《投资学》——讲义

- 格式:doc

- 大小:520.00 KB

- 文档页数:11

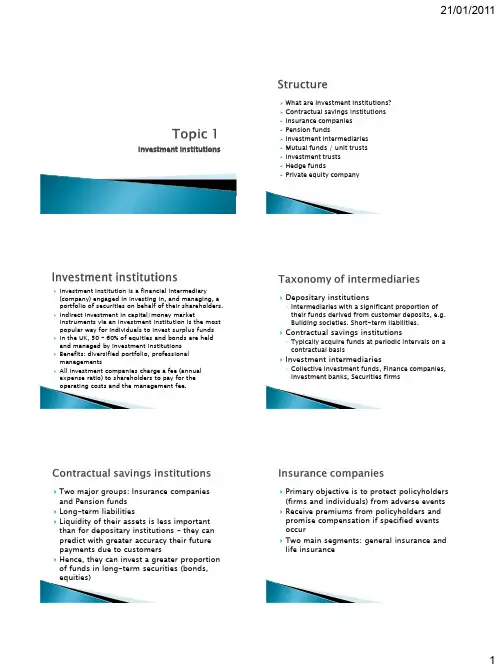

Investment InstitutionsWhat are Investment institutions? Contractual savings institutions -Insurance companies -Pension fundsInvestment intermediaries -Mutual funds / unit trusts -Investment trusts -Hedge funds-Private equity company❝Investment institution is a financial intermediary (company) engaged in investing in, and managing, a portfolio of securities on behalf of their shareholders. ❝Indirect investment in capital/money marketinstruments via an investment institution is the most popular way for individuals to invest surplus funds ❝In the UK, 50 –60% of equities and bonds are held and managed by investment institutions ❝Benefits: diversified portfolio, professional managements❝All investment companies charge a fee (annual expense ratio) to shareholders to pay for theoperating costs and the management fee.❝Depositary institutions◦Intermediaries with a significant proportion of their funds derived from customer deposits, e.g. Building societies. Short-term liabilities.❝Contractual savings institutions◦Typically acquire funds at periodic intervals on a contractual basis❝Investment intermediaries◦Collective investment funds, Finance companies,Investment banks, Securities firms❝Two major groups: Insurance companies and Pension funds ❝Long-term liabilities❝Liquidity of their assets is less important than for depositary institutions –they can predict with greater accuracy their future payments due to customers❝Hence, they can invest a greater proportion of funds in long-term securities (bonds,equities)❝Primary objective is to protect policyholders (firms and individuals) from adverse events ❝Receive premiums from policyholders and promise compensation if specified events occur❝Two main segments: general insurance and life insurance❝Protection against personal injury and liabilities such as accidents, theft and fire❝Usually over a fixed time period e.g. 1 year ❝Claims usually made soon after the event so liabilities are mostly short term❝Hence they hold a greater proportion of liquid assets than life insurers. Holding financial assets might be viewed as a byproduct of the business.❝Some authors (e.g. B&T) do not view this category as an investment intermediary❝Protects the policyholder in the event of death, illness or retirement; hence long-term liabilities❝Term assurance, Whole-of-life policy, Endowment policy, Annuities❝Term assurance: provides insurance cover, for specifiedperiod, against the risk of death. If the insured survivesthe specified period then no payment is made.❝Whole-of-life policy pays a capital sum on the death ofthe person assured, whenever that event occurs.❝Endowment policy pays a capital sum at the end ofsome specified term or earlier if the assured dies withinthe term.-The premium for Whole-of-life and endowment policieswill be higher than for term assurance.❝Annuities: A policyholder pay an initial lump sumwhich used by the insurance company to providean agreed income until death.-The insurance company immediately creates a fund❝Risk: certain sums are guaranteed to be paid in thefuture and these sums exceed the value of thepremiums over the life of the contract.❝Match the term structure of its assets and liabilities❝Invest in long-term assets e.g. bonds, equities andmortgages.❝Provide retirement income (in the form ofannuities) to employees covered by a pension plan❝Personal scheme and public (state) scheme❝Funded scheme and unfunded (pay-as-you-go)scheme❝Funded scheme: Receive contributions fromemployers and/or employees and invest thesefunds in assets, including equities and bonds.Returns from the investment are used to paybenefits to members of the scheme.❝Two main types of funded scheme: defined benefit(DB) and defined contribution (DC)❝DB: the sponsor agrees to pay members ofthe scheme a pension equal to apredetermined percentage of their finalsalary (average salary), subject to themember‟s years of service❝DC: the return on the investmentsdetermines pension benefits❝Occupational schemes where the sponsor isthe employer have historically been DB,while private pensions are DC❝Risk: benefits to be paid are not known with certainty;inflation complications as it increases the benefits to bepaid by fund.