财务会计学4(1)

- 格式:ppt

- 大小:684.50 KB

- 文档页数:64

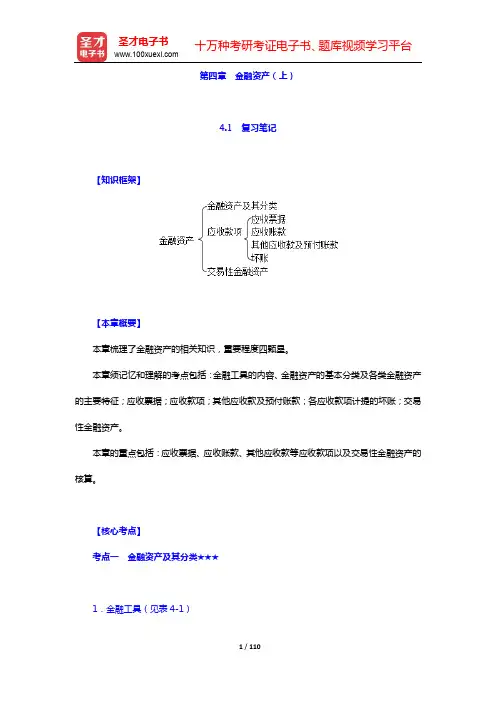

第四章金融资产(上)4.1 复习笔记【知识框架】【本章概要】本章梳理了金融资产的相关知识,重要程度四颗星。

本章须记忆和理解的考点包括:金融工具的内容、金融资产的基本分类及各类金融资产的主要特征;应收票据;应收款项;其他应收款及预付账款;各应收款项计提的坏账;交易性金融资产。

本章的重点包括:应收票据、应收账款、其他应收款等应收款项以及交易性金融资产的核算。

【核心考点】考点一金融资产及其分类★★★1.金融工具(见表4-1)表4-1 金融工具2.金融资产定义金融资产是指企业持有的货币资金、持有其他企业的权益工具,以及符合下列任一条件的资产:(1)从其他方收取现金或其他金融资产的权利。

(2)在潜在有利条件下,与其他方交换金融资产或金融负债的合同权利。

(3)将来须用或可用企业自身权益工具进行结算的非衍生工具合同,且企业根据该合同将收到可变数量的自身权益工具。

(4)将来须用或可用企业自身权益工具进行结算的衍生工具合同(不包括以固定数量的自身权益工具交换固定金额的现金或其他金融资产的衍生工具合同)。

考点二应收款项★★★★1.应收票据(见表4-2)表4-2 应收票据2.应收账款应收账款是指企业因销售商品、提供服务等经营活动,应向购货单位或接受劳务单位收取的价款,增值税销项税额,以及代购货单位垫付的包装费、运杂费等。

【说明】不单独设置“预收账款”科目的企业,预收的账款也可以在“应收账款”科目核算。

如果应收账款期末余额在贷方,则为企业预收的款项。

【注意】在销售业务中,发生的商业折扣影响应收账款的入账价值;而现金折扣情况下,我国规定企业应当按照总价法入账,实际发生的现金折扣,计入当期财务费用,不影响应收账款的入账价值。

3.其他应收款其他应收款的主要内容①应收的各种赔款、罚款,如因企业财产等遭受意外损失而应向有关保险公司收取的赔款等。

②应收的出租包装物租金。

③应向职工收取的各种垫付款项,如为职工垫付的水电费、应由职工负担的医药费、房租费等。

2024年财务会计学习心得体会范本财务会计是现代企业的一项重要的基础性工作,由于投资者关注的是企业价值的创造和增加,而企业价值是由未来自由现金流量和必要报酬率决定的,财务会计通过一系列会计程序,用现金流量和盈利两个会计信息为管理层提供决策有用的信息,所以财务会计学是侧重于决策时对技术与方法的应用。

一、要学习好财务会计学,我觉得可以从以下几方面考虑:(1)财务会计学作为一门操作性较强的学科、每一笔会计业务处理和会计方法的选择都离不开基本理论的指导。

为此,要求我们首先要熟悉基本会计准则,正确理解会计核算的一般原则,并在每一会计业务处理时遵循一般原则的要求。

(2)财务会计学的学习,必须力求总结和应用相关技巧,使之更加便于理解和掌握。

学习时应充分利用知识的关联性,通过分析实质,找出核心要点。

所谓核心要点,就是相关知识的相同点和区别点。

在财务会计学中,财产物资的报废业务、批发企业和零售企业有关业务的核算和现金流量表的编制等内容,均可通过找出核心要点的方法,精炼其繁杂的内容。

(3)通常可利用账务处理程序图,使复杂的问题变得简单、直观、明了。

如在学习委托加工物资、包装物出租出借、低值易耗品的报废、固定资产出售、报废、毁损、短期借款以及长期借款等内容时,利用账务处理程序图的方法进行描述,即可清晰地勾勒出其核算程序。

