国际金融试题库word版

- 格式:doc

- 大小:139.50 KB

- 文档页数:54

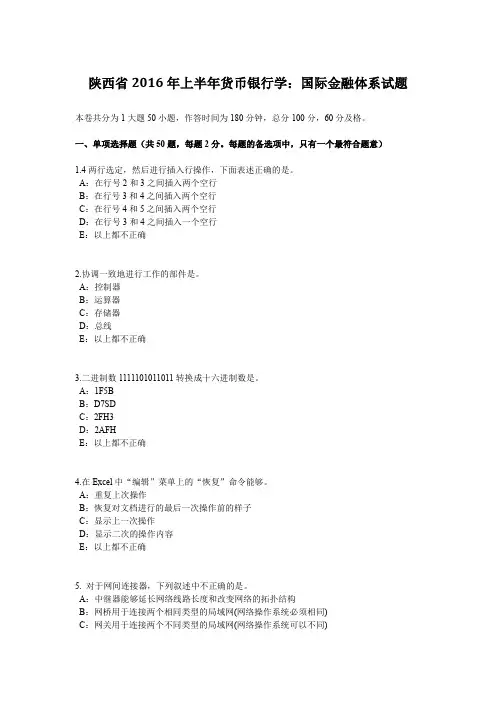

陕西省2016年上半年货币银行学:国际金融体系试题本卷共分为1大题50小题,作答时间为180分钟,总分100分,60分及格。

一、单项选择题(共50题,每题2分。

每题的备选项中,只有一个最符合题意)1.4两行选定,然后进行插入行操作,下面表述正确的是。

A:在行号2和3之间插入两个空行B:在行号3和4之间插入两个空行C:在行号4和5之间插入两个空行D:在行号3和4之间插入一个空行E:以上都不正确2.协调一致地进行工作的部件是。

A:控制器B:运算器C:存储器D:总线E:以上都不正确3.二进制数1111101011011转换成十六进制数是。

A:1F5BB:D7SDC:2FH3D:2AFHE:以上都不正确4.在Excel中“编辑”菜单上的“恢复”命令能够。

A:重复上次操作B:恢复对文档进行的最后一次操作前的样子C:显示上一次操作D:显示二次的操作内容E:以上都不正确5. 对于网间连接器,下列叙述中不正确的是。

A:中继器能够延长网络线路长度和改变网络的拓扑结构B:网桥用于连接两个相同类型的局域网(网络操作系统必须相同)C:网关用于连接两个不同类型的局域网(网络操作系统可以不同)D:网间连接器不能将局域网和广域网连接起来E:以上都不正确6. 计算机所能识别并执行的全部指令的集合,称为该计算机的。

A:二进制代码B:程序设计系统C:指令系统D:软件E:以上都不正确7. MAC地址通常固化在计算机的上。

A:内存B:网卡C:硬盘D:高速缓冲区E:以上都不正确8. RAM具有的特点是。

A:海量存储B:存储在其中的信息可以永久保存C:一旦断电,存储在其上的信息将全部消失且无法恢复D:存储在其中的数据不能改写E:以上都不正确9. 在Word文档编辑过程中,为了防止突然断电等意外造成的数据丢失,应经常单击工具栏上的“保存”按钮或按快捷键。

A:Alt+SB:Shift+SC:Ctrl+SD:Ctrl+Shift+SE:以上都不正确10. 在Word 2003中,要选择一段文字,从文字开头处单击鼠标,再在这段文字的结尾处,按键,同时按鼠标。

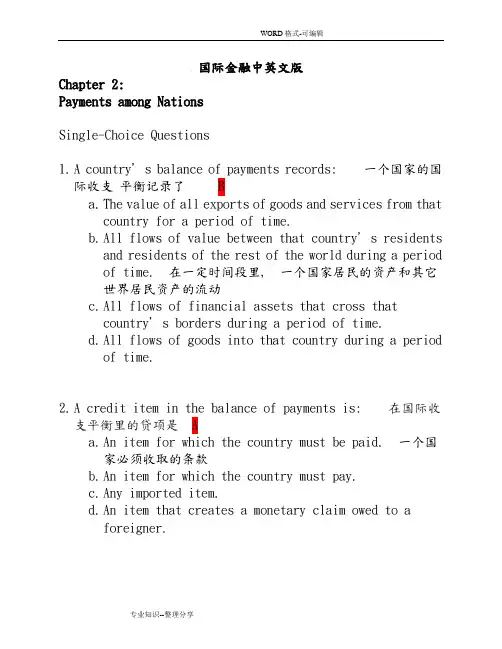

国际金融中英文版Chapter 2:Payments among NationsSingle-Choice Questions1.A country’s balance of payments records:一个国家的国际收支平衡记录了 Ba.The value of all exports of goods and services from thatcountry for a period of time.b.All flows of value between that c ountry’s residentsand residents of the rest of the world during a periodof time. 在一定时间段里, 一个国家居民的资产和其它世界居民资产的流动c.All flows of financial assets that cross thatcountry’s borders during a period of time.d.All flows of goods into that country during a periodof time.2.A credit item in the balance of payments is: 在国际收支平衡里的贷项是 Aa.An item for which the country must be paid. 一个国家必须收取的条款b.An item for which the country must pay.c.Any imported item.d.An item that creates a monetary claim owed to aforeigner.3.Every international exchange of value is entered into thebalance-of-payments accounts __________ time(s). 每一次国际等价交换都记进国际收支帐户2次 Ba.1b.2c.3d.44.A debit item in the balance of payments is: 在国际收支平衡中的借项是 Ba.An item for which the country must be paid.b.An item for which the country must pay. 一个国家必须支付的条款c.Any exported item.d.An item that creates a monetary claim on a foreigner.5.In a nation's balance of payments, which one of the followingitems is always recorded as a positive entry? D 在国际收支中, 下列哪个项目总被视为有利条项a.Changes in foreign currency reserves.b.Imports of goods and services.itary foreign aid supplied to allied nations.d.Purchases by foreign travelers visiting the country.国外游客在本国发生的购买6.The sum of all of the debit items in the balance of payments:在收支平衡中,所有贷项的总和 Ba.Equals the overall balance.b.Equals the sum of all credit items.等于所有借项的总和c.Equals ‘compensating’ transactions.d.Equals the sum of credit items minus errors andomissions.7.Which of the following capital transactions are entered asdebits in the U.S. balance of payments? 下列哪个资本交易在美国的收支平衡中当作借项?Ba.A U.S. resident transfers $100 from his account atCredit Suisse in Basel (Switzerland) to his account ata San Francisco branch of Wells Fargo Bank.b.A French resident transfers $100 from his account atWells Fargo Bank in San Francisco to his Credit Suisseaccount in Basel. 一个法国居民在旧金山的Fargo Bank用其帐户转帐100美金到位于巴塞尔的瑞士信贷户口c.A U.S. resident sells his IBM stock to a Frenchresident.d.A U.S. resident sells his Credit Suisse stock to aFrench resident.8.An increase in a nation's financial liabilities to foreignresidents is a: 一个国家对另一个国家金融负债的增加是一种Ca.Reserve inflow.b.Reserve outflow.c.Capital inflow.资本流入d.Capital outflow.9.___A_______ are money-like assets that are held bygovernments and that are recognized by governments as fully acceptable for payments between them. 官方国际储备资产是一种类似于钱的资产,这种资产由政府掌握并作为政府间的一种支付手段得到充分认可.a.Official international reserve assets 官方国际储备资产b.Unofficial international reserve assetsc.Official domestic reserve assetsd.Unofficial domestic reserve assets10.Which of the following is considered a capital inflow?下列哪项被视为资本流入 Aa.A sale of U.S. financial assets to a foreign buyer.美国一金融资产卖给一外国买家b.A loan from a U.S. bank to a foreign borrower.c.A purchase of foreign financial assets by a U.S. buyer.d.A U.S. citizen’s repayment of a loan from a foreignbank.11.In a country’s balance of payments, which of thefollowing transactions are debits?一个国家的收支平衡表中,哪个交易属于借项? Aa.Domestic bank balances owned by foreigners aredecreased. 外国人拥有的国内银行资产的下降b.Foreign bank balances owned by domestic residents aredecreased.c.Assets owned by domestic residents are sold tononresidents.d.Securities are sold by domestic residents tononresidents.12.The role of ___D_______ is to direct one nation’ssavings into another nation’s investments: 资金流的作用是指导一个国家的储蓄进入到另一个国家的投资a.Merchandise trade flowsb.Services flowsc.Current account flowsd.Capital flows 资金流13.The net value of flows of goods, services, income, andunilateral transfers is called the: 商品,服务,收入和单方面转让等现金流的净收益叫经常账目(户)Ba.Capital account.b.Current account.经常账目(户)c.Trade balance.d.Official reserve balance.14.The net value of flows of financial assets and similarclaims (excluding official international reserve asset flows) is called the: 金融资产和类似的资产(官方国际储备资产流除外)的净值流叫 Aa.Financial account.金融帐b.Current account.c.Trade balance.d.Official reserve balance.15.The financial account in the U.S. balance of paymentsincludes: 美国国家收支表中的金融帐包括: Ba.Everything in the current account.b.U.S. government payments to other countries for the useof military bases.美政府采用其它国家军事基地所需支付款项c.Profits that Nissan of America sends back to Japan.d.New U.S. investments in foreign countries.16.A U.S. resident increasing her holdings of a foreignfinancial asset causes a: 一个美国居民增持一外国金融资产会引起Da.Credit in the U.S. current account.b.Debit in the U.S. current account.c.Credit in the U.S. capital account.d.Debit in the U.S. capital account. 美国资本帐的借帐17. A foreign resident increasing her holdings of a U.S.financial asset causes a: 一个美国居民增持本国一金融资产会引起 Ca.Credit in the U.S. current account.b.Debit in the U.S. current account.c.Credit in the U.S. capital account.美国资本帐的贷帐d.Debit in the U.S. capital account.18. A deficit in the current account: 经常帐户中的赤字 Aa.Tends to cause a surplus in the financial account.会导致金融帐中的盈余b.Tends to cause a deficit in the financial account.c.Has no relationship to the financial account.d.Is the result of increasing exports and decreasingimports.19.In September, 2005, exports of goods from the U.S.decreased $3.3 billion to $73.4 billion, and imports of goods increased $3.8 billion to $144.5 billion. Thisincreased the deficit in:2005年8月,美国商品出口降低了33亿美元,共734亿美元;商品进口上升到1145亿美元,上长了38亿.这样增加了哪个方面的赤字?Ca.The balance of payments.b.The financial account.c.The current account. 经常帐户d.Unilateral transfers.20.Which of the following would contribute to a U.S. currentaccount surplus? 以下哪项有助于美国现金帐的盈余? Ba.The United States makes a unilateral tariff reductionon imported goods.b.The United States cuts back on American militarypersonnel stationed in Japan.美国削减在日本的军事人员c.U.S. tourists travel in large numbers to Asia.d.Russian vodka becomes increasingly popular in theUnited States.21.Which of the following transactions is recorded in thefinancial account?以下哪个交易会被当作金融帐Aa.Ford motor company builds a new plant in China 福特摩托公司在中国设立车间b.A Chinese businessman imports Ford automobiles from theUnited States.c.A U.S. tourist spends money on a trip to China.d.The New York Yankees are paid $10 million by the Chineseto play an exhibition game in Beijing, China.22.If a British business buys U.S. government securities,how will this be entered in the balance of payments? 如果一英国商人购买了美国政府的债券,那么这个交易在收支平衡表中会被当作是? Ca.It will appear in the trade account as an import.b.It will appear in the trade account as an export.c.It will appear in the financial account as an increasein U.S. assets held by foreigners.会被当作是外国人所有的美国资产增长d.It will appear in the financial account as a decreasein U.S. assets held by foreigners.23.In the balance of payments, the statistical discrepancyor error term is used to: 在收支平衡表中, 统计差异与错误项目会用来确保借帐总和跟贷帐总和一致 Aa.Ensure that the sum of all debits matches the sum ofall credits.b.Ensure that imports equal the value of exports.c.Obtain an accurate account of a balance-of-paymentsdeficit.d.Obtain an accurate account of a balance-of-paymentssurplus.24.Official reserve assets are: 官方储备资产是Ba.The gold holdings in the nation’s central bank.b.Money like assets that are held by governments and thatare recognized by governments as fully acceptable forpayments between them. 官方国际储备资产是一种类似于钱的资产,这种资产由政府掌握并作为政府间的一种支付手段得到充分认可ernment T-bills and T-bonds.ernment holdings of SDR’s25.Which of the following constitutes the largest componentof the world’s international reserve assets?下列哪项构成了世界国际储备资产的大部份? Da.Gold.b.Special Drawing Rights.c.IMF Reserve Positions.d.Foreign Currencies. 外汇(币)26.The net accumulation of foreign assets minus foreignliabilities is: 海外净资产的积累减去外债等于C official reserves. domestic investment. foreign investment. 国外投资净值 foreign deficit.27. A country experiencing a current account surplus: 一个国家经历经常帐户的盈余 Ba.Needs to borrow internationally.b.Is able to lend internationally.就有能力向外放贷c.Must also have had a surplus in its "overall" balance.d.Spent more than it earned on its merchandise and servicetrade, international income payments and receipts andinternational transfers.28.The ___C_______ measures the sum of the current accountbalance plus the private capital account balance. 官方结算差额是指经常帐户余额的总和加上私人资本帐(B=CA+FA,FA:为非官方投资和储备)a.Official capital balanceb.Unofficial capital balancec.Official settlements balance官方结算差额d.Unofficial settlements balance29.If the overall balance is in __A________, there is anaccumulation of official reserve assets by the country ora decrease in foreign official reserve holdings of thecountry's assets. 如果综合差额处于盈余,那么会出现本国官方储备资产的积累或者国外官方储备的减少(B=CA+FA,B+OR=0,OR:官方储备金额)a.Surplus盈余b.Deficitc.Balanced.Foreign hands30.Which of the following is the current account balance NOTequal to? 以下哪项不等同于现金帐 Da.The difference between domestic product and domesticexpenditure.b.The difference between national saving and domesticinvestment. foreign investment.d.The difference between government saving andgovernment investment. 政府储蓄与政府投资的差值True/False Questions31.Capital inflows are debits and capital outflows arecredits. 资金流入是借项,资金外流是贷项32.The net value of the flow of goods, services, income, andgifts is the current account balance. (T) 商品,服务,收入和单方面转让等现金流的净收益叫经常账目余额33.The net flow of financial assets and similar claims isthe private current account balance. 金融资产和类似的资产的净值叫经常帐目余额34.The majority of countries' official reserves assets arenow foreign exchange assets, financial assets denominated in a foreign currency that is readily acceptable ininternational transactions. (T) 大部份官方储备资产作为以外汇资产和金融资产为命名的外币在世界上交易与流通.35. A country's financial account balance equals thecountry's net foreign investment.一个国家的金融帐差额相当于一个国家的净国外投资36. A country has a current account deficit if it is savingmore than it is investing domestically.一个国家如果在国内的储蓄比投资要大,那么会出现经常账目赤字37.The official settlements balance measures the sum of thecapital account balance plus the public current account balance. 官方结算差额是资金帐户余额的总额加上公共经常帐户余额38. A nation's international investment position shows itsstock of international assets and liabilities at a moment in time. (T) 一个国家的国际投资状况反映出它在特定时间里的国际资产股份以及债务情况.39. A nation is a borrower if its current account is indeficit during a time period. (T)在一段时间内,如果一个国家的经常帐出现赤字,那么它就是借方.40. A nation is a debtor if its net stock of foreign assetsis positive. 如果一个国家的国外资产净储备是正数,那么它是借方(债务方)41. A transaction leading to a foreign resident increasingher holdings of a U.S. financial asset will be recorded asa debit on the U.S. financial account. 如果一项交易引起一外国居民增持美国金融资产的股份,那么这项交易在美国金融帐中会被当作借项42. A credit item is an item for which a country must pay.贷项是指一个国家必须还款的条项43.Gold is a major reserve asset that is currently often usedin official reserve transactions. 黄金作为主要的储备资产,常被用在官方储备交易当中.44.The current account balance is equal to the differencebetween domestic product and national expenditure.(T) 经常项目余额等于国民生产与国民支出的差额45.In 2007 U.S. households, businesses and government werebuying more goods and services than they were producing.(T)2007年,美国家庭,商业,政府购买的商品和服务比他们生产(商品和服务)的要多.46。

