投资者情绪与股票截面收益翻译

- 格式:docx

- 大小:532.39 KB

- 文档页数:63

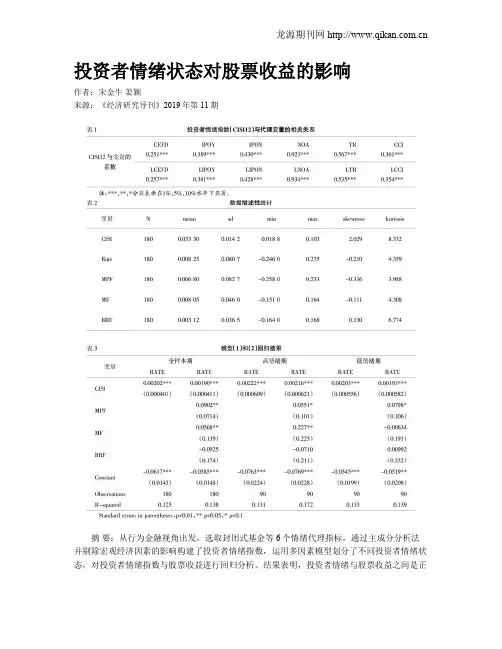

投资者情绪状态对股票收益的影响作者:宋金牛姜颖来源:《经济研究导刊》2019年第11期摘要:从行为金融视角出发,选取封闭式基金等6个情绪代理指标,通过主成分分析法并剔除宏观经济因素的影响构建了投资者情绪指数,运用多因素模型划分了不同投资者情绪状态,对投资者情绪指数与股票收益进行回归分析。

结果表明,投资者情绪与股票收益之间是正相关关系,在加入三因子控制变量以后,二者之间的拟合度变高;同时还发现,投资者处于情绪高涨期相较于情绪低迷期对股票收益的影响更大。

关键词:投资者情绪;主成分分析;股票收益中图分类号:F830.91 ; ; ;文献标识码:A ; ; ;文章编号:1673-291X(2019)11-0128-03引言传统金融学理论基于理性人假设和有效市场假说构建了一套现代金融理论体系,这对金融资产定价和金融市场运行机制具有很好的解释作用。

但是,随着金融学的深入发展,传统金融学理论已经无法深入解释金融市场异象和诠释现实人的经济行为,这时候“行为金融学”应运而生。

在传统金融理论背景下以心理学为基础并辅以社会学、生物学以及系统动力学等理论的行为金融学,将投资者的实际行为和心理特征结合在一起,较好地解释了传统金融理论无法解释的“未解之谜”。

