[宏观经济学第12讲_短期权衡取舍

- 格式:ppt

- 大小:655.50 KB

- 文档页数:33

2023版经济学原理名词解释第一章1.稀缺性:社会拥有的资源是有限的,因此不能生产人们希望用油的所有物品与劳务2.经济学:研究社会如何管理自己的稀缺资源3.效率:社会能从稀缺资源中得到的最大利益4.平等:讲这些资源的成果平均地分配给社会成员5.机会成本:为了得到这种东西所放弃的东西6.理性人:能系统而由母的的尽最大努力去实现目标7.编辑变动:对现有行动计划的微小增量调整8.激励:引起一个人做出某种行为的某种东西9.市场失灵:市场本身不能有效配置资源的情况10.外部性:一个人的行为对旁观者福利的影响11.市场势力:单个人或者一小群人不适当地影响市场价格的能力12.生产率:每一单位劳动投入所生产的物品与劳动数量经济学十大原理1.人们面临权衡取舍2、某种东西的成本是为了得到它所放弃的东西3、理性人考虑边际量4、人们会对激励做出反应5、毛衣可以使每个人的状况都变得更好6、市场通常是组织经济活动的一种好方法7、政府又是可以改善市场结果8、一国的生活水平取决于它生产物品与劳务的能力9、当政府发行了过多的货币时,物价上升10、社会面临通货膨胀与事业之间的短期权衡取舍第二章要点1.循环流向图,见书20o在这个模型中,经济由两类觉得这,家庭和企业组成,2.物品与劳务市场上,家庭是买者,生产要素市场上,家庭是卖者3.生产可能性边界:一个图形,标明在生产要素和生产技术既定时,一个经济所能生产的产出。

大炮与黄油4.微观经济学:研究家庭和企业如何做出决策,以及他们如何在特定市场上相互影响5.宏观经济学:研究整体经济现象6.关于世界的表述有两种类型:一,实证表述:描述性的,关于世界是什么样子的表述;二,规范表述:关于世界应该是什么样子的表述第四章供给与需求的市场力量1.某种物品与劳务的买者与卖者组成的一个群体2、竞争市场:有许多买者与卖者,以至于一个人对市场价格的影响微乎其微的市场3、完全竞争的市场具有的两个特征:可供销售的物品是完全相同的;买者与卖者众多以至于任何一个买者或卖者无法影响市场价格,此时他们被称为价格接受者4、垄断者:一些市场只有一个卖者,由他决定价格5.需求量:买者愿意并且能够购买的该种物品的数量6.需求定理:在其他条件不变的情况下,价格上升,该物品的需求量减少,价格下降,需求量增加7.需求曲线:把价格与需求量联系一起的向右下方倾斜的曲线8.市场需求:所有个人对某种特定物品或劳务的需求的总和9.需求变动:需求曲线向右移动为去求增加,向左移动为需求减少10.影响需求量的因素:价格11.影响需求的因素:收入,相关物品的价格,嗜好,预期,买者数量12.供给量:卖者愿意并且能够出售的该种物品的数量13.供给定理:在其他条件不变时,一种物品价格上升,该物品的供给量增加,一种物品价格下降,该物品供给量减少14.供给变动:供给曲线向右移动,为供给增加,供给曲线向左移动,为供给减少15.影响供给的因素:投入品的价格,技术,预期,卖者数量16.分析均衡变动的三个步骤:一,确定该事件是使供给曲线移动还是使需求曲线移动,还是两者都移动;二,确定曲线移动方向;三。

