信用风险计量和RWA

- 格式:dps

- 大小:2.06 MB

- 文档页数:76

商业银行风险加权资产计算及新资本协议监管报表系统简介(RWA项目)北京高伟达软件技术有限公司2020年5月1 系统概述1.1 项目背景根据中国银行业监督管理委员会(以下简称“银监会”)发布的《中国银行业实施新协议指导意见》和银监会相关指引要求,各商业银行应该使用内部评级法计量信用风险的资本要求,使用内部模型法计量市场风险的资本要求。

风险加权资产计算及新资本协议监管报表系统(RWA)实施是满足新巴塞尔协议和中国银监会对风险加权资产计算及相关报告方面的功能要求,实现信用风险、市场风险、操作风险相关加权资产的全面计算和相关风险报告的生成。

1.2 系统目标在充分满足巴塞尔新资本协议(BASEL II)和我国银监会相关监管要求前提下,为银行设计数据管理体系;提出满足新资本协议的目标数据模型和数据质量要求,分析银行数据现状与目标数据需求和数据质量要求的差距,撰写银行数据管理框架、数据管理政策,提出银行数据质量改进和控制方案,并制定相关数据标准。

系统实现以下功能:1、计算覆盖银行法人、集团全部风险敞口的RWA;2、资本充足率的计算;3、风险参数敏感性分析;4、加工生成监管报表及信息披露报表;5、按各种维度对RWA进行分析,加工生成内部管理报表;6、报表灵活展现和查询;7、数据管理功能:包括总分核对、数据质量报表、数据审计、参数管理;8.、系统安全与权限管理。

1.3 参考资料《巴塞尔新资本协议》《商业银行银行账户信用风险暴露分类指引》《商业银行信用风险内部评级体系监管指引》《商业银行专业贷款监管资本计量指引》《商业银行信用风险缓释监管资本计量指引》《商业银行操作风险监管资本计量指引》1.4 术语定义RWA(Risk-weighted Assets):风险加权资产。

PD(Probability of Default):违约概率。

LGD(Loss Given Default):违约损失率。

EAD(Exposure at Default):违约风险暴露。

2014年厦门银行从业资格考试备考指导风险管理之信用风险资本计量《巴塞尔新资本协议》提出了两种计量信用风险资本的方法:标准法和内部评级法。

一、标准法标准法以1988年《巴塞尔资本协议》为基础,采用外部评级机构确定风险权重,使用对象是复杂程度不高的银行。

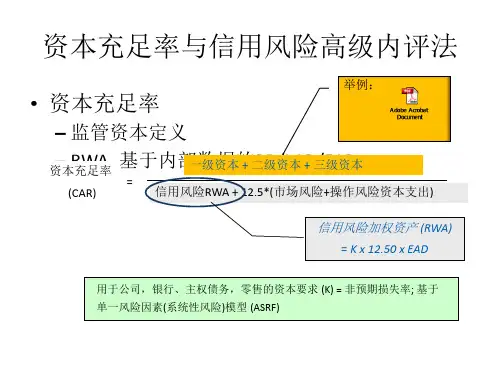

1.标准法下的信用风险计量框架:债权、信贷资产、风险缓释2.将风险加权资产合计之后乘以8%即可计算最低信用风险资本二、内部评级法1.根据商业银行对内部评级体系依赖程度的不同,内部评级法分为初级法和高级法两种(1)初级法要求商业银行运用资深客户评级估计每一等级的客户违约概率,其他风险要素采用监管当局的估计值;(2)高级法要求银行运用自身二维评级体系自行估计违约概率、违约损失率、违约风险暴露、期限二者的区分只适用于非零售暴露2.商业银行风险加权资产RWA=RW×EAD风险加权资产的8%就是《巴塞尔新资本协议》规定的银行对风险资产所应持有的资本金,即该项资产的监管资本要求3.内部评级法(IRB)与内部评级体系(IRS)的区别:(1)内部评级法是计算资本充足率的方法,各银行可自行决定是否实施;(2)内部评级体系是风险管理的基础平台、制度。

