海关估价协议英文版

- 格式:doc

- 大小:233.50 KB

- 文档页数:27

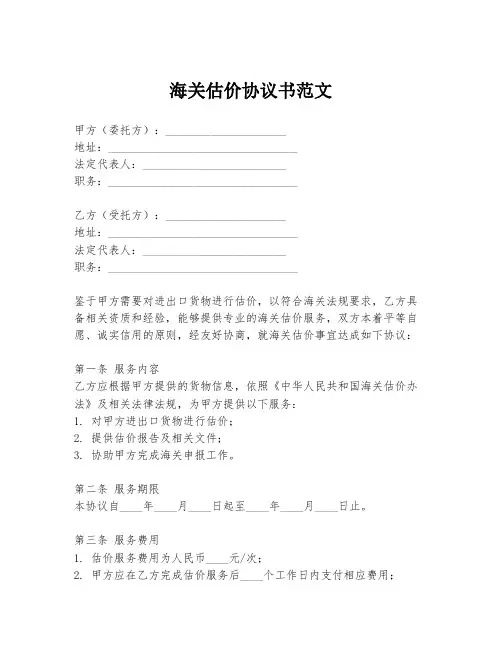

海关估价协议书范文甲方(委托方):_____________________地址:_________________________________法定代表人:_________________________职务:_________________________________乙方(受托方):_____________________地址:_________________________________法定代表人:_________________________职务:_________________________________鉴于甲方需要对进出口货物进行估价,以符合海关法规要求,乙方具备相关资质和经验,能够提供专业的海关估价服务,双方本着平等自愿、诚实信用的原则,经友好协商,就海关估价事宜达成如下协议:第一条服务内容乙方应根据甲方提供的货物信息,依照《中华人民共和国海关估价办法》及相关法律法规,为甲方提供以下服务:1. 对甲方进出口货物进行估价;2. 提供估价报告及相关文件;3. 协助甲方完成海关申报工作。

第二条服务期限本协议自____年____月____日起至____年____月____日止。

第三条服务费用1. 估价服务费用为人民币____元/次;2. 甲方应在乙方完成估价服务后____个工作日内支付相应费用;3. 如因乙方原因造成估价错误,乙方应无偿重新估价。

第四条甲方权利与义务1. 甲方应提供真实、准确的货物信息及相关资料;2. 甲方有权要求乙方按时完成估价服务;3. 甲方应按时支付乙方服务费用。

第五条乙方权利与义务1. 乙方应保证估价服务的专业性和准确性;2. 乙方有权要求甲方提供必要的货物信息及资料;3. 乙方应保守甲方商业秘密,未经甲方同意,不得向第三方披露。

第六条违约责任如任何一方违反本协议约定,应承担违约责任,并赔偿对方因此遭受的损失。

第七条争议解决双方因履行本协议发生争议,应首先通过友好协商解决;协商不成时,任何一方可向乙方所在地人民法院提起诉讼。

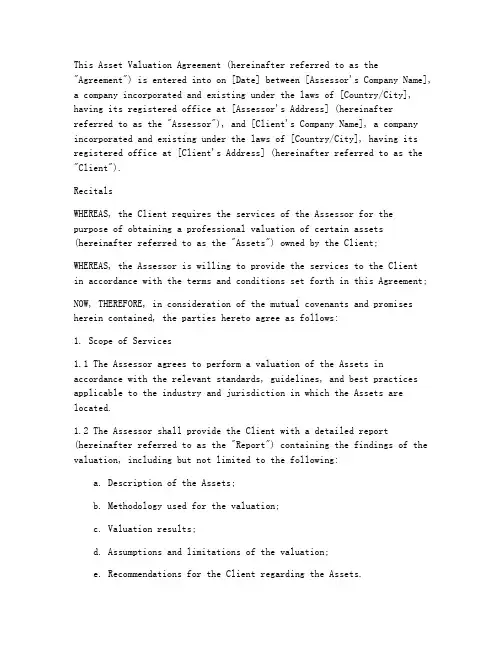

This Asset Valuation Agreement (hereinafter referred to as the "Agreement") is entered into on [Date] between [Assessor's Company Name], a company incorporated and existing under the laws of [Country/City], having its registered office at [Assessor's Address] (hereinafterreferred to as the "Assessor"), and [Client's Company Name], a company incorporated and existing under the laws of [Country/City], having its registered office at [Client's Address] (hereinafter referred to as the "Client").RecitalsWHEREAS, the Client requires the services of the Assessor for the purpose of obtaining a professional valuation of certain assets (hereinafter referred to as the "Assets") owned by the Client;WHEREAS, the Assessor is willing to provide the services to the Clientin accordance with the terms and conditions set forth in this Agreement;NOW, THEREFORE, in consideration of the mutual covenants and promises herein contained, the parties hereto agree as follows:1. Scope of Services1.1 The Assessor agrees to perform a valuation of the Assets in accordance with the relevant standards, guidelines, and best practices applicable to the industry and jurisdiction in which the Assets are located.1.2 The Assessor shall provide the Client with a detailed report (hereinafter referred to as the "Report") containing the findings of the valuation, including but not limited to the following:a. Description of the Assets;b. Methodology used for the valuation;c. Valuation results;d. Assumptions and limitations of the valuation;e. Recommendations for the Client regarding the Assets.2. Duties and Responsibilities of the Assessor2.1 The Assessor shall perform the valuation services with due care, skill, and diligence in accordance with the applicable standards and guidelines.2.2 The Assessor shall maintain confidentiality with respect to all information obtained in the course of performing the valuation services.2.3 The Assessor shall provide the Client with the Report within [Number] days of the completion of the valuation services, unless otherwise agreed upon by the parties.3. Duties and Responsibilities of the Client3.1 The Client shall provide the Assessor with all necessary information and access to the Assets required for the performance of the valuation services.3.2 The Client shall promptly notify the Assessor of any changes to the Assets or the business environment that may affect the valuation.3.3 The Client shall pay the Assessor the fees agreed upon in accordance with the terms of this Agreement.4. Fees and Payment Terms4.1 The Assessor shall invoice the Client for the valuation services rendered, in accordance with the fee schedule attached hereto as Exhibit A.4.2 The Client shall pay the invoices submitted by the Assessor within [Number] days of the date of the invoice, unless otherwise agreed uponby the parties.5. Confidentiality5.1 The parties agree to maintain the confidentiality of all information disclosed to them by the other party in connection with this Agreement.5.2 The confidentiality obligations shall survive the termination or expiration of this Agreement.6. Limitation of Liability6.1 The Assessor shall not be liable for any loss or damage suffered by the Client arising from or in connection with the valuation servicesp rovided, except to the extent caused by the Assessor’s gross negligence or willful misconduct.6.2 The total liability of the Assessor to the Client under this Agreement shall not exceed the amount of the fees paid by the Client to the Assessor.7. Term and Termination7.1 This Agreement shall commence on the date hereof and shall remain in effect for [Number] days from the date of the Report, unless terminated earlier in accordance with the provisions of this Agreement.7.2 Either party。