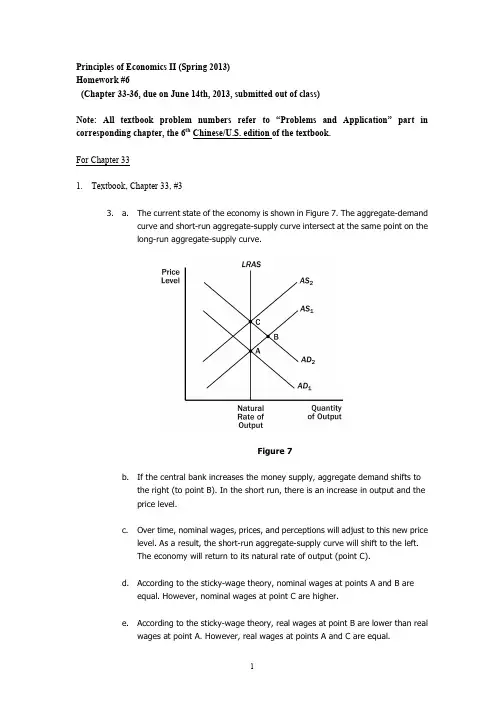

Principles of Economics II (Spring 2013)Homework #6(Chapter 33-36, due on June 14th, 2013, submitted out of class)Note: All textbook problem numbers refer to “Problems and Application” part in corresponding chapter, the 6th Chinese/U.S. edition of the textbook.For Chapter 331.Textbook, Chapter 33, #33. a. The current state of the economy is shown in Figure 7. The aggregate-demandcurve and short-run aggregate-supply curve intersect at the same point on thelong-run aggregate-supply curve.Figure 7b. If the central bank increases the money supply, aggregate demand shifts tothe right (to point B). In the short run, there is an increase in output and theprice level.c. Over time, nominal wages, prices, and perceptions will adjust to this new pricelevel. As a result, the short-run aggregate-supply curve will shift to the left.The economy will return to its natural rate of output (point C).d. According to the sticky-wage theory, nominal wages at points A and B areequal. However, nominal wages at point C are higher.e. According to the sticky-wage theory, real wages at point B are lower than realwages at point A. However, real wages at points A and C are equal.f. Yes, this analysis is consistent with long-run monetary neutrality. In the longrun, an increase in the money supply causes an increase in the nominal wage,but leaves the real wage unchanged.2.Textbook, Chapter 33, # 55. a. The statement that "the aggregate-demand curve slopes downward because itis the horizontal sum of the demand curves for individual goods" is false. Theaggregate-demand curve slopes downward because a fall in the price levelraises the overall quantity of goods and services demanded through the wealtheffect, the interest-rate effect, and the exchange-rate effect.b. The statement that "the long-run aggregate-supply curve is vertical becauseeconomic forces do not affect long-run aggregate supply" is false. Economicforces of various kinds (such as population and productivity) do affect long-runaggregate supply. The long-run aggregate-supply curve is vertical because theprice level does not affect long-run aggregate supply.c. The statement that "if firms adjusted their prices every day, then the short-runaggregate-supply curve would be horizontal" is false. If firms adjusted pricesquickly and if sticky prices were the only possible cause for the upward slope ofthe short-run aggregate-supply curve, then the short-run aggregate-supplycurve would be vertical, not horizontal. The short-run aggregate supply curvewould be horizontal only if prices were completely fixed.d. The statement that "whenever the economy enters a recession, its long-runaggregate-supply curve shifts to the left" is false. An economy could enter arecession if either the aggregate-demand curve or the short-runaggregate-supply curve shifts to the left.3.Textbook, Chapter 33, # 88. a. People will likely expect that the new chairman will not actively fight inflationso they will expect the price level to rise.b. If people believe that the price level will be higher over the next year, workerswill want higher nominal wages.c. At any given price level, higher labor costs lead to reduced profitability.d. The short-run aggregate-supply curve will shift to the left as shown in Figure10.Figure 10e. A decline in short-run aggregate supply leads to reduced output and a higherprice level.f. No, this choice was probably not wise. The end result is stagflation, whichprovides limited choices in terms of policies to remedy the situation.Figure 114.Textbook, Chapter 33, # 99. a. If households decide to save a larger share of their income, they must spendless on consumer goods, so the aggregate-demand curve shifts to the left, as shown in Figure 11. The equilibrium changes from point A to point B, so theprice level declines and output declines.b. If Florida orange groves suffer a prolonged period of below-freezingtemperatures, the orange harvest will be reduced. This decline in the naturalrate of output is represented in Figure 12 by a shift to the left in both theshort-run and long-run aggregate-supply curves. The equilibrium changesfrom point A to point B, so the price level rises and output declines.Figure 12Figure 13c. If increased job opportunities cause people to leave the country, the long-runand short-run aggregate-supply curves will shift to the left because there arefewer people producing output. The aggregate-demand curve will also shift tothe left because there are fewer people consuming goods and services. Theresult is a decline in the quantity of output, as Figure 13 shows. Whether theprice level rises or declines depends on the relative sizes of the shifts in theaggregate-demand curve and the aggregate-supply curves.5.Textbook, Chapter 33, #1111. a. If firms become optimistic about future business conditions and increaseinvestment, the result is shown in Figure 18. The economy begins at point Awith aggregate-demand curve AD1 and short-run aggregate-supply curve AS1.The equilibrium has price level P1 and output level Y1. Increased optimismleads to greater investment, so the aggregate-demand curve shifts to AD2.Now the economy is at point B, with price level P2 and output level Y2. Theaggregate quantity of output supplied rises because the