Chapter 7Money Markets(金融市场学)

- 格式:ppt

- 大小:291.00 KB

- 文档页数:31

FinanceChapter2 Financial MarketsInterest Rates and Calculation of Interest RatesThe Behavior of Interest RatesThe Risk and Term Structure of Interest RatesThe Stock Market, the Theory of Rational Expectations, and the Efficient Market HypothesisLecture 7The Stock Market, the Theory of Rational Expectations, and the Efficient Market Hypothesis •What Is a Stock?•Computing the Price of Common Stock•How the Market Sets Stock Prices•The Theory of Rational Expectations•The Efficient Market Hypothesis •Behavioral FinanceLearning ObjectivesCalculate the price of common stock.Recognize the impact of new information on stock prices.Compare and contrast adaptive expectations and rational expectations.Identify and explain the implications of the efficient market hypothesis for financial markets.Summarize the reasons why behavioral finance suggests that the efficient market hypothesis may not hold.What Is a Stock?1.1 What Is a Stock?A stock (also known as equity) is a security that represents the ownership of a fraction of a corporation.This entitles the owner of the stock to a proportion of the corporation’s assets and profits equal to how much stock they own.Units of stock are called “shares”.股票(也称为股权)是代表公司一部分所有权的证券。

《金融市场学》课程教学大纲教案授课专业:金融学学时数:48 学分数:3一、课程的性质和目的《金融市场学》金融学专业的专业主干课程,是一门相对独立的现代金融理论与实务课,它以证券金融为基础,对证券金融中的票据、股票、债券、投资基金等的发行和流通,以及由此而形成的市场金融机制进行深入研究,成为市场经济条件下经济类必须掌握的重要金融形式和方法。

本课程的教学目的在于通过教与学,使学生了解和掌握金融市场的基本构成要素,金融市场的基本概念、基本理论和方法,金融市场的基本原则、目标、功能、作用、基本运行机制和原理;能运用所学理论、方法分析我国金融市场现状,并能对一些常用金融工具进行模拟操作。

二、课程教学的基本要求《金融市场学》是一门理论和应用性很强的课程,在教学方法上,采用课堂讲授、案例阅读、自学等方式进行。

教师在课堂上应对金融市场学的基本概念、规律、原理和方法进行必要的讲授,并详细讲授每章的重点、难点内容;讲授中应注意理论联系实际,通过必要的案例展示启迪学生的思维,加深学生对有关概念、理论等内容的理解,并应采用多媒体辅助教学,加大课堂授课的知识含量。

重要术语用英文单词标注。

上课之前,需要学生进行课前预习和准备,部分内容要引导学生进行课堂讨论,适当安排课外案例阅读和案例分析。

为了增强学生的实际动手能力,本课程安排了9个学时的上机实习时间,在相关内容学习结束之后,学生要能够利用所学知识在股票市场、期货市场、外汇市场、黄金市场进行模拟操作。

三、课程教学内容第一章金融市场概述(3学时)一、金融市场及其特征二、金融市场的要素构成三、金融市场的类型四、金融市场功能五、金融市场的发展趋势作业:了解我国金融市场概况,并进行简单分析。

重点和难点:金融市场概念,金融市场的功能,金融市场要素,资产证券化。

第二章货币市场(6学时)一、同业拆借市场二、回购市场三、商业票据市场四、银行承兑汇票市场五、大额可转让定期存单市场六、货币市场共同基金作业:阅读并分析案例重点和难点:同业拆借,回购协议,货币市场共同基金,我国货币市场发展中存在的问题及原因。

