends.D) stock prices are, for all practical purposes, unpredictable.Answer:D13) The efficient market hypothesis suggests thatA) investors should purchase no-load mutual funds which have low management fees.B) investors can use the advice of technical analysts to outperform the market.C) investors let too many unexploited profit opportunities go by if they adopt a ?buy andhold? strategy.D) only A and B of the above are sensible strategies.Answer: A14) Which of the following is empirical evidence indicating that the efficient market hypothesismay not always be generally applicable?A) Small-firm effectB) January effectC) Market OverreactionD) All of the aboveAnswer: D15) An open market purchase of securities by the Fed willA) increase assets of the nonbank public and increase assets of the banking system.B) decrease assets of the nonbank public and increase assets of the Fed.C) decrease assets of the banking system and increase assets of the Fed.D) have no effect on assets of the nonbank public but increase assets of the Fed.E) increase assets of the banking system and decrease assets of the Fed.Answer: D16) Under usual circumstances, an increase in the discount rate causesA) the federal funds rate to fall.B) the federal funds rate to rise.C) no change in the federal funds rate.D) the supply of reserves to increase.E) the supply of reserves to decrease.Answer: C17) Which of the following is not an operating target?A) Nonborrowed reservesB) Monetary baseC) Federal funds interest rateD) Discount rateE) All are operating targets.Answer: D18) Money market instrumentsA) are usually sold in large denominations.B) have low default risk.C) mature in one year or less.D) are characterized by all of the above.E) are characterized by only A and B of the above.Answer: D19) If the Fed wants to lower the federal funds interest rate, it will _________ the banking system by _________ securities.A) add reserves to; sellingB) add reserves to; buyingC) remove reserves from; sellingD) remove reserves from; buyingAnswer: B20) Money market transactionsA) do not take place in any one particular location or building.B) are usually arranged purchases and sales between participants over the phone by tradersand completed electronically.C) both (a) and (b).D) none the the above.Answer: C21) The primary reason that individuals and firms choose to borrow long-term is to reduce the risk that interest rates will fall before they pay off their debt.Answer:False22) Typically, the interest rate on corporate bonds will be higher the more restrictions areplaced on management through restrictive covenants, because the bonds will beconsidered safer by bondholdersAnswer: False23) A change in the current yield always signals a change in the same direction of the yield tomaturity.Answer: True24) A bank?s balance sheet indicates whether or not the bank is profitable. Answer: False25) Deposits that banks keep in accounts at the Federal Reserve less vault cash is called reserves.Answer: False26) Since a bank?s assets exceed its equity capital, the return on assets always exceeds the return on equity.Answer: False27) Adverse selection refers to those most at risk being most aggressive in their search for funds.Answer: True28) Financial innovation has provided more options to both investors and borrowers. Answer: True28) When the federal government?s budget deficit decreases, the demand curve for bonds shifts tothe right.Answer: False29) An increase in the inflation rate will cause the demand curve for bonds to shift to the right.Answer: False30) A positive liquidity premium indicates that investors prefer long-term bonds over short-termbonds.Answer: False31) When yield curves are downward sloping, long-term interest rates are above short-terminterest rates.Answer: False32) In an efficient market, abnormal returns are not possible even using inside information.Answer: False33) Technical analysis is a popular technique used to predict stock prices by studying past stock price data and search for patterns such as trends and regular cycles. Answer: True34) An open market sale leads to an expansion of reserves and deposits in the banking system and hence to a decline in the monetary base and the money supply.Answer: False35) Open market purchases by the Fed increase the supply of nonborrowed reserves.Answer: True36) In general, money market instruments are low risk, high yield securities.Answer: False37) Money markets are referred to as retail markets because small individual investorsare theprimary buyers of money market securities.Answer: False38) Capital market securities are less liquid and have longer maturities than moneymarketsecurities.Answer: True39) The current yield on a bond is a good approximation of the bond?s yield tomaturity when the bond matures in five years or less and its price differs from itspar value by a large amount.Answer: False40) A bank?s largest source of funds is its borrowing from the Fed.Answer: False1.Consider a bond with a 7% annual coupon and a face value of $1,000. Completethe following table:Years to Maturity Discount Rate Current Price3 53 76 79 79 9What relationship do you observe between yield to maturity and the currentmarket value?