price level has risenand people have misperceptions about the price level, wages are sticky, orprices are sticky, all of which cause output supplied to increase.Figure 18b. Over time, as the misperceptions of the price level disappear, wages adjust, orprices adjust, the short-run aggregate-supply curve shifts up to AS2 and theeconomy gets to equilibrium at point C, with price level P3 and output level Y1.The quantity of output demanded declines as the price level rises.c. The investment boom might increase the long-run aggregate-supply curvebecause higher investment today means a larger capital stock in the future,thus higher productivity and output.6.Textbook, Chapter 33, # 1212. Economy B would have a more steeply sloped short-run aggregate-supply curvethan would Economy A, because only half of the wages in Economy B are “sticky.”A 5% increase in the money supply would have a larger effect on output inEconomy A and a larger effect on the price level in Economy B.7.True or false? Keynes's primary message in The General Theory was that short-run economicfluctuations were the result of inadequate aggregate demand that could be corrected by using government policy.TrueFor Chapter 348.Textbook, Chapter 34, # 11. a. When the Fed’s bond traders buy bonds in open-market operations, themoney-supply curve shifts to the right from MS1 to MS2, as shown in Figure 1.The result is a decline in the interest rate.Figure 1 Figure 2b. When an increase in credit card availability reduces the cash people hold, themoney-demand curve shifts to the left from MD1 to MD2, as shown in Figure 2.The result is a decline in the interest rate.c. When the Federal Reserve reduces reserve requirements, the money supplyincreases, so the money-supply curve shifts to the right from MS1 to MS2, asshown in Figure 1. The result is a decline in the interest rate.d. When households decide to hold more money to use for holiday shopping, themoney-demand curve shifts to the right from MD1 to MD2, as shown in Figure3. The result is a rise in the interest rate.Figure 3e. When a wave of optimism boosts business investment and expands aggregatedemand, money demand increases from MD1 to MD2 in Figure 3. The increasein money demand increases the interest rate.Figure 49.Textbook, Chapter 34, # 22. a. The increase in the money supply will cause the equilibrium interest rate todecline, as shown in Figure 4. Households will increase spending and willinvest in more new housing. Firms too will increase investment spending. Thiswill cause the aggregate demand curve to shift to the right as shown in Figure5.Figure 5b. As shown in Figure 5, the increase in aggregate demand will cause an increasein both output and the price level in the short run (point B).c. When the economy makes the transition from its short-run equilibrium to itslong-run equilibrium, short-run aggregate supply will decline, causing the pricelevel to rise even further (point C).d. The increase in the price level will cause an increase in the demand for money,raising the equilibrium interest rate.e. Yes. While output initially rises because of the increase in aggregate demand,it will fall once short-run aggregate supply declines. Thus, there is no long-runeffect of the increase in the money supply on real output.10.Textbook, Chapter 34, # 3Figure 63. a. When fewer ATMs are available, money demand is increased and themoney-demand curve shifts to the right from MD1 to MD2, as shown in Figure6. If the Fed does not change the money supply, which is at MS1, the interestrate will rise from r1 to r2. The increase in the interest rate shifts theaggregate-demand curve to the left, as consumption and investment fall.b. If the Fed wants to stabilize aggregate demand, it should increase the moneysupply to MS2, so the interest rate will remain at r1 and aggregate demand willnot change.c. To increase the money supply using open market operations, the Fed shouldbuy government bonds.11.Textbook, Chapter 34, #88. a. The initial effect of the tax reduction of $20 billion is to increase aggregatedemand by $20 billion × 3/4 (the MPC) = $15 billion.b. Additional effects follow this initial effect as the added incomes are spent. Thesecond round leads to increased consumption spending of $15 billion × 3/4 =$11.25 billion. The third round gives an increase in consumption of $11.25billion × 3/4 = $8.44 billion. The effects continue indefinitely. Adding them allup gives a total effect that depends on the multiplier. With an MPC of 3/4, themultiplier is 1/(1 – 3/4) = 4. So the total effect is $15 billion × 4 = $60 billion.c. Government purchases have an initial effect of the full $20 billion, becausethey increase aggregate demand directly by that amount. The total effect of anincrease in government purchases is thus $20 billion × 4 = $80 billion. Sogovernment purchases lead to a bigger effect on output than a tax cut does.The difference arises because government purchases affect aggregatedemand by the full amount, but a tax cut is partly saved by consumers, andtherefore does not lead to as much of an increase in aggregate demand.d. The government could increase taxes by the same amount it increases itspurchases.12.Textbook, Chapter 34, # 99. If the marginal propensity to consume is 0.8, the spending multiplier will be 1/(1 – 0.8) = 5. Therefore, the government would have to increase spending by $400/5 = $80 billion to close the recessionary gap.13.Textbook, Chapter 34, 1111. a. Expansionary fiscal policy is more likely to lead to a short-run increase ininvestment if the investment accelerator is large. A large investmentaccelerator means that the increase in output caused by expansionary fiscalpolicy will induce a large increase in investment. Without a large accelerator,investment might decline because the increase in aggregate demand will raisethe interest rate.b. Expansionary fiscal policy is more likely to lead to a short-run increase ininvestment if the interest sensitivity of investment is small. Because fiscalpolicy increases aggregate demand, thus increasing money demand and theinterest rate, the greater the sensitivity of investment to the interest rate thegreater the decline in investment will be, which will offset the positiveaccelerator effect.For Chapter 3514.Textbook, Chapter 35, #11. Figure 8 shows two different short-run Phillips curves depicting these four points.Points A and D are on SRPC1 because both have expected inflation of 3%. Points Band C are on SRPC2 because both have expected inflation of 5%.Figure 815.Textbook, Chapter 35, #4Figure 144. a. Figure 14 shows the economy in long-run equilibrium at point A, which is onboth the long-run and short-run Phillips curves.b. A wave of business pessimism reduces aggregate demand, moving theeconomy to point B in the figure. The unemployment rate rises and theinflation rate declines. If the Fed undertakes expansionary monetary policy, itcan increase aggregate demand, offsetting the pessimism and returning theeconomy to point A, with the initial inflation rate and unemployment rate.c. Figure 15 shows the effects on the economy if the price of imported oil rises.The higher price of imported oil shifts the short-run Phillips curve up fromSRPC1 to SRPC2. The economy moves from point A to point C, with a higherinflation rate and higher unemployment rate. If the Fed engages inexpansionary monetary policy, it can return the economy to its originalunemployment rate at point D, but the inflation rate will be higher. If the Fedengages in contractionary monetary policy, it can return the economy to itsoriginal inflation rate at point E, but the unemployment rate will be higher. Thissituation differs from that in part (b) because in part (b) the economy stayedon the same short-run Phillips curve, but in part (c) the economy moved to ahigher short-run Phillips curve, which gives policymakers a less favorabletrade-off between inflation and unemployment.Figure 1516.Textbook, Chapter 35, #6Figure 166. If the Fed acts on its belief that the natural rate of unemployment is 4%, when thenatural rate is in fact 5%, the result will be a spiraling up of the inflation rate, asshown in Figure 16. Starting from a point on the long-run Phillips curve, with anunemployment rate of 5%, the Fed will believe that the economy is in a recession,because the unemployment rate is greater than its estimate of the natural rate.Therefore, the Fed will increase the money supply, moving the economy along theshort-run Phillips curve SRPC1. The inflation rate will rise and the unemploymentrate will fall to 4%. As the inflation rate rises over time, expectations of inflationwill rise, and the short-run Phillips curve will shift up to SRPC2. This process willcontinue, and the inflation rate will spiral upwards.The Fed may eventually realize that its estimate of the natural rate ofunemployment is wrong by examining the rising trend in the inflation rate.17.Textbook, Chapter 35, #77. a. If wage contracts have short durations, a recession induced by contractionarymonetary policy will be less severe, because wage contracts can be adjustedmore rapidly to reflect the lower inflation rate. This will allow a more rapidmovement of the short-run aggregate-supply curve and short-run Phillipscurve to restore the economy to long-run equilibrium.b. If there is little confidence in the Fed's determination to reduce inflation, arecession induced by contractionary monetary policy will be more severe. Itwill take longer for people's inflation expectations to adjust downwards.c. If expectations of inflation adjust quickly to actual inflation, a recessioninduced by contractionary monetary policy will be less severe. In this case,people's expectations adjust quickly, so the short-run Phillips curve shiftsquickly to restore the economy to long-run equilibrium at the natural rate ofunemployment.18.Textbook, Chapter 35, #9Figure 179. a. As shown in the left diagram of Figure 17, equilibrium output and employmentwill fall. However, the effects on the price level and inflation rate will beambiguous. The fall in aggregate demand puts downward pressure on prices,while the decline in short-run aggregate supply pushes prices up. The diagramon the right side of Figure 17 assumes that the inflation rate rises.b. The Fed would have to use expansionary monetary policy to keep output andemployment at their natural rates. Aggregate demand would have to shift toAD3.c. The Fed may not want to pursue this action because it will lead to a rise in theinflation rate as shown by point C.19.选举周期与经济波动:一个经济某一年的菲利普斯曲线由下列的关系式确定:π = πe - (u - 4%)。

