Case Interview 八大类型及分析工具

- 格式:doc

- 大小:17.50 KB

- 文档页数:2

计算机辅助软件工程中的工具和技术在现代软件开发中,计算机辅助工具和技术已经成为了不可或缺的一部分。

这些工具和技术通常被称为计算机辅助软件工程(CASE)技术。

CASE技术可以帮助开发人员更有效地管理和开发软件,并提高软件的质量。

本文将介绍几种常见的CASE工具和技术。

1. 需求分析工具需求分析是软件开发中非常重要的一环。

一个好的需求分析可以确保软件的正确性、稳定性和可靠性。

这里有一些常见的需求分析工具:- 用例建模:用例是一个系统行为的描述。

用例图可以描述用户和系统之间的交互,并且可以帮助开发人员理解系统的架构和模块之间的关系。

- 数据流图:数据流图可以表示数据在系统中的流动以及流动的路径。

这对于识别系统中的数据流程和数据来往非常有用。

- 原型工具:原型是一个类似于“草图”的设计,它可以帮助开发人员确定系统的布局和用户界面。

原型工具可以让开发人员更轻松地创建原型。

2. 设计工具设计工具主要用于设计系统的架构和模块。

这些工具通常包括以下几种:- UML建模:UML是一种用于创建图形化模型的语言,它可以描述系统的结构和行为。

开发人员可以使用UML来设计系统的架构,并且可以通过UML检查系统的正确性和一致性。

- 架构设计工具:架构设计工具可以帮助开发人员创建和维护系统的架构和组件之间的关系。

这些工具通常包括绘图工具、版本控制、依赖管理工具等。

- 数据库设计工具:数据库设计工具可以帮助开发人员创建和管理数据库。

这些工具可以自动生成数据库表和字段,并提供数据统计和查询功能。

3. 编码工具编码工具是用于编写和管理代码的工具。

以下是一些常见的编码工具:- 集成开发环境(IDE):IDE是一个集成了编辑器、编译器和调试器的开发环境。

它可以让开发人员更方便地编写代码、测试和调试代码。

- 版本控制:版本控制工具可以帮助开发人员跟踪代码的变化,记录每个版本的差异并协作开发。

Git和SVN是最流行的版本控制工具。

- 自动化测试工具:自动化测试工具可以帮助开发人员自动化测试,验证代码是否符合预期和规格。

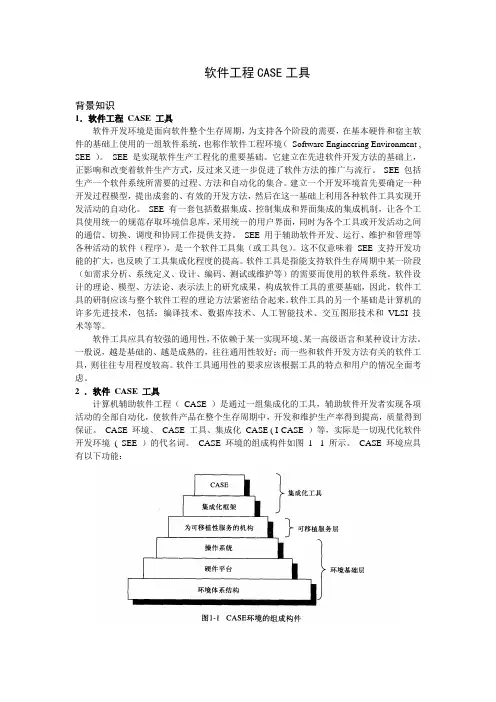

软件工程CASE工具背景知识1.软件工程CASE 工具软件开发环境是面向软件整个生存周期,为支持各个阶段的需要,在基本硬件和宿主软件的基础上使用的一组软件系统,也称作软件工程环境(Software Engineering Environment , SEE )。

SEE 是实现软件生产工程化的重要基础。

它建立在先进软件开发方法的基础上,正影响和改变着软件生产方式,反过来又进一步促进了软件方法的推广与流行。

SEE 包括生产一个软件系统所需要的过程、方法和自动化的集合。

建立一个开发环境首先要确定一种开发过程模型,提出成套的、有效的开发方法,然后在这一基础上利用各种软件工具实现开发活动的自动化。

SEE 有一套包括数据集成、控制集成和界面集成的集成机制,让各个工具使用统一的规范存取环境信息库,采用统一的用户界面,同时为各个工具或开发活动之间的通信、切换、调度和协同工作提供支持。

SEE 用于辅助软件开发、运行、维护和管理等各种活动的软件(程序),是一个软件工具集(或工具包)。

这不仅意味着SEE 支持开发功能的扩大,也反映了工具集成化程度的提高。

软件工具是指能支持软件生存周期中某一阶段(如需求分析、系统定义、设计、编码、测试或维护等)的需要而使用的软件系统。

软件设计的理论、模型、方法论、表示法上的研究成果,构成软件工具的重要基础,因此,软件工具的研制应该与整个软件工程的理论方法紧密结合起来。

软件工具的另一个基础是计算机的许多先进技术,包括:编译技术、数据库技术、人工智能技术、交互图形技术和VLSI 技术等等。

软件工具应具有较强的通用性,不依赖于某一实现环境、某一高级语言和某种设计方法。

一般说,越是基础的、越是成熟的,往往通用性较好;而一些和软件开发方法有关的软件工具,则往往专用程度较高。

软件工具通用性的要求应该根据工具的特点和用户的情况全面考虑。

2 .软件CASE 工具计算机辅助软件工程(CASE )是通过一组集成化的工具,辅助软件开发者实现各项活动的全部自动化,使软件产品在整个生存周期中,开发和维护生产率得到提高,质量得到保证。

MBB Cass Interview高频考题一、常考的五大类Market Sizing 市场规模估算Market Entry 市场准入研究Profitability 盈利能力分析Merger & Acquisition 兼并与收购问题Pricing & Valuation 定价与估值问题二、高频考题1. Market Sizing 市场规模估算n How many cups of coffee will the Starbucks downstairs sell each day? n How many smoke detectors are there in Chicago?n How many gas stations are there in New York?n Estimate the number of planes flying over the UK at a given time? n How many ATMs are there in the country?n What is the market size of online courses in the U.S. today?2. Market Entry 市场准入研究n How would you assess whether or not international expansion of XX company is a good idea?n If so, which country or countries offer the greatest three-yearrevenue opportunity?n Whether or not they should enter U.S. market?n What key challenges they might face upon entry?n What approach would you recommend to your client regarding entering the U.S- market?n If XXX, should they proceed or pass?3. Profitability 盈利能力分析n How would you approach figuring out the bottom line of increasing one passenger per aircraft in XX airlines1 domestic flights?n What corrective actions can be taken to improve XX' s profitability? n Recently, XX Club' s profits in the U.S. are going down. What is going on?n What can they do to restore profitability?n Determine if your client should buy those new products, if so, how many should he buy?4. Merger & Acquisition 兼并与收购问题n Should A acquire or merge with B?n Why do they want to acquire this company?n What type of acquirer you are dealing with? What are they looking for?n What factors should they consider?n Is the work culture and values of target companies compatible with theirs?n Is the new acquisition in line with their growth strategy?5. Pricing & Valuation 定价与估值问题n How much would you pay for a 10-Minute NYC-London trip?n Advise your client XXX on how much should they bid on the contract. n What should your client take into account when bidding?n What are the alternatives or substitute products?n Are the supply and demand foreseeable?。

