国际金融第四章chapter 4

- 格式:ppt

- 大小:556.00 KB

- 文档页数:32

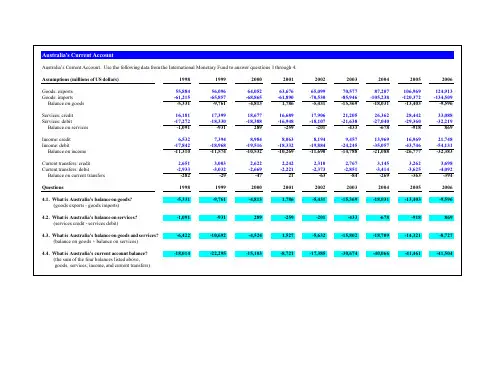

国际金融Fi na n c e Te s t Ba nk4Chapter 4—Exchange Rate Determination加息会降低通货膨胀本国货币就增值涨价了,出口就会减少进口就会增加1. The value of the Australian dollar (A$) today is $0.73. Yesterday, thevalue of the Australian dollar was $0.69. The Australian dollar ____ by ____%.a. depreciated; 5.80b. depreciated; 4.00c. appreciated; 5.80d. appreciated; 4.00ANS: CSOLUTION: ($0.73 $0.69)/$0.69 =5.80%PTS: 12. If a currency's spot rate market is ____, its exchange rate is likely to be____ to a single large purchase or sale transaction.a. liquid; highly sensitiveb. illiquid; insensitivec. illiquid; highly sensitived. none of the above.ANS: C PTS: 13. ____ is not a factor that causes currency supply and demand schedulesto change.a. Relative inflation ratesb. Relative interest ratesc. Relative income levelsd. Expectationse. All of the above are factorsthat cause currency supplyand demand schedules tochange.ANS: E PTS: 14. A large increase in the income level in Mexico along with no growth inthe U.S. income level is normally expected to cause (assuming nochange in interest rates or other factors) a(n) ____ in Mexican demand for U.S. goods, and the Mexican peso should ____.a. increase; appreciateb. increase; depreciatec. decrease; depreciated. decrease; appreciateANS: B PTS: 15. An increase in U.S. interest rates relative to German interest rateswould likely ____ the U.S. demand for euros and ____ the supply of euros for sale.a. reduce; increaseb. increase; reducec. reduce; reduced. increase; increaseANS: A PTS: 16. Investors from Germany, the United States, and the U.K. frequentlyinvest in each other based on prevailing interest rates. If Britishinterest rates increase, German investors are likely to buy ____ dollar-denominated securities, and the euro is likely to ____ relative to the dollar.a. fewer; depreciateb. fewer; appreciatec. more; depreciated. more; appreciateANS: A PTS: 17. When the "real" interest rate is relatively low in a given country, thenthe currency of that country is typically expected to be:a. weak, since the country'squoted interest rate would behigh relative to the inflationrate.b. strong, since the country'squoted interest rate would below relative to the inflationrate.c. strong, since the country'squoted interest rate would behigh relative to the inflationrate.d. weak, since the country'squoted interest rate would below relative to the inflationrate.ANS: D PTS: 18. Assume that the inflation rate becomes much higher in the U.K.relative to the U.S. This will place ____ pressure on the value of theBritish pound. Also, assume that interest rates in the U.K. begin torise relative to interest rates in the U.S. The change in interest rateswill place ____ pressure on the value of the British pound.a. upward; downwardb. upward; upwardc. downward; upwardd. downward; downwardANS: C PTS: 19. In general, when speculating on exchange rate movements, thespeculator will borrow the currency that is expected to appreciate andinvest in the country whose currency is expected to depreciate.a. Trueb. FalseANS: F PTS: 110. Baylor Bank believes the New Zealand dollar will appreciate over thenext five days from $.48 to $.50. The following annual interest ratesapply:Currency Lending Rate Borrowing Rate Dollars 7.10% 7.50%6.80%7.25%New Zealand dollar(NZ$)Baylor Bank has the capacity to borrow either NZ$10 million or $5million. If Baylor Bank's forecast is correct, what will its dollar profitbe from speculation over the five-day period (assuming it does not useany of its existing consumer deposits to capitalize on its expectations)?a. $521,325.b. $500,520.c. $104,262.d. $413,419.e. $208,044.ANS: ESOLUTION:1. Borrow $5 million.2. Convert to NZ$:$5,000,000/$.48 =NZ$10,416,667.3. Invest the NZ$ at anannualized rate of 6.80% overfive days.NZ$10,416,667 [1+ 6.80% (5/360)]= NZ$10,426,5054. Convert the NZ$ back todollars:NZ$10,426,505$.50 = $5,213,2525. Repay the dollars borrowed.The repayment amount is:$5,000,000 [1 +7.5% (5/360)]= $5,000,000[1.00104]= $5,005,2086. After repaying the loan, theremaining dollar profit is:$5,213,252$5,005,208 = $208,044 PTS: 111. Assume the following information regarding U.S. and Europeanannualized interest rates:Currency Lending Rate Borrowing Rate U.S. Dollar ($) 6.73% 7.20%Eu ro (?) 6.80% 7.28%Trensor Bank can borrow either $20 million or ?20 million. Thecurrent spot rate of the euro is $1.13. Furthermore, Trensor Bankexpects the spot rate of the euro to be $1.10 in 90 days. What isTrensor Bank's dollar profit from speculating if the spot rate of theeuro is indeed $1.10 in 90 days?a. $579,845.b. $583,800.c. $588,200.d. $584,245.e. $980,245.ANS: ASOLUTION:1. Borrow ?20 million.2. Convert the ?20 million to?20,000,000 $1.13 =$22,600,000.3. Invest the $22,600,000 at anannualized rate of 6.73% for90 days.