财政部、国家税务总局、中国人民银行关于印发《财税库银税收收入电子缴库横向联网实施方案》的通知-EN

- 格式:doc

- 大小:64.50 KB

- 文档页数:12

TIPS宣传尊敬的纳税人:为了简化纳税缴库程序,方便纳税人缴税,提高税款征缴工作效率,让您更深入了解财税库银税收收入电子缴库横向联网系统(简称TIPS),现对TIPS作如下介绍:一、TIPS的基本涵义TIPS是财税库银税收收入电子缴库横向联网系统的简称,是指中国人民银行、税务部门按照统一联网方案、统一业务标准、统一接口规范、统一软件开发的要求,运用先进的信息技术和网络技术,建立财政、税务、国库、商业银行等部门间的电子信息通道,为税收收入的征缴、入库、退库、更正、对账等业务,提供安全、准确、快捷的电子处理手段,为纳税人提供便利、高效的纳税服务,实现税款资金的快速划缴、高效对账、全程监控。

二、TIPS的基本操作流程在使用TIPS扣缴税款前,税务部门、纳税人、商业银行三方必须签订“三方协议”,绑定委托缴税账号。

在日后的申报缴税中,基本流程如下:1、纳税人申报后,税务机关向国库系统发送扣款请求;2、国库校验扣款数据的逻辑关系无误后,转发扣款请求给各商业银行;3、如果商业银行从纳税人账户上扣款成功,则返回税务机关“扣款成功”信息;4、商业银行为纳税人打印《电子缴税付款凭证》,纳税人据此记账。

三、签订“三方协议”的流程1、纳税人到税务机关领取“三方协议”(包括《税务事项通知书》与《电子缴款协议书》),税务机关辅导纳税人填写相关内容,并加盖税务机关印鉴;2、纳税人在每份协议书上加盖预留印鉴后提交开户银行;3、待纳税人到银行签订好协议书后,将协议书送税务机关校验;4、税务机关校验通过后,纳税人即可使用TIPS扣缴税款。

四、常见问题解答(一)通过TIPS缴纳税款的纳税人,要承担的什么义务?开通TIPS缴纳税款业务的纳税人,必须履行以下义务:1、纳税人要确保其缴税绑定账户状态正常,能够正常转帐,如有变化要及时办理有关手续。

2、纳税人扣缴税款前要确保其绑定户资金余额应大于本期申报缴款合计金额,账户余额不足将导致扣缴税款失败。

财政部国家税务总局中国人民银行关于印发《财税库银税收收入电子缴库横向联网管理暂行办法》的通知财库〔2007〕50号2007-06-06各省、自治区、直辖市、计划单列市财政厅(局)、国家税务局、地方税务局,中国人民银行上海总部、各分行、营业管理部、省会(首府)城市中心支行,大连、青岛、宁波、厦门、深圳市中心支行,各国有独资商业银行、股份制商业银行:为了顺利推进财税库银税收收入电子缴库横向联网,规范税收收入电子缴库行为,根据《财税库银税收收入电子缴库横向联网实施方案》(财库〔2007〕49号),财政部、国家税务总局、中国人民银行制定了《财税库银税收收入电子缴库横向联网管理暂行办法》,现印发给你们,请遵照执行。

执行中如果发现问题,请及时向财政部、国家税务总局、中国人民银行反映。

请中国人民银行上海总部、各分支行及时将本通知转发至辖区。

内有关金融机构。

附件:财税库银税收收入电子缴库横向联网管理暂行办法财税库银税收收入电子缴库横向联网管理暂行办法第一章总则第一条为了规范税收收入电子缴库行为,提高税收收入征缴入库工作效率,加快税款资金入库速度,实现信息共享,根据《财税库银税收收入电子缴库横向联网实施方案》(财库〔2007〕49号),制定本办法。

第二条本办法适用于财税库银税收收入电子缴库横向联网(以下简称横向联网)地区财政部门、税务机关(含国家税务局和地方税务局,下同)、中国人民银行国库(以下简称国库)、商业银行(含信用社,下同)等联网单位,采用电子方式办理税收收入缴库、退库、更正、免抵调、对账等业务以及信息共享的管理。

第三条本办法所称税收收入电子缴库,是指联网单位通过横向联网系统,采用电子方式,办理税收收入缴库、退库、更正、免抵调、对账等业务以及共享信息的过程。

本办法所称电子缴库信息,是指联网单位通过横向联网系统收发的各种信息,包括税收收入缴库、退库、更正、免抵调、对账等业务处理过程的信息,以及为实现业务处理和信息共享所需的公共数据代码等其他信息。

阿勒泰地区行政公署办公室关于开展财税库银税收收入电子缴库横向联网工作的通知正文:---------------------------------------------------------------------------------------------------------------------------------------------------- 阿勒泰地区行政公署办公室关于开展财税库银税收收入电子缴库横向联网工作的通知各县(市)人民政府,喀纳斯景区管理委员会,新区建设指挥部,行署有关部门,地直有关单位:根据自治区人民政府办公厅《关于开展财税库银税收收入电子缴库横向联网工作的通知》(新政办发〔2010〕34号)精神,经行署研究,决定在地区范围内开展财税库银税收收入电子缴库横向联网(以下简称“横向联网”)工作。

现将有关事项通知如下:一、实行横向联网的必要性横向联网是指财政部门、税务机关、国库和商业银行(含信用社,下同)利用信息网络技术,通过使用国库信息处理系统(简称TIPS),建立部门之间横向电子网络,采用电子方式,办理税收收入的缴库、退库、更正、免抵调、对账等业务。

税款直接缴库,可简化业务操作,方便纳税人缴税,加快入库速度,实现财税库三方税款征缴信息共享。

现行的手工操作税款缴库方式存在的主要问题有:税务和国库部门需人工重复录入信息并传送纸质票证,工作效率较低;税款征缴入库过程透明度低,缺乏事前、事中控制,税款入库时间长;税收收入信息反馈机制不健全,难以及时为财政预算执行分析及预测提供准确依据;不方便纳税人缴税,纳税人需分别到税务机关和商业银行办理缴税手续等。

为进一步增强各级政府公共服务能力,中央财政2007年制定了横向联网工作有关规定,进一步加强和规范了横向联网工作,并在全国统一推行横向联网工作。

二、横向联网的指导思想、目标和原则(一)指导思想:按照社会主义市场经济体制下公共财政的发展要求,利用现代信息网络技术,通过财政部门、税务机关、国库和商业银行之间的横向联网,实行税收电子缴库,实现财税库信息共享,方便纳税人缴税,加快税款入库速度,提高财政资金运转效率,建立规范高效的税款收缴管理运行机制。

转发《财政部国家税务总局中国人民银行关于2010年财税库银税收收入电子缴库横向联网推广工作有关事宜的通知》的通知鲁财库〔2010〕10号颁布时间:2010-5-24发文单位:山东省人民政府市财政局、国家税务局、地方税务局、中国人民银行(山东省)各市中心支行、分行营业管理部,各国有商业银行山东省分行,交通银行山东省分行,邮政储蓄银行山东省分行,山东省农村信用社联合社,恒丰银行,各股份制银行济南、青岛分行:现将《财政部国家税务总局中国人民银行关于2010年财税库银税收收入电子缴库横向联网推广工作有关事宜的通知》(财库〔2010〕32号)转发给你们,并就做好2010年山东省财税库银横向联网工作提出以下意见,请一并遵照执行。