(10分)Solution:Years to Maturity Yield to Maturity Current Price3 5 $1,054.463 7 $1,000.006 7 $1,000.009 5 $1,142.169 9 $ 880.10When yield to maturity is above the coupon rate, the band’s current price is below its face value. The opposite holds true when yield to maturity is below the couponrate. For a given maturity, the bond’s current price falls as yield to maturity rises.For a given yield to maturity, a bond’s value rises as its maturity increases. When yield to maturity equals the coupon rate, a bond’s current price equals its facevalue regardless of years to maturity.2. At your favorite bond store, Bonds-R-Us, you see the following prices:1-year $100 zero selling for $90.193-year 10% coupon $1000 par bond selling for $10002-year 10% coupon $1000 par bond selling for $1000Assume that the pure expectations theory for the term structure of interest rates holds, no liquidity or maturity premium exists, and the bonds are equally risky. What is the implied 1-year rate two years from now? (10分)Solution:From (a), you know that the 1-year rate today is 10.877%.Using this information, (c) tells you that:2-year rate)^2 1100/(1 100/1.10877 1000So, the 2-year rate today is 9.95%.Using these two rates, (b) tells you that:3-year rate)3 1100/(1 100/1.09952 100/1.10877 1000So, the 3-year rate today is 9.97%9.97% – 2 (3 year rate 2 years from now 10.01%9.95%)3. A bank has two, 3-year commercial loans with a present value of $70 million. The first is a $30 million loan that requires a single payment of $37.8 million in 3 years, with no other payments until then. The second is for $40 million. It requires an annual interest payment of $3.6 million. The principal of$40 million is due in 3 years. (15分)What is the duration of the bank’s commercial loan portfolio?What will happen to the value of its portfolio if the general level of interest rates increased from 8% to 8.5%?Solution:The duration of the first loan is 3 years since it is a zero-coupon loan. The duration of the second loan is as follows:Year 1 2 3 SumPayment 3.60 3.60 43.60PV of Payments 3.33 3.09 34.61 41.03Time Weighted PV of Payments 3.33 6.18 103.83Time Weighted PV of PaymentsDivided by Price 0.08 0.15 2.53 2.76The duration of a portfolio is the weighted average duration of its individual securities.2.86 (2.76) 4/7 (3) 3/ 7 durationSo, the portfolio’sIf rates increased,4. According to the loanable funds frameworks, draw two figures to explain the changes of interest rates during expansion and recession. (5分)Problems1. The following table lists foreign exchange rates between US dollars and British pounds during April.Date US Dollars perGBP Date US Dollars perGBP4/1 1.9564 4/18 1.75044/4 1.9293 4/19 1.72554/5 1.914 4/20 1.69144/6 1.9374 4/21 1.6724/7 1.961 4/22 1.66844/8 1.8925 4/25 1.66744/11 1.8822 4/26 1.68574/12 1.8558 4/27 1.69254/13 1.796 4/28 1.72014/14 1.7902 4/29 1.75124/15 1.7785Which day would have been the best day to convert $200 into British pounds?Which day would have been the worst day? What would be the difference in pounds?2. Consider a bond with a 7% annual coupon and a face value of $1,000. Complete the following table:Years to Maturity Discount Rate CurrentPrice3 53 76 79 79 9What relationship do you observe between yield to maturity and the current market value?3. You are willing to pay $15,625 now to purchase a perpetuity which will pay you and your heirs $1,250 each year, forever, starting at the end of this year. If your required rate of return does not change, how much would you be willing to pay if this were a 20-year, annual payment, ordinary annuity instead of a perpetuity?4. A bank has two, 3-year commercial loans with a present value of $70 million. The first is a $30 million loan that requires a single payment of $37.8 million in 3 years, with no other payments until then. The second is for $40 million. It requires an annual interest payment of $3.6 million. The principal of$40 million is due in 3 years.a. What is the duration of the bank’s commercial loan portfolio?b. What will happen to the value of its portfolio if the general level of interest rates increased from 8% to 8.5%?5. Consider a bond that promises the following cash flows. The required discount rate is 12%.Year 0 1 2 3 4Promised Payments 160 170 180 230You plan to buy this bond, hold it for 2? years, and then sell the bond.a. What total cash will you receive from the bond after the 2? years? Assume that periodic cash flows are reinvested at 12%.b. If immediately after buying this bond, all market interest rates drop to 11% (including your reinvestment rate), what will be the impact on your total cash flow after 2? years? How doesthis compare to