宏观经济学(高鸿业版)第12章重点总结第一篇:宏观经济学(高鸿业版)第12章重点总结第十三章简单国民收入决定理论1.均衡产出:是和总需求相一致的产出,也就是经济社会的收入正好等于全体居民和企业想要有的产出。

简单的说就是和总需求相等的产出或收入。

2.均衡产出的条件:E=y 也可以用 i=s来表示。

3.消费函数:消费与可支配收入之间的依存关系。

c=c(y)c=α+βy4.边际消费倾向MPC:增加的消费与增加的收入之比率,也就是增加的1单位收入中用于增加消费部分的比率。

MPC=△c/△y =dc/dy5.平均消费倾向APC:指任一收入水平上消费之支出在收入中的比率。

APC=c/y6.储蓄函数:指储蓄与决定储蓄的各种因素之间的依存关系。

(广义)7.储蓄函数方程式: s=y-c=y-(α+βy)=-α+(1-βy)8.消费函数和储蓄函数的关系 P3879.均衡收入:y=(α+ I)/(1-β)P39310.投资乘数:指收入的变化与带来这种变化的投资支出的变化的比率。

k=1/(1-β)11.三部门经济中各种乘数 P399第十四章产品市场和货币市场的一般均衡1.资本边际效率MEC : 是一种贴现率,这种贴现率正好使一项资本物品的使用期内各预期收益的现值之和等于这项资本品的供给价格或者重置成本。

(公式P412)2.IS曲线:一条反应利率和收入间相互关系的曲线。

这条曲线上任何一点都代表一定的利率和收入的组合,在这些组合下,投资和储蓄都是相等的,即I=S,从而产品市场是均衡的。

3.货币需求动机:1)交易动机:指个人和企业需要货币是为了进行正常的交易活动。

收入越高,交易数量越大,为应付日常开支所需的货币量就越大。

2)谨慎动机(预防性动机):指为预防意外支出而持有一部分货币的动机,货币需求量大体上和收入成正比。

3)投机动机:指人们为了抓住有利的购买有价证券的机会而持有一部分货币的动机。

4.流动偏好陷阱:当利率极低,人们认为这时利率不大可能再下降,或者说有价证券市场价格不大可能再上升而只会跌落,人们不管有多少货币都愿意持在手中。

![[经济学]第35章 通货膨胀和失业之间的短期权衡取舍](https://uimg.taocdn.com/02b01b01680203d8ce2f24da.webp)

[经济学]第35章通货膨胀和失业之间的短期权衡取舍第三十五章通货膨胀与失业之间的短期权衡,菲利普斯曲线,菲利普斯曲线运动:预期效应,通货膨胀与失业之间的短期权衡,菲利普斯曲线运动:供给冲击,降低通货膨胀成本,结论,顺序,执行摘要,菲利普斯曲线描述了通货膨胀与失业之间的负相关关系。

