宏观经济学第六章习题及答案

- 格式:doc

- 大小:107.50 KB

- 文档页数:28

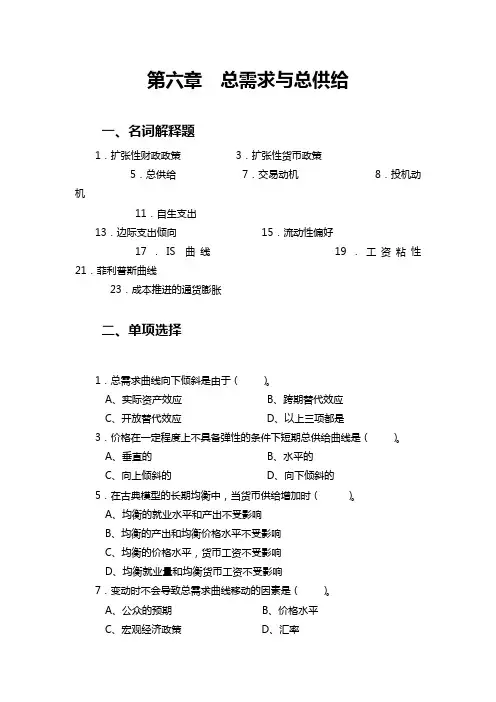

第六章总需求与总供给一、名词解释题1.扩张性财政政策 3.扩张性货币政策5.总供给 7.交易动机 8.投机动机 11.自生支出13.边际支出倾向 15.流动性偏好17.IS曲线19.工资粘性21.菲利普斯曲线23.成本推进的通货膨胀二、单项选择1.总需求曲线向下倾斜是由于()。

A、实际资产效应B、跨期替代效应C、开放替代效应D、以上三项都是3.价格在一定程度上不具备弹性的条件下短期总供给曲线是()。

A、垂直的B、水平的C、向上倾斜的D、向下倾斜的5.在古典模型的长期均衡中,当货币供给增加时()。

A、均衡的就业水平和产出不受影响B、均衡的产出和均衡价格水平不受影响C、均衡的价格水平,货币工资不受影响D、均衡就业量和均衡货币工资不受影响7.变动时不会导致总需求曲线移动的因素是()。

A、公众的预期B、价格水平C、宏观经济政策D、汇率9.“滞胀”理论不符合()观点。

A、货币主义B、凯恩斯主义C、理性预期学派D、实际经济周期11.假设可支配收入增加50元,消费支出增加45元,那么边际消费倾向为()。

A、0.05B、0.10C、0.90D、1.0013.按照凯恩斯的观点,人们需要货币,是出于()。

A、交易动机B、预防动机C、投机动机D、以上三项15.一般地说,位于LM曲线左方的收入和利率的组合,都是()。

A、货币需求大于货币供给的非均衡组合B、货币需求等于货币供给的均衡组合C、货币需求小于货币供给的非均衡组合D、产品需求小于产品供给的非均衡组合17.IS曲线向左方移动的条件是()。

A、总支出增加B、总支出减少C、价格水平下降D、价格水平上升19.IS曲线为y=500-2000 r,下列哪一个利率和收入水平的组合不在IS 曲线上()。

A、r=0.02,y=450B、r=0.05,y=400C、r=0.07,y=360D、r=0.10,y=30021.计划总支出曲线()。

A、是向上倾斜的B、是向下倾斜的C、是垂直的D、是水平的23.如果总存货等于计划存货,那么()。

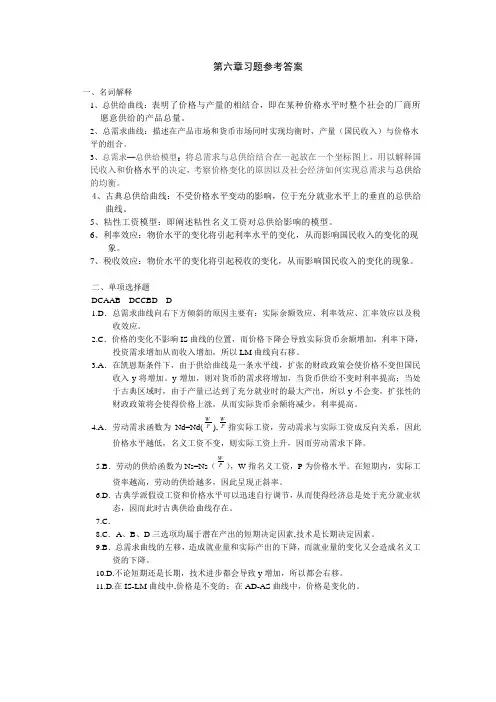

第六章习题参考答案一、名词解释1、总供给曲线:表明了价格与产量的相结合,即在某种价格水平时整个社会的厂商所愿意供给的产品总量。

2、总需求曲线:描述在产品市场和货币市场同时实现均衡时,产量(国民收入)与价格水平的组合。

3、总需求—总供给模型:将总需求与总供给结合在一起放在一个坐标图上,用以解释国民收入和价格水平的决定,考察价格变化的原因以及社会经济如何实现总需求与总供给的均衡。

4、古典总供给曲线:不受价格水平变动的影响,位于充分就业水平上的垂直的总供给曲线。

5、粘性工资模型:即阐述粘性名义工资对总供给影响的模型。

6、利率效应:物价水平的变化将引起利率水平的变化,从而影响国民收入的变化的现象。

7、税收效应:物价水平的变化将引起税收的变化,从而影响国民收入的变化的现象。

二、单项选择题DCAAB DCCBD D1.D.总需求曲线向右下方倾斜的原因主要有:实际余额效应、利率效应、汇率效应以及税收效应。

2.C.价格的变化不影响IS曲线的位置,而价格下降会导致实际货币余额增加,利率下降,投资需求增加从而收入增加,所以LM曲线向右移。

3.A.在凯恩斯条件下,由于供给曲线是一条水平线,扩张的财政政策会使价格不变但国民收入y将增加。

y增加,则对货币的需求将增加,当货币供给不变时利率提高;当处于古典区域时,由于产量已达到了充分就业时的最大产出,所以y不会变,扩张性的财政政策将会使得价格上涨,从而实际货币余额将减少,利率提高。

4.A.劳动需求函数为Nd=Nd(WP),WP指实际工资,劳动需求与实际工资成反向关系,因此价格水平越低,名义工资不变,则实际工资上升,因而劳动需求下降。

5.B.劳动的供给函数为Ns=Ns(WP),W指名义工资,P为价格水平。

在短期内,实际工资率越高,劳动的供给越多,因此呈现正斜率。

6.D.古典学派假设工资和价格水平可以迅速自行调节,从而使得经济总是处于充分就业状态,因而此时古典供给曲线存在。

7.C.8.C.A、B、D三选项均属于潜在产出的短期决定因素,技术是长期决定因素。

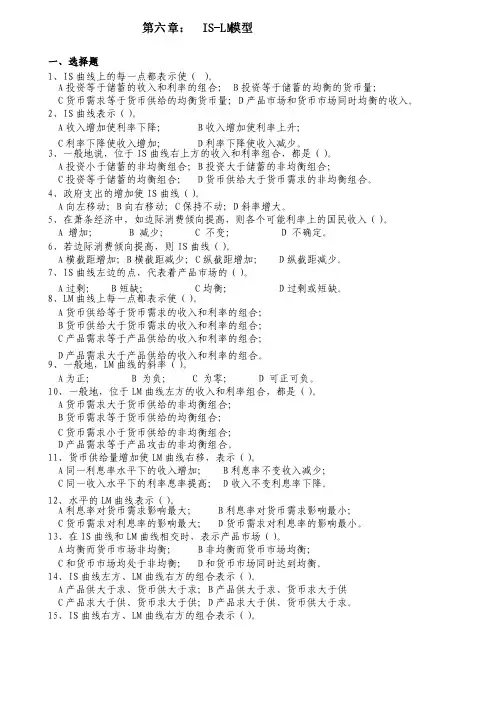

第六章: IS-LM模型一、选择题1、IS曲线上的每一点都表示使( )。

A投资等于储蓄的收入和利率的组合; B投资等于储蓄的均衡的货币量;C货币需求等于货币供给的均衡货币量;D产品市场和货币市场同时均衡的收入。

2、IS曲线表示()。

A收入增加使利率下降; B收入增加使利率上升;C利率下降使收入增加; D利率下降使收入减少。

3、一般地说,位于IS曲线右上方的收入和利率组合,都是()。

A投资小于储蓄的非均衡组合;B投资大于储蓄的非均衡组合;C投资等于储蓄的均衡组合; D货币供给大于货币需求的非均衡组合。

4、政府支出的增加使IS曲线()。

A向左移动;B向右移动;C保持不动;D斜率增大。

5、在萧条经济中,如边际消费倾向提高,则各个可能利率上的国民收入()。

A 增加;B 减少;C 不变;D 不确定。

6、若边际消费倾向提高,则IS曲线()。

A横截距增加;B横截距减少;C纵截距增加; D纵截距减少。

7、IS曲线左边的点,代表着产品市场的()。

A过剩; B短缺; C均衡; D过剩或短缺。

8、LM曲线上每一点都表示使()。

A货币供给等于货币需求的收入和利率的组合;B货币供给大于货币需求的收入和利率的组合;C产品需求等于产品供给的收入和利率的组合;D产品需求大于产品供给的收入和利率的组合。

