金融专业英语证考试经验理解.doc

- 格式:doc

- 大小:78.50 KB

- 文档页数:4

金融专业英语证书考试的经验交流金融专业英语证书考试运行十周年随笔金融英语证书考试,缩写FECT,全称Financial English Certificate Test,是中国人民银行和国家教育部联合主办的金融行业英语证书考试。

旨为适应金融业改革发展和扩大对外开放的需要,加快我国金融业与国际接轨的步伐,同时面向未来,为国家和各金融机构培养既精通现代金融知识、又能运用英语从事金融业务及管理工作的跨世纪的中、高层复合型人才,促进金融职工队伍素质的全面提高,1994年4月,中国人民银行与国家教委联合发出《关于建立<金融专业英语证书考试制度>的通知》,在全国试行金融专业英语证书考试制度。

1995年试点,1996年正式推行,XX年此项考试向社会全面开放,受众由业界发展到社会,这一行业性的英语考试对社会产生了很大的影响,证书的权威性也不断得到肯定。

金融英语证书从一个评价业内在职人员英语素质的行业证书扩大到无报考限制的社会性行业证书,经历了十年的历程。

值此十周年纪念日,我从自己参加考试的体会和收获谈谈对其的认识。

1997年当我进入中国银行铜陵分行国际结算科工作后,我首次听到了“金融英语专业考试”这个名词,当时不识庐山真面目,但行内部分英语专业的同事连续参加但没有通过考试的经历激励了我报考的志向。

当我报名后拿着银行初级类的三本教材后,确实有些发懵了,除了第三本涉及英文函电的内容我还能应付,前两本涉及的业务范围要包括:经济及金融基础知识、贸易和非贸易结算、信贷、会计、资金交易、外汇管理、银行法律等诸多知识。

很多基本的业务概念和术语及一般的业务程序和原理,我都看不连贯甚至不懂,看来确实不能轻视。

当时,我还在进行金融本科的自学考试,为能顺利通过金融英语考试,我拟定了三个月的学习计划。

其中的两个月主要进行金融专业的了解和金融知识储备,比如国际金融、货币银行学、国际经济、会计学的基本内容以及对相关法律的基本认识,国际贸易结算和非贸易结算的实际操作,还要进行专业词汇的准备,掌握一定的金融专业英语词汇量。

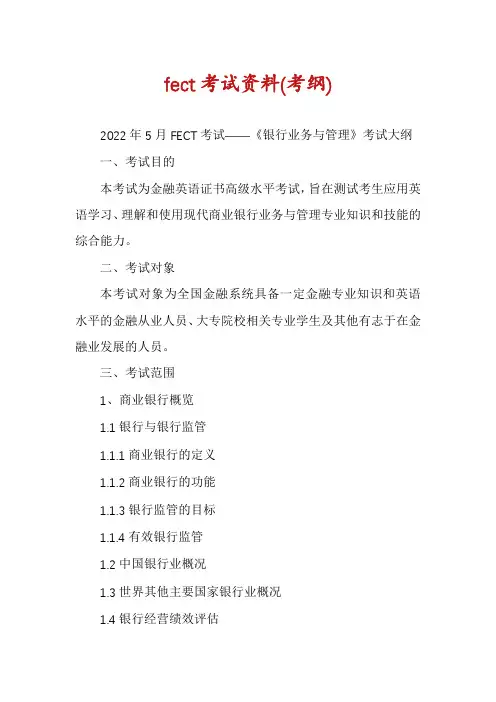

fect考试资料(考纲)2022年5月FECT考试――《银行业务与管理》考试大纲一、考试目的本考试为金融英语证书高级水平考试,旨在测试考生应用英语学习、理解和使用现代商业银行业务与管理专业知识和技能的综合能力。

二、考试对象本考试对象为全国金融系统具备一定金融专业知识和英语水平的金融从业人员、大专院校相关专业学生及其他有志于在金融业发展的人员。

三、考试范围1、商业银行概览1.1银行与银行监管1.1.1商业银行的定义1.1.2商业银行的功能1.1.3银行监管的目标1.1.4有效银行监管1.2中国银行业概况1.3世界其他主要国家银行业概况1.4银行经营绩效评估1.4.1商业银行财务报表1.4.2资本回报率模型1.4.3银行市场价值最大化2、银行负债业务2.1银行负债结构2.2银行存款与存款保险2.2.1银行存款种类2.2.2核心存款与不稳定借款2.2.3存款定价2.2.4存款保险3、银行贷款3.1贷款类型和贷款政策3.2银行贷款流程3.2.1业务拓展与信用分析3.2.2贷款审批与发放3.2.3贷后检查3.3企业贷款3.3.1企业贷款种类3.3.2企业贷款特征3.3.3企业贷款评估3.3.4企业贷款定价3.4个人贷款3.4.1个人贷款种类3.4.2个人贷款特征3.4.3个人贷款信用分析3.5小企业贷款的评估4、银行中间业务4.1银行中间业务发展趋势4.2支付与现金管理服务4.2.1基本支付工具4.2.2基本支付方法4.2.3现金管理服务4.3银行卡业务4.3.1贷记卡与借记卡4.3.2银行卡交易主体4.3.3银行卡业务的收益与成本4.4投资银行业务4.4.1公司理财顾问服务4.4.2兼并与重组顾问服务4.5证券交易业务4.5.1银行证券投资的会计分类4.5.2消极投资战略与积极投资战略4.5.3银行交易业务的盈利来源4.6其他中间业务4.6.1代理业务4.6.2保管业务4.6.3财富管理业务5、银行国际业务5.1银行国际化扩张5.2贸易融资5.2.1打包贷款5.2.2押汇5.2.3出口信用5.2.4保理业务5.2.5福费廷业务5.3国际贷款5.3.1.国际贷款风险5.3.2银团贷款5.3.3项目融资5.4国际借款5.4.1国际货币市场5.4.2国际资本市场5.5国际结算5.5.1汇出汇款业务5.3.2汇入汇款业务5.3.3光票托收业务5.3.4跟单托收业务5.3.5信用证业务5.3.5保函业务6、银行资本6.1会计资本6.2监管资本6.2.1银行资本的功能6.2.2资本充足率与巴塞尔协议I6.2.2新资本协议6.3经济资本6.3.1经济资本的计算6.3.2经济资本的应用7、银行风险管理与内部控制7.1银行风险管理的发展与挑战7.2银行全面风险管理7.3银行内部控制8、信用风险、市场风险和操作风险管理8.1信用风险管理8.1.1信用风险与损失8.1.2信用风险类型8.1.3风险评级体系8.1.4违约风险统计数据8.2市场风险管理8.2.1市场风险管理的传统方法8.2.2市场风险管理的新方法8.3操作风险管理8.3.1操作风险的定义、影响因素与特殊性8.3.2操作风险度量8.3.3操作风险管理体系的建立9、银行创新管理9.1银行创新的定义与作用9.2银行创新类型9.2.1产品和服务创新9.2.2流程创新9.2.3组织形式创新9.3金融衍生工具9.3.1金融衍生工具的作用9.3.2金融衍生工具的功能9.3.3利率衍生工具9.3.4信用衍生工具9.4证券化9.4.1资金池和转移9.4.2证券化产品发行9.4.3信用增级与分层9.4.4还本付息服务9.4.5还款结构10、银行营销管理10.1银行营销框架10.2对公营销管理10.2.1组织购买行为10.2.2组织购买决策的影响因素10.2.3组织购买过程10.2.4政府市场10.2.5忠诚客户的培育与管理10.3对私营销管理10.3.1个人购买决策的影响因素10.3.2个人购买决策的过程10.3.3个人购买决策的阶段四、考试方式及题型本考试为笔试(不含听力),使用英语答卷,总分100分。