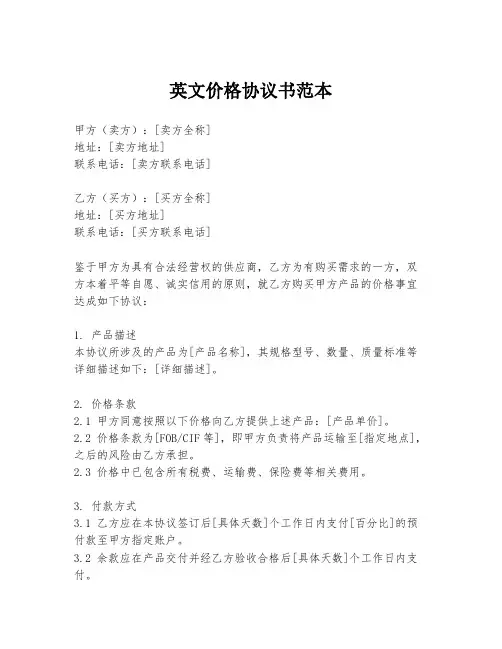

英文价格协议书范本甲方(卖方):[卖方全称]地址:[卖方地址]联系电话:[卖方联系电话]乙方(买方):[买方全称]地址:[买方地址]联系电话:[买方联系电话]鉴于甲方为具有合法经营权的供应商,乙方为有购买需求的一方,双方本着平等自愿、诚实信用的原则,就乙方购买甲方产品的价格事宜达成如下协议:1. 产品描述本协议所涉及的产品为[产品名称],其规格型号、数量、质量标准等详细描述如下:[详细描述]。

2. 价格条款2.1 甲方同意按照以下价格向乙方提供上述产品:[产品单价]。

2.2 价格条款为[FOB/CIF等],即甲方负责将产品运输至[指定地点],之后的风险由乙方承担。

2.3 价格中已包含所有税费、运输费、保险费等相关费用。

3. 付款方式3.1 乙方应在本协议签订后[具体天数]个工作日内支付[百分比]的预付款至甲方指定账户。

3.2 余款应在产品交付并经乙方验收合格后[具体天数]个工作日内支付。

4. 交货时间甲方应在收到乙方预付款后[具体天数]个工作日内完成产品的生产,并在[具体日期]前将产品交付至乙方指定地点。

5. 质量保证甲方保证所提供的产品符合双方约定的质量标准。

如产品存在质量问题,甲方应在接到乙方通知后[具体天数]个工作日内负责更换或修复。

6. 违约责任6.1 如甲方未能按时交付产品,应按延迟交付产品价值的[百分比]向乙方支付违约金。

6.2 如乙方未能按时支付货款,应按逾期支付金额的[百分比]向甲方支付违约金。

7. 协议的变更和解除双方应本着友好协商的原则解决本协议执行过程中出现的问题。

如需变更或解除本协议,应提前[具体天数]天书面通知对方,并经双方协商一致。

8. 争议解决因执行本协议所发生的任何争议,双方应首先通过协商解决;协商不成时,任何一方均可向甲方所在地人民法院提起诉讼。

9. 其他9.1 本协议一式两份,甲乙双方各执一份,具有同等法律效力。

9.2 本协议自双方签字盖章之日起生效,有效期至[协议有效期]。

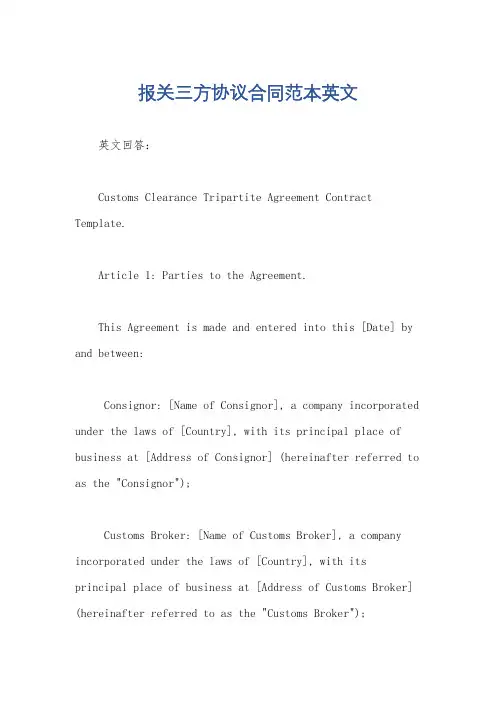

报关三方协议合同范本英文英文回答:Customs Clearance Tripartite Agreement Contract Template.Article 1: Parties to the Agreement.This Agreement is made and entered into this [Date] by and between:Consignor: [Name of Consignor], a company incorporated under the laws of [Country], with its principal place of business at [Address of Consignor] (hereinafter referred to as the "Consignor");Customs Broker: [Name of Customs Broker], a company incorporated under the laws of [Country], with itsprincipal place of business at [Address of Customs Broker] (hereinafter referred to as the "Customs Broker");Importer: [Name of Importer], a company incorporated under the laws of [Country], with its principal place of business at [Address of Importer] (hereinafter referred to as the "Importer").Article 2: Purpose of the Agreement.The purpose of this Agreement is to set forth the terms and conditions under which the Customs Broker will provide customs clearance services to the Consignor and the Importer for the importation of goods into [Country of Importation].Article 3: Services to be Provided.The Customs Broker agrees to provide the following services to the Consignor and the Importer:Preparing and filing all necessary customs documentation, including but not limited to:Entry Summary.Commercial Invoice.Packing List.Certificate of Origin.Classifying the goods in accordance with the Harmonized Tariff Schedule of the United States (HTSUS)。

fob中英文合同范本英文English:A Foreign Sales Contract (FSC) typically includes several essential clauses to ensure the smooth execution of international trade transactions. Firstly, it should clearly delineate the identities of the parties involved, including their names, addresses, and contact information. Secondly, the FSC should specify the details of the goods being traded, including their quantity, quality, specifications, and any applicable standards or certifications. Thirdly, the contract should outline the terms of sale, including price, currency of payment, delivery terms, and the mode of transportation. Additionally, it should address issues related to payment terms, such as the method of payment, installment schedule if applicable, and any penalties for late payment. Importantly, the FSC should include provisions regarding inspection, acceptance, and rejection of goods, as well as procedures for resolving disputes. It's also crucial to include clauses regarding force majeure events that may disrupt the fulfillment of the contract, outlining the responsibilities of both parties in such circumstances. Furthermore, the contract should specify the governing law and jurisdiction for resolving disputes. Finally, bothparties should sign the contract to signify their agreement and acceptance of its terms.中文翻译:外销合同(FSC)通常包括几个关键条款,以确保国际贸易交易的顺利执行。

报关用的英文合同模板Customs Declaration English Contract Template。

When it comes to international trade, customs declaration is a crucial aspect that must be carefully considered. A customs declaration is a formal statement made by the importer or exporter of the goods, providing information about the goods being imported or exported. This information is used by the customs authorities to calculate and collect duties and taxes, and to ensure that the goods comply with all relevant regulations.In order to facilitate the customs declaration process, it is important for importers and exporters to have a clear and comprehensive contract in place. This contract should outline the responsibilities of both parties, as well as the terms and conditions of the import or export transaction. By having a well-drafted contract, both parties can ensure that the customs declaration process is smooth and efficient, and that all necessary information is provided to the customs authorities.The following is a sample customs declaration English contract template that can be used as a starting point for importers and exporters:Customs Declaration English Contract Template。

