中级宏观经济学Abel_Chapter08

- 格式:ppt

- 大小:550.50 KB

- 文档页数:36

第二章:国民收入核算

收入法、支出法、产出法

链式加权的实际GDP

第三章长期中的封闭经济模型

第五章长期中的开放经济模型小型、大型

第七、八章经济增长

第九-十一章短期中的封闭经济凯恩斯交叉图

IS-LM AS-AD

长短期调整

第十二章短期中的开放经济

第十三章政策无效性命题

第十四章DAD-DAS模型

考试题型:

1.单选题(15分-20分,2-3分/题)

2.作图题(15-20分,2题)

要求:

3.计算、分析、作图题(60-70分)

要求:要有计算步骤和必要的文字说明,作图要以题目的计算结果为基础,

小数位数的保留按照题目要求,

计算结果可保留分数和根号等形式。

考试具体题型及分布确定后会及时发送到课程邮箱。

考试时间:16周周一7-8节

作图题练习:

作图分析政府购买增加在各模型中的效应,对变量有何影响?。

第1章宏观经济学概述1.1 复习笔记一、宏观经济学的研究内容宏观经济学(macroeconomics)研究国民经济构成及其运行,以及政府用以调节经济运行的政策。

宏观经济学关注六个方面的问题:①一国长期经济增长的决定因素是什么?②一国经济波动的根源是什么?③失业产生的原因是什么?④引起价格上涨的因素是什么?⑤一国作为全球经济体系的一部分,如何影响其他国家的经济?⑥政府政策能否用来改善一国经济的运行?1.长期经济增长(1)富国与穷国存在差距的原因富国在其历史的某一时点上经历过长期的经济高速增长,而穷国要么从未经历过持续的经济增长,要么其经济增长的成果因随后的经济衰退而损失殆尽。