part (a)?c. Assuming all market interest rates are 12%, what is the duration of this bond?Solution:a. You will receive 160, reinvested that for 1.5 years, and 170 reinvested for 0.5 years. Then you will sell the remaining cash flows, discounted at 12%. This gives you:1.50.50.51.5180230160(1.12)170(1.12)$733.69.1.121.12b. This is the same as part (a), but the rate is now 11%.1.50.50.51.5180230160(1.11)170(1.11)$733.74.1.111.11Notice that this is only $0.05 different from part (a).6. You own a $1,000-par zero-coupon bond that has 5 years of remaining maturity. You plan on selling the bond in one year, and believe that the required yield next year will have the following probability distribution:Probability Required Yield0.1 6.60% 0.2 6.75% 0.4 7.00% 0.2 7.20% 0.17.45%a. What is your expected price when you sell the bond?b. What is the standard deviation? Multiple Choice1.When the inflation rate is expected to increase, the real cost of borrowing declines at any given interest rate; as a result, the _________ bonds increases and the _________ curve shifts to the right. A) demand for; demand B) demand for; supply C) supply of; demand D) supply of; supplyIn Figure 4.1, the most likely cause of the increase in the equilibrium interest rate from i1 to i2 isA)an increase in the price of bonds. B) a business cycle boom.C) an increase in the expected inflation rate. D) a decrease in the expected inflation rate.In Figure 4.2, one possible explanation for the increase in the interest rate from i1 to i2 is a(n) _________ in _________. A) increase; the expected inflation rateB) decrease; the expected inflation rateC) increase; economic growthD) decrease; economic growthSolution:Years to Maturity Yield to Maturity Current Price3 5 $1,054.463 7 $1,000.006 7 $1,000.009 5 $1,142.169 9 $ 880.10When yield to maturity is above the coupon rate, the band’s current price is below its facevalue. The opposite holds true when yield to maturity is below the coupon rate. For agivenield tomaturity, the bond’s current price falls as yield to maturity rises. For a given ymaturity, a bond’s value rises as its maturity increases. When yield to maturity equalsthecoupon rate, a bond’s current price equals its face value regardless of years tomaturity.Solution: To find your yield to maturity, Perpetuity value PMT/I.So, 15625 1250/I. I 0.08The answer to the final part, using a financial calculator:N 20; I 8; PMT 1250; FV 0Compute PV : PV 12,272.69Solution:a. You will receive 160, reinvested that for 1.5 years, and 170 reinvested for 0.5 years. Then you will sell the remaining cash flows, discounted at 12%. This gives you:1.50.50.51.5180230160(1.12)170(1.12)$733.69.1.121.12b. This is the same as part (a), but the rate is now 11%.1.50.50.51.5180230160(1.11)170(1.11)$733.74.1.111.11Notice that this is only $0.05 different from part (a). c. The duration is calculated as follows:Year 1 2 3 4 SumPayments160.00 170.00 180.00 230.00 PV of Payments142.86 135.52 128.12 146.17 552.67 Time Weighted PV of Payments142.86 271.05 384.36 584.68 Time Weighted PV of PaymentsDivided by Price0.260.490.701.062.50Since the duration and the holding period are the same, you are insulated from immediate changes in interest rates! It doesn ’t always work out this perfectly, but the idea is important.Solution:The duration of the first loan is 3 years since it is a zero-coupon loan. The duration of the second loan is as follows:Year 1 2 3 SumPayment 3.60 3.60 43.60 PV of Payments 3.33 3.09 34.61 41.03 Time Weighted PV of Payments3.33 6.18 103.83 Time Weighted PV of PaymentsDivided by Price0.080.152.532.76 The duration of a portfolio is the weighted average duration of its individual securities.So, the portfolio ’s duration 3/7 (3) 4/7 (2.76) 2.86If rates increased, 0.005DUR2.8670,000,000926,852.1 1.08i P P iASMT 02_1112A1. Consider a bond with a 7% annual coupon and a face value of $1,000. Completethe following table:Years to Maturity Yield to MaturityCurrent Price3 5 3 7 6 7 9 7 99What relationship do you observe between yield to maturity and the current market value?2. You are willing to pay $15,625 now to purchase a perpetuity which will pay youand your heirs $1,250 each year, forever, starting at the end of this year. If your required rate of return does not change, how much would you be willing to pay if this were a 20-year, annual payment, ordinary annuity instead of a perpetuity? 3. Assume you just deposited $1,000 into a bank account. The current real interestrate is 2% and inflation is expected to be 6% over the next year. What nominal interest rate would you require from the bank over the next year? How muchmoney will you have at the end of one year? If you are saving to buy a stereo that currently sells for $1,050, will you have enough to buy it? 4. A 10-year, 7% coupon bond with a face value of $1,000 is currently selling for$871.65. Compute your rate of return if you sell the bond next year for $880.10.。

