海商法第六章 船舶保险条款(必考)汇总

- 格式:ppt

- 大小:547.00 KB

- 文档页数:30

船舶保险附加险条款限制类:一、船舶保险附加火灾、爆炸除外条款兹经保险合同双方同意,本保险不负责赔偿被保险船舶因火灾、爆炸而引起的被保险船舶本身损失及由此引起的责任和费用。

本附加条款与主条款内容相抵触之处,以本附加条款为准;未尽之处,以主条款为准。

二、船舶保险附加碰撞举证特别条款兹经保险合同双方同意,被保险船舶发生碰撞事故时,如果被保险人不能举证对方碰撞船舶的船名及其所承担的碰撞责任比例,保险人仅承担被保险船舶损失金额% 的赔偿责任。

本附加条款与主条款内容相抵触之处,以本附加条款为准;未尽之处,以主条款为准。

三、船舶保险附加全损比例赔偿特别条款兹经保险合同双方同意,如果被保险船舶全损或推定全损,保险人按照保险金额的% 赔付,不再扣除免赔额。

本附加条款与主条款内容相抵触之处,以本附加条款为准;未尽之处,以主条款为准。

四、船舶保险附加碰撞责任除外条款兹经保险合同双方同意,碰撞责任为本保险除外责任。

本附加条款与主条款内容相抵触之处,以本附加条款为准;未尽之处,以主条款为准。

五、船舶保险附加碰撞、触碰责任除外条款兹经保险合同双方同意,碰撞、触碰责任为本保险除外责任。

本附加条款与主条款内容相抵触之处,以本附加条款为准;未尽之处,以主条款为准。

规范类:一、船舶保险附加约定免赔额条款兹经保险合同双方同意,本保险项下的船舶全损绝对免赔额为**** 元或免赔率为****% ,两者以高者为准;部分损失每次事故绝对免赔额为**** 元或免赔率****% ,两者以高者为准;本保险附加险项下每次事故绝对免赔额为**** 元或免赔率****% ,两者以高者为准。

本附加条款与主条款及其他附加条款内容相抵触之处,以本附加条款为准;未尽之处,以主条款及其他附加条款为准。

二、船舶保险附加转场及拖航除外条款兹经保险合同双方同意,本保险不负责被保险船舶在转场及拖航作业期间发生的任何损失、费用与责任。

本附加条款与主条款内容相抵触之处,以本附加条款为准;未尽之处,以主条款为准。

沿海内河船舶保险条款本保险的保险标的是指在中华人民共和国内合法登记注册从事沿海、内河航行的船舶,包括船体、机器、设备、仪器和索具。

船上燃料、物料、给养、淡水等财产和渔船不属于本保险标的范围。

本保险分为全损险和一切险,本保险按保险单注明的承保险别承担保险责任。

保险责任第一条全损险由于下列原因造成保险船舶发生的全损,本保险负责赔偿。

一、八级以上(含八级)大风、洪水、地震、海啸、雷击、崖崩、滑坡、泥石流、冰凌;二、火灾、爆炸;三、碰撞、触碰;四、搁浅、触礁;五、由于上述一至四款灾害或事故引起的倾覆、沉没;六、船舶失踪第二条一切险本保险承保第一条列举的六项原因所造成保险船舶的全损或部分损失以及引起的下列责任和费用:一、碰撞、触碰责任:本公司承保的保险船舶在可航水域碰撞其它船舶或触碰码头、港口设施、航标,致使上述物体发生的直接损失和费用,包括被碰撞船舶上所载货物的直接损失,依法应当由被保险人承担的赔偿责任。

本保险对每次碰撞、触碰责任仅负责赔偿金额的四分之三,但在保险期限内一次或累计最高赔偿额一不超过船舶保险金额为限。

非机动船舶不负碰撞、触碰责任,但保险船舶由本公司承保的拖船拖带时,可视为机动船舶。

二、共同海损、救助及施救本保险负责赔偿依照国家有关法律或规定应当由保险船舶摊负的共同海损。

除合同另有约定外,共同海损的理算办法应按《北京理算规则》办理。

保险船舶在发生保险事故时,被保险人为防止或减少损失而采取施救及救助措施所支付的必要的、合理的施救或救助费用、救助报酬,由本保险负责赔偿。

但共同海损、救助及施救三项费用之和的累计最高赔偿额以不超过保险金额为限。

除外责任第三条保险船舶由于下列情况所造成的损失、责任及费用,本保险不负责赔偿:一、船舶不适航,船舶不适拖(包括船舶技术状态、配员、装载等,拖船的拖带行为引起的被拖船舶的损失、责任和费用,非拖轮的拖带行为引起的一切损失、责任和费用);二、船舶正常的维修、油漆,船体自然磨损、锈蚀、腐烂及机器本身发生的故障和舵、螺旋桨、桅、锚、锚链、橹及子船的单独损失;三、浪损、座浅;四、被保险人及其代表(包括船长)的故意行为或违法犯罪行为;五、清理航道、污染和防止或清除污染、水产养殖及设施、捕捞设施、水下设施、桥的损失和费用;六、因保险事故引起本船及第三者的间接损失和费用以及人员伤亡或由此引起的责任和费用;七、战争、军事行动、扣押、骚乱、罢工、哄抢和政府征用、没收;八、其他不属于保险责任范围内的损失。

国内船舶保险条款建筑或修理中的船舶、试航的船舶、石油钻探船、失去航行能力的船舶,以及从事捕捞作业的渔船,都不在本保险范畴内。

第二条本保险的保险标的包括下列各项.一、船体;二、机器、仪器及用于航行的设备(其中包括舵、桅、锚、橹、子船);三、专门约定的船舶附属设备。

零星工具、备用材料、燃料及水、盐等给养品和船员的衣物、行李不属本保险范畴。

第三条投保本保险的船舶必须具有港航监督部门签发的适航证明和按规定配备持有职务证书的船员,从事客货营业运输的必须持有工商行政治理部门核发的营业执照。

第二章保险责任一、八级以上(含八级)大风、洪水、海啸、地震、崖崩、滑波、泥石流、冰凌、雷击;二、火灾、爆炸;三、碰撞、搁浅、触礁、倾覆、沉没;四、船舶航行中失踪六个月以上。

