表外负债

- 格式:pptx

- 大小:52.47 KB

- 文档页数:6

Finance金融视线0342019年6月 DOI:10.19699/ki.issn2096-0298.2019.12.034浅谈企业资产负债表外融资河南省进口物资公共保税中心集团有限公司 孙思思摘 要:资金对于企业的生产、发展、运转就像是流淌的血液,为保证足够的资金链,企业往往离不开融拢资金的需求,而针对企业资产负债表外的融资,往往存在一些问题和不规范之处,在制度和准则的约束下,虽然在不断规范,但结合实际,还是有很多问题以及可预见的风险因素。

因此,本文结合个人工作具体,结合当前企业、单位、金融机构等团体实际,从当下实际出发,结合企业、单位、金融机构等团体的具体操作执行情况,理论联系实际,浅析企业资产负债表外的融资问题及浅谈解决问题的具体方法措施。

关键词:资产负债表外融资 制度准则 实际操作 风险控制中图分类号:F832 文献标识码:A 文章编号:2096-0298(2019)06(b)-034-021 企业资产负债表外融资概述资金链就像是企业运转流动的血液,融资是企业发展、运作、连续资金链的重要方式。

管理者通过对自身经营情况的评估把握,按照对企业未来发展计划和规划,采用一定的方式从投资机构或个人获取相应的资金,进而将其运用到项目运行与扩大生产中来。

随着我国经济的持续快速发展,投资机构与企业、企业与企业之间的合作发展方式种类越来越多,在开展业务的过程中,传统单一的合作模式已经不能够完全满足新时代下企业的发展需求,从而不断产生了新的合作形式,而资产负债表外融资是非常具有代表性的一种,也是使用最为广泛的方式方法之一。

资产负债表外融资是指不需列入企业资产负债表中的融资行为。

有一种说法是,企业所采取的融资行为,通过利用法律以及会计准则的空白点,无需在资产负债表上反映此行为。

另一种说法是,公司开展的融资活动,在资产负债表中,既不增加也不减少。

而究其实质是,根据适用于现有企业的会计惯例,企业保持所需资产的使用,通过各种协议或其他方式达到目的,或为此目的维持相同的资产。

我国地方政府表外负债的相关问题研究作者:陈红黎锐来源:《商业会计》2015年第13期摘要:近些年来,随着我国经济体制改革的不断深入,地方政府债务规模不断加大,再加上西方国家债务危机的爆发,我国政府对债务也越来越重视。

表外负债作为地方政府债务中比例较大的一部分,对于地方债务信息的披露和管理起着举足轻重的作用。

鉴于此,本文将基于表外负债的角度对地方政府债务信息的相关问题进行研究,并对地方政府提出改革意见,以提高地方政府会计信息的透明度和决策有用程度。

关键词:地方政府债务 ;表外负债会计信息一、引言自改革开放以来,我国各项社会事业蓬勃发展,工业化和城镇化的进程日新月异,其间由地方建设的剧增带来的地方政府的融资需求也大幅度增长,造成了大量的地方政府债务。

我国现行的《中华人民共和国预算法》中明确要求地方政府财政做到收支平衡,另外,除了国务院批准的特殊几个地区外,其他地方政府不得发行政府债券。

为了防止地方政府出现行政经费亏空的状况,现行的《中华人民共和国担保法》明确规定国家行政机关不得对外提供担保。

但实际上几乎所有的地方政府都没有遵循国家制定的再担保和政府贷款的禁令,规避法律约束的后果是形成了大量的地方政府债务,其中还有较大比例的隐性债务。

一般认为,规模适中的地方政府债务,可以提高当地公共服务水平和质量,推动地方经济发展。

但是如果规模过大,就会影响其履行行政职能,同时带来财政风险,进而影响国家的财政状况。

2013年12月30日,国家审计署公布的全国政府性债务审计结果显示,截至2013年6月底,地方政府性债务余额178 908.66亿元,比2010年末的数字增长了40%,其中14.9%是政府负有担保责任的债务总额,24.25%是政府可能要承担救助责任的债务总额,表外负债占总地方政府债务的比例为39.15%。

这一结果的公布引起了国内外广泛的关于中国地方政府性债务的讨论,更有学者提出地方政府债务问题与房地产泡沫将成为引发我国经济危机的主要推手。

资产负债表外融资若干方面的探究一、资产负债表外融资理论概述资产负债表外融资,简称表外融资,是指不需列入资产负债表的融资方式,即该项融资既不在资产负债表的资产方表现为某项资产的增加,也不在负债及所有者权益方表现为负债的增加。