二、对财务会计的理论学习体会在学习《基础会计》时,主要学习了会计的基本原理。

如资金平衡原理:收入-费用____利润;资产____负债+所有者权益+(收入-费用);会计科目和会计帐户的设置以及复式记账法,等等。

财务会计的学习就是在以上的基础上进行的。

通过对总论的学习,我们知道企业财务会计的目标主要是以对外提供财务报告的形式满足有关方面的决策对企业会计信息的需求。

要实现这一目标,关键是保证财务报告的质量,因此需要有专门的会计规范。

(一)关于货币资金中现金与银行存款管理的认识以前,我们从日常的生活中就知道有会计和出纳这样的职业,也在银行遇到过这类人拿着一大笔钱在银行办理业务。

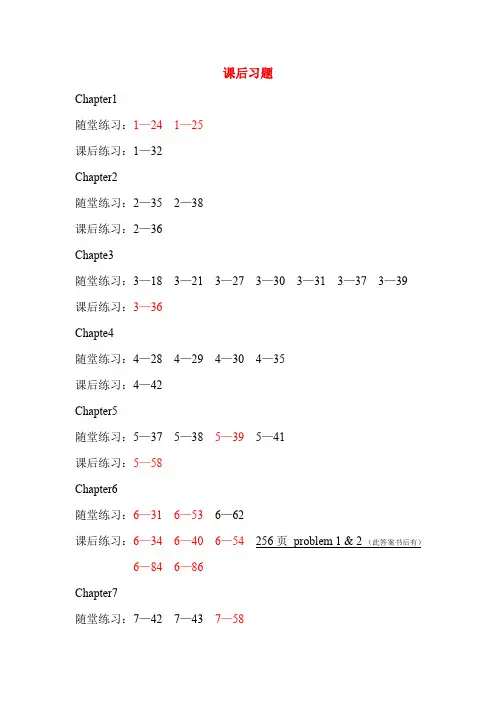

课后习题Chapter1随堂练习:1—24 1—25课后练习:1—32Chapter2随堂练习:2—35 2—38课后练习:2—36Chapte3随堂练习:3—18 3—21 3—27 3—30 3—31 3—37 3—39课后练习:3—36Chapte4随堂练习:4—28 4—29 4—30 4—35课后练习:4—42Chapter5随堂练习:5—37 5—38 5—39 5—41课后练习:5—58Chapter6随堂练习:6—316—536—62课后练习:6—346—406—54 256页problem 1 & 2 (此答案书后有)6—846—86Chapter7随堂练习:7—42 7—43 7—58课后练习:7—28Chapter8随堂练习:8—33 8—32课后练习:8—44Chapter9随堂练习:9—26 9—28 9—29 9—45 9—57课后练习:9—49 9—58Chapter10 :无Chapter11随堂练习:11—52课后练习:11—43 11—46 11—47Chapter12随堂练习:12—2712—28课后练习:12—3112—4012—41备注:标注有红色的题号都是可以找到答案的题,其余的习题没答案,没答案的题可以借阅平时上课做了笔记的同学。