第五条碰撞责任.保险机动船舶或其拖带的保险船舶与它船、它物发生直截了当碰撞责任事故,致使被碰撞的船舶及所载物资,或者被碰撞的码头、港口设备、航标、桥墩、固定建筑物遭受缺失以及被碰撞船舶上的人员伤亡,依法应当由被保险人所负的赔偿责任,由保险人负责赔偿。

但最高赔偿额以不超过船舶的保险金额为限。

属于本船舶上的人员伤亡和物资缺失,保险人不负赔偿责任。

一、依照国家有关规定或惯例应当由保险船舶摊负的共同海损牺牲和费用;二、保险船舶在发生保险责任范畴内的灾难或事故时,被保险人为防止或减少保险船舶的缺失而支付的必要的、合理的施救或救助费用,由保险人负责赔偿,但最高赔偿额以不超过保险船舶的保险金额为限。

第七条保险期限为_______年,起止日期以保险单载明的时刻为准。

第三章除外责任第八条保险船舶由于下列缘故造成的经济缺失或赔偿责任,保险人不负责赔偿:一、战争、军事行动和政府征用;二、不具备适航条件;三、被保险人及其代表的有意行为;四、超载、浪损、座浅引起的事故缺失;五、船体和机件的正常修理、油漆费用和自然磨损、朽蚀,机器本身发生的故障;六、因保险事故导致停航、停业的缺失以及因海事造成第三者的一切间接缺失;七、木船、水泥船的锚及锚链(缆)或子船的单独缺失;八、清理航道,清除污染的费用;九、其他不属于保险责任范畴内的缺失。

船舶保险附加险条款限制类:一、船舶保险附加火灾、爆炸除外条款兹经保险合同双方同意,本保险不负责赔偿被保险船舶因火灾、爆炸而引起的被保险船舶本身损失及由此引起的责任和费用。

本附加条款与主条款内容相抵触之处,以本附加条款为准;未尽之处,以主条款为准。

二、船舶保险附加碰撞举证特别条款兹经保险合同双方同意,被保险船舶发生碰撞事故时,如果被保险人不能举证对方碰撞船舶的船名及其所承担的碰撞责任比例,保险人仅承担被保险船舶损失金额 %的赔偿责任。

本附加条款与主条款内容相抵触之处,以本附加条款为准;未尽之处,以主条款为准。

三、船舶保险附加全损比例赔偿特别条款兹经保险合同双方同意,如果被保险船舶全损或推定全损,保险人按照保险金额的 %赔付,不再扣除免赔额。

本附加条款与主条款内容相抵触之处,以本附加条款为准;未尽之处,以主条款为准。

四、船舶保险附加碰撞责任除外条款兹经保险合同双方同意,碰撞责任为本保险除外责任。

本附加条款与主条款内容相抵触之处,以本附加条款为准;未尽之处,以主条款为准。

五、船舶保险附加碰撞、触碰责任除外条款兹经保险合同双方同意,碰撞、触碰责任为本保险除外责任。

本附加条款与主条款内容相抵触之处,以本附加条款为准;未尽之处,以主条款为准。

规范类:一、船舶保险附加约定免赔额条款兹经保险合同双方同意,本保险项下的船舶全损绝对免赔额为****元或免赔率为 ****%,两者以高者为准;部分损失每次事故绝对免赔额为****元或免赔率****%,两者以高者为准;本保险附加险项下每次事故绝对免赔额为****元或免赔率****%,两者以高者为准。

本附加条款与主条款及其他附加条款内容相抵触之处,以本附加条款为准;未尽之处,以主条款及其他附加条款为准。

二、船舶保险附加转场及拖航除外条款兹经保险合同双方同意,本保险不负责被保险船舶在转场及拖航作业期间发生的任何损失、费用与责任。

本附加条款与主条款内容相抵触之处,以本附加条款为准;未尽之处,以主条款为准。

船舶保险人保财产保险公司条款一、概述船舶保险是一种重要的财产保险,它涉及到航运、海洋事业和国际贸易等诸多领域。

保险人保险公司的条款是船舶保险合同的重要组成部分,它规定了保险责任、赔偿范围、理赔条件等内容,对于保险合同的解释和适用具有重要意义。

二、船舶保险的基本原则1. 保险合同订立时,船舶保险人应按照互惠原则和合同自愿原则确定保险金额、保险费率和其他保险条件,保险人和被保险人应按照诚实信用原则提供真实、准确的信息;2. 船舶保险的签订应依法合规,保险合同应符合保险法等相关法律法规的规定;3. 保险合同应明确规定保险标的、保险金额、保险费率、保险期间、免赔额、保险责任、特别约定等内容;4. 船舶保险合同应保障双方的合法权益,确保被保险人在发生意外损失时能够得到及时合理的补偿。

三、船舶保险人保财产保险公司条款的重要内容1. 保险标的:船舶保险人保财产保险公司的条款中应明确规定保险标的,包括但不限于船舶、船上设备、货物等;2. 保险金额:保险合同中应明确规定保险金额,确保在保险事故发生时被保险人能够得到足额的赔偿;3. 保险费率:保险合同中应明确规定保险费率,确保保险费的公平合理;4. 保险期间:保险合同中应明确规定保险期间,确保在保险期间内发生的损失能够得到赔偿;5. 免赔额:保险合同中应明确规定免赔额,双方应在合同中明确免赔额的具体金额或比例;6. 保险责任:保险合同中应明确规定保险责任的范围和条件,确保被保险人在合理范围内得到补偿;7. 特别约定:保险合同中应包括双方的特别约定,对于一些特殊情况的处理应明确规定。