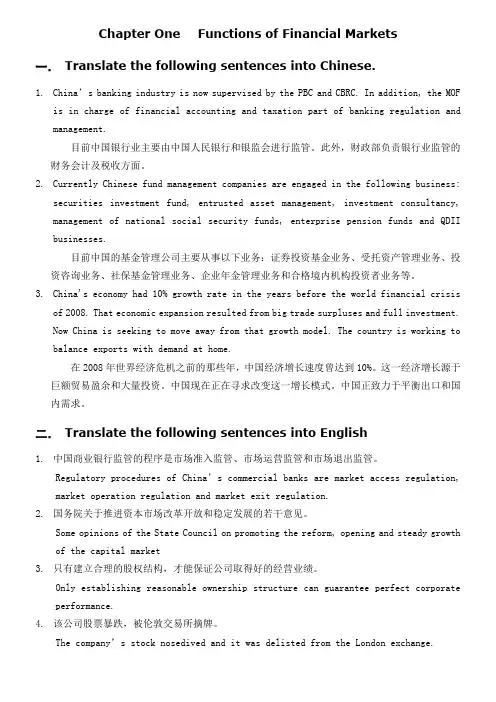

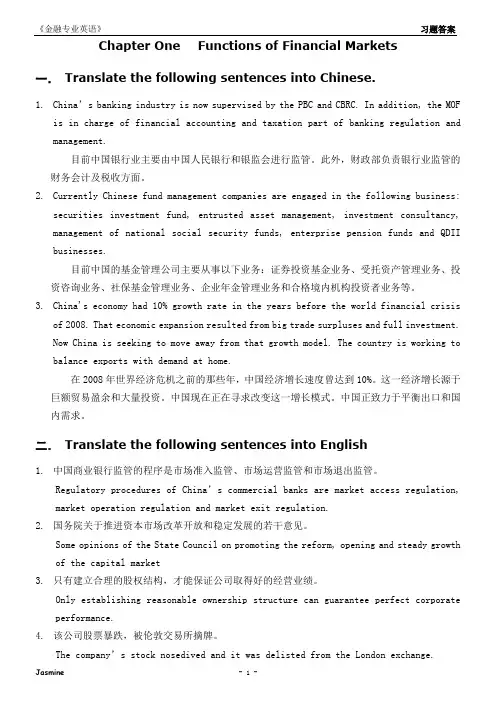

Chapter One Functions of Financial Markets 一.Translate the following sentences into Chinese.1.China’s banking industry is now supervised by the PBC and CBRC. In addition, the MOFis in charge of financial accounting and taxation part of banking regulation and management.目前中国银行业主要由中国人民银行和银监会进行监管。

此外,财政部负责银行业监管的财务会计及税收方面。

2.Currently Chinese fund management companies are engaged in the following business:securities investment fund, entrusted asset management, investment consultancy, management of national social security funds, enterprise pension funds and QDII businesses.目前中国的基金管理公司主要从事以下业务:证券投资基金业务、受托资产管理业务、投资咨询业务、社保基金管理业务、企业年金管理业务和合格境内机构投资者业务等。

3.China's economy had 10% growth rate in the years before the world financial crisisof 2008. That economic expansion resulted from big trade surpluses and full investment.Now China is seeking to move away from that growth model. The country is working to balance exports with demand at home.在2008年世界经济危机之前的那些年,中国经济增长速度曾达到10%。

好消息!好消息!中财金院金融硕士进入复试112人,录取92人,育明教育学员8人,进入复试6人,全部录取!未进入复试学员成功调剂东北财经金融专硕。

首先说下英语,(完型运气好6分,阅读+新题型+翻译33.5,大小作文共19分)作为英语渣,我四六级都没到过480,我觉得从小学到现在背单词对于我几乎没用,我相信很多人和我有同样遭遇,当你经常盯着一个单词边写边读时,其实是在走思,到头来还是不会做题(试想高中学语文,汉字全都懂但是阅读理解还是拿不了满分,想想你语文是背字典而学好的吗?)。

非常建议朱伟的恋练有词,讲课很实用很吸引人。

40个单元,每周完成5个单元就不错了,每天用一个小时左右复习一下昨天的单元内容,一定要坚持,当你完成10个单元会感觉有点质的飞跃,当你听完20个单元时,要开始做真题,近十年真题要做3遍,如果没有时间至少近五年要做3遍。

最后一年要留到考前一个月再做。

拒绝其他任何模拟题!96年到2003年的真题做做阅读和作文就好,这些真题难度最低,但也有不少经典的题目,如果没时间就只写写作文。

04到10年难度增加,10年以后很难,必须要钻研透彻(每个题型每个单词每个句子都要弄懂)!这里说下怎么做真题,每套题要严格按照考试时间来,下午2点到5点,去淘宝买下英语和政治的答题卡,然后去打印店用A3的纸复印,我每次大小作文模拟也是用答题纸,这样可以和考试做到最大可能的一致,否则和真正考试稍有一点不一样也会耽误你一会儿时间的。

以下是我的答题顺序,仅供参考:2点到2.15小作文,2.15-2.55前两篇阅读,2.55-3.35大作文,3.35-4.15后两篇阅读,4.15-4.35翻译,4.35-4.50新题型,最后十分完型,因为我英语很渣所以大作文用时间长,我说的时间都包括涂卡的时间!完型是用来调节时间的,没时间就直接涂在卡上!阅读理解的网课推荐唐迟老师和李剑,结合真题分析的很透彻。

李剑老师前几节课很好,后面就有些啰嗦了(我在淘宝买的李剑的专项阅读班才10块-_-||)基础不好的可以听完如果基础还可以只听前几节课就好了。

Chapter One Functions of Financial Markets 一.Translate the following sentences into Chinese.1.China’s banking industry is now supervised by the PBC and CBRC. In addition, the MOFis in charge of financial accounting and taxation part of banking regulation and management.目前中国银行业主要由中国人民银行和银监会进行监管。

此外,财政部负责银行业监管的财务会计及税收方面。

2.Currently Chinese fund management companies are engaged in the following business:securities investment fund, entrusted asset management, investment consultancy, management of national social security funds, enterprise pension funds and QDII businesses.目前中国的基金管理公司主要从事以下业务:证券投资基金业务、受托资产管理业务、投资咨询业务、社保基金管理业务、企业年金管理业务和合格境内机构投资者业务等。

3.China's economy had 10% growth rate in the years before the world financial crisisof 2008. That economic expansion resulted from big trade surpluses and full investment.Now China is seeking to move away from that growth model. The country is working to balance exports with demand at home.在2008年世界经济危机之前的那些年,中国经济增长速度曾达到10%。