一、计划安排为确保财税库银横向联网工作顺利推进,经省财政厅、人民银行济南分行、省地税局共同研究决定,我省今年财税库银税收收入电子缴库横向联网(以下简称TIPS)上线分三批进行。

济宁市为第一批推广上线单位,德州、聊城、泰安、菏泽和莱芜为第二批推广上线单位,威海、潍坊、临沂、日照和枣庄为第三批推广上线单位。

我省国税部门TIPS的上线计划待有关事宜研究确定后再另行部署。

各级各单位要充分认识开展财税库银横向联网工作的重要意义,尽快成立由财政部门牵头的跨部门横向联网工作领导小组,建立、健全沟通联系机制,明确工作任务,落实工作责任,密切搞好配合,共同抓好此项工作。

二、几点要求(一)各级各部门要结合当地实际,尽快研究制定具体可行的实施方案和时间安排表,并按照时间表抓紧组织实施,开展好纳税人委托商业银行划缴税款协议(以下简称三方协议)的签约工作。

要制定配套工作应急预案,对TIPS上线运行后可能出现的各类技术、业务等问题,制定有针对性的详细的防范措施,一旦发现问题及时处理,妥善解决。

对于人民银行国库、税务机关、商业银行因系统维护或升级等原因,影响业务处理、需要暂停业务或变更业务处理时间的,应提前3个工作日通知各联网单位,税务机关、商业银行应提前告知纳税人。

★什么是财税库银税收收入电子缴库横向联网?财税库银税收收入电子缴库横向联网是指财政部门、税务机关、人民银行、商业银行(含信用社)利用信息网络技术,通过电子网络系统办理税款征缴、入库等业务,税款直接缴入国库,实现税款征缴信息共享的缴库模式。

★使用横向联网系统缴税与传统缴税有什么区别?通过横向联网系统缴纳税款,纳税人可避免多次重复往返于税务部门和商业银行之间缴纳税款,突破了在纳税申报、缴款等环节所受时间和空间的限制,足不出户就可纳税,能够为纳税人节约更多的时间和空间,同时,纳税人也能够清晰明了的监测自身账户的税收缴纳情况,切实维护纳税人利益。

★横向联网电子缴税的基本流程怎样?(1)纳税人首先与基层税务部门及其开户银行签订授权划缴税款三方协议书,纳税人申报纳税时,税务部门综合征管软件根据纳税申报生成电子税票信息,根据电子税票信息生成实时扣款请求,发给税务前置系统。

税务前置系统将实时扣款请求转发TIPS(即人民银行国库信息处理系统)。

(2) TIPS转发扣款请求给相应的纳税人开户行;纳税人开户行收到电子缴款信息后,经确认无误,从纳税人账户划转税款,通过资金清算系统将税款上划国库,并将划款成功和未成功信息发回TIPS。

(3) TIPS将扣款结果返回给税务前置系统,税务前置系统将扣款结果返回至综合征管软件★实行横向联网纳税人需要办理的事项?首先,纳税人要在开通财税库银横向联网电子缴税业务的商业银行开立或明确缴纳税款的账户,并对该账户的真实性、准确性和有效性负责;其次,纳税人要与税务机关、开户银行签订授权划缴税款三方协议书;第三,纳税人进行纳税申报扣缴税款前要确保协议缴税账户有足够余额以缴纳当期税款。

★为什么要签订三方协议书?三方协议书是纳税人、税务机关、开户银行之间就纳税人申报、缴纳税款权利和义务的一种合约,签订之后的协议具有法律效力;签订三方协议后,纳税人无需直接到税务部门报税,可以通过多元方式电子缴税,税务机关方可凭其申报的应缴税款,通知纳税人开户行直接从其存款账户中划转税款。

1、什么是财税库银横向联网系统?答:财税库银横向联网系统是中国人民银行与财政部、国家税务总局、各商业银行共同建设的电子缴税系统。

财税库银横向联网系统的运行,为纳税人提供了方便、快捷的服务、充分体现了党中央提出的以人为本、建设和谐社会的精神,是从广大纳税人利益出发,为纳税人办的一件实事和好事。

2、使用横向联网系统纳税有哪些好处?答:财税库银横向联网以后,在已经实施网上申报、简易报税等多元化申报纳税方式的基础上,进一步完善了税款缴纳方面的功能,实现了实时扣缴税款,极大地方便纳税人办理申报纳税事项,节省纳税人的办税时间,提高工作效率,节约纳税人的缴税成本,维护了纳税人的利益。

3、什么是实时扣款?答:实时扣款是指纳税人和税务机关、开户银行签订委托缴税协议后,根据纳税申报信息,由纳税人或由税务机关发起逐笔扣税信息,扣款银行收到后予以扣款,并将回执实时返回纳税人和税务机关。

实时扣款避免了过去网上申报纳税人发出扣款指令后,需要较长时间等待扣款结果的情况,纳税人可以实时得到扣款结果的回执,方便了纳税人办理进一步的其他税收业务。

4、什么是批量扣款?答:批量扣款主要适用于定期定额缴税的个体工商户,是指纳税人在银行建立存款帐户,并和开户银行签订委托缴税协议后,由税务机关每月定时发起批量扣税信息,纳税人开户银行收到后从纳税人存款帐户扣缴税款,并将扣款结果返回税务机关。

5、如何签订委托缴税协议书?答:纳税人办理实时扣税和批量扣税时,需要事先与银行签订委托缴税协议书(又称三方扣税协议)。

纳税人签订委托缴税协议书的流程为:(1)纳税人在实行财税库银横向联网的任意一家银行分支机构开立一个账户作为缴税账户;(2)纳税人持缴税账户的存折、银行卡或帐户印鉴到主管税务机关办理三方扣税协议的签订;(3)主管税务机关录入三方扣税协议相关信息,生成并打印出纸质三方协议书一式三份,税务机关和纳税人在协议书上分别签章;(4)纳税人将三份协议书提交给开户银行,开户银行对协议书有关内容进行确认,补录相关信息,签章后留存一份,将另外二份退还纳税人;(5)纳税人将另外两份协议书送主管税务机关验证,主管税务机关验证通过的三方扣税协议即为有效的协议,协议验证通过后,主管税务机关将一份协议书存档,一份交纳税人留存。

财税库银税收收入电子缴库横向联网简介徐州市财政局、徐州市国税局、徐州市人民银行为了简化纳税缴库程序,方便纳税人缴税,提高税款征缴工作效率,实现税款资金实时划缴足额入库,根据财政部、国家税务总局、中国人民银行计划安排,将于2010年8月份开始对徐州市国税管辖纳税人推广使用财税库银税收收入电子缴库横向联网系统(简称TIPS)。

一、财税库银税收收入电子缴库横向联网简介为规范和推进税收收入电子缴库业务,建立财税库信息共享机制,财政部、国家税务总局、中国人民银行制定了《财税库银税收收入电子缴库横向联网实施方案》财库〔2007〕49号,江苏省财政厅、国家税务局、地方税务局、人民银行南京分行四部门联合转发了明确横向联网的目标模式,为全国横向联网制定了统一的标准,有效地促进全国横向联网工作的开展。

财税库银税收收入电子缴库横向联网是指财政部门、税务机关、国库、商业银行(含信用社)利用信息网络技术,通过电子网络系统办理税收收入征缴入库等业务,税款直接缴入国库,实现税款征缴信息共享的缴库模式。