四、船舶保险人保财产保险公司条款的解释和适用1. 关于保险责任的解释:保险合同中对于保险责任的范围、条件、免责条款等内容应予以明确解释,确保被保险人在合理范围内得到赔偿;2. 关于特别约定的适用:保险合同中的特别约定对于双方的权利与义务具有约束力,双方应遵守特别约定;3. 关于保险事故的处理:当发生保险事故时,双方应按照保险合同的规定进行理赔,保险人应及时、合理地进行赔偿;4. 关于争议解决的方式:当双方发生保险纠纷时,应按照保险合同中约定的争议解决方式进行处理,如协商、仲裁等。

第六章船舶租用合同161、什么是船舶租用合同?远洋运输营运方式可以分为定期船运输和不定期船运输。

定期船运输又称为班轮运输,是指船舶在固定的航线上,按既定的船期表和港口顺序,经常地从事港口间运输的营运方式。

不定期船运输又称租船运输,是指承租人向船舶所有人租赁船舶或舱位进行的海上货物运输方式。

可分为航次租船、定期租船和光船租船三种营运方式。

不论采用哪种运输方式,都需相应地签订运输合同。

比如,班轮运输合同主要通过提单来体现;航次租船应有航次租船合同等。

根据我国《海商法》的规定,提单和航次租船合同,属于海上货物运输合同的一种;而定期租船合同和光船租赁合同,则属于船舶租用合同。

如我国《海商法》第128条规定:“船舶租用合同,包括定期租船合同和光船租赁合同,均应当书面订立。

”所以,租船运输方式与船舶租用合同两者之间有一定得联系,但也有很大的区别。

不应产生概念上的混淆。

特别值得注意的是,航次租船虽然属于租船方式的一种,但航次租船合同却不属于船舶租用合同,而属于海上货物运输合同的范畴。

162、租船交易需要经过哪些程序?在租船市场上,租船大多通过经纪人进行。

一般地说,从承租人提出租船要求,到最后与出租人签订合同,大致要经过如下几个步骤:即询价、报价、还价、报实盘、接受订租、签订订租确认书、编制、审核、签订租船合同。

询价(Enquiry),又称“询盘”,是承租人根据货物的情况表示需要租船,并说明自己对船舶要求的业务。

通常以电传、电报、传真或其他书面形式提出。

内容包括:货物的种类、数量、名称、装卸港、装货日期、计划运价等。

报价(Offer),又称“开盘”,是租船经纪人或船舶所有人在接到询价后,根据自己的条件向承租人提出自己所能够提供船舶的情况和条件的业务。

报价的内容,除对询价的答复外,通常还包括:船名、载重量或载货容积、装卸港口、受载期、装卸条件和费用条款、租金或运费、滞期或速遣费率、佣金、拟选定的租船合同范本等。