与此同时,降低失业率的政策导致了更高的通货膨胀率以及通货膨胀与失业之间的负相关。

只有在短期内,不利的供应冲击才会改变短期菲利普斯曲线。

当美联储收紧货币供应以降低通货膨胀时,它将使经济沿着短期菲利普斯曲线运行,这将导致暂时的高失业率。

反通胀的成本取决于通胀预期的下降速度。

一些经济学家认为,可信的低通胀承诺可以通过调整预期来降低反通胀成本。

通货膨胀和失业之间的短期权衡。

依次,通货膨胀和失业是人们经常关心的两个指标。

一些经济学家称通货膨胀率和失业率之和为社会的“痛苦指数”。

从长远来看,最低工资法、工会力量、效率工资和求职的有效性决定了失业率。

货币供应量的增长决定了通货膨胀率。

短期内情况完全不同。

当决策者使用财政或货币政策来扩大总需求时,他们可以在短期内扩大产出并降低失业率,但这会导致价格快速上涨。

当决策者采取紧缩的财政或货币政策时,通货膨胀和失业之间的短期权衡可以在短期内减少,但代价是暂时的低产出和高失业率。

在本章中,我们将进一步研究通货膨胀和失业之间的短期权衡。

1958年,英国经济学家菲利普斯首次发现了通货膨胀和失业之间的负相关关系(当时他用名义工资的变化来表示通货膨胀)。

两年后,美国经济学家萨缪尔森(Samuelson)和索洛(Solow)用美国数据显示了通胀和失业之间的负相关性。

此外,得出的结论是,这种相关性是由于低失业率和高总需求之间的相关性。

两人指出,菲利普斯曲线为决策者提供了一个可能的经济结果菜单。

通过改变货币或财政政策,决策者可以选择曲线上的任何一点,通货膨胀和失业之间的短期权衡,菲利普斯曲线和菲利普斯曲线为决策者提供了一个可能的经济结果菜单。

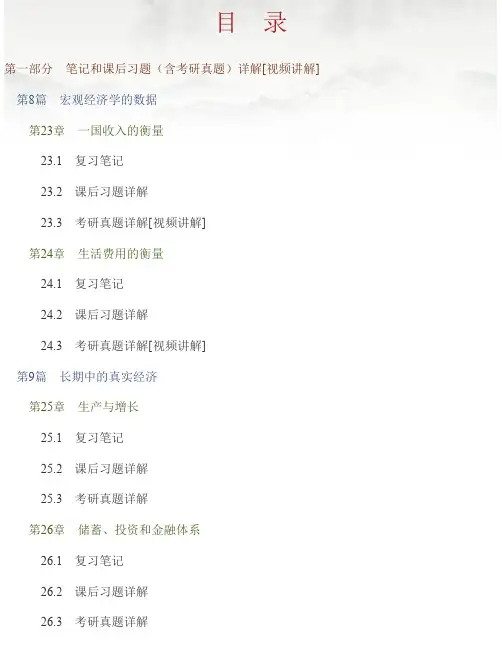

目 录第一部分 笔记和课后习题(含考研真题)详解[视频讲解]第8篇 宏观经济学的数据第23章 一国收入的衡量23.1 复习笔记23.2 课后习题详解23.3 考研真题详解[视频讲解]第24章 生活费用的衡量24.1 复习笔记24.2 课后习题详解24.3 考研真题详解[视频讲解]第9篇 长期中的真实经济第25章 生产与增长25.1 复习笔记25.2 课后习题详解25.3 考研真题详解第26章 储蓄、投资和金融体系26.1 复习笔记26.2 课后习题详解26.3 考研真题详解第27章 基本金融工具27.1 复习笔记27.2 课后习题详解27.3 考研真题详解[视频讲解]第28章 失 业28.1 复习笔记28.2 课后习题详解28.3 考研真题详解[视频讲解]第10篇 长期中的货币与物价第29章 货币制度29.1 复习笔记29.2 课后习题详解29.3 考研真题详解[视频讲解]第30章 货币增长与通货膨胀30.1 复习笔记30.2 课后习题详解30.3 考研真题详解[视频讲解]第11篇 开放经济的宏观经济学第31章 开放经济的宏观经济学:基本概念31.1 复习笔记31.2 课后习题详解[视频讲解]31.3 考研真题详解第32章 开放经济的宏观经济理论32.1 复习笔记32.2 课后习题详解[视频讲解]32.3 考研真题详解[视频讲解]第12篇 短期经济波动第33章 总需求与总供给33.1 复习笔记33.2 课后习题详解33.3 考研真题详解[视频讲解]第34章 货币政策和财政政策对总需求的影响34.1 复习笔记34.2 课后习题详解34.3 考研真题详解[视频讲解]第35章 通货膨胀与失业之间的短期权衡取舍35.1 复习笔记35.2 课后习题详解35.3 考研真题详解[视频讲解]第13篇 最后的思考第36章 宏观经济政策的六个争论问题36.1 复习笔记36.2 课后习题详解36.3 考研真题详解[视频讲解]第二部分 模拟试题及详解曼昆《经济学原理(宏观经济学分册)》(第6版)模拟试题及详解(一)曼昆《经济学原理(宏观经济学分册)》(第6版)模拟试题及详解(二)第一部分 笔记和课后习题(含考研真题)详解[视频讲解]第8篇 宏观经济学的数据第23章 一国收入的衡量23.1 复习笔记1.经济的收入与支出在一国的宏观经济中,收入必定等于支出。

曼昆《经济学原理(宏观经济学分册)》(第6版)第35章通货膨胀与失业之间的短期权衡取舍课后习题详解跨考网独家整理最全经济学考研真题,经济学考研课后习题解析资料库,您可以在这里查阅历年经济学考研真题,经济学考研课后习题,经济学考研参考书等内容,更有跨考考研历年辅导的经济学学哥学姐的经济学考研经验,从前辈中获得的经验对初学者来说是宝贵的财富,这或许能帮你少走弯路,躲开一些陷阱。

以下内容为跨考网独家整理,如您还需更多考研资料,可选择经济学一对一在线咨询进行咨询。

一、概念题1.菲利普斯曲线(Phillips curve)(北京师范大学2004研;北京工业大学2005、2006研;山东大学2006研)答:菲利普斯曲线是指货币工资变动率与失业率之间交替关系的曲线。