综合考试题(二)一、填空题:( 请将正确答案直接填在题中横线上, 每小题2分,共10分) 1. 设P (A ) = 0.7, P (A - B ) = 0.3 , 则 ()P AB = 0.6 。

2. 随机变量X 服从区间 [1,4]上的均匀分布,则P { 0< X < 3} =233. 设随机变量X 服从正态分布()20,N σ,且已知X 则σ=12π4. 设随机变量X 的数学期望为EX u =、方差2DX σ=,则由切比雪夫不等式有{}2P X u σ-≥≤145. 设12,,,n X X X 相互独立,且均服从()01N ,,则它们的平方和22212nX X X X =+++服从2()n χ分布 。

二、单项选择题: (在每小题的四个备选答案中,选出一个正确的答案,并将其号码填在括号内。

每小题 3分,共30分)1. 设对于随机事件A 、B 、C , 有1()()(),()()0,4P A P B P C P AB P BC =====1(),()08P AC P ABC == 则三个事件A 、B 、C , 至少发生一个的概率为 ( B )。

(A ) 38 (B ) 58 (C ) 34 (D ) 542. 每张奖券中尾奖的概率为110,某人购买了20张号码杂乱的奖券,设中尾奖的张数为X ,则X 服从 ( A )。

(A ) 二项 分布(B ) 泊松分布 (C ) 指数分布 (D ) 正态分布3. 设X 服从泊松分布,且 )6(2-X E = 0 ,则P {X = 0} = ( B )。

(A ) 1-e (B ) 2-e (C ) 3-e (D ) 6-e4. 对于随机变量X , F (x ) = P {X ≤ x } 称为随机变量X 的( D )。

(A ) 概率分布 (B ) 概率 (C ) 概率密度 (D ) 分布函数5. 设随机变量X 服从正态分布N (μ ,2σ),则随 σ 的增大,概率{}P X μσ-< (C )(A ) 单调增大 (B ) 单调减少 (C ) 保持不变 (D ) 增减不定6. 设两个相互独立的随机变量X 和Y 分别服从正态分布()01N ,和()11N ,,则下列结论正确的是( A )。

判断题下列各命题,如果正确,请在后面的括号内画“√”,如果错误,请在后面的括号内画“×”多元函数微分1.球心在(1,2,3),半径为4的球面方程为4)3()2()1(222=-+-+-z y x 。

( ) 2.3=x 代表空间平行于x 轴的平面。

( )3.点集 })()(|),{(2020δ<-+-y y x x y x 为),(000y x P 的δ邻域。

( ) 4.函数 )sin(122y x z +=定义域是}}0{,2|),{(22 +∈≠+=Z k k y x y x D π。

( )5.1sin lim50=→→xy xy x 。

( )6.设),(y x f z =当令kx y =时有3),(lim )1,1(),(=→kx x f kx x ,则()()3),(lim1,1,=→y x f y x 。

( )7.若),(),(lim 000y x f y x f y y x x =→→,则称),(y x f z =在),(00y x 点连续。

( )8.若),(lim 0y x f y y x x →→不存在。

则),(y x f z =在点),(00y x 间断。

( )9.若函数 ),(y x f z =在),(00y x 有定义,且),(lim 00y x f y y x x →→存在,则),(y x f z =在),(00y x 点连续。