报价有硬性报价和条件报价两种。

国内船舶保险条款第一章保险船舶范围第一条凡中华人民共和国国家、集体、个人所有或与他人共有的机动船舶与非机动船舶,依照本条款的规定,都可以向保险人即中国人民保险公司,下同投保船舶保险.建造或修理中的船舶、试航的船舶、石油钻探船、失去航行能力的船舶,以及从事捕捞作业的渔船,都不在本保险范围内.第二条本保险的保险标的包括下列各项.一、船体;二、机器、仪器及用于航行的设备其中包括舵、桅、锚、橹、子船;三、特别约定的船舶附属设备.零星工具、备用材料、燃料及水、盐等给养品和船员的衣物、行李不属本保险范围.第三条投保本保险的船舶必须具有港航监督部门签发的适航证明和按规定配备持有职务证书的船员,从事客货营业运输的必须持有工商行政管理部门核发的营业执照.第二章保险责任第四条保障船舶由于下列原因造成的全部或部分损失保险人负赔偿责任:一、八级以上含八级大风、洪水、海啸、地震、崖崩、滑波、泥石流、冰凌、雷击;二、火灾、爆炸;三、碰撞、搁浅、触礁、倾覆、沉没;四、船舶航行中失踪六个月以上.第五条碰撞责任.保险机动船舶或其拖带的保险船舶与它船、它物发生直接碰撞责任事故,致使被碰撞的船舶及所载货物,或者被碰撞的码头、港口设备、航标、桥墩、固定建筑物遭受损失以及被碰撞船舶上的人员伤亡,依法应当由被保险人所负的赔偿责任,由保险人负责赔偿.但最高赔偿额以不超过船舶的保险金额为限.属于本船舶上的人员伤亡和货物损失,保险人不负赔偿责任.第六条共同海损和救助.一、依照国家有关规定或惯例应当由保险船舶摊负的共同海损牺牲和费用;二、保险船舶在发生保险责任范围内的灾害或事故时,被保险人为防止或减少保险船舶的损失而支付的必要的、合理的施救或救助费用,由保险人负责赔偿,但最高赔偿额以不超过保险船舶的保险金额为限.第七条保险期限为_______年,起止日期以保险单载明的时间为准.第三章除外责任第八条保险船舶由于下列原因造成的经济损失或赔偿责任,保险人不负责赔偿:一、战争、军事行动和政府征用;二、不具备适航条件;三、被保险人及其代表的故意行为;四、超载、浪损、座浅引起的事故损失;五、船体和机件的正常维修、油漆费用和自然磨损、朽蚀,机器本身发生的故障;六、因保险事故导致停航、停业的损失以及因海事造成第三者的一切间接损失;七、木船、水泥船的锚及锚链缆或子船的单独损失;八、清理航道,清除污染的费用;九、其他不属于保险责任范围内的损失.第四章保险金额第九条国营、集体所有的新船按照出厂造价确定保险金额钢质船五年内、木质船三年内、米泥船二年内可视同新船.旧船按照实际价值确定保险金额,也可以由被保险人和保险人协商确定保险金额.第十条个体船舶按照最高不超过实际价值的七成确定保险金额.第五章被保险人义务第十一条被保险人应在签定保险合同时一次交清保险费.有特别约定者,可按约定分期缴费.第十二条保险船舶发生保险责任范围内的灾害或事故时,保险人应及时采取合理的施救保护措施,并须在到达第一港后四十八小时内向港航监督部门报告,同时通知保险人.第十三条被保险人及其代表应当严格遵守港航监督部门制定的各项安全航行规则和制度,按期做好保险船舶的检验和修理,确保船舶的适航性.第十四条被保险人对保险船舶的情况应如实申报.在保险期限内,保险船舶出售、转借、出租、变更航行区域,以及被保险人需要调整保险金额,应当事先书面通知保险人,经保险人同意并办理批改手续后方为有效.第十五条被保险人不履行本章第十一条至第十四条各款规定的义务,保险人有权自发出书面通知之日起终止保险责任或拒绝赔偿.第六章无赔款安全优待第十六条保险船舶在1年保险期限内安全航行无赔款,续保时可事受无赔款安全优待,优待金额为上年度应交保险费的10%.被保险人投保的船舶不止一艘,无赔偿安全优待按艘分别计算.第七章赔偿处理第十七条在保险期限内,保险船舶不论发生一次或多次保险责任范围内的损失或费用支出,保险人均按以下规定赔偿.一、全部损失按照保险金额赔偿,但保险金额高于出险时新船造价的,以不超过出险时同类型新船造价为限.二、部分损失在保险金额的范围内,按下列规定赔偿.一新船按照出厂造价确定保险金额的,按实际损失部位的修理费用赔偿;二按照估价或实际价值以及实际价值的成数确定保险金额的,按照保险金额与同类型新船造价比例赔偿.三、保险船舶发生保险责任范围内的灾害或事故,保险人按照本条款第五条对碰撞责任的畴偿趔定,以及按照本条款第六条负责的共同海损、施救、救助费用的规定,与保险船舶本身的赔款分别计算.以上船舶损失的一次赔款,等于保险金额全数或同类型新船出厂造价时,船舶保险责任即行终止.第十八条保险船舶发生毕独海损事故时,对施救、救助费用的赔偿,保险人只负责获救的船舶价值与获救的船、货总价值的比例分摊部分.第十九条保险船舶发生保险责任范围内的损失时,被保险人必须经与保险人商定后方可进行修理或支付所需费用.否则保险人有权重新核定.第二十条被保险人索赔时,必须向保险人摄供保险单、海损事故证明、事故责任裁定书、损失清单和各种赔偿费用的有关单证.保险人应根据本条款和参照现行海事处理的规定迅速查证核实,赔款一经确定,保险人应在10天内赔付.第二十一条保险船舶发生保险责任范围内的损失,根据法律规定应由第三方负责赔偿的,被保险人应先向第三方追偿损失.如果被保险人向保险人提出赔偿要求,保险人可按照本条款的规定先予赔偿,但被保险人必须将向第三方追偿的权利及有关证据转让给保险人,并协助保险人向第三方追偿.第二十二条保险船舶遭受损失以后的残余部分,应由被保险人与保险人议定价值后,折归被保险人,并在赔款中扣除.第二十三条被保险人从知道或应当知道保险船舶遭受损失或发生事故的当天起,1年内不向保险人申请赔偿,不提出本条款第二十条规定的有关单证,或者在达成结案协议时起_______年内不领取应得的赔款,即作为自愿放弃权益.第二十四条被保险人与保险人发生争议时,应本着实事求是、公平合理的精神协商解决,双方不能达成协议时,可提交仲裁机关仲裁或向人民法院起诉.说明国内船舶保险条款是保险人向投保人提出的要约.投保人在签订国内船舶保险合同时,应当认真了解保险条款的内容,以确定是否投保.国内船舶保险条款是船舶保险合同的标准条款,详细载明保险船舶范围、保险责任、除外责任、保险金额、被保险人义务、无赔款安全优待、赔偿处理等内容.投保人研究标准条款后,如有投保利益和需要,可填具国内船舶投保单,经双方签章后,成为保险合同成立的书面证明,上述条款即成为合同中的主要条款,合同双方均须遵守.当然,双方根据需要,还可特殊约定附加条款.图说明国内船舶保险投保单是投保人向保险人出具的要求投保国内船舶险的要式文书,经双方认可后,即成为船舶保险合同的组成部分,是保险人签发保险单的依据.投保人在投保船舶险时,必须如实告知对保险人有关的一切事项.我国海商法规定,合同订立前,被保险人应当将其知道的或者在通常业务中应当知道的有关影响保险人据以确定保险费率或者确定是否承保的重要情况,如实告知保险人.由于被保险人的故意或重大过失,未履行上述告知义务,保险人有权解除合同或者相应增加保费.投保人在填制投保单时应当如实填写相关内容.船舶保险分为全损险和一切险两个险别,投保人可视不同情况来决定投保险别.本保险的保险期限分为定期保险和航次保险两种.定期保险期限最长为1年;航次保险的期限以启航至航行终止期限计.保险金额按照保险条款第四章的规定来填写.费率和保险费依照国内船舶保险费率规章计算填报.对分项保险金额,投保人应当根据实际情况据实填写.投保人在投保单中还应如实填报船名船号、种类、用途、制造年份、总吨位或马力、载重吨、航行范围、航行证书编号等内容,以便保险人决定是否承保和厘定保费.投保单须有投保人、代理单位签章并注明填报日期.国内船舶保险单被保险人________保险单号码______本公司依照本保险单载明的国内船舶保险条款和其它条件承保被保险人下开各种船舶的保险经理副经理______主管负责人______复核______制单附:国内舶舶保险费率规章一、本表所订费率,按保险金额的每百元计算.二、本表所列船质档次均包括机动船舶与非机动船舶非机动船舶包括驳船.其它材质船舶,如玻璃钢船均按水泥船的费率厘订.三、根据国家对固定资产折旧试行条例的有关规定国发〔85〕63号文件,各类钢质客货轮,油轮为二十五年;各类木质船为十八年;水泥船为十年.凡超过规定使用年限的船舶均按费率规定加费20%.四、各种工程船测量船、挖泥船、打桩船、救护船和港作船船、消防船、交通船、巡逻艇、供应船以及渡船、游船可分别按各类船舶的费率降低20%.五、各种油轮、液化燃气船、运输化学产品专用船等均按费率规定加费50%.六、凡从事拖航作业的拖船,按年费率加费20%.七、凡船舶航行不止一类区域时,则应以其中的_______高档费率计算.平流河、苏州河、黄浦江承其他永流平稳的江河.半急流——长江下游宜昌及宜昌以下、淮河、赣江、湘江、甬江、洪泽湖、高邮湖、邵伯湖、太湖、洞庭湖、鄱阳湖、巢湖以及其他半急流的江河.急流——长江上游宜昌以上、嘉陵江、乌讧、金沙江、源江、资水、澄水、陀江及其他水流湍急的江河.八、承保航次保险按年费率的15%计算.九、承保短期保险按下列费率表计算.备注:1.投保1年,中途退保,按短期费率计算退保费.但保险船舶在保险有效期内,因停航或出售,转借等申请退保,其退保费应按日计算.2.保险期限不满一个月的,均按一个月计算.3.各省、自治区、直辖市,计划单列市分公司可以根据各类船舶的经营赔付倩况,在总颁费率的基础上上下浮动30%,凡实行浮动费率的地区须将费率向总公司备案.说明国内船舶保险单是保险人签发的对投保人投保的船舶予以承保的书面文件,它是船舶保险合同成立的证明文件.在保险事故发生后,保险单是被保险人索赔的重要依据,也是保险人进行赔偿的依据.国内船舶保险单中应当写明承保船舶的种类、名称、船质结构、用途、制造年份、总吨位或马力、船舶造价、保险金额、保险费率、保险费、航行区域、载重吨、船籍港、总保险金额、保费总数、保险期限以及双方的特别约定.制作保险单时应注意核对船舶险投保单的填写是否正确、完整,审查投保船舶是否适航.如果符合承保条件,在收取保险费或者约定收取保险费后一般应在起保时全部付清保险费,定期保险也可分期付费,签发保险单.保险单所列各项内容要清楚完整地填写,并加盖印章.国内船舶保险投保单保单号:投保人:________ 地址:___________________ 电话:__________兹将下列船舶向本保险公司投保国内船舶保险:注意:本投保单在未经保险公司同意或未签发保险单之前,不发生保险效力.审核:经办:。

