贸易术语基本计算题图文稿

- 格式:docx

- 大小:123.87 KB

- 文档页数:11

国际贸易实务计算题1、老三种贸易术语的价格换算(计算题)1、主要贸易术语的价格构成(FOB、CFR、CIF贸易术语)FOB=进货成本价+国内费用+净利润CFR=进货成本价+国内费用+国外运费+净利润CIF=进货成本价+国内费用+国外运费+国外保险费+净利润2、主要贸易术语的价格换算:(一)FOB价换算为其它价1、CFR=FOB价+运费2、CIF=(FOB+运费)/(1-投保加成×保险费率)(二)CFR价换算为其它价1、FOB价=CFR价-运费2、CIF价=CFR价/(1-投保加成×保险费率)(三)CIF价换算为其它价1、FOB=CIF价×(1-投保加成×保险费率)-运费2、CFR价=CIF价×(1-投保加成×保险费率)Eg: 1、某出口公司对外报价牛肉罐头2.20美元/听CIF古晋,按发票金额加成10%投保一切险,保险费率0.3%,客户要求改报CFR价格,请问改报多少?解:CFR= CIF - I= CIFX(1-投保加成X保险费率)=2.2X[1-(1+10%)X0.3%]=2.1932、某公司对外报价CIF纽约50美元每袋,后进口商要求我方改报FOB价,若运费是每袋3美元,保险费率是0.2%,按惯例加一成,在不影响外汇收入的情况下,试计算该货物的FOB价。

解:FOB价=CIF价*[1-保险费率*(1+加成率)]-运费= 50*(1-0.2%*1.1) - 3= 46.89(美元)3、我出口公司对外报价某产品每公吨350美元FOB青岛(大宗散装货物),后外国商人要求报CIF横滨价,假设运费每公吨35美元,保险费率为5%0,按惯例加一成,在不影响外汇收入的情况下,试计算我方应报的CIF横滨价。

解:CIF =(FOB价+国外运费)/(1-投保加成*保险费率)=(350+35)/(1-0.5%*1.1)= 387.13(美元)2、含佣价和净价的计算净价=含佣价×(1–佣金率)含佣价=净价/ (1 –佣金率)3、盈亏率的计算(计算题)出口商品盈亏率=(出口人民币净收入-出口总成本)×100%出口总成本出口总成本=出口商品进货成本+国内费用-出口退税出口外汇净收入= FOB价格出口人民币净收入= FOB价格×汇率Eg:1、某公司以每公吨1000美元CIF价格出口商品,已知每公吨需支付国际运输费100美元,保险费率为0.1%,国内商品采购价格为5000元人民币,其他商品管理费为500元,试计算该笔业务出口盈亏率?(汇率为1:6.25)解:出口成本=5000+500=5500出口净收入(FOB) =CIF-F-I=CIF-F-110%CIF*I%=1000-100-1.1*1000*0.001=898.9出口人民币净收入=898.9*6.25=5618.125出口盈亏率=(5618.125-5500)/5500=2.15%2、我国甲公司出口新加坡乙公司货物,总货价是CIF新加坡80000美元,其中运费为3800美元,保险费为176美元,该货物的出口总成本是58万人民币。

计算题:CIF,FOB,CFR 三者之间的关系CIF:成本+保险+运费FOB:成本CFR:成本+运费CIF=FOB+运费+保费=CFR+保险1.FOB价换算为其他价CFR价=FOB价+国外运费CIF价=(FOB价+国外运费)/(1-投保加成×保险费率)2.CFR价换算为其他价FOB价=CFR价-国外运费CIF价=CFR价/(1-投保加成×保险费率)3.CIF价换算为其他价FOB价=CIF价×(1-投保加成×保险费率)-国外运费CFR价=C IF价×(1-投保加成×保险费率) CFR计算报价1.净价CFR=FOB+F2.含佣价CFRC=CFR/(1-Rc)=FOB+F/(1-Rc)CIF=CFR+保险四、计算题1.我向英国出口商品报价是每公吨USD1600CFR伦敦,外商来电要求改报CIF伦敦价,该商品投保加一成投保一和战争险,保险费分别为0.55%和0.04%,请问我方新报价应是多少?CIF=1600/[1-1.1×(0.55%+0.04%)=1600/(1-1.1×0.59%)=1610.45(USD)2.我某出口公司推销某商品对外报价为每箱450美元FOB上海,后国外商人要求改报CIF汉堡价。

问我方应报多少?(运费每箱50美元,保险加成至110%,保险费率为0.8%)。

CIF=(450+50)/(1-1.1×0.8%)=504.44(USD)3.我出口公司对非洲某客商发盘,供应某商品,价格条件为CIF非洲某口岸每公吨1500美元;按发票金额110%投保一切险和战争险。

对方要求改报FOB中国口岸。

经查自中国口岸至非洲某口岸的海洋运输费用为每公吨50美元,一切的保险费率为0.5%,战争险的保险率为0.3%。

问如维持出口销售净收入不变,改报FOB中国口岸价,应为多少美元?FOB=1500-50-1500×1.1×(0.5%+0.3%)=1436.8(USD)4.我方公司向西欧某客商推销商品,发盘价格为每公吨1150英镑CFR西欧某港口,对方复电要求改按FOB中国口岸定价,并给予2%佣金,查自中国口岸至西欧某港口的运费为每公吨170英镑,我方如要保持外汇收入不变,怎样改按买方要求条件报价?.FOBC2=(1150-170)/(1-2%)=1000(英镑)5.某公司对外某商品每箱50美元CIF西雅图。

贸易术语基本计算题文件管理序列号:[K8UY・K9IO69・O6M243・OL889・F88688] 1、某出口公司按每公吨1, 200美元FOB上海对外报价,国外客户要求改报CIF旧金山。