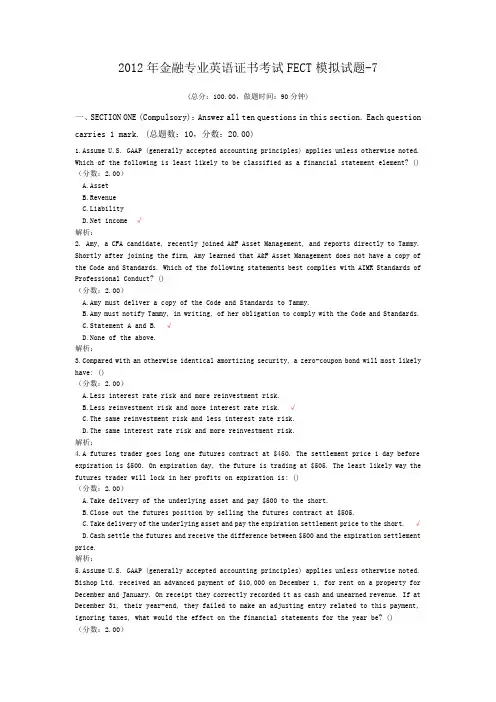

2012年金融专业英语证书考试FECT模拟试题-7(总分:100.00,做题时间:90分钟)一、SECTION ONE (Compulsory):Answer all ten questions in this section. Each question carries 1 mark. (总题数:10,分数:20.00)1.Assume U.S. GAAP (generally accepted accounting principles) applies unless otherwise noted. Which of the following is least likely to be classified as a financial statement element? () (分数:2.00)A.AssetB.RevenueC.Liability income √解析:2. Amy, a CFA candidate, recently joined A&F Asset Management, and reports directly to Tammy. Shortly after joining the firm, Amy learned that A&F Asset Management does not have a copy of the Code and Standards. Which of the following statements best complies with AIMR Standards of Professional Conduct? ()(分数:2.00)A.Amy must deliver a copy of the Code and Standards to Tammy.B.Amy must notify Tammy, in writing, of her obligation to comply with the Code and Standards.C.Statement A and B. √D.None of the above.解析:pared with an otherwise identical amortizing security, a zero-coupon bond will most likely have: ()(分数:2.00)A.Less interest rate risk and more reinvestment risk.B.Less reinvestment risk and more interest rate risk. √C.The same reinvestment risk and less interest rate risk.D.The same interest rate risk and more reinvestment risk.解析:4.A futures trader goes long one futures contract at $450. The settlement price 1 day before expiration is $500. On expiration day, the future is trading at $505. The least likely way the futures trader will lock in her profits on expiration is: ()(分数:2.00)A.Take delivery of the underlying asset and pay $500 to the short.B.Close out the futures position by selling the futures contract at $505.C.Take delivery of the underlying asset and pay the expiration settlement price to the short. √D.Cash settle the futures and receive the difference between $500 and the expiration settlement price.解析:5.Assume U.S. GAAP (generally accepted accounting principles) applies unless otherwise noted. Bishop Ltd. received an advanced payment of $10,000 on December 1, for rent on a property for December and January. On receipt they correctly recorded it as cash and unearned revenue. If at December 31, their year-end, they failed to make an adjusting entry related to this payment, ignoring taxes, what would the effect on the financial statements for the year be? ()(分数:2.00)A.Assets are overstated by $5,000 and Liabilities are overstated by $5,000.B.Liabilities are overstated by $5,000 and Net income is overstated by $5,000. √C.Assets are overstated by $5,000 and Owner’s equity is overstated by $5,000.D.Liabilities are overstated by $5,000 and Owners’ equity is understated by $5,000.解析:6.A market participant has a view regarding the potential movement of a stock. He sells a customized over-the-counter put option on the stock when the stock is trading at $38. The put has an exercise price of $36 and the put seller receives $2.25 in premium. The price of the stock is $35 at expiration. The profit or loss for the put seller at expiration is: ()(分数:2.00)A.$1.25.B.$1.00.C.$1.25 √D.$2.25.解析:7.As part of an AIMR investigation into the conduct of Helen, CFA, AIMR requests records from Helen about her investment accounts. Helen writes AIMR a letter stating that under Standard IV (B.5), Preservation of Confidentiality that she is unable to comply with their request. Which of the following statement is TRUE? ()(分数:2.00)A.Is correct in her interpretation of Standard IV (B.5).B.Should not turn over the information because it will violate federal material nonpublic information statutes and AIMR’s Standard V (A) Prohibit against Use of Material Nonpublic information.C.Will no be in violation of Standard IV (B.5) by turning over the requested information because under the Professional Conduct Program, the Disciplinary Review Subcommittee is considered an extension of Helen. √D.All of the above.解析:8.Which of the following is the least accurate statement about the short sale of stocks? () (分数:2.00)A.The short seller must pay any dividends due to the lender of shares.B.A stop buy order would enable a short seller to minimize potential losses.C.Short sales involve time limits for returning the shares borrowed to the lender. √D.A short sale can be made only on an uptick or a zero uptick trade if the previous trade was an uptick trade.解析:9.The appropriate measures of free cash flow and discount rate to use when estimating the total(分数:2.00)A.Answer A.B.Answer B.C.Answer C.D.Answer D. √解析:10. Assume U.S. GAAP (generally accepted accounting principles) applies unless otherwise noted. An analyst gathered the following information from a company’s accounting records: Theanalyst’s estimate of net income for 2007 would be closest to: ()(分数:2.00)A.$650,000.B.$850,000.C.$1,050,000. √D.$1,850,000.解析:二、SECTION TWO(Compulsory):Answer the questions in this section. (总题数:1,分数:10.00)Kammel Capital Management is an institutional money manager that oversees over $12 billion in client assets. Most of its assets under management are invested in the Kammel Funds, a family of 12 mutual funds encompassing 9 growth and value equity funds, and 3 fixed income funds. Linda Karazim is an analyst for the Kammel Strategic Income Fund, a flexible fixed-income fund benchmarked to the Lehman Brothers Aggregate Index. The fund owns a substantial portion of subordinated debentures that were issued by Gernot Incorporated to finance the acquisition of a major competitor in 2002. Karazim has been assigned by the Strategic Income Senior Portfolio Manager, Mark Davidson, to analyze the subordinated debt of Gernot, Inc. Karazim decides that the best way to assess the credit quality of the Gernot’s bonds is to analyze the firm’s financial statements and calculate ratios that will identify trends in the firm’s operations and financing decisions. Karazim searches online and pulls up Gernot’s financial statements for the last threeyears. The statements Karazim uses for her analysis are shown below: As Karazim is working on her project, Jacob Cannon, an analyst for Kammel’s Large Cap Growth F und, stops by Karazim’s office to chat. When Karazim tells him that she is working on a ratio analysis project to assess Gernot Inc.’s subordinated debt, Cannon tells her that Kammel’s growth equity team is potentially looking to purchase Gernot’s stock fo r their fund. Karazim tells Cannon that the return on assets ratio that she has calculated for evaluating Gernot’s debt rating would also be considered one of the most effective ratios for use in valuing Gernot’s stock. Cannon replies that he has been doin g his own ratio analysis to assess Gernot’s systematic risk and one of the most useful ratios for identifying relationships between accounting variables and beta is the current ratio, which would also be useful in forecasting the possibility of Gernot, Inc. going bankrupt. After Karazim completes her analysis, she has a meeting with Davidson to discuss her findings. At the meeting, Karazim tells Davidson that Gernot’s Inc.’s sustainable growth rate based on 2004 data is 9 percent, and that a growing company has a much lower chance of defaulting on its debt. Davidson, always critical of the work of the analysts that work for him, concludes the meeting by telling Karazim that she did good work, but one of the major limitations of the cross-sectional analysis she has performed is that comparisons are made difficult due to different accounting treatments. (分数:10.00)(1).What are Gernot’s total asset turnover for 2004 and the change in the ratio from 2002 to 2004? () 2004 Ratio Change in Ratio (分数:2.00)A.2. 08 decline of 0.18B.1 .52 decline of 0.56 √C.2.08 increase of 0.18D.1.52 increase of 0.56解析:The total asset turnover ratio = sales/assets. In 2002, the ratio was (10,424/5,012) = 2.08. In 2004, the ratio was (11,606/7,636) = 1.52. From 2002 to 2004 the ratio declined by (2.08 –1.52) = 0.56.(2).What is the change in Gernot Inc.’s cash conversion cycle from 2003 to 2004? The cash conversion cycle has: () (分数:2.00)A.Increased by 17 days.B.Increased by 33 days.C.Increased by 25 days. √D.Decreased by 13 days.解析:The cash conversion cycle = (average receivables collection period) + (average inventory processing period) –(payables payment period). For 2003: Receivables turnover = (sales/average receivables) = 11,718/((625+798)/2) = 11,718/712 = 16.46 Average receivables collection period = (365/receivables turnover) = 365/16.46 = 22.17 days Inventory turnover = (COGS/average inventory) = 7183/((1342+937)/2) = 7183/1140 = 6.3 Average inventory processing period = (365/inventory turnover) = 365/6.3 = 57.94 days. Payables turnover = (COGS/average payables) = 7183/((620 + 544)/2) = 7183/582 = 12.34 Payables payment period = (365/12.34) = 29.58 days 2003 cash conversion cycle = 22.17 + 57.94 –29.58 = 50.53 days. For 2004: Receivables turnover = (sales/average receivables) = 11,606/((1294+798)/2) = 11,606/1046 = 11.10 Average receivables collection period =(365/receivables turnover) = 365/11.10 = 32.88 days Inventory turnover = (COGS/average inventory) = 7150/((1342+1552)/2) = 7150/1447 = 4.94 Average inventory processing period = (365/inventory turnover) = 365/4.94 = 73.89 days. Payables turnover = (COGS/average payables) = 7150/((620 + 597)/2) = 7150/609 = 11.74 Payables payment period = (365/11.74) = 31.09 days 2004 cash conversion cycle = 32.88 + 73.89 –31.09 = 75.68 days. From 2003 to 2004, the cash conversion cycle increased by (75.68-50.53) = 25.15 days.(3). Karazim has noted in her analysis that Gernot Inc.’s return on equity has fallen significantly from 2002 to 2004. Using the extended DuPont system, which of the following components had the most impact on Gernot’s ROE decline? () (分数:2.00)A.Financial leverage multiplier.B.Operating profit margin.C.Interest coverage ratio.D.Tax retention rate. √解析:From 2002 to 2004, ROE declined from (328/1575) = 20.8% to (304/2292) = 13.3%. The extended DuPont formula states that ROE = [(operating profit margin)(total asset turnover) – (interest expense rate)](financial leverage multiplier)(tax retention rate) For 2002: Operating profit margin = (EBIT/sales) = (513 + 147)/10,424 = 0.0633 = 6.33%. Total Asset Turnover = (sales/assets) = 10424/5012 = 2.08x Interest Expense rate = (interest expense/assets) = 147/5012 = 2.93% Financial leverage multiplier = (assets/equity) = 5012/1575 = 3.18 Tax retention rate = (1-tax rate) = 1 – (185/513) = 1 – 0.36 = 64%. For 2004: Operating profit margin = (EBIT/sales) = (516 + 340)/11,606 = 0.0738 = 7.38%. Total Asset Turnover = (sales/assets) = 11,606/7,636 = 1.52x Interest Expense rate = (interest expense/assets) = 340/7,636 = 4.45% Financial leverage multiplier = (assets/equity) = 7,636/2,292 = 3.33 Tax retention rate = (1-tax rate) = 1 – (212/516) = 1 – 0.41 = 59%. Since the operating profit margin and the financial leverage multiplier both increased, these did not have an adverse impact on the ROE. The interest coverage ratio is not part of the DuPont formula. The only viable answer is the tax retention rate, which, in fact did decline significantly.(4).Regarding Karazim’s conver sation with Cannon regarding the most useful ratios for various tasks: () (分数:2.00)A.Karazim’s statement is incorrect; Cannon’s statement is incorrect.B.Karazim’s statement is incorrect; Cannon’s statement is correct.√C.Karazim’s statement is correct; Cannon’s statement is correct.D.Karazim’s statement is correct; Cannon’s statement is incorrect.解析:Although return on assets is one of the ratios that bond agencies rely on heavily for deriving their debt ratings, it is not one of the ratios that is deemed most useful for stock valuation, therefore Karazim’s statement is incorrect. Return on equity, (not ROA), is a ratio that is deemedto be very effective for both stock valuation and determining credit ratings. Cannon’s statement is correct – the current ratio is considered to be one of the most effective ratios for both determining systematic risk (beta) based on accounting variables and for forecasting bankruptcy.(5).Karazim decides to enhance her analysis by creating common size statements for Gernot, Inc. Which of the following statements is CORRECT? A common size balance sheet expresses all balance sheet accounts as a percent of: () (分数:2.00)A.Total assets and a common size income statement expressall items as a percentage of net income.B.Sales and a common size income statement expressall items as a percentage of net income.C.Sales and a common size income statement expressall items as a percentage of total assets.D.Total assets and a common size income statement expressall items as a percentage of sales. √解析:Common size statements normalize balance sheet items by expressing each item as a percentage of total assets, and normalize income statements by expressing each item as a percentage of sales. Using common size statements allows the analyst to make easier comparisons of different sized firms. Explanations of terms:(10 points) 1. Legal tender:The status of legal tender simply means that coins and paper currency cannot lawfully be refused in payment for goods and services and in discharge of debts. 