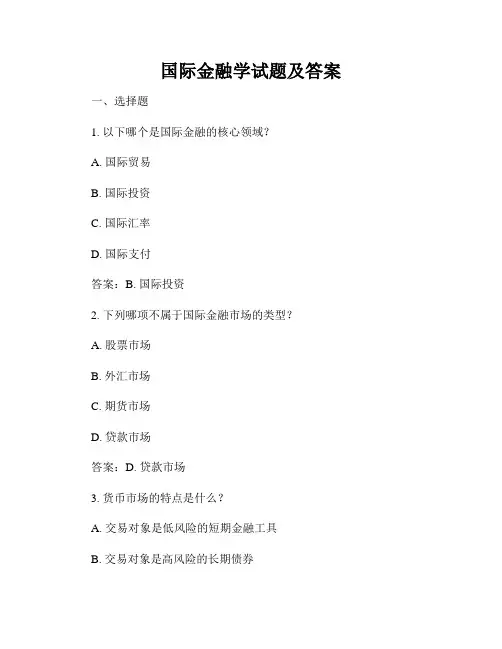

国际金融学试题及答案一、选择题1. 以下哪个是国际金融的核心领域?A. 国际贸易B. 国际投资C. 国际汇率D. 国际支付答案:B. 国际投资2. 下列哪项不属于国际金融市场的类型?A. 股票市场B. 外汇市场C. 期货市场D. 贷款市场答案:D. 贷款市场3. 货币市场的特点是什么?A. 交易对象是低风险的短期金融工具B. 交易对象是高风险的长期债券C. 交易对象是外汇D. 交易对象是股票答案:A. 交易对象是低风险的短期金融工具4. 下列哪种情况属于贸易逆差?A. 进口多于出口B. 进口少于出口C. 进口等于出口D. 进口在一定范围内波动答案:A. 进口多于出口5. 以下哪个因素不会影响汇率的波动?A. 利率水平B. 政府干预C. 外汇储备D. 贸易差额答案:D. 贸易差额二、判断题判断下列说法是否正确。

1. 国际金融市场的发展与国际交流和合作密切相关。

答案:正确2. 国际金融市场的主要参与者是个人投资者。

答案:错误3. 汇率变动对国际经济和金融产生重要影响。

答案:正确4. 国际金融市场具有高度的流动性。

答案:正确5. 国际金融市场的主要功能之一是为企业提供融资渠道。

答案:正确三、问答题1. 请简要说明国际金融的定义和范畴。

国际金融是研究跨国金融活动的学科,它涉及到国际投资、国际贸易、国际汇率、国际支付等多个方面。

国际金融的范畴包括国际金融市场、国际金融机构、国际金融制度等内容。

2. 国际金融市场的种类有哪些?国际金融市场包括货币市场、债券市场、股票市场、外汇市场、期货市场等。

货币市场是短期资金融通的市场,债券市场提供长期融资的工具,股票市场是股权融资的市场,外汇市场是进行不同货币之间的交易,期货市场是进行标的物交割的市场。

3. 请简要说明汇率的意义及影响因素。

汇率是一国货币兑换另一国货币的比率。

汇率的变动对于国际经济和金融具有重要影响。

汇率的升值或贬值会直接影响国际贸易和国际投资,进而会对国家的经济发展产生影响。

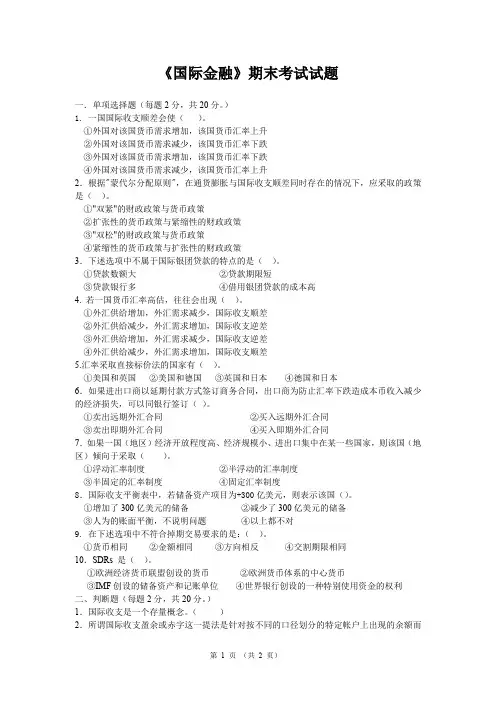

《国际金融》期末考试试题一.单项选择题(每题2分,共20分。

)1. 一国国际收支顺差会使()。

①外国对该国货币需求增加,该国货币汇率上升②外国对该国货币需求减少,该国货币汇率下跌③外国对该国货币需求增加,该国货币汇率下跌④外国对该国货币需求减少,该国货币汇率上升2.根据"蒙代尔分配原则",在通货膨胀与国际收支顺差同时存在的情况下,应采取的政策是()。

①"双紧"的财政政策与货币政策②扩张性的货币政策与紧缩性的财政政策③"双松"的财政政策与货币政策④紧缩性的货币政策与扩张性的财政政策3.下述选项中不属于国际银团贷款的特点的是()。

①贷款数额大②贷款期限短③贷款银行多④借用银团贷款的成本高4. 若一国货币汇率高估,往往会出现()。

①外汇供给增加,外汇需求减少,国际收支顺差②外汇供给减少,外汇需求增加,国际收支逆差③外汇供给增加,外汇需求减少,国际收支逆差④外汇供给减少,外汇需求增加,国际收支顺差5.汇率采取直接标价法的国家有()。

①美国和英国②美国和德国③英国和日本④德国和日本6.如果进出口商以延期付款方式签订商务合同,出口商为防止汇率下跌造成本币收入减少的经济损失,可以同银行签订()。

①卖出远期外汇合同②买入远期外汇合同③卖出即期外汇合同④买入即期外汇合同7.如果一国(地区)经济开放程度高、经济规模小、进出口集中在某一些国家,则该国(地区)倾向于采取()。

①浮动汇率制度②半浮动的汇率制度③半固定的汇率制度④固定汇率制度8.国际收支平衡表中,若储备资产项目为+300亿美元,则表示该国()。

①增加了300亿美元的储备②减少了300亿美元的储备③人为的账面平衡,不说明问题④以上都不对9. 在下述选项中不符合掉期交易要求的是:()。

①货币相同②金额相同③方向相反④交割期限相同10.SDRs 是()。

①欧洲经济货币联盟创设的货币②欧洲货币体系的中心货币③IMF创设的储备资产和记账单位④世界银行创设的一种特别使用资金的权利二、判断题(每题2分,共20分。

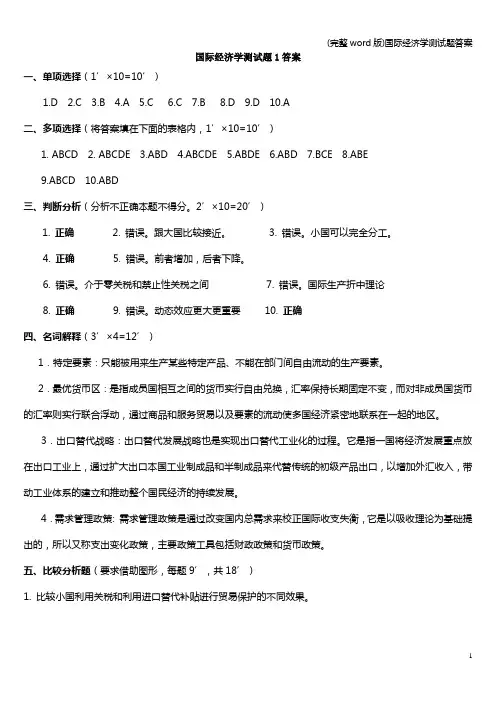

国际经济学测试题1答案一、单项选择(1’×10=10’)1.D2.C3.B4.A5.C6.C7.B8.D9.D 10.A二、多项选择(将答案填在下面的表格内,1’×10=10’)1. ABCD2. ABCDE3.ABD4.ABCDE5.ABDE6.ABD7.BCE8.ABE9.ABCD 10.ABD三、判断分析(分析不正确本题不得分。

2’×10=20’)1. 正确2. 错误。

跟大国比较接近。

3. 错误。

小国可以完全分工。

4. 正确5. 错误。

前者增加,后者下降。

6. 错误。

介于零关税和禁止性关税之间7. 错误。

国际生产折中理论8. 正确9. 错误。

动态效应更大更重要10. 正确四、名词解释(3’×4=12’)1.特定要素:只能被用来生产某些特定产品、不能在部门间自由流动的生产要素。

2.最优货币区:是指成员国相互之间的货币实行自由兑换,汇率保持长期固定不变,而对非成员国货币的汇率则实行联合浮动,通过商品和服务贸易以及要素的流动使多国经济紧密地联系在一起的地区。

3.出口替代战略:出口替代发展战略也是实现出口替代工业化的过程。

它是指一国将经济发展重点放在出口工业上,通过扩大出口本国工业制成品和半制成品来代替传统的初级产品出口,以增加外汇收入,带动工业体系的建立和推动整个国民经济的持续发展。