9、一般地,LM曲线的斜率()。

A为正; B 为负; C 为零; D 可正可负。

10、一般地,位于LM曲线左方的收入和利率组合,都是()。

A货币需求大于货币供给的非均衡组合;B货币需求等于货币供给的均衡组合;C货币需求小于货币供给的非均衡组合;D产品需求等于产品攻击的非均衡组合。

11、货币供给量增加使LM曲线右移,表示()。

A同一利息率水平下的收入增加; B利息率不变收入减少;C同一收入水平下的利率息率提高; D收入不变利息率下降。

12、水平的LM曲线表示()。

A利息率对货币需求影响最大; B利息率对货币需求影响最小;C货币需求对利息率的影响最大; D货币需求对利息率的影响最小。

第六章开放经济一、选择题1.当一国的净资本流入为正值时:A 该国的资本账户处于盈余状态。

B 该国存在贸易盈余和资本账户盈余。

C 该国的资本账户处于平衡状态。

D 该国存在贸易赤字和资本账户赤字。

E 该国资本账户处于赤字状态。

答案:A2.以下选项正确的是:A 进口+出口=净资本流入。

B 进口=出口-净资本流入。

C 进口=出口+净资本流入。

D 进口+净资本流入=出口。

E 进口=净资本流入。

答案:C3.对于一个大国开放经济来说,紧缩性的财政政策对该国的长期影响是( C )A.国民储蓄的减少 B.利率上升 C.净出口的上升 D.产出减少4.在开放经济中:A 私人储蓄+净资本流入=投资+政府储蓄B 私人储蓄=净资本流入+投资+政府储蓄C 私人储蓄+投资=净资本流入+政府储蓄D 私人储蓄+政府储蓄+净资本流入=投资E 私人储蓄+净资本流入+投资=政府储蓄答案:D5.在小型开放经济中,预算赤字的上升将:A 降低利率和投资。

B 不改变利率或投资。

C提高利率和投资。

D 提高利率但降低投资。

E 降低利率但提高投资。

答案:B6.汇率是指:A 两国之间的贸易赤字。

B 一国的净资本流入。

C 两种货币的相对价格。

D 一国货币的升值率。

E 一国货币的贬值率。

答案:C7.在开放经济中,投资—储蓄恒等式表明:A 私人储蓄必定等于私人投资。

B 私人储蓄加上从国外的资本流入必定等于投资C 私人储蓄加上从国外的资本流入必定等于投资加上政府赤字。

D 私人储蓄加上从国外的资本流入必定等于政府赤字加上经常账户赤字。

E 私人储蓄加上从国外的资本流入必定等于政府赤字加上经常账户赤字再加上投资。

答案:C8.对美国而言,提高私人储蓄可能会:A 提高预算赤字。

B 降低预算赤字。

C 增加投资。

D 对利率和投资没有影响。

E 引起美元升值答案:C二、名词解释1.贸易逆差 2.贸易顺差 3.名义汇率 4.实际汇率1.贸易逆差:一国在一定时期内进口贸易总值大于出口总值。

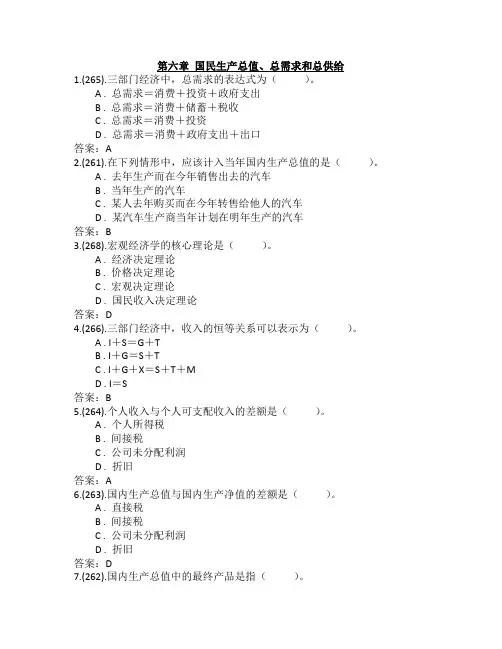

第六章国民生产总值、总需求和总供给1.(265).三部门经济中,总需求的表达式为()。

A . 总需求=消费+投资+政府支出B . 总需求=消费+储蓄+税收C . 总需求=消费+投资D . 总需求=消费+政府支出+出口答案:A2.(261).在下列情形中,应该计入当年国内生产总值的是()。

A . 去年生产而在今年销售出去的汽车B . 当年生产的汽车C . 某人去年购买而在今年转售给他人的汽车D . 某汽车生产商当年计划在明年生产的汽车答案:B3.(268).宏观经济学的核心理论是()。

A . 经济决定理论B . 价格决定理论C . 宏观决定理论D . 国民收入决定理论答案:D4.(266).三部门经济中,收入的恒等关系可以表示为()。

A . I+S=G+TB . I+G=S+TC . I+G+X=S+T+MD . I=S答案:B5.(264).个人收入与个人可支配收入的差额是()。

A . 个人所得税B . 间接税C . 公司未分配利润D . 折旧答案:A6.(263).国内生产总值与国内生产净值的差额是()。

A . 直接税B . 间接税C . 公司未分配利润D . 折旧答案:D7.(262).国内生产总值中的最终产品是指()。

A . 有形的产品B . 无形的产品C . 既包括有形的产品,也包括无形的产品D . 供以后的生产阶段作为投入的产品答案:C8.(267).净出口是指()。

A . 出口减进口B . 出口加进口C . 出口加政府转移支付D . 进口减出口答案:A9.(477).在理解国内生产总值时要注意()。

A . 国内生产总值是指最终产品的总值B . 国内生产总值是指一年内生产出来的产品的总值C . 国内生产总值指的是最终产品市场价值的总和D . 国内生产总值是指一年内在本国领土上所生产的最终产品的价值总和答案:ABCD10.(478).国内生产总值的计算方法主要有()。

A . 支出法B . 收入法C . 平衡法D . 动态法答案:AB11.(479).在国民收核算中,除了国内生产总值之外还有另外几个重要总量,它们是()。

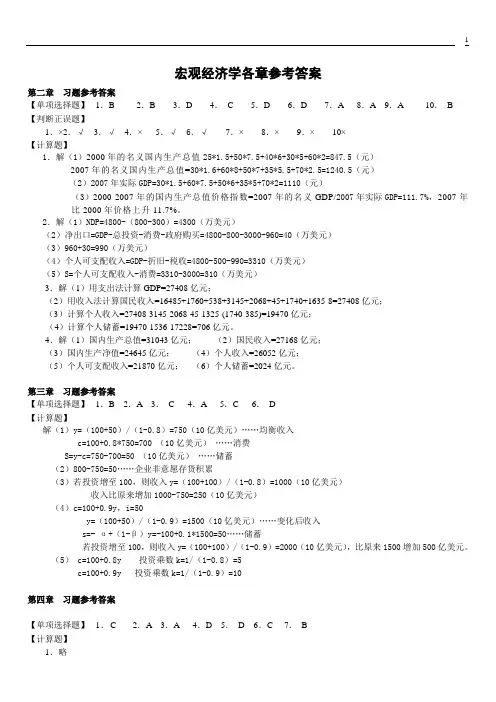

宏观经济学各章参考答案第二章习题参考答案【单项选择题】1.B 2.B 3.D 4.C 5.D 6.D 7.A 8.A 9.A 10.B 【判断正误题】1.×2.√3.√4.×5.√ 6.√7.×8.×9.×10×【计算题】1.解(1)2000年的名义国内生产总值25*1.5+50*7.5+40*6+30*5+60*2=847.5(元)2007年的名义国内生产总值=30*1.6+60*8+50*7+35*5.5+70*2.5=1240.5(元)(2)2007年实际GDP=30*1.5+60*7.5+50*6+35*5+70*2=1110(元)(3)2000-2007年的国内生产总值价格指数=2007年的名义GDP/2007年实际GDP=111.7%,2007年比2000年价格上升11.7%。