❝Benefit from tax deferral: in the UK, contributions arenot taxable, pensioner pays income tax❝Pension fund trustees will determine the overallinvestment strategy❝They will often decide what proportion of assets to beheld in different asset classes❝Asset mix will be influenced by the maturity of the fund❝Long-term liabilities hence long-term assets❝Index-linked bonds, Equities❝Investment companies are classified, depending on whether their own capitalisation (number of shares outstanding) is constantly changing or fixed:-Open-end : capitalisation constantly changing; new investors buy additional shares from the company and some existing shareholders sell their shares back to the company.-Closed-end : fixed capitalization; share traded onexchange.open-ended❝Mutual funds / unit trusts❝Open-ended investment companies OEICsClosed ended❝Investment trusts ❝Hedge funds❝Private equity company❝Pool resources from many individuals andcompanies and invest these in a range of assets ❝Provide opportunities for small investors to investin a diversified fund at low cost❝Take advantage of lower transaction costs in trading larger blocks of securities❝Trusts in the legal sense; controlled and monitored by trustees; who act as guardian of the assets on behalf of the beneficial owners ❝Investment decisions❝When an investor buys a stake in a unit trust, he/she purchases a new unit in the fund (unless matched with a seller by the fund manager)❝Open-ended fund where the size of the fund can varyaccording to the number of contributors to the fund ❝Price of each unit reflects current value of the fund divided by the number of outstanding units❝All sales and purchases of units are made with the trust manager.❝Do not trade on stock exchange.❝Dual pricing structure: offer price (investors buy units)and bid price (investors sell units back to the trust)❝Annual management fee (usually 0.5 -1% of the funds under management), plus the bid-offer spread on buying and selling units❝Limited in the amount that can be invested in any single security❝Total return for a mutual fund includes reinvestment dividends and capital gain.❝A cumulative total return measures the actual performance over 3, 5 or 10 years.❝In Jan 2009, 8,000 domestic mutual funds withassets of $9.4 trillion in the US.❝Short-term funds:-Money market mutual funds ❝Long-term funds: -Capital market funds;-Equity (stock) funds, Bond funds or Hybrid(balanced) funds (hold combination of stocks and bonds)-Index funds: mutual funds holding an managed portfolio of bonds or stocks designed to match particular market index, such as S&P 500. Has low expenses ratio.❝OEICs operate similarly to a unit trust in the sense that they are open-ended❝But an OEIC has a company structure and can be listed on the stock exchange ❝Shares will reflect the value of the fund ❝Shares will have a single price (rather than the separate buying and selling prices indicated for unit trusts)❝Companies whose business is the investment of funds in financial assets.❝A closed-end fund, only able to raise more funds through rights issue shares or borrowing (bonds) ❝Not a trust in the legal sense; limited liability company with listed shares (traded in stock market).❝Investors can purchase ordinary shares of the ITC ❝A portfolio, managed by ITC‟s board of directors who determine the investment strategy❝Not faced with outflow of funds, so investment strategy does not depend on maintaining cash flows to meet future liabilities❝The existence of borrowed funds in the capitalstructure implies a …gearing effect‟ on the value of the ITC shares❝Net asset value (NAV) per share is the value of assetsless debt divided by number of issued shares-E.g. ITC capital structure: £8m in equities (4m shares) + £2m debt. Thus the NAV per share = £2-If the value of ITC asset portfolio were to doubled to £20m, then the NAV per would increase to £4.5 (£18m/4m shares)-A 100% in the value of assets held has led to an increase in the NAV per share of 125%❝The gearing effect is of benefit to shareholders in a rising stock market.❝The hedge funds are largely unregulated❝Reputation is as risky funds, shrouded by mystery and only accessible to the wealthy.