东北财经大学会计系列教材 管理会计.

- 格式:ppt

- 大小:206.00 KB

- 文档页数:36

Chapter 2Cost Terms, Concepts, and Classifications Solutions to Questions2-1The three major elements of product costs in a manufacturing company are direct materials, direct labor, and manufacturing over-head.2-2a.Direct materials are an integral part of a finished product and their costs can be conven-iently traced to it.b.Indirect materials are generally small items of material such as glue and nails. They may be an integral part of a finished product but their costs can be traced to the product only at great cost or inconvenience. Indirect materials are ordinarily classified as manufacturing over-head.c.Direct labor includes those labor costs that can be easily traced to particular products. Direct labor is also called “touch labor.”d.Indirect labor includes the labor costs of janitors, supervisors, materials handlers, and other factory workers that cannot be conven-iently traced to particular products. These labor costs are incurred to support production, but the workers involved do not directly work on the product.e.Manufacturing overhead includes all manufacturing costs except direct materials and direct labor.2-3 A product cost is any cost involved in purchasing or manufacturing goods. In the case of manufactured goods, these costs consist of direct materials, direct labor, and manufacturing overhead. A period cost is a cost that is taken directly to the income statement as an expense in the period in which it is incurred.2-4The income statement of a manufactur-ing company differs from the income statement of a merchandising company in the cost of goods sold section. The merchandising company sells finished goods that it has purchased from a supplier. These goods are listed as “Purchases” in the cost of goods sold section. Since the manufacturing company produces its goods rather than buying them from a supplier, it lists “Cost of Goods Manufactured” in place of “Pur-chases.” Also, the manufacturing company iden-tifies its inventory in this section as “Finished Goods Inventory,” rather than as “Merchandise Inventory.”2-5The schedule of cost of goods manufac-tured lists the manufacturing costs that have been incurred during the period. These costs are organized under the three major categories of direct materials, direct labor, and manufacturing overhead. The total costs incurred are adjusted for any change in the Work in Process inventory to determine the cost of goods manufactured (i.e. finished) during the period.The schedule of cost of goods manufac-tured ties into the income statement through the Cost of Goods Sold section. The cost of goods manufactured is added to the beginning Finished Goods inventory to determine the goods available for sale. In effect, the cost of goods manufactured takes the place of the “Purchases” account in a merchandising firm.2-6 A manufacturing company has three inventory accounts: Raw Materials, Work in Process, and Finished Goods. A merchandising company generally identifies its inventory ac-count simply as Merchandise Inventory.2-7Since product costs accompany units of product into inventory, they are sometimes called inventoriable costs. The flow is from di-rect materials, direct labor, and manufacturing overhead to Work in Process. As goods are com-pleted, their cost is removed from Work in Proc-ess and transferred to Finished Goods. As goods are sold, their cost is removed from Finished Goods and transferred to Cost of Goods Sold. Cost of Goods Sold is an expense on the income statement.2-8Yes, costs such as salaries and depre-ciation can end up as assets on the balance sheet if these are manufacturing costs. Manu-facturing costs are inventoried until the associ-ated finished goods are sold. Thus, if some units are still in inventory, such costs may be part of either Work in Process inventory or Finished Goods inventory at the end of a period.2-9Cost behavior refers to how a cost will react or respond to changes in the level of activ-ity.2-10No. A variable cost is a cost that varies, in total, in direct proportion to changes in the level of activity. A variable cost is constant per unit of product. A fixed cost is fixed in total, but will vary inversely on an average per-unit basis with changes in the level of activity.2-11When fixed costs are involved, the av-erage cost of a unit of product will depend on the number of units being manufactured. As production increases, the average cost per unit will fall as the fixed cost is spread over more units. Conversely, as production declines, the average cost per unit will rise as the fixed cost is spread over fewer units.2-12Manufacturing overhead is an indirect cost since these costs cannot be easily and con-veniently traced to particular units of products. 2-13 A differential cost is a cost that differs between alternatives in a decision. An opportu-nity cost is the potential benefit that is given up when one alternative is selected over another. A sunk cost is a cost that has already been in-curred and cannot be altered by any decision taken now or in the future.2-14No; differential costs can be either vari-able or fixed. For example, the alternatives might consist of purchasing one machine rather than another to make a product. The difference in the fixed costs of purchasing the two ma-chines would be a differential cost. 2-15Direct labor cost(34 hours × $15 per hour) .............$510 Manufacturing overhead cost(6 hours × $15 per hour) (90)Total wages earned...........................$6002-16Direct labor cost(45 hours × $14 per hour) .............$630 Manufacturing overhead cost(5 hours × $7 per hour) (35)Total wages earned...........................$6652-17Costs associated with the quality of con-formance can be broken down into prevention costs, appraisal costs, internal failure costs, and external failure costs. Prevention costs are in-curred in an effort to keep defects from occur-ring. Appraisal costs are incurred to detect de-fects before they can create further problems. Internal and external failure costs are incurred as a result of producing defective units.2-18Total quality costs are usually minimized by increasing prevention and appraisal costs in order to reduce internal and external failure costs. Total quality costs usually decrease as prevention and appraisal costs increase.2-19Shifting the focus to prevention and away from appraisal is usually the most effective way to reduce total quality costs. It is usually more effective to prevent defects than to at-tempt to fix them after they have occurred.2-20First, a quality cost report helps manag-ers see the financial consequences of defects. Second, the report may help managers identify the most important areas for improvement. Third, the report helps managers see whether quality costs are appropriately distributed among prevention, appraisal, internal