IHG(洲际酒店集团) financial data (2007-2011)英文版财务报告

- 格式:xls

- 大小:68.00 KB

- 文档页数:4

世界知名酒店管理集团一、洲际酒店集团(InterContinental Hotels Group)1、简介:洲际集团成立于1946年,总部位于英国,是目前全球最大及网络分布最广的专业酒店管理集团,世界上客房量拥有量最大(5.4万间)分布将近100个国家。

同时也是在中国接管酒店最多的超级酒店集团,包括中国大陆25个省市,经营特点均是委托管理,投资极少。

2、旗下主要品牌:(1)洲际酒店及度假村(Intercontinental Hotels & Resorts)(2)皇冠广场酒店及度假村(Crown Plaza Hotels & Resorts)(3)假日酒店及度假村(Holiday Inn Hotels & Resorts)(4)假日快捷酒店(Express by Holiday Inn)3、酒店广告语:(1)洲际酒店: By yourself. 自在自我。

(2)假日酒店: We know what it takes. 明白所需,满足所想。

4、洲际在中国主要酒店的分布情况:二、希尔顿酒店集团(Hilton Hotels Corp)1、简介:在全球的78个国家拥有7万多名雇员,总部位于英国,有酒店2259座,房间358408间,列第11位(2004年美国《HOTELS》杂志公布数据),在全球的发展以谨慎著称。

2、旗下主要品牌:(1)希尔顿 (Hilton)(2)康拉德酒店 (Conrad Hotels)(3)双树酒店 (Doubletree Hotels)(4)汉普顿旅馆 (Hampton Inn)3、希尔顿在中国主要酒店的分布情况:三、喜达屋酒店集团(Starwood Hotels &Resorts Worldwide)1、简介:喜达屋集团是全球最大的饭店及娱乐休闲集团之一,1998年收购了威斯汀饭店度假村国际集团,特许经营41.8%,委托管理28.5%,带资管理29.7%。

关于InterContinental 洲际酒店集团(英国)一、集团简介洲际酒店集团发家于1777年的第一家巴斯(Bass)酿酒厂;1988年购入Holiday Inns International后,开始涉足宾馆业;2003年4月,随着Six Continents PLC将集团的酒店业务和软饮料业务从零售业中(公司名称为Mitchells & Butlers plc)分离,洲际酒店集团(IHG)正式成立。

目前,洲际酒店集团是全球最大及网络分布最广的酒店管理集团,拥有洲际酒店及度假村、皇冠假日酒店、英迪格酒店、假日酒店、智选/快捷假日酒店、假日酒店度假村(Holiday Inn Resort)、假日酒店度假俱乐部(Holiday Inn Club Vacations)、华邑酒店及度假村、Even酒店、宿之桥酒店公寓(Staybridge Suites)、蜡木酒店公寓(Candlewood Suites)共11个酒店品牌(其中,华邑品牌仅针对中国市场,Even品牌目前仅针对美国市场),覆盖高、中、低档酒店市场。

(注:洲际官网称自己旗下只有9大品牌,不包括“假日酒店度假村(Holiday Inn Resort)、假日酒店度假俱乐部(Holiday Inn Club Vacations)”这两个品牌,但是在酒店数量、酒店房间数计算的时候,会列为独立品牌进行计算)截止2015年1月31日,洲际酒店集团在全球100多个国家和地区拥有已开业酒店4,912家,在建签约酒店1,237家,已开业客房总数721,595间,客房数位居全球第一,同时也是目前为止跨国经营范围最广的国际酒店集团。

洲际1984年开始进入中国市场,至今为止在大中华区已引入7大酒店品牌,包括:洲际酒店及度假村、皇冠假日酒店、英迪格酒店、假日酒店、智选假日酒店、华邑酒店及度假村、假日酒店度假村。

截至2014年12月31日,洲际在华(含港澳台)已开业酒店总数达241家,另外有189家酒店在建,是目前在中国接管酒店最多的国际酒店集团。

根据我所查找的资料,2011年全球前十大酒店管理集团并未产生较大变化,十大集团仍然名列前十,但内部名次则有了一些调整。

调整后的名次如下一、洲际酒店集团——InterContinental Hotels Group PLC(IHG)酒店预订官方网站:/intercontinental/zh/cn/home?clearQuickRes=true酒店管理集团官方网站:/洲际酒店集团是一个全球化的酒店集团,在全球100多个国家和地区经营和特许经营超过4400家酒店,超过656000间客房,为全球拥有客房最多的酒店集团。

洲际酒店集团的经营目标是让InterContinental这一品牌成为消费者和酒店所有者心目中的首选。

目前洲际酒店集团旗下拥有七个酒店品牌,分别是洲际酒店及度假村(InterContinental Hotels & Resorts)、皇冠假日酒店及度假村(Crowne Plaza Hotels & Resorts)、假日酒店及度假村(Holiday Inn Hotels & Resorts)、快捷假日酒店(Holiday Inn Express)、Staybridge Suites酒店、Candlewood Suites酒店以及Hotel Indigo品牌酒店。

其中既有洲际酒店及度假村和皇冠假日酒店及度假村这类高端豪华酒店品牌,也有假日酒店及度假村、快捷假日酒店等中端舒适酒店,更不乏Staybridge Suites这样专为延长住宿酒店市场而创立的特色酒店。

目前,洲际酒店集团在亚太地区拥有290家酒店,并有223家在建中。

在中国,洲际酒店集团拥有16家正在经营的酒店和4家旅游景区度假村,分别坐落在北京、上海、成都、南京、深圳等大城市;此外,位于石家庄、唐山和无锡的洲际酒店也即将在2011年内开业。

在积极扩张中国市场的过程中,洲际集团已经开始了由一线城市向二三线城市进发的过程。

洲际集团一、公司简介洲际酒店集团(IHG)是世界上最具全球化并拥有客房数最多的酒店集团之一,总部位于英国,该集团拥有全世界最多的客房数量4506家酒店,661,000间客房,分布在100个国家和地区,总市值66亿美元,2011财年营业收入17.68亿美元,税后利润4.73亿美元;拥有九个酒店品牌InterContinental(洲际酒店),Crowne Plaza(皇冠酒店),Hotel Indigo (英迪格酒店),Holiday Inn(假日酒店),Holiday Inn Express(快捷假日酒店),Staybridge Suites,Candlewood Suites,EVEN Hotels and HUALUXE Hotelsand Resorts(华邑酒店及度假村)。

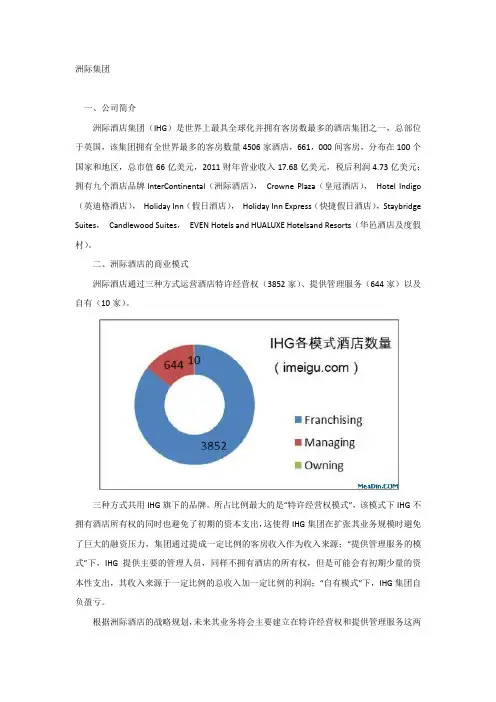

二、洲际酒店的商业模式洲际酒店通过三种方式运营酒店特许经营权(3852家)、提供管理服务(644家)以及自有(10家)。

三种方式共用IHG旗下的品牌。

所占比例最大的是“特许经营权模式”,该模式下IHG不拥有酒店所有权的同时也避免了初期的资本支出,这使得IHG集团在扩张其业务规模时避免了巨大的融资压力,集团通过提成一定比例的客房收入作为收入来源;“提供管理服务的模式”下,IHG提供主要的管理人员,同样不拥有酒店的所有权,但是可能会有初期少量的资本性支出,其收入来源于一定比例的总收入加一定比例的利润;“自有模式”下,IHG集团自负盈亏。