2. Double-entry bookkeeping:Bookkeeper debits the transaction to one account and credits it to another bill of exchange: A non-interest-bearing written order used primarily in international trade that binds one party to pay a fixed sum of money to another party at a predetermined future date. 3. Arbitrage pricing theory:An equilibrium model of asset pricing that states that the expected return on a security is a linear function of the security’s sensit ivity to various common factors. 4. Soft law:Quasi-legal instruments which do not have any legally binding force, or whose binding force is somewhat "weaker" than the binding force of traditional law, often contrasted to soft law by being referred to as "hard law". 5. Gold markets:According to its nature and the influence on the entire world gold transaction, gold market may be divided into leading market and regional market. According to the difference of transaction type and the transaction way, gold market may be divided into spot transaction and future transaction. Following international experiences, gold market participants include; gold enterprises, banks, hedge funds, organizations and personal investors, broker companies and the exchanges. Factors that Affect Gold Market are the quantity change of structure of supply and demand, economic factors and political situation and unexpected significant events. There are many different ways to invest in gold, such as gold futures, gold exploration companies, blue-chip gold mining stocks, gold mutual funds, gold bars, gold bullion and gold coins.三、Explanations of terms:(总题数:5,分数:30.00)11.Legal tender(分数:6.00)__________________________________________________________________________________________正确答案:()解析:12.Double-entry bookkeeping(分数:6.00)__________________________________________________________________________________________正确答案:()解析:13.Arbitrage pricing theory(分数:6.00)__________________________________________________________________________________________正确答案:()解析:14.Soft law(分数:6.00)__________________________________________________________________________________________ 正确答案:()解析:15.Gold markets(分数:6.00)__________________________________________________________________________________________ 正确答案:()解析:四、Question and Answer(总题数:4,分数:40.00)16. What is the Theory of Money Supply by the Monetarist School?(分数:10.00)__________________________________________________________________________________________ 正确答案:(Friedman held that money demand is relatively stable and money supply must be guaranteed stable, too, if there should be equilibrium between money demand and money supply. So Friedman opposed the management of the aggregate demand raised by Keynes and focused on the importance of money supply. According to the Monetarist School, the core of economic policies is placed on monetary policy, which should be the only important wander-working among all economic policies. Without monetary policy, other eco nomic policies can’t achieve their anticipated effect. Friedman assumed that the best choice in controlling money supply was the "single rule" of monetary policy, i. e. , making it known to the public to adapt a fixed increasing rate of money supply, excluded other factors, such as interest rates, credit flow, excess reserves on a voluntary basis, and so on. So monetary policy should just take a certain money stock as the only decisive factor. In order to carry out the "single rule”, three problems should be solved; the first is how to define the scope of the aggregate money supply; the second is how to decide the increasing rate of money supply and the third is whether or not fluctuation of the increasing rate of money supply is allowed during a certain period, a year or a season. The solution to the above problems is as follows; firstly, M2 should be the scope of the aggregate money supply; secondly, the increasing rate of money supply should be suited to economic growth rate and thirdly, it couldn’t be c hanged at will when the increasing rate of money supply had been decided. If there is need for change of the increasing rate of money supply, it should be announced and the band of fluctuation should be as small as possible. )解析:17.Explain the Open Market Operations.(分数:10.00)__________________________________________________________________________________________ 正确答案:(The most widely used instrument of monetary policy is open market operations. Open market operations involve the purchase of securities by a central bank to put additional reserves at the disposal of the banking system or the sale of securities to reduce reserves so that money supply can be altered. Open market operations are the bread-and-butter instrument of Federal Reserve policy in U. S. Because the central bank earns interest income from its securities portfolio, the total revenues earned by the central bank vary in direct proportion to the magnitude of its portfolio. However, this consideration plays no role in the central bank’s decision to acquire or sell securities. Indeed, if it did, the central bank could not perform the chief function of a central bank—conducting monetary policy in a way that contributes to the stability of aggregate expenditures and economic activity. Suppose the U. S. economy is encountering excessive aggregate demand and escalating inflation. The central bank is therefore intent on implementing a policy of monetary restraint. In that event, the central bank would sell securities on the openmarket. Assume that the central bank sells $225 million in U. S. Treasury bills to a government securities dealer, receiving payment via a check written against the dealer’s bank checking account. When the central bank receives the check, it "collects" by debiting the reserve account of (making a bookkeeping entry against) the dealer’s commercial bank and returns the check to that bank. Upon receipt of the check, the commercial bank debits the dealer’s demand deposit account. The relevant balance sheets exhibit the following changes. )解析:18.(1) State the difference between a documentary credit and a documentary collection. (2) Why is a documentary credit arrangement important to an exporter? (3) What is the difference between a revocable credit and an irrevocable credit?(分数:10.00)__________________________________________________________________________________________正确答案:((1) A documentary credit is a written undertaking by a banker who is the agent fro the importer or the buyer. The function of a documentary collection is to provide both importer (buyer) and exporter (seller) with a compromise to settle their trade transactions between payment in advance and on open account terms. The parties involved in a documentary credit arrangement include issuing banker, advising banker, the applicant and the beneficiary. Parties involved in a documentary collection include the drawer (exporter or seller), the remitting bank, the collecting bank and the drawee (importer or buyer). . Their processes are different. (2) In accordance with the instructions of the importer, the bank undertakes to pay the exporter, up to a limit, within a designated time period and against any stipulated terms and documents. The credit created for international settlement among banks not only provides a sense of security for the traders involved , but also a reliable source of finance for foreign trade where required .(3) A "revocable credit" may be cancelled at any time up to the moment the advising bank pays. This type of credit is the least favorable to the exporter. An irrevocable credit may not be amended or even cancelled without the consent of all the parties involved. This type of credit guarantees payment to the beneficiary, provided that the credit terms and conditions are met. ) 解析:19.What are the Countering Financial Abuse and Crime? What Others Are Doing?(分数:10.00)__________________________________________________________________________________________正确答案:((1) Since the late 1980s, the growing concerns about drug trafficking and the uses made of globalization facilitated by the advancements in communication technology have led to direct and indirect approaches by different international institutions and the international community to combat financial crime and money laundering. (2) The FATF and affiliated regional organizations lead the international efforts in directly combating money laundering. Members of the FATF engage in annual self-assessments and in periodic mutual evaluations of members’ anti-money laundering efforts. In June 2000, the FATF identified 15 non-member jurisdictions that it considers as "non-cooperative with international efforts against money laundering". Since the FATF is a voluntary task force and not a treaty organization, its recommendations do not constitute a binding international convention. Fund staff has participated, as observers, in most FATF plenaries since 1980. At the request of the FATF, Fund staff made a statement at the Junel996 FATF Plenary on the macroeconomic impact of money laundering, and the Managing Director made a statement at the February 1998 FATF plenary. The FATF has recently agreed to share results from their exercises with Fund staff conducting financial assessments, in the context of FSAP and OFC assessments. At a recent IMF Executive Board meeting, the possibility was raised that the FATF could be invited to prepare ROSC modules on Fund members’ observance of the FATFs Forty Recommendations. Some members of the FATF have asked that the Fund’s Article IV"? Surveill ance and program conditionally include anti-money laundering considerations. The FATF President, ina letter to Fund management, suggested that the FATF Forty Recommendations be adopted as the anti-money laundering standard. (3) Other direct efforts to counter financial crime are undertaken mainly by the International Criminal Police Organization (Interpol) and national financial intelligence units (FIUs). The United Nations takes part in the direct efforts through the United Nation’s Office for Drug Cont rol and Crime Prevention Global Program against Money Laundering (UNDCCP), which monitors weaknesses in global financial systems and assists countries in criminal investigations. Recently, the international community’s awareness of financial system abuse has been heightened by the work of the FSF. In May 2000, the FSF classified 42 OFCs into three groupings, and called on the Fund to take the lead in assessing OFCs adherence to internationally accepted standards and codes. (4) Indirect efforts to counter financial system abuse focus on the preconditions for the proper functioning of financial systems and the formulation and enforcement of relevant laws. These efforts encompass general standards for the supervision and regulation of banks, securities markets, and insurance, as incorporated in the standards developed by the Basel Committee, the IOSCO, and the IAIS. The substance of relevant FATF recommendations is incorporated in the principles of supervision of the Basel Committee and other international supervisory standard-setters. (5) Banking, insurance, and securities markets supervisors are involved in both indirect and direct efforts to combat financial system abuse. Supervisors in different countries exchange information (often based on a network of memoranda of understandings) about individual banks, insurance companies, or agents in the securities markets, with a view to uncover unsound and illegal activities such as securities fraud, insider trading, or misreporting. Supervision is also exercised over the internal mechanisms to control risks, particularly operational risks, which also contributes to countering fraud and other forms of financial crime. (6) Out of concern over the potential impact of tax-induced distortions in capital and financial flows on welfare and on individual countries tax bases, the OECD initiated coordinated action for the elimination of harmful tax practices. In May 1998, the OECD issued a report on Harmful Tax Competition including a series of 19 recommendations for combating harmful tax practices, established a Forum on Harmful Tax Practices, and proposed Guidelines for Dealing with Harmful Preferential Regimes in Member Countries (Annex II). In June 2000, OECD issued a list of countries it considers as engaged in harmful tax practices. )解析:。

