相关财务英文全称及缩写

- 格式:doc

- 大小:34.00 KB

- 文档页数:7

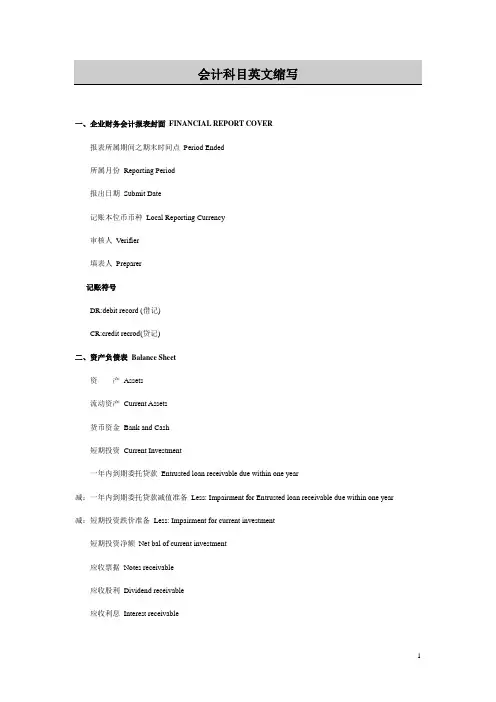

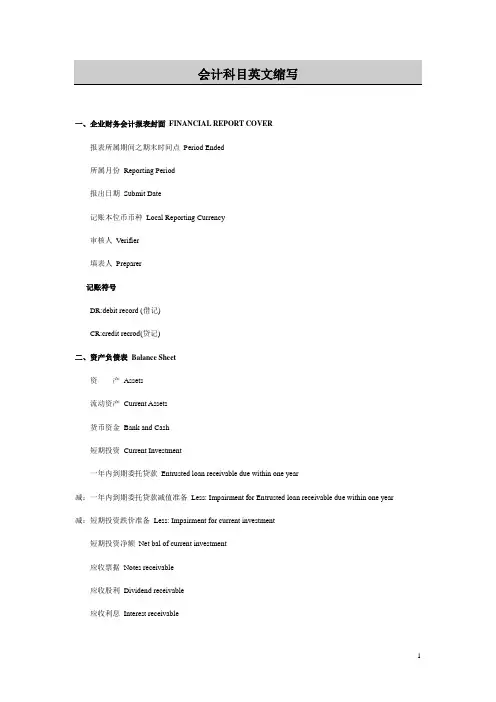

一、企业财务会计报表封面FINANCIAL REPORT COVER报表所属期间之期末时间点Period Ended所属月份Reporting Period报出日期Submit Date记账本位币币种Local Reporting Currency审核人Verifier填表人Preparer记账符号DR:debit record (借记)CR:credit recrod(贷记)二、资产负债表Balance Sheet资产Assets流动资产Current Assets货币资金Bank and Cash短期投资Current Investment一年内到期委托贷款Entrusted loan receivable due within one year减:一年内到期委托贷款减值准备Less: Impairment for Entrusted loan receivable due within one year 减:短期投资跌价准备Less: Impairment for current investment短期投资净额Net bal of current investment应收票据Notes receivable应收股利Dividend receivable应收利息Interest receivable应收账款Account receivable减:应收账款坏账准备Less: Bad debt provision for Account receivable 应收账款净额Net bal of Account receivable其他应收款Other receivable减:其他应收款坏账准备Less: Bad debt provision for Other receivable 其他应收款净额Net bal of Other receivable预付账款Prepayment应收补贴款Subsidy receivable存货Inventory减:存货跌价准备Less: Provision for Inventory存货净额Net bal of Inventory已完工尚未结算款Amount due from customer for contract work待摊费用Deferred Expense一年内到期的长期债权投资Long-term debt investment due within one year 一年内到期的应收融资租赁款Finance lease receivables due within one year 其他流动资产Other current assets流动资产合计Total current assets长期投资Long-term investment长期股权投资Long-term equity investment委托贷款Entrusted loan receivable长期债权投资Long-term debt investment长期投资合计Total for long-term investment减:长期股权投资减值准备Less: Impairment for long-term equity investment 减:长期债权投资减值准备Less: Impairment for long-term debt investment减:委托贷款减值准备Less: Provision for entrusted loan receivable 长期投资净额Net bal of long-term investment其中:合并价差Include: Goodwill (Negative goodwill)固定资产Fixed assets固定资产原值Cost减:累计折旧Less: Accumulated Depreciation固定资产净值Net bal减:固定资产减值准备Less: Impairment for fixed assets固定资产净额NBV of fixed assets工程物资Material holds for construction of fixed assets在建工程Construction in progress减:在建工程减值准备Less: Impairment for construction in progress 在建工程净额Net bal of construction in progress固定资产清理Fixed assets to be disposed of固定资产合计Total fixed assets无形资产及其他资产Other assets & Intangible assets无形资产Intangible assets减:无形资产减值准备Less: Impairment for intangible assets无形资产净额Net bal of intangible assets长期待摊费用Long-term deferred expense融资租赁——未担保余值Finance lease –Unguaranteed residual values 融资租赁——应收融资租赁款Finance lease –Receivables其他长期资产Other non-current assets无形及其他长期资产合计Total other assets & intangible assets递延税项Deferred Tax递延税款借项Deferred Tax assets资产总计Total assets负债及所有者(或股东)权益Liability & Equity流动负债Current liability短期借款Short-term loans应付票据Notes payable应付账款Accounts payable已结算尚未完工款预收账款Advance from customers应付工资Payroll payable应付福利费Welfare payable应付股利Dividend payable应交税金Taxes payable其他应交款Other fees payable其他应付款Other payable预提费用Accrued Expense预计负债Provision递延收益Deferred Revenue一年内到期的长期负债Long-term liability due within one year 其他流动负债Other current liability流动负债合计Total current liability长期负债Long-term liability长期借款Long-term loans应付债券Bonds payable长期应付款Long-term payable专项应付款Grants & Subsidies received其他长期负债Other long-term liability长期负债合计Total long-term liability递延税项Deferred Tax递延税款贷项Deferred Tax liabilities负债合计Total liability少数股东权益Minority interests所有者权益(或股东权益)Owners’Equity实收资本(或股本)Paid in capital减;已归还投资Less: Capital redemption实收资本(或股本)净额Net bal of Paid in capital资本公积Capital Reserves盈余公积Surplus Reserves其中:法定公益金Include: Statutory reserves未确认投资损失Unrealised investment losses未分配利润Retained profits after appropriation其中:本年利润Include: Profits for the year外币报表折算差额Translation reserve所有者(或股东)权益合计Total Equity负债及所有者(或股东)权益合计Total Liability & Equity 三、利润及利润分配表Income statement and profit appropriation一)、主营业务收入Revenue减:主营业务成本Less: Cost of Sales主营业务税金及附加Sales Tax二)、主营业务利润(亏损以“—”填列)Gross Profit ( - means loss) 加:其他业务收入Add: Other operating income减:其他业务支出Less: Other operating expense减:营业费用Selling & Distribution expense管理费用G&A expense财务费用Finance expense三)、营业利润(亏损以“—”填列)Profit from operation ( - means loss) 加:投资收益(亏损以“—”填列)Add: Investment income 补贴收入Subsidy Income营业外收入Non-operating income减:营业外支出Less: Non-operating expense四、利润总额(亏损总额以“—”填列)Profit before Tax减:所得税Less: Income tax少数股东损益Minority interest加:未确认投资损失Add: Unrealised investment losses五、净利润(净亏损以“—”填列)Net profit ( - means loss)加:年初未分配利润Add: Retained profits其他转入Other transfer-in六、可供分配的利润Profit available for distribution( - means loss)减:提取法定盈余公积Less: Appropriation of statutory surplus reserves提取法定公益金Appropriation of statutory welfare fund提取职工奖励及福利基金Appropriation of staff incentive and welfare fund提取储备基金Appropriation of reserve fund提取企业发展基金Appropriation of enterprise expansion fund利润归还投资Capital redemption七、可供投资者分配的利润Profit available for owners' distribution减:应付优先股股利Less: Appropriation of preference share's dividend提取任意盈余公积Appropriation of discretionary surplus reserve应付普通股股利Appropriation of ordinary share's dividend转作资本(或股本)的普通股股利Transfer from ordinary share's dividend to paid in capital八、未分配利润Retained profit after appropriation补充资料:Supplementary Information:1.出售、处置部门或被投资单位收益Gains on disposal of operating divisions or investments2.自然灾害发生损失Losses from natural disaster3.会计政策变更增加(或减少)利润总额Increase (decrease) in profit due to changes in accounting policies 4.会计估计变更增加(或减少)利润总额Increase (decrease) in profit due to changes in accounting estimates 5.债务重组损失Losses from debt restructuring。

