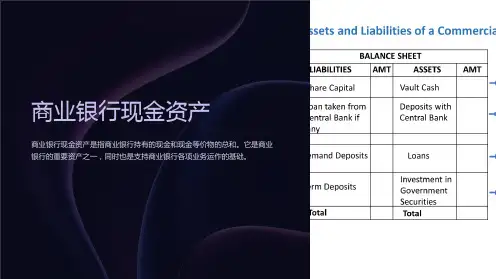

2、头寸种类:商业银行的头寸概念有可用 头寸、基础头寸和可贷头寸之分。

1)可用头寸

所谓可用头寸,是指扣除了法定准备金以后的 所有现金资产,包括库存现金、在中央银行的 超额准备金及存放同业存款。

可用头寸也称为可用现金。包括两方面:

(1)可用于应付客户提存和满足债权债务清偿 需要的头寸。称为支付准备金(备付金)

Moreover, the competence(能力) of repay(偿还) liquidity managers is an important barometer of management’s overall effectiveness( in achieving any financial institution’s goal).

If interest rates rises, financial assets (that the financial firm plans to sell to raise liquid funds ),such as government bonds, will decline in value, and some must de sold at a loss.

-Customer deposit withdrawals(提取)

-Credit requests from quality loan customers

-Repayment of nondeposit borrowings(偿还非存款借款)

-Operating expenses and taxes incurred(招致) in Producing and selling services

For example , during the 1990s ,the Federal Reserve forced the closure of the $10 billion Southeast Bank of Miami because it couldn’t come up with(提出,拿出,发现,宣布) enough liquidity to repay the loans it had already received from the Fed.