精选-国际货币与金融经济学课后习题答案

- 格式:doc

- 大小:138.00 KB

- 文档页数:17

国际金融(第五版)-课后习题以及答案学习资料国际金融(第五版)-课后习题以及答案国际金融全书课后习题以及答案第一章国际收支复习思考题一、选择题1.《国际收支和国际投资头寸手册》(第六版)将国际收支账户分为( )。

A.经常账户B.资本账户C.储备账户D.金融账户2.国际收支反映的内容是以交易为基础的,其中交易包括( )。

A.交换B.转移C.移居D.其他根据推论而存在的交易3.经常账户包括( )。

A.商品的输出和输入B.运输费用C.资本的输出和输入D.财产继承款项4.下列项目应记入贷方的是( )。

A.反映进口实际资源的经常项目B.反映出口实际资源的经常项目C.反映资产增加或负债减少的金融项目D.反映资产减少或负债增加的金融项目5.若在国际收支平衡表中,储备资产项目为–100亿美元,表示该国( )。

A.增加了100亿美元的储备B.减少了100亿美元的储备C.人为的账面平衡,不说明问题D.无法判断6.下列( )账户能够较好地衡量国际收支对国际储备造成的压力。

A.货物和服务账户差额B.经常账户差额C.资本和金融账户差额D.综合账户差额7.因经济和产业结构变动滞后所引起的国际收支失衡属于( )。

A.临时性不平衡B.结构性不平衡C.货币性不平衡D.周期性不平衡E.收入性不平衡8.国际收支顺差会引起( )。

A.外汇储备增加B.国内经济萎缩C.国内通货膨胀D.本币汇率下降二、判断题1.国际收支是一个流量的、事后的概念。

( )2.国际货币基金组织采用的是狭义的国际收支概念。

( )3.资产减少、负债增加的项目应记入借方。

( )4.由于一国的国际收支不可能正好收支相抵,因而国际收支平衡表的最终差额绝不恒为零。

( )5.理论上说,国际收支的不平衡指自主性交易的不平衡,但在统计上很难做到。

( )6.因经济增长率的变化而产生的国际收支不平衡,属于持久性失衡。

( )7.资本和金融账户可以无限制地为经常账户提供融资。

( )8.综合账户差额比较综合地反映了自主性国际收支状况,对于全面衡量和分析国际收支状况具有重大意义。

《货币金融学》课后习题参考答案第一章货币与货币制度1.解释下列概念:狭义货币、广义货币、准货币、实物货币、格雷欣法则。

答:(1)狭义货币,通常由现金和活期存款组成。

这里的现金是指流通中的通货。

活期存款,在国外是指全部的活期存款,在我国只包括支票类和信用类活期存款。

狭义货币是现实购买力的代表,是各国货币政策调控的主要对象。

(2)广义货币,通常由现金、活期存款、储蓄存款、定期存款及某些短期流动性金融资产组成。

这里的短期流动性金融资产是指那些人们接受程度较高的可在一定程度上执行货币某些职能的信用工具,如商业票据、可转让存单、国库券、金融债券、保险单、契约等。

广义货币扩大了货币的范围,包括了一切可能成为现实购买力的货币形式。

对于研究货币流通整体状况和对未来货币流通的预测都有独特作用。

(3)准货币,也称亚货币。

一般将广义货币口径中除狭义货币以外的部分称为准货币或亚货币。

包括活期存款、储蓄存款、定期存款及某些短期流动性金融资产组成。

这里的短期流动性金融资产是指那些人们接受程度较高的可在一定程度上执行货币某些职能的信用工具,如商业票据、可转让存单、国库券、金融债券、保险单、契约等。

准货币本身虽非真正的货币,但由于它们在经过一定的手续后,能比较容易地转化为现实的购买力,加大流通中的货币供应量。

所以,也称为近似货币。

(4)实物货币,是指以自然界存在的某种物品或人们生产出来的某种物品来充当的货币。

最初的实物货币形式五花八门,各地、各国和各个时期各不相同。

例如,在中国历史上,充当过实物货币的物品种类就有:龟壳、海贝、布匹、农具、耕牛等。

实物货币的缺点在于:不易分割和保存、不便携带,而且价值不稳定,很难满足商品交换的需要。

所以,它不是理想的货币形式,随后被金属货币所取代。

(5)格雷欣法则,是指两种实际价值不同而法定价值相同的货币同时流通时,实际价值高.2.如何理解货币的定义?它与日常生活中的通货、财富和收入概念有何不同?答:(1)货币是日常生活中人们经常使用的一个词,它的含义丰富,在不同的场合有不同的意义。

货币金融学第十二版课后题答案货币金融学第十二版课后题答案第一章经济学和货币金融学1. 什么是货币金融学?货币金融学是经济学中的一个分支领域,研究货币和金融市场的运作及其对经济总量、价格水平和就业率等方面的影响。