行为金融学的有关研究可以追溯到19世纪,当时学者Gustave已经开始研究投资市场行为,随后“空中阁楼理论”认为投资者投资决策行为受到了行为主体的心理因素影响。

Lee、Shleifer 和 Thaler(1991)[1]发现,在封闭式基金交易中,投资者情绪对投资者预期产生影响,进而对基金价格产生影响。

Barberis(1998)[2]等指出,投资者情绪会影响金融资产价格。

Cornelli(2006)[3]发现,在新股发行市场上,投资者情绪对股价的影响表现的比较明显。

Stambuage et al(2012)[4]发现,市场上越来越多的市场异象出现,这其中一部分原因与投资者情绪有关。

投资者情绪对股票收益的影响投资者情绪对股票收益具有重要影响。

投资者的情绪波动会直接影响市场的走势,从而对股票收益产生深远的影响。

当投资者情绪高涨时,股票价格往往会上涨,而当投资者情绪低迷时,股票价格则会下跌。

了解和分析投资者情绪对股票收益的影响,对于投资者制定正确的投资策略和决策具有重要意义。

投资者情绪对股票收益的影响可以从心理学角度进行解读。

投资者的情绪受多种因素影响,比如新闻事件、市场消息、宏观经济环境等。

这些因素都有可能引发投资者情绪的波动,进而影响股票价格。

当市场发生利好消息时,投资者的情绪往往会变得乐观,股票价格便有可能上涨;而当市场出现利空消息时,投资者的情绪可能会变得悲观,股票价格则有可能下跌。

投资者的情绪波动可以被视为市场心理的一种反映,对股票收益产生直接影响。

投资者情绪对股票收益的影响也与投资者行为倾向相关。

在市场交易中,投资者的情绪也会直接影响其投资行为。

当投资者情绪乐观时,他们更有可能进行买入操作,从而推升股票价格;而当投资者情绪悲观时,他们更倾向于进行卖出操作,导致股票价格下跌。

投资者情绪还会影响其交易决策的理性程度。

在情绪高涨时,投资者可能更容易受到市场热度的影响,做出不够理性的交易决策;而在情绪低迷时,投资者可能更容易受到恐惧和焦虑情绪的影响,导致盲目的卖出操作。

投资者情绪会直接影响其在市场中的交易行为,进而影响股票的收益。

投资者情绪对股票收益的影响也与市场的短期波动相关。

市场的短期波动是由投资者情绪的波动所驱动的。

当投资者情绪高涨时,市场往往会出现短期的过热现象,股票价格快速上涨;而当投资者情绪低迷时,市场可能会出现短期的恐慌性抛售,股票价格大幅下跌。

这种短期波动会直接影响股票的日收益率和波动率,进而影响股票的长期收益。

投资者情绪对市场短期波动的影响也直接反映在股票的收益上。

投资者情绪状态对股票收益的影响

投资者的情绪状态对股票市场有着重要的影响,它可以影响股票的价格、交易量和市

场的波动性。

投资者情绪可以分为乐观情绪和悲观情绪两种。

乐观情绪时投资者对市场持

乐观态度,预期股票价格将上涨,交易活跃度较高;悲观情绪时投资者对市场持悲观态度,预期股票价格将下跌,交易活跃度较低。

乐观情绪会推动股票价格上涨。

当投资者认为市场将迎来一个牛市时,他们会购买更

多的股票,推动股票价格上涨。

投资者的乐观情绪会激发更多的买入需求,从而推高市场

需求曲线,提高股票价格。

乐观的情绪也会对股票市场的波动性产生影响,乐观的投资者

往往会产生更多的交易活动,更多的交易活动会加剧股票市场的波动性。

乐观情绪也有可能导致投资者过度买入股票,使股价超过其真实价值,形成泡沫。

当

乐观情绪达到顶峰时,市场可能会出现过度投机和恐慌性卖出,导致股票价格的剧烈下跌。

这种情况下,投资者的情绪状态会对股票收益产生负面影响。

悲观情绪在一定程度上也可以对投资者产生积极影响。

当悲观情绪过高时,市场可能

会出现过度抛售和恐慌性买入,这会引发市场的剧烈波动。

对于有经验的投资者来说,这

种波动可以提供一些低买高卖的机会,获得较高的收益。

截面因子和时序因子

截面因子(Cross-sectional Factor)和时序因子(Time-series Factor)在金融经济学和投资组合管理中是两个重要的概念,它们分别用来解释资产回报在不同维度上的变化规律:

截面因子:

截面因子主要用于描述和解释不同资产在同一时间点上收益率差异的原因。

在多因子模型中(如Fama-French三因子模型),截面因子是用来捕捉市场中不同证券间收益率横截面分布的系统性特征。

比如,市值因子(Size)、账面市值比因子(Book-to-Market Ratio,简称B/M因子)等,可以解释为何在某一时点上,小盘股相比于大盘股会有不同的平均收益率,或者价值型股票相较于成长型股票有不同的表现。

时序因子:

时序因子则关注单个资产或一组资产在不同时间点上的收益率变化,通常用来分析资产收益率的时间序列特性,以及这些特性如何受到宏观经济因素、市场情绪、周期性变化等因素的影响。

例如,动量因子(Momentum)就是一个时序因子,因为它反映了资产过去一段时间内的价格变动对未来短期内价格走势的影响。

在实际应用中,研究人员可能会采用横截面回归分析来发现并估

计截面因子,而时间序列分析则用于考察时序因子的效果。

投资者可以通过识别和利用这些因子来进行有效的资产配置和风险管理。

同时,现代投资理论中也有结合横截面和时序信息的因子模型,旨在更好地理解和预测资产收益。

会计之友2020年第13期一、引言现代金融理论认为,市场上的参与者并不是完全理性的,他们会受到市场上“噪音”的影响,表现出投资者情绪的波动,对市场做出有偏估计,从而对公司股票收益产生影响。

从我国金融市场的特征来看,个人投资者所占比例较大,而且由于金融市场发展不够完善和投资者专业性不强等,我国投资者表现出更为强烈的投资者情绪,使得我国上市公司的股票收益波动表现得更加明显。

目前大量学者对投资者情绪与股票收益之间的关系进行了研究,并指出公司层面特征(如投资行为、融资行为、会计信息质量等)对两者的关系具有调节作用。

近年来,越来越多的上市公司开始使用衍生金融工具进行风险管理,衍生品的使用情况作为公司套利风险的重要组成部分,受到了投资者的广泛关注。

尤其是中信泰富、深南电等公司衍生金融工具巨亏丑闻披露后,投资者对使用衍生金融工具的上市公司抱有更加谨慎的投资态度,因此衍生金融工具的使用可能会抑制高涨的投资者情绪对股票收益的提升作用。

本文以2008—2017年A 股上市公司使用衍生金融工具的情况出发,通过实证研究检验投资者情绪对我国上市公司个股股票收益所发挥的作用,深入探索投资者情绪对股票收益的影响路径。

本文的贡献主要在于:其一,实证检验了投资者情绪的高低与股票收益的关系,并使用衍生金融工具作为调节变量,讨论在企业的不同投资行为下,投资者情绪对个股股票收益的影响是否存在差异;其二,进一步分析了投资者情绪的变动对个股股票收益的影响;其三,研究结论有利于监管部门根据投资者情绪提前预测市场动向,及时提醒投资者潜在风险,从而降低投资者损失,维护金融市场的稳定运行。

