米什金 货币金融学 英文版习题答案chapter 18英文习题

- 格式:doc

- 大小:143.50 KB

- 文档页数:27

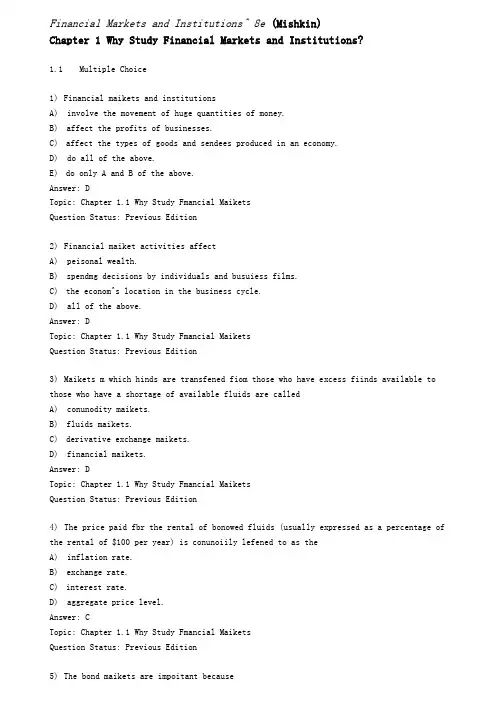

Financial Markets and Institutions^ 8e (Mishkin)Chapter 1 Why Study Financial Markets and Institutions?1.1Multiple Choice1)Financial maikets and institutionsA)involve the movement of huge quantities of money.B)affect the profits of businesses.C)affect the types of goods and sendees produced in an economy.D)do all of the above.E)do only A and B of the above.Answer: DTopic: Chapter 1.1 Why Study Fmancial MaiketsQuestion Status: Previous Edition2)Financial maiket activities affectA)peisonal wealth.B)spendmg decisions by individuals and busuiess films.C)the econom^s location in the business cycle.D)all of the above.Answer: DTopic: Chapter 1.1 Why Study Fmancial MaiketsQuestion Status: Previous Edition3)Maikets m which hinds are transfened fiom those who have excess fiinds available to those who have a shortage of available fluids are calledA)conunodity maikets.B)fluids maikets.C)derivative exchange maikets.D)financial maikets.Answer: DTopic: Chapter 1.1 Why Study Fmancial MaiketsQuestion Status: Previous Edition4)The price paid fbr the rental of bonowed fluids (usually expressed as a percentage of the rental of $100 per year) is conunoiily lefened to as theA)inflation rate.B)exchange rate.C)interest rate.D)aggregate price level.Answer: CTopic: Chapter 1.1 Why Study Fmancial MaiketsQuestion Status: Previous Edition5)The bond maikets are impoitant becauseA)they are easily the most widely followed financial maikets m the Umted States.B)they are the maikets where mteiest rates are detemiined.C)they are the maikets where foreign exchange rates are detemimed.D)all of the above.Answer: BTopic: Chapter 1.1 Why Study Fmancial MaiketsQuestion Status: Previous Edition6)hiterest rates are impoilant to financial institutions since an interest rate mcrease the cost of acquumg fiinds and the income from assets.A)decreases; decreasesB)mcieases; increasesC)decreases; incieasesD)increases; decreasesAnswer: BTopic: Chapter 1.1 Why Study Fmancial MaiketsQuestion Status: Previous Edition7)Typically, increasing mteiest ratesA)discourages individuals fiom saving.B)discourages coiporate mvestments.C)encourages corporate expansion.D)encourages corporate bonowing.E)none of the above.Answer: BTopic: Chapter 1.1 Why Study Fmancial MaiketsQuestion Status: Previous Edition8)Compaied to mteiest rates on long-term U.S. govenmient bonds, interest rates on fluctuate more and are lower on average.A)medium-quality coiporate bondsB)low-quality coiporate bondsC)lugh-quality coiporate bondsD)tluee-montli Treasuiy billsE)none of the aboveAnswer: DTopic: Chapter 1.1 Why Study Fmancial MaiketsQuestion Status: Previous Edition9)Compaied to mterest rates on long-term U.S. govenmient bonds, interest rates on tluee-month Treasury bills fluctuate and are on average.A)more; lowerB)less; lowerC)more; lugherD)less; higherAnswer: ATopic: Chapter 1.1 Why Study Fmancial MarketsQuestion Status: Previous Edition10)The stock maiket is important becauseA)it is where interest rates are determined.B)it is the most widely followed financial maiket in the United States.C)it is where foreign exchange rates are deteimined.D)all of the above.Answer: BTopic: Chapter 1.1 Why Study Fmancial MarketsQuestion Status: Previous Edition11)Stock prices smce the 1980s have beenA)relatively stable, trending upward at a steady pace.B)relatively stable, tiending downward at a moderate rate.C)extiemely volatile.D)unstable, trendmg downwaid at a moderate rate.Answer: CTopic: Chapter 1.1 Why Study Fmancial MarketsQuestion Status: Previous Edition12)The largest one-day drop m the histoiy of the Aineiican stock markets occuned in A) 1929.B)1987.C)2000.D)2001.Answer: BTopic: Chapter 1.1 Why Study Fmancial MarketsQuestion Status: Previous Edition13) A declining stock market index due to lower share pricesA)reduces people's wealth and as a result may reduce then willingness to spend.B)mcieases people's wealth and as a result may increase their willmgness to spend.C)decreases the amount of hinds that business films can raise by sellmg newly issued stock.D)both A and C of the above.E)both B and C of the above.Answer: DTopic: Chapter 1.1 Why Study Fmancial MarketsQuestion Status: Previous Edition14)Changes m stock pricesA)affect people's wealth and their willmgness to spend.B)affect films' decisions to sell stock to finance investment spending.C)are chaiacteiized by considerable fluctuations.D)all of the above.E)only A and B of the above.Answer: DTopic: Chapter 1.1 Why Study Fmancial MarketsQuestion Status: Previous Edition15)(I) Debt maikets are often refened to genencally as the bond maiket.(II) A bond is a security that is a claim on the earnings and assets of a corporation.A)(I) is tine, (II) false.B)(I) is false, (II) tine.C)Both are tme.D)Both are false.Answer: ATopic: Chapter 1.1 Why Study Fmancial MaiketsQuestion Status: Previous Edition16) (I) A bond is a debt secunty that pionuses to make payments peiiodically for a specified penod of tune. (II) A stock is a secunty that is a claim on the eanimgs and assets of a coipoiation.A)(I) is true, (II) false.B)(I) is false, (II) tine.C)Both are tme.D)Both are false.Answer: CTopic: Chapter 1.1 Why Study Fmancial MaiketsQuestion Status: Previous Edition17)The piice of one country's cunency in terms of anothei J s is calledA)the foreign exchange rate.B)the interest rate.C)the Dow Jones mdustrial average.D)none of the above.Answer: ATopic: Chapter 1.1 Why Study Fmancial MaiketsQuestion Status: Previous Edition18) A stronger dollar benefits and hints.A)Aineiican busuiesses; Aineiican consumeisB)Aineiican busmesses; foreign businessesC)Aineiican consumeis; Aineiican busmessesD)foreign businesses; Ameiican consumeisAnswer: CTopic: Chaptei 1.1 Why Study Fmancial MarketsQuestion Status: Previous Edition19) A weaker dollar benefits and hurts.A)Aineiican busmesses; Aineiican consumeisB)Aineiican busmesses; foieign consumersC)Aineiican consumeis; Aineiican busmessesD)foreign businesses; Ameiican consumersAnswer: ATopic: Chaptei 1.1 Why Study Fmancial MarketsQuestion Status: Previous Edition20)From 1980 to early 1985 the dollar in value, thereby benefitingAinencan.A)appreciated; businessesB)appreciated; consumersC)depreciated; businessesD)depreciated; consumersAnswer: BTopic: Chaptei 1.1 Why Study Fmancial MarketsQuestion Status: Previous Edition21)hi generaL fiom 2001 tluough 2013, the dollar m value relative tomajor foreign cuuencies.A)appreciatedB)depreciatedC)lemained about the sameAnswer: BTopic: Chaptei 1.1 Why Study Fmancial MarketsQuestion Status: New Question22)Money is defined asA)anythmg that is geneially accepted in payment fbr goods and sendees or in the repayment of debt.B)bills of exchange.C) a nskless repositoiy of spending power.D)all of the above.E)only A and B of the above.Answer: ATopic: Chaptei 1.2 Why Study Financial InstitutionsQuestion Status: Previous Edition23)The organization responsible fbf the conduct of monetaiy policy in the United States is theA)Comptioller of the Currency.B)U.S. Treasuiy.C)Federal Reserve System.D)Bureau of Monetaiy Affaus.Answer: CTopic: Chaptei 1.2 Why Study Fmancial InstitutionsQuestion Status: Previous Edition24)The central bank of the United States isA)Citicoip.B)The Fed.C)Bank of America.D)The Tieasuiy.E)none of the above.Answer: BTopic: Chaptei 1.2 Why Study Fmancial InstitutionsQuestion Status: Previous Edition25)Monetaiy policy is cluefly concerned withA)how much money businesses earn.B)the level of mterest rates and the nation's money supply.C)how much money people pay in taxes.D)whether people have saved enough money for letnement.Answer: BTopic: Chaptei 1.2 Why Study Fmancial InstitutionsQuestion Status: Previous Edition26)Econonusts group conuneicial banks, savings and loan associations, credit unions, mutual ftinds, mutual savings banks, msuiance companies, pension fiinds, and finance companies together under the heading financial inteniiedianes. Financial mtermedianes A)act as middlemen, bonowmg ftinds fiom those who have saved and lending these fluids to others.B)produce nothing of value and are therefore a drain on society's resoui ces.C)help promote a more efficient and dynamic economy.D)do all of the above.E)do only A and C of the above.Answer: ETopic: Chaptei 1.2 Why Study Fmancial InstitutionsQuestion Status: Previous Edition27)Econonusts group conuneicial banks, savings and loan associations, credit unions, mutual fiinds, mutual savings banks, msuiance companies, pension fiinds, and finance companies together under the heading financial inteimedianes. Financial mtermedianesA)act as middlemen, bonowmg fiinds fiom those who have saved and