2.解(1)NDP=4800-(800-300)=4300(万美元)(2)净出口=GDP-总投资-消费-政府购买=4800-800-3000-960=40(万美元)(3)960+30=990(万美元)(4)个人可支配收入=GDP-折旧-税收=4800-500-990=3310(万美元)(5)S=个人可支配收入-消费=3310-3000=310(万美元)3.解(1)用支出法计算GDP=27408亿元;(2)用收入法计算国民收入=16485+1760+538+3145+2068+45+1740+1635-8=27408亿元;(3)计算个人收入=27408-3145-2068-45-1325-(1740-385)=19470亿元;(4)计算个人储蓄=19470-1536-17228=706亿元。

4.解(1)国内生产总值=31043亿元;(2)国民收入=27168亿元;(3)国内生产净值=24645亿元;(4)个人收入=26052亿元;(5)个人可支配收入=21870亿元;(6)个人储蓄=2024亿元。

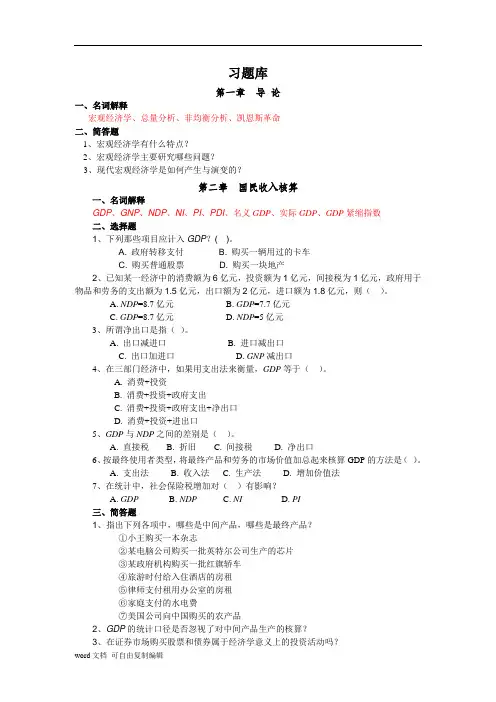

习题库第一章导论一、名词解释宏观经济学、总量分析、非均衡分析、凯恩斯革命二、简答题1、宏观经济学有什么特点?2、宏观经济学主要研究哪些问题?3、现代宏观经济学是如何产生与演变的?第二章国民收入核算一、名词解释GDP、GNP、NDP、NI、PI、PDI、名义GDP、实际GDP、GDP紧缩指数二、选择题1、下列那些项目应计入GDP?( )。

A. 政府转移支付B. 购买一辆用过的卡车C. 购买普通股票D. 购买一块地产2、已知某一经济中的消费额为6亿元,投资额为1亿元,间接税为1亿元,政府用于物品和劳务的支出额为1.5亿元,出口额为2亿元,进口额为1.8亿元,则()。

A. NDP=8.7亿元B. GDP=7.7亿元C. GDP=8.7亿元D. NDP=5亿元3、所谓净出口是指()。

A. 出口减进口B. 进口减出口C. 出口加进口D. GNP减出口4、在三部门经济中,如果用支出法来衡量,GDP等于()。

A. 消费+投资B. 消费+投资+政府支出C. 消费+投资+政府支出+净出口D. 消费+投资+进出口5、GDP与NDP之间的差别是()。

A. 直接税B. 折旧C. 间接税D. 净出口6、按最终使用者类型,将最终产品和劳务的市场价值加总起来核算GDP的方法是()。

A. 支出法B. 收入法C. 生产法D. 增加价值法7、在统计中,社会保险税增加对()有影响?A. GDPB. NDPC. NID. PI三、简答题1、指出下列各项中,哪些是中间产品,哪些是最终产品?①小王购买一本杂志②某电脑公司购买一批英特尔公司生产的芯片③某政府机构购买一批红旗轿车④旅游时付给入住酒店的房租⑤律师支付租用办公室的房租⑥家庭支付的水电费⑦美国公司向中国购买的农产品2、GDP的统计口径是否忽视了对中间产品生产的核算?3、在证券市场购买股票和债券属于经济学意义上的投资活动吗?4、为什么政府转移支付不能计入GDP?5、为什么间接税应该计入GDP?6、GDP指标有哪些缺陷或不足?7、为什么要区分名义国内生产总值和实际国内生产总值?8、国内生产总值与国民生产总值关系如何?四、计算题1、若某国GDP为8800单位,总投资为1150单位,净投资为292单位,消费为5800单位,政府购买的产品和劳务价值为1500单位,间接税为620单位,政府财政盈余为44单位,求该国NDP、净出口、个人可支配收入、个人储蓄各为多少。

第六单元通货膨胀与失业理论本单元所涉及到的主要知识点:1.通货膨胀的含义、衡量与种类2.通货膨胀的原因3.通货膨胀对经济的影响及其对策4.失业的含义与衡量5.失业的种类6.失业的原因7.失业的影响及其治理8.失业与通货膨胀的关系:菲利普斯曲线一、单项选择1.一般用来衡量通货膨胀的物价指数是( D )。

a.消费者物价指数; b.生产物价指数;c.GDP缩减指数; d.以上均正确。

2.可以称为温和的通货膨胀的情况是指( D)。

a.通货膨胀率以每年5%的速度增长; b.通货膨胀率在10%以上;c.通货膨胀率一直保持在2%-3%水平;d.通货膨胀率处于3%—10%之间。

3.通货膨胀的主要类型有( D )。

a.需求拉上型; b.成本推进型;c.结构型; d.以上均正确。

4.通货膨胀会( C )。

a.使国民收入提高到超过其平常水平;b.使国民收入下降到其平常水平以下;c.使国民收入提高或下降,主要看通货膨胀产生的原因;d.只有在经济处于潜在的产出水平时,国民收入才会增长。

