广州地区一般纳税人报税流程ppt课件

- 格式:ppt

- 大小:5.07 MB

- 文档页数:48

2024年一般纳税人报税流程下载温馨提示:该文档是我店铺精心编制而成,希望大家下载以后,能够帮助大家解决实际的问题。

文档下载后可定制随意修改,请根据实际需要进行相应的调整和使用,谢谢!并且,本店铺为大家提供各种各样类型的实用资料,如教育随笔、日记赏析、句子摘抄、古诗大全、经典美文、话题作文、工作总结、词语解析、文案摘录、其他资料等等,如想了解不同资料格式和写法,敬请关注!Download tips: This document is carefully compiled by theeditor.I hope that after you download them,they can help yousolve practical problems. The document can be customized andmodified after downloading,please adjust and use it according toactual needs, thank you!In addition, our shop provides you with various types ofpractical materials,such as educational essays, diaryappreciation,sentence excerpts,ancient poems,classic articles,topic composition,work summary,word parsing,copy excerpts,other materials and so on,want to know different data formats andwriting methods,please pay attention!2024年一般纳税人报税流程详解:轻松应对大征期挑战随着2024年4月的大征期到来,一般纳税人的报税工作再度成为财务会计人员关注的焦点。

2024年一般纳税人报税流程英文回答:Step 1: Prepare Your Documents.Gather all necessary documents, including:Business registration certificate.Income statements (e.g., profit and loss statement, balance sheet)。

Expense records.Invoices and receipts.Bank statements.Step 2: Choose a Filing Method.Select your preferred method of filing:Online:Electronic Tax Reporting System (eTRS)。

Tax Administration System (TAS)。

Offline:Submit paper forms to the tax office.Step 3: Calculate Your Tax Liability.Determine your taxable income and calculate the amount of income tax owed. Consider:Net income from business operations.Deductible expenses.Taxable deductions.Step 4: File Your Tax Return.Complete the necessary tax forms (eTRS/TAS or paper forms) with accurate information. Include all required supporting documents.Step 5: Pay Your Taxes.Settle your tax liability by the specified deadline. Payment options include:Online banking.Credit card.Cheque or cash.Step 6: Keep Records.Maintain records of your tax filing for future reference. Legal requirements apply.Additional Considerations:Deadlines: File your tax return before the prescribed due date.Penalties: Failure to file or pay taxes on time may result in penalties.Professional Assistance: Consult with a tax professional if needed.中文回答:2024年一般纳税人报税流程。

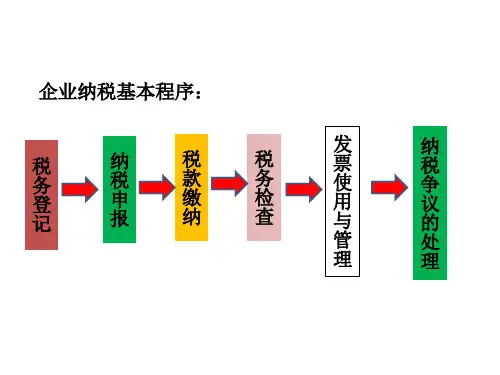

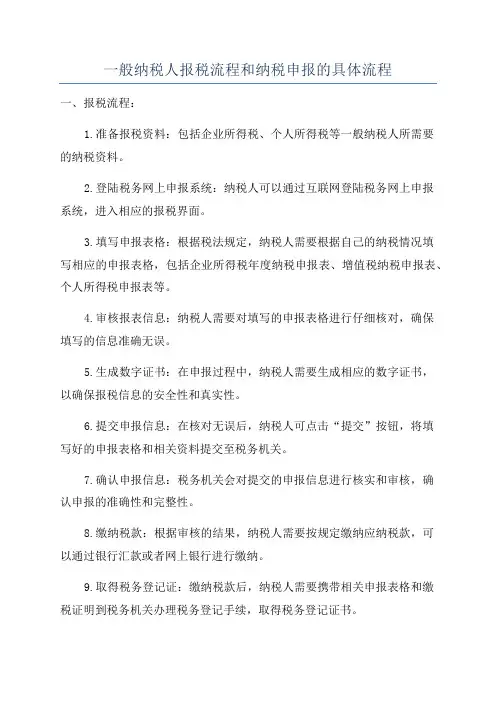

一般纳税人报税流程和纳税申报的具体流程一、报税流程:1.准备报税资料:包括企业所得税、个人所得税等一般纳税人所需要的纳税资料。

2.登陆税务网上申报系统:纳税人可以通过互联网登陆税务网上申报系统,进入相应的报税界面。

3.填写申报表格:根据税法规定,纳税人需要根据自己的纳税情况填写相应的申报表格,包括企业所得税年度纳税申报表、增值税纳税申报表、个人所得税申报表等。

4.审核报表信息:纳税人需要对填写的申报表格进行仔细核对,确保填写的信息准确无误。

5.生成数字证书:在申报过程中,纳税人需要生成相应的数字证书,以确保报税信息的安全性和真实性。

6.提交申报信息:在核对无误后,纳税人可点击“提交”按钮,将填写好的申报表格和相关资料提交至税务机关。

7.确认申报信息:税务机关会对提交的申报信息进行核实和审核,确认申报的准确性和完整性。

8.缴纳税款:根据审核的结果,纳税人需要按规定缴纳应纳税款,可以通过银行汇款或者网上银行进行缴纳。

9.取得税务登记证:缴纳税款后,纳税人需要携带相关申报表格和缴税证明到税务机关办理税务登记手续,取得税务登记证书。

二、纳税申报的具体流程:1.税务登记:纳税人首先需要到所在地的税务机关办理税务登记手续,核定纳税人的纳税人资格和税务等级,并领取税务登记证书。

2.纳税申报:按照所得税法规定的纳税期限,纳税人需要按规定的时间提交年度或季度的纳税申报表格和相关资料。

4.缴纳税款:纳税人根据审核结果,确定应纳税款后,需要按照规定时间和方式缴纳所得税款。

5.税务审查:税务机关可能对纳税人的纳税申报情况进行审查,对涉嫌违法违规的行为进行调查和处理。

6.税务登记变更:如有必要,纳税人需要及时办理税务登记变更手续,包括企业名称变更、经营范围变更等。