三、内部评级体系的验证1.验证是银行优化内部评级体系的重要手段,也是监管当局衡量银行内部评级体系是否符合《巴塞尔新资本协议》内部评级法要求的重要方式。

2.内部评级体系的验证应评估内部评级和风险参数量化的准确性、稳定性和审慎性。

四、经济资本管理1,经济资本计量对象为表内各类风险资产和表外业务,包括:贷款、存放与拆放同业、抵债资产、其他应收款、承兑、担保和信用证等。

2.从我国目前实施经济资本管理的经验来看,对信用风险的经济资本管理可通过三个环节来完成信息来源:/?wt.mc_id=bk14865更多银行考试请关注福建中公金融人:/?wt.mc_id=bk14865。

RWA系统简介商业银⾏风险加权资产计算及新资本协议监管报表系统简介(RWA项⽬)北京⾼伟达软件技术有限公司2019年8⽉1 系统概述1.1 项⽬背景根据中国银⾏业监督管理委员会(以下简称“银监会”)发布的《中国银⾏业实施新协议指导意见》和银监会相关指引要求,各商业银⾏应该使⽤内部评级法计量信⽤风险的资本要求,使⽤内部模型法计量市场风险的资本要求。

风险加权资产计算及新资本协议监管报表系统(RWA)实施是满⾜新巴塞尔协议和中国银监会对风险加权资产计算及相关报告⽅⾯的功能要求,实现信⽤风险、市场风险、操作风险相关加权资产的全⾯计算和相关风险报告的⽣成。

1.2 系统⽬标在充分满⾜巴塞尔新资本协议(BASEL II)和我国银监会相关监管要求前提下,为银⾏设计数据管理体系;提出满⾜新资本协议的⽬标数据模型和数据质量要求,分析银⾏数据现状与⽬标数据需求和数据质量要求的差距,撰写银⾏数据管理框架、数据管理政策,提出银⾏数据质量改进和控制⽅案,并制定相关数据标准。

系统实现以下功能:1、计算覆盖银⾏法⼈、集团全部风险敞⼝的RWA;2、资本充⾜率的计算;3、风险参数敏感性分析;4、加⼯⽣成监管报表及信息披露报表;5、按各种维度对RWA进⾏分析,加⼯⽣成内部管理报表;6、报表灵活展现和查询;7、数据管理功能:包括总分核对、数据质量报表、数据审计、参数管理;8.、系统安全与权限管理。

1.3 参考资料《巴塞尔新资本协议》《商业银⾏银⾏账户信⽤风险暴露分类指引》《商业银⾏信⽤风险内部评级体系监管指引》《商业银⾏专业贷款监管资本计量指引》《商业银⾏信⽤风险缓释监管资本计量指引》《商业银⾏操作风险监管资本计量指引》1.4 术语定义RWA(Risk-weighted Assets):风险加权资产。

PD(Probability of Default):违约概率。

LGD(Loss Given Default):违约损失率。

EAD(Exposure at Default):违约风险暴露。

rwa风险指标【原创实用版】目录1.RWA 风险指标的定义和意义2.RWA 风险指标的计算方法3.RWA 风险指标的应用领域4.RWA 风险指标的优缺点分析正文1.RWA 风险指标的定义和意义RWA(Risk Weighted Assets)风险加权资产,是一种衡量金融机构风险敞口的重要指标。