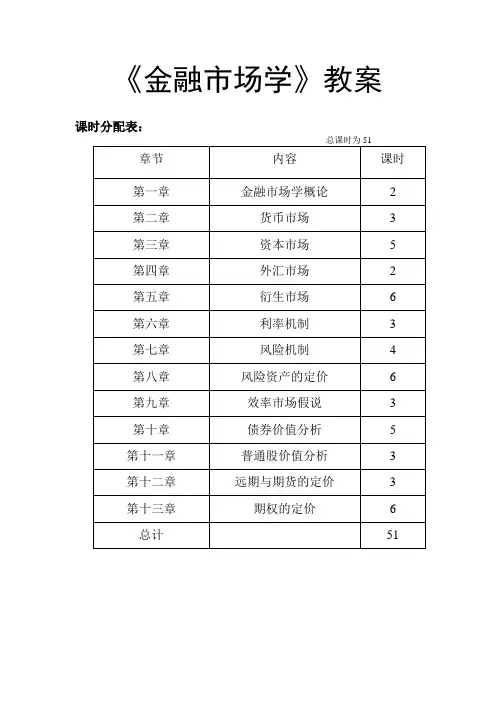

《金融市场学》教案课时分配表:主要参考文献:[1]王兆星等主编《金融市场学》北京中国金融出版社1999[2]陈共等主编《证券市场基础知识》北京中国人民大学出版社1999[3]代鹏主编《金融市场学导论》北京中国人民大学出版社2002[4]徐兆宏主编《中国证券法学》上海上海财经大学出版社2000[5]王维安主编《网络金融学》杭州浙江大学出版社2002[6]黄孝武主编《网络银行》武汉武汉出版社2001[7]潘清木主编《金融市场学》西南财经大学出版社1999[8]王庆先主编《金融市场学》广州广东经济出版社1997[9]周升业主编《金融理论与实务》北京中国财政经济出版社2000[10]胡继之主编《中国股市的演进与制度变迁》经济科学出版社1999[10]《中华人民共和国公司法》[11]《中华人民共和国证券法》第一章金融市场概论教学要求:本章要求学生理解金融市场的概念与功能,理解金融市场的分类的依据和内容,并对金融市场发展的几个趋势有所了解重点难点:金融市场的概念与功能教学方法:讲述为主,结合案例教学内容:第一节金融市场的概念与功能一、金融市场的概念所谓金融,即货币资金的融通,就是指资金盈余的一方通过金融交易将多余的资金贷借、融通给资金短缺的另一方。

融资的形式主要有两种,即直接融资和间接融资。

直接融资是指资金供求双方以发行股票、债券等各种有价证券而直接进行的资金融通。

间接融资是指交易双方通过银行或非银行的金融机构来实现资金融通的。

金融市场(Financial Markets)是指资金融通的场所或进行金融资产交易的场所,它是以金融资产(Financial Assets)为交易对象而形成的供求关系及其机制的总和。

这个概念包括如下三层含义:一是金融市场是进行金融资产交易的场所,这个场所可以是有形的,如证券交易所,期货交易所;也可以是无形的,如外汇交易员们通过电信网络构成的看不见的市场所进行的资金调拨。