5.在通货膨胀不能完全预期的情况下,通货膨胀将有利于( A )。

a.债务人; b;债权人;c.在职工人; d.离退休人员。

6.已知充分就业的国民收入是12000亿元,实际国民收入11800亿,边际消费倾向0.8,在增加3000亿的投资后,经济将发生( A )。

a.需求拉上通货膨胀;b.成本推进通货膨胀;c.结构性通货膨胀; d.需求不足的失业。

7.收入政策主要是用来治理( B )。

a.需求拉上的通货膨胀; b.成本推进的通货膨胀;c.结构性通货膨胀; d.供求混合通货膨胀。

8.抑制通货膨胀的收入政策是指( C )。

a.收入初次分配; b.收入再分配;c.收入—价格管制; d.以上均正确。

9.失业率是指( A )。

a.失业人口占劳动力的百分比; b.失业人数占人口总数的百分比; c.失业人数占就业人数的百分比; d.以上均正确。

10.充分就业的含义是(B )。

Chapter 6 Solutions to the Problems in the Textbook:Conceptual Problems:1. The aggregate supply curve and the Phillips curve describe very similar relationships and bothcurves can be used to analyze the same phenomena. The AS-curve shows a relationship between the price level and the level of output. The Phillips curve shows a relationship between the rate of inflation and the unemployment rate, given certain inflationary expectations. For example, a movement along the AS-curve depicts an increase in the price level that is associated with an increase in the level of output. As output increases, the rate of unemployment decreases (see Okun’s law).Therefore, with a larger increase in the price level (a higher level of inflation) there will be a decrease in unemployment, creating a downward-sloping Phillips curve.This downward sloping Phillips curve shifts whenever inflationary expectations change. If one assumes that workers will change their wage demands whenever their inflationary expectations change, one can conclude that a shift in the Phillips curve corresponds to a shift in the upward sloping AS-curve, since higher wages mean higher cost of production.2. In the short run, when wages and prices are assumed to be fixed, there can be no inflation and thusthe Phillips curve makes no sense over this very brief time frame. But in the medium run (in this chapter also often referred to as the short run), the Phillips curve is downward sloping as inflationary expectations are assumed to be constant. In the long run, the Phillips curve is vertical at the natural rate of unemployment, which corresponds to the vertical long-run AS-curve at the full-employment level of output.3. A variety of explanations are given in this chapter for the stickiness of wages in the short orintermediate run. One is that workers have imperfect information and nobody knows the actual price level. People don’t know whether a change in their nominal wage is the result of an increase in prices or in the real wage they receive for the work they provide. Due to this uncertainty, labor markets will not clear immediately. Another argument relies on coordination problems, that is, different firms within an economy cannot coordinate price changes in response to monetary policy changes.Individual firms change their prices only reluctantly, since they are afraid of losing market share. The efficiency wage theory argues that employers pay above market-clearing wages to motivate their workers to work harder. Firms are also reluctant to change wages because of the perceived menu costs involved. There are long-term relations between firms and workers and wages are usually set in nominal terms by wage contracts, which are renegotiated only periodically. Thus real wages fluctuate over time as the price level changes. Finally, the insider-outsider model argues that firms negotiate only with their own employees but not with unemployed workers. Since a turnover in the labor force is costly to firms, they are willing to offer above market-clearing wages to the currently employed rather than hiring the unemployed who may be willing to work for lower wages.These different views are not necessarily mutually exclusive and it is up to students to decide which of the arguments presented here they find most plausible. The explanations differ mainly in their assumption of how fast markets clear and whether employment variations are voluntary.4.a. Stagflation is defined as a period of high unemployment accompanied by high inflation.4.b. Stagflation can occur in time periods when people have high inflationary expectations. If theeconomy goes into a recession, the actual rate of inflation will fall below the expected rate of inflation.However, the actual inflation rate may still be very high while the rate of unemployment is increasing.For example, the Fed may have let money supply grow much too fast in the past, so everyone expectsa high inflation rate. If a supply shock occurs, we will see an increase in the rate of unemploymentwhile inflationary expectations and actual inflation remain very high. This scenario occurred during the 1970s. Once we have reached such a situation, it becomes necessary to design policies that will reduce inflationary expectations to shift the Phillips curve back to the left.5. Assume a disturbance occurs and the AD-curve shifts to the right. Unemployment decreases andinflation increases, and we move along the downward sloping Phillips curve to the left. However, as soon as people realize that actual inflation is higher than their inflationary expectations, they adjust their inflationary expectations upward and the downward-sloping Phillips curve shifts to the right, eventually returning unemployment back to its natural rate. In other words, the economy adjusts back at the full-employment level of income.If an adverse supply shock occurs (the upward-sloping AS-curve shifts to the left), unemployment and inflation increase simultaneously. This will correspond to a shift of the downward-sloping Phillips curve to the right. However, when people realize that actual inflation is less than expected inflation, then the downward-sloping Phillips curve starts to shift back and the economy adjusts back to the natural rate of unemployment in the long run.6.The expectations-augmented Phillips curve predicts that inflation will rise above the expected levelwhen unemployment drops below its natural rate. However, if people know that this is going to happen, why don’t they immediately adjust to it? And if people immediately adjusted to it, wouldn’t this imply that anticipated monetary policy would be ineffective to cause any deviation from the full-employment level of output? In reality, however, even if people have rational expectations, they may not be able to adjust immediately. One reason is that wage contracts often set wages for an extended time period. Similarly, prices cannot always be changed right away and the costs of changing prices may outweigh the benefits. A further argument is that even rational people make forecasting mistakes and learn only slowly.In other words, the location of the expectations-augmented Phillips curve is determined by the level of expected inflation, which is set by recent historical experience. A shift in this curve caused by changing inflationary expectations occurs only gradually. The rational expectations model, on the other hand, assumes that the Phillips curve shifts almost instantaneously as new information about the near future becomes available.Technical Problems:1. A reduction in the supply of money leads to excess demand for money and increased interest rates,reducing the level of private spending (especially investment). Therefore the AD-curve shifts to the left. This causes an excess supply of goods and services at the original price level so the price level starts to decrease. Since the AS-curve is upward sloping, a new short-run macro-equilibrium is reached at a lower level of output (and thus a higher level of unemployment) and a lower price level.PP1However, the higher level of unemployment eventually puts downward pressure on wages, reducing the cost of production and shifting the upward-sloping AS-curve to the right. Alternatively, since this equilibrium output level is below the full-employment level, prices will continue to fall, and the upward-sloping AS-curve will shift to the right. As long as output is below the full-employment level Y*, the upward-sloping AS-curve will continue to shift to the right, which means that the price level will continue to decline. Eventually a new long-run equilibrium will be reached at the full-employment level of output (Y*) and a lower price level.2. According to the rational expectations theory, an announced change in monetary policy wouldimmediately change people’s perception in regard to the expected inflation rate. If people could adjust immediately to this change in inflationary expectations, then the rate of unemployment or the output level would remain the same. In other words, we would immediately move from point 1 to point 3 in the diagram used to explain the previous question and the Fed would be unable to affect the unemployment rate. In reality, however, even if people have rational expectations and can anticipate the effects of a policy change correctly, they may not be able to immediately adjust due to wage contracts, etc. Thus, there will always be some deviation from the full-employment output level Y*.3.a. A favorable supply shock, such as a decline in material prices, shifts the upward-sloping AS-curve tothe right, leading to excess supply at the existing price level. A new short-run equilibrium is reached at a higher level of output and a lower price level. But since output is now above the full-employment level Y*, there is upward pressure on wages and prices and the upward-sloping AS-curve shifts back to the right. A new long-run equilibrium is reached back at the original position (Y*), and the original price level (assuming that the change in material prices did not affect the full-employment level of output). Since nominal wages (W) will have risen but the price level (P) will not have changed, real wages (W/P) will have increased.PP1P20 13.b. Lower material prices lower the cost of production, shifting the upward-sloping AS-curve shiftsto the right, and leading to an increase in output and a lower price level. Since unemployment is now below its natural rate, there is a shortage of labor, providing upward pressure on wages. This will increase the cost of production again, eventually shifting the upward-sloping AS-curve back to the original long-run equilibrium (assuming that potential GDP has not been affected).Additional Problems:1. Explain the long-run effect of an increase in nominal money supply on the amount of realmoney balances available in the economy.In the very short run, the price level is fixed, so if nominal money supply (M) increases, a higher level of real money balances is available, causing interest rates to fall and the level of investment spending to increase. This leads to an increase in aggregate demand. The shift to the right of the AD-curve causes the price level (P) to increase, leading to a reduction in real money balances (M/P). In the medium run (an upward-sloping AS-curve), we reach a new equilibrium at a higher output level and a higher price level. Since prices have gone up proportionally less than nominal money supply, real money balances have increased. However, to reach a new long-run equilibrium, prices have to increase further, and as a result, the level of real money balances will decrease further. When the new long-run equilibrium at Y* is finally reached, the price level will have risen proportionally to nominal money supply and the level of real money balances will be back at its original level.2. Assume the economy is in a recession. Describe an adjustment process that will ensure that theeconomy eventually will return to full employment. How can the government speed up this process?If the economy is in a recession, there will be downward pressure on wages and prices, which will bring the economy back to the full-employment output level. The upward-sloping AS-curve will shift to the right due to lower production costs. However, this process may take a fairly long time. The government can shorten this adjustment process with the help of expansionary fiscal or monetary policies to stimulate aggregate demand. The resulting shift to the right of the AD-curve implies that the final long-run equilibrium will be at a higher price level. In other words, the reduction in unemployment can only be achieved at the cost of higher inflation.3. "The stickiness of wages implies that policy makers can achieve low unemployment only if theyare willing to put up with high inflation." Comment on this statement.There are several explanations of why wages and prices adjust only slowly. One is that workers have imperfect information, so they do not realize that lower prices mean higher real wages. Another is that firms are reluctant to change prices and wages since they are unsure about the behavior of their competitors and want to avoid the perceived cost of making these changes. Finally, wage contracts tend to be long-term and staggered, so it takes time to adjust wages to price changes. Some firms may pay their workers above market-clearing wages to keep them happy and productive. For these reasons, wages and prices tend to be rigid in the short run. Thus it takes time for the economy to adjust back to full-employment.If there were a stable Phillips-curve relationship, a low rate of unemployment could only be achieved by allowing inflation to increase. However, such a stable relationship does not exist. Wages tend to be rigid in the short run, so expansionary policies lower unemployment and increase inflation in the short run. In the long run, however, the economy will adjust back to the natural rate of unemployment, so expansionary policies simply lead to a higher price level.4. "If we assume that people have rational expectations, then fiscal policy is always irrelevant.But monetary policy can still be used to affect the rate of inflation and unemployment."Comment on this statement.Individuals and firms with rational expectations consistently make optimal decisions based on all information available. As long as a policy change is anticipated, people are able to assess its long-run outcome and will try to immediately adjust. Since fiscal policy doesn't affect inflation or unemployment in the long run, it is also ineffective in the short run if wages and prices are assumed to be flexible. An anticipated change in monetary growth, on the other hand, will be reflected in a change in the inflation rate. If wages are flexible, workers will adjust their wage demands immediately and no significant change in the unemployment rate will occur. However, even if people have rational expectations, wages tend to be fairly rigid in the short run due to wage contracts. Therefore, it will take time for the economy to adjust back to a long-run equilibrium. This implies that both fiscal and