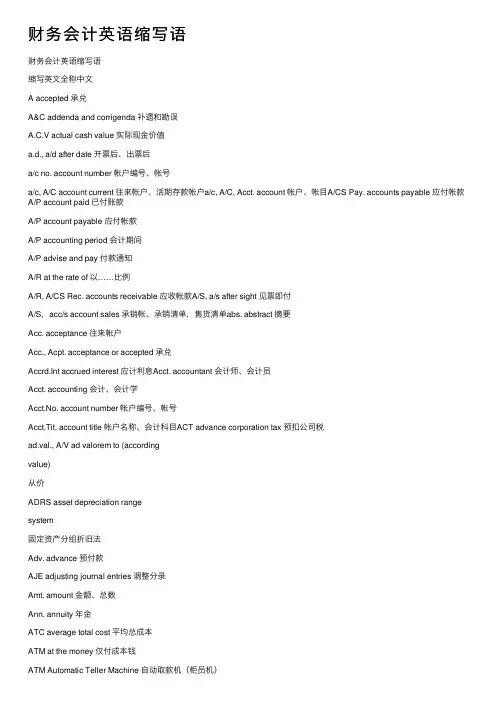

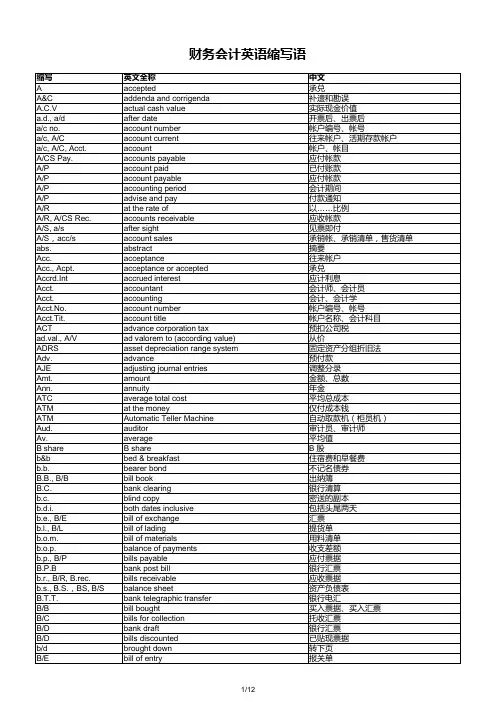

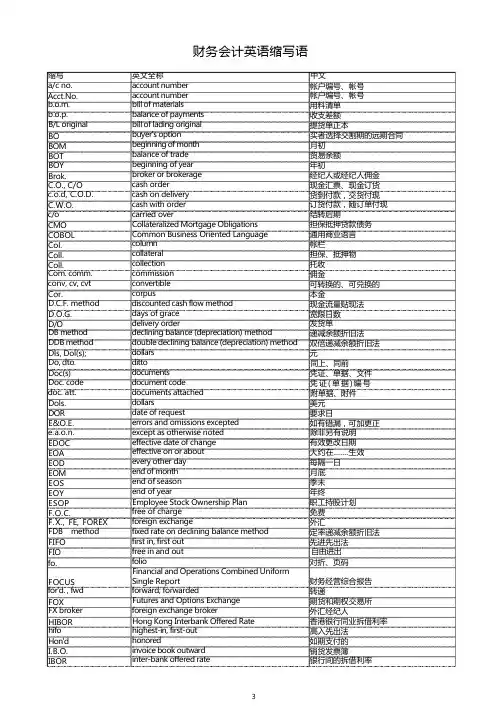

财务会计英语缩写语财务会计英语缩写语缩写英⽂全称中⽂A accepted 承兑A&C addenda and corrigenda 补遗和勘误A.C.V actual cash value 实际现⾦价值a.d., a/d after date 开票后、出票后a/c no. account number 帐户编号、帐号a/c, A/C account current 往来帐户、活期存款帐户a/c, A/C, Acct. account 帐户、帐⽬A/CS Pay. accounts payable 应付帐款A/P account paid 已付账款A/P account payable 应付帐款A/P accounting period 会计期间A/P advise and pay 付款通知A/R at the rate of 以……⽐例A/R, A/CS Rec. accounts receivable 应收帐款A/S, a/s after sight 见票即付A/S,acc/s account sales 承销帐、承销清单,售货清单abs. abstract 摘要Acc. acceptance 往来帐户Acc., Acpt. acceptance or accepted 承兑Accrd.Int accrued interest 应计利息Acct. accountant 会计师、会计员Acct. accounting 会计、会计学Acct.No. account number 帐户编号、帐号Acct.Tit. account title 帐户名称、会计科⽬ACT advance corporation tax 预扣公司税ad.val., A/V ad valorem to (accordingvalue)从价ADRS asset depreciation rangesystem固定资产分组折旧法Adv. advance 预付款AJE adjusting journal entries 调整分录Amt. amount ⾦额、总数Ann. annuity 年⾦ATC average total cost 平均总成本ATM at the money 仅付成本钱ATM Automatic Teller Machine ⾃动取款机(柜员机)Aud. auditor 审计员、审计师Av. average 平均值B share B share B 股b&b bed & breakfast 住宿费和早餐费b.b. bearer bond 不记名债券B.B., B/B bill book 出纳簿B.C. bank clearing 银⾏清算b.c. blind copy 密送的副本both dates inclusive 包括头尾两天b.e., B/E bill of exchange 汇票b.l., B/L bill of lading 提货单bill of materials ⽤料清单balance of payments 收⽀差额b.p., B/P bills payable 应付票据B.P.B bank post bill 银⾏汇票b.r., B/R, B.rec. bills receivable 应收票据b.s., B.S.,BS, B/S balance sheet 资产负债表bank telegraphic transfer 银⾏电汇B/B bill bought 买⼊票据、买⼊汇票B/C bills for collection 托收汇票B/D bank draft 银⾏汇票B/D bills discounted 已贴现票据b/d brought down 转下页B/E bill of entry 报关单b/f brought forward 承前B/L bill of lading 提货单B/L original bill of lading original 提货单正本B/R bank rate 银⾏贴现率B/S bill of sales 卖据、出货单BA bank acceptance 银⾏承兑汇票bal. balance 余额、差额banky. bankruptcy 破产、倒闭BC buyer credit 买⽅信贷Bd. bond 债券BEP breakeven point 保本点、盈亏临界点Bfcy. Beneficiary 受益⼈bit binary digit 两位数Bk. bank 银⾏Bk. bank book 银⾏帐簿Bk. book 帐册BN bank note 钞票BO buyer's option 买者选择交割期的远期合同BOM beginning of month ⽉初BOT balance of trade 贸易余额BOY beginning of year 年初BR bank rate 银⾏贴现率Brok. broker or brokerage 经纪⼈或经纪⼈佣⾦BV book value 票⾯价值C cash; coupon; currency 现⾦、息票、通货c.,Cts. cents 分C.A. chartered accountant, chief accountant 特许会计师、主任(主管)会计师C.A. commercial agent 商业代理、代理商C.A.D cash against document 交单付款,凭单付现cost accounting standards 成本会计标准C.B. cash book 现⾦簿c.b., C.B. cash book 现⾦簿C.C. contra credit 贷⽅对销C.C. cashier's check 银⾏本票C.d. cum dividend 附股息报关单C.H. clearing house 票据交换所C.H. custom house 海关comprehensive income tax 综合所得税C.L. call loan 短期拆放certified management accountant 注册管理会计师C.O., C/O cash order 现⾦汇票、现⾦订货cash on delivery 货到付款,交货付现C.P.A Certified Public Accountant 注册公共会计师Certified Public Accountant 注册会计师C.S. capital stock 股本Cost Volume Profit analysis 本---量---利分析cash with order 订货付款,随订单付现C/A capital account 资本帐户C/A current account 往来帐C/A current assets 流动资产c/d carried down 过次页、结转下期c/f carry forward 过次页、结转C/I certificate of insurance 保险凭证C/L current liabilities 流动负债c/o carried over 结转后期can. cancelled 注销cap. capital 资本CAPM capital asset pricing mode 固定资产计价模式CBD cash before delivery 先付款后交货CD certificate of deposit 存单CG capital gain 资本利得CG capital goods ⽣产资料、资本货物Chgs charges 费⽤Chq. cheque ⽀票CIA certified internal auditor 注册内部审计员Ck. check ⽀票CML capital market line 资本市场线性CMO Collateralized Mortgage Obligations 担保抵押贷款债务CMV current market value 现时市场价值CN consignment note 铁路运单CN credit note 贷⽅通知书COBOL Common Business Oriented Language 通⽤商业语⾔Col. column 帐栏Coll. collateral 担保、抵押物Coll. collection 托收Com. comm. commission 佣⾦conv, cv, cvt convertible 可转换的、可兑换的Cor. corpus 本⾦CP commercial paper 商业票据CPM cost per thousand 每⼀千个为单位的成本Cps. coupons 息票CR cash receipts 现⾦收⼊CR current rate 当⽇汇率、现⾏汇率Cr. Credit, creditor 贷记、贷⽅CS convertible securities 可转换证券CT cable transfer 电汇CT corporate treasurer 公司财务主管ctge cartage 货运费、搬运费、车费CTT capital transfer tax 资本转移税cur curr current 本⽉、当⽉CV convertible security 可转换债券CVD countervailing duties 反倾销税CY calendar year ⽇历年Cy. currency 货币缩写英⽂全称中⽂D degree; draft 度、汇票D.A. debit advice ⽋款报单D.B day book ⽇记帐、流⽔帐discounted cash flow method 现⾦流量贴现法D.D., D/D demand draft 即期汇票d.f, D.F., d.frt. dead freight 空舱费days of grace 宽限⽇数D.R., DR discount rate 贴现率、折扣率d/a days after acceptance 承兑后......⽇(付款)D/A deposit account 存款帐户D/A document against acceptance 承兑交单D/D documentary draft 跟单汇票D/D Demand Draft 票汇D/d; d/d days after date 出票后......⽇(付款) D/N debit note 清单D/O delivery order 发货单D/P documents against payment 付款交单D/R. deposit receipt 存款收条D/W dock warrant 码头仓单DB method declining balance (depreciation) method 递减余额折旧法Dd. delivered 交付DDB method double declining balance (depreciation) method 双倍递减余额折旧法Def. deferred 延期def. deficit ⾚字、亏损Dely. delivery 交付dem. demurrage 滞期费Depr. depreciation 折旧Dft. draft 汇票diff. difference 差额Dis. discount 折扣、贴现dish'd; dished dishonored 不名誉、拒付Div. dividend; division 红利div.; divd dividend 红利、股息DL direct loan 直接贷款DLD deadline date 最后时限Dls, Dol(s); dollars 元DN date number ⽇期号DN, D/N debit note 借记通知单DNR do not reduce 不减少Do, dto. ditto 同上、同前Doc(s) documents 凭证、单据、⽂件Doc. code document code 凭证(单据)编号doc. att. documents attached 附单据、附件Dols. dollars 美元DOR date of request 要求⽇DP, D/P document against payment 交单付款Dr debtor 债务⼈DR deposit receipt 存单、存款收据Dr debit 借记、借⽅Dr drawer 借⽅DS, d/s days after sight(days' sight) 见票后.......⽇(付款) Ds, d's days ⽇DTC deposit taking company 接受存款公司DTC Deposit Trust Company 储蓄信托公司Dup, dupl duple, duplicate 副本DVP delivery versus payment 付款交货Dy, d/y day; delivery ⽇、交货dz dozen ⼀打E exchange; export 交易所、输出E&O.E. errors and omissions excepted 如有错漏,可加更正except as otherwise noted 除⾮另有说明E.D. ex dividend 股息除外E.E., e.e. errors excepted 如有错误,可加更正E.P.T excess profit tax 超额利润税Ea. each 每Ea. earning assets 盈利资产,有收益的资产EAT earnings after tax 税后收益EB ex budgetary 预算外EBIT earnings before interest and income tax 税前收益EBIT earnings before interest and tax 扣除利息和税⾦前收益EBS Electronic Broking Service 电⼦经纪服务系统EBT earning before taxation 税前盈利EC error corrected 错误更正EC export credit 出⼝信贷Ec. ex coupon ⽆息票Ec. example causa 例如ECA export credit agency 出⼝信贷机构ECG Export Credit Guarantee 出⼝信⽤担保ECI export credit insurance 出⼝信⽤保险ECR export credit refinancing 出⼝信贷再融资ECT estimated completion time 估计竣⼯时间ED ex dividend ⽆红利、除息、股利除外EDD estimated delivery date 预计交割⽇EDI electronic data interchange 电⼦数据交换EDOC effective date of change 有效更改⽇期EDP Electronic Data Processing 电⼦数据⾃理EF Exchange Fund 外汇基⾦EF export finance 出⼝融资EFT electronic funds transfer 电⼦资⾦转帐EIB Export-Import Bank 进出⼝银⾏EMIP equivalent mean investment period 等值平均投资期EMP end-of month payment ⽉末付款EMS European Monetary System 欧洲货币体系encd. enclosed 附件encl(s). enclosure 附件End., end. endorsement 背书Entd. entered 登记⼈。

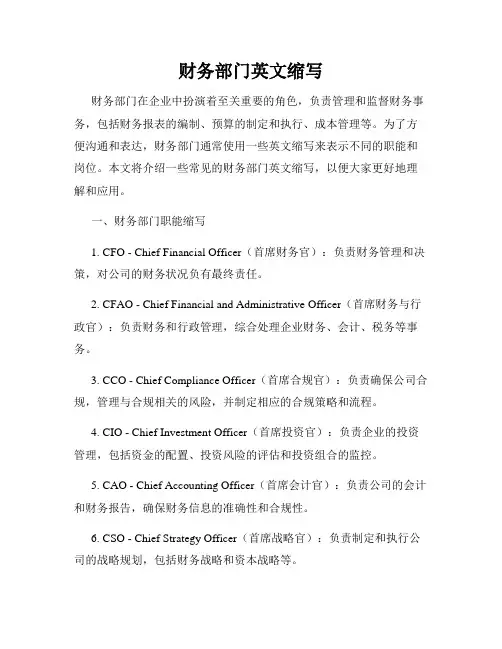

财务部门英文缩写财务部门在企业中扮演着至关重要的角色,负责管理和监督财务事务,包括财务报表的编制、预算的制定和执行、成本管理等。

为了方便沟通和表达,财务部门通常使用一些英文缩写来表示不同的职能和岗位。

本文将介绍一些常见的财务部门英文缩写,以便大家更好地理解和应用。

一、财务部门职能缩写1. CFO - Chief Financial Officer(首席财务官):负责财务管理和决策,对公司的财务状况负有最终责任。

2. CFAO - Chief Financial and Administrative Officer(首席财务与行政官):负责财务和行政管理,综合处理企业财务、会计、税务等事务。

3. CCO - Chief Compliance Officer(首席合规官):负责确保公司合规,管理与合规相关的风险,并制定相应的合规策略和流程。

4. CIO - Chief Investment Officer(首席投资官):负责企业的投资管理,包括资金的配置、投资风险的评估和投资组合的监控。

5. CAO - Chief Accounting Officer(首席会计官):负责公司的会计和财务报告,确保财务信息的准确性和合规性。

6. CSO - Chief Strategy Officer(首席战略官):负责制定和执行公司的战略规划,包括财务战略和资本战略等。

7. CRO - Chief Risk Officer(首席风险官):负责管理和监控公司的风险,制定相应的风险管理策略和控制措施。

8. TFO - Treasurer and Finance Officer(财务主管):负责公司的资金管理和融资活动,管理企业的现金流量和资本结构。

9. FAO - Financial Accounting Officer(财务会计主管):负责公司的财务会计工作,编制财务报表和分析财务状况。

二、财务部门岗位缩写1. AP - Accounts Payable(应付账款):负责管理和支付公司的应付账款,核对发票和付款申请。

些财务术语的英文缩写 YKK standardization office【 YKK5AB- YKK08- YKK2C- YKK18】一般是指资金、固定资产的投入.对电信运营商来说,有关的网络设备、计算机、仪器等一次性支出的项目都属于CAPEX,其中网络设备占最大的部分。

OPEX 指的是企业的管理支出.2.什么是OPEX? OPEX是(Operating Expense)即运营成本,计算公式为:OPEX=维护费用+营销费用+人工成本(+折旧)。

运营成本主要是指当期的付现成本。

(Capital Expenditure)即资本性支出,计算公式为:CAPEX=战略性投资+滚动性投资。

资本性投资支出指用于基础建设、扩大再生产等方面的需要在多个会计年度分期摊销的资本性支出。

4.由于战略性投资的决策权不在本地网,因此BPR的指标考核中,Capex仅限于滚动性投资,不包括战略性投资。

主要指标是Capex收入率和投资、回报率(ROI),前者为Capex收入比,反映资本性支出占收入的比重;后者反映投资效益。

&L就是profit&loss statement 也就是损益表,全称Earnings Before Interest and Tax,即息税前利润,从字面意思可知是扣除利息、所得税之前的利润。

