战略联盟(Strategic Alliance)

- 格式:doc

- 大小:49.00 KB

- 文档页数:5

跨国企业的战略联盟策略随着全球经济的快速发展,跨国企业(MNEs)之间的竞争变得越来越激烈。

在这个竞争激烈的环境中,企业为了保持自身竞争力,需要采取更加创新和效率化的经营策略。

而其中,战略联盟(Strategic Alliance)就成为了一种相对有效的手段。

本文将从什么是战略联盟开始,探讨跨国企业采取战略联盟的原因、战略联盟的形式以及战略联盟的风险和管理。

一、什么是战略联盟战略联盟是指企业之间为了实现某项特定的战略目标、共同进行业务合作和分享资源,以达成既定目标的一种协议关系。

而双方之间形成的共同目标,可能是产品或技术的共享,市场拓展,成本共同承担等,通过联盟的形式来减轻企业自身的风险压力以及提高企业发展的效率和速度。

二、跨国企业采取战略联盟的原因1、资源互补性一般情况下,跨国企业之间的资源不完全相同。

合作的其中一方可能拥有另一方所需的资源,这种资源的互补可以很好的促进战略联盟的形成。

并且通过优势互补、资源共享、风险分散,并且实现最终效益的提高。

2、研发共享和技术合作通过与其他企业的合作,不仅可以得到与自己业务或目标相关的专业知识,还可以共享研发成果和新技术、专利等资源。

而这些可能经过联盟合作而得到,这些研发成果也对企业进一步的发展和维护竞争优势发挥重要作用。

3、全球化战略的推进通过联盟形式,可以依托合作伙伴的资源和市场,更好的了解地域文化以及市场需求。

这样可以减少企业对新市场的不了解和进入难度,同时还可以在合适的时机获得资源的便利性。

这种全球化战略的推进不仅可以减少企业在全球市场游戏中的失误和风险,而且可以加快企业全球化布局的进程。

三、战略联盟的形式1、合资公司合资公司是一种在产品和服务领域进行的深度合作模式。

双方通过组建合资公司来平等参与共同开展业务的利润和风险分担。

此时,合同约定是非常重要的合作成功因素,包括业务范围、所有权分配、资源分配等内容。

2、联营究竟是自己深度合作,还是组合伙人参与共同开展业务,这取决于跨国企业的实际情况。

战略联盟名词解释战略联盟是指两个或多个企业之间通过合作、共享资源和互助来实现共同目标的一种合作关系。

战略联盟的志愿参与者之间在商业、技术、市场、资源和其他领域进行协作,从而共同实现竞争优势和利益最大化。

战略联盟是基于长期合作关系构建的,参与者之间通过合作达成共识,并共享风险和利益。

战略联盟的目标通常是通过整合两个或多个企业的优势资源和核心能力,以弥补各自的不足,互补优势,提高竞争力。

战略联盟通常包括以下几个重要要素:1. 合作伙伴:战略联盟的参与者是合作伙伴,他们之间应该具备一定的互补性和相互依赖性。

合作伙伴之间需要共同确定合作目标,并愿意为实现这些目标而进行合作。

2. 共同目标:战略联盟的参与者应该有共同的目标,这些目标可以是市场份额的扩大、成本降低、技术创新或国际扩张等。

共同目标是战略联盟的核心,也是合作伙伴进行合作的基础。

3. 资源共享:战略联盟的参与者需要共享资源,包括资金、技术、渠道、品牌等。

资源共享可以帮助合作伙伴减少成本,提高效率,并提供更好的产品和服务。

4. 风险共担:战略联盟的参与者需要共同承担风险,包括市场风险、经营风险、技术风险等。

风险共担可以降低合作伙伴面临的风险,增加成功的概率。

5. 互补优势:战略联盟的参与者应该具备互补的优势,可以通过合作整合各自的资源和能力,形成竞争优势。

互补优势是战略联盟获得成功的重要因素。

战略联盟可以带来许多优势,包括资源共享、风险共担、市场扩大和成本降低等。

同时,战略联盟也存在一些风险和挑战,包括合作伙伴之间的利益冲突、合作失衡和合作协议的执行等。

战略联盟的成功取决于参与者之间的合作关系和互信,合作伙伴需要密切合作、沟通和协调,以实现共同的目标。

只有通过良好的合作关系,战略联盟才能得到持续的发展和成功。

国际企业战略联盟成功和失败案例分析一、战略联盟的概念随着经济全球化和科学技术的迅猛发展,越来越多的企业开始认识到,单凭企业自身的力量很难在这激烈竞争的市场环境中求得生存和发展。

20世纪80年代以来,西方企业尤其是跨国公司迫于强大的竞争压力,开始对企业竞争关系进行战略性的调整,纷纷从对立竞争走向大规模的合作竞争;其中合作竞争最主要的形式之一就是建立企业战略联盟。

战略联盟作为企业组织关系中的制度创新,已成为现代企业强化其竞争优势的重要手段,被誉为"20世纪20年代以来最重要的组织创新。

"自从美国DEC公司总裁简·霍普兰德(J.Hepland)和管理学家罗杰奈杰尔(R-NigeI)提出战略联盟的概念以来,战略联盟就成了管理学界和企业界关注的焦点。