4.需求管理政策: 需求管理政策是通过改变国内总需求来校正国际收支失衡,它是以吸收理论为基础提出的,所以又称支出变化政策,主要政策工具包括财政政策和货币政策。

五、比较分析题(要求借助图形,每题9’,共18’)1. 比较小国利用关税和利用进口替代补贴进行贸易保护的不同效果。

征收关税之后,该国的总福利水平下降了:消费者剩余损失了(a+b+c+d),其中a被生产者所得,c为政府财政收入所得,但尚有b和d的损失,国内没有任何人能得到相应的补偿。

这是由于关税使本国的生产资源从效率较高的部门转移到了效率较低的部门,即一国的生产资源向没有比较优势的进口竞争部门集中,因此造成了国民福利净损失。

文档基本上包括了所有课后问题的答案不过因为是乱序,所以只好下载下来然后通过word关键词搜索法,方法如下,把题目复制到word搜索框,就会弹出。

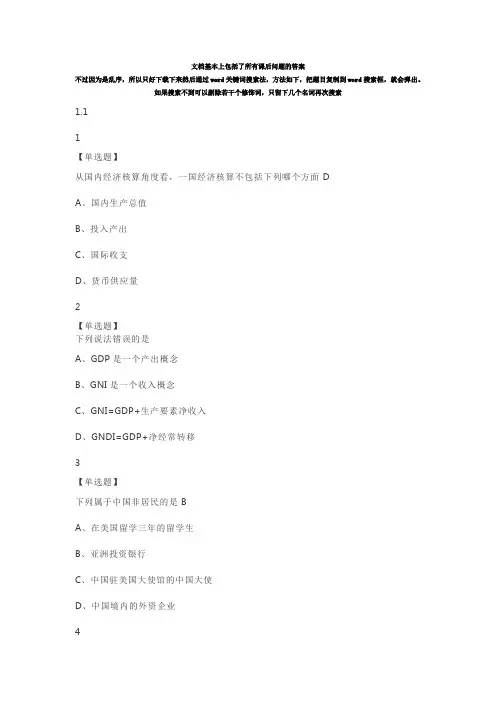

如果搜索不到可以删除若干个修饰词,只留下几个名词再次搜索1.11【单选题】从国内经济核算角度看,一国经济核算不包括下列哪个方面 DA、国内生产总值B、投入产出C、国际收支D、货币供应量2【单选题】下列说法错误的是A、GDP是一个产出概念B、GNI是一个收入概念C、GNI=GDP+生产要素净收入D、GNDI=GDP+净经常转移3【单选题】下列属于中国非居民的是BA、在美国留学三年的留学生B、亚洲投资银行C、中国驻美国大使馆的中国大使D、中国境内的外资企业4【判断题】在本国国内居住满一年以及一年以上的个人就是本国居民×5【判断题】住户的居民属性取决于其住所所在地,而不是工作所在地。

√1.2 封闭经济下的国民收入恒等式(上)1【单选题】下列活动不应计入GDP的是 CA、企业自己制造的生产用机器设备B、农民生产出供自己消费的粮食C、家庭主妇每天在家里带孩子D、某家庭请了一个保姆每天照看孩子2【单选题】固定资产与存货的差异为CA、空间上的“位置”是否固定B、时间上是否有耐久性C、是否可以在较长时间内反复或者连续用于生产D、体积的大小3【单选题】下列说法错误的是A、本期生产出来的产品是否销售出去与本期GDP规模无关B、以前年度生产出来的产品在本期销售也与本期GDP规模无关C、野生果实、原始森林的自然生长,公海中鱼类数量的自然增长计入GDPD、加总生产过程各个环节的增加值(value added)得到4【判断题】房产中介小王将手中的1套二手房以100万价格卖出,因此本年GDP增加80万元。

×5【判断题】房产中介小王将手中的1套二手房以100万价格卖出,所获提成为1万,该笔收入应计入GDP。

√1.3 封闭经济下的国民经济恒等式(下)1【单选题】下列说法错误的是A、生产税包括产品税、销售税、营业税B、生产补贴包括对企业的价格补贴和出口退税以及消费目的的补贴C、营业盈余体现了资本所得D、营业盈余是企业从事生产经营活动所获得的利润2【单选题】在封闭经济环境下,下列等式错误的是CA、Sg=T-TR-INT-GB、PDI=GDP+TR-TC、S=GDP-C-G-ID、Sp=GDP+TR+INT-T-C3【单选题】下列说法错误的是A、政府部门的可支配收入等于政府的税收收入T减去转移支付TRB、政府的转移支付(Transfer Payment),包括各种形式的失业救济金、养老金等C、国民储蓄包括私人部门的储蓄加上政府部门的储蓄D、国民储蓄就是本国国民收入中未被用于消费的部分。

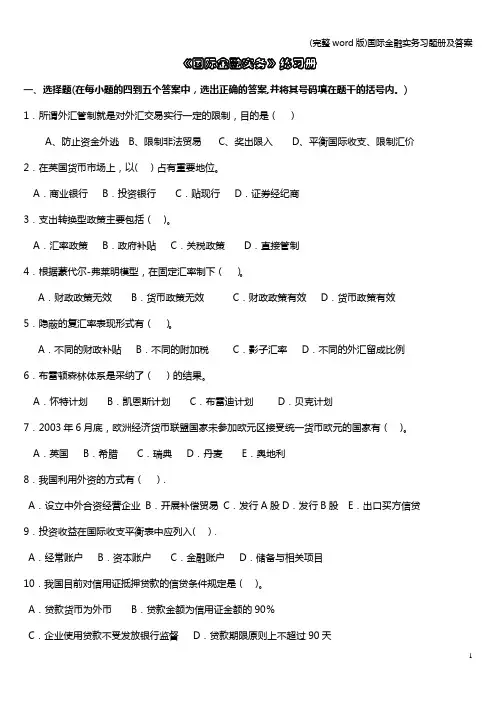

《国际金融实务》练习册一、选择题(在每小题的四到五个答案中,选出正确的答案,并将其号码填在题干的括号内。

) 1.所谓外汇管制就是对外汇交易实行一定的限制,目的是()A、防止资金外逃B、限制非法贸易C、奖出限入D、平衡国际收支、限制汇价2.在英国货币市场上,以( )占有重要地位。

A.商业银行B.投资银行C.贴现行D.证券经纪商3.支出转换型政策主要包括()。

A.汇率政策B.政府补贴C.关税政策D.直接管制4.根据蒙代尔-弗莱明模型,在固定汇率制下()。

A.财政政策无效B.货币政策无效C.财政政策有效D.货币政策有效5.隐蔽的复汇率表现形式有()。

A.不同的财政补贴B.不同的附加税C.影子汇率D.不同的外汇留成比例6.布雷顿森林体系是采纳了()的结果。

A.怀特计划B.凯恩斯计划C.布雷迪计划D.贝克计划7.2003年6月底,欧洲经济货币联盟国家未参加欧元区接受统一货币欧元的国家有()。

A.英国B.希腊C.瑞典D.丹麦E.奥地利8.我国利用外资的方式有().A.设立中外合资经营企业B.开展补偿贸易C.发行A股D.发行B股E.出口买方信贷9.投资收益在国际收支平衡表中应列入( ).A.经常账户B.资本账户C.金融账户D.储备与相关项目10.我国目前对信用证抵押贷款的信贷条件规定是()。

A.贷款货币为外币B.贷款金额为信用证金额的90%C.企业使用贷款不受发放银行监督D.贷款期限原则上不超过90天11、国际债券包括( )A、固定利率债券和浮动利率债券B、外国债券和欧洲债券C、美元债券和日元债券D、欧洲美元债券和欧元债券12、二次世界大战前为了恢复国际货币秩序达成的(),对战后国际货币体系的建立有启示作用。

A、自由贸易协定B、三国货币协定C、布雷顿森林协定D、君子协定13、外汇远期交易的特点是()A、它是一个有组织的市场,在交易所以公开叫价方式进行B、业务范围广泛,合约具是非标准化的特点C、合约规格标准化D、交易只限于交易所会员之间14、金融汇率是为了限制()A、资本流入B、资本流出C、套汇D、套利15、汇率定值偏高等于对非贸易生产给予补贴,这样()A、对资源配置不利B、对进口不利C、对出口不利D、对本国经济发展不利16、国际储备运营管理有三个基本原则是()A、安全、流动、盈利B、安全、固定、保值C、安全、固定、盈利D、流动、保值、增值17、一国国际收支顺差会使( )A、外国对该国货币需求增加,该国货币汇率上升B、外国对该国货币需求减少,该国货币汇率下跌C、外国对该国货币需求增加,该国货币汇率下跌D、外国对该国货币需求减少,该国货币汇率上升18、金本位的特点是黄金可以()A、自由买卖、自由铸造、自由兑换B、自由铸造、自由兑换、自由输出入C、自由买卖、自由铸造、自由输出入D、自由流通、自由兑换、自由输出入19、布雷顿森林体系规定会员国汇率波动幅度为()A、±10%B、±2。

搜索时不要带括号1。

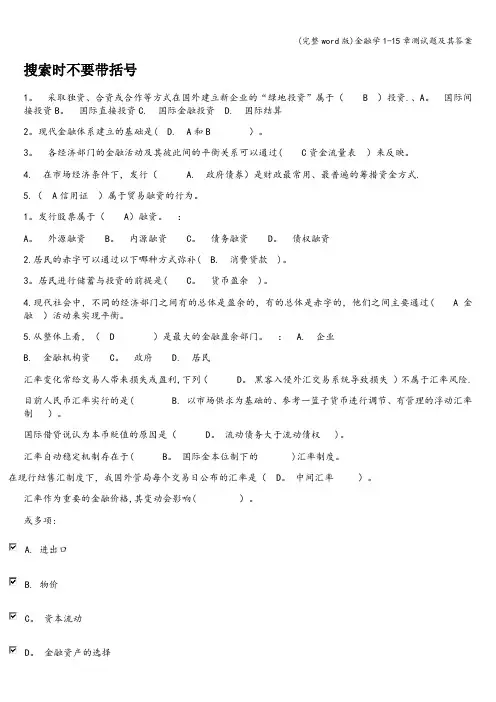

采取独资、合资或合作等方式在国外建立新企业的“绿地投资”属于( B )投资.、A。

国际间接投资B。

国际直接投资C. 国际金融投资 D. 国际结算2。

现代金融体系建立的基础是( D. A和B )。

3。

各经济部门的金融活动及其彼此间的平衡关系可以通过( C资金流量表)来反映。

4. 在市场经济条件下,发行( A. 政府债券)是财政最常用、最普遍的筹措资金方式.5.(A信用证)属于贸易融资的行为。

1。

发行股票属于(A)融资。

:A。

外源融资B。

内源融资C。

债务融资D。

债权融资2.居民的赤字可以通过以下哪种方式弥补( B. 消费贷款)。

3。

居民进行储蓄与投资的前提是( C。

货币盈余)。

4.现代社会中,不同的经济部门之间有的总体是盈余的,有的总体是赤字的,他们之间主要通过( A金融)活动来实现平衡。

5.从整体上看,( D )是最大的金融盈余部门。

: A. 企业B. 金融机构资C。

政府 D. 居民汇率变化常给交易人带来损失或盈利,下列(D。

黑客入侵外汇交易系统导致损失)不属于汇率风险.目前人民币汇率实行的是( B. 以市场供求为基础的、参考一篮子货币进行调节、有管理的浮动汇率制)。

国际借贷说认为本币贬值的原因是(D。

流动债务大于流动债权 )。

汇率自动稳定机制存在于( B。

国际金本位制下的 )汇率制度。

在现行结售汇制度下,我国外管局每个交易日公布的汇率是(D。

中间汇率)。

汇率作为重要的金融价格,其变动会影响( )。

或多项:A. 进出口B. 物价C。

资本流动属于早期汇率决定理论的是()。

或多项:A. 国际借贷理论C. 利率平价理论D. 汇兑心理说E. 购买力平价理论银行以不同方式卖出外汇时,下列正确的选项是()。

或多项:A. 电汇汇率是外汇市场的基准汇率B。

信汇汇率低于电汇汇率D. 票汇汇率低于电汇汇率下列说法正确的是( )。

或多项:A。

直接标价法下,外币的数额固定不变,本币的数额随币值变化B. 直接标价法下,汇率越高,本币价值越低E. 间接标价法下,汇率越高,本币价值越高根据利率平价理论,下列说法正确的是()。