咨询公司的case interview题库

1.一家快递公司在市场份额上遭遇了困境,请你提出一些解决方案。

2. 一家餐饮公司想要扩大市场,你有什么建议?

3. 一家银行遇到了财务问题,请你分析原因并提供解决方案。

4. 一家零售商想要提高销售额,请你提出一些策略。

5. 一家医疗保健公司想要增加知名度,请你提出一些推广计划。

6. 一家汽车制造企业想要推出一款新车型,请你进行市场调研

并提出建议。

7. 一家电信公司想要提高客户满意度,请你提出一些方法。

8. 一家房地产开发企业想要在竞争激烈的市场中脱颖而出,请

你提出一些竞争策略。

9. 一家新兴科技公司想要扩大业务范围,请你提出一些扩展计划。

10. 一家航空公司想要提高飞行安全性,请你提出一些改进措施。

- 1 -。

商业分析CaseInterview的⼩套路⼤家好,我是Minnie。

在商业分析师(Business Analyst,简称BA)这个⾏业我⼲了不少年,认识了不少相似背景的同⾏,也认识了许多不同背景的同学。

在和同学们的交流中我发现,同学们纷纷认为BA⾯试相对⽐较随机,准备起来缺乏系统的知识体系,⾯试过后也得不到反馈、⽆法提⾼。

今天开始,我启动⼀个“BA⾯试”系列专题,希望能帮到⼤家准备和应对BA⾯试。

接下来的⼏个⽉,欢迎⼤家持续关注!如果你也是BA⽼司机,欢迎私聊给我提提建议!不知道我是谁?Minnie硅⾕FLAG中⽼年商业分析师BitTiger.io商业分析师课程主讲⽼师在BA⾯试的准备过程中,不知道同学们有没有过如下的问题:啥叫case interview?我只听说过SQL。

为什么我的case interview(⼜双叒叕)挂了?到底什么叫business sense?......如果你有这样的问题,那么希望接下来的内容能够有帮助。

先给⼤家画画重点。

BA这个职位,说⽩了就是考察这两种技能:数据分析的能⼒商业分析的能⼒数据分析数据分析很好理解,它属于类似于抡榔头的“硬技能”。

SQL学会了就是学会,让你去任何公司、遇到任何数据你都可以抡起这个榔头开始⼲活。

训练硬技能的⽅法,也没有什么秘密,就是学SQL,学统计,学Excel,然后通过反复练习达到熟练。

我以后会找机会,对这类知识画画重点,以及展开讲讲如何练习。

此处图⽂⽆关商业分析商业分析不同于数据分析,它是⼀种“软技能”。

顾名思义,商业分析包含两层含义:第⼀层是商业,这需要同学们对商业(公司怎么赚钱)有⼀定理解。

⼤到公司CEO、部门领导,⼩到包⼦铺⽼板、时尚博主,其实或多或少都具备最基本的商业分析的能⼒。

第⼆层是分析,说⽩了就是如何回答⼀个商业问题。

商业问题不同于数据问题。

数据问题⼀般都是⾮常事先定义好的问题,不仅有着明确的input和output,就连解决问题的⼯具都已经知道了(SQL)。

奥法赛case面试project management三大经典Case思路解析Case Interview怎样练习?各个Case案例有什么特点和思路?历时两个月的Case Interview精品课刚刚落下帷幕,主页君就迫不及待地想把导师提到的干货统统告诉大家:涵盖Market Sizing,Profitability,Mergers & A question,Pricing...几乎已经覆盖了最全的Case考核题型。

Market SizingGuesstimates,这种问题也常被称作Market Sizing,即需要在没有什么细节提供给你的情况下估计一个市场的大小,你不需要得出一个正确答案,这里主要考察你如何把一个大问题分解成小问题来回答。

在这种问题中你需要有一些常识(比如纽约人口840.6 万等)。

典型问题五年后加拿大无人机的市场有多大?纽约地铁一天的客运量?波士顿有多少棵树?美国每年消耗多少只啤酒瓶?...这些都是典型的关于Market Sizing的问题解题思路1. 从供给角度还是需求角度切入市场由供给端与需求端构成,所以一般Market Sizing问题从这两端分析都有相应的思路,但是有些市场的供求明显不平衡,某一方会受到限制,比如问一个机场一天高峰时期客流量有多少,这个问题从供给端来思考就会更加合理2. 从目标问题开始,将其分解成组成部分咨询很核心的一个思维就是把一个大问题breakdown成很多小问题,从而发现问题,各个击破。

3. 将不同的组成部分进一步分解,根据现实经验合理假设。

以星巴克的营业额为例:一天中,星巴克早中晚的客户人数会有一定差异。

即可假设,早上8:00-11:00,每个小时200人可以完成购买,由于是早上,这200人都会买一杯咖啡,同时很可能其中100个人也会买一个面包;同时假设每件物品的单价。

这就可以算出早上8点至11点间的营业额。

4. 算出数字,给出答案主要通过假设数字确定最后的结果,面试官考查的是你的分析能力,而不需要一个具体的正确的结果,所以数字并不重要,重要的是整个过程中你所展现的思维方式。

(1) 什么是Case Interview?一般来说,Case Interview主要针对咨询公司面试而言。

也有一些公司如Dell二面会用一些小case来考察面试者的应变能力、考虑问题的全面性以及逻辑分析能力。

咨询公司的Case Interview可以分成两个部分,一开始先是Warm-up。

在这一部分,你可能需要自我介绍,然后大致回答一下面试官针对简历以及个人选择提出的一些问题。

接下来才是真正的Case Interview。

简而言之,Case Interview就是现场对一个商业问题进行分析的面试。

但是和大多数其他面试不同,这是一个互动的过程。

你的面试官会给你提出一个Business Issue,并且会让你给出分析和意见。

而你的任务是向面试官有逻辑的提出一些问题以使得你能够对这个Business Issue有更全面,更细致的了解,并且通过系统的分析最后给出建议。

一般而言,Case Interview是没有绝对正确的答案的。

面试官看重的不是答案,而是从面试过程当中你表现出来的分析能力和创造力。

对于大学毕业,没有工作经验的学生来说,大多数情况下Case不会很难,也不会需要你对那个行业有系统的了解。

Case Interview一般是一对一的,一轮会有两个Case Interview,由两个不同的面试官来负责,每个Interview持续45分钟,包括10-15分钟的warm-up以及一些Behavior questions,剩下的30分钟就是讨论Case。