所谓战略联盟(strategic alliance),是指两个或两个以上的企业为了实现各自的某种战略目的,通过公司协议或;联合组织等方式而结成的一种网络式的联合体。

如美国的IBM、摩托罗拉及苹果公司之间的联盟,目的就是通过减少竞争和需求的不确定性来开发和普及P0。

er Pc芯片。

日本的索尼、松下、东芝等电器公司通过各种产品不同定位的协议与合作,各自占领了一定的市场份额。

在我国,1998年8月,新科、上广电、熊猫、广东万燕4家在上海宣布成寺DVD联合体。

2000年5月,中国最大的洗衣机生产企业小天鹅集团和中国最大的冰箱生产企业科龙集团宣布结盟。

在过去的十几年中,战略联盟的数量激增,战略联盟已成为最广泛使用的战略之一,它可以使来自不同国家的企业共同分担风险、共享资源、获取知识、进入新市场。

战略联盟不仅包括股权合资企业,还包括生产、营销、分销、RInD的非股权协议。

战略联盟与合并或兼并是有区别的。

美国战略管理学家迈克尔.波特说:战略联盟是"企业之间达成的既超出正常交易,可是又达不到合并程度的长期协议。

"并购意味着投人大量资金,全盘接受对方企业的全部各类资产,操作复杂、风险很大;而战略联盟却强调伙伴之间的全面相容性,它所重视的是相互之间某些经营资源的共同运用,对相容的要求是部分的、有选择的。

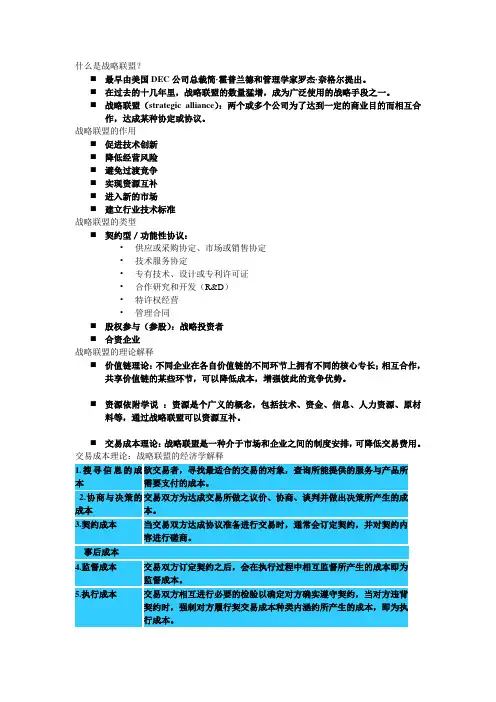

什么是战略联盟?⏹最早由美国DEC公司总裁简·霍普兰德和管理学家罗杰·奈格尔提出。

⏹在过去的十几年里,战略联盟的数量猛增,成为广泛使用的战略手段之一。

⏹战略联盟(strategic alliance):两个或多个公司为了达到一定的商业目的而相互合作,达成某种协定或协议。

战略联盟的作用⏹促进技术创新⏹降低经营风险⏹避免过渡竞争⏹实现资源互补⏹进入新的市场⏹建立行业技术标准战略联盟的类型⏹契约型/功能性协议:•供应或采购协定、市场或销售协定•技术服务协定•专有技术、设计或专利许可证•合作研究和开发(R&D)•特许权经营•管理合同⏹股权参与(参股):战略投资者⏹合资企业战略联盟的理论解释⏹价值链理论:不同企业在各自价值链的不同环节上拥有不同的核心专长;相互合作,共享价值链的某些环节,可以降低成本,增强彼此的竞争优势。

⏹资源依附学说:资源是个广义的概念,包括技术、资金、信息、人力资源、原材料等,通过战略联盟可以资源互补。

⏹交易成本理论:战略联盟是一种介于市场和企业之间的制度安排,可降低交易费用。

交易成本理论:战略联盟的经济学解释物流联盟产生的背景⏹物流服务的全球化——21世纪必将是物流服务全球化的时代,即所谓“经济全球化、物流无国界”⏹物流服务的综合化——“一站式”一体化物流服务。

⏹国内背景:物流企业小而散,条块分割,地方保护严重,竞争力低下。

物流联盟⏹物流业的固有特点决定了物流企业必须走联合的道路,一个企业的物流资源毕竟是有限的,单一的物流服务提供商往往难以满足物流服务的全球化与综合化发展需要。

⏹联合是当今企业发展的趋势,竞争与合作并存,才能不断壮大。

⏹物流联盟(logistics alliance)是以物流为合作基础的企业战略联盟,它是指两个或两个以上的经济组织为实现特定的物流目标而采取的联合与合作。

物流联盟的类型⏹纵向联盟⏹横向联盟⏹混合型联盟⏹动态联盟(虚拟联盟)纵向物流联盟⏹纵向物流联盟是指处于物流活动不同作业环节的企业之间通过相互协调形成的合作性、共同化的物流管理系统。

战略联盟(Strategic Alliance)2008-06-061人分享此文什么是战略联盟?战略联盟就是两上或两个以上的企业或跨国公司为了达到共同的战略目标而采取的相互合作、共担风险、共享利益的联合行动。