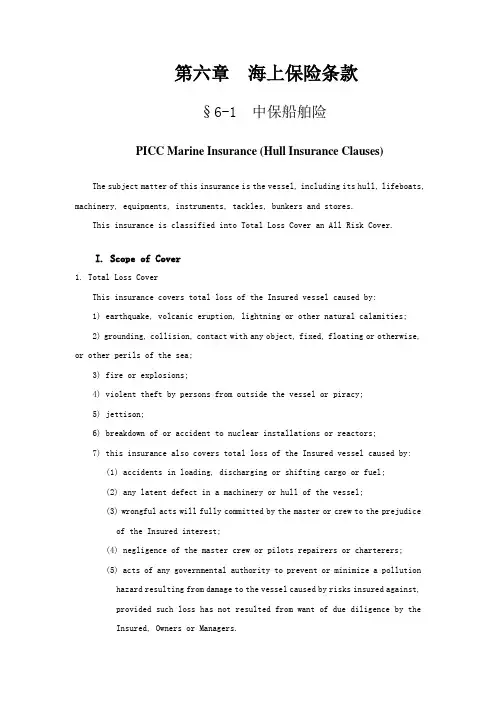

第六章海上保险条款§6-1 中保船舶险PICC Marine Insurance (Hull Insurance Clauses)The subject matter of this insurance is the vessel, including its hull, lifeboats, machinery, equipments, instruments, tackles, bunkers and stores.This insurance is classified into Total Loss Cover an All Risk Cover.I. Scope of Cover1. Total Loss CoverThis insurance covers total loss of the Insured vessel caused by:1) earthquake, volcanic eruption, lightning or other natural calamities;2) grounding, collision, contact with any object, fixed, floating or otherwise, or other perils of the sea;3) fire or explosions;4) violent theft by persons from outside the vessel or piracy;5) jettison;6) breakdown of or accident to nuclear installations or reactors;7) this insurance also covers total loss of the Insured vessel caused by:(1) accidents in loading, discharging or shifting cargo or fuel;(2) any latent defect in a machinery or hull of the vessel;(3) wrongful acts will fully committed by the master or crew to the prejudiceof the Insured interest;(4) negligence of the master crew or pilots repairers or charterers;(5) acts of any governmental authority to prevent or minimize a pollutionhazard resulting from damage to the vessel caused by risks insured against,provided such loss has not resulted from want of due diligence by theInsured, Owners or Managers.2. All Risks CoverThis insurance covers total loss of or partial loss of or damage to the Insured vessel arising from the causes under the Total Loss Cover and also covers the under-mentioned liability or expense:1) Collision Liabilities(1) This insurance covers legal liabilities of the Insured as a consequenceof the Insured vessel coming into collision or contact with any othervessel, or any object, fixed, floating or otherwise. However, this clausedoes not cover any liabilities in respect of: loss of life, personal injuryor illness; cargo or other property on or engagements of the Insured vessel;removal or disposal of obstructions, wrecks, cargoes or any other thingwhatsoever; pollution or contamination of any property or thing whatsoever(including cost of preventive measures and clean-up operations) exceptpollution or contamination of the other vessel with which the Insuredvessels is in collision or property on such other vessel; indirect expensesarising from delay to or loss of use of any object, fixed, floating orotherwise.(2) Where the Insured vessel is in collision with another vessel and bothvessels are to blame, then unless the liability of one or both vesselsbecomes limited by law, the indemnity under this clause shall be calculatedon the principle of cross liabilities. This principle also applies whenthe Insured vessel comes into contact with an object.(3) The insurer’s liability (including legal costs) under this clause shallbe in addition to his liability under the other provisions of thisinsurance but shall not exceed the Insured amount of the vessel herebyinsured in respect of each separate occurrence.2) General Average and Salvage(1) This insurance covers the Insured vessel’s proportion of general average,salvage or salvage charges, but in case of general average sacrifice of thevessel, the Insured may recover fully for such loss without obtainingcontributions from other parties.(2) General average shall be adjusted in accordance with the relative contractand of governing law and practice. However, where the contract of affreightment or carriage does not so provide, the adjustment shall be according to the Beijing Adjustment Rules or similar provisions of other rules.(3) Where all the contributing interests are owned by the Insured, or whenthe Insured vessel sails in ballast and there ate no other contributing interests the provisions of the Beijing Adjusting Rules (excluding Article5), or similar provisions of other rules if expressly agreed, shall applyas if the interests were owned by different persons. The voyage for this purpose shall be deemed to continue from the port or place of departure until the arrival of the vessel at the first port or place of call for bunkering only. If at any such intermediate port or place there is an abandonment of the adventure originally contemplated the voyage shall thereupon be deemed to be terminated.3) Sue and Labour(1) Where there is loss or damage to the vessel from a peril insured againstor where the vessel is in immediate danger from such a peril, and as a result reasonable expenditure is incurred by the Insured in order to avert or minimize a loss which would be recoverable under this insurance, the Insurer will be liable for the expenses so incurred by the Insured. This clause shall not apply to general average, salvage or salvage charges or to expenditure otherwise provided for in this insurance.(2) The insurer’s liability under this clause is in addition to his liabilityunder the other provisions of this insurance, but shall not exceed an amount equal to the sum insured in respect of the vessel.II. ExclusionsThis insurance does not cover loss, damage, liability or expense cause by:1. Unseaworthiness including not being properly manned, equipped or loaded, providedthat the Insured knew, or should have know, of such unseaworthiness when the vessel was sent to sea;2. Negligence or intentional act of the Insured and his representative;3. Ordinary wear and tear, corrosion, rottenness or insufficient upkeep, or defectin material which the Insured should have discovered with due diligence, or replacement of or repair to any part in unsound condition as mentioned above.4. Risks covered and excluded in the Hull War and Strikes Clauses of this Company.III. Deductible1. Partial loss caused by a peril insured against shall be payable subject to thedeductible stipulated in the policy for each separate accident or occurrence (excluding claims under collision liability, salvage and general average, and sue and labour).2. Claims for damage by heavy weather occurring during a single sea passage betweentwo successive ports shall be treated as being due to one accident.This clause shall not apply to a claim for total loss of vessel, and the reasonable expense of sighting the bottom after grounding, if incurred specially for that purpose.IV. ShippingUnless previously approved by the insurer and any amended terms of cover and additional premium required have been agreed, this insurance does not cover loss, damage, liability and expense caused under the following circumstances:1. towage or salvage service undertaken by the Insured vessel;2. cargo loading or discharging operation at sea from or into another vessel (not being a harbor or inshore craft) including whist approaching, lying alongside and leaving;3. the Insured vessel sailing with an intention of being broken up or sold for breaking up.V. Period of InsuranceThis insurance is classified into Time Insurance and Voyage Insurance.1. Time Insurance: Longest duration is one year, the time of commencement andtermination being subject to the stipulation in the policy. Should the Insured vessel at the expiration of this insurance be at sea or in distress or at port of refuge or of call, she shall, provided previous notice be given to the insurer, be held covered to her port of destination with the payment of an additional pro rata daily premium. However, in case of a total loss of the vessel during such period of extension, an additional six moths premium shall be paid to the insurer.2. Voyage Insurance: to be subject of the voyage stipulated in the policy. The timeof commencement and termination to be dealt with according to the following provisions:1) With no cargo on board: to commence from the time of unmooring or weightinganchor at the port of sailing until the completion of casing anchor or mooring at the port of destination.2) With cargo on board: to commence from the time of loading at the port of sailinguntil the completion