10-15分钟的Warm-up一般用英文,Case可能是英文,也有可能是中文,不同的公司以及不同的面试官对语言是有不同的偏好的。

(2) 为什么使用Case Interview?由于咨询师在工作上的不少时间都是在和客户以及同事进行相互的沟通,同时咨询工作本身的特点要求咨询师必须具备一系列的特质才能够成功。

这些特质包括:在压力之下保持冷静,对问题能够很快的根据细节建立假设,并且运用很强的逻辑分析能力来解决问题等等。

案例面试Caseinterview八类类型介绍及分析工具第一篇:案例面试Case interview八类类型介绍及分析工具案例面试Case interview八类类型介绍及分析工具面试案例主要有以下8种类型,或者是其中2-3种的叠加。

Falling Profits Case这个类型的案例需要你挖掘分析出导致企业利润下降的可能因素。

考察的是面试者的分析能力,深入洞察事务的能力, 熟悉金融工具,交流能力及相关行业知识相关分析工具有:Market assessment, BCG matrix, product mix assessment.New Product Introduction这个类型的案例是要求你推荐一种新产品引进的策略。

考察的是面试者的分析能力,对品牌管理及供应链的理解程度,交流能力及相关行业知识。

相关分析工具有:4p理论,市场分析,竞争者分析,product portfolio assessmentEntering a New Market这个类型的案例需要你分析出加公司是否应该进入一个新的市场,是否需要发展一种新产品或新服务。

(通常新产品或服务在某种程度上与公司已有业务相关)。

考察的是面试者的分析能力,对市场、供应链动态的理解、交流能力及相关行业知识相关分析工具有:Market assessment, product portfolio analysisEntering a New Geographic Market这个类型的案例需要你分析企业是否应该将业务拓展到新的国家或地区。

此类问题考察的是面试者的分析能力,对国际市场动态、当地通货情况、供应链动态的理解,及交流能力与相关行业知识相关分析工具有: Market assessment, supply chain analysis, competitor analysisWhere to Locate a New Facility(“Site Selection Case”)这个类型的案例需要你评估一下,公司应该在哪里添置新的工厂或设备,有时也需要你分析出公司的整体运营是否需要重新规划和部署。

实验1软件工程case工具1. 简介软件工程是现代软件开发过程中不可或缺的一部分,为了更好地进行软件开发,团队需要使用一些合适的工具来支持软件开发和项目管理过程。

本文将介绍一些实验1中常见的软件工程case工具,以及它们的特点和作用。

2. ExcelExcel是一种非常流行的电子表格应用程序,可以用于创建和处理各种数据表格,也可以用于制作统计图表和计算公式等。

在软件工程中,Excel通常被用来管理项目数据、制作时间表和计算预算等。

Excel具有简单易用、功能强大等特点,使得它成为了绝大多数软件开发团队的首选。

3. JIRAJIRA是一款流行的项目管理工具,由Atlassian公司开发,被广泛用于软件开发中。

它支持项目管理和问题跟踪,包括缺陷跟踪、需求管理、工作流程等。

JIRA的特点是配置灵活,可快速适应各种团队需求。

它还具有多种插件,使得开发者可以扩展其功能。

4. GitLabGitLab是一个开源的基于Git的软件开发工具,它是一个集代码仓库、问题追踪、持续集成和部署于一身的平台。

GitLab支持多人协作开发,简化了开发者的工作流程,提高了开发的效率。

它还有一个强大的CI/CD功能,可以帮助开发者构建和部署软件。

5. GitHubGitHub是一个基于Git的代码托管平台,是全球最大的社交编程和开源社区之一。

它提供Git的代码托管服务,并支持团队协作开发、问题跟踪和代码审查等。

GitHub的强大社区和开源共享的精神,使得它成为了全球最著名的代码库之一。

6. 综合比较Excel、JIRA、GitLab和GitHub都是软件工程case工具的代表,每种工具都有其独特的优点和应用场景。

Excel简单易用,适用于项目管理和数据处理等;JIRA适用于团队协作和问题跟踪等;GitLab是一个基于Git的平台,适用于代码仓库托管、持续集成和持续部署等;GitHub则是一个用于开源共享和团队协作的代码托管平台,适用于共享和协作开发等。

Case interview分析工具/框架来源:张旭的日志最近在准备CASE INTERVIEW,刚接触这个,对里面涉及到的FRAMEWORK和STRATEGY非常不熟悉,偶获珍宝,与诸君共享。

顺便攒RP!!案例面试分析工具/框架一.Business Strategy1.市场进入类●行业分析(波特5力,市场趋势,市场规模,市场份额,市场壁垒等)●公司宏观环境(人口,经济,自然,技术,政治),公司微观环境(公司,供应商,市场中介,顾客,竞争对手,大众)●3C(Competitor, Consumer, Company/Capabilities)●Cost-revenue固定成本,可变成本收入怎么计算?时间序列估计,可比公司估计●市场细分很重要,niche marketA.地理细分B.人口细分(年龄及生命周期阶段细分,性别细分,收入细分)C.心理细分(社会阶层,生活方式,个性特征)D.行为细分(购买时机-柯达,利益细分-牙膏,用户状况,使用率,忠诚度)2.行业分析类●市场(市场规模,市场细分,产品需求/趋势分析,客户需求)●竞争(竞争对手的经济情况,产品差异化,市场整合度,产业集中度)●顾客/供应商关系(谈判能力,替代者,评估垂直整合)●进入/离开的障碍(评估公司进入/离开。