完美WORD 格式 专业整理知识分享Suggested an swers to questio ns and p roblems(in the textbook)Chap ter 2Disagree, at least as a general statement. One meaning of a current account surplus is that the country is exporting more goods and services than it isbe con sidered good the extra imp orts allow the country to con sume and in vest domestically more tha n thevalue of its curre nt production. Another meaning of a current account surplus is that the country is en gaging in foreig n finan cial inv estme nt it is buildi ng up its claimson foreig ners, and this adds to n ati onal wea 1th. This sounds good, but as no ted above it comes at thecost of forego ing curre nt domestic pu rchases of goods and services ・ A curre nt acco unt deficit is thecountry running dow n its claims on foreigners or increasing its indebtedness toforeigners ・ Thissounds bad, but it comeswith the ben efit of higher levels of curre nt domestic expen diture.Differe nt coun tries at differe nt times may weigh the bala nee of these costs and ben efitsdiffere ntly, so that we cannot simply say that a curre nt acco unt surplus is better tha n a curre nt account deficit.4. Disagree ・ If the country has a surplus (a p ositive value) for its official settleme nts bala nee, the n the valuefor its official reserves bala nee must be a negative value of the sameamount (so that the two add to zero)・A negative value for this asset item means that funds are flow ing out in order for the country to acquire moreof these kinds of assets ・ Thus, the country is in creas ing its hold ings of official reserve assets ・Item e is a tran sacti on in which foreig n official hold ings of U.S. assets in crease ・ This is a po sitive(credit) item for official reserve assets and a negative (debit) item for private capital flows as the U ・S ・bank acquires pound bank depo sits ・ The debit item con tributes to a U.S. deficit in the official settleme ntsbala nee (while the credit item is recorded "below the lin e, " p ermitti ng the official settleme nts bala neeto be in deficit)・ All other transactions involve debit and credit items both of which are includedin the official settleme nts bala nee, so that they do not directly con tribute to a deficit (or surpi us)in the official settleme nts bala nee ・8. a. Mercha ndise trade bala nee: $330 - 198 二 $132Goods and services bala nee: $330 - 198 + 196 - 204 = $1242.importing.Onemightgood the count ry isCurre nt account bala nee: $330 - 198 + 196 - 204 + 3 - 8 = $119Official settleme nts bala nee: $330 - 198 + 196 - 204 + 3 - 8 + 102 - 202 + 4 = $23b・ Change in official reserve assets (net) = - official settlements balanee =-$23.The country is in creas ing its net hold ings of official reserve assets.10. 8. In ternatio nal in vestme nt p ositio n (billio ns) : $30 + 20 + 15 一40 一25 二so.The country is n either an intern ati onal creditor nor a debtor・ Its hold ing of intern ati onal assets equals its liabilities to foreig ners.b. A curre nt acco unt surplus p ermits the country to add to its net claims on foreig ners・ For this reas onthe coun try,s intern atio nal inv estme nt po siti on will becomea p ositive value・ The flow in crease in net foreig n assets results in the stock of net foreig n assets beco ming po sitive.Chap ter 32. Exports of merchandise and services result in supply of foreign currency in the foreig n exchange market・ Domestic sellers ofte n want to be p aid using domestic curre ncy, while the foreig n buyers want to pay in their curre ncy・In the p rocess of paying for these exp orts, foreig n curre ncy is excha nged for domestic curre ncy, creat ing supply of foreig n curre ncy・Intern ati onalcap ital in flows result in a supply of foreig n curre ncy in the foreig n excha nge market・ I n maki ng inv estme nts in domestic finan cial assets, foreig ninvestors often start with foreign currency and must exchange it for domestic curre ncy before they can buy the domestic assets・The excha nge creates a supply of foreig n curre ncy. Sales of foreig n finan cial assets that the country's residents had previously acquired, and borrowing from foreignersby this coun try's reside nts are other forms of cap ital in flow that can create supply of foreig n curre ncy・4. The U. S. firm obta ins a quotatio n from its bank on the spot excha nge rate for buying yen with dollars・ If therate is acce ptable, the firm in struets its bank that it wants to use dollars from its dollar check ing acco unt to buy 1 millio n yen at this spot excha nge rate・ It also in struets its bank to send the yen to the bank acco unt of the Japan ese firm. To carry out thisinstruction, the U.S. bank instructs its correspondent bank in Japan to take1 milli on yen from its acco unt at the corres pondent bank and tran sfer the yen to the bank acco unt of theJapan ese firm. (The U.S. bank could also use yen at its own branch if it has a branch in Japan.)5 The trader would seek out the best quoted spot rate for buying euros with dollars, either throughdirect con tact with traders at other banks or by using the services of a foreign exchange broker・ The trader would use the best :rate to buy euro spot. Sometime in the n ext hour or so (or, typ ically at least by the end of the day), the trader will en ter the in terba nk market aga in, to obtain the best quoted spot rate for selling euros for dollars・The traderwill use the best spot rate to sell her p reviously acquired euros・ If the spot value of the euro has rise n duri ng this short time, the trader makes a p rofit・The cross rate betwee n the yen and the krone is too high (the yen value of the krone is too high) relative to the dollar-foreig n curre ncy excha nge rates・ Thus, in a p :rofitable tria ngular3 a arbitrage, you want to sell kroner at the high cross rate・ The arbitrage will be: Use dollars to buy kroner at$0. 20/kr one, use these kroner to buy yen at 25 yen/krone, and use the yen to buy dollars at $0. 01/ye n.For each dollar that you sell in itially, you can obta in 5 kroner, these 5 kroner can obta in 125 yen, and the 125 yen can obta in $1.25. The arbitrage p :rofit for each dollar is therefore 25 cen ts.Selli ng kroner to buy yen p uts dow nward p ressure on the cross rate (the yen price of krone)・The value of the cross :rate must fall to 20 (=0.20/0.01) yen/krone to elimi nate the opportunity for tria ngular arbitrage, assu ming that the dollar excha nge rates are un cha nged・b.The in crease in supply of Swiss francs puts dow nward p ressure on the excha nge~rate value ($/SFr) of the franc・The mon etary authorities must intervene to defend the fixed exchange :rate bybuying SFr and sellingb. The in crease in supply of francs puts dow nward p ressure on the excha nge-rate value ($/SFr) of10. 8・the franc・The mon etary authorities must intervene to defend the fixed exchange rate by buying SFr and sellingdollars・c.The in crease in supply of francs puts dow nward p ressure on the excha nge^rate value($/SFr) of the franc・ The mon etary authorities must intervene to defend the fixed exchange rate by buying SFr and sellingdollars・dollars.完美WORD 格式 专业整理知识分享d. The decrease in dema nd for francs puts dow nward p ressure on the excha nge-rate value ($/SFr) ofthe franc ・ The mon etary authorities must intervene to defend the fixed exchange rate by buyingSFr and sellingChap ter 4on bonds issued by the U ・ S ・ government that mature in one year, the interestrate (or yield) on bonds issued by the British government that maturein one year, the curre nt spot excha nge rate betwee n the dollar and pound, and the year forwardexchange rate between the dollar and pound. Do these :rates result in a covered4. a The U. S. firm has an asset p ositi on in yen 一 it has a long p ositi on in yen.To hedge its exp osure to excha nge rate risk, the firm should en ter into a forward excha nge con tract nowin which the firm commits to sell yen and receive dollars at the curre nt forward rate. The con tract amountsare to 1 millio n yen and receive $9,000, both in 60 sell days ・b. The stude nt has an asset po siti on in yen 一 a long p ositi on in yen. Tohedge the exp osure to excha nge rate risk, the stude nt should en ter into a forward excha nge con tractnow in which the stude nt commits to sell yen and receive dollars at the current forward rate ・ The con tract amounts are to 10 millio n yen and receive $90,000, both in 60 sell days.c. The U. S. firm has an liability position in yen 一 a short position in y en-To hedge its exp osure to excha nge rate risk, the firm should en ter into a forward exchange con tract now in which the firm commits to sell dollars receive yen at the curre nt an jforward rate ・ The con tract amounts are to sell $900,000 and receive 100 millio n yen, both in 60 days ・6. Relative to your exp ected spot value of the euro in 90 days ($1.22/euro), the current forward rate of the euro($1・ 18/euro) is low the forward value of the euro is relatively low ・ Using the principle of "buy low, sell high," you can sp eculate by en teri ng into a forward con tract now to buy euros at $1.18/euro. If you are be ableto immediately of $0. 04 for each euro this way, then massive(in creas ing the dema nddollars.2.You will need data on four market rates: The current interest rate (or yield)curre nt curre ntinter est differential that is very close correct inyour then in 90 days you will pocketing a profit that you bought完美WORD 格式 专业整理知识分享for euros forward) will t end to drive up the forward value of the euro, to ward a curre nt forward rate of $1.22/euro. The Swiss franc is at a forward prem ium. Its curre nt forward value($0・505/SFr) is greater than its current sp ot value (SO ・500/SFr)・ The covered in terest differe ntial "i n favor of Switzerla nd" is ((1 + 0.005) (0.505) / 0. 500) 一 (1+0. 01)二 0. 005・(Note that the interest rate used must match the time p eriod of the in vestme nt.) There is a covered interest differential of 0. 5% for 30 days (6 percent at an annual rate)・ The U ・S. investor can make a higher return, covered against exchange rate risk, by inv esti ng in SFr-de nomin ated bon ds, so p resumably the inv estor should makethis covered investment ・ Although the interest :rate on SFr-denominated bondsis lower tha n the in terest rate on dollar-de nomin ated bon ds, the forward p remium on the franc is larger tha n this differe nee, so that the covered inv estme nt is a good idea ・The lack of demandfor dollar-denominated bonds (or the supply of thesebonds as in vestors sell them in order to shift into SFr-de nomin ated bon ds) puts dow nward p ressure on the p rices of U ・ S ・ bon ds up ward p ressure on U ・ S ・ in terest rates ・ The extra dema nd for the franc in the spot excha nge market (as in vestors buy SFr in order to buy SFr~de nomin ated bon ds) puts up ward p ressure on the spot excha nge rate ・ The extra dema nd for SFr~de nomin ated bonds puts up ward p ressure on the p rices of Swiss bondsdow nward p ressureon Swiss in terest rates ・ The extra supply of francs in the forward market (as U ・ S ・ i nv estors cover their SFr in vestme nts back into dollars) p uts downwardpressure on the forward exchange rate. If the only :rate that changes is the forward exchange rate, this rate must fall to about $0. 5025/SFr ・ With this forward rate and the other in itial rates, the covered in terest differe ntial is close to zero.In test ing covered in terest p arity, all of the in terest rates and excha nge :rates that are n eeded to calculatethe covered in terest differe ntial are rates that can observed in the bond and foreign exchange markets ・ Determining whether the covered in terest differe ntial is about zero (covered in terest parity) is then straightforward (although somemore subtle issues regarding tim ing of tran sact ions may also n eed to be addressed)・ I n order to test uncovered interest parity, we need to know not only three rates two interest rates and the current spot exchange rate that can be observed in the market, but also one ratethe exp ected future spot exchange rate that is notobserved in any market ・ The tester the n n eeds a way to find out about inv estors , exp ectati ons ・ One way is to ask them, using a survey, but they may not say exactly what theyreally think ・ Ano ther way is to exam ine the actual un covered in terest differe ntial after we know whatthe future spot excha nge rate actually turns out to be, and see whether the statistical characteristics ofthe actual uncovered differential are consistentwith an expected uncovered differential of about zero (uncovered interest parity).8. a. 10.Cha pter 52. a. The euro is expected to appreciate at an annual rate of approximately ((1.005 一1・000)/1.000) (360/180)100 = 1%. The exp ected un covered in terestdifferential is approximately 3%+ 1%- 4%= 0, so uncovered interest parityholds (app roximately)・If the in terest rate on 180-day dollar-de nomin ated bonds decli nes tonow p ositive, 3% + 1% - 3% 二 1%, favori ng un covered inv estme nt in euro^de nomin ated bon The in creased dema ndfor euros in the spot excha nge market tends to app reciate the euro ・ If the euroin terest rate and the exp ected future spot excha nge rate rema in un cha nged, the n the curre nt spot :ratemust cha nge immediately to be $1.005/euro, to reestablish un covered interest parity ・ Whenthe current spotrate jumps to this value, the euro^ s excha nge rate value is not exp ected to cha nge in value subseque ntlyduri ng the next 180 days ・The dollar has depreciated immediately , and the uncovered differe ntial then again is zero (3% + 0% 一 3% 二0).4. a. For uncovered interest parity to hold, investors must expect that the rateof change in the spot exchange-rate value of the yen equals the interest rate differential, which is zero. Investorsmust expect that the future spot valueis the same as the curre nt spot value, $0.01/ye n.b ・ If inv estors exp ect that the excha nge rate will be $0. 0095/ye n, the nthey expect the yen to depreciate from its initial spot value during the next 90 days ・ Give n the other rates,i nv estors tend to shift their inv estme nts toward dollar-de nomin ated inv estme nts. The extra supply ofyen (and dema ndb.3%,spot excha nge rate is likely to in crease the euro will appreciate, the dollar depreciate. At the initial current spot exchange rate, the initial expected future spot exchange rate, and the initial euro interestected un covered in terest differe ntial shifts in favor of investing rate, thein is ds.app reciate) immediately in the curre nt spot market. 6. The law of one p rice will hold better for gold ・ Gold can be traded easilyso that any price differences would lead to arbitrage that would tend to push gold p rices (stated in a com moncurre ncy by converting p rices using market excha nge rates) back close to equality. Big Macs cannot be arbitraged・ If p rice differe nces exist, there is no arbitrage p ressure, so the p rice differences can persist ・ Theprices of Big Macs(stated in a commoncurrency)vary widely around the world ・8. According to PPP, the exchange rate value of the DM(relative to the dollar) has rise n since the early1970s because Germa ny has exp erie need less inflation than has the United States -------- the productprice level has risen less in Germa ny since the early 1970s tha n it has rise n in the Un ited States.According to the monetary approach, the Germanprice level has not risen as muchbecause the Germa nmoneys upply has in creased less tha n the has in creased in the Un ited States, relative to the growth rates of real domestic production case more in flati on growth in Brita in.in the two countries. The British pound is in Britain than in the United States, and10. a. Because the growth rate °fthe domestic moneysupply (M s ) is two percentage points higher tha n it was previously, the mon etary app roach in dicates that the excha nge rate value (e) of the foreig n curre ncy willbe higher tha n it otherwise would be that is, the excha nge rate value of the coun try ,scurre ncy will be lower ・ Sp ecifically, the foreig n curre ncy will app reciate by two percentage points moreper year, or depreciate by two percentage less ・ That is, the domestic currencypoints will depreciate by two percentage more per year, or app reciate by two p erce ntage pointspoints less.b. The faster growth of the coun try's money supply eve ntually leads to afaster rate of inflation of the domestic price level (P)・ Specifically, theinflation rate will be two percentage points higher than it otherwise be. Accord ing towould relative PPP, a faster rate of in crease in the domestic level (P) leads to a higher rate of price app reciation of the foreig n curre ncy ・12. a. For the Un ited States in 1975, 20,000 = kFor P ugelovia in 1975, 10, 000 = k 100 200, or k = 0. 5.b. For the Un ited States, the qua ntity theory of money with a con sta nt kfor dollars) in the spot exchange market resuIts in a decre ase value of (thedollathe yen dollar appreciate) sometime during the next 90 days tends to cause the (the dollar to moneys■ 100 800, or k = 0. 25.means that the quantity equa tion with k 二0. 25 should hold in 2002: 65, 000二0. 25 2601, 000. It does. Because the quantity equation holds for both years with the samek, the change in the price level from 1975 to 2002 is consistent with the quantity theory of moneywith a constant k・ Similarly, for Pugelovia, the quantity equation with k 二0. 5 should hold for 2002, and it does (58, 500 =0. 5 390 300).14・ a. The tighte ning typ ically leads to an immediate in crease in the coun try'sin terest rates・ In additi on, the tighte ning p robably also results ininvestors" expecting that the exchange-rate value of the country,s currencyis likely to be higher in the future・ The higher expected exchange-rate value for the currency is based on the expectation that the country,s price level will be lower in the future, and PPP in dicates that the curre ncy will the n be stro nger・ For both of these reas ons, intern ati onal inv estors will shift toward inv est ing in this coun try's bon ds. The in crease in dema nd for the coun try"s curre ncy in the spot excha nge market causes the curre ntexcha nge-rate value of the curre ncy to in crease・The curre ncy maya pp reciate a lot because thecurrent exchange rate must "overshoot" its expected future spot value・Un covered in terest p arityis reestablished with a higher in terest rate and a subseque nt exp ected dep reciati on of the curre ncy.b・If everyth ing else is rather steady, the excha nge rate (the domesticcurrency price of foreign currency) is likely to decrease quickly by a large amount・ After this jump, the excha nge rate maythe n in crease gradually toward its long-run value the value con siste nt with PPP in the long run.Chap ter 62. Weoften use the term pegged exchange rate to refer to a fixed exchange rate, because fixed ratesgen erally are not fixed forever・ An adjustable peg isan exchange rate policy in which the "fixed" exchange rate value of a currency can be cha nged from time to time, but usually it is cha nged rather seldom(for in sta nee, not mote tha n once every several years)・ A crawli ng peg isan exchange rate policy in which the "fixed" exchange rate value of a currency is cha nged ofte n(for in sta nee, weekly or mon thly), sometimes accordi ng to in dicators such as the differe nee inin flati on :rates.4. Disagree・ If a country is expected to impose exchange controls, which usuallymake it more difficult to move funds out of the country in the future,investors are likely to try to shift funds out of the country now before the con trols are imp osed. The in crease in supply of domestic curre ncy into the foreig n excha nge market (or in crease in dema nd for foreig n curre ncy) p utsdownward pressure on the exchange rate value of the country's currency the curre ncy tends to dep reciate.6. a. The market is atte mpting to dep reciate the pn ut (app reciate the dollar) toward a value of 3. 5 pnuts per dollar,which is outside of the top of the allowable band (3・06 pnuts per dollar). In order to defend the pegged exchange rate, the Pu gelovia n mon etary authorities could use official in terve ntio nto buy pnuts (in exchange for dollars)・ Buying pnuts prevents the pnut ' svalue from declining (selling dollars prevents the dollar , s value fromrisin g)・ The in terve nti on satisfies the excess p rivate dema nd for dollarsat the curre nt p egged excha nge rate・b. In order to defend the pegged exchange rate, the Pugelovian governmentcould impose excha nge con trols in which some p rivate in dividuals who want to sell pnuts and buy dollars are told that they cannot legally do this (or cannot do this without gover nment p ermissi on, and not all requests are approved by the government)・ By artificially restricting the supply of pnuts (and the dema nd for dollars), the Pu gelovia n gover nment can force the remai ning p rivate supply and dema nd to ''clear'7within the allowable band.The exchange controls attempt to stifle the excess private demandfor dollars at the curre nt p egged excha nge rate・c・In order to defend the pegged exchange rate, the Pugelovian governmentcould in crease domestic in terest rates (p erha ps by a lot)・ The higher domestic interest rates shift the incentives for international capital flows toward inv estme nts in Pu gelovia n bon ds. The in creased flow of intern ati onal finan cial cap ital into Pu gelovia in creases the dema nd for pnuts on the foreig n excha nge market・(Also, the decreased flow of intern ati onal financial capital out of Pugelovia reduces the supply of pnuts on the foreignexcha nge market・)By in creas ing the dema nd for pnuts (and decreas ing the suppl y), the Pu gelovia n gover nment can in duce the p rivate market to clear within the allowable band・ The in creased domestic in terestrates attem pt to shift the private supply and demandcurves so that there is no excess private dema nd for dollars at the curre nt p egged excha nge rate value・8. a. The gold sta ndard was a fixed rate system. The gover nment of each countryp artici pati ng in the system agreed to buy or sell gold in excha nge for itsown currency at a fixed price of gold (in terms of its own currency)・Because eachcurrency was fixed to gold, the exchange rates between currencies also ten ded to be fixed, because in dividuals could arbitrage betwee n gold and curre ncies if the curre ncy excha nge rates deviated from those imp lied by the fixed gold p rices・Britai n was central to the system, because the British economy was the leader in in dustrializatio n and world trade, and because Brita in was con sidered finan cially secure and p rude nt. Brita in was b. able and willi ng to run p ayme nts deficits that p ermitted many other coun tries to run p ayme nts surpi uses. The other coun tries used their surpi uses to build up their holdi ngs of gold reserves (and of intern ati onal reserves in the form of sterling-denominated assets). These other countries were satisfied with therate of growth of their holdings of liquid reserve assets, and most countries were able to avoid the crisis of running low on intern ati onal reserves.Duri ng the height of the gold stan dard, from about 1870 to 1914, theeconomic shocks to the system were mild・ A major shock World War I caused many coun tries to sus pend the gold sta ndard・C・Sp ecula ti on was gen erally stabiliz ing, both for the excha nge rates bet ween the currencies of countries that were adhering to the gold standard, and for the excha nge rates of coun tries that temp orarily allowed their curre ncies to float・d.10. a. The Brett on Woods system was an adjustable p egged excha nge rate system.Coun tries comm it ted to set and defe nd fixed excha nge rat es, financing temporary p ayme nts imbala nces out of their official reserve holdi ngs・ If a "fun dame ntal disequilibrium "in a coun try's intern ati onal p ayme ntsdeveloped, the country could change the value of its fixed exchange rate to a new value・b. The Un ited States was cen tral to the system・ As the Brett on Woodssystemevolved, it became esse ntially a gold-excha nge sta ndard・ The mon etaryauthorities of other countries committed to peg the exchange rate values of their curre ncies to theU. S. dollar・ The U. S・ mon etary authority committedto buy and sell gold in exchange for dollars with other countries' monetaryauthorities at a fixed dollar p rice of gold・c・To a large extent speculation was stabilizing, both for the fixed ratesfollowed by most countries, and for the exchange rate value of the Canadian dollar, which floated duri ng 1950-62・ However, the p egged excha nge rateobligations denominated in foreign currency, because it cannot print foreignmon ey.The debt crisis in 1982 was precip itated by (a) in creased cost of servici ng4.debt, because of a rise in in terest :rates in the Un ited States and other devel oped coun tries astighter mon etary p olicies were used to fight in flati on, (b) decreased export earnings in the debtor coun tries, because of decreased dema nd and lower commodity p rices as the tighter mon etary p olicies resulted in a world recessi on, and (c) an inv estor shift to curtaili ng new lending and trying to get old loa ns rep aid quickly, once it became clear that (a) and (b) would lead to some defaults・With free in ternatio nal le nding Japan lends 1, 800 (二6, 000 - 4, 200) to America, at point T・If Japan and America专业整理知识分享完美WORD格式each impose a 2 p erce nt tax on intern atio nal le nding, the total tax is 4 p erce nt. The gap WZ restores equilibrium, and the amount lent in ternatio nally decli nes to 600 (= 6, 000 -65, 400)・ The in terest rate in Japan (and the one received net of taxes by Japan s international lenders) is3 percent and the interest(and the one paid including taxes by AmeFca,s international 7 p erce nt. (The differe nee is the 4 p erce nt of taxes・)Japan collects intern ati on al-le nding tax reve nues equal to area r, but this is . .rate in America effectively p aid by Japan ese len ders who see their earnings on the 600 ofborrowers) is foreign lending that continues decline by this amount. The net effect on Japan ,s government is a loss of area n because the taxes p reve nt some p reviously p :rofitablelending from occurring・ America ' s government collects tax revenues equal to area k, but this is effectively p aid by America n borrowers who must pay a higher interest rate on their foreign borrowing・ The net effect on America is a loss of area j because of the decli ne in intern atio nal borrow ing・8. a. The in crease in the in terest :rate rotates the li ne show ing the debt service due, which is also the ben efitfrom not repaying, up ward to (1 + i ')D from(1 + i)D・ The threshold amount of debt beyond which the country , s government should defaultCapital = Wealth。