英文资产评估合同范本ASSET VALUATION AGREEMENTThis Asset Valuation Agreement (the "Agreement") is made and entered into as of the [Effective Date] (the "Effective Date"), by and between [Client Name], a [Client'sJurisdiction of Incorporation] [Client's Form of Entity] with a principal place of business at [Client's Address] ("Client"), and [Valuator Name], a [Valuator's Jurisdiction of Incorporation] [Valuator's Form of Entity] with aprincipal place of business at [Valuator's Address] ("Valuator").1. Purpose of Agreement1.1 The Client desires to engage the Valuator to perform an assessment of the value of certain assets (the "Assets") as more particularly described in Exhibit A attached hereto (the "Valuation").2. Scope of Services2.1 The Valuator shall provide the following services to the Client:- A comprehensive valuation of the Assets in accordance with generally accepted valuation principles and practices.- A written report detailing the methodology and findings ofthe Valuation (the "Valuation Report").- Assistance in the interpretation of the Valuation Report as may be required by the Client.2.2 The Valuator shall not be required to perform any services beyond those outlined in Section 2.1 without the mutual written agreement of both parties.3. Fees and Payment3.1 The Client shall pay the Valuator a fee (the "Fee") for the services rendered under this Agreement, as detailed in Exhibit B attached hereto.3.2 The Fee shall be due and payable in accordance with the payment schedule set forth in Exhibit B.4. Confidentiality4.1 The Valuator agrees to keep confidential all information obtained from the Client in the course of providing the services under this Agreement, except as required by law or with the Client's prior written consent.5. Representations and Warranties5.1 The Client represents and warrants that it has the right to enter into this Agreement and to grant the rights and permissions herein.5.2 The Valuator represents and warrants that it is dulyqualified and authorized to perform the services under this Agreement and that it will perform such services with due care and diligence.6. Term and Termination6.1 This Agreement shall commence on the Effective Date and shall continue until the Valuation is completed and the Valuation Report is delivered to the Client, unless earlier terminated in accordance with this Section 6.6.2 Either party may terminate this Agreement upon written notice to the other party if the other party breaches any material term or condition of this Agreement and fails to cure such breach within thirty (30) days after receipt of written notice thereof.7. Indemnification7.1 The Client agrees to indemnify and hold harmless the Valuator, its officers, directors, employees, and agents, from and against any and all claims, losses, damages, liabilities, costs, and expenses arising out of or in connection with the Valuator's performance of the services under this Agreement, except to the extent such claims, losses, damages, liabilities, costs, or expenses arise from the Valuator's gross negligence or willful misconduct.8. Governing Law8.1 This Agreement shall be governed by and construed inaccordance with the laws of the [Governing Jurisdiction], without regard to its conflict of law provisions.9. Entire Agreement9.1 This Agreement, including any Exhibits attached hereto, constitutes the entire agreement between the parties with respect to the subject matter hereof and supersedes all prior and contemporaneous agreements and understandings, whether oral or written.10. Amendments10.1 No amendment or modification of this Agreement shall be effective unless it is in writing and signed by both parties.11. Notices11.1 All notices or communications required or permitted by this Agreement shall be in writing and shall be deemed given when delivered personally or by overnight courier service, or three (3) days after being sent by certified mail, postage prepaid, return receipt requested, to the respective addresses of the parties set forth above, or at such other address as either party may designate in writing in accordance with this Section.IN WITNESS WHEREOF, the parties have executed this Agreement as of the date first above written.Client: [Client Name]By: [Authorized Signatory Name]Valuator: [Valuator Name]By: [Authorized Signatory Name] Title: [Authorized Signatory Title]Exhibit A: Description of Assets [List of Assets to be Valuated] Exhibit B: Fee Schedule[Fee Details and Payment Schedule]。

协议的主要内容协议共四部分,24个条款和3个附件,规定了适用范围、海关估价的方法、对海关估价决定的复议、发展中国家的特殊和差别待遇、成员间的磋商和争端解决以及海关估价委员会和海关估价技术委员会的职能等内容。

(一)适用范围该协议适用于商业意义上正常进口的货物。

对于以下情况的进口货物,不适用本协议:第一,倾销或补贴进口的货物。

也就是说,不能采用协议规定的方法确定倾销进口的货物倾销价格,从而对其征收反倾销税或反补贴税;第二,非商业性进口。

对于非商业性的进口,包括旅客入境物品或行李邮递物品等。

第三,非直接进口,主要包括:暂时进口的货物、进入到特定自由区的货物、从自由区或加工保税区进入到国内消费的货物、退运货物、运输中损坏的货物等。

各成员自行确定如何对这类货物进行估价。

(二)海关估价的方法协议规定,海关应在最大限度内以进口货物的成交价格作为货物完税价格。

首先,进口货物的成交价格是海关估价的首要依据,但在无法使用这种方法的情况下,可使用协议规定的其他5种方法,即以相同货物的成交价格,以类似货物的成交价格,以倒扣价格,以计算价格,以"回顾"方法确定货物的完税价格。

上述6种估价方法必须严格按顺序实施,只有在上一估价方法无法确定完税价格的情况下才可采用下一种估价方法。

海关不得颠倒适用顺序,但进口商可要求颠倒使用第4 种倒扣价格方法和第5种计算价格方法的顺序。

1.以进口货物的成交价格确定完税价格这是海关估价时应首先使用的方法,海关用于估价的成交价格是指货物被出口到进口国,海关根据实际情况调整后实付或应付的价格(实付或应付的价格是指买方为购买进口货物向卖方已经完成或将要完成的全部支付)。

但海关不是在任何条件下都将进口货物的成交价格作为完税价格,采用这种估价方法必须符合一定的条件。

首先,买方对货物享有的处置或使用权不受任何限制,但进口国法律或政府主管机关实施或要求的限制、卖方对该货物转售地域的限制,或卖方提出的对货物价格无实质影响的限制除外(如要求汽车买主不要在新产品年度开始日前出售或展览汽车),其次,卖方不能在买方购买进口货物时设定某些影响销售或价格的条件,比如:卖方以买方购买一定数量的其他货物、或依据买方向卖方出售其他货物的价格、或根据与进口货物无关的支付方式等为条件出售货物或确定出口价格。