monetary policy can affect the rate of inflation and unemployment to some degree in the short run.5. "Inflation cannot accelerate in a recession, when the rate of unemployment is above its naturalrate." Comment on this statement.Inflation can accelerate even in a recession, that is, when the unemployment is high, if a supply shock occurs. An oil price increase will increase the cost of production, so the upward-sloping AS-curve will shift to the left. This will increase the inflation rate and the rate of unemployment simultaneously, as firms increase their product prices and cut their production. If the Fed tries to accommodate the supply shock with expansionary monetary policy in an effort to stimulate the economy, then inflation will accelerate even more, as the AD-curve shifts to the right.6. Comment on the following statement:"The coordination approach to the Phillips curve focuses on the problems that the administration has in coordinating its fiscal policies with the monetary policies of the Fed." The coordination approach has nothing to do with fiscal or monetary policy but is simply one explanation of why wages adjust slowly. This view asserts that firms generally are unable to coordinate wage and price changes in response to a monetary policy change. For example, any firm that cuts workers' wages in response to monetary contraction while other firms don't, will anger its employees who may then choose to leave. Firms are also reluctant to change their prices since they are unsure about their competitors' behavior. Thus wages and prices change only slowly in response to a change in aggregate demand. This implies an upward-sloping (short-run) AS-curve.7. Comment on the following statement:"The unemployment rate is zero at the full-employment level of output."With a higher price level real wages decline, increasing the quantity of labor demanded. Therefore the nominal wage rate is bid up until the real wage rate is restored to its unique equilibrium level. Similarly, if prices fall, real wages increase, leading to unemployment. The nominal wage rate falls to bring the real wage rate back to its equilibrium level. So the nominal wage rate changes in proportion to the price level to maintain a real wage rate that clears the labor market. At this wage rate, the full-employment level of output is produced. However, at the full-employment output level the unemployment rate is not zero. Due to frictions in the labor market, there is always a positive unemployment rate, as workers switch between jobs. This is called the natural rate of unemployment.8. Briefly state the reason for the slow adjustment of wages to changes in aggregate demand. The reasons for the slow adjustment of nominal wages can be explained in several ways. One explanation is that workers have imperfect information, that is, they do not immediately realize whether a change in their nominal wage is the result of an increase in prices or in the real wage they receive for the work they provide. Another explanation is that coordination problems exist, that is, different firms within an economy are unsure about the behavior of their competitors and thus they only reluctantly change wages or prices. The efficiency wage theory, on the other hand, argues that firms pay above market-clearing wages to motivate their workers to work harder. Firms are also reluctant to change wages due to the perceived cost of doing so. Another argument is that wage contracts tend to be long-term, so real wages tend to fluctuate over the length of the contract and output adjusts only slowly to price changes. Finally, the insider-outsider model argues that firms negotiate only with their employees but not the unemployed. Since a turnover of the labor force is costly to firms, they are willing to offer above market-clearing wages to the currently employed rather than hiring the unemployed who may be willing to work for less. These various explanations are not mutually exclusive, and they all imply that the AS-curve is positively sloped, that is, that a change in aggregate demand will affect both output and prices in the short run.9. True or false? Why?"There is no frictional unemployment at the natural rate of unemployment."False. The natural rate of unemployment is the rate at which the labor market is in equilibrium. But there is always some unemployment due to new entrants into the labor force, people between jobs, and the like.This rate of unemployment is considered normal, due to frictions in the labor market, and is often called frictional unemployment.10. "If everyone in this economy had rational expectations, then wages would be flexible andunemployment could not occur." Comment on this statement.The new Keynesian models argue that even if people have rational expectations, socially undesirable outcomes may still occur due to imperfect competition and the existence of wage contracts. Prices may not change freely, since firms in imperfectly competitive markets are reluctant to change them, due to the menu costs involved. Nominal wages are set by contracts over a period of time, so the economy may adjust only slowly to a decrease in aggregate demand. Thus a rate of unemployment higher than the natural rate can exist over an extended period of time.11. True or false? Why?"If nominal wages were more flexible, expansionary policies would be more effective in reducing the rate of unemployment."False. In Chapter 5 we learned that in the classical case (where nominal wages are completely flexible) the AS-curve is vertical, whereas in the Keynesian case (where wages do not change, even if unemployment persists) the AS-curve is horizontal. From this we can conclude that more flexible nominal wages imply a steeper upward-sloping AS-curve. Any type of expansionary demand-side policy will shift the AD-curve to the right and this will cause the level of output and prices to increase (at least in the short-run). A steeper upward-sloping AS-curve results in a larger price increase and a smaller increase in output. But a smaller increase in the level of output results in a smaller reduction in unemployment. In either case, the economy will settle back at the full-employment level of output in the long run. In the long run, the rate of unemployment always goes back to its natural level.12. Explain the short-run and long-run effects of an increase in the level of government spendingon output, unemployment, interest rates, prices, and real money balances.An increase in government spending increases aggregate demand, shifting the AD-curve to the right. Because there is excess demand, the price level increases, which reduces the level of real money balances. Therefore interest rates increase, leading to some crowding out of investment. Due to this real balance effect, the increase in output is less than the shift in the AD-curve. Assuming an upward-sloping AS-curve, a new equilibrium is reached at a higher price level, a higher level of output, a lower unemployment rate and a higher interest rate. Since output is now above the full-employment level, wages and prices will continue to rise and the upward-sloping AS-curve will start shifting to the left. This process will continue until a new long-run equilibrium is reached at the full-employment level of income Y*, that is, until unemployment is back at its natural rate. At this point the price level, nominal wages, and interest rates will be higher than previously and real money balances will be lower.13. Briefly explain why there seems to be so much interest in finding ways to shift theupward-sloping aggregate supply curve to the right.Shifting the upward-sloping AS-curve to the right seems to be the only way to offset the effects of an adverse supply shock without any negative side effects. An adverse supply shock, such as an increase in oil prices, causes a simultaneous increase in unemployment and inflation, and policy makers have only two options for demand-management policies. Expansionary fiscal or monetary policy will help to achieve full employment faster but will raise the price level, while restrictive fiscal or monetary policy will reduce inflationary pressure but increase unemployment. Therefore, any policy that would shift the upward sloping AS-curve back to the right seems preferable, since it might bring the economy back to the original equilibrium by simultaneously lowering inflation and unemployment.14. Use an AD-AS framework to show the effect of monetary restriction on the level of output,prices and the interest rate in the medium and the long run.A decrease in nominal money supply will increase interest rates, leading to a decrease in investment spending. This will shift the AD-curve to the left, creating an excess supply of goods and services. Therefore price level will decrease and real money balances will increase. A new equilibrium will be achieved at the intersection of the new AD-curve and the upward-sloping AS-curve at an output level that is below the full-employment level.In the long run, higher unemployment will cause downward pressure on wages. As the cost of production decreases, the upward-sloping AS-curve will keep shifting to the right until a new long-run equilibrium is established at the full-employment level of output, that is, where the new AD-curve intersects the long-run vertical AS-curve at Y*. At this point, real output, the real interest rate, real money balances, and the real wage rate will be back at their original level. Nominal money supply, the price level and the nominal wage rate will all have decreased proportionally.A simplified adjustment can be shown as follows:1-->2: Ms down ==> i up ==> I down ==> Y down ==> the AD-curve shifts left ==>excess supply ==> P down ==> real ms up ==> i down ==> I up ==> Y up(The first line describes a policy change, that is, a shift in the AD-curve; the second line describes the price adjustment, that is, a movement along the AD-curve.)Short-run effect:Y down, i up, P down2-->3: Since Y < Y* ==> downwards pressure on nominal wages ==> cost of production down ==> the short run AS-curve shifts right ==> excess supply of goods ==> P down ==> real ms up==> i down ==> I up ==> Y up (This process continues until Y = Y*)Long-run effect:Y stays at Y*, i remains the same, P down.Note: Even though only one shift of the short-run AS-curve to the new long-run equilibrium is shown here, this shift is actually a combination of many shifts.P2P1P2P30 215. Briefly discuss the importance of Okun’s law in evaluating the cost of unemployment.Okun’s law states that a reduction in the unemployment rate of 1 percent will increase the level of output by about 2 percent. This relationship allows us to measure the cost to society (in terms of lost production) of a given rate of unemployment.16. True or false? Why?"If monetary policy accommodates an adverse supply shock, it will worsen any inflationary effects."True. An adverse supply shock shifts the upward-sloping AS-curve to the left. There is excess demand for goods and services at the original price level and prices start to rise, leading to lower real money balances, higher interest rates, and lower output. If no policy is implemented, then unemployment will force the nominal wage down to restore equilibrium at the original position. If the government views this adjustment process as too slow, it can respond by implementing expansionary policies. Accommodating the supply shock in this way shifts the AD-curve to the right and a new equilibrium can be reached at full-employment but at a higher price level. It is unlikely, though, that the economy will remain there for long since workers will realize that their purchasing power has been diminished by higher prices and will demand a wage increase. If they are successful, the cost of production will increase and the upward-sloping AS-curve will shift to the left again. In other words, we will enter a wage-price spiral.PP3P2P1217. Assume oil prices decline. What kind of monetary policy should the Fed undertake if its goal isto stabilize the level of output while keeping inflation low? Show with the help of an AD-AS diagram and briefly explain the adjustment process.1-->2: As oil prices decline, the cost of production decreases and the upward-sloping AS-curve shifts to the right, causing excess supply of goods. Thus the price level decreases, real money balances increase, and the interest rate declines.2-->3: A decrease in money supply will increase the interest rate, decrease private spending, and shift the AD-curve to the left. This means that prices will decrease even further and the level of output will decline. (We assume, for simplicity, that it goes back to the full-employment level Y*, so no long-run adjustment is needed.) Overall, the level of output has remained at its full-employment level but the level of prices and the interest rate have decreased.PP1P2218. Comment on the following statement:"A favorable oil shock causes lower inflation and lower unemployment."A decrease in material prices (or any other favorable supply shock) shifts theupward-sloping AS-curve to the right, and prices begin to decrease. The new equilibrium is at a lower price level and a higher level of output (a lower level of unemployment).Since output is now above the full-employment level, there will be upward pressure on nominal wages and prices, and the upward-sloping AS-curve will start shifting back to its original position (assuming that potential output was not affected). In the long run, unemployment will be back at its natural rate but the price level will have decreased (and thus real wages increased).19. “Falling oil prices will lead to increased employment, higher wage rates an dincreased real money balances.” Comment on this statement with the help of an AD-AS diagram and explain the short-run and long-run adjustment processes.A decline in material prices shifts the upward-sloping AS-curve to the right, leading to excess supply at the existing price level. A new equilibrium is reached at a higher level of output and a lower price level. But since output is now above the full-employment level Y*, there is upward pressure on wages and prices and the upward-sloping AS-curve starts shifting back to the right. A new long-run equilibrium is reached back at the original position (Y*), and the original price level (assuming that the change in material prices did not affect the full-employment level of output). Since nominal wages (W) will have risen but the price level (P) will not have changed, real wages (W/P) will have increased.PP1P2Y*Y2Y。