希望大家期末都努力复习争取取得好的成绩!加油!O(∩_∩)O习题答案Chapter11-24ALBANY CORPORATIONBalance SheetMarch 31, 20X1Liabilities andAssets Stockholders' EquityCash $ 6,000 (a) Liabilities:Accounts receivable 14,000 Accounts payable $ 11,000 (f) Notes receivable 2,000 Notes payable 10,000 Merchandise inventory 43,000 (b) Long-term debt 32,000 (g) Furniture and fixtures 2,000 (c) Total liabilities 53,000 Machinery and equipment 27,000 (d) Stockholders' equity:Land 31,000 (e) Paid-in capital 92,000 (h) Building 20,000Total $145,000 Total $145,000(a) Cash: 10,000 + 1,000 – 5,000 = 6,000(b) Merchandise inventory: 40,000 + 3,000 = 43,000(c) Furniture and fixtures: 3,000 – 1,000 = 2,000(d) Machinery and equipment: 15,000 + 12,000 = 27,000(e) Land: 6,000 + 25,000 = 31,000(f) Accounts payable: 8,000 + 3,000 = 11,000(g) Long-term debt: 12,000 + 20,000 = 32,000(h) Paid-in capital: 80,000 + 12,000 = 92,000Note: Event 5 requires no change in the balance sheet.1-25BROADWAY CORPORATIONBalance SheetNovember 30, 20X1Liabilities andLiabilities andAssets Stockholders’ EquityCash $ 13,000 (a) Liabilities:Accounts receivable 16,000 (b) Accounts payable $ 10,000 (e) Notes receivable 8,000 Notes payable 31,000 (f) Merchandise inventory 29,000 Long-term debt 119,000 (g) Furniture and fixtures 8,000 Total liabilities 160,000 Machinery and equip. 34,000 (c) Stockholders’ equity:Land 35,000 (d) Paid-in Capital 213,000 (h)Building 230,000Total $373,000 Total $373,000(a) Cash: 22,000 – 6,000 – 3,000 = 13,000(b) Accounts receivable: 10,000 + 6,000 = 16,000(c) Machinery and equipment: 20,000 + 14,000 = 34,000(d) Land: 41,000 – 6,000 = 35,000(e) Accounts payable: 16,000 – 6,000 = 10,000(f) Notes payable: 20,000 + (14,000 – 3,000) = 31,000(g) Long-term debt: 142,000 – 23,000 = 119,000(h) Paid-in capital: 190,000 + 23,000 = 213,000Note: Event 4 requires no change in the balance sheet.Chapter2(无答案)Chapter33-36(30-45 min.) A nswers are in thousands of dollars.1. a. Inventory 550Accounts payable 550 Acquisition of inventoriesb. Accounts receivable 800Sales 800 Sales on accountc. Cost of goods sold 440Inventory 440 Cost of inventory soldd. Cash 80Note payable 80 Borrowed from a supplier onJune 1, 20X8. Four-year note,interest at 15%, and principalpayable at end of four yearse. Prepaid rent 25Cash 25 Paid rent in advancef. Wages expense 165Cash 165 Paid wagesg. Miscellaneous expenses 76Cash 76 Paid miscellaneous expensesh. Note receivable 20Cash 20 Loan to office manager one-yearnote, 10 % interesti. Cash 691Accounts receivable 691Collections on accountsj. Accounts payable 471Cash 471 Payments on accountsk. Rent expense 26Prepaid rent 26 To reduce prepaid rent to $3,000l. Depreciation expense 6Accumulated depreciation,store equipment 6 Depreciation for the year 19X8m. Wages expense 6Cash 6 Adjustment for wagesn. Interest expense 7Cash 7 Adjustment: .15 x $80,000 x 7/12o. Cash 1Interest revenue 1 Adjustment: .10 x $20,000 x 6/122.A ccumulated Depreciation,Wages Expense Miscellaneous Expense(g) 76* Balance 12/31/X7** Balance 12/31/X83. CANSECO GA RDENSTrial BalanceDecember 31, 20X8Debits Credits Cash $ 24Accounts receivable 146Note receivable 20Inventory 241Prepaid rent 3Store equipment 60Accumulated depreciation,store equipment $ 30 Accounts payable 190Note payable 80Paid-in capital 40Retained income 79Sales 800Interest revenue 1Cost of goods sold 440Rent expense 26Depreciation 6Interest expense 7Miscellaneous expenses 76Wages expense 171Total $1,220 $1,220Chapter4(无答案)Chapter55-391. Gross sales $650,000*Deduct:Sales returns and allowances $30,000Cash discounts on sales 20,000 50,000Net sales $600,000 *$600,000 + $20,000 + $30,000 = $650,0002. (a) Accounts receivable 650,000Sales revenue 650,000(b) Sales returns and allowances 30,000Accounts receivable 30,000(c) Cash 600,000Cash discounts on sales 20,000Accounts receivable 620,0005-58(20 min.)Note that the data provide four years of experience to use in calculating the properpercentage. Sales and ending accounts receivable from 20X1 through20X4 are matched with write-offs for 20X2 through 20X5.1. Bad debt write-offs as a percentage of sales provides the amount to be added tothe allowance account. Bad debt write-offs as a percentage of sales are:($12,500 + $14,000 + $16,500 + $17,600)/($680,000 + $750,000 + $750,000 +$850,000) = $60,600/$3,030,000 = 2%Bad debt expense, 20X5 = 2% x $850,000 = $17,000Ending balance, allowance for uncollectible accounts= Beginning balance +bad debt expense– bad de = $16,000 + $17,000 – $17,600= $15,4005-58 (continued)Use of T-accounts might help:2. The percentage of ending accounts receivable method provides the desiredbalance in the allowance account. The allowance account balance, as apercentage of ending accounts receivable, should be calculated asfollows:($12,500 + $14,000 + $16,500 + $17,600)/($90,000 + $97,000 + $103,000 + $114,000)= $60,600/$404,000 = 15%Ending balance, allowance for uncollectible accounts, 20X5 = 15% x $112,000 =$16,800Beginning + bad debt –bad d balance expense write $16,000 +bad debt –$17,600 = $expenseBad debt expense = $16,800 + $17,600 – $16,000 = $18,400The critical issue is to realize the allowance balance before the bad debt expense entry isthe beginning balance of $16,000 less the write-offs of $17,600; a debitbalance of 1,600. The expense must bring this balance to zero and thencreate the required $16,800 credit balanceChapter 66-31PRA G’s JEWELRY WHOLESA LERSStatement of Gross ProfitFor the Year Ended December 31, 20X8(In Thousands)Gross sales $1,000 Deduct: Sales returns and allo wances $40 Cash discounts on sales 5 45Net sales 955Cost of goods sold:Inv entory, December 31, 20X7 $103A dd: Gross purchases $650Deduct: Purchase returnsand allo wances $27Cash discounts on purchases 6 33Net purchases 617A dd Freight-in 50Cost of merchandise acquired 667Cost of goods av ailable for sale 770Deduct: Inv entory, December 31, 19X8 170 Cost of goods sold 600 Gross profit $355 6-34 (10-15 min.)Cost of Goods A vailable = £21,300(8,000 + 4,200 + 4,400 + 2,300 + 2,400)L I F O E n d i n g I n v e n t o r y=(4,000@£2)+(1,500@£2.10)=£11,150FIFO Ending Inventory = 1,000 @ 2.40 =1,000 @ 2.30 = 2,3002,000 @ 2.20 = 4,4001,500 @ 2.10 = 3,1505,500 £12,250 Weighted av erage = £= £Ending inventory 5,500 @ £2.13 = £11,715Cost of Goods Sold Calculation:LIFO FIFO A verage Goods av ailable £21,300 £21,300 £21,300 Less Ending Inv entory (11,150) (12,250) (11,715) Cost of Goods Sold £10,150 £ 9,050 £ 9,585 6-40(10-15 min.)Compound entries could be prepared. (A mounts are in millions.)a. Sales returns and allowances 5Cash discounts on sales 8A ccounts receivable 226Sales 239b. Cost of goods sold 157Purchase returns and allowances 6Cash discounts on purchases 1Inventory 25Purchases 125Freight-in 14c. Inventory 40Cost of goods sold 40d. Other expenses 80Cash 80 6-53(15-25 min.)Under the FIFO cost-flow assumption, the periodic and perpetual procedures giv e identical results. The ending inv entory will be v alued on the basis of the last purchases during the period.Units $Beginning Inv entory 110 550Purchases 290 2,050Goods av ailable 400 2,600Units sold 255 1,485**Units in ending Inv entory145 1,115** 145 units remain in ending inv entory100 will be v alued at the $8 cost from the October 21 purchase and the remaining 45 will be v alued at the $7 cost from the May 9 purchase100 x $8 = $ 80045 x $7 = 315$1,115 Ending inv entory** Reconciliation: Cost of Goods Sold:255 Units: 110 x $5 = $ 55080 x $6 = 48065 x $7 = 455$1,4856-54 (30-35 min.)1. Gross profit percentage = $1,200,000 ÷ $3,000,000 = 40%Inventory turnover = $1,800,000 ÷2000, 550000,650$= 3 times2. Inv entory turnov er = $1,800,000 ÷ $450,000 = 4 times, a 1/3 increase in turnov er.3. With a lower av erage inv entory and constant turnover, cost of sales must fall. T o t alcost of goods sold = $450,000 x 3 = $1,350,000. To achiev e a gross profit of$1,200,000, total sales must be $1,350,000 + $1,200,000, or $2,550,000. The grossprofit percentage must be $1,200,000 ÷ $2,550,000 = 47.1%. Requirements 2 & 3sho w that if inv entory levels are reduced y ou must increase either turnover ormargins to maintain profitability.4. Summary (computations are sho wn belo w):Succeeding YearGiv en Year 4a 4b Sales $3,000,000 $2,892,857 $3,093,750Cost of goods sold 1,800,000 1,620,000 1,980,000 Gross profit $1,200,000 $1,272,857 $1,113,750a. New gross profit percentage, 40% + .10(40%) = 44%New inv entory turnover, 3 – .10(3) = 2.7New cost of goods sold, $600,000 x 2.7 = $1,620,000New sales = $1,620,000 ÷ (1 – .44)= $1,620,000 ÷ .56= $2,892,857Note that this is a more profitable alternative, assuming that the gross profitpercentage and the turnover can be achiev ed. In contrast, alternative 4b is lessattractiv e than the original 40% gross profit and turnover of 3.b. New gross profit percentage, 40% – .10(40%) = 36%New inv entory turnover, 3 + .10(3) = 3.3New cost of goods sold, $600,000 x 3.3 = $1,980,000New sales = $1,980,000 ÷ (1 .36)= $1,980,000 ÷ .64= $3,093,7505. Retailers find these ratios (and variations thereof) helpful for a v ariety of operatingdecisions, too many to enumerate here. A n obvious help is the quantify ing of theoptions facing management regarding what and how much inv entory to carry, andwhat pricing policies to follo w. You may want to stress that this analy sis ig n o res o n ebenefit of higher turnover—the firm reduces its inv estment in inv entory and reducesstorage and display requirements.6-84(15-20 min.)1.A n understatement of ending inventories overstates cost of goods sold andunderstates taxable income by $500,000. Taxes evaded would be .40 x $500,000 =$200,000.2.This news story provides a good illustration of why a basic knowledge ofaccounting is helpful in understanding the business press. The news story isincomplete or misleading in one important respect. The business owner'sunderstated ending inventory becomes the understated beginning inventory of thenext y ear. If no other manipulations occur, the owner will understate cost of go odssold during the next y ear, overstate taxable income, and pay an extra $200,000 inincome taxes. Thus, the owner will have postponed pay ing income taxes for oneyear, pay ing no interest on the money "borrowed" from the government.To continue to evade the $200,000 of income taxes of y ear one, the endinginventory of the second year must be understated by $500,000 again. Ho wev er, ifonly the $500,000 understatement persists y ear after y ear, the owner is enjoy ing aperpetual loan of $200,000 (based on a 40% tax rate) from the government. Datafollow (in dollars):6-84 (continued)Honest Reporting Dishonest ReportingFirst Year Second Year First Year Second Year Beginning inventory 3,000,000 2,500,000 3,000,000 2,000,000 Purchases 10,000,000 10,000,000 10,000,000 10,000,000 Available for sale 13,000,000 12,500,000 13,000,000 12,000,000 Ending inventory 2,500,000 2,500,000 2,000,000 2,000,000 Cost of goods sold 10,500,000 10,000,000 11,000,000 10,000,000 Income tax savings @ 40% 4,200,000 4,000,000 4,400,000 4,000,000 Income tax savings fortwo y ears together 8,200,000 8,400,000 Some students may incorrectlycumulative effect. You may wish to emphasize that the second y ear has the samecost of goods sold in each column, because in the "dishonest" case bothbeginning and ending inventory are understated by the same amount. To evadean additional $200,000 of income taxes in the second year, the ending inventorymust be understated by $1,000,000 (not $500,000) in the second y ear.6–86(35-45 min.) A mounts are in millions.Inventory Calculation1. Beginning + Purchases – Sales = Ending658 + Purchases – 6,746 = 1,232Purchases = 6,746 – 658 + 1,232Purchases = $7,3202. Turnover = Cost of sales ÷ average inventory Turnover = $6,746 ÷ ($1,232 + $658) ÷ 2 = $6,746 ÷ $945 = 7.143. Gross MarginSales$18,928$6,746 $18,928 -= .64 2000$12,1734,259$ $12,173-= .65 1999489,8$924,2$ 489,8$ -= .66 1998The gross margin has fallen slightly over the three y ears.Gross margins for Cisco are high. This is because of the industry . Software and technology innovations are expensive to develop but inexpensive to produce and distribute. Note that costs of creating these products are largely research and development, and these costs are accounted for as operating expenses in the year incurred.Chapater77-28(10-15 min.) You may want to use T-accounts too.1. Depreciation expense, equipment 160,000Accumulated depreciation, equipment 160,000 To record annual depreciation:($880,000-$80,000) ÷ 5 = $160,0002. Cash 160,000Accumulated depreciation,equipment 80,000Equipment 220,000Gain on sale of equipment 20,000 To record sale of equipment:Cash proceeds $160,000Original cost $220,000Accumulated depre-ciation, 2 x $40,000 = 80,000Book value (or carryingamount) 140,000Gain on sale $ 20,0003. Cash 110,000Accumulated depreciation,equipment 80,000 Loss on sale of equipment 30,000 Equipment 220,000 To record sale of equipment:Cash proceeds $110,000Book value (see above) 140,000Loss on sale $ 30,0007-58(25-35 min.) A mounts in table are in thousands of dollars.1. Zero Income Taxes2. 