lending these fimds to others.B)play an important role in detemmuiig the quantity of money m the economy.C)help promote a more efficient and dynanuc economy.D)do all of the above.E)do only A and C of the above.Answer: DTopic: Chapter 1.2 Why Study Fmancial InstitutionsQuestion Status: Previous Edition28)Banks are unpoitant to the study of money and the economy because they A) provide a chaimel for Imkrng those who want to save with those who want to mvest.B)have been a source of financial nmovation that is expandmg the alternatives available to those wanting to mvest then money.C)are the only financial mstitution to play a role in detemuiHiig the quantity of money in the economy.D)do all of the above.E)do only A and B of the above.Answer: ETopic: Chapter 1.2 Why Study Fmancial InstitutionsQuestion Status: Previous Edition29)Banks, savings and loan associations, mutual savings banks, and credit unions A) are no longer unportant players in financial intemiediation.B)have been providing services only to small depositors since deregulation.C)have been adept at iimovating in response to changes in the regulatoiy envuomnent.D)all of the above.E)only A and C of the above.Answer: CTopic: Chapter 1.2 Why Study Fmancial InstitutionsQuestion Status: Previous Edition30)(I) Banks are financial intennediaiies that accept deposits and make loans.(II) The tenn n baiiks n includes films such as commercial banks, savmgs and loan associations, mutual savings banks, credit unions, msuiance companies, and pensionfluids.A)(I) is true, QI) false.B)(I) is false, (II) tine.C)Both are tme.D)Both are false.Answer: ATopic: Chapter 1.2 Why Study Fmancial InstitutionsQuestion Status: Previous Edition31)was the stock market^ worst one-day chop in histoiy in the 1980s.A)Black FridayB)Black MondayC)Blackout DayD)none of the aboveAnswer: BTopic: Chapter 1.1 Why Study Fmancial MarketsQuestion Status: Previous Edition32)The largest financial intennedianes areA)insuiance companies.B)finance compames.C)banks.D)all of the above.Answer: CTopic: Chapter 1.2 Why Study Financial InstitutionsQuestion Status: Previous Edition33)hi recent yearsA)interest rates have lemained constant.B)the success of financial institutions has leached levels unpiecedented smce the Great Depiession.C)stock markets have crashed.D)all of the above.Answer: CTopic: Chapter 1.1 Why Study Fmancial MarketsQuestion Status: Previous Edition34) A securityA)is a claun oi puce of propeity that is subject to ownership.B)piomises that payments will be made penodically fbr a specified penod of time.C)is the piice paid fbr the usage of ftinds.D)is a claun on the issuers fiituie mcome.Answer: DTopic: Chapter 1.1 Why Study Fmancial MarketsQuestion Status: Previous Edition35)are an example of a financial institution.A)BanksB)hisuiance companiesC)Fmance companiesD)All of the aboveAnswer: DTopic: Chapter 1.2 Why Study Fmancial InstitutionsQuestion Status: Previous Edition36)Monetaiy policy affectsA)interest rates.B)mflation.C)business cycles.D)all of the above.Answer: DTopic: Chapter 1.2 Why Study Fmancial InstitutionsQuestion Status: Previous Edition37) A using stock market index due to higher share pricesA)increases people's wealth and as a result may increase their willmgness to spend.B)uicieases the amount of fluids that business firms can raise by selling newly issued stock.C)decreases the amount of hinds that business films can raise by selling newly issued stock.D)both A and B of the above.Answer: DTopic: Chapter 1.1 Why Study Fmancial MarketsQuestion Status: Previous Edition38)From the peak of the high-tech bubble in 2000, the stock market byovei by late 2002.A)collapsed; 75%B)rose; 35%C)collapsed; 30%D)rose; 50%Answer: CTopic: Chapter 1.1 Why Study Fmancial MarketsQuestion Status: Previous Edition39)The Dow fell below 7,000 m 2009, only to start a bull market run, reaching new highs above m 2013.A)12,000B)10,000C) 15,000D) 19,000Answer: CTopic: Chapter 1.1 Why Study Fmancial MarketsQuestion Status: New Question1.2 Tme/False1)Money is anything accepted by anyone as payment fbr services or goods.Answer: TRUETopic: Chapter 1.2 Why Study Fmancial InstitutionsQuestion Status: Previous Edition2)hiterest rates are determined in the bond markets.Answer: TRUETopic: Chapter 1.1 Why Study Fmancial MarketsQuestion Status: Previous Edition3) A stock is a debt secuiity that promises to make penodic payments fbr a specific period of time.Answer: FALSETopic: Chapter 1.1 Why Study Fmancial MarketsQuestion Status: Previous Edition4)Monetaiy policy affects interest rates but has little effect on inflation oi busmess cycles.JAnswer: FALSETopic: Chapter 1.2 Why Study Fmancial InstitutionsQuestion Status: Previous Edition5)The govenunent orgamzation lesponsible for the conduct of monetaiy policy m the United States is the U.S. Treasuiy.Answer: FALSETopic: Chapter 1.2 Why Study Financial InstitutionsQuestion Status: Previous Edition6)hiterest rates can be accuiately described as the rental price of money.Answer: TRUETopic: Chapter 1.1 Why Study Fmancial MarketsQuestion Status: Previous Edition7)Holding eveiytliuig else constant, as the dollar weakens vacations abroad become less attractive.Answer: TRUETopic: Chapter 1.1 Why Study Fmancial MarketsQuestion Status: Previous Edition8)In recent years, financial markets have become more stable and less risky. Answer: FALSETopic: Chapter 1.1 Why Study Fmancial MarketsQuestion Status: Previous Edition9)Financial innovation lias provided more options to both mvestors and bonowers. Answer: TRUETopic: Chaptei 1.1 Why Study Fmancial MarketsQuestion Status: Previous Edition10) A financial mtennediaiy borrows fiinds fiom people who have saved.Answer: TRUETopic: Chaptei 1.2 Why Study Fmancial InstitutionsQuestion Status: Previous Edition11)Holding eveiything else constant, as the dollar strengthens fbieigneis will buy more U.S. exports.Answer: FALSETopic: Chaptei 1.1 Why Study Fmancial MarketsQuestion Status: Previous Edition12)In a bull market stock prices are rising, on average.Answer: TRUETopic: Chaptei 1.1 Why Study Fmancial MarketsQuestion Status: Previous Edition13)Financial institutions are among the largest employers m the country and fiequently pay very high salaries.Answer: TRUETopic: Chaptei 1.3 Applied Managerial PerspectiveQuestion Status: Previous Edition14)Different interest rates have a tendency to move in unison.Answer: TRUETopic: Chaptei 1.1 Why Study Fmancial MarketsQuestion Status: Previous Edition15)Financial markets are what makes financial mstitutions work.Answer: FALSETopic: Chaptei 1.1 Why Study Fmancial MarketsQuestion Status: Previous Edition16)In recent years, financial markets have become more iisky. However, only a linuted number of tools (such as deiivatives) are available to assist in managing this lisk. Answer: FALSETopic: Chaptei 1.1 Why Study Fmancial MarketsQuestion Status: Previous Edition17)Although the internet has changed many aspects of oui lives, it hasn't proven veiy usefill for collectmg and/oi analyzmg financial and econonuc data.Answer: FALSETopic: Chapter 1.4 How We Study Fmancial Markets and InstitutionsQuestion Status: New Question1.3 Essay1)Have inteiest rates been more or less volatile m recent years? Why?Topic: Chapter 1.1 Why Study Fmancial MarketsQuestion Status: Previous Edition2)Why should consumers be concerned with movements in foreign exchange rates?Topic: Chapter 1.1 Why Study Fmancial MarketsQuestion Status: Previous Edition3)How does the value of the dollar affect the competitiveness of Aineiican busmesses? Topic: Chapter 1.1 Why Study Fmancial MarketsQuestion Status: Previous Edition4)What is monetaiy policy and who is responsible fbi its implementation?Topic: Chapter 1.2 Why Study Fmancial InstitutionsQuestion Status: Previous Edition5)What are financial intennediaiies and what do they do?Topic: Chapter 1.2 Why Study Fmancial InstitutionsQuestion Status: Previous Edition6)What is money?Topic: Chapter 1.1 Why Study Fmancial MarketsQuestion Status: Previous Edition7)How does a bond differ fiom a stock?Topic: Chapter 1.1 Why Study Fmancial MarketsQuestion Status: Previous Edition8)Why is the stock market so important to individuals, films, and the economy? Topic: Chapter 1.1 Why Study Fmancial MarketsQuestion Status: Previous Edition9)What is the cential bank and what does it do?Topic: Chapter 1.2 Why Study Fmancial InstitutionsQuestion Status: Previous Edition10)If you are plaiming a vacation to Europe, do you prefer a strong dollar or weak dollar relative to the euio? Why?JTopic: Chapter 1.1 Why Study Fmancial MarketsQuestion Status: Previous Edition11)How has the stock market peifbimed smce 2000?Topic: Chapter 1.1 Why Study Fmancial MarketsQuestion Status: New Question。