failure, and external failure costs.2-21Most accounting systems do not track and accumulate the costs of quality. It is par-ticularly difficult to get a feel for the magnitude of quality costs since they are incurred in many departments throughout the organization.1. The cost of a hard-drive installed in a computer: direct materials cost.2. The cost of advertising in the Puget Sound Computer User newspaper:marketing and selling cost.3. The wages of employees who assemble computers from components:direct labor cost.4. Sales commissions paid to the company’s salespeople: marketing andselling cost.5. The wages of the assembly shop’s supervisor: manufacturing overheadcost.6. The wages of the company’s accountant: administrative cost.7. Depreciation on equipment used to test assembled computers before re-lease to customers: manufacturing overhead cost.8. Rent on the facility in the industrial park: a combination of manufactur-ing overhead, administrative, and marketing and selling cost. The rent would most likely be prorated on the basis of the amount of space oc-cupied by manufacturing, administrative, and marketing operations.Product Cost PeriodCost1. Depreciation on salespersons’ cars .......................... X2. Rent on equipment used in the factory....................X3. Lubricants used for maintenance of machines ..........X4. Salaries of finished goods warehouse personnel .......X5. Soap and paper towels used by factory workers atthe end of a shift.................................................X 6. Factory supervisors’ salaries....................................X 7. Heat, water, and power consumed in the factory......X 8. Materials used for boxing products for shipmentoverseas (units are not normally boxed)................ X 9. Advertising costs....................................................X10. Workers’ compensation insurance on factory em-ployees...............................................................X 11. Depreciation on chairs and tables in the factorylunchroom ..........................................................X 12. The wages of the receptionist in the administrativeoffices ................................................................ X 13. Lease cost of the corporate jet used by the com-pany's executives ................................................ X 14. Rent on rooms at a Florida resort for holding theannual sales conference....................................... X 15. Attractively designed box for packaging the com-pany’s product—breakfast cereal ..........................XCyberGamesIncome StatementSales....................................................... $1,450,000Cost of goods sold:Beginning merchandise inventory............$ 240,000Add: Purchases...................................... 950,000Goods available for sale.......................... 1,190,000 Deduct: Ending merchandise inventory.... 170,000 1,020,000Gross margin...........................................430,000Less operating expenses:Selling expense...................................... 210,000Administrative expense........................... 180,000 390,000Net operating income...............................$ 40,000Lompac ProductsSchedule of Cost of Goods ManufacturedDirect materials:Beginning raw materials inventory.............$ 60,000Add: Purchases of raw materials............... 690,000Raw materials available for use.................Deduct: Ending raw materials inventory..... 45,000Raw materials used in production..............$ 705,000 Direct labor................................................135,000 Manufacturing overhead............................. 370,000 Total manufacturing costs...........................Add: Beginning work in process inventory.... 120,000Deduct: Ending work in process inventory.... 130,000 Cost of goods manufactured........................ $1,200,000A few of these costs may generate debate. For example, some may arguethat the cost of advertising a Madonna rock concert is a variable cost sincethe number of people who come to the rock concert depends on theamount of advertising. However, one can argue that if the price is within reason, any Madonna rock concert in New York City will be sold out andthe function of advertising is simply to let people know the event will be happening. Moreover, while advertising may affect the number of personswho ultimately buy tickets, the causation is in one direction. If more peoplebuy tickets, the advertising costs don’t go up.Cost Behavior1. X-ray film used in the radiology lab at VirginiaMason Hospital in Seattle (X)2. The costs of advertising a Madonna rock con-cert in New York City (X)3. Rental cost of a McDonald’s restaurant build-ing in Hong Kong (X)4. The electrical costs of running a roller coasterat Magic Mountain (X)5. Property taxes on your local cinema (X)6. Commissions paid to salespersons at Nord-strom (X)7. Property insurance on a Coca-Cola bottlingplant (X)8. The costs of synthetic materials used to makeNike running shoes (X)9. The costs of shipping Panasonic televisions toretail stores (X)10. The cost of leasing an ultra-scan diagnosticmachine at the American Hospital in Paris (X)Cost Costing object Direct Cost IndirectCost1. The wages of pediatricnursesThe pediatric depart-ment X2. Prescription drugs A particular patient X3. Heating the hospital The pediatric depart-ment X4. The salary of the headof pediatricsThe pediatric depart-ment X 5. The salary of the headof pediatricsA particular pediatricpatient X 6. Hospital chaplain’s sal-aryA particular patientX7. Lab tests by outsidecontractorA particular patientX8. Lab tests by outsidecontractorA particular departmentXItem Differential Cost Opportunity Cost SunkCost1. Cost of the old X-ray machine........X 2. The salary of the head of theRadiology Department................ 3. The salary of the head of thePediatrics Department................4. Cost of the new color laserprinter.......................................X 5. Rent on the space occupied byRadiology.................................. 6. The cost of maintaining the oldmachine....................................X 7. Benefits from a new DNA ana-lyzer ......................................... X 8. Cost of electricity to run the X-ray machines.............................XNote: The costs of the salaries of the head of the Radiology Department and Pediatrics Department and the rent on the space occupied by Radiol-ogy are neither differential costs, nor opportunity costs, nor sunk costs. These are costs that do not differ between the alternatives and are there-fore irrelevant in the decision, but they are not sunk costs since they occur in the future.1. No. It appears that the overtime spent completing the job was simply amatter of how the job happened to be scheduled. Under these circum-stances, an overtime premium probably should not be charged to a cus-tomer whose job happens to fall at the end of the day’s schedule.2. Direct labor cost: 9 hours × $14 per hour............