海关估价协议(英文版)(doc 30页)背景:Agreement on Implementation of Article VII of the General Agreement on Tariffs and Trade 1994General Introductory Commentary1. The primary basis for customs value under this Agreement is “transaction value” as defined i n Article 1. Article 1 is to be read together with Article 8 which provides, inter alia, for adjustments to the price actually paid or payable in cases where certain specific elements which are considered to form a part of the value for customs purposes are incurred by the buyer but are not included in the price actually paid or payable for the imported goods. Article 8 also provides for the inclusion in the transaction value of certain considerations which may pass from the buyer to the seller in the form of specified goods or services rather than in the form of money. Articles 2 throughdetermining a proper basis of value for customs purposes.3. Articles 5 and 6 provide two bases for determining the customs value where it cannot be determined on the basis of the transaction value of the imported goods or of identical or similar imported goods. Under paragraph 1 of Article 5 the customs value is determined on the basis of the price at which the goods are sold in the condition as imported to an unrelated buyer in the country of importation. The importer also has the right to have goods which are further processed after importation valued under the provisions of Article 5 if the importer so requests. Under Article 6 the customs value is determined on the basis of the computed value. Both these methods present certain difficulties and because of this the importer is given the right, under the provisions of Article 4, to choose the order of application of the two methods.4. Article 7 sets out how to determine the customs value in cases where it cannot be determined under the provisions of any of the preceding Articles.Members,Having regard to the Multilateral Trade Negotiations;Desiring to further the objectives of GATT 1994 and to secure additional benefits for the international trade of developing countries;Recognizing the importance of the provisions of Article VII of GATT 1994 and desiring to elaborate rules for their application in order to provide greater uniformity and certainty in their implementation;Recognizing the need for a fair, uniform and neutral system for the valuation of goods for customs purposes that precludes the use of arbitrary or fictitious customs values;Recognizing that the basis for valuation of goods for customs purposes should,to the greatest extent possible, be the transaction value of the goods being valued;Recognizing that customs value should be based on simple and equitable criteria consistent with commercial practices and that valuation procedures should be of general application without distinction between sources of supply;Recognizing that valuation procedures should not be used to combat dumping;Hereby agree as follows:正文:Part I : Rules on Customs ValuationArticle 1 back to top1. The customs value of imported goods shall be the transaction value, that is the price actually paid or payable for the goodswhen sold for export to the country of importation adjusted in accordance with the provisions of Article 8, provided:(a) that there are no restrictions as to the disposition or use of the goods by the buyer other than restrictions which:(i) are imposed or required by law or by the public authorities in the country of importation;(ii) limit the geographical area in which the goods may be resold; or(iii) do not substantially affect the value of the goods;(b) that the sale or price is not subject to some condition or consideration for which a value cannot be determined with respect to the goods being valued;(c) that no part of the proceeds of any subsequent resale, disposal or use of the goods by the buyer will accrue directly or indirectly to the seller, unless an appropriate adjustment can be made in accordance with the provisions of Article 8; and(d) that the buyer and seller are not related, or where the buyer and seller are related, that the transaction value is acceptable for customs purposes under the provisions of paragraph 2.2. (a) In determining whether the transaction value is acceptable for the purposes of paragraph 1, the fact that the buyer and the seller are related within the meaning of Article 15 shall not in itself be grounds for regarding the transaction value as unacceptable. In such case the circumstances surrounding the sale shall be examined and the transaction value shall be accepted provided that the relationship did not influence the price. If, in the light ofinformation provided by the importer or otherwise, the customs administration has grounds for considering that the relationship influenced the price, it shall communicate its grounds to the importer and the importer shall be given a reasonable opportunity to respond. If the importer so requests, the communication of the grounds shall be in writing.(b) In a sale between related persons, the transaction value shall be accepted and the goods valued in accordance with the provisions of paragraph 1 whenever the importer demonstrates that such value closely approximates to one of the following occurring at or about the same time:(i) the transaction value in sales to unrelated buyers of identical or similar goods for export to the same country of importation;(ii) the customs value of identical or similar goods as determined under theprovisions of Article 5;(iii) the customs value of identical or similar goods as determined under the provisions of Article 6;In applying the foregoing tests, due account shall be taken of demonstrated differences in commercial levels, quantity levels, the elements enumerated in Article 8 and costs incurred by the seller in sales in which the seller and the buyer are not related that are not incurred by the seller in sales in which the seller and the buyer are related.(c) The tests set forth in paragraph 2(b) are to be used at the initiative of the importer and only for comparison purposes. Substitute values may not be established under the provisions of paragraph 2(b).Article 2 back to top1. (a) If the customs value of the imported goods cannot be determined under the provisions of Article 1, the customs value shall be the transaction value of identical goods sold for export to the same country of importation and exported at or about the same time as the goods being valued.(b) In applying this Article, the transaction value of identical goods in a sale at the same commercial level and in substantially the same quantity as the goods being valued shall be used to determine the customs value. Where no such sale is found, the transaction value of identical goods sold at a different commercial level and/or in different quantities, adjusted to take account of differences attributable to commercial level and/or to quantity, shall be used, provided that such adjustments can be made on the basis of demonstrated evidence which clearly establishes the reasonableness and accuracy of the adjustment, whether the adjustment leads to anincrease or a decrease in the value.2. Where the costs and charges referred to in paragraph 2 of Article 8 are included in the transaction value, an adjustment shall be made to take account of significant differences in such costs and charges between the imported goods and the identical goods in question arising from differences in distances and modes of transport.3. If, in applying this Article, more than one transaction value of identical goods is found, the lowest such value shall be used to determine the customs value of the imported goods.Article 3 back to top1. (a) If the customs value of the imported goods cannot be determined under the provisions of Articles 1 and 2, the customs value shall be the transaction value of similar goods sold for export to the same country ofimportation and exported at or about the same time as the goods being valued.(b) In applying this Article, the transaction value of similar goods in a sale at the same commercial level and in substantially the same quantity as the goods being valued shall be used to determine the customs value. Where no such sale is found, the transaction value of similar goods sold at a different commercial level and/or in different quantities, adjusted to take account of differences attributable to commercial level and/or to quantity, shall be used, provided that such adjustments can be made on the basis of demonstrated evidence which clearly establishes the reasonableness and accuracy of the adjustment, whether the adjustment leads to an increase or a decrease in the value.2. Where the costs and charges referred to in paragraph 2 of Article 8 are included in the transaction value, an adjustment shall be made to take account of significantdifferences in such costs and charges between the imported goods and the similar goods in question arising from differences in distances and modes of transport.3. If, in applying this Article, more than one transaction value of similar goods is found, the lowest such value shall be used to determine the customs value of the imported goods.Article 4 back to topIf the customs value of the imported goods cannot be determined under the provisions of Articles 1, 2 and 3, the customs value shall be determined under the provisions of Article 5 or, when the customs value cannot be determined under that Article, under the provisions of Article 6 except that, at the request of the importer, the order of application of Articles 5 and 6 shall be reversed.Article 5 back to top1. (a) If the imported goods or identical or similar imported goods are sold in the country of importation in the condition as imported, the customs value of the imported goods under the provisions of this Article shall be based on the unit price at which the imported goods or identical or similar imported goods are so sold in the greatest aggregate quantity, at or about the time of the importation of the goods being valued, to persons who are not related to the persons from whom they buy such goods, subject to deductions for the following:(i) either the commissions usually paid or agreed to be paid or the additions usually made for profit and general expenses in connection with sales in such country of imported goods of the same class or kind;(ii)) the usual costs of transport and insurance and associated costs incurred within the country of importation;(iii)) where appropriate, the costs and charges referred to in paragraph 2 of Article 8; and(iv)) the customs duties and other national taxes payable in the country of importation by reason of the importation or sale of the goods.(b) If neither the imported goods nor identical nor similar imported goods are sold at or about the time of importation of the goods being valued, the customs value shall, subject otherwise to the provisions of paragraph 1(a), be based on the unit price at which the imported goods or identical or similar imported goods are sold in the country of importation in the condition as imported at the earliest date after the importation of the goods being valued but before the expiration of 90 days after such importation.2. If neither the imported goods noridentical nor similar imported goods are sold in the country of importation in the condition as imported, then, if the importer so requests, the customs value shall be based on the unit price at which the imported goods, after further processing, are sold in the greatest aggregate quantity to persons in the country of importation who are not related to the persons from whom they buy such goods, due allowance being made for the value added by such processing and the deductions provided for in paragraph 1(a).Article 6 back to top1. The customs value of imported goods under the provisions of this Article shall be based on a computed value. Computed value shall consist of the sum of:(a) the cost or value of materials and fabrication or other processing employed in producing the imported goods;(b) an amount for profit and general expenses equal to that usually reflected in sales of goods of the same class or kind as the goods being valued which are made by producers in the country of exportation for export to the country of importation;(c) the cost or value of all other expenses necessary to reflect the valuation option chosen by the Member under paragraph 2 of Article 8.2. No Member may require or compel any person not resident in its own territory to produce for examination, or to allow access to, any account or other record for the purposes of determining a computed value. However, information supplied by the producer of the goods for the purposes of determining the customs value under the provisions of this Article may be verified in another country by the authorities of the country of importationwith the agreement of the producer and provided they give sufficient advance notice to the government of the country in question and the latter does not object to the investigation.Article 7 back to top1. If the customs value of the imported goods cannot be determined under the provisions of Articles 1 through 6, inclusive, the customs value shall be determined using reasonable means consistent with the principles and general provisions of this Agreement and of Article VII of GATT 1994 and on the basis of data available in the country of importation.2. No customs value shall be determined under the provisions of this Article on the basis of:(a) the selling price in the country of importation of goods produced in such country;(b) a system which provides for theacceptance for