Economics of Money, Banking, and Financial Markets, 11e, Global Edition (Mishkin) Chapter 2 An Overview of the Financial System2.1 Function of Financial Markets1) Every financial market has the following characteristic.A) It determines the level of interest rates.B) It allows common stock to be traded.C) It allows loans to be made.D) It channels funds from lenders-savers to borrowers-spenders.Answer: DAACSB: Reflective Thinking2) Financial markets have the basic function ofA) getting people with funds to lend together with people who want to borrow funds.B) assuring that the swings in the business cycle are less pronounced.C) assuring that governments need never resort to printing money.D) providing a risk-free repository of spending power.Answer: AAACSB: Reflective Thinking3) Financial markets improve economic welfare becauseA) they channel funds from investors to savers.B) they allow consumers to time their purchase better.C) they weed out inefficient firms.D) they eliminate the need for indirect finance.Answer: BAACSB: Reflective Thinking4) Well-functioning financial marketsA) cause inflation.B) eliminate the need for indirect finance.C) cause financial crises.D) allow the economy to operate more efficiently.Answer: DAACSB: Reflective Thinking5) A breakdown of financial markets can result inA) financial stability.B) rapid economic growth.C) political instability.D) stable prices.Answer: CAACSB: Reflective Thinking6) The principal lender-savers areA) governments.B) businesses.C) households.D) foreigners.Answer: CAACSB: Application of Knowledge7) Which of the following can be described as direct finance?A) You take out a mortgage from your local bank.B) You borrow $2500 from a friend.C) You buy shares of common stock in the secondary market.D) You buy shares in a mutual fund.Answer: BAACSB: Analytical Thinking8) Assume that you borrow $2000 at 10% annual interest to finance a new business project. For this loan to be profitable, the minimum amount this project must generate in annual earnings isA) $400.B) $201.C) $200.D) $199.Answer: BAACSB: Analytical Thinking9) You can borrow $5000 to finance a new business venture. This new venture will generate annual earnings of $251. The maximum interest rate that you would pay on the borrowed funds and still increase your income isA) 25%.B) 12.5%.C) 10%.D) 5%.Answer: DAACSB: Analytical Thinking10) Which of the following can be described as involving direct finance?A) A corporation issues new shares of stock.B) People buy shares in a mutual fund.C) A pension fund manager buys a short-term corporate security in the secondary market.D) An insurance company buys shares of common stock in the over-the-counter markets. Answer: AAACSB: Analytical Thinking11) Which of the following can be described as involving direct finance?A) A corporation takes out loans from a bank.B) People buy shares in a mutual fund.C) A corporation buys a short-term corporate security in a secondary market.D) People buy shares of common stock in the primary markets.Answer: DAACSB: Analytical Thinking12) Which of the following can be described as involving indirect finance?A) You make a loan to your neighbor.B) A corporation buys a share of common stock issued by another corporation in the primary market.C) You buy a U.S. Treasury bill from the U.S. Treasury at .D) You make a deposit at a bank.Answer: DAACSB: Analytical Thinking13) Which of the following can be described as involving indirect finance?A) You make a loan to your neighbor.B) You buy shares in a mutual fund.C) You buy a U.S. Treasury bill from the U.S. Treasury at Treasury .D) You purchase shares in an initial public offering by a corporation in the primary market. Answer: BAACSB: Analytical Thinking14) Securities are ________ for the person who buys them, but are ________ for the individual or firm that issues them.A) assets; liabilitiesB) liabilities; assetsC) negotiable; nonnegotiableD) nonnegotiable; negotiableAnswer: AAACSB: Reflective Thinking15) With ________ finance, borrowers obtain funds from lenders by selling them securities in the financial markets.A) activeB) determinedC) indirectD) directAnswer: DAACSB: Application of Knowledge16) With direct finance, funds are channeled through the financial market from the ________ directly to the ________.A) savers, spendersB) spenders, investorsC) borrowers, saversD) investors, saversAnswer: AAACSB: Reflective Thinking17) Distinguish between direct finance and indirect finance. Which of these is the most important source of funds for corporations in the United States?Answer: With direct finance, funds flow directly from the lender/saver to the borrower. With indirect finance, funds flow from the lender/saver to a financial intermediary who then channels the funds to the borrower/investor. Financial intermediaries (indirect finance) are the major source of funds for corporations in the U.S.AACSB: Reflective Thinking2.2 Structure of Financial Markets1) Which of the following statements about the characteristics of debt and equity is FALSE?A) They can both be long-term financial instruments.B) They can both be short-term financial instruments.C) They both involve a claim on the issuer's income.D) They both enable a corporation to raise funds.Answer: BAACSB: Reflective Thinking2) Which of the following statements about the characteristics of debt and equities is TRUE?A) They can both be long-term financial instruments.B) Bond holders are residual claimants.C) The income from bonds is typically more variable than that from equities.D) Bonds pay dividends.Answer: AAACSB: Reflective Thinking3) Which of the following statements about financial markets and securities is TRUE?A) A bond is a long-term security that promises to make periodic payments called dividends to the firm's residual claimants.B) A debt instrument is intermediate term if its maturity is less than one year.C) A debt instrument is intermediate term if its maturity is ten years or longer.D) The maturity of a debt instrument is the number of years (term) to that instrument's expiration date.Answer: DAACSB: Reflective Thinking4) Which of the following is an example of an intermediate-term debt?A) a fifteen-year mortgageB) a sixty-month car loanC) a six-month loan from a finance companyD) a thirty-year U.S. Treasury bondAnswer: BAACSB: Analytical Thinking5) If the maturity of a debt instrument is less than one year, the debt is calledA) short-term.B) intermediate-term.C) long-term.D) prima-term.Answer: AAACSB: Application of Knowledge6) Long-term debt has a maturity that isA) between one and ten years.B) less than a year.C) between five and ten years.D) ten years or longer.Answer: DAACSB: Application of Knowledge7) When I purchase ________, I own a portion of a firm and have the right to vote on issues important to the firm and to elect its directors.A) bondsB) billsC) notesD) stockAnswer: DAACSB: Application of Knowledge8) Equity holders are a corporation's ________. That means the corporation must pay all of its debt holders before it pays its equity holders.A) debtorsB) brokersC) residual claimantsD) underwritersAnswer: CAACSB: Reflective Thinking9) Which of the following benefits directly from any increase in the corporation's profitability?A) a bond holderB) a commercial paper holderC) a shareholderD) a T-bill holderAnswer: CAACSB: Reflective Thinking10) A financial market in which previously issued securities can be resold is called a ________ market.A) primaryB) secondaryC) tertiaryD) used securitiesAnswer: BAACSB: Application of Knowledge11) An important financial institution that assists in the initial sale of securities in the primary market is theA) investment bank.B) commercial bank.C) stock exchange.D) brokerage house.Answer: AAACSB: Application of Knowledge12) When an investment bank ________ securities, it guarantees a price for a corporation's securities and then sells them to the public.A) underwritesB) undertakesC) overwritesD) overtakesAnswer: AAACSB: Application of Knowledge13) Which of the following is NOT a secondary market?A) foreign exchange marketB) futures marketC) options marketD) IPO marketAnswer: DAACSB: Reflective Thinking14) ________ work in the secondary markets matching buyers with sellers of securities.A) DealersB) UnderwritersC) BrokersD) ClaimantsAnswer: CAACSB: Application of Knowledge15) A corporation acquires new funds only when its securities are sold in theA) primary market by an investment bank.B) primary market by a stock exchange broker.C) secondary market by a securities dealer.D) secondary market by a commercial bank.Answer: AAACSB: Reflective Thinking16) A corporation acquires new funds only when its securities are sold in theA) secondary market by an investment bank.B) primary market by an investment bank.C) secondary market by a stock exchange broker.D) secondary market by a commercial bank.Answer: BAACSB: Reflective Thinking17) An important function of secondary markets is toA) make it easier to sell financial instruments to raise funds.B) raise funds for corporations through the sale of securities.C) make it easier for governments to raise taxes.D) create a market for newly constructed houses.Answer: AAACSB: Reflective Thinking18) Secondary markets make financial instruments moreA) solid.B) vapid.C) liquid.D) risky.Answer: CAACSB: Reflective Thinking19) A liquid asset isA) an asset that can easily and quickly be sold to raise cash.B) a share of an ocean resort.C) difficult to resell.D) always sold in an over-the-counter market.Answer: AAACSB: Reflective Thinking20) The higher a security's price in the secondary market the ________ funds a firm can raise byselling securities in the ________ market.A) more; primaryB) more; secondaryC) less; primaryD) less; secondaryAnswer: AAACSB: Reflective Thinking21) When secondary market buyers and sellers of securities meet in one central location to conduct trades the market is called a(n)A) exchange.B) over-the-counter market.C) common market.D) barter market.Answer: AAACSB: Application of Knowledge22) In a(n) ________ market, dealers in different locations buy and sell securities to anyone who comes to them and is willing to accept their prices.A) exchangeB) over-the-counterC) commonD) barterAnswer: BAACSB: Application of Knowledge23) Forty or so dealers establish a "market" in these securities by standing ready to buy and sell them.A) secondary stocksB) surplus stocksC) U.S. government bondsD) common stocksAnswer: CAACSB: Application of Knowledge24) Which of the following statements about financial markets and securities is TRUE?A) Many common stocks are traded over-the-counter, although the largest corporations usually have their shares traded at organized stock exchanges such as the New York Stock Exchange. B) As a corporation gets a share of the broker's commission, a corporation acquires new funds whenever its securities are sold.C) Capital market securities are usually more widely traded than shorter-term securities and so tend to be more liquid.D) Prices of capital market securities are usually more stable than prices of money market securities, and so are often used to hold temporary surplus funds of corporations.Answer: AAACSB: Reflective Thinking25) A financial market in which only short-term debt instruments are traded is called the________ market.A) bondB) moneyC) capitalD) stockAnswer: BAACSB: Analytical Thinking26) Equity instruments are traded in the ________ market.A) moneyB) bondC) capitalD) commoditiesAnswer: CAACSB: Analytical Thinking27) Because these securities are more liquid and generally have smaller price fluctuations, corporations and banks use the ________ securities to earn interest on temporary surplus funds.A) money marketB) capital marketC) bond marketD) stock marketAnswer: AAACSB: Reflective Thinking28) Corporations receive funds when their stock is sold in the primary market. Why do corporations pay attention to what is happening to their stock in the secondary market? Answer: The existence of the secondary market makes their stock more liquid and the price in the secondary market sets the price that the corporation would receive if they choose to sell more stock in the primary market.AACSB: Reflective Thinking29) Describe the two methods of organizing a secondary market.Answer: A secondary market can be organized as an exchange where buyers and sellers meet in one central location to conduct trades. An example of an exchange is the New York Stock Exchange. A secondary market can also be organized as an over-the-counter market. In this type of market, dealers in different locations buy and sell securities to anyone who comes to them and is willing to accept their prices. An example of an over-the-counter market is the federal funds market.AACSB: Reflective Thinking2.3 Financial Market Instruments1) Prices of money market instruments undergo the least price fluctuations because ofA) the short terms to maturity for the securities.B) the heavy regulations in the industry.C) the price ceiling imposed by government regulators.D) the lack of competition in the market.Answer: AAACSB: Reflective Thinking2) U.S. Treasury bills pay no interest but are sold at a ________. That is, you will pay a lower purchase price than the amount you receive at maturity.A) premiumB) collateralC) defaultD) discountAnswer: DAACSB: Analytical Thinking3) U.S. Treasury bills are considered the safest of all money market instruments because there isa low probability ofA) defeat.B) default.C) desertion.D) demarcation.Answer: BAACSB: Analytical Thinking4) A debt instrument sold by a bank to its depositors that pays annual interest of a given amount and at maturity pays back the original purchase price is calledA) commercial paper.B) a certificate of deposit.C) a municipal bond.D) federal funds.Answer: BAACSB: Analytical Thinking5) A short-term debt instrument issued by well-known corporations is calledA) commercial paper.B) corporate bonds.C) municipal bonds.D) commercial mortgages.Answer: AAACSB: Analytical Thinking6) ________ are short-term loans in which Treasury bills serve as collateral.A) Repurchase agreementsB) Negotiable certificates of depositC) Federal fundsD) U.S. government agency securitiesAnswer: AAACSB: Analytical Thinking7) Collateral is ________ the lender receives if the borrower does not pay back the loan.A) a liabilityB) an assetC) a presentD) an offeringAnswer: BAACSB: Analytical Thinking8) Federal funds areA) funds raised by the federal government in the bond market.B) loans made by the Federal Reserve System to banks.C) loans made by banks to the Federal Reserve System.D) loans made by banks to each other.Answer: DAACSB: Analytical Thinking9) An important source of short-term funds for commercial banks are ________ which can be resold on the secondary market.A) negotiable CDsB) commercial paperC) mortgage-backed securitiesD) municipal bondsAnswer: AAACSB: Application of Knowledge。