二是金融市场反映了金融资产的供应者和需求者之间所形成的供求关系。

Chapter13. Distinguish between money and capital markets.ANSWER: Money markets facilitate the trading of short-term (money market) instruments while capital markets facilitate the trading of long-term (capital market) instruments.Commercial banks use some funds to purchase securities and other funds to make loans. Why are the securities more marketable than loans in the secondary market?ANSWER: Securities are more standardized than loans and therefore can be more easily sold in the secondary market. The excessive documentation oncommercial loans limits a bank's ability to sell loans in the secondary market.21. How does a money market mutual fund differ from a stock or bond mutual fund?ANSWER: A money market mutual fund invests in money market securities, whereas other mutual funds normally invest in stocks or bonds.Chapter23. Would you expect federal government demand for loanable funds to be more or less interestelastic than household demand for loanable funds? Why?ANSWER: Federal government demand for loanable funds should be less interest elastic than the consumer demand for loanable funds, because the government's planned borrowings will likely occur regardless of the interest rate.Conversely, the quantity of loanable funds by consumers is more responsive to the interest rate level.7. Jayhawk Forecasting Services analyzed several factors that could affect interestrates in the future. Most factors were expected to place downward pressure on interest rates. Jayhawk also felt that although the annual budget deficit was to be cut by 40 percent from the previous year, it would still be very large. Thus, Jayhawk believed that the deficit's impact would more than offset the other effectsand therefore forecast interest rates to increase by 2 percent. Comment on Jayhawk's logic.ANSWER: A reduction in the deficit should free up some funds that had been used to support the government borrowings. Thus, there should be additional funds available to satisfy other borrowing needs. Given this situation plus the other information, Jayhawk should have forecasted lower interest rates.10.What is the logic behind the Fisher effect's implied positive relationshipbetween expected inflation and nominal interest rates?ANSWER: Investors require a positive real return, which suggests that they will only invest funds if the nominal interest rate is expected to exceed inflation. In this way, the purchasing power of invested funds increases over time. As inflation rises, nominal interest rates should rise as well since investors would require a nominal return that exceeds the inflation rate.16. If foreign investors expected that the . dollar's value would weaken overthe next few years, how might this affect (a) the foreign supply of funds to the U.S. markets and (b) U.S. interest rates? Explain.ANSWER: The expectation of a weaker . dollar can cause a lower foreign supply of funds to the U.S. markets, as foreign investors reduce their investment in the United States, because a weakened dollar over the investment horizon reduces the return to foreign investors. The reduced foreign supply of funds to U.S. markets places upward pressure on U.S. interest rates.19. If financial market participants overestimate inflation in a particularperiod, will real interest rates be relatively high or low? Explain.ANSWER: If inflation is overestimated, the real interest rate will be relatively high. Investors had required a relatively high nominal interest rate because they expected inflation to be high (according to the Fisher effect).Chapter 37. Explain how a yield curve would shift in response to a sudden expectationof rising interest rates, according to the pure expectations theory.ANSWER: The demand for short-term securities would increase, placing upward (downward) pressure on their prices (yields). The demand for long-term securities would decrease, placing downward (upward) pressure on their prices (yields). If the yield curve was originally upward sloped, it would now have a steeper slope as a result of the expectation. If it was originally downward sloped, it would now be more horizontal (less steep), or may have even become upward sloping.10. Assume there is a sudden expectation of lower interest rates in the future.What would be the effect on the shape of the yield curve? Explain.ANSWER: The demand for short-term securities would decrease, placing downward (upward) pressure on their prices (yields). The demand for long-term securities would increase, placing upward (downward) pressure on their prices (yields). If the yield curve was originally upward sloped, it would now be more horizontal (less steep). If it was downward sloped, it would now be more steep.11. Explain the liquidity premium theory.ANSWER: If investors believe that securities with larger maturities are less liquid, they will require a premium when investing in such securities to compensate. This theory can be combined with the other theories to explain the shape of a yield curve.12. If liquidity and interest rate expectations are both important for explainingthe shape of a yield curve, what does a flat yield curve indicate about the market's perception of future interest rates?ANSWER: A flat yield curve without consideration of a liquidity premium would represent no expected change in interest rates according to the pure expectations theory. Therefore, if the flat yield curve reflects the existence of a liquidity premium, this curve would actually have a slightdownward slope when removing the liquidity premium. This suggestsexpectations of a slight decline in future interest rates.14. If the segmented markets theory causes an upward-sloping yield curve, whatdoes this imply?ANSWER: An upward-sloped yield curve caused by segmented markets implies that the demand for short-term funds is low relative to the supply of short-term funds. In addition, the demand for long-term funds is high relative to the supply of long-term funds.20. Suppose that the Treasury decided to finance its deficit with mostlylong-term funds. How could this decision affect the term structure of interest rates? If