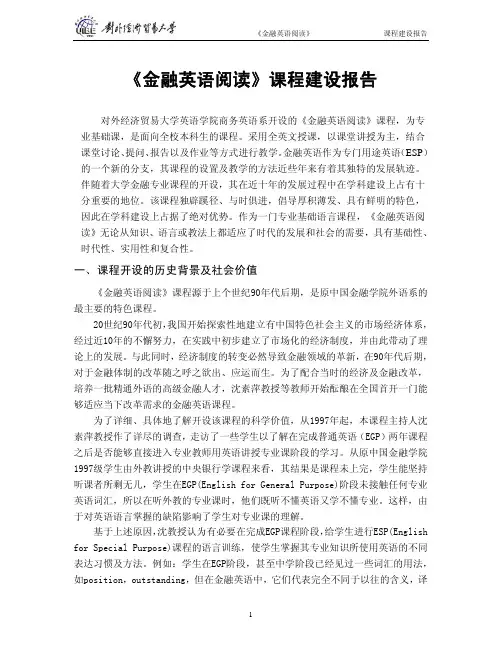

《金融英语阅读》课程建设报告对外经济贸易大学英语学院商务英语系开设的《金融英语阅读》课程,为专业基础课,是面向全校本科生的课程。

采用全英文授课,以课堂讲授为主,结合课堂讨论、提问、报告以及作业等方式进行教学。

金融英语作为专门用途英语(ESP)的一个新的分支,其课程的设置及教学的方法近些年来有着其独特的发展轨迹。

伴随着大学金融专业课程的开设,其在近十年的发展过程中在学科建设上占有十分重要的地位。

该课程独辟蹊径、与时俱进,倡导厚积薄发、具有鲜明的特色,因此在学科建设上占据了绝对优势。

作为一门专业基础语言课程,《金融英语阅读》无论从知识、语言或教法上都适应了时代的发展和社会的需要,具有基础性、时代性、实用性和复合性。

一、 课程开设的历史背景及社会价值《金融英语阅读》课程源于上个世纪90年代后期,是原中国金融学院外语系的最主要的特色课程。

20世纪90年代初,我国开始探索性地建立有中国特色社会主义的市场经济体系,经过近10年的不懈努力,在实践中初步建立了市场化的经济制度,并由此带动了理论上的发展。

与此同时,经济制度的转变必然导致金融领域的革新,在90年代后期,对于金融体制的改革随之呼之欲出、应运而生。

为了配合当时的经济及金融改革,培养一批精通外语的高级金融人才,沈素萍教授等教师开始酝酿在全国首开一门能够适应当下改革需求的金融英语课程。

为了详细、具体地了解开设该课程的科学价值,从1997年起,本课程主持人沈素萍教授作了详尽的调查,走访了一些学生以了解在完成普通英语(EGP)两年课程之后是否能够直接进入专业教师用英语讲授专业课阶段的学习。

从原中国金融学院1997级学生由外教讲授的中央银行学课程来看,其结果是课程未上完,学生能坚持听课者所剩无几,学生在EGP(English for General Purpose)阶段未接触任何专业英语词汇,所以在听外教的专业课时,他们既听不懂英语又学不懂专业。