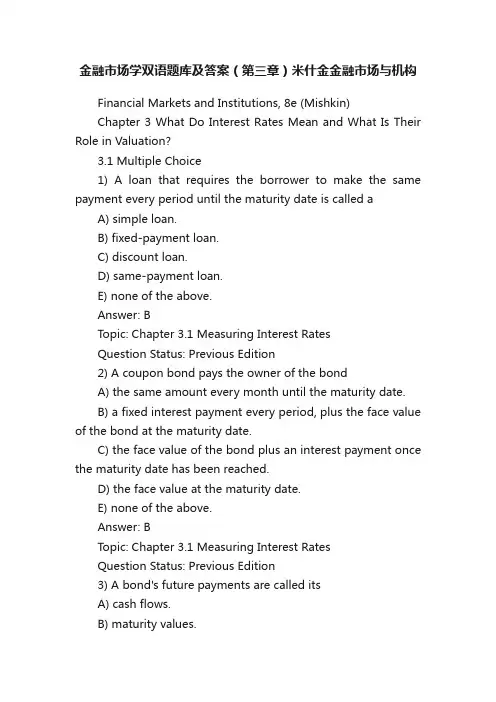

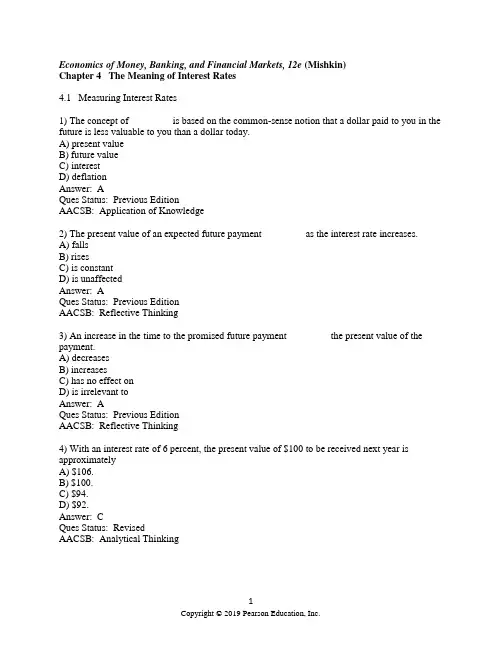

金融市场学双语题库及答案(第三章)米什金金融市场与机构Financial Markets and Institutions, 8e (Mishkin)Chapter 3 What Do Interest Rates Mean and What Is Their Role in Valuation?3.1 Multiple Choice1) A loan that requires the borrower to make the same payment every period until the maturity date is called aA) simple loan.B) fixed-payment loan.C) discount loan.D) same-payment loan.E) none of the above.Answer: BTopic: Chapter 3.1 Measuring Interest RatesQuestion Status: Previous Edition2) A coupon bond pays the owner of the bondA) the same amount every month until the maturity date.B) a fixed interest payment every period, plus the face value of the bond at the maturity date.C) the face value of the bond plus an interest payment once the maturity date has been reached.D) the face value at the maturity date.E) none of the above.Answer: BTopic: Chapter 3.1 Measuring Interest RatesQuestion Status: Previous Edition3) A bond's future payments are called itsA) cash flows.B) maturity values.C) discounted present values.D) yields to maturity.Answer: ATopic: Chapter 3.1 Measuring Interest RatesQuestion Status: Previous Edition4) A credit market instrument that pays the owner the face value of the security at the maturity date and nothing prior to then is called aA) simple loan.B) fixed-payment loan.C) coupon bond.D) discount bond.Answer: DTopic: Chapter 3.1 Measuring Interest Rates Question Status: Previous Edition5) (I) A simple loan requires the borrower to repay the principal at the maturity date along with an interest payment.(II) A discount bond is bought at a price below its face value, and the face value is repaid at the maturity date.A) (I) is true, (II) false.B) (I) is false, (II) true.C) Both are true.D) Both are false.Answer: CTopic: Chapter 3.1 Measuring Interest RatesQuestion Status: Previous Edition6) Which of the following are true of coupon bonds?A) The owner of a coupon bond receives a fixed interest payment every year until the maturity date, when the face or par value is repaid.B) U.S. Treasury bonds and notes are examples of coupon bonds.C) Corporate bonds are examples of coupon bonds.D) All of the above.E) Only A and B of the above.Answer: DTopic: Chapter 3.1 Measuring Interest RatesQuestion Status: Previous Edition7) Which of the following are generally true of all bonds?A) The longer a bond's maturity, the lower is the rate of return that occurs as a result of the increase in the interest rate.B) Even though a bond has a substantial initial interest rate, its return can turn out to be negative if interest rates rise.C) Prices and returns for long-term bonds are more volatile than those forshorter-term bonds.D) All of the above are true.E) Only A and B of the above are true.Answer: DTopic: Chapter 3.1 Measuring Interest RatesQuestion Status: Previous Edition8) (I) A discount bond requires the borrower to repay the principal at the maturity date plus an interest payment.(II) A coupon bond pays the lender a fixed interest payment every year until the maturity date, when a specified final amount (face or par value) is repaid.A) (I) is true, (II) false.B) (I) is false, (II) true.C) Both are true.D) Both are false.Answer: BTopic: Chapter 3.1 Measuring Interest RatesQuestion Status: Previous Edition9) If a $5,000 coupon bond has a coupon rate of 13 percent, then the coupon payment every year isA) $650.B) $1,300.C) $130.D) $13.E) None of the above.Answer: ATopic: Chapter 3.1 Measuring Interest RatesQuestion Status: Previous Edition10) An $8,000 coupon bond with a $400 annual coupon payment has a coupon rate ofA) 5 percent.B) 8 percent.C) 10 percent.D) 40 percent.Answer: ATopic: Chapter 3.1 Measuring Interest RatesQuestion Status: Previous Edition11) The concept of ________ is based on the notion that a dollar paid to you in the future is less valuable to you than a dollar today.A) present valueB) future valueC) interestD) deflationAnswer: ATopic: Chapter 3.1 Measuring Interest RatesQuestion Status: Previous Edition12) Dollars received in the future are worth ________ than dollars received today. The process of calculating what dollars received in the future are worth today is called ________.A) more; discountingB) less; discountingC) more; inflatingD) less; inflatingAnswer: BTopic: Chapter 3.1 Measuring Interest RatesQuestion Status: Previous Edition13) The process of calculating what dollars received in the future are worth today is calledA) calculating the yield to maturity.B) discounting the future.C) compounding the future.D) compounding the present.Answer: BTopic: Chapter 3.1 Measuring Interest RatesQuestion Status: Previous Edition14) With an interest rate of 5 percent, the present value of $100 received one year from now is approximatelyA) $100.B) $105.C) $95.D) $90.Answer: CTopic: Chapter 3.1 Measuring Interest RatesQuestion Status: Previous Edition15) With an interest rate of 10 percent, the present value ofa security that pays $1,100 next year and $1,460 four years from now is approximatelyA) $1,000.B) $2,000.C) $2,560.D) $3,000.Answer: BTopic: Chapter 3.1 Measuring Interest RatesQuestion Status: Previous Edition16) With an interest rate of 8 percent, the present value of $100 received one year from now is approximatelyA) $93.B) $96.C) $100.D) $108.Answer: ATopic: Chapter 3.1 Measuring Interest RatesQuestion Status: Previous Edition17) With an interest rate of 6 percent, the present value of $100 received one year from now is approximatelyA) $106.B) $100.C) $94.D) $92.Answer: CTopic: Chapter 3.1 Measuring Interest RatesQuestion Status: Previous Edition18) The interest rate that equates the present value of the cash flow received from a debt instrument with its market pricetoday is theA) simple interest rate.B) discount rate.C) yield to maturity.D) real interest rate.Answer: CTopic: Chapter 3.1 Measuring Interest RatesQuestion Status: Previous Edition19) The interest rate that financial economists consider to be the most accurate measure is theA) current yield.B) yield to maturity.C) yield on a discount basis.D) coupon rate.Answer: BTopic: Chapter 3.1 Measuring Interest RatesQuestion Status: Previous Edition20) Financial economists consider the ________ to be the most accurate measure of interest rates.A) simple interest rateB) discount rateC) yield to maturityD) real interest rateAnswer: CTopic: Chapter 3.1 Measuring Interest RatesQuestion Status: Previous Edition21) For a simple loan, the simple interest rate equals theA) real interest rate.B) nominal interest rate.C) current yield.D) yield to maturity.Answer: DTopic: Chapter 3.1 Measuring Interest RatesQuestion Status: Previous Edition22) For simple loans, the simple interest rate is ________ the yield to maturity.A) greater thanB) less thanC) equal toD) not comparable toAnswer: CTopic: Chapter 3.1 Measuring Interest RatesQuestion Status: Previous Edition23) The yield to maturity of a one-year, simple loan of $500 that requires an interest payment of $40 isA) 5 percent.B) 8 percent.C) 12 percent.D) 12.5 percent.Answer: BTopic: Chapter 3.1 Measuring Interest RatesQuestion Status: Previous Edition24) The yield to maturity of a one-year, simple loan of $400 that requires an interest payment of $50 isA) 5 percent.B) 8 percent.C) 12 percent.D) 12.5 percent.Answer: DTopic: Chapter 3.1 Measuring Interest RatesQuestion Status: Previous Edition25) A $10,000, 8 percent coupon bond that sells for $10,000 has a yield to maturity ofA) 8 percent.B) 10 percent.C) 12 percent.D) 14 percent.Answer: ATopic: Chapter 3.1 Measuring Interest RatesQuestion Status: Previous Edition26) A $10,000, 8 percent coupon bond that sells for $10,100 has a yield to maturity ________.A) equal to 8 percentB) greater than 8 percentC) less than 8 perfectD) that cannot be calculatedAnswer: CTopic: Chapter 3.1 Measuring Interest RatesQuestion Status: New Question27) Which of the following $1,000 face value securities has the highest yield to maturity?A) A 5 percent coupon bond selling for $1,000B) A 10 percent coupon bond selling for $1,000C) A 12 percent coupon bond selling for $1,000D) A 12 percent coupon bond selling for $1,100Answer: CTopic: Chapter 3.1 Measuring Interest RatesQuestion Status: Previous Edition28) Which of the following $1,000 face value securities has the highest yield to maturity?A) A 5 percent coupon bond selling for $1,000B) A 10 percent coupon bond selling for $1,000C) A 15 percent coupon bond selling for $1,000D) A 15 percent coupon bond selling for $900Answer: DTopic: Chapter 3.1 Measuring Interest RatesQuestion Status: Previous Edition29) Which of the following $1,000 face value securities has the lowest yield to maturity?A) A 5 percent coupon bond selling for $1,000B) A 7 percent coupon bond selling for $1,100C) A 15 percent coupon bond selling for $1,000D) A 15 percent coupon bond selling for $900Answer: BTopic: Chapter 3.1 Measuring Interest RatesQuestion Status: New Question30) Which of the following are true for a coupon bond?A) When the coupon bond is priced at its face value, the yield to maturity equals the coupon rate.B) The price of a coupon bond and the yield to maturity are negatively related.C) The yield to maturity is greater than the coupon rate when the bond price is below the par value.D) All of the above are true.E) Only A and B of the above are true.Answer: DTopic: Chapter 3.1 Measuring Interest Rates Question Status: Previous Edition31) Which of the following are true for a coupon bond?A) When the coupon bond is priced at its face value, the yieldto maturity equals the coupon rate.B) The price of a coupon bond and the yield to maturity are negatively related.C) The yield to maturity is greater than the coupon rate when the bond price is above the par value.D) All of the above are true.E) Only A and B of the above are true.Answer: ETopic: Chapter 3.1 Measuring Interest RatesQuestion Status: Previous Edition32) Which of the following are true for a coupon bond?A) When the coupon