它是由英国经济学家菲利普斯根据1861~1957年英国的失业率和货币工资变动率的经验统计资料提出来的,故称之为菲利普斯曲线。

这条曲线表示,当失业率高时,货币工资增长率低,反之,当失业率低时,货币工资增长率高。

因此,如图35-1所示,横轴代表失业率(U),纵轴代表货币工资增长率(W),菲利普斯曲线是一条向右下方倾斜的曲线。

根据成本推动型通货膨胀的理论,货币工资增长率决定了价格增长率,所以,菲利普斯曲线也可以表示通货膨胀率和失业率之间的交替关系,即当失业率高时,通货膨胀率低;反之,当失业率低时,通货膨胀率高。

图35-1 菲利普斯曲线新古典综合派经济学家把菲利普斯曲线作为调节经济的依据,即当失业率高时,实行扩张性财政政策与货币政策,以承受一定通货膨胀率为代价换取较低的失业率;当通货膨胀率高时,实行紧缩性的财政政策与货币政策,借助提高失业率以降低通货膨胀率。

货币主义者对菲利普斯曲线所表示的通货膨胀率与失业率之间的交替关系提出了质疑,并进一步论述了短期菲利普斯曲线、长期菲利普斯曲线和附加预期的菲利普斯曲线,以进一步解释在不同条件下,通货膨胀率与失业率之间的关系。

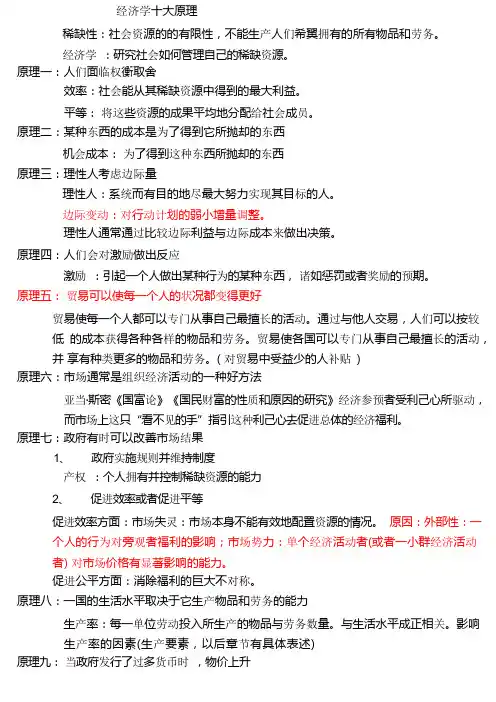

经济学十大原理稀缺性:社会资源的的有限性,不能生产人们希翼拥有的所有物品和劳务。

经济学:研究社会如何管理自己的稀缺资源。

原理一:人们面临权衡取舍效率:社会能从其稀缺资源中得到的最大利益。

平等:将这些资源的成果平均地分配给社会成员。

原理二:某种东西的成本是为了得到它所抛却的东西机会成本:为了得到这种东西所抛却的东西原理三:理性人考虑边际量理性人:系统而有目的地尽最大努力实现其目标的人。

边际变动:对行动计划的弱小增量调整。

理性人通常通过比较边际利益与边际成本来做出决策。

原理四:人们会对激励做出反应激励:引起一个人做出某种行为的某种东西,诸如惩罚或者奖励的预期。

原理五:贸易可以使每一个人的状况都变得更好贸易使每一个人都可以专门从事自己最擅长的活动。

通过与他人交易,人们可以按较低的成本获得各种各样的物品和劳务。

贸易使各国可以专门从事自己最擅长的活动,并享有种类更多的物品和劳务。

( 对贸易中受益少的人补贴)原理六:市场通常是组织经济活动的一种好方法亚当·斯密《国富论》《国民财富的性质和原因的研究》经济参预者受利己心所驱动,而市场上这只“看不见的手”指引这种利己心去促进总体的经济福利。

原理七:政府有时可以改善市场结果1、政府实施规则并维持制度产权:个人拥有并控制稀缺资源的能力2、促进效率或者促进平等促进效率方面:市场失灵:市场本身不能有效地配置资源的情况。

原因:外部性:一个人的行为对旁观者福利的影响;市场势力:单个经济活动者(或者一小群经济活动者) 对市场价格有显著影响的能力。

促进公平方面:消除福利的巨大不对称。

原理八:一国的生活水平取决于它生产物品和劳务的能力生产率:每一单位劳动投入所生产的物品与劳务数量。

与生活水平成正相关。

影响生产率的因素(生产要素,以后章节有具体表述)原理九:当政府发行了过多货币时,物价上升通货膨胀:经济中物价总水平的上升原理十:社会面临通货膨胀与失业之间的短期权衡取舍经济周期(波动):就业和生产等经济活动的无规律的、大部份无法预测的波动。