假设每公吨运费为130美元,加1成投保,保险费为1%,问该出口公司应报价多少答CIF二FOB+F+I(1200+130)/(1-110%*1%)1330/0. 989=1344. 7932、我对外出售商品一批,报价CIF纽约,23500美元(按发票金额110%投保一切险和战争险,两者费率合计为1.2%),客户要求该报CFR价,试问不影响收汇额的前提下,正确的CFR价应报多少?答CFR二CIF-ICIF*(1-投保加成*保险汇率)23500* (1-110%*1.2%)23500*0.9868=23189. 83、我出口某商品对外报价为480美元/吨FOB湛江,现外商要求将价格改报CIF 旧金山,试求我方的报价应为多少才使FOB净值不变?(设运费是FOB价的3%,保险费为FOB价的0. 8%)答CIF二FOB+F+I480+(480*3%)+ (480*0. 8%) =498. 244、某出口商品对外报价USD450/箱FOB天津新港,外商要求该报CIF汉堡,问我方应报的价格是多少?(运费USD50/箱,保险费率0. 8%)答CIF二FOB+F+I(450+50)/(1-110%*0. 8%)500/0. 9912=504. 4395、某商品的出口价为每公吨CFR香港700美元,买方提出改报CIF价,并要求按CIF价的110%投保水渍险和战争险,查总保险费率为1.2%,求CIF报价。

答CIF二CFR+I700/(1-110%*!. 2%)700/0. 9868=709. 3646、一批出口货物CFR价为99450美元,现客户要求改CIF价加一成投保海运一切险,我同意照办。

如果一切险保险费率为0.5%,请计算:(要求写出计算公式及计算过程)。

贸易术语和进出口商品的价格一、《2000年国际贸易术语解释通则》(INCOTERMS2000,以卜简称《2000通则》) :13种贸易术语《2000通则》是目前在国际贸易中最广泛使用的贸易术语惯例,它是国际商会在《1936年国际贸易术语解释通则》的基础上,历经5次修订形成的,于2000年1月1日起生效。

《2000通则》包含13种术语,并将这13种术语按其自身特点分为E、F、C、D四组。

13种术语含义的主要区别与联系如下:1、EXW:工厂交货价,卖方义务最小,买方责任最大,还要出口报关,属于起运术语,其合同属于发货合同(唯一进口方需要报出口关)。

2、F组:FCA(货交承运人)、/ FOB(装运港船上交货)、FAS(装运港船边交货),其合同属于“装运合同”(1)主运费未付;(2)运输过程的风险由买方承担;(3)买方租船,卖方出口清关并货交承运人(如船公司);谁投保没有明确。

3、C组:CFR(成本加运费)、CIF(成本加运保费)、/ CPT(运费付至)、CIP(运保费付至),其合同属于“装运合同”(1)主运费已付;(2)虽然本组保费由卖方支付,但属于帮忙性质,运输过程的风险仍由买方承担;(3)本组术语下保险缴费办理和风险承担相分离,风险转移地点在装货港;(4)卖方租船投保并出口清关,然后货交承运人。

4、D组:DAF(边境交货)、DES(目的港船上交货)、DEQ(目的港码头交货)、DDU(未完税交货)、DDP(完税后交货),其合同属于“到达合同”(1)海上的运输风险由卖方承担;(2)卖方负责租船订舱,DDP卖方还要负责进口清关(惟一需出口方在进口国清进口关的术语)(3)谁投保责任没有明确,卖方是否投保取决于其对风险的判断。

5、FAS;FOB、CIF、CFR只能适用海运,其余术语适用各种运输方式,包括海运的、陆运的、空运等等授人以鱼不如授人以渔! 1一、《2000年国际贸易术语解释通则》:掌握E、F、C、D组术语装运港船边交货(→指定装运港)装运港口水上运输货交装运港船边买方装运港船上交货(→指定装运港)装运港口水上运输货物越过装运港船舷买方成本加运费(→指定目的港)装运港口水上运输货物越过装运港船舷卖方成本加保险费、运费(→指定目的港)装运港口水上运输货物越过装运港船舷卖方运费付至(→指定目的地)出口国内地、港口任何方式货交承运人处置时起卖方运费、保险费付至(→指定目的地)出口国内地、港口任何方式货交承运人处置时起卖方授人以鱼不如授人以渔! 2授人以鱼不如授人以渔!3(一) E 组术语:授人以鱼不如授人以渔!4(二) F 组术语:授人以鱼不如授人以渔!5(二) F 组术语:授人以鱼不如授人以渔!6(二)F 组术语:授人以鱼不如授人以渔!71. FOB 术语下买卖双方的基本义务:授人以鱼不如授人以渔!8(三)C 组 术语授人以鱼不如授人以渔!9(三)C 组 术语CIF即成本加保险费、运费(→指定目的港),指卖方负责租船或订舱,支付从装运港至目的港的运费,办理货运保险,支付保险费,在合同规定的装运期限内在装运港将货物交付至运往指定目的港的船上,负担货物越过船舷以前的一切费用和货物灭失或损坏的风险。