$126General overhead cost: 1 hour × $7 per hour (7)Total labor cost..................................................$1333. A charge for an overtime premium might be justified if the customer re-quested a “rush” order that caused the overtime.1.PreventionCost AppraisalCostInternalFailureCostExternalFailureCosta. Product testing (X)b. Product recalls (X)c. Rework labor and overhead..Xd. Quality circles (X)e. Downtime caused by de-fects (X)f. Cost of field servicing (X)g. Inspection of goods (X)h. Quality engineering (X)i. Warranty repairs (X)j. Statistical process control (X)k. Net cost of scrap (X)l. Depreciation of test equip-ment (X)m. Returns and allowancesarising from poor quality (X)n. Disposal of defective prod-ucts (X)o. Technical support to suppli-ers (X)p. Systems development (X)q. Warranty replacements (X)r. Field testing at customersite (X)s. Product design (X)2. Prevention costs and appraisal costs are incurred in an effort to keeppoor quality of conformance from occurring. Internal and external failurecosts are incurred because poor quality of conformance has occurred.© The McGraw-Hill Companies, Inc., 2006. All rights reserved.1.Mason CompanySchedule of Cost of Goods Manufactured Direct materials:Raw materials inventory, beginning..................$ 7,000Add: Purchases of raw materials...................... 118,000Raw materials available for use........................125,000Deduct: Raw materials inventory, ending.......... 15,000Raw materials used in production.....................$110,000 Direct labor....................................................... 70,000 Manufacturing overhead:Indirect labor.................................................30,000Maintenance, factory equipment......................6,000Insurance, factory equipment (800)Rent, factory facilities......................................20,000Supplies.........................................................4,200Depreciation, factory equipment...................... 19,000Total overhead costs......................................... 80,000 Total manufacturing costs..................................260,000 Add: Work in process, beginning........................ 10,000270,000 Deduct: Work in process, ending........................ 5,000 Cost of goods manufactured.............................. $265,000 2. The cost of goods sold section of Mason Company’s income statement:Finished goods inventory, beginning............$ 20,000Add: Cost of goods manufactured................ 265,000Goods available for sale..............................285,000Deduct: Finished goods inventory, ending.... 35,000Cost of goods sold......................................$250,000© The McGraw-Hill Companies, Inc., 2006. All rights reserved.Selling andCost Behavior Administrative ProductCost Item Variable Fixed Cost Cost1. Hamburger buns at aWendy’s outlet...........X X2. Advertising by a dentaloffice........................ X X3. Apples processed andcanned by Del Monte.X X4. Shipping canned ap-ples from a DelMonte plant to cus-tomers......................X X5. Insurance on a Bausch& Lomb factory pro-ducing contactlenses....................... X X 6. Insurance on IBM’scorporate headquar-ters........................... X X7. Salary of a supervisoroverseeing produc-tion of printers atHewlett-Packard........ X X 8. Commissions paid toEncyclopedia Britan-nica salespersons.......X X9. Depreciation of factorylunchroom facilitiesat a General Electricplant......................... X X 10. Steering wheels in-stalled in BMWs.........X X© The McGraw-Hill Companies, Inc., 2006. All rights reserved.1. a. Batteries purchased......................................................... 8,000Batteries drawn from inventory.........................................7,600 Batteries remaining in inventory (400)Cost per battery.............................................................. × $10 Cost in Raw Materials Inventory at April 30........................$4,000b. Batteries used in production (7,600 – 100)........................7,500Motorcycles completed and transferred to Finished Goods(90% × 7,500 = 6,750).................................................6,750 Motorcycles still in Work in Process at April 30. (750)Cost per battery.............................................................. × $10 Cost in Work in Process Inventory at April 30.....................$7,500c. Motorcycles completed and transferred to Finished Goods(see above)..................................................................6,750 Motorcycles sold during the month (70% × 6,750 =4,725).......................................................................... 4,725 Motorcycles still in Finished Goods at April 30....................2,025 Cost per battery.............................................................. × $10 Cost in Finished Goods Inventory at April 30......................$20,250d. Motorcycles sold during the month (above).......................4,725Cost per battery.............................................................. × $10 Cost in Cost of Goods Sold at April 30............................... $47,250e. Batteries used in salespersons’ motorcycles (100)Cost per battery.............................................................. × $10 Cost in Selling Expense at April 30.................................... $ 1,000 2. Raw Materials Inventory—balance sheetWork in Process Inventory—balance sheetFinished Goods Inventory—balance sheetCost of Goods Sold—income statementSelling Expense—income statement© The McGraw-Hill Companies, Inc., 2006. All rights reserved.1. Direct labor cost: 31 hours × $14 per hour...................$434Manufacturing overhead cost: 9 hours × $14 per hour (126)Total cost................................................................... $5602. Direct labor cost: 48 hours × $14 per hour...................$672Manufacturing overhead cost: 8 hours × $7 per hour (56)Total cost................................................................... $7283. A company could treat the cost of fringe benefits relating to direct laborworkers as part of manufacturing overhead. This approach spreads the cost of such fringe benefits over all units of output. Alternatively, the company could treat the cost of fringe benefits relating to direct labor workers as additional direct labor cost. This latter approach charges the costs of fringe benefits to specific jobs rather than to all units of output.© The McGraw-Hill Companies, Inc., 2006. All rights reserved.1. T otal wages for the week:Regular time: 40 hours × $20 per hour....................$800 Overtime: 6 hours × $30 per hour (180)Total wages..............................................................$980 Allocation of total wages:Direct labor: 46 hours × $20 per hour......................