customs purposes of the higher of two alternative values;(c) the price of goods on the domestic market of the country of exportation;(d) the cost of production other than computed values which have been determined for identical or similar goods in accordance with the provisions of Article 6;(e) the price of the goods for export to a country other than the country of importation;(f) minimum customs values; or(g) arbitrary or fictitious values.3. If the importer so requests, the importer shall be informed in writing of the customs value determined under the provisions of this Article and the method used to determine such value.Article 8 back to top1. In determining the customs value under the provisions of Article 1, there shall be added to the price actually paid or payable for the imported goods:(a) the following, to the extent that they are incurred by the buyer but are not included in the price actually paid or payable for the goods:(i) commissions and brokerage, except buying commissions;(ii) the cost of containers which are treated as being one for customs purposes with the goods in question;(iii) the cost of packing whether for labour or materials;(b) the value, apportioned asappropriate, of the following goods and services where supplied directly or indirectly by the buyer free of charge or at reduced cost for use in connection with the production and sale for export of the imported goods, to the extent that such value has not been included in the price actually paid or payable:(i) materials, components, parts and similar items incorporated in the imported goods;(ii) tools, dies, moulds and similar items used in the production of the imported goods;(iii) materials consumed in the production of the imported goods;(iv) engineering, development, artwork, design work, and plans and sketches undertaken elsewhere than in the country of importation and necessary for the production of theimported goods;(c) royalties and licence fees related to the goods being valued that the buyer must pay, either directly or indirectly, as a condition of sale of the goods being valued, to the extent that such royalties and fees are not included in the price actually paid or payable;(d) the value of any part of the proceeds of any subsequent resale, disposal or use of the imported goods that accrues directly or indirectly to the seller.2. In framing its legislation, each Member shall provide for the inclusion in or the exclusion from the customs value, in whole or in part, of the following:(a) the cost of transport of the imported goods to the port or place of importation;(b) loading, unloading and handling charges associated with the transport of theimported goods to the port or place of importation; and(c) the cost of insurance.3. Additions to the price actually paid or payable shall be made under this Article only on the basis of objective and quantifiable data.4. No additions shall be made to the price actually paid or payable in determining the customs value except as provided in this Article.Article 9 back to top1. Where the conversion of currency is necessary for the determination of the customs value, the rate of exchange to be used shall be that duly published by the competent authorities of the country of importation concerned and shall reflect as effectively as possible, in respect of the period covered by each such document of publication, the current value of such currencyin commercial transactions in terms of the currency of the country of importation.2. The conversion rate to be used shall be that in effect at the time of exportation or the time of importation, as provided by each Member.Article 10 back to topAll information which is by nature confidential or which is provided on a confidential basis for the purposes of customs valuation shall be treated as strictly confidential by the authorities concerned who shall not disclose it without the specific permission of the person or government providing such information, except to the extent that it may be required to be disclosed in the context of judicial proceedings.Article 11back to top1. The legislation of each Member shall provide in regard to a determination ofcustoms value for the right of appeal, without penalty, by the importer or any other person liable for the payment of the duty.2. An initial right of appeal without penalty may be to an authority within the customs administration or to an independent body, but the legislation of each Member shall provide for the right of appeal without penalty to a judicial authority.3. Notice of the decision on appeal shall be given to the appellant and the reasons for such decision shall be provided in writing. The appellant shall also be informed of any rights of further appeal.Article 12 back to topLaws, regulations, judicial decisions and administrative rulings of general application giving effect to this Agreement shall be published in conformity with Article X of GATT 1994 by the country of importation concerned.Article 13 back to topIf, in the course of determining the customs value of imported goods, it becomes necessary to delay the final determination of such customs value, the importer of the goods shall nevertheless be able to withdraw them from customs if, where so required, the importer provides sufficient guarantee in the form of a surety, a deposit or some other appropriate instrument, covering the ultimate payment of customs duties for which the goods may be liable. The legislation of each Member shall make provisions for such circumstances.Article 14 back to topThe notes at Annex I to this Agreement form an integral part of this Agreement and the Articles of this Agreement are to be read and applied in conjunction with their respective notes. Annexes II and III also form an integral part ofthis Agreement.Article 15 back to top1. In this Agreement:(a) “customs value of imported goods” means the value of goods for the purposes of levying ad valorem duties of customs on imported goods;(b) “country of importation” means country or customs territory of importation; and(c) “produced” includes grown, manufactured and mined.2. In this Agreement:(a) “identical goods” means goods which are the same in all respects, including physical characteristics, quality and reputation. Minor differences in appearance would not preclude goods otherwise conforming to thedefinition from being regarded as identical;(b) “similar goods” means goods which, although not alike in all respects, have like characteristics and like component materials which enable them to perform the same functions and to be commercially interchangeable. The quality of the goods, their reputation and the existence of a trademark are among the factors to be considered in determining whether goods are similar;(c) the terms “identical goods” and “similar goods” do not include, as the case may be, goods which incorporate or reflect engineering, development, artwork, design work, and plans and sketches for which no adjustment has been made under paragraph 1(b)(iv) of Article 8 because such elements were undertaken in the country of importation;(d) goods shall not be regarded as “identical goods” or “similar goods” unless they were produced in the same country as the goods being valued;(e) goods produced by a different person shall be taken into account only when there are no identical goods or similar goods, as the case may be, produced by the same person as the goods being valued.3. In this Agreement “goods of the same class or kind” means goods which fall within a group or range of goods produced by a particular industry or industry sector, and includes identical or similar goods.4. For the purposes of this Agreement, persons shall be deemed to be related only if: (a) they are officers or directors of one another’s businesses;(b) they are legally recognized partners in business;(c) they are employer and employee;(d) any person directly or indirectly owns, controls or holds 5 per cent or more of the outstanding voting stock or shares of both of them;(e) one of them directly or indirectly controls the other;(f) both of them are directly or indirectly controlled by a third person;(g) together they directly or indirectly control a third person; or(h) they are members of the same family.5. Persons who are associated in business with one another in that one is the sole agent, sole distributor or sole concessionaire,however described, of the other shall be deemed to be related for the purposes of this Agreement if they fall within the criteria of paragraph 4.Article 16 back to topUpon written request, the importer shall have the right to an explanation in writing from the customs administration of the country of importation as to how the customs value of the importer’s goods was determined.Article 17 back to topNothing in this Agreement shall be construed as restricting or calling into question the rights of customs administrations to satisfy themselves as to the truth or accuracy of any statement, document or declaration presented for customs valuation purposes.Part II: Administration, Consultations And Dispute SettlementArticle 18: Institutions back to top1. There is hereby established a Committee on Customs Valuation (referred to in this Agreement as “the Committee”) composed of representatives from each of the Members. The Committee shall elect its own Chairman and shall normally meet once a year, or as is otherwise envisaged by the relevant provisions of this Agreement, for the purpose of affording Members the opportunity to consult on matters relating to the administration of the customs valuation system by any Member as it might affect the operation of this Agreement or the furtherance of its objectives and carrying out such other responsibilities as may be assigned to it by the Members. The WTO Secretariat shall act as the secretariat to the Committee.2. There shall be established a Technical Committee on Customs Valuation (referred to in this Agreement as “the Technical Committee”) under the auspices of the Customs Co-operation Council (referred to in thisAgreement as “the CCC”), which shall carry out the responsibilities described in Annex II to this Agreement and shall operate in accordance with the rules of procedure contained therein.Article 19: Consultations and Dispute Settlement back to top1. Except as otherwise provided herein, the Dispute Settlement Understanding is applicable to consultations and the settlement of disputes under this Agreement.2. If any Member considers that any benefit accruing to it, directly or indirectly, under this Agreement is being nullified or impaired, or that the achievement of any objective of this Agreement is being impeded, as a result of the actions of another Member or of other Members, it may, with a view to reaching a mutually satisfactory solution of this matter, request consultations with the Member or Members in question. Each Member shall afford sympathetic consideration to any requestfrom another Member for consultations.3. The Technical Committee shall provide, upon request, advice and assistance to Members engaged in consultations.4. At the request of a party to the dispute, or on its own initiative, a panel established to examine a dispute relating to the provisions of this Agreement may request the Technical Committee to carry out an examination of any questions requiring technical consideration. The panel shall determine the terms of reference of the Technical Committee for the particular dispute and set a time period for receipt of the report of the Technical Committee. The panel shall take into consideration the report of the Technical Committee. In the event that the Technical Committee is unable to reach consensus on a matter referred to it pursuant to this paragraph, the panel should afford the parties to the dispute an opportunity to present their views on the matter to the panel.5. Confidential information provided to the panel shall not be disclosed without formal authorization from the person, body or authority providing such information. Where such information is requested from the panel but release of such information by the panel is not authorized, a non-confidential summary of this information, authorized by the person, body or authority providing the information, shall be provided.Part III: Special And Differential TreatmentArticle 20 back to top1. Developing country Members not party to the Agreement on Implementation of Article VII of the General Agreement on Tariffs and Trade done on 12 April 1979 may delay application of the provisions of this Agreement for a period not exceeding five years from the date of entry into force of the WTO Agreement for such Members. Developingcountry Members who choose to delay application of this Agreement shall notify the Director-General of the WTO accordingly.2. In addition to paragraph 1, developing country Members not party to the Agreement on Implementation of Article VII of the General Agreement on Tariffs and Trade done on 12 April 1979 may delay application of paragraph 2(b)(iii) of Article 1 and Article 6 for a period not exceeding three years following their application of all other provisions of this Agreement. Developing country Members that choose to delay application of the provisions specified in this paragraph shall notify the Director-General of the WTO accordingly.3. Developed country Members shall furnish, on mutually agreed terms, technical assistance to developing country Members that so request. On this basis developed country Members shall draw up programmes of technical assistance which may include, inter alia, training of personnel,。