计算公式有两种,EBIT=净利润+所得税+利息,或EBIT=经营利润+投资收益+营业外收入-营业外支出+以前年度损益调整。

EBIT主要用来衡量企业主营业务的盈利能力,EBITDA则主要用于衡量企业主营业务产生现金流的能力。

他们都反映企业现金的流动情况,是资本市场上投资者比较重视的两个指标,通过在计算利润时剔除掉一些因素,可以使利润的计算口径更方便投资者使用。

EBIT通过剔除所得税和利息,可以使投资者评价项目时不用考虑项目适用的所得税率和融资成本,这样方便投资者将项目放在不同的资本结构中进行考察。

EBIT与净利润的主要区别就在于剔除了资本结构和所得税政策的影响。

一、企业财务会计报表封面FINANCIAL REPORT COVER报表所属期间之期末时间点Period Ended所属月份Reporting Period报出日期Submit Date记账本位币币种Local Reporting Currency审核人Verifier填表人Preparer记账符号DR:debit record (借记)CR:credit recrod(贷记)二、资产负债表Balance Sheet资产Assets流动资产Current Assets货币资金Bank and Cash短期投资Current Investment一年内到期委托贷款Entrusted loan receivable due within one year减:一年内到期委托贷款减值准备Less: Impairment for Entrusted loan receivable due within one year 减:短期投资跌价准备Less: Impairment for current investment短期投资净额Net bal of current investment应收票据Notes receivable应收股利Dividend receivable应收利息Interest receivable应收账款Account receivable减:应收账款坏账准备Less: Bad debt provision for Account receivable 应收账款净额Net bal of Account receivable其他应收款Other receivable减:其他应收款坏账准备Less: Bad debt provision for Other receivable 其他应收款净额Net bal of Other receivable预付账款Prepayment应收补贴款Subsidy receivable存货Inventory减:存货跌价准备Less: Provision for Inventory存货净额Net bal of Inventory已完工尚未结算款Amount due from customer for contract work待摊费用Deferred Expense一年内到期的长期债权投资Long-term debt investment due within one year 一年内到期的应收融资租赁款Finance lease receivables due within one year 其他流动资产Other current assets流动资产合计Total current assets长期投资Long-term investment长期股权投资Long-term equity investment委托贷款Entrusted loan receivable长期债权投资Long-term debt investment长期投资合计Total for long-term investment减:长期股权投资减值准备Less: Impairment for long-term equity investment 减:长期债权投资减值准备Less: Impairment for long-term debt investment减:委托贷款减值准备Less: Provision for entrusted loan receivable 长期投资净额Net bal of long-term investment其中:合并价差Include: Goodwill (Negative goodwill)固定资产Fixed assets固定资产原值Cost减:累计折旧Less: Accumulated Depreciation固定资产净值Net bal减:固定资产减值准备Less: Impairment for fixed assets固定资产净额NBV of fixed assets工程物资Material holds for construction of fixed assets在建工程Construction in progress减:在建工程减值准备Less: Impairment for construction in progress 在建工程净额Net bal of construction in progress固定资产清理Fixed assets to be disposed of固定资产合计Total fixed assets无形资产及其他资产Other assets & Intangible assets无形资产Intangible assets减:无形资产减值准备Less: Impairment for intangible assets无形资产净额Net bal of intangible assets长期待摊费用Long-term deferred expense融资租赁——未担保余值Finance lease –Unguaranteed residual values 融资租赁——应收融资租赁款Finance lease –Receivables其他长期资产Other non-current assets无形及其他长期资产合计Total other assets & intangible assets递延税项Deferred Tax递延税款借项Deferred Tax assets资产总计Total assets负债及所有者(或股东)权益Liability & Equity流动负债Current liability短期借款Short-term loans应付票据Notes payable应付账款Accounts payable已结算尚未完工款预收账款Advance from customers应付工资Payroll payable应付福利费Welfare payable应付股利Dividend payable应交税金Taxes payable其他应交款Other fees payable其他应付款Other payable预提费用Accrued Expense预计负债Provision递延收益Deferred Revenue一年内到期的长期负债Long-term liability due within one year 其他流动负债Other current liability流动负债合计Total current liability长期负债Long-term liability长期借款Long-term loans应付债券Bonds payable长期应付款Long-term payable专项应付款Grants & Subsidies received其他长期负债Other long-term liability长期负债合计Total long-term liability递延税项Deferred Tax递延税款贷项Deferred Tax liabilities负债合计Total liability少数股东权益Minority interests所有者权益(或股东权益)Owners’Equity实收资本(或股本)Paid in capital减;已归还投资Less: Capital redemption实收资本(或股本)净额Net bal of Paid in capital资本公积Capital Reserves盈余公积Surplus Reserves其中:法定公益金Include: Statutory reserves未确认投资损失Unrealised investment losses未分配利润Retained profits after appropriation其中:本年利润Include: Profits for the year外币报表折算差额Translation reserve所有者(或股东)权益合计Total Equity负债及所有者(或股东)权益合计Total Liability & Equity 三、利润及利润分配表Income statement and profit appropriation一)、主营业务收入Revenue减:主营业务成本Less: Cost of Sales主营业务税金及附加Sales Tax二)、主营业务利润(亏损以“—”填列)Gross Profit ( - means loss) 加:其他业务收入Add: Other operating income减:其他业务支出Less: Other operating expense减:营业费用Selling & Distribution expense管理费用G&A expense财务费用Finance expense三)、营业利润(亏损以“—”填列)Profit from operation ( - means loss) 加:投资收益(亏损以“—”填列)Add: Investment income 补贴收入Subsidy Income营业外收入Non-operating income减:营业外支出Less: Non-operating expense四、利润总额(亏损总额以“—”填列)Profit before Tax减:所得税Less: Income tax少数股东损益Minority interest加:未确认投资损失Add: Unrealised investment losses五、净利润(净亏损以“—”填列)Net profit ( - means loss)加:年初未分配利润Add: Retained profits其他转入Other transfer-in六、可供分配的利润Profit available for distribution( - means loss)减:提取法定盈余公积Less: Appropriation of statutory surplus reserves提取法定公益金Appropriation of statutory welfare fund提取职工奖励及福利基金Appropriation of staff incentive and welfare fund提取储备基金Appropriation of reserve fund提取企业发展基金Appropriation of enterprise expansion fund利润归还投资Capital redemption七、可供投资者分配的利润Profit available for owners' distribution减:应付优先股股利Less: Appropriation of preference share's dividend提取任意盈余公积Appropriation of discretionary surplus reserve应付普通股股利Appropriation of ordinary share's dividend转作资本(或股本)的普通股股利Transfer from ordinary share's dividend to paid in capital八、未分配利润Retained profit after appropriation补充资料:Supplementary Information:1.出售、处置部门或被投资单位收益Gains on disposal of operating divisions or investments2.自然灾害发生损失Losses from natural disaster3.会计政策变更增加(或减少)利润总额Increase (decrease) in profit due to changes in accounting policies 4.会计估计变更增加(或减少)利润总额Increase (decrease) in profit due to changes in accounting estimates 5.债务重组损失Losses from debt restructuring。

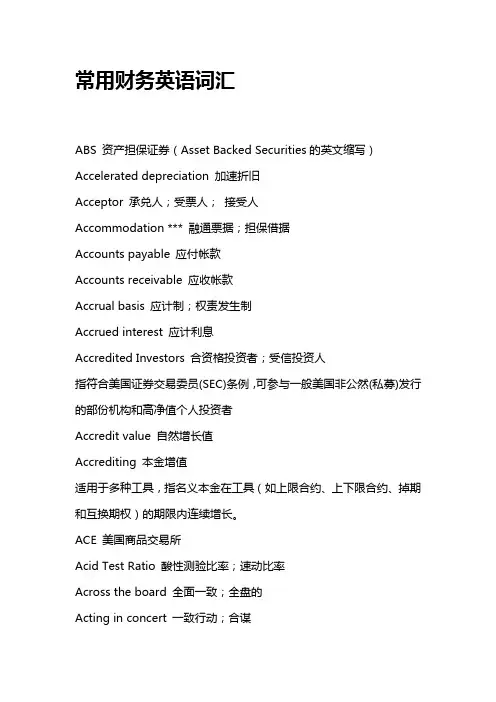

常用财务英语词汇ABS 资产担保证券(Asset Backed Securities的英文缩写)Accelerated depreciation 加速折旧Acceptor 承兑人;受票人;接受人Accommodation *** 融通票据;担保借据Accounts payable 应付帐款Accounts receivable 应收帐款Accrual basis 应计制;权责发生制Accrued interest 应计利息Accredited Investors 合资格投资者;受信投资人指符合美国证券交易委员(SEC)条例,可参与一般美国非公然(私募)发行的部份机构和高净值个人投资者Accredit value 自然增长值Accrediting 本金增值适用于多种工具,指名义本金在工具(如上限合约、上下限合约、掉期和互换期权)的期限内连续增长。

ACE 美国商品交易所Acid Test Ratio 酸性测验比率;速动比率Across the board 全面一致;全盘的Acting in concert 一致行动;合谋Active assets 活动资产;有收益资产Active capital 活动资本Actual market 现货市场Actuary 精算师;保险统计专家ADB 亚洲开发银行ADR 美国存股证;美国预托收据;美国存托凭证以指全球预托收(GDR)欧洲预托收据(EDR)国际预托收据(IDR)ADS 美国存托股份Ad valorem 从价;按值Affiliated company 关联公司;联营公司After date 发票后,出票后After-market 后市Age dependency (ratio) 年龄抚养比率AGM 周年大会Agreement 协议;协定All-or-none order 整批委托Allocation 分配;配置Allotment 配股Alpha (Market Alpha) 阿尔法;预期市场可得收益水平Alternative investment 另类投资American Commodities Exchange 美国商品交易所American Depository Receipt 美国存股证;美国预托收据;美国存托凭证(简称“ADR ”参见ADR栏目)American Depository Share 美国存托股份Amercian Stock Exchange 美国证券交易所American style option 美式期权Amex 美国证券交易所Amortizable intangibles 可摊销的无形资产Amortization 摊销Amsterdam Stock Exchange 阿姆斯特丹证券交易所Annual General Meeting 周年大会Annualized 年度化;按年计Annual report 年报;年度报告Anticipatory breach 预期违约Antitrust 反垄断APEC 亚太区经济合作组织(亚太经合组织)Appreciation [财产] 增值;涨价Appropriation 拨款;经费;指拨金额Arbitrage 套利;套汇;套戥Arbitration 仲裁Arm’s length transaction 公平交易Articles of Association 公司章程;组织细则At-the-money option 平价期权;等价期权ASEAN 东南亚国家同盟(东盟)Asian bank syndication market 亚洲银团市场Asian dollar bonds 亚洲美元债券Asset Allocation 资产配置Asset Backed Securities 资产担保证券(简称“ABS”)Asset Management 资产治理Asset swap 资产掉期;资产互换Assignment method 转让方法;指定分配方法ASX 澳大利亚证券交易所At-the-money 平价Auckland Stock Exchange 奥克兰证券交易所Auction market 竞价市场Authorized capital 法定股本;核准资本Authorized fund 认可基金Authorized representative 授权代表Australian Options Market 澳大利亚期权交易所Australian Stock Exchange 澳大利亚证券交易所B Back-door listing 借壳上市Back-end load 撤离费;后收用度Back office 后勤办公室Back to back FX agreement 背靠背外汇协议Balance of payments 国际收支平衡;收支结余Balance of trade 贸易平衡Balance sheet 资产负债表Balloon maturity 期末放气式偿还Balloon payment 最末期大笔还清Bank, Banker, Banking 银行;银行家;银行业Bank for International Settlements 国际结算银行Bankruptcy 破产Base day 基准日Base rate 基准利率Basel Capital Accord 巴塞尔资本协议Basis point 基点;点子Basis swap 基准掉期Bear market 熊市;股市行情看淡Bearer 持票人Bearer stock 不记名股票Behind-the-scene 未开拓市场Below par 低于平值Benchmark 比较基准Beneficiary 受益人Bermudan option 百慕大期权Best practice 最佳做法;典范做法Beta (Market beta) 贝他(系数);市场风险指数Bills department 押汇部Bid 出价;投标价;买盘指由买方报出表示愿意按此水平买进的一个价格。

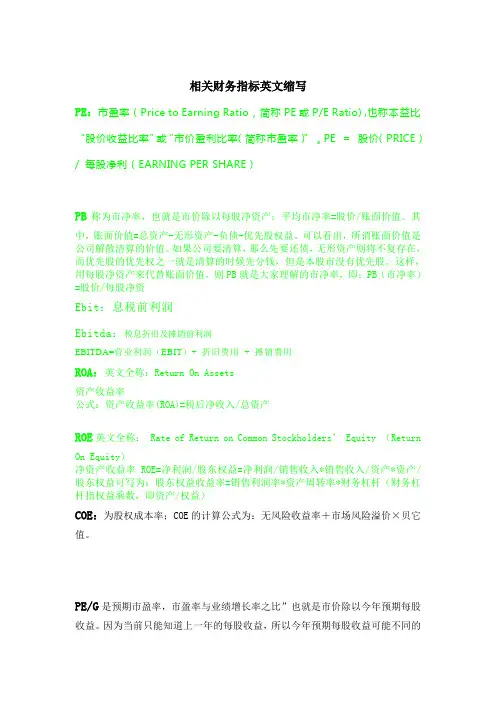

相关财务指标英文缩写PE:市盈率(Price to Earning Ratio,简称PE或P/E Ratio) ,也称本益比“股价收益比率”或“市价盈利比率(简称市盈率)”。

PE =股价(PRICE) / 每股净利(EARNING PER SHARE)PB称为市净率,也就是市价除以每股净资产;平均市净率=股价/账面价值。

其中,账面价值=总资产-无形资产-负债-优先股权益。

可以看出,所谓账面价值是公司解散清算的价值。

如果公司要清算,那么先要还债,无形资产则将不复存在,而优先股的优先权之一就是清算的时候先分钱,但是本股市没有优先股。

这样,用每股净资产来代替账面价值,则PB就是大家理解的市净率,即:PB(市净率)=股价/每股净资Ebit:息税前利润Ebitda:税息折旧及摊销前利润EBITDA=营业利润(EBIT)+ 折旧费用+ 摊销费用ROA:英文全称:Return On Assets资产收益率公式:资产收益率(ROA)=税后净收入/总资产ROE英文全称:Rate of Return on Common Stockholders’ Equity (ReturnOn Equity)净资产收益率ROE=净利润/股东权益=净利润/销售收入*销售收入/资产*资产/股东权益可写为:股东权益收益率=销售利润率*资产周转率*财务杠杆(财务杠杆指权益乘数,即资产/权益)COE:为股权成本率;COE的计算公式为:无风险收益率+市场风险溢价×贝它值。