根据洲际酒店的战略规划,未来其业务将会主要建立在特许经营权和提供管理服务这两块业务上。

这两种业务模式之所以具有吸引力主要在于它们能够通过少量的资本支出就能够使得公司达到快速增长的目标,以及相对于自营业务而言更加稳定的现金流来源以及稳健的财务状况。

这两种业务模式的一个核心亮点是它能够产生的现金流大于业务要求的投资额,这就使得投入资本能够有高的回报,这也是为何洲际酒店在这两项业务上的毛利率高达87%的原因之一。

洲际酒店集团英文全称(北京、青岛、香港、重庆、阿坝藏族羌族自治州、上海、沈阳、福州、马鞍山Intercontinental Hotels Group英文缩写IHG洲际酒店集团创立于1946 年,是目前全球分布最广、拥有客房最多的专业酒店管理集团—在全球100 多个国家和地区拥有酒店4462 家(美国3471 家,欧洲、中东和非洲701 家,亚太地区290 家),客房超过656,000 间,在建酒店1190 家。

其中,洲际酒店集团授权经营的酒店约占总数的85%,代管酒店约占14%,集团拥有的酒店不足1%。

集团旗下拥有七个闻名遐迩的酒店品牌,包括洲际酒店及度假村、皇冠假日酒店及度假村、英迪格酒店、假日酒店、智选假日酒店、Staybridge Suites 品牌酒店以及Candlewood Suites 品牌酒店,竭诚为客人的商务出行、家庭度假、蜜月旅行等提供舒适的下榻环境和贴心周到的卓越服务。

我们以“创建客人挚爱的杰出酒店”为使命,不断以卓越的服务提升我们的信誉,使洲际酒店集团旗下的酒店品牌成为客人的首选下榻之所,也成为酒店业主的首选合作伙伴。

我们的战略始终是以最能发挥规模效应的市场为核心,建立最强大的酒店运营体系。

我们在全球设有十个呼叫中心,提供13 种语言的官方网站,拥有一支由8000 多名专业人士组成的全球销售团队,还拥有全球规模最大的酒店忠诚客户计划—优悦会。

目前,优悦会在全球已经拥有超过5,800 万名会员。

通过该计划,优悦会会员可在全球100 个国家和地区的4400 多家酒店尊享会员特权。

优悦会奖励计划的核心魅力在于奖励住宿不设日期限制,且积分永远有效。

我们是中国市场上规模最大的国际酒店集团。

自1984 年进入中国市场以来,集团旗下七个品牌中已有五个落户中国,包括洲际酒店及度假村、皇冠假日酒店及度假村、假日酒店、智选假日酒店以及英迪格酒店。

您知道么,皇冠假日酒店是亚太区发展最为迅速的高端商务酒店品牌。

酒店管理-世界酒店集团分析(一)酒店集团排名2009年6月25日,全球酒店业权威杂志《HOTELS》发布了2008年的世界酒店排名情况。

以客房规模为标准的酒店公司(集团)300强排名单中,前10名分别为:(1)洲际酒店集团(IHG InterContinental Hotels Group)、(2)温德姆酒店集团(Wyndham Hotel Group)、(3)万豪国际酒店集团(Marriott International)、(4)希尔顿酒店集团(Hilton Hotels Corp.)、(5)雅高国际酒店集团(Accor)、(6)精选国际酒店(Choice Hotels International)、(7)最佳西方酒店国际集团(Best Western International)、(8)喜达屋酒店集团(Starwood Hotels& Resorts Worldwide)、(9)卡尔森国际酒店集团(Carlson Hotels Worldwide)、(10)凯悦国际酒店集团(Global Hayatt Corp.)。

(二)酒店网站访问数量排名根据Alexa综合每个网站的访问量和访问人数,独家发布2009年4月17日部分中外饭店集团网站全球排名、日均IP访问量(一周平均)、日均PV浏览量(一周平均、如果相关数据不充分则无法统计)、反向链接的数量等情况排名为前五名的见下:(1)万豪国际集团反向链接12558 4月17日全球排名2051、日均IP访问量297600、日均PV浏览量1083264(2)希尔顿酒店集团反向链接7398 4月17日全球排名2203、日均IP访问量279600、日均PV浏览量1087644(3)洲际酒店集团反向链接9130 4月17日全球排名2303、日均IP访问量261000、日均PV浏览量1041390(4)喜达屋国际酒店集团反向链接6760 4月17日全球排名2491、日均IP访问量249000、日均PV浏览量888930(5)凯悦国际酒店集团反向链接2325 4月17日全球排名4755、日均IP访问量108600、日均PV浏览量760200(三)国际酒店集团优势1.经济规模大,综合实力强按照2009年半年时的市值计算,各大酒店集团市值排名为雅高、万豪、喜达屋、洲际、温德姆、精选。

关于InterContinental 洲际酒店集团(英国)一、集团简介洲际酒店集团发家于1777年的第一家巴斯(Bass)酿酒厂;1988年购入Holiday Inns International后,开始涉足宾馆业;2003年4月,随着Six Continents PLC将集团的酒店业务和软饮料业务从零售业中(公司名称为Mitchells & Butlers plc)分离,洲际酒店集团(IHG)正式成立。

目前,洲际酒店集团是全球最大及网络分布最广的酒店管理集团,拥有洲际酒店及度假村、皇冠假日酒店、英迪格酒店、假日酒店、智选/快捷假日酒店、假日酒店度假村(Holiday Inn Resort)、假日酒店度假俱乐部(Holiday Inn Club Vacations)、华邑酒店及度假村、Even酒店、宿之桥酒店公寓(Staybridge Suites)、蜡木酒店公寓(Candlewood Suites)共11个酒店品牌(其中,华邑品牌仅针对中国市场,Even品牌目前仅针对美国市场),覆盖高、中、低档酒店市场。

(注:洲际官网称自己旗下只有9大品牌,不包括“假日酒店度假村(Holiday Inn Resort)、假日酒店度假俱乐部(Holiday Inn Club Vacations)”这两个品牌,但是在酒店数量、酒店房间数计算的时候,会列为独立品牌进行计算)截止2015年1月31日,洲际酒店集团在全球100多个国家和地区拥有已开业酒店4,912家,在建签约酒店1,237家,已开业客房总数721,595间,客房数位居全球第一,同时也是目前为止跨国经营范围最广的国际酒店集团。

洲际1984年开始进入中国市场,至今为止在大中华区已引入7大酒店品牌,包括:洲际酒店及度假村、皇冠假日酒店、英迪格酒店、假日酒店、智选假日酒店、华邑酒店及度假村、假日酒店度假村。

截至2014年12月31日,洲际在华(含港澳台)已开业酒店总数达241家,另外有189家酒店在建,是目前在中国接管酒店最多的国际酒店集团。

跨国酒店集团(一)--洲际洲际根据2005年7月美国《HOTELS》杂志公布2004年的统计,洲际集团(英)在100多个国家有酒店3540座、房间534202间,列第1位;2003年列第1位,酒店3520座、房间536918间。

英国洲际酒店集团 PLC (伦敦股票交易所:IHG,纽约股票交易所:IHG(ADRs)),拥有多个酒店品牌,包括洲际(R)酒店、皇冠假日(R)酒店、假日(R)酒店、假日快捷(R)酒店、Staybridge Suites(R)、Candlewood Suites(R)和 Hotel Indigo(TM)。