有的观点认为战略联盟为巨型跨国公司采用,但这决不仅限于跨国公司,作为一种企业经营战略,它同样适用于小规模经营的企业。

当然,由于产品的特点、行业的性质、竞争的程度、企业的目标和自身优势等因素的差异,企业间采取的战略联盟形式自然也呈现出多样性。

如联合技术开发、合作生产与后勤供应、分销协议、合资经营等。

普辛克(V·Pucik)教授认为公司建立战略联盟主要应强调如何利用技术变化带来好处,以及如何对世界市场上不断加深的竞争性作出反应。

他将战略联盟分为五种:因技术变动而建立的联盟,交叉许可证等;合作生产和OEM协议;联合销售或联合分销;共同开发产品项目;共同开发产品项目。

25种全球最流行的管理工具:目录1 客户关系管理(Customer Relationship Management,CRM)2 全面质量管理(Total Quality Management,TQM)3 顾客细分(Customer Segmentation)4 外包(Outsourcing)5 核心能力6 供应链管理(Supply Chain Management ,SCM)7 战略规划(Strategic Planning)8 业务流程再造(Business Process Reengineering,BPR)9 知识管理( Knowledge Management,KM)10 使命书和愿景书11 平衡记分卡(The Blanced ScoreCard,BSC)12 作业导向管理13 忠诚度管理14 六西格玛(6σ)15 战略联盟(Strategic Alliance)16 基准管理(benchmarking)17 变革管理计划(Change Management)18 增长战略(Growth Strategies)19 经济附加值增值分析(Economic Value Added,EVA)20 价格优化模型(Price Optimization Models)21 开放市场创新22 规模定制(Mass Customiza.tion,MC)23 情景设定和突发计划(Scenario Planning)24 海外经营25 射频识别(Radio Frequency Identification,RFID)战略联盟产生的背景企业战略联盟的出现绝不是偶然的,它是时代发展的产物。

企业战略联盟的建立与管理在今天的商业世界中,企业之间的竞争日益激烈,人们也越来越意识到,通过企业之间的合作与联盟建立,可以创造更多机会和更好的业务成果。

因此,企业战略联盟作为一种重要的商业战略,已经在很多行业中得到了广泛的应用和成功的实践。

本文将从联盟的定义、建立、管理等方面介绍企业战略联盟的相关内容。

一、企业战略联盟的定义企业战略联盟(Strategic alliance)是指两个或多个企业通过协议、合同等方式合作,共同完成一项业务或实现一项共同目标的一种商业组织形式。