$920 Manufacturing overhead: 6 hours × $10 per hour.. (60)Total wages..............................................................$9802. T otal wages for the week:Regular time: 40 hours × $20 per hour....................$ 800 Overtime: 8 hours × $30 per hour (240)Total wages..............................................................$1,040 Allocation of total wages:Direct labor: 45 hours × $20 per hour......................$ 900 Manufacturing overhead:Idle time: 3 hours × $20 per hour.........................$60Overtime premium: 8 hours × $10 per hour........... 80 140 Total wages..............................................................$1,0403. T otal wages and fringe benefits for the week:Regular time: 40 hours × $20 per hour....................$ 800 Overtime: 10 hours × $30 per hour. (300)Fringe benefits: 50 hours × $6 per hour (300)Total wages and fringe benefits............................$1,400 Allocation of wages and fringe benefits:Direct labor: 48 hours × $20 per hour......................$ 960overhead:ManufacturingIdle time: 2 hours × $20 per hour.........................$ 40Overtime premium: 10 hours × $10 per hour (100)Fringe benefits: 50 hours × $6 per hour................ 300 440 Total wages and fringe benefits.................................$1,400© The McGraw-Hill Companies, Inc., 2006. All rights reserved.© The McGraw-Hill Companies, Inc., 2006. All rights reserved.Solutions Manual, Chapter 2354. A llocation of wages and fringe benefits: Direct labor: Wage cost: 48 hours × $20 per hour..................... $960 Fringe benefits: 48 hours × $6 per hour................ 288 $1,248 Manufacturing overhead: Idle time: 2 hours × $20 per hour......................... 40 Overtime premium: 10 hours × $10 per hour......... 100 Fringe benefits: 2 hours × $6 per hour.................. 12 152 Total wages and fringe benefits............................... $1,400© The McGraw-Hill Companies, Inc., 2006. All rights reserved. 36Managerial Accounting, 11th Edition1. Florex Company Quality Cost ReportThis Year Last YearAmountPercent ofSales Amount Percent of Sales Prevention costs: Quality engineering...........$ 5700.76 $ 4200.56 Systems development.......750 1.00 4800.64 Statistical process control.. 180 0.24 0 0.00 Total prevention costs......... 1,500 2.00 900 1.20Appraisal costsInspection........................900 1.20 750 1.00 Product testing.................1,200 1.60 810 1.08 Supplies used in testing ....600.08 300.04 Depreciation of testingequipment.....................240 0.32 210 0.28 Total appraisal costs............ 2,400 3.201,8002.40Internal failure costs:Net cost of scrap..............1,125 1.50 6300.84 Rework labor....................1,500 2.00 1,050 1.40 Disposal of defectiveproducts........................ 975 1.30 720 0.96 Total internal failure costs....3,600 4.802,4003.20External failure costs:Cost of field servicing........900 1.20 1,200 1.60 Warranty repairs ..............1,050 1.40 3,600 4.80 Product recalls.................. 750 1.00 2,100 2.80Total external failure costs...2,700 3.60 6,9009.20Total quality cost ................$10,20013.60 $12,00016.002.© The McGraw-Hill Companies, Inc., 2006. All rights reserved. Solutions Manual, Chapter 2 37© The McGraw-Hill Companies, Inc., 2006. All rights reserved. 38Managerial Accounting, 11th Edition3. The overall impact of the company’s increased emphasis on quality over the past year has been positive in that total quality costs have de-creased from 16% of sales to 13.6% of sales. Despite this improvement, the company still has a poor distribution of quality costs. The bulk of the quality costs in both years is traceable to internal and external failure, rather than to prevention and appraisal. Although the distribution of these costs is poor, the trend this year is toward more prevention and appraisal as the company has given more emphasis on quality.Probably due to the increased spending on prevention and appraisal ac-tivities during the past year, internal failure costs have increased by one half, going from $2.4 million to $3.6 million. The reason internal failure costs have gone up is that, through increased appraisal activity, defects are being caught and corrected before products are shipped to custom-ers. Thus, the company is incurring more cost for scrap, rework, and so forth, but it is saving huge amounts in field servicing, warranty repairs, and product recalls. External failure costs have fallen sharply, decreasing from $6.9 million last year to just $2.7 million this year.If the company continues its emphasis on prevention and appraisal—and particularly on prevention—its total quality costs should continue to de-crease in future years. Although internal failure costs are increasing for the moment, these costs should decrease in time as better quality is de-signed into products. Appraisal costs should also decrease as the need for inspection, testing, and so forth decreases as a result of better engi-neering and tighter process control.© The McGraw-Hill Companies, Inc., 2006. All rights reserved. 40Managerial Accounting, 11th Edition1. The controller is correct in his viewpoint that the salary cost should be classified as a selling (marketing) cost. The duties described in the prob-lem have nothing to do with manufacturing a product, but rather deal with moving finished units from the factory to distribution warehouses. Selling costs include all costs necessary to secure customer orders and to get the finished product into the hands of customers. Coordination of shipments of finished units from the factory to distribution warehouses falls in this category.2. No, the president is not correct. The reported net operating income for the year will differ depending on how the salary cost is classified. If the salary cost is classified as a selling expense all of it will appear on the income statement as a period cost. However, if the salary cost is classi-fied as a manufacturing (product) cost, then it will be added to Work In Process Inventory along with other manufacturing costs for the period. To the extent that goods are still in process at the end of the period, part of the salary cost will remain with these goods in the Work in Proc-ess Inventory account. Only that portion of the salary cost that has been assigned to finished units will leave the Work In Process Inventory ac-count and be transferred into the Finished Goods Inventory account. In like manner, to the extent that goods are unsold at the end of the pe-riod, part of the salary cost will remain with these goods in the Finished Goods Inventory account. Only the portion of the salary that has been assigned to finished units that are sold during the period will appear on the income statement as an expense (part of Cost of Goods Sold) for the period. The remainder of the salary costs will be on the balance sheet as part of inventories.。