萨缪尔森《宏观经济学》(第版)第章 消费与投资课后习题详解跨考网独家整理最全经济学考研真题,经济学考研课后习题解析资料库,您可以在这里查阅历年经济学考研真题,经济学考研课后习题,经济学考研参考书等内容,更有跨考考研历年辅导的经济学学哥学姐的经济学考研经验,从前辈中获得的经验对初学者来说是宝贵的财富,这或许能帮你少走弯路,躲开一些陷阱。

以下内容为跨考网独家整理,如您还需更多考研资料,可选择经济学一对一在线咨询进行咨询。

一、概念题.可支配收入,消费,储蓄( ,,)答:()可支配收入指人们可用来消费或储蓄的收入,个人收入不能全归个人支配,因为要缴纳个人所得税,税后的个人收入才是可支配收入。

可支配收入被认为是消费开支的最重要的决定性因素。

常被用来衡量一国的生活水平。

()消费指消费者个人购买的产品和服务的价值,它是国民收入核算恒等式的一项。

消费分为三个子项目:非耐用品、耐用品以及服务。

非耐用品是使用持续较短时间的产品,如食物和衣服。

耐用品是使用持续时间长的产品,如汽车和电视。

服务包括个人和企业为消费者所做的工作,如理发和就医。

决定消费的因素很多,主要因素是可支配收入、利率、价格水平、收入分配等。

()储蓄指将一部分不用于当前消费的收入存储和积蓄起来的行为及其相应的金额。

支配人们将收入用于储蓄而不是用于当前消费的动机,称为“储蓄动机”。

影响储蓄水平高低的两个主要因素是收入水平和储蓄倾向。

若储蓄倾向不变,个人收入水平越高,则储蓄水平也越高。

若收入水平不变,储蓄倾向越高,则储蓄水平也越高。

个人储蓄与企业储蓄、政府储蓄的加总构成国民总储蓄。

国民总储蓄是一国资本形成和经济增长的重要基础。

.消费函数和储蓄函数( )答:()消费函数是“储蓄函数”的对称,反映了消费与收入水平之间的依存关系,即消费支出取决于收入水平。

以C 表示消费,Y 表示收入,则消费函数的一般形式是:()C f Y =。

消费函数这一概念是凯恩斯最先提出来的,凯恩斯的消费函数理论被称为绝对收入假说。

《宏观经济学》章节习题及答案解析第一章导论1、怎样理解宏观经济学的研究对象?【解答】宏观经济学研究的对象是经济的总体行为。

它的基本研究方法是考察经济的总体趋势,采用总量分析法。

它解决的主要中心问题经济周期与失业、通货膨胀和经济增长。

与微观经济学不同,宏观经济学则主要研究整体经济,以产出、失业、通货膨胀这些大范围内的经济现象为研究对象,其目的是对产出、失业以及价格的变动作出经济解释,宏观经济学的研究方法则是总量分析,即对能够反映整个经济运行情况的经济变量的决定、变动及其相互关系进行分析。

这些总量包括两类,一类是个量的总和,另一类是平均量。

因此,宏观经济学又称为“总量经济学”。

《宏观经济学》章节习题及答案解析第二章国民收入核算1、下列项目是否计入GDP,为什么?(1)政府转移支付(2)购买一辆用过的卡车(3)购买普通股票(4)购买一块地产【解答】(1)政府转移支付不计入GDP,因为政府转移支付只是简单地通过税收(包括社会保障税)和社会保险及社会救济等把收入从一个人或一个组织转移到另一个人或另一个组织手中,并没有相应的货物或劳务发生。

例如,政府给残疾人发放救济金,并不是残疾人创造了收入;相反,倒是因为他丧失了创造收入的能力从而失去生活来源才给予救济的。

(2)购买一辆用过的卡车不计入GDP,因为在生产时已经计入过。

(3)购买普通股票不计入GDP,因为经济学上所讲的投资是增加或替换资本资产的支出,即购买新厂房,设备和存货的行为,而人们购买股票和债券只是一种证券交易活动,并不是实际的生产经营活动。