英文报关合同模板Customs Clearance Contract Template。

This Customs Clearance Contract (the "Contract") is entered into by and between [Importer/Exporter Name], with a principal place of business at [Address], hereinafter referred to as "Importer/Exporter", and [Customs Broker Name], with a principal place of business at [Address], hereinafter referred to as "Customs Broker".1. Scope of Services。

1.1 The Importer/Exporter hereby engages the Customs Broker to provide customs clearance services for the import and export of goods as specified in the attached list of goods (the "Goods").1.2 The Customs Broker agrees to provide the following services:a. Preparation and submission of all necessary documentation to the relevant customs authorities for the clearance of the Goods.b. Payment of any customs duties, taxes, or other fees on behalf of the Importer/Exporter, as required.c. Coordination with relevant government agencies to ensure compliance with all import and export regulations.d. Providing the Importer/Exporter with regular updates on the status of the customs clearance process.2. Obligations of the Importer/Exporter。

英文清关合同范本Customs Clearance ContractThis Customs Clearance Contract (the "Contract") is made and entered into as of [date] and between:Party A:Name: [Party A's Name]Address: [Party A's Address]Contact Person: [Contact Person's Name]Telephone Number: [Telephone Number]E: [E Address]Party B:Name: [Party B's Name]Address: [Party B's Address]Contact Person: [Contact Person's Name]Telephone Number: [Telephone Number]E: [E Address]WHEREAS, Party A requires customs clearance services for certn goods, and Party B is engaged in the business of providing customs clearance services.NOW, THEREFORE, in consideration of the mutual covenants and agreements contned herein, the parties agree as follows:1. Services to be ProvidedParty B shall provide customs clearance services for the goods of Party A in accordance with the applicable laws, regulations, and customs requirements. The services shall include but not be limited to:Preparation and submission of customs declaration documents.Handling of customs inspections and examinations.Payment of customs duties, taxes, and other charges on behalf of Party A.Obtning necessary customs clearances and permits.2. Obligations of Party AParty A shall:Provide Party B with accurate and plete information regarding the goods, including but not limited to the description, quantity, value, and origin of the goods.Cooperate with Party B in the customs clearance process, including providing necessary documents and assisting in any inquiries or inspections the customs authorities.Pay Party B the service fees as stipulated in this Contract in a timely manner.3. Obligations of Party BParty B shall:Perform the customs clearance services with due diligence and in a professional manner.Keep Party A informed of the progress of the customs clearance process and promptly notify Party A of any issues or problems that may arise.Mntn the confidentiality of the information provided Party A.4. Service Fees and PaymentThe service fees for the customs clearance services shall be [amount] and shall be pd Party A to Party B within [number of days] after the pletion of the customs clearance. Party A shall make the payment to the bank account designated Party B.5. Delivery of GoodsUpon successful customs clearance, Party B shall deliver the goods to the designated location as instructed Party A.6. Liability and IndemnificationParty B shall be liable for any losses or damages caused its negligence or flure to perform the customs clearance services in accordance with this Contract. However, Party B shall not be liable for any losses or damages resulting from circumstances beyond its control, such as force majeure events.Party A shall indemnify Party B agnst any clms, losses, or damages arising from the inaccuracy or inpleteness of the information provided Party A or from Party A's flure to ply with the applicable laws and regulations.7. ConfidentialityBoth parties shall keep the contents of this Contract and the information related to the customs clearance services confidential and shall not disclose such information to any third party without the prior written consent of the other party.8. Force MajeureIf either party is unable to perform its obligations under this Contract due to a force majeure event, such as natural disasters, war, or government actions, the affected party shall notify the other party as soon as possible and shall take reasonable measures to minimize the impact of the event. The performance of the affected party's obligations shall be suspended for the duration of the force majeure event.9. Dispute ResolutionAny disputes arising out of or in connection with this Contract shall be resolved through友好协商 (friendly negotiation). If the parties fl to reach an agreement through negotiation, the dispute shall be submitted to arbitration in accordance with the rules of [arbitration institution]. The arbitration award shall be final and binding on both parties.10. Governing Law and JurisdictionThis Contract shall be governed and construed in accordance with the laws of [jurisdiction]. Any legal action or proceeding arising out of or in connection with this Contract shall be brought in the courts of [jurisdiction].11. Entire AgreementThis Contract constitutes the entire agreement between the parties with respect to the subject matter hereof and supersedes all prior agreements and understandings, whether written or oral.12. Amendment and TerminationThis Contract may be amended or terminated only a written agreement signed both parties.IN WITNESS WHEREOF, the parties have executed this Contract as of the date first above written.Party A: ______________________Signature: ______________________ Date: ______________________ Party B: ______________________ Signature: ______________________ Date: ______________________。