of discharge at the port of destination, but in no case shall a period of thirty days be exceeded counting from midnight of the day of arrival of the vessel at the port of distination.VI. Termination1. This insurance shall terminate automatically in the event of payment for totalloss of the Insured vessel.2. Unless previously agreed by the Insurer in writing, this insurance shall terminateautomatically at the time of any change of the Classification Society of the Insured vessel, change or cancellation or withdrawal of her Class therein, change in the ownership or flag, assignment or transfer to new management, charter ona bareboat basis, requisition for title. If the vessel has cargo on board or isat sea, such termination shall, if required, be deferred until arrival at hernext port or final port of discharge or destination.3. In case of any such breach of warranty as to cargo, voyage, trading limit, towage,salvage services or date of sailing, this insurance shall terminate automatically unless notice be given to the Insurer immediately after receipt of advice and any amended terms of cover and any additional premium required be agreed.VII. Premium and Returns1. Time Insurance: Full premium shall be due and payable on attachment, and if agreedby the Insurer payment may be made by installments, but in the event of total loss of the Insured vessel, any unpaid premium shall be immediately due and payable. Premium is returnable as follows:1) If this insurance is cancelled or terminated, premium shall be returned prorata daily net for the uncommenced day, but this clause shall not be applicable to clause .2) Where the Insured vessel is laid up in a port or a lay-up area approved bythe Insurer for a period exceeding thirty consecutive days irrespective of whether she is under repairs in dock or shipyard, loading or discharging, 50% (fifty percent) of net premium for such period shall be returned pro rata daily but in no case shall such return of premium be recoverable in the event of total loss of the vessel.In the event of any return recoverable under this clause being based on thirty consecutive days which fall on successive insurance effected for the same Insured, such return of premium shall be calculated pro rata separately for the number of days covered by each insurance.2. Voyage insurance: In no case shall voyage insurance be cancelable and the premiumthereof be returnable once it commences.VIII. Duty of Insured1. Immediately upon receipt of advice of any accident or loss to the Insured vessel,it is the duty of the Insured to give notice to the Insurer within 48 hours, andif the vessel is abroad, to the Insurer’s nearest agent immediately, and so take all reasonable measures for the purpose of averting or minimizing a loss which would be recoverable under this insurance.2. Measures taken by the Insured or the Insurer with the object of averting orminimizing a loss which would be recoverable under this insurance shall not be considered as waiver or acceptance of abandonment or otherwise prejudice the rights of either party.3. The Insured shall obtain prior agreement of the Insurer in determining theliabilities and expenses in respect of the Insured vessel.4. In submitting a claim for loss, the Insured shall transfer to the Insurer allnecessary documents and assist him in pursuing recovery against the third party in case of third party liabilities or expenses being involved.IX. Tender1. Where the Insured vessel is damaged and repairs are required, the Insured shalltake such tenders as a diligent uninsured owner would take to obtain the most favourable offer for the repairs of the damaged vessel.2. The Insurer may also take tenders or may require further tenders to be taken forthe repair of the vessel. Where such a tender is accepted with the approval of the Insurer, the allowance in respect of fuel and stores and wages and maintenance of the master and crew shall be made for the time lost between the dispatch of the invitations to tender required by the Insurer and the acceptance of a tender, but the maximum allowance shall not exceed the rate of 30% per annum on the Insured value of the vessel.3. The Insured may decide the place of repair of the damaged vessel, however, ifthe Insured in making such decisions does not act as a diligent uninsured owner, then the Insurer shall have a right of veto concerning the place of repair ora repairing firm decided by the owner or deduct any increased costs resultingtherefrom from the indemnity.X. Claim and IndemnityIn case of accident or loss insured against, no claim shall be recoverable should the Insured failed to submit claim document to the insurer within two years following the accident or loss.Total Loss1) Where the Insured vessel is completely destroyed or so seriously damaged asto cease to be a thing of the kind insured or there the Insured is irretrievably deprived of the vessel, it may be deemed a actual total loss, and the full insured amount shall be indemnified.2) Where no news is received of the whereabouts of the Insured vessel over aperiod of two months after the date on which she is expected to arrive at the port of destination it shall be deemed an actual total loss and the full insured amount shall be indemnified.3) Where an actual total loss of the Insured vessel appears to be unavoidableor the cost of recovery, repair and/or salvage or the aggregate thereof will exceed the Insured value of the vessel, it may be deemed a constructive total loss and the full insured amount shall be indemnified after notice of abandonment of the vessel is given to the Insurer irrespective of whether the Insurer accepts the abandonment. Once the Insurer accepts the abandonment, the subject matter insured belongs to the Insurer.Partial loss1) Claims under this insurance shall be payable without deduction new for old;2) In no case shall a claim be admitted in respect of scrapping derusting orpainting of the vessel’s bottom unless directly related repairs of plating, damaged by an insured peril;3) Where repairs for owner’s account necessary to make the vessel seaworthyand/or a routine drydocking are carried out concurrently with repairs covered by this insurance, then the cost of entering and leaving dock and the dock dues for the time spent in dock shall be divide equally.4) Where it is necessary to place the vessel in drydock for repair of the damagecovered by this insurance, the Insurer’s liability for the cost of docking shall not be reduced, should the Insured has surveys or other work carried out while the vessel is in dock provided the time for the work for the Insured’s account is not prolonged in dock or the cost of docking is not in any way increased.In no case shall any sum be allowed under this insurance either by way of remuneration of the Insured for time and trouble taken to obtain and supply information or documents or in respect of the commission or charges of any manager, agent, managing or agency company or the like, appointed by or on behalf of the Insured to perform such services, unless prior agreement has been obtained.Where the Insured amount is less than the agreed value or the contributory value in respect of general average or salvage, then the Insurer is only liable to pay that proportion of any loss or expense covered by this insurance that the amount insured bears to the agreed or contributory value.Where the Insured vessel comes into collision with or receives salvage services from another vessel owned by the Insured or under the same management, the Insurer shall be liable under this insurance as if the other vessel were owned by a third party.XI. Treatment of DisputesShould disputes arise between the insured and insurer and it is necessary to submit to arbitration or take legal action, such arbitration or legal action shall be carried out at the place where the defendant is domiciled.注释tackle, 索具。