(4)购买一块地产也不计入GDP,因为购买地产只是一种所有权的转移活动,不属于经济意义的投资活动,故不计入GDP。

2、如果甲乙两国并成一个国家,对GDP 总和会有什么影响(假定两国产出不变)?【解答】如果甲乙两国合并成一个国家,对GDP 总和会有影响。

因为甲乙两国未合并成一个国家时,双方可能有贸易往来,但这种贸易只会影响甲国或乙国的GDP,对两国GDP 总和不会有影响。

第六章总需求——总供给模型一、单项选择题1、价格水平下降时,下列说法正确的是()A、实际货币供给减少并使LM曲线右移B、实际货币供给减少并使LM曲线左移C、实际货币供给增加并使LM曲线右移D、实际货币供给增加并使LM曲线左移2、总需求曲线向右下方倾斜是由于()A、价格水平上升时,投资会减少B、价格水平上升时,消费会减少C、价格水平上升时,净出口会减少D、以上几个因素都是3、其它条件不变的情况下,下列情况( )引起总需求曲线向右方移动A.物价水平不变时利率上升B.货币供给量增加C.税收增加D.物价水平下降4、长期总供给曲线( )A.向右上方倾斜B.向右下方倾斜C.是一条垂线D.是一条水平线5、当( ),古典总供给曲线存在A.产出水平是由劳动力供给等于劳动力需求的就业水平决定时B.劳动力市场的均衡不受劳动力供给曲线移动的影响C. 劳动力供给等于劳动力需求立即对价格水平的变化作出调整时D. 劳动力市场的均衡不受劳动力需求曲线移动的影响时6、假定经济实现充分就业,总供给曲线是垂直线,扩张的财政政策将() A.提高价格水平和实际产出 B.提高价格水平但不影响实际产出C.提高实际产出但不影响价格 D.对价格水平和产出均无影响7、如果经济处于低于充分就业均衡水平 ,那么,总需求增加就会引起( )A. 物价水平上升和实际国民生产总值增加B. 物价水平上升和实际国民生产总值减少C. 物价水平下降和实际国民生产总值增加D. 物价水平下降和实际国民生产总值减少8、当( )时,总需求曲线更平缓。

A.投资支出对利率变化较敏感B.支出乘数较小C.货币需求对利率变化较敏感D.货币供给量较大9、假定经济实现了充分就业,总供给曲线为正斜率,那么减税会使()A.价格水平上升,实际产出增加B.价格水平上升,但不影响实际产出C.实际产出增加,但不影响价格水平D.名义和实际工资都上升10、实际GDP与潜在GDP的关系是()A.总是相等的B.实际GDP总是低于潜在GDPC.实际GDP总是高于潜在GDPD.实际GDP可以大于也可以小于或者等于潜在GDP,一般情况下,实际GDP总是小于潜在GDP二、判断题1、AS-AD模型是决定实际GDP和物价水平(GDP平减指数)之间关系的模型。

宏观经济学知到章节测试答案智慧树2023年最新浙江大学第一章测试1.宏观经济学的中心理论是()。

参考答案:国民收入决定理论2.宏观经济学与微观经济学的研究对象()。

参考答案:分别是一国的国民经济和个别的厂商或消费者3.宏观经济学研究的基本问题主要体现在哪两个方面()。

参考答案:保持物价稳定;实现充分就业4.经济模型作为理论分析工具应该面面俱到,其所有因素和变量都应该与现实生活保持一致。

()参考答案:错5.在凯恩斯主义宏观经济学的视野内,用扩张的经济政策刺激增长,从而使一个国家的宏观经济摆脱衰退和失业的困扰,是其理论研究的主要目的。

()参考答案:对第二章测试1.下列哪一项不是公司间接税()。

参考答案:公司利润税2.在统计中,社会保险税增加会影响()。

参考答案:个人收入3.下列可列入国内生产总值核算的是()。

参考答案:保险公司收到的一笔家庭财产保险;出口到国外的一批货物;房屋中介公司为一座旧房买卖收取的佣金4.在总产出核算的三种方法中,支出法是最基本的方法,最后得到的GDP或GNP的数字应以它为标准。

()参考答案:对5.作为政府支出的两个组成部分,政府购买和政府转移支付都应该计入国内生产总值(GDP)中。

()参考答案:错第三章测试1.当消费函数为C=a+bY,a、b>0,这表明,平均消费倾向()。

参考答案:大于边际消费倾向2.从投资的动机上看,可以把投资分作()参考答案:生产性投资和投机性投资3.下列哪些项属于宏观经济学中的投资?()参考答案:企业因产品滞销而导致存货增加。

;居民建造一座住宅。

4.自发性消费随收入的变动而变动,它取决于收入和边际消费倾向。

()参考答案:错5.厂商预期、风险偏好和政府投资等因素会造成投资曲线的水平移动。

()参考答案:对第四章测试1.利率越高()。

参考答案:债券的价格越低,投机性货币需求越小2.如果政府希望把整个货币供给的规模控制在3000亿元的水平,在基础货币发行数量为600亿元的条件下,法定准备金率应为多少()。

第六单元通货膨胀与失业理论本单元所涉及到的主要知识点:1.通货膨胀的含义、衡量与种类2.通货膨胀的原因3.通货膨胀对经济的影响及其对策4.失业的含义与衡量5.失业的种类6.失业的原因7.失业的影响及其治理8.失业与通货膨胀的关系:菲利普斯曲线一、单项选择1.一般用来衡量通货膨胀的物价指数是( D )。

a.消费者物价指数; b.生产物价指数;c.GDP缩减指数; d.以上均正确。

2.可以称为温和的通货膨胀的情况是指( D)。

a.通货膨胀率以每年5%的速度增长; b.通货膨胀率在10%以上;c.通货膨胀率一直保持在2%-3%水平;d.通货膨胀率处于3%—10%之间。

3.通货膨胀的主要类型有( D )。

a.需求拉上型; b.成本推进型;c.结构型; d.以上均正确。

4.通货膨胀会( C )。

a.使国民收入提高到超过其平常水平;b.使国民收入下降到其平常水平以下;c.使国民收入提高或下降,主要看通货膨胀产生的原因;d.只有在经济处于潜在的产出水平时,国民收入才会增长。

5.在通货膨胀不能完全预期的情况下,通货膨胀将有利于( A )。

a.债务人; b;债权人;c.在职工人; d.离退休人员。

6.已知充分就业的国民收入是12000亿元,实际国民收入11800亿,边际消费倾向0.8,在增加3000亿的投资后,经济将发生( A )。

a.需求拉上通货膨胀;b.成本推进通货膨胀;c.结构性通货膨胀; d.需求不足的失业。

7.收入政策主要是用来治理( B )。

a.需求拉上的通货膨胀; b.成本推进的通货膨胀;c.结构性通货膨胀; d.供求混合通货膨胀。

8.抑制通货膨胀的收入政策是指( C )。

a.收入初次分配; b.收入再分配;c.收入—价格管制; d.以上均正确。

9.失业率是指( A )。

a.失业人口占劳动力的百分比; b.失业人数占人口总数的百分比; c.失业人数占就业人数的百分比; d.以上均正确。

10.充分就业的含义是(B )。

a.人人都有工作,没有失业者; b.消灭了周期性失业的就业状态; c.消灭了自然失业时的就业状态; d.消灭了自愿失业时期就业状态。

11.在充分就业的情况下,下列哪一因素最可能导致通货膨胀( C )。

a.进口增加; b.出口减少;c.政府收入不变,但支出增加; d.工资不变,但劳动生产率提高。

12.在经济处于充分就业均衡时,名义货币增长率的上升会( D )。

a.使总需求曲线右移,均衡水平位于更高的通货膨胀率和产量水平;b.使总共供给曲线右移,均衡水平位于更高的通货膨胀率和产量水平; c.使总需求曲线和总共供给曲线右移,均衡水平位于更高的通货膨胀率和产量水平;d.使总需求曲线右移和总共供给曲线左移,均衡水平位于更高的通货膨胀率而产量不变。