东北财经大学《管理会计》题库(第1章)及附满分答案第一章1、与传统财务会计相对立而存在的是(c)A、现代会计B、企业会计C、管理会计D、管理会计学2、管理会计的奋斗目标是(a)A、确保企业实现最佳的经济效益B、降低成本C、增加企业的收入D、加强管理3、以下对管理会计的描述正确的是(abcde)A、对象是企业的经营活动B、手段是加工利用财务信息C、职能是体现现代企业管理的要求D、目标是使企业实现最佳的经济效益E、本质是企业管理的重要组成部分4、下列会计子系统中,能够履行管理会计“考核评价经营业绩”职能的是(D)A、预测决策会计B、规划控制会计C、对外报告会计D、责任会计5、下列各项中,处于现代管理会计的核心地位的是(abcd)A、预测决策会计B、规划控制会C、责任会计D、业绩评价会计6、下列各项中,属于管理会计职能的有(abcde)A、预测经济前景B、参与经济决策C、规划经营目标D、控制经济过程E、考核评价经营业绩7、下列各项中,属于正确描述预测决策会计特征的说法包括(abc)A、它最具有能动性B、它处于现代管理会计的核心地位C、它是现代管理会计形成的关键标志之一D、它主要履行规划经营目标的职能E、它能够考核评价经营业绩8、现代管理会计的内容包括(abc)A、预测决策会计B、规划控制会计C、责任会计D、考核评价会计E、对外报告会计9、现代管理会计形成的关键标志是(A)A、预测决策会计B、规划控制会计C、责任会计D、考核评价会计10、能够作为管理会计原始雏形的标志之一,是于20世纪初在美国出现的(D)A、责任会计B、预测决策会计C、科学管理理论D、标准成本计算制度11、管理会计的雏形产生于(B)A、19世纪末B、20世纪上半叶C、第二次世界大战之后D、20世纪70年代12、在管理会计发展史上,第一次被人们使用的管理会计术语是(A)A、“管理的会计”B、“管理会计”C、“传统管理会计”D、“现代管理会计”13、管理会计原始雏形形成的主要标志为(AD)A、标准成本计算制度B、科学管理理论C、责任会计D、预算控制E、成本性态分析14、管理会计是由许多因素共同作用的必然结果,其中内在因素包括(ABC)A、社会生产力的进步B、现代化大生产C、高度繁荣的市场经济D、资本主义社会制度E、现代管理科学的发展15、管理会计形成和发展的原因包括(abcd)A、社会生产力的进步B、市场经济的繁荣C、现代电脑技术的进步D、现代管理科学理论的发展E、人们思想观念的更新16、划分传统管理会计和现代管理会计两个阶段的时间标志是(C)A、19世纪90年代B、20世纪20年代C、20世纪50年代D、20世纪70年代17、下列项目中,属于在现代管理会计阶段产生和发展起来的有(bcde)A、规划控制会计B、预测决策会计C、责任会计D、管理会计师职业E、管理会计专业团体18、管理会计是一门新兴的会计学科和知识体系 BA、对B、错19、管理会计是一个用于概括管理会计工作与管理会计理论的概念。