bond is priced at its face value, the yield to maturity equals the coupon rate.B) The price of a coupon bond and the yield to maturity are positively related.C) The yield to maturity is greater than the coupon rate when the bond price is above the par value.D) All of the above are true.E) Only A and B of the above are true.Answer: ATopic: Chapter 3.1 Measuring Interest RatesQuestion Status: Previous Edition33) A consol bond is a bond thatA) pays interest annually and its face value at maturity.B) pays interest in perpetuity and never matures.C) pays no interest but pays its face value at maturity.D) rises in value as its yield to maturity rises.Answer: BTopic: Chapter 3.1 Measuring Interest RatesQuestion Status: Previous Edition34) The yield to maturity on a consol bond that pays $100 yearly and sells for $500 isA) 5 percent.B) 10 percent.C) 12.5 percent.D) 20 percent.E) 25 percent.Answer: DTopic: Chapter 3.1 Measuring Interest RatesQuestion Status: Previous Edition35) The yield to maturity on a consol bond that pays $200 yearly and sells for $1000 isA) 5 percent.B) 10 percent.C) 20 percent.D) 25 percent.Answer: CTopic: Chapter 3.1 Measuring Interest RatesQuestion Status: Previous Edition36) A frequently used approximation for the yield to maturity on a long-term bond is theA) coupon rate.B) current yield.C) cash flow interest rate.D) real interest rate.Answer: BTopic: Chapter 3.1 Measuring Interest RatesQuestion Status: Previous Edition37) The current yield on a coupon bond is the bond's ________ divided by its________.A) annual coupon payment; priceB) annual coupon payment; face valueC) annual return; priceD) annual return; face valueAnswer: ATopic: Chapter 3.1 Measuring Interest RatesQuestion Status: Previous Edition38) When a bond's price falls, its yield to maturity ________ and its current yield________.A) falls; fallsB) rises; risesC) falls; risesD) rises; fallsAnswer: BTopic: Chapter 3.1 Measuring Interest RatesQuestion Status: Previous Edition39) The yield to maturity for a one-year discount bond equalsA) the increase in price over the year, divided by the initial price.B) the increase in price over the year, divided by the face value.C) the increase in price over the year, divided by the interest rate.D) none of the above.Answer: ATopic: Chapter 3.1 Measuring Interest Rates Question Status: Previous Edition40) If a $10,000 face value discount bond maturing in oneyear is selling for $8,000, then its yield to maturity isA) 10 percent.B) 20 percent.C) 25 percent.D) 40 percent.Answer: CTopic: Chapter 3.1 Measuring Interest RatesQuestion Status: Previous Edition41) If a $10,000 face value discount bond maturing in one year is selling for $9,000, then its yield to maturity is approximatelyA) 9 percent.B) 10 percent.C) 11 percent.D) 12 percent.Answer: CTopic: Chapter 3.1 Measuring Interest RatesQuestion Status: Previous Edition42) If a $10,000 face value discount bond maturing in one year is selling for $5,000, then its yield to maturity isA) 5 percent.B) 10 percent.C) 50 percent.D) 100 percent.Answer: DTopic: Chapter 3.1 Measuring Interest RatesQuestion Status: Previous Edition43) If a $5,000 face value discount bond maturing in one year is selling for $5,000, then its yield to maturity isA) 0 percent.B) 5 percent.C) 10 percent.D) 20 percent.Answer: ATopic: Chapter 3.1 Measuring Interest RatesQuestion Status: Previous Edition44) The Fisher equation states thatA) the nominal interest rate equals the real interest rate plus the expected rate of inflation.B) the real interest rate equals the nominal interest rate less the expected rate of inflation.C) the nominal interest rate equals the real interest rate less the expected rate of inflation.D) both A and B of the above are true.E) both A and C of the above are true.Answer: DTopic: Chapter 3.2 Distinction Between Real and Nominal Interest Rates Question Status: Previous Edition45) If you expect the inflation rate to be 15 percent next year and a one-year bond hasa yield to maturity of 7 percent, then the real interest rate on this bond isA) 7 percent.B) 22 percent.C) -15 percent.D) -8 percent.E) none of the above.Answer: DTopic: Chapter 3.2 Distinction Between Real and Nominal Interest Rates Question Status: Previous Edition46) If you expect the inflation rate to be 5 percent next year and a one-year bond has a yield to maturity of 7 percent, then the real interest rate on this bond isA) -12 percent.B) -2 percent.C) 2 percent.D) 12 percent.Answer: CTopic: Chapter 3.2 Distinction Between Real and Nominal Interest Rates Question Status: Previous Edition47) The nominal interest rate minus the expected rate of inflationA) defines the real interest rate.B) is a better measure of the incentives to borrow and lend than the nominal interest rate.C) is a more accurate indicator of the tightness of credit market conditions than the nominal interest rate.D) all of the above.E) only A and B of the above.Answer: DTopic: Chapter 3.2 Distinction Between Real and Nominal Interest RatesQuestion Status: Previous Edition48) The nominal interest rate minus the expected rate of inflationA) defines the real interest rate.B) is a less accurate measure of the incentives to borrow and lend than is the nominal interest rate.C) is a less accurate indicator of the tightness of credit market conditions than is the nominal interest rate.D) defines the discount rate.Answer: ATopic: Chapter 3.2 Distinction Between Real and Nominal Interest Rates Question Status: Previous Edition49) In which of the following situations would you prefer to be making a loan?A) The interest rate is 9 percent and the expected inflation rate is 7 percent.B) The interest rate is 4 percent and the expected inflation rate is 1 percent.C) The interest rate is 13 percent and the expected inflation rate is 15 percent.D) The interest rate is 25 percent and the expected inflation rate is 50 percent. Answer: BTopic: Chapter 3.2 Distinction Between Real and Nominal Interest Rates Question Status: Previous Edition50) In which of the following situations would you prefer to be borrowing?A) The interest rate is 9 percent and the expected inflation rate is 7 percent.B) The interest rate is 4 percent and the expected inflation rate is 1 percent.C) The interest rate is 13 percent and the expected inflation rate is 15 percent.D) The interest rate is 25 percent and the expected inflation rate is 50 percent. Answer: DTopic: Chapter 3.2 Distinction Between Real and Nominal Interest Rates Question Status: Previous Edition51) What is the return on a 5 percent coupon bond that initially sells for $1,000 and sells for $1,200 one year later?A) 5 percentB) 10 percentC) -5 percentD) 25 percentE) None of the aboveAnswer: DTopic: Chapter 3.3 Distinction Between Interest Rates and ReturnsQuestion Status: Previous Edition52) What is the return on a 5 percent coupon bond that initially sells for $1,000 and sells for $900 one year later?A) 5 percentB) 10 percentC) -5 percentD) -10 percentE) None of the aboveAnswer: CTopic: Chapter 3.3 Distinction Between Interest Rates and ReturnsQuestion Status: Previous Edition53) The return on a 5 percent coupon bond that initially sells for $1,000 and sells for $1,100 one year later isA) 5 percent.B) 10 percent.C) 14 percent.D) 15 percent.Answer: DTopic: Chapter 3.3 Distinction Between Interest Rates and ReturnsQuestion Status: Previous Edition54) The return on a 10 percent coupon bond that initially sells for $1,000 and sells for $900 one year later isA) -10 percent.B) -5 percent.C) 0 percent.D) 5 percent.Answer: CTopic: Chapter 3.3 Distinction Between Interest Rates and ReturnsQuestion Status: Previous Edition55) Which of the following are generally true of all bonds?A) The only bond whose return equals the initial yield to maturity is one whose time to maturity is the same as the holding period.B) A rise in interest rates is associated with a fall in bond prices, resulting in capital losses on bonds whose term to maturities are longer than the holding period.C) The longer a bond's maturity, the greater is the price change associated with a given interest rate change.D) All of the above are true.E) Only A and B of the above are true.Answer: DTopic: Chapter 3.3 Distinction Between Interest Rates and ReturnsQuestion Status: Previous Edition56) Which of the following are true concerning the distinction between interest rates and return?A) The rate of return on a bond will not necessarily equal the interest rate on that bond.B) The return can be expressed as the sum of the current yieldand the rate of capital gains.C) The rate of return will be greater than the interest rate when the price of the bond falls between time t and time t + 1.D) All of the above are true.E) Only A and B of the above are true.Answer: ETopic: Chapter 3.3 Distinction Between Interest Rates and ReturnsQuestion Status: Previous Edition57) If the interest rates on all bonds rise from 5 to 6 percent over the course of the year, which bond would you prefer to have been holding?A) A bond with one year to maturityB) A bond with five years to maturityC) A bond with ten years to maturityD) A bond with twenty years to maturityAnswer: ATopic: Chapter 3.3 Distinction Between Interest Rates and ReturnsQuestion Status: Previous Edition58) Suppose you are holding a 5 percent coupon bond maturing in one year with a yield to maturity of 15 percent. If the interest rate on one-year bonds rises from 15 percent to 20 percent over the course of the year, what is the yearly return on the bond you are holding?A) 5 percentB) 10 percentC) 15 percentD) 20 percentAnswer: CTopic: Chapter 3.3 Distinction Between Interest Rates and ReturnsQuestion Status: Previous Edition59) (I) Prices of longer-maturity bonds respond more dramatically to changes in interest rates.(II) Prices and returns for long-term bonds are less volatile than those for short-term bonds.A) (I) is true, (II) false.B) (I) is false, (II) true.C) Both are true.D) Both are false.Answer: A。

