英文财务报表

- 格式:doc

- 大小:27.50 KB

- 文档页数:7

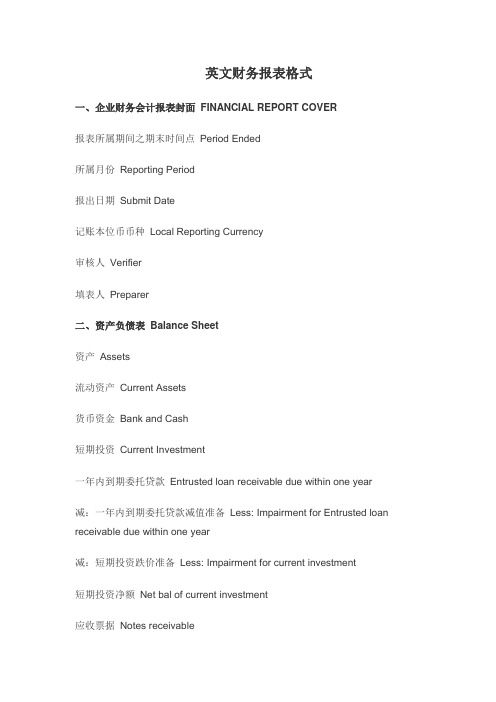

英文财务报表格式一、企业财务会计报表封面FINANCIAL REPORT COVER报表所属期间之期末时间点Period Ended所属月份Reporting Period报出日期Submit Date记账本位币币种Local Reporting Currency审核人Verifier填表人Preparer二、资产负债表Balance Sheet资产Assets流动资产Current Assets货币资金Bank and Cash短期投资Current Investment一年内到期委托贷款Entrusted loan receivable due within one year减:一年内到期委托贷款减值准备Less: Impairment for Entrusted loan receivable due within one year减:短期投资跌价准备Less: Impairment for current investment短期投资净额Net bal of current investment应收票据Notes receivable应收股利Dividend receivable应收利息Interest receivable应收账款Account receivable减:应收账款坏账准备Less: Bad debt provision for Account receivable应收账款净额Net bal of Account receivable其他应收款Other receivable减:其他应收款坏账准备Less: Bad debt provision for Other receivable其他应收款净额Net bal of Other receivable预付账款Prepayment应收补贴款Subsidy receivable存货Inventory减:存货跌价准备Less: Provision for Inventory