2. 描述货币的组成部分。

货币主要由现金和存款两部分组成。

现金包括纸币和硬币,存款包括支票存款、储蓄存款、时间存款、银行间市场存款等。

3. 描述货币的职能。

货币具有交易媒介、价值尺度、价值储藏和债务履行手段等职能。

4. 描述货币增发的影响。

货币增发可能导致通货膨胀、货币贬值、利率上升、经济不稳定等后果。

第二章货币市场1. 描述货币市场的特征。

货币市场是指短期债券和货币市场基金等金融工具在交易的市场,具有低风险、低收益、高流动性和高度竞争等特征。

2. 描述央行在货币市场中的作用。

央行通过货币政策、公开市场操作等手段影响货币市场利率和流动性,维护货币市场的稳定运转。

3. 描述国库券的特点。

国库券是一种以政府信用为担保和支付利息的短期国债,具有零风险、流动性好、购买门槛低等特点。

第三章利率1. 描述名义利率和实际利率的区别。

名义利率是指借贷协议中的利率,实际利率则考虑通货膨胀等因素后的利率。

2. 描述实际利率对投资的影响。

实际利率越高,对投资的机会成本就越高,从而会减少投资的数量和规模。

3. 描述利率曲线的形态及含义。

利率曲线表现出各种期限的借贷利率之间的关系,常见的包括正常型、倒挂型、平坦型等。

利率曲线的形状反映市场对未来经济情况的预期。

第四章中央银行和货币政策1. 描述中央银行的职能。

中央银行的职能包括银行监管、货币政策、支付系统稳定、国际储备等。

2. 描述开放市场操作的作用。

开放市场操作是央行通过购买或卖出政府债券等金融工具来影响货币市场流动性和利率的工具。

3. 描述货币多重生成过程。

货币多重生成过程指的是银行通过贷款来创造存款,从而进一步带动其他银行贷款和存款的生成的过程。

第五章货币政策的框架1. 描述主要通胀预期测量指标。

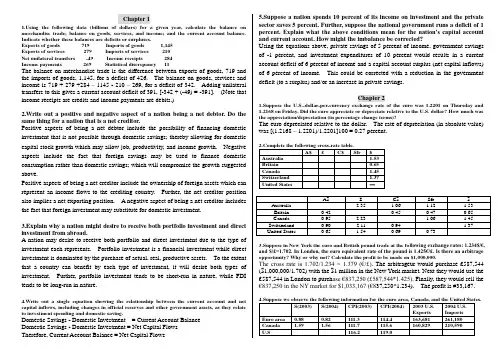

Answers to End of Chapter QuestionsChapter 1Keeping Up With a Changing World-Trade Flows, Capital Flows, and the Balance Of Payments1. The balance on merchandise trade is the difference between exports of goods,719 and the imports of goods, 1,145, for a deficit of 426. The balance on goods, services and income is 719 + 279 +284 – 1145 - 210 – 269, for a deficit of 342.Adding unilateral transfers to this gives a current account deficit of 391, [-342 + (-49) = -391]. (Note that income receipts are credits and income payments are debits.)2. Because the current account balance is a deficit of 391, then without a statisticaldiscrepancy, the capital account is a surplus of 391. In this problem, however, the statistical discrepancy is recorded as a positive amount (credit) of 11. Hence, the sum of the debits in the balance of payments must exceed the credits by 11.So, the deficit of the current account must be greater than the surplus on thecapital account by 11. The capital account, therefore, is a surplus of 391 – 11 = 380.3. A balance-of-payments equilibrium is when the debits and credits in the currentaccount and the private capital account sum to zero. In the problem above we do not know the private capital account balance. We cannot say, therefore,whether this country is experiencing a balance-of-payments surplus or deficit or if it is in equilibrium.4 The current account is a deficit of $541,830 and the private capital accountbalance is a surplus of $369,068. The U.S., therefore, has a balance ofpayments deficit.5 Positive aspects of being a net debtor include the possibility offinancing domestic investment that is not possible through domestic savings; thereby allowing for domestic capital stock growth whichmay allow job, productivity, and income growth. Negative aspects include the fact that foreign savings may be used to finance domesticconsumption rather than domestic savings; which will compromise the growth suggested above.Positive aspects of being a net creditor include the ownership of foreign assets which can represent an income flows to the crediting country. Further, the net creditor position also implies a net exporting position. A negative aspect ofbeing a net creditor includes the fact that foreign investment may substitute for domestic investment.6 A nation may desire to receive both portfolio and direct investment due to thetype of investment each represents. Portfolio investment is a financialinvestment while direct investment is dominated by the purchase of actual, real, productive assets. To the extent that a country can benefit by each type ofinvestment, it will desire both types of investment. Further, portfolioinvestment tends to be short-run in nature, while FDI tends to be long-run innature. This is also addressed in much greater detail in Chapter 7.7. Domestic Savings - Domestic Investment = Current Account BalanceDomestic Savings - Domestic Investment = Net Capital FlowsTherefore, Current Account Balance = Net Capital Flows8 Using the equations above, private savings of 5 percent of income, governmentsavings of -1 percent, and investment expenditures of 10 percent would results ina current account deficit of 6 percent of income and a capital account surplus (netcapital inflows) of 6 percent of income. This could be corrected with areduction in the government deficit (to a surplus) and/or an increase in private savings.Chapter 2The Market for Foreign Exchange1. Because it costs fewer dollars to purchase a euro after the exchange rate change,the euro depreciated relative to the dollar. The rate of depreciation (in absolute value) was [(1.2168 – 1.2201)/1.2201]100 = 0.27 percent.2. Note that the rates provided are the foreign currency prices of the U.S. dollar.Every value has been rounded to two decimal places which may cause somedifferences in answers.3 The cross rate is 1.702/1.234 = 1.379 (€/£), which is smaller in value than thatobserved in the London market. The arbitrageur would purchase £587,544($1,000,000/1.702) with the $1 million in the New York market. Next theywould use the £587,544 in London to purchase €837,250 (£587,544*1.425).Finally, they would sell the €837,250 in the New York market for $1,033,167(€837,250*1.234). The profit is #33,167.4. Total trade is (163,681 + 160,829 + 261,180 + 210, 590) = 796,280. Trade withthe Euro area is (163,681 + 261,180) = 424,861. Trade with Canada is (160,829 + 210,590) = 371,419. The weight assigned to the euro is 424,861/796,280 =0.53 and the weight assigned to the Canadian dollar is 0.47. (Recall the weightsmust sum to unity.)Because the base year is 2003, the 2003 EER is 100. The value of the 2004 EER is:[(0.82/0.88)•0.53 + (1.56/1.59)•0.47]•100 = (0.4939 + 0.4611)•100 = 95.4964, or95.5. This represents a 4.5 percent depreciation of the U.S. dollar.5 The real effective exchange rate (REER) for 2003 is still 100. The real rates ofexchange are, for 2003, 0.88•(116.2/111.3) = .9187, 1.59•(116.2/111.7) = 1.6541, and for 2004, 0.82•(119.0/114.4) = 0.8530, 1.56•(119.0/115.6) = 1.6059. The value of the 2004 REER is:[(0.8530/0.9187)•0.53 + (1.6059/1.6541)•0.47]•100 = (0.4921 + 0.4563)•100 =94.84, or 94.8. This represents a 5.2 percent depreciation of the U.S. dollar inreal terms6. This is a nominal appreciation of the euro relative to the U.S. dollar. The percentchange is [(1.19 –1.05)/1.05]•100 = 13.3 percent.7. The January 200 real exchange rate is 1.05•(107.5/112.7) = 1.0016. The May2004 real rate is 1.19•(116.4/122.2) = 1.1335.8 In real terms the euro appreciated relative to the U.S. dollar. The rate ofappreciation is [(1.1335 – 1.0016)/1.0016]*100 = 13.17 percent.9 Absolute PPP suggests the May 2004 exchange rate should be 122.2/116.4 =1.0498. The actual exchange rate is 1.19. Hence, the euro is overvaluedrelative to the U.S. dollar by (1.19 –1.0498)/1.0498]•100 = 13.35 percent.10Relative PPP can be used to calculate a predicted value of the exchange rate as: S PPP = 1.05•[(122.2/112.7)/(116.4/107.5)] = 1.0014.11. The actual exchange rate is 1.19. Hence, the euro is overvalued relative to theU.S. dollar by (1.19 –1.0014)/1.0014]•100 = 18.83 percent.Chapter 3Exchange Rate Systems, Past to Present1. Ranking the various exchange rate arrangements by flexibility is not so clearcut. Nonetheless the arrangements described in this chapter are (from fixedto flexible): dollarization, currency board, commodity (standard) peg,dollar (standard) peg, currency basket peg, crawling peg, managed float,flexible.2. The two primary functions of the International Monetary Fund are:surveillance of member nations' macroeconomic policies, and to provideliquidity to member nations experiencing payments imbalances.3. The value of the Canadian dollar relative to gold is CAN$69 (1.38 • $50) andthe value of the British pound relative to gold is £33.33 ($50/1.50).4. The exchange rate between the Canadian dollar and the British pound isC$/£2.07 (1.38 • 1.50).5. The currency value of the peso can be expressed as $0.50 + €.50=P1. Theexchange rate between the dollar and the euro can be used to convert the euroamount to its dollar equivalent of $0.55. Hence, $1.05=P1, or and exchangevalue of 0.952 P/$. Using the exchange rate between the dollar and the euroagain, the exchange rate between the peso and the euro is 0.1.048 P/€ (0.952P/$ • 1.10 $/€).6. Because $1.05 is the currency content of the basket, as shown above, and$0.50 of that content is attributable to the dollar, the weight assigned to thedollar is 0.50/1.05 = 0.476, or 47.6 percent. Because the weights must sumto unity, the weight assigned to the euro is 52.4 percent.7. The main difference between the two systems was that, in the Smithsoniansystem, the dollar was not pegged to the value of gold. One reason that thesystem was short was because there was little confidence that U.S. economicpolicy would be conducted in a manner conducive to a system of peggedexchange rates.8. The principle responsibilities of a currency board are to issue domesticcurrency notes and peg the value of the domestic currency. A currency boardis not allowed to purchase domestic debt, act as a lender of last resort, or setreserve requirements.9. The Lourve accord established unofficial limits on currency value movements.In a sense, it was peg with bands for each of the main currencies (dollar, yenand mark).10. Differences in the fundamental determinants of currency values between thepegging country and the other country should be considered. To this point of the text, the rate of inflation is a good example. Relative PPP can be used to determine the rate of crawl.11. Under a currency board system, a nation still maintains its domestic currency.Hence, policymakers can change exchange rate policies and monetary policies if they so desire. When a nation dollarizes and disposes of its domesticcurrency it no longer has this option.Chapter 4The Forward Currency Market and International Financial Arbitrage1. Given that the exchange rate is expressed as dollars to euros, we treat the dollar as the domestic currency. Note also that interest rates are quoted on an annual basis even though the maturity period is only one month. In this problem we divide the interest rates by 12 to put them on a one-month basis.a. The interest rate differential, therefore, is (1.75%/12 - 3.25%/12) = -0.125%.The forward premium/discount, expressed as a percentage, is calculated as: ((F-S)/S)•100 = ((1.089 –1.072)/1.072)•100=1.5858%b. Transaction costs are shown in the figure above by the dashed lines that interestthe horizontal axis at values of -1.00 and 1.00.c. The positive value indicates that the euro is selling at a premium. In addition,the interest rate differential favors the euro-denominated instrument. Hence, a saver shift funds to euro-denominated instruments.2. Using the provided information:(1.75/12) – (3.25/12) < [(1.089 - 1.072/1.072)]•100-0.125% < 1.5858%.3. The four markets are graphed below. An explanation follows.Graph 1, the spot market for the euro.R – R*450 (F-S)/S-0.125 1.58581.00 -1.00 $/€ $/€Graph 4, U.S. loanable funds Graph 5, Euro loanable fundsIn graph 1, the demand for the euro rises as international savers shift funds into euro-denominated instruments. In graph 2, the supply of euros increases in the forward market. (Consider a U.S. saver that moves funds into a euro-denominated instrument. They would desire to sell the euro forward so they may convert euro-denominated proceeds at the time of maturity into their dollar equivalent.) Graph 3 illustrates a decrease in loanable funds in the United States as savers shift funds to euro-denominated instruments. Graph 4 illustrates the increase in thesupply of loanable funds that occurs when savers shift funds to the euro-denominated instrument.4. Because (1.03125) > (1.04250)(1.4575/1.5245) = 0.9967, an arbitrage opportunityexists in this example if one were to borrow the pound and lend the euro.Suppose you were to borrow one pound, the steps are then:a. Borrow £1, convert to €1.5245 on the spot market.b. Lend euros, yielding €1.5245•(1.03125) = €1.5721.c. See euros forward, yielding €1.5721/1.4575 = £1.0787.d. Repay the pound loan at £1•(1.04250) = £1.04250.e. The profit is £0.0362, or 3.62 percent.5. Because interest rates are quoted as annualized rates, we need to divide eachinterest rate by 4 (12/3). The uncovered interest parity equation is:R -R* = (S e +1 - S) /Sa. Rewriting the equation for the expected future expected exchange rate yields:S e+1 = [(R- R*) + 1]Sb. Using the values given yields the expected future spot rateS e+1 = [(0.0124/4 - 0.0366/4) + 1]•1.5245 = 1.5153.6. Given this information, we can calculate the forward premium/discount with theUIP condition:(F - S)/S = R - R*The interest differential is 1.75% - 3.25% = 1.5%. This is the expected forward premium on the euro. Hence, (F – 1.08)/1.08 = 0.015 implies that F = 1.0962. 7. We can adjust for the shorter maturity by dividing the interest rates by 2 (12/6).Now the interest differential is 0.75%, still a forward premium on the euro. The forward rate now is (F – 1.08)/1.08 = 0.0075 implies that F = 1.0881.8. The U.S. real rate is 1.24% – 2.1% = -0.86% and the Canadian real rate is 2.15% –2.6% = -0.45%. Ignoring transaction costs, because the real interest rates are notequal, real interest parity does not hold.9. Uncovered interest parity is R -R* = (S e+1 - S) /S + ρ.a. Using the same process as in question 5 above, the expected future spot rate is:S e+1 = [(R- R*) + 1]S,S e+1 = [(0.075 - 0.035) + 1]•30.35 = 31.564.b. Using the same process as in question 5 above, the expected future spot rate is:S e+1 = [(R- R*) + 1 - ρ]S,S e+1 = [(0.075 - 0.035) + 1 –0.02]•30.35 = 30.957.10. Because the forward rate, 30.01, is less than the expected future spot rate, 30.957,you should sell the koruna forward. For example, $1 would purcase k30.957, which you could sell forward yielding k30.957/30.01 = $1.0316.11. International financial instruments:a. Global Bond: long term instruments issued in the domestic currency.b. Eurobond: term is longer than one year and is issued in a foreign currency.c. Eurocurrency: keyword is that it is a deposit.d. Global equity: keyword is that it is a share.Chapter 7The International Financial Architecture and Emerging Economies1. The difference between direct and indirect financing has to do with whether theborrower and lender seek each other out or whether an intermediary matchesborrowers and lenders. Direct financing requires no intermediary to matchsavers and borrowers. An economy will benefit from having both direct and indirect financing because both are appropriate ways to save and invest underdifferent circumstances. As discussed in the text, financial intermediaries absorba fraction of each saver's dollar that is borrowed. Thus, the intermediary takessome of the funds that otherwise would have gone to a borrower. However, the financial intermediary provides an important service by reducing informationasymmetries, allowing savers to pool risk, and matching risk and return.Therefore, when an individual cannot research these issues on his/her own, the intermediary is necessary to help the financial markets operate. However, astrong bond market, in