联盟中的各个企业通常是相互独立的,合作的重点在于共享资源、知识、技术和市场机会等,以达到互利共赢的结果。

具体来说,企业战略联盟的成员之间需要建立一定的互信和合作关系,同时需要明确各自的责任和权利,制定明确的目标和规划,并通过合作来实现这些目标和规划。

联盟的形式可以很多,最常见的形式包括合资、合作、战略合作等。

二、企业战略联盟的建立企业战略联盟建立起来,并不是一件容易的事情。

成功建立企业战略联盟,需要考虑很多因素,包括联盟成员选择、合作目标、合作模式、管理体制和发展战略等。

以下是一些关键的步骤。

1. 识别目标和资源在构建企业战略联盟之前,成员企业需要明确目标和资源分析。

包括联盟的目标和任务,共享资源类型,合作领域和方式等。

此外,还需要对市场策略、竞争对手和市场趋势进行分析,以保证联盟方向与企业核心业务相匹配。

2. 确立联盟成员联盟成员的选择至关重要,成员之间应该有相近的企业文化和价值观,经营理念应相似。

同时,需要考虑企业之间的实力和资源优势,以及潜在的利益冲突。

最终,要选择具有相互补充资源和能力的企业作为联盟成员。

3. 确定合作模式企业战略联盟形式有多种,包括合资、合作、战略合作等。

这些不同的形式应该在联盟建立之前予以明确。

在考虑哪种形式时,需要考虑成员企业的经营特点、法律法规和财务状况等各方面因素。

4. 制定联盟合同联盟合同是联盟建立的基础。

CONTENTExecutive Summary (1)1.Introduction (1)2.Drivers of Strategic Alliance (2)3. Main Problems of Strategic Alliance (5)4. Conclusion (7)5. References (8)Executive SummaryThe term of s trategic alliance is defined as “a variety of interfirm cooperation agreements, ranging from shared research to formal joint ventures and minority equity participation”(Barlett et al 2008; 560). Cullen and Parboteeah (2005; 259) defined international strategic alliances are “cooperative agreements between two or more firms from different countries to parti cipate in business activities”. Inkpen (2001) summarised three features of strategic alliances. Firstly, the two or more partner firms remain “independent subsequent to the formation of the alliance”(Inkpen 2001; 403). Secondly, alliances are based upon mutual interdependence, which means one firm is easily influenced by the other (Parkhe 1993). Finally, one firm is uncertain about the othe r firm’s action due to the independent positions of each firm (Powell 1996). There are various reasons/drivers giving rise to the forming of strategic alliances and a number of problems may be encountered during the process of alliance management. This report will discuss these drivers and problems with reference to the pharmaceutical company of Eli Lilly. In the first part of this report, the company of Eli Lilly will be introduced briefly. Then, drivers of strategic alliances within the company will be critically discussed followed by an analysis of the main problems encountered in the alliances.1.IntroductionEli Lilly and Company is a global research-based pharmaceutical company with more than 130 years’ history headquartered in Indiana, US. It is conducting clinical research in more than 50 countries and marketing products in 143 countries with approximately 38,350 global employees (Eli Lilly and Company 2011a). The company’s mission is to “discover, develop, and commercialize innovative pharmaceutical therapies that enable people to live longer, healthier, and more active lives” (Eli Lilly and Company 2008). Thanks to higher sales of Alimta, Cymbalta, Humalog, Zyprexa and Erbitux, the company achieved total revenue of $21,836 million in the fiscal year of 2009, increased by 7.2 per cent than the fiscal year of 2008, (Datamonitor 2010). At the same fiscal year, its operating profit reached $5,587.3 million (ibid).Active innovation, advanced research and successive launch of new pharmaceutical prod ucts are crucial to the operation of Eli Lilly’s operation. As the president and CEO of Eli Lilly, John Lechleiter, put it “Lilly's number-one priority is increasing the flow of innovative products that make a real difference for patients. Partnering has been a key element of our strategy for more than a decade, and successful partnerships are essential for Lilly's ongoing pursuit of innovation” (Eli Lilly and Company 2008). Senior Vice President of the company, Gino Santini echoed the importance of the par tnership by saying that “dynamic partnerships are at work across Lilly’s entire value chain…successful alliances brought products like Actos, Byetta and Cialis to market” (Eli Lilly and Company 2011b).Eli Lilly’s tradition of strategic alliances with sel ected partners has played an integral role in creating innovative products, boosting the company’s growth, and maintains the competitive advantage in the world market.2.Drivers of Strategic AlliancesThe drivers or motivations of strategic alliances are discussed numerously in alliance literature (e.g. Campbell 2004; Cullen and Parboteeah 2005; Gulati 1998; Inkpen 2001; Osborn and Hagedoorn 1997; Porter and Fuller 1986).There are several general drivers underlying strategic alliances. It is generally agreed that strategic alliance partners are likely to leverage resources and core competences between them in order to improve their business performance and specialise in their own competencies. For instance, nearly 100 years ago, Banting and Macleod discovered insulin and patented their insulin extract. Then, they devoted all the rights to the University of Toronto. Alliance partnership with the University of Toronto helped Eli Lilly to produce the first commercial insulin product in the world (Eli Lilly and Company 2011b; 2011). About 60 years later, human insulin was generated by the biotechnology company, Genentech. In 1982, Eli Lilly obtained the license from Genentech and launched human insulin product into the market (The Motley Fool 2011). In both examples, Eli Lilly used its production capabilities to combine with patent and license of the University of Toronto and Genentech to bring the insulin products into the market. Hence core competences andresources of partners were leveraged to achieve the synergy and benefited to both partners of alliances as a result. De Wit and Meyer (1998) presented other potential sources of resource leveraging that may boost the forming of alliances, including bargain power against customers or suppliers, relations with distributors, marketing resource and finance resource. Another example is the alliance between Eli Lilly and India-based Piramal Life Sciences. In this partnership, Lilly gained the improvement of productivity in drug development leading to an increase in core competence for the company (Eli Lilly and Company 2008).Spreading and reducing costs is another important driver for many strategic alliances. Lilly’s partnership with Belgium-based Galapagos to cooperate in the field of osteoporosis with their complementary expertise. Currently, Galapagos is undertaking 12 osteoporosis drug discovery programs. Eli Lilly shared the costs and risks in the process of testing and drug discovery in this partnership (Eli Lilly and Company 2008). Another example is the Amylin/Lilly Alliance. In 2002, Eli Lilly and Amylin Pharmaceuticals signed a strategic agreement and formed the alliance dedicated to research on a treatment option for diabetes. According the agreement, Lilly and Amylin incurred the total development and commercialization costs equally inside the US. With regard to costs outside the US, the two companies shared the development costs equally but Lilly had to take the commercialization costs (Eli Lilly and Company 2011c). As the pharmaceutical research needs a great deal of investment and Lilly is involved with a number of fields of drug developing, alliance