这样,由于对英语语言掌握的缺陷影响了学生对专业课的理解。

Answer the questions1、What are the ways by which the money flows from individual surplus unitsto deficit units?financial markets facilitate the flow of funds from surplus units to deficit units. Those financial markets that facilitate the flow of short-term funds (with maturities of less than one year) are known as money markets.Those that facilitate the flow of long-term funds are known as capital markets. Debt bond stock fund deritives2、How does the level of tax, do you think, affect the demand of household forloanable funds? (please explain by pictures)if tax rates on household income are expected to significantly decrease in the future, households might believe that they can more easily afford future loan repayment and thus be willing to borrow more funds. For any interest rate, the quantity of loanable funds demanded by households would be greater as a result of tax law adjustment. This represents an outward shift in the demand schedule.tax rates on household income (income tax decreases →the line of household demand moves right)3、What is the relationship between the government demand for loanable fundsand interest rate? (explain by pictures)Whenever a government’s planed expenditures cannot be completely covered by its incoming revenues from taxes and other sources, it demands loanable funds.The way to obtain fund: Municipal (state and local) governments issue municipal bonds to obtain funds, while the federal government and its agencies issue Treasury securities and federal agency securities❖Interest-inelastic (insensitive to interest rates): federal government expenditure and tax policies are generally thought to be independent ofinterest rate. Thus the federal government demand for funds is said to beInterest-inelastic, or insensitive to interest rates. In contrast, municipalgovernments sometimes postpone proposed expenditures if the cost offinancing is too high, implying that their demand for loanable funds issomewhat sensitive to interest rates.•Like the household and business demand, the government demand for loanable funds can shift in response to various events.Deficit increases →move rightExhibit 2.3 impact of increased government budget deficit on the government demand for loanable fundsThe federal government demand-for-loanable-funds schedule is Dg1, if newbills are passed that cause a net increase in the deficit of USD20 billion, thefederal government demand for loanable funds will increaseby that amount.The new demand schedule is Dg2.4、What are the economic factors that affect interest rates?1)Impact of Economic Growth on Interest Rates2)Impact of Inflation on Interest Rates3)Impact of the Money Supply on Interest Rates4)Impact of the Budget Deficit on Interest Rates5)Impact of foreign Flows of Funds on Interest Rates6)Summary of Forces that Affect Interest Rates5、Explain “crowding-out effect〞please.The deficit might not necessarily place upward pressure on interest rates.Given a certain amount of loanable funds supplied to the market( through saving), excessive government dem and for these funds tends to “crowd out〞the private demand (by consumer and corporation) for funds. The federal government may be willing to pay whatever is necessary to borrow these funds, but the private sector may not. This impact is known as the crowding-out effect.6、What are the monetary policy tools?Open market operationsAdjustments in the discount rateAdjustments in the reserve requirement ratio7、What are the ways by which the money flows from individual surplus unitsto deficit units?8、How does the Fed use the monetary policy tools to adjust the money supply?〔答案待定〕1.Open Market OperationsThe buying and selling of government securities (through the Trading Desk) is referred to as open market operations.✓When the Fed issues securities, the commercial banks purchase those that are most attractive. The total funds decrease and the money supply falls.✓When the Fed purchase securities, the total funds increase, which representsa loosening of money supply growth.✓Adjusting the Discount RateThe interest rate that an eligible(有资格的) depository institution is charged to borrow short-term funds directly from a Federal Reserve Bank.To increase the money supply, the Fed can authorized a reduction in thediscount rate; to decrease the money supply, the Fed can increase thediscount rate.3.Adjusting the Reserve Requirement RatioReserve Requirement Ratio is the proportion of their deposit accounts thatmust be held as reserves.The lower the reserve requirement ratio, the greater the lending capacity ofdepository institutions, so a larger money supply.When the fed manipulates the money supply to influence economic variables, it must decide what form of money to manipulate. The optimal form of money should (1)be controllable by the fed and (2)have a predictable(可预测的) impact on economic variables when adjusted by the fed. The most narrow form of money, known as M1, includes currency held by the public and checking deposits(such as demand deposits, NOW accounts, and automatic transfer balances) at depository institutions.9、What are the differences between the general obligation bonds and revenuebonds both of which belong to municipal bonds?Like the federal government, state and local government frenquently spend more than the revenues they receive. To finance the difference, they issue municipal bonds, most of which can be classified as either General obligation bonds or revenue bonds. payments on General obligation bonds are supported by the municipal government’s ability to tax, whereas payments on revenue bond s must be generated by revenues of the project( tollway, toll bridge, state college dormitory, etc) for which the bonds were issued.Material: municipal bond10、What are the characteristics of corporate bonds?The bond indenture, trusteeCorporate bonds can be described according to a variety of characteristics. The bond indenture(契约) is a legal document specifying the rights and obligations of both the issuing firm and the bondholders. It is very comprehensive( normally several hundred pages) and is designed to address all matters related to the bond issue ( collateral, payment dates, default provision, call provisions, etc)Sinking-Fund Provision(偿债基金准备)Bond indentures frequently include a sinking-fund provision, or a reqirement that the firm retire a certain amount of bond issue each year. This provision is considered to be an advantage to the remaining bondholders because it reduces the payments necessary at maturity.Protective Covenants(保护条款)Bond indentures normally place restrictions on the issuing firm that are designed to protest the bondholders from being exposed to increasing risk during the investment period. Those so called Protective Covenants frequently limit the amount of dividends and corporate officers’ salaries the firm can pay and also r estrict theamount of additional debt the firm can issue. Other financial policies may be restricted as well.10、What are the main differences between common stock and preferredstock?●The ownership of common stock entitles shareholders to a number of rights notavailable to other individuals. Normally, only the owner of common stock are permitted to vote on certain key matters concerning the firm,such as theelection of the board of directors, authorization to issue new shares of common stock, approval of amendments to the corporate charter, and adoption ofbylaws(附例).●Usually not allow for significant voting rights,The preferred stockholders have the priority to earn dividends compared with common stockholders .But a firm is not legally required to pay preferred stock dividends.11、What are the similarities and differences between forward contract andfuture contract?Futures and forward contracts are similar in the following ways: ➢Both are derivative securities for future delivery. The parties agree today on price and quantity for settlement in the future.➢Both are used to hedge currency risk, interest rate risk or commodity price risk.They differ in these ways:➢Forward contracts are private, customized定制contracts between a bank and its clients depending on the client’s needs (OTC). There is no secondarymarket for forward contracts since they are private contractual agreements.➢Forward contracts are settled at expiration. Futures contracts are continually settled (mark to market)12、What are the risks of trading futures contracts?Market riskBasis riskLiquidity riskCredit riskPrepayment riskOperational risk13、What are the determinants of call option premiums?Market price of the underlying instrumentInfluence of the market price: the higher the existing market price of the underlying financial instrument relative to the exercise price, the higher the call option premium, other things being equal.Volatility of the underlying instrumentInfluence of the stock’s volatility: the greater the volatility of t he underlying stock, the higher the call option premium, other things being equal.Time to maturity of the call optionInfluence of the call option’s time to maturity: the longer the call option’s time to maturity, the higher the call option premium, other things being equal14、What are the reasons that the Eurodollar market is attractive for bothdepositors and borrowers?the spread between the rate banks pay and the rate they charge is relativelysmall✓Only governments and large corporations participate in this market—lower risk✓Investors in the market avoid some costs (no deposit insurance, lower taxes, no government-mandated credit allocations)✓Eurodollar CDs are not subject to reserve requirements✓Less regulations and restrictions✓✓【本文档内容可以自由复制内容或自由编辑修改内容期待你的好评和关注,我们将会做得更好】✓✓。

金融英语证书综合考试科目(总6页)-CAL-FENGHAI.-(YICAI)-Company One1-CAL-本页仅作为文档封面,使用请直接删除金融英语证书综合考试科目-《现代金融业务》考试大纲一、考试目的本考试为金融英语证书综合水平考试,旨在测试并认定应试人员的金融英语语言水平与实际运用英语处理业务的能力。

本考试的证书可作为在金融部门从事相应的涉外业务工作、参加涉外培训、职称评定和各类毕业学生进入金融部门就业等方面的参考依据。

二、考试对象本考试对象为全国金融系统具备一定金融专业知识和英语水平的金融从业人员、大专院校相关专业学生及其他有志于在金融业发展的人员。

三、考试要求及范围本考试要求应试人员具备在金融业务中较熟练地运用英语的能力。

参加本考试的应试人员应掌握7000个基础英语及金融专业英语词汇,熟悉基本的业务概念和术语及一般的业务程序和原理,能听懂日常会话和一般的业务交谈,具有在篇章水平上运用英语基本语法知识的能力。

能看懂与金融业务有关的一般文字材料,拟写一般的业务文件。

四、考试范围1、中国金融业概述银行业证券业保险业2、银行和金融机构监管银行业证券业保险业3、中国外汇体制概述外汇体系金融机构外汇业务对外汇账户的监管经常账户处理资本项目处理国际收支统计申报外汇业务4、会计财务会计管理会计银行会计5、银行中间业务中间业务金融市场投资银行业网上银行业6、银行信贷贷款种类信贷计划借款人的筛选信贷风险管理7、国际结算票据国际结算方式国际结算中使用的单据贸易融资《贸易术语通则2000》8、证券、期货市场概述证券市场期货市场法律体制9、保险基础保险原则和保险合约保险种类保险市场保险业务10、金融函电银行业务信函电传SWIFT备忘录电子邮件五、考试构成本考试包括听力和笔试两部分,主要从以下方面测试应试人员运用英语处理日常银行业务能力:听力部分(占30%):包括简短会话、报告、陈述、访谈、讨论、电话通讯对话、接待客户、介绍业务、提供服务等。

金融专业英语函电写作(答案)第一章第一节I.1. International Business Dept.The Export-Import Bank of ChinaNo. 77, Beiheyan Street, Dongcheng DistrictBeijing 100009 ChinaPhone: (8610) 64099988 Telex: 210202 EXIM CNFax: (8610) 64005186 SWIFT:EIBCCNBJWebsite: 2. Policy and Regulation DepartmentBeijing Municipal Development and Restructuring CommissionNo. 2D, Fuxingmen Neidajie,Beijing 100031 China3. Export DepartmentJiangxi Huacai Import & Export Corporation6/F Foreign Trade Building66 Zhanbo Road, Nangchang 330000Jiangxi, China4. Credit Management DepartmentBank of China410 Fuchengmen NeidajieBeijing 100818P. R. China5. Import DeparmentChaoyang Chemicals Company23 Renmin Road, HaidianBeijing 100083, P. R. China6.中国建设银行海口市沿江三路分理处7.中国河南南阳市七一路129号,中国银行南阳分行8.邮编100020,中国北京市朝阳区雅宝路8号,中国银行北京分行II.1.Thank you for your letter of December 9,2010.2.We have received with thanks your letter dated December 25,2010.3.Please inform us of…4.We shall appreciate it very much if you would let us know…5.This is in reply to your letter dated…regarding…6.In response to your letter ref…of…,we wish to inform you that…7.We refer to the above demand draft and inform you that…8.In compliance with the request in your letter of…,we are pleased to…9.We regret to inform you that…10.As requested in your letter dated…,we…11.就…日贵行来函之事,现答复如下。