横向联网通过财政部门、税务机关、国库间建立横向联网系统,在确保安全、准确、快捷、高效的前提下,实行税收收入电子缴库。

二、横向联网电子缴税基本流程一是纳税人、税务机关、开户银行签订《委托银行扣缴税款协议书》(以下简称三方协议),并各留一份;二是纳税人在每月申报期之前将应纳税款足额存入《三方协议》中所填写的银行账户中,并在税法或税务机关规定的纳税期限前通过网络或上门进行纳税申报;三是税务机关根据三方协议规定和纳税申报成功的信息,生成电子缴款书,并通过横向联网系统及时将电子缴款书信息发送国库。

国库对收到电子缴款书进行校验,并将校验审核无误的转发至纳税人开户银行进行划缴税款,并将划转成功与否信息发送至税务机关;四是纳税人开户银行根据收到的电子缴款书相关信息,按照授权划缴税款协议,及时从纳税人账户将款项划缴国库,并将付款成功和不成功的信息反馈国库。

2020年国库知识竞赛题库258题[含参考答案]一、填空题1.经收预算收入的商业银行分支机构和信用社均为国库经收处。

2.根据《关于财税库银横向联网电子退库、电子更正、电子免抵调业务有关事宜的通知》,TIPS系统与商业银行资金对账分为日间对账和日切对账。

3.代理支库办理预算资金拨付,应于接到拨付指令当日及时办理,不得延误、积压;如当日确实不能办理的,最迟在下一个工作日办理。

4.代理支库办理的拨款、退付业务实行三级审核制度。

5.代理支库的国库主任由代理行行长兼任,副主任由分管国库工作的副行长兼任。

6.《中华人民共和国预算法》规定,各级政府及有关部门、单位截留、占用、挪用或者拖欠应当上缴国库的预算收入的,责令改正,对负有直接责任的主管人员和其他直接责任人员依法给予降级、撤职、开除的处分。

7.国库经收处占压、挪用所收纳税款的,经人民银行国库部门核实后,按《金融违法行为处罚办法》等予以处罚。

8.凡要求代理支库的商业银行,应向上一级人民银行提出书面申请。

9.国库经收处收纳的预算收入,应在收纳当日办理报解入库手续,不得延解、占压和挪用;如当日确实不能报解的,必须在次日报解。

10.财税库银横向联网系统中心设立在中国人民银行。

11.中国人民银行有权对金融机构代理人民银行经理国库的行为进行检查监督。

12.代理银行应当将零余额账户的开立、变更、撤销等基本情况报同级人民银行国库部门备案。

13.储蓄国债承销机构营业网点一经发现可疑国债凭证,应立即向当地人民银行、公安机关及相关部门报告并留下凭证影像证据,切实做好国债反假防伪工作。

14.根据POS机布设机构的不同,分为商业银行和中国银联股份有限公司布设POS机实现刷卡缴税两种模式。

15.《中华人民共和国预算法》规定,政府的全部收入应当上缴国家金库,任何部门、单位和个人不得截留、占用、挪用或者拖欠。

16.电子缴款书,是纸质缴款书的电子形式,由税务部门生成。

17.人民银行依法对商业银行代理支库和商业银行、信用社经收处所办国库业务实施垂直管理。

财政部、国家税务总局、中国人民银行关于财税库银税收收入电子缴库横向联网2008年试点工作的通知

【法规类别】电子工业企业财会税费

【发文字号】财库[2008]69号

【失效依据】财政部关于公布废止和失效的财政规章和规范性文件目录(第十二批)的决定【发布部门】财政部国家税务总局中国人民银行

【发布日期】2008.10.10

【实施日期】2008.10.10

【时效性】失效

【效力级别】XE0303

财政部、国家税务总局、中国人民银行关于财税库银税收收入电子缴库横向联网2008年

试点工作的通知

(财库[2008]69号)

河北、山西、大连、湖北、广东、重庆、西藏、陕西、甘肃省(自治区、直辖市、计划单列市)财政厅(局)、国家税务局,宁夏回族自治区财政厅、地方税务局,河北省地方税务局,中国人民银行武汉、广州、西安分行,重庆营业管理部,石家庄、太原、大连、拉萨、兰州、银川中心支行:

为推进全国财税库银税收收入电子缴库横向联网工作,根据《财政部国家税务总局中国人民银行关于印发〈财税库银税收收入电子缴库横向联网实施方案〉的通知》(财库

[2007]49号)、《财政部国家税务总局中国人民银行关于印发〈财税库银税收收入电子缴库横向联网管理暂行办法〉的通知》(财库[2007]50号)和《财政部国家税务总局中国人民银行关于财税库银税收收入电子缴库横向联网试点有关问题的通知》(财库[2007]92号)有关规定,现将2008年财税库银税收收入电子缴库横向联网试点工作有关事项通知如下:

一、关于试点范围。

财政部国家税务总局中国人民银行关于印发《财税库银税收收入电子缴库横向联网实施方案》的通知

佚名

【期刊名称】《中华人民共和国财政部文告》

【年(卷),期】2007(000)008

【摘要】<正>2007年6月6日财库[2007]49号各省、自治区、直辖市、

计划单列市财政厅(局)、国家税务局、地方税务局,中国人民银行上海总部、各分行、营业管理部、省会(首府)城市中心支行,大连、青岛、宁波、厦门、深圳市中心支行,各国有

【总页数】7页(P26-32)

【正文语种】中文

【中图分类】F812.42

【相关文献】

1.财政部国家税务总局中国人民银行关于印发《财税库银税收收入电子缴库横

向联网管理暂行办法》的通知 [J], ;

2.陕西省财税库银税收收入横向联网电子缴库工作会议在西安召开 [J], 杜华

3.财税库银税收收入电子缴库横向联网的成效与不足 [J], 牛芸芸;秦婉婉

4.我省财税库银税收收入电子缴库横向联网工作进展显著 [J],

5.认真践行科学发展观建立税收征缴新机制——甘肃省财税库银税收收入电子缴

库横向联网正式运行 [J], 魏巍;王宁涛

因版权原因,仅展示原文概要,查看原文内容请购买。

电子缴税凭证可以作为会计核算凭证【问题】一家企业在年终结账审核时发现,自实行电子缴库完税以来,他们均以划款银行的电子缴税付款凭证作为缴纳税款的会计核算凭证,而未到税务机关开具完税凭证。

请问,如果已经取得电子缴税付款凭证,是否还要到税务机关开具完税凭证?【解答】根据《税收征管法》第三十四条规定,税务机关征收税款时,必须给纳税人开具完税凭证。

《税收征管法实施细则》第四十五条规定,完税凭证是指各种完税证、缴款书、印花税票、扣(收)税凭证以及其他完税证明。

第四十六条规定,税务机关收到税款后,应当向纳税人开具完税凭证。

纳税人通过银行缴纳税款的,税务机关可以委托银行开具完税凭证。

在实现了财税库银税收收入电子缴税横向联网后,纳税人申报缴纳的税款全部由银行进行划缴,从银行部门只取得电子缴税付款凭证。

对此,《财政部、国家税务总局、中国人民银行关于印发〈财税库银税收收入电子缴库横向联网管理暂行办法〉的通知》(财库〔2007〕50号)第十三条规定,电子缴税付款凭证,是由纳税人开户银行根据接收的电子缴款书相关要素信息生成,从纳税人账户划缴税款资金的专用凭证。