$22,600,000 [1 +6.73% (90/360)]= $22,980,2454. Determine euros owed:?20,000,000 [1 + 7.28%(90/360)] = ?20,364,000.5. Determine dollars needed torepay euro loan:?20,364,000 $1.10 =$22,400,400.6. The dollar profit is$22,980,245 $22,400,400= $579,845.PTS: 112. The equilibrium exchange rate of pounds is $1.70. At an exchangerate of $1.72 per pound:a. U.S. demand for pounds wouldexceed the supply of poundsfor sale and there would be ashortage of pounds in theforeign exchange market.b. U.S. demand for pounds wouldbe less than the supply ofpounds for sale and therewould be a shortage of poundsin the foreign exchangemarket.c. U.S. demand for pounds wouldexceed the supply of poundsfor sale and there would be asurplus of pounds in theforeign exchange market.d. U.S. demand for pounds wouldbe less than the supply ofpounds for sale and therewould be a surplus of poundsin the foreign exchangemarket.e. U.S. demand for pounds wouldbe equal to the supply ofpounds for sale and therewould be a shortage of poundsin the foreign exchangemarket.ANS: D PTS: 113. Assume that Swiss investors have francs available to invest insecurities, and they initially view U.S. and British interest rates asequally attractive. Now assume that U.S. interest rates increase whileBritish interest rates stay the same. This would likely cause:a. the Swiss demand for dollarsto decrease and the dollar willdepreciate against the pound.b. the Swiss demand for dollarsto increase and the dollar willdepreciate against the Swissfranc.c. the Swiss demand for dollarsto increase and the dollar willappreciate against the Swissfranc.d. the Swiss demand for dollarsto decrease and the dollar willappreciate against the pound.ANS: C PTS: 114. The real interest rate adjusts the nominal interest rate for:a. exchange rate movements.b. income growth.c. inflation.d. government controls.e. none of the aboveANS: C PTS: 115. If U.S. inflation suddenly increased while European inflation stayed thesame, there would be:a. an increased U.S. demand foreuros and an increased supplyof euros for sale.b. a decreased U.S. demand foreuros and an increased supplyof euros for sale.c. a decreased U.S. demand foreuros and a decreased supplyof euros for sale.d. an increased U.S. demand foreuros and a decreased supplyof euros for sale.ANS: D PTS: 116. If inflation in New Zealand suddenly increased while U.S. inflationstayed the same, there would be:a. an inward shift in the demandschedule for NZ$ and anoutward shift in the supplyschedule for NZ$.b. an outward shift in thedemand schedule for NZ$ andan inward shift in the supplyschedule for NZ$.c. an outward shift in thedemand schedule for NZ$ andan outward shift in the supplyschedule for NZ$.d. an inward shift in the demandschedule for NZ$ and aninward shift in the supplyschedule for NZ$.ANS: A PTS: 117. If the U.S. and Japan engage in substantial financial flows but littletrade, ____ directly influences their exchange rate the most. If the U.S.and Switzerland engage in much trade but little financial flows, ____directly influences their exchange rate the most.a. interest rate differentials;interest rate differentialsb. inflation and interest ratedifferentials; interest ratedifferentialsc. income and interest ratedifferentials; inflationdifferentialsd. interest rate differentials;inflation and incomedifferentialse. inflation and incomedifferentials; interest ratedifferentialsANS: D PTS: 118. If inflation increases substantially in Australia while U.S. inflationremains unchanged, this is expected to place ____ pressure on the value of the Australian dollar with respect to the U.S. dollar.a. upwardb. downwardc. either upward or downward(depending on the degree ofthe increase in Australianinflation)d. none of the above; there willbe no impactANS: B PTS: 119. Assume that British corporations begin to purchase more suppliesfrom the U.S. as a result of several labor strikes by British suppliers.This action reflects:a. an increased demand forBritish pounds.b. a decrease in the demand forBritish pounds.c. an increase in the supply ofBritish pounds for sale.d. a decrease in the supply ofBritish pounds for sale.ANS: C PTS: 120. The exchange rates of smaller countries are very stable because themarket for their currency is very liquid.a. Trueb. FalseANS: F PTS: 121. The phrase "the dollar was mixed in trading" means that:a. the dollar was strong in someperiods and weak in otherperiods over the last month.b. the volume of trading wasvery high in some periods andlow in other periods.c. the dollar was involved insome currency transactions,but not others.d. the dollar strengthenedagainst some currencies andweakened against others.ANS: D PTS: 122. Assume that the U.S. places a strict quota on goods imported fromChile and that Chile does not retaliate. Holding other factors constant,this event should immediately cause the U.S. demand for Chilean pesos to ____ and the value of the peso to ____.a. increase; increaseb. increase; declinec. decline; declined. decline; increaseANS: C PTS: 123. Any event that increases the U.S. demand for euros should result ina(n) ____ in the value of the euro with respect to ____, other thingsbeing equal.a. increase; U.S. dollarb. increase; nondollar currenciesc. decrease; nondollar currenciesd. decrease; U.S. dollarANS: A PTS: 124. Any event that reduces the U.S. demand for Japanese yen shouldresult in a(n) ____ in the value of the Japanese yen with respect to ____, other things being equal.a. increase; U.S. dollarb. increase; nondollar currenciesc. decrease; nondollar currenciesd. decrease; U.S. dollarANS: D PTS: 125. Any event that increases the supply of British pounds to be exchangedfor U.S. dollars should result in a(n) ____ in the value of the Britishpound with respect to ____, other things being equal.a. increase; U.S. dollarb. increase; nondollar currenciesc. decrease; nondollar currenciesd. decrease; U.S. dollarANS: D PTS: 126. Any event that reduces the supply of Swiss francs to be exchanged forU.S. dollars should result in a(n) ____ in the value of the Swiss francwith respect to ____, other things being equal.a. increase; U.S. dollarb. increase; nondollar currenciesc. decrease; nondollar currenciesd. decrease; U.S. dollarANS: A PTS: 127. Assume that the U.S. experiences a significant decline in income, whileJapan's income remains steady. This event should place ____ pressure on the value of the Japanese yen, other things being equal. (Assumethat interest rates and other factors are not affected.)a. upwardb. downwardc. nod. upward and downward(offsetting)ANS: B PTS: 128. News of a potential surge in U.S. inflation and zero Chilean inflationplaces ____ pressure on the value of the Chilean peso. The pressure will occur ____.a. upward; only after the U.S.inflation surgesb. downward; only after the U.S.inflation surgesc. upward; immediatelyd. downward; immediatelyANS: C PTS: 129. Assume that Canada places a strict quota on goods imported from theU.S. and that the U.S. does not retaliate. Holding other factorsconstant, this event should immediately cause the supply of Canadian dollars to be exchanged for U.S. dollars to ____ and the value of theCanadian dollar to ____.a. increase; increaseb. increase; declinec. decline; declined. decline; increaseANS: D PTS: 130. Assume that Japan places a strict quota on goods imported from theU.S. and the U.S. places a strict quota on goods imported from Japan.This event should immediately cause the U.S. demand for Japaneseyen to ____, and the supply of Japanese yen to be exchanged for U.S.dollars to ____.a. increase; increaseb. increase; declinec. decline; declined. decline; increaseANS: C PTS: 131. Which of the following is not mentioned in the text as a factoraffecting exchange rates?a. relative interest rates.b. relative inflation rates.c. government controls.d. expectations.e. all of the above are mentionedin the text as factors affectingexchange rates.ANS: E PTS: 132. If a country experiences high inflation relative to the U.S., its exportsto the U.S. should ____, its imports should ____, and there is ____pressure on its currency's equilibrium value.a. decrease; increase; upwardb. decrease; decrease; upwardc. increase; decrease; downwardd. decrease; increase; downwarde. increase; decrease; upwardANS: D PTS: 133. If a country experiences an increase in interest rates relative to U.S.interest rates, the inflow of U.S. funds to purchase its securities should____, the outflow of its funds to purchase U.S. securities should ____,and there is ____ pressure on its currency's equilibrium value.a. increase; decrease; downwardb. decrease; increase; upwardc. increase; decrease; upwardd. decrease; increase; downwarde. increase; increase; upwardANS: C PTS: 134. An increase in U.S. inflation relative to Singapore inflation placesupward pressure on the Singapore dollar.a. Trueb. FalseANS: T PTS: 135. When expecting a foreign currency to depreciate, a possible way tospeculate on this movement is to borrow dollars, convert the proceedsto the foreign currency, lend in the foreign country, and use theproceeds from this investment to repay the dollar loan.a. Trueb. FalseANS: F PTS: 136. Since supply and demand for a currency are constant (primarily dueto government intervention), currency values seldom fluctuate.a. Trueb. FalseANS: F PTS: 137. Relatively high Japanese inflation may result in an increase in thesupply of yen for sale and a reduction in the demand for yen.a. Trueb. FalseANS: T PTS: 138. The main effect of interest rate movements on exchange rates isthrough their effect on international trade.a. Trueb. FalseANS: F PTS: 139. Country X frequently engages in trade flows with the U.S. (such asimports and exports). Country Y frequently engages in capital flowswith the U.S. (such as financial investments). Everything else heldconstant, an increase in U.S. interest