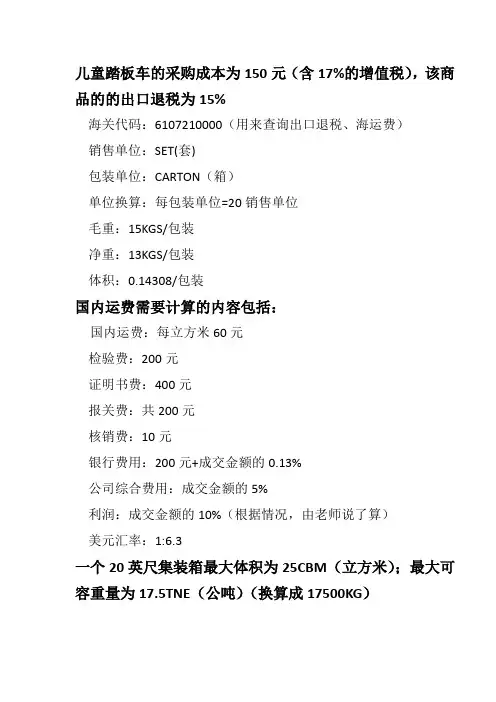

儿童踏板车的采购成本为150元(含17%的增值税),该商品的的出口退税为15%海关代码:6107210000(用来查询出口退税、海运费)销售单位:SET(套)包装单位:CARTON(箱)单位换算:每包装单位=20销售单位毛重:15KGS/包装净重:13KGS/包装体积:0.14308/包装国内运费需要计算的内容包括:国内运费:每立方米60元检验费:200元证明书费:400元报关费:共200元核销费:10元银行费用:200元+成交金额的0.13%公司综合费用:成交金额的5%利润:成交金额的10%(根据情况,由老师说了算)美元汇率:1:6.3一个20英尺集装箱最大体积为25CBM(立方米);最大可容重量为17.5TNE(公吨)(换算成17500KG)解答步骤设总的CIF成交金额为X实际成本:按体积计算箱数:25/0.143=174.83(取整)=174(箱)按重量计算箱数:17500/15=1166.67(取整)=1166(箱)二者取最小的值,即174箱每箱20套,则一共:174*20=3480(套)每套睡衣的实际成本:150-150/(1+17%)*15%=130.77(元)总的实际成本:130.77*3480=455079.6(元)国内费用:=国内运费+检验费+证明书费+报关费+核销费+银行费用+公司综合费用=174*0.143*60+200+400+200+10+200+0.13%X+5%=1492.92+1010+5.13%X海运费:=基本运费+港口附加费+燃油附加费=USD(2915+117+142)=USD3174(换算人民币)=19996.2元预期利润:=10%XCIF=实际成本+国内费用+海运费+保险费+预期利润X=455079.6+2502.92+5.13%X+19996.2+10%XX=477578.72/0.8487=562717.95每套睡衣的CIF报价为:562717.95/3480=CNY161.70(元)= USD25.67(美元)。

国贸计算题(总7页) -CAL-FENGHAI.-(YICAI)-Company One1-CAL-本页仅作为文档封面,使用请直接删除(一)保险费的计算1、一批出口货物做CFR价为250000美元,现客户要求改报CIF价加20%投保海运一切险我方同意照办,如保险费率为0.6%时,我方应向客户报价多少?2、一批出口货CFR价为1980美元,现客户来电要求按CIF价加20%投保海上一切险,我方照办,如保险费率为2%时,我方应向客户补收保险费若干3、我国某商品对某国出口的CFR单价是110美元,如外商要求我们改报CIF 价,在不影响我外汇净收入的前提下,我应报何价(注:按发票金额的110%投保,保险费率为0.5%)4、一批货物由上海出口至某国某港口CIF总金额为30000美元,投保一切险(保险费率为?0.6%)及战争险(保险费率0.03%),保险金额按CIF总金额,客户要求加保一成。

5、某商品出口报价CFR1200美元,保险费率0.63%,客户要求加一成保险,求:CIF价、保险金额、保险费。

6、某批CIF总金额为USD30000货物,投保一切险(保险费率为0.6%)及战争险(保险费率为0.03%),保险金额按CIF总金额加10%。

问:1)该货主应交纳的保险费是多少2)若发生了保险公司承保范围内的损失,导致货物全部灭失,保险公司最高赔偿金额是多少7、中国A公司对外出售货物一批,合同规定:数量100公吨,单价每公吨1000英镑CIF伦敦,卖方按发票金额加一成投保水渍险和短量险,保险费率分别为0.3%和0.2%。

问:保险公司应收多少保险费?8、例:大连某贸易公司向日本出口一批水果,发票总金额为USD15000,加一成投保了一切险和战争险,费率分别为0.7%和0.3%。

请计算投保金额和保险费。

9、我国某公司对外出售商品一批,报价CIF London23500欧元,按发票金额110%投保一切险和战争险,两者费率合计为0.7%,现客户要求改报CFR价。

国际贸易术语解释通则中文版文件管理序列号:[K8UY-K9IO69-O6M243-OL889-F88688]国际贸易术语解释通则(2010)目录前言. 1EXW——工厂交货(……指定地点). 5FCA——货交承运人(……指定地点). 7CPT——运费付至(……指定目的港). 10CIP——运费和保险费付至(……指定目的地) 13DAT——终点站交货(……指定目的港或目的地) 16DAP——目的地交货(……指定目的地). 18DDP——完税后交货(……指定目的地). 20FAS——船边交货(……指定装运港). 22FOB——船上交货(……指定装运港). 24CFR——成本加运费付至(……指定目的港) 27CIF——成本,保险加运费付至(……指定目的港) 30国际贸易术语解释通则2010全球化经济赋予商业以空前宽广途径通往世界各地市场。