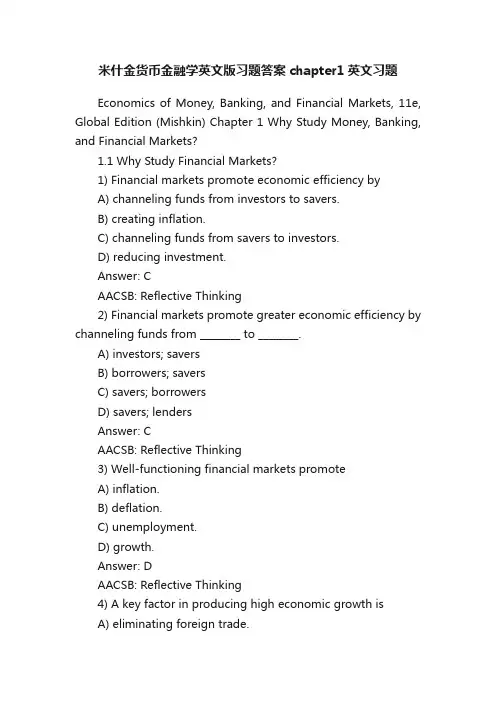

米什金货币金融学英文版习题答案chapter1英文习题Economics of Money, Banking, and Financial Markets, 11e, Global Edition (Mishkin) Chapter 1 Why Study Money, Banking, and Financial Markets?1.1 Why Study Financial Markets?1) Financial markets promote economic efficiency byA) channeling funds from investors to savers.B) creating inflation.C) channeling funds from savers to investors.D) reducing investment.Answer: CAACSB: Reflective Thinking2) Financial markets promote greater economic efficiency by channeling funds from ________ to ________.A) investors; saversB) borrowers; saversC) savers; borrowersD) savers; lendersAnswer: CAACSB: Reflective Thinking3) Well-functioning financial markets promoteA) inflation.B) deflation.C) unemployment.D) growth.Answer: DAACSB: Reflective Thinking4) A key factor in producing high economic growth isA) eliminating foreign trade.B) well-functioning financial markets.C) high interest rates.D) stock market volatility.Answer: BAACSB: Reflective Thinking5) Markets in which funds are transferred from those who have excess funds available to those who have a shortage of available funds are calledA) commodity markets.B) fund-available markets.C) derivative exchange markets.D) financial markets.Answer: DAACSB: Application of Knowledge6) ________ markets transfer funds from people who have an excess of available funds to people who have a shortage.A) CommodityB) Fund-availableC) FinancialD) Derivative exchangeAnswer: CAACSB: Application of Knowledge7) Poorly performing financial markets can be the cause ofA) wealth.B) poverty.C) financial stability.D) financial expansion.Answer: BAACSB: Reflective Thinking8) The bond markets are important because they areA) easily the most widely followed financial markets in the United States.B) the markets where foreign exchange rates are determined.C) the markets where interest rates are determined.D) the markets where all borrowers get their funds.Answer: CAACSB: Reflective Thinking9) The price paid for the rental of borrowed funds (usually expressed as a percentage of the rental of $100 per year) is commonly referred to as theA) inflation rate.B) exchange rate.C) interest rate.D) aggregate price level.Answer: CAACSB: Application of Knowledge10) Compared to interest rates on long-term U.S. government bonds, interest rates on three-month Treasury bills fluctuate ________ and are ________ on average.A) more; lowerB) less; lowerC) more; higherD) less; higherAnswer: AAACSB: Reflective Thinking11) The interest rate on Baa corporate bonds is ________, on average, than interest rates on Treasuries, and the spread between these rates became ________ in the 1970s.A) lower; smallerB) lower; largerC) higher; smallerD) higher; largerAnswer: DAACSB: Reflective Thinking12) Everything else held constant, a decline in interest rates will cause spending on housing toA) fall.B) remain unchanged.C) either rise, fall, or remain the same.D) rise.Answer: DAACSB: Analytical Thinking13) High interest rates might ________ purchasing a house or car but at the same time high interest rates might ________ saving.A) discourage; encourageB) discourage; discourageC) encourage; encourageD) encourage; discourageAnswer: AAACSB: Analytical Thinking14) An increase in interest rates might ________ saving because more can be earned in interest income.A) encourageB) discourageC) disallowD) invalidateAnswer: AAACSB: Analytical Thinking15) Everything else held constant, an increase in interest rates on student loansA) increases the cost of a college education.B) reduces the cost of a college education.C) has no effect on educational costs.D) increases costs for students with no loans.Answer: AAACSB: Analytical Thinking16) High interest rates might cause a corporation to ________ building a new plant that would provide more jobs.A) completeB) considerC) postponeD) contemplateAnswer: CAACSB: Analytical Thinking17) The stock market isA) where interest rates are determined.B) the most widely followed financial market in the United States.C) where foreign exchange rates are determined.D) the market where most borrowers get their funds.Answer: BAACSB: Reflective Thinking18) Stock prices areA) relatively stable trending upward at a steady pace.B) relatively stable trending downward at a moderate rate.C) extremely volatile.D) unstable trending downward at a moderate rate.Answer: CAACSB: Reflective Thinking19) A rising stock market index due to higher share pricesA) increases people's wealth, but is unlikely to increase their willingness to spend.B) increases people's wealth and as a result may increase their willingness to spend.C) decreases the amount of funds that business firms can raise by selling newly-issued stock.D) decreases people's wealth, but is unlikely to increase their willingness to spend. Answer: BAACSB: Analytical Thinking20) When stock prices fallA) an individual's wealth is not affected nor is their willingness to spend.B) a business firm will be more likely to sell stock to finance investment spending.C) an individual's wealth may decrease but their willingness to spend is not affected.D) an individual's wealth may decrease and their willingness to spend may decrease. Answer: DAACSB: Analytical Thinking21) Changes in stock pricesA) do not affect people's wealth and their willingness to spend.B) affect firms' decisions to sell stock to finance investment spending.C) occur in regular patterns.D) are unimportant to decision makers.Answer: BAACSB: Reflective Thinking22) An increase in stock prices ________ the size of people's wealth and may ________ their willingness to spend, everythingelse held constant.A) increases; increaseB) increases; decreaseC) decreases; increaseD) decreases; decreaseAnswer: AAACSB: Analytical Thinking23) Low stock market prices might ________ consumers’ willingness to spend and might________ businesses willingness to undertake investment projects.A) increase; increaseB) increase; decreaseC) decrease; decreaseD) decrease; increaseAnswer: CAACSB: Analytical Thinking24) Fear of a major recession causes stock prices to fall, everything else held constant, which in turn causes consumer spending toA) increase.B) remain unchanged.C) decrease.D) cannot be determined.Answer: CAACSB: Reflective Thinking25) A share of common stock is a claim on a corporation'sA) debt.B) liabilities.C) expenses.D) earnings and assets.Answer: DAACSB: Application of Knowledge26) On ________, October 19, 1987, the stock market experienced its worst one-day drop in its entire history with the DJIA falling by 22%.A) "Terrible Tuesday"B) "Woeful Wednesday"C) "Freaky Friday"D) "Black Monday"Answer: DAACSB: Application of Knowledge27) The decline in stock prices from 2000 through 2002A) increased individuals' willingness to spend.B) had no effect on individual spending.C) reduced individuals' willingness to spend.D) increased individual wealth.Answer: CAACSB: Analytical Thinking28) The Dow reached a peak of over 11,000 before the collapse of the ________ bubble in 2000.A) housingB) manufacturingC) high-techD) bankingAnswer: CAACSB: Application of Knowledge29) When I purchase a corporate ________, I am lending the corporation funds for a specific time. When I purchase a corporation's ________, I become an owner in the corporation.A) bond; stockB) stock; bondC) stock; debt securityD) bond; debt securityAnswer: AAACSB: Application of Knowledge30) What is a stock? How do stocks affect the economy?Answer: A stock represents a share of ownership of a corporation, or a claim on a firm's earnings/assets. Stocks are part of wealth, and changes in their value affect people's willingness to spend. Changes in stock prices affect a firm's ability to raise funds, and thus their investment. AACSB: Application of Knowledge31) Why is it important to understand the bond market?Answer: The bond market supports economic activity by enabling the government and corporations to borrow to undertake their projects and it is the market where interest rates are determined.AACSB: Application of Knowledge1.2 Why Study Financial Institutions and Banking?1) Channeling funds from individuals with surplus funds to those desiring funds when the saver does not purchase the borrower's security is known asA) barter.B) redistribution.C) financial intermediation.D) taxation.Answer: CAACSB: Application of Knowledge2) A financial crisis isA) not possible in the modern financial environment.B) a major disruption in the financial markets.C) a feature of developing economies only.D) typically followed by an economic boom.Answer: BAACSB: Application of Knowledge3) Banks are important to the study of money and the economy because theyA) channel funds from investors to savers.B) have been a source of rapid financial innovation.C) are the only important financial institution in the U.S. economy.D) create inflation.Answer: BAACSB: Reflective Thinking4) BanksA) provide a channel for linking those who want to save with those who want to invest.B) produce nothing of value and are therefore a drain on society's resources.C) are the only financial institutions allowed to give loans.D) hold very little of the average American's wealth.Answer: AAACSB: Reflective Thinking5) Banks, savings and loan associations, mutual savings banks, and credit unionsA) are no longer important players in financial intermediation.B) since deregulation now provide services only to small depositors.C) have been adept at innovating in response to changes in the regulatory environment.D) produce nothing of value and are therefore a drain on society's resources.Answer: CAACSB: Reflective Thinking6) Financial institutions search for ________ has resulted in many financial innovations.A) higher profitsB) regulationsC) respectD) higher riskAnswer: AAACSB: Application of Knowledge7) Banks and other financial institutions engage in financial intermediation, whichA) can hurt the performance of the economy.B) can benefit economic performance.C) has no effect on economic performance.D) involves borrowing from investors and lending to savers.Answer: BAACSB: Reflective Thinking8) Financial institutions that accept deposits and make loans are calledA) exchanges.B) banks.C) over-the-counter markets.D) finance companies.Answer: BAACSB: Application of Knowledge9) The financial intermediaries that the average person interacts with most frequently areA) exchanges.B) over-the-counter markets.C) finance companies.D) banks.Answer: DAACSB: Application of Knowledge10) Which of the following is NOT a financial institution?A) A life insurance companyB) A pension fundC) A credit unionD) A business collegeAnswer: DAACSB: Application of Knowledge11) The delivery of financial services electronically is calledA) e-business.B) e-commerce.C) e-finance.D) e-possible.Answer: CAACSB: Information Technology12) What crucial role do financial intermediaries perform in an economy?Answer: Financial intermediaries borrow funds from people who have saved and make loans to other individuals and businesses and thus improve the efficiency of the economy.AACSB: Reflective Thinking1.3 Why Study Money and Monetary Policy?1) Money is defined asA) bills of exchange.B) anything that is generally accepted in payment for goods and services or in the repayment of debt.C) a risk-free repository of spending power.D) the unrecognized liability of governments.Answer: BAACSB: Application of Knowledge2) The upward and downward movement of aggregate output produced in the economy is referred to as theA) roller coaster.B) see saw.C) business cycle.D) shock wave.Answer: CAACSB: Application of Knowledge3) Sustained downward movements in the business cycle are referred to asA) inflation.B) recessions.C) economic recoveries.D) expansions.Answer: BAACSB: Application of Knowledge4) During a recession, output declines result inA) lower unemployment in the economy.B) higher unemployment in the economy.C) no impact on the unemployment in the economy.D) higher wages for the workers.Answer: BAACSB: Analytical Thinking5) Prior to almost all recessions since 1950, there has been a drop inA) inflation.B) the money stock.C) the growth rate of the money stock.D) interest rates.Answer: CAACSB: Application of Knowledge6) Evidence from business cycle fluctuations in the United States indicates thatA) a negative relationship between money growth and general economic activity exists.B) recessions are usually preceded by declines in bond prices.C) recessions are usually preceded by dollar depreciation.D) recessions are usually preceded by a decline in the growth rate of money.Answer: DAACSB: Reflective Thinking7) ________ theory relates the quantity of money and monetary policy to changes in aggregate economic activity and inflation.A) MonetaryB) FiscalC) FinancialD) SystemicAnswer: AAACSB: Application of Knowledge8) A continuing increase in the growth of the money supply is likely followed byA) a recession.B) a depression.C) an increase in the price level.D) no change in the economy.Answer: CAACSB: Reflective