另外也有利于对公司使用衍生品进行警示,抑制投机动机。

二、文献综述、理论分析及研究假设(一)文献综述传统金融理论把人看作是“理性经济人”,认为市场参与者能够充分获得市场上的有效信息,并以效用最大化为目标,对市场做出正确的判断,从而对市场上的金融资产做出无偏估计。

继Fischer 提出“噪音”的存在之后,De Long et al.[1]进一步提出了噪声交易者模型(DSSW )。

投资学中的投资者情绪与市场效率投资者情绪是投资学中一个重要的研究领域,它涉及到投资者的信念、情感和行为,对市场效率和资产定价等方面产生重要影响。

本文将从理论角度探讨投资者情绪的概念和影响,并分析其与市场效率的关系。

一、投资者情绪的概念投资者情绪是指投资者对市场和资产的情感反应和预期表现。

投资者情绪包含了投资者的信心、恐惧、贪婪等心理因素,这些情绪会影响投资者的决策和行为。

例如,当市场情绪乐观时,投资者容易高估资产的价值,盲目追涨杀跌;而当市场情绪悲观时,投资者往往低估资产的价值,过度悲观地抛售资产。

二、投资者情绪对市场效率的影响1. 投资者情绪与资产定价投资者情绪的波动会导致资产价格的非理性波动,这与有效市场假说相违背。

例如,当市场情绪乐观时,投资者倾向于高估股票等资产的价值,导致市场上出现泡沫;当市场情绪悲观时,投资者往往低估资产的价值,造成市场的低估。

因此,投资者情绪可以导致资产价格出现明显的非理性波动。

2. 投资者情绪与市场波动投资者情绪的波动会对市场产生一定的影响,特别是在短期市场波动剧烈的情况下。

研究表明,当市场情绪偏向乐观时,投资者更愿意投资高风险的资产,导致市场波动加剧;而当市场情绪偏向悲观时,投资者更趋向于冲销资产,进一步加剧市场的波动。

三、投资者情绪的研究方法为了研究投资者情绪与市场效率之间的关系,学者们开发了一系列的情绪指标和研究方法。

其中比较常用的情绪指标包括股票市场的波动率指数、投资者情绪调查指数、消息面情绪指标等。

这些指标可以用来测量和跟踪市场情绪的变化,并与市场效率进行相关性分析。

四、应对投资者情绪的策略1. 理性投资决策投资者应该保持冷静理性的投资决策,在市场情绪波动较大时,更加注重基本面分析和风险管理,避免盲目跟风或恐慌抛售。

2. 多元化投资组合投资者可以通过多元化投资组合的方式来降低投资风险,分散市场情绪对资产组合的影响。

通过配置不同类型和不同规模的资产,可以减少对特定投资者情绪的过度依赖。

个人和机构投资者情绪与股票收益——基于上证A股市场的研究个人和机构投资者情绪与股票收益——基于上证A股市场的研究摘要:本文通过分析个人和机构投资者情绪对股票收益的影响,以上证A股市场为例进行研究。

首先,介绍了个人和机构投资者情绪的概念及其测量方法。

接着,通过实证研究发现,个人和机构投资者情绪对股票收益有显著影响。

具体而言,个人投资者情绪与股票收益呈正相关关系,而机构投资者情绪与股票收益呈负相关关系。

最后,本文对研究结果进行了讨论,并给出了相关政策建议。

关键词:个人投资者情绪,机构投资者情绪,股票收益,上证A股市场一、引言股票市场是个人和机构投资者交易股票的场所,投资者的情绪对市场的走势和股票的收益有着重要影响。