货物得以在更多的国家、大量且种类愈繁地销售。

然而随着全球贸易数额的增加与贸易复杂性的提升,因销售合同不恰当起草引致误解与高代价争端可能性也提高了。

国际贸易术语解释通则这一用于国内与国际贸易事项的国际商会规则使得全球贸易行为更便捷。

在销售合同中参引国际贸易术语解释通则2010可清晰界定各方义务并降低法律纠纷的风险。

自1936年国际商会创制国际贸易术语以来,这项在全球范围内普遍被接受的合同标准经常更新,以保持与国际贸易发展步调一致。

国际贸易术语解释通则2010版考虑到了全球范围内免税区的扩展,商业交往中电子通讯运用的增多,货物运输中安保问题关注度的提高以及运输实践中的许多变化。

国际贸易术语解释通则2010更新并加强了“交货规则”——规则的总数从13降到11,并为每一规则提供了更为简洁和清晰的解释。

国际贸易术语解释通则2010同时也是第一部使得所有解释对买方与卖方呈现中立的贸易解释版本。

国际商会商法和实践委员会成员来自世界各地和所有贸易领域,该委员会宽泛的专业技能确保了国际贸易术语解释通则2010与各地的商贸需要照应。

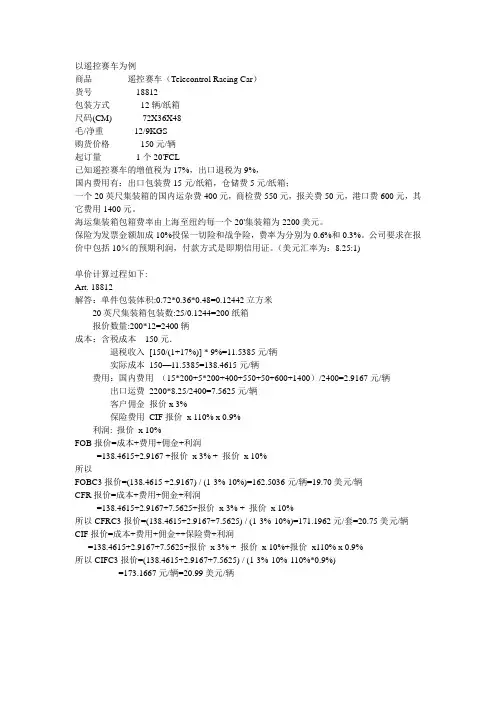

以遥控赛车为例商品遥控赛车(Telecontrol Racing Car)货号 18812包装方式12辆/纸箱尺码(CM) 72X36X48毛/净重 12/9KGS购货价格150元/辆起订量 1个20'FCL已知遥控赛车的增值税为17%,出口退税为9%,国内费用有:出口包装费15元/纸箱,仓储费5元/纸箱;一个20英尺集装箱的国内运杂费400元,商检费550元,报关费50元,港口费600元,其它费用1400元。

海运集装箱包箱费率由上海至纽约每一个20'集装箱为2200美元。

保险为发票金额加成10%投保一切险和战争险,费率为分别为0.6%和0.3%。

公司要求在报价中包括10%的预期利润,付款方式是即期信用证。

(美元汇率为:8.25:1)单价计算过程如下:Art. 18812解答:单件包装体积:0.72*0.36*0.48=0.12442立方米20英尺集装箱包装数:25/0.1244=200纸箱报价数量:200*12=2400辆成本:含税成本150元.退税收入 [150/(1+17%)] * 9%=11.5385元/辆实际成本 150—11.5385=138.4615元/辆费用:国内费用(15*200+5*200+400+550+50+600+1400)/2400=2.9167元/辆出口运费 2200*8.25/2400=7.5625元/辆客户佣金报价x 3%保险费用 CIF报价x 110% x 0.9%利润: 报价x 10%FOB报价=成本+费用+佣金+利润=138.4615+2.9167 +报价x 3% + 报价x 10%所以FOBC3报价=(138.4615 +2.9167) / (1-3%-10%)=162.5036元/辆=19.70美元/辆CFR报价=成本+费用+佣金+利润=138.4615+2.9167+7.5625+报价x 3% + 报价x 10%所以CFRC3报价=(138.4615+2.9167+7.5625) / (1-3%-10%)=171.1962元/套=20.75美元/辆CIF报价=成本+费用+佣金++保险费+利润=138.4615+2.9167+7.5625+报价x 3% + 报价x 10%+报价x110% x 0.9%所以CIFC3报价=(138.4615+2.9167+7.5625) / (1-3%-10%-110%*0.9%)=173.1667元/辆=20.99美元/辆。