which borrowers and savers can directly interact, allows for informed parties to save the funds that otherwise would go to an intermediary.This, in turn, uses the savings more efficiently.2. Portfolio flows are relatively short term in nature (have a shorter term to maturity),involve lower borrowing costs, and can generate near-term income. They also do not require a firm to give up control to a foreign investor. Consequently, they may help to improve capital allocation within an economy and help the economy's financial sector develop. These are all potential benefits of portfolio investments.By the same token, however, they are also relatively easy to reverse in direction, which is a potential disadvantage of portfolio investment.On the other hand, foreign direct investment (FDI) involve some degree ofownership and control of a foreign firm, are typically long term in nature, and help provide a stabilizing influence on a nation's economy. As such, FDI is typically more difficult to arrange.It is not advantageous to rely on either type of investment exclusively, in so far as each type accomplishes different goals for an economy. Both near-andlong-term capital are important for an economy's growth.3. As either portfolio investment of FDI increase, the demand for the local currencyrises (e.g., there is a shift from D0 to D1), which puts upward pressure on the value of the currency, from S0 to S1. If the central bank expects to hold the value of the currency constant at S0, it will have to increase the quantity of the domesticcurrency supplied (e.g., accommodate the excess quantity demanded at the initial spot rate S0) to maintain the peg. The opposite would hold for capital outflows.4. Suppose that a multinational bank (MNB) headquartered in a developed economyenters a developing economy. The MNB has gained considerable expertise in working as a financial intermediary, and likely has achieved economies of scale in doing so. By entering a foreign market, it helps to allocate the savings moreefficiently through its intermediation services; which in turn will lead to additional economic development. Specifically, it should help to make sure that the best investment projects are funded. Moreover, the competition it introduces into the capital market helps to improve the quality of the indigenous financialintermediaries. This, in turn, should also add to financial stability.5. Savers and borrowers can also benefit from the regulation of financialintermediaries when portfolio capital flows dominate a country's capital inflows.It can be argued that regulation to limit short-term inflows can stabilize theeconomy and that these regulations can be gradually lifted as the economybecomes more stable (financial markets develop) and resilient to external shocks.These regulations do impose costs in that they require resources to enforce, and may inhibit otherwise helpful capital inflows which may aid economicdevelopment. However, these costs must be considered against the potential losses that may be incurred if the absence of capital controls would lead to more volatile and capital markets (which may deter the inflow of foreign capital).6. Policymakers should undertake actions that attract both portfolio capital flows andFDI flows. Actions that improve transparency in both the private a public sector reduces information asymmetries and their associate problems thereby making portfolio flows more stable, in other words, reducing the risk of massive capital outflows. Policymakers may also undertake actions that promote education,improve the tax structure and tax collection, and improve the countriesinfrastructure. These actions may, in turn, attract FDI.7. In the following two examples it is assumed that the policymaker maintains apegged-exchange rate regime and does not opt for a floating-rate regime. Hence, the policymaker may either intervene and maintain the peg or change the value of the peg. In both cases there is pressure for the domestic currency to appreciate visa vis the foreign currency.a. If the exchange rate pressure is only temporary in nature, then the policymakermay intervene by accommodating the excess quantity demanded, as explained in question 3 above.b. Because the exchange rate pressure is longer-term in nature, the policymakerwould be well advised to revalue the domestic currency.8. The World Bank was initially established to help countries rebuild after WWIIand in the 1960s expanded to also make long term loans to developing nations in order to help reduce poverty and improve living standards. Recently, some of the World Bank's activities have begun to overlap the IMF's activities to finance long-term structural adjustments and provide refinancing for some heavilyindebted countries. Critics may argue that the tasks that are duplicated by the IMF and the World Bank create conflicting goals for the World Bank. Thus, the two organizations may each benefit by focusing on different aims. For instance, the IMF may return to financing shorter-term objectives and leave the World Bank to worry about longer-term projects.Another conflicting line of reasoning involves donors' expectation that the World Bank maintain a revenue stream form its projects. This can be argues asunrealistic, however, in that the poorest countries are less likely to yield a payoff for the needed projects; and these are precisely the countries that the World Bank is designed and intended to help. On the other hand, the less risky projects,which could provide a positive revenue stream are likely to attract private capital.9. The first cause of a crisis could be an imbalance in the economy. In other words,an incongruity in economic fundamentals could cause a crisis. Possibleindicators include theoretical divergences between various economic variables such as the exchange rate and interest rates, income, and money supply. In terms of evaluation, if fundamental economic variables seem to be out of line, there may be an impending crisis.A second cause is that of self-fulfilling expectations and contagion effects. Inthis case, mere expectations of a potential inability to maintain a specifiedexchange rate or a slight incongruity between economic conditions and the market exchange rate may cause a cascade of speculation that leads to a crisis. Since this is based on perception, it is difficult to find an indicator. One possibleindicator would be trading volumes of currency for countries that may be at risk from the viewpoint of economic fundamentals. If trading volumes grew quickly, a crisis may be on the horizon.Finally, the structural moral hazard problem may indicate a crisis. In this case, a credit rating bureau, such as Moody's may provide the data needed to indicate a potential crisis. The quality of the credit rating would be relatively easily interpreted to indicate a potential crisis.10. It can be argued that such below market interest rate loans are critical for a developing nation's economy in order for the economy to grow unburdened by high interest payments when it is trying to funnel profits back into the economy and sustain growth. Conversely, providing these non-market rate loans can also be argued to distort the market for loanable funds and attract inefficientinvestment. Students' perspectives will vary as to which argument is the best.Chapter 8Traditional Approaches to Exchange-Rate and Balance-Of-Payments Determination1. Using the formula provided in the question, the elasticity of foreign exchangedemand is, in absolute value()(),5236.01818.00952.020.100.12/100.120.12002202/1220200==⎥⎦⎤⎢⎣⎡+-⎥⎦⎤⎢⎣⎡+-and the elasticity of foreign exchange supply is()().5782.01818.01053.020.100.12/100.120.12001802/1180200==⎥⎦⎤⎢⎣⎡+-⎥⎦⎤⎢⎣⎡+-2. A 1 percent depreciation of the Canadian dollar results in a 0.52 percent declinein imports demanded and a rise of 0.58 percent in exports supplied.3. In absolute value, the smallest elasticity measure (most inelastic) is Germany’selasticity of import demand from the U.K. In absolute value, the largestelasticity meas ure (most elastic) is the United States’ elasticity of demand forimports from Germany.4. Table 8-1 provides measures of the price elasticity of import demand. If theU.S. dollar depreciates relative to the Japanese yen, U.S. exports becomerelatively less expensive to Japanese consumers and Japanese exports becomerelatively more expensive to U.S. consumers.a. The U.S. quantity of imports demanded from Japan falls by 1.13 percent.b. Japan’s quantity of imports demanded from the U.S. rises by 0.72 p ercent.c. Because U.S. exports rise and imports decline, the trade balance should improve.5. The trade balance may not improve in the short-run because of pass-through andJ-curve effects. Over a longer time horizon, import demand is relative moreelastic and the trade balance should improve.6. If the Canadian dollar depreciates relative to the U.S. dollar, then the quantity ofhockey pucks demanded declines. Hence, Slovakian manufacturers would have to absorb all of the exchange rate change in their profit margins and the price of hockey pucks would have to decline by 5 percent for the quantity demanded to remain unchanged.7. Using the values given in the problem:a. real income, y, equals c + i + g + x = $23,500, absorption, a, equals c + i + g +im = $24,000.b. Net exports, x - im, equals -$500. Therefore, there is a trade deficit of $500.8. Net exports now equal $550 - $950 = $400. The devaluation did improve theexternal balance.9. The advertising campaign would induce consumers to increase expenditures ondomestic output and decrease expenditures on foreign output. Domesticabsorption will rise and, if expenditures on imports decrease, the trade balance improves.10. As the U.S. economy expands, we would expect real income and real absorptionto increase. On the one hand, if real income increases more than real absorption, net exports will rise. This would lead to an appreciation of the U.S. dollar. If, on the other hand, real absorption rises faster than real income, net exports fall.This would lead to a depreciation of the U.S. dollar.Chapter 9Monetary and Portfolio Approaches to Exchange-Rate andBalance-of-Payments Determination1. Using the formula provided on page 222, m(DC + FER) = kSP*y.a. The money stock is 2($1,000 + $80) = $2,160 million.b. The level of real income is: [2($1,000 + $80)]/[(0.20)(1.2)(2)] = $4,500 million.2 An open market purchase of securities in the amount of $10 million:a. A fixed exchange rate regime requires a decrease in foreign reserves in anequal amount. Hence, this action results in a balance of payments deficit inthe amount of $10 million.b. A flexible exchange rate regime results in a new spot exchange rate of 2.019,which is a depreciation of the domestic currency. This problem is solved byusing the value for real income derived in 5 b above: [(2($1,010 +80)]/[(0.20)(1.2)($4,500)] = 2.019.3. The wealth identity is given on page 229 as W≡ M + B+ SB*. An open marketsale of securities would reduce bank reserves, increasing the domestic interest rate.Individuals would shift from foreign bonds to domestic bonds, leading to anappreciation of the domestic currency. Under a fixed exchange rate, the open market sale would result in an improvement of the domestic nation’s balance of payments. (The elasticity diagrams in Chapter 8 are useful in answering thisquestion.)4. This answer is an illustration of problem 3 under flexible exchange rates. Theopen market sale would cause an increase in the demand for the domesticcurrency and the domestic currency would appreciate as a result.5. The wealth identity is given on page 315 as W≡ M + B SB*. From the foreignnation it is W ≡ M* + B* + (1/S)B. An open market sale of securities by theforeign central bank would reduce foreign bank reserves, increasing the foreign interest rate relative to the domestic interest rate. Individuals would shift from domestic bonds to foreign bonds, leading to an depreciation of the domesticcurrency.Chapter11Economic Policy with Fixed Exchange Rates(Chose the right answers from the following 10 answers by yourself . SuGuangjin)1. Achieving a balance-of-payments surplus requires that the sum of the capitalaccount balance and current account balance is positive, which requires a higher interest rate to attract greater capital inflows and lower real income to dampen import spending. Consequently, the BP schedule would lie above and to the left of the position it otherwise would have occupied if the external-balanceobjective were to ensure only a balance-of- payments equilibrium. Undoubtedly, if the central bank felt pressure to sterilize under the latter objective, the pressure to do so would be greater if it seeks to attain a balance-of-payments surplus, which would require the central bank to steadily acquire foreign-exchangereserves. In the absence of sterilization, the nation's money stock would steadily decline.1. In this situation, variations in the domestic interest rate relative to interest rates inother nations would have not effect on the nation's capital account balance and its balance of payments. Its BP schedule, therefore, would be vertical. Anexpansionary fiscal policy, given a fixed exchange rate (as assumed in thischapter), would cause the IS schedule to shift rightward, initially inducing a rise in equilibrium real income. This, however, would cause import spending toincrease, and the nation would experience a balance-of-payments deficit, which would place downward pressure on the value of its currency. To prevent achange in the exchange rate, the central bank would have to sell foreign exchange reserves. If this intervention is unsterilized, then the nation's money stock would decline, ultimately causing the LM schedule to shift back too a final IS-LMequilibrium at a point vertically above the initial equilibrium point, along thevertical BP schedule.3. A reduction in the quantity of money shifts the LM schedule leftward. At thenew IS-LM equilibrium, the nominal interest rate rises and real income declines.Irrespective of the shape of the BP schedule, this would result in a balance ofpayment surplus, which would tend to place upward pressure on the value of the nation's currency. To maintain a fixed exchange rate, the central bank would have to purchase foreign exchange reserves. If this foreign-exchange-market intervention is unsterilized, then the nation's money stock increases, causing the LM schedule to shift back to the right. Ultimately, the original IS-LMequilibrium is re-attained.4. If capital is highly mobile, a drop in government spending will likely cause aprivate payments deficit. The fall in income will cause a decrease in imports anda trade surplus. As the domestic interest rate increases, however, the capitaloutflow will lead to a private payments deficit. If capital is not mobile, thecapital outflows are likely not large enough to counteract the effect of a drop in imports. Therefore, a private payments surplus would result.。

Answers to End of Chapter QuestionsChapter 1Keeping Up With a Changing World-Trade Flows, Capital Flows, and the Balance Of Payments1. The balance on merchandise trade is the difference between exports of goods, 719 and theimports of goods, 1,145, for a deficit of 426. The balance on goods, services and income is 719 + 279 +284 – 1145 - 210 – 269, for a deficit of 342. Adding unilateral transfers to this gives a current account deficit of 391, [-342 + (-49) = -391]. (Note that income receipts are credits and income payments are debits.)2. Because the current account balance is a deficit of 391, then without a statisticaldiscrepancy, the capital account is a surplus of 391. In this problem, however, the statistical discrepancy is recorded as a positive amount (credit) of 11. Hence, the sum of the debits in the balance of payments must exceed the credits by 11. So, the deficit of the current account must be greater than the surplus on the capital account by 11. The capital account, therefore, is a surplus of 391 – 11 = 380.3. A balance-of-payments equilibrium is when the debits and credits in the current account andthe private capital account sum to zero. In the problem above we do not know the private capital account balance. We cannot say, therefore, whether this country is experiencinga balance-of-payments surplus or deficit or if it is in equilibrium.4 The current account is a deficit of $541,830 and the private capital account balance is asurplus of $369,068. The U.S., therefore, has a balance of payments deficit.5 Positive aspects of being a net debtor include the possibility of financing domesticinvestment that is not possible through domestic savings; thereby allowing for domestic capital stock growth which may allow job, productivity, and income growth. Negative aspects include the fact that foreign savings may be used to finance domestic consumption rather than domestic savings; which will compromise the growth suggested above.Positive aspects of being a net creditor include the ownership of foreign assets which can represent an income flows to the crediting country. Further, the net creditor position also implies a net exporting position. A negative aspect of being a net creditor includes the fact that foreign investment may substitute for domestic investment.6 A nation may desire to receive both portfolio and direct investment due to the type ofinvestment each represents. Portfolio investment is a financial investment while direct investment is dominated by the purchase of actual, real, productive assets. To the extent that a country can benefit by each type of investment, it will desire both types of investment.Further, portfolio investment tends to be short-run in nature, while FDI tends to be long-run in nature. This is also addressed in much greater detail in Chapter 7.7. Domestic Savings - Domestic Investment = Current Account BalanceDomestic Savings - Domestic Investment = Net Capital FlowsTherefore, Current Account Balance = Net Capital Flows8 Using the equations above, private savings of 5 percent of income, government savings of-1 percent, and investment expenditures of 10 percent would results in a current account deficit of 6 percent of income and a capital account surplus (net capital inflows) of 6 percent of income. This could be corrected with a reduction in the government deficit (to a surplus) and/or an increase in private savings.Chapter 2The Market for Foreign Exchange1. Because it costs fewer dollars to purchase a euro after the exchange rate change, the eurodepreciated relative to the dollar. The rate of depreciation (in absolute value) was [(1.2168 – 1.2201)/1.2201]100 = 0.27 percent.2. Note that the rates provided are the foreign currency prices of the U.S. dollar. Every valuehas been rounded to two decimal places which may cause some differences in answers.3 The cross rate is 1.702/1.234 = 1.379 (€/£), which is smaller in value than that observedin the London market. The arbitrageur would purchase £587,544 ($1,000,000/1.702) with the $1 million in the New York market. Next they would use the £587,544 in London to purchase €837,250 (£587,544*1.425). Finally, they would sell the €837,250 in the New York market for $1,033,167 (€837,250*1.234). The profit is #33,167.4. Total trade is (163,681 + 160,829 + 261,180 + 210, 590) = 796,280. Trade with the Euro areais (163,681 + 261,180) = 424,861. Trade with Canada is (160,829 + 210,590) = 371,419. The weight assigned to the euro is 424,861/796,280 = 0.53 and the weight assigned to the Canadian dollar is 0.47. (Recall the weights must sum to unity.)Because the base year is 2003, the 2003 EER is 100. The value of the 2004 EER is:[(0.82/0.88)•0.53 + (1.56/1.59)•0.47]•100 = (0.4939 + 0.4611)•100 = 95.4964, or 95.5.This represents a 4.5 percent depreciation of the U.S. dollar.5 The real effective exchange rate (REER) for 2003 is still 100. The real rates of exchangeare, for 2003, 0.88•(116.2/111.3) = .9187, 1.59•(116.2/111.7) = 1.6541, and for 2004, 0.82•(119.0/114.4) = 0.8530, 1.56•(119.0/115.6) = 1.6059. The value of the 2004 REER is:[(0.8530/0.9187)•0.53 + (1.6059/1.6541)•0.47]•100 = (0.4921 + 0.4563)•100 = 94.84, or94.8. This represents a 5.2 percent depreciation of the U.S. dollar in real terms6. This is a nominal appreciation of the euro relative to the U.S. dollar. The percent changeis [(1.19 – 1.05)/1.05]•100 = 13.3 percent.7. The January 200 real exchange rate is 1.05•(107.5/112.7) = 1.0016. The May 2004 real rateis 1.19•(116.4/122.2) = 1.1335.8 In real terms the euro appreciated relative to the U.S. dollar. The rate of appreciationis [(1.1335 – 1.0016)/1.0016]*100 = 13.17 percent.9 Absolute PPP suggests the May 2004 exchange rate should be 122.2/116.4 = 1.0498. The actualexchange rate is 1.19. Hence, the euro is overvalued relative to the U.S. dollar by (1.19 – 1.0498)/1.0498]•100 = 13.35 percent.10Relative PPP can be used to calculate a predicted value of the exchange rate as: S PPP = 1.05•[(122.2/112.7)/(116.4/107.5)] = 1.0014.11. The actual exchange rate is 1.19. Hence, the euro is overvalued relative to the U.S. dollarby (1.19 – 1.0014)/1.0014]•100 = 18.83 percent.Chapter 3Exchange Rate Systems, Past to Present1. Ranking the various exchange rate arrangements by flexibility is not so clear cut.Nonetheless the arrangements described in this chapter are (from fixed to flexible): dollarization, currency board, commodity (standard) peg, dollar (standard) peg,currency basket peg, crawling peg, managed float, flexible.2. The two primary functions of the International Monetary Fund are: surveillance of membernations' macroeconomic policies, and to provide liquidity to member nations experiencing payments imbalances.3. The value of the Canadian dollar relative to gold is CAN$69 (1.38 • $50) and the valueof the British pound relative to gold is £33.33 ($50/1.50).4. The exchange rate between the Canadian dollar and the British pound is C$/£ 2.07 (1.38• 1.50).5. The currency value of the peso can be expressed as $0.50 + €.50=P1. The exchange ratebetween the dollar and the euro can be used to convert the euro amount to its dollar equivalent of $0.55. Hence, $1.05=P1, or and exchange value of 0.952 P/$. Using the exchange rate between the dollar and the euro again, the exchange rate between the peso and the euro is 0.1.048 P/€ (0.952 P/$ • 1.10 $/€).6. Because $1.05 is the currency content of the basket, as shown above, and $0.50 of thatcontent is attributable to the dollar, the weight assigned to the dollar is 0.50/1.05 = 0.476, or 47.6 percent. Because the weights must sum to unity, the weight assigned to the euro is 52.4 percent.7. The main difference between the two systems was that, in the Smithsonian system, the dollarwas not pegged to the value of gold. One reason that the system was short was because there was little confidence that U.S. economic policy would be conducted in a manner conducive to a system of pegged exchange rates.8. The principle responsibilities of a currency board are to issue domestic currency notesand peg the value of the domestic currency. A currency board is not allowed to purchase domestic debt, act as a lender of last resort, or set reserve requirements.9. The Lourve accord established unofficial limits on currency value movements. In a sense,it was peg with bands for each of the main currencies (dollar, yen and mark).10. Differences in the fundamental determinants of currency values between the peggingcountry and the other country should be considered. To this point of the text, the rate of inflation is a good example. Relative PPP can be used to determine the rate of crawl.11. Under a currency board system, a nation still maintains its domestic currency. Hence,policymakers can change exchange rate policies and monetary policies if they so desire.When a nation dollarizes and disposes of its domestic currency it no longer has this option.Chapter 4The Forward Currency Market and International Financial Arbitrage1. Given that the exchange rate is expressed as dollars to euros, we treat the dollar as the domestic currency. Note also that interest rates are quoted on an annual basis even though thematurity period is only one month. In this problem we divide the interest rates by 12 to put them on a one-month basis.a. The interest rate differential, therefore, is (1.75%/12 - 3.25%/12) = -0.125%. Theforward premium/discount, expressed as a percentage, is calculated as:((F-S)/S)•100 = ((1.089 – 1.072)/1.072)•100=1.5858%b. Transaction costs are shown in the figure above by the dashed lines that interest thehorizontal axis at values of -1.00 and 1.00.c. The positive value indicates that the euro is selling at a premium. In addition, the interestrate differential favors the euro-denominated instrument. Hence, a saver shift funds to euro-denominated instruments.2. Using the provided information:(1.75/12) – (3.25/12) < [(1.089 - 1.072/1.072)]•100-0.125% < 1.5858%.3.Graph 1, the spot market for the euro.R–R*450(F-S)/S-0.1251.58581.00-1.0$/€$/€In graph 1,the demand for the euro rises as international savers shift funds into euro-denominated instruments. In graph 2, the supply of euros increases in the forward market. (Consider a U.S. saver that moves funds into a euro-denominated instrument. They would desire to sell the euro forward so they may convert euro-denominated proceeds at the time of maturity into their dollar equivalent.) Graph 3 illustrates a decrease in loanable funds in the United States as savers shift funds to euro-denominated instruments. Graph 4 illustrates the increase in the supply of loanable funds that occurs when savers shift funds to the euro-denominated instrument.4. Because (1.03125) > (1.04250)(1.4575/1.5245) = 0.9967, an arbitrage opportunity exists inthis example if one were to borrow the pound and lend the euro. Suppose you were to borrow one pound, the steps are then:a. Borrow £1, convert to €1.5245 on the spot market.b. Lend euros, yielding €1.5245•(1.03125) = €1.5721.c. See euros forward, yielding €1.5721/1.4575 = £1.0787.d. Repay the pound loan at £1•(1.04250) = £ 1.04250.e. The profit is £0.0362, or 3.62 percent.5. Because interest rates are quoted as annualized rates, we need to divide each interest rateby 4 (12/3). The uncovered interest parity equation is:R -R* = (S e+1 - S) /Sa. Rewriting the equation for the expected future expected exchange rate yields:S e+1 = [(R- R*) + 1]Sb. Using the values given yields the expected future spot rateS e+1 = [(0.0124/4 - 0.0366/4) + 1]• 1.5245 = 1.5153.6. Given this information, we can calculate the forward premium/discount with the UIP condition:(F - S)/S = R - R*The interest differential is 1.75% - 3.25% = 1.5%. This is the expected forward premium on the euro. Hence, (F – 1.08)/1.08 = 0.015 implies that F = 1.0962.7. We can adjust for the shorter maturity by dividing the interest rates by 2 (12/6). Now theinterest differential is 0.75%, still a forward premium on the euro. The forward rate now is (F – 1.08)/1.08 = 0.0075 implies that F = 1.0881.8. The U.S. real rate is 1.24% – 2.1% = -0.86% and the Canadian real rate is 2.15% – 2.6% =-0.45%. Ignoring transaction costs, because the real interest rates are not equal, real interest parity does not hold.9. Uncovered interest parity is R -R* = (S e+1 - S) /S + ρ.a. Using the same process as in question 5 above, the expected future spot rate is:S e+1 = [(R- R*) + 1]S,S e+1 = [(0.075 - 0.035) + 1]•30.35 = 31.564.b. Using the same process as in question 5 above, the expected future spot rate is:S e+1 = [(R- R*) + 1 - ρ]S,S e+1 = [(0.075 - 0.035) + 1 – 0.02]•30.35 = 30.957.10. Because the forward rate, 30.01, is less than the expected future spot rate, 30.957, you shouldsell the koruna forward. For example, $1 would purcase k30.957, which you could sell forward yielding k30.957/30.01 = $1.0316.11. International financial instruments:a. Global Bond: long term instruments issued in the domestic currency.b. Eurobond: term is longer than one year and is issued in a foreign currency.c. Eurocurrency: keyword is that it is a deposit.d. Global equity: keyword is that it is a share.Chapter 7The International Financial Architecture and Emerging Economies1. The difference between direct and indirect financing has to do with whether the borrower andlender seek each other out or whether an intermediary matches borrowers and lenders. Direct financing requires no intermediary to match savers and borrowers. An economy will benefit from having both direct and indirect financing because both are appropriate ways to save and invest under different circumstances. As discussed in the text, financial intermediaries absorb a fraction of each saver's dollar that is borrowed. Thus, the intermediary takes some of the funds that otherwise would have gone to a borrower. However, the financialintermediary provides an important service by reducing information asymmetries, allowing savers to pool risk, and matching risk and return. Therefore, when an individual cannot research these issues on his/her own, the intermediary is necessary to help the financial markets operate. However, a strong bond market, in which borrowers and savers can directly interact, allows for informed parties to save the funds that otherwise would go to an intermediary. This, in turn, uses the savings more efficiently.2. Portfolio flows are relatively short term in nature (have a shorter term to maturity), involvelower borrowing costs, and can generate near-term income. They also do not require a firm to give up control to a foreign investor. Consequently, they may help to improve capital allocation within an economy and help the economy's financial sector develop. These are all potential benefits of portfolio investments. By the same token, however, they are also relatively easy to reverse in direction, which is a potential disadvantage of portfolio investment.On the other hand, foreign direct investment (FDI) involve some degree of ownership and control of a foreign firm, are typically long term in nature, and help provide a stabilizing influence on a nation's economy. As such, FDI is typically more difficult to arrange.It is not advantageous to rely on either type of investment exclusively, in so far as each type accomplishes different goals for an economy. Both near-and long-term capital are important for an economy's growth.3. As either portfolio investment of FDI increase, the demand for the local currency rises (e.g.,there is a shift from D0to D1), which puts upward pressure on the value of the currency, from S0 to S1. If the central bank expects to hold the value of the currency constant at S0, it will have to increase the quantity of the domestic currency supplied (e.g., accommodate theexcess quantity demanded at the initial spot rate S0) to maintain the peg. The opposite would hold for capital outflows.4. Suppose that a multinational bank (MNB) headquartered in a developed economy enters adeveloping economy. The MNB has gained considerable expertise in working as a financialQ s Q dintermediary, and likely has achieved economies of scale in doing so. By entering a foreign market, it helps to allocate the savings more efficiently through its intermediation services;which in turn will lead to additional economic development. Specifically, it should help to make sure that the best investment projects are funded. Moreover, the competition it introduces into the capital market helps to improve the quality of the indigenous financial intermediaries. This, in turn, should also add to financial stability.5. Savers and borrowers can also benefit from the regulation of financial intermediaries whenportfolio capital flows dominate a country's capital inflows. It can be argued that regulation to limit short-term inflows can stabilize the economy and that these regulations can be gradually lifted as the economy becomes more stable (financial markets develop) and resilient to external shocks. These regulations do impose costs in that they require resources to enforce, and may inhibit otherwise helpful capital inflows which may aid economic development. However, these costs must be considered against the potential losses that may be incurred if the absence of capital controls would lead to more volatile and capital markets (which may deter the inflow of foreign capital).6. Policymakers should undertake actions that attract both portfolio capital flows and FDI flows.Actions that improve transparency in both the private a public sector reduces information asymmetries and their associate problems thereby making portfolio flows more stable, in other words, reducing the risk of massive capital outflows. Policymakers may also undertake actions that promote education, improve the tax structure and tax collection, and improve the countries infrastructure. These actions may, in turn, attract FDI.7. In the following two examples it is assumed that the policymaker maintains a pegged-exchangerate regime and does not opt for a floating-rate regime. Hence, the policymaker may either intervene and maintain the peg or change the value of the peg. In both cases there is pressure for the domestic currency to appreciate vis a vis the foreign currency.a. If the exchange rate pressure is only temporary in nature, then the policymaker mayintervene by accommodating the excess quantity demanded, as explained in question 3 above.b. Because the exchange rate pressure is longer-term in nature, the policymaker would bewell advised to revalue the domestic currency.8. The World Bank was initially established to help countries rebuild after WWII and in the 1960sexpanded to also make long term loans to developing nations in order to help reduce poverty and improve living standards. Recently, some of the World Bank's activities have begun to overlap the IMF's activities to finance long-term structural adjustments and provide refinancing for some heavily indebted countries. Critics may argue that the tasks that are duplicated by the IMF and the World Bank create conflicting goals for the World Bank. Thus, the two organizations may each benefit by focusing on different aims. For instance, the IMF may return to financing shorter-term objectives and leave the World Bank to worry about longer-term projects.Another conflicting line of reasoning involves donors' expectation that the World Bank maintain a revenue stream form its projects. This can be argues as unrealistic, however, in that the poorest countries are less likely to yield a payoff for the needed projects; and these are precisely the countries that the World Bank is designed and intended to help. On the other hand, the less risky projects, which could provide a positive revenue stream are likely to attract private capital.9. The first cause of a crisis could be an imbalance in the economy. In other words, anincongruity in economic fundamentals could cause a crisis. Possible indicators include theoretical divergences between various economic variables such as the exchange rate and interest rates, income, and money supply. In terms of evaluation, if fundamental economic variables seem to be out of line, there may be an impending crisis.A second cause is that of self-fulfilling expectations and contagion effects. In this case,mere expectations of a potential inability to maintain a specified exchange rate or a slight incongruity between economic conditions and the market exchange rate may cause a cascade of speculation that leads to a crisis. Since this is based on perception, it is difficult to find an indicator. One possible indicator would be trading volumes of currency for countries that may be at risk from the viewpoint of economic fundamentals. If trading volumes grew quickly, a crisis may be on the horizon.Finally, the structural moral hazard problem may indicate a crisis. In this case, a credit rating bureau, such as Moody's may provide the data needed to indicate a potential crisis.The quality of the credit rating would be relatively easily interpreted to indicate a potential crisis.10. It can be argued that such below market interest rate loans are critical for a developingnation's economy in order for the economy to grow unburdened by high interest payments when it is trying to funnel profits back into the economy and sustain growth. Conversely, providing these non-market rate loans can also be argued to distort the market for loanable funds and attract inefficient investment. Students' perspectives will vary as to which argument is the best.Chapter 8Traditional Approaches to Exchange-Rate and Balance-Of-Payments Determination1. Using the formula provided in the question, the elasticity of foreign exchange demand is,in absolute value ()(),5236.01818.00952.020.100.12/100.120.12002202/1220200==⎥⎦⎤⎢⎣⎡+-⎥⎦⎤⎢⎣⎡+- and the elasticity of foreign exchange supply is ()().5782.01818.01053.020.100.12/100.120.12001802/1180200==⎥⎦⎤⎢⎣⎡+-⎥⎦⎤⎢⎣⎡+- 2.A 1 percent depreciation of the Canadian dollar results in a 0.52 percent decline in imports demanded and a rise of 0.58 percent in exports supplied. 3. In absolute value, the smallest elasticity measure (most inelastic) is Germany ’s elasticityof import demand from the U.K. In absolute value, the largest elasticity measure (most elastic) is the United States ’ elasticity of demand for imports from Germany.4. Table 8-1 provides measures of the price elasticity of import demand. If the U.S. dollardepreciates relative to the Japanese yen, U.S. exports become relatively less expensive to Japanese consumers and Japanese exports become relatively more expensive to U.S. consumers.a. The U.S. quantity of imports demanded from Japan falls by 1.13 percent.b. Japan ’s quantity of imports demanded from the U.S. rises by 0.72 percent.c. Because U.S. exports rise and imports decline, the trade balance should improve.5. The trade balance may not improve in the short-run because of pass-through and J-curve effects.Over a longer time horizon, import demand is relative more elastic and the trade balance should improve. 6. If the Canadian dollar depreciates relative to the U.S. dollar, then the quantity of hockeypucks demanded declines. Hence, Slovakian manufacturers would have to absorb all of the exchange rate change in their profit margins and the price of hockey pucks would have to decline by 5 percent for the quantity demanded to remain unchanged.7.Using the values given in the problem:a. real income, y, equals c + i + g + x = $23,500, absorption, a, equals c + i + g + im = $24,000.b. Net exports, x - im, equals -$500. Therefore, there is a trade deficit of $500. 8.Net exports now equal $550 - $950 = $400. The devaluation did improve the external balance. 9. The advertising campaign would induce consumers to increase expenditures on domestic outputand decrease expenditures on foreign output. Domestic absorption will rise and, ifexpenditures on imports decrease, the trade balance improves.10. As the U.S. economy expands, we would expect real income and real absorption to increase.On the one hand, if real income increases more than real absorption, net exports will rise. This would lead to an appreciation of the U.S. dollar. If, on the other hand, real absorption rises faster than real income, net exports fall. This would lead to a depreciation of the U.S. dollar.Chapter 9Monetary and Portfolio Approaches to Exchange-Rate and Balance-of-Payments Determination1. Using the formula provided on page 222, m(DC + FER) = kSP*y.a. The money stock is 2($1,000 + $80) = $2,160 million.b. The level of real income is: [2($1,000 + $80)]/[(0.20)(1.2)(2)] = $4,500 million.2 An open market purchase of securities in the amount of $10 million:a. A fixed exchange rate regime requires a decrease in foreign reserves in an equal amount.Hence, this action results in a balance of payments deficit in the amount of $10 million.b. A flexible exchange rate regime results in a new spot exchange rate of 2.019, which isa depreciation of the domestic currency. This problem is solved by using the value forreal income derived in 5 b above: [(2($1,010 + 80)]/[(0.20)(1.2)($4,500)] = 2.019. 3. The wealth identity is given on page 229 as W≡ M + B+ SB*. An open market sale of securitieswould reduce bank reserves, increasing the domestic interest rate. Individuals would shift from foreign bonds to domestic bonds, leading to an appreciation of the domestic currency.Under a fixed exchange rate, the open market sale would result in an improvement of the domestic nation’s balance of payments. (The elasticity diagrams in Chapter 8 are useful in answering this question.)4. This answer is an illustration of problem 3 under flexible exchange rates. The open marketsale would cause an increase in the demand for the domestic currency and the domestic currency would appreciate as a result.5. The wealth identity is given on page 315 as W≡ M + B SB*. From the foreign nation it isW ≡ M* + B* + (1/S)B. An open market sale of securities by the foreign central bank would reduce foreign bank reserves, increasing the foreign interest rate relative to the domestic interest rate. Individuals would shift from domestic bonds to foreign bonds, leading to an depreciation of the domestic currency.Chapter11Economic Policy with Fixed Exchange Rates(Chose the right answers from the following 10 answers by yourself . SuGuangjin)1. Achieving a balance-of-payments surplus requires that the sum of the capital account balanceand current account balance is positive, which requires a higher interest rate to attract greater capital inflows and lower real income to dampen import spending. Consequently, the BP schedule would lie above and to the left of the position it otherwise would have occupied if the external-balance objective were to ensure only a balance-of- payments equilibrium.Undoubtedly, if the central bank felt pressure to sterilize under the latter objective, the pressure to do so would be greater if it seeks to attain a balance-of-payments surplus, which would require the central bank to steadily acquire foreign-exchange reserves. In the absence of sterilization, the nation's money stock would steadily decline.2. In this situation, variations in the domestic interest rate relative to interest rates inother nations would have not effect on the nation's capital account balance and its balance of payments. Its BP schedule, therefore, would be vertical. An expansionary fiscal policy, given a fixed exchange rate (as assumed in this chapter), would cause the IS schedule to shift rightward, initially inducing a rise in equilibrium real income. This, however, would cause import spending to increase, and the nation would experience a balance-of-payments deficit, which would place downward pressure on the value of its currency. To prevent a change in the exchange rate, the central bank would have to sell foreign exchange reserves. If this。

第一章课后习题答案一、关键词1.货币(money;currency)从商品中分离出来固定地充当一般等价物的商品。

现代货币:是指以某一权力机构为依托,在一定时期一定地域内推行的一种可以执行交换媒介、价值尺度、延期支付标准及作为完全流动的财富的储藏手段等功能的凭证。

一般可以分为纸凭证及电子凭证,就是人们常说的纸币及电子货币。

2.信用货币(credit money)由国家法律规定的,强制流通不以任何贵金属为基础的独立发挥货币职能的货币。

目前世界各国发行的货币,基本都属于信用货币。

3.货币职能(monetary functions)货币本质所决定的内在功能。

货币的职能主要包括了价值尺度、流通手段、贮藏手段、支付手段和国际货币这五大职能。

4.货币层次(monetary levels)货币层次的划分:M1=现金+活期存款;M2=M1+储蓄存款+定期存款;M3=M2+其他所有存款;M4=M3+短期流动性金融资产。

这样划分的依据是货币的流动性。

5.流动性(liquidity)资产能够以一个合理的价格顺利变现的能力,它是一种所投资的时间尺度(卖出它所需多长时间)和价格尺度(与公平市场价格相比的折扣)之间的关系。

6.货币制度(monetary system)国家对货币的有关要素、货币流通的组织与管理等加以规定所形成的制度,完善的货币制度能够保证货币和货币流通的稳定,保障货币正常发挥各项职能。

二、重要概念1.价值形式商品的价值表现形式。

商品的价值不能自我表现,必须在两种商品的交换中通过另一种商品表现出来。

2.一般等价物从商品中分离出来的充当其它一切商品的统一价值表现材料的商品,它的出现,是商品生产和交换发展的必然结果。

3.银行券由银行(尤指中央银行)发行的一种票据,俗称钞票。

早期银行券由商业银行分散发行,代替金属货币流通,通过与金属货币的兑现维持其价值。

中央银行产生以后,银行券由中央银行垄断发行,金属货币制度崩溃后,银行券成为不兑现的纸制信用货币。

国际金融(第五版)课后习题以及答案一、选择题1. 以下哪个因素不属于决定汇率变动的长期因素?()A. 国际收支状况B. 贸易政策C. 通货膨胀率D. 货币政策答案:B2. 以下哪个国家的货币被认为是避险货币?()A. 美元B. 欧元C. 英镑D. 日元答案:A3. 以下哪个组织负责监督国际金融秩序和协调国际金融政策?()A. 国际货币基金组织B. 世界银行C. 国际清算银行D. 二十国集团答案:A二、简答题1. 简述国际收支平衡表的主要内容。

答案:国际收支平衡表是反映一个国家与其他国家在一定时期内经济交易情况的表格。

其主要内容包括以下几部分:(1)经常账户:包括货物、服务、收入和转移支付四个子账户;(2)资本和金融账户:包括直接投资、证券投资、其他投资和储备资产四个子账户;(3)误差与遗漏:用于调整统计误差。

2. 简述汇率制度的主要类型。

答案:汇率制度是指一个国家或地区货币当局对本币与外币汇率变动进行管理和调整的制度。

主要类型包括以下几种:(1)固定汇率制度:货币当局将本币与某一外币或一篮子货币的汇率固定在一个水平上;(2)浮动汇率制度:货币当局不干预外汇市场,本币汇率由市场供求关系决定;(3)有管理的浮动汇率制度:货币当局在必要时对外汇市场进行干预,以调节汇率水平;(4)双重汇率制度:对不同的交易实行不同的汇率。

三、论述题1. 论述国际资本流动的原因及影响。

答案:国际资本流动的原因主要有以下几点:(1)投资收益差异:投资者追求更高的投资回报,从而将资本从低收益国家转移到高收益国家;(2)汇率变动:汇率变动会影响国际资本的流动,如本币贬值会吸引外国投资者购买本币资产;(3)金融监管政策:不同国家的金融监管政策差异,导致投资者寻求监管较为宽松的市场进行投资;(4)政治、经济稳定性:政治、经济稳定性较高的国家更容易吸引国际资本。

国际资本流动的影响如下:(1)促进资源在全球范围内优化配置;(2)提高全球金融市场一体化程度;(3)加剧国际金融市场波动;(4)可能引发货币危机和债务危机。

货币金融学课后习题答案货币金融学是一门研究货币、信用、银行以及金融市场运作机制的学科。

它不仅涉及到理论的学习,还包括对实际问题的分析和解决。

以下是一些货币金融学课后习题的答案,这些答案仅供参考,具体问题可能需要结合具体情境进行分析。

1. 货币的定义及其功能货币是一种普遍接受的交换媒介、价值尺度、价值储藏和支付手段。

它具有以下功能:交易媒介、价值尺度、价值储藏和支付手段。

2. 货币供应量的组成货币供应量通常分为M0、M1和M2。

M0是流通中的现金;M1是M0加上活期存款;M2是M1加上定期存款和其他短期存款。

3. 中央银行的作用中央银行是国家的货币当局,其主要作用包括制定和执行货币政策、监管金融机构、维护金融稳定、管理国家外汇储备等。

4. 货币政策工具货币政策工具主要包括公开市场操作、存款准备金率和再贴现率。

这些工具可以用来调节货币供应量,影响利率和信贷条件。

5. 利率的决定因素利率的决定因素包括货币的供求关系、预期通货膨胀率、中央银行的货币政策以及风险溢价等。

6. 金融市场的分类金融市场可以分为货币市场和资本市场。

货币市场交易短期金融工具,如国库券和商业票据;资本市场交易长期金融工具,如股票和债券。

7. 银行的资产负债表银行的资产负债表包括资产、负债和所有者权益。

资产主要包括现金、贷款和证券;负债主要包括存款和借款;所有者权益是银行的净资产。

8. 信用风险和市场风险信用风险是指借款人可能无法偿还债务的风险;市场风险是指由于市场条件变化导致资产价值下降的风险。

9. 金融衍生品的作用金融衍生品如期货、期权、掉期等,可以用来对冲风险、投机或投资。

10. 金融危机的原因和影响金融危机可能由多种因素引起,如资产泡沫、信贷过度扩张、监管不力等。

金融危机的影响包括信贷紧缩、资产价格下跌、经济衰退等。

请注意,这些答案仅提供了一些基本的概念和理论框架,实际的货币金融学问题可能更为复杂,需要结合具体的情况和数据进行分析。

货币金融学课后习题答案货币金融学课后习题答案在学习货币金融学的过程中,课后习题是巩固知识、检验理解的重要方式。

下面将针对一些常见的货币金融学课后习题进行解答,帮助读者更好地理解和应用相关知识。

1. 什么是货币供应量?货币供应量的组成有哪些?货币供应量是指经济中流通的货币总量。

它包括M1、M2和M3三个层次。

M1是最窄的货币供应量,包括流通中的现金和活期存款。

M2是相对较宽的货币供应量,包括M1以及定期存款、储蓄存款和其他短期投资。

M3是最宽的货币供应量,包括M2以及较长期的定期存款和其他较长期的投资。

2. 什么是货币乘数?如何计算货币乘数?货币乘数是指货币供应量与货币基础之间的关系。

它表示货币基础增加一单位,货币供应量会增加多少单位。

货币乘数的计算公式为:货币乘数 = 1 / 银行存款准备金率。

例如,如果银行存款准备金率为10%,则货币乘数为1 / 0.1 = 10。

这意味着每增加1单位的货币基础,货币供应量将增加10单位。

3. 货币政策对经济的影响是什么?货币政策是中央银行通过调整货币供应量和利率等手段来影响经济活动的政策。

它对经济的影响主要体现在以下几个方面:- 货币政策可以通过调整利率来影响投资和消费行为。

降低利率可以鼓励借款投资和消费,促进经济增长;而提高利率则可以抑制通胀和过热经济。

- 货币政策也可以通过调整货币供应量来影响经济活动。

增加货币供应量可以刺激经济活动,促进就业和增长;而减少货币供应量则可以抑制通胀和过热经济。

- 货币政策还可以通过影响汇率来影响经济。

提高利率可以吸引外资流入,提高汇率;而降低利率则可以促进出口,降低汇率。

4. 什么是货币市场?货币市场的特点是什么?货币市场是指短期借贷和投资交易的市场。

它包括各类金融机构和个人之间进行的短期借贷和投资交易。

货币市场的特点包括:- 高度流动性:货币市场上的交易一般都是短期的,资金可以快速流动。

- 低风险:货币市场上的交易一般都是低风险的,因为参与者通常是信用良好的金融机构和政府。

(完整版)国际金融习题含答案一、填空题1. 国际金融市场中,外汇市场的交易额远远超过其他金融市场,每天的交易额约为______万亿美元。

答案:6.62. 根据汇率变动的弹性,汇率制度可以分为固定汇率制度和______。

答案:浮动汇率制度3. 国际货币基金组织(IMF)成立于______年,总部设在美国首都华盛顿。

答案:19444. 国际金融市场上,美元指数(USDX)是衡量美元对一篮子货币汇率变动的指标,目前美元指数的权重货币包括美元、欧元、日元、英镑和______。

答案:瑞士法郎二、选择题1. 以下哪项不是国际收支平衡表的组成部分?A. 经常账户B. 资本账户C. 错误和遗漏账户D. 通货膨胀账户答案:D2. 以下哪种汇率制度属于固定汇率制度?A. 金本位制B. 物价挂钩制C. 管理浮动汇率制度D. 自由浮动汇率制度答案:A3. 以下哪个国家不属于世界四大经济体?A. 美国B. 中国C. 德国D. 日本答案:D4. 以下哪个国家是世界上最大的外汇储备国?A. 美国B. 中国C. 日本D. 德国答案:B三、判断题1. 国际金融市场的形成和发展,有利于全球资源的优化配置和风险分散。

()答案:正确2. 浮动汇率制度下,汇率完全由市场供求关系决定,政府不进行任何干预。

()答案:错误3. 国际货币基金组织(IMF)的主要任务是调整国际收支失衡,促进成员国经济的稳定增长。

()答案:正确4. 通货膨胀率高的国家,其货币汇率往往呈贬值趋势。

()答案:正确四、简答题1. 简述国际金融市场的功能。

答案:国际金融市场的功能主要包括以下几点:(1)资金融通功能:为全球范围内的资金需求者和资金供应者提供融资和投资渠道;(2)风险分散功能:通过金融工具的多样化,降低投资者面临的风险;(3)价格发现功能:金融市场上的价格反映了市场供求关系,有助于投资者做出投资决策;(4)促进国际贸易和投资的发展:国际金融市场为国际贸易和投资提供了便利条件。

国际金融习题含答案一、选择题1. 以下哪项不是国际货币基金组织(IMF)的主要职能?A. 监测全球经济趋势B. 提供技术援助C. 为成员国提供短期资本流动支持D. 制定国际金融法规答案:D解析:国际货币基金组织(IMF)的主要职能包括监测全球经济趋势、提供技术援助以及为成员国提供短期资本流动支持,而不包括制定国际金融法规。

2. 以下哪个国家的货币不属于欧元区?A. 法国B. 德国C. 英国D. 荷兰答案:C解析:欧元区是指使用欧元作为官方货币的国家组成的区域,法国、德国和荷兰都属于欧元区,而英国并未加入欧元区。

3. 以下哪个汇率制度属于固定汇率制度?A. 浮动汇率制度B. 管制汇率制度C. 联系汇率制度D. 黑市汇率制度答案:C解析:联系汇率制度是一种固定汇率制度,它将一国货币与另一国货币挂钩,保持固定汇率。

而浮动汇率制度、管制汇率制度和黑市汇率制度均不属于固定汇率制度。

二、填空题1. 国际金融市场上的主要金融工具包括______、______、______和______。

答案:股票、债券、期货和期权解析:国际金融市场上的主要金融工具包括股票、债券、期货和期权,这些金融工具是投资者进行投资和风险管理的重要手段。

2. 国际收支平衡表包括______和______两大组成部分。

答案:经常账户和资本账户解析:国际收支平衡表是反映一个国家与其他国家在一定时期内经济交易情况的报表,它包括经常账户和资本账户两大组成部分。

三、判断题1. 国际货币基金组织(IMF)的主要职能是为成员国提供短期资本流动支持。

()答案:正确解析:国际货币基金组织(IMF)的主要职能之一是为成员国提供短期资本流动支持,以应对国际收支失衡问题。

2. 欧元区的成立有助于降低成员国之间的贸易壁垒。

()答案:正确解析:欧元区的成立使得成员国之间使用统一的货币,这有助于降低贸易壁垒,促进成员国之间的贸易往来。

四、简答题1. 简述外汇市场的功能。

国际金融第六版全书课后习题以及答案一、选择题1. 以下哪项不是国际金融市场上的主要货币?()A. 美元B. 欧元C. 英镑D. 人民币答案:D2. 以下哪个组织负责监督国际金融体系的运行?()A. 国际货币基金组织(IMF)B. 世界银行C. 国际清算银行(BIS)D. 世界贸易组织(WTO)答案:A3. 以下哪个国家不属于国际货币基金组织(IMF)的创始成员国?()A. 美国B. 英国C. 法国D. 中国答案:D二、判断题1. 国际金融市场上的汇率波动对国际贸易有很大的影响。

()答案:√2. 世界银行的主要职能是提供国际金融援助,促进成员国经济发展。

()答案:√3. 汇率制度是指一个国家货币当局对其货币汇率的变动幅度和方式所作出的规定。

()答案:√三、简答题1. 简述国际金融市场的主要功能。

答案:国际金融市场的主要功能包括:(1)资金流动:为各国政府、企业、金融机构和个人提供融资、投资和支付手段。

(2)信用创造:通过金融工具的创新和交易,实现信用创造,促进经济发展。

(3)风险分散:通过金融市场的交易,实现风险分散和转移。

(4)价格发现:金融市场上的价格反映了市场供求关系,为投资者提供参考。

(5)促进国际贸易:国际金融市场为国际贸易提供支付手段和融资服务。

2. 简述固定汇率制度与浮动汇率制度的优缺点。

答案:固定汇率制度的优点:(1)汇率稳定,有利于国际贸易和投资。

(2)有利于抑制通货膨胀。

固定汇率制度的缺点:(1)政府需要经常干预外汇市场,维持汇率稳定。

(2)容易导致国际收支失衡。

浮动汇率制度的优点:(1)市场供求关系自动调节汇率,有利于国际收支平衡。

(2)政府干预较少,有利于金融市场的发展。

浮动汇率制度的缺点:(1)汇率波动较大,对国际贸易和投资产生不利影响。

(2)容易导致金融市场动荡。

四、计算题1. 假设某国货币贬值10%,请问该国出口商品的价格在国际市场上降低了多少?答案:假设原价为100,贬值后价格为90,降低了10%。

2010级国际货币与金融经济学课后答案——中文版!!!10级考国金的孩子们,为了大家好背我把国际货币与金融经济学课后题的简答题部分翻译成中文版的给大家了,翻译水平有限·····另外添加了些自己的观点,时间紧迫,没有校对,如有问题,欢迎指出,也怕误人子弟。

老师说的是简答出书里面的,答题中英文都可以,但我觉得大家还是中文的多吧。

计算题比较费劲,如果大家需要再说声,我手写出来照成照片传上来,希望大家最后国金都100!!!!!第一章3 BOP均衡:在不考虑统计误差的时候,经常账户跟私人资本账户的借贷方之和为零的情况。

由于不知道此国家的私人资本账户余额,因此无法判断BOP是否赤字还是盈余。

5 净债务人的优势:无法通过国内融资的项目可以利用外部投资得以实现,从而可以使该国的资本存量得以增加,从而增加了就业,生产力,收入等。

另外,可以使人们在当期消费未来的商品。

净债务人的劣势:外国可能更多的为改过的消费融资,而不是该国的储蓄,这会使上述的增长得以减缓,另外,加重了该国家的未来偿债的负担。

净债权人的优势:净债权人表示本国拥有的国外资产多于外国拥有的本国资产,因此表示有外国资产的净流入,会带给该国收入,因此这种外国资产的流入可以看作为一种收入的流入,另外净债权人代表资本项目赤字,经常项目盈余,意味着该国为净出口,有利于出口发展。

净债权人的劣势:由于过多的对外国投资,可能会一定程度挤出国内投资,影响本国的金融体系的发展。

组合投资是一种金融工具的投资,更多是短期的,帮助一国金融体系短期发展,但是由于他可以很快的撤回,会对金融体系的稳定产生影响,而FDI是一种对真实资产具有生产力的资产的投资,更倾向于长期的投资,对一国的国民经济有稳定作用。

6 Domestic savings -Domestic Investment = Current Account BalanceDomestic Savings - Domestic Investment = Net Capital Flows因此,资本账户余额= 净资本流动8 公共储蓄=私人部门-政府部门=5%-1%=4%,而投资=10%,即投资大于储蓄,因此社会总支出大于总收入,即该国进口大于出口,有资本净流入,资本账户盈余,经常账户赤字。

国际金融课后习题答案(doc 48页)期性失衡,2.结构性失衡,3.货币性失衡,4.收入性失衡,5.贸易竞争性失衡,6.过度债务性失衡,7.其他因素导致的临时性失衡。

以上几方面原因不是截然分开的,而且,固定汇率制与浮动汇率制下国际收支不平衡,发展中国家与发达国家国际收支不平衡都是有区别和联系的。

5.汇率在国际收支失衡的协调中究竟意义何在?答:在国际收支失衡的调节中,有一类是市场自动调节机制,另一类为各国政府的政策调节,在前一类的调节机制中,在浮动汇率制下,国际收支的调节是通过汇率的变动来实现的,如当一国的国际收支为赤字时,外汇市场上的外汇需求会大于外汇供给,汇率上升,这将导致进口增加,出口减少,国际收支得到改善。

当自动调节机制不能完全解决国际收支失衡时,各国政府就会采取不同的政策进行调节,汇率政策就是其中的一类,如当一国的国际收支发生逆差时,该国可使本国货币贬值,以增强本国商品在国外的竞争力,扩大出口;同时,国外商品的本币价格上升,竞争力下降,进口减少,国际收支逐步恢复平衡。

由此可见,汇率无论是在自动调节还是政策调节中都发挥着重要的作用,汇率的上升下降不仅引起外汇市场供求的变化,更重要的是,他将导致进出口贸易的变化,使得国际收支失衡得以解决。

6.一国应该如何选择政策措施来调节国际收支的失衡?答:一国的国际收支失衡的调节,首先取决于国际收支失衡的性质,其次取决于国际收支失衡时国内社会和宏观经济结构,再次取决于内部均衡与外部平衡之间的相互关系,由于有内外均衡冲突的存在。

正确的政策搭配成为了国际收支调节的核心。

国际收支失衡的政策调节包括有:货币政策,财政政策,汇率政策,直接管制政策,供给调节政策等,要相机的选择搭配使用各种政策,以最小的经济和社会代价达到国际收支的平衡或均衡。

其次,在国际收支的国际调节中,产生了有名的“丁伯根原则”,“米德冲突”,“分派原则”,他们一起确定了开放经济条件下政策调控的基本思想,即针对内外均衡目标,确定不同政策工具的指派对象,并且尽可能地进行协调以同时实现内外均衡。

第一章思考题详解1.国际收支盈余或赤字这一说法是针对按不同口径划分的特定账户项目上出现的余额而言的;这是因为,就具体项目来说,借方和贷方经常是不相等的,会产生一定的差额;当特定账户项目的贷方总额大于借方总额时,称国际收支有顺差,也叫盈余;相反,当特定账户项目的贷方总额小于借方总额时,称国际收支有逆差,也叫赤字;当特定账户项目的贷方总额与借方总额相等时,称国际收支平衡;平时我们经常可以听到看到关于贸易收支出超、入超,经常帐户盈余、赤字、国际收支顺差、逆差等国际收支状况的报导或资料;2.我国国际收支的基本特征:1收支规模逐步扩大2国际收支结构改变,非贸易扩大,资本帐户大幅度增长3顺逆差互动4储备波浪式起伏,逐渐增长3.1997-2001年以上三个账户的算术绝对值均呈波动下滑态势,2001年达到谷底,2002年又开始大幅度上升;2006年全年进出口总额17607亿美元,比上年增长%,加快个百分点;进出口相抵,顺差达1775亿美元,比上年增加755亿美元;全年实际使用外商直接投资金额630亿美元,比上年增长%;年末国家外汇储备10663亿美元,比上年末增加2473亿美元;1997-2001年以上三个账户的算术绝对值均呈波动下滑态势,究其原因可以追溯到1997-1998年的东南亚金融危机,从那次危机以后我国经济就开始下滑,经常账户和资本与金融账户也顺周期的恶化;但是,2001年加入世界贸易组织,到去年底结束了5年过渡期,中国对外经济迅速发展;中国的对外贸易保持了20%以上的持续较快增长,同时,外商直接投资每年也大体上以500多亿到600多亿的额度进入中国市场;改革开放进入了一个新阶段;外汇管理顺应加入世贸组织和融入经济全球化的挑战,进一步深化改革,继续完善经常项目可兑换,稳步推进资本项目可兑换,推进贸易便利化;经常账户差额与资本和金融差额的双顺差扩大的局面是对外贸易以加工贸易为主、国际生产持续向中国转移、人民币升值下的变相资本内流等因素共同作用的结果;降低和取消部分商品出口退税制度改革虽然在中长期内有助于减少贸易顺差,但在短期内因为企业在出口退税新规则生效之前出口而扩大了贸易顺差;我国持续出现双顺差原因主要有:第一,资本净流入逐步成为国际收支顺差的主要来源;1997年,经常项目顺差占总顺差的%,该比重较2005年高出近20个百分点;资本项目顺差的贡献相应提高;1997年以来,资本项目累计顺差占国际收支总顺差的比重达%;第二,货物贸易顺差上升;货物贸易进出口状况是国际收支中的一项基本内容,反映了国际竞争力等经济基本面情况,是考察国际收支平衡与否的重要先行指标;第三,我国的出口鼓励政策;长期以来我国执行了“奖出限入”的外贸政策,这些政策包括:出口退税政策、有利于出口的汇率政策以及鼓励发展加工贸易的政策等;第四,在资本项目长期保持顺差方面,我国金融市场仍处在不发达状态;尽管就总体来说,我国的储蓄大于投资,但许多潜在投资者无法得到必要的资金;与此同时,中国的对外商直接投资实行优惠政策,建立合资企业是一件相对容易的事情;一些企业为了获得资金,于是引进外商直接投资;在获得外汇之后,便将外汇卖给中央银行,并用所得人民币购进国产设备和其他产品;其结果是直接投资流入转化为外汇储备的增加;第五,外汇储备增长加快;1994-1997年,我国外汇储备年均增加近300亿美元;1998-2000年,受亚洲金融危机传染效应的波及,外汇储备增势骤然放缓,年均增加额不足90亿美元;近年来,外汇储备增长重新加速;2001到2005年外汇储备年均增长额为亿美元,2006年外汇储备就已突破一万亿美元大关;2007年底亿美元,2008年底亿美元,2009年底亿美元;4.见本章第二节5.1管理浮动制阶段1949——19522固定汇率制度1953——19723人民币实行“一篮子货币”盯住汇率制度1972——19804实行贸易内部结算价1981——19845实行以美元为基准的有限弹性汇率制1985——19936实行以供求为基础、单一的有管理的浮动汇率制度1994——20057实行参考“一篮子货币”进行调节的有管理的浮动汇率制度2005年至今6.见本章第二节7.一经常项目顺差的成因1.内需不足的情况长期得不到解决.内需不足是中国当期经济发展的一个重要问题,1990——2008 年,中国GDP 的平均增速为%,而消费的平均增速仅为%;消费增长长期落后于GDP,而且相差达到二点几个百分点;同时消费占GDP 比重呈逐年下降的趋势;2.收入增长缓慢,社会保障不健全及传统观念影响近年来,中国GDP 保持了多年高速增长,但是收入的增长速度却没有GDP 如此高速,相对来说比较缓慢,使得居民边际消费倾向较低;同时,由于社会保障不健全,居民基本生活保障无法适应中国经济高速发展所带来的生活成本的提高,还有中国传统观念注重储蓄,这些都导致居民储蓄率逐年处于高位,消费较少;3.中国“世界工厂”地位特征导致顺差格局的出现中国产品的特点在于其是使用廉价劳动力生产出来的,其价格在国际市场上具有较强的竞争力;发达国家因此将其低端制造业转移至中国利用廉价劳动力进行生产,再从中国出口回本国及其他国家,加大了中国的出口;同时,这些产品可以直接在中国国内市场销售,不需要通过进口,这样也减少了中国的进口;二资本与金融项目顺差的成因1.奉行吸引外资政策和优良投资环境,吸引外国直接投资大量流入;自改革开放以来,我国相继出台了多项关于吸引外资投资中国的优惠政策;从投资环境上来说中国经济已经进入了长期稳定的发展时期,同时在亚洲金融危机爆发后,为抵消亚洲金融危机对中国吸引外资的不利影响,中国政府进一步出台了许多引资政策,并承诺人民币不贬值,减少了投资风险,使得大量外资继续流入中国;2.人民币升值预期的存在;近年来,国际上要求人民币大幅升值的呼声仍旧此起彼伏,由于巨额的国际贸易顺差和两万多亿的外汇储备,人民币存在很大的升值压力,人民币的升值预期长期存在;特别的是,美元在次贷危机爆发后继续步上贬值大道,人民币的升值预期更加强烈;在这样的升值预期下,海外投机资本为了从人民币升值过程中获取收益,通过各种途径流入中国,扩大了国际收支双顺差;这样,人民币的升值预期又进一步加强,越来越多的投机性资本就随之涌入我国,从这个角度来讲,国际收支顺差与投机性资本是相互推进的,形成了一个自我加强的循环过程;3.资本管制严,对外投资渠道狭窄;中国资本项目下的自由兑换到2010 年为止还未全部开放,只有部分项目被批准能够进行自由兑换,中国的资本管制仍比较严,除国家外汇储备经营外,中国资本流出渠道主要是商业银行对外拆借和购买国外债券,其他渠道的资本流出很少,保险公司等非银行金融机构和一般企业的证券投资尚未放开,居民境外证券投资的需求难得到满足;虽然近年来国家积极提倡企业“走出去”战略,但是与“引进来”战略相比,中国企业的“走出去”战略还非常滞后;由此造成中国资本与金融项目流出较少的局面,使得资本与金融项目的顺差不断扩大;8.开放性题目,可根据自己的理解认识来阐述第二章思考题详解1.ABC外汇管制主要指一国政府为平衡国际收支和维持本国货币汇率而对外汇进出实行的限制性措施;主要包括对外汇收入与运用的管理,外汇汇率的管理,货币可兑换性的管理等;2.D1994年1月1日,人民币官方汇率与外汇调剂价格正式并轨,我国开始实行以市场供求为基础的、单一的、有管理的浮动汇率制;3.BA“清洁浮动”又称自由浮动,指中央银行对外汇市场不采取任何干预活动,汇率完全由市场力量自发地决定;货币局制度的不足:1政府不能控制货币供应和利率,利率由基准货币发行国制定,货币总量取决于收支平衡,以及银行体系中的货币乘数;②政府不能利用汇率来调整外来因素对本国经济的影响,如进口价格的上涨、资本流通的转移等,而只能调整国内工资和商品价格;③正统货币局制度不会像传统的中央银行那样,帮助周转困难的银行平息危机;香港实行的联系汇率制度,实际上是一种货币局制度;4 .B 我国外汇管理的主要机关是国家外汇管理局;国家外汇管理局是隶属于国务院部委管理下的国家局;5. D 金融市场的发育程度;金融市场发育程度较高或金融国际化程度较高的国家,需要采取弹性较大的汇率制度;在货币自由兑换的情况下实行钉住汇率;思考题C:课外延伸分析:在金融市场特别是资本市场没有完全开放之前,在利率没有完全市场化之前,中国无须放弃目前的汇率政策,也无须屈服于日美等国所要求的人民币升值的压力;对于人民币汇率政策的真正挑战来自于中国加入世贸组织以后未来金融市场的全面开放,而此时银行的贷款利率等也将实现完全的市场化,这将意味着中国的利率已不可能独立于国际市场的利率;在这种情况下,任何旨在改变本国利率的货币政策都将可能因国际间金融资本的流入或流出而功亏一篑;因此,未来对于人民币汇率的挑战不在于人民币是否应该升值,而更在于人民币汇率制度的选择;我们是否应该仍然保持现有的固定汇率制度或者我们应转而采取浮动汇率制度如果我们维持现有的固定汇率制度,则是否还存在一些其他措施使得货币政策继续保持其现有的独立性尽管本人认为,这些措施还是存在的,但其合理性仍需通过进一步的研究而得以证实;如果我们决定采用浮动汇率制,则我们不得不问:我们的国家是否已经作好了准备,以承受因汇率波动而给我们所带来挑战1.ABC国际储备管理的原则有:第一,储备资产的安全性,即储备资产本身价值稳定、存放可靠;第二,储备资产的流动性,即储备资产要容易变现,可以灵活调用和稳定地供给使用;第三,储备资产的盈利性,即储备资产在保值的基础上有较高的收益;2.ABCDE国际清偿能力有广义与狭义之分;狭义一般指官方直接掌握的国际储备资产,又称第一线储备;广义则包括一国从国外借入的外汇储备、该国商业银行的短期外汇资产和该国官方或私人拥有的中、长期外汇资产主要指对外中长期投资,又称第二线储备3.A所谓三级准备主要是针对流动性而言的;4.B美国经济学家特里芬教授在其1960年出版的黄金与美元危机一书中总结了几十个国家的历史经验,并得出结论说:一国的国际储备额应同其进口额保持一定的比例关系,这个比例关系应以40%为最高限,20%最低限;一般认为,一国持有的国际储备应能满足其3个月的进口需要;照此计算,储备额对进口的比率为25%;这即所谓的储备进口比率法;5. B 国际收支主要包括两个主要的部分,即经常项目和资本项目,经常项目是本国与外国进行经济交易而经常发生的项目,是国际收支平衡表中最主要的项目,包括对外贸易收支、非贸易往来和无偿转让三个项目;经常项目顺差也是作为国际储备主要的和稳定的来源;6.错特别提款权是国际货币基金组织创设的一种储备资产和记账单位,也叫“纸黄金”;7.错合理的储备量取决于多种因素,并非越多越好;思考题C:课外延伸分析:国际储备对一国具有非常重要的作用,1975-1984年,10年间,阿根廷和墨西哥两个国家面临同样有利的外部国际收支状况,可是他们采取了不同的国际储备政策,也到来了不同的后果;在当前变幻莫测的年代里,国际经济十分动荡不安,保留一定量的国际储备是使国内经济免受外部冲击的最好办法;一、思考题A:基础知识题1A 2C 3B 4 A 5 D解析:1. 怀特计划和凯恩斯计划虽然目的相似,但两者的运营方式是不同的,反映了英美两国经济实力的对比变化和在争夺金融霸权上的尖锐矛盾2. SDR是国际货币基金组织于1969年创设的一种储备资产和记账单位,亦称“纸黄金”,最初是为了支持布雷顿森林体系而创设,后称为“特别提款权”;3. 在金币本位制下,流通中使用的是具有一定成色和重量的金币,金币可以自由铸造、自由兑换、自由输出输入国境;4. 布雷顿森林体系确定了以黄金为基础,以美元为最主要的国际储备货币的储备体系;5. 明确现行的国际货币体系是牙买加体系;二、思考题B:名校试题. 何谓国际货币体系它包括哪些内容试说明其演进历程;国际货币体系是指影响国际支付的原则、惯例、安排以及组织机构的总和,它包含的主要内容有:1国际结算制度,即国际交往中使用什么样的货币--金币还是不兑现的信用货币;2汇率制度:各国货币间的汇率安排,是钉住某一种货币,还是允许汇率随市场供求自由变动;3国际收支调节机制:各国外汇收支不平衡如何进行调节;4国际储备资产的确定;随着世界经济和政治形势发展,各个时期对上述几个方面的安排也有所不同,从而形成具有不同特征的国际货币体系,大体可分为金本位下的国际货币体系、以美元为中心的国际货币体系、牙买加协定之后以浮动汇率为特征的国际货币体系;2. 简述金币本位制的特点;1国家以法律形式规定铸造一定形状、重量和成色的金币,具有无限法偿效力的自由流通;2金币和黄金可以自由输出和输入国境;3金币可以自由铸造,也可以自由熔毁;4银行券可以自由兑换成金币或等量的黄金;3. 简述布雷顿森林体系的主要内容;1建立国际货币基金组织,对国际事项进行磋商;2采用可调整的钉住汇率制;3通过“双挂钩,确定美元和黄金并列作为国际储备资产的体制;4由 IMF 提供短期融资或在国际收支出现根本性不平衡时调整汇率平价进行国际收支调节;5取消外汇管制;6制定稀缺性货币条款;主要内容包括:建立国际货币基金组织,对国际事项进行磋商;采用可调整的钉住汇率制;通过“双挂钩,确定美元和黄金并列作为国际储备资产的体制;由 IMF 提供短期融资或在国际收支出现根本性不平衡时调整汇率平价进行国际收支调节;取消外汇管制;制定稀缺性货币条款;崩溃的根本原因主要在于布雷顿森林体系的内在矛盾,尤其是特里芬两难;即在布雷顿森林体系下,由于美元充当唯一的国际储备货币而带来的一种内在矛盾;当美国保持国际收支顺差时,国际储备供应不足,从而国际清偿力不足并不能满足国际贸易发展的需要;当美国出现国际收支逆差时,美元在国际市场上的信用就难以保持,产生美元危机;4. 牙买加货币体系存在的问题有哪些1在多元化国际储备格局下,储备货币发行国仍享有“铸币税”等多种好处,同时,在多元化国际储备下,缺乏统一的稳定的货币标准,这本身就可能造成国际金融的不稳定;2汇率大起大落,变动不定,汇率体系极不稳定;其消极影响之一是增大了汇率风险,从而在一定程度上抑制了国际贸易与国际投资活动,对发展中国家而言,这种负面影响尤为突出;3国际收支调节机制并不健全,各种现有的渠道都有各自的局限,牙买加体系并没有消除全球性的国际收支失衡问题;5. 什么是特里芬难题特里芬难题是由美国耶鲁大学教授罗伯特·特里芬在美元与黄金危机一书中提出的观点,他认为任何一个国家的货币如果充当国际货币,则必然在货币的币制稳定方面处于两难境地;一方面,随着世界经济的发展,各国持有的国际货币增加,这就要求该国通过国际收支逆差来实现,这就必然会带来该货币的贬值;另一方面,作为国际货币又必须要求货币币值比较稳定,而不能持续逆差;这就使充当国际货币的国家处于左右为难的困境,这就是特里芬难题;三、思考题C:课外延伸国际金本位制的“三自由”是什么为什么至今仍然有人怀念金本位制它有那些缺陷国际金本位制具有以下几个特点:①黄金作为储备资产充当国际货币的职能,成为各国之间的最后清偿手段;②金币可以自由铸造和熔化,金币面值与所含黄金实际价值可保持一致;金币或黄金可自由兑换,因此价值符号辅币和银行券名义价值稳定,不致发生通货贬值;黄金可以自由输出输入,保证各国货币之间的兑换率相对固定和世界市场的统一,货币兑换率由两种货币的含金量之比来确定,汇率波动受到黄金输送点的限制,是严格的固定汇率制;③可在市场完全兑换以供资本流动;④国际金本位制具有自动调节国际收支的机制,即所谓的价格-铸币流动机制;在这一时期世界经济理想化的运转中,各国政策制度和贯彻都受到“游戏规则”自动地控制和协调,国际货币体系具有相对稳定性,因此金本位对资本主义发展起着促进作用,主要表现在:促进生产的发展和商品流通扩大;促进资本主义信用制度的发展;促进国际贸易和国际投资的发展;物价收入稳定;自动调节国际收支,国际收支基本平衡;典型的国际金本位制主要有以下优点:①各国货币对内和对外价值稳定;②黄金自由发挥世界货币的职能,促进了各国商品生产的发展和国际贸易的扩展,促进了资本主义信用事业的发展,也促进了资本输出;③自动调节国际收支;简言之,促进了资本主义上升阶段世界经济的繁荣和发展;国际金本位制的主要缺点是:①货币供应受到黄金数量的限制,不能适应经济增长的需要;②当一国出现国际收支赤字时,往往可能由于黄金输出,货币紧缩,而引起生产停滞和工人失业;第五章课后练习答案1、ABCE2、ABCD3、C4、国际金融市场及其作用国际金融市场是指在国际之间进行资金融通的场所,是指具有现代化通讯设备、具有广泛联系的各国居民参与的国际金融交易场所;作用:1发挥了国际结算和国际信贷的中心作用,从而促进国际贸易和国际投资的发展2能够广泛组织和吸收国际社会资金,是国际融资渠道畅通,增强资金活力,促进世界资源重新配置,提高资源在国际间运作效率;3有利于国际分工,促进生产与市场的国际化4有助于各国国际收支的调节,从而使国际收支交易容易平衡5使各国经济联系日趋密切,有助于世界经济的全球一体化发展5、什么是亚洲美元市场亚洲美元市场,是欧洲货币市场的一个重要组成部分,是亚太地区的境外金融市场;6、货币市场与资本市场的区别货币市场是指资金的借贷期限为一年以内的短期资金市场;资本市场是指期限在一年以上的中长期资金金融市场;两者的重要区别在于资本的借贷期限不同;货币市场主要从事一年以内的短期资金拆借业务,资本市场主要从事一年以上的资本贷放活动;7、欧洲货币市场有哪些特点1该市场不受任何国家管制和约束,经营非常自由2分布在世界好多国家和地区,突破了传统国际金融市场集中在少数发达国家的旧格局3以银行同业拆借为主,是一个批发市场4参加十分自由,交易者来自世界各地,是他成为一个竞争十分激烈和高效率的市场8、欧洲债券与外国债券的区别欧洲债券是有一种可自由兑换的货币作为面值的债务凭证,他的发行必须是在其票面所用货币国的国境以外进行;而且,可同时在两个国家以上的债券市场发行,而不在任何特定的国内资本市场上注册和销售;外国债券的面值货币为债券发行所在国的货币,即它的发行必须是在其票面所用货币国的国境内进行,并由该国市场内的公司负责包销、出售,还必须在该国的国内市场上注册;9、证券市场国际化的原因1生产与资本国际化的发展2国际资产调节机制的存在3欧洲货币市场使得国际资本有了充分的流动性4由于统一的国际债券市场的形成10、欧洲货币市场的含义欧洲货币市场又称离岸金融市场或境外金融市场,它起源于五十年代末期,首先在欧洲的伦敦出现了这个新兴的国际资金市场;现在已覆盖全球;他是一个新型的、独立和基本不受法规和税制限制的国际资金市场,市场交易使用主要发达国家的可兑换货币,各项交易一般是在货币发行国的国境之外进行的;11、外汇市场的参与者有哪些一般而言,凡是在外汇市场上进行交易活动的人都可定义为外汇市场的参与者;但外汇市场的主要参与者大体有以下几类:外汇银行政府或中央银行、外汇经纪人和顾客;1外汇银行;外汇银行是外汇市场的首要参与者,具体包括专业外汇银行和一些由中央银行指定的没有外汇交易部的大型商业银行两部分;2中央银行;中央银行是外汇市场的统治者或调控者;3外汇经纪人;外汇经纪人是存在于中央银行、外汇银行和顾客之间的中间人,他们与银行和顾客都有着十分密切的联系;4顾客;在外汇市场中,凡是在外汇银行进行外汇交易的公司或个人,都是外汇银行的顾客;12、外汇市场上的交易可以分为哪些层次外汇市场上的外汇交易分为三个层次:银行与客户间的外汇交易、本国银行间的外汇交易以及本国银行和外国银行间的外汇交易;其中,银行同业间的外汇买卖大都通过外汇经纪人办理;外汇市场的经纪商,虽然有些专门从事某种外汇的买卖,但大部分还是同时从事多种货币的交易;外汇经纪人的业务不受任何监督,对其安排的交易不承担任何经济责任,只是在每笔交易完成后向卖方收取佣金; 13、远期外汇交易的目的有哪些进出口商和资金借贷这为避免商业或金融交易遭受汇率变动的风险而进行远期外汇交易;外汇银行为满足为客户的远期外汇交易要求和平衡远期外汇头寸而进行远期外汇买卖;投机者为谋取汇率变动的差价而进行远期外汇交易;14、外汇期货交易的特点有哪些外汇期货交易也称货币期货交易,是指外汇交易双方在外汇期货交易所以公开喊价的方式成交后,承诺在未来某一特定日期,以约定的价格交割某种特定标准量货币的交易活动;外汇期货交易的特点:1固定的交易场所:在有形的货币期货交易市场内进行交易活动;2公开喊价:买家喊买价,卖家喊卖价;3交易契约--外汇期货交易合同;双方承诺的交易品种,日期,约定的价格,特定标准量货币,保证金,手续费,交易地点等,一张标准的外汇期货合同:标准交割日,标准交割量,标准交割地点;4外汇期货交易只有价格风险,没有信用风险;5交易采用"美元报价制度";6交易的双向性;15、外汇期合约的内容有哪些期货合约是由交易所设计,经国家监管机构审批上市的标准化的合约;期货合约可借交收现货或进行对冲交易来履行或解除合约义务;合约组成要素:A.交易品种 B.交易数量和单位 C.最小变动价位,报价须是最小变动价位的整倍数; D.每日价格最大波动限制,即涨跌停板;当市场价格涨到最大涨幅时,我们称"涨停板",反之,称"跌停板"; E.合约月份 F.交易时间 G.最后交易日 H.交割时间 I.交割标准和等级 J.交割地点 K.保证金 L.交易手续费16、什么是外汇风险它有哪些类型由于汇率变动致使外汇交易的一方,以及外汇资产持有者或负有债务的政府,企业或个人,有遭受。

国际金融课后习题答案一、选择题1. 以下哪项不是国际金融市场的主要功能?A. 资金融通B. 外汇交易C. 货币兑换D. 商品交易答案:D2. 以下哪个国家不属于国际货币基金组织(IMF)的成员国?A. 中国B. 美国C. 俄罗斯D. 巴西答案:C3. 以下哪个国家不属于世界银行集团?A. 国际复兴开发银行B. 国际金融公司C. 国际开发协会D. 国际货币基金组织答案:D二、填空题1. 国际金融市场是指全球范围内的金融市场,包括____、____、____等。

答案:外汇市场、资本市场、债券市场2. 国际货币基金组织(IMF)的宗旨是促进国际货币合作,实现汇率稳定,____、____。

答案:平衡国际收支、提供资金援助3. 世界银行集团成立于____年,总部位于____。

答案:1944年,华盛顿三、判断题1. 国际金融市场对各国经济具有积极的影响,可以提高资源配置效率。

()答案:正确2. 国际货币基金组织(IMF)的主要任务是提供短期资金援助,解决成员国国际收支困难。

()答案:正确3. 世界银行的主要业务是向发展中国家提供长期贷款,支持基础设施建设和经济发展。

()答案:正确四、简答题1. 简述国际金融市场的作用。

答案:国际金融市场具有以下作用:(1)促进全球资本流动,提高资源配置效率;(2)促进国际贸易和投资,推动世界经济发展;(3)为各国政府和企业提供融资渠道,降低融资成本;(4)提供风险管理工具,帮助市场主体应对市场风险;(5)推动国际金融合作,促进国际货币体系稳定。

2. 简述国际货币基金组织(IMF)的主要职能。

答案:国际货币基金组织(IMF)的主要职能包括:(1)监督国际金融市场,监测全球经济走势;(2)提供短期资金援助,帮助成员国解决国际收支困难;(3)协调成员国之间的宏观经济政策,促进国际货币合作;(4)提供技术援助和培训,帮助成员国提高金融管理能力;(5)参与国际债务重组和救助,维护国际金融稳定。