partners can share and spread the R&D costs and risks for the company and enhance the feasibility of research as the same time.To learn knowledge from a partner also can be a general driver of strategic alliances. Kyowa Hakko Kogyo Co., Ltd is a Tokyo based company with a cancer therapy, an inhibitor of the mitotic kinesin Eg5. Lilly enjoys exclusive license of the compound and have the rights to develop and market it in the world market except in Japan (Eli Lilly and Company 2008). In this alliance, Lilly acquired the access to preclinical program that target on a variety cancers and the great opportunity to gain knowledge on oncology capabilities and expertise (ibid). Strategic alliance is a crucial strategy of Eli and Lilly. This strategy enables the company to participate in numerous fields of pharmaceutical research and market its products all over the world. Through a wide range of alliances with different research institutions in difference fields, the company gained a great amount of knowledge and enhanced theresearch capability significantly. Additionally, in order to market its products, the company also has partnership with many companies from local market. Through cooperation, the company learned the local market knowledge as well as cultural, political and economic differences.In addition to above three drivers, companies may be strategically allied to avoid or counter competition. Some market can only afford certain number of competitors. Thus, competitor companies may ally to avoid fierce competition or two or more firms may form strategic alliances to compete with market leaders. Moreover, strategic alliances may aim at securing vertical and horizontal links. Vertical alliances can help firms ensure their supply and increase the efficiency across the value chain while horizontal alliance leads to efficiency in existing distribution.In addition to general drivers, there are some more drivers for international strategic alliances. Strategic alliances can help companies gain location-specific assets. In this way, companies are likely to overcome cultural, political/legal, competitive and economic barriers. In 1992, Lilly formed a joint venture with Ranbaxy Laboratories Limited, India, focusing on marketing Lilly’s products (Barlett et al 2008). The joint venture was established with equal capital contribution, equity share, board of directors and management committees. With this joint venture with Indian companies, Lilly obtained the assets in India and successfully overcame the legal constraints from the Indian government. This is because at that time, foreign ownership companies are not allowed in pharmaceutical industry in India. Therefore, Lilly got access to the Indian market by forming joint venture with Ranbaxy to overcome legal barriers as well as cultural barriers. Furthermore, Lilly can learn certain marketing knowledge from the Indian company.Strategic alliance is one of companies’ preferred entry models to expand into overseas market. Through strategic alliance, companies can spread their assets across borders quickly and smoothly, which facilitate companies’ geograp hically diversification. Furthermore, strategic alliances help companies reduce risks when they step into the foreign markets for the first time.3.Main Problems of Strategic AlliancesIn the collaboration process of strategic alliance, differences in national and corporation cultures may give rise to incompatible operations or conflicting evaluations of the success of a venture. Elli Lilly had the experience of challenges for operations due to cultural differences. With reference to the joint venture between Lilly and Ranbaxy, cultural differences posed managerial and administrative challenges for the business operation. The first managing director of the joint venture was Andrew Mascarenhas, who shouldered the responsibility to build up the JV’s team. The first challenge for him was to recruit personal including sales force, doctors and financial staff and train and covey them the Eli Lilly’s corporate culture, including the company’s ph ilosophy, values, and ethical code (Docuter, 2011). Moreover, Indian pharmaceutical industry was famous for its high employee turnover. Thus, a new scheme of human resource management was launched by Andrew to alleviate the problem of high turnover (Bartlett et al 2008; Docuter 2011). When Andrew left the office, the JV had made the break-even and started to create profit.As in the partnering alliance, both sides remain independent positions. Thus, partners may lose synergy as the relationship evolving. In addition to cultural distinction, a variety of issues may arise to challenge the operation of alliances. Firstly, partners might value the importance of the strategic alliance and collaborative arrangement distinctively. As discussed in the part of drivers, two or more firms can be motivated by any one or a combination of drivers to form strategic alliances. Therefore, it is possible that alliance partners view the importance of the strategic alliance differently from the beginning. On the other hand, as the relationship evolving, two or more sides are not likely to always keep the same pace. This can be attributed to the changing of external marketing environment or the changes within the ventures or alliance partnerships. As a result, partners may review the alliance and re-value the importance of it and differences between partners may occur. Secondly, the evolving of alliance over time may lead to different objectives for a strategic alliance as well. Conflicts between strategic objectives can hinder the cooperation between partners, jeopardize the performance of alliances, and even lead to the collapse of the strategic alliance. Thirdly, partners may disagree on control issues, or provide insufficient direction to a venture. This situation erects significant barriers to the collaborative arrangement and the future performance of the alliance remains doubted. Finally,capabilities and contributions from partners are often unequal in alliances and expectations on the alliance from partners often varied as well. In practice, these pose challenges to collaborative arrangement considerably.The company of Eli Lilly is widely credited as a typical example of excellent alliance management (Futrell et al 2001; Luvison 2009; Sagal and Slowinski 2003; Stach 2006). This can be attributed to the company’s tradition of alliance with partners and the rich experience in alliance management. Eli Lilly has Office of Alliance Management (OAM) and its alliance manager. Towards strategic alliances, the company sticks to its three principles: (1) alliances should have written policies, (2) the company should have actual process for forming alliances and support the running of alliances with the company’s resources, (3) the fundamental elements of one alliance success should be hold consistently in all other alliances (Luvision 2009). The written policies of alliance often