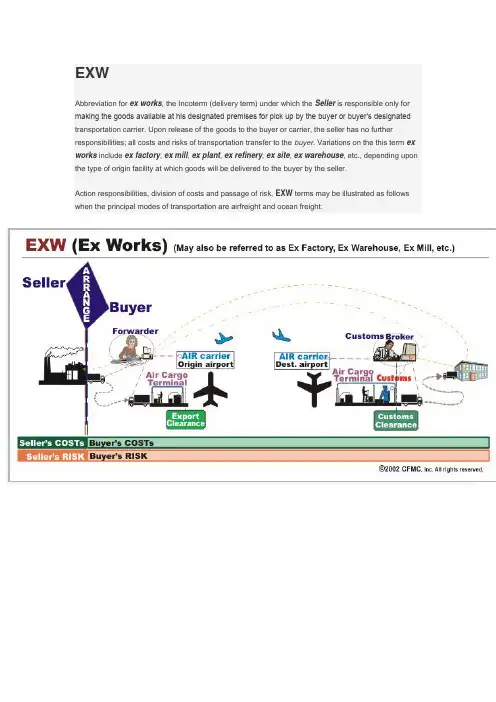

EXWAbbreviation for ex works, the Incoterm (delivery term) under which the Seller is responsible only for making the goods available at his designated premises for pick up by the buyer or buyer’s designated transportation carrier. Upon release of the goods to the buyer or carrier, the seller has no further responsibilities; all costs and risks of transportation transfer to the buyer. Variations on the this term ex works include ex factory, ex mill, ex plant, ex refinery, ex site, ex warehouse, etc., depending upon the type of origin facility at which goods will be delivered to the buyer by the seller.Action responsibilities, division of costs and passage of risk, EXW terms may be illustrated as follows when the principal modes of transportation are airfreight and ocean freight:The official Incoterms publications (Incoterms 2010) may be ordered from the International Chamber of Commerce.FCA(Incoterms) Abbreviation for free carrier (named place). The Incoterm (delivery term) under which the seller is responsible for handing over the goods, cleared for export, to a transportation carrier named by the buyer at a named location, typically at either the seller’s facility or else the terminal of thebuyer-nominated carrier or freight forwarder, typically within the country of export. If the FCA point is the seller’s facility, and loading the conveyance is essential to “handing over the goods,” the seller is responsible for the risk and expense of loading (if loading is not otherwise included in the carrier’s basic transportation charge). FCA, shipper’s facility, is the appropriate delivery term for situations in which the shipper will load an intermodal container, truck trailer, rail car, barge or other conveyance.The seller is not responsible for the cost of unloading the conveyance at the named destination point, nor for transfer of the goods to the on-carrier. For example, if the FCA point is an ocean carrier and/or inland waterway terminal (other than the seller’s own facility), the buyer is responsible for unloading the incoming FCA conveyance, inclusive of forklift charge or other expenses, and for loading the outgoing vessel (e.g., the terminal charges, or wharfage and handling charge, etc.). See also FOB (vessel), under which the seller is additionally responsible for the cost of loading the vessel. Under FCA terms, the seller has no obligation to insure the shipment.Action responsibilities, division of costs and passage of risk under FCA terms may be illustrated as follows when the principal modes of transportation are airfreight and ocean freight:Responsibility for govern security requirements: Incoterms 2010 changed rules A2 & B2, now captioned “Licenses, authorizations, security clearances and other formalities,” to include government imposed security requirements, whatever they may be, as part of export formalities and import formalities. The trading party responsible for export formalities is thus responsible for security requirements in the export country whereas the party responsible for import formalities is responsible for security responsibilities in the import country. For security requirements in a transit country, if any, if the seller has accomplished delivery under the applicable term, the buyer is responsible for this; otherwise security requirements are the seller’s responsibility.FAS(Incoterms) Abbreviation for free alongside. The Incoterm (delivery term) under which the seller is responsible for arranging transportation of the goods to a named ocean or inland waterway port and placing them “alongside” the vessel which the buyer has arranged to transport the goods. The seller is also responsible for export clearance (under pre-2000 versions of Incoterms, this was the buyer’s responsibility). For this reason, FAS terms require special coordination by the shipper or freight forwarder with the inland carrier and water carrier. Under FAS terms, the seller has no obligation to insure the shipment. See Also definitions for ship’s rail, ship’s tackle and shipside delivery.Note: This term is used for shipment via ocean and inland water transportation only and is different from FOB in that the seller is not responsible for placing the goods on the vessel.Action responsibilities, division of costs and passage of risk, FAS terms may be illustrated as follows:Responsibility for government security requirements: Incoterms 2010 changed rules A2 & B2, now captioned “Licenses, authorizations, security clearances and other formalities,” to include government imposed security requirements, whatever they may be, as part of export formalities and import formalities. Under FAS terms, the seller is responsible for export formalities and thus also security requirements in the export country whereas the buyer is responsible for import formalities and thus for security responsibilities in the import country. For security requirements in a transit country, if any, since the seller has already accomplished delivery, the buyer is responsible for this.FOB(Incoterms) Abbreviation for free on board. The Incoterm (trade term) under which the seller is responsible for arranging transportation of goods to a vessel named by the buyer at a namedport, and for all costs of placing t he goods on board the vessel if this not included in the ocean carrier’s basic transportation rate (which it rarely is—see terminal charge, handling charge). The seller’s responsibility is satisfied when the cargo is “on-board” the vessel. The seller is not responsible for costs of actually stowing the goods on board, but is responsible for that portion of the terminal charges which cover services other than stowage and vessel wharfage charges. The seller is not responsible for the cost of ocean carriage, marine cargo insurance, nor for arranging the contract of carriage unless the buyer requests his assistance with this. This Incoterm may never be used alone; rather it must be clarified by stating a specific location, an, because of possible uncertainty as to mode (see box below) the type of conveyance (e.g., “FOB vessel, Baltimore”).ImportantUnder Incoterms 1990 and 2000, “FOB” may be used only for shipments via vessel (prior to these editions, “fob” could be used with other transportation modes). However, “fob” remains applicable to all modes under the American Foreign Trade Definitions (terms of sale). Furthermore, as traditionally used, “fob” can become ambiguous as to whether it means on board the carrier at point of origin vs. destination. For example, “FOB truck, Baltimore” would typically describe a shipment originating in Baltimore by truck. But it might also be used to describe goods shipped prepaid by a supplier consigned to an exporter, at a port city, hold and notify the exporter or his freight forwarder. To eliminate these problems, and to create the precision needed for EDI transactions, Incoterms 1990dropped all use of “FOB” except with respect to the trade term under which the seller is responsible for placing the cargo on-board a vessel at a named origin port. Otherwise, “FOB” was replaced with “FCA.” Notwithstanding this change in the Incoterms, “fob” continues to be widely used domestically and by U.S. exporters for modes of transportation other than vessel, which can result in ambiguity and confusion. When in doubt as to the intention of theseller/shipper as to their use of “fob” for a particular transaction, always clarify this before further dispatching or forwarding cargo.See also definitions for FOB stowed (FOBS), FOB stowed and trimmed (FOBST), FOBFO and FOBLO, which are used with charter vessels and/or bulk vessels, and FOB liner.Action responsibilities, division of costs and passage of risk, the FOB trade term may be illustrated as follows:CPT(Incoterms) Abbreviation for carriage paid to; the Incoterm (delivery term) under which the seller is responsible for arranging transportation and paying the freight for goods to a named point, typically in the destination country. Note, however, that the seller has fulfilled his obligation when he has tendered the goods to the transportation carrier who, under the contract of carriage, will accomplish this transportation to the named point. At this point, typically in the origin country, the buyer assumes the risk of loss of the goods and/or unforeseeable costs. This Incoterm may be used with any transportation mode, including through multimodal movements. Under CPT terms, the seller has no obligation to insure the shipment.In terms of action responsibilities, division of costs and passage of risk, CPT terms may be illustrated as follows where the principal modes of transportation are airfreight and ocean freight:Responsibility for government security requirements: Incoterms 2010 changed rules A2 & B2, now captioned “Licenses, authorizations, security clearances and other formalities,” to include government imposed security requirements, whatever they may be, as part of export formalities and import formalities. Under CPT terms, the seller is responsible for export formalities and thus also security requirements in the export country whereas the buyer is responsible for import formalities and thus for security responsibilities in the import country. For security requirements in a transit country, if any, since the seller has already accomplished delivery, the buyer is responsible for this.CFR(Incoterms) Abbreviation for cost and freight; the Incoterm (delivery term) under which the seller is responsible for arranging and paying for transportation of the goods (but not shipping insurance) through to a named ocean/inland waterway destination port, typically in the destination country. Note, however, that the seller has fulfilled his obligation when he has tendered the goods to the transportation carrier who, under the contract of carriage, will accomplish this transportation to the named point. When the cargo is “on-board” the vessel, typically in the origin country, the risk of loss of the goods and/or unforeseeable costs transfers to the buyer. This Incoterm may be