电子缴税付款凭证一式二联,第一联作付款银行记账凭证,第二联交纳税人作付款回单,纳税人以此作为缴纳税款的会计核算凭证。

电子缴税付款凭证必须加盖银行转(收)讫章才有效。

因此,纳税人可以以划缴银行出具的电子缴税付款凭证作为完税证明入账核算,或者作为已履行纳税义务后进行税务行政复议及诉讼的法律依据。

如果因其他情况必须取得完税凭证,按照财库〔2007〕50号文件第二十九条“税务机关按照纳税人的需要及有关规定,依据税收征收管理系统中已入库电子缴款书信息,开具完税凭证”的规定,纳税人可以持相应的电子缴税付款凭证,到所属税务机关开具完税凭证。

小编寄语:会计学是一个细节致命的学科,以前总是觉得只要大概知道意思就可以了,但这样是很难达到学习要求的。

因为它是一门技术很强的课程,主要阐述会计核算的基本业务方法。

财政部关于财政部门与人银行国库横向联网接口软件上线工作流程有关问题的通知文章属性•【制定机关】财政部•【公布日期】2008.12.26•【文号】财库[2008]100号•【施行日期】2008.12.26•【效力等级】部门规范性文件•【时效性】现行有效•【主题分类】财政综合规定正文财政部关于财政部门与人银行国库横向联网接口软件上线工作流程有关问题的通知(财库[2008]100号)各省、自治区、直辖市、计划单列市财政厅(局)、中国人民银行上海总部、各分行、营业管理部、省会(首府)城市中心支行,大连、青岛、宁波、厦门、深圳市中心支行:为加快实施财税库银税收收入电子缴库财政部门与人民银行国库之间横向联网工作,根据《财政部国家税务总局中国人民银行关于印发〈财税库银税收收入电子缴库横向联网实施方案〉的通知》(财库[2007]49号)和《财政部国家税务总局中国人民银行关于印发〈财税库银税收收入电子缴库横向联网管理暂行办法〉的通知》(财库[2007]50号)有关规定,现就财政部门与人民银行国库横向联网接口软件上线工作流程有关问题通知如下:一、认真做好横向联网接口软件上线各阶段工作经财政部、国家税务总局、中国人民银行批准同意开展横向联网试点工作的省份,要认真做好接口软件上线准备、联调测试、正式上线等阶段的各项工作。

(一)财政部门与人民银行国库联网上线准备工作阶段。

该阶段的主要工作由省级财政部门完成,具体包括:安装与所在地人民银行(以下简称省级人民银行)的联网专线;做好技术基础准备工作,包括准备数据库服务器一台(最低配置-P4 Xeon 1.8G双cpu/4G内存/3块36G硬盘),应用服务器一台(最低配置-P4 Xeon 1.8G双cpu/4G内存/3块36G硬盘),9.02以上版本的Oracle数据库软件,V8.1.1或以上版本的Weblogic中间件软件,MQ中间件软件,其中,MQ中间件软件具体版本及配置方式与中国金融电子化公司(以下简称金电公司)、当地人民银行确定;安装并调试横向联网接口软件。

乐税智库文档财税法规策划 乐税网中国人民银行、财政部、国家税务总局关于印发财税库计算机横向联网会议纪要的通知【标 签】财税库,计算机横向联网,会议纪要【颁布单位】中国人民银行,财政部,国家税务总局【文 号】银发﹝1995﹞337号【发文日期】1995-12-22【实施时间】1995-12-22【 有效性 】全文有效【税 种】其他各省、自治区、直辖市及计划单列市人民银行分行、财政厅(局)、国家税务局、地方税务局: 现将财税库计算机横向联网会议纪要印发给你们。

请各地有组织有步骤地扩大财税库计算机横向联网试点,在试点中及时总结经验,不断完善。

一九九五年十二月二十二日财税库计算机横向联网会议纪要 中国人民银行、财政部、国家税务总局关于1995年7月3日到6日在天津市蓟县联合召开了财税库计算机横向联网会议。

南京市、扬州市、苏州市、宁波市、杭州市、武汉市、恩施自治州、深圳市的代表在会上汇报了试点情况,演示了横向联网程序,北京市、天津市、浙江省、江苏省、湖北省等地的代表也参加了这次会议。

与会者对各地的汇报演示进行了认真的观摩、交流、讨论,就许多问题达成了共识。

会议对前一段财税库计算机横向联网运行情况作了充分肯定,认为各地联网的试点已达到了预期的目的,试点是成功的。

会议还对下一步工作做了安排。

一、财税库计算机横向联网试点运行情况 (一)计算机横向联网将财政、税务、国库的相关业务紧密衔接,联成一体,实现了数据一次录入,网上传输信息,数据资源共享。

主要成效有以下几点: 1、避免了部门之间的重复活动,各部门的工作量都明显减少。

2、提高了工作效率,减少了库款在途时间,加快了库款的报解速度,有利于解决商业银行占压税款的问题。

3、实现信息一体化,工作透明度增强,有利于部门间的制约、监督。

同时,对纳税人在申报纳税后,是否及时缴税,财税库随时可以查阅,改变了原先开出税票后,税票处于失控的状况。

4、数据出自一个源头,前后联贯,保证了财税库数据的准确和一致,方便了财税对帐工作。

银行财税库银税收收入电子缴库横向联网系统业务操作规程为进一步拓展服务领域,完善服务功能,拓宽增存渠道,我行上线运行了财税库银税收收入电子缴库横向联网系统(TIPS),实现了税款直接缴入国库,方便了纳税人,丰富了我行服务品种。

为确保税收收入电子缴库业务顺利开展和实施,特制定本业务操作规程。

第一章总则第一条财税库银税收收入电子缴库横向联网是指财政部门、税务机关、国库、商业银行利用信息网络技术,通过电子网络系统办理税收收入征缴入库等业务,税款直接缴入国库,实现税款征缴信息共享的缴库模式。

第二条电子缴库主要采取划缴入库方式。

不具备划缴入库条件的,采取自缴入库方式。

在电子缴库信息发送方式上,电子缴款书等税收收入电子缴库信息由税务机关发送国库,国库转发到纳税人开户银行和财政部门。

第三条划缴入库具体程序是,税务机关对纳税人纳税申报进行审核,并根据纳税申报成功的信息生成电子缴款书,通过横向联网系统,将电子缴款书信息发送国库,国库对电子缴款书信息校验审核无误后转发至纳税人开户银行,通知纳税人开户银行从纳税人账户划缴税款,直接缴入国库单一账户,并将划缴税款成功与否信息发送税务机关;国库按照规定时间将所有电子缴款书明细信息和划缴税款成功与否信息发送财政部门。

第四条采取划缴入库方式的,应当由纳税人与其开户银行事先签订具有法律效力的授权划缴税款协议,并由纳税人将所签协议书面通知税务机关。

第二章划缴税款协议的签约、终止第五条纳税人与税务机关、开户银行签订划缴税款协议流程:(一)纳税人在支行开立一个结算账户作为缴税账户(亦可使用原有结算账户),而后到主管税务机关办税服务厅办理签约手续。

