- 1、下载文档前请自行甄别文档内容的完整性,平台不提供额外的编辑、内容补充、找答案等附加服务。

- 2、"仅部分预览"的文档,不可在线预览部分如存在完整性等问题,可反馈申请退款(可完整预览的文档不适用该条件!)。

- 3、如文档侵犯您的权益,请联系客服反馈,我们会尽快为您处理(人工客服工作时间:9:00-18:30)。

Chapter 10

Fixed Assets and Intangible Assets

Accounting, 21st Edition

Warren Reeve Fess

© Copyright 2004 South-Western, a division of Thomson Learning. All rights reserved. Task Force Image Gallery clip art included in this electronic presentation is used with the permission of NVTech Inc.

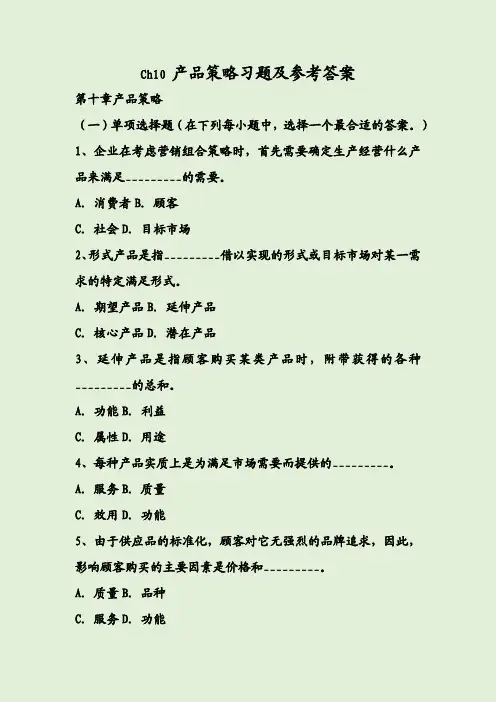

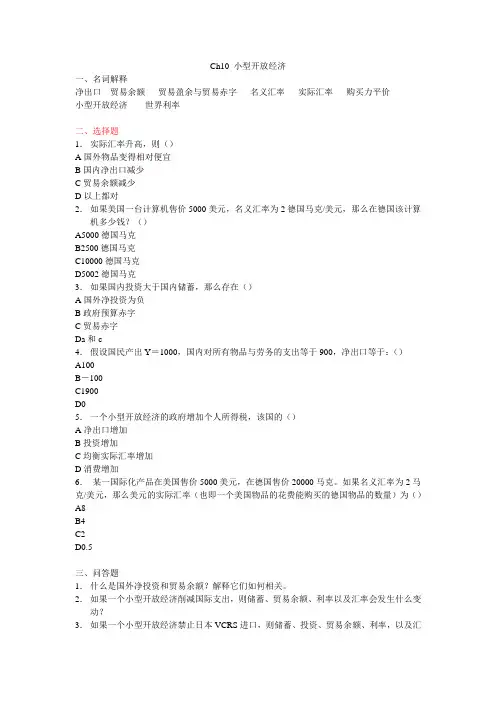

$ 4,400 8,800 13,200 17,600

$24,000 19,600 15,200 10,800 6,400

$4,400 4,400 4,400 4,400 4,400

$19,600 15,200 10,800 6,400 2,000

Cost ($24,000) – Residual Value ($2,000) Estimated Useful Life (5 years)

Land

• Purchase price • Delinquent real estate taxes • Sales taxes • Razing or removing • Permits from government agencies unwanted buildings, less the salvage • Broker’s commissions • Grading and leveling • Title fees • Paving a public street • Surveying fees bordering the land

Buildings

Architects’ fees Engineers’ fees Insurance costs incurred

during construction Interest on money borrowed to finance construction Walkways to and around the building

Nature of Fixed Assets

Fixed assets are long term or relatively permanent assets Fixed assets are tangible assets because they exist physically. They are owned and used by the business and are not held for sale as part of normal operations.