Thinking9) It is true that inflation is aA) continuous increase in the money supply.B) continuous fall in prices.C) decline in interest rates.D) continually rising price level.Answer: DAACSB: Application of Knowledge10) Which of the following is a TRUE statement?A) Money or the money supply is defined as Federal Reserve notes.B) The average price of goods and services in an economy is called the aggregate price level.C) The inflation rate is measured as the rate of change in the federal government budget deficit.D) The aggregate price level is measured as the rate of change in the inflation rate.Answer: BAACSB: Application of Knowledge11) If the prices would have been much higher ten years ago for the items the average consumer purchased last month, then one can likely conclude thatA) the aggregate price level has declined during this ten-year period.B) the average inflation rate for this ten-year period has been positive.C) the average rate of money growth for this ten-year period has been positive.D) the aggregate price level has risen during this ten-year period.Answer: AAACSB: Analytical Thinking12) From 1950-2014 the price level in the United States increased more thanA) twofold.B) threefold.C) sixfold.D) tenfold.Answer: DAACSB: Reflective Thinking13) Complete Milton Friedman's famous statement, "Inflation is always and everywhere a________ phenomenon."A) recessionaryB) discretionaryC) repressionaryD) monetaryAnswer: DAACSB: Application of Knowledge14) There is a ________ association between inflation and the growth rate of money ________.A) positive; demandB) positive; supplyC) negative; demandD) negative; supplyAnswer: BAACSB: Application of Knowledge15) Evidence from the United States and other foreign countries indicates thatA) there is a strong positive association between inflation and growth rate of money over long periods of time.B) there is little support for the assertion that "inflation is always and everywhere a monetary phenomenon."C) countries with low monetary growth rates tend to experience higher rates of inflation, all else being constant.D) money growth is clearly unrelated to inflation.Answer: AAACSB: Reflective Thinking16) Countries that experience very high rates of inflation may also haveA) balanced budgets.B) rapidly growing money supplies.C) falling money supplies.D) constant money supplies.Answer: BAACSB: Reflective Thinking17) Between 1950 and 1980 in the U.S., interest rates trended upward. During this same time periodA) the rate of money growth declined.B) the rate of money growth increased.C) the government budget deficit (expressed as a percentage of GNP) trended downward.D) the aggregate price level declined quite dramatically.Answer: BAACSB: Reflective Thinking18) The management of money and interest rates is called________ policy and is conducted bya nation's ________ bank.A) monetary; superiorB) fiscal; superiorC) fiscal; centralD) monetary; centralAnswer: DAACSB: Application of Knowledge19) The organization responsible for the conduct of monetary policy in the United States is theA) Comptroller of the Currency.B) U.S. Treasury.C) Federal Reserve System.D) Bureau of Monetary Affairs.Answer: CAACSB: Application of Knowledge20) ________ policy involves decisions about government spending and taxation.A) MonetaryB) FiscalC) FinancialD) SystemicAnswer: BAACSB: Application of Knowledge21) When tax revenues are greater than government expenditures, the government has a budgetA) crisis.B) deficit.C) surplus.D) revision.AACSB: Application of Knowledge22) A budget ________ occurs when government expenditures exceed tax revenues for a particular time period.A) deficitB) surplusC) surgeD) surfeitAnswer: AAACSB: Application of Knowledge23) Budgets deficits can be a concern because they mightA) ultimately lead to higher inflation.B) lead to lower interest rates.C) lead to a slower rate of money growth.D) lead to higher bond prices.Answer: AAACSB: Reflective Thinking24) Budget deficits are important because deficitsA) cause bank failures.B) always cause interest rates to fall.C) can result in higher rates of monetary growth.D) always cause prices to fall.Answer: CAACSB: Reflective Thinking25) When a budget deficit occurs in the United States, the U.S. Treasury finances this deficit byA) borrowing.B) imposing a moratorium of new government spending.C) increasing the tax rate.D) printing more dollars.AACSB: Application of Knowledge26) What happens to economic growth and unemployment during a business cycle recession? What is the relationship between the money growth rate and a business cycle recession? Answer: During a recession, output declines and unemployment increases. Prior to almost every recession in the U.S. the money growth rate has declined; however, not every decline is followed by a recession.AACSB: Reflective Thinking1.4 Why Study International Finance?1) American companies can borrow fundsA) only in U.S. financial markets.B) only in foreign financial markets.C) in both U.S. and foreign financial markets.D) only from the U.S. government.Answer: CAACSB: Diverse and multicultural work environments2) The price of one country's currency in terms of another country's currency is called theA) exchange rate.B) interest rate.C) Dow Jones industrial average.D) prime rate.Answer: AAACSB: Application of Knowledge3) The market where one currency is converted into another currency is called the ________ market.A) stockB) bondC) derivativesD) foreign exchangeAnswer: DAACSB: Application of Knowledge4) Everything else constant, a stronger dollar will mean thatA) vacationing in England becomes more expensive.B) vacationing in England becomes less expensive.C) French cheese becomes more expensive.D) Japanese cars become more expensive.Answer: BAACSB: Analytical Thinking5) Which of the following is most likely to result from a stronger dollar?A) U.S. goods exported aboard will cost less in foreign countries, and so foreigners will buy more of them.B) U.S. goods exported aboard will cost more in foreign countries and so foreigners will buy more of them.C) U.S. goods exported abroad will cost more in foreign countries, and so foreigners will buy fewer of them.D) Americans will purchase fewer foreign goods.Answer: CAACSB: Diverse and multicultural work environments6) Everything else held constant, a weaker dollar will likely hurtA) textile exporters in South Carolina.B) wheat farmers in Montana that sell domestically.C) automobile manufacturers in Michigan that use domestically produced inputs.D) furniture importers in California.Answer: DAACSB: Diverse and multicultural work environments7) Everything else held constant, a stronger dollar benefits ________ and hurts ________.A) American businesses; American consumersB) American businesses; foreign businessesC) American consumers; American businessesD) foreign businesses; American consumersAnswer: CAACSB: Diverse and multicultural work environments8) From 1980 to early 1985 the dollar ________ in value, thereby benefiting American________.A) appreciated; consumersB) appreciated, businessesC) depreciated; consumersD) depreciated, businessesAnswer: AAACSB: Diverse and multicultural work environments9) From 1980 to 1985 the dollar appreciated relative to the British pound. Holding everything else constant, one would expect that, when compared to 1980A) fewer Britons traveled to the United States in 1985.B) Britons imported more wine from California in 1985.C) Americans exported more wheat to England in 1985.D) more Britons traveled to the United States in 1985.Answer: AAACSB: Diverse and multicultural work environments10) When in 1985 a British pound cost approximately $1.30,a Shetland sweater that cost 100 British pounds would have cost $130. With a weaker dollar, the same Shetland sweater wouldhave costA) less than $130.B) more than $130.C) $130, since the exchange rate does not affect the prices that American consumers pay for foreign goods.D) $130, since the demand for Shetland sweaters will decrease to prevent an increase in price due to the stronger dollar.Answer: BAACSB: Diverse and multicultural work environments11) Everything else held constant, a decrease in the value of the dollar relative to all foreign currencies means that the price of foreign goods purchased by AmericansA) increases.B) decreases.C) remains unchanged.D) either increases, decreases, or remains unchanged.Answer: AAACSB: Diverse and multicultural work environments12) American farmers who sell beef to Europe benefit most fromA) a decrease in the dollar price of euros.B) an increase in the dollar price of euros.C) a constant dollar price for euros.D) a European ban on imports of American beef.Answer: BAACSB: Diverse and multicultural work environments13) If the price of a euro (the European currency) increases from $1.00 to $1.10, then, everything else held constantA) a European vacation becomes less expensive.B) a European vacation becomes more expensive.C) the cost of a European vacation is not affected.D) foreign travel becomes impossible.Answer: BAACSB: Application of Knowledge14) Everything else held constant, Americans who love French wine benefit most fromA) a decrease in the dollar price of euros.B) an increase in the dollar price of euros.C) a constant dollar price for euros.D) a ban on imports from Europe.Answer: AAACSB: Application of Knowledge15) From 2000 to 2014, the dollar depreciated substantially against other currencies. This drop in value most likely benefittedA) European citizens traveling in the U.S.B) U.S. citizens traveling in Europe.C) U.S. manufacturers importing parts from abroad.D) U.S. citizens purchasing foreign-made automobiles.Answer: AAACSB: Application of Knowledge16) From 1980-1985, the dollar strengthened in value against other currencies. Who was helped and who was hurt by this strong dollar?Answer: American consumers benefitted because imports were cheaper and consumers could purchase more. American businesses and workers in those businesses were hurt as domestic and foreign sales of American products fell.AACSB: Reflective Thinking1.5 How We Will Study Money, Banking, and Financial Markets1) The basic concepts used in the analytic framework of this text include all of the following EXCEPTA) the not-for-profit nature of most financial institutions.B) a basic supply and demand analysis to explain the behavior of financial markets.C) an approach to financial structure based on transaction costs and asymmetric information.D) the concept of equilibrium.Answer: AAACSB: Application of Knowledge2) Using a unified analytic framework to present the information in the text keeps the knowledgeA) focused on theories that have little to do with actual behavior.B) theoretical and uninteresting.C) abstract and not applicable to real life.D) from becoming obsolete.Answer: DAACSB: Application of Knowledge1.6 Appendix: Defining Aggregate Output, Income, the Price Level, and the Inflation Rate1) The most comprehensive measure of aggregate output isA) gross domestic product.B) net national product.C) the stock value of the industrial 500.D) national income.Answer: AAACSB: Application of Knowledge2) The gross domestic product is theA) the value of all wealth in an economy.B) the value of all goods and services sold to other nations in a year.C) the market value of all final goods and services produced in an economy in a year.D) the market value of all intermediate goods and services produced in an economy in a year. Answer: CAACSB: Application of Knowledge3) Which of the following items are NOT counted in U.S. GDP?A) your purchase of a new Ford MustangB) your purchase of new tires for your old carC) GM's purchase of tires for new carsD) a foreign consumer's purchase of a new Ford MustangAnswer: CAACSB: Reflective Thinking4) If an economy has aggregate output of $20 trillion, then aggregate income isA) $10 trillion.B) $20 trillion.C) $30 trillion.D) $40 trillion.Answer: BAACSB: Analytical Thinking5) When the total value of final goods and services is calculated using current prices, the resulting measure is referred to asA) real GDP.B) the GDP deflator.C) nominal GDP.D) the index of leading indicators.Answer: CAACSB: Application of Knowledge6) Nominal GDP is output measured in ________ prices while real GDP is output measured in ________ prices.A) current; currentB) current; fixedC) fixed; fixedD) fixed; currentAnswer: BAACSB: Application of Knowledge7) GDP measured with constant prices is referred to asA) real GDP.B) nominal GDP.C) the GDP deflator.D) industrial production.Answer: AAACSB: Application of Knowledge8) If your nominal income in 2014 was $50,000, and prices doubled between 2014 and 2017, to have the same real income, your nominal income in 2017 must beA) $50,000.B) $75,000.C) $90,000.D) $100,000.Answer: DAACSB: Analytical Thinking9) If your nominal income in 2014 is $50,000, and prices increase by 50% between 2014 and 2017, then to have the same real income, your nominal income in 2017 must beA) $50,000.B) $75,000.。