PE/G是预期市盈率,市盈率与业绩增长率之比”也就是市价除以今年预期每股收益。

因为当前只能知道上一年的每股收益,所以今年预期每股收益可能不同的研究员预期的不一样,相应的PE/G也就不一样。

但PB、PE是不会不一样的。

EPS是指每股收益。

每股收益又称每股税后利润、每股盈余,是分析每股价值的一个基础性指标。

传统的每股收益指标计算公式为:每股收益=期末净利润÷期末总股本。

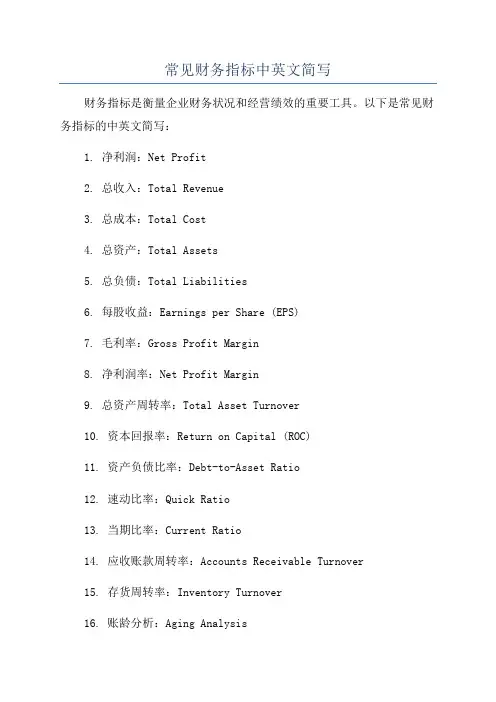

常见财务指标中英文简写财务指标是衡量企业财务状况和经营绩效的重要工具。

以下是常见财务指标的中英文简写:1. 净利润:Net Profit2. 总收入:Total Revenue3. 总成本:Total Cost4. 总资产:Total Assets5. 总负债:Total Liabilities6. 每股收益:Earnings per Share (EPS)7. 毛利率:Gross Profit Margin8. 净利润率:Net Profit Margin9. 总资产周转率:Total Asset Turnover10. 资本回报率:Return on Capital (ROC)11. 资产负债比率:Debt-to-Asset Ratio12. 速动比率:Quick Ratio13. 当期比率:Current Ratio14. 应收账款周转率:Accounts Receivable Turnover15. 存货周转率:Inventory Turnover16. 账龄分析:Aging Analysis17. 资本结构:Capital Structure18. 经营现金流量:Operating Cash Flow19. 投资现金流量:Investing Cash Flow20. 财务杠杆:Financial Leverage21. 存货周转天数:Inventory Turnover Days22. 应收账款周转天数:Accounts Receivable Turnover Days23. 资本收益率:Return on Equity (ROE)24. 总债务比率:Total Debt Ratio25. 资产净利润率:Return on Net Assets (RONA)26. 资本周转率:Capital Turnover27. 财务报表:Financial Statements28. 现金流量表:Statement of Cash Flows30. 资产负债表:Balance Sheet31. 利润率:Profit Margin32. 总股东权益:Total Equity33. 股东权益回报率:Return on Equity (ROE)34. 游离现金流量:Free Cash Flow35. 流动比率:Current Ratio36. 短期债务覆盖率:Short-term Debt Coverage Ratio37. 负债资产比率:Liabilities-to-Assets Ratio38. 资本周转周期:Capital Turnover Cycle39. 毛利率:Gross Margin40. 资产周转周期:Asset Turnover Cycle41. 营业收入:Operating Revenue42. 营业成本:Operating Cost43. 毛利:Gross Profit44. 销售费用:Selling Expenses45. 管理费用:Administrative Expenses46. 财务费用:Financial Expenses47. 营业利润:Operating Profit48. 利润总额:Total Profit49. 期初存货:Beginning Inventory50. 期末存货:Ending Inventory以上是常见财务指标的中英文简写。

a/c no. account number 帐户编号、帐号Acct.No.account number 帐户编号、帐号b.o.m. bill of materials 用料清单b.o.p. balance of payments 收支差额B/L original bill of lading original 提货单正本BO buyer's option 买者选择交割期的远期合同BOM beginning of month 月初BOT balance of trade 贸易余额BOY beginning of year 年初Brok.broker or brokerage 经纪人或经纪人佣金C.O., C/O cash order 现金汇票、现金订货c.o.d, C.O.D. cash on delivery 货到付款,交货付现C.W.O.cash with order 订货付款,随订单付现c/o carried over 结转后期CMO Collateralized Mortgage Obligations担保抵押贷款债务COBOL Common Business Oriented Language通用商业语言Col.column 帐栏Coll.collateral 担保、抵押物Coll.collection 托收Com. comm. commission 佣金conv, cv, cvt convertible 可转换的、可兑换的Cor.corpus 本金D.C.F. method discounted cash flow method 现金流量贴现法D.O.G.days of grace 宽限日数D/O delivery order 发货单DB method declining balance (depreciation) method 递减余额折旧法DDB method double declining balance (depreciation) method 双倍递减余额折旧法Dls, Dol(s); dollars 元Do, dto. ditto 同上、同前Doc(s) documents 凭证、单据、文件Doc. code document code 凭证(单据)编号doc. att. documents attached 附单据、附件Dols.dollars 美元DOR date of request 要求日E&O.E.errors and omissions excepted 如有错漏,可加更正e.a.o.n. except as otherwise noted 除非另有说明EDOC effective date of change 有效更改日期EOA effective on or about 大约在.......生效EOD every other day 每隔一日EOM end of month 月底EOS end of season 季末EOY end of year 年终ESOP Employee Stock Ownership Plan职工持股计划F.O.C.free of charge 免费F.X., FE, FOREX foreign exchange 外汇FDB method fixed rate on declining balance method 定率递减余额折旧法FIFO first in, first out 先进先出法FIO free in and out 自由进出对折、页码fo. folioFinancial and Operations Combined UniformFOCUS Single Report财务经营综合报告for'd. , fwd forward; forwarded 转递FOX Futures and Options Exchange 期货和期权交易所FX broker foreign exchange broker 外汇经纪人HIBOR Hong Kong Interbank Offered Rate香港银行同业拆借利率hifo highest-in, first-out 高入先出法Hon'd honored 如期支付的I.B.O.invoice book outward 销货发票簿IBOR inter-bank offered rate 银行间的拆借利率ICONs index currency option notes 指数货币期权票据ICOR incremental capital-output ratio 资本-产出增量比INLO in lieu of 代替inv.doc.,attach. invoice with document attached 附提货单的发票IOU I owe you 借据IOV inter-office voucher 内部传票IPO initial public offering 首次发售股票J., Jour.journal 日记帐lifo, LIFO last in,first out 后进先出法M.O.money order 邮汇MBO management by objectives 目标管理MO,M.O. money order 汇票mo. month 月Mos.months 月NIFO next in, first out 次进先出法no a/c no account 无此帐户NO. (no.) number 编号、号数NOP net open position 净开头寸NOW a/c negotiable order of withdrawal 可转让存单帐户NPV method net present value method 净现值法.B., O/B order book 订货簿O.E., o.e. omission excepted 遗漏除外O.F.ocean freight 海运费O/a on account 赊帐o/a on account of 记入......帐户O/d on demand 见票即付o/d, o.d., O.D. overdrawn 透支O/s outstanding 未清偿、未收回的OA open account 赊帐、往来帐OAAS operational accounting and analysis system 经营会计分析制OB other budgetary 其他预算OBV on-balance volume 持平数量法OD overdraft 透支OEC original equipment cost 设备原值OFC open for cover 预约保险OI original issue 原始发行OII overseas investment insurance 海外投资保险ok. all correct 全部正确opp opposite 对方opt. optional 可选择的ord. ordinary 普通的OVA overhead variance analysis 间接费用差异分析OW offer wanted 寻购启示P.O.D pay on delivery 货到付款P.O.R.payable on receipt 货到付款P/E ratio price-eanings ratio 收益率PMO postal money order 邮政汇票POR pay on return 收益REVOLVER revolving letter of credit 循环信用证ROA return on asset 资产回报率ROC return on capital 资本收益率ROE ratio of equity 股本利润率ROE return on equity 股本回报率ROI return on investment 投资收益ROP registered option principal 记名期权本金ROS ratio of sales 销售利润率ROS return on sales 销售收益率Rto ratio 比率RTO round trip operation 往返作业英文全称sum of the year's digits method to be declared policy 中文年数加总折旧法预保单,待报保险单缩写SOYD TBD policy。

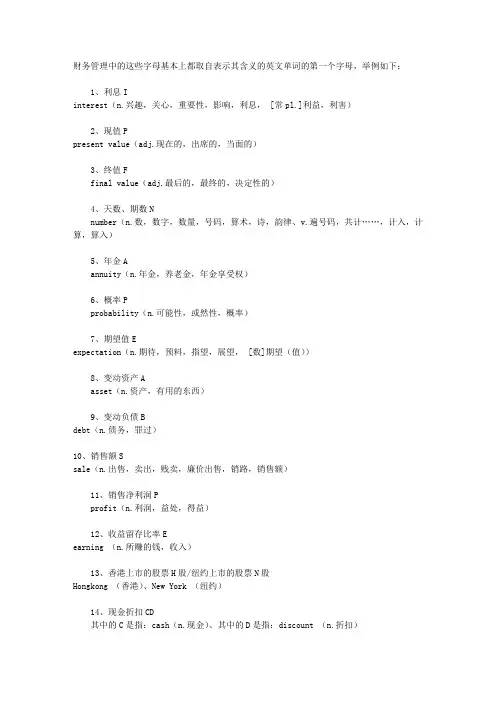

财务管理中的这些字母基本上都取自表示其含义的英文单词的第一个字母,举例如下:1、利息Iinterest(n.兴趣,关心,重要性,影响,利息, [常pl.]利益,利害)2、现值Ppresent value(adj.现在的,出席的,当面的)3、终值Ffinal value(adj.最后的,最终的,决定性的)4、天数、期数Nnumber(n.数,数字,数量,号码,算术,诗,韵律、v.遍号码,共计……,计入,计算,算入)5、年金Aannuity(n.年金,养老金,年金享受权)6、概率Pprobability(n.可能性,或然性,概率)7、期望值Eexpectation(n.期待,预料,指望,展望, [数]期望(值))8、变动资产Aasset(n.资产,有用的东西)9、变动负债Bdebt(n.债务,罪过)10、销售额Ssale(n.出售,卖出,贱卖,廉价出售,销路,销售额)11、销售净利润Pprofit(n.利润,益处,得益)12、收益留存比率Eearning (n.所赚的钱,收入)13、香港上市的股票H股/纽约上市的股票N股Hongkong (香港)、New York (纽约)14、现金折扣CD其中的C是指:cash(n.现金)、其中的D是指:discount (n.折扣)15、债券成本的计算公式其中的K是指:key(n.钥匙,关键,解答,要害等)、其中的b是指:bond(n.结合(物),粘结(剂),联结,公债,债券,合同)、其中的T是指:tax(n.税,税款,税金)、其中的f是指:fee(n.费(会费、学费、手续费等),酬金)、其中的i是指利息,注解同第1条16、银行借款成本的计算公式其中的L是指:lend(v.借给,贷(款))、其它字母的注解同上文所指17、优先股成本的计算公式其中的D是指:dividend (n.被除数,股息,红利,额外津贴,奖金,年息)、其中的P是指:preferred stock(n.<;美>;优先股)。

IT及财务的常用英文缩写B2B: Business To(2,two) BusinessB2C: Business To CustomerCRM: Customer Relation ManagementERP: Enterprise Resource PlanningSCM: Supply Chain ManagementISP: Internet Service ProviderICP: Internet Content ProviderASP: Application Service ProviderFAQ: Frequent Ask Question(Call Center)常见问题AR: Account Receivable 应收款AP: Account Payable 应付款MRP 物料需求计划MRPII 制造资源计划DRP 分销资源计划MPS 主生产计划BOM 物料清单EAM 企业资产管理PDM 产品数据管理KRM 知识资源管理BI 商业智能BPR 业务流程重组HRM 人力资源管理MIS 管理信息系统EAI 企业应用集成EIP 企业信息门户PM 项目管理CAD 计算机辅助设计EDI 电子数据交换OA 办公自动化CAPP 计算机辅助工艺设计CAM 计算机辅助制造CAQ 计算机辅助质量管理GT 成组技术DSS 决策支持系统DCS 分布控制系统WFM 工作流管理VMI Vender Managed Inventory 卖方主导型库存管理/供应商管理仓库TQM Total Quality Management 全面质量管理TQC Total Quality Control 全面质量控制TPM Total Productive Maintenance 全员生产力维护TPL Third-Part Logistics 第三方物流TOC Theory Of Constraints/Constraints managemant 约束理论/约束管理TES Technology-enabled Selling 技术辅助式销售TEM Technology-enabled Marketing 技术辅助式营销TEI Total Enterprise Integration 全面企业集成TCO Total Cost Ownership 总体运营成本SRM Supplier Relationship Management 供应商关系管理SFA Sales Force Automation 销售自动化SCP Supply Chain Partnership 供应链合作伙伴关系SCM Supply Chain Management 供应链管理RRP Resource Requirements Planning 资源需求计划RPM Rapid Prototype Manufacturing 快速原形制造ROI Return On Investment 投资回报率RM Risk Management 风险管理RCCP Rough-Cut Capacity Planning 粗能力计划PTF Planning time fence 计划时界PRM Partner Relationship Management 合作伙伴关系管理POS Point Of Sells 电子收款机POQ Period Order Quantity 周期定量法PM Project Management 项目管理PLM Production Lifecycle Management 产品生命周期管理PERT Program Evaluation Research Technology 计划评审技术PDM Product Data Management 产品数据管理PAB Projected Available Balance 预计可用库存(量)OPT Optimized Production Technology 最优生产技术OPT Optimized Production Timetable 最优生产时刻表OLAP On-line Analysis Processing 联机/在线分析系统OAG Open Application Group 开放应用集成NPV Net Present Value 净现值MTS Make To Stock 现货(备货)生产MTO Make To Order 定货(订货)生产MES Manufacturing Executive System 制造执行系统LRP Logistics Resource Planning 物流资源计划LP Lean Production 精益生产LCL less than container load 拼装货KPI Key Performance Indicators 关键业绩指标KPA Key Process Areas 关键过程域GL General Ledger 总账FPR Fixed Period Requirements 定期用量法FOQ Fixed Order Quantity 固定定货批量法FMS Flexible Manufacturing System 柔性制造系统FCS Finite Capacity Scheduling 有限能力计划FAS Final Assembly Schedule 最终装配计划ETO Engineer To Order 专项设计,按订单设计EOQ Economic Order Quantity 经济订货批量(经济批量法)EOI Economic Order Interval 经济定货周期EAI Enterprise Application Integration 企业应用集成DTP Delivery to Promise 可承诺的交货时间DTF Demand Time Fence 需求时界DSS Decision Support System 决策支持系统DM Data Mining 数据挖掘DEM Dynamic Enterprise Module 动态企业建模技术DCS Distributed Control System 分布式控制系统CRP capacity requirements planning 能力需求计划CPM Critical Path Method 关键线路法CPIM Certified Production and Inventory Management 生产与库存管理认证资格CLT Cumulative Lead Time 累计提前期CASE Computer-Aided Software Engineering 计算机辅助软件工程CAQ computer aided quality assurance 计算机辅助质量保证CAPP Computer-Aided Process Planning 计算机辅助工艺设计CAM Computer-Aided Manufacturing 计算机辅助制造CAID Computer-Aided Industrial Design 计算机辅助工艺设计CAD Computer-Aided Design 计算机辅助设计ATP Available To Promise 可供销售量(可签约量)ATO Assemble To Order 定货组装ASP Application Service/Software Provider 应用服务/软件供应商APS Advanced Planning and Scheduling 高级计划与排程技术APO Advanced Planning and Optimization 先进计划及优化技术。