特许经营约占88.9%、委托管理约占6%、带资管理及其它5.1%。

此外,集团还拥有英国第二大软性饮料生产商 Britvic 公司47.5%的控股权。

洲际酒店集团亚太地区酒店数量位居国际酒店公司之首。

在中国均委托管理,投资极少。

集团同时管理着全球最大的酒店忠实客户计划优悦会(R),该计划在全球拥有超过2500万名会员.洲际酒店集团的忠实客户奖励计划——优悦会在由顾客自行投票选举的2004年度FREDDIE奖盛典中荣获6项冠军,8项亚军,揽得了16个奖项中的14项大奖。

FREDDIE奖从1989年开始在旅游业内评选最佳旅游忠实奖励计划,该奖由全球130个国家和地区的超过277000常旅客投票选出他们心目中的最佳酒店及航空公司忠实奖励计划,可以称是旅游业内的奥斯卡奖,优悦会是世界上第一个并且最全球化的酒店忠实奖励计划,通过该计划,优悦会会员可在全球100个国家的3500家酒店享有会员特权。

平均每个月都有超过300000新会员加入这项奖励计划,优悦会也成为酒店业内发展最迅速的忠实奖励计划,在过去的三年时间内,其会员增长近一倍,目前全球会员已超过1900万。

优悦会会员可以在洲际酒店和度假酒店、皇冠假日酒店和度假酒店,假日酒店和度假酒店、快捷假日酒店、STAYBRIDGE SUITES及CANDLEWOOD SUITES等酒店件享有各项优惠特权。

世界十大酒店治理集团1、洲际酒店集团洲际酒店集团是一个全球化的酒店集团,在全球100多个国家和地区共有4,200间不同类型的“洲际〞旗下的酒店品牌有洲际酒店〔InterContinentalHotels&Resorts〕,酒店,超过610,000间客房。

假日酒店〔HolidayInn〕,皇冠假日酒店〔CrownePlazaHotels&Resorts〕,假日快捷〔HolidayExpress〕,Indigo品牌酒店,Candlewood品牌酒店,Staybridge公寓式酒店等品牌。

洲际集团成立于1777年,是目前全球最大及网络分布最广的专业酒店治理集团,拥有洲际、皇冠假日、假日酒店等多个国际知名酒店品牌和超过60年国际酒店治理经验。

同时洲际酒店集团也是世界上客房拥有量最大〔高达610,000间〕、跨国经营范围最广,分布将近100个国家,同时在中国接管酒店最多的超级酒店集团。

包括中国大陆25个省、区、市。

其在中国有48家酒店,是目前在华酒店数量最多的集团,2021年酒店数扩至125家。

2、圣达特国际集团圣达特公司作为世界最大的特许连锁饭店集团,成立于1995年,旗下有九个连锁酒店品牌,包括天天旅馆(DaysInnOfAmerica),霍华德·约翰逊特许系统〔HowardJohnsonFranchiseSystems〕,KnightInn,华美达特许系统〔RamadaFranchiseSystems〕,超级8汽车旅馆〔Super8Motel〕,Travelodge,VillagerLodge,WingateInn等多个连锁系统。

Super8、DaysInn、Ramada、BaymontInn、Travelodge、HowardJohnson、KnightsInn、WingateInn、AmeriHostInn、WyndhamHotels,全球排名第一的特许经营酒店集团,特许经营饭店占100%3、万豪国际集团万豪、JW万豪、丽思-卡尔顿〔Ritz-Carlton〕、万丽〔Renaissance〕、ResidenceInn、万怡〔Courtyard〕、Bulgari、MarriottVacationClubInternational、Horizons、TheRitz-CarltonClub、MarriottGrandResidenceClub。