40% IncomeTaxesStraight-line Accelerated Straight-line AcceleratedDepreciation Depreciation Depreciation Depreciation Revenues 900 900 900 900 Cash operating expenses 600 600 600 600 Cash provided by operationsbefore income taxes 300 300 300 300 Depreciation expense 50 100 50 100 Operating income 250 200 250 200 Income tax expense ––100 80 Net income 250 200 150 120 Supplementary analysis:Cash provided by operationsbefore income taxes 300 300 300 300 Income tax payments ––100 80 Net cash provided byoperations 300 300 200 220 3. By itself, depreciation expense does not provide cash. This point is illustrated bypart 1 that compares the amounts shown before taxes. Note that the cashprovided by operations (and the ending cash balances) are exactly the same. Nomatter what depreciation expense is allocated to the year (whether $50,000,$100,000, or zero), the $300,000 cash provided by operations and the ending cashwill be unaffected.Examine part 2, that compares amounts after taxes. A gain, by itself, depreciationdoes not affect the cash inflow provided by operations. However, depreciationdoes affect the cash outflow for income taxes. The use of accelerateddepreciation results in a strange combination of showing less net income butconserving more cash. The accelerated method shows net income of $120,000(compared with $150,000 using straight-line), but accelerated shows a netincrease in cash provided by operations (less income taxes) of $220,000(compared with $200,000 using straight-line). A ccordingly, the final cash balanceis $20,000 higher for accelerated than for straight-line.4. Journal entries (not required) may clarify the effects:Depreciation expense 50,000 moreAccumulated depreciation 50,000 moreIncome tax expense 20,000 lessCash 20,000 less7-58 (continued)The reduction of retained income would be $150,000 – $120,000. That is, net income(and hence retained income) would be $30,000 lower. In summary:Cash, increase by tax savings, .40 x $50,000 = $20,000Accumulated depreciation, increased by $50,000Operating income, decrease by $50,000Income tax expense, decrease by $20,000Retained income, decrease by $30,0005. The doubling of depreciation would cause net income to decrease but in theabsence of tax effects would have no effect on cash provided by operations:Straight-line AcceleratedDepreciation DepreciationBefore Doubled Before Doubled Revenues 900 900 900 900 Cash operating expenses 600 600 600 600 Cash provided by operations 300 300 300 300 Depreciation expense 50 100 100 200 Income before income taxes 250 200 200 100 Income tax expense ----Net income 250 200 220 100Chapater88-32(10-15 min.)1. Claims Distribution of ProceedsFirst mortgage bondspayable $13,000,000 In full $13,000,000 Accounts payable 3,000,000 3/8 of remainder* 2,250,000 Unsubordinated debentures 5,000,000 5/8 of remainder* 3,750,000 Total claims $21,000,000 Total distribution $19,000,000 * Total general unsecured claims = $3,000,000 + $5,000,000 = $8,000,000,so remaining proceeds of $19,000,000 – $13,000,000, or $6,000,000, will besplit 3/8, 5/8, or 75 cents per dollar of claim ($6,000,000 ÷ 8,000,000).2. Claims Distribution of ProceedsFirst mortgage bondspayable $13,000,000 In full $13,000,000 Accounts payable 3,000,000 In full 3,000,000 Subordinated debentures 5,000,000 Remainder 3,000,000 Total claims $21,000,000 Total distribution $19,000,000 Ordinary trade creditors have than subordinatedholders who would now receive only 60 cents per dollar of claim.If only $14.5 million cash becomes available, the first mortgage holders would get$13 million, the trade creditors would receive $1.5 million (only 50 cents for eachdollar claimed), and the holders of subordinated debentures would receivenothing.8-33(10 min.) A mounts are in millions.1. Income tax expense 4,045Income taxes payable 1,904Deferred income taxes 2,141 To record income tax expense.Income taxes payable 1,904Cash 1,904 To record payment of income taxes.These two transactions could have been combined:Income tax expense 4,045Deferred income taxes 2,141Cash 1,904 To record income tax expense and payments.2. The deferred tax liability increases by $4,045 $1,904 = $2,141.8-44 (15-25 min.)1. Debt to Equity Ratios1999 1992AT&T $90,479 ÷ $78,927 = 1.15 $17,122 ÷ $20,313 = .84 MICRON $ 3,001 ÷ $3,964 = .76 $ 213 ÷ $ 511 = .42 AMGEN $ 1,054 ÷ $ 3,024 = .35 $ 440 ÷ $ 934 = .472. AT&T is a large company with well-established credit reputations and largeamounts of fixed assets to use as collateral for debt. Earnings are relativelystable. Therefore, A T&T has the ability to borrow large amounts, as shown bythe high debt-to-equity ratio.In contrast, Micron Technologies and A mgen are newer, smaller companies involatile high-tech industries. They have not yet established the credit worthinessto borrow as much as A T&T.3. Each company's ratio changes over the seven-year period, but the direction is notconsistent. Thus, the changes appear more idiosyncratic than economy driven.Particularly for small firms such as MICRON and AMGEN, a single new issue ofdebt or equity can have a large immediate effect on the ratios.Chapter99-26(10-20 min.)1. a. PV = $20,000(.6830) = $13,660b. PV = $20,000(.4823) = $ 9,6462. The annual rates would be halved and the periods doubled. Present valuesdecline:a. PV = $20,000(.6768) = $13,536b. PV = $20,000(.4665) = $ 9,3303. Present values rise because the money is repaid more quickly:a. PV = $5,000(3.1699) = $15,849.50b. PV = $5,000(2.5887) = $12,943.509-28(10-15 min.)1. Equipment 394,000Cash 100,000Contract payable (or note payable) 294,000 Equipment is capitalized at its cash-equivalent cost.2. The imputed interest rate makes the present value of the payments equal to thecash price:DM100,000 + (DM400,000 x (4-year, Y% factor in Table 9-2)) = 394,000Factor = (DM394,000 DM100,000) ÷ DM400,000 = .7350From the 4-year row of Table 9-2, Y = 8%Year 1 Interest expense 23,520Contract payable 23,520 .08 x DM294,000 = DM23,520Year 2 Interest expense 25,402Contract payable 25,402 .08 x (DM294,000 + 23,520) =.08 x DM317,520 = DM25,4029-29(15-20 min.)1. Equipment 416,990Cash 100,000Contract payable, current 68,301Contract payable, long-term 248,689 Equipment is capitalized at its cash-equivalent cost of $100,000 plus thepresent value of the contract:PV = $100,000(3.1699) = $316,990Analysis of first installment:Total amount $100,000Interest portion, .10 x $316,990 = 31,699Principal portion, current liability $ 68,301Total contract payable $316,990Current liability 68,301Long-term portion $248,2892. Interest expense 31,699Contract payable, current 68,301Cash 100,000 To record interest expense andreduction of principal.Contract payable, long-term 75,131Contract payable, current portion 75,131 To reclassify current liability oflong-term debt as short-term debt.Analysis of second installment:Total amount $100,000Interest portion,.10 x ($316,990 – $68,301)or .10 x $248,689 = 24,869Principal portion current liability $ 75,3119-45 (25-35 min.)Analysis of Bond Transactions (In Thousands of Norwegian Kroner)A = L + SECashBonds Payable Discount on Bonds Payable Retained Incomea. Issuance7,881=+10,000 –2,119b. First semi-annual interest– 500* =+ 52 – 552** ⎥⎥⎦⎤⎢⎢⎣⎡Expense Interest Increasec. Maturity value–10,000 = –10,000 Bond related totals***–12,119 =0 0 –12,119* NKR10,000,000 x 10% x 1/2 ** NKR7,881,000 x 14% x 1/2*** Twenty semi-annual payments of NKR500 plus repayment of NKR2,119 in excessof the original borrowing. 2. Sample Journal Entries Bond Transactions (In Thousands of Norwegian Kroner)a. Cash 7,881 Discount on bonds payable 2,119 Bonds payable 10,000To record proceeds upon issuance of 10%bonds maturing on December 31, 2015. b. Interest expense 552 Discount on bonds payable 52 Cash 500To record amortization of discount and payment of interest.c. Bonds payable 10,000Cash 10,000 To record payment of maturity valueof bonds and their retirement.3. When presented on balance sheets, unamortized discounts are deducted fromthe face value of the related bonds (in thousands):December 31, 2005 June 30, 2006Bonds payable, 10% due December 31, 2015 NKR10,000 NKR10,000 Deduct: Discount on bonds payable 2,119 2,067* Net liability NKR 7,881 NKR 7,933* 2,119 – 52 = 2,0679-49(20-40 min.)1. To compute the gain or loss, first calculate the net liability at December 31, 2001:Face amount $20,000,000Proceeds 17,880,800 * Discount at issuance 2,119,2006/30/01 discount amortization (51,656) ** 12/31/01 discount amortization (55,272) †Bond discount unamortized at 12/31/01 $ 2,012,272 * ($1,200,000 x 10.5940) + ($20,000,000 x .2584)** (7% x $17,880,800) – (6% x $20,000,000)†(7% x ($17,880,800 + $51,656)] - (6% x $20,000,000)The net liability is the face amount less the discount:Face amount $20,000,000 Bond discount unamortized at 12/31/01 2,012,272 Net liability at 12/31/01 $17,987,728 The amount by which the cash payment for the debentures exceeds the netliability is the loss on early extinguishment. A mounts are in thousands:Cash payment $19,000Net liability at 12/31/01 17,988Loss on early extinguishment of debt $ 1,0129-49 (continued) 2. Analysis of Early Extinguishment of Debt (In Thousands of Dollars)A =L+ SEIssuer's Record Cash = Bonds Payable Discount on Bonds PayableRetained IncomeRedemption,December 31, 2001 –19,000= –20,000+2,012⎥⎦⎤⎢⎣⎡Discount Decrease –1,012 ⎥⎦⎤⎢⎣⎡ment Extinguish Early on Loss 3. Journal Entry(In Thousands)Issuer's RecordsDecember 31, 2001 Bonds payable 20,000 Loss on early extinguishment of debt 1,012 Discount on bonds payable 2,012 Cash 19,000To record open-market acquisition of entire issue of 12% bonds for $19 million. 4. A gain arises if the bond is extinguished for less than the carrying value,$17,987,728 – $500,000 gives a price of $17,487,728.9-57 (20-30 min.)Some instructors may prefer to (a) ask students to prepare entries for two years only here and (b) also assign the next problem. 1. PV A = $40,000 x A nnuity Factor for 3 years at 18% = $40,000 x 2.1743= $86,9722. Equipment leasehold 86,972Lease liability, current*24,345Lease liability, long-term 62,627 To record capital lease.Analysis of first installment:Total amount $40,000Interest, .18 x $86,972 15,655Principal portion, current liability $24,345Total liability $86,972Current liability 24,345Long-term liability $62,627Entry for straight-line amortization of the asset for each of three years: Amortization of equipment leasehold 28,991 Equipment leasehold 28,991 To record straight-line amortization:$86,972 ÷ 3 = $28,991.Lease Payments and Liability ReclassificationsYear OneInterest expense 15,655Lease liability, current 24,345 Cash 40,000 To record interest expense andreduction of liability.Lease liability, long term 28,727 Lease liability, current 28,727 To reclassify next installment oflong-term debt as short-term debt.Analysis of second installment:Total $40,000Interest portion:.18 x ($86,972 – $24,345)= .18 x $62,627 = 11,273 Principal portion, current liability $28,727Total liability $62,627Current liability 28,727Long-term liability $33,9009-57 (continued)Year TwoInterest expense 11,273Lease liability, current 28,727Cash 40,000 To record interest expense andreduction of liability.Lease liability, long-term 33,900Lease liability, current 33,900 To reclassify next installmentof long-term debt as short-term debt.Year ThreeInterest expense 6,100Lease liability, current 33,900Cash 40,000Analysis of third installment:Total amount $40,000Interest, .18 x $33,900 6,102Principal $33,898** Rounding causes this amount to differ from the $33,900 liability. These roundingerrors occur because the present value tables are carried to four places only rather thanto five or more places. This rounding causes the present value of the lease to be rounded at its inception.。