(2)美国的长期经济增长的原因①人口增加为经济发展提供了源源不断的劳动力。

②给定劳动力数量的条件下劳动所带来的产量的增加。

平均劳动生产率(average labor productivity)指单位劳动投入(如每位工人或每单位工作时间)所生产的产量。

(3)经济增长率的决定因素①储蓄率和投资率的增加。

②技术进步率以及其他一些有助于提高机器和工人生产率的因素。

2.经济周期美国产出的增长历程表明:产出的增长路径并不总是平滑的,而是存在谷峰和谷底。

宏观经济学家用经济周期来描绘经济活动的短期收缩与扩张,但一些非常剧烈的收缩与扩张有时并不是经济周期。

经济周期的下降阶段为衰退期,在这一时期国民产出可能下降,也可能以极慢的速度增长。

衰退对许多人而言意味着陷入经济困境,此外,衰退还是一个重要的政治焦点。

因为对于每个希望再次当选的政治家来说,经济在其任期间内处于繁荣期(而不是衰退期)将使其再次当选的把握更大。

3.失业经济衰退往往伴随着失业(unemployment)。

失业是指有能力工作并正在积极寻找工作的劳动者未能找到工作的现象。

失业率是用来衡量失业最常见的指标,其计算公式为失业人口除以总劳动力人口,其中,总劳动力人口指正在工作或正在寻找工作的劳动者的总数目。

中级宏观经济学讲义第一讲绪论一、宏观经济学研究经济问题的独特视角经济学:研究如何利用稀缺资源生产有价值的商品并分配给不同的个人的科学。

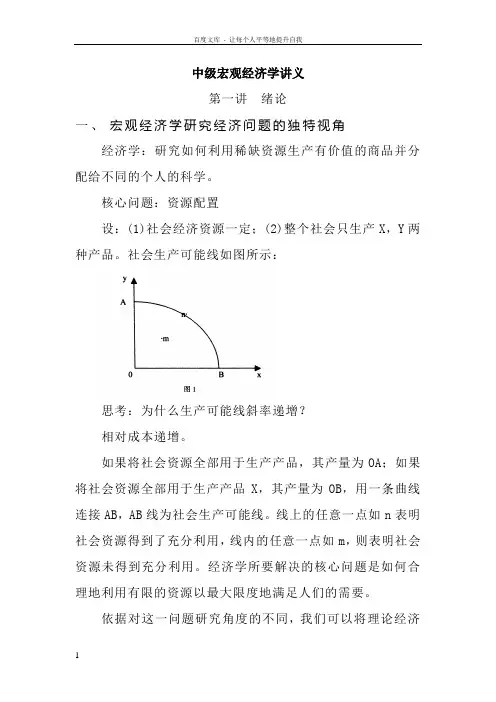

核心问题:资源配置设:(1)社会经济资源一定;(2)整个社会只生产X,Y两种产品。

社会生产可能线如图所示:思考:为什么生产可能线斜率递增?相对成本递增。

如果将社会资源全部用于生产产品,其产量为OA;如果将社会资源全部用于生产产品X,其产量为OB,用一条曲线连接AB,AB线为社会生产可能线。

线上的任意一点如n表明社会资源得到了充分利用,线内的任意一点如m,则表明社会资源未得到充分利用。

经济学所要解决的核心问题是如何合理地利用有限的资源以最大限度地满足人们的需要。

依据对这一问题研究角度的不同,我们可以将理论经济学分为三大块:1.制度经济学研究经济活动中的质的问题。

在本课程中,把资本主义市场经济当作既定的已知的制度前提。

2.微观经济学研究的假定前提:整个社会的资源已充分利用(资源配置点落在生产可能线)。

讨论的核心问题:在生产可能性边界上有无数个点,每一个点代表一种资源的配置方式(X,Y两种产品的不同组合),哪一种资源配置方式是最优的,能最大限度地满足人们的需要?显然在生产可能线上的每一点所利用的资源的总量是相同的,所不同的是资源利用的结构问题。

要增加一种产品的产出,就必须相应地减少另外一种产品的产出,生产可能线上的点的移动只是资源利用结构的调整。

3.宏观经济学研究的假定前提:资源尚未充分利用(资源配置点落在生产可能性边界以内)。

讨的核心问题:如何将资源配置点从生产可能线以内调节到生产可能线之上,使社会资源得到充分利用?这就是宏观经济学与微观经济学所不同的研究经济问题的独特视角。

在资源配置点的移动过程中,社会对资源利用的总量在变化,社会总的产出水平在变化,但资源的利用结构和社会产出结构可以不变。

微观经济学宏观经济学创始人斯密,1776 凯恩斯,1936研究对象个别企业,个别家庭,个别市场国民经济整体研究前提完全信息,完全理性,市场出清资源未充分利用中心内容价格理论收入理论理论框架二、宏观经济模型的构造关于国民收入决定的原理,宏观经济学可以用一个简单的经济模型表示。