对新加入者的反应,经济规模,预测学习曲线,研究政府调控)●资金金融(主要金融资金来源,产业风险因素,可变成本/固定成本)●风险预测与防范3.新产品引入类●营销调研●产品?价格?即4P●4C (Customer, Competition, Cost, Capabilities)●市场促销,分校渠道(渠道选择,库存,运输,仓储)●STP和4P(Product, Price, Place, Promotion)●产品生命周期二.Business Operation1.市场容量扩张(竞争对手,消费者,自己实力)2.利润改善型●Revenue, Cost分析,到底是销售额下降造成,还是成本上升造成●如果销售额下降,看4P了(是价格过高?产品质量问题?分校渠道问题?还是promotion的efficacy有问题?)●如果成本上升,看固定成本or可变成本是否有问题?(固定成本过高,设备是否老化,需要关闭生产线、厂房,降低管理者工资等,可变成本过高,看原材料价格是否上升,有没有降低的可能,switch suppliers? 还是人员工资过高,需要裁员等)●成本结构是否合理,产能利用率如何(闲置率)3.推销任何一种产品/服务●4P,3c4.定价●以成本为基础的定价成本加成定价,以目标利润(盈亏平衡定价)●以价值为基础定价●以竞争为基础定价三.Market Sizing/Estimation●市场趋势,市场规模,市场份额,市场壁垒等●市场集中度●市场驱动因素(价格,服务,质量,外观)●关键成功要素KSF四.M&A类●整合原因(synergy, scale, management impulse, Taxconsideration, Diversification, Breakup Value)●5C(Character, Capacity, Capital, Conditions, Competitive Advantage)●类型:horizontal, vertical, congeneric, conglomerate●估值方法:DFC,Market Multiple( EBITDA,P/E,P/B)●DFC:Pro Forma Cash Flow Statement,Discount Rate●Hostile VS Friendly takeovers所有咨询公司面试可能用到的分析结构Advanced concepts & frameworksMBAs and other candidates with business background, take note - interviewers will expect you to have a more detailed take on your case than an undergrad uate would have. Here are some commonly used case concepts.Net present valuePerhaps the most important type of decision company managers must make o n a daily basis is whether to undertake a proposed investment. For example, should the company buy a certain piece of equipment? Build a particular facto ry? Invest in a new project? These types of decisions are called capital budget ing decisions. The consultant makes such decisions by calculating the net pres ent value of each proposed investment and making only those investments tha t have positive net present values.Example: Hernandez is the CFO of Western Manufacturing Corp., an automobil e manufacturer. The company is considering opening a new factory in Ohio th at will require an initial investment of $1 million. The company forecasts that t he factory will generate after-tax cash flows of $100,000 in Year 1, $200,000 in Year 2, $400,000 in Year 3, and $400,000 in Year 4. At the end of Year 4, the company would then sell the factory for $200,000. The company uses a discount rate of 12 percent. Hernandez must determine whether the company should go ahead and build the factory. To make this decision, Hernandez must calculate the net present value of the investment. The cash flows associated with the factory are as follows:Hernandez then calculates the NPV of the factory as follows:Since the factory has a negative net present value, Hernandez correctly decide s that the factory should not be built.The net present value ruleNote from the example above that once the consultant has figured out the NP V of a proposed investment, she then decides whether to undertake the invest ment by applying the net present value rule:Make only those investments that have a positive net present value.As long as the consultant follows this rule, she can be confident that each inv estment is making a positive net contribution to the company.The Capital Asset Pricing Model (CAPM)In the above example, we assumed a given discount rate. However, part of a consultant's job is to determine an appropriate discount rate (r) to use when c alculating net present values. The discount rate may vary depending on the in vestment.BetaThe first step in arriving at an appropriate discount rate for a given investmen t is determining the investments riskiness. The market risk of an investment is measured by its "beta" (?), which measures riskiness when compared to the market as a whole. An investment with a beta of 1 has the same riskiness a s the market as a whole (so, for example, when the market moves down 10 percent, the value of the investment will on average fall 10 percent as well). An investment with beta of 2 will be twice as risky as the market (so when th e market falls 10 percent, the value of the investment will on average fall 20 percent).CAPMOnce the consultant has determined the beta of a proposed investment, he ca n use the Capital Asset Pricing Model (CAPM) to calculate the appropriate disc ount rate (r):The risk-free rate of return is the return the company could receive by makin g a risk-free investment (for example, by investing in U.S. Treasury bills). The market rate of return is the return the company could receive by investing in a well-diversified portfolio of stocks (for example, S&P 500).Example: Shen, Inc., a coal producer, is considering investing in a new ventur e that would manufacture and market carbon filters. Shen's chief financial offic er, Apelbaum, wants to calculate the NPV of the proposed venture in order to determine whether the company should make the investment. After studying t he riskiness of the proposed venture, Apelbaum determines that the beta of th e investment is 1.5. A U.S. Treasury note of comparable maturity currently yie lds 7 percent, while the return on the S&P 500 stock index is 12 percent. The refore, the discount rate Apelbaum will use when calculating the NPV of the in vestment will be:Although this is an overly simplified discussion of how consultants calculate dis count rate to use in their cash-flow analysis, it does give you an overview of how consultants incorporate the notion of an investment's market to select the appropriate discount rate.Porter's Five ForcesDeveloped by Harvard Business School professor Michael Porter in his book Co mpetitive Strategy, the Porter's Five Forces framework helps determine the att ractiveness of an industry. Before any company expands into new markets, di vests product lines, acquires new businesses, or sells divisions, it should ask it self, "Is the industry we're entering or exiting attractive?" By using Porter's Fi ve Forces, a company can begin to develop a thoughtful answer. Consultants f requently utilize Porter's Five Forces as a starting point to help companies eval uate industry attractiveness.Take, for example, entry into the copy store market (like Kinko's). How attract ive is the copy store market?Potential entrants: What is the threat of new entrants into the market? Copy s tores are not very expensive to open - you can conceivably open a copy store with one copier and one employee. Therefore, barriers to entry are low, so th ere's a high risk of potential new entrants.Buyer power: How much bargaining power do buyers have? Copy store custo mers are relatively price sensitive. Between the choice of a copy store that ch arges 5 cents a copy and a store that charges 6 cents a copy, buyers will usu ally head for the cheaper store. Because copy stores are common, buyers hav e the leverage to bargain with copy store owners on large print jobs, threateni ng to take their business elsewhere. The only mitigating factors are location a nd hours. On the other hand, price is not the only factor. Copy stores that ar e willing to stay open 24 hours may be able to charge a premium, and custo mers may simply patronize the copy store closest to them if other locations ar e relatively inconvenient.Supplier power: How much bargaining power do suppliers have? While paper p rices may be on the rise, copier prices continue to fall. The skill level employe es need to operate a copy shop (for basic services, like copying, collating, etc.) are relatively low as well, meaning that employees will have little bargaining power. Suppliers in this situation have low bargaining power.Threat of substitutes: What is the risk of substitution? For basic copying jobs, more people now possess color printers at home. Additionally, fax machines h ave the capability to fulfill copy functions as well. Large companies will normal ly have their own copying facilities. However, for large-scale projects, most in dividuals and employees at small companies will still use the services of a cop y shop. The Internet is a potential threat to copy stores as well, because som e documents that formerly would be distributed in hard copy will now be post ed on the Web or sent through e-mail. However, for the time being, there is s till relatively strong demand for copy store services.Competition: Competition within the industry appears to be intense. Stores oft en compete on price, and are willing to "underbid" one another to win printing contracts. Stores continue to add new features to compete as well, such as e xpanding hours to 24-hour service and offering free delivery.From this analysis, you can ascertain that copy stores are something of a com modity market. Consumers are very price-sensitive, copy stores are inexpensiv e to set up, and the market is relatively easily entered by competitors. Advan ces in technology may reduce the size of the copy store market. Value-added services, such as late hours, convenient locations, or additional services such as creating calendars or stickers, may help copy stores differentiate themselve s. But overall, the copy store industry does not appear to be an attractive one.As dot-coms come under fire, one case question we've heard increasingly is " How would you create barriers to entry as an Internet Startup?"Product life cycle curveIf you're considering a product case, figure out how "mature" your product or service isStrategy tool/framework chartHere's one way to think about the choice between being the lowest-cost provi der or carving out a higher-end market niche - what consultants call differenti ation.The Four PsThis is a useful framework for evaluating marketing cases. It can be applied t o both products and services. The Four Ps consist of:PriceThe price a firm sets for its product/service can be a strategic advantage. For example, it can be predatory (set very low to undercut the competition), or it can be set slightly above market average to convey a "premium" image. Consi der how pricing is being used in the context of the case presented to you. ProductThe product (or service) may provide strategic advantage if it is the only prod uct/service that satisfies a particular intersection of customer needs. Or it may simply be an extension of already existing products, and therefore not much of a benefit. Try to tease out the value of the product in the marketplace bas ed on the case details you have been given.Position/PlaceThe physical location of a product/service can provide an advantage if it is sup erior to its competition, if it is easier or more convenient for people to consu me, or if it makes the consumer more aware of the product/service over its c ompetition. In the context of a business case, you may want to determine the placement of the product or service compared to its competition.PromotionWith so much noise in today's consumer (and business to business) marketpla ce, it is difficult for any one product/service to stand out in a category. Promo tional activity (including advertising, discounting to consumers and suppliers, c elebrity appearances, etc.) can be used to create or maintain consumer aware ness, open new markets, or target a specific competitor. You may want to sug gest a promotional strategy in the context of the case you are presented relati ve to the promotional activity of other competing products/services.The Four CsThe Four Cs are especially useful for analyzing new product introductions and for industry analysis.CustomersHow is the market segmented?What are the purchase criteria that customers use?CompetitionWhat is the market share of the clients?What is its market position?What is its strategy?What is its cost position?Does he/she have any market advantages?CostWhat kind of economies of scale does the client have?What is the client's experience curve?Will increased production lower cost?CapabilitiesWhat resources can the client draw from?How is the client organized?What is the production system?The Five CsThis framework is mostly applied to financial cases and to companies (althoug h it can be applied to individuals). You may employ it in other situations if yo u think it is appropriate.CharacterEvaluate the dedication, track record, and overall consumer perception of the company. Are there any legal actions pending against the company? If so, for what reason? Is the company progressive about its waste disposal, quality of l ife for its employees, and charitable contributions? What sort of impact would this have on the case you are evaluating?CapacityIf you are dealing with a manufacturing entity, are its factories at, above, or below capacity, and for what reasons? Are there plans to add new plants, imp rove the technology in existing plants, or close underperforming plants? What about production overseas?CapitalWhat is the company's cost of capital relative to its competitors? How healthy are its cash flows, revenues, and debt load relative to its competition? ConditionsWhat is the current business climate the company (and its industry) faces? W hat is the short- and long-term growth potential in the industry? How is the market characterized? Is it emerging or mature? These questions can assist yo u in evaluating the facts of the case against the environment that the compan y/industry inhabits.Competitive AdvantageThis is the unique edge a company possesses over its competitors. It can bean unparalleled set of business processes, the ability to produce a product/ser vice at a lower cost, charge a market premium, or any number of other asset s that create an advantage over other market players. Whatever the case, the se advantages are usually defensible and not easily copied.In evaluating business cases using the Five Cs framework, you should look for those unique qualities that a company possesses and identify any that meet t he criteria mentioned above. You may suggest that the company leverage its competitive advantage more aggressively or recommend alternatives if that co mpany has no discernible advantage.Value Chain AnalysisThis approach involves assessing a company's overall business processes and i dentifying where that company actually adds value to a product or service. Th e total margin of profit will be the value of the product or service to buyers, l ess the cost of its production, as determined by the value chain.In most cases, a competitive advantage is only temporary for many of today's products/services. Being first to market, having a unique formula or configura tion, or having exclusivity in a market were once long-term defensible strategi es. But today, businesses are globally connected by lightning-fast communicati ons and knowledge-sharing systems and manufacturing technologies are gettin g better and faster at reacting to and anticipating market conditions. Thus the se advantages are only fleeting or may not exist at all.Value Chain Analysis attempts to identify a competitive advantage by deconstr ucting the various "changes" a company's business processes perform on a set of raw materials or other inputs. Most can be easily copied by other competit ors, but there is usually a unique subset that represents the "value-added" qu alities only the company under scrutiny possesses. This set is that company's competitive advantage, or "value chain." Sometimes this set can be copied, bu t a unique set of circumstances may still allow the company in question to per form them at a lower cost, charge a premium in the market, or retain higher market share than its competitors.In the context of a business case, you can use this framework to identify a co mpany's overall business processes set and then determine if one or more of t he processes are defensible competitive advantages.For example, a manufacturer of fruit juice might have the following value chai n elements:•Research and development (Will mango really taste good with cloudberry juic e?)•Cost of goods sold (How much does it cost to manufacture the fruit juice? Is there a frost in Florida that drives up the costs of oranges? Is the currency c risis in Indonesia making papaya very cheap? Are per-volume purchases lower than, for example, those of Tropicana?)•Packaging and shipping (How much does that new banana-shaped container c ost? Are many bottles lost in transit? What are the fixed costs of shipping?)•Manufacturing (How much do those juice pulpers cost? How often do factories need to be reengineered?)•Labor (How many employees do we have? Where are they located? Are they unionized?)•Distribution(Where are the distribution centers? Where are the products distri buted?)•Advertising (Billboards, TV, magazines?)•Margin (How profitable is the juice company?)For more detailed information on this type of analysis, you may want to consi der the authoritative text on competitive strategy: Competitive Strategy: Tech niques for Analyzing Industries and Competitors, by Michael E. Porter.Core competencies"Core competencies" is the idea that each firm has a limited number of things it is very good at (that is, its core competence or competencies).When restructuring or reengineering, one of the starting points for a company should be identifying its core competencies. A firm should define its core com petencies broadly in order to be flexible enough to adapt to changes in the m arketplace. (For instance, when Xerox defined itself as a "document company," rather than a maker of copy machines, it was able to take advantage of the more lucrative business of document handling and outsourcing for major corpo rations, as well as of the market for fax machines, scanners, and other docum ent-handling equipment.)Companies should seriously consider selling/spinning off business units that ar e not part of their "core" business. For instance, Pepsi recently spun off its re staurant operations after it concluded that its expertise was in manufacturing and marketing beverages, not in managing restaurants.Benchmarking and "best practices"A commonly used concept in consulting (especially in operations and implemen tation engagements) is "benchmarking." Benchmarking basically means researc hing what other companies in the industry are doing (usually in order to evalu ate whether your client is operating efficiently or to identify areas where the c lient can cut costs). For example, if a mail-order company wants to reduce its order-processing costs, it would want to compare its order processing costs w ith those of other mail-order companies, breaking down its costs for each part of the process (including order-taking and shipping) and comparing them with industry averages. It can then pinpoint those areas where its costs are higher than average for the industry.A related concept is "best practices": once you've benchmarked what other co mpanies are doing, you want to focus on those companies that have particular low costs or which otherwise operate particularly well. What are they doing ri ght (i.e., what are their "best practices")? And how can our client (in the case) emulate or copy what they're doing? Remember to look outside your client'sparticular industry, if necessary, to find the best practices for a particular proc ess or operation.The 2x2 matrixThe 2x2 matrix is a good framework to use any time you have two factors th at, when combined, yield different outcomes. A very rudimentary example wou ld be what happens when you turn on your bathroom faucets, as follows:A more business-appropriate example would involve acquiring a company. Let? s say a company is interested in understanding the difficulty of acquiring or b uilding a distribution center and it is considering financing this decision with ei ther stock or debt. The potential outcomes might look like this:The BCG MatrixThe BCG Matrix, named after the Boston Consulting Group (BCG), is perhaps t he most famous 2x2 matrix. The matrix measures a company's relative marke t share on the horizontal axis and its growth rate on the vertical axis.M&A cases: Determining the value of an acquisitionCase interviews aren't just for consultants. Mergers & acquisition cases are wil dly popular at investment banks. Here's how to analyze a potential acquisition.Value Drivers (M&A) FrameworkIn order to understand value, we need to understand the three primary value drivers:The value components can be further broken out into specific "value drivers":M&A Cases: Data Gathering and AnalysisMarket Analysis Tools• Competitive position framework• Relative value versus competitors to customer through supply chain• Product life cycle• Supply and demand analysis- Industry capacity- Industry utilization- Demand drivers- Regressions• Segmentation analysis• Porter's Five Forces• Experience curves• Trends and outlook• Key success factorsTarget Analysis Tools• Business system - comparison with competitors• Market share (over time and by segment)• Capacity (growth and utilization of)• Customer's key purchase criteria and relative performance• Financial history• Sales and profitability by segment• Cash flow analysis• Margin and expense structure• Relative cost position• Cost benchmarkingYour data gathering strategy will vary depending on industry:A framework cautionAll the frameworks detailed above are widely used, and most U.S. business sc hools teach them as part of their core curriculums. Your interviewers will insta ntly recognize when you are applying them, since they are already familiar wit h the techniques. While this is OK, consider that you are trying to demonstrat e your unique analytical and deductive reasoning skills that set you apart from other candidates. You must be creative and original in analyzing case questio ns. Use these frameworks sparingly. (Another note: No interviewer will be imp ressed if you proudly proclaim, "I'm going to apply Porters Five Forces now." Apply frameworks without identifying them.)。