狭义是指:未满足资本租赁全部条件,从而其承诺付款的金额的现值没有被确认为负债,而且未在资产负债表或附注中得以反映的租赁进行筹资的财务行为。

广义是指:表外融资泛指对企业经营成果、财务状况和现金流量产生重大影响的一切不纳入资产负债表的融资行为。

二、企业表外融资的主要形式分析1.租赁租赁是一种传统的表外融资方式。

由于租赁分为经营租赁和融资租赁两类,其中只有经营租赁被视为一种合理合法的表外融资方式。

因此,承租人往往会绞尽脑汁地与出租人缔结租赁协议,想方设法地进行规避,使得实质上是融资租赁的合同被视为经营租赁进行会计处理,以获得表外融资的好处。

2.合资经营合资经营是指一个企业持有其他企业相当数量,但未达到控股程度的经营方式,后者被称为未合并企业。

人们通过在未合并企业中安排投资结构,从事表外业务,尽可能地获得完全控股的好处,而又不至于涉及合并问题,不必在资产负债表上反映未合并企业的债务。

还有一种流行的形式叫特殊目的实体,即一个企业作为发起人成立一个新企业,后者被称为特殊目的实体,其经营活动基本上是为了服务于发起人的利益而进行的。

3.资产证券化资产证券化是指将缺乏流动性,但能够产生可预见的稳定现金流的资产,通过一定的结构安排,进而转换为在金融市场上可以出售和流通的证券的过程。

证券化融资业务通常是对银行的信贷资产、企业的交易或服务应收款这类金融资产进行证券化的业务。

证券化作为企业的一种有效的表外融资方式,最近几年在美国非常流行,并且无论是在证券化的金融资产种类上还是在价值量上都得到了发展。

4.创新金融工具当前是创新金融工具大爆炸时期,这些金融工具包括掉期、嵌入期权、复合期权、上限期权、下限期权、上下取胜权等。

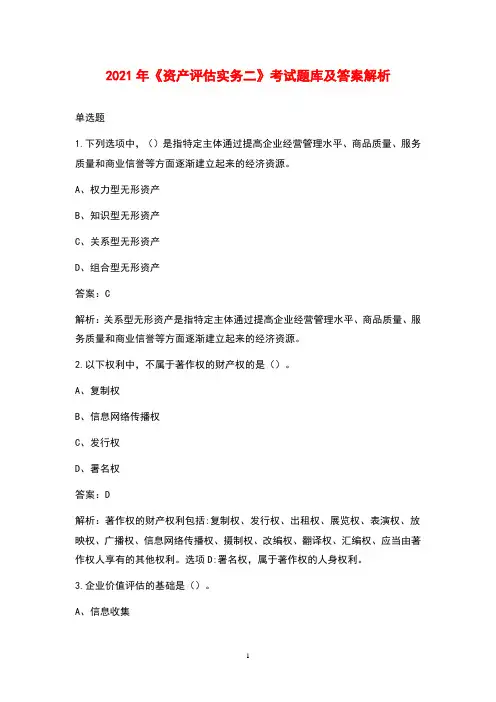

2021年《资产评估实务二》考试题库及答案解析单选题1.下列选项中,()是指特定主体通过提高企业经营管理水平、商品质量、服务质量和商业信誉等方面逐渐建立起来的经济资源。

A、权力型无形资产B、知识型无形资产C、关系型无形资产D、组合型无形资产答案:C解析:关系型无形资产是指特定主体通过提高企业经营管理水平、商品质量、服务质量和商业信誉等方面逐渐建立起来的经济资源。

2.以下权利中,不属于著作权的财产权的是()。

A、复制权B、信息网络传播权C、发行权D、署名权答案:D解析:著作权的财产权利包括:复制权、发行权、出租权、展览权、表演权、放映权、广播权、信息网络传播权、摄制权、改编权、翻译权、汇编权、应当由著作权人享有的其他权利。