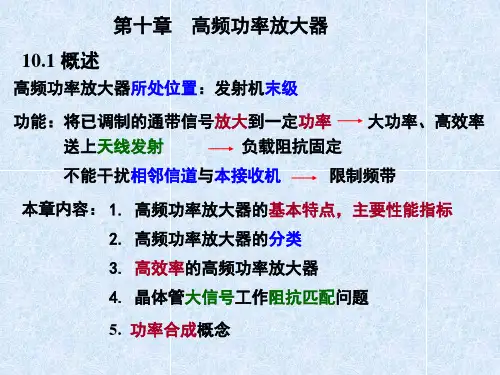

Depreciation Expense Factors

Initial Cost

-

Residual Value

=

Depreciable Cost

Useful Life

Periodic Depreciation Expense

Use of Depreciation Methods

Declining4% Balance

Facts

Original Cost.....………….. Estimated Life in years….. $24,000 5 years

Estimated Life in hours…..

Estimated Residual Value...

10,000

$2,000

Straight-Line Method Cost – estimated residual value Estimated life

= Annual depreciation

Straight-Line Method $24,000 – $2,000 5 years

= $4,400 annual depreciation

Straight-Line Rate

$24,000 – $2,000

5 years = $4,400

$4,400 = 18.3% $24,000

Annual = Depreciation Expense ($4,400)

Straight-Line Method

Year 1 2 3 4 5 Cost $24,000 24,000 24,000 24,000 24,000

Accum. Depr. at Beginning of Year Book Value at Beginning of Year Depr. Expense for Year Book Value at End of Year

Buildings

Sales taxes Repairs (purchase of

existing building) Reconditioning (purchase of an existing building) Modifying for use Permits from governmental agencies

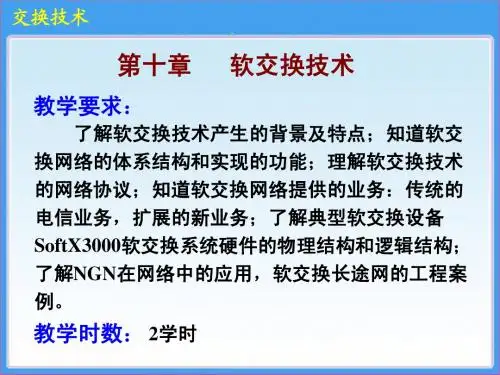

Objectives

6. Describe internal controls over fixed assets. 7. Compute depletion and journalize the entry for depletion. 8. Describe the accounting for intangible assets, such as patents, copyrights, and goodwill. 9. Describe how depreciation expense is reported in an income statement, and prepare a balance sheet that includes fixed assets and intangible assets. 10. Compute and interpret the ratio of fixed assets to long-term debt.

Cost of Acquiring Fixed Assets Excludes:

Vandalism Mistakes in installation Uninsured theft Damage during unpacking and installing Fines for not obtaining proper permits from government agencies

Other Units-of-Production

ce: Accounting Trends & Techniques, 56th. ed., American Institute of Certified Public Accountants, New York, 2002.

Classifying Costs

Is the purchased item long-lived?

Yes Is the asset used in a productive purpose? Yes No No

Expense

Fixed Assets

Investment

Land

• Purchase price • Sales taxes • Permits from government agencies • Broker’s commissions • Title fees • Surveying fees

Straight-Line Method

The straight-line method is widely used by firms because it is simple and it provides a reasonable transfer of cost to periodic expenses if the asset is used about the same from period to period.

PowerPoint Presentation by Douglas Cloud

Professor Emeritus of Accounting Pepperdine University

Some of the action has been automated, so click the mouse when you see this lightning bolt in the lower right-hand corner of the screen. You can point and click anywhere on the screen.

Nature of Depreciation

All fixed assets except land lose their capacity to provide services. This loss of productive capacity is recognized as Depreciation Expense. Physical depreciation occurs from wear and tear while in use and from the action of the weather. Functional depreciation occurs when a fixed asset is longer able to provide services at the level for which it was intended, e.g., personal computer.

Objectives

1. Define fixed assets and describe the accounting for their cost. this After studying 2. Compute depreciation, using the following chapter, you should methods: straight-line method, units-ofbe and declining-balance production method,able to: method. 3. Classify fixed asset costs as either capital expenditures or revenue expenditures. 4. Journalize entries for the disposal of fixed assets. 5. Define a lease and summarize the accounting rules related to the leasing of fixed assets.