RWA 风险指标主要用于衡量银行、保险公司等金融机构在资产负债表中的风险加权资产,以评估其在一定期间内的风险承受能力。

RWA 风险指标的数值越大,表明金融机构的风险越高,需要加强风险管理。

2.RWA 风险指标的计算方法RWA 风险指标的计算方法是将金融机构的各类资产乘以相应的风险权重,然后将乘积相加,得到 RWA 风险指标的数值。

风险权重是根据资产的性质和风险程度确定的,一般来说,风险越高的资产,其风险权重也越高。

例如,对于银行的贷款业务,根据贷款对象的信用评级,可以确定不同的风险权重。

对于国债等风险较低的资产,其风险权重可能为 20%,而对于次贷等风险较高的资产,其风险权重可能为 50% 甚至更高。

3.RWA 风险指标的应用领域RWA 风险指标在金融监管、金融机构内部风险管理和投资者评估金融机构风险等方面有着广泛的应用。

首先,在金融监管方面,监管部门可以通过 RWA 风险指标来衡量金融机构的风险水平,对其进行宏观审慎管理,确保金融市场的稳定。

其次,在金融机构内部风险管理方面,金融机构可以利用 RWA 风险指标来评估自身的风险水平,制定相应的风险管理策略和措施。

最后,在投资者评估金融机构风险方面,投资者可以通过 RWA 风险指标来评估金融机构的风险水平,作为投资决策的参考依据。

4.RWA 风险指标的优缺点分析RWA 风险指标的优点在于其具有较高的敏感性和针对性,能够反映金融机构在一定时期内的风险水平。

同时,RWA 风险指标的计算方法相对简单,便于金融机构和监管部门进行操作。

然而,RWA 风险指标也存在一定的缺点。

RWA(Risk Weighted Assets)风险加权资产,是用于计算银行所需的经济资本(或风险资本)的指标,它将每种资产类别和风险等级赋予不同的权重,以反映不同资产的风险水平。

RWA的计算方法主要包括信用风险、市场风险和操作风险三个方面。

1. 信用风险是指银行贷款、投资等业务中可能出现的违约风险,其计算方法主要采用内部评级法。

2. 市场风险是指由于市场价格波动导致银行资产负债表价值发生变化的风险,其计算方法主要采用标准法。

3. 操作风险是指由于内部管理不善、人为失误等原因导致的风险,其计算方法可能涉及内部衡量法。

此外,RWA在风险管理、资本充足率计算、监管合规等方面具有重要作用。

它可以帮助银行了解其业务的风险水平,并制定相应的资本充足计划和合规措施。

RWA计量与管理手册1. 引言本手册旨在介绍RWA(Risk Weighted Assets,风险加权资产)计量与管理的基本概念、方法和流程。

RWA是衡量银行风险资产的指标,是银行监管和风险管理的核心指标之一。

通过合理的RWA计算和管理,银行能够更准确地评估和控制风险,提高风险管理水平,从而确保业务的稳健运营。

2. RWA计量的基本原理RWA计量的基本原理是基于资产的风险权重计算风险加权资产。

资产的风险权重是根据不同资产的风险程度来确定的,风险越高,风险权重越大。

RWA计算公式为:\[RWA = EAD \times LGD \times PD\]其中,EAD(Exposure at Default)表示违约敞口,是债权敞口的度量;LGD(Loss Given Default)表示违约损失率,是在违约情况下银行可能损失的资金比例;PD(Probability of Default)表示违约概率,是违约可能性的度量。