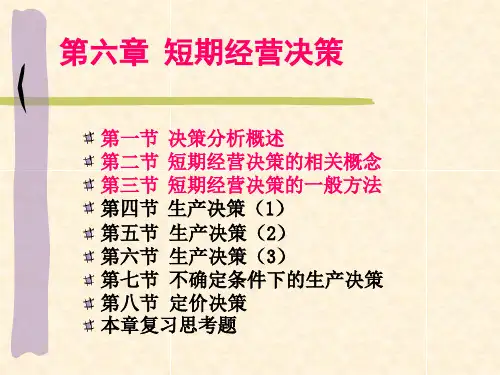

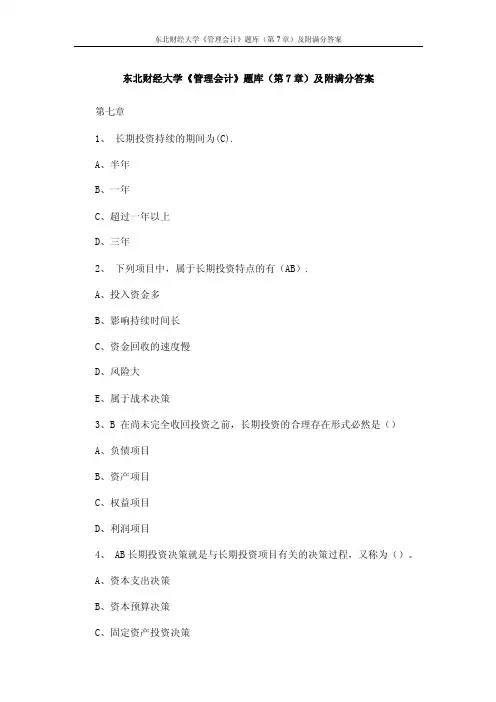

东北财经大学《管理会计》题库(第7章)及附满分答案第七章1、长期投资持续的期间为(C).A、半年B、一年C、超过一年以上D、三年2、下列项目中,属于长期投资特点的有(AB).A、投入资金多B、影响持续时间长C、资金回收的速度慢D、风险大E、属于战术决策3、B 在尚未完全收回投资之前,长期投资的合理存在形式必然是()A、负债项目B、资产项目C、权益项目D、利润项目4、 AB长期投资决策就是与长期投资项目有关的决策过程,又称为()。

A、资本支出决策B、资本预算决策C、固定资产投资决策D、长期发展计划决策E、企业战略决策5、A 按照长期投资的对象可将长期投资分为项目投资、证券投资和其他投资三类;其中,证券投资和其他投资属于财务会计长期投资核算的范畴,项目投资属于管理会计研究的范畴A、对B、错6、A 在管理会计中,将以特定项目为对象,直接与新建项目或更新改造项目有关的长期投资行为称为()。

A、项目投资B、证券投资C、固定资产投资D、融资性投资7、AB 项目投资是直接与固定资产的()项目有关的长期投资行为。

A、购建B、更新改造C、变卖D、折旧E、清理8、B 将长期投资分为诱导式投资和主动式投资的分类标志是()。

A、投资对象B、投资动机C、投资影响范围D、投资目标的层次9、ABC 长期投资决策必须考虑地因素包括()A、投资项目B、现金流量C、货币时间价值D、资产负债水平E、资本结构10、A 管理会计研究的长期投资决策通常会对企业本身未来的生产经营能力和创利能力产生直接的影响A、对B、错11、B 长期投资决策不必搞好投资地可行性研究和项目评估A、对B、错12、A 长期投资本身具备地特点决定长期投资决策直接影响企业未来长期效益和发展A、对B、错13、A 有些长期决策还会影响国民经济建设,甚至影响到全社会地发展A、对B、错14、A 管理会计长期投资决策的研究对象是项目投资决策。