近年来,随着金融市场的快速发展,越来越多的研究聚焦于个人和机构投资者情绪对股票收益的影响。

然而,目前对这一领域的研究仍然相对有限,特别是在中国的上证A股市场上的研究。

因此,本文以上证A股市场为例,研究个人和机构投资者情绪对股票收益的影响。

二、个人和机构投资者情绪的概念与测量方法个人投资者情绪是指个人投资者的观点、情感和信心等因素对股票市场和股票收益的预期和影响。

机构投资者情绪则是指机构投资者的观点、情感和信心等因素对股票市场和股票收益的预期和影响。

个人和机构投资者情绪的测量方法包括调查问卷、媒体评论分析、互联网大数据分析等。

三、个人和机构投资者情绪与股票收益的关系通过对上证A股市场的历史数据进行实证研究,我们发现个人投资者情绪与股票收益呈正相关关系。

具体来说,当个人投资者情绪处于高位时,股票收益率往往较高;而当个人投资者情绪处于低位时,股票收益率则较低。

这可能是因为个人投资者情绪的高位反映了市场的乐观预期,使得个人投资者更倾向于购买股票,从而推高股票收益率。

相反,个人投资者情绪的低位则导致市场的悲观预期,使得个人投资者更倾向于卖出股票,从而压低股票收益率。

然而,机构投资者情绪与股票收益的关系则相反。

投资者情绪对股票收益影响的研究综述近年来,越来越多的研究表明投资者情绪对股票收益有着重要的影响。

这些研究在理论、实证和实践方面都得出了许多重要结论,本文将综述相关研究。

理论方面的研究表明,投资者情绪主要有两种类型:乐观情绪和悲观情绪。

乐观情绪主要指投资者看好经济和市场前景的情绪,通常会导致股票价格上涨;悲观情绪则指投资者对经济和市场前景持悲观态度,通常会导致股票价格下跌。

此外,研究还表明,投资者情绪受到多种因素的影响,包括新闻报道、公司财报、政治事件等。

实证方面的研究表明,投资者情绪确实对股票收益有着显著的影响。

其中,一些研究发现,投资者情绪的变化可以预测股票市场的短期波动。

例如,当投资者情绪处于高位时,股票市场通常处于过热状态,此时的股票收益可能会出现回调;相反,当投资者情绪处于低位时,股票市场通常处于过度恐慌状态,此时的股票收益可能会出现反弹。