(二)税务人员将纳税人缴税账户信息录入征管信息系统,生成并打印纸质划缴税款协议书一式3份(或4份),加盖公章后全部交纳税人。

(三)纳税人在划缴税款协议书上签章后,送交其开户银行;开户银行对协议书有关内容进行确认后,补录相关信息,签章并留存一份,其余退还纳税人。

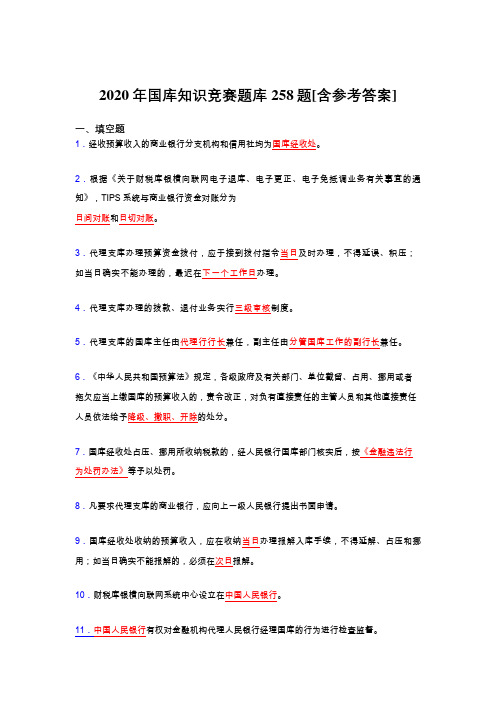

![国家税务总局、中国人民银行关于规范横向联网系统银行卡缴税业务的通知-税总发[2014]73号](https://img.taocdn.com/s1/m/4430ce167dd184254b35eefdc8d376eeaeaa176e.png)

国家税务总局、中国人民银行关于规范横向联网系统银行卡缴税业务的通知正文:---------------------------------------------------------------------------------------------------------------------------------------------------- 国家税务总局、中国人民银行关于规范横向联网系统银行卡缴税业务的通知(税总发〔2014〕73号)各省、自治区、直辖市和计划单列市国家税务局、地方税务局,中国人民银行上海总部,各分行、营业管理部、省会(首府)城市中心支行,大连、青岛、宁波、厦门、深圳市中心支行:根据《国家税务总局中国人民银行关于横向联网系统银行卡刷卡缴税业务有关问题的通知》(国税发〔2011〕69号)的要求,各地应积极协调配合,在办税服务厅推广安全规范的银行卡缴税业务。

现将有关事项通知如下:一、安全规范的银行卡缴税业务是财税库银横向联网电子缴税系统银行端查询缴税业务的一种重要形式,是通过在税务机关办税服务厅布设符合国家及行业金融领域相关标准的POS机具(含PSAM芯片),采用税务身份认证手段,在POS机具与税收征管系统间传递电子数据,为纳税人提供通用、安全、便捷和实时的电子缴税方式。

二、税务机关在信息系统业务实现过程中,要积极推广安全规范的银行卡缴税业务。

未与税务专网连接的POS机具,可继续保留手工操作方式开展业务。

已与税务专网连接,但不符合安全规范的POS机具,要抓紧进行改造。

三、各商业银行、中国银联股份有限公司应根据有关业务流程、通用电子缴税客户端软件POS机通讯接口规范(见附件)、国家及行业金融领域相关标准,做好与税收征管信息系统等相关系统的接口开发工作,配合税务机关开展安全规范的银行卡缴税业务。

四、中国人民银行各分行、营业管理部、省会(首府)城市中心支行、大连、青岛、宁波、厦门、深圳市中心支行应将本通知转发至辖区内各城市商业银行、农村商业银行和城市信用社、农村信用社。

财政部、国家税务总局、中国人民银行关于2016年财税库银税收收入电子缴库横向联网有关工作事项的通知文章属性•【制定机关】财政部,国家税务总局,中国人民银行•【公布日期】2016.04.07•【文号】财库[2016]66号•【施行日期】2016.04.07•【效力等级】部门规范性文件•【时效性】现行有效•【主题分类】税务综合规定正文关于2016年财税库银税收收入电子缴库横向联网有关工作事项的通知财库[2016]66号各省、自治区、直辖市、计划单列市财政厅(局)、国家税务局、地方税务局,中国人民银行上海总部、各分行、营业管理部、省会(首府)城市中心支行、副省级城市中心支行,各国有商业银行、股份制商业银行、外资银行,中国邮政储蓄银行,中国银联:为进一步推进财税库银税收收入电子缴库横向联网(以下简称横向联网)工作,根据《财政部国家税务总局中国人民银行关于印发〈财税库银税收收入电子缴库横向联网实施方案〉的通知》(财库〔2007〕49号)等有关规定,现将2016年横向联网有关工作事项通知如下:一、2016年工作总体要求2015年,在各级财政部门、税务机关、人民银行(国库)和商业银行等联网单位的共同努力和密切配合下,全国横向联网工作取得新的进展和成效。

横向联网电子缴税覆盖范围进一步扩大,电子退库、更正、免抵调业务稳步推行。

横向联网在提高税收收入征缴工作效率和服务水平、保证税款及时足额入库、支持跨部门信息共享的作用得到进一步发挥。

2016年,各级联网单位要加强组织领导和沟通协作,进一步做好扩大横向联网覆盖范围、拓展横向联网创新业务推广应用、健全横向联网系统运维机制、深化财税信息共享和利用、完善相关制度机制、配合金税三期推广上线等各项工作,推进横向联网工作提质增效。

二、2016年主要工作安排(一)进一步扩大横向联网覆盖范围。

进一步扩大市、县横向联网上线范围和纳税人采用横向联网方式缴税的范围,提高横向联网电子缴税占比。

银行财税库银税收收入电子缴库横向联网系统业务操作规程为进一步拓展服务领域,完善服务功能,拓宽增存渠道,我行上线运行了财税库银税收收入电子缴库横向联网系统(TIPS),实现了税款直接缴入国库,方便了纳税人,丰富了我行服务品种。

为确保税收收入电子缴库业务顺利开展和实施,特制定本业务操作规程。

第一章总则第一条财税库银税收收入电子缴库横向联网是指财政部门、税务机关、国库、商业银行利用信息网络技术,通过电子网络系统办理税收收入征缴入库等业务,税款直接缴入国库,实现税款征缴信息共享的缴库模式。

第二条电子缴库主要采取划缴入库方式。

不具备划缴入库条件的,采取自缴入库方式。

在电子缴库信息发送方式上,电子缴款书等税收收入电子缴库信息由税务机关发送国库,国库转发到纳税人开户银行和财政部门。

第三条划缴入库具体程序是,税务机关对纳税人纳税申报进行审核,并根据纳税申报成功的信息生成电子缴款书,通过横向联网系统,将电子缴款书信息发送国库,国库对电子缴款书信息校验审核无误后转发至纳税人开户银行,通知纳税人开户银行从纳税人账户划缴税款,直接缴入国库单一账户,并将划缴税款成功与否信息发送税务机关;国库按照规定时间将所有电子缴款书明细信息和划缴税款成功与否信息发送财政部门。

第四条采取划缴入库方式的,应当由纳税人与其开户银行事先签订具有法律效力的授权划缴税款协议,并由纳税人将所签协议书面通知税务机关。

第二章划缴税款协议的签约、终止第五条纳税人与税务机关、开户银行签订划缴税款协议流程:(一)纳税人在支行开立一个结算账户作为缴税账户(亦可使用原有结算账户),而后到主管税务机关办税服务厅办理签约手续。