财务部门的英语缩写?会计英文缩写?出纳英文缩写?财务部门的英语缩写?会计英文缩写?出纳英文缩写?财务部:Financial Department -- FD会计:aountant出纳:cashier英文缩写:当天统计英文缩写是?月统计英文缩写是?没有缩写,也不需缩写,本来就不长:当天统计:daily subtotal月统计 monthly total各个部门的英文缩写?总经理办公室 GM office食堂 dining room法务审计部 legal and audit department资讯部 Information department仓库 warehouse产品开发部 product develope department国际事务部 international business affairscGMP专案组 cGMP project team公司部门的英文缩写?总公司Head Office 分公司Branch Office 营业部Business Office人事部 Personnel Department人力资源部Human Resources Department 总务部General Affairs Department 财务部 General Aounting Department 销售部Sales Department促销部Sales Promotion Department 国际部International Department 出口部Export Department 进口部Import Department公共关系Public Relations Department 广告部AdvertisingDepartment 企划部 Planning Department产品开发部 Product Development Department研发部 Research and Development Department(R&D) 祕书室Secretarial Pool采购部Purchasing Department 工程部Engineering Department 行政部Admin. Department 人力资源部HR Department 市场部Marketing Department 技术部Technolog Department 客服部 Service Department 行政部: Administration 财务部 Financial Department总经理室、Direcotor, or President副总经理室、Deputy Director, or Vice president 总经办、General Deparment采购部、Purchase & Order Department 工程部、Engineering Deparment 研发部、Research Deparment 生产部、Productive Department 销售部、Sales Deparment广东业务部、GD Branch Deparment无线事业部、Wireless Industry Department 拓展部Business Expending Department 物供部、Supply Department B&D business and development 业务拓展部 Marketing 市场部 Sales 销售部 HR 人力资源部 Aount 会计部PR people relationship 公共关系部OFC (Office, 但不常见) / OMB = Office of Management and Budget 办公室 Finance 财务部MKTG (Marketing) 市场部R&D (Research & Development) 研发部 MFG (Manufacturing) 产品部 Administration Dept. 管理部 Purchasing Dept 采购部Chairman/President Office Gerneral Manager office or GM office 总经理办公室Monitor & Support Department 监事会 Strategy Research 战略研究部财务的英文缩写financefinancial affairsfinancing财务部在部门的英文缩写是什么?比如工程部是PD.finance department = FD财务部的英文缩写是什么呀?Financial Department:F.D.或者Financial Affairs Department:F.A.D英文缩写A股—人民币普通股票AA制—平摊聚餐费AB角—担任一个角色的两个演员ABS —制动防抱着死装置ADSL —非对称数字使用者线路宽频AIDS —艾滋病AM —调幅APC —阿司匹林APEC —亚太经济合作组织API —空气污染指数ATM机—自动柜员机a粒子—阿尔法粒子a射线—阿尔法射线B超—B型超声诊断(仪)B股—以美元或港币交易的股票B细胞或B淋巴细胞—一种免疫细胞BBS —电子公告牌系统BP机—无限寻呼机BIAS —乖离率b粒子—贝塔粒子CAD —计算机辅助设计CBD —商业中心CCO —首席文化官CD —镭射唱盘CDMA —码头多址CD-R—可录光碟CD-ROM—只读光碟CD-RW —可擦写光碟CEO —执行长CFO —首席财务官CGO —首席沟通官CI —企业标识C3I系统—军队指战员指挥系统CIMS —计算机整合制造系统CIO —资讯长CIP —在版编目;预编目录C4ISR —军队自动化指挥系统COO —营运长CPA —注册会计师CPU —中央处理器CT —计算机体层成像(仪)CTO —首席技术官DELL —戴尔DIY —自己动手做DNA 脱氧核糖核酸DNA晶片—基因晶片DOS —磁碟作业系统DSL —数字使用者线路DVD —数字镭射唱盘e 化—电子化ED —男子性功能障碍EDI —电子资料交换E-mail—电子邮件EMS —邮政特快专递EQ —情商FA —工厂自动化FAX —传真件FM —调频GDP —国内生产总值GIS —地理资讯系统GMDSS —全球海上遇险情与安全系统GNP —国民生产总值GPS —全球定位系统GRE —美国等国家研究生入学资格考试GSM —全球移动通讯系统H股—在香港上市的股票HA —家庭自动化HDTV —高清晰度电视hi-fi —高保真度HIV —在艾滋病病毒HSK —汉语水平考试IC卡—积体电路卡ICP —因特网资讯提供商ICQ —网路寻呼机ICU —重病监护病房IDC —网际网路资料中心inter—网际网路Intnr—因特网IOC —国际奥林匹克委员会IP地址—网际协议地址IP电话—网路电话IP卡—IP电话卡IQ —智商ISDN —综合业务数字网络ISO —国际标准化组织ISP —因特网服务提供商IT —资讯科技ITS —智慧交通系统KTV —配有卡拉OK和电视装置的包间KDJ —随机指数LD —镭射视盘MACD —平滑异同移动平均线MBA —工商管理硕士MD —迷你光碟MP3 —一种常用的数字音讯压缩格式MPA —公共管理硕士MTO —多边贸易组织MTV —一种用电视画面配合歌曲演唱的艺术形式NC —网路计算机NMD —国家导弹预防系统OA —办公自动化OAPEC —阿拉伯石油输出国组织OCR —光学字元识别OEM —原始装置制造商业OPEC —石油输出国组织(欧佩克)PC机—个人电子计算机PDA —个人数字助理pH值—氢离子浓度指数PICC —中国人民保险公司POS机—商场电子收款机PPA —苯丙醇胺某些感冒药和减肥药中的一种成分,已被国家通告停用。

常见财务指标中英文简写1. ROI - Return on Investment (投资回报率)2. ROE - Return on Equity (净资产回报率)3. EPS - Earnings per Share (每股收益)4. P/E - Price-to-Earnings Ratio (市盈率)5. DR - Debt Ratio (负债率)6. CR - Current Ratio (流动比率)7. QR - Quick Ratio (速动比率)8. ROA - Return on Assets (总资产回报率)9. GPM - Gross Profit Margin (毛利率)10. NPM - Net Profit Margin (净利率)11. OCF - Operating Cash Flow (经营性现金流量)12. CFO - Cash Flow from Operations (经营性现金流入)13. CFI - Cash Flow from Investing (投资性现金流入)14. CFF - Cash Flow from Financing (筹资性现金流入)15. EBIDTA - Earnings Before Interest, Taxes, Depreciation, and Amortization (息税前利润,折旧及摊销)16. EV - Enterprise Value (企业价值)17. BV - Book Value (账面价值)18. DPS - Dividends Per Share (每股分红)19. PE - Price-to-Earnings Ratio (市盈率)20. CRM - Customer Relationship Management (客户关系管理)21. R&D - Research and Development (研发)22. COGS - Cost of Goods Sold (销售成本)23. EBIT - Earnings before Interest and Taxes (税前利润)24. ATAR - Average Time to Answer Rate (平均应答时间)25. ARR - Average Revenue per User (平均用户收入)26. CAC - Customer Acquisition Cost (客户获取成本)28. NPV - Net Present Value (净现值)29. IRR - Internal Rate of Return (内部收益率)30. EVA - Economic Value Added (经济增加值)31. CAPM - Capital Asset Pricing Model (资本资产定价模型)32. CPM - Critical Path Method (关键路径法)33. RAROC - Risk-Adjusted Return on Capital (风险调整资本回报率)34. WACC - Weighted Average Cost of Capital (加权平均资本成本)35. APR - Annual Percentage Rate (年化利率)36. APR - Average Production Rate (平均生产速率)37. ROI - Return on Investment (投资回报率)38. ROIC - Return on Invested Capital (投资的资本回报)39. ROCE - Return on Capital Employed (资本利用率)40. NWC - Net Working Capital (净营运资本)41. EVA - Economic Value Added (经济增加值)42. PEG - Price/Earnings to Growth (市盈率与增长比率)43. DSCR - Debt-Service Coverage Ratio (债务服务覆盖率)44. EBITDA - Earnings Before Interest, Taxes, Depreciation, and Amortization (息税折旧摊销前利润)45. WIP - Work-in-Progress (在建工程)46. NPV - Net Present Value (净现值)47. GPM - Gross Profit Margin (毛利率)48. OPM - Operating Profit Margin (营业利润率)49. NPM - Net Profit Margin (净利润率)50. FCF - Free Cash Flow (自由现金流)51. CFO - Cash Flow from Operations (经营活动产生的现金流量)52. CFI - Cash Flow from Investing (投资活动产生的现金流量)53. CFF - Cash Flow from Financing (筹资活动产生的现金流量)54. FCFE - Free Cash Flow to Equity (股东权益自由现金流)55. PVA - Present Value of Annuity (年金现值)56. PVT - Present Value of Terminal Value (终值现值)57. WIP - Work-in-Progress (在建工程)58. FCF - Free Cash Flow (自由现金流)59. EBITDA - Earnings Before Interest, Taxes, Depreciation, and Amortization (息税折旧摊销前利润)60. NWC - Net Working Capital (净营运资本)61. CAPEX - Capital Expenditure (资本支出)62. OCF - Operating Cash Flow (经营活动现金流)63. EPS - Earnings per Share (每股收益)64. BVPS - Book Value per Share (每股净资产)65. DPS - Dividends per Share (每股股息)66. CR - Current Ratio (流动比率)67. QR - Quick Ratio (速动比率)68. DR - Debt Ratio (负债率)69. SR - Solvency Ratio (偿债能力比率)70. AR - Accounts Receivable (应收账款)71. AP - Accounts Payable (应付账款)72. GR - Growth Rate (增长率)74. EVA - Economic Value Added (经济增加值)75. WACC - Weighted Average Cost of Capital (加权平均资本成本)76. ROIC - Return on Invested Capital (投资资本回报率)77. ROCE - Return on Capital Employed (资本运营回报率)78. ROA - Return on Assets (资产回报率)79. RAROC - Risk-Adjusted Return on Capital (风险调整资本回报率)80. EM - Equity Multiplier (权益乘数)81. FA - Financial Analysis (财务分析)82. BC - Budget Control (预算控制)83. CF - Cash Flow (现金流量)84. CCP - Capital Cost Position (资金成本位置)85. CRAD - Cost Reduction and Avoidance (成本降低与避免)86. DBC - Days Beyond Contract Terms (超出合同约定的天数)87. EM - Equity Multiplier (权益乘数)88. FC - Fixed Costs (固定成本)89. FCF - Free Cash Flow (自由现金流)90. FOF - Fund of Funds (基金)91. IC - Investment Cost (投资成本)92. IR - Investment Rate (投资率)93. LV - Liquidity Value (流动性价值)94. MCA - Market Capitalization (市场资本化)95. MotM - Month over Month (按月)96. OP - Operational Profit (运营利润)97. PAC - Project Activity Cost (项目活动成本)98. PAP - Price Action Plan (价格行动计划)99. PBT - Profit Before Taxes (税前利润)。