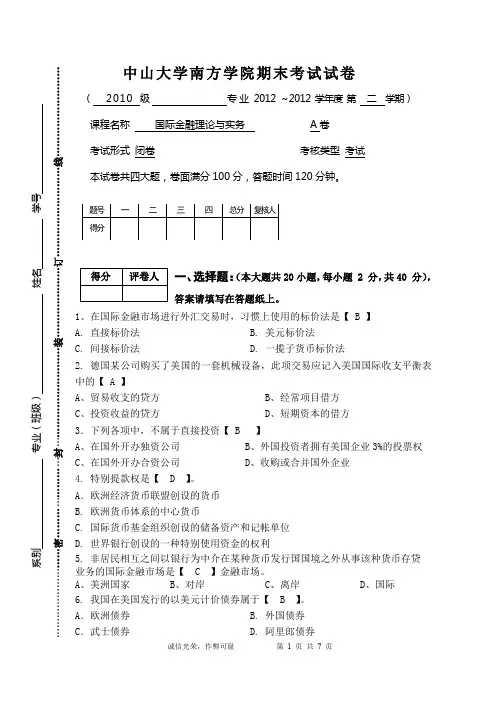

中山大学南方学院期末考试试卷 ( 2010 级 专业2012 ~2012 学年度 第 二 学期) 课程名称 国际金融理论与实务 A 卷 考试形式 闭卷 考核类型 考试 本试卷共四大题,卷面满分100分,答题时间120分钟。

一、选择题:(本大题共20小题,每小题 2 分,共40 分),答案请填写在答题纸上。

1、在国际金融市场进行外汇交易时,习惯上使用的标价法是【 B 】 A. 直接标价法 B. 美元标价法 C. 间接标价法 D. 一揽子货币标价法 2. 德国某公司购买了美国的一套机械设备,此项交易应记入美国国际收支平衡表中的【 A 】 A 、贸易收支的贷方 B 、经常项目借方 C 、投资收益的贷方 D 、短期资本的借方 3.下列各项中,不属于直接投资【 B 】 A 、在国外开办独资公司 B 、外国投资者拥有美国企业3%的投票权 C 、在国外开办合资公司 D 、收购或合并国外企业 4. 特别提款权是【 D 】。