Case_Interview案例面试案例面试是一种常见的面试方式,用于评估应聘者的解决问题的能力和分析思维能力。

在案例面试中,面试官会给应聘者一个实际业务问题或情景,要求应聘者通过提出假设、分析问题、制定解决方案等步骤来解决问题。

在进行案例面试时,应聘者需要注意以下几点:1. 理解问题:在面试开始时,应聘者需要仔细阅读问题描述,并确保对问题的理解准确。

如果有任何不清楚的地方,可以向面试官提出问题进行澄清。

2. 提出假设:在分析问题之前,应聘者可以先提出一些假设,以帮助自己更好地理解问题和制定解决方案。

这些假设可以是关于市场、竞争对手、客户需求等方面的。

3. 分析问题:在分析问题时,应聘者可以运用各种工具和方法,如SWOT分析、五力模型、价值链分析等,来帮助自己全面地理解问题,并找出问题的关键因素。

4. 制定解决方案:在制定解决方案时,应聘者需要考虑到问题的各个方面,包括市场、竞争、财务等。

解决方案应该是可行的、具有可操作性,并且能够解决问题的根本原因。

5. 沟通能力:在整个面试过程中,应聘者需要清晰地表达自己的思路和观点,并能够与面试官进行良好的沟通。

沟通能力是评估面试者综合素质的一个重要指标。

案例面试的评估标准主要包括以下几个方面:1. 问题分析能力:评估应聘者对问题的分析能力和逻辑思维能力。

应聘者需要能够准确地找出问题的关键因素,并能够运用相关工具和方法进行分析。

2. 解决方案的可行性:评估应聘者制定解决方案的能力。

解决方案应该是可行的,具有可操作性,并且能够解决问题的根本原因。

3. 沟通能力:评估应聘者的沟通能力和表达能力。

应聘者需要能够清晰地表达自己的思路和观点,并能够与面试官进行良好的沟通。

4. 团队合作能力:评估应聘者在团队合作中的能力。

案例面试中往往会有小组讨论环节,应聘者需要能够积极参与讨论,与团队成员合作,共同制定解决方案。

在准备案例面试时,应聘者可以通过以下几个途径提高自己的能力:1. 阅读案例分析书籍:可以通过阅读相关的案例分析书籍,了解不同行业的案例,并学习分析问题的方法和技巧。

【留学生就业】完美通过麦肯锡Case Interview,你需要这份材料清单以及这十个面试Tips为了麦肯锡的校招我准备了大半年,自己也总结出不少准备Case的方法。