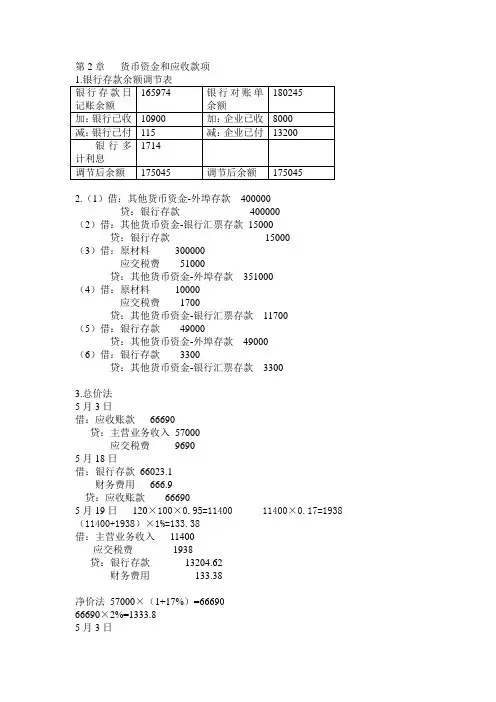

第2章货币资金和应收款项1.银行存款余额调节表银行存款日记账余额165974 银行对账单余额180245加:银行已收10900 加:企业已收8000减:银行已付115 减:企业已付13200 银行多计利息1714调节后余额175045 调节后余额1750452.(1)借:其他货币资金-外埠存款400000贷:银行存款400000(2)借:其他货币资金-银行汇票存款15000贷:银行存款15000(3)借:原材料300000应交税费51000贷:其他货币资金-外埠存款351000(4)借:原材料10000应交税费1700贷:其他货币资金-银行汇票存款11700(5)借:银行存款49000贷:其他货币资金-外埠存款49000(6)借:银行存款3300贷:其他货币资金-银行汇票存款33003.总价法5月3日借:应收账款66690贷:主营业务收入57000应交税费96905月18日借:银行存款66023.1财务费用666.9贷:应收账款666905月19日120×100×0.95=11400 11400×0.17=1938 (11400+1938)×1%=133.38借:主营业务收入11400应交税费1938贷:银行存款13204.62财务费用133.38净价法57000×(1+17%)=6669066690×2%=1333.85月3日借:应收账款65356.2贷:主营业务收入55666.2应交税费96905月18日借:银行存款66023.1贷:应收账款65356.2财务费用666.95月19日借:主营业务收入11133.24应交税费1938财务费用133.38贷:银行存款13204.624.2009年借:资产减值损失10000贷:坏账准备1000020XX年借:坏账准备4000贷:应收账款4000借:资产减值损失8000贷:坏账准备80002011 借:坏账准备20000贷:应收账款20000借:应收账款3000贷:坏账准备3000借:资产减值损失12000贷:坏账准备12000第三章1.(1)借:在途物资-甲10300应交税费1700贷:银行存款12000(2)借:原材料-甲10300贷:在途物资-甲10300(3)乙货款30000丙货款20000运费分配率=1000/(300+200)=2保险费分配率=1500/(30000+20000)=0.03乙的成本=30000+600×(1-7%)+900=31458丙的成本=20000+400×(1-7%)+600=20972借:在途物资-乙31458-丙20972应交税费8570贷:银行存款61000(4)借:原材料-乙31458-丙20972贷:在途物资-乙31458-丙20972(5)借:在途物资-甲20000应交税费3400贷:银行存款23400(6)借:原材料-乙9000贷:在途物资9000(7)借:原材料-丁30000贷:应付账款300002.(1)借:在途物资30930应交税费5170贷:银行存款36100(2)借:库存商品57000贷:在途物资30930商品进销差价26070(3)借:银行存款60000贷:主营业务收入60000借:主营业务收入60000贷:库存商品60000(4)60000/(1+17%)=5128251282×17%=8717.95借:主营业务收入8717.95贷:应交税费8717.95(5)商品进销差价率=(9700+26070)/(43000+570000×100%=35.77% 已销商品进销差价=60000×35.77%=21462借:商品进销差价21462贷:主营业务成本214623.(1)甲材料可变现净值=510-9-200=301账面价值=300未发生减值。

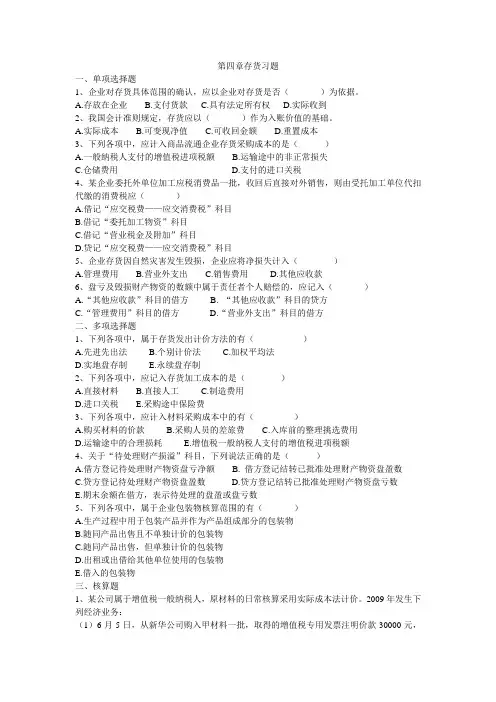

第四章存货习题一、单项选择题1、企业对存货具体范围的确认,应以企业对存货是否()为依据。

A.存放在企业B.支付货款C.具有法定所有权D.实际收到2、我国会计准则规定,存货应以()作为入账价值的基础。

A.实际成本B.可变现净值C.可收回金额D.重置成本3、下列各项中,应计入商品流通企业存货采购成本的是()A.一般纳税人支付的增值税进项税额B.运输途中的非正常损失C.仓储费用D.支付的进口关税4、某企业委托外单位加工应税消费品一批,收回后直接对外销售,则由受托加工单位代扣代缴的消费税应()A.借记“应交税费——应交消费税”科目B.借记“委托加工物资”科目C.借记“营业税金及附加”科目D.贷记“应交税费——应交消费税”科目5、企业存货因自然灾害发生毁损,企业应将净损失计入()A.管理费用B.营业外支出C.销售费用D.其他应收款6、盘亏及毁损财产物资的数额中属于责任者个人赔偿的,应记入()A.“其他应收款”科目的借方B. “其他应收款”科目的贷方C.“管理费用”科目的借方D.“营业外支出”科目的借方二、多项选择题1、下列各项中,属于存货发出计价方法的有()A.先进先出法B.个别计价法C.加权平均法D.实地盘存制E.永续盘存制2、下列各项中,应记入存货加工成本的是()A.直接材料B.直接人工C.制造费用D.进口关税E.采购途中保险费3、下列各项中,应计入材料采购成本中的有()A.购买材料的价款B.采购人员的差旅费C.入库前的整理挑选费用D.运输途中的合理损耗E.增值税一般纳税人支付的增值税进项税额4、关于“待处理财产损溢”科目,下列说法正确的是()A.借方登记待处理财产物资盘亏净额B. 借方登记结转已批准处理财产物资盘盈数C.贷方登记待处理财产物资盘盈数D.贷方登记结转已批准处理财产物资盘亏数E.期末余额在借方,表示待处理的盘盈或盘亏数5、下列各项中,属于企业包装物核算范围的有()A.生产过程中用于包装产品并作为产品组成部分的包装物B.随同产品出售且不单独计价的包装物C.随同产品出售,但单独计价的包装物D.出租或出借给其他单位使用的包装物E.借入的包装物三、核算题1、某公司属于增值税一般纳税人,原材料的日常核算采用实际成本法计价。