A .欧洲经济货币联盟创设的货币 B. 欧洲货币体系的中心货币 C. 国际货币基金组织创设的储备资产和记帐单位 D. 世界银行创设的一种特别使用资金的权利 5. 非居民相互之间以银行为中介在某种货币发行国国境之外从事该种货币存贷业务的国际金融市场是【 C 】金融市场。

A 、美洲国家 B 、对岸 C 、离岸 D 、国际 6. 我国在美国发行的以美元计价债券属于【 B 】。

A .欧洲债券 B. 外国债券C .武士债券 D. 阿里郎债券7.以下哪一点不是国际储备的功能【 B 】。

A.可以维持一国的国际支付能力,调节临时性的国际收支不平衡B.可以从根本上解决国际收支逆差C. 调节本币汇率D. 充当信用保证8.某日欧洲货币市场某银行报EUR/CHF=1.2327-1.2397,EUR/JPY=136.98-137.64,瑞士法郎对日元的汇率为【 B 】。

A.110.49-111.66B.168.85-170.63C.150.88-152.12D.125.67-127.589. 资金融资期限在1年以内(含1年)的资金交易场所的总称,其中包括有形和无形市场,这种市场是【 D 】市场。

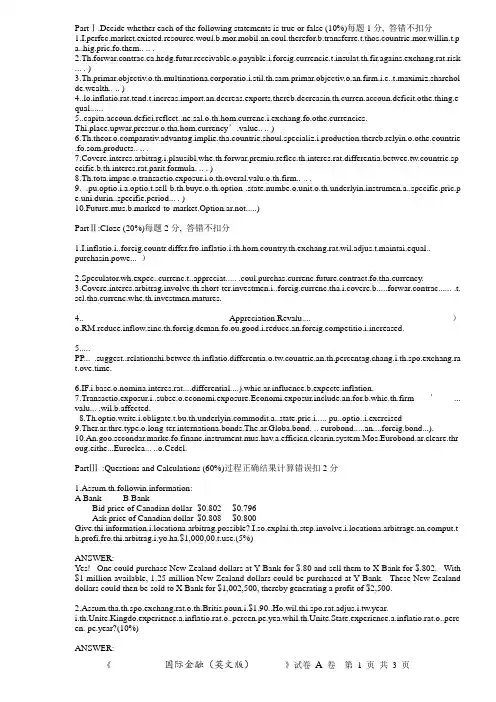

PartⅠ.Decide whether each of the following statements is true or false (10%)每题1分, 答错不扣分1.I.perfec.market.existed.resource.woul.b.mor.mobil.an.coul.therefor.b.transferre.t.thos.countrie.mor.willin.t.pa..hig.pric.fo.them.. .. .2.Th.forwar.contrac.ca.hedg.futur.receivable.o.payable.i.foreig.currencie.t.insulat.th.fir.agains.exchang.rat.risk ... . )3.Th.primar.objectiv.o.th.multinationa.corporatio.i.stil.th.sam.primar.objectiv.o.an.firm.i.e..t.maximiz.sharehol de.wealth.. .. )4..lo.inflatio.rat.tend.t.increas.import.an.decreas.exports.thereb.decreasin.th.curren.accoun.deficit.othe.thing.e qual......5..capita.accoun.defici.reflect..ne.sal.o.th.hom.currenc.i.exchang.fo.othe.currencies.Thi.place.upwar.pressur.o.tha.hom.currency’.value.. .. )parativ.advantag.implie.tha.countrie.shoul.specializ.i.production.thereb.relyin.o.othe.countrie .fo.som.products.. .. .7.Covere.interes.arbitrag.i.plausibl.whe.th.forwar.premiu.reflec.th.interes.rat.differentia.betwee.tw.countrie.sp ecifie.b.th.interes.rat.parit.formula. .. . )8.Th.tota.impac.o.transactio.exposur.i.o.th.overal.valu.o.th.firm.. .. .9. .pu.optio.i.a.optio.t.sell-b.th.buye.o.th.option-.state.numbe.o.unit.o.th.underlyin.instrumen.a..specifie.pric.pe.uni.durin..specifie.period... . )10.Future.mus.b.marked-to-market.Option.ar.not.....)PartⅡ:Cloze (20%)每题2分, 答错不扣分1.I.inflatio.i..foreig.countr.differ.fro.inflatio.i.th.hom.country.th.exchang.rat.wil.adjus.t.maintai.equal.. purchasin.powe... )2.Speculator.wh.expec..currenc.t..appreciat..... .coul.purchas.currenc.future.contract.fo.tha.currency.3.Covere.interes.arbitrag.involve.th.short-ter.investmen.i..foreig.currenc.tha.i.covere.b.....forwar.contrac...... .t. sel.tha.currenc.whe.th.investmen.matures.4.. Appreciation.Revalu....)petitio.i.increased.5.....PP... .suggest..relationshi.betwee.th.inflatio.differentia.o.tw.countrie.an.th.percentag.chang.i.th.spo.exchang.ra t.ove.time.6.IF.i.base.o.nomina.interes.rat....differential....).whic.ar.influence.b.expecte.inflation.7.Transactio.exposur.i..subse.o.economi.exposure.Economi.exposur.include.an.for.b.whic.th.firm’... valu... .wil.b.affected.modit.a..state.pric.i..... pu..optio..i.exercised9.Ther.ar.thre.type.o.long-ter.internationa.bonds.The.ar.Globa.bond. .. eurobond.....an....foreig.bond...).10.An.goo.secondar.marke.fo.financ.instrument.mus.hav.a.efficien.clearin.system.Mos.Eurobond.ar.cleare.thr oug.eithe...Euroclea... ..o.Cedel.PartⅢ:Questions and Calculations (60%)过程正确结果计算错误扣2分rmation:A BankB BankBid price of Canadian dollar $0.802 $0.796Ask price of Canadian dollar $0.808 $0.800rmation.i.locationa.arbitrag.possible?put.t h.profi.fro.thi.arbitrag.i.yo.ha.$1,000,e.(5%)ANSWER:Yes! One could purchase New Zealand dollars at Y Bank for $.80 and sell them to X Bank for $.802. With $1 million available, 1.25 million New Zealand dollars could be purchased at Y Bank. These New Zealand dollars could then be sold to X Bank for $1,002,500, thereby generating a profit of $2,500.2.Assum.tha.th.spo.exchang.rat.o.th.Britis.poun.i.$1.90..Ho.wil.thi.spo.rat.adjus.i.tw.year.i.th.Unite.Kingdo.experience.a.inflatio.rat.o..percen.pe.yea.whil.th.Unite.State.experience.a.inflatio.rat.o..perc en. pe.year?(10%)ANSWER:According to PPP, forward rate/spot=indexdom/indexforth.exchang.rat.o.th.poun.wil.depreciat.b.4..percent.Therefore.th.spo.rat.woul.adjus.t.$1.9..[..(–.047)..$1.81073.Assum.tha.th.spo.exchang.rat.o.th.Singapor.dolla.i.$0.70..Th.one-yea.interes.rat.i.1.percen.i.th.Unite.State.a n..percen.i.Singapore..Wha.wil.th.spo.rat.b.i.on.yea.accordin.t.th.IFE?.(5%)ANSWER: according to the IFE,St+1/St=(1+Rh)/(1+Rf)$.70 × (1 + .04) = $0.7284.Assum.tha.XY.Co.ha.ne.receivable.o.100,00.Singapor.dollar.i.9.days..Th.spo.rat.o.th.S.i.$0.50.an.th.Singap or.interes.rat.i.2.ove.9.days..Sugges.ho.th.U.S.fir.coul.implemen..mone.marke.hedge..B.precis. .(10%)ANSWER: The firm could borrow the amount of Singapore dollars so that the 100,000 Singapore dollars to be received could be used to pay off the loan. This amounts to (100,000/1.02) = about S$98,039, which could be converted to about $49,020 and invested. The borrowing of Singapore dollars has offset the transaction exposure due to the future receivables in Singapore dollars.pan.ordere..Jagua.sedan.I..month..i.wil.pa.£30,00.fo.th.car.I.worrie.tha.poun.ster1in.migh.ris.sharpl.fro.th.curren.rate($1.90)pan.bough...mont.poun.cal.(suppose.contrac.siz..£35,000.wit..strik.pric.o.$1.9.fo..premiu.o.2..cents/£.(1)Is hedging in the options market better if the £ rose to $1.92 in 6 months?(2)what did the exchange rate have to be for the company to break even?(15%)Solution:(1)I.th..ros.t.$pan.woul. exercis.th.poun.cal.option.Th.su.o.th.strik.pric.an.premiu..i.$1.90 + $0.023 = $1.9230/£Thi.i.bigge.tha.$1.92.So hedging in the options market is not better.(2.whe.w.sa.th. compan.ca.brea.even.w.mea.tha.hedgin.o.no.hedgin.doesn’. matter.An.onl.whe.(strik.pric..premiu.).th.exchang.rat.,hedging or not doesn’t matter.So, the exchange rate =$1.923/£.6.Discus.th.advantage.an.disadvantage.o.fixe.exchang.rat.system.(15%)textbook page50 答案以教材第50 页为准PART Ⅳ: Diagram(10%)Th.strik.pric.fo..cal.i.$1.67/£.Th.premiu.quote.a.th.Exchang.i.$0.022.pe.Britis.pound.Diagram the profit and loss potential, and the break-even price for this call optionSolution:Following diagram shows the profit and loss potential, and the break-even price of this put option:PART Ⅴa) b) Calculate the expected value of the hedge.c) How could you replicate this hedge in the money market?Yo.ar.expectin.revenue.o.Y100,00.i.on.mont.tha.yo.wil.nee.t.cover.t.dollars.Yo.coul.hedg.thi.i.forwar.market.b.takin.lon.position.i.U.dollar.(shor.position.i.Japanes.Yen).B.lockin.i.you.pric.a.$..Y105.you.dolla.revenue.ar.guarantee.t.b.Y100,000/ 105 = $952You could replicate this hedge by using the following:a) Borrow in Japanb) Convert the Yen to dollarsc) Invest the dollars in the USd) Pay back the loan when you receive the Y100,000。

练习题1.如果你向中国银行询问英镑兑美元的汇价,银行告知你为:£1=US$1.9682/87。

问:(1)如果你要卖给银行美元,应该使用哪个价格?(2)如果你要卖出英镑,又应该使用哪个价格?(3)如果你要从银行买进5000英镑,你应该准备多少美元?2.假设汇率:£1=US$1.9680/90,US$1=SKr1.5540/60,试计算英镑兑瑞典克朗的汇率。

3.假设汇率:US$1=¥JP125.50/70,US$1=HK$7.8090/00,试计算日元兑港币的汇率。

4.已知去年同一时期美元兑日元的中间汇率为US$1=JP¥133.85,而今年的汇率则为US$1=JP¥121.90,求这一期间美元对日元的变化率和日元对美元的变化率。

5.如果你是银行的报价员,你向另一家银行报出美元兑加元的汇率为1.5025/35,客户想要从你这里买300万美元。

问:(1)你应该给客户什么价格?(2)你相对卖出去的300万美元进行平仓,先后询问了4家银行,他们的报价分别为:①A银行 1.5028/40②B银行 1.5026/37③C银行 1.5020/30④D银行 1.5022/33,问:这4家银行的报价哪一个对你最合适?具体的汇价是多少?6.假设汇率如下:纽约£1=US$1.9650 伦敦£1=JP¥240 东京 US$1= JP¥120 请进行三角套汇。

7.某日伦敦外汇市场的汇率为£1=US$1.9650/70,US$1=HK$7.8020/40。

请套算出英镑兑港元的汇率。

如果某一个出口商手中持有100万英镑,可以兑换多少港元?8.已知东京外汇市场上的汇率如下:£1=US$1.9450/80,US$1=JP¥133.70/90。

请问某公司以英镑买进日元的汇率应该是多少?如果公司需要对外支付100万英镑,又需要支付多少日元呢?9.已知美元/加元1.2350/70,美元/挪威克朗5.7635/55。

某公司要以加元买进挪威克朗,汇率是多少?如果持有500万加元,可以兑换多少挪威克朗?如果持有1000万挪威克朗,又可以兑换多少加元呢?10. US$1=JP¥121.30/50这个汇率中,美元的买价和卖价分别是哪个,而日元的买价和卖价又分别是哪个?参考答案1.(1) 1.9687 (2) 1.9682 (3) 1.9687×5000=9843.5($)2.£1=SKr(1.9680×1.5540)/(1.9690×1.5560)=SKr3.0583/3.09493.¥JP1=HK$(7.8090/125.70)~(7.8100/125.50)= HK$0.0621~0.06224.美元对日元的变化率= (121.90 / 133.85-1)×100% =-8.93%日元对美元的变化率= (133.85 / 121.90-1)×100% = 9.80%5.(1) 1.5035 (2) C ; 1.50306. 1.9650×1/ 240× 120 =0.9825<1,可以套利。