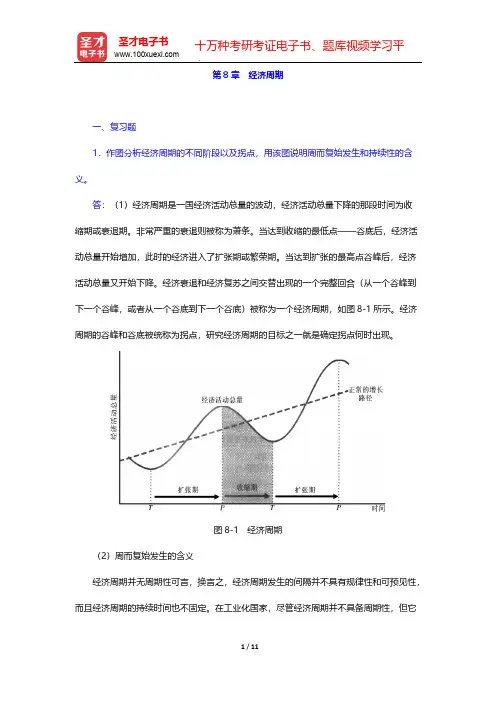

第8章 经济周期一、复习题1.作图分析经济周期的不同阶段以及拐点,用该图说明周而复始发生和持续性的含义。

答:(1)经济周期是一国经济活动总量的波动,经济活动总量下降的那段时间为收缩期或衰退期。

非常严重的衰退则被称为萧条。

当达到收缩的最低点——谷底后,经济活动总量开始增加,此时的经济进入了扩张期或繁荣期。

当达到扩张的最高点谷峰后,经济活动总量又开始下降。

经济衰退和经济复苏之间交替出现的一个完整回合(从一个谷峰到下一个谷峰,或者从一个谷底到下一个谷底)被称为一个经济周期,如图8-1所示。

经济周期的谷峰和谷底被统称为拐点,研究经济周期的目标之一就是确定拐点何时出现。

图8-1 经济周期(2)周而复始发生的含义经济周期并无周期性可言,换言之,经济周期发生的间隔并不具有规律性和可预见性,而且经济周期的持续时间也不固定。

在工业化国家,尽管经济周期并不具备周期性,但它却是周而复始的,遵循收缩——谷底——扩张——谷峰这一标准模式循环往复。

(3)持续性的含义完整的经济周期所持续的时间差别很大,一旦衰退开始,经济会持续收缩一段时间——1年或更长时间。

同样,扩张一旦开始也会持续一段时间。

经济活动下降后又进一步下降,或增长后又进一步增长,这种趋势被称为持续性。

2.什么是协动性?它与本章提到的经济周期事实有什么关系?答:(1)许多经济变量在经济周期中同步运动,这种趋势被称为协动性。

经济周期不只发生在几个部门,也不仅涉及几个经济变量,而是在许多经济活动中扩张或收缩几乎同时发生。

因此,尽管不同行业对经济周期敏感度有所差别,但大部分行业的产出和就业还是趋向于在衰退期下降,而在扩张期上升。

诸如价格、劳动生产率、投资和政府购买等许多经济变量在经济周期中也具有规律性和可预测性。

(2)经济周期事实反映了经济变量与经济周期的协动性。

主要经济变量随经济周期变动的特征如表8-1所示。

表8-1 主要经济变量随经济周期变动的特征3.美国经济周期随时间推移变得温和了,哪些证据可以支持这一观点?经济周期是否会随时间推移而变温和,这为什么是一个重要问题?答:(1)克里斯蒂娜·罗默撰写了一系列文章来否认经济周期随时间的推移变温和了,罗默的主要观点是怀疑1929年以前数据的质量,认为用于估算历史数据的方法一般夸大了早期的经济波动。

BarroChapter 1TRUE/FALSE1. Macroeconomists study the amount of employment and unemployment.2. Macroeconomists study the price of individual products like beer.3. When the gross domestic product is growing, it is called inflation.4. A recession is when GDP is falling toward a trough.5. If price is below equilibrium in a market, then quantity supplied will be less than quantity demanded.MULTIPLE CHOICE1. Macroeconomics deals with:a. how individual markets work.b. the overall performance of the economy.c. relative prices in different markets.d. substitution of one good for another good.2. Macroeconomics includes the study of:a. the general price level. c. the relative price of goods.b. the price of individual goods. d. all of the above.3. Macroeconomists study:a. the determination of the economy’s total production.b. unemploymentc. the general price level.d. all of the above.4. Macroeconomists study:a. the determination of real GDP.b. the production of specific goods.c. the relative production in different markets.d. all of the above.5. Among the prices that macroeconomist study are:a. the price of coffee. c. the interest rate.b. the price of tea. d. all of the above.6. Among the prices that macroeconomists study are:a. the wage rate. c. the exchange rate.b. the interest rate.d. all of the above.7. Monetary policy involves:a. the government’s expenditure. c. determining the quantity of money.b. taxation.d. the fiscal deficit.8. The unemployment rate is:a. the fraction of the population with no job. b. the fraction of those seeking work with no job.c. the rate of growth of those with no job.d. the rate of growth of those seeking work.9. Fiscal policy involves:a. determining exchange rates. c. interest rates.b. government expenditures.d. all of the above.10. The rate of growth of GDP for period t is:a. c.b.d.11. Variations in real GDP are called:a. inflation. c. economic fluctuations.b. deflation. d. all of the above.12. When GDP is expanding toward a high point it is called a[n]:a. depression. c. recession.b. boom. d. inflation.13. When real GDP falls toward a low point or trough it is called a[n]:a. boom. c. inflation.b. recession. d. expansion.14. During recessions the unemployment rate:a. declines. c. is stable.b. increases.d. is unmeasureable.15. The unemployment rate in the US was highest in the:a. 1990s c. 1980sb. 1930s d. 1950s16. The inflation rate for year t is:a.c.b.d.17. A variable that macroeconomists want to