(二)税务人员将纳税人缴税账户信息录入征管信息系统,生成并打印纸质划缴税款协议书一式3份(或4份),加盖公章后全部交纳税人。

(三)纳税人在划缴税款协议书上签章后,送交其开户银行;开户银行对协议书有关内容进行确认后,补录相关信息,签章并留存一份,其余退还纳税人。

Promulgationdate:06-06-2007Department:Ministry of Finance,StateAdministration of Taxation,People'sBank of ChinaEffective date:06-06-2007Subject:Banking&Finance,IndustrialManagementNotice of the Ministry of Finance, the State Administration of Taxation and the People’s Bank of China on Printing and Distributing the Executive Plan for the Horizontal Networking among Finance Departments, Taxation Authorities, the Treasury and Commercial Banks for the Electronic Payment of Tax Revenues to the Treasury(No. 49 [2007] of the Ministry of Finance)The finance departments (bureaus), state taxation bureaus, and local taxation bureaus of all provinces, autonomous regions, municipalities directly under the Central Government and cities under separate state planning; Shanghai Headquarters, all branches, business management departments, all central sub-branches in the provincial capital cities, Dalian, Qingdao, Ningbo, Xiamen and Sh enzhen central branches of the People’s Bank of China; and all the exclusively state-owned commercial banks and joint-stock commercial banks:In order to regulate and promote the electronic payment of tax revenues to the treasury and establish an information sharing system among the finance departments, taxation authorities, the treasury and commercial banks, the Ministry of Finance, the State Administration of Taxation and the People’s Bank of China have formulated the Executive Plan for the Horizontal Ne tworking among Finance Departments, Taxation Authorities, the Treasury and Commercial Banks for the Electronic Payment of Tax Revenues to the Treasury, which are hereby printed and distributed to you, please implement them accordingly.The horizontal networking among finance departments, taxation authorities, the treasury and commercial banks for the electronic payment of tax revenues to the treasury will be conducive for simplifying business operations, facilitate the tax payment of taxpayers, conducive for enhancing the speed of paying tax revenues to the treasury, realizing the information sharing among finance departments, taxation authorities and the treasury, and providing a strong support to the relevant departments in strengthening their tax collection and payment administration and making statistical analysis and forecasting. All the relevant departments shall attach great importance toand actively support this work. In 2006, the horizontal networking for electronic tax payment has been implemented as a pilot in some provinces, and relevant preparations before implementation have been organized. In 2007, the implementation scope will be further enlarged on the basis of summing up experiences, improving measures and optimizing operations. All the regions shall, in strict accordance with this Executive Plan and by considering their own actualities, actively promote the horizontal networking among finance departments, taxation authorities, the treasury and commercial banks for the electronic payment of tax revenues to the treasury inside their own jurisdictions, and realize a comprehensive implementation of the horizontal networking among finance departments, taxation authorities, the treasury and commercial banks for the electronic payment of tax revenues to the treasury across the country before 2010.The horizontal networking among finance departments, taxation authorities, the treasury and commercial banks for the electronic payment of tax revenues to the treasury involves a wide coverage and complicated circumstances, and the regions and departments for the implementation thereof shall strengthen the leadership, and make meticulous organization and deployment, timely feed back relevant circumstances and problems to the Ministry of Finance, the State Administration of Taxation and the People’s Bank of China, and ensure that the horizontal networking among finance departments, taxation authorities, the treasury and commercial banks for the electronic payment of tax revenues to the treasury can be smoothly implemented.Shanghai Headquarters, all the branches and sub-branches of the People’s Bank of China shall timely forward this Notice to the relevant financial institutions within their own jurisdictions.Annex: Executive Plan for the Horizontal Networking among Finance Departments, Taxation Authorities, the Treasury and Commercial Banks for the Electronic Payment of Tax Revenues to the TreasuryMinistry of FinanceState Administration of TaxationPeople’s Bank of ChinaJune 6, 2007Annex:Executive Plan for the Horizontal Networking among Finance Departments, Taxation Authorities, the Treasury and Commercial Banks for the Electronic Payment of Tax Revenues to the TreasuryIn order to strengthen the public service capacity of government departments, regulate the administration of the electronic payment of tax revenues to the treasury, enhance the speed of turning over tax revenues to the treasury, establish and improve an information sharing mechanism among finance departments, taxation authorities (including state taxation bureaus and local taxation bureaus, similarly hereinafter) and the treasury of the People’s Bank of China (hereinafter referred to as the treasury), this Executive Plan is enacted.I. Necessity for Implementing the Horizontal Networking among Finance Departments, TaxationAuthorities, the Treasury and Commercial Banks for the Electronic Payment of Tax Revenues to the TreasuryThe “horizontal networking among finance departments, taxation authorities, the treasury and commercial banks for the electronic payment of tax revenues to the treasury (hereinafter referred to as the horizontal networking)” refers to such a method of turning over tax revenues to the treasury in which finance departments, taxation authorities, the treasury and commercial banks (including credit cooperatives, similarly hereinafter) make use of information network technologies to collect and turn over tax revenues to the treasury through the electronic network system, the tax revenues are turned over to the treasury directly, and the information about the collection and payment of tax revenues are shared. In the current manual operating method of turning over tax revenues to the treasury, the main problems are: repeated input of the relevant information by and transmission of paper certificates between taxation authorities and treasuries when turning over tax revenues to the treasuries, the low efficiency of turning over tax revenues to the treasuries, the nontransparent process of collecting and turning over tax revenues to the treasuries, the lack of prior or in-process control, occasional delays in the payment of tax revenues, the fairly long time requirement for turning over tax revenues to the treasury, the imperfect information feedback mechanism for tax revenues, difficulty in timely providing accurate basis for the analysis and forecasting of state budget implementation or the statistical analysis of taxation authorities or the treasury, and inconveniencies for taxpayers to pay taxes, and the taxpayers’ need to separately go through tax payment formalities at taxation authorities and commercial banks. For the moment, some regions have begun to piloted the horizontal networking, and gradually realized the electronic payment, transfer, payment of tax revenues to the treasury and electronic checking of accounts, which have facilitated the tax payment of taxpayers, simplified business operations, accelerated the speed of turning over tax revenues to the treasury, realized the sharing of information about collection of tax revenues among finance departments, taxation authorities and the treasury, and produced certain favorable results. However, because there is no unified disposition and guidance, during the process of exploring the horizontal networking, every region is confronted with some difficulties and problems, which mainly include: 1. diversified horizontal networking system construction and lack of uniform or normalized business standards; 2. repeated development of horizontal networking systems in different regions, which results in the waste of a large sum of money; 3. the retarded system construction; and 4. no guarantee of expenses, and commercial banks’ lack of enthusiasm for this business. The said problems have gone against the normalized development of horizontal networking, affected the normalized management of national horizontal networking, hence, unified policies and rules need to be formulated immediately so as to clarify the targets and modes of horizontal networking, strengthen the guidance and the administration, and effectively promote the implementation of national horizontal networking.II. Guiding Ideology, Targets and Principles for the Horizontal Networking among Finance Departments, Taxation Authorities, the Treasury and Commercial Banks for the Electronic Payment of Tax Revenues to the TreasuryThe guiding ideology for horizontal networking is: to follow the development requirements for public finance under the socialist market economic mechanism, utilize modern information network technologies, realize the electronic payment of tax revenues to the treasury through thehorizontal networking among finance departments, taxation authorities, the treasury and commercial banks, realize the information sharing among finance departments, taxation authorities and the treasury, facilitate the tax payment of taxpayers, accelerate the speed of turning over tax revenues to the treasury, enhance the efficiency in operating financial capital, and establish a normalized and efficient operational mechanism for management of the collection and payment of tax revenues.Targets for the horizontal networking include: simplifying the procedures for tax payment and the payment of tax revenues to the treasury, facilitating the tax payment of taxpayers, enhancing the efficiency in collecting and turning over tax