此外,还有一些研究发现,不同类型的投资者情绪对股票收益的影响可能存在差异。

例如,一些研究发现,投资者情绪与机构投资者的股票交易行为相关性更高,因此,机构投资者的情绪可能会更加影响股票收益。

实践方面的研究表明,投资者情绪对投资者制定投资决策也有着重要的影响。

一些实践研究发现,投资者的情绪状况可能会影响其决策质量。

例如,投资者在情绪激动或不稳定的状态下,往往会偏向于做出过度乐观或过度悲观的投资决策,这可能会导致投资失败。

此外,一些实践研究还发现,投资者可以通过调整自己的情绪状态来改善自己的投资表现。

例如,投资者可以通过保持冷静和镇定来规避由情绪决策带来的错误,从而提高投资决策的质量。

总之,投资者情绪是影响股票收益的一个重要因素。

投资者应该认识到情绪的影响,并尽可能保持冷静和理性,以避免情绪决策带来的错误。

未来,随着投资者情绪研究的不断深入和完善,我们相信对股票市场的预测和投资决策制定将变得更加科学和准确。

外文翻译原文Private equity funds: Return characteristics, return drivers andconsequences for investorsMaterial Source: Journal of Financial Transformation, 2005(12), p107-117.Author: Christoph Kaserer and Christian DillerIntroductionThis article addresses two important topics concerning the performance of private equity funds. Firstly, we argue that the performance of a private equity fund should not be measured by the IRR. Instead, we offer the PME as a more meaningful performance measure. On that basis we offer some performance data for mature European private equity funds. Secondly, we analyze what factors have an impact on these returns. In our perspective, this asset class is characterized by illiquidity, stickiness, and segmentation. As a consequence, we can show that the so-called ‘money chasing deals phenomenon’explains a significant part of the variation in private equity funds’ returns. Apart from the importance of fund flows, we can also demonstrate that the skills of the management team have a significant impact on the fund’s returns. Finally we discuss the impact of these results on private equity investment strategies.DatasetOver the last decade private equity has become an important asset class for institutional investors. For several reasons its importance will further increase over the years to come. Evidently, the changing regulatory environment will have a substantial influence in this process. Actually, the widespread implementation of international accounting rules in Europe (IFRS/IAS) may increase institutional investors’ propensity to allocate more of their investments to this asset class. On the other side, however, it may be that the ongoing change in banking and insurancesupervision makes private equity investments more expensive. Whatever the shift in the regulatory environment will be, any portfolio allocation decision is ultimately driven by return expectations. Therefore, there is a widespread need to gather more information on the historical performance record of private equity investment. It is the aim of this article to make a contribution with respect to that question.The past three years have been extremely good for private equity with returns for all but the smallest funds comfortably beating the S&P 500 index. Long-term performance also looks strong, at least at first glance. From 1980 to 2001, the average fund generated higher gross returns than investing in the S&P 500, according to a study by Steve Kaplan of the University of Chicago and Antoinette Schoar of the Massachusetts Institute of Technology.The results of this article are based on a large dataset provided by the European Venture Capital and Private Equity Association (EVCA) and Thomson Venture Economics (TVE). It consists of 777 European private equity funds with vintage years from 1980 to 2003. At this point it should be noted that one cannot calculate a time weighted return for a private equity fund due to the unobservable market price. This again is a very important difference with public market funds. It is well known that the alternative to a time weighted return is a value weighted return, with the IRR being the most prominent example. However, the IRR can only be calculated if the complete cash flow history of a fund is known. For most of the funds in our dataset this is not the case, as most of them were still in operation by the year 2003. Only 95 funds in the dataset were liquidated by that year. Looking at liquidated funds only could bias our findings, as there would be an under representation of more recent vintage years in our sample2.Performance analysis of private equity funds:Some puzzling issues in return measurementWe start with presenting the results of the return distribution of our sample of European private equity funds. We have already pointed out that for an illiquid asset, i.e., an asset without an observable market price, a time weighted return cannot be calculated. The most frequent alternative used is the IRR, which is also a very common return measure used by the private equity industry. Two important drawbacks of this approach should be mentioned here [Kaserer and Diller(2004b)]. Firstly, it is well known from finance textbooks that the IRR is not a return measure but just a critical interest rate giving the maximum opportunity cost of capitalsupported by the project under analysis. In other words, if the IRR is equal to 15% then the investment in that project generates value as long as the cost of capital is not higher than 15%. From this it follows that the comparison of different investment projects on the basis of the IRR makes no sense. We will see in the following that this is not just a theoretical argument, but that there is a possible pitfall when comparing existing private equity funds on the basis of their IRRs.Secondly, institutional investors need information about the return distribution of private equity investments in order to feed their asset allocation models. By definition, all these models start from the distribution of time weighted returns. Furthermore, an asset allocation approach makes the use of a value weighted return meaningless. Hence, the IRR provides only limited information to limited partners (LP) in private equity funds. Evidently, this is also true for the multiple, another return measure used in the industry. As a multiple does not even account for the time value of money, its shortcomings are more than obvious.Now, the interesting question is whether there is any alternative to the IRR that is not affected by these caveats. Well, the answer is yes, although this alternative return measure, which is called the public market equivalent (PME), comes at a price. Basically, under this approach the simplifying assumption is made that the opportunity cost of a private equity investment is equal to the rate of return of a public market benchmark [Kaserer and Diller (2004b)]. Using this assumption, any cash flow pattern of a private equity fund could be transformed over time in an arbitrary way, as any distribution can be reinvested in the benchmark portfolio for whatever period is desired.Finally, it should be noted that there is a second alternative to the IRR used in the literature, namely the excess-IRR approach. It is defined as the IRR of a single fund minus the return on a benchmark index over the fund’s lifetime. It is presumed that in this way the return of a fund is benchmarked against a public market investment. However, given that the IRR is not an appropriate return measure, any other measure based directly on the IRR must suffer from the same problems. We will see that, in fact, a fund ranking based on the excess-IRR approach can contradict a fund ranking based on the PME approach.Evidence of the money chasing deals phenomenon It has already been argued that the paradigm of frictionless and perfectly competitive capital markets cannot be applied to the private equity market. Mainlythis is due to three specific characteristics of this market: segmentation, stickiness, and illiquidity. Convincing evidence in this regard has already been presented by Gompers and Lerner (2000), who show that capital inflows into venture funds increase the valuations of venture deals. Although it is an open question whether increased valuations are triggered by money pouring into the private equity industry or whether this money flow is triggered by improved expectations of future investment opportunities, and hence by increased valuations, Gompers and Lerner (2000) present some evidence that is more consistent with the former hypothesis. They basically argue that there is a limited number of favorable investments in the private equity industry giving way to the so-called money chasing deals phenomenon.Segmentation might be an especially important argument in this regard. Actually, private equity funds are not normally allowed to invest their committed capital in any other asset class. Often, they are even restrained from investing in segments within the private equity industry. Hence, even if the GPs would be aware of an overvaluation in the industry or in a specific part of the industry, it would be hard for them to redirect their money towards other investment projects. As a second problem, Ljungqvist and Richardson (2003) point out that capital flows between GPs and LPs tend to be sticky, i.e., it takes a longer time to adjust the capital invested in the industry to changed expectations or valuations. Those who are not familiar with private equity funds should note that such a fund typically collects capital commitments during its fundraising. Committed capital, however, is not paid into the fund immediately, but drawn down over a period of 3 to 5 years, depending on the market conditions. Now, if expectations of investors improve because of improved economic prospects, capital commitments would increase. However, it may take months or even years before the money is completely drawn down. Hence, it may well be that the time pattern of capital supply does not match the capital demand caused by attractive target companies. This mismatch may be accentuated because one can easily imagine that attractive investment opportunities are fixed in the short-run. So, if the market is not perfectly flexible and investors do not have perfectly rational foresight, it might be the case that abundant capital supply faces only a small number of promising target companies. In that situation, deal competition may be high, which would push prices higher. Alternatively, it could be that capital supply is scarce, while the number of promising target companies is high. In that case deal competition is low and entrepreneurs have to offer shares in theircompanies at rather low prices.Finally, illiquidity, i.e., the absence of a secondary market, aggravates the pressure on deal pricing. Because investors already engaged in the private equity market cannot sell their investment stakes, additional money pouring into the industry must be absorbed in the primary markets in their entirety.What is the impact of the GP’s skills?From the specific characteristics of the private equity market it follows that skills of the management team could have a more significant impact on fund returns than is the case for funds investing in public securities markets. In efficient public markets a great deal of information, public or private, is incorporated in asset prices. Hence, the ultimate outcome of an investment strategy should be almost the same, regardless of whether the investor undertakes informational activities or not. In fact, there is no clear evidence from the mutual fund performance literature that fund returns may be driven by fund managers’ skills, like selection or timing abilities.We would expect fund management skills to be much more important in private equity funds than in public mutual funds. knowledge about investment opportunities in the private equity industry may be distributed very unequally and, due to the lack of a secondary market for these assets, it may take a long time until this information is disseminated. Now, if there is a systematic difference in knowledge about private equity investment opportunities among different management teams, we would expect that good deals are concentrated in a small number of fund portfolios, i.e., the portfolios of the skilled management teams. The first consequence of this idea is that deal returns should have a much more skewed distribution than public stock market prices. In fact, private equity funds’ returns distributions are heavily skewed. Finally, if skills are unequally distributed at a given point in time, it may well be that their distribution is not independent over time. Hence, we would expect that returns of subsequent funds run by the same management team are correlated. This gives way to the so called persistence phenomenon in private equity funds’ returns.ConclusionIn this article a comprehensive dataset of European private equity funds was analyzed. In the first step we analyzed the performance of a sample of mature funds. Instead of using the widespread IRR as a performance measure, we introduced the PME-approach. As one would expect from theoretical considerations, we were ableto show that benchmarking on an IRR-basis could lead to substantially distorted results. Moreover, even a ranking of different funds on basis of the IRR could generate pitfalls. Hence, LPs should not benchmark the track record of a GP on the basis of IRR; they should instead use the PME.The main focus of this article, however, was to give new insights into the determinants of funds’ returns. For that purpose we started from the presumption that the private equity asset class is characterized by illiquidity, stickiness, and segmentation. It has been argued in theoretical and empirical papers that these characteristics can cause an over- or undershooting of private equity asset prices, at least in the short-run. We document that funds closed in periods where overshooting is less present have significantly higher returns than funds closed during these periods. Hence, the so-called money chasing deals phenomenon is an important factor in explaining private equity returns. From an investment perspective, this result has two implications. Firstly, a private equity investor should implement a contrarian investment strategy, in the sense that he should invest when overshooting does not occur. Secondly, diversifying funds over different vintage years as well as different fund types seems to be very important for reducing the risk of being exposed to the money chasing deal phenomenon.Apart from the importance of fund flows the article also shows that GPs’ skills have a significant impact on fund returns. More precisely, returns of subsequent funds run by the same management team are correlated. So, we present evidence in favor of the persistence phenomenon governing the returns of European private equity funds. From an investment perspective it is, however, rather difficult to base an investment strategy on this result. Although the result is a justification of why track records are very important for inferring the abilities of a management team, it is of little help as this information is almost public. Nevertheless, the result indicates that the selection of a management team is a key success factor for private equity investments.Due to the specific characteristics of the private equity asset class — i.e., the illiquidity of the investment, the stickiness of fund flows, the restricted number of target companies, and the segmentation from other asset classes — the market may be far from being frictionless and perfectly competitive, at least in the short-run. Overall, the lack of an organized secondary market seems to be the crucial factor.译文私募股权投资基金:收益特征、收益因素和投资者策略资料来源:金融转型[J]. 2006(5),第5期,p107-117.作者:克里斯多夫·卡瑟勒尔,克里斯汀·第勒尔引言本文以论述私募股权投资基金两种重要的运作业绩表现为主题。