常用经济类缩写词(中英文对照)Abb. English Chinesea accepted 承兑AA Auditing Administration (中国)审计署AAA 最佳等级abs. abstract 摘要a/c, A/C account 帐户、帐目a/c, A/C account current 往来帐户、活期存款帐户A&C addenda and corrigenda 补遗和勘误Acc. acceptance or accepted 承兑Accrd.Int accrued interest 应计利息Acct. account 帐户、帐目Acct. accountant 会计师、会计员Acct. accounting 会计、会计学Acct.No. account number 帐户编号、帐号Acct.Tit. account title 帐户名称、会计科目ACN air consignment 航空托运单a/c no. account number 帐户编号、帐号Acpt. acceptance or accepted 承兑A/CS Pay. accounts payable 应付帐款A/CS Rec. accounts receivable 应收帐款ACT advance corporation tax 预扣公司税ACU Asia Currency Unit 亚洲货币单位A.C.V actual cash value 实际现金价值a.d., a/d after date 开票后、出票后ADRS asset depreciation range system 固定资产分组折旧法Adv. advance 预付款ad.val.,A/V ad valorem to (according value)从价Agt. agent 代理人Agt. agreement 协议、契约AJE adjusting journal entries 调整分录Amt. amount 金额、总数Ann. annuity 年金A/P account paid 已付账款A/P account payable 应付帐款A/P accounting period 会计期间A/P advise and pay 付款通知A/R account receivable 应收帐款A/R at the rate of 以……比例a/r all risks (保险)全险Arr. arrivals, arrived 到货、到船A/S, a/s after sight 见票即付A/S,acc/s account sales 承销帐、承销清单,售货清单ASAP as soon as possible 尽快ASR acceptance summary report 验收总结报告ass. assessment 估征、征税assimt. assignment 转让、让与ATC average total cost 平均总成本ATM at the money 仅付成本钱ATM Automatic Teller Machine 自动取款机(柜员机)ATS automated trade system 自动交易系统ATS automatic transfer service 自动转移服务Attn. attention 注意Atty. attorney 代理人auct. auction 拍卖Aud. auditor 审计员、审计师Av. average 平均值a.w. all wool 纯羊毛A/W air waybill 空运提单A/W actual weight 实际重量BA bank acceptance 银行承兑汇票bal. balance 余额、差额banky. bankruptcy 破产、倒闭Bat battery 电池b.b. bearer bond 不记名债券B.B., B/B bill book 出纳簿B/B bill bought 买入票据、买入汇票b&b bed & breakfast 住宿费和早餐费b.c. blind copy 密送的副本BC buyer credit 买方信贷B/C bills for collection 托收汇票B.C. bank clearing 银行清算b/d brought down 转下页Bd. bond 债券B/D bills discounted 已贴现票据B/D bank draft 银行汇票b.d.i. both dates inclusive, both days inclusive 包括头尾两天B/E bill of entry 报关单b.e., B/E bill of exchange 汇票BEP breakeven point 保本点、盈亏临界点b/f brought forward 承前BF bonded factory 保税工厂Bfcy. Beneficiary 受益人B/G, b/g bonded goods 保税货物BHC Bank Holding Company 银行控股公司BIS Bank of International Settlements 国际清算银行bit binary digit 两位数Bk. bank 银行Bk. book 帐册b.l., B/L bill of lading 提货单B/L original bill of lading original 提货单正本bldg. building 大厦BMP bank master policy 银行统一保险BN bank note 钞票BO branch office 分支营业处BO buyer’s option 买者选择交割期的远期合同BOM beginning of month 月初b.o.m. bill of materials 用料清单BOO build-operate-own 建造—运营—拥有BOOM build-operate-own-maintain 建造—运营—拥有—维护BOOT build-operate-own- transfer 建造—运营—拥有—转让b.o.p. balance of payments 收支差额BOT balance of trade 贸易余额BOY beginning of year 年初b.p., B/P bills payable 应付票据Br. branch 分支机构BR bank rate 银行贴现率b.r., B/R bills receivable 应收票据Brok. broker or brokerage 经纪人或经纪人佣金b.s., BS, B/S balance sheet 资产负债表B/S bill of sales 卖据、出货单B share B share B 股B.T.T. bank telegraphic transfer 银行电汇BV book value 票面价值c. cents 分C cash; coupon; currency 现金、息票、通货C centigrade 摄氏(温度)C. A. chartered accountant; chief accountant 特许会计师、主任(主管)会计师C. A. commercial agent 商业代理、代理商C. A. consumers' association 消费者协会C/A capital account 资本帐户C/A current account 往来帐C/A current assets 流动资产C. A. D cash against documnet 交单付款can. cancelled 注销cap. capital 资本CAPM capital asset pricing model 固定资产计价模式C. A. S. cost accounting standards 成本会计标准c. b., C. B. cash book 现金簿CBD cash before delivery 先付款后交货C. C. cashier's check 银行本票C. C contra credit 贷方对销c/d carried down 过次页、结转下期CD certificate of deposit 存单c/f carry forward 过次页、结转CG capital gain 资本利得CG capital goods 生产资料、资本货物C. H. custom house 海关C. H. clearing house 票据交换所Chgs charges 费用Chq. cheque 支票C/I certificate of insurance 保险凭证CIA certified internal auditor 注册内部审计员c. i. f. , C. I. F. cost, insurance and freight 到岸价,货价+保险+运费C. I. T. comprehensive income tax 综合所得税Ck. check 支票C. L. call loan 短期拆放C / L current liabilities 流动负债C. M. A. certificed management accountant 注册管理会计师CMEA, Comecon Council for Mutual Economic Assistance 经济互助委员会CML capital market line 资本市场线性CMO Collateralised Mortgage Obligations 担保抵押贷款债务CMV current market value 现时市场价值CN consignment note 铁路运单CN credit note 贷方通知书c/o carried over 结转后期C. O., C/O cash order 现金汇票、现金订货C. O. certificate of origin 产地证明书Co. company 公司COBOL Common Business Oriented Language 通用商业语言CoCom Coordinating Committee for Multilateral Export Controls 多边出口控制协调委员会c. o. d, C. O. D. cash on delivery 货到付款Col. column 帐栏Coll. collateral 担保、抵押物Coll. collection 托收Com.; comm. commission 佣金cont. container 集装箱cont., contr. contract 契约、合同conv., cv., cvt. convertible 可转换的、可兑换的Cor. corpus 本金Cor. correspodent 代理行Corp. corporation 公司CP. commercial paper 商业票据C. P. A certified Public Accountant 注册公共会计师CPB China Patent Bureau 中国专利局CPI consumer price index 消费者价格指数CPM cost per thousand 每一千个为单位的成本CPP current purchasing power 现行购买力Cps. coupons 息票CPT carriage paid to 运费付至......C/R company's risk 企业风险Cr. credit 贷记、贷方CR carrier's risk 承运人风险CR current rate 当日汇率、现行汇率CR cash receipts 现金收入CR class rate 分级运费率CS civil servant; civil service 公务员、文职机关CS convertible securities 可转换证券C. S. capital stock 股本CSI customer satisfaction index 顾客满意指数csk. cask 木桶CT corporate treasurer 公司财务主管CT cable transfer 电汇ct crate 板条箱ctge cartage 货运费、搬运费、车费Cts. cents 分CTT capital transfer tax 资本转移税cu cubic 立方CU customs unions 关税联盟cu. cm. cubic centimeter 立方厘米cu. in. cubic inch 立方英寸cu. m. cubic meter 立方米cu. yd. cubic yard 立方码cum. pref. cumulative preference (share) 累积优先(股)cur. curr. current 本月、当月CV convertible security 可转换债券CVD countervailing duties 抵消关税、反倾销税C.V. P. analysis Cost Volume Profit analysis 本---量---利分析C. W. O. cash with order 订货付款Cy. currency 货币CY calendar year 日历年CY container 整装货柜CY container yard 货柜堆场、货柜集散场D degree; draft 度、汇票D/A deposit account 存款帐户D/A document.nbspagainst acceptance 承兑交单d/a days after acceptance 承兑后......日(付款)D. A. debit advice 欠款报单D. B day book 日记帐、流水帐DB method declining balance (depreciation) 递减余额折旧法D. C. F. method discounted cash flow method 现金流量贴现法D/D document.ry draft 跟单汇票D. D.; D/D demand draft 即期汇票D/d; d/d days after date 出票后......日(付款)d. d. dry dock 干船坞DDB method double declining balance (depreciation) 双倍递减余额折旧法D. D. D deadline delivery date 交易最后日期def. deficit 赤字、亏损dem. demurrage 滞期费Depr. depreciation 折旧d. f; D. F.; d. frt. dead freight 空舱费D. G dangerous goods 危险货物diff. difference 差额Dis. discount 折扣、贴现dish'd; dishd dishonored 不名誉、拒付D. I. T double income-tax(relief) 双重所得税(免征)div.; divd dividend 红利、股息D-J Dow Jones & Co. 美国道—琼斯公司DJIA Dow Jones Industrial Average (Stock Index) 道—琼斯工业股票指数DJTA Dow Jones Transportation Average 道—琼斯运输平均数DJUA Dow Jones Utility Average 道—琼斯公用事业平均数DK Don't know 不知道DL direct loan 直接贷款DL discretionary limit 无条件限制DLD deadline date 最后时限Dls. Dol(s) Doll(s) 元DM Deutsche Mark; D-mark; Deutschmark; 德国马克DMCs developing member countries 发展中国家DN date number 日期号DN; D/N debit note 借记通知单DNR do not reduce 不减少do.; dto. ditto 同上、同前D/O delivery order 发货单Doc(s) 凭证、单据、文件doc. att. document.attached 附单据、附件Doc. code document.nbspcode 凭证(单据)编号D. O. G. days of grace 宽限日数DOR date of request 要求日DP; D/P document.nbspagainst payment 交单付款DPI disposable personal income 个人可支配收入DPOB date and place of birth 出生时间和地点DPP damp proofing 防潮的Dr. debit 借记、借方D. R.; DR discount rate 贴现率、折扣率Dr debtor 债务人DR deposit receipt 存单、存款收据dr. drawer 借方DS; d/s days after sight(days' sight) 见票后.......日(付款)ds.; d's days 日dstn. destination 日的地(港)DTC Deposit taking company 接受存款公司DTC Deposit Trust Company 储蓄信托公司dup.; dupl.; dupte. duplicate 副本DVP delivery versus payment 付款交货dy.; d/y day; delivery 日、交货dz dozen 一打E. exchange; export 交易所、输出E. & O. E. errors and omissions excepted 如有错漏,可加更正e.a.o.n. except as otherwise noted 除非另有说明EAT earnings after tax 税后收益EB ex budgetary 预算外EBIT earnings before interest and tax 扣除利息和税金前收益EBS Electronic Broking Service 电子经纪服务系统EBT earning before taxation 税前盈利EC European Community; European Commission 欧洲共同体、欧洲委员会EC export credit 出口信贷EC error corrected 错误更正Ec. exempli causa 例如Ec. ex coupon 无息票ECA export credit agency 出口信贷机构ECAFE Economic Commission for Asia and the Far East 亚洲及远东经济委员会ECE Economic Commission for Europe 欧洲经济委员会ECG Export Credit Guarantee 出口信用担保ECI export credit insurance 出口信用保险ECR export credit refinancing 出口信贷再融资ECT estimated completion time 估计竣工时间ECU European Currency Unit 欧洲货币单位E/D export declaration 出口申报单ED ex dividend 无红利、除息、股利除外EDD estimated delivery date 预计交割日EDI electronic data interchange 电子数据交换EDOC effective date of change 有效更改日期EDP Electronic Data Processing 电子数据自理E. E.; e.e errors excepted 如有错误,可加更正EERI Effective Exchange Rate Indexes of Hong Kong 港汇指数EET East European Time 东欧时间EF export finance 出口融资EF Exchange Fund 外汇基金EFT electronic funds transfer 电子资金转帐EFTA European Free Trade Area (Association) 欧洲自由贸易区(协会)EGM Extraordinary Genaral Meeting 特别股东大会EIB Export-Import Bank 进出口银行EIL WB Economic Integration Loan 世界银行经济一体化贷款EL export license 出口许可证ELI extra low impurity 极少杂质EMF European Monetary Fund 欧洲货币基金EMIP equivalent mean investment period 等值平均投资期EMP end-of month payment 月末付款EMP European main ports 欧洲主要港口EMS European Monetary System 欧洲货币体系EMS express mail service 邮政特快专递EMU European Monetary Union 欧洲货币联盟enc enclosed 停业encl(s) 附件encd. enclosed 附件End. end. endorsement 背书Entd. entered 登记人EOA effective on or about 大约在.......生效EOD every other day 每隔一日EOE European Options Exchange 欧洲期权交易EOM end of month 月底EOQ economic order quantity 最底订货量EOS end of season 季末EOU export-oriented unit 出口型单位EOY end of year 年终EPD earliest possible date 最早可能日期EPN export promissory note 出口汇票EPOS electronic point of sale 电子销售点EPR earnings price ratio 收益价格比率EPR effective protection rate 有效保护率EPS earnings per share 每股收益额、每股盈利额E. P. T excess profit tax 超额利润税EPVI excess present value index 超现值指数EPZ export processing zone 出口加工区ERM exchange rate mechanism 汇率机制ERS Export Refinance Scheme 出口再融资计划ESOP Employee Stock Ownership Plan 职工持股计划Est. estate 财产、遗产EST Eastern Standard Time 美国东部标准时间et seq. et sequents 以下ETA estimated time of arrival 预计到达时间ETD estimated tiem of departure 预计出发时间ETDZ Economic and Technological Development Zone 经济技术开发区ETLT equal to or less than 等于或少于ETS estimated time of sailing 预计启航时间EU European Union 欧盟EUA European Units of Account 欧洲记帐单位ex.; exch exchange 汇兑、况换excl. exclusive 另外、不在内ex cont. from contract 从合同ex cp. ex coupon 无息票ex div. ex dividend 无股息Exp. export 出口Extd. extend 展期EXW ex works 工厂交货价f feet 英尺F dealt in flat 无息交易的f. following (page) 接下页f. fairs 定期集市F. A. face amount 票面金额F. A. fixed assets 固定资产F. A freight agent 货运代理行FA free alongside 启运港船边交货FABB Fellow of the British Association of Accountants and Auditors 英国会计师和审计师协会会员FAC facility 设施、设备f.a.c. fast as can 尽快FACT factor analysis chart technique 因素分析图解法fad. free delivery (discharge, dispatch) 免费送货F. A. F. free at factory 工厂交货FAIA Fellow of the Association of International Accountants 国际会计协会会员F. A. Q fair average quality (货品)中等平均质量F. A. S. free alongside ship 发运地船边交货价FASB Financial Accounting Standards Boards 财务会计标准委员会FAT fixed asset transfer 固定资产转移FAT factory acceptance test 工厂验收试验FB foreign bank 外国银行F. B. E. foreign bill of exchange 外国汇票F. C. fixed capital 固定资本F. C. fixed charges 固定费用F. C. future contract 远期合同fc. franc 法郎FCA Fellow of the Institute of Chartered Accountants 特许会计师学会会员FCG foreign currency guarantee 外币担保FCL full container load 整货柜装载FCL/LCL full container load/less (than) 整装/分卸FCR forwarder's cargo receipt 货运代理行收据FCT forwarding agent's certificate of transport 货运代理行领货证fd. fund 资金FDB method fixed rate on declining balance method 定率递减余额折旧法FDI foreign direct investment 外商直接投资FDIC Federal Deposit Insurance Corporation 联邦储蓄保险公司FE foreign exchange 外汇FE future exchange 远期外汇FF French franc 法国法郎fib free into barge 驳船上的交货价FIBC financial institution buyer credit policy 金融机构买方信贷险FIFO first in, first out 先进先出法fin. stadg.(stndg.) 资信状况fin. stat. (F/S) 财务报表fin.yr. financial year 财政年度FINA following items not available 以下项目不可获得FIO free in and out 自由进出F. I. T free of income tax 免交所得税fl. florin 盾FLG finance lease guarantee 金融租赁担保flt. flat 无利息FMV fair market value 合理市价FO free out 包括卸货费在内的运费fo. folio 对折、页码FOB free on board (启运港)船上交货、离岸价格FOB airport FOB airport (启运) 机场交货(价)FOBST free on board stowed and trimming 包括清理及平仓的离岸价格F.O.C. free of charge 免费FOCUS Financial and Operations Combined Uniform Single Report 财务经营综合报告FOK fill or kill 要么买进或卖出,要么取消FOR free on rail (or road) 铁路或(公路)上交货价for'd., fwd forward; forwarded 转递FOREX foreign exchange 外汇FOS free on steamer 蒸汽船上交货(价)FOUO for official use only 仅用于公事FOW, f. o. w. free on wagon (启运站)火车上交货(价)FOX Futures and Options Exchange 期货和期权交易所FP floating policy 浮动政策FP fully paid 已全付的FRA forward rate agreement 远期利率协议FRCD floating rate certificate of deposit 浮动利率存单frt., frgt. forward 期货、远期合约free case no charge for case 免费事例FREF fixed rate export finance 固定利率出口融资frt. & grat. freight and gratuity 运费及酬金Frt. fwd freight forward 运费待付Frt. ppd freight prepaid 运费已付FS final settlement 最后结算FSR feasibility study report 可行性研究报告FTW free trade wharf 码头交易FTZ free trade zone 自由贸易区fut. futures 期货、将来FV face value 面值FVA fair value accounting 合理价值法FWD forward (exchange) 远期合约F.X. foreign exchange 外汇FX broker foreign exchange broker 外汇经纪人fxd fixed 固定的FXRN fixed rate note 定息票据FY fiscal year (financial year) 财政(务)年度fy. pd. fully paid 全部付讫FYI for your information 供您参考g gallon; grain; gram (s) ;gold 加仑;格令;克; 金G. A. general agent 总代理商、总代理人GA go ahead 办理、可行GAAP general Accepted Accounting Principles 通用会计准则GAAS Generally Accepted Auditing Standard 通用审计标准GAC General Administration of Customs 海关总署gal., gall gallon 加仑gas. gasoline 汽油GATT General Agreement on Tariffs and Trade 关税及贸易总协定GCL government concessional loan 政府优惠贷款GDP gross domestic product 国内生产总值gds. goods 商品、货物GJ general journal 普通日记帐GL general ledger 总分类帐gm. gram(s) 克GMP graduated payment mortgage 递增付款按揭GND gross national demand 国民总需求GNE gross national expeditures 国民支出总额GNP gross national product 国民生产总值GOFO gold forward rate 黄金远期利率GP gross profit 毛利GPP general purchasing power 总购买能力gr. (grs.) gross weight 毛重GR gross revenue 毛收入GS gross sales 销售总额GSP generalised system of preferences 普惠制GTM good this month 本月有效GTW good this week 本星期有效HAB house air bill 航空托运单HAWB house air waybill 航空托运单HCA historical cost accounting 历史成本会计hdqrs. headquarters 总部hg. hectogram 一百公克HIBOR Hong Kong Interbank Offered Rate 香港银行同业拆借利率hifo highest-in, first-out 高入先出法H. in D. C. holder in due course 正当持票人Hi-Q high quality 高质量HIRCS high interest rate currencies 高利率货币hi-tech high technology 高技术HKD Hong Kong dollar 香港元HKI Hong Kong Index 香港指数hl. hectoliter 百升hldg. holding 控股Hon'd honored 如期支付的HSCPI Hang Seng Consumer Price Index 恒生消费价格指数HSI Hang Seng Index 恒生指数hwevr. however 无论如何Hz hertz 赫兹I. A. intangible assets 无形资产I & A inventory and allocations 库存和分配IAS International Accounting Standard 国际会计标准IB investment banking 投资银行(业)I. B. invoice book 发票簿IBA International Bank Association 国际银行家协会IBBR interbank bid rate 银行间报价利率I. B. I invoice book inward 购货发票簿IBNR incurred but not reported 已发生未报告I. B. O. invoice book outward 销货发票簿IBOR inter-bank offered rate 银行间的拆借利率ICB international competitive bidding 国际竞标ICIA International Credit Insurance Association 国际信用保险协会ICJ International Court of Justice 国际法庭ICM international capital market 国际资本市场ICONs index currency option notes 指数货币期权票据ICOR incremental capital-output ratio 资本—产出增量比I. C. U. International Code Used 国际使用的电码IDB industrial development bond 工业发展债券IDB Inter-American Development Bank 泛美开发银行IDB inter-dealer broker 交易商之间经纪人IDC intangible development cost 无形开发成本IDR international depositary receipt 国际寄存单据IE indirect export 间接出口I. F. insufficient fund 存款不足IFB invitation for bids 招标邀请I. G. imperial gallon 英制加仑IL, I/L import licence 进口许可证ILC irrevocable letter of credit 不可撤销信用证IMF International Monetary Fund 国际货币基金组织imp. import 进口,输入Inc. incorporated 注册(有限)公司incl. inclusive 包括在内incldd. included 已包含在内incldg. including 包含inl. haul inland haulage 内陆运输费用INLO in lieu of 代替Ins, ins. insurance 保险inst. instant 即期、分期付款Instal., instal. installment 分期付款Int., int. interest 利息inv., Inv. invoice 发票、付款通知in trans (I. T.)在(运输)途中inv.doc./attach. invoice with document.nbspattached 附提货单的发票Inv't., invt. inventory 存货I-O input-output 输入--输出IOU I owe you 借据IOV inter-office voucher 内部传票IPN industrial promissory note 工业汇票IPO initial public offering 首次发售股票IQ import quota 进口配额IR Inland Revenue 国内税收I. R. inward remittance 汇入款项IRA individual retirement account 个人退休金帐户IRA interest rate agreement 利率协议IRR interest rate risk 利率风险IRR internal rate of return 内部收益率irred. irredeemable 不可赎回的IRS interest rate swap 利率调期IS International System 公制度量衡ISIC International Standard Industrial Classification 国际标准产业分类IT information technology 信息技术IT international tolerance 国际允许误差I/T income tax 所得税ITC investment tax credit 投资税收抵免ITO International Trade Organization 国际贸易组织ITS intermarket trading system 跨市场交易系统IV investment value 投资价值J., Jour. journal 日记帐J. A. (J/A) 联合(共管)帐簿J. D. B. journal day-book 分类日记帐J/F, j/f journal folio 日记帐页数J. V. joint venture 合资经营企业J. V. journal voucher 分录凭单JVC joint venture company 合资公司K. D. knocked down 拆散K. D. knocked down price 成交价格kg kilogram 千克kilom. kilometer 千米kv kilovolt 千伏kw kilowatt 千瓦KWH kilowatt-hour 千瓦小时L listed (securities)(证券)上市L., (Led.) ledger分类帐L. lira 里拉L. liter 公升L. A. (L/A) 授权书L. A. liquid assets 流动资产L. B. letter book 书信备查簿LB licensed bank 许可银行lb pound 磅LC (L/C) 信用证LCL/FCL less than container load/full container load 拼装/整拆LCL/LCL less than container load/less than container load 拼装/拼拆L.& D. loans and discounts 放款及贴现L&D loss and damage 损失和损坏ldg. loading 装(卸)货L/F ledger folio 分类帐页数LG letter of guarantee 保函Li. liability 负债LI letter of interest (intent) 意向书lifo (LIFO) last in,first out 后进先出法L. I. P. (LIP) life insurance policy人寿保险单LIRCs low interest rate currencies 低利率货币L/M list of materials 材料清单LMT local mean time 当地标准时间LRP limited recourse project 有限追索项目LRPF limited recourse project financing 有限追索项目融资i. s. lump sum 一次付款总额i. s. t. local standard time 当地标准时间LT long term 长期Ltd. limited 有限(公司)m million 百万M matured bond 到期的债券M mega- 百万M milli- 千分之一m. meter, mile 米、英里M&A merger & acquisition 兼并收购MA my account 本人帐户Mat. maturity 到期日Max., max maximum 最大量M. B. memorandum book 备忘录MBB mortgage-backed bonds 抵押支持的债券MBO management by objectives 目标管理M/C marginal credit 信贷限额m/c metallic currency 金属货币MCA mutual currency account 共同货币帐户MCP mixed credit program 混合信贷计划M/d months after deposit 出票后......月M. D. maturity date 到期日M. D. (M/D) memorandum of deposit 存款(放)单M. D. malicious damage 恶意损坏mdse. merchandise 商品MEI marginal efficiency of investment 投资的边际效率mem. memorandum 备忘录MERM multilateral exchange rate model 多边汇率模型M. F. mutual funds 共同基金MF mezzanine financing 过渡融资mfg. manufacturing 制造的MFN most favoured nations 最惠国mfrs. manufacturers 制造商mg milligram 毫克M/I marine insurance 海险micro one millionth part 百万分之一min minimum 最低值、最小量MIP monthly investment plan 月度投资计划Mk mark 马克mks. marks 商标mkt. market 市场MLR minimum lending rate 最低贷款利率MLTG medium-and-long-term guarantee 中长期担保M. M. money market 货币市场mm millimeter 毫米MMDA money market deposit account 货币市场存款帐户MMI major market index 主要市场指数MNC multinational corporation 跨(多)国公司MNE multinational enterprise 跨国公司MO (M. O.) meney order 汇票mo. month 月MOS management operating system 经营管理制度Mos. months 月MP market price 市价M/P months after payment 付款后......月MPC marginal propensity to consume 边际消费倾向Mrge.(mtg. ) mortgage 抵押MRJ materials requisition journal 领料日记帐MRO maintenance, repair and operation 维护、修理及操作MRP manufacturer's recommended price 厂商推荐价格MRP material requirement planning 原料需求计划MRP monthly report of progress 进度月报MRR maintenance, repair and replace 维护、修理和替换M/s months of sight 见票后.......月msg message 留言MT medium term 中期M/T mail transfer 信汇mthly monthly 每月MTI medium-term insurance 中期保险MTN medium-term note 中期票据MTU metric unit 米制单位n. net 净值N. A. net assets 净资产n. a not available 暂缺N. A. non-acceptance 不承兑NA not applicable 不可行N. B. nota bene 注意NC no charge 免费N/C net capital 净资本n. d. no date 无日期N. D. net debt 净债务n. d. non-delivery 未能到达ND next day delivery 第二天交割NDA net domestic asset 国内资产净值N.E. net earnings 净收益n. e. no effects 无效n. e. not enough 不足negb. negotiable 可转让的、可流通的Neg. Inst., N. I. negotiable instruments 流通票据nego. negotiate 谈判N. E. S. not elsewhere specified 未另作说明net. p. net proceeds 净收入N/F no fund 无存款NFD no fixed date 无固定日期NFS not for sale 非卖品N. G. net gain 纯收益NH not held 不追索委托N. I. net income 净收益N. I. net interest 净利息NIAT net income after tax 税后净收益NIFO next in, first out 次进先出法nil nothing 无NIM net interest margin 净息差NIT negative income tax 负所得税N. L. net loss 净损失NL no load 无佣金n. m. nautical mile 海里NM no marks 无标记N. N. no name 无签名NNP net national product 国民生产净值NO. (no.)编号、号数no a/c no account 无此帐户NOP net open position 净开头寸NOW a/c negotiable order of withdrawal 可转让存单帐户N/P net profit 净利NP no protest 免作拒付证书N. P. notes payable 应付票据NPC nominal protection coefficient 名义保护系数NPL non-performing loan 不良贷款NPV method net present value method 净现值法N. Q. A. net quick assets 速动资产净额NQB no qualified bidders 无合格投标人NR no rated (信用)未分等级N/R no responsibility 无责任N. R. notes receivable 应收票据N. S. F. (NSF) no cufficient fund存款不足NSF check no sufficient fund check 存款不足支票nt. wt. net weight 净重NTA net tangible assets 有形资产净值NTBs non-tariffs barriers 非关税壁垒ntl no time lost 立即NTS not to scale 不按比例NU name unknown 无名N. W. net worth 净值NWC net working capital 净流动资本NX not exceeding 不超过N. Y. net yield 净收益NZ$ New Zealand dollar 新西兰元o order 订单o. (O.) offer发盘、报价OA open account 赊帐、往来帐o/a on account of 记入......帐户o. a. overall 全面的、综合的OAAS operational accounting and analysis system 经营会计分析制OB other budgetary 其他预算O. B. ordinary business 普通业务O. B. (O/B) order book订货簿OB/OS index overbought/oversold index 超买超卖指数OBV on-balance volume 持平数量法o. c. over charge 收费过多OC open cover 预约保险o/d, o. d.,(O. D.) overdrawn透支OD overdraft 透支O/d on demand 见票即付O. E. (o. e. ) omission excepted遗漏除外O. F. ocean freight 海运费OFC open for cover 预约保险O. G. ordinary goods 中等品O. G. L. Open General License 不限额进口许可证OI original issue 原始发行OII overseas investment insurance 海外投资保险ok. all correct 全部正确o. m. s. output per manshift 每人每班产量O. P. old price 原价格O. P. open policy 不定额保险单opp opposite 对方opt. optional 可选择的ord. ordinary 普通的OS out of stock 无现货O/s outstanding 未清偿、未收回的O. T. overtime 加班OTC over-the -counter market 市场外交易市场OVA overhead variance analysis 间接费用差异分析OW offer wanted 寻购启示OWE optimum working efficiency 最佳工作效率oz ounce(s)盎司ozws. otherwise 否则p penny; pence; per 便士;便士;每P paid this year 该年(红利)已付p. pint 品托(1/8加仑)P.A. particular average; power of attorney 单独海损;委托书P.A. personal account; private account 个人账户、私人账户p.a., per ann. per annum 每年P&A professional and administrative 职业的和管理的P&I clause protection and indemnity clause 保障与赔偿条款P&L profit and loss 盈亏,损益P/A payment of arrival 货到付款P/C price catalog; price current 价格目录;现行价格P/E price/earning 市盈率P/H pier-to-house 从码头到仓库P/N promissory note 期票,本票P/P posted price (股票等)的牌价PAC put and call 卖出和买入期权pat. patent 专利PAYE pay as you earn 所得税预扣法PAYE pay as you enter 进入时支付PBT profit before taxation 税前利润pc piece; prices 片,块;价格pcl. parcel 包裹pd paid 已付per pro. per procurationem (拉丁)由...代理PF project finance 项目融资PFD preferred stock 优先股pk peck 配克(1/4蒲式耳)PMO postal money order 邮政汇票P.O.C. port of call 寄航港,停靠地P.O.D. place of delivery 交货地点P.O.D. port of destination; port of discharge 目的港;卸货港P.O.R. payable on receipt 货到付款P.P. payback period (投资的)回收期P.P.I. policy proof of interest 凭保证单证明的保险利益POE port of entry 报关港口POP advertising point-of-purchase advertising 购物点广告POR pay on return 收益PR payment received 付款收讫PS postscript 又及PV par value; present value 面值;现值q. quarto 四开,四开本Q. quantity 数量QB qualified buyers 合格的购买者QC quality control 质量控制QI quarterly index 季度指数qr. quarter 四分之一,一刻钟QT questioned trade 有问题交易QTIB Qualified Terminal Interest Property Trust 附带可终止权益的财产信托quad. quadruplicate 一式四份中的一份quotn. quotation 报价q.v. quod vide (which see)参阅q.y. query 查核R option not traded 没有进行交易的期权R. response; registered; return 答复;已注册;收益r. rate; rupee; ruble 比率;卢比;卢布RAD research and development 研究和开发RAM diverse annuity mortgage 逆向年金抵押RAN revenue anticipation note 收入预期债券R&A rail and air 铁路及航空运输R&D research and development 研究与开发R&T rail and truck 铁路及卡车运输R&W rail and water 铁路及水路运输R/A refer to acceptor 洽询(汇票)承兑人R/D refer to drawer (银行)洽询出票人RB regular budget 经常预算RCA relative comparative advantage 相对比较优势RCMM registered competitive market maker 注册的竞争市场自营商rcvd. received 已收到r.d. running days=consecutive days 连续日RDTC registered deposit taking company 注册接受存款公司Re. subject 主题re. with reference to 关于RECEIVED B/L received for shipment bill of lading 待装云提单REER real effective exchange rate 实效汇率ref. referee; reference; refer(red)仲裁者;裁判;参考;呈递REO real estate owned 拥有的不动产REP import replacement 进口替代REP Office representative office 代办处,代表处REPO, repu, RP Repurchase Agreement 再回购协议req. requisition 要货单,请求REVOLVER revolving letter of credit 循环信用证REWR read and write 读和写RIEs recognized investment exchanges 认可的投资交易(所)Rl roll 卷RLB restricted license bank 有限制牌照银行RM remittance 汇款rm room 房间RMB RENMINBI 人民币,中国货币RMS Royal Mail Steamer 皇家邮轮。