下面和大家分享一下我自己的经验,推荐的准备材料以及面试建议。

为什么你需要大量的练习?有同学说30个case等于一个offer,Victor Cheng说一般拿到offer的人有50个case。

但是,我认识的去年的拿到offer的有40个的,有70个的,有上百个的。

大量的练习绝对是必不可少的。

因为练习到后面,解决case找到答案已经不是问题,主要是进一步完善自己对于各类case设计的issue tree和通过做case了解不同行业的信息。

为什么你需要和不同的人Mock?不同的人能从不同的角度给你意见,适应不同的人也能更充分地应对不同风格的面试官。

一个好的case partner是一笔巨大的财富。

我们学校有比较固定的4,5个人的组合,水平都不错,而且彼此信任度很高。

建议一开始不要约定长期合作关系,练一次观察好对方的水平和态度后再决定。

为什么你需要商业知识的累积?在激烈的竞争下,有这方面的积累绝对是脱颖而出的利器。

不然你解决case 的思路就太模板化,太死板。

面试时结合自己对于行业的了解言之有物绝对是个亮点。

牢记你解决的是real life problem,而不仅仅是个case! 我直接订了Wall Street Journal三个月,恶补商业知识。

解决Case只是一部分,另一部分是你如何解决是否用hypothesis-driven, fact-based approach? 是否能在压力下保持冷静和enthusiastic的态度(多微笑,多保持眼神接触)? It is not about what you say, it is about what they hear. 一定要确保你的思路以最清晰的方式传递给了对方。

另外,Victor Cheng说过一句话,我十分赞同:Even if you are uncertain about sth, you must be certain that youare uncertain about sth. 也就是任何时候都得充满自信。