RWA计量的基本原理是将各类资产按风险加权计算,并进行综合加总,得到整体的风险资产水平。

这样可以更精确地衡量银行所承担的风险,从而为风险管理提供准确的数据基础。

3. RWA计量与管理的方法3.1 风险权重的确定风险权重是衡量不同资产风险的关键指标。

各类资产的风险权重通过法规或内部模型来确定。

常见的风险权重包括标准法定权重、内部评级权重和基于VaR(Value at Risk)的权重等。

3.2 EAD的度量EAD是违约敞口的度量,表示在违约情况下银行可能损失的金额。

EAD的度量方法因资产类型而异,常见的度量方法包括标准方法、内部评级法、推定方法等。

3.3 LGD和PD的测定LGD表示违约损失率,是在违约情况下银行可能损失的资金比例。

PD表示违约概率,是违约可能性的度量。

LGD和PD的测定主要依据资产的违约历史数据或市场数据进行估算。

3.4 综合计算与报告根据风险权重、EAD、LGD和PD的数据,进行RWA计算,并进行综合加总得到整体的风险资产水平。

风险加权资产的计量方法

风险加权资产(RWA)计量方法包括权重法、内部评级法等。

权重法,即首先从表内资产账面价值中扣除相应的减值准备,然后乘以风险权重。

表外项目则以名义金额为基础乘以信用转换系数得到等值的表内资产,再按表内资产的方式进行处理计提。

内部评级法,主要基于内部评级,对风险进行加权,进而计量风险加权资产。

请注意,不同的银行可能采取不同的风险加权资产计量方法,如中小银行主要采取权重法。

这些方法的采取应以实际情况为准。

信用风险加权资产计量与管理培训教材Section 1: Introduction to Credit Risk Weighted Asset1.1 What is Credit Risk Weighted Asset?Credit Risk Weighted Asset (RWA) is a regulatory measure used by financial institutions to quantify the credit risk associated with their lending activities. It provides a standardized approach for measuring the potential losses that could arise from defaults on loans and other credit exposures.1.2 Importance of Credit Risk Weighted AssetUnderstanding and managing credit risk is crucial for financial institutions as it directly affects their capital adequacy and solvency. By calculating and managing RWAs effectively, institutions can ensure that they maintain a sufficient level of capital to absorb potential losses, thus safeguarding their own financial stability.Section 2: Determining Credit Risk Weight2.1 Factors Influencing Credit Risk WeightMultiple factors can impact the credit risk weight assigned to a specific exposure. These factors include the creditworthiness of the borrower, the type of collateral provided, the nature of the loan, and various other risk-specific parameters.2.2 Calculation MethodologiesThere are different methodologies for calculating credit risk weight, the most common being the Standardized Approach and the Internal Ratings-Based Approach. This section will outline bothmethods and provide examples of how to calculate RWAs under each approach.Section 3: Credit Risk Management Strategies3.1 Loan Origination and UnderwritingProper origination and underwriting practices are essential to mitigate credit risk. This section will discuss the key principles and best practices involved in evaluating borrower creditworthiness, performing credit assessments, and setting appropriate loan terms.3.2 Collateral Valuation and MonitoringThe use of collateral can reduce credit risk exposure. This section will explore the importance of valuing collateral accurately, establishing proper monitoring processes, and determining appropriate haircuts.3.3 Credit Risk Mitigation TechniquesFinancial institutions employ various techniques to mitigate credit risk, including loan guarantees, credit derivatives, and credit insurance. This section will provide an overview of these techniques and discuss their benefits and limitations.Section 4: Reporting and Monitoring of Credit Risk4.1 Regulatory Reporting RequirementsFinancial institutions are required to report their credit risk exposures to regulatory bodies regularly. This section will outline the reporting requirements and provide guidance on preparing accurate and compliant reports.4.2 Credit Risk Monitoring and Stress TestingMonitoring credit risk exposures and conducting stress tests enables institutions to identify potential vulnerabilities and take proactive measures. This section will discuss the importance of ongoing monitoring and provide a framework for stress testing credit portfolios.Section 5: Credit Risk Weighted Asset Optimization5.1 Capital Planning and OptimizationOptimizing RWAs allows financial institutions to manage their capital more efficiently. This section will explore strategies for optimizing RWAs, such as portfolio diversification, risk mitigation, and capital allocation.5.2 Advanced Techniques for RWA OptimizationAdvanced techniques, such as credit portfolio modeling and advanced risk measurement methodologies, can further enhance RWA optimization efforts. This section will provide an overview of these techniques and their implementation considerations.Section 6: ConclusionIn conclusion, understanding and effectively managing credit risk weighted assets are critical for financial institutions to ensure their financial stability and regulatory compliance. By following the principles and best practices outlined in this training material, institutions can make informed decisions, optimize their RWAs, and mitigate credit risk effectively.Section 3: Credit RiskManagement Strategies3.1 Loan Origination and UnderwritingProper loan origination and underwriting practices are essential for financial institutions to mitigate credit risk. When evaluating a potential borrower's creditworthiness, several factors should be considered:a) Financial Statements and Credit History: Financial institutions should review the borrower's financial statements and credit history to assess their ability to repay the loan. This includes analyzing the borrower's income, expenses, debt levels, payment history, and credit scores.b) Analysis of Industry and Economic Trends: Financial institutions should also assess the industry in which the borrower operates and the broader economic conditions. Understanding the risks associated with the borrower's industry and how external factors could impact their ability to repay the loan is crucial.c) Evaluation of Collateral: If the loan is secured by collateral, financial institutions should conduct a thorough evaluation of the collateral's value and marketability. This helps mitigate the credit risk by providing a secondary source of repayment in case of default.d) Loan Structuring and Terms: Proper loan structuring and terms are important to ensure that the borrower can meet the repayment obligations. Financial institutions should consider the borrower'scash flow, income stability, and repayment capacity when setting loan amounts, interest rates, and repayment schedules.3.2 Collateral Valuation and MonitoringCollateral can significantly reduce credit risk exposure. However, it is essential to value collateral accurately and establish proper monitoring processes to effectively mitigate credit risk. Key considerations include:a) Independent Valuation: Financial institutions should obtain independent professional valuations of the collateral to ensure its accuracy. This may involve engaging external appraisers or using automated valuation models.b) Establishing Haircuts: Haircuts are applied to the value of collateral to account for potential fluctuations in its market value or other factors that could affect its liquidation value. Financial institutions should establish appropriate haircuts based on the volatility and liquidity of the collateral.c) Regular Monitoring: Financial institutions should implement processes to monitor the value of collateral over time and identify any significant changes that may impact the loan's risk profile. Regular monitoring helps ensure that the collateral remains sufficient to cover the outstanding loan amount.d) Documentation and Legal Considerations: Financial institutions should maintain proper documentation of collateral, including security agreements and legal filings. This ensures that theinstitution has a valid claim on the collateral in the event of default.3.3 Credit Risk Mitigation TechniquesIn addition to loan origination practices and collateral management, financial institutions can employ various credit risk mitigation techniques to further reduce credit risk