model is a[n]a. endogenous variable. c. exogenous variable.b. dummy variable. d. predetermined variable.18. A variable taken as given in a model is a[n]a. endogenous variable. c. exogenous variable.b. dummy variable. d. dichotomous variable.19. The dollar price paid to use capital is known as:a. the interest rate. c. the rental price of capital.b. the exchange rate. d. the general price level.20. The price of labor is the:a. exchange rate. c. interest rate.b. wage rate. d. the rental price.Figure1.1Price21. In Figure1.1 the equilibrium price is:a. 2 c. 7b. 5 d. 022. In Figure1.1 the equilibrium quantity isa. 5 c. 7b. 2 d. 823. In Figure1.1 if price is 7, thena. the market is in equilibrium. c. there is excess quantity demanded.b. there is excess quantity supplied. d. the market clears.24. In Figure1.1 if the price is 2, then:a. the market is in equilibrium. c. there is excess quantity demanded.b. there is excess quantity supplied. d. the market clears.25. In Figure1.1, if price is 7, then quantity demanded is:a. 2. c. 3.b. 7. d. 8.26. In Figure1.1, if price is 7, then quantity demanded is:a. 2. c. 3.b. 7. d. 8.27. In Figure1.1, if price is 7, then quantity supplied is:a. 2. c. 3.b. 7. d. 8.28. In Figure1.1, if price is 2, then quantity demanded is:a. 2. c. 3.b. 7. d. 8.29. In Figure1.1, if price is 2, then quantity supplied is:a. 2. c. 3.b. 7. d. 8.30. In Figure1.1, if price is 5, then quantity demanded is:a. 2. c. 3.b. 7. d. 5.31. In Figure1.1, if demand falls, then equilibrium:a. price and quantity fall. c. price falls and quantity rises.b. price and quantity rise. d. prices rises and quantity falls.32. In Figure1.1 if supply increases, then equilibrium:a. price and quantity fall. c. price rises and quantity falls.b. price and quantity rise. d. price falls and quantity rises.33. A possible order of events in an economy over time is:a. expansion, recession, peak, expansion. c. expansion, peak, trough, recession.b. recession, trough, expansion, peak. d. recession, trough, peak, expansion.34. A trough in an economy is when the economy:a. is growing. c. is contracting.b. reaches a low point. d. reaches a high point.35. A peak in an economy is when the economy:a. is growing. c. is contracting.b. reaches a low point. d. reaches a high point.36. A possible order of economic fluctuations is:a. recession, boom, expansion, trough. c. recession, trough, expansion, peak.b. expansion, recession, boom, trough. d. expansion, trough, recession, peak.37. If prices are sticky:a. the market quickly sticks at equilibrium. c. the market only slowly moves towardequilibrium.b. the market clears quickly. d. all of the above.38. In an economic model:a. endogenous variables feed into a model toaffect exogenous variable. c. exogenous and endogenous variables feedinto the model.b. exogenous variables feed into a model toaffect endogenous variables.d. none of the above.39. A price taker:a. takes the price to the market. c. accepts the market price and decideswhether and how much to buy or sell.b. controls the market price. d. accepts the market quantity and sets price.40. A macroeconomist would study the:a. price of cars. c. the sales of beer.b. the market for shoes. d. none of the above. SHORT ANSWER1. What types of economic issues do macroeconomists study?2. How is the annual inflation rate calculated?3. What is the rate of growth of real GDP?4. Describe what happens when demand or supply increase in a market.5. What are exogenous and endogenous variables?。