revenues; realizing the real-time transfer and payment of tax revenues, guaranteeing the timely and sufficient payment of tax revenues to the treasury; realizing the information sharing among finance departments, taxation authorities and the treasury, and providing support to relevant departments for their statistical analysis and research and formulation of macro control policies.According to the said guiding ideology and targets, the horizontal networking shall be governed by the following principles:1. Being good for enhancing the service level: simplifying the procedures for the tax payment and the payment of tax revenues to the treasury, providing convenient and swift electronic tax payment services to taxpayers, and enhancing the service level in the collection and payment of tax revenues;2. Being good for timely and sufficiently turning over tax revenues to the treasury: being relied on the information network system, establishing a mutually restricted, scientific and rational flow system for electronic payment of tax revenues to the treasury, enhancing the efficiency in collecting and turning over tax revenues to the treasury, and guaranteeing the timely and sufficiently payment of tax revenues to the treasury;3. Being good for information sharing: making full use of the horizontal networking system, establishing and improving the information sharing mechanism among finance departments, taxation authorities and the treasury, and realizing the sharing of information about the collection and payment of tax revenues;4. Being good for normalized operations: reasonably defining the duties of finance departments, taxation authorities, the treasury and commercial banks, regulating the procedures and business operations for collection and payment of tax revenues, and ensuring that the tax revenues are turned over to a single account of the treasury; and5. Being good for administration and supervision: enhancing the transparency of the payment of tax revenues to the treasury by way of horizontal networking, strengthening the supervision over the whole process of the collection and payment of tax revenues, and guaranteeing the normalization and safety of the collection and payment of tax revenues to the treasury.III. Main Contents of the Horizontal Networking among Finance Departments, Taxation Authorities, the Treasury and Commercial Banks for the Electronic Payment of Tax Revenues to the TreasuryThe main contents of horizontal networking include: establishing horizontal networking systems among finance departments, taxation authorities and the treasury, realizing the electronic paymentof tax revenues to the treasury on the premise that the safety, accuracy, speediness and efficiency are guaranteed, and realizing the information sharing among finance departments, taxation authorities and the treasury.1. Implementing the electronic payment of tax revenues to the treasuryThe electronic payment of tax revenues to the treasury will be realized mainly by the method of transfer. In case the conditions are not met, the method of self-payment shall be adopted. In the method of transmitting the information about electronic payment of tax revenues to the treasury, electronic payment warrants and other information about the electronic payment of tax revenues to the treasury shall be transmitted by taxation authorities to the treasury, and then be forwarded by the treasury to account opening banks of taxpayers and finance departments. Along with the deepening of horizontal networking, the direct networking among finance departments, taxation authorities and the treasury shall be gradually realized, and the procedures for electronic payment of tax revenues to the treasury and the information sharing mode shall also be improved.Specific procedures for the payment of tax revenues to the treasury by way of transfer are: the taxation authority examines the tax filings of taxpayers, produces electronic paid-in warrants according to the information about successful tax filings, sends the information on electronic paid-in warrants to the treasury through the horizontal networking system, then the treasury forwards the information on electronic paid-in warrants to the account opening banks of taxpayers after finding no error upon checking, notifies the account opening banks of taxpayers to deduct taxes from the accounts of taxpayers directly to a single account of the treasury, and sends the information about whether the deduction of taxes is successful or not to the taxation authority; the treasury will, within the prescribed time limit, send all the detailed information on electronic paid-in warrants and the information about whether the deduction of taxes is successful or not to the finance department. In the payment of tax revenues to the treasury by way of transfer, written paid-in warrants may be substituted by electronic paid-in warrants; and a taxpayer shall conclude an agreement on authorizing the deduction of taxes with its account opening bank in advance and notify the written agreement to the taxation authority in writing. In case the taxation authority has already grasped the information about tax filings, the taxpayers may also carry out the electronic payment of tax revenues to the treasury by way of bank-end inquiry, transfer and turn over tax revenues from their bank accounts to the treasury, and substitute written paid-in warrants by electronic paid-in warrants.Specific procedures for the self-payment of tax revenues to the treasury are: the taxation authority issues written paid-in warrants according to legal provisions and produces electronic paid-in warrants, sends the information on electronic paid-in warrants to the treasury through the horizontal networking system; taxpayers themselves make tax payment by cash or transfer upon the strength of written paid-in warrants or the taxation authority make tax payment on a consolidated basis; commercial banks transfer tax revenues to the treasury, and transmit written paid-in warrants to the treasury according to legal provisions; the treasury will, after making checking between the information on written paid-in warrants and that on electronic paid-in warrants and canceling electronic paid-in warrants upon verification, turn over tax revenues to the treasury, and send the information about whether the cancellation of electronic paid-in warrants issuccessful or not to the taxation authority; the treasury will, within the prescribed time limit, send all the detailed information on electronic paid-in warrants and the information about whether the cancellation of electronic paid-in warrants is successful or not to the finance department. In the self-payment of tax revenues to the treasury, written paid-in warrants are processed together with electronic paid-in warrants, and the cancellation upon verification shall be carried out on the basis of written paid-in warrants but to be supplemented by electronic paid-in warrants. The self-payment of tax revenues to the treasury is generally applicable to such business in which rural bazaars, individual industrial and commercial households or urban residents, etc. pay a small amount of taxes or in which taxpayers themselves come to commercial banks for tax payment upon the strength of written paid-in warrants.After the electronic payment of tax revenues to the treasury is adopted, the refund of tax revenues from the treasury, corrections by the treasury, exemption, deduction and transfer of tax revenues and checking of accounts, etc. will be carried out by way of electronic operations through the horizontal networking system, and written vouchers and electronic vouchers will be used together, however, written vouchers will be taken as the basis and the business will be carried out after making checks between written vouchers and electronic vouchers, and relevant information transmission shall be carried out by referring to the procedures for electronic payment of tax revenues to the treasury.After the electronic payment of tax revenues to the treasury is adopted, finance departments, taxation authorities, the treasury and commercial banks shall strengthen the checking of accounts, check accounts on a daily basis, and ensure the safe and accurate payment of tax revenues to the treasury.Finance departments, taxation authorities and the treasury shall, according to the principle of providing convenience to taxpayers and enhancing the efficiency of tax collection and payment, make full use of all sources available and computerization achievements, actively improve the horizontal networking for electronic payment of tax revenues to the treasury.2. Establishing and improving an information sharing mechanismFinance departments, taxation authorities and the treasury shall, through the horizontal networking system, automatically exchange the information according to the prescribed procedures, and realize the sharing of the information about electronic payment of tax revenues to the treasury, the information about the statements of the treasury and other information. Finance departments, taxation authorities and the treasury shall actively create conditions to realize the mutual direct networking as soon as possible, improve information sharing modes and enlarge the scope of information as shared.The “information about electronic payment of tax revenues to the treasury” refers to all kinds of information received or sent out by finance departments, taxation authorities and the treasury about the electronic payment of tax revenues to the treasury through the horizontal networking system, including electronic paid-in warrants, electronic refund warrants, electronic correction notices, electronic exemption, deduction or transfer notices, etc., and is mainly based on electronicpaid-in warrants. The basic information on an electronic paid-in warrant includes: name and code of the tax collection organ, serial number of the paid-in warrant, date of production; name of the taxpayer, identification number