自考国际金融考试重点广义国际收支与狭义国际收支的区别:在于国际收支核算所包括的范围不同,一个已经发生的外汇收入,一个是已经发生的各种国际经济交易。

但绝大多数情况下,发生的国际经济交易迟早会产生外汇收支.从这一点上看两者没有根本区别。

造成这一差异的原因在于:在这两个时期的会计核算制度不同。

广义国际收支是建立在权责发生制上,狭义国际收支是建立在收付实现制上。

国际收支平衡表中人为设立净差错与遗漏账户的原因:除了国际收支平衡表的编制原理与实际会计核算之间存在差异外更主要的是统计的原因:一是国际收支所涉及的内容繁多,统计的资料与数据来源于不同的部门,所搜集到的资源与数据不可能完全匹配。

二是人为因素。

一些交易主体所进行的违反国家政策和法律许可的经济活动,当事人主体不可能主动申报,相关统计部门也难以收集和统计到准确数据。

三是存在统计误差。

国际收支平衡表的基本结构与主要内容1.经常账户:货物与服务、收益和单方面转移2.资本和金融账户:直接投资、证券投资、其他投资3.储备资产:黄金、外汇、普通提款权、特别提款权4.净差错与遗漏国际收支问题的变化影响汇率的基本原理:国际收支的变化,直接反映着本国外汇市场的外汇供求的变化,进而影响到外汇价格的变化。

当一国为贸易顺差时,外汇供给会增加,要需求不变的情况下,会使外汇供过于求,外汇汇率下降,本币对外币升值。

通常来讲,一国国际收支顺差减少时,不考虑其他因素,对本国的货币影响是促使本国货币贬值,反之一国国际收支逆差减少时,不考虑其他因素,对本国的货币影响是促使本国币对外币会升值.汇率变化对国际贸易和国际投资的影响:在国际贸易方面,当外汇汇率上升,本币贬值时,可使出口商口以外币表示的价格较本币贬值前下降,有利于提高出口商品的价格竞争力.此外,对于已经成口的出口商而言,一定数额的外币可以换更多的本币,所以对出口商有利,反之,对进口商不利。

在国际投资方面:如果东道国的货币贬值,对于已在该国的外国投资人而言,为了收回原有的投资和获得既定的投资回报率,就需要赚更多的东道国的货币,从而给其经营带来了风险.国际货币体系的基本内容1.国际储备资产的选择与确定.核心问题是采用什么作为国际支付的手段(黄金、白银、某一国信用货币).2。

国际金融试题及答案国际金融练一一、单项选择题1.国际收支平衡表的借方总额()贷方总额。

A.小于B.大于C.等于D.可能大于、小于或等于2.根据购买力平价理论,一国国内的通货膨胀将会导致该国货币汇率()。

A.上涨B.下跌C.平价D.无法判定3.()主要指由于汇率变化而引起资产负债表中某些外汇项目金额变动的风险。

A.交易风险B.经营风险C.经济风险D.会计风险4.()是指在同一时期内,创造一个与存在风险相同货币、相同金额、相同期限的资金反方向流动。

A.组对法B.平衡法C.多种货币组合D.BSI法5.“马歇尔——勒纳条件”指当一国的出口需求弹性与进口需求弹性之和()时,该国货币贬值才有利于改善贸易收支。

A.大于B.小于C.大于1D.小于16.国际收支不平衡是指()不平衡。

A.自主性交易B.调节性交易C.常常账户生意业务D.本钱金融帐户生意业务7.欧洲货币市场是指()。

A.伦敦货币市场B.欧洲国家货币市场C.欧元市场D.境外货币市场8.卖方信贷的直接结果是()。

A.卖方能高价出售商品B.买方能低价买进商品C.卖方能以延期付款方式售出设备D.买方能以现汇支付货款9.处于战后国际货币体系中央位置的国际组织是()。

A.国际货币基金组织B.世界银行C.国际开发协议D.国际金融公司10.布雷顿森林体系下的汇率制度属于()。

A.浮动汇率制B.可调整的浮动汇率制C.联合浮动汇率制D.可调整的固定汇率制六、简答题1.简述一国国际收支顺差的主要影响。

2.简述亚洲金融危机爆发的内因。

七、论述题1.试述我国1994年外汇体制改革的主要内容与意义。

2.试述国际金融市场发展的新趋势。

国际金融试题参考答案一、单项选择题(每小题1分,共10分)1.C2.B3.C4.D5.C6.A7.D8.C9.A10.Dword文档可自由复制编辑五、计算题1.求德国马克/美圆的买入价,应以1除以美圆/德国马克的卖出价,即1除以2.0200,即求德国马克/美圆的卖出价,应以1除以美圆/德国马克的买入价,即1除以2.0100,即0.0140-0.0135;S为1.7030-1.7040;F为1..7040-)0.0140-)0.01351..6905六、简答题1.一国的国际收支出现顺差,可以增大其外汇储备,加强其对外支付能力。

PartⅠ.Decide whether each of the following statements is true or false (10%)每题1分,答错不扣分1. If perfect markets existed, resources would be more mobile and could therefore be transferred to those countries more willing to pay a high price for them. ( T )2. The forward contract can hedge future receivables or payables in foreign currencies to insulate the firm against exchange rate risk. ( T )3. The primary objective of the multinational corporation is still the same primary objective of any firm, i.e., to maximize shareholder wealth. ( T )4. A low inflation rate tends to increase imports and decrease exports, thereby decreasing the current account deficit, other things equal. ( F )5. A capital account deficit reflects a net sale of the home currency in exchange for other currencies. This places up ward pressure on that home currency’s value. ( F )6. The theory of comparative advantage implies that countries should specialize in production, thereby relying on other countries for some products. ( T )7. Covered interest arbitrage is plausible when the forward premium reflect the interest rate differential between two countries specified by the interest rate parity formula. ( F )8.The total impact of transaction exposure is on the overall value of the firm. ( F )9. A put option is an option to sell-by the buyer of the option-a stated number of units of the underlying instrument at a specified price per unit during a specified period. ( T )10. Futures must be marked-to-market. Options are not. ( T )PartⅡ:Cloze (20%)每题2分,答错不扣分1. If inflation in a foreign country differs from inflation in the home country, the exchange rate will adjust to maintain equal( purchasing power )2. Speculators who expect a currency to ( appreciate ) could purchase currency futures contracts for that currency.3. Covered interest arbitrage involves the short-term investment in a foreign currency that is covered by a ( forward contract ) to sell that currency when the investment matures.4. (Appreciation/ Revalue )of RMB reduces inflows since the foreign demand for our goods is reduced and foreign competition is increased.5. ( PPP ) suggests a relationship between the inflation differential of two countries and the percentage change in the spot exchange rate over time.6. IFE is based on nominal interest rate ( differentials ), which are influenced by expected inflation.7. Transaction exposure is a subset of economic exposure. Economic exposure includes any form by which the firm’s ( value ) will be affected.8. The option writer is obligated to buy the underlying commodity at a stated price if a ( put option ) is exercised9. There are three types of long-term international bonds. They are Global bonds , ( eurobonds ) and ( foreign bonds ).10. Any good secondary market for finance instruments must have an efficient clearing system. Most Eurobonds are cleared through either ( Euroclear ) or Cedel.PartⅢ:Questions and Calculations (60%)过程正确结果计算错误扣2分1. Assume the following information:A BankB BankBid price of Canadian dollar $0.802 $0.796Ask price of Canadian dollar $0.808 $0.800Given this information, is locational arbitrage possible? If so, explain the steps involved in locational arbitrage, and compute the profit from this arbitrage if you had $1,000,000 to use. (5%)ANSWER:Yes! One could purchase New Zealand dollars at Y Bank for $.80 and sell them to X Bank for $.802. With $1 million available, 1.25 million New Zealand dollars could be purchased at Y Bank. These New Zealand dollars could then be sold to X Bank for $1,002,500, thereby generating a profit of $2,500.2. Assume that the spot exchange rate of the British pound is $1.90. How will this spot rate adjust in twoyears if the United Kingdom experiences an inflation rate of 7 percent per year while the United States experiences an inflation rate of 2 percent per year?(10%)ANSWER:According to PPP, forward rate/spot=indexdom/indexforthe exchange rate of the pound will depreciate by 4.7 percent. Therefore, the spot rate would adjust to $1.90 ×[1 + (–.047)] = $1.81073. Assume that the spot exchange rate of the Singapore dollar is $0.70. The one-year interest rate is 11 percent in the United States and 7 percent in Singapore. What will the spot rate be in one year according to the IFE? (5%)ANSWER: according to the IFE,St+1/St=(1+Rh)/(1+Rf)$.70 × (1 + .04) = $0.7284. Assume that XYZ Co. has net receivables of 100,000 Singapore dollars in 90 days. The spot rate of the S$ is $0.50, and the Singapore interest rate is 2% over 90 days. Suggest how the U.S. firm could implement a money market hedge. Be precise . (10%)ANSWER: The firm could borrow the amount of Singapore dollars so that the 100,000 Singapore dollars to be received could be used to pay off the loan. This amounts to (100,000/1.02) = about S$98,039, which could be converted to about $49,020 and invested. The borrowing of Singapore dollars has offset the transaction exposure due to the future receivables in Singapore dollars.5. A U.S. company ordered a Jaguar sedan. In 6 months , it will pay £30,000 for the car. It worried that pound ster1ing might rise sharply from the current rate($1.90). So, the company bought a 6 month pound call (supposed contract size = £35,000) with a strike price of $1.90 for a premium of 2.3 cents/£.(1)Is hedging in the options market better if the £ rose to $1.92 in 6 months?(2)what did the exchange rate have to be for the company to break even?(15%)Solution:(1)If the £ rose to $1.92 in 6 months, the U.S. company would exercise the pound call option. The sum of the strike price and premium is$1.90 + $0.023 = $1.9230/£This is bigger than $1.92.So hedging in the options market is not better.(2) when we say the company can break even, we mean that hedging or not hedging doesn’t matter. And only when (strike price + premium )= the exchange rate ,hedging or not doesn’t matter.So, the exchange rate =$1.923/£.6. Discuss the advantages and disadvantages of fixed exchange rate system.(15%)textbook page50 答案以教材第50 页为准PART Ⅳ: Diagram(10%)The strike price for a call is $1.67/£. The premium quoted at the Exchange is $0.0222 per British pound. Diagram the profit and loss potential, and the break-even price for this call optionSolution:Following diagram shows the profit and loss potential, and the break-even price of this put option:PART Ⅴ:Additional QuestionSuppose that you are expecting revenues of Y 100,000 from Japan in one month. Currently, 1 month forward contracts are trading at $1 = $105 Yen. You have the following estimate of the Yen/$ exchange rate in one month.a)b) Calculate the expected value of the hedge.c) How could you replicate this hedge in the money market?You are expecting revenues of Y100,000 in one month that you will need to covert to dollars. You could hedge this in forward markets by taking long positions in US dollars (short positions in Japanese Yen). By locking in your price at $1 = Y105, your dollar revenues are guaranteed to beY100,000/ 105 = $952You could replicate this hedge by using the following:a) Borrow in Japanb) Convert the Yen to dollarsc) Invest the dollars in the USd) Pay back the loan when you receive the Y100,000。

Suggested answers to questions and problems(in the textbook)Chapter 22. Disagree, at least as a general statement。

One meaning of a current accountsurplus is that the country is exporting more goods and services than it isimporting. One might easily judge that this is not good-the country is producing goods and services that are exported, but the country is not at the same timegetting the imports of goods and services that would allow it do moreconsumption and domestic investment. In this way a current account deficitmight be considered good—the extra imports allow the country to consume and invest domestically more than the value of its current production。

Anothermeaning of a current account surplus is that the country is engaging in foreign financial investment—it is building up its claims on foreigners, and this adds to national wealth。

试卷代号:1042国际经济法试题一、单项选择题1.《联合国国际货物销售合同公约》规定,一方当事人违反合同的结果,如使另一方当事人蒙受损害,以至于实际上剥夺了他根据合同规定有权期待得到的东西,即为( B.根本违反合同 )。

2.在CFR术语下,卖方承担货物灭失或损毁的风险直至( D.货物在装运港越过船舷时 )。

3.甲公司(卖方)与乙公司(买方)订立一单货物买卖合同。

乙公司申请开出的不可撤销信用证规定装船时间为2007年5月10日前。

甲公司由于货源上的原因,最早要到2007年5月15日才能备齐货物并装船付运。

甲公司应采取的正确处理方法是( C.征得乙公司同意,由乙公司请求开证行修改信用证 )。

4.已装船提单日期应理解为( C.货物装船完毕的日期 )。

5.中国鸿运公司与日本阪井公司于2001年5月签订了购买3500吨钢材的合同,由中国远洋公司的“青远”号将该批货物从日本神户运至宁波,“青远”号在途中遇小雨,因舱盖不严使部分货物生锈。