选项D:署名权,属于著作权的人身权利。

3.企业价值评估的基础是()。

A、信息收集B、信息整理C、信息对比D、信息评价和归纳答案:A解析:信息收集是企业价值评估的基础。

4.下列各项中不得成为普通合伙人的是()。

A、国有独资公司B、有限合伙企业C、普通合伙企业D、个人独资企业答案:A解析:国有独资公司、国有企业、上市公司以及公益性的事业单位、社会团体不得成为普通合伙人。

5.以收益率形成过程的多因子模型为基础,认为证券收益率与一组因子线性相关,这组因子代表资产收益率的一些基本因素,且假设均衡中的资产收益取决于多个不同的外生因素。

该测算股权资本成本的方法是()。

A、资本资产定价模型B、套利定价模型C、三因素模型D、风险累加法答案:B解析:套利定价模型(APT)是由罗斯(StephenA.Ross)于1976年提出的,该模型以收益率形成过程的多因子模型为基础,认为证券收益率与一组因子线性相关,这组因子代表资产收益率的一些基本因素,且假设均衡中的资产收益取决于多个不同的外生因素。

6.甲企业以一项先进的技术向乙企业投资,该技术的重置成本为200万元,乙企业拟投入的资产重置成本为4000万元,甲企业无形资产成本利润率为500%,乙企业拟合作的资产原利润率为25%,则无形资产投资的分成率为()。