This Customs Clearance Agent Appointment Agreement (the "Agreement") is entered into as of [Date], by and between the following parties:[Company Name]Address: [Company Address]Contact Person: [Name]Phone: [Phone Number]Email: [Email Address]Hereinafter referred to as "Principal."[Freight Forwarder Name]Address: [Freight Forwarder Address]Contact Person: [Name]Phone: [Phone Number]Email: [Email Address]Hereinafter referred to as "Agent."Recitals:WHEREAS, Principal is engaged in the import/export business and requires the services of an Agent to act as its customs clearance agent for the purposes of clearing goods through customs; andWHEREAS, Agent is a qualified and experienced customs clearance agent willing to provide such services to Principal;NOW, THEREFORE, in consideration of the mutual covenants and agreements contained herein, the parties hereto agree as follows:1. Appointment and Scope of Services1.1 Principal hereby appoints Agent as its exclusive customs clearance agent for the purposes of clearing goods through customs, in accordance with the terms and conditions set forth in this Agreement.1.2 The scope of services provided by Agent under this Agreement shall include, but not be limited to, the following:- Preparing and submitting all necessary customs documents for the import/export of goods;- Assisting Principal in obtaining customs clearance for the goods;- Ensuring compliance with all applicable customs regulations and laws;- Handling all customs inspections and audits;- Representing Principal in any customs disputes or claims.2. Obligations of Principal2.1 Principal shall provide Agent with all necessary information and documentation required for the customs clearance of goods, including, but not limited to, commercial invoices, packing lists, bills of lading, and other relevant documents.2.2 Principal shall pay Agent the agreed-upon fees for the services provided under this Agreement, in accordance with the payment terms set forth herein.2.3 Principal shall be responsible for the accuracy and completeness of all information and documentation provided to Agent.3. Obligations of Agent3.1 Agent shall act in a professional and diligent manner in performing the services required under this Agreement.3.2 Agent shall ensure that all customs clearance activities are carried out in compliance with applicable customs regulations and laws.3.3 Agent shall promptly inform Principal of any issues or delays that may affect the customs clearance process.4. Fees and Payment Terms4.1 Agent shall submit to Principal an itemized invoice for all services rendered under this Agreement, detailing the nature of the services provided and the corresponding fees.4.2 Principal shall pay Agent the fees invoiced in accordance with the payment terms agreed upon by the parties, which may include a deposit or advance payment prior to the commencement of services, and regular payments following the completion of each customs clearance.5. Confidentiality5.1 The parties agree to maintain the confidentiality of all information and documentation exchanged between them during the term of this Agreement and for a period of [X] years thereafter.6. Term and Termination6.1 This Agreement shall commence on the [Date] and shall remain in effect until terminated by either party upon [X] days' written notice to the other party.6.2 Either party may terminate this Agreement immediately in the event of a breach of any material term hereof by the other party, providedthat the breaching party has failed to cure such breach within [X] days after receipt of written notice thereof.7. Governing Law and Dispute Resolution7.1 This Agreement shall be governed by and construed in accordance with the laws of [Jurisdiction].7.2 Any disputes arising out of or in connection with this Agreement shall be resolved through am。

报关买卖合同范本英文Customs Declaration Sales AgreementThis Customs Declaration Sales Agreement (the "Agreement") is made and entered into as of the __________ day of __________, 20__, by and between __________ ("Seller"), with itsprincipal place of business at __________, and __________ ("Buyer"), with its principal place of business at __________.1. Subject Matter of the Agreement1.1 The Seller agrees to sell, and the Buyer agrees to purchase, the goods described in Schedule A (the "Goods"), subject to the terms and conditions set forth herein.2. Price and Payment2.1 The purchase price for the Goods shall be __________ (the "Purchase Price"), payable in accordance with the payment schedule set forth in Schedule B.2.2 The Buyer shall make payment in the manner and currency specified in Schedule B. Time is of the essence with respectto payment.3. Delivery and Customs Declaration3.1 The Seller shall deliver the Goods to the port of exportspecified in Schedule C, in accordance with the Incoterms specified in Schedule D.3.2 The Seller shall be responsible for all customs declarations and clearances required for the export of the Goods from the country of origin.3.3 The Buyer shall be responsible for all customsdeclarations and clearances required for the import of the Goods into the country of destination.4. Inspection and Acceptance4.1 The Buyer shall have the right to inspect the Goods prior to shipment. If the Goods do not conform to thespecifications set forth in Schedule A, the Buyer shallnotify the Seller within __________ days of the inspection.4.2 Acceptance of the Goods by the Buyer shall be deemed to have occurred upon the Buyer's written acknowledgment of receipt of the Goods in accordance with the specifications.5. Warranty5.1 The Seller warrants that the Goods are free from defectsin material and workmanship and conform to the specifications set forth in Schedule A for a period of __________ from the date of delivery.5.2 The Seller shall, at its own expense, repair or replace any Goods that do not conform to the warranty provided herein.6. Limitation of Liability6.1 The Seller's liability for any breach of this Agreement shall be limited to the Purchase Price paid by the Buyer for the Goods.6.2 In no event shall the Seller be liable for any indirect, incidental, special, or consequential damages arising out of or in connection with this Agreement.7. Termination7.1 Either party may terminate this Agreement by written notice if the other party breaches any material term of this Agreement and fails to cure such breach within __________ days after receipt of written notice thereof.7.2 Upon termination, the Seller shall be entitled to payment for all Goods delivered and accepted by the Buyer prior to the effective date of termination.8. Force Majeure8.1 Neither party shall be liable for any failure or delay in performing its obligations under this Agreement to the extent that such failure or delay is caused by circumstances beyond the reasonable control of that party, including but not limited to, acts of God, war, terrorism, civil unrest, labor disputes, or any other causes beyond the reasonable control of the affected party.9. Confidentiality9.1 Each party agrees to keep confidential all information received from the other party that is designated as confidential or that a reasonable person would understand to be confidential.10. Governing Law and Dispute Resolution10.1 This Agreement shall be governed by and construed in accordance with the laws of the __________.10.2 Any disputes arising out of or in connection with this Agreement shall be resolved by arbitration in accordance with the rules of the __________.11. Entire Agreement11.1 This Agreement constitutes the entire agreement between the parties with respect to the subject matter hereof and supersedes all prior and contemporaneous agreements and understandings, whether written or oral.12. Amendment12.1 This Agreement may be amended only in writing signed by both parties.13. Notices13.1 All notices and other communications given or made pursuant to this Agreement shall be in writing and shall be deemed effectively given upon personal delivery, receipt of telegraphic confirmation, or three days after deposit in the mail as certified or registered mail with postage prepaid.14. Assignment14.1 The Buyer shall not assign this Agreement or any of its rights or obligations hereunder without the prior written consent of the Seller.IN WITNESS WHEREOF, the parties have executed this Agreement as of the date first above written.Seller: __________By: __________Buyer: __________By: __________Title: __________Schedule A: Description of GoodsSchedule B: Payment ScheduleSchedule C: Port of ExportSchedule D: Incoterms[Note: The Schedules should be attached and contain the specific。