关于货物责任的选项正确的是( D.承运人应赔偿货物锈损的损失 )。

6.有一批货物,投保了平安险,由货轮装运,驶往目的港。

在航行过程中发生的下述几种情况中,保险公司无需承担赔偿责任的是( A.货轮遭遇暴风雨的袭击,因船身倾覆进水导致该批货物发生的部分损失 )。

7.中国甲厂、乙厂和丙厂代表中国新闻纸产业向主管部门提出了对原产于.A国、B国和C国的新闻纸进行反倾销调查的申请,经审查终局裁定确定倾销成立并对国内产业造成了损害,决定征收反倾销税。

反倾销税的纳税人应是( B.新闻纸的进口经营者 )。

8.在国际许可合同中,如果规定在合同约定的范围和期限内,只允许被许可人使用该技术,许可人不得在该地域内使用该技术,也不得将此项技术向第三方转让。

这种许可合同属于( A.独占许可合同 )9.下列关于《华盛顿公约>规定的表述中,正确的是( D.有关投资争议必须是关于法律问题的争议 )。

10.下述有关ADR的说法,正确的是( A.ADR体现了当事人的自愿性 )。

姜波克国际金融学习题国际收支和国际收支平衡表一、单项选择题1.资本项目的利息收入应列入下列国际收支平衡表的哪一个项目中A. 资本项目B. 经常项目C. 国际储备D. 净误差与遗漏2.国际旅游、保险引起的收支属于下列国际收支平衡表中的哪一个项目A. 经常项目B. 国际储备C. 净误差与遗漏D. 资本项目3.资本项目中的长期资本是指借贷期为多长的资本A. 期限不定B. 一年以内C. 一年D. 一年以上4.当国际收支平衡表中的收入大于支出时,就在“净误差与遗漏”的哪一方加上相差的数字。

A. 右方B. 左方C. 收入方D. 支出方5.一国国民收入增加,会引起进口商品与劳务增加,导致国际收支出现下列哪一种情况A. 不确定B. 不变C. 逆差D. 顺差6.狭义的国际收支仅指A. 贸易收支B. 经常项目收支C. 外汇收支D. 全部对外交易7.国际货币基金组织对国际收支的解释属于下列哪一种收支概念A. 狭义的B. 广义的C. 事前的D. 规划性的8.下列哪一项属于劳务收支项目A 进口商品支出B 国外捐款C 侨民汇款D 对外投资利润9.特别提款权不能直接用于A. 换取外汇B. 换回本币C. 贸易支付D. 归还贷款10.到岸价格中的运费和保险费属于A. 无形收支B. 有形收支C. 转移收支D. 资本项目收支11、国际收支基本差额是指()。

A、贸易差额B、经常项目差额C、经常项目差额与长期资本项目差额之和D、经常项目差额与短期资本项目差额之和12、根据《国际收支手册》第五版规定,记在资本金融帐户的是()。

A、服务收入B、股本收入C、债务核销D、债务收入13、根据国际收支的定义,以下机构的工作人员属于一国居民的是()。

A、联合国B、一国国外大使馆C、IMFD、世界银行集团14、一国经济状况为经济膨胀和经常帐户顺差,采用调整政策是()。

A、紧缩性的货币政策B、扩张性财政政策C、紧缩性的货币政策和紧缩性的财政政策D、扩张性的货币政策和紧缩性的财政政策15、根据国际收支平衡表的记帐原则,属于借方项目的是()。

A、出口商品B、官方储备的减少C、本国居民收到国外的单方向转移D、本国居民偿还非居民债务。

16、根据国际收入平衡表的记帐原则,属于贷方项目的是()。

A、进口劳务B、本国居民获得外国资产C、官方储备增加D、非居民偿还本国居民债务17、采用资金融通政策来调整()的国际收支不平衡。

A、货币性B、收入性C、临时性D、结构性18、本币贬值,可能会引起()。

A、国内失业率上升B、国内通胀率上升C、国内出口减少D、国内经济增长率下降19、一般来说,由()引起的国际收支不平衡是长期且持久的。

A、经济周期更迭B、货币价值变动C、国民收入增减D、经济结构变化20、一般来说,一国的国际收支顺差会使其()。

A、货币坚挺B、物价下跌C、通货紧缩D、货币疲软二、判断题(正确打“√”,错误打“×”)1.国际收支的绝大部分要通过外汇进行,外汇收支的盈亏所形成的一个国家的外汇储备的增减对一国对外经济有重要意义,但并非一切国际经济交易都要表现为外汇的收支。

2.经常项目余额也称为基本余额。

3.自主性项目反映了出于某种经济动机而产生的国际交易。

4.调节性项目反映了由于国际收支其他活动而需要进行的融资。

5.构成国际投资头寸的金融项目包括非居民债权、对非居民的债务、货币黄金和普通提款权等。

6、国际收支反映的是居民和非居民之间的交易。

7、一般来说,经常帐户中的货物是按边境的离岸价(FOB)计价。

8、股本收入应记在国际收支平衡表的资本与金融帐户。

9、所有由交易引起的实现的资本损益都应记在国际收支平衡表的资本与金融帐户。

10、非居民为本国居民提供劳务或从本国取得收入,属于贷方项目。

11、本国居民对非居民的单方面转移,属于借方项目。

12、非居民获得本国资产或对本国投资,属于借方项目。

13、国际收支不平衡是指自主性交易的不平衡。

14、一般来说,一国的国民收入增加,可能造成该国国际收支顺差。

15、支出增减型调节政策的宗旨是通过改变社会总需求或总支出的水平,来达到调节国际收支的目的。

三、填空题1、国际收支帐户可分为三大类:、、。

2、最新的《国际收支手册》将转移分为转移和转移。

3、根据国际收支平衡表的记帐原则,进口商品属于项目,出口商品属于项目。

4、根据国际收支平衡表的记帐原则,官方储备增加属于项目,官方储备减少属于项目。

5、国际收支平衡表中的基本差额是差额加上差额。

6、国际收支平衡表上的各个项目,按其交易性质的不同可分为和两种。

7、一国出现国际收支结构性不平衡,有两种含议;一是,二是。

8、国际收支失衡的调节政策主要有三种即:、、。

9、国际收支需求调节政策可分为和两大类。

10、根据政策搭配理论,一国的经济情况为经济膨胀和国际收支出现顺差,其政策搭配是:和。

四、名词解释:1、国际收支2、克鲁格曼三角3、自主性交易4、复式记帐原则5、马歇尔-勒纳条件五、简答题1、简述编制国际收支平衡表对编制国家的意义。

2、简述吸收分析法的主要观点。

3、简述国际收支调节机制4、简述国际收支弹性理论的主要内容。

5、简述国际收支失衡的原因、类型。

六、分析和论述题1.论述国际清偿力。

2.分析国际收支平衡表的项目构成状况。

3.测定国际收支赤字和盈余的方法有哪些。

4.世界国际储备结构是怎样演变的?5.下列为2003年和2004年的中国国际收支简表,试作出你的分析与比较。

中国国际收支表(单位:千美元)20032004经常项目45,874,812 68,659,162其中:出口519,580,386 700,697,007 进口473,705,574 632,037,845 资本与金融项目52,725,942 110,659,756净误差与遗漏18,422,347 27,045,082 国际储备-117,023,100 -206,364,000 其中:外汇储备-116,844,100 -206,681,000国际收支调节手段和理论一、单项选择题1、进出口商品的供求价格弹性是A.进出口商品的价格对其供求数量变化的反映程度B.进出口商品的供求数量对其价格变化的反映程度C.供给对需求的反映程度D.需求对供给的反映程度2.休谟机制的理论基础是A.货币数量论B.凯恩斯主义C.货币主义D.理性预期3.用Dx表示一国出口的需求价格弹性,用Dm表示一国进口的需求价格弹性,则马歇尔—勒纳条件可以表示为A. Dx+Dm>1B. Dx+Dm<1C. |Dx|+|Dm|>1D. |Dx|+|Dm|<14.根据货币分析法对货币需求函数Md的假设,下列说法错误的是A. y与Md之间呈正比例变化关系B. P与Md之间呈正相关关系C. I与Md之间呈负相关关系D. E(P)与Md之间呈正相关关系5.下列哪一项是60年代以后形成的国际收支理论A.价格—现金自动调节理论B.弹性分析方法C.吸收分析方法D.货币分析方法6.从局部均衡(贸易项目)方面来考察国际收支的理论是A.吸收分析法B.弹性分析法C.货币分析法D.资产市场分析法7.根据货币分析法,下列关于国际收支失衡调节的那一个描述是错误的A.如果国际收支的自动调节机制能够不受干扰的进行下去,从长期来讲,货币市场的不均衡以及国际收支赤字或盈余会最终消失B.在持续的经济增长条件下,货币需求超过国内货币供给的结果是国际储备的流入C.作为国际储备货币的流动,对作为国际储备货币国家和非国际储备货币国家的影响是对称的D.在浮动汇率制下,国际收支的不均衡可直接由汇率自动的改变而得到纠正,不需要国际间货币和国际储备的流动8.在其他条件不变的情况下,流入本国的净资本增加会导致实际汇率A.下降B.上升C.不变D.上升或下降9.关于吸收效益的收入再分配效应,下列的哪一个描述是错误的A.物价上涨先于工资的提高,从而使物价上涨转变为企业家利润B.物价上涨使收入从固定货币收入集团转移到社会的其他集团手中C.物价上涨使实际收入的一个更大部分转变为政府的税收D.在收入从低边际吸收倾向向高边际吸收倾向移动的情况下,贸易差额得到改善10.下列关于货币分析法的政策意义叙述错误的是A.国际收支的失衡本质上是货币失衡B.国际收支的失衡是永久性失衡,所以政府必须采取措施调节C.一个国家在不变动汇率的情况下也能对国际收支的失衡进行调节,其方法就是采用国内货币政策D.贬值仅仅是国内信贷收缩的一种替代品11国际收支失衡是指A.国际收支顺差B.国际收支逆差C.国际收支顺差或逆差D.贸易收支逆差12.J曲线效应是用来描述经常项目的A.贬值的效果B.升值的效果C.先贬值,后升值的效果D.先升值,后贬值的效果13.货币分析法将国际收支视为A.货币现象B.实物现象C.货币和实物现象D.其他现象14.在吸收表达式B=Y-A中,B代表A.国民收入B.吸收C.贸易差额D.贬值15.米德冲突说明,一国如果要同时实现内外均衡,就必须同时使用下列哪两种政策A.支出调整政策和支出转移政策B. 财政政策和货币政策C. 支出调整政策和货币政策D. 支出转移政策和财政政策16.根据蒙代尔的搭配法则,下列那一种政策应着眼于稳定国内经济,而另外哪一种政策则应用于稳定国际收支A. 支出调整政策和支出转移政策B. 支出转移政策和支出调整政策C. 财政政策和货币政策D. 货币政策和财政政策17. 下列哪一位经济学家开创性地提出了“两种目标,两种工具”的理论模式A.丁伯根B.蒙代尔C.斯旺D.米德18.要实现N个经济目标,必须至少具备N种政策工具,称为A.丁伯根法则B.蒙代尔的政策指派理论C.米德冲突D.斯旺模型19.IB曲线左右两边的点各意味着哪种情况A.失业通货膨胀B.通货膨胀失业C.充分就业通货紧缩D.通货紧缩充分就业二、判断题1.马歇尔-勒纳条件是指货币贬值后,只有出口商品的需求弹性和出口商品的供给弹性之和大于1,贸易收支才能改善。

2.J曲线揭示:汇率贬值后,短期贸易状况恶化,长期贸易状况改善。

3.在货币分析法下,超额的货币供给产生的压力会导致经常项目赤字。

4.根据资产分析法,国内货币需求与本国利率呈负相关关系,与外国利率呈正相关关系。

5.实际汇率对各种冲击的反应取决于本国和外国的产出水平,取决于净资本流动对冲击的反应程度,取决于本国和外国的贸易与产出的比例。

6.因为货币错觉的存在,要求人们应更多地关注货币收入而不是关注物价。

7.根据弹性分析法,本币贬值有利于出口,不利于进口,所以会有助于减少国际收支赤字。

8.国际收支的货币分析法是一种短期分析理论。

9.弹性分析法强调的是经济社会需求的一面,吸收分析法强调的是经济社会供给的一面。

10.在金本位制年代,各国政府把对内均衡的实现看得比对外均衡的实现更重要。

11.国际收支的吸收分析法所说的吸收就是通常所说的消费与投资。