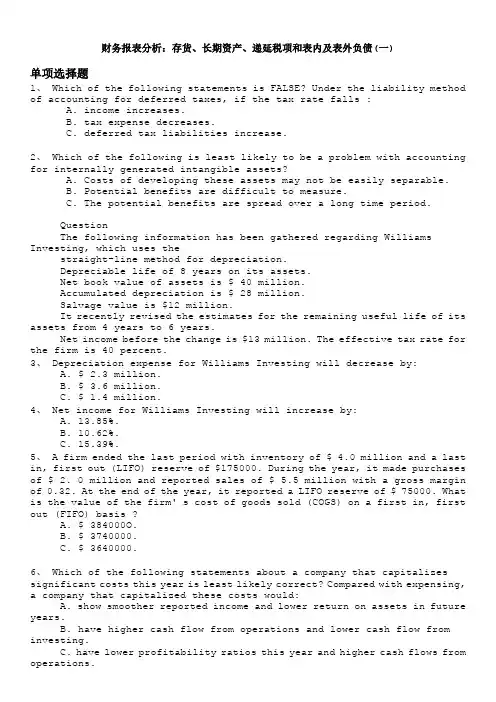

财务报表分析:存货、长期资产、递延税项和表内及表外负债(一)单项选择题1、 Which of the following statements is FALSE? Under the liability method of accounting for deferred taxes, if the tax rate falls :A. income increases.B. tax expense decreases.C. deferred tax liabilities increase.2、 Which of the following is least likely to be a problem with accounting for internally generated intangible assets?A. Costs of developing these assets may not be easily separable.B. Potential benefits are difficult to measure.C. The potential benefits are spread over a long time period.QuestionThe following information has been gathered regarding Williams Investing, which uses thestraight-line method for depreciation.Depreciable life of 8 years on its assets.Net book value of assets is $ 40 million.Accumulated depreciation is $ 28 million.Salvage value is $12 million.It recently revised the estimates for the remaining useful life of its assets from 4 years to 6 years.Net income before the change is $13 million. The effective tax rate for the firm is 40 percent.3、 Depreciation expense for Williams Investing will decrease by:A. $ 2.3 million.B. $ 3.6 million.C. $ 1.4 million.4、 Net income for Williams Investing will increase by:A. 13.85%.B. 10.62%.C. 15.39%.5、 A firm ended the last period with inventory of $ 4.0 million and a last in, first out (LIFO) reserve of $175000. During the year, it made purchases of $ 2. 0 million and reported sales of $ 5.5 million with a gross margin of 0.32. At the end of the year, it reported a LIFO reserve of $ 75000. What is the value of the firm' s cost of goods sold (COGS) on a first in, first out (FIFO) basis ?A. $ 384000O.B. $ 3740000.C. $ 3640000.6、 Which of the following statements about a company that capitalizes significant costs this year is least likely correct? Compared with expensing, a company that capitalized these costs would:A. show smoother reported income and lower return on assets in future years.B. have higher cash flow from operations and lower cash flow from investing.C. have lower profitability ratios this year and higher cash flows from operations.7、 Which of the following situations will most likely require a company to record a valuation allowance on its balance sheet?A. To report depreciation, a firm uses the double-declining balance method for tax purposes and the straight-line method for financial reporting purposes.B. A firm with deferred tax assets expects an increase in the tax rate.C. A firm is unlikely to have future taxable income that would enable it to take advantage of deferred tax assets.8、 The best way to compute an inventory turnover ratio is to use:A. LIFO for COGS and FIFO for average inventory.B. FIFO for both COGS and average inventory.C. LIFO for both COGS and average inventory.9、 During periods of rising prices and stable or growing inventories, the most informative inventory accounting method for income statement purposes is:A. FIFO because it allocates historical prices to cost of good sold (COGS) and provides a better measure of current income.B. LIFO because it allocates historical prices to cost of good sold (COGS) and provides a better measure of current income.C. LIFO because it allocates current prices to cost of good sold (COGS) and provides a better measure of current income.10、 TY Corp. is a manufacturing firm with a reputation for very aggressive financial management. The company has a very high ROE of 28 percent and a spectacular return on assets of 42 percent.Which of the following is the most likely explanation of these ratios? TY Corp. :A. has just started using accelerated depreciation methods.B. leases most of its fixed assets.C. does not capitalize most of its product development costs.11、 Ralph & Sons, Inc., uses the straight-line method of depreciation for its long-lived assets. After a recent meeting with the independent accountants where industry depreciation practices were discussed, Ralph decided to switch to the double-declining balance method. In the year in which the switch occurs, Ralph should report this change as:A. a change in accounting principle and report its effect on prior period results as a non-recurring item, net of tax.B. an accounting error and directly adjust retained earnings.C. a change in accounting principle and report its effect on prior earnings as part of operating earnings.12、 Selected financial data from Krandall, Inc. ' s balance sheet for theassumption. The tax rate is 40 percent. If Krandall used first in, first out (FIFO) instead of LIFO and paid any additional tax due, its assets-to-equity ratio would be closest to:A. 4.06.B. 3.63.C. 3.73.13、 A company issued a bond with a face value of $ 67831, maturity of 4 years, and 7 percent coupon, while the market interest rates are 8 percent.What is the unamortized discount when the bonds are issued?A. $498.58.B. $ 15726.54.C. $ 2246. 65.14、 Lakeside Co. recently determined that one of its processing machines has become obsolete three years early and, unexpectedly, has no salvage value. Which of the following statements is most consistent with this discovery?A. Historically, economic depreciation was understated.B. Lakeside Co. will owe back taxes.C. Historically, economic depreciation was overstated.15、 In 2005, Carpet Company decides to change from the straight-line method of depreciation to the sum of the year' s digits method. The followingA. $ 400000 depreciation expense in the 2005 income statement and $ 800000 separately as a change in accounting principle net of taxes.B. $ 500000 depreciation expense in the 2005 income statement and $ 700000 separately as a change in accounting principle net of taxes.C. $1200000 depreciation expense in the 2005 income statement and include a footnote of explanation including the tax effect.16、 Annual interest expense is the:A. sum of the annual coupon payments.B. amount paid to creditors in excess of par.C. book value of the debt times the market interest rate when it was issued.17、 Selected information from the financial statements of Salvo Company for。

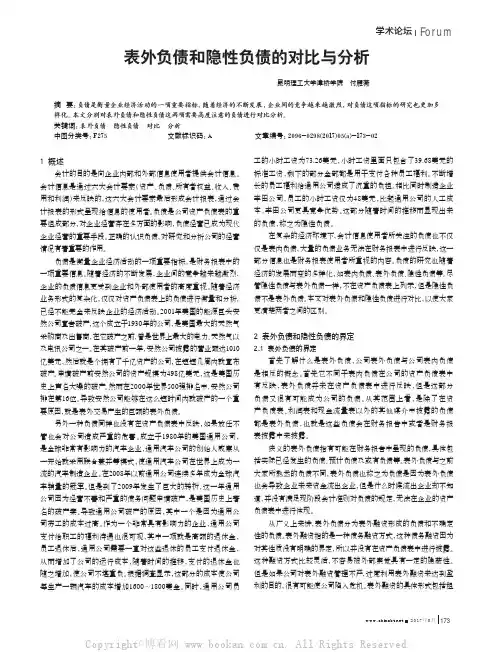

Forum学术论坛 2017年5月173表外负债和隐性负债的对比与分析昆明理工大学津桥学院 付雁薇摘 要:负债是衡量企业经济活动的一项重要指标,随着经济的不断发展,企业间的竞争越来越激烈,对负债这项指标的研究也更加多样化。

本文分别对表外负债和隐性负债这两项需要高度注意的负债进行对比分析。

关键词:表外负债 隐性负债 对比 分析中图分类号:F275 文献标识码:A 文章编号:2096-0298(2017)05(a)-173-021 概述会计的目的是向企业内部和外部信息使用者提供会计信息。