of the taxpayer, account name of the payer, account opening bank, account number; the recipient treasury, budgetary level, sharing proportion, budgetary item, tax category, tax item, amount, respective period, and expiry date of payment, etc.The “statements of the treasury” refers to the reports made by the treasury after classifying and gathering the relevant information according to legal provisions. The treasury shall be responsible for sending out the information about its statements concerning budgetary incomes, expenses, refund of tax revenues from it, as well as the exemption, deduction and transfer of tax revenues, etc.The “other information” refers to the information other than that about electronic payment of tax revenues to the treasury and that about the statements of the treasury and to be shared by relevant departments for their statistical analysis or budgetary implementation or analysis.3. Establishing a horizontal networking system among finance departments, taxation authorities, the treasury and commercial banks for the electronic payment of tax revenues to the treasuryOn the premise that the business procedures of finance departments, taxation authorities and the treasury are independent from each other, a horizontal networking system shall be established among them by utilizing modern information network technologies and adopting the horizontal networking mode among them. In order to guarantee the unity of the horizontal networking system across the country, the Ministry of Finance, the State Administration of Taxation and the People’s Bank of China shall be responsible for stud ying and formulating the interface standards and criteria for national unified horizontal networking system, and clarify the runtime environment and configuration requirements of the system.The horizontal networking system is an information network system among several networking departments, and puts a high demand on the network operating and the safety, stability and confidentiality of the information. Finance departments, taxation authorities, the treasury and commercial banks shall attach great importance to and strengthen the network system construction, rigidly prevent system loopholes and hidden safety troubles, practically guarantee the safe and effective system operating. Finance departments, taxation authorities, the treasury and commercial banks shall generally realize their mutual system connection at or above the level of prefecture or city.IV. Relevant Measures for the Horizontal Networking among Finance Departments, Taxation Authorities, the Treasury and Commercial Banks for the Electronic Payment of Tax Revenues to the TreasuryTo promote the horizontal networking, the following work shall be carried out:1. Accelerating the horizontal networking system construction among finance departments, taxation authorities, the treasury and commercial banks for the electronic payment of tax revenues to the treasury. According to the actual requirements for the electronic payment of tax revenues to the treasury, it is necessary to study and enact the Measures for the Administration of theCommercial Banks for the Electronic Payment of Tax Revenues to the Treasury; and simultaneously study and enact the rules for taxation, accounting, treasury accounting, etc.; and a ccelerate the research and revision of the Regulation of the People’s Republic of China on State the Treasury and the detailed rules for the implementation thereof, and provide the legal guarantee for the smooth promotion of horizontal networking when conditions are ripe.2. Promoting the horizontal networking system among finance departments, taxation authorities, the treasury and commercial banks for the electronic payment of tax revenues to the treasury. In order to smoothly establish a horizontal networking system, finance departments, taxation authorities and the treasury shall organize relevant system configuration, runtime environment, and make other initial preparations inside their respective systems. The relevant information systems of taxation authorities and the treasury shall satisfy the demands of the horizontal networking for electronic tax payment to the system disposal capacity and the network transmission capacity, etc. At the same time, commercial banks shall be urged to do a good job in building relevant network systems, so as to provide the technical guarantee to the safe and timely transfer of tax revenues to the treasury.3. Organizing the trainings about implementing the horizontal networking among finance departments, taxation authorities, the treasury and commercial banks for the electronic payment of tax revenues to the treasury. Since the new electronic payment of tax revenues to the treasury has changed the former mode by manually transferring tax revenues to the treasury, the trainings about systems and businesses are required. Finance departments, taxation authorities, the treasury and commercial banks shall organize relevant staff members in their own systems for the trainings, and ensure that relevant staff members can command new systems, new businesses, and provide guarantee of business skills for the smooth implementation of horizontal networking.4. Doing a good job in the supervision over and emergency handling of the collection and payment of tax revenues after the horizontal networking. After the electronic payment of tax revenues to the treasury has been implemented, the transfer and payment of tax revenues to the treasury and other business will be completed mainly through the information network system, and finance departments, taxation authorities and the treasury shall attach great importance to the supervision over the collection and payment of tax revenues, and ensure the timely and full payment of tax revenues. Finance departments shall fully perform the supervisory duty over treasury funds and do a good job in the use and management of shared information. Taxation authorities shall practically strengthen the monitoring over the whole process of the collection of tax revenues, and ensure the timely and full payment of tax revenues to the treasury. The treasury shall strengthen the supervision over and administration of the collection and transfer of tax revenues to the treasury by commercial banks, and ensure the real-time and timely transfer of money and payment of tax revenues to the treasury. At the same time, all the networking departments shall study to establish an emergency handling mechanism for the electronic payment of tax revenues to the treasury, so as to guarantee the normal and orderly collection and payment of tax revenues.Treasury and Commercial Banks for the Electronic Payment of Tax Revenues to the TreasuryThe horizontal networking involves many departments, needs strong operational collaboration, and requires relevant parties to strengthen communications and coordination and to do a good job jointly. A horizontal networking leading group in which finance departments take the lead, and taxation authorities, the treasury and commercial banks, etc. take participation in shall be established to take charge of organization, leadership, communications and coordination during the process of horizontal networking, studying and determining the development orientation and the promotion of horizontal networking, coordinating the major emergency handling, taking the lead in organizing and resolving important problems relating to the horizontal networking, and specifying the division of work and mutual coordination among different networking departments and jointly promoting the smooth implementation of horizontal networking.1. Duties of the finance departmentsThe Ministry of Finance shall, jointly with the State Administration of Taxation and the People’s Bank of China, be responsible for organizing the implementation of horizontal networking across the country, and study and enact the relevant policies and rules for the horizontal networking countrywide. It shall study and enact the national criteria of network interfaces between finance departments and the treasury jointly with the People’s Bank of China, and organize the interface software development for the finance system and other network system construction work; and shall be responsible for organizing the national finance system to do a good job in relevant system preparations for horizontal networking, and guide local finance systems to carry out the horizontal networking.The finance department at the level of province (including the city under separate state planning, similarly hereinafter) shall, jointly with the taxation authority and the treasury at the same level, be responsible for organizing the implementation of horizontal networking within its jurisdiction, study and enact the specific implementation measures for the horizontal networking within its jurisdiction; be responsible for organizing the implementation of horizontal networking at the provincial level, and guide the finance departments at the level of prefecture or city to carry out the horizontal networking.The finance departments at the level of prefecture or city shall be responsible for the implementation of horizontal networking within its jurisdiction jointly with the taxation authority and the treasury at the same level.2. Duties of taxation authoritiesThe State Administration of Taxation shall, jointly with the Ministry of Finance and the People’s Bank of China, organize the implementation of national horizontal networking, and jointly study and enact the relevant policies and rules for the countrywide horizontal networking. It shall be responsible for studying and enacting the rules and measures for tax accounting as well as the use and management of tax payment vouchers, etc.; shall study and enact the national criteria of network int erfaces between finance departments and the treasury jointly with the People’s Bank of China, and organize the interface software development for the finance system and other network。