中央财经大学公司理财第1章

- 格式:ppt

- 大小:1.28 MB

- 文档页数:36

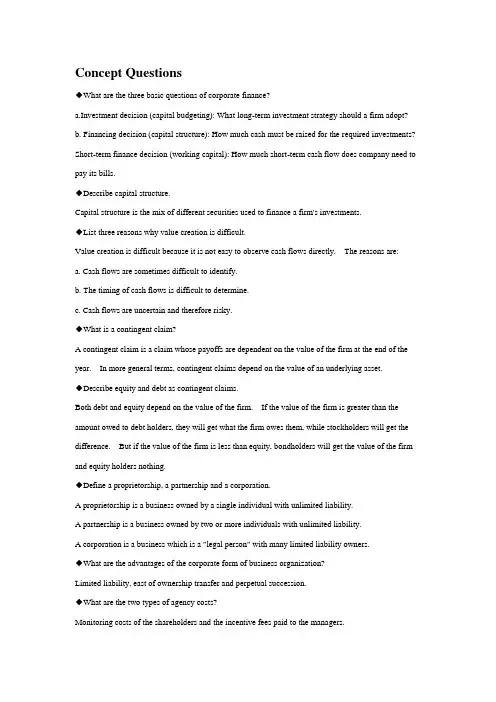

Concept Questions◆What are the three basic questions of corporate finance?a.Investment decision (capital budgeting): What long-term investment strategy should a firm adopt?b. Financing decision (capital structure): How much cash must be raised for the required investments? Short-term finance decision (working capital): How much short-term cash flow does company need to pay its bills.◆Describe capital structure.Capital structure is the mix of different securities used to finance a firm's investments.◆List three reasons why value creation is difficult.Value creation is difficult because it is not easy to observe cash flows directly. The reasons are:a. Cash flows are sometimes difficult to identify.b. The timing of cash flows is difficult to determine.c. Cash flows are uncertain and therefore risky.◆What is a contingent claim?A contingent claim is a claim whose payoffs are dependent on the value of the firm at the end of the year. In more general terms, contingent claims depend on the value of an underlying asset.◆Describe equity and debt as contingent claims.Both debt and equity depend on the value of the firm. If the value of the firm is greater than the amount owed to debt holders, they will get what the firm owes them, while stockholders will get the difference. But if the value of the firm is less than equity, bondholders will get the value of the firm and equity holders nothing.◆Define a proprietorship, a partnership and a corporation.A proprietorship is a business owned by a single individual with unlimited liability.A partnership is a business owned by two or more individuals with unlimited liability.A corporation is a business which is a "legal person" with many limited liability owners.◆What are the advantages of the corporate form of business organization?Limited liability, east of ownership transfer and perpetual succession.◆What are the two types of agency costs?Monitoring costs of the shareholders and the incentive fees paid to the managers.◆How are managers bonded to shareholders?Shareholders determine the membership to the board of directors, which selects management. Management contracts and incentives are build into compensation arrangements.If a firm is taken over because the firm's price dropped, managers could lose their jobs. Competition in the managerial labor market makes managers perform in the best interest of stockholders.◆Can you recall some managerial goals?Maximization of corporate wealth, growth and company size.◆What is the set-of-contracts perspective?The view of the corporation as a set of contracting relationships among individuals who have conflicting objectives.◆Distinguish between money markets and capital markets.Money markets are markets for debt securities that pay off in less than one year, while capital markets are markets for long-term debt and equity shares.◆What is listing?Listing refers to the procedures by which a company applies and qualifies so that its stock can be traded on the New York Stock Exchange.◆What is the difference between a primary market and a secondary market?The primary market is the market where issuers of securities sell them for the first time to investors, while a secondary market is a market for securities previously issued.。

公司理财课程作业第1阶段一、单选题1.(2分)下列关于优先股的说法中不正确的是()• A. A、优先股股东对公司的投资在公司注册成立后可以抽回• B. B、其投资收益从公司的税后利润中提取• C. C、在公司清算时其对公司财产的要求权也排在公司债权人之后• D. D、从公司资本结构上看,优先股属于公司的权益资本。