13.自然失业率(D )。

a.恒为零; b.是没有摩擦性失业时的失业率;c.是没有结构性失业时的失业率; d.是经济处于潜在产出水平的失业率。

14.由于经济萧条而形成的失业属于( C )。

a.摩擦性失业; b.结构性失业;c.周期性失业; d.自愿失业。

15.如果某人由于冶金行业不景而失去工作,这种失业属于( B )。

a.摩擦性失业; b.结构性失业;c.周期性失业; d.自愿失业。

16.如果某人大学刚毕业尚未找到工作,这种属于( A )。

a.摩擦性失业; b.结构性失业;c.周期性失业; d.自愿失业。

17.引起周期性失业的原因是( B )。

a.工资刚性; b.总需求不足;c.经济中劳动力的正常流动; d.经济结构的调整。

18.奥肯法则说明了失业率每增加1%,则实际国民收入减少2.5%。

在美国这种比例关系( B )。

a.始终不变; b.在不同时期会有所不同; c.只适用于经济实现了充分就业时的状况; d.以上均不正确。

19.根据菲利普斯曲线,降低通货膨胀率的办法是( C )。

a.减少货币供给量; b.降低失业率;c.提高失业率; d.增加财政赤字。

20.货币主义者认为,菲利普斯曲线所表示的失业与通货膨胀之间的交替关系( A )。

a.只存在于短期; b.只存在于长期;c.在短期与长期均存在; d.在长与短期均不存在。

21.认为在短期与长期都不存在失业与通货膨胀之间交替关系的经济学流派是( D )。

a.凯恩斯主义学派; b.货币主义学派;c.供给学派; d.理性预期学派。

22.“适应性预期”与“理性预期”的区别是( A )。

a.适应性预期强调过去信息,理性预期强调现在信息;b.理性预期以大量数学模型为论证依据,因而更科学;c.适应性预期是凯恩斯主义的理论假设,内存陈旧,应被淘汰;d.适应性预期难以解释与过去完全不一样的未来经济变动。

23.理想预期学派的就业理论认为(C )。

a.可以以高通货膨胀率来换取得失业率;b.短期内可以降低失业率,长期却不行;c.通过政府的欺骗性行为,可以换得低失业率;d.必须维持自然失业率,否则会出现滞涨。

24.根据有伸缩性的工资理论,实际国内总产值增加意味着( A )。

a.长期总供给增加; b.总需求增加;c.物价水平将上升; d.经济将超过其总供给。

25.菲利普斯曲线说明( C )。

a.通货膨胀导致失业; b.失业导致通货膨胀;c.通货膨胀率与失业率之间呈负相关;d.通货膨胀率与失业率之间呈正相关。

26.“滞胀”指的是以下何种情况?( A )。

a.高通货膨胀与高失业率并存; b.高通货膨胀与低失业率并存;c.下降的通货膨胀与上升的失业率并存;d.低通货膨胀与高失业率并存。

27.“滞胀”理论不符合下列谁的观点?( B )a.货币主义 b.凯恩斯主义c.理性预期学派 d.供应学派28.如果工资具有向下刚性,则在经济衰退中当对劳动的需求减少时,我们将观察到( D )。

a.较高的就业量和较低的工资; b.较高的就业量而工资并没有提高;c.就业量和工资均没有变化; d.较低的就业量而工资并没有降低。

二、多项选择1.按照物价上涨的幅度,通货膨胀可以分为( ABC )。

a、温和的通货膨胀;b、奔腾的通货膨胀;c、超级的通货膨胀;d、平衡的通货膨胀。

2.通货膨胀形成的原因是( ABC )。

a.需求拉动; b.成本推进;c.经济结构变动; d.失业率提高。

3.如果工资具有完全弹性,下列说法正确的是(B CD )。

a.自愿失业人数不随工资水平变动而变动; b.劳动需求降低,则自愿失业增加;c.只要自愿失业没有非自愿失业; d.劳动市场是出清的。

4.下列哪些是治理通货膨胀的措施(A BCD )。

a.指数化政策; b.紧缩性需求管理政策;c.收入政策; d.扩大总供给。

5.通货膨胀的收益者有(BD )。

a.工资收入者; b.利润收入者;c.债权人; d.债务人。

6.收入政策的主要手段是( ABCD )。

a.税收; b.工资价格管制;c.工资价格指导; d.道德规劝。

7.导致需求拉上通货膨胀的因素有( AC )。

a.投资需求增加; b.货币供给增加;c.政府支出增加; d.政府收入增加。

8.引起结构性通货膨胀的主要原因在于(AC )。

a.各部门工资相继上升; b.货币需求过大;c.部门间生产率提高快慢不同; d.国际市场上的不稳定。

9.采用“冷火鸡式”治理通货膨胀与渐进式的治理有和不同?( AC )a.时间较短; b.时间较长;c.失业率较大; d.失业率较小。

10.治理通货膨胀的需求管理政策包括( ACBD )。

a.财政政策; b.货币政策;c.人力政策; d.收入政策。

三、名词解释1.通货膨胀; 2.通货紧缩; 3.消费者价格指数; 4.需求拉上的通货膨胀;5.成本推动的通货膨胀; 6.结构性通货膨胀; 7.收入政策; 8.通货膨胀税;9.失业; 10.失业率; 11.充分就业; 12.自然失业率; 13.摩擦性失业;14.结构性失业; 15.周期性失业; 16.紧缩性缺口; 17.奥肯定律;18.菲利普斯曲线;四、判断题1、衡量一个国家经济中失业状况的最基本指标是失业率。

(T )2、因不满工资待遇而不愿就业属于自愿失业。

(T )3、新加入劳动力队伍,正在寻找工作而造成的失业属于结构性失业。

(F )4、结构性失业是一种自愿失业。

(F )5、实行适当的经济政策可以消除结构性失业。

( F )6、需求不足的失业是一种非自愿失业。

(T )7、充分就业与任何失业的存在都是矛盾的。

因此,只要经济中有一个失业者存在,就不能说实现了充分就业。

( F8、消费物价指数、批发物价指数和国民生产总值折算价格指数的变化方向和变化幅度是一致的。

( F )9、通货膨胀会引起收入的再分配。

()10、温和的通货膨胀对生产有一定的扩张作用。

()11、凯恩斯对失业和通货膨胀相互关系的看法,与菲利普斯曲线的含义是一致的。

()12、失业率和通货膨胀率所以存在相互交替的关系,原因之一是通货膨胀率的上升会低实际工资和提高利润率,从而使厂商增雇工人扩大生产,导致失业率下降。

()13、根据奥肯定理,在经济中实现了充分就业后,失业率每增加1%,则实际国民收入就会减少2.5%。

()14、在任何经济中,只要存在着通货膨胀的压力,就会表现为物价水平的上升。

()15、紧缩性缺口是指实际总需求大于充分就业的总需求时两者的差额,膨胀性缺口是指实际总需求小于充分就业总需求时两者之间的差额。

()16、能够“自我实现”、持续存在的预期通货膨胀率也成为惯性通货膨胀。

()17、凯恩斯认为,引起总需求过度的根本原因是贷币的过量发行。

()18、如果通货膨胀是人们预料之中的,就不会对就业和国民收入产生直接的、实质性的影响。

()19、在总需求不变的情况下,总供给曲线向左上方移动所引起的通货膨胀称为供给推动的通货膨胀。

()20、价格调整方程表明,通货膨胀率与人们的通货膨胀预期呈同方向变动,并且也受来自需求压力的正向影响。

()21、凯恩斯主义、货币主义和理性预期学派,围绕非利蒲斯曲线的争论,表明了他们对宏观经济政策的不同态度。

()22、如果以经济衰退程度来衡量治理通货膨胀的代价,则渐进主义式的方法的代价要比激进主义的方法的代价小。

()五、辨析题1.物价上涨即为通货膨胀。

2.对于预期到的通货膨胀,银行贷款利率将会降低。

3.工资和利润的大幅度上升是导致成本推动通货膨胀的主要原因。

4.未预期到的通货膨胀有利于债权人,不利于债务人。

5.通货膨胀使政府占有更大部分的国民收入。

6.如果工资率的提高小于劳动生产率的增加,那么,这种工资的提高不会导致通货膨胀。

7.通货膨胀有利于工资领取者,不利于利润获得者。

8.由于不同部门劳动生产率增长快慢不同导致的通货膨胀被称为需求拉动型通货膨胀。

9.对于需求拉动型的通货膨胀,可以采取收入政策来解决。

10.以衰退来降低通货膨胀率会引起失业率上升。

11.摩擦性失业是一种自愿失业。