exposure. Some common techniques include:a) Loan Guarantees: Loan guarantees involve obtaining a third-party guarantee or co-signor for the loan. This provides an additional level of security as the guarantor can be held liable in case of default by the borrower.b) Credit Derivatives: Credit derivatives, such as credit default swaps, can be used to transfer credit risk to another party. Financial institutions can enter into these derivative contracts to protect themselves from potential credit losses.c) Credit Insurance: Credit insurance can be purchased to protect against the risk of borrower default. In the event of default, the insurer pays out a predetermined amount to the financial institution, reducing the potential credit losses.d) Loan Restructuring and Workouts: In cases where a borrower is experiencing financial difficulties, financial institutions can restructure the loan terms or work out a repayment plan. This can help mitigate credit risk by providing the borrower with a viable path to repay the loan.Section 4: Reporting and Monitoring of Credit Risk4.1 Regulatory Reporting RequirementsFinancial institutions are subject to regulatory reporting requirements regarding their credit risk exposures. These requirements aim to enhance transparency and allow regulatory authorities to monitor and assess systemic risks. Common reporting requirements include:a) Basel III Reporting: Financial institutions are required to report their credit risk exposures based on the Basel III framework. This includes reporting key risk indicators, such as risk-weighted assets, capital adequacy ratios, and credit exposure.b) Credit Risk Mitigation Reporting: Institutions that employ credit risk mitigation techniques, such as credit derivatives or loan guarantees, may be required to report these activities separately. This ensures that the regulatory authorities have a clear understanding of the institution's overall risk profile.c) Stress Testing Reporting: Financial institutions may also be required to conduct stress tests and report the results to regulatory authorities. Stress testing assesses the institution's vulnerability to adverse economic scenarios and provides insights into the potential impact on credit risk exposures.4.2 Credit Risk Monitoring and Stress TestingOngoing monitoring of credit risk exposures is crucial for financialinstitutions to identify potential vulnerabilities and take proactive measures to address them. This includes:a) Regular Credit Portfolio Reviews: Financial institutions should conduct regular reviews of their credit portfolios to identify deteriorating credit quality, concentrations, or other emerging risks. This allows them to take timely actions, such as imposing higher credit risk weights or increasing loan loss provisions.b) Early Warning Systems: Implementing early warning systems enables financial institutions to detect warning signs of potential credit deterioration. These systems can be based on various key performance indicators, such as changes in cash flow, debt service coverage ratios, or creditworthiness assessments.c) Stress Testing: Stress testing involves analyzing the potential impact of adverse economic scenarios on the credit portfolio. By subjecting the portfolio to various stress scenarios, financial institutions can identify potential weaknesses and proactively manage their credit risk exposures.d) Portfolio Diversification Strategies: Financial institutions should diversify their credit portfolios to reduce concentration risk. This involves spreading credit exposures across different industries, sectors, geographic regions, and borrower types, thereby reducing the impact of defaults in any single area.Section 5: Credit Risk Weighted Asset Optimization5.1 Capital Planning and OptimizationOptimizing credit risk weighted assets allows financial institutions to manage their capital more efficiently. Effective capital planning and optimization strategies include:a) Capital Allocation: Financial institutions should allocate capital to different businesses and portfolios based on their respective risk profiles. This can be achieved by assigning appropriate risk weights to each asset class and calculating the corresponding RWAs.b) Risk Mitigation Techniques: Implementing effective risk mitigation techniques, such as credit derivatives or loan guarantees, can reduce the credit risk associated with certain asset classes. Financial institutions should evaluate the cost-effectiveness of these techniques and allocate capital accordingly.c) Portfolio Diversification: Diversification of credit exposures across different asset classes, industries, geographical regions, and borrower types can help reduce overall credit risk and optimize RWAs. By spreading the risks, financial institutions can better manage their capital and minimize potential losses.d) Risk-Adjusted Return on Capital (RAROC): Financial institutions should calculate the risk-adjusted return on capital for different portfolios to assess their performance. This helps identify areas where capital allocation can be optimized to maximize returns while keeping credit risk within acceptable levels.5.2 Advanced Techniques for RWA OptimizationIn addition to portfolio diversification and risk mitigation techniques, financial institutions can utilize advanced techniques and models to further optimize credit risk weighted assets. Some examples include:a) Credit Portfolio Modeling: Financial institutions can develop sophisticated credit portfolio models that simulate various credit scenarios and assess the impact on RWAs. These models help institutions optimize their credit exposure, allocate capital more efficiently, and assess the impact of potential regulatory changes.b) Advanced Risk Measurement Methodologies: Financial institutions can employ advanced risk measurement methodologies, such as value-at-risk (VaR) or conditional value-at-risk (CVaR), to quantify and manage credit risk. These methodologies provide a more nuanced understanding of the potential losses associated with credit exposures.c) Economic Capital Models: Economic capital models allow financial institutions to calculate the amount of capital required to cover unexpected credit losses. By utilizing these models, institutions can allocate capital more precisely and optimize RWAs based on their specific risk appetite.d) Data Analytics and Artificial Intelligence: Financial institutions can leverage data analytics and artificial intelligence techniques to analyze large datasets and identify patterns or trends that can inform credit risk decision-making. These techniques can enhance credit risk measurement and optimization efforts.Section 6: ConclusionIn conclusion, managing credit risk weighted assets is critical for financial institutions to ensure their financial stability and regulatory compliance. By employing proper loan origination practices, collateral valuation and monitoring, and credit risk mitigation techniques, institutions can effectively mitigate credit risk. Furthermore, monitoring credit risk exposures and conducting stress tests enable institutions to identify potential vulnerabilities and take proactive measures. Finally, optimizing credit risk weighted assets through capital planning, advanced techniques, and models allows institutions to efficiently manage their capital and minimize potential losses. By following the principles and best practices outlined in this training material, financial institutions can make informed decisions, optimize their RWAs, and mitigate credit risk effectively.。