rates would affect the exchange rate of Country X's currency more than the exchange rate of Country Y's currency.a. Trueb. FalseANS: F PTS: 140. Increases in relative income in one country vs. another result in anincrease in the first country's currency value.a. Trueb. False41. Trade-related foreign exchange transactions are more responsive tonews than financial flow transactions.a. Trueb. FalseANS: F PTS: 142. Signals regarding future actions of market participants in the foreignexchange market sometimes result in overreactions.a. Trueb. FalseANS: T PTS: 143. The markets that have a smaller amount of foreign exchange tradingfor speculatory purposes than for trade purposes will likely experience more volatility than those where trade flows play a larger role.a. Trueb. FalseANS: T PTS: 144. Liquidity of a currency can affect the extent to which speculation canimpact the currency's value.a. Trueb. False45. Forecasting a currency's future value is difficult, because it is difficultto identify how the factors affecting the currency value will change,and how they will interact to impact the currency's value.a. Trueb. FalseANS: T PTS: 146. The standard deviation should be applied to values rather thanpercentage movements when comparing volatility among currencies.a. Trueb. FalseANS: F PTS: 147. Movements of foreign currencies tend to be more volatile for shortertime horizons.a. Trueb. FalseANS: F PTS: 148. If a currency's spot market is ____, its exchange rate is likely to be ____to a single large purchase or sale transaction.a. liquid; highly sensitiveb. illiquid; insensitivec. liquid; insensitived. none of the aboveANS: C PTS: 149. The value of euro was $1.30 last week. During last week the eurodepreciated by 5%. What is the value of euro today?a. $1.365b. $1.235c. $1.330d. $1.30ANS: BSOLUTION: $1.3 (1 .05) = $1.235 PTS: 150. Government controls can only affect the supply of a given currencyfor sale and not the demand.a. Trueb. FalseANS: F PTS: 151. If one foreign currency will appreciate against the dollar, then allforeign currencies will appreciate against the dollar but by differentdegrees.a. Trueb. FalseANS: F PTS: 152. Assume that the income levels in U.K. start to rise, while U.S. incomelevels remain unchanged. This will place ____ pressure on the value of British pound. Also, assume that U.S. interest rates rise, while theBritish pound remains unchanged. This will place ____ pressure on the value of British pound.a. downward; downwardb. upward; downwardc. upward; upwardd. downward; upwardANS: D PTS: 153. If the Fed announces that it will decrease the U.S. interest rates, andEuropean Central Bank takes no action, then the value of euro will____ against the value of U.S. dollar. The Fed's action is called ____intervention.a. appreciate; directb. depreciate; directc. appreciate; indirectd. depreciate; indirectANS: C PTS: 154. Assume that the total value of investment transactions between U.S.and Mexico is minimal. Also assume that total dollar value of tradetransactions between these two countries is very large. Now assumethat Mexico's inflation has suddenly increased, and Mexican interestrates have suddenly increased. Overall, this would put ____ pressure on the value of Mexican peso. The inflation effect should be ____pronounced than the interest rate effect.a. downward; moreb. upward; morec. downward; lessd. upward; lessANS: A PTS: 155. If U.S. experiences a sudden surge in inflation and surge in interestrates while Japanese inflation and interest rates remain unchanged,the value of Japanese yen will ____ against the U.S. dollar.a. appreciateb. depreciatec. remain unchangedd. cannot be determined fromthe information provided.ANS: D PTS: 156. If the Japanese yen is expected to appreciate against the U.S. dollarand interest rates in the U.S. and Japan are similar, banks may tryspeculating on this anticipated exchange rate movement by borrowing ____ and investing in ____.a. yen; dollarsb. yen; yenc. dollars; yend. dollars; dollarsANS: C PTS: 157. British investors frequently invest in the U.S. or Italy, depending onthe prevailing interest rates. If Italian interest rates suddenly rise high above U.S. rates, the investors will ____ the supply of pounds to beexchanged for dollars and thus put ____ pressure on the value of the pound against the U.S. dollar.a. increase; downwardb. decrease; upwardc. increase; upwardd. decrease; downwardANS: B PTS: 158. The equilibrium exchange rate of the Swiss franc is $0.90. At anexchange rate $.83:a. U.S. demand for Swiss francswould exceed the supply offrancs for sale and therewould be a shortage of francsin the foreign exchangemarket.b. U.S. demand for Swiss francswould be less than the supplyof francs for sale and therewould be a shortage of francsin the foreign exchangemarket.c. U.S. demand for Swiss francswould exceed the supply offrancs for sale and therewould be a surplus of