short-term and long-term markets are segmented, would the Treasury's decision have a more or less pronounced impact on the term structure? Explain.ANSWER: If the Treasury borrowed heavily in the long-term markets, it could place upward pressure on long-term rates without having as much of an impact on short-term rates (assuming that markets are somewhat segmented).Chap 43. What are the main goals of the Federal Open Market Committee? How does itattempt to achieve these goals?ANSWER: The main goals of the FOMC are to promote high employment, economic growth, and price stability.Chap 55. Briefly summarize the pure Keynesian philosophy and identify the key variableconsidered.ANSWER: The pure Keynesian philosophy suggests that the money supply should be adjusted by the Fed to influence interest rates and aggregate spending for goods and services. A loose-money policy can lower interest rates and increase aggregate spending, while a tight-money policy can increaseinterest rates and reduce aggregate spending.6. Briefly summarize the Monetarist approach.ANSWER: The Monetarist philosophy advocates a stable, low growth in the money supply. Monetarists may contend that sporadic changes in money supply growth are likely to result in volatile business cycles.14. If a change in the discount rate is not likely to directly affect marketinterest rates, why do financial markets sometimes react to such a change?ANSWER: A change in the discount rate may signal t he Fed’s plan to adjust money supply targets and attempt to raise or lower interest rates, which would affect prices of securities such as bonds and mortgages.Chap 63. Why do large corporations typically make competitive bids rather thannoncompetitive bids for T-bills?ANSWER: Because noncompetitive bidders are limited to purchasing Treasury bills with a maximum par value of $1 million per auction, large corporations desiring a larger investment typically submit competitive bids.6. Why do some firms create a department that can directly place commercial paper?What criteria affect the decision to create such a department?ANSWER: Those firms that issue commercial paper may decide to establish a department that can directly place the paper. In this way, the firms can avoid the transactions costs incurred when commercial paper dealers issuecommercial paper. Such a strategy is only worthwhile if the firmscontinuously issue commercial paper.Chap 87. If a bond's coupon rate is above its required rate of return, would its pricebe above or below its par value? Explain.ANSWER: When a bond's coupon rate is above the required rate of return, the price of the bond would be above its par value because the coupons providemore than the return required.8. Is the price of a long-term bond more or less sensitive to a change in interestrates than the price of a short-term security? Why?ANSWER: The price of a long-term bond is more sensitive to a given change in interest rates than the price of a short-term security. The long-term bond provides fixed payments for a longer period of time. Consequently, it will provide these fixed payments, whether interest rates decline or rise. The benefit of fixed payments during a period of falling interest rates is more pronounced for longer maturities. The same is true for the disadvantage of fixed payments during a period of rising rates.16. Assume that the bond market participants suddenly expect the Fed tosubstantially increase money supply.a. Assuming no threat of inflation, how would bond prices be affected bythis expectation?ANSWER: Without the threat of inflation, an increase in the money supply could reduce interest rates and bond prices would increase. Thus, bond portfolio managers would purchase more bonds now, causing immediate upward pressure on bond prices.b. Assuming that inflation may result, how would bond prices be affected?ANSWER: If inflation increases, interest rates will likely increase, and prices of existing bonds will decline. Therefore, bond portfolio managers would sell bonds now, causing immediate downward pressure on bond prices.17. Bond portfolio managers closely monitor the trade deficit figures.a. When the trade deficit figure is higher than anticipated, bond pricestypically decline. Explain why this reaction may occur.ANSWER: A higher trade deficit figure signals the possibility ofcontinued high trade deficits, which would place downward pressure on the dollar. If the dollar weakens, U.S. inflation may rise, and U.S.interest rates may rise. Thus, bond portfolio managers sell bonds,placing downward pressure on bond prices.b. On some occasions, the trade deficit figure has been very large, but thebond markets did not respond to the announcement. Assuming that no other information offset its impact, explain why the bond markets may not have responded to the announcement.ANSWER: If the large trade deficit was already anticipated by the market, the announcement does not offer any additional information. Therefore, the market does not react. Existing bond prices already reflect themarket's expectations.Chap 105. Why do firms engage in IPOs?ANSWER: Firms engage in IPOs when they have feasible expansion plans but are already near their debt capacity.7. Describe the motivation for a firm to do a road show before its IPO.ANSWER: The firm does a road show to promote its offering. That is, it explains to various institutional investors how it will use the funds to support its expansion. The goal of the road show is to convince some large investors to invest in the shares of the firm.18. Describe how the interaction between buyers and sellers affects the marketvalue of a firm, and explain how that can subject a firm to the market for corporate control.ANSWER: If a firm’s business performance is weak, investor demand for shares will typically be weak, and the firm’s stock price will be weak. Another firm’s managers may consider purchasing the weak firm at its prevailing weak price, and then improving that firm’s performance by replacing managers and reorganizing that firm. Managers of the weak firm have an incentive to improve their firm to prevent the firm from being acquired.。