中级宏观经济学引言中级宏观经济学是经济学领域中的一个重要分支,它研究的是整个经济系统的运行和发展。

在宏观经济学中,我们关注的不仅是个体或个体市场的行为,而是从整体的角度来研究经济问题,例如整个国家的产出、就业、通货膨胀等。

本文将介绍中级宏观经济学的基本概念和主要内容。

宏观经济学的重要概念1.GDP(国内生产总值):GDP是衡量一个国家经济活动总量的指标。

它包括了私人消费、政府支出、投资和净出口的值。

2.通货膨胀:通货膨胀指的是物价普遍上涨的情况。

它可以通过消费者物价指数(CPI)来衡量。

3.失业率:失业率表示劳动力市场上未就业人口的比例。

它是衡量一个经济体活力和劳动力利用率的重要指标。

4.货币政策:货币政策是指中央银行调整货币供应量和利率,以影响经济活动和价格水平的政策工具。

中级宏观经济的主要内容经济增长理论经济增长理论是中级宏观经济学的核心内容之一。

它研究的是长期经济增长的原因和机制。

在经济增长理论中,我们常见的模型有新古典增长模型和克里斯蒂娜·罗默模型等。

新古典增长模型认为,技术进步、人力资本等因素是推动经济增长的主要驱动力。

它强调资本积累和技术进步对经济增长的重要性。

而克里斯蒂娜·罗默模型则强调创新和知识的重要性,认为技术进步是经济增长的主要来源。

货币与物价水平货币政策对经济增长和物价水平具有重要影响。

中级宏观经济学研究货币政策的工具、目标和影响机制。

货币政策工具包括调整基准利率、调整存款准备金率等。

通过控制货币供应量和利率,中央银行可以影响经济活动和价格水平。

物价水平的变化会对经济产生重要影响。

通货膨胀会导致物价上涨,对消费、投资和资金分配产生影响。

以往的货币超发和通货膨胀案例,如德国的魏玛共和国时期,给经济和社会带来了巨大的破坏。

失业与经济政策失业是一个严重的经济问题,中级宏观经济学研究失业的类型、原因和影响。

失业率的高低反映了一个经济体的劳动力利用率和经济活力。

经济政策对失业的影响也是宏观经济学关注的重点之一。

Barro,Chapter8QuestionsCraig BurnsideEconomics302University of Virginia8.2If someone gives up a unit of consumption at date t,they gain P t dollars,which can beused to purchase bonds maturing at t+1that will pay P t(1+R)dollars.These additionaldollars,in turn,will allow the person to purchase P t(1+R)/P t+1=(1+R)/(1+π)=1+rextra units of consumption at time t+1.8.4(a)i.1+R=(1+r)(1+π)=1.04×1=1.04so that R=0.04,or4%.(a)ii.Ifπ=0.10,or10%,we can use the approximation,R≈r+π=0.04+0.1=0.14(or14%).On the other hand if we wanted an exactfigure we would need to compute1+R=(1+r)(1+π)=1.04×1.1=1.144,so that R=0.144or14.4%.(b)There would be excess demand.If R didn’t rise in proportion toπ,then the realinterest rate would be lower than the equilibrium real interest rate.So people want to borrowtoo much tofinance higher consumption,and output would be too low because labor supplywould be lower.8.8The answer here depends on how you define revenue.If you define it in dollar termsthen the answer is yes.The government can always dump as much money into the economyas it wants,and its revenue is M t−M t−1,so the more money it pours in the more revenue it gets.But if you ask the question in terms of the purchasing power of the government’srevenue then the answer is no.Notice that the purchasing power of the government’s money isM t−M t−1P t.Take the example where Y and r and the money growth rate,µ,are all constant.In thatcase,we saw that inflation will be constant and equal toµ.Our model predicts M t/P t=Φ(r+µ,Y).Notice that this impliesM t−M t−1P t =M tP t−M t−1P t−1P t−1P t=Φ(r+µ,Y) 1−11+π =Φ(r+µ,Y)µ1+µ.An increase inπwill make theΦ(r+µ,Y)term smaller,while making theµ/(1+µ)term bigger(you should verify the latter statement by checking thatµ/(1+µ)goes up ifµgoes up).One effect makes revenue smaller while the other makes it bigger.For small values of µ,the latter effect is probably stronger so that revenue should rise asµrises.Eventually, however,we might expect this effect to be reversed.For very large values ofµwe might see Φ(r+µ,Y)→0,whereasµ/(1+µ)→1,implying that revenue might actually get close to 0for very large money growth rates.8.9(a)If you could hold goods between periods(i.e.they were not perishable)and their real value depreciated at the rateδbetween periods,then the“nominal interest rate”to holding them would be given by1+R G=P t+1(1−δ)P t=(1+π)(1−δ).So R G≈π−δ.The interest rate on bonds would still be R=r+π,so it seems unlikely that anyone would actually store the goods as long as R>R G,or r>−δ.The demand for money should still depend on R,and should remain unaffected as long as r>−δ.(b)Since R=r+πe,ifπe rises and R stays the same,r must be falling.If r fell so far that it became less than−δthen people would no longer hold bonds and would switch to storing goods as a way of saving.At that point,the demand for money would depend on the spread between the interest rate on storing goods,π−δ,and the interest rate on money,0. For this reason money demand would probably still fall becauseπe andπwould be rising.8.10(a)Real money demand isΦ(R,Y),so it falls if R rises.(b)People economize on money holdings by going to the bank more often.Therefore, they pay more transactions fees.(c)This implies a negative wealth effect,so C and leisure will fall and L rise.(d)Yes.Leisure also becomes relatively cheap because you don’t have to use money to purchase it.This means C will fall further,and the negative(positive)impact of the rise in R on leisure(labor supply)is mitigated by the substitution effect.8.13The House of Lords was right.By issuing the getting the bank note printers(Waterlow Co.)to deliver them fake notes the swindlers were able to use the fake notes to purchase real goods from the Portuguese economy.In a sense they were able to take some of what would otherwise have been the Portuguese government’s“tax”revenue and use it to purchase goods the Portuguese government could otherwise have acquired.Although printed money is not a claim to anything concrete,it has a value determined by people’s willingness to hold it.As a result,the swindlers were able to acquire goods by doing something only the Portuguese government was allowed to do:i.e.printing money.。