( )10.有界闭区域D 上的二元函数),(y x f z =一定有最大值和最小值。

( )11.xy x f y x x f xz x y y x x ∆∆∆),(),(lim000000-+=∂∂→==。

( )12.3),(00=y x f x ,则曲线),(y x f z =在),(000y x P 处的法线斜率为31-。

( ) 13.若),(00y x f x ,),(00y x f y 存在,则),(y x f z =在),(000y x P 点连续。

西南财经大学天府学院2007-2008 学年第一学期期末考试试卷(B 卷)考试科目:概率统计系别:教学班:姓名: 学号:本次考试为闭卷考试。

2.请将答案依次写在专用答题纸上,交卷时将试卷和答题纸分开。

一、填空题(请将正确答案填写在答题纸上相应的括号内,不填或填错均不得分。

每小题4分,共15个小题,计60分)1.在产品质量的抽样检验中,每次抽取一个产品,记事件n A =“第n 次取到正品(n=1,2,3)”,则“三次中至多有一次取到正品”可表示为_______。

2.抛掷一枚均匀硬币,观察其正反面,设试验E 为“把一枚硬币连续抛掷两次”,则E 的样本空间Ω=_______________。

3.如果随机事件A 与B 相互独立,则=)(AB P ______________ 4.设随机变量X 的分布列为10,8,6,4,2,51}{===k k X p ,则DX= 。

5.用三个机床加工同一种零件。

零件由各机床加工的概率分别为2.0,3.0,5.0,各机床加工零件的合格率分别为95.0,9.0,94.0。

则全部产品的合格率为 。

6.设连续型随机变量X 的分布函数⎪⎩⎪⎨⎧≥<≤<=1 ,110 ,0 ,0)(x x x x x F ,则X 的密度函数=)(x f ___________________。

7.设),(~p n B X ,则==)(m X P ______________,n m ,,2,1,0 =,=EX _______________,=DX __________________。

8.已知42.0)(,4.0)(,6.0)(=-==B A p B p A p ,则)(B A p += 。

9.设943.0)58.1(),1,0(~=ΦN X ,则}58.1{≥X p = ;10.设4.0)(=A P ,7.0)(=B A P ,那么,若A 与B 互不相容,则 =)(B P _______。

西南财经大学《 概率论与数理统计》第一章单元测试 满分100分 考试时间 120分钟一、选择题(每题2分,共20分)1.事件A ,B 为对立事件,则( )不成立。

(A) 0)(=AB P ; (B) A P (B )=0; (C) )(B A P =1;(D) P (B A )=1 2.对于任意两个事件A 与B ,则有)(B A P -为( )(A) )()(B P A P -;(B) )()()(AB P B P A P +-; (C))()(AB P A P -; (D) )()(AB P A P +3.设 B A ,相互独立,7.0)(=A P ,88.0)(=B A P ,则).()(=-B A P(A )0.10; (B) 0.52; (C) 0.42; (D) 0.284.设A ,B 为随机事件,0)(>B P ,1)|(=B A P ,则必有( )。

A. )()(A P B A P =⋃B. B A ⊃C. )()(B P A P =D. )()(A P AB P =5.某人连续向一目标射击,每次命中目标的概率为43,他连续射击直到命中为止,则射击次数为3的概率是( )。

A. 343)( B. 41432⨯)( C. 43412⨯)( D. 22441C )( 6.已知A 、B 、C 为三个随机事件,则A 、B 、C 不都发生的事件为( )。

A. C B A B. ABC C. A +B +C D. ABC7.若随机事件A 与B 相互独立,则)(B A P +=( )。

A. )()(B P A P +B. )()()()(B P A P B P A P -+C. )()(B P A PD.)()(B P A P +8.设随机事件A 、B 互不相容,q B P p A P ==)( ,)(,则)(B A P =( )。

A. q p )1(-B. pqC. qD.p9.若A 、B 相互独立,则下列式子成立的为( )。

概率论与数理统计试题

一、单项选择题(本大题共10小题,每小题2分,共20分)

在每小题列出的四个备选项中只有一个是符合题目要求的,请将其代码填写在题后的括号内。

错选、多选或未选均无分。

1.设A与B是任意两个互不相容事件,则下列结论中正确的是()

A. P(A)=1-P(B)

B. P(A-B)=P(B)

C. P(AB)=P(A)P(B)

D. P(A-B)=P(A)

2.设A,B为两个随机事件,且,则()

A. 1

B. P(A)

C. P(B)

D. P(AB)

3.下列函数中可作为随机变量分布函数的是()

A.