IHG works with more than 2,000 hotel owners throughout the world. They are our business colleagues and one of our greatest strengths.Successful hotel development depends on matching owners with the right brands and markets. The IHG Global Development website provides the information owners need to learn more, make contact and get started.Developing hotels with us connects owners and their hotels to a host of resources worldwide. We have scale in the largest markets, our global portfolio投资组合has measurable performance and our brands outperform 胜过their market segments细分市场and categories类别. Our brands work hard for our owners, winning guest loyalty and building momentum动力. And our growth projections预测have never been higher: our hotel development pipeline传递途径outpaces超过all of our competitors, which leads to strong, enduring持久global distribution分布.If you would like to learn more about the IHG opportunity, visit the IHG Global Development website. You can download brochures小册子, watch interviews with our leadership team and get acquainted with the award-winning备受赞誉的brands and global operating system that can put your hotel on the map.HistoryWilliam Bass sets up a brewery in Burton-on-Trent. The Bass business thrives兴旺, developing into one of the UK's leading brewers酿酒者.The Bass red triangle becomes the first trademark商标to be registered in the UK.Bass acquires购入a number of well-known regional brewing companies including Mitchells & Butlers in the Midlands (1961), before merging融入with Charringtons in London in 1967. These acquisitions兼并make Bass one of the largest brewers and pub酒馆owners in the UK.Bass makes its first significant象征international move into the hotel industry, buying Holiday Inns International.The Beer Orders legislation立法is passed. This limits the number of tied pubs that major brewers can own and signals a major industry restructuring调整.Bass reduces降低the number of pubs that it owns dramatically and focuses on larger outlets批发商点. At the same time, it directs cashflow现金流转into developing an international hotel business.Bass buys the North American Holiday Inn business and Holiday Inn grows internationally国际性地.Bass launches Holiday Inn Express快捷假日, a complementary brand in the limited service segment.Bass launches Crowne Plaza皇冠假日五星, a move into the upscale迎合高层次消费者hotel market.Bass's pubs酒吧business continues to grow. The business has also become increasingly branded. Bass opens the first O'Neill’s public house小旅馆in 1994 and acquires the restaurant chain Harvester in September 1995.The Harvester acquisition, the development of the All Bar One brand in 1994 and the acquisition of the Browns restaurant chain marks a significant commitment to the growing eating out外出就餐market in the UK.Bass's attempt to acquire half of the Carlsberg-Tetley brewing business in the UK is blocked by the UK government.Bass renews its focus on its hotels and pubs divisions分类. Over the next few years, it sells smaller, non-core非核心businesses such as Gala bingo and Coral bookmakers, along with some of its pubs, including the leased租用的pub business.As the hotel business becomes more purely brand focused, Bass sells its North American midscale hotel buildings, but keeps control of the branding of the hotels through franchise经营权agreements.Bass creates and launches a new hotel brand, Staybridge Suites by Holiday Inn. It's an entry into the profitable赚钱的North American upscale extended stay market. Staybridge Suites becomes the fastest brand in this segment部分to reach 50 units单位in the Americas.Bass acquires the InterContinental hotel company, adding an upper upscale brand to its hotel portfolio. It's an acquisition that brings considerable synergies合并效果and cost savings.The group strengthens its pub division in the UK by cherry picking随意选取550 high-potential sites from Punch Taverns, who had acquired the 3,500 strong pub estate of Allied Domecq联合多美.By acquiring Southern Pacific Hotels Corporation (SPHC) in Australia, Bass confirms its position as the leading hotel company in Asia Pacific.It also acquires Bristol Hotels & Resorts Inc., a US-based hotel management company comprising包含112 hotels operating mainly under leases. This gives the group a stronger management contract presence in the world's largest hotel market.The group sells Bass Brewers to a major Belgian比利时brewer for £2.3 billion十亿.This marks the final step in refocusing再聚焦the group from a domestic家庭的brewing operation to a leading international hospitality retailer – a process that has taken over ten years to complete.It also involves the sale of the Bass name and a change of name to Six Continents PLC – a name that better reflects the global spread of the group's businesses.In February, Six Continents sells 988 smaller, unbranded pubs for £625 million.In April, it acquires the European Posthouse chain of hotels for £810 million. The chain has hotels in strategic战略locations that are suitable for conversion转换to Holiday Inn, consolidating巩固the Holiday Inn brand in the UK and Europe.The group buys the InterContinental Hong Kong for £241 million, strengthening its position in the upscale hotel market in the key Chinese and Asia Pacific markets.On 1 October, Six Continents PLC announces the proposed被提议的separation of the group’s hotels and soft drinks businesses (to be called InterContinental Hotels Group PLC) from the retail零售business (to be called Mitchells & Butlers plc), and the return of £700 million of capital资本输入to shareholders.This process is completed on 15 April 2003. InterContinental Hotels Group PLC (IHG) is now a distinct, discrete离散的company, listed in the UK and the US stock markets.In July, IHG sells 16 Staybridge Suites hotels to Hospitality Properties Trust (HPT) and enters into a20-year management agreement.In December, IHG adds the midscale extended-stay长期居住brand Candlewood Suites to its portfolio.In April, IHG announces the introduction of a new brand, Hotel Indigo, focused on providing affordable实惠boutique精品屋accommodation住处.In the same month, the group adopts new standards for selling or re-selling hotel rooms for guest stays through online travel companies.Following the success of the extended-stay Staybridge Suites brand in North America, IHG launches Staybridge Suites UK in April 2005.IHG announces the disposal清理of 100% of its holding in Britvic plc. IHG is now a company with a pure hotels focus.IHG signs an operating joint venture合资企业with All Nippon Airways全日空(ANA). The resulting joint venture – IHG ANA Hotels Group Japan – will be the largest international hotel operator in Japan, the world’s second largest hotel market. The deal sees the introduction of three new brands created for Japan: ANA-InterContinental, ANA-Crowne Plaza and ANA-Holiday Inn.IHG announces a worldwide relaunch of the Holiday Inn brand family, comprising包含Holiday Inn, Express by Holiday Inn and Holiday Inn Express快捷. The relaunch programme will give Holiday Inn a refreshed and contemporary当代的brand image. All Holiday Inn hotels open or under development are expected to have implemented the relaunch programme by the end of 2010, with the first due to open in mid 2008 in the US.BrandsOur seven hotel brands include some of the best-known and most popular in the world. We've built up a portfolio that covers everything from luxurious upscale hotels in the world's major cities and resorts toreliable family-oriented hotels that offer great service and value.This diverse不同的portfolio means that we have the flexibility灵活性to respond to most types of hotel development opportunity. What's more, our hotel owners can choose the hotel brand that will work for them and maximise尽量增大the potential of a particular特别的site. And whether our guests are travelling for business or leisure安逸, for a honeymoon or a family holiday, we'll have a hotel that's right for them.InterContinental Hotels & Resorts is our most prestigious有名望的hotel brand, located in major cities in over 60 countries worldwide, offering business and leisure travellers the highest level of service and facilities.57,002 rooms, 168 hotels, 62 hotels in the pipeline在准备中Did you know?InterContinental is the world's first hotel brand to provide destination specific concierge门房websites and videos.A dynamic有活力的hotel brand located in nearly 60 countries around the world. Truly international, Crowne Plaza offers premium accommodation, designed for the discerning眼光敏锐的business and leisure traveller who appreciates simplified elegance高雅.103,678 rooms, 376 hotels, 125 hotels in the pipelineDid you know?Crowne Plaza Changi airport was ranked among the world’s best airport hotels by Forbes Traveler.A new innovative创新的brand designed for the style-conscious注重风格traveller looking for the individual approach and facilities of a boutique hotel精品饭店. Our hotels are located in urban, mid-town and suburban areas, close to businesses, restaurants and entertainment venues throughout America.4,264 rooms, 36 hotels, 57 hotels in the pipelineDid you know?Hotel Indigo hotels will be located in urban, mid-town and near-urban markets proximate to businesses, restaurants and entertainment venues.Holiday Inn offers today’s business and leisure travellers dependability可靠性, friendly service, modern facilities and excellent value.You’ll find them throughout the world – in small towns and major cities, along quiet roadways and near bustling airports.240,025 rooms, 1,315 hotels, 308 hotels in the pipelineDid you know?100 million guest nights every year globally.A fresh, clean, uncomplicated hotel choice offering comfort, convenience and good value. Holiday Inn Express (or Express by Holiday Inn) is one of the fastest growing hotel brands in its segment.192,264 rooms, 2,101 hotels, 501 hotels in the pipelineDid you know?The complimentary Express Start breakfast bar, represented the most rapid food and beverage implementation in the hospitality industry. Available at more than 1,600 hotels in the US.Staybridge Suites is an all-suite hotel brand for extended-stay guests looking for a residential-style住宅式的hotel for business, relocation迁徙or leisure.20,323 rooms, 184 hotels, 110 hotels in the pipelineDid you know?In 2007 Staybridge Suites reached its 100th hotel opening faster than any other brand in the extended-stay segment.Candlewood Suites' high-quality accommodation caters to迎合mid-market business and leisure travellers looking for a multiple多样的night hotel stay.26,996 rooms, 273 hotels, 139 hotels in the pipelineDid you know?The first Candlewood Suites property was opened in Wichita, Kansas in 1996.Priority优先Club is the largest reward scheme in the hotel industry, offering our members a variety of privileges特权and rewards as well as unparalleled无比的levels of freedom and choice through our Any Hotel, Anywhere scheme.Did you know?We have 300,000 new members each month and have 52 million members worldwide (as at Interim Results 2010).What are our Winning Ways?IHG’s Winning Ways are how we behave every day – a set of behaviours based on our values that are helping us to become one of the very best companies in the world.They reflect the values that are important to us and were developed through research with our employees across the world into how they behave at work every day – and how they want the people they work with to behave.Our Winning Ways provide a strong sense of shared purpose, and are critical to driving our business performance forward, as well as making us a great, enjoyable place to work. They make us a high-performing organisation that helps deliver our company’s core purpose –‘Great Hotels Guests Love’.The heart of our company has always been our people. It is our people who bring our brands to life for our guests.We operate hotels in three different ways – as a franchisor授予特许者, a manager and on an owned and leased basis.Our business model focuses on managing and franchising hotels, whilst同时our business partners own the bricks and mortar房产. We have approximately 2,000 business partners – hotel owners – throughout the world.FranchisingThis is the largest part of our business: over 3,800 hotels operate under franchise agreements. ManagingWe manage 633 hotels worldwide.OwningWe own 15 hotels worldwide (less than 1% of our portfolio).。

简介洲际酒店集团InterContinental Hotels Group PLC (IHG)是一个全球化的酒店集团,在全球100多个国家和地区经营和特许经营着超过4,400家酒店,超过660,000间客房。

“洲际”旗下的酒店品牌有洲际酒店及度假村(InterContinental Hotels & Resorts),假日酒店及假日度假酒店(Holiday Inn),皇冠假日酒店(Crowne Plaza Hotels),智选假日酒店(Holiday Inn Express),英迪格酒店(Indigo) 。

历史1777年,英国巴斯(BASS)集团成立,成为英国第一家独立注册商标的集团。

成立之初,巴斯集团主要以饮料和啤酒的生产和销售为主。

至20世纪80年代末,转入酒店行业。

美国企业家凯蒙斯?威尔逊(Kemmons Wilson)在一次举家出外度假时,有感于所入住的饭店缺乏宾至如归的服务及收费过高,遂于1952年在美国田纳西州孟斐斯开设了第一间假日饭店。

该饭店设有泳池、空调设备与餐厅,还提供电话、冰块及免费停车场等基本设施,而孩童则可免费入住父母的客房。

这些现在看来只能算是很普通的设施,在当时来说,却在饭店业掀起了一场革命,并由此而形成了一套饭店业的标准,这套标准不仅为每间假日饭店所采用,也引领着全球饭店业的发展进程。