文章编号:1001-4098(2007)07-0013-05中国股市投资者情绪与股票收益的实证研究X张 强1,杨淑娥2,杨 红1(1.西安交通大学管理学院,陕西西安 710049;2.上海对外贸易学院金融学院,上海 201600)摘 要:应用GARCH-M(1,1)模型检验了中国股市投资者情绪对股票收益的影响,结果发现:机构投资者情绪是影响股票价格的重要因素,但对不同市场和组合的影响方式不同且未形成系统风险;而个人投资者情绪的影响并不显著,也不存在小盘股主要受个人投资者情绪影响的现象。

这与国外相关研究结论不同。

关键词:噪音交易;投资者情绪;股票收益中图分类号:F830 文献标识码:A1 引言投资者非理性行为是否会影响股票价格和收益是现代金融理论和行为金融理论争论的焦点。

现代金融理论认为,在某种程度上某些投资者可能并非理性,但由于他们之间的交易是随机进行的,所以他们的非理性会相互抵消,股票价格不会受到影响;即使在某些情况下,非理性的投资者会犯同样的错误,但市场中的理性套利者也会消除他们对价格的影响。

因此,股票的价格等于其基础价值,股票的预期收益由其基础风险大小决定。

行为金融理论则认为,由于非理性投资者行为的不可预测性和套利的非完美性,理性套利者并不能及时纠正非理性投资者导致的股票价格与价值之间的偏离[1]。

因此,股票的价格和收益由其基础风险和非理性投资者的错误估价共同决定[2]。

作为对这种争论的直接回应,一些研究者对投资者的情绪与股票收益间的关系进行实证检验。

相关研究主要围绕投资者情绪能否对股票收益做出预测、投资者情绪的变化是否构成系统性的噪音交易风险等问题展开。

中国股市作为新兴资本市场,各种制度尚不健全,过度投机是其突出的特点,这决定了中国股市比成熟的股票市场具有更强的心理特征,也为检验行为金融理论提供了很好的实证基础。