rwa风险加权资产计算公式RWA 风险加权资产计算公式,这可真是个让金融从业者和学生们都得认真琢磨的重要概念。

咱们先来说说啥是风险加权资产(RWA)。

简单讲,它就是银行根据资产的风险程度给资产打的“权重分”,然后加权算出来的总数。

比如说,现金风险小,权重就低;而一些复杂的金融衍生品,风险高,权重就大。

那 RWA 的计算公式是啥呢?一般来说,它是通过把每种资产的金额乘以对应的风险权重,然后加总得到的。

这个公式看起来好像挺简单,但是里面的门道可多了去了。

我记得之前在给一群金融专业的学生讲这个知识点的时候,有个同学一脸迷茫地问我:“老师,这权重到底咋定的啊?”我就跟他说,这就好比你去超市买东西,不同的商品有不同的价格标签,风险权重就是资产的“价格标签”。

比如说国债,国家信用背书,风险低,权重可能就是 0%;而一些信用不太好的企业债券,风险高,权重可能就得 50%甚至更高。

再比如说,银行放出去的贷款,得根据借款人的信用状况、贷款的担保情况等等来确定风险权重。

要是借款人信用特别好,有足额的抵押物,那风险权重可能就低;要是借款人信用差,又没啥担保,那风险权重就高得吓人。

在实际操作中,计算 RWA 可不是一件轻松的事儿。

银行得有一套完善的风险管理系统,收集各种数据,进行复杂的分析和计算。

而且,监管部门也会盯着银行,确保他们算得准确,不能随便糊弄。

我还碰到过一家小银行,因为 RWA 计算不准确,被监管部门狠狠批评了一顿。

这就好比考试作弊被老师抓了个正着,后果很严重呐!总之,RWA 风险加权资产计算公式虽然复杂,但对于银行的稳健运营和金融系统的稳定至关重要。

咱们搞金融的,得把这个公式弄明白,不能马虎!希望我这么一讲,能让您对 RWA 风险加权资产计算公式有个更清楚的认识。