Wilson 先生其后还成为连锁经营的先驱。

他利用当时美国的州际高速公路系统向全国伸展的时机,沿途开设饭店,迅速扩展了假日饭店的网络。

假日饭店在美国取得成功后,很快引起了欧洲及亚洲投资者的兴趣,进而发展成全球最具规模的单一饭店品牌。

如今假日饭店的品牌在全球已随处可见。

发展1777年Bass在英国创立了一个酿酒厂,后来发展成为英国顶级酿造者之一。

1876年Bass的商标红三角成为英国第一个注册商标。

二十世纪六十年代Bass公司收购了一些知名的酿酒公司,成为英国最大的酿酒商,也拥有最多的酒馆。

InterContinental Hotels Group (IHG)At IHG, we’re committed to delivering True Hospitality for everyone. We believe in making you feel welcome and valued, wherever you are in the world. That’s because we truly care about people and the communities we serve, and because we pride ourselves on providing the highest quality of service.Each of our hotel brands caters to guests in their own distinct way. And our reach spans the globe. So, whether you’re travelling for business, fun with friends and family, or pure luxury, we have a hotel for you.We look forward to seeing you soon.一、核心词汇intercontinental [,ɪntɚ,kɑntɪ’nentl]adj. 洲际的;大陆间的deliver [dɪ’lɪvɚ] vt. 递送;发表;给……接生community [kəˈmjunətɪ] n. 社区pride [praɪd] vt. 使得意,以……而自豪 n. 自豪;骄傲provide [prə’vaɪd] vt. 提供brand [brænd] n. 品牌;商标 vt. 给……打烙印cater [ˈkeɪtɚ] vt. 提供饮食及服务;迎合;满足需要distinct [dɪ’stɪŋkt]adj. 明显的;明显不同的span [spæn] n. 跨度 vt. 跨越globe [gləʊb] n. 球体;全球pure[pjʊr] adj. 纯的;纯粹的;纯洁的luxury[ˈlʌkʃərɪ] n. 奢侈,奢华二、核心表达be committed to sth./doing sth.致力于某事/做某事believe in sth./doing sth.信奉某事/做某事pride oneself on sth. 为……而自豪;对……引以为荣cater to sb. 迎合某人;满足某人的需要span the globe遍布全球三、参考译文洲际酒店集团洲际酒店集团致力于为每一位宾客提供充满真情实意的热情款待。

洲际酒店集团介绍及其营销策略一、基本介绍【简介】洲际酒店集团InterContinental Hotels Group PLC (IHG)是一个全球化的酒店集团,在全球100多个国家和地区经营和特许经营着超过4,400家酒店,超过660,000间客房。

“洲际”旗下的酒店品牌有洲际酒店(InterContinental Hotels & Resorts),假日酒店(Holiday Inn),皇冠假日酒店(Crowne Plaza Hotels & Resorts),假日快捷(Holiday Express),英迪格(Indigo)品牌酒店,Candlewood品牌酒店,Staybridge公寓式酒店等品牌。

同时,洲际酒店集团也是世界上客房拥有量最大、跨国经营范围最广,并且在中国接管酒店最多的超级酒店集团。

包括中国大陆25个省、区、市。

集团旗下七个品牌(一)洲际酒店及度假村(二)皇冠假日酒店及度假村(三)假日酒店及度假村(四)快捷假日(五)Staybridge Suites(六)CandleWood Suites(七)Indigo洲际酒店在中国地区的分布:香港洲际酒店重庆洲际酒店九寨沟九寨天堂洲际大饭店上海锦江汤臣大酒店沈阳洲际酒店福州洲际大酒店马鞍山海外海皇冠假日酒店重庆滨江皇冠假日酒店北京中成天坛假日酒店海南饭店三亚亚龙湾假日渡假酒店【历史背景】1777年,英国巴斯(BASS)集团成立,成为英国第一家独立注册商标的集团。

成立之初,巴斯集团主要以饮料和啤酒的生产和销售为主。

至20世界80年代末,转入酒店行业。

美国企业家凯蒙斯•威尔逊(Kemmons Wilson)在一次举家出外度假时,有感于所入住的饭店缺乏宾至如归的服务及收费过高,遂于1952年在美国田纳西州孟斐斯开设了第一间假日饭店。