财务英文缩写二、财管英文意思1、 ACF Annuity compound factor2、 ADF Annuity discounted factor3、 PVIFA Present-Value Interest Factors of Annuity4、 FVIFA Future-Value Interest Factors of Annuity5、XFVA X可能是先付年金的声母(没有查到具体出处)Future-Value of Annuity6、XPVA X可能是先付年金的声母(没有查到具体出处)Present-Value of Annuity7、 RA relavant asset8、 RL relavant liability9、 RE Retained Earnings10、 DOL Degree of Operational Leverage11、 DFL Degree of Financial Leverage12、 DCL Degree of Combined Leverage13、 DTL Degree of Total Leverage14、 EBIT Earnings before interest and tax15、 EAT Earnings after tax16、 EPS Earnings per share17、 NDR Net debt ratio18、 NPV Net present value19、 NCF Net cash flow20、 CFAT Cash flow after tax21、 PI Profitability index22、 ANPV Average of Net present value23、 JIT Just-in-time24、 CD(现金折扣百分比但是不知道单词) cash discount25、 SP 这个是市销率PS吧:price to sales26、 FCFF Free Cash Flow for the Firm27、DQⅡ(在理财杂志上看到的一种工具)28、 ETF(买卖基金) exchange traded fund29、 IPO Initial Public Offering30、 PE price per share/earnings per share31、 PE/VC Private Equity私募股权/ Venture Capital风险投资32、 ISM(制造业指数) institute for supply management33、 PMI(采购经理人指数)Purchasing Manager's Index财管英文简称对照1、利息Iinterest(n.兴趣,关心,重要性,影响,利息, [常pl.]利益,利害) 2、现值Ppresent value(adj.现在的,出席的,当面的)3、终值Ffinal value(adj.最后的,最终的,决定性的)4、天数、期数Nnumber(n.数,数字,数量,号码,算术,诗,韵律、v.遍号码,共计……,计入,计算,算入)5、年金Aannuity(n.年金,养老金,年金享受权)6、概率Pprobability(n.可能性,或然性,概率)7、期望值Eexpectation(n.期待,预料,指望,展望, [数]期望(值))8、变动资产Aasset(n.资产,有用的东西)9、变动负债Bdebt(n.债务,罪过)10、销售额Ssale(n.出售,卖出,贱卖,廉价出售,销路,销售额)11、销售净利润Pprofit(n.利润,益处,得益)12、收益留存比率Eearning (n.所赚的钱,收入)13、香港上市的股票H股/纽约上市的股票N股Hongkong (香港)、New York (纽约)14、现金折扣CD其中的C是指:cash(n.现金)、其中的D是指:discount (n.折扣) 15、债券成本的计算公式其中的K是指:key(n.钥匙,关键,解答,要害等)、其中的b 是指:bond(n.结合(物),粘结(剂),联结,公债,债券,合同)、其中的T 是指:tax(n.税,税款,税金)、其中的f是指:fee (n.费(会费、学费、手续费等),酬金)、其中的i是指利息,注解同第1条16、银行借款成本的计算公式其中的L是指:lend(v.借给,贷(款))、其它字母的注解同上文所指 17、优先股成本的计算公式其中的D是指:dividend (n.被除数,股息,红利,额外津贴,奖金,年息)、其中的P是指:preferred stock(n.<美>优先股)。