❝According to IFSL, the number of hedge funds increased from 4,000 with $324bn of assets in 1999 to peak of 11,000 with $2,150bn in 2007, and then declined to 10,000 hedge funds and $1,500bn by the start of 2009. ❝There is no unique definition of hedge fund since it is an industry term rather than a legal term❝“Includes a multitude of skill -based investment strategies with a broad range of risk and returnobjectives. A common element is the use of investment and risk management skills to seek positive returns regardless of market direction.”❝A hedge fund is an actively managed investment fund ❝Seeks an attractive …absolute return‟, a return whether the market go up or down.❝Do not follow any benchmark, but rather just try to generate high returns (larger than ordinary available return) while managing risks, by exploiting various market opportunities❝Typical strategies include -Short selling,-Borrowing, Leverage -Use of derivatives❝Fees include a fixed fee and management fee e.g. 1-2% of assets plus 20-25% of upside performance.Hedge fundsMutual funds and pension fundsInvestment trusts FreedomLimitation on borrowing, short selling, and the use of derivatives May borrow Limitations on short selling, and the use of derivatives❝Typical investors◦Wealthy individuals ◦Pension funds◦Other hedge funds, creating …funds of hedge funds‟ –diversity in strategy and risk❝Returns and risk can vary a great deal among the different hedge fund strategies❝Market neutral (or relative value arbitrage) funds ◦Attempt to produce returns that have no or low correlation with e.g. equity markets◦Highly quantitative portfolio construction◦Concentrate on the relative value of individual shares, bonds, currencies ...◦Commonly apply arbitrage strategies-e.g. exploit mispricing between an underlying asset and a derivative instrument-Concentrate on the difference in performance of two given securities in homogenous universe. E.g. belief that BP will do better than X in oil firm; go long on BP and short on X.-Take position with convertible bonds❝Long/short funds-Generally invest in equity and bonds, taking directional bets on individual security or sector-Analyse individual companies and individual shares-Micro investors (look at individual/specific stocks)-Some may specialize in geographical sectors -Others may specialize in either small or large companies -E.g. 130/30-Timing is crucial-Stock-picking skill (short selling overpriced stocks and buying underpriced stocks)-Not automatically market neutral e.g. could havestrong positive correlation with equityGlobal (macro) asset funds-Look at stocks, bonds, currencies, and commodities from a global point of view -Macro-investors (look at broad themes) -Have positive exposure to the market-A fund might go long in sectors they believe will provide good returns, and short on countries they believe will have negative returns❝Event driven funds-Looks to exploit special situations -Take over bids-Merger, Corporate restructuring❝A group of individuals set up a limited liabilitypartnership, might have a limited life of around 10 years.❝Make good returns by buying public companies or neglected subsidiaries at good price and turning them into more attractive business❝They will gear up with debt that a public company would not want to risk.❝Normally be turned into non-quoted company❝They get involved in the business, bringing their own expertise and give managers big incentives to improve the business❝They seek cut costs, squeeze suppliers and sell unwanted assets, sell and lease back property ❝Large amount of leverage involved❝They take their profit in a variety of ways:-Refloat the company-Sell the company to someone else in the same business -Refinancing❝The private equity market was boosted in the early 2000s.❝IFSL shows that the global private equity investment amounted to $176.6bn in 2000, this increased to $317.6bn in 2007, then hit by the credit crisis andfell to $189bn.❝In the UK, well-known firms that are or have been owned by private equity groups: Boots, Iceland, Debenhams, New Look, Kwik-Fit❝E.g. In Dec. 2003, a group of private equity firms-Texas Pacific, CVC and Merrill Lynch Global Private Equity-bough Debenhams for £1.7bn, of which £600m was their own capital.❝In two refinancing in 2004 and 2005, they reconstructed the balance sheet with new borrowings and paid themselves back £1.3bn(twice of their original capital) in about 18 months. ❝They refloated Debenhams in May 2006.Explain the different types of investment institution. Identify and analyse the factors that will influence the investment strategy applied by each type of institution.。