()A、对B、错15、A 管理会计长期投资决策研究的具体对象称为投资项目。

东财管理会计教材管理会计是一门研究如何有效管理企业资源和制定决策的学科。

东北财经大学(以下简称东财)是中国著名的经济学院之一,其管理会计教材堪称经典。

本文将对东财管理会计教材进行介绍和评价。

一、教材概述东财管理会计教材是由专家学者精心编写的教材,涵盖了管理会计的基本概念、原理、方法和实践等方面的内容。

教材体系完整,知识结构合理,适合管理会计专业的学生学习和教师教学使用。

二、教材特点1. 理论与实践结合东财管理会计教材不仅侧重于理论的介绍,还注重理论与实践的结合。

教材会通过案例分析、模拟实验等形式,帮助学生将理论应用于实际问题的解决中,培养学生的实际操作能力。

2. 更新及时管理会计是一个不断变化的领域,教材需要随时更新以跟上最新的发展。

东财管理会计教材在理论和实践的结合上始终与时俱进,及时反映最新的管理会计理念和实践经验,保持教材的权威性和时效性。

3. 清晰易懂教材语言通俗易懂,将抽象的理论概念转化为生动的实例和案例,使学生能够迅速理解和掌握相关知识。

同时,教材还提供了大量的习题和案例,帮助学生巩固所学内容,提高学习效果。

4. 综合性强东财管理会计教材综合了国内外管理会计的研究成果和实践经验。

教材内容广泛,涉及了成本管理、预算管理、绩效评价、投资决策等多个方面,能够为学生提供全面的管理会计知识体系。

三、教材的应用和影响东财管理会计教材既适用于学校教学,也适用于行业培训和企业自学。

该教材已在全国范围内广泛应用,享有较高的声誉和影响力。

许多企业管理者和会计师都将该教材作为重要的参考书,帮助他们在实践中解决问题。

四、对教材的评价东财管理会计教材深入浅出,条理清晰,能够很好地引导学生理解和掌握管理会计的核心概念和方法。

教材内容丰富,案例翔实,能够有效激发学生的学习兴趣和实践能力。

同时,教材还注重培养学生的批判性思维和问题解决能力,提升学生的综合素质。

五、教材的改进建议尽管东财管理会计教材已具备较高的水平,但仍存在一些可以进一步改进的地方。

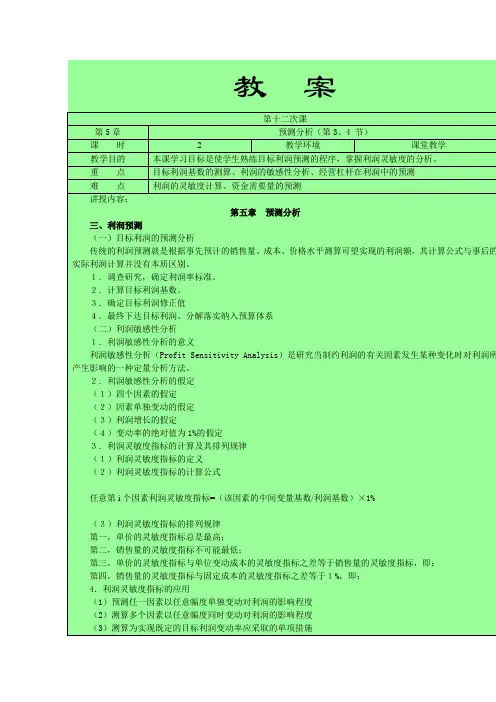

(4)预测为实现确保企业不亏损的因素变动率极限(三)经营杠杆系数在利润预测中的应用1.经营杠杆的涵义2.经营杠杆系数及其计算(1)经营杠杆系数的定义经营杠杆系数(Degree of Operating Leverage,DOL)又称经营杠杆率,是指在一定业务量基础上,利润的变动率相当于产销业务量变动率的倍数。

计算经营杠杆系数,可分别采用理论公式和简化公式。

(2)经营杠杆系数的理论公式计算经营杠杆系数的理论公式为:经营杠杆系数(DOL)=利润变动率/产销业务量变动率(3)经营杠杆系数的简化公式按理论公式5.3.18式计算经营杠杆系数,必须以掌握利润变动率和产销量变动率为前提。

这就不便于利用经营杠杆系数进行预测。

为了事先能够确定经营杠杆系数,在实践中可按以下应用公式进行计算:经营杠杆系数(DOL)=基期贡献边际/基期利润3.经营杠杆系数的变动规律(1)只要固定成本不等于零,经营杠杆系数恒大于1。

(2)在前后期单价、单位变动成本和固定成本不变的情况下,产销量越大,经营杠杆系数越小;产销量越小,经营杠杆系数越大。

所以产销量的变动与经营杠杆系数的变动方向相反。

(3)成本指标的变动与经营杠杆系数的变动方向相同。

(4)单价的变动与经营杠杆系数的变动方向相反。

(5)在同一产销量水平上,经营杠杆系数越大,利润变动幅度就越大,从而风险也就越大。

4.经营杠杆系数在利润预测中的应用(1)预测产销业务量变动对利润的影响在已知经营杠杆系数DOL、基数利润P和产销变动率K3的情况下,可按下列公式预测未来利润变动率K0和利润预测额P1:未来利润变动率(K0)=产销量变动率×经营杠杆系数=K3·DOL预测利润额(P1)=基期利润×(1+产销量变动率×经营杠杆系数)= P (1+ K3·DOL)(2)预测为实现目标利润应采取的调整产销量措施在已知经营杠杆系数DOL、基数利润P和目标利润P1或目标利润变动率K0的情况下,可按下列公式预测销量变动率K3:销量变动率(K3)=(目标利润-基期利润)/(基数利润×经营杠杆系数)或 = 目标利润变动率/经营杠杆系数(四)概率分析法及其在利润预测中的应用1.概率分析法概述2.期望值分析法及其在利润预测中的应用3.联合概率法及其在利润预测中的应用四、成本与资金需要量的预测(一)成本预测1.成本预测的意义2.成本预测的程序(1)提出目标成本草案第一,按目标利润进行预测。

东北财经大学22春“会计学”《管理会计》作业考核题库高频考点版(参考答案)一.综合考核(共50题)1.滚动预算的基本特点是()。

A.预算期是相对固定的B.预算期是连续不断的C.预算期与会计年度一致D.预算期不可随意变动参考答案:B2.按长期投资项目的类型分类,可将工业企业投资项目分为()。

A.单纯固定资产投资项目B.完整工业投资项目C.合伙联营投资项目D.更新改造投资项目参考答案:ABD3.变动成本法的缺点包括()A.不符合传统的成本观念的要求B.不能适应长期决策的需要C.对所得税产生较大的影响D.不利于成本分析参考答案:ABC4.如果要编制现金预算,所依据的预算有()。

A.生产预算B.直接材料预算C.直接人工预算D.制造费用预算参考答案:BCDE5.保本点是指在单价和成本水平确定的情况下,企业刚好保本,没有盈利时的销售量。

()A.正确B.错误参考答案:B6.实务中的管理会计机构设置具有灵活性,没有固定的模式可循。

()A.正确B.错误参考答案:A7.一个企业如果存在亏损产品,亏损产品是否停产取决于()。

A.亏损产品是否为主要产品B.企业是否有剩余生产能力C.亏损产品能否提供大于零的贡献毛益D.亏损产品能否提供大于零的销售毛利参考答案:C8.按照变动成本法的解释,期间成本中只包括固定性制造费用。