used only with ocean or inland waterway transportation for cargo delivered directly to the vessel (i.e., cargo shipped loose or in bulk, aboard a breakbulk vessel, ro-ro vessel, bulk vessel, etc.); it is not used for cargo to be shipped in an intermodal container via a container vessel, where the correct term for delivery to a foreign port or inland container yard is CPT.Action responsibilities, division of costs and passage of risk, CFR terms may be illustrated as follows:Responsibility for government security requirements: Incoterms 2010 changed rules A2 & B2, now captioned “Licenses, authorizations, security clearances and other formalities,” to include government imposed security requirements, whatever they may be, as part of export formalities and import formalities. Under CFR terms, the seller is responsible for export formalities and thus also security requirements in the export country whereas the buyer is responsible for import formalities and thus for security responsibilities in the import country. For security requirements in a transit country, if any, since the seller has already accomplished delivery, the buyer is responsible for this.CIF(Incoterms) Abbreviation for cost, insurance and freight; the Incoterm (trade terms) under which the seller is responsible for arranging and paying for transportation of the goods and shipping insurance through to a named ocean or inland waterway destination port. Note, however, that the seller has fulfilled his obligation when he has tendered the goods to the transportation carrier who, under the contract of carriage, will accomplish this transportation to the named point. Once the cargo i s “on-board” the vessel, typically in the origin country, the risk of loss of the goods and/or unforeseeable costs transfers to the buyer.Note that under Incoterms, CIF is used only for ocean or inland waterway shipment, and then only for cargo shipped loose or in bulk (e.g., via a breakbulk vessel, ro-ro vessel or bulk vessel), and not for cargo shipped in an intermodal container via a container vessel, where the CIP term is used for this other mode shipments where the seller is responsible for insuring and paying freight through to a named destination point/airport.Action responsibilities, division of costs and passage of risk, CIF terms may be illustrated as follows:Responsibility for government security requirements: Incoterms 2010 changed rules A2 & B2, now captioned “Licenses, authorizations, security clearances and other formalities,” to include government imposed security requirements, whatever they may be, as part of export formalities and import formalities. Under CIF terms, the seller is responsible for export formalities and thus also security requirements in the export country whereas the buyer is responsible for import formalities and thus for security responsibilities in the import country. For security requirements in a transit country, if any, since the seller has already accomplished delivery, the buyer is responsible for this.CIP(Incoterms) Abbreviation for carriage and insurance paid to; the Incoterm (delivery term) under whichthe seller is responsible for arranging and paying for both the transportation of the goods and shipping insurance through to a named destination point, typically in the destination country. Note, however, that the seller has fulfilled his obligation when he has properly insured the goods and tendered them to the transportation carrier who, under the contract of carriage, will accomplish this transportation to the named point. At this point, typically in the origin country, the risk of loss of the goods and/or unforeseeable costs transfers to the buyer.This Incoterm may be used with any transportation mode, including cargo to be shipped in intermodal containers aboard a container vessel, and through multimodal movements. (For cargo shipped loose or in bulk via vessel, CIF would typically be used instead of CIP for port-to-port ocean or inland waterway shipments where seller was to provide insurance.)Action responsibilities, division of costs and passage of risk, CIP terms may be illustrated as follows where the principal modes of transportation are airfreight and ocean freight:Responsibility for government security requirements: Incoterms 2010 changed rules A2 & B2, now captioned “Licenses, authorizations, security clearances and other formalities,” to include govern ment imposed security requirements, whatever they may be, as part of export formalities and import formalities. Under CIP terms, the seller is responsible for export formalities and thus also security requirements in the export country whereas the buyer is responsible for import formalities and thus for security responsibilities in the import country. For security requirements in a transit country, if any, since the seller has already accomplished delivery, the buyer is responsible for this.DAT(Incoterms) Abbreviation for delivered at terminal, the Incoterm (delivery term) under which the seller is responsible for delivering the goods, export cleared, to the carrier’s terminal at thenamed destination location, unloaded from the delivering conveyance, available for customs clearance and/or pick-up by the buyer. Under DAT terms, the seller assumes the cost and risk of unloading at the named destination terminal, where as the buyer is responsible for customs clearance. This term may be used with any transportation mode, including through intermodal transportation, and for international as well as domestic sales transactions.Allocation of responsibilities, division of costs and passage of risk under DAT terms may be illustrated as follows for international delivery via airfreight, ocean freight and truck transportation:Note: DAT is new under Incoterms 2010, replacing Incoterm DEQ, but may be used with any mode of transportation, including through intermodal transportation.or use with any mode of transportation.See also DAP, under which the seller is not responsible for unloading the delivering conveyance place of delivery, but rather only for placing the cargo “at the disposal of the buyer” on board the conveya nce at the named place of delivery.Under DAT terms, the seller has no obligation to insure the shipment. In contrast to “C” terms in which the seller’s risk terminates once he has tendered the goods over to the export carrier in the origin country, under t his and other “D” terms, the seller remains at risk for cargo loss or damage until delivery occurs at the named destination point.Responsibility for government security requirements: Incoterms 2010 changed rules A2 & B2, now captioned “Licenses, authorizations, security clearances and other formalities,” to include government imposed security requirements, whatever they may be, as part of export formalities and import formalities. Under DAT terms, the seller is responsible for export formalities and thus also security requirements in the export country whereas the buyer is responsible for import formalities and thus for security responsibilities in the import country. For security requirements in a transit country, if any, since the seller has already accomplished delivery, the buyer is responsible for this.DAP(Incoterms) Abbreviation for delivered at place, the Incoterm (delivery term) under which the seller is responsible for delivering the goods, export cleared, to a named destination place, on-board the transportation conveyance, available (“at the disposal of the buyer”) for unloading by the buyer. Under DAP terms, the buyer assumes the cost and risk of unloading at the named destination place and for customs clearance. This term may be used with any transportation mode, including through intermodal transportation, and for international as well as domestic sales transactions.Allocation of responsibilities, division of costs and passage of risk under DAT terms may be illustrated as follows for international delivery via truck transportation:Note: DAP is new under Incoterms 2010, replacing Incoterms DAF, DES, and DDU.See also DAT, under which the seller is additionally responsible for the costs of unloading the delivering conveyance place of delivery (e.g., the delivering carrier’s terminal or another cargo terminal as the designated place of delivery).Under DAP terms, the seller has no obligation to insu re the shipment. In contrast to “C” terms in which the seller’s risk terminates once he has tendered the goods over to the export carrier in the origin country, under this and other “D” terms, the seller remains at risk for cargo loss or damage until delive ry occurs at the named destination point.Responsibility for government security requirements: Incoterms 2010 changed rules A2 & B2, now captioned “Licenses, authorizations, security clearances and other formalities,” to include government imposed security requirements, whatever they may be, as part of export formalities and import formalities. Under DAP terms, the seller is responsible for export formalities and thus also security requirements in the export country whereas the buyer is responsible for import formalities and thus for security responsibilities in the import country. For security requirements in a transit country, if any, since the seller has not yet accomplished delivery, the seller is responsible for this.DDP(Incoterms) Abbreviation for delivered duty paid. The Incoterm (delivery term) under which the seller is responsible for arranging transportation of the goods through to the buyer’s door, and pays all costs required to accomplish this, including customs clearance, customs duty, and taxes due upon importation. Under pre-1990 versions of Incoterms, and under American Foreign Trade Definitions, this is also knownas free domicile or free house. Under DDP terms, the seller has no obligation to insure the shipment. This Incoterm may be used with any transportation mode or combination of modes.Action responsibilities, division of costs and passage of risk, DDP terms may be illustrated as follows where the principal modes of transportation are airfreight and ocean freight:。