船舶保险相关条款沿海、内河,船舶保险条款 (1)船(渔)工责任险条款 (2)螺旋浆、舵、锚、锚链及子船单独损失保险条款 (3)四分之一碰撞、触碰责任保险条款 (4)沿海内河船舶附加部分损失特约条款 (4)水路货物运输承运责任保险特约条款(试行) (5)沿海内河油船油污责任保险特约条款(试行) (6)缉私船舶附加执行公务意外损失保险特约条款(试行) (7)沿海内河船舶保险条款附加第三者人身伤害责任保险条款 8沿海、内河,船舶保险条款本保险的保险标的是指在中华人民共和国境内合法登记注册从事沿海、内河航行的船舶,包括船体、机器、设备、仪器和索具。

船上燃料、物料、给养、淡水等财产和渔船不属于本保险标的范围。

本保险分为全损险和一切险,本保险按保险单注明的承保险别承担保险责任。

保险责任第一条全损险由于下列原因造成保险船舶发生的全损,本保险负责赔偿。

一、八级以上(含八级)大风、洪水、地震、海啸、雷击、崖崩、滑坡、泥石流、冰凌;二、火灾、爆炸;三、碰撞、触碰;四、搁浅、触礁;五、由于上述一至四款灾害或事故引起的倾覆、沉没;六、船舶失踪。

第二条一切险本保险承保第一条列举的六项原因所造成保险船舶的全损或部分损失以及所引起的下列责任和费用:一、碰撞、触碰责任:本公司承保的保险船舶在可航水域碰撞其它船舶或触碰码头、港口设施、航标、致使上述物体发生的直接损失和费用,包括被碰撞船舶上所载货物的直接损失,依法应当由被保险人承担的赔偿责任。