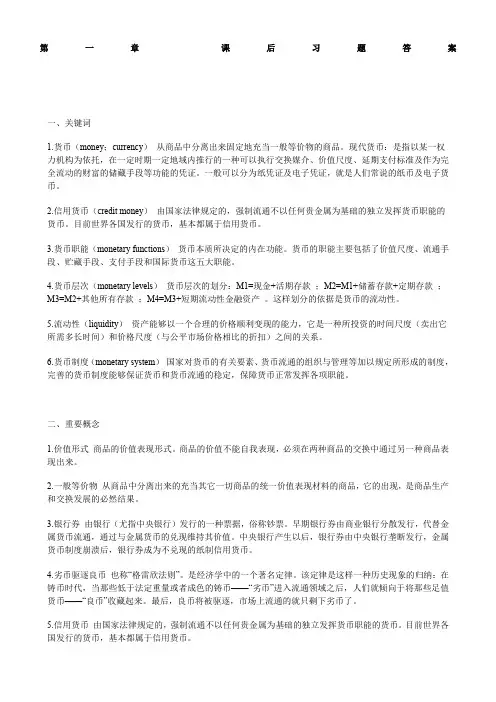

第一章课后习题答案一、关键词1.货币(money;currency)从商品中分离出来固定地充当一般等价物的商品。

现代货币:是指以某一权力机构为依托,在一定时期一定地域内推行的一种可以执行交换媒介、价值尺度、延期支付标准及作为完全流动的财富的储藏手段等功能的凭证。

一般可以分为纸凭证及电子凭证,就是人们常说的纸币及电子货币。

2.信用货币(credit money)由国家法律规定的,强制流通不以任何贵金属为基础的独立发挥货币职能的货币。

目前世界各国发行的货币,基本都属于信用货币。

3.货币职能(monetary functions)货币本质所决定的内在功能。

货币的职能主要包括了价值尺度、流通手段、贮藏手段、支付手段和国际货币这五大职能。

4.货币层次(monetary levels)货币层次的划分:M1=现金+活期存款;M2=M1+储蓄存款+定期存款;M3=M2+其他所有存款;M4=M3+短期流动性金融资产。

这样划分的依据是货币的流动性。

5.流动性(liquidity)资产能够以一个合理的价格顺利变现的能力,它是一种所投资的时间尺度(卖出它所需多长时间)和价格尺度(与公平市场价格相比的折扣)之间的关系。

6.货币制度(monetary system)国家对货币的有关要素、货币流通的组织与管理等加以规定所形成的制度,完善的货币制度能够保证货币和货币流通的稳定,保障货币正常发挥各项职能。

二、重要概念1.价值形式商品的价值表现形式。

商品的价值不能自我表现,必须在两种商品的交换中通过另一种商品表现出来。

2.一般等价物从商品中分离出来的充当其它一切商品的统一价值表现材料的商品,它的出现,是商品生产和交换发展的必然结果。

3.银行券由银行(尤指中央银行)发行的一种票据,俗称钞票。

早期银行券由商业银行分散发行,代替金属货币流通,通过与金属货币的兑现维持其价值。

中央银行产生以后,银行券由中央银行垄断发行,金属货币制度崩溃后,银行券成为不兑现的纸制信用货币。