define the objectives, mission, and operation guidelines for the strategic alliances. Hence, objectives and missions can be aligned between partners. Moreover, with written policies, control issues can be clearly defined. However, Neely and Wilson (1992) pointed out that if goals and missions are not promoted and communicated effectively throughout the organization, these goals and missions are not effective. In the case of Eli Lilly, the company have devoted significant efforts to communicate and reinforce its missions and values both inside and outside the company (Luvision 2009). The latter two principles help the company increase the alliance capability based on the accumulated collaborative experience.In 2003, the company developed a three-dimensional fit analysis to examine strategic fit, cultural fit and operational fit with its partners so that the company can effectively manage the alliance relationship and the alliance performance (Stach 2006). In terms of strategic fit, the company concerns strategic alignment between partners, commitment and trust with partners. Cultural fit pertains to flexibility and knowledge management while operational fit is related to communication, conflict management, decision-making, leadership and performance management. These fit analysis method contains objective, motivation, culture, capability and management assessing for potential partners. Therefore, according to this three-dimensional fit analysis, the company can evaluate and select right partners for the company.In addition to initial analysis, OAM is responsible for clearly and concisely defining the drivers of alliances with partners and regularly review them. Furthermore, the company require both part of alliance have enough passion and focus. This action ensures partners of Lilly view the same importance on the alliance and supervise the fits of partners over the time. Therefore, the company has effective control over the alliances and the ability to monitor the performance of alliances as the collaborative activities processing.4.ConclusionWith reference to the cases of Eli Lilly and Company, it can be viewed that there are various drivers of strategic alliances and some problems may be encountered in the strategic alliances. As one of the world largest pharmaceutical company, Eli Lilly has rich experience in strategic alliances and alliance management. The company has tried to integrate resources and core competences in order to increase its own performance and specialise its core competences. Strategic alliances are also acted as a cost and risk reduction method for the company with regard to significant investment in pharmaceutical research. In addition, Lilly gained significant knowledge through strategic alliance. Other reasons for strategic alliances can be avoiding or countering competition and securing vertical and horizontal links. International strategic alliances have some more divers. For instance, Eli Lilly formed the joint venture with Indian Laboratories Ranbaxy to gain local specific assets. In addition, strategic alliances can help companies achieve geographically diversification and reduce the risk of exposure in unfamiliar markets.However, some problems may be encountered during the process of strategic alliances. Firstly, national and corporation cultural differences often lead to incompatibility in collaborative arrangement. In the early stage of the joint venture with Ranbaxy, Eli Lilly had to overcome managerial issues due to cultural differences. Secondly, objectives and managerial view may differ resulting from independent position in strategic alliances. Thirdly, both sides may view the importance of alliance. Lilly deals with these two problems effectively by exploiting advanced alliance management.5.ReferencesBartlett C., Ghoshal S., Beamish P. (2008). Transnational Management: Text, Cases and Readings in Cross-Border Management. 5th Edition. McGraw-Hill: IrwinCampbell, D., Hamill, J., Purdie, T., and Stonehouse, G. (2004) Global and Transnational Business Strategy and Management. 2nd Edition. John Wiley & Sons Ltd.Cullen, J. B. and Parboteeah, K. P. (2005) Multinational Management: A Strategic Approach. 3rd Edition. South WesternDatamonitor (2010) “Eli Lilly and Company: Company Profile”. Eli Lilly&Company SWOT Analysis (April 2010): 1-11Docuter (2011) “Eli Lilly in India Rethinking the Joint Venture Strategy”./viewer.asp?documentid=16122690284ac82b2f312bc1254632239&e li%20lilly%20in%20india%20rethinking%20the%20joint%20venture%20strategy Retrieved 21 FebruaryEli Lilly and Company (2008) Power in Partnership: Turning Ideas into Reality through Relationships. Brochure /pdf/power_in_partnerships.pdf Retrieved 20 February 2011Eli Lilly and Company (2011a) “Facts at a Glance”. /about/facts/ Retrieved 19 February 2011Eli Lilly and Company (2011b) “Partnering Profiles”./about/partnerships/profiles/ Retrieved 20 February 2011Eli Lilly and Company (2011c) “Amylin Pharmaceuticals, Inc. – Eli Lilly and Company Alliance Backgrounder”. /pdf/byetta_alliance_bkgrounder_060606.pdf Retrieved 20 February 2011Futrell, D, Slugay, M, & Stephens, C 2001, 'Becoming a premier partner: Measuring, managing and changing partnering capabilities at Eli Lilly and Company', Journal of Commercial Biotechnology, 8, 1, p. 5Inkpen, A. C. (2001) "CHAPTER 15: STRATEGIC ALLIANCES." Oxford Handbook of International Business: 402-427.Gulati, R. (1998) “Alliances and Networks”. Strategic Management journal, 19: 293-318.Luvison, D. (2009) “Alliance Management at Eli Lilly: Lessons on How Alliance Capability Contributes to Sustainable Advantage”. Journal of Applied Management and Entrepreneurship, Jul 2009Neely, A., & Wilson, J. (1992). Measuring product goal congruence: An exploratory case study. International Journal of Operations & Production Management, 12(A), 45-52. (2011) “The Discovery of Insulin”./educational/medicine/insulin/discovery-insulin.html Retrieved 20 February 2011Osborn, R. and Hagedoorn, J. (1997) “The Institutionalization and Evolutionary Dynamics of Inter organizational Alliances and Network”, Academy of Management Journal, 40: 261-78.Parkehe, A. (1993) “Strategic Alliance Structuring: A Game Theoretic and Transaction Cost Examination of Interfirm Cooperation”, Academy of Management Journal, 36; 794-829.Porter, M. and Fuller, M. (1986) Coalitions and Global Strategy. In M. Porter (ed.), Competition in Global Industries. Boston, Mass: Harvard Business School Press, 315-43. Powell, W.W. (1996) “Trust-Based Forms of Governance”, in R.M. Kramer and T.R. Tyler (eds.), Trust in Organizations: Frontiers of Theory and Research. Thousand Oaks,Calif.: Sage, 51-67.Sagal, M. W. and Slowinski, G. The Stronges Link: forging a profitable and enduring corporate alliance. New York: AMACOM, c2003.Stach, G. (2006). “Business alliances at Eli Lilly: a successful innovation strategy”.Strategy & Leadership,34(5), 28-33.The Motley Fool (2011) “Genentech” /Genentech Retrieved 21 February 2011。