纠错得分:2知识点: 4.2 长期融资收起解析A2.(2分)A与B两个项目寿命期不同,A项目的初始投资为40000元,净年费用3000元,计算期为4年;B项目初始投资为25000元,净年费用为4500元,计算期为3年。

基准利率为10%,通过计算等价年金,最佳方案为()。

• A. A• B. B• C. A和B无差异• D. 无法确定纠错得分:2知识点: 2.1 货币的时间价值收起解析B3.(2分)市场组合的期望收益率为12.8%,其风险报酬率为4.3%,T公司股票的β值为0.8 64,则该公司股票的期望收益率为()。

• A. 10.97%• B. 11.25%• C. 11.48%• D. 12.22%纠错得分:2知识点: 2.2 收益与风险的关系收起解析D4.(2分)某项目的初始投资额为100000,寿命为6年,每年可产生30000元的净现金流入量,若此项目要求的贴现率为12%,该项目的净现值为()。

• A. 19880• B. 23330• C. 25540• D. 27770纠错得分:2知识点: 3.2 确定条件下的资本预算收起解析B5.(2分)以下对公司财务管理目标的描述最正确的是()。

• A. 利润最大化• B. 股东财富最大化• C. 企业价值最大化• D. 每股收益最大化纠错得分:2知识点: 1.1 公司理财概述收起解析C企业价值最大化6.(2分)公司A的股票的期望收益率为30%,标准差为10%。

公司B的股票期望收益率为4 0%,标准差为20%,则()的风险较高。

• A. A• B. B• C. A和B无差异• D. 无法确定纠错得分:2知识点: 2.2 收益与风险的关系收起解析B7.(2分)下列哪项是在计算相关现金流时需要计算的()。

第一章(P14)1.股东是公司的所有者。

股东选举公司的董事会,董事会任命该公司的管理层。

企业的所有权和控制权分离的组织形式是导致的代理关系存在的主要原因。

管理者可能追求自身或别人的利益最大化,而不是股东的利益最大化,可能因为目标不一致而存在代理问题。

2.非营利公司经常追求社会或政治任务等各种目标。

非营利公司财务管理的目标是获取并有效使用资金以最大限度地实现组织的社会使命。

3.这句话是不正确的。

管理者实施财务管理的目标就是最大化现有股票的每股价值,当前的股票价值反映了短期和长期的风险、时间以及未来现金流量。

4.比如在市场经济中所有的东西都被定价。

因此所有目标都有一个最优水平,包括避免不道德或非法的行为,股票价值最大化。

5.财务管理的目标都是相同的,但实现目标的最好方式可能是不同的,因为不同的国家有不同的社会、政治环境和经济制度。

6.管理层的目标是最大化股东现有股票的每股价值。

如果管理层认为能提高公司利润,使股价超过 35 美元,应该展开对恶意收购的斗争。

如果管理层认为该投标人或其它未知的投标人将支付超过每股35美元的价格收购公司,也应该展开斗争。

但是,如果管理层不能增加企业的价值,并且没有其他更高的投标价格,那么管理层不是在为股东的最大化权益行事。

现在的管理层经常在公司面临这些恶意收购的情况时迷失自己的方向。

7.不严重,因为他们的私人投资者占比重较小。

较少的私人投资者能减少不同的企业目标。

高比重的机构所有权导致高学历的股东和管理层讨论决策风险项目,减少决策失误,它也可以根据自己的资源和经验更好地对管理层实施有效的监督机制。

8.大型金融机构成为股票的主要持有者可能减少美国公司的代理问题,形成更有效率的公司控制权市场。

但也不一定,如果共同基金或者退休基金的管理层并不关心的投资者的利益,代理问题可能仍然存在,甚至有可能增加基金和投资者之间的代理问题。

9.市场需求首席执行官,首席执行官的薪酬是由市场决定的。