曼昆《经济学原理》(上)名词解释1、稀缺性:社会资源的有限性。

2、经济学:研究社会如何管理自己的稀缺资源。

3、效率:社会能从其稀缺资源中得到最多东西的特性。

4、平等:经济成果在社会成员中公平分配的特性。

5、机会成本:为了得到某种东西所必须放弃的东西。

理性人:系统而有目的地尽最大努力实现起目标的人。

6、边际变动:对行动计划微小的增量调整。

激励:引起一个人做出某种行为的某种东西。

7、市场经济:当许多企业和家庭在物品与劳务市场上相互交易时,通过他们的分散决策配置资源的经济。

8、市场失灵:市场本身不能有效配置资源的情况。

9、外部性:一个人的行为对旁观者福利的影响。

10、"市场势力:一个经济活动者(或经济活动者的一个小集团)对市场价格有显著影响的能力。

11、"生产率:一个工人一小时所生产的物品与劳务量。

12、"通货膨胀:经济中物价总水平的上升。

13、"菲利普斯曲线:通货膨胀与失业之间的短期权衡取舍。

14、"经济周期:就业和生产等经济活动的波动(就是生产这类经济活动的波动。

)15、"循环流向图:一个说明货币如何通过市场在家庭与企业之间流动的直观经济模型。

16、"生产可能性边界:表示一个经济在可得到的生产要素与生产技术既定时所能生产的产量的各种组合的图形。

17、"微观经济学:研究家庭和企业如何做出决策,以及它们在市场上的相互交易。

18、"宏观经济学:研究整体经济现象,包括通货膨胀、失业和经济增长。

19、"实证表述:企图描述世界是什么的观点。

20、"规范描述:企图描述世界应该如何运行的观点。

21、"绝对优势:根据生产率比较一种物品的生产者。

22、"比较优势:根据机会成本比较一种物品的生产者。

23、"进口:国外生产而在国内销售的物品。

24、"出口:国内生产而在国外销售的物品。

第十二章、总供给与通货膨胀和失业之间的短期权衡第一节、总供给的基本理论一、两种总供给模型1、粘性价格模型强调企业不能针对需求变动即刻调整他们索取的价格。

(1)价格粘性的原因①企业与顾客之间的长期合约决定;②一旦企业印制和分发它的产品目录或价格单,改变起来成本高昂;③可能是工资黏性的反映。

(2)企业的合意价格企业的合意价格p 取决于两个宏观经济变量:1)价格总体水平更高的价格水平意味着更高的企业成本。

因此,价格总体水平越高,企业对自己的产品想要收取的价格也越高。

2)总收入水平更高的收入水平提高了对企业产品的需求。

由于在更高的生产水平上边际成本增加,所以,需求越大,企业的合意价格也越高。

企业的合意价格是:p=P+ a(Y-Y(预期))其中a > 0,衡量企业的合意价格对总产出水平的反应有多大这个方程表明:当价格水平偏离预期的价格水平时,产出就偏离其自然水平;参数α表明产出对未预期到的价格水平变动作出的反应有多大,1/α是总供给曲线的斜率。

(3)表现形式与结论2、不完备信息模型(1)假定①市场出清,供需平衡;②每个供给者只生产一种产品和消费很多产品,因此无法观测到所有价格;③信息不完全,混淆了价格总水平变动与相对价格的变动,影响了供给决策,导致价格水平和产出在短期存在正相关关系。

(2)分析供给者进行生产决策时,并不知道价格水平,因此使用预期的价格水平P e。

当价格水平发生了未预期到的上升时,经济中所有供给者都观察到了自己所生产的产品价格的上升。

他们都理性但是却错误地推断,他们所生产的产品的相对价格上升了,因此生产更多商品。

不完备信息模型说明,当实际价格P超过P e,供给者提高他们的产出。

3、总结①两个总供给模型中的每个模型都用来解释短期总供给曲线向右上方倾斜的市场不完备性;②第一个模型假设一些产品的价格是黏性的;第二个模型假设关于价格的信息是不完备的。

第二节、通货膨胀、失业和菲利普斯曲线一、菲利普斯曲线的定义货币工资变动率与失业率之间有一种稳定的此消彼长的关系,失业率高则表明经济处于萧条阶段,这时工资与物价水平都较低,因而有低通货膨胀率。