()A.正确B.错误参考答案:B9.产品定价决策分析中,需要考虑的因素有()。

A.成本D.供需情况E.市场竞争情况参考答案:ABCDE10.内部经济仲裁委员会工作内容包括()A.调解经济纠纷B.对无法调解的纠纷进行裁决C.办理内部交易结算D.办理内部责任结转参考答案:AB11.完全成本法下计算保本点时,分子应表示为()。

A.当期的固定成本B.期初固定成本+本期固定成本-期末固定成本C.期初固定成本+本期固定成本D.期初固定成本-期末固定成本参考答案:B12.管理会计属于企业管理的一个组成部分,需要提供内部报告。

管理会计第四章_本量利分析习题和答案解析_东北财经⼤学第⼆版4.利润⼀业务量式本量利关系图⼆、分析思考1?本量利分析的基本假定是什么? 2?贡献边际及其相关指标的计算公式? 3?单⼀品种保本点的确定⽅法有哪些?1 .经营安全程度的评价指标的内容及其计算?2 .单⼀品种下有关因素变动对保本点和保利点,对安全边际以及对营业利润的影响是什么?1?本量利关系图的含义及其类型有哪些? 2?因素变动对保本点等指标有哪些影响? 三、单项选择题1 .称为本量利分析的基础,也是本量利分析出发点的是(B ?相关范围及线性假设C ?产销平衡假设必须假定产品成本的计算基础是(1.已知某企业本年⽬标利润为 2 000万元,产品单价为 600元,变动成本率为 30%固定成本总额为600⼀、关键概念 1 .本量利分析 2. 贡献边际第四章本量利分析3 .保本点 1 .安全边际1 .本量利关系图3 .保本点.保本作业率2?传统式本量利关系图4 .保利点3 ?贡献式本量利关系图A.成本性态分析假设2 .在本量利分析中,D ?品种结构不变假设 A .完全成本法B .变动成本法C .吸收成本法D.制造成本法3 .进⾏本量利分析, A .税⾦成本必须把企业全部成本区分为固定成本和B.材料成本()C.⼈⼯成本D .变动成本4?按照本量利分析的假设,收⼊函数和成本函数的⾃变量均为同⼀个A .销售单价B.单位变动成本.固定成本)。

D.产销量5 ?计算贡献边际率,可以⽤单位贡献边际去除以A .单位售价B.总成本()。

C.销售收⼊D.变动成本1 ?下列指标中,可据以判定企业经营安全程度的指标是A .保本量()。

贡献边际 C ?保本作业率保本额2 ?当单价单独变动时,安全边际()。

A.不会随之变动 B ?不⼀定随之变动C ?将随之发⽣同⽅向变动D ?将随之发⽣反⽅向变动 3.已知企业只⽣产⼀种产品,元,为使安全边际率达到 60% A . 2000 件B . 1333件单位变动成本为每件 45元,固定成本总额该企业当期⾄少应销售的产品为().1280件60, 000元,产品单价为120C . 800件 D4?已知企业只⽣产⼀种产品,单价5元,单位变动成本 3元,固定成本总额 600元,则保本销售量为()。

管理会计第三章变动成本法习题及答案东北财经大学第二版(总11页)--本页仅作为文档封面,使用时请直接删除即可----内页可以根据需求调整合适字体及大小--第三章习题及答案一、关键概念1.成本计算的含义2.变动成本法3.产品成本4.期间成本5.变动成本的理论前提6.贡献式损益确定程序7.传统式损益确定程序8.利润差额9.两种成本法分析利润差额10.贡献式损益确定程序 11.传统式损益确定程序 12.广义营业利润差额 13.狭义营业利润差额二、分析思考1.变动成本法的理论前提有哪些?2.变动成本法与完全成本法在产品成本构成上有哪些不同?3.变动成本法与完全成本法相比有哪些区别? 5.广义营业利润差额的变动规律是什么?4.变动成本法与完全成本法相比在损益确定方面与哪些不同?6.变动成本法的优点和局限性各是什么?7.在我国应用变动成本法有哪些设想?三、单项选择题1.下列各项中,能构成变动成本法产品成本内容的是()。

A.变动成本B.固定成本C.生产成本D.变动生产成本2.在变动成本法下,固定性制造费用应当列作()。

A.非生产成本B.期间成本C.产品成本D.直接成本3.下列费用中属于酌量型固定成本的是()。

A.房屋及设备租金B.技术研发费C.行政管理人员的薪金D.不动产税金1.若本期完全成本法计算下的利润小于变动成本法计算下的利润,则()。

A.本期生产量大于本期销售量B.本期生产量等于本期销售量C.期末存货量大于期初存货量D.期末存货量小于期初存货量2.在相同成本原始资料条件下,变动成本法计算下的单位产品成本比完全成本法计算下的单位产品成本()。

A.相同 B.大 C.小 D.无法确定3.下列各项中,能构成变动成本法产品成本内容的是()。

A.变动成本B.固定成本C.生产成本D.变动生产成本4.在Y=a+( )X中,Y表示总成本,a表示固定成本,X表示销售额,则X的系数应是()。

A.单位变动成本B.单位边际贡献C.变动成本率D.边际贡献率5.当相关系数r→+1时,表明成本与业务量之间的关系是()。