金融英语证书考试大纲第一部分考试说明一、考试目的金融英语证书考试是国家级行业性专业外语水平考试,旨在通过统一的标准化考试程序和测试标准,为中国金融业提供金融英语水平行业参考标准,测试并认定应试人员的金融英语语言水平及应用能力,促进金融从业人员及相关社会人员不断提高金融英语水平。

本考试的证书可作为金融业在职人员岗位任职、职称评定、涉外培训、海外机构任职、后备人才选拔以及大专院校学生入职金融部门等方面金融英语能力的参考依据。

二、考试对象考试对象为金融系统从业人员及一切有志于从事金融事业的人员。

三、考试时间与报名时间金融英语证书考试每年举行1次。

每年10月下旬或11月上旬择时在全国统一开考。

考试报名时间为每年5月至9月。

第二部分考试内容一、考试要求金融英语证书考试以专业英语为载体,测试应试人员所掌握的金融理论、政策与业务知识及其在业务环境中使用专业英语的能力,从而测试、评价应试人员专业英语与金融专业知识的结合程度。

在语言能力方面,金融英语证书考试主要从听、读两个方面测评考生对英语词汇、语法、听力和阅读等知识和技能的应用和掌握程度。

在专业知识方面,金融英语证书考试涵盖了金融知识与理论、金融政策、规制与金融业务等方面。

对专业知识要求分为了解、理解和掌握三个层次,了解层次指对有关知识有感性认识;理解层次指对有关知识有较深刻的理性认识;掌握层次指能够利用知识分析、解决具体相关经济问题。

二、考试范围及试题中比重(一)语言应用能力((一)语言应用能力(30%30%30%))主要考核考生应用和掌握常用词汇、词组以及专业词汇的能力;应用和掌握语法知识的能力;获取口头信息的能力;通过阅读获取书面信息并通过分析综合判断解决问题的能力。

(二)金融知识与理论((二)金融知识与理论(30%30%30%))1、主要考核内容及要求(1)了解货币的类型和职能;了解货币制度的构成及其演变;了解货币流通及其计量;了解信用的功能与形式;掌握存款货币创造过程,并能简单计算派生存款。

CFA考试知识点CFA(Chartered Financial Analyst)是金融业内的一个国际性资格认证,被公认为是金融行业从业者的职业素养和专业能力的象征。

CFA考试分为三级,涵盖了金融和投资领域的广泛知识,包括投资组合、股票和债券等金融工具、财务报表分析、公司估值、风险管理等方面的内容。

在这篇文章中,我将为您介绍CFA考试的一些重要知识点。

1.投资组合理论:投资组合理论是CFA考试中的重要部分,它研究如何构建一个最优的投资组合,以实现最大的收益或最小的风险。

投资组合理论的核心概念包括资产配置(Asset Allocation)、风险分散(Diversification)和有效边界(Efficient Frontier)等。

2.股票和债券分析:CFA考试涵盖了对股票和债券的分析和估值。

对于股票分析,考生需要了解公司的财务报表分析、盈利能力和估值方法等。

对于债券分析,考生需要学习债券价格计算、利率风险和信用风险的评估等内容。

3.财务报表分析:财务报表分析是评估公司财务状况和绩效的重要工具。

考生需要学习如何分析财务报表,包括利润表、资产负债表和现金流量表。

财务报表分析涉及到比率分析、现金流分析和财务预测等技术。

4.金融市场与机构:了解金融市场和金融机构是CFA考试的基础知识。

金融市场包括股票市场、债券市场和衍生品市场等。

金融机构包括商业银行、投资银行和资产管理公司等。

考生需要熟悉这些市场和机构的运作机制和相关法规。

5.风险管理:风险管理是金融业务中至关重要的一环。

CFA考试涵盖了对风险的评估和管理的知识点。

考生需要学习不同类型的风险,如市场风险、信用风险和操作风险,并了解使用不同的工具和方法来管理这些风险。

6.伦理和职业行为:作为金融从业者,遵守伦理规范和职业道德是至关重要的。

CFA考试要求考生了解和遵守CFA协会的道德准则和职业行为标准。

这些准则包括诚实、公正、诚信、尊重客户利益和保持专业独立性等。

Opposite指“位置、方向、地位、性质、意义等对立的、相反的〞, 如:如: “True〞and “ false 〞 have opposite meanings.“真〞与“假〞有着相反的意思。

Contrary指“两物朝相反的方向开展〞, 含有“互相冲突, 不一致〞的意思, 如:Your plan is contrary to mine.你的计划与我的相反。

Inverse 颠倒的;倒数的Evil is the inverse of good.Reverse 反过来,翻转He reversed the car.他倒车.教育类素质教育 education for all-round development应试教育 the examination-oriented education义务教育 pulsory education片面追求升学率 place undue emphasis on the proportion of students' entering school of a higher level高分低能 good scores but low qualities扩招 expand enrollment教书育人 impart knowledge and educate people因材施教 teach students according to their aptitude提高身心素质 improve the health and psychological quality大学生创业 the university students' innovative undertaking社会实践 social practice文凭 diplomas and certificates复合型人才 interdisciplinary talents文化底蕴 the rich cultural deposits适应社会的改变 adjust to the social changes满足社会的急需 meet the urgent needs the society工作类人才流动和双向选择 talent flow and a dual-way selection试用期 probationary period跳槽 job-hopping自由职业 freelance work拜金主义 money worship获得名利 achieve fame and wealth充分发挥个人的潜力 develop fully one's potential and creativity工作出色 excel in one's work社会和个人的尊重 social and personal esteem生计问题 a bread and butter issue人才交流 talents exchange培养人才 cultivate talents人才外流 brain drain失业问题 unemployment problems下岗职工 the laid-off workers自谋生路 be self-employed劳动力短缺 shortage of manpower医药卫生类卫生环境 sanitary environment营养不良 malnutrition杀虫剂 pesticide传染病 infectious disease呼吸疾病 respiratory disease商业类假冒伪劣 forged and fake modities物美价廉 goods with high qualities low price售后服务 after-sale service家用电器 household electrical appliances旺季 during peak selling seasons促销 promote sales提高购置力 raise the purchasing power刺激购物欲 stimulate the desire to buy超前消费 premature consumption国有企业 state-owned enterprise私人企业 private enterprise偷税漏税 tax evasion保持时常良好的秩序 keep market in good order垄断市场 monopolize the market社会道德类遵守公德 ply with public morality物质和精神文明建设 material and ideological progress守法 observe/obey the law遵守交规 observe traffic regulations改良社会风气 improve public morals## offend against the law侵犯个人隐私 invasion of privacy违反公共规章 break/violate public regulations扰乱治安 disturb the social order要求索赔 claim pensation应该受法律严惩 deserve to be punished heavily by the law环保类生态系统 ecosystem环保意识 environmental awareness生态失衡 disruption of ecological balance全球变暖 global warming温室效应 greenhouse effect沙尘暴 sand/dust storms淡水资源短缺 shortage of fresh waterdownsizing减员**streamline精简**on the job/in-service在职**disposable一次性**think tank智囊团**round the clock service全天候服务**(free) convertibility〔自由〕兑换**find a sugar daddy傍大款**Nordic北欧**non-renewable不可再生**out and out彻头彻尾**deadlock僵局**tertiary industry第三产业**fair (market) value市值**refund退款**axis-of-evil邪恶轴心**(nuclear) nonproliferation核不扩散**holistic整体的**one-off一次性〔解决〕的;一揽子的**turnkey总承包的;现成可使用的**in-house自有的;〔in-house finance pany) **round-up汇总?**overseas returnee海归**framework accord框架协议**WTO accession参加WTO**non-exclusive license非专用特许**royalty free无费的**sublicense转授权;转发许可证**creature forts衣食**recapitalization资产重组**RPI〔Retail Price Index〕零售物价指数**overriding concern高于一切的考虑**Lanyard系索**copyright著作权**royalty**pliance合规性**extension展期**co-lead underwriter副主承销商**Advisory Board咨询委员会**Board of Councillors理事会**entrepreneur创业者**upmarket高端的**attorney general首席检察官**upscale高端的**clientele客户群**self starter白手起家人**down round筹资首轮**mass market vs. submarket总的市场/次级市场〔比如根据某个标准分的客户群〕**letter/power of attorney委任书**market clout市场影响〔?〕**rehaul (a business)重组;**sell-back (与buy-out相对〕**monograph专题〔论述〕**verbatim逐字逐句的说法〔比如销售“定式〞用语〕**Liquidity Trap流动性陷阱〔宁愿把资金存放于银行拿取零利息的回报,也不愿再投资赔了〕**many a little makes a mickle集腋成裘**reservist后备兵**at eleventh hours关键时刻**misnomer用词不当**payoff收益**outperform超过**bailout解决;救援〔for instance, the bailout from IMF for South Korea and other SE Asian countries after financial crisis)**honor of N/R (notes receivable)/dishonor到期兑现**political cronies政府人员办的关联企业**value-based pricing价值导向定价法〔区别于cost-based pricing,指能为客户带来多少价值来确定价格,而不是消耗了多少本钱,比如飞机票)**clearinghouse like exchange〔交换场所〕**value of synergy企业兼并之后带来的利益**post-investment values〔注意post的用法〕**techie做技术的人〔与salesman相对〕**on-target专注于最终目标的**optimum最适宜的**overhead还有一个意思是“投影〞,类似powerpoint**in line与预期相符的**YTD (year-to-date)从Jan 1到目前的时间**scorched earth焦土政策**economies of scopeX围经济〔与economies of scale相比〕**toehold小支点,起点**industry observer行业观察家**networking商业构建私人关系网**conference backdrop会议背景幕**trade-up升级**ease of maintenance/repair维修的容易度**cap〔金额〕最高限度;upper limit**lifetime〔债券等的〕存期**double dip recession二次萧条〔特指本次美国经济泡沫破灭后,还将面临的进一步衰退〕**fringe benefits附加福利〔除国家规定外的〕**annual leave年假**call to order宣布开会;要求遵守秩序**second the motion附议**motion carried动议通过**window dressing粉饰**end-state最终状态**scrap废品〔与rework相对〕**disagrregate分解**solidity可*性**MIS (management information system) 管理信息系统**in due course稍后**7-11便利店**numerator/denominator分子/分母**winding-up结算;停业**subsidiary/member panies下属公司**coach大客车**OEM/aftermarket parts汽车业的前/后配件**assembly plant汽车整车厂**elevated rail轻轨**honorary名誉**deputy magistrate副区长〔虹口〕**size up估计**offer .. Advancement over比。