1 前言 投 资 学 时间(周一1-2节、单周周三3-4节)、地点五教、自我介绍 一、我们熟悉的“投资” 当今经济生活中人们使用最多、最广泛的一个词是:投资。大家听到投资两字的时候也是开始神游与心花怒放。 投资才能发展;投资才能进步;投资才能脱贫;投资才能赚钱;投资才能创业;投资才能建设工厂;投资才能住进新房;投资才能买入股票;投资才能读硕读博;投资才能办北京奥运;投资才能对抗SARS和艾滋;投资才能全面建设小康! 经济越发达、生活越富裕、智商越高,越谈论“投资”!

例1:2008年年底,国务院常务会议出台了扩大内需促进经济平稳较快增长的十项措施。据初步匡算,到2010年底总共约需投资4万亿元。11月9日出台的“4万亿投资计划”已使很多部门和企业“迫不及待”,钱从哪里来,往哪里去?成为大家关心的焦点。 从过去的经验看,充其量1/3的资金由财政投入就可以了,因为财政资金要努力起到四两拨千斤的作用,其放大效应至少有2至3倍,能带动其他配套资金,比如商业银行贷款配套、地方配套、国际金融资金等多种资金进入。 哪里来:①首批资金--中央新增1000亿政府投资,投向包括农业部、水利部、住房和城乡建设部、环境保护部和卫生部等11个部委。②可能还包括一部分银行贷款。如,三大政策性银行2008年底前“撒钱”1000亿元。③发改委副主任透露,4万亿中中央政府直接投资1万亿,同时带动地方、企业投资、金融机构贷款等。④4万亿“拼盘”中央政府两年可能增发1万亿国债。 即4万亿的投资最终由中央投资、地方投资和社会投资共同构成。这4万亿元投资是中央和地方政府以及金融系统贷款和其他来源资金(包括可用的国外资金)的总和,其中有1万亿元是中央政府直接投资的,3万亿是从其它渠道筹措(中央财政发行2000亿的国债,发放一部分政策性贷款,扩大地方企业债券发行)。从短期来看需要中央财政投资先期导入,从长期来看必将带动广泛的民间投资。而中央财政投资主要通过发行长期国债、动用预算调节稳定基金和可用的增收财力等渠道来筹措。 哪里去: 2

效果:针对巨额投资计划,很多人担忧微观经济主体会不会很好地消化,产生的拉动效应能否如愿以偿。 中国社科院世界经济与政治研究所研究员张斌表示,这总体是一个救急的方案,解决经济增长的可持续性、效率和福利这些问题,需要根本性的制度变化,包括服务业的准入、交通、医疗、教育等部门投资限制的放开,只有这样才会带来私人部门可持续的投资,光靠公共部门投入解决不了问题。 清华大学中国经济研究中心研究员袁钢明对记者指出:“决策层这一调控思路的转变无疑有着十分积极的意义,但单靠积极财政还无法支撑经济的平稳较快增长,政府基建投资规模虽然很大,但如果内需没有真正启动起来,宏观经济很可能又要走一个涨跌的轮回。”在他看来,现在中国经济9%的平均增长速度还不需要这么大的投资计划来刺激。“中国经济内需不足不是因为人们不敢消费,而是居民收入过低。”要解决内需不足的问题,应该加强对消费的引导,包括切实提高农村居民收入。 另外,他指出,目前的刺激计划只是考虑用大规模的政府投资来替代民间投资,并没有考虑如何引导民间投资的问题。私营资本已经占到中国固定资产投资较大的比重,但很多行业产能过剩,如何帮助他们找到新的投资机会是当前重要的问题。 有关人士担心,“巨大的公共投资肯定会挤掉一些民间投资,而经济长远发展的驱动力是微观经济主体,而不是政府的巨额投资。”袁钢明对这一现象表示担忧。如此巨大的国家投资会不会造成对民间资金的挤出效应?对此,有专家指出,在经济社会投资都运行正常情况下,如果国家大规模增加投入就可能从资金来源角度对民间投资产生负面影响。不过,由于我国2008年经济处于下行通道中,企业投资意愿是在下降的。在这种情况下,国家加大投入就是为了弥补企业投资的不足,不会有什么挤出的问题。他同时表示,国家加大投资反而将会对民间投资产生拉动作用。首先,国家加大投资必然需要水泥、钢材等相关产业的支持,也必然带动这些行业企业的发展;其次,十项措施中提到的增值税改革,就是给民间投资的主体——企业减负,从而鼓励、刺激企业投资意愿。 3