B.

C.

D.

4.设离散型随机变量X的分布律为

则()

A.0.3

B.0.4

C.0.6

D.0.7

5.设二维随机变量(X,Y)的分布律为()

且X与Y相互独立,则下列结论正确的是A.a=0.2,b=0.6

B.a=-0.1,b=0.9

C.a=0.4,b=0.4

D.a=0.6,b=0.2

6.设二维随机变量(X,Y)的概率密度为

则P{0>X<1,0<Y<1}=()

A.

B.

C.

D.1

7.设随机变量X服从参数为的指数分布,则E(X)=()

A.

B.

C.2

D.4

8.设随机变量X与Y相互独立,且X~N(0,9),Y~N(0,1),令Z=X-2Y,则D(Z)=()

A.5

B.7

C.11

D.13

9.设(X,Y)为二维随机变量,且D(X)>0,D(Y)>0,则下列等式成立的是()

A.E(XY)=E(X)·E(Y)

B.Cov

C.D(X+Y)=D(X)+D(Y)

D.Cov(2X,2Y)=2Cov(X,Y)

10.设总体X服从正态分布N(),其中未知,x1,x2,…,x n为来自该总体的样本,为样本均值,s为样本标准差,欲检验假设

,则检验统计量为()

A.

B.

C.

D.

二、填空题(本大题共15小题,每小题2分,共30分)

请在每小题的空格中填上正确答案。

错填、不填均无分。

11.设A,B为两个随机事件,若A发生必然导致B发生,且P(A)=0.6,则P (AB)=_____.

12.设随机事件A与B相互独立,且P(A)=0.7,P(A-B)=0.3,则=_______.

13.已知10件产品中有2件次品,从该产品中任意取3件,则恰好取到一件次品的概率等于______.

14.已知某地区的人群吸烟的概率是0.2,不吸烟的概率是0.8,若吸烟使人患某种疾病的概率为0.008,不吸烟使人患该种疾病的概率是0.001,则该人群患这种疾病的概率等于______.

15.设连续型随机变量X的概率密度为则当

时,X的分布函数F(x)=______.

16.设随机变量,则=______.(附:

)

17.设二维随机变量(X,Y)的分布律为

则______.

18.设随机变量X的期望E(X)=2,方差D(X)=4,随机变量Y的期望E(Y)=4,方差D(Y)=9,又E(XY)=10,则X,Y的相关系数=______.

19.设随机变量X服从二项分布,则=______.

20.设随机变量X~B(100,0.5),应用中心极限定理可算得

______.

(附:)

21.设总体为来自该总体的样本,,则______.

22.设总体,为来自该总体的样本,则服从自由度为______的分布.

23.设总体X服从均匀分布,是来自该总体的样本,则的矩估计=______.

24.设样本来自总体,假设检验问题为

,则检验统计量为______.

25.对假设检验问题,若给定显著水平0.05,则该检

验犯第一类错误的概率为______.

三、计算题(本大题共2小题,每小题8分,共16分)

26.设随机变量X与Y相互独立,且X~N(0.1),Y~N(1,4).

(1)求二维随机变量(X,Y)的概率密度f(x,y);

(2)设(X,Y)的分布函数为F(x,y),求F(0,1).

27.设一批产品中有95%的合格品,且在合格品中一等品的占有率为60%.

求:(1)从该批产品中任取1件,其为一等品的概率;

(2)在取出的1件产品不是一等品的条件下,其为不合格品的概率.

四、综合题(本大题共2小题,每小题12分,共24分)

28.设随机变量X的概率密度为

试求:(1)常数.

29.设某型号电视机的使用寿命X服从参数为1的指数分布(单位:万小时). 求:(1)该型号电视机的使用寿命超过t(t>0)的概率;

(2)该型号电视机的平均使用寿命.

五、应用题(10分)

30.设某批建筑材料的抗弯强度,现从中抽取容量为16的样本,测得样本均值,求μ的置信度为0.95的置信区间.(附:)。