英文清关合同范本合同编号:_______甲方(委托方):_______乙方(代理方):_______根据《中华人民共和国合同法》及相关法律法规的规定,甲乙双方在平等、自愿、公平、诚实信用的原则基础上,就甲方委托乙方代理办理货物清关事宜,达成如下协议:一、货物信息1.1 货物名称:_______1.2 货物数量:_______1.3 货物价值:_______1.4 货物产地:_______1.5 货物HS编码:_______二、清关服务内容2.1 乙方应根据甲方提供的货物信息,负责办理货物的清关手续,包括但不限于申报、缴税、查验、放行等。

2.2 乙方应在接到甲方委托后,及时向海关提交相关单证,确保货物顺利通关。

2.3 乙方应协助甲方处理海关查验、质疑等事宜,确保货物通关的顺利进行。

2.4 乙方应在货物清关完成后,及时将清关单证及相关资料交付给甲方。

三、费用及支付3.1 甲方应按照乙方提供的清关费用明细支付清关费用。

3.2 清关费用包括但不限于报关费、关税、增值税、消费税、查验费等。

3.3 甲方应在货物清关完成后_______日内支付清关费用。

四、甲方责任4.1 甲方应确保所提供货物信息的真实性、准确性和完整性。

4.2 甲方应按照乙方的要求,及时提供办理清关手续所需的相关单证和资料。

4.3 甲方应按照本合同约定支付清关费用。

五、乙方责任5.1 乙方应按照甲方提供的货物信息,及时办理清关手续。

5.2 乙方应确保清关手续的合法性、合规性。

5.3 乙方应在货物清关完成后,及时将清关单证及相关资料交付给甲方。

六、保密条款6.1 双方在履行本合同过程中所获悉的对方商业秘密和技术秘密,应予以严格保密。

6.2 保密期限自本合同签订之日起算,至本合同终止或履行完毕之日止。

七、违约责任7.1 一方违反本合同的约定,导致合同无法履行或造成对方损失的,应承担违约责任。

7.2 甲方未按照约定支付清关费用的,乙方有权拒绝办理清关手续,并要求甲方支付滞纳金。

清关合同模板英文This Customs Clearance Contract (the "Contract") is entered into on [Date] by and between [Exporter], with a business address at [Address] (the "Exporter"), and [Customs Broker], with a business address at [Address] (the "Customs Broker").1. Appointment of Customs BrokerExporter hereby appoints Customs Broker as its exclusive customs broker for the purpose of clearing and handling customs formalities for all goods to be exported by Exporter. Customs Broker agrees to provide all necessary services to ensure timely and efficient customs clearance of Exporter's goods.2. Scope of ServicesCustoms Broker agrees to provide the following services in accordance with the terms of this Contract:- Preparation and submission of all necessary documentation to customs authorities for clearance of goods- Communication with customs authorities on behalf of Exporter- Payment of any duties, taxes, or fees required for the clearance of goods- Handling of any disputes or issues related to customs clearance- Coordination with other relevant parties, such as freight forwarders, carriers, and government agencies, to facilitate customs clearance3. Fees and PaymentExporter agrees to pay Customs Broker a fee for the services provided under this Contract. The fee shall be calculated based on the volume or value of goods being cleared and shall be agreed upon by both parties prior to the commencement of services. Payment shall be made in [Currency] within [Number] days of receipt of an invoice from Customs Broker.4. Compliance with Laws and RegulationsExporter agrees to provide all necessary documentation and information to Customs Broker to ensure compliance with all relevant laws and regulations governing the export of goods. Customs Broker shall not be liable for any delays or penalties resulting from Exporter's failure to provide such information.5. IndemnificationExporter agrees to indemnify and hold harmless Customs Broker from any claims, damages, or liabilities arising out of Exporter's breach of this Contract or any violation of laws or regulations related to the export of goods.6. TerminationEither party may terminate this Contract with [Number] days' written notice. In the event of termination, Customs Broker shall be entitled to payment for all services rendered up to the date of termination.7. ConfidentialityBoth parties agree to keep all information exchanged in connection with this Contract confidential and not to disclose it to any third party without the other party's consent.8. Governing LawThis Contract shall be governed by and construed in accordance with the laws of[State/Country].9. Entire AgreementThis Contract constitutes the entire agreement between the parties with respect to the subject matter hereof and supersedes all prior agreements and understandings, whether written or oral.IN WITNESS WHEREOF, the parties hereto have executed this Contract as of the date first above written.[Exporter]By: ____________________________Name: __________________________Title: ___________________________[Customs Broker]By: ____________________________Name: __________________________Title: ___________________________。

fob术语合同范本英文Contract for Sale of Goods under FOB TermsThis Contract is made and entered into on [date] between [Buyer's name and address] (hereinafter referred to as the "Buyer") and [Seller's name and address] (hereinafter referred to as the "Seller").1. Commodity and SpecificationThe Seller agrees to sell and the Buyer agrees to buy [description of goods] (hereinafter referred to as the "Goods") in accordance with the following specifications: [specify detls]2. QuantityThe quantity of the Goods is [quantity].3. PriceThe price of the Goods is [price] per [unit], FOB [port of shipment]. The total price is [total amount].4. DeliveryThe Seller shall deliver the Goods on board the vessel nominated the Buyer at the port of shipment on or before [delivery date]. The risk of loss or damage to the Goods shall pass from the Seller to the Buyer when the Goods have passed over the ship's rl at the port of shipment.5. Shipping ArrangementsThe Buyer shall arrange for the shipping of the Goods and bear all costs and risks associated with the transportation from the port of shipment.6. InspectionThe Buyer has the right to inspect the Goods before shipment. If the Buyer finds any non-conformity or defect, the Seller shall make necessary corrections or replacements.7. PaymentThe Buyer shall make payment to the Seller as follows: [payment terms and conditions]8. Force MajeureNeither party shall be liable for flure or delay in performance of this Contract due to force majeure events beyond their reasonable control.9. Dispute ResolutionAny dispute arising from or in connection with this Contract shall be resolved through friendly negotiation. If the negotiation fls, the dispute shall be submitted to arbitration in accordance with the rules of [arbitration institution].10. Governing LawThis Contract shall be governed and construed in accordance with the laws of [applicable law jurisdiction].IN WITNESS WHEREOF, the parties hereto have caused this Contract to be executed their duly authorized representatives as of the date first above written.Buyer: [Buyer's signature and name]Seller: [Seller's signature and name]Please note that this is a basic template and may need to be customized and adjusted based on the specific circumstances and requirements of your transaction. It is remended to consult with a legal professional for a prehensive and legally binding contract.。