投资的保障:(摩根大通则认为)46万亿元的人民币存款、2万亿美元的外汇储备、平衡的收支将是中国实行巨额经济刺激计划的保障 二、《投资学》的魅力 学好《投资学》可以帮助我们:从事工作:证券分析、资产管理;从事单位:一般为商业银行、投资银行、投资公司、资产管理公司、信托投资公司、咨询公司等;从事报酬:挣钱多、白领或金领职业; 投资的精髓:创造力思维,走在别人前面。 郁闷的是:涉及金融数据分析和公司财务分析,工作富有挑战性和艰难性;竞争激烈。 投资一般涉及的知识:财务、会计学;高等数学、概率论;计量经济学;管理学,尤其项目管理知识;阅读一些文献可能涉及到英语水平;……多多益善。 教学目的:该课程旨在使学生系统了解和掌握投资学的基础知识和基本技能,认识投资一般原理,掌握证券投资、产业投资投资决策的基本的分析方法,了解投资在国家宏观经济发展中的作用。 三、教材及参考书 教科书:郎荣燊、黎谷:《投资学》,中国人民大学出版社。 主要参考书:1、(美)滋维.博迪等著,朱宝宪等译:《投资学》,机械工业出版社,2007。 2、高倚云等编著:《30部必读的投资学经典》,北京工业大学出版社,2009。 3、杨大楷主编:《投资学》,高等教育出版社,2006。 4、汪昌云,谭松涛,类承曜等编著:《投资学》,中国人民大学出版社, 2009。 四、主要内容以及时间安排 1、课程体系以及时间安排 理论学习:计划共16周,每周三学时,包括第1-12周和第15周,因第2周、第5周中秋节和国庆节放假,实际教学计划按照42课时来设计。 总复习: 第16周 。考试:第17周, 第一篇 总论(导论、投资与经济发展、投资体制、投资结构) 14课时 杨 第二篇 项目投资与决策(资金的时间价值、可行性研究与投资决策、市场调查与市场预测、投资条件评价、项目投资的风险分析) 12课时 任 第三篇 证券投资(项目融资、证券、证券市场、投资组合与证券定价原理、现代投资银行)8课时 潘和高(本年级曾经开设有证券投资学课程,因此本课程简化一些内容) 第四篇 国际投资(国际投资、汇率与外汇风险)8课时 宋 2、教学方式 时间少,任务重,请各位同学要做好充分的思想准备。 注重立体多维教学方式,教学形式包括:课前预习、课堂面授、模拟实验。 3、课堂教学基本要求 提前预习、记好笔记,积极参与分组讨论。 作业:每组1次书面分析,1次案例讨论,派一名代表上台发言(5分钟左右)。每周两个小组交报告出成果。具体分组如下。 严禁上课手机乱叫,交头接耳,将严格执行课堂纪律。 3、游戏规则 ①最后成绩:期末考试(60%)平时成绩(作业15%,课堂考勤15%,课堂综合表现10%) ②每堂课均课堂随机点名。课堂提问,视作点名。 ③听课认真、学习积极的同学应该有奖励(平时成绩),相反扣除平时成绩。 五、课堂讨论题材 悦达投资600805(综合) 大恒科技600288(信息技术) 华兰生物002007(生物医药) 獐子岛002069(农林牧渔)隆平高科000998(农林牧渔) 大杨创世600233(纺织服装) 方大炭素600516(金属) 民生银行600016(金融保险) 宁波韵升600366(机械设备) 金地集团600383(房地产) 这周下课后选择一只股票,买入。一周以后,看是不是涨的比较好?①请说明你当初选择的原因,分析你们买入的股票涨跌多少,并试图分析这周有什么利空利好消息,并总结经验教训。②这10支股票中哪只股票这周涨的最好?并分析其大涨的原因。③预测下周哪只股票会涨的好,即如果让你周一重新买入你会买哪支? 4