相关财务指标英文缩写PE:市盈率(Price to Earning Ratio,简称PE或P/E Ratio) ,也称本益比“股价收益比率”或“市价盈利比率(简称市盈率)”。

PE =股价(PRICE)/ 每股净利(EARNING PER SHARE)PB称为市净率,也就是市价除以每股净资产;平均市净率=股价/账面价值。

其中,账面价值=总资产-无形资产-负债-优先股权益。

可以看出,所谓账面价值是公司解散清算的价值。

如果公司要清算,那么先要还债,无形资产则将不复存在,而优先股的优先权之一就是清算的时候先分钱,但是本股市没有优先股。

这样,用每股净资产来代替账面价值,则PB就是大家理解的市净率,即:PB(市净率)=股价/每股净资Ebit:息税前利润Ebitda:税息折旧及摊销前利润EBITDA=营业利润(EBIT)+ 折旧费用+ 摊销费用ROA:英文全称:Return On Assets资产收益率公式:资产收益率(ROA)=税后净收入/总资产ROE英文全称:Rate of Return on Common Stockholders’ Equity (ReturnOn Equity)净资产收益率ROE=净利润/股东权益=净利润/销售收入*销售收入/资产*资产/股东权益可写为:股东权益收益率=销售利润率*资产周转率*财务杠杆(财务杠杆指权益乘数,即资产/权益)COE:为股权成本率;COE的计算公式为:无风险收益率+市场风险溢价×贝它值。

PE/G是预期市盈率,市盈率与业绩增长率之比”也就是市价除以今年预期每股收益。

因为当前只能知道上一年的每股收益,所以今年预期每股收益可能不同的研究员预期的不一样,相应的PE/G也就不一样。

但PB、PE是不会不一样的。

EPS是指每股收益。

每股收益又称每股税后利润、每股盈余,是分析每股价值的一个基础性指标。

传统的每股收益指标计算公式为:每股收益=期末净利润÷期末总股本。

每股收益突出了分摊到每一份股票上的盈利数额,是股票市场上按市盈率定价的基础。

如果一家公司的净利润很大,但每股盈利却很小,表明它的业绩背过分稀释,每股价格通常不高。

St股:Special TreatmentR 缩写,意即“特别处理”。

该政策针对的对象是出现财务状况或其他状况异常的上市公司。

PT股“PT”的英语 Particular Transfer(意为特别转让)的缩写。

这是旨在为暂停上市股票提供流通渠道的“特别转让服务”。

对于进行这种"特别转让"的股票,沪深交易所在其简称前冠以“PT”,称之为“PT股” 。

A股的正式名称是人民币普通股票。

它是以人民币计价,面对中国公民发行且在境内上市的股票;B股的正式名称是人民币特种股票。

它是以人民币标明面值,以外币认购和买卖,在境内(上海、深圳)证券交易所上市交易的股票;H股,即注册地在内地、上市地在香港的外资股。

香港的英文是Hong Kong,取其字首,在港上市外资股就叫做H股。

此外,还有N股、S股的称呼。

因纽约的第一个英文字母是N,新加坡的第一个英文字母是S,在纽约和新加坡上市的股票就分别叫做N股和S股。

沪(上海)市挂牌B股以美元计价,深(深圳)市B 股以港元计价。

ECI是就业成本指数NNP:(Net National Product)简单地说,NNP=GNP-折旧。

NI(National Income) is the income earned by the factors of production。

简单地说,国民收入NI=NNP-间接税和企业转移支出+政府对企业补贴。

PI(Personal Income) is the income received by households。

简单地说,个人收入PI=NI-挣到但没有收到的收入+收到的但不是挣到的收入(政府对私人的转移支出)。

DPI(Disposable Personal Income) is income remaining after payingpersonal income taxes。

简单地说,DPI=PI-所得税=个人消费C+个人储蓄S。

CPI(Consumer’s Price Index),消费者价格指数PPI(Producer’s Price Index),生产者价格指数ICR:利息支付倍数Interest Coverage RatioGNP缩减指数(GNP Deflator)。

DOL: Degree of Operating Leverage 经营杠杆DFL: Degree of Financial Leverage 财务杠杆DCL: Degree of Combined Leverage 复合杠杆EBIT:earnings before interest and tax 息税前利润ROI: return on investment 投资收益率NPV: net present value 净现值NPVR: net present value rate 净现值率Cov: covariance 协方差CPI 消费者物价指数PPI(英文全称Producer Price Index):生产者物价指数,GNP(英文全称Gross National Product):国民生产总值,GDP gross domestic product的缩写,也就是国内生产总值,ETF Exchange Traded Fund的英文缩写,中译为“交易型开放式指数基金”,又称交易所交易基金。

LOF:“listed open-ended fund”,中文称为“上市开放式基金”,LME 伦敦金属交易所(London Metal Exchange)N.N.P(英文全称Net National Product):国民生产净值,N.I(英文全称National Income):国民收入,BVPS,英文Book Value Per Share的缩写,每股帐面净值,等于股东权益除以已发行股数。

EVA是经济增加值(Economic & Value Added)的英文缩写。

从算术角度说,EVA 等于税后经营利润减去债务和股本成本,是所有成本被扣除后的剩余收入(Residual income)。

EVA 是对真正 "经济"利润的评价,或者说,是表示净营运利润与投资者用同样资本投资其他风险相近的有价证券的最低回报相比,超出或低于后者的量值。

EVA是股东衡量利润的方法投资报酬率ROI 净现值NPV 净现值率NPVP获利指数PI 内部收益率IRR公司相关部门英文缩写MIS 杂项收入GL 总账会计TAX 政府税FIN 财务部B&D business and development 业务拓展部Marketing 市场部Sales 销售部HR 人力资源部Account 会计部PR people relationship 公共关系部OFC (Office, 但不常见) / OMB = Office of Management and Budget 办公室Finance 财务部MKTG (Marketing) 市场部R&D (Research & Development) 研发部MFG (Manufacturing) 产品部Administration Dept. 管理部Purchasing Dept 采购部Chairman/President Office // Gerneral Manager office or GM office 总经理办公室Monitor & Support Department 监事会Strategy Research 战略研究部资产负债表相关英文翻译l 资产负债表 Balance Sheet资产 ASSETS流动资产: Current asset货币资金 Cash(currency fund)Bank短期投资 Short-term investment应收票据 Notes receivable应收股利 Dividends receivable应收利息 Interests receivable应收账款 Accounts receivable其他应收款 Other receivable预付账款 Advances to suppliers应收补贴款 Subsidies receivable存货 Inventories待摊费用 Prepaid expenses一年内到期的长期债券投资 Long-term investments maturing within one year 其他流动资产 Other current assets流动资产合计 Total current assets长期投资: LONG TERM INVESTMENTS长期股权投资 Long-term equity investment长期债权投资 Long-term debt investment长期投资合计 Total long term investment固定资产: FIXED ASSETS:固定资产原值 Fixed assets-cost减:累计折旧 Less:Accumulated depreciation固定资产净值 Fixed assets-net value减:固定资产减值准备 Less: Impairment of fixed assets固定资产净额 Fixed assets-book value工程物资 Materials for projects在建工程 Construction in progress固定资产清理 Disposal of fixed assets固定资产合计 Total Fixed Assets无形资产及其它资产 INTANGIBLE ASSETS AND OTHER ASSETS:无形资产 Intangible assets长期待摊费用 Long-term deferred expenses其他长期资产 Other long-term assets无形资产及其他资产合计 Total intangible assets and other assets递延税项 Deferred tax递延税款借项 Deferred tax debit资产总计 TOTAL ASSETSl 负债及所有者权益(或股东权益) LIABILITIES AND OWNER`S EQUITY流动负债: CURRENT LIABILITIES短期借款 Short-term loans应付票据 Notes payable应付账款 Accounts payable预收账款 Advances from customers应付工资 Accrued payroll应付福利费Accrued Employee’s welfare expenses应付股利 Dividends payable未交税金 Taxes payable其他应交款 Other taxes and expenses payable其他应付款 Other payables预提费用 Accrued expenses预提负债 Provisions一年内到期的长期负债 Long-term liabilities due within one year其他流动负债 Other current liabilities流动负债合计 Total current liabilities长期负债: LONG-TERM LIABILITIES:长期借款 Long-term loans应付债券 Bonds payable长期应付款 Long-term accounts payable专项应付款 Specific accounts payable其他长期负债 Other long-term liabilities长期负债合计 Total long-term liabilities递延税项: Deferred tax递延税款贷项 Deferred tax credit负债合计 Total other liabilities所有者权益:(或股东权益) OWNER`S EQUITY实收资本(或股本) Paid-in capital减:已归还投资 Less:Investments returned实收资本(或股本)净额 Paid-in capital-net资本公积 Capital surplus盈余公积 Surplus from profits其中:法定公益金 Including:statutory public welfare fund未分配利润 Undistributed profit所有者权益(或股东权益)合计 Total owner`s equity负债及所有者权益(或股东权益)合计 TOTAL LIABILITIES AND OWNER`S EQUITYl 损益表 Profit and Loss Statement 项目 ITEMS一、营业收入 Income from main减:营业成本 Less:Cost of main operation营业税金及附加 Tax and additional expense二、经营利润 Income from main operation加:其他业务利润 Add:Income from other operation 减:营业费用 Less:Operating expense管理费用 General and administrative expense财务费用 Financial expense三、营业利润 Operating Income加:投资收益 Add:Investment income补贴收入 Income from subsidies营业外收入 Non-operating income减:营业外支出 Less:Non-operating expense四、利润总额 Income before tax减:所得税 Less:Income tax五、净利润 NET INCOME。