该饭店设有泳池、空调设备与餐厅,还提供电话、冰块及免费停车场等基本设施,而孩童则可免费入住父母的客房。

CORPORATE FINANCE MANUALThis updated manual focuses on the IFRS accounting policies relevant to IHG. Guidance and interpretation is also provided on the key policies.US GAAP is not covered as the technical US GAAP issues are all dealt with by the Controller’s Group.Section Contents1 General2 Updates and resolving queries3 Accounting policies4 Policy applicationSection Description Page1 general 52 updates and resolving queries 7 Section Description Page 3.1 basis of accounting 10 3.2 consolidation 113.2.1 subsidiary undertakings 113.2.2 minority interest 123.2.3 associates and joint ventures 133.2.4 off balance sheet items 143.2.5 acquisition of subsidiary undertakings 143.2.6 disposals of subsidiary undertakings 153.2.7 translation of overseas subsidiaries 153.2.8 consolidation adjustments 16 3.3 foreign currencies 17 3.4 prior period adjustments 18 3.5 post balance sheet events 19 3.6 tangible fixed assets 203.6.1 tangible fixed assets 203.6.2 capital expenditure and initial measurement 213.6.3 capitalisation of own labour 223.6.4 depreciation 223.6.5 disposal / sale of fixed assets 233.6.6 licences 243.6.7 impairment reviews 24 3.7 intangible assets 253.7.1 software costs 253.7.2 research and development 263.7.3 inducement payments 263.7.4 management contracts 27 3.8 associates, joint ventures and other equity investments 283.8.1 fixed asset investments 283.8.2 associates and joint ventures 283.8.3 other equity investments 29 3.9 other non-current financial assets 30 3.10 inventory 31 3.11 cash and cash equivalents 323.11.1 cash equivalents 32 3.12 provisions for liabilities 33 3.13 contingencies 34 3.14 revenue recognition 35 3.15 revenue expenditure 363.15.1 research and development 363.15.2 repairs and maintenance 363.15.3 advertising, sponsorship and promotions 373.15.4 pre-opening expense 37 3.16 pensions, holiday pay and employee benefits 383.16.1 defined benefit pension scheme costs 383.16.2 defined contribution pension scheme costs 383.16.3 Holiday / vacation pay / long term service awards 383.16.4 Severance / termination / redundancy payments 39 3.17 share based payments 40 3.18 leases 413.18.1 finance leases 413.17.2 operating leases 413.18.3 other lease issues 41 3.19 segmental reporting 42 3.20 assets held for sale and discontinued operations 443.20.1 assets held for sale 443.20.2 discontinued operations 44 Section Description Page4.1 identification of subsidiaries 464.1.1 principles and definitions 46 4.2 acquisitions and disposals 474.2.1 principles and definitions 474.2.2 acquisitions 484.2.3 disposals 534.2.4 key information to be gathered and retained 53 4.3 foreign currencies 574.3.1 principles and definitions 574.3.2 approach to foreign currency translation 58 4.4 tangible fixed assets 594.4.1 principles and definitions 594.4.2 carrying value 594.4.3 categorisation of tangible fixed assets 604.4.4 properties 614.4.5 fixtures, fittings and equipment 624.4.6 payments on account and assets in the course of construction 62 4.5 capital and revenue expenditure 634.5.1 principles and definitions 634.5.2 initial measurement 644.5.3 capital retirements 65 4.6 depreciation 664.6.1 principles and definitions 664.6.2 timing of depreciation and depreciation base 664.6.3 accelerated depreciation 674.6.4 depreciation rates 684.6.5 standard depreciation assumptions 704.6.6 illustration of assets and asset components 71 4.7 sales / disposals of fixed assets 754.7.1 principles and definitions 754.7.2 disclosure 764.7.3 accounting treatment 76 4.8 impairment of fixed assets and goodwill 774.8.1 overview 774.8.2 key concepts 774.8.3 impairment review 794.8.4 allocation of impairment losses 804.8.5 subsequent monitoring of cash flows 80 4.9 associates, joint ventures and other equity investments 814.9.1 principles and definitions 814.9.2 consolidated accounts 834.9.3 checklist for qualification of an investment as an associate 844.9.4 disclosure required in consolidated financial statements 85 4.10 non-current financial assets 864.10.1 principles and definitions 864.10.2 accounting 86 4.11 provisions for liabilities and charges 874.11.1 definition 874.11.2 recognition of provision 874.11.3 measurement of provision 874.11.4 future operating losses 884.11.5 onerous contracts 884.11.6 restructuring costs 884.11.7 disclosures 89 4.12 contingencies 904.12.1 principles and definitions 904.12.2 normal uncertainties 904.12.3 contingent assets 914.12.4 identification of contingent liabilities 914.12.5 accounting treatment of contingent liabilities 92 4.13 revenue recognition 934.13.1 principles and definitions 934.13.2 treatment of franchise fees 934.13.3 treatment of management fees 944.13.4 technical service fees 944.13.5 supplier incentives and rebates 95 4.14 pension costs 964.14.1 principles and definitions 964.14.2 group income statement 974.14.3 balance sheet accounts 974.14.4 disposal of a subsidiary 984.14.5 acquisition of a subsidiary 98 4.15 leases 994.15.1 principles and definitions 994.15.2 accounting for finance leases 1004.15.3 operating leases 1024.15.4 sale and leaseback transactions 1024.15.5 lease incentives 1034.15.6 other lease issues 1031.0 GeneralA. ContextThe system of financial reporting within IHG is designed to ensure that the Group publishes accounting information in the public domain which is consistent and complies with best accounting practice. In order to achieve these objectives Group accounting polices and procedures are established which should be consistently applied throughout the Group for the purposes of Group reporting. These policies and procedures should also be applied to individual entity's financial statements unless to do so would contravene local legislation or standards.The preparation of accounting information for release into the public domain is ultimately the responsibility of the IHG PLC directors. It is their responsibility to review this information and to ensure that the financial statements give a true and fair view of the company and comply with appropriate legislation. Quality control for accounting information is effectively achieved by the main board delegating the responsibility for preparing the underlying financial statements to the Finance Director. Ultimately it is the Board which must ensure that appropriate control procedures are adopted in order to achieve the group objectives.Information contained in this Manual is strictly confidential and for use only by IHG Group personnel and the Group's professional advisers. It is not to be distributed or otherwise published outside the Group. Any external advisers using the manual are not permitted to copy any material or to remove the Manual from the premises.B. ControlControl is exercised at three levels, namely:1.Controllers Group (Global)2.Regional and Functional Finance Director (divisional level)3.Business Service Centres (global and divisional)4.Project managementAt the corporate level, information supplied by divisions is consolidated into a Group total and reviewed for compliance against published reporting standards. At the divisional level control is exercised by monitoring performance against specific operating targets. The BSCs are responsible for transaction processing.C. StructureFinancial control and reporting recognises two related structures within the Group - the management structure and the legal structure.The management structure is based on the Group's operating divisions plus those companies not falling naturally within a division. It links to the segments used for external reporting.The legal structure represents the legally recognised entities (companies and branches) which comprise the total Group. For the sake of convenience, financial reporting is concentrated into certain reporting units (components) though still greater in number than divisions.2.0 Updates and resolving queriesTo:See Distribution From:Ralph WheelerRef:Date:Cc:Page: 1 of 3 PROCEDURES FOR ESTABLISHING/AMENDING ACCOUNTINGPOLICIESDecision RightsDecision Rights for establishing and amending accounting policies resides with the Controller.What is in scope?All accounting policies and interpretations.At a high level, Policies include all the accounting policies followed in the preparation of the Group Financial statements (IFRS and US GAAP). At a more detailed level the Controller responsibility extends to all interpretations of Group policies for specific local/regional application.‘Interpretation’ includes, as required, establishing the accounting for specific transactions or types of transaction to enable a consistent global approach to be followed within the boundaries of Group policies.What is not in scope?In some circumstances local GAAP or statutory requirements will necessitate variations to Group policies. In these instances, those responsible for the preparation of local accounts should agree an interpretation with the local auditors and ensure a consistent regional application. The Controller Group should be advised of all material deviations and can be involved in local discussions if technical support is required.This document deals only with accounting policies and interpretations and not with issues related to Delegation of Authority, Chart of Accounts or Standard Reporting.Proceduresi) New policies required because of changes in GAAPThe need for new policies will generally arise because of changes to the statutory environment in which the Group operates. In most cases the need for a newpolicy will be driven by the introduction of new Accounting Standards in the UK.Within three months of the issue of a new Standard, the Controller Group will summarise the key points of the Standard and issue this summary, together with a timetable for establishing a new policy, to the Regional Finance Directors and the BSC Global Process Owners.When possible, the timetable will target finalisation of the new policy at leastthree months ahead of implementation date to ensure that systems changes and impact can be properly assessed. For Standards with accelerated implementation dates this may not be possible.The process will include interpretation of the Standard, Industry view, Technical view, Auditor input, assessment of impact, policy recommendation, BusinessUnit and BSC input.The final policy will be drafted by the Controller Group and circulated to theRegional Finance Directors and BSC Global Process Owners for comment, prior to finalisation and submission to the Executive Committee, if appropriate.ii) New policies required because of changes in the business operating environment; andiii) Amendments to existing policies and interpretationsIn most cases, requests for amendments will come from the Regions or Global Functions in conjunction with the BSC, in light of experience of the application of existing policies or changes in business processes. BSC requests must be in a globally agreed format before submission.All requests for amendments must be sent to the Controller indicating: •reason for change•financial impact of change•requested timetable for implementation•potential impact on CoA, RCoA and Standard Reports•potential impact on other policies (non-accounting policies)•requesting Business Unit/BSC sign off•SVP Global BSC sign off if the request is driven from the BSCWithin 2 weeks of receipt of a request for change, the Controller will assess whether the change requested appears acceptable under relevant GAAP – if not, then the request will be denied. If compliance is not an issue, the Controller will send the request to the Regional and Functional Heads of Finance, the BSC Global Process Owners and the SVP Global Business Service Centres (and tax if appropriate) for comment within 3 weeks.Once all comments are received the Controller Group will summarise the responses and report to the originator any questions raised.Following receipt of clarification from the originator, the Controller will decide on approval/non-approval.Notification of changesOnce approved the Controller Group will issue formal notification to the Executive Committee, if appropriate, Business Unit Finance Heads and the BSC Global Process Owners, who will then distribute as appropriateAll changes will be included in the next update version of the relevant accounting manual.3.1 Basis of accountingA. DefinitionThe basis of accounting is the convention under which the Groups financial statements are expressed. The Group financial statements are prepared on a historic cost basis, except for certain items of property plant and equipment which are held at revalued amounts under the transitional rules of IFRS 1, and derivative financial instruments and available-for-sale financial assets that are measured at fair value. The consolidated financial statements are presented in sterling and all values are rounded to the nearest thousand (£000) except when otherwise indicated.B. Group policyThe Group’s consolidated accounts are prepared on the basis of applicable IFRS, including all International Accounting Standards (IAS), Standing Interpretations Committee (SIC) and International Financial Reporting Interpretations Committee (IFRIC) interpretations issued by the International Accounting Standards Board (IASB) as published.In 2005 IFRS 1, first-time Adoption of International Financial Reporting Standards, was applied in preparing the financial statements. The Group adopted the following exemptions available under IFRS 1:a)Not to restate the comparative information disclosed in the 2005 financial statementsin accordance with IAS 32 ‘Financial Instruments: Disclosure and Presentation’ andIAS 39 ‘Financial Instruments: Recognition and Measurement’.b)Not to restate business combinations before 1 January 2004.c)To recognise all actuarial gains and losses on pensions and other post-retirementbenefits directly in shareholders’ equity at 1 January 2004.d)To retain UK GAAP carrying values of property plant and equipment, includingrevaluations, as