基于此,本文在借鉴国内外相关研究基础上,对我国股市机构投资者情绪及变动、个人投资者情绪及变动与股票收益的关系进行实证分析。

投资者情绪与股票截面收益翻译 投资者情绪与截面股票收益率 摘要:我们研究投资者情绪如何影响股票的截面收益。我们预测投资者情绪对证券有较大的影响(其价值高度主观且很难套利)。与此预测一致,我们发现如果投资者的情绪代理指标一开始较低,则事后回报率相对较高(尤其对那些小公司股票,新发行股票,高波动性的股票,亏损企业股票,不分红企业的股票,高速成长的股票,困境企业的股票而言)。另一方面,当投资者情绪很高时,这些类别的股票获取相对较低的事后回报。

经典的金融理论并没有对投资者情绪做出解释。相反,这一理论认为,理性的投资者之间进行竞争,并且他们多样化投资以最优化其投资组合,将产生价格等于预期现金流的贴现值这样一个均衡,并且预期截面回报率仅依赖于截面的系统性风险(β值)。即使有些投资者是非理性的, 经典理论认为他们的投资需求被套利者抵消,因此对价格不产生重大影响。

在本文中,我们有证据表明,投资者的情绪可能对股票截面价格有显著的影响。我们先从简单的理论预期开始。因为错误定价是这样的一个结果:即面对套利约束的情况下,大量未知需求冲击所致。当股票交易是以情绪为基础的需求或套利的结果时,我们预测大量的投资者情绪会产生截面效应(即并非简单的所有股票价格同时上升或下降)。 在实践中,有两个截然不同的渠道会产生类似的预测结果。由于股票对投机性需求最为敏感,那些有较高主观价值的股票同时也可能是风险和套利成本最高的股票。具体地说,理论表明两个不同的渠道更容易受投资者情绪变化的影响,这些影响通过具有某些特征(新发行的,小公司的,高波动的,亏损的,不分红的,困境中的,或者高速增长当中的股票)的企业股票来表现。

为了检验经验预测的真实性,并得到投资者情绪更真实意义上的概念,我们从1961年开始到 互联网泡沫时代,总结美国市场这段时间内市场情绪的波动作为开始。这个总结以生动的描述为基础,因此仅仅别看作一个建议性的、投资者情绪波动的事后特征。然而,该总结的基本信息似乎和我们的理论预测是一致的,并认为一个更准确地实证是必要的。

我们的主要经验做法如下。因为情绪驱动的错误定价的截面模式将很难直接被发现,我们考察股票收益的截面预测模式是否依赖于一开始的情绪代理指标。例如,相对于老公司而言,新公司的未来低回报率和事前新公司的股票被高估一致。像往常一样,我们注意到共同的假说问题,我们发现任何可预见性模式实际上反映系统性风险补偿。

第一步是选取投资者情绪代理指标,我们可以用时间序列的条件变量。因为没有完美的或无可争议的投资者情绪代理指标,我们的做法是一定要符合实际。具体来说,我们考虑最近文献中使用的大量情绪代理指标,形成一个复合情绪指数(以主成分分析为基础)。为了减少这些情绪代 理指标和系统性风险相关的可能性,我们也形成一个以情绪代理指标为基础的指数,并且该指数与几个宏观经济条件垂直正交化。该情绪指数明显和历史上的股市泡沫及股灾一致。

然后,我们测试随后的股票截面收益如何不同于开始时期的情绪变化。使用1963年和2001年之间的月度股票收益,我们以几个主要的公司特征为基础形成一个投资组合,该组合中每个成分权重一样。(我们的理论预测以及实证结果证实,大企业受情绪的影响较小,因此价值的比重往往会使相关性模式变得不清晰。)我们发现,当情绪低(低于样本平均),小型股随后的收益特别高,但是当情绪高(高于平均水平),完全没有规模效应。当投资者情绪低时,以后的回报是新公司(新上市)股票高于老公司的股票,高波动性股票比低波动性股票,亏损公司的股票比盈利公司的股票,不分红公司股票比分红公司股票收益高。当情绪很高,这些模式完全相反。虽然以前的数据不像现在这样丰富,在覆盖1935到1961年的样本中这些模式中的一些也是明显的。 排序(sorts)也表明投资者情绪以类似的方式影响快速增长和困境中的企业。注意到股票以这样的指标分类排序(销售增长率,账面市值比,或者外部融资活动)时,快速增长的企业和困境中的企业在排序的两端,而那些更稳定些的企业位于排序的中部位置。我们发现,当投资者情绪低时,在排序两端的企业的股票事后收益明显高于它们没有条件限制时的平均值,而在排序中间的股票则较少受到投资者情绪的影响(对于账面市值比结果在统计上是不显著的)。这个U型排序模式在很大程度上与理论预期是一致的:快速增长和困境中的企业通常有相对主观的价值并且相对难以进行套利活动,所以它们可能更容易受投资者情绪影响。