本保险对每次碰撞、触碰责任仅负责赔偿金额的四分之三,但在保险期限内一次或累计最高赔偿额以不超过船舶保险金额为限。

属于本船舶上的货物损失,本保险不负赔偿责任。

非机动船舶不负碰撞、触碰责任,但保险船舶由本公司承保的拖船拖带时,可视为机动船舶。

二、共同海损、救助及施救本保险负责资赔偿依照国家有关法律或规定应当由保险船舶摊负的共同海损。

除合同另有约定外,共同海损的理算办法应按《北京理算规则》办理。

保险船舶在发生保险事故时,被保险人为防止或减少损失而采取施救及救助措施所支付的必要的、合理的施救或救助费用、救助报酬,由本保险负责赔偿。

海商法试题及答案一、单项选择题(在每小题的备选答案中选出一个正确的答案,并将正确答案的号码填在题干的括号内。

每小题1分,共10分)1.世界上最老的船级社是1760年成立的( )。

A.劳埃德船级社B.法国巴黎国际船级社 C.德国劳氏船级社2.跟单信用证通常有装船日期的约定,该装船日期也即是提单的签发日期,它通常是指( )。

A.承运人接收货物的日期 B.托运人将货物运至船上的日期C.承运人开始将货物装船的日期D.承运人将货物装完船的日期3.根据海商法实际承运人的界定,实际承运人可以是( )。

A.定期租船合同的承租人 B. 多式联运经营人C.除光船租赁合同外的出租人4.1978年“汉堡规则”彻底废除了“航海过失免责条款”,但是它要求火灾造成的海上运输货物的损坏或灭失,由( )负举证责任。

A.承运人 B.承运人或其雇佣人员、代理人 C. 托运人D.收货人5.船舶在定期租船期内不合约定的适航状态或者其他状态,( )应当采取可能采取的合理措施,使之尽快恢复适航状态。

A.出租人 B.承租人 C.承运人 D.船长6.船舶碰撞的损害赔偿,适用( )A.受损害船舶的船旗国法B.侵权行为地法 C.法院所在地法 D.扣押法院所在地法7.在海上货物运输责任期间,货物发生灭失或损坏,是由( )造成,承运人不负赔偿责任。

A. 船舶碰撞 B.平舱不当 C.船长及船员管理货物过失8.我国海商法关于海难救助的规定,是依照( 制订的。

A.新劳氏求助合同格式 B.1910年求助公约C.1989年国际求助公约9.根据国际贸易的习惯做法,被保险人根据海上保险单所享有的权利,通常都可以采用( )的方式转让给受让人。

A.买卖B.背书 C.银行托收10.海事请求人申请诉前扣押船舶的,时效自( )起中断。

A.申请扣船之日 B.提起诉讼之日 C.取得担保之日 D.海事法院作出扣航裁定之日答案要点1.A 2.D 3.C 4.C 5.A 6.B 7.A 8.C 9.B 10.A四、判断改错题(判断下列每小题的正误。

(完整版)船舶保险条款(86年)船舶保险条款(1986.1.1)本保险的保险标的是船舶,包括其船壳、救生艇、机器、设备、仪器、索具、燃料和物料。

本保险分为全损险和一切险。

一、责任范围(一)全损险本保险承保由于下列原因所造成的被保险船舶的全损:地震、火山爆发、闪电或其他自然灾害;搁浅、碰撞、触碰任何固定或浮动物体或其他物体或其他海上灾害;火灾或爆炸;来自船外的暴力盗窃或海盗行为;抛弃货物;核装置或核反应堆发生的故障或意外事故;本保险还承保由于下列原因所造成的被保险船舶的全损:①装卸或移动货物或燃料时发生的意外事故;②船舶机件或船壳的潜在缺陷;③船长、船员有意损害被保险人利益的行为;④船长、船员和引水员、修船人员及租船人的疏忽行为;⑤任何政府当局,为防止或减轻因承保风险造成被保险船舶损坏引起的污染,所采取的行动。

但此种损失原因应不是由于被保险人、船东或管理人未克尽职责所致的。

(二)一切险本保险承保上述原因所造成被保险船舶的全损和部分损失以及下列责任和费用:1.碰撞责任①本保险负责因被保险船舶与其他船舶碰撞或触碰任何固定的、浮动的物体或其他物体而引起被保险人应负的法律赔偿责任。

但本条对下列责任概不负责:a.人身伤亡或疾病;b.被保险船舶所载的货物或财物或其所承诺的责任;c.清除障碍物、残骸、货物或任何其他物品;d.任何财产或物体的污染或沾污(包括预防措施或清除的费用)但与被保险船舶发生碰撞的他船或其所载财产的污染或沾污不在此限。

e.任何固定的、浮动的物体以及其他物体的延迟或丧失使用的间接费用。

②当被保险船舶与其他船舶碰撞双方均有过失时,除一方或双方船东责任受法律限制外,本条项下的赔偿应按交叉责任的原则计算。

当被保险船舶碰撞物体时,亦适用此原则。

③本条项下保险人的责任(包括法律费用)是本保险其他条款项下责任的增加部分,但对每次碰撞所负的责任不得超过船舶的保险金额。

2.共同海损和救助①本保险负责赔偿被保险船舶的共同海损、救助、救助费用的分摊部分。

人保船舶险条款

人保船舶险条款如下:

1、定期保险:期限最长一年。

起止时间以保险单上注明的日期为准。

保险到期时,如被保险船舶尚在航行中或在危险中或在避难港或中途港停靠,经被保险人事先通知保险人并按日比例加付保险费后,本保险继续负责到船舶抵达目的港为止。

保险船舶在延长时间内发生全损,需加交6个月保险费。

2、航次保险:按保单订明的航次为准。

起止时间按下列规定办理:不载货船舶:自起运港解缆或起锚时开始至目的港抛锚或系缆完毕时终止。

载货船舶:自起运港装货时开始至目的港卸货完毕时终止。

但自船舶抵达目的港当日午夜零点起最多不得超过30天。