战略联盟(Strategic Alliance)2008-06-061人分享此文什么是战略联盟?战略联盟就是两上或两个以上的企业或跨国公司为了达到共同的战略目标而采取的相互合作、共担风险、共享利益的联合行动。

有的观点认为战略联盟为巨型跨国公司采用,但这决不仅限于跨国公司,作为一种企业经营战略,它同样适用于小规模经营的企业。

当然,由于产品的特点、行业的性质、竞争的程度、企业的目标和自身优势等因素的差异,企业间采取的战略联盟形式自然也呈现出多样性。

如联合技术开发、合作生产与后勤供应、分销协议、合资经营等。

普辛克(V·Pucik)教授认为公司建立战略联盟主要应强调如何利用技术变化带来好处,以及如何对世界市场上不断加深的竞争性作出反应。

他将战略联盟分为五种:因技术变动而建立的联盟,交叉许可证等;合作生产和OEM协议;联合销售或联合分销;共同开发产品项目;共同开发产品项目。

25种全球最流行的管理工具:目录1 客户关系管理(Customer Relationship Management,CRM)2 全面质量管理(Total Quality Management,TQM)3 顾客细分(Customer Segmentation)4 外包(Outsourcing)5 核心能力6 供应链管理(Supply Chain Management ,SCM)7 战略规划(Strategic Planning)8 业务流程再造(Business Process Reengineering,BPR)9 知识管理( Knowledge Management,KM)10 使命书和愿景书11 平衡记分卡(The Blanced ScoreCard,BSC)12 作业导向管理13 忠诚度管理14 六西格玛(6σ)15 战略联盟(Strategic Alliance)16 基准管理(benchmarking)17 变革管理计划(Change Management)18 增长战略(Growth Strategies)19 经济附加值增值分析(Economic Value Added,EVA)20 价格优化模型(Price Optimization Models)21 开放市场创新22 规模定制(Mass Customiza.tion,MC)23 情景设定和突发计划(Scenario Planning)24 海外经营25 射频识别(Radio Frequency Identification,RFID)战略联盟产生的背景企业战略联盟的出现绝不是偶然的,它是时代发展的产物。

究其原因,战略联盟产生的大背景主要有以下几个:1.世界经济一体化;全球经济一体化为跨国公司的经营提供了很好的机会,因为只有全球的市场才能满足它们的巨大胃口。

不过更为激烈的国际竞争也给跨国公司的经营带来了困难,迫使它们不得不寻找新的更为有效的竞争武器。

尽管各跨国公司在调整过程中的具体目标各不相同或各有侧重,但多数都采取了战略联盟作为实现战略调整的手段和方法。

2.科学技术的飞速发展;近五十年来科学技术的发展速度超过了有史以来的任何时期,而科技革命所带来的影响也是前所未有的,科研成果不断地将产品推向高科技化和复杂化,一种新产品的问世往往涉及越来越多的技术领域,经过越来越多的生产和经营环节。

因此,无论从技术上还是以成本上讲,单个公司依靠自身的有限能力是无法面对当今科技发展的要求的。

战略联盟可以把各种研究机构和企业联成一体,为着共同的战略目标组成灵活直辖市的网络,大于各简单成员相加之和。

3.实现总体战略目标;战略联盟以一种全新的思维和观念,为企业的扩张、全球战略目标的实现提供了一条新的途径,传统的与所有权密切相关的股权安排正在被新兴的以合作为基础的战略联盟所代替。

采用战略联盟形式进行合作,即可以保存原有资源,又能在共享外部资源的基础上,相互交换经营所需的其他资源,从而能实现其全球战略目标。

4.分担风险并获规模和范围经济;激烈变动的外部环境对企业的研发提出三点基本要求:不断缩短开发时间、降低研究开发成本、分散研究开发风险。

通过建立战略联盟。

扩大信息传递的密度与速度,以避免单个企业在研发中的盲目性和因孤单作战引起的重复劳动和资源浪费,从而降低风险。

5.防止竞争损失;为避免丧失企业的未来竞争优势,避免在诸如竞争、成本、特许及贸易等方面引起纠纷,企业间通过建立战略联盟,加强合作,可以理顺市场、共同维护竞争秩序。