分析报告1500字以上,上台发言5分钟以上。 第一章 导论

第一节 投资概述 一、关于投资的概念 1、投资和消费的关系 威廉·夏普的定义:为了(可能不确定的)将来的消费(价值)而牺牲现在(一定)的消费(价值)。the sacrifice of certain present value for possibly uncertain future consumption (future value)。 2、投资区分为广义投资和狭义投资 德威尔的定义:广义的投资是指以获利为目的的资本使用,包括购买股票和债券,也包括运用资金以建筑厂房、购置设备、原材料等从事扩大生产流通事业;狭义的投资指投资人购买各种证券,包括政府公债、公司股票、公司债券、金融债券等。 3、宏观经济分析的角度 萨缪尔森在其《经济学》中认为:“对于经济学者而言,投资的意义总是实际的资本形成——增加存货的生产,或新工厂、房屋和工具的生产……只有当物质资本形成生产时,才有投资。” 4、我国投资概念的演进

投资的概念:是将一定数量的资财(有形的或无形的)投放于某种对象或事业,以取得一定收益或社会效益的活动;也指为获得一定收益或社会效益而投入某种活动中的资财。 二、投资要素 1、投资主体:具有资金或资财来源和投资决策权的投资活动主体。 ⑴投资主体的内涵:拥有一定数量的货币资金,拥有对资金的支配权,享受投资收益,承担投资可能发生的损失 ⑵投资主体的类型:①居民②企业:国有独资企业、私有企业、股份制企业、合资企业或外资企业③其他盈利性机构:投资基金、证券公司等④政府:中央政府或地方政府⑤其他非盈利组织:学校、福利基金会等 ⑶投资所有权与经营权分离 产业投资的投资主体:企业所有权与经营权的分离 证券投资的投资主体:在证券市场上,居民投资者并不一定要直接向发行债券和股票的企业购买债券和股票,而可以委托证券公司代理购买。 投资基金的二次分离功能:居民投资者还可以投资于投资基金,由投资基金公司代理买卖实业公司的债券和股票。 ⑷所有权与经营权分离引发的问题:委托代理 信息不对称 道德风险 案例:“国美与黄光裕” 陈晓与贝恩投资 “做人不能太陈晓”

2、投资客体:即投资对象、目标或标的物。 3、投资目的:即投资主体的意图及所要取得的效果。投资主体总是始于一定的目的,投资目的也就是投资的动机。 ⑴投资效益 微观经济效益和社会效益(宏观经济效益、政治效益);直接效益和最终效益 ⑵不同制度条件下的投资目的 市场经济下企业投资的目的是为了获取剩余价值,追求利润 政府投资的目的多样性: 经济稳定、社会公平……… 传统社会主义体制下的投资动机:科尔内的描述:最重要的动机是,领导者总是与他的工作结为一体。他深信自己负责的单位的活动很重要,必须发展,相信通过投资能解决这些问题。 除了高尚的动机外,还可能伴随着其它不那么高尚,但属于人之常情,可以理解的动机: