备用信用证租单协议(英文)

- 格式:pdf

- 大小:271.17 KB

- 文档页数:17

常见各类信用证的英文表达在国际贸易中,信用证(Letter of Credit,简称 L/C)是一种常见的支付方式,为买卖双方提供了一定的保障。

不同类型的信用证在条款和应用场景上有所差异,下面我们就来了解一下常见各类信用证的英文表达。

一、跟单信用证(Documentary Credit)跟单信用证是指凭跟单汇票或仅凭商业单据付款的信用证。

跟单信用证在国际贸易中使用最为广泛,其英文表达为“Documentary Credit”。

在这种信用证下,受益人需要向银行提交符合信用证规定的各种单据,如商业发票(Commercial Invoice)、提单(Bill of Lading)、保险单(Insurance Policy)等,银行才会付款。

二、不可撤销信用证(Irrevocable Credit)不可撤销信用证是指一经开出,在有效期内未经受益人及有关当事人同意,开证行不得单方面修改或撤销的信用证。

其英文表述为“Irrevocable Credit”。

这种信用证对受益人提供了较高的保障,因为开证行不能随意撤销或修改信用证的条款。

三、可撤销信用证(Revocable Credit)与不可撤销信用证相反,可撤销信用证是指开证行在开出信用证后,有权随时撤销或修改的信用证。

“Revocable Credit”就是它的英文表达。

由于可撤销信用证的不确定性较大,受益人承担的风险较高,因此在实际贸易中使用较少。

四、保兑信用证(Confirmed Credit)保兑信用证是指由另一家银行对开证行开出的信用证加以保兑,保证对符合信用证条款规定的单据履行付款义务。

其英文表述为“Confirmed Credit”。

当开证行的信誉不够好或者受益人对开证行不信任时,通常会要求开证行开出保兑信用证,以增加付款的保障。

五、即期信用证(Sight Credit)即期信用证是指开证行或付款行收到符合信用证条款的跟单汇票或装运单据后,立即履行付款义务的信用证。

备用信用证融资合作协议COOPERATION AGREEMENT OF STANDBY CREDIT LETTER甲方(开证方)Party A: (Issuer):乙方(接证方):Party B (Receiver):鉴于甲方开具境外备用信用证给乙方,由乙方银行办理抵押贷款,为此双方达成协议如下:Commissioned by Party B to Party A that Party A shall issue an available standby credit letter and to let Party B get a mortgage loan from the bank, for which both parties agree as follows.译注:备用信用证备用信用证[standby credit letter ]又称担保信用证,是指不以清偿商品交易的价款为目的,而以贷款融资,或担保债务偿还为目的所开立的信用证。

一.票据概述:I; Note Overview:1. 抵押品担保:备用信用证。

The mortgage collateral: standby credit letter2. 面值:合约总额度 _____分批操作,第一单 _____,第二单____,第三单_____,完成第一单后每隔_____个工作天操作第二,第三单,后续按双方商定的金额办理。

至本合同金额操作完成,本合同便自动终止The nominal value: Total contract amount is______, the first transaction is ______, the second transaction is _____, the third transaction is _____. The Second and Third transaction will be started within FIVE banking days after completion of the last transaction. the following transaction amount will be proceeded under discussion of both two parties. After completion of the contract amount, this contract will be finished automatically3. 期限:三百六十五天加一天。

备用信用证(Standby L/C)国际商会“UCP 500”规定,该惯例也适用于备用信用征。

备用信用证的定义和前述信用证的定义并无不同,都是银行(开证行)应申请人的请求,向受益人开立的,在一定条件下凭规定的单据向受益人支付一定款项的书面凭证。

所不同的是,规定的单据不同。

备用信用证要求受益人提交的单据,不是货运单据,而是受益人出具的关于申请人违约的声明或证明。

传统的银行保函有可能使银行卷入商业纠纷,美、日等国的法律禁止银行开立保函。

于是美国银行采用备用信用证的形式,对国际经济交易行为提供担保。

随着银行保函在应用中性质的变化,特别是1992年国际商会《见索即付保函统一规则》的公布,银行保函和备用信用证的内容和作用已趋一致。

所不同的只是两者遵循的惯例不同。

备用信用证运用于“UCP 600”,而银行保函则适用于上述《规则》。

备用信用证是担保银行向贴现或贷款银行承诺到期为借款方偿还债务,如果借款方到期偿还了贷款,那么,备用信用证就备而不用,如果,借款方到期不归还贷款,那么,备用信用证就起作用,担保银行就要为借款方向贷款银行偿还贷款。

备用信用证有无条件兑付信用证和有条件兑付信用证。

备用信用证样本1:T Bank of communications, SHENYING BranchFrom: XYZ BANKDate: 20 DECEMBER 2004Standby Letter of CreditWith reference to the loan agreement no. 2004HN028 (hereinafter referred to as "the agreement" ) signed between Bank of Communications, SHENYANG Branch (hereinafter referred to as "the lender" ) and LIAONING ABC CO., LTD (hereinafter referred to as "the borrower" )for a principal amount of RMB2,000,000 (in words),we hereby issue our irrevocable standby letter of credit no.810LC040000027D in the lender's favor for amount of the HONGKONG AABBCC CORPORATION which has its registered office at AS 8 FL. 2SEC. CHARACTER RD. HONG KONG for an amount up to UNITED STATES DOLLARS THREE MILLION ONLY.(USD3,000,000) which covers the principal amount of the agreement plus interest accrued from aforesaid principal amount and other charges all of which the borrower has undertaken to pay the lender. The exchange rate will be the buying rate of USD/RMB quoted by Bank of Communications on the date of our payment. In the case that the guaranteed amount is not sufficient to satisfy your claim due to the exchange rate fluctuation between USD and RMB we hereby agree to increase the amount of this standby L/C accordingly.Partial drawing and multiple drawing are allowed under this standby L/C.This standby letter of credit is available by sight payment. We engage with you that upon receipt of your draft(s) and your signed statement or tested telex statement or SWIFT stating that the amount in USD represents the unpaid balance of indebtedness due to you by the borrower, we will pay you within 7 banking days the amount specified in your statement or SWIFT. All drafts drawn hereunder must be marked drawn under XYZ Bank standby letter of credit no. 810LC040000027D dated 20 DECEMBER 2004.This standby letter of is credit will come into effect on 20 DECEMBER 2004 and expire on 09 DECEMBER 2005 at the counter of bank of Communications , SHENYANG branch.This standby letter of credit is subject to Uniform Customs and Practice for Document Credits(1993 revision) International Chamber of Commerce Publication No.500.备用信用证样本2:To: Bank of communications, SHENYANG BranchFrom: XYZ BANKDate: 20 DECEMBER 2004Standby Letter of CreditWith reference to the loan agreement no. 2004HN028 (hereinafter referred to as "the agreement" ) signed between Bank of Communications, SHENYANG Branch (hereinafter referred to as "the lender" ) and LIAONING ABC CO., LTD (hereinafter referred to as "the borrower" )for a principal amount of RMB2,000,000 (in words),we hereby issue our irrevocable standby letter of credit no.810LC040000027D in the lender's favor for amount of the HONGKONG AABBCC CORPORATION which has its registered office at AS 8 FL. 2SEC. CHARACTER RD. HONGKONG for an amount up to UNITED STATES DOLLARS THREE MILLION ONLY.(USD3,000,000) which covers the principal amount of the agreement plus interest accrued from aforesaid principal amount and other charges all of which the borrower has undertaken to pay the lender. The exchange rate will be the buying rate of USD/RMB quoted by Bank of Communications on the date of our payment. In the case that the guaranteed amount is not sufficient to satisfy your claim due to the exchange rate fluctuation between USD and RMB we hereby agree to increase the amount of this standby L/C accordingly.Partial drawing and multiple drawing are allowed under this standby L/C.This standby letter of credit is available by sight payment. We engage with you that uponreceipt of your draft(s) and your signed statement or tested telex statement or SWIFT stating that the amount in USD represents the unpaid balance of indebtedness due to you by the borrower, we will pay you within 7 banking days the amount specified in your statement or SWIFT. All drafts drawn hereunder must be marked drawn under XYZ Bank standby letter of credit no. 810LC040000027D dated 20 DECEMBER 2004.This standby letter of is credit will come into effect on 20 DECEMBER 2004 and expire on 09 DECEMBER 2005 at the counter of bank of Communications , SHENYANG branch.This standby letter of credit is subject to Uniform Customs and Practice for Document Credits(1993 revision) International Chamber of Commerce Publication No.500.。

ISP98备用信用证条款格式中英文对照-阅

读版

简介

ISP98备用信用证,即《备用信用证可接受条款和惯例》(International Standby Practices),是由国际商会于1998年制定的备用信用证惯例。

此惯例规定了各方在备用信用证交易过程中应遵循的各项规则和标准。

意义

ISP98备用信用证可以用于通过银行向国际贸易合作伙伴提供保证的交易。

备用信用证不同于一般信用证,其使用场景主要是保证交易的顺利实施。

在国际贸易风险较大或是信任度尚未建立的情况下,ISP98备用信用证可以保障卖方的权益,同时也不会增加买方的风险和成本。

主要条款

ISP98备用信用证包含三个主要条款:

1. 证书条款(Certificate Provision):须提供责任证书和其他文件。

2. 要求条款(Demand Provision):要求银行提供责任和契约证书。

3. 能力条款(Ability Provision):银行提供证明其存在提供任何有关信用证保证的能力。

格式

ISP98备用信用证的格式包含多个部分,包括:

1. 正文部分

2. 附件部分

3. 表格部分

此文档为ISP98备用信用证条款格式中英文对照阅读版,其中对照了主要条款和格式要求,需要注意的是具体条款应根据具体情况和交易双方约定而定。

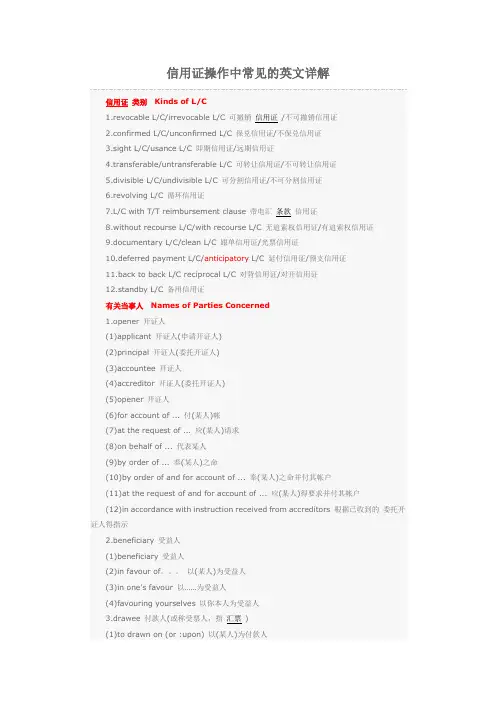

信用证操作中常见的英文详解信用证类别Kinds of L/C1.revocable L/C/irrevocable L/C 可撤销信用证/不可撤销信用证2.confirmed L/C/unconfirmed L/C 保兑信用证/不保兑信用证3.sight L/C/usance L/C 即期信用证/远期信用证4.transferable/untransferable L/C 可转让信用证/不可转让信用证5.divisible L/C/undivisible L/C 可分割信用证/不可分割信用证6.revolving L/C 循环信用证7.L/C with T/T reimbursement clause 带电汇条款信用证8.without recourse L/C/with recourse L/C 无追索权信用证/有追索权信用证9.documentary L/C/clean L/C 跟单信用证/光票信用证10.deferred payment L/C/anticipatory L/C 延付信用证/预支信用证11.back to back L/C reciprocal L/C 对背信用证/对开信用证12.standby L/C 备用信用证有关当事人Names of Parties Concerned1.opener 开证人(1)applicant 开证人(申请开证人)(2)principal 开证人(委托开证人)(3)accountee 开证人(4)accreditor 开证人(委托开证人)(5)opener 开证人(6)for account of ... 付(某人)帐(7)at the request of ... 应(某人)请求(8)on behalf of ... 代表某人(9)by order of ... 奉(某人)之命(10)by order of and for account of ... 奉(某人)之命并付其帐户(11)at the request of and for account of ... 应(某人)得要求并付其帐户(12)in accordance with instruction received from accreditors 根据已收到的委托开证人得指示2.beneficiary 受益人(1)beneficiary 受益人(2)in favour of。

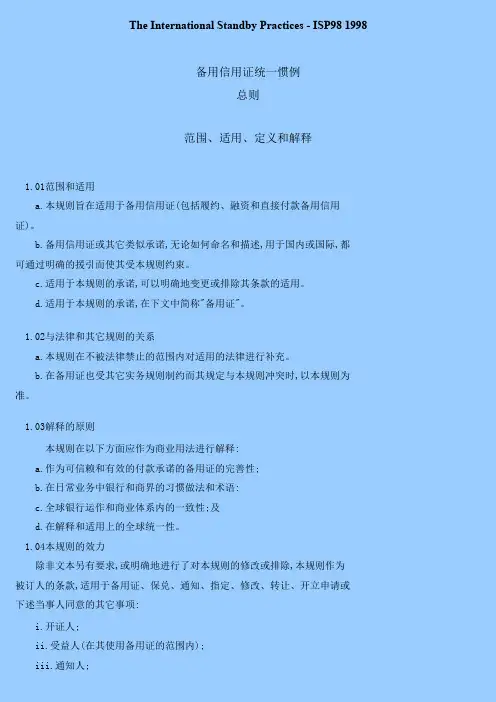

The International Standby Practices - ISP98 1998备用信用证统一惯例总则范围、适用、定义和解释1.01范围和适用a.本规则旨在适用于备用信用证(包括履约、融资和直接付款备用信用证)。

b.备用信用证或其它类似承诺,无论如何命名和描述,用于国内或国际,都可通过明确的援引而使其受本规则约束。

c.适用于本规则的承诺,可以明确地变更或排除其条款的适用。

d.适用于本规则的承诺,在下文中简称"备用证"。

1.02与法律和其它规则的关系a.本规则在不被法律禁止的范围内对适用的法律进行补充。

b.在备用证也受其它实务规则制约而其规定与本规则冲突时,以本规则为准。

1.03解释的原则本规则在以下方面应作为商业用法进行解释:a.作为可信赖和有效的付款承诺的备用证的完善性;b.在日常业务中银行和商界的习惯做法和术语:c.全球银行运作和商业体系内的一致性;及d.在解释和适用上的全球统一性。

1.04本规则的效力除非文本另有要求,或明确地进行了对本规则的修改或排除,本规则作为被订人的条款,适用于备用证、保兑、通知、指定、修改、转让、开立申请或下述当事人同意的其它事项:i.开证人;ii.受益人(在其使用备用证的范围内);iii.通知人;iv.保兑人;V.在备用证中被指定并照其行事或同意照其行事的任何人;及vi .授权开立备用证或同意适用本规则的申请人。

1.05有关开证权力和欺诈或滥用权利提款等事项的排除本规则对下述事项不予界定或规定:a.开立备用证的权力或授权;b.对签发备用证的形式要求(如:署名的书面形式);或c.以欺诈、滥用权利或类似情况为根据对承付提出的抗辩。

这些事项留给适用的法律解决。

一般原则1.06备用证的性质a.备用证在开立后即是一个不可撤销的、独立的、跟单的及具有约束力的承诺,并且无需如此写明。

b.因为备用证是不可撤销的,除非在备用证中另有规定,或经对方当事人同意,开证人不得修改或撤销其在该备用证下之义务。

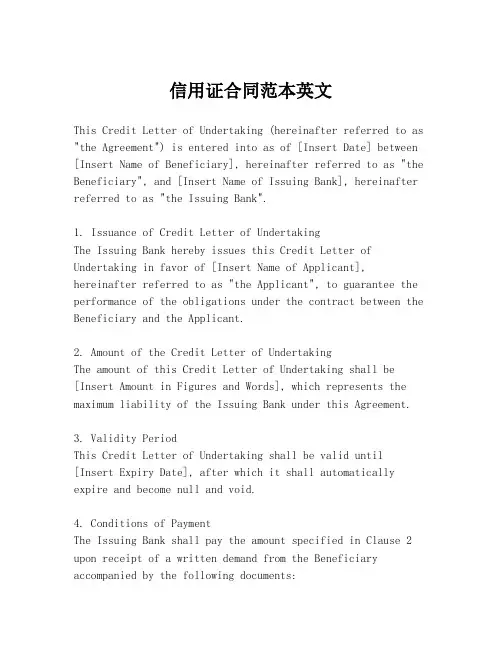

信用证合同范本英文This Credit Letter of Undertaking (hereinafter referred to as "the Agreement") is entered into as of [Insert Date] between [Insert Name of Beneficiary], hereinafter referred to as "the Beneficiary", and [Insert Name of Issuing Bank], hereinafter referred to as "the Issuing Bank".1. Issuance of Credit Letter of UndertakingThe Issuing Bank hereby issues this Credit Letter of Undertaking in favor of [Insert Name of Applicant], hereinafter referred to as "the Applicant", to guarantee the performance of the obligations under the contract between the Beneficiary and the Applicant.2. Amount of the Credit Letter of UndertakingThe amount of this Credit Letter of Undertaking shall be [Insert Amount in Figures and Words], which represents the maximum liability of the Issuing Bank under this Agreement.3. Validity PeriodThis Credit Letter of Undertaking shall be valid until [Insert Expiry Date], after which it shall automatically expire and become null and void.4. Conditions of PaymentThe Issuing Bank shall pay the amount specified in Clause 2 upon receipt of a written demand from the Beneficiary accompanied by the following documents:a. A statement certifying that the Beneficiary hasfulfilled the obligations under the contract with the Applicant.b. Any other documents as stipulated by the terms of this Agreement.5. Presentation of DocumentsThe Beneficiary shall present the demand and documents required under Clause 4 within [Insert Number of Days] days from the occurrence of the event triggering the payment.6. Auto-ExtensionShould the Beneficiary fail to present the documents within the time specified in Clause 5, this Credit Letter of Undertaking shall automatically extend for a period of [Insert Number of Days] days from the original expiry date, unless the Issuing Bank receives a written notice from the Applicant to the contrary.7. Fees and ChargesThe Beneficiary shall be responsible for all fees and charges associated with the issuance and management of this Credit Letter of Undertaking.8. Governing Law and JurisdictionThis Agreement shall be governed by and construed in accordance with the laws of [Insert Jurisdiction]. Any disputes arising out of or in connection with this Agreement shall be resolved by [Insert Method of Dispute Resolution].9. AmendmentsAny amendments to this Agreement must be made in writing and signed by both parties.10. Entire AgreementThis Agreement constitutes the entire understanding between the parties and supersedes all prior negotiations, representations, and agreements.11. NoticesAll notices under this Agreement shall be in writing andshall be deemed duly given when delivered to the addresses specified by each party for such purpose or when sent by registered mail, return receipt requested.12. WaiverThe failure of either party to enforce any provision of this Agreement shall not be construed as a waiver or limitation of that party's right to subsequently enforce and compel strict compliance with every provision of this Agreement.IN WITNESS WHEREOF, the parties have executed this Credit Letter of Undertaking on the date first above written.[Insert Name of Beneficiary][Insert Title of Authorized Signatory][Insert Signature][Insert Date][Insert Name of Issuing Bank][Insert Title of Authorized Signatory][Insert Signature] [Insert Date]。

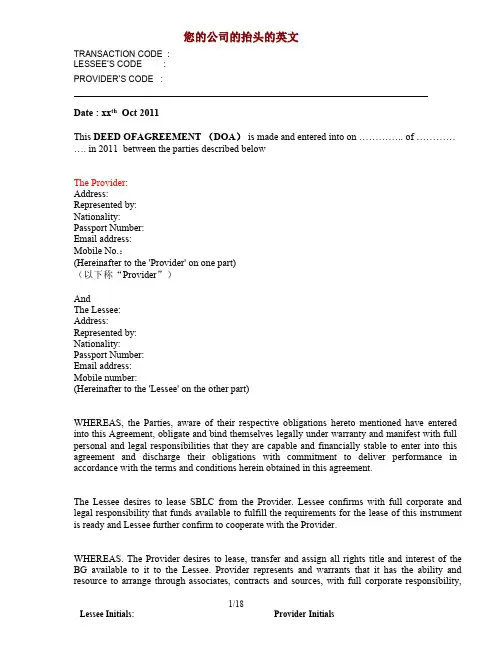

PROVIDER’S CODE:Date:xx th Oct2011This DEED OFAGREEMENT(DOA)is made and entered into on…………..of…………….in2011between the parties described belowThe Provider:Address:Represented by:Nationality:Passport Number:Email address:Mobile No.:(Hereinafter to the'Provider'on one part)(以下称“Provider”)AndThe Lessee:Address:Represented by:Nationality:Passport Number:Email address:Mobile number:(Hereinafter to the'Lessee'on the other part)WHEREAS,the Parties,aware of their respective obligations hereto mentioned have entered into this Agreement,obligate and bind themselves legally under warranty and manifest with full personal and legal responsibilities that they are capable and financially stable to enter into this agreement and discharge their obligations with commitment to deliver performance in accordance with the terms and conditions herein obtained in this agreement.The Lessee desires to lease SBLC from the Provider.Lessee confirms with full corporate and legal responsibility that funds available to fulfill the requirements for the lease of this instrument is ready and Lessee further confirm to cooperate with the Provider.WHEREAS.The Provider desires to lease,transfer and assign all rights title and interest of the BG available to it to the Lessee.Provider represents and warrants that it has the ability and resource to arrange through associates,contracts and sources,with full corporate responsibility,PROVIDER’S CODE:financial instrument in the term of assignments to be provided to Lessee.Provider hereby declares under penalty of perjury that the SBLC will be backed by funds that are good,clean,clear,and free of non criminal origin,the SBLC will be free and clear of all liens,encumbrances and third party interests.NOW THEREFORE,the Lessee has agreed to lease the SBLC at8%of Face Value for the instrument requested and Provider has agreed to issue for lease and both Parties hereby agree to the following:Description of Instrument单据描述1.Instrument:Cash backed Stand By Letter of Credit SBLC(Annex A)单据类型以现金为抵押的备用信用证SBLC(附件A)Currency:EUR币种欧元3.Age of Issue:Fresh Cut已开年限4.Term:One year and One day有效期限一年零一天5.Face Value:10Million min to50B面额1000万至500亿6.Issuing Bank7.Lease Fee:Eight percent(8%)of Face Value费用8%mission:Two(15%)of Face Value佣金15%9.Delivery Term:By SWIFT MT760信用证指令SIWFT MT76010.Payment Term:By ICBPO via MT799(Annex B)11.Hard Copy:By Bank Bonded Courier SBLC正本银行传输渠道电子打印版本由银行TRANSATION PROCEDURE交易手续:1.Lessee signs and submits the Agreement(DOA)with full banking details along withCIS,Certificate of Incorporation,Board Resolution,Signatory passport copy andIFPA to Provider.PROVIDER’S CODE:租证方签署本协议并附上全部银行信息提交给Provider,同时应一并提交CIS (客户信息表)、公司营业执照、董事会决议和签名护照复印件。

![[转载]备用信用证(Standby](https://uimg.taocdn.com/41ae7b215b8102d276a20029bd64783e09127d8b.webp)

[转载]备⽤信⽤证(Standby LC)的保函功能原⽂地址:备⽤信⽤证(Standby L/C)的保函功能作者:⼯程合同实验室具备银⾏保函功能的备⽤信⽤证,其实最近在翻译《国际商会⼯⼚交钥匙合同范本》这本书过程中,也遇到 standby L/C 作为预付款和履约保函替代⽅案,⼀位伊朗做⼯程的朋友称他们在⽤信⽤证作为预付款保函,我才觉得对这个问题值得⼤家好好学习。

但既然国外对备⽤信⽤证作为保函的功能已经有详述,那我就不多说了,直接引⽂分享给⼤家。

⼤家也可以看看百度百科中备⽤信⽤证的阐述。

What is a standby letter of credit?A Standby Letter of Credit (called“SLC or “LC” ) are written obligations of an issuing bank to pay a sum of money to a beneficiary on behalf of their customer in the event that the customer does not pay the beneficiary. It is important to note that standby letters of credit apply only whenever the issuing bank's commitment to pay is not contingent on the existence, validity and enforceability of it’s customer’s obligation; this is called an “abstract” guarantee; that is, the bank’s obligation is to pay regardless of any disputes between its customer and the beneficiary. The issuance of letters of credit is a private transaction and does not result in the issuance of any public trading securities.Why do we have standby letters of credit?The standby letter of credit comes from the banking legislation of the United States, which forbids US credit institutions from assuming guarantee obligations of third parties. (Most other countries outside of the USA continue to allow bank guaruntees.) To circumvent this US banking rule, the US banks created the standby letter of credit, which is based on the uniform customs and practice for documentary credits. In 1998 the International Chamber of Commerce (ICC) added ISP98 (International Standby Practices 98)(详见链接) as the rules to guide standby letters of credit. These rules are slowly being adopted; however, many of the standby letters of credit continue to rely on the ICC’s older guide, Uniform Customs and Practices for Documentary Credits, 1993 revision, ICC Publication 500.Who are the parties to the standby letter of credit?(1) The Applicant. This is the customer of the bank who applies to the bank for the standby letter of credit. He must provide collateral to the bank or have sufficient credit to induce the bank to issue the instrument. He also must pay the banka fee for issuing the instrument.(2) The Issuing Bank. This is the applicant’s bank that issues the standby letter of credit.(3) The Beneficiary. This is the party in whose favor the instrument is issued.(4) Confirming Bank. This is a bank (usually located near the beneficiary) that agrees (confirms) to pay the beneficiary rather than have the issuing bank pay the beneficiary. The beneficiary pays the Confirming Bank a fee for this convenience. The Confirming Bank then collects from the Issuing Bank the amount paid to the beneficiary.(5) Advising Bank. This is the bank that represents the beneficiary. It may accept the letter of credit on behalf of the beneficiary and collect on it on behalf of the beneficiary. In order for the transaction to be a bank-to-bank transaction, the advising bank works for the beneficiary to keep the instrument in the banking system. Sometimes the Advising Bank also is the Confirming Bank, but not always.What is the purpose of the standby letter of credit?The standby basically fulfills the same purpose as a bank guarantee: it is payable upon first demand and without objections or defenses on the basis of the underlying transaction between the applicant and the beneficiary. It is up to the beneficiary to decide whether he may accept a standby.What are the types of standby letters of credit?(1) Performance Standby. This instrument supports an obligation to perform other than to pay money including the purpose of covering losses arising from a default of the applicant in completion of the underlying transaction.(2) Advance Payment Standby. This instrument supports an obligation to account for an advance payment made by thebeneficiary to the applicant.(3) Bid Bond/Tender Standby. This standby supports an obligation of the applicant to execute a contract if the applicant is awarded a bid.(4) Counter Standby. This instrument supports the issuance of a separate standby or other undertaking by the beneficiary of the counter standby.(5) Direct Pay Standby. This instrument serves to support payment when due of an underlying payment obligation typically in connection with a financial standby without regard to default. This standby is also used to directly pay an obligation where the only conditions of payment are the passage of the term and presentment of payment.(6) Insurance Standby. This instrument is an insurance or reinsurance obligation of the applicant.(7) Commercial Standby. This is the most used standby and it supports the obligations of an applicant to pay for goods or services in the event of non-payment by a business debtor.Are standby letter of credits transferable?Assignment of Standby letter of credit proceeds -The beneficiary can assign the proceeds of a standby letter of credit. But this assignment does not assign the rights of the beneficiary as “drawer” on the standby letter of credit, and only the beneficiary may exercise the “drawer” rights and present the demand for payment under the terms of the standby letter of credit unless the terms of the instrument provide otherwise. This means that the assignee may receive the proceeds of the standby, but in order to obtain those proceeds the beneficiary must first make the demand for payment. This also means that the beneficiary can sell by assignment, at discount, the benefits of the standby. An assignment of proceeds requires notice to the issuing bank of this action; otherwise the issuing bank would pay the beneficiary rather than the assignee.Transfer of Standby letter of credits. Standby letter of credits can be transferred to a third party ONLY with the written consent of the issuing bank AND the beneficiary.Are standby letter of credits the subject of trading?There is no public market for the trading of standby letters of credits.Standby letters of credits can only be transferred or the proceeds assigned in private transactions (as previously noted above).Standby letters of credit do not have CUSIP or ISIN numbering.Standby letters of credits are not trading securities, trading debt instruments, or trading investment funds, and therefore are not subject to the rules and regulations of the Security and Exchange Commission.。

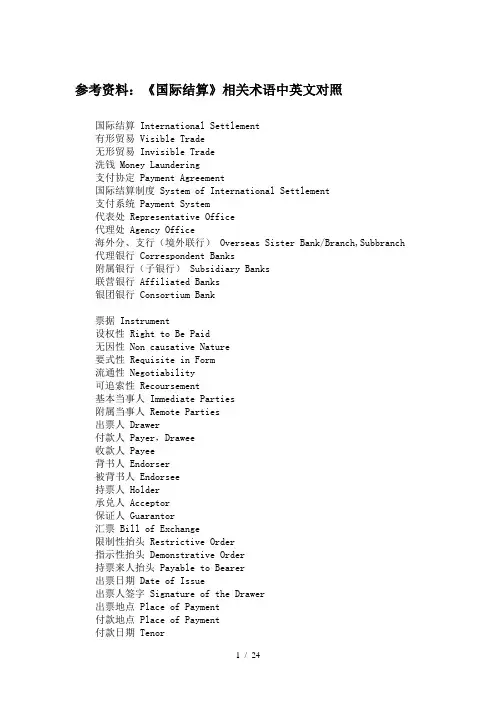

参考资料:《国际结算》相关术语中英文对照国际结算 International Settlement有形贸易 Visible Trade无形贸易 Invisible Trade洗钱 Money Laundering支付协定 Payment Agreement国际结算制度 System of International Settlement支付系统 Payment System代表处 Representative Office代理处 Agency Office海外分、支行(境外联行) Overseas Sister Bank/Branch,Subbranch 代理银行 Correspondent Banks附属银行(子银行) Subsidiary Banks联营银行 Affiliated Banks银团银行 Consortium Bank票据 Instrument设权性 Right to Be Paid无因性 Non causative Nature要式性 Requisite in Form流通性 Negotiability可追索性 Recoursement基本当事人 Immediate Parties附属当事人 Remote Parties出票人 Drawer付款人 Payer,Drawee收款人 Payee背书人 Endorser被背书人 Endorsee持票人 Holder承兑人 Acceptor保证人 Guarantor汇票 Bill of Exchange限制性抬头 Restrictive Order指示性抬头 Demonstrative Order持票来人抬头 Payable to Bearer出票日期 Date of Issue出票人签字 Signature of the Drawer出票地点 Place of Payment付款地点 Place of Payment付款日期 Tenor见票即付 At Sight or on Demand定日付款 At a Fixed Date见票后定期付款 At a Fixed Period after Sight出票后定期付款 At a Fixed Period after Date付一不付二 Pay This First/Second Bill担当付款人 Person Designated as payer预备付款人 Referee in Case of Need必须提示承兑 Presentment for Acceptance Required 不得提示承兑 Acceptance Prohibited付对价持票人 Holder for Value正当持票人Holder in Due Course/Bona Fide Holder 银行汇票 Banker’s Draft商业汇票 Trade Bill承兑汇票Acceptance Bill银行承兑汇票 Banker’s Acceptance Bill商业承兑汇票 Trade’s Acceptance Bill即期汇票 Sight Draft ,Demand Draft远期汇票 Time Bill, Usance Bill光票 Clean Bill跟单汇票 Documentary Bill本票 Promissory Note商业本票Promissory Note银行本票 Cashier’s Order/Check国际汇票 Overseas Money Order支票 Cheque or Check出票 Issue背书 Indorsement承兑 Acceptance保证 Guarantee保付 Certified to Pay提示 Presentation付款 Payment拒付 Dishonour追索 Recourse顺汇 Remittance逆汇 Reverse Remittance汇款人 Remitter汇出行 Remitting Bank汇入行 Paying Bank收款人 Payee电汇 Telegraphic Transfer信汇 Mail Transfer票汇 Remittance by Banker’s Demand Draft预付货款 Payment in Advance货到付款 Payment after Arrival of the Goods托收 Collection委托人 Principal托收行 Remitting Bank代收行 Collecting Bank付款人 Drawee提示行 Presenting Bank托收申请书 Collection Application托收委托书 Collection Advice信用证 Letter of Credit议付行 Negotiating Bank偿付行 Reimbursing Bank开证申请人Applicant开证行 Issuing Bank受益人 Beneficiary通知行 Advising Bank保兑行 Confirming Bank付款行 Paying Bank光票信用证 Clean Credit跟单信用证 Document Credit不可撤销信用证Irrevocable Credit可撤销信用证 Revocable Credit保兑信用证 Confirmed Credit不保兑信用证 Unconfirmed Credit即期付款信用证 Sight Payment Credit延期付款信用证 Deferred Payment Credit承兑信用证 Acceptance Credit转让信用证 Transferable Credit不可转让信用证 Nor-transferable Credit背对背信用证 Back to Back Credit循环信用证 Revolving Credit预支信用证 Anticipatory Credit银行保函 Letter of Guarantee申请人 Applicant/Principal受益人 Beneficiary担保行 Guarantor Bank通知行 Advising Bank转开行 Reissuing Bank反担保行 Counter Guarantor Bank保兑行 Confirming Bank投标保函 Tender Gurantee履约保函 Performance Gurantee预付款保函 Advanced Payment Gurantee质量保函Quality Gurantee关税保付保函 Customs Gurantee付款保函 Payment Gurantee延期付款保行 Defeerd Payment Gurantee补偿贸易保函 Compensation Gurantee来料加工保函 Processing Gurantee租赁保函 Lease Gurantee借款保函 Loan Gurantee保释金保函 Bail Bond票据保付保函Gurantee For Bill费用保付保函 Payment Gurantee for Commission 备用信用证 Stand-by Letter of Credit单据 Documents商业发票 Commercail Invoice首文 Heading正文Body海关发票 Customs Invoice形式发票 Proforma Invoice领事发票 Consular Invoice样品发票 Sample Invoice广商发票 Manufacturer Invoice证实发票 Certified Invoice货物运输单据 Transport documents海运提单Marine Bill of Loading托运人 Shipper/Consignor承运人 Carrier收货人 Consignee受让人 Transferee or Assignee已装船提单 Shipped on Board待运提单 Received for Shipment直达提单Direct B/L转船提单 Transshipmen B/L联运提单 Through B/L清洁提单 Clean B/L不清洁提单 Unclean B/L记名提单 Straight B/L不记名提单 Open B/L指示性提单 Order B/L简式提单 Short Form B/L全式提单 Long Form B/L班轮提单 Liner B/L租船提单 Charter B/L运输代理行提单 Horse B/L过期提单 Stale B/L倒签提单Anti-dated B/L集装箱运输提单 Container B/L多式运输 Multimodal Transport多是运输单据Multimodal Transport Document不可流通转让的海运单 Non-negotiable Sea Waybill租船合约提单 Charter Party Bill of Lading航空运单 Airway Bill基本险 Chief Risk一般附加险 Additional Risk特殊附加险 Special Additional Risk保险单 Insurance Policy预约保险单Open Policy of Open Cover保险凭证 Insurance Certificate保险声明 Insurance Declaration联合凭证 Combined Certificate暂保单 Cover Note商品验证说明 Inspection Certificate产地证明书 Certificate of Origin包装单据 Packing Document装货箱 Packing List重量单 Weight List打包贷款 Packing Credit/Loan出口押汇 Outward Bill质押书 Letter of Hypothecation出口托收押汇 Advance against Documentary Collection 银行承兑 Bank’s Acceptance票据贴现 Bill Discount出口发票 Invoice Discounting进口开证额度 Limits for Issuing of Credit信托收据 Trust Receipt, T.R, T/R留置权书 Letter of Lien进口押汇 Inward Bills进口信用证押汇 Inward Bill Receivables买房远期信用证 Buyer’s Usance L/C提货担保 Delivery against Bank Guarantee国际保理 International Factoring销售分户账管理 Maintenance of The Sales Ledger债款回收 Collection from Debtors信用销售控制 Credit Control坏账担保 Full Protection Against Bad Debts贸易融资 Trade Financing福费廷 Forfaiting贴现率 Discount Rate承诺费 Commitment Fee利息补贴 Interest Make-up侨汇 Overseas Chinese Remittance外币兑换业务 Exchange of Foreign Currency旅行支票 Traveler’s Cheque信用卡 Credit Card万事达卡 Master Card维萨卡 VISA Card运通卡 American Express Card大莱卡 Diners Club Car国际贸易结算:以票据为基础,单据为条件,银行为中枢,结算与融资相结合的非现金结算体系。

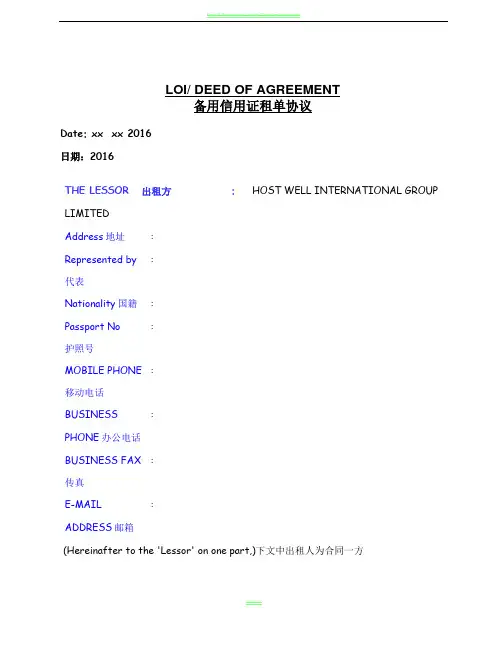

LOI/ DEED OF AGREEMENT备用信用证租单协议Date: xx xx 2016日期:2016THE LESSOR 出租方 : HOST WELL INTERNATIONAL GROUP LIMITEDAddress地址:Represented by:代表Nationality国籍::Passport No护照号:MOBILE PHONE移动电话:BUSINESSPHONE办公电话:BUSINESS FAX传真:E-MAILADDRESS邮箱(Hereinafter to the 'Lessor' on one part,)下文中出租人为合同一方THE LESSEE:承租人 ---------------Address地址::Represented by代表Nationality国籍::Passport No护照号MOBILE PHONE:移动电话:BUSINESSPHONE办公电话BUSINESS FAX:传真:E-MAILADDRESS邮箱(Hereinafter to the 'Lessee' on the other part) 下文中承租人为合同另一方WHEREAS. The lessee desires to lease Five billion Euro SBLC from the Lessor.(To be issued in first tranch of XX million Euro) Lessee confirms with full corporate and legal responsibility that funds are available to fulfill the requirements for the lease of this instrument and is ready and lessee further confirm to cooperate with the Lessor.鉴于承租方希望向出租人租赁50亿欧元的银行保函(首批XXX欧元)。

1。

General Provisions一般规定Contract 合同Contract Agreement 合同协议书1。

6Letter of Acceptance 中标函1.1。

3(a。

业主对承包商正式接受函,签字;b.双方商定的其他内容,双方签字)Letter of Tender 投标函(承包商的报价函)Specification 规范Drawings 图纸Schedules 明细表Tender 投标书(a。

投标函;b。

投标者填写的各类明细表,投标保函等)Appendix to Tender 投标函附录Bill of Quantities 工程量表Daywork Schedule 计日工表Parties and Persons 合同双方和人员Engineer 工程师(natural/legal)(监理)DAB 争端裁决委员会(投标函附录列出)FIDIC 国际咨询工程联合会(International Federation of Consulting Engineers)Dates 日期Tests 检验Periods 期间Completion 竣工Base Date 基准日期(提交投标书截止日期之前的第28天当天;与调价有关)Commencement Date 开工日期(工程师通知开工的日期)Time for Completion 竣工日期(指时间段,从开工日期开始计算)Tests on Completion 竣工检验Taking-over Certificate 接收证书(证明工程按照合同实质竣工,进入缺陷通知期)Tests after Completion 竣工后检验Defects Notification Period 缺陷通知期维修期Performance Certificate 履约证书Money and Payments 款项和支付Accepted Contract Amount 中标合同金额(中标的承包商的投标价格,名义合同价格)Contract Prise 合同价格(a. b。

LOI/ DEED OF AGREEMENT备用信用证租单协议Date: xx xx 2016日期:2016THE LESSOR^ 租方:HOST WELL INTERNATIONAL GROUP LIMITED Address 地址:Represe nted by :代表Nationality 国籍:Passport No :护照号MOBILE PHONE :移动电话BUSINESS PHONE :办公电话BUSINESS FAX :传真E-MAIL ADDRESS :邮箱(Here in after to the 'Lessor' on one part,)下文中出租人为合同一方THE LESSEE:承租人 -------------------Address 地址:Represe nted by :代表Nationality 国籍:Passport No :护照号MOBILE PHONE :移动电话BUSINESS PHONE :办公电话BUSINESS FA传直/、E-MAIL ADDRESS :邮箱(Here in after to the 'Lessee' on the other part)下文中承租人为合同另一方WHEREASThe lessee desires to lease Five billion Euro SBLC from the Lessor.(To be issued in first tranch of XX millio n Euro) Lessee con firms with full corporate and legal resp on sibility that funds are available to fulfill the requirements for the lease of this instrument and is ready and lessee further confirm to cooperate with the Lessor.鉴于承租方希望向出租人租赁 50亿欧元的银行保函(首批 XXX欧元)。

sblc租赁合同1. 合同主体1.1 甲方:______________________1.2 乙方:______________________2. 合同标的2.1 本合同为备用信用证(SBLC)租赁合同。

甲方作为备用信用证的出租方,同意将符合相关国际金融标准及法律法规要求的备用信用证出租给乙方使用。

2.2 备用信用证的金额为[X](大写:[大写金额表述]),有效期自[起始日期]起至[截止日期]止。

2.3 该备用信用证应由[开证行名称]开具,且应具备真实、合法、有效的性质,能够在国际金融交易中被认可并按照其条款履行相应担保等功能。

3. 双方权利义务3.1 甲方权利义务3.11 甲方有权按照本合同约定收取租金。

3.12 甲方有义务确保所提供的备用信用证真实、合法、有效,并及时向乙方提供备用信用证的相关资料副本。

3.13 在合同有效期内,甲方应保证备用信用证维持有效状态,如遇特殊情况可能影响备用信用证有效性时,应及时通知乙方。

3.2 乙方权利义务3.21 乙方有权在本合同约定的范围内合理使用备用信用证进行合法的商业活动。

3.22 乙方有义务按照本合同约定按时、足额向甲方支付租金,租金金额为[每期租金金额],支付方式为[具体支付方式,如银行转账等],支付周期为[按日/周/月等]。

3.23 乙方应妥善保管甲方提供的备用信用证相关资料副本,不得用于本合同约定以外的任何非法目的,且不得泄露备用信用证相关信息。

4. 违约责任4.1 若甲方未能按照本合同约定提供真实、合法、有效的备用信用证或者因甲方原因导致备用信用证失效,甲方应退还乙方已支付的所有租金,并按照合同总租金的[X]%向乙方支付违约金。

4.2 若乙方未按照本合同约定按时、足额支付租金,每逾期一日,应按照未支付金额的[X]%向甲方支付逾期违约金;逾期超过[X]日的,除支付逾期违约金外,甲方有权解除本合同,收回备用信用证,乙方已支付的租金不予退还,并且乙方应按照合同总租金的[X]%向甲方支付违约金。

INTERNATIONAL STANDBY PRACTICES (ISP98)1. GENERAL PROVISIONSScope, Application, Definitions, and Interpretation of These Rules1.01 Scope and Applicationa. These Rules are intended to be applied to standby letters of credit (including performance, financial, and direct pay standby letter of credit)b. A standby letter of credit or other similar undertaking, however named or described, whether for domestic or international use, may be made subject to these Rules by express reference to them.c. An undertaking subject to these Rules may expressly modify or exclude their application.d. An undertaking subject to these Rules is hereinafter referred to as a "standby".1.02 Relationship to Law and Other Rulesa. These Rules supplement the applicable law to the extent not prohibited by that law.b. These Rules supersede conflicting provisions in any other rules of practice to which a standby letter of credit is also made subject.1.03 Interpretative PrinciplesThese Rules shall be interpreted as mercantile usage with regard for:a. integrity of standbys as reliable and efficient undertakings to payb. practice and terminology of banks and businesses in day-to-day transactionsc. consistency within the worldwide system of banking operations and commerce; andd. worldwide uniformity in their interpretation and application.1.04 Effect of the RulesUnless the context otherwise requires, or unless expressly modified or excluded, these Rules apply as terms and conditions incorporated into a standby, confirmation, advice, nomination, amendment, transfer, request for issuance, or other agreement of: 规则1:总则本规则司范围、适用、定义和解释1.01范围和适用a.本规则旨在适用于备用信用证(包括履约、融资和直接付款备用信用证)。

信用证中英文对照一、基本术语对照1. 信用证(Letter of Credit,简称LC)2. 申请人(Applicant)3. 受益人(Beneficiary)4. 开证行(Issuing Bank)5. 通知行(Advising Bank)6. 议付行(Negotiating Bank)7. 付款行(Paying Bank)8. 保兑行(Confirming Bank)二、信用证类型对照1. 可撤销信用证(Revocable Letter of Credit)2. 不可撤销信用证(Irrevocable Letter of Credit)3. 即期信用证(Sight Letter of Credit)4. 远期信用证(Usance Letter of Credit)5. 可转让信用证(Transferable Letter of Credit)6. 循环信用证(Revolving Letter of Credit)7. 背对背信用证(BacktoBack Letter of Credit)8. 预支信用证(Anticipatory Letter of Credit)三、信用证关键条款对照1. 信用证金额(Credit Amount)英文:The total amount for which the Letter of Credit is issued.2. 信用证有效期(Validity of the Credit)英文:The date until which the Letter of Credit remains valid for presentation of documents.3. 交单期限(Period for Presentation)英文:The time frame within which the shipping documents must be presented to the bank.4. 货物描述(Description of Goods)英文:A detailed description of the merchandise covered the Letter of Credit.5. 装运条款(Shipment Terms)英文:The conditions under which the goods are to be shipped, including the latest date of shipment.6. 付款条件(Payment Terms)英文:The conditions under which the payment will be made, whether at sight or on a deferred basis.四、信用证相关单据对照1. 发票(Invoice)英文:A document issued the seller to the buyer, indicating the goods sold and their agreed prices.2. 提单(Bill of Lading,简称B/L)英文:A receipt issued the carrier to the shipper, acknowledging receipt of goods for transportation.3. 保险单(Insurance Policy)4. 检验证书(Inspection Certificate)5. 装箱单(Packing List)英文:A detailed list of the contents of each package, prepared the shipper.五、信用证操作注意事项对照1. 信用证条款审核(Review of Credit Terms)英文:Carefully examine the terms and conditions ofthe Letter of Credit to ensure they match the sales contract.2. 单据准备与提交(Preparation and Submission of Documents)英文:Prepare all required documents accurately and submit them to the bank within the specified time frame.3. 银行费用承担(Bank Charges)英文:Clarify which party is responsible for the bank charges associated with the Letter of Credit.4. 风险防范(Risk Prevention)英文:Be aware of potential risks such as discrepancies in documents, bank defaults, and changes intrade policies.六、信用证修改与撤销对照1. 信用证修改(Amendment to the Letter of Credit)英文:A formal request to change certain terms or conditions of the Letter of Credit after it has been issued.2. 信用证撤销(Cancellation of the Letter of Credit)英文:The act of terminating the Letter of Credit before its expiry date, if it is a revocable credit.七、信用证常见问题及解决方案对照1. 文件不符(Discrepancy in Documents)英文:When the documents presented do not conform to the terms and conditions of the Letter of Credit.解决方案:Rectify the discrepancies and resubmit the corrected documents within the allowed time frame.2. 信用证延期(Extension of the Letter of Credit)英文:Requesting an extension of the validity period of the Letter of Credit.解决方案:Coordinate with the applicant to request the issuing bank to extend the credit's validity.3. 信用证付款延迟(Delay in Payment)英文:When the payment under the Letter of Credit is not made on time the issuing bank.解决方案:Communicate with the issuing bank to expedite the payment process or seek assistance from the confirming bank, if applicable.八、信用证在国际贸易中的作用对照1. 降低交易风险(Reducing Transaction Risks)英文:The Letter of Credit provides a secure payment method, reducing the risk of nonpayment for the seller.2. 促进贸易便利化(Facilitating Trade)英文:By offering a guarantee of payment, the Letter of Credit facilitates smoother trade transactions between parties in different countries.3. 融资工具(Financing Instrument)英文:The Letter of Credit can be used the beneficiary to obtain financing from the bank before the actual payment is received.。

1.International Settlement 国际结算2.International Customs 国际惯例3.booklet of authorized signatures 签字样本4.test key 密押5.Correspondent Bank代理行6.SWIFT 环球银行金融电讯协会1.bill of exchange 汇票2.b anker’s draft 银行汇票3.commercial bill 商业汇票4.banker’s acceptance bill 银行承兑汇票5.trader’s acceptance bill 商业承兑汇票6.documentary bill 跟单汇票7.clean bill 光票8.sight draft,demand draft 即期汇票9.time bill,usance bill 远期汇票10.drawer,payee,drawee 出票人,收款人,付款人;11.endorsement 背书12.acceptance 承兑13.without recourse 免于追索14.notice of dishonour 拒付通知15.protest 拒绝证书16.promissory note 本票17.cheque / check 支票18.cash cheque 现金支票19.cheque for transfer 转帐支票20.crossed check 划线支票1.T/T:Telegraphic Transfer,电汇2.M/T:Mail Transfer,信汇3.D/D:Banker's Demand Draft,票汇4.O/A:Open Account,赊销交易5.CAD:Cash against documents,交单付现6.B/O:By order of,汇款人1.Remittance:汇款2.payment order:汇款委托书3.M/T advice:信汇委托书4.telegraphic transfer:电汇5.banker's demand draft:票汇6.mail transfer:信汇1.Financial Documents金融单据2.Commercial Documents 商业单据3.Collection 托收4.Principal 委托人5.Remitting Bank 托收行6.Collecting Bank 代收行7.Clean Collection光票托收8.Documentary C ollection 跟单托收9.Documents against Payment 付款交单10.Documents against Acceptance 承兑交单11.Trust Receipt 信托收据12.Outward Bills 出口押汇13.Uniform Rules for Collection 托收统一规则14.Documentary Bill for Collection 跟单托收1.Documentary Credit 跟单信用证2.Cover Letter或Bill of Purchase 寄单面函3.Credit Opened by Mail 信开本信用证4.Credit Opened by Teletransmission 电开本信用证5.Operative Instrument 有效文本6.Expiry Date and Plac e 有效日期和地点7.Nominated Bank 指定银行8.Partial Shipment 分批装运9.Special Condition 特别条款10.Discrepancy 不符点11.Issuing Bank 开证行12.Applicant 申请人13.Advising Bank 通知行14.Beneficiary 受益人15.Negotiating Bank 议付行16.Confirming Bank 保兑行17.Reimbursing Bank 偿付行18.Sight Payment Credit 即期付款信用证19.Deferred Payment Credit 迟期付款信用证20.Acceptance Credit 承兑信用证21.Confirmed Credit 保兑信用证22.Usance Credit Payable at Sight 假远期信用证23.Anticipatory Credit 预支信用证24.Transferable Credit 可转让信用证25.Back to Back Credit 背对背信用证26.Reciprocal Credit 对开信用证27.Revolving Credit 循环信用证28.Strict Compliance 严格相符29.Substantial Compliance 实质相符30.Fraud Exception Principle 欺诈例外原则五、将下列英文译成中文1.Independent guarantee:独立性保函2.Accessory Guarantee:从属性保函3.reissuing bank:转开行4.counter-guarantor:反担保人5.Standby letter of credit:备用信用证六、将下列英文译成中文1.International Factoring 国际保理2.Credit Control 信用销售控制3.Collection of Receivables 带收账款4.Financed Factoring 融资保理5.Non-Financed Factoring非融资保理6.Maturity Factoring 到期保理7.Non-Recoursed Factoring无追索权保理8.Recoursed Factoring 有追索权保理9.Disclosed Factoring公开型保理10.Undisclosed Factoring 隐蔽型保理11.Two Factor System双保理商保理型式12.Single Factor System 单保理商保理型式13.Maintenance of Sales Ledger 销售账务管理14.Protection for buyer's Credit 信用担保15.Export Trade Finance 贸易融资16.Application for a Credit Approval 信用额度申请表1.Commercial Invoice 商业发票2.Transport Documents 运输单据3.Insurance Documents 保险单据4.Receipt Invoice 收妥发票5.Shipping Mark 唛头6.Ocean Bill of Lading 海运提单7.Shipped B/L 已装船提单8.Received for Shipment B/L 备运提单9.Transshipment B/L 转船提单10.Through B/L 联运提单11.Direct B/L 直达提单12.Order B/L 指示提单13.Anti-dated B/L 倒签提单14.Non-negotiable Sea Waybill 不可转让海运单15.Air Waybill 空运运单16.Master Air Waybill 主运单17.Cargo Receipt,C/R 承运货物收据18.Parcel Post Receipt 邮包收据19.Insurance Policy 正式保险单20.Multimodal Transport Document 多式运输单据21.Insurance Certificate 保险凭证22.Open Policy 预约保险单23.Insurance Declaration 保险声明24.Cover Note, Binder 暂保单25.Certificate of Origin 原产地证明书26.Inspection Certificate 检验证明书学习好资料欢迎下载。

PROVIDER’S CODE:Date:xx th Oct2011This DEED OFAGREEMENT(DOA)is made and entered into on…………..of…………….in2011between the parties described belowThe Provider:Address:Represented by:Nationality:Passport Number:Email address:Mobile No.:(Hereinafter to the'Provider'on one part)(以下称“Provider”)AndThe Lessee:Address:Represented by:Nationality:Passport Number:Email address:Mobile number:(Hereinafter to the'Lessee'on the other part)WHEREAS,the Parties,aware of their respective obligations hereto mentioned have entered into this Agreement,obligate and bind themselves legally under warranty and manifest with full personal and legal responsibilities that they are capable and financially stable to enter into this agreement and discharge their obligations with commitment to deliver performance in accordance with the terms and conditions herein obtained in this agreement.The Lessee desires to lease SBLC from the Provider.Lessee confirms with full corporate and legal responsibility that funds available to fulfill the requirements for the lease of this instrument is ready and Lessee further confirm to cooperate with the Provider.WHEREAS.The Provider desires to lease,transfer and assign all rights title and interest of the BG available to it to the Lessee.Provider represents and warrants that it has the ability and resource to arrange through associates,contracts and sources,with full corporate responsibility,PROVIDER’S CODE:financial instrument in the term of assignments to be provided to Lessee.Provider hereby declares under penalty of perjury that the SBLC will be backed by funds that are good,clean,clear,and free of non criminal origin,the SBLC will be free and clear of all liens,encumbrances and third party interests.NOW THEREFORE,the Lessee has agreed to lease the SBLC at8%of Face Value for the instrument requested and Provider has agreed to issue for lease and both Parties hereby agree to the following:Description of Instrument单据描述1.Instrument:Cash backed Stand By Letter of Credit SBLC(Annex A)单据类型以现金为抵押的备用信用证SBLC(附件A)Currency:EUR币种欧元3.Age of Issue:Fresh Cut已开年限4.Term:One year and One day有效期限一年零一天5.Face Value:10Million min to50B面额1000万至500亿6.Issuing Bank7.Lease Fee:Eight percent(8%)of Face Value费用8%mission:Two(15%)of Face Value佣金15%9.Delivery Term:By SWIFT MT760信用证指令SIWFT MT76010.Payment Term:By ICBPO via MT799(Annex B)11.Hard Copy:By Bank Bonded Courier SBLC正本银行传输渠道电子打印版本由银行TRANSATION PROCEDURE交易手续:1.Lessee signs and submits the Agreement(DOA)with full banking details along withCIS,Certificate of Incorporation,Board Resolution,Signatory passport copy andIFPA to Provider.PROVIDER’S CODE:租证方签署本协议并附上全部银行信息提交给Provider,同时应一并提交CIS (客户信息表)、公司营业执照、董事会决议和签名护照复印件。

2.Provider countersigns the Agreement and returns it to the Lessee along withProvider’s full banking information,Certificate of Incorporation,Signatory passport copy,which makes the Agreement become a full commercial recourse and legalcontract binding on the parties and both parties lodge the contract with respective bank开证方在确认接证方又能力接证后会签回该文档并附上开证的银行资料公司执照以及签署者的护照信息。

当双方都签署了该协议后,该协议将具有法律约束,具有完整的商业追索合约。

同时该协议会转给银行作为存底。

3.Within3banking days upon receipt of the countersigned DOA,the Lessee shallinstruct his bank to issues a ICBPO(Annex B)by MT799to the Provider’sdesignated bank account for leasing fee of8%of face value of bank instrument of First tranche在收到经会签的本协议的三个银行工作日内,租证方指示其银行开出MT799格式的ICBPO(附件B),用以面额8%的首笔配款租金。

4.Within3banking days after receipt and verification of the ICBPO,Provider willinstruct his issuing bank to issue and deliver the Bank Instrument(Annex A)bySWIFT MT760in favor of the Lessee or his designated party to Lessee’s receiving bank for verification and Authentication.经确认收到ICBPO后的三个银行工作日内,Provider应指示其开证行开出并邮寄以租证方或租证方指定的某一方为受益人的SWIFT MT760备用信用证给租方接证行,供验证并确认。

5.Within5banking days upon receipt,verification&authentication and validation ofMT760Bank Instrument on bank to bank basis,Lessee bank will effect full payment 8%leasing fee to Provider’s designated bank account by Swift wire as per ICBPO and pays2%commission into respective paymaster as per FPA.在收到了MT760的5个银行工作日后依据有关协议付款。

6.Within7banking days after receipt of payment of the leasing fees and commission,the Provider bank will deliver the hard copy of the Bank instrument to the Lessee's bank by bank bonded courier.在收到有关款项的7个工作日内,银行用银行快递将SBLC正本送到接证方银行。

7.Should Lessee fails to pay the8%leasing fees and2%commission within allowedtime stipulated in the Agreement after confirmation of SBLC MT760in Lessee’sPROVIDER’S CODE:bank account,Provider will instruct the issuing bank to put a claim on the BankInstrument thereby forcing the Lessee's bank to return the Bank Instrument MT760to the issuing Bank.如果有关费用,开证方会授权起银行将该SBLC撤销。