FOB+I+F =CFR+I =CIF FCA+I+C =CPT+I =CIP保险金额=CIF(1+投保加成率) 保险费=保险金额×保险费率CIF=CFR/(1-保险费率×投保加成) 含佣价=净价/(1-佣金率)出口总成本=进货成本(含增值税)+国内费用—出口退税收入其中:出口退税收入=进货成本(不含增值税) ×出口退税率=[进货成本(含增值税)÷(1十增值税率)]×出口退税率出口外汇净收入:FOB净价总收入 出口换汇成本=出口总成本(人民币)/出口外汇净收入(外汇)出口盈亏率=[(出口人民币净收入-出口总成本)/出口总成本]×100%出口创汇率=[(成品出口外汇净收入-原料外汇成本)/原料外汇成本]×100%计算题1.某商品出口成本为RMB¥27000,出口后的外汇净收入为US$5500。

设外汇牌价为每100美元合人民币630.00元。

试计算该出口商品的盈亏率。

解:出口盈亏率=[(出口人民币净收入-出口总成本)/出口总成本]×100%=[(5500÷100×630-27000)/2700])×100%=28.33%答:该出口商品的盈亏率为28.33%。

2.某公司出口尼龙袜,每打出口总成本为RMB¥24.27,出口价格为Per dozen3.80 美元CIFC3某港(设运费为US$0.35,保险费为US$0.02,佣金为US$0.11)。

试计算该出口商品的换汇成本。

解:出口换汇成本=出口总成本(人民币)/出口外汇净收入(外汇)=24.27÷(3.80-0.35-0.02-0.11)=7.3 人民币/美元答:该出口商品的换汇成本为7.3人民币/美元。

3.某进出口公司按CIF价进口原棉一批共花外汇45000美元,经加工为印花布出口,外汇净收入为59000美元。

试计算该笔业务的外汇创汇率。

贸易术语基本计算题文件管理序列号:[K8UY-K9IO69-O6M243-OL889-F88688]1、某出口公司按每公吨1,200美元FOB上海对外报价,国外客户要求改报CIF 旧金山。

假设每公吨运费为130美元,加1成投保,保险费为1%,问该出口公司应报价多少答CIF=FOB+F+I(1200+130)/(1-110%*1%)1330/0.989=1344.7932、我对外出售商品一批,报价CIF纽约,23500美元(按发票金额110%投保一切险和战争险,两者费率合计为1.2%),客户要求该报CFR价,试问不影响收汇额的前提下,正确的CFR价应报多少?答CFR=CIF-ICIF*(1-投保加成*保险汇率)23500*(1-110%*1.2%)23500*0.9868=23189.83、我出口某商品对外报价为480美元/吨FOB湛江,现外商要求将价格改报CIF 旧金山,试求我方的报价应为多少才使FOB净值不变(设运费是FOB价的3%,保险费为FOB价的0.8%)答CIF=FOB+F+I480+(480*3%)+(480*0.8%)=498.244、某出口商品对外报价USD450/箱FOB天津新港,外商要求该报CIF汉堡,问我方应报的价格是多少(运费USD50/箱,保险费率0.8%)答CIF=FOB+F+I(450+50)/(1-110%*0.8%)500/0.9912=504.4395、某商品的出口价为每公吨CFR香港700美元,买方提出改报CIF价,并要求按CIF价的110%投保水渍险和战争险,查总保险费率为1.2%,求CIF报价。

答CIF=CFR+I700/(1-110%*1.2%)700/0.9868=709.3646、一批出口货物CFR价为99450美元,现客户要求改CIF价加一成投保海运一切险,我同意照办。

如果一切险保险费率为0.5%,请计算:(要求写出计算公式及计算过程)。

1)我方应报的CIF价。

4分2)我方应该向客户收多少保险费?答CIF=CFR+I(2)答保险费=CIF*(1+投保加成)*保险率99450/(1-110%*0.5%)100000*110%*0.5%99450/0.9945110000*0.5%=100000=5507、我方出口货物3000件,对外报价为2美元/件CFR纽约。

为避免漏保,客户来证要求我方装船前按CIF总值代为办理投保手续。

查得该货的保险费率为0.8%,问:我方对该货投保时的投保金额和应缴的保险费各是多少?答先算CIF=CFR+I6000/(1-110%*0.8%)6000/0.9912=6053.269再算保险费=CIF*(1+投保加成)*0.8%(2)保险金额=CIF*(1*投保加成)6053.269*1.1*0.8%6053.269*110%=53.268=6658.5968、我对外报价为每公吨1000美元CIF新加坡,而外商还盘为每公吨902美元FOB 中国口岸。

经查该货物由中国港口运至新加坡每公吨运费为88美元,保险费率合计为0.95%。

试问单纯从价格角度上讲,我方可否接受该项还盘?答CIF=FOB+F+I(902+88)/(1-110%*0.95%)990/0.98955=1000.4551000.455,>1000所以不接受9、净价改报含佣价:某商品FOB价100美元,试改为FOBC3%价,并保持卖方的净收入不变答含佣价=净价+佣金100/(1-3%)100/0.97=103.09310、调整含佣价的佣金率:已知CFRC3%为1200美元,保持卖方的净收入不变,试该报CFRC5%价。