然后,我们考虑回归的方法,使用Fama-French因素模型分析以企业规模和账面市值比分类的股票的联动效应。我们使用情绪指数来预测从高到低排序(以对情绪敏感性形式)的投资组合的收益。毫不奇怪的是,鉴于我们的投资组合权重相等以及我们所考查的几个特征与规模相关,包含SMB作为一个控制性趋势降低了 预测的准确性,尽管仍有一些预测能力。 然后,我们再转向另一种经典的解释,他们只是反映了补偿系统性风险的一种复杂模式。无论是以理性的市场风险溢价这种时间变量还是以风险的截面模式(beta loadings)这种时间变量,这都说明了可预测的证据。进一步的检验对这些假设提出了疑问。我们直接测试第二种可能性,发现在可预测性模式与以市场回报或者消费增长的贝塔模式之间并无关系。如果风险不随时间变化,那么第一个可能性不仅要求以风险溢价的时间变量,也要求标志的变化。简而言之,它要求在一半的样本期间内(当情绪相对低时),对老公司,较少波动的公司,盈利的公司,以及分红的公司有一个风险溢价(相对于新的、高波动性的、亏损的以及不分红的公司)。这是有悖常理的。结论的其他方面也表明系统性风险并不是一个完全的解释。

在最近研究的基础上,得出的结论挑战股票价格的截面收益这样一个经典的观点。首先,该结 论补充了早期文献研究,即证明了投资者情绪有助于解释股票的时间序列收益(Kothari and Shanken (1997), Neal and Wheatley (1998), Shiller (1981, 2000), Baker and Wurgler (2000)). Campbell and Cochrane (2000), Wachter (2000), Lettau and Ludvigson (2001), and Menzly, Santos, and Veronesi (2004),研究了有条件的系统性风险的影响;这里我们以投资者情绪为条件。Daniel and Titman (1997)检验了截面预期收益为特征基础的模型。我们把他们的说明延伸到条件特征为基础的模型。Shleifer (2000)研究早期关于投资者情绪和有限套利的文献,在这是两个关键因素。Barberis and Shleifer (2003), Barberis, Shleifer, and Wurgler (2005), and Peng and Xiong (2004)讨论交易范围,Fama and French (1993)讨论类似规模股票和账面市场比之间的联动效应;对有类似特征股票的未认识到的需求冲击归于我们的研究。最后我们扩展并统一了投资者情绪、IPOs以及小企业股票收益之间的关系(Lee, Shleifer, and Thaler (1991), Swaminathan (1996), Neal and Wheatley (1998))。 第一节讨论了理论预期。第二节提供了最近一个投机性事件的定性历史。第三节介绍了我们的经验假设和数据。第四节提出了主要的实证检验。第五节得出结论。

I. Theoretical Effects of Sentiment on the Cross-Section 一个错误定价是一个未认识到的需求冲击和一个有限套利的结果。因此可以通过两种不同的渠道使投资者情绪来影响股票的截面收益,下面作详细定义。第一个渠道,情绪性的需求冲击改变截面收益,而套利限制不变。第二个渠道,套利的难度随股票不同而变化但是投资者情绪是一般通用的。下面我们依次讨论这些。 A. Cross-Sectional Variation in Sentiment 投资者情绪的一个可能定义是投机的倾向。根据这一定义,情绪驱动投机性投资的相对需求,并因此导致股票收益的截面效应,即使套利的力量在股票之间是一样的。 是什么使得一些股票在投机的倾向中更易大幅波动?我们认为最主要的因素是其估值的主 观性。例如,考虑一个新上市公司,亏损企业以及快速成长型企业股票。缺乏盈利的历史以及看似不受限制的增长机会使天真的投资者(没有经验)进行一个更广泛的估值(从很低到很高),这也与他们的情绪相符。在泡沫期间,当投机倾向较高时,这也使得投资银行家进一步高估股票价值。相比之下,具有长期盈利历史、实物资产以及稳定分红企业的价值,其主观性较低,因此它的股票较少受投机性波动的影响。

虽然上述渠道表明投机性倾向的变量如何影响截面收益,它并不说明有情绪的投资者如何实际选择股票。我们建议,投资者应该选择那些有突出特征的股票,并且这些特征和投资者情绪相符合。也就是说,有较低投机倾向的投资者也可能需要有盈利且分红公司的股票,这并非因为盈利和分红就和企业一些看不到的对投资者而言安全的性质相关,确切的说是因为盈利和分红这些重要特征足以定义对投资者的安全性。同样,非盈利、新企业、以及不分红这些企业特征意味着投机性的股票。偶然的观察表明,这样一个投资过程更确切的说是典型投资者挑选股票的过