中国银行笔试经验之英语笔试在中国银行的英语考试中要注意哪些问题呢?下面为大家了中国银行英语笔试,欢送阅读参考!第一局部,中国银行笔试:单项选择,20题,每道题一句话,中间挖个空,下面四个选项,选个适宜的填进去。

属于常规题,但是单词都比拟fancy,不太认识的。

第二局部,中国银行笔试:挑错,10道好似,也是每题一句话,有四个地方划线,挑出错的即可,不用改。

第三局部,中国银行笔试:完形,20题,说的是non-native 在美国学英语的事情,先说黑人(不确定)要从小学英语,然后说有一阵反德时期学校不允许教德语,把德语书都烧掉了之类,然后又宣布这样不好,要尊重他们的权力啥的。

第三段说修铁路期间移民过去许多,小孩子都在不合法(我选的是illegal,还有别的选项,不记得了)的学校学英语,不标准。

后面就没做完了。

第四局部,中国银行笔试:阅读。

100分A.常规阅读,四篇。

60分。

难度……不太好说,一直在忙学校期末考试,英语一点都没碰,有点生疏,看别人以前笔经说六级偏难,我觉得大概差不多吧,我六级588分,但已经整整一年了。

反正以后大家可以拿六级阅读练手,不要拿托福或者GMAT,思路完全不一样,就要拿六级这种思路,又文绉绉的文章。

每篇五个问题。

我最后一篇连看都没来得及看。

B.排序。

15分。

一篇文章,首段和尾段排好,中间打乱。

不太好排,还是那句话,思路不好看出来。

也许我GMAT文章看多了,受不了这种思路不清的吧,sigh……C.句子填空。

15分。

一篇文章,根本上每段挖个空吧,后面8个句子,填进去。

说实话真的很难,有种话里有话的感觉,摸不准。

文章大概说的是美国那边的经济学家和社评对经济形势很悲观,预期一个比一个低,后面又涉及了01年和86(?)年的几次低谷,还有theGreatRecession,反正相当难的一篇文章,还时事,没准从wallstreetjournal之类上摘下来的说。

D.快速阅读。

5道题,10分,这是整个考试最容易的局部了。

金融专业英语证考试经验体会

中级所有科目考试教材全部来自于香港银行学会,试题及评卷均与香港银行学会有关。

很多考生虽已熟记教材内容,但却依然无法通过考试,其原因是香港的法律、会计制度、成熟的商业银行环境等与中国大陆有很大不同。

要想成功地在四年内通过全科考试并非易事。

这要求有扎实地英文功底,是大学英语六级以上。

同时要有一定的金融理论知识基础和银行工作实践经验。

同时具备这些条件的人并不多,这就需要考生通过艰苦的努力和锲而不舍的精神来获得中级金融专业英语证书。

本人已全部通过四科考试,现将考试经验介绍给大家,希望对您有所帮助。

1、西方经济学:

教材明显的是由英国人编写,语言相对比较晦涩。

建议考生在时间允许的情况下,先选择一本400页左右的中文西方经济学教材了解该学科内容。

本人在没有西方经济学基础的情况下,在考试前读了8遍指定教材,非常痛苦。

建议没有基础的考生先通过中文了解该学科。

另外,教材的内容较有限,但考题的范围却很广。

2001年的考题中有一道题目是问:中国实行最低保障制度对社会的影响(大意)。

考生要了解收入再分配的原理,并与中国实际相结合才能完整作答。

曲线分析是该科考试的难点和重点。

2、西方会计学

会计学的内容集中在试算表、资产负债表、损益表各项目,以及存货管理等内容。

本科考试内容不深,但陷阱较多,很多考生考完之后自我感觉良好,但成绩却非常低。

其原因是对陷阱没有察觉。

本人认为该考试的关键在于练习,对陷阱的设计有所了解。

3、银行业务

很多考生认为银行业务的参考书是最薄的,考,但实际情况并不是这样。

香港的商业银行环境与大陆有很多区别,主要区别是:香港是混业经营,即,银行可以经营证券和保险业务,同时商人银行业务也是大陆所没有的。

法律和传统的不同使“商业银行”这一概念在大陆和香港有不同的理解。

香港商业银行的监管环境与大陆也不同,业务经营范围差别更大。

所以,用中国商业银行的理念去回答完全竞争环境下的商业银行的问题,会使考生觉得答得不错,但成绩不佳。

另外,本科考试中包括听力测试,人行提供的参考材料内容过于简单,使考生形成误解。

听力是考试的难点之一,其语速达到大学英语六级,答题方式类似于专业英语考试,即,听完整个文章后答题。

听力的内容考生比较陌生,例如,2001年,通篇文章讨论的是“Bills department”(押汇部),1999年是“smart card”(灵通卡),考生对该内容非常陌生。

听力测试共20分,大多数考生只能拿到7-8分,或更少。

所以,了解香港得金融环境和其部门设置以及金融产品是至关重要的。

4.法律

人行提供的材料中,四部法律的译文非常有价值。

但香港的

法律体制与中国大陆还是存在很多区别的。

例如,衡平法制度和判例法制度是大陆所没有的。

如果不了解这些区别是很难通过考试的。

另外,考题中经常要求考生提供法律建议,如何提供建议,即,如何回答问题,是答题的关键,应该将各种条件想充分,从不同的角度和设想来回答,这就需要答题技巧。

同时判例较多,而且判例能够说明法律的细节问题。

由于时间关系,多数考生没有认真研究判例,所以对香港法律只知其然不知其所以然。

应对本科考试关键是:了解香港法律体制,熟悉判例,掌握答题技巧。

正因为老师有这份等待的勇气,有这份等待的耐心,有这份等待的智慧,有这份等待的艺术,所以学生才能有足够的时间潜心阅读并深入思考,所以学生的心灵才会有感动和震撼,所以课堂上才会出现不可预约的精

彩。

在学生进行文本阅读的时候,老师在教室里轻轻地踱着步子。

在学生发言的时候,老师不会因为学生思维的暂时停顿而急躁地叫他坐下,也不会因为回答得不到位而抢过话语权,把答案引向或指向“目标”。

当学生说出“信赖,往往创造出美好的境界”时,老师的脸上露出了欣慰的笑容。

有位教育家说过:“教室里寂静,说明学生在集中精力思考,要珍惜这样的时刻。

”夏老师,他懂得去珍惜。

老师在给我们讲他的教学设计时还说到他对教参中一些设计的看法。

最后,他还告诉我们:“照着教参上课是上不出好课的。

”

我佩服老师,有个性,能坚定不移地走自己的路,能坚持自己对教学的理解。