答先算净价=含佣价-佣金1200*(1-3%)1200*0.97=1164含佣价=净价+佣金1164/(1-5%)1164/0.95=1225.26311、出口价格为每公吨CIF伦敦430美元包括3%佣金,外商要求我方增加佣金两个百分点,问我报价多少方不降低外汇收入?答净价=含佣价-佣金430*(1-3%)430*0.97=417.1含佣价=净价+佣金417.1/(1-5%)417.1/0.95=439.05312、某商品FOBC2%上海每件200欧元,现在客户要求将佣金增加到5%,若想不减少外汇收入,应改报的价格为多少?答净价=含佣价-佣金200*(1-2%)200*0.98=196含佣价=净价+佣金196/(1-5%)196/0.95=206.31613、设CFR价为840美元,加成10%投保,保险费率为1.2%。

求:CIFC5价。

答CIF=CFR+I840/(1-110%*1.2%)840/0.9868=851.236含佣价=净价+佣金851.236/(1-5%)851.236/0.95=896.03815、我某公司对外报价每公吨1000美元CFR曼谷,而外商来电要求改报CIF曼谷含5%佣金价。

我方应报CIFC5曼谷价多少(注:按CIF价加一成投保,保险费率合计为1.5%)答先算CIF=CFR+I1000/(1-110%*1.5%)1000/0.0835=1016.78含佣价=净价+佣金1016.78/(1-5%)=1070.2916、某商品FOB价为USD5.00/DOZ,至国外某港口的运费为USD1.2DOZ,保险费率为1.04%,投保加成10%,佣金率5%,求CIFC5%。

答CIF=FOB+F+I(5+1.2)/(1-110%*1.04%)6.2/0.98856=6.27含佣价=净价+佣金6.27/(1-5%)6.27/0.95=6.617、我公司拟向美出口0#锌锭,原报价为USD1600perM/TFOBSHANGHAI,现外商要求改报CIFN.Y价含2%佣金。

该产品从上海至纽约的运费为USD100PERM/T,保险费率为0.5%,加成10%投保。

答先算CIF=FOB+F+I(1600+100)/(1-110%*0.5%)1700/0.9945=1709.4含佣价=净价+佣金1709.1/(1.2%)1709.1/0.98=1744.2918、某商品报价USD1200/MTCFRC3N.Y,外商要求该报CIFC5N.Y,问我方应报的价格是多少(运费USD120/MT,保险费率1%,加一成)答先算CFR净价=含佣价-佣金1200*(1-3%)1200*0.97=1164再算CIF=CFR+I1164/(1-110%*1%)1164/0.989=1176.9519、我某出口商品对外报价为每公吨1200欧元FOB黄埔,对方来电要求改报CIFC5%伦敦,试求CIFC5%伦敦价.(已知保险费率为1.68%,运费合计为9.68欧元)答先算CIF=FOB+F+I(1200+9.68)/(1-110%*1.68)1209.68/0.98152=1232.456含佣价=净价+佣金1232.456/(1-5%)1232.456/0.95=1297.32220、我出口某商品,原报价为350美元/桶CIF纽约,现外商要求将价格改报CFRC5%。

已知保险费率为0.6%,试求我方应将价格改报为多少?答先算CFR=CIF-I350*(1-110%*0.6%)350*0.9934=347.69含佣价=佣金+净价347.69/(1-5%)347.69/0.95=365.98921、某公司向香港客户报水果罐头200箱,每箱132.6港元CIF香港,客户要求改报CFR香港含5%佣金价。

假定保险费相当于CIF价的2%,在保持原报价格不变的情况下,试求:1)CFRC5%香港价应报多少?2)出口200箱应付给客户多少佣金?3)某公司出口200箱可收回多少外汇?答1)CFR=CIF-I2)佣金=含佣价-净价3)答136.505*200132.6*(1-110%*2%)136.505-129.68=27301132.6*0.978=6.825*200=129.68=1365含佣价=净价+佣金129.68/(1-5%)129.68/0.95=136.50522、我某公司出口一批商品共1000公吨,出口价格为每公吨2000美元CIFXXX 港。

客户现要求改报FOBC5%上海价。

查该商品总重量为1200公吨,总体积1100立方米,海运运费按W/M计收,每运费吨基本运费率为120美元,港口附加费15%,原报价的保险金额按CIF价另加成10%,保险险别为一切险,保险费率为1%,求该商品的FOBC5%上海价答(1)CFR=CIF*(1-110%*l%)=1978(2)运费按W计算:货物总运费=120*1200*(1十15%)=165600每运费吨运费:165600/1000=165.6023、我某公司出口某种商品,对外报价为每箱$120FOBC2%上海,外商要求改报CFRC3%伦敦,问:我方在不影响自身利益的情况下,改报价应为多少美元(设运费每箱$10),要求写出计算公式及计算过程。

答先算FOB净价=含佣价-佣金120*(1-2%)120*0.97=117.65再算CFRC3=净价+佣金127.65/(1-3%)=131.60美元24、已知A商品CIF香港价格为每吨1000港元,现港商要求改报CIFC5%香港,并保持卖方的收入不变,应报价多少?请用中、英文写出报价条款。

(保留一位小数)答含佣价=净价+佣金1000/(1-5%)1000/0.95=1052.63HKD1052.63PERM/TCIFC5%HONGKONG25、我某公司向外商报价每公吨CIF香港1000美元,而外商来电要求改报CFR香港含5%佣金价。

在保证我方外汇净收入不变的情况下,我方应报价多少(注:设保险费率合计为0.85%答CFR=CIF-I1000*(1-110%*0.85%)1000*0.99065=990.6526、我某公司出口某种商品,对外报价为每箱120$FOB上海,外商要求改报CIF 伦敦。

问我方改报价应为多少美元(设运费每箱20$,保险费率为0.5%,卖方按CI 价的110%投保),要求求写出计算公式及计算过程。

答CIF=FOB+F+I(120+20)/(1-110%*0.5)140/0.9945=139.23。