会计信息是通过六大会计要素(资产、负债、所有者权益、收入、费用和利润)来反映的,这六大会计要素最后形成会计报表,通过会计报表的形式呈现给信息的使用者。

负债是公司资产负债表的重要组成部分,对企业经营存在多方面的影响,负债经营已成为现代企业经营的重要手段。

正确的认识负债,对研究和分析公司的经营情况有着重要的作用。

负债是衡量企业经济活动的一项重要指标,是财务报表中的一项重要信息。

随着经济的不断发展,企业间的竞争越来越激烈,企业的负债信息更受到企业和外部使用者的高度重视。

随着经济业务形式的复杂化,仅仅对资产负债表上的负债进行衡量和分析,已经不能完全来反映企业的经济活动。

2001年美国的能源巨头安然公司宣告破产,这个成立于1930年的公司,是美国最大的天然气采购商及出售商,在它破产之前,曾是世界上最大的电力、天然气以及电讯公司之一。

在其破产前一年,安然公司披露的营业额达1010亿美元,然后就是个拥有了千亿资产的公司,在短短几周内就宣布破产。

申请破产前安然公司的资产规模为498亿美元,这是美国历史上声名大噪的破产。

然而在2000年世界500强排名中,安然公司排在第16位。

导致安然公司能够在这么短时间内就破产的一个重要原因,就是表外交易产生的巨额的表外负债。

另外一种负债同样也没有在资产负债表中反映,如果放任不管也会对公司造成严重的危害。

上市公司表外负债相关问题研究摘要:随着经济业务形式的复杂化,上市公司对表外负债运用越来越广泛。

表外负债是一把双刃剑,在给公司带来收益的同时也可能产生各种经济后果,因此我们应该高度重视表外负债。

本文结合风险运用表外负债不当产生的严重后果,分析了表外负债存在的问题,并在此基础上对其问题提出政策建议。

关键词:表外负债;风险信息披露一、表外负债界定1.内涵界定主要是指那些已经或有可能成为公司的负债,但根据现有制度规定和会计准则及其他因素的影响未能反映在公司的资产负债表中的负债。

从内容上,表外负债包括表外筹资形成的负债和不确定性的负债。

从范围上,指的是在三大会计主表之外披露的,即披露在财务报表附注和其他财务报告中负债。

公司形成表外负债不一定都是由于蓄意违法的结果,且可能是符合现行法律法规的,即使没有法律法规没有明确规定,但至少也没有其禁止的行为。

另外,公司多数的表外负债是由于从事正常经营活动产生的。

2.外延界定狭义的表外负债指财务报告中潜在的负债,具体包括实际已经发生的负债,预计负债及或有负债等。

由于表外负债的概念与传统意义上的观点不同,虽然它是一种导致未来经济利益流出的负债,但其却很难确认、计量,因而通常不在资产负债表中反映。

广义的表外负债分为表外融资形成的负债和不确定性的负债。

表外融资是指财务报告中在资产负债表之外的一种债务融资方式。

具体形式包括:租赁、资产证券化、售后资产回购、附有追索权的应收状况出售、未合并实体等。

表外融资负债灵活、隐蔽、具风险性的特点,可能会导致公司出现债务危机,而最终走向破产。

不确定性负债指的是有关未来的责任义务,这种负债在未来将出现不确定性。

它的不确定性主要体现在导致的结果、负债的确认和金额的计量上,并且其存在可能会使表外负债的披露成本大大增加,这正是公司和审计人员对不确定性负债回避的原因,从而不披露详细的表外负债信息,对信息使用者的决策产生影响。

二、研究表外负债的意义上市公司财务造假反复证明了表外负债的利润操纵性和隐蔽性,不仅虚增利润误导利益相关者,并可能给上市公司带来破产风险,因此人们越来越迫切地要求表外负债信息披露和风险识别。

表内与表外的解读

1.表内业务就是指在资产负债表上反映的业务。

比如银行存款、贷款等。

一般认为贷款和存款涉及银行资产和负债为表内业务,结算业务不涉及资产负债为表外业务。

2.表外业务是不在资产负债表上反映,但是在一定时期可以转化成资产负债表上的内容的或有负债业务.比如,担保业务、承诺业务。

表外业务也称为中间业务。

表外业务一般包括以下三种类型:

1)担保类业务,是指商业银行接受客户的委托对第三方承担责任的业务,包括担保(保函)、备用信用证、跟单信用证、承兑等。

2)承诺业务,是指商业银行在未来某一日期按照事先约定的条件向客户提供约定的信用业务,包括贷款承诺等。

3)金融衍生交易类业务,是指商业银行为满足客户保值或自身头寸管理等需要而进行的货币(包括外汇)和利率的远期、掉期、期权等衍生交易业务。

3. 中信银行赣州分行贷款余额15.71亿元,其中表内融资余额合计10.07亿元,由流动资金贷款7.27亿元、房地产开发贷款2亿元、贸易融资0.8亿元组成;表外融资余额合计5.64亿元,由银行承兑汇票余额3.14亿元、国内信用证2亿元、黄金租赁5000万元组成。

预计负债表外项目减值准备预计负债表外项目减值准备是指企业在编制财务报表时,根据市场环境和经营状况等因素,对负债表外的资产或负债进行减值计提的一种会计处理方式。

这种减值计提是企业为了保障财务报表的真实性和准确性,以及保护投资者的利益而采取的一种措施。

预计负债表外项目减值准备的计提原则是“预计损失原则”,即在财务报表编制日前,如果企业已经发生了可能导致资产或负债价值减少的事件,或者已经存在了可能导致资产或负债价值减少的条件,那么企业应该根据这些情况,预计可能发生的损失,并计提相应的减值准备。

预计负债表外项目减值准备的计提对象包括但不限于以下几种情况:1. 长期股权投资:如果企业持有的股权投资的市场价值低于其账面价值,或者企业已经预计到该股权投资可能存在的风险和损失,那么企业应该计提相应的减值准备。

2. 长期应收款项:如果企业持有的应收款项的市场价值低于其账面价值,或者企业已经预计到该应收款项可能存在的风险和损失,那么企业应该计提相应的减值准备。

3. 存货:如果企业持有的存货的市场价值低于其账面价值,或者企业已经预计到该存货可能存在的风险和损失,那么企业应该计提相应的减值准备。

4. 长期债权投资:如果企业持有的债权投资的市场价值低于其账面价值,或者企业已经预计到该债权投资可能存在的风险和损失,那么企业应该计提相应的减值准备。

总之,预计负债表外项目减值准备是企业为了保障财务报表的真实性和准确性,以及保护投资者的利益而采取的一种措施。

企业应该根据市场环境和经营状况等因素,对负债表外的资产或负债进行减值计提,以反映其真实价值和风险水平。

同时,企业应该遵守会计准则和相关法律法规的规定,确保减值计提的合理性和合法性。

单式记账法核算所有金融企业会计的表外科目金融企业会计的表外科目是指在会计报表中没有直接体现的资产、负债、所有者权益和收入、费用等项目。

这些科目虽然不在会计报表中直接体现,但对于金融企业的经营状况和财务状况具有重要影响。

本文将以单式记账法为基础,对金融企业会计的表外科目进行核算和分析。

一、资产类表外科目1. 无形资产:包括商誉、专利权、商标权等无形资产。

这些资产虽然在会计报表中没有具体体现,但对金融企业的价值和经营能力具有重要影响。

2. 投资性房地产:金融企业投资的房地产,如租赁物业、投资房产等。

这些房地产虽然不属于主营业务的固定资产,但对金融企业的经营收益和风险管理具有重要作用。

二、负债类表外科目1. 银行承兑汇票:金融企业作为承兑人接受的银行承兑汇票,这些汇票虽然在会计报表中没有直接体现,但对企业的信誉和流动性风险具有重要影响。

2. 授信额度:金融企业为客户提供的信贷额度,这些额度在会计报表中没有具体体现,但对企业的风险控制和收益能力具有重要作用。

三、所有者权益类表外科目1. 未分配利润:金融企业在会计年度结束时,将利润进行分配前的未分配部分。

这部分利润在会计报表中没有直接体现,但对企业的再投资能力和发展潜力具有重要影响。

2. 盈余公积:金融企业通过股票发行溢价等方式形成的公积金,这些公积金在会计报表中没有直接显示,但对企业的资本结构和财务稳定性具有重要意义。

四、收入类表外科目1. 未实现收益:金融企业持有的金融工具在会计报表日尚未实现的收益,如股票升值、债券利息等。

这部分收益在会计报表中没有具体体现,但对企业的投资回报和业绩评估具有重要影响。

2. 未分配股利:金融企业在会计年度结束时,将利润进行分配前的未分配股利。

这部分股利在会计报表中没有直接显示,但对股东权益和股东收益具有重要作用。

五、费用类表外科目1. 预提费用:金融企业在会计报表日尚未发生但已经确认的费用,如预提税费、预提职工薪酬等。