财务会计学的基本知识1. 概述财务会计学是一门研究组织的财务状况和业绩的学科,它涵盖了财务报告、会计准则、会计政策以及财务分析等方面的知识。

在现代经济中,财务会计学已经成为了组织管理和决策的重要工具。

本文将介绍财务会计学的基本概念和核心内容,帮助读者了解和掌握这一学科的基本知识。

2. 财务报告与会计准则财务报告是组织向外界提供其财务状况和业绩信息的重要手段。

财务报告包括资产负债表、利润表、现金流量表以及附注等内容。

这些报表通过会计准则的规定和约束,确保了财务报告的准确性和可比性。

会计准则是财务会计学的基础,它规定了组织应该如何处理和记录其财务交易和业务活动。

国际上广泛使用的会计准则是国际财务报告准则(IFRS)和美国公认会计准则(GAAP)。

会计准则的遵循对于组织的财务报告的准确性和可比性至关重要。

3. 会计政策与原则会计政策是组织根据会计准则制定的一系列方针和规定,用于处理和记录财务交易和业务活动。

会计政策的选择和应用对于财务报告的准确性和可比性具有重要的影响。

会计原则是财务会计学中的一些基本规则和约束,用于指导会计人员在处理财务交易和业务活动时的操作和判断。

常见的会计原则包括货币计量、成本原则、收入确认原则以及匹配原则等。

4. 财务分析与决策财务分析是对组织财务信息进行定量和定性的评估,以便为管理层和投资者提供决策依据。

财务分析的方法包括比率分析、趋势分析、营运能力分析等。

通过财务分析,可以了解组织的盈利能力、偿付能力、成长潜力等方面的情况。

基于财务分析的结果,管理层和投资者可以做出各种决策,例如投资决策、筹资决策和分红决策等。

财务会计学提供了对财务信息的理解和分析的工具,帮助决策者做出明智的决策,促进组织的可持续发展。

5. 财务会计学的应用领域财务会计学广泛应用于各个领域和行业,包括企业、金融机构、非营利组织等。

在企业中,财务会计学对于财务报告的编制和分析具有重要的作用。

金融机构需要财务会计学的知识来评估风险和决策贷款等业务。

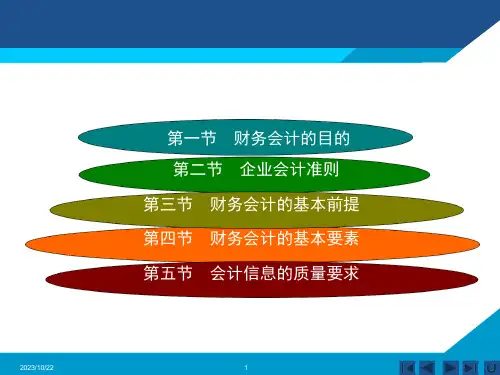

第一章绪论[内容提要]:主要介绍财务会计概念框架的有关内容。

[学习目标]:了解、理解财务会计概念框架的有关内容,为本课程乃至本专业的理解性学习打下全局性(整体性)、工具性的必备基础。

[学习重点]:会计核算的13项一般原则、会计(六个基本)要素及其特性。

[教学方法]:课堂讲授与课外阅读相结合。

一、课程简介◆本课程是会计学专业主干课程之一;◆本课程介绍、阐述工商行业的财务会计的“三基”(基本概念、基本理论与基本方法);◆本课程教材的编写与教学的组织按“会计六要素”的思路展开;第一节会计与财务会计目标一、会计的社会环境与现代会计的分野对于这一内容,不作要求。

◆本课程的鲜明特征是“内容多且更新快”、“较复杂”、“能操作”、“能理解”;◆课程学习任务是掌握工商行业企业的基本经济业务的核算方法,并在学习中注重会计学习方法的发现、总结与运用。

二、课程的重、难点第一章各节的理论性都较强,因而都是难点,其中,第四节和第五节是重难点。

第二章比较容易,其各节都不是重难点。

第三章是本课程的重点章之一,其中,第一节和第四节是重难点,第二节是重点。

二、财务会计的目标财务会计的目标是指财务会计应向谁提供什么财务信息。

对于这一问题的回答,西方有决策有用学派和经管责任学派两大学派,我国《企业会计准则》也有具体规定。

第四章是本课程的重点章之一,其中,第三节、第四节和第七节是重难点。

第五章是本课程的难点章之一,其中,第二节是重难点,第三节和第四节是难点。

第六章是本课程的重点章之一,其中,第二节和第三节是重难点,第四节和第六节是重点。

第七章比较容易,其各节都不是重难点。

第八章的第五节中的“增值税”是重难点,对第七节不作要求。

应该指出,在本第八章之前的第二、三、四等章中,就大量地、经常地涉及到“增值税”这一本章乃至本课程的重难点内容。

为了使大家理解、掌握第八章之前的各章涉中及“增值税”的大量经济业务的核算,我们将本章第节五中的“增值税”提前于第一章之后、第二章之前进行学教。