CASE工具及环境概述1. 介绍计算机辅助软件工程(CASE)工具是一种能够协助软件开发人员完成软件开发过程中各种任务的工具集合。

这些工具旨在提高软件开发的效率和质量,减少人为错误,促进团队合作。

本文将对CASE工具及相关环境进行概述,介绍其在软件开发中的重要性和应用。

2. CASE工具分类2.1. 需求管理工具需求管理工具帮助团队收集、分析、记录和跟踪软件项目的需求。

常见的需求管理工具包括门户系统、需求管理软件等。

2.2. 建模工具建模工具用于设计和绘制软件系统的结构图、流程图等模型。

典型的建模工具有UML、ER图等。

2.3. 编码工具编码工具用于编写、编辑、测试和调试软件代码。

常用的编码工具有IDE集成开发环境、文本编辑器等。

2.4. 测试工具测试工具用于自动化测试、性能测试、负载测试等,提高软件质量。

常见的测试工具有Junit、Selenium等。

2.5. 配置管理工具配置管理工具用于追踪版本控制、变更管理和配置管理。

典型的配置管理工具包括Git、SVN等。

3. CASE环境CASE环境是指软件开发团队使用的工具和资源的集合,包括硬件、软件和人员等方面的资源。

一个良好的CASE环境能够提高团队的协作效率和软件开发的质量。

3.1. 硬件环境硬件环境是指团队成员使用的计算机、服务器、网络设备等硬件设施。

为了保证CASE工具的正常运行和协作,团队需要配置高性能的计算机和稳定的网络环境。

3.2. 软件环境软件环境包括团队使用的CASE工具、开发环境、数据库系统等软件资源。

团队需要选择适合自身需求的软件工具,并确保这些工具相互兼容、稳定。

3.3. 人员环境人员环境是指团队成员的技能水平、沟通能力、团队协作等方面。

一个高效的人员环境能够促进团队成员之间的协作和沟通,提高软件开发的效率和质量。

4. CASE工具及环境的重要性CASE工具及环境在软件开发中扮演着重要的角色,对团队的效率和软件质量都有着重大的影响。

Case_Interview案例面试案例面试(Case Interview)是一种常见的面试方式,特别在咨询、金融和科技行业中被广泛采用。

它通过模拟真实业务场景,考察应聘者的分析能力、解决问题的能力以及沟通能力。

本文将介绍案例面试的背景、常见类型以及一些应对策略。

一、案例面试背景案例面试起源于咨询行业,最早由波士顿咨询集团(BCG)在20世纪60年代引入。

随着时间的推移,案例面试逐渐成为各行业招聘中的重要环节。

这种面试方式主要考察应聘者的问题解决能力,因为在实际工作中,员工需要能够分析问题、找出关键因素并提出解决方案。

二、案例面试类型1. 市场调研案例:此类案例要求应聘者对市场进行调研,分析竞争对手、消费者需求以及市场趋势。

应聘者需要利用数据分析工具,收集和整理数据,并提出相应的市场策略。

2. 运营优化案例:这类案例要求应聘者分析企业的运营流程,找出潜在问题并提出改进方案。

应聘者需要具备流程优化和项目管理的知识,能够通过数据分析和业务理解找到问题的症结。

3. 财务分析案例:此类案例要求应聘者对财务数据进行分析,并提出相应的财务建议。

应聘者需要具备财务知识,能够理解财务报表和指标,并结合业务情况进行分析。

4. 战略规划案例:这类案例要求应聘者对企业的战略进行分析,并提出相应的战略规划。

应聘者需要具备战略思维和行业洞察力,能够分析企业内外部环境,并提出可行的战略方案。

三、应对策略1. 理清思路:在面对案例面试时,应聘者首先要理清思路,明确问题的关键点。

可以通过提问来澄清问题,确保自己对问题的理解准确。

2. 数据分析:案例面试通常会提供大量数据,应聘者需要具备数据分析的能力。

可以通过制作图表、计算指标等方式来对数据进行分析,并提炼出关键信息。

3. 结构化思维:在回答问题时,应聘者需要采用结构化思维,将问题拆解成多个子问题,并逐一解决。

这样可以使回答更有条理,也更容易找到解决问题的关键点。

4. 沟通表达:案例面试不仅考察应聘者的分析能力,还考察其沟通和表达能力。

CASE工具介绍CASE工具的出现主要是为了解决传统软件开发过程中的一些问题。

传统的软件开发过程通常是以纸质文档为主的,而且往往需要手动编写大量的代码,容易出现错误和重复劳动。

而CASE工具则通过提供自动化和集成化的功能,可以提高软件开发的质量和效率。

1.需求分析工具:它们用于帮助软件开发人员收集、分析和管理需求。

常见的功能包括需求模型化、需求跟踪、需求变更管理等。

2.系统设计工具:它们用于帮助软件开发人员进行软件系统的设计。

常见的功能包括设计建模、结构和数据流程图绘制、接口设计等。

3.编码工具:它们用于辅助程序员进行代码编写。

常见的功能包括代码自动补全、代码调试、版本控制等。

4.测试工具:它们用于帮助软件开发人员进行软件的测试和验证。

常见的功能包括自动化测试、单元测试、性能测试等。

5.项目管理工具:它们用于帮助项目经理管理软件开发项目。

常见的功能包括任务分配、进度跟踪、资源管理等。

6.文档管理工具:它们用于帮助软件开发人员管理文档。

常见的功能包括文档版本控制、文档共享、文档检索等。

7.配置管理工具:它们用于管理软件配置和变更。

常见的功能包括配置项管理、变更控制、版本管理等。

综合来说,CASE工具的主要优点包括:1.提高开发效率:CASE工具可以自动化大量的开发任务,减少了手工工作量,提高了开发效率。

2.减少错误:CASE工具可以提供自动化的检查和验证功能,减少人为错误。

3.提高质量:CASE工具可以提供设计建模、需求跟踪等功能,帮助开发人员更好地进行软件开发过程中的各个环节,从而提高软件质量。

4.便于管理:CASE工具可以提供项目管理、文档管理、配置管理等功能,帮助项目经理进行项目管理。

5.促进协作:CASE工具可以提供共享和协作的功能,使得开发团队成员之间更容易进行沟通和合作。

当然,CASE工具也存在一些局限性:1.学习成本:CASE工具通常需要较长的学习时间和培训成本,以便熟练使用其功能。

Case Interview In Point—通往咨询的必经之路(1)第一部分. 认识咨询,认识自我第一部分我觉得还是老规矩,先谈谈Why consulting? Why hires you? 这两个问题。

比如你今天去某咨询公司参加一面,面试官肯定会问你为什么选择咨询,为什么选择这家公司,我们为什么要聘用你?这是需要首先解决的问题。

咨询公司一直受着大学毕业生的顶礼膜拜,那些咨询公司的offeree更是被同学奉为牛人,虽然很多人会对此嗤之以鼻,不以为然,但事实上情况的确如此。

原因到底是什么呢?高薪?诱人的职业发展道路?能力的成长和锻炼?等等其实要说咨询公司是高薪工作,我不敢苟同,至少对于应届毕业硕士生而言,不尽然。

一般交大的计算机系硕士毕业去微软、英特尔、IBM的话,年薪加上奖金和福利一年少说也有14万以上,而咨询公司的起薪和这个数字也相差也不大,但是工作量远远超出这些公司的工作量,所以如果用一个indicator来衡量的话,我们经常会说性价比不高。

但是说到能力的锻炼和成长, 咨询和投行的确是很锻炼人的地方, 而咨询和投行不一样的地方就在于投行还是偏向于金融财务领域的服务,投行主要帮助公司筹钱、融资、兼并与收购,而咨询可以接触到不通职能领域的服务,如战略、营销、运营、组织架构、兼并收购、IT架构设计和实施等等,而且相对而言,咨询工作没有投行工作累(其实都是属于很累的工作,只是相对而言,差别就在于咨询平均周工作量在80小时,而投行在100小时左右)。

我个人觉得选择咨询业的原因有以下几点1.有机会同很多睿智的人一起工作并向他们学习2.在一种声望显赫的环境中培养一系列广泛、受欢迎的工作技能3.不断的培训,不断的学习4.有机会接触不同的行业5.被顶尖商学院录取的可能性将增大6.收入丰厚7.有着良好的职业发展前景8.增强思考问题和解决问题的能力9.有机会和大公司的管理层直接对话,出谋划策等等以上我的观点只是解决了why consulting的问题,那why hires you呢?你到底具有什么样的素质,让咨询公司的Partner决定聘用你呢?我个人认为咨询公司物色的是“低风险的”人选。

Case Interview 八大类型及分析工具(精华转帖)来源:苏小敏Felix的日志

面试案例主要有以下8种类型,或者是其中2-3种的叠加。

Falling Profits Case

这个类型的案例需要你挖掘分析出导致企业利润下降的可能因素。

考察的是面试者的分析能力,深入洞察事务的能力, 熟悉金融工具,交流能力及相关行业知识

相关分析工具有:Market assessment, BCG matrix, product mix assessment.

New Product Introduction

这个类型的案例是要求你推荐一种新产品引进的策略。

考察的是面试者的分析能力,对品牌管理及供应链的理解程度,交流能力及相关行业知识。

相关分析工具有:4p理论,市场分析,竞争者分析,product portfolio assessment Entering a New Market

这个类型的案例需要你分析出加公司是否应该进入一个新的市场,是否需要发展一种新产品或新服务。

(通常新产品或服务在某种程度上与公司已有业务相关)。

考察的是面试者的分析能力,对市场、供应链动态的理解、交流能力及相关行业知识

相关分析工具有:Market assessment, product portfolio analysis

Entering a New Geographic Market

这个类型的案例需要你分析企业是否应该将业务拓展到新的国家或地区。

此类问题考察的是面试者的分析能力,对国际市场动态、当地通货情况、供应链动态的理解,及交流能力与相关行业知识

相关分析工具有: Market assessment, supply chain analysis, competitor analysis

Where to Locate a New Facility ("Site Selection Case")

这个类型的案例需要你评估一下,公司应该在哪里添置新的工厂或设备,有时也需要你分析出公司的整体运营是否需要重新规划和部署。

考察的是面试者的分析能力,对全球市场动态、相关的规管环境,进出口环境及供应链动态的理解,交流能力及相关行业知识。

相关分析工具有:Market assessment, supply chain analysis, competitor analysis

Mergers & Acquisitions Case

这个类型的案例需要你判断出公司是否应该实施兼并和收购,这样做是不是明智。

考察的是面试者的分析能力,对监管法规环境的了解,及供应链动态的掌握程度,除此之外,还有沟通交流能力及相关行业知识。

相关分析工具有:Market assessment, supply chain analysis, competitor analysis, structural analysis

Competitive Response Case

这个类型的案例需要你为你的客户提供一个方案,告诉他在当前的竞争形势下,对竞争者应该做出怎样的反应。

此类案例考察的是面试者的分析能力,对供应链动态、市场动态的理解,交流能力及相关行业知识。

相关分析工具有:Useful concepts/frameworks: Market assessment, supply chain analysis, competitor analysis, structural analysis

Changes in Government/Regulatory Environment

这个类型的案例会向你描述,你的客户公司所处的政府与监管环境发生了变化(如在公司所在地,政府实行了一种新的法律法规)并要求你为该公司提供合理的建议。

此类案例考察的是面试者的分析能力,对供应链动态的理解,交流能力,相关行业知识,市场动态分析,监管环境分析等等。

相关分析工具有:Market assessment, supply chain analysis, competitor analysis, structural analysis,regulatory analysis

补充一下:俺在MC见过两个方法,PEST和Value Chain,前者做Market Entry,后者做过Industry Research。