deemed cost at transition.e)Not to recognise separately cumulative foreign exchange movements up to the 1January 2004.f)To apply IFRS 2 ’Share-bas ed Payments’ to grants of equity instruments after 7November 2002 that had not vested at 1 January 2004.The Group is registered with the Securities and Exchange Commission in the United States and so is required to prepare and file certain financial information in compliance with US GAAP.3.2 ConsolidationA. DefinitionConsolidation is the process of adjusting and combining financial information from the individual accounts of a parent undertaking and its subsidiary undertakings to prepare financial statements that present financial information for the Group as a single economic entity.B. Group policyIHG PLC prepares consolidated accounts incorporating the balance sheet, cash flows and results of the company and all of its subsidiary undertakings. The results of each subsidiary undertaking are incorporated between the dates of acquisition and disposal of that undertaking.All subsidiary undertakings comply with Group accounting policies in the preparation of their financial pro formas.The majority of subsidiary undertakings have a year end coterminous with or no more than three months before that of IHG PLC. Where a subsidiary has a different year end, financial pro forma information for the year to the Group's year end is produced.All intercompany balances and transactions are eliminated.3.2.1 Subsidiary undertakings (4.1)A. DefinitionA subsidiary of the Group is any undertaking (incorporated or unincorporated, partnership, joint venture, Trust or other vehicle) where the Group has control or the ability to control the entity, either directly or indirectly through one or more intermediaries.Control is the power to govern the financial and operating policies of the investee so as to obtain benefits from its activities.B. Group policyAny entity meeting the above definition is classified as a subsidiary and all its activities are consolidated within the group financial statements.Owing to the broad nature of the definition of a subsidiary, guidance must be sought from Group Finance where there is any doubt as to the relationship between undertakings.3.2.2 Minority interestA. DefinitionMinority interest is defined as the interest in a subsidiary undertaking included in the consolidation that is attributable to the interest held by or on behalf of persons other than the parent undertaking and its subsidiary undertakings.B. Group policyPartly owned subsidiary undertakings are fully consolidated by including their assets and liabilities at the latest balance sheet date. The percentage attributable to the minority is shown as "minority interests" and presented as an element of equity on the balance sheet. Loan capital issued by minority participants is treated within the Group accounts as other external borrowings. Minority interests are debited in full with their share of any loss unless this results in a debit balance. If the minority has a binding obligation to fund a loss then a debit balance can be recognised, otherwise, the losses are attributable to the parent’s interest.The results of a subsidiary undertaking down to and including profit after tax are fully consolidated. The results attributable to the minority are then shown on the face of the profit and loss account as an allocation of profit after tax for the period.The minority's interest in transactions between Group undertakings represents a realised profit or loss from the perspective of the Group. Such profits or losses are not material to the results of the Group and so are eliminated in full.In general, for the purposes of quarterly financial packs, minority interest figures are calculated and reported by the partly owned subsidiary undertakings themselves from the perspective of IHG PLC's interest in the undertaking. Group Finance will inform the relevant reporting divisions of the approach to be adopted.3.2.3 Associates and joint ventures (4.9)A. DefinitionAn associate is an entity, including an unincorporated entity, such as a partnership, over which the investor has the ability to exercise significant influence, but not control, and that is neither a subsidiary nor an interest in a joint venture.Significant influence is the power to participate in the financial and operating policy decision of the investee but is not control, or joint control, over those policies.A joint venture is an entity which is jointly controlled by the Group and one or more other venturers under a contractual arrangement.B. Group policyThe Group regards those undertakings in which IHG PLC or its subsidiary undertakings own between 20% and 50% of the equity capital, but does not exert control, as associates. This includes all 50:50 joint ventures unless they are structured in such a way as to give the Group the ability to control or joint control. Where the Group has the ability to control, such entities are accounted for as subsidiary undertakings. Where joint control exists, entities are accounted for as joint ventures.The Group accounts for its interests in associates under the equity method of accounting. The Group's interests in joint ventures are normally accounted for using the equity method. There may be circumstances where the Group must proportionately consolidate joint ventures. Group Finance will advise on the nature of any new undertaking.3.2.4 Off balance sheet itemsA. DefinitionOff-balance sheet items are expected to be extremely rare since, when considering the accounting treatment of a transaction, the substance of the transaction must be reflected in the financial statements. A group or series of transactions that achieves or is designed to achieve an overall commercial effect should be viewed as a whole for this purpose.B. Group policyIf there is any doubt as to the recognition, or otherwise, of an asset or liability Group Finance should be consulted.The following circumstances may indicate that an entity controls a special purpose entity (SPE) and consequently should consolidate the SPE even if it does not meet other consolidation requirements:a)Activities – the activities of the SPE are conducted on behalf of the Group whichcreated the SPEb)Decision making – the Group has the decision-making powers to control or to obtaincontrol of the SPEc)Benefits – the Group has the rights to obtain a majority of the benefits of the SPEd)Risks – the Group has the majority of the risks of the SPE i.e. guarantees a return orgives credit protection.3.2.5 Acquisition of subsidiary undertakings (4.2.2)A. DefinitionThe purchase of shares or other interest in a company or un-incorporated undertaking, bringing the control in the undertaking to the point where it is consolidated within the Group financial statements.B. Group policyAt acquisition the net assets of the acquired undertaking, adjusted to fair value, are consolidated into the Group balance sheet and from that date its results form part of the consolidated profit and loss account and cash flow statement of the Group. At acquisition, adjustments are made to conform the accounting policies of the undertaking acquired to those of the Group and, when allowed by local Company legislation, the accounting reference date of the undertaking is changed to bring it into line with the year end of the Group.The date for accounting for an undertaking becoming a subsidiary undertaking is the date on which control of that undertaking passes to its new parent undertaking. This triggering date is a matter of fact and cannot be backdated or otherwise altered.Guidance should be obtained from Group Finance regarding acquisition accounting.3.2.6 Disposal of subsidiary undertakings (4.2.3)A. DefinitionThe disposal of shares or other interest in an undertaking such that the undertaking is no longer consolidated within the Group financial statements.B. Group policyThe date for accounting for an undertaking ceasing to be a subsidiary undertaking is the date on which its former parent undertaking relinquishes its control over that undertaking. This triggering date is a matter of fact and cannot be backdated or otherwise altered.At disposal, the profit or loss recorded is the disposal proceeds plus fair value of non-monetary assets received less the net assets disposed of, less associated costs and any goodwill related to the acquisition. Adequate provisions should be made for future costs arising as a result of the disposal such as warranty costs and future claims.With regard to provisions for losses and costs arising as a consequence of a decision to sell or terminate an operation, provisions should only be established once an entity is committed to the sale or termination i.e. there is a binding sale agreement or the decision to terminate has created an expectation in those affected that the termination will occur.The definition encompasses the situation where a subsidiary undertaking becomes an associated undertaking i.e. on a part disposal of shares. The basic procedure for calculating any profit or loss on disposal is the same as a complete disposal however further complications can arise and Group Finance should be contacted in these circumstances.3.2.7 Translation of overseas subsidiariesA. DefinitionTranslation is the process whereby financial data denominated in the currency of a reporting subsidiary undertaking is expressed in terms of the currency of its parent undertaking.B. Group policyAssets and liabilities of overseas subsidiary undertakings are translated into sterling at the rate of exchange ruling on the balance sheet date.Items of revenue and expense are translated at appropriate average exchange rates. The average rate of exchange is computed by taking the arithmetic mean for each period weighted by the operating profit in that period.Exchange differences arising on the retranslation of net assets of overseas subsidiary undertakings are presented as a separate component of equity.Cash flows are translated at appropriate average exchange rates.Where foreign currency borrowings have been used to finance, or provide a hedge against (as defined by IAS 39), equity investments in overseas subsidiary undertakings, exchange differences on the retranslation of the borrowings are taken to the cumulative translation adjustments reserve to the extent that they are an effective hedge. Where they relate to an ineffective hedge, the excess is included in operating profit.Where an overseas subsidiary undertaking is acquired or disposed of, the fair value of the net assets of that subsidiary undertaking are translated into sterling at the rate of exchange ruling on the transaction date for the purposes of determining the initial goodwill or the profit/loss on disposal.3.2.8 Consolidation adjustmentsA. DefinitionConsolidation adjustments are those adjustments which are necessary in preparing consolidated group accounts and are not reflected in the accounts of the individual entities being consolidated. There are essentially four types of consolidation adjustment:(i) Elimination of inter-group transactions (e.g. turnover, profit on stock, etc.)(ii) Elimination of the cost of control (i.e. the elimination of the cost of investment of an entity), recorded in a parent undertaking's accounts, against the net assets at the date of acquisition of the subsidiary undertaking.(iii) Processing bank set-off adjustments (eliminating cash balances against overdrafts with the same bank where the Group has a set-off arrangement).(iv) Processing centrally required adjustments which cannot be allocated to a specific entity.B. Group policyAdjustments in respect of specific entities are "pushed down" and reflected in the individual entity accounts and not held as "central consolidation adjustments". Only those adjustments defined above are made in the preparation of consolidated Group accounts and held outside the scope of an individual entity's accounts. Such adjustments can only be made by Group Finance following the governance procedures adopted by that Group.3.3 Foreign currencies (4.3)A. DefinitionsA foreign currency transaction is a transaction that is denominated or requires settlement in a foreign currency, including transactions arising when an entity buys or sells goods or services whose price is denominated in a foreign currency.Presentation currencyThe currency in which the financial statements are presentedFunctional currencyThe currency of the primary economic environment in which the entity operates. Foreign currencyA currency other than the functional currency of the entity.Monetary itemsCurrency and assets and liabilities that will be received or paid in a fixed amount ofcurrency (balances to be settled by cash).RecognitionInitial recognitionForeign currency transactions shall be translated into the functional currency usingthe month end rate.Subsequent balance sheet datesMonetary itemsTranslated using the month end rate.Non-monetary itemsItems measured at historical cost (i.e. tangible assets) should be translatedusing the historical exchange rate.B. Group policyExchange differences on monetary assets and liabilities that are settled or retranslated at the end of the period shall be recognized as a component of operating profit in the profit or loss account.Financial statements of foreign operations are translated for purpose of consolidation as follows: assets and liabilities are translated at the closing rate, revenues and expenses are translated at average rate and equity components are not translated.Use of Month End RateIAS 21 paragraph 21 and 22 state that the spot rate or an approximation i.e. weekly or monthly average rate should be used to translate foreign currency transactions. The Group has adopted a policy of using the previous month end balance sheet rate as the approximation for actual rate. The difference between the previous month ending rate and average rate would not fluctuate significantly.。