6. 提高企业的竞争力;在产品技术日益分散化的今天,已经没有任何企业可以长期拥有生产某种产品的全部最新技术,单纯一个企业已经很难掌握竞争的主动权。

战略联盟的出现使传统的竞争对手发生了根本的变化,企业为了自身生存的成功,需要与竞争对手进行合作,即为竞争而合作,靠合作竞争。

企业建立战略联盟可使其处于有利的竞争地位,或有利于实施某种竞争战略,最终的目的是提高企业竞争实力。

战略联盟的特点目前,网络或组织已成为企业组织发展的一种趋势,战略联盟正是具备网络组织的特点。

1.边界模糊;战略联盟并不像传统的企业具有明确的层级和边界;而是一种你中有我,我中有你的局面。

2.关系松散;战略联盟主要是契约式或联结起来的,因此合作各方之间的关系十分松散,兼具了市场机制与行政管理的特点,合作各方主要通过协商的方式解决各种问题。

3.机动灵活;战略联盟组建过程也十分简单,无需大量附加投资。

而且合作者之间关系十分松散,战略联盟存在时间不长,解散十分方便;所以战略联盟还适应变化的环境时可迅速将其解散。

4.动作高效;合作各方将核心资源加入到联盟中来,联盟的各方面都是一流的;在这种条件下,联盟可以高效动作,完成一些企业很难完成的任务。

战略联盟的形式1.合资;由两家或两家以上的企业共同出资、共担风险、共享收益而形成企业;是目前发展中国家尤其是亚非等地普遍的形式。

合作各方将各自的优势资源投入到合资企业中,从而使其发挥单独一家企业所不能发挥的效益。

2.研发协议;为了某种新产品或新技术,合作各方鉴定一个联发协议;汇集各方的优势,大大提高了成功的可能性,加快了开发速度,各方共担开发费用,降低了各方开发费用与风险。

3.定牌生产;如果一方有知名品牌但生产力不足;另一方则有剩余生产能力;则另一方可以为对方定牌生产。

一方可充分利用闲置生产能力,谋取一定利益;对于拥有品牌的一方,还可以降低投资或购并所生产的风险。

4.特许经营;通过特许的方式组成战略联盟,其中一方具有重要无形资产,可以与其他各方签署特许协议,允许其使用自身品牌、专利或专用技术,从而形成一种战略联盟。

拥有方不仅可获取收益,并可利用规模优势加强无形资产的维护,受许可方当然利于扩大销售、谋取收益。

5.相互持股;合作各方为加强相互联系而持有对方一定数量的股份;这种战略联盟中各方的关系相对更加紧密,而双方的人员、资产无须全并。

当然,组建战略联盟一定要慎重选择合作伙伴,并建立合理的组织关系;合作各方加强沟通。

战略联盟的优势战略联盟成功的四大关键在于:订立联盟策略;选择合适对象;建立联盟结构与管理制度;订立终止联盟计划。

任何企业都有各自的长处和短处,不同的阶段,不同的时间,不同的地点,都应有自己的发展重点,不同的策略。

为此,有必要通过开展合作,来达到优势互补的目的,尤其是当自己有着明显劣势,同时又暂时有没有能力或精力来顾及且又不能“熟视无睹”的时候,就非常有必要通过寻找合作伙伴来弥补自身的不足,化劣势为优势。

中国的许多企业家或多或少有“多元化”情结,以为企业发展到了一定阶段就必须走多元化的发展道路,他们最喜欢举的例子就是“通用电器”,而事实上,非多元化的企业远比多元化的企业要多,即使在美国也是如此,比如:通用汽车、摩托罗拉、微软,等等。

我们的企业家似乎看不到这一点,总喜欢什么都自己做,结果是,我们听到了一个又一个的失败故事,确很少听到多元化成功的案例。

战略联盟具有非常显著的优势,比如:快速性、互补性、低成本、成效大,等等,是一个相对比较容易实施的策略。

当然,也是有几点需要把握的:第一、订立联盟策略,在合适的时候发现自己的企业在哪些方面缺乏竞争优势,在哪些方面有竞争优势,从而制定策略;第二,选择合作伙伴,合作伙伴的选择要适合本公司的情况,有时候并不是越大的伙伴越好,而是适合自己的伙伴越好;第三、建立联盟结构与管理制度,同自己的策略联盟伙伴制定一个相互之间权利和义务的协定以及出现问题的协商制度,这对于战略联盟合约的履行是至关重要的;第四、订立终止联盟计划,在开始的时候就应该考虑善始善终。

古希腊哲学大师亚里士多德说:人有两种,一种即“吃饭是为了活着”,一种是“活着是为了吃饭”.一个人之所以伟大,首先是因为他有超于常人的心。

“志当存高远”,“风物长宜放眼量”,这些古语皆鼓舞人们要树立雄心壮志,要有远大的理想。

有一位心理学家到一个建筑工地,分别问三个正在砌砖的工人:“你在干什么?”第一个工人懒洋洋地说:“我在砌砖。

” 第二个工人缺乏热情地说:“我在砌一堵墙。

” 第三个工人满怀憧憬地说:“我在建一座高楼!”听完回答,心理学家判定:第一个人心中只有砖,他一辈子能把砖砌好就不错了;第二个人眼中只有墙,好好干或许能当一位技术员;而第三个人心中已经立起了一座殿堂,因为他心态乐观,胸怀远大的志向!井底之蛙,只能看到巴掌大的天空;摸到大象腿的盲人,只能认为大象长得像柱子;登上五岳的人,才能感觉“一览众山小”;看到大海的人,就会顿感心胸开阔舒畅;心中没有希望的人,是世界上最贫穷的人;心中没有梦想的人,是普天下最平庸的人;目光短浅的人,是最没有希望的人。

清代“红顶商人”胡雪岩说:“做生意顶要紧的是眼光,看得到一省,就能做一省的生意;看得到天下,就能做天下的生意;看得到外国,就能做外国的生意。

”可见,一个人的心胸和眼光,决定了他志向的短浅或高远;一个人的希望和梦想,决定了他的人生暗淡或辉煌。