francs inthe foreign exchange market.d. U.S. demand for Swiss francswould be less than the supplyof francs for sale and therewould be a surplus of Swissfrancs in the foreign exchangemarket.ANS: A PTS: 159. Financial flow foreign exchange transactions are more responsive tonews than trade-related transactions.a. Trueb. FalseANS: T PTS: 160. Assume that the British government eliminates all controls on importsby British companies. Other things being equal, the U.S. demand forpounds would ____, the supply of pounds for sale would ____, and the equilibrium value of the pound would ____.a. increase; increase; increaseb. decrease; increase; decreasec. remain unchanged; increase;decreased. remain unchanged; increase;increaseANS: C PTS: 161. Country X frequently engages in trade flows with the U.S. (such asimports and exports). Country Y frequently engages in capital flowswith the U.S. (such as financial investments). Everything else heldconstant, an increase in U.S. inflation would affect the exchange rateof Country Y's currency more than the exchange rate of Country X'scurrency.a. Trueb. FalseANS: F PTS: 162. Assume that U.S. inflation is expected to surge in the near future. Theexpectation of surge in inflation will most likely place ____ pressure on U.S. dollar immediately.a. upwardb. downwardc. nod. cannot be determinedANS: A PTS: 163. When the Japanese yen appreciates against the U.S. dollar, this meansthat the U.S. dollar is strengthening relative to the yen.a. Trueb. FalseANS: F PTS: 164. Illiquid currencies tend to exhibit less volatile exchange ratemovements than liquid currencies.a. Trueb. FalseANS: F PTS: 165. The supply curve for a currency is downward sloping since U.S.corporations would be encouraged to purchase more foreign goodswhen the foreign currency is worth less.a. Trueb. FalseANS: F PTS: 166. Relatively high Japanese inflation may result in an increase in thesupply of yen for sale and a reduction in the demand for yen, otherthings being equal.a. Trueb. FalseANS: T PTS: 167. If the British government desires an appreciation in its currency withrespect to the U.S. dollar, it would consider intervening in the foreign exchange market by buying dollars with pounds.a. Trueb. FalseANS: F PTS: 168. Country X frequently engages in trade flows with the U.S. (such asimports and exports). Country Y frequently engages in financial flows with the U.S. (such as financial investments). Everything else heldconstant, an increase in U.S. interest rates would affect the exchange rate of Country X's currency more than the exchange rate of Country Y's currency.a. Trueb. FalseANS: F PTS: 169. Illiquid currencies tend to exhibit ____ volatile exchange ratemovements, as the equilibrium prices of their currencies adjust to ____changes in supply and demand conditions.a. less; even minorb. less; only largec. more; even minord. more; only largee. none of the aboveANS: C PTS: 170. Which of the following is not mentioned in the text as a factoraffecting exchange rates?a. Relative interest ratesb. Relative inflation ratesc. Government controlsd. Expectationse. All of the above are mentionedin the text as factors affectingexchange rates.ANS: E PTS: 171. Which of the following events would most likely result in anappreciation of the U.S. dollar?a. U.S. inflation is very high.b. The Fed indicates that it willraise U.S. interest rates.c. Future U.S. interest rates areexpected to decline.d. Japan is expected to increaseinterest rates in the nearfuture.ANS: B PTS: 172. Which of the following interactions will likely have the least effect onthe dollar's value? Assume everything else is held constant.a. A reduction in U.S. inflationaccompanied by an increase inreal U.S. interest ratesb. A reduction in U.S. inflationaccompanied by an increase innominal U.S. interest ratesc. An increase in U.S. inflationaccompanied by an increase innominal, but not real, U.S.interest ratesd. An increase in Singapore'sinflation accompanied by anincrease in real U.S. interestratese. An increase in Singapore'sinterest rates accompanied byan increase in U.S. inflation.ANS: C PTS: 173. If a country experiences high inflation relative to the U.S., its exportsto the U.S. should ____, its imports should ____, and there is ____pressure on its currency's equilibrium value.a. decrease; increase; upwardb. decrease; decrease; upwardc. increase; decrease; downwardd. decrease; increase; downwarde. increase; decrease; upwardANS: D PTS: 174. If a country experiences an increase in interest rates relative to U.S.interest rates, the inflow of U.S. funds to purchase its securities should____, the outflow of its funds to purchase U.S. securities should ____,and there is ____ pressure on its currency's equilibrium value.a. increase; decrease; downwardb. decrease; increase; upwardc. increase; decrease; upwardd. decrease; increase; downwarde. increase; increase; upward ANS: C PTS: 1。