Exchange London Exchange(Main Ma Country UNITED KINGDOM Industry CUSIP

G4804L130

Sedol

B85KYF3

ISIN

12/31/2011

GBP

12/31/2010

GBP

12/31/2009

GBP

12/31/2008

GBP restated

12/31/2007

GBP restated

120.349.930.863.062.0118.324.327.456.252.92.025.6 3.4 6.99.1225.6215.7226.1276.1263.12.6 2.6 2.7 2.7 3.01.3 1.3 1.4 1.4 1.50.00.00.00.00.01.3 1.3 1.4 1.4 1.50.00.00.00.00.027.330.127.430.829.70.00.00.00.00.0375.7298.2287.0372.6357.826.70.00.00.00.056.627.530.829.532.8101.486.489.1104.194.8885.31,081.61,257.71,153.5974.71,400.1

1,628.8

1,827.6

1,552.2

1,290.7

-----804.1

990.7

1,111.1

935.7

809.4

--------------------596.1

638.1

716.5

616.5

481.3

-----514.8

547.2

569.9

398.7

316.0

----- (Less) Accumulated Depreciation Accum Depr-Land

Construction Work In Progress Machinery & Equipment Rental/Lease Property Transportation Equipment PP&E - Other

PP&E Under Capitalized Leases Investment In Unconsolidated Subsidiaries Other Investments

Property Plant & Equipment - Net Property Plant & Equipment - Gross Land Buildings

Finished Goods

Progress Payments & Other Prepaid Expenses Other Current Assets Current Assets - Total Long Term Receivables

Cash

Short Term Investments Receivables (Net)Inventories - Total Raw Materials Work In Process INTERCONTINENTAL HOTELS GROUP PLC (IHG)

Travel & Leisure GB00B85KYF37

Annual Balance Sheet

Assets

Cash & ST Investments

113.1

136.3

145.2

68.5

65.0

---------------401.7

410.9

424.7

330.2

251.0

-----414.7232.3252.1476.1362.913.7 3.28.227.424.7141.10.00.0143.958.0260.0229.1243.9304.8280.21,860.31,726.11,916.62,135.81,823.081.972.367.876.050.413.7

11.5

72.6

14.4

8.1-----78.0

106.9

132.9

256.2

214.7

-----385.5398.7439.1435.0344.7559.0589.4712.4781.6617.9435.5496.6696.0913.8881.0310.1375.0567.2786.4788.3310.1375.0567.2786.4788.30.00.00.00.00.0125.5121.6128.8127.492.7123.5129.397.388.456.40.00.00.00.00.0(5.9) 3.215.880.174.663.153.880.880.1

74.6

68.9

50.6

65.1

-------387.4321.3288.4271.3143.61,499.6

1,539.8

1,809.8

2,135.1

1,773.6

0.00.00.00.00.05.2 4.5 4.8 4.8 3.00.00.00.00.00.00.0

0.0

0.0

0.0

0.0

Minority Interest Preferred Stock

Preferred Stock - Non Redeemable

Deferred Taxes - Debit

Deferred Tax Liability In Untaxed Reserves Other Liabilities Total Liabilities Shareholders' Equity Non-Equity Reserves Convertible Debt

Capitalized Lease Obligations Provision for Risks & Charges Deferred Income Deferred Taxes

Deferred Taxes - Credit Dividends Payable Other Current Liabilities Current Liabilities - Total Long Term Debt

LT Debt Excl Capital Leases Non-Convertible Debt Total Assets Liabilities Accounts Payable

ST Debt & Current Portion of LT Debt Accrued Payroll Income Taxes Payable Accum Depr-PP&E Other

Accum Depr-PP&E Under Cap Leases Other Assets Deferred Charges Tangible Other Assets Intangible Other Assets Accum Depr-Buildings

Accum Depr-Machinery & Equip. Accum Depr-Rental/Lease Property Accum Depr-Transport Equip.

0.00.00.00.00.0355.6181.8102.1(4.1)46.439.739.097.3

80.8

82.2

65.760.2---0.00.00.00.00.0(1,874.0)

(1,845.8)

(1,979.0)

(1,972.8)

(1,465.6)

-----1,972.8

1,784.3

1,819.4

1,797.4

1,335.1

-----17.622.4 2.733.641.8122.9135.0147.3117.8117.446.231.419.9 6.219.20.00.00.00.00.0355.6181.8102.1(4.1)46.41,860.31,726.11,916.62,135.81,823.0269.8

268.4

267.6

266.5

275.0

Common Shares Outstanding

ESOP Guarantees

Unrealized Foreign Exchange Gain(Loss) Unrealized Gain(Loss) on Marketable Securities (Less) Treasury Stock Total Shareholders Equity

Total Liabilities & Shareholders Equity Capital Surplus Revaluation Reserves Other Appropriated Reserves Unappropriated (Free) Reserves Retained Earnings

Equity In Untaxed Reserves Preferred Stock - Redeemable Common Equity Common Stock

Market Cap4,506.77Scale1,000,000 Shares Outstanding269.22。