国际⾦融第四章第四章国际⾦融市场第⼀节国际⾦融市场概论⼀、国际⾦融市场的概念国际⾦融市场是指原⽣⾦融⼯具和衍⽣⾦融⼯具交易的场所或⽹络。

国际⾦融市场作⽤:实现国际资⾦融通;为国际⾦融资产交易提供便利。

⼆、国际⾦融市场的形成与发展伦敦纽约欧洲货币市场稳定的政局与制度⾃由开放的经济体制健全的⾦融制度和发达的⾦融机构现代化的通信设施与交通⽅便的地理位置训练有素的国际⾦融⼈才三、国际⾦融市场的构成(⼀)国际货币市场和国际资本市场国际货币市场:银⾏短期信贷市场、短期票据市场、贴现市场国际资本市场:银⾏长期信贷市场、国际证券市场按照借贷期限的不同,分为国际货币市场和国际资本市场国际货币市场:借贷期不超过1年的借贷资本市场,短期资⾦市场国际资本市场:借贷期在1年以上的借贷资本市场,长期资本市场1、国际货币市场(1)银⾏短期信贷市场:主要包括银⾏同业拆放市场和银⾏对外国⼯商企业的短期信贷。

(2)短期票据市场:是国际间以短期信⽤⼯具为对象的交易场所。

(3)贴现市场:是经营贴现业务的短期资⾦市场。

贴现是指银⾏购买未到期票据,并扣除⾃贴现⽇⾄到期⽇利息的业务,它是短期资⾦市场融通资⾦的⼀种重要⽅式。

2、国际资本市场(1)银⾏中长期信贷市场:是商业银⾏向政府机构、跨国公司提供中长期资⾦融通的市场。

中期为1-5年,长期为5-10年。

(2)国际证券市场:包括国际债券市场和国际股票市场。

国际债券包括外国债券和欧洲债券。

外国债券:⼀国借款⼈在外国证券市场上发⾏的以该市场所在国货币标明⾯值的国际债券。

欧洲债券:⼀国借款⼈在另⼀国市场上发⾏的、以第三国货币标明⾯值的国际债券。

(⼆)国际银⾏信贷市场和国际证券市场按照融资⽅式的不同,分为国际银⾏信贷市场和国际证券市场国际银⾏信贷市场:⼀国银⾏向⾮居民提供短期和中长期信贷的市场。

国际债券市场:进⾏国际证券交易的市场,主要包括国际债券市场和国际股票市场。

(三)传统的国际⾦融市场和新型的国际⾦融市场按照业务涉及的交易主体的不同,分为传统的国际⾦融市场和新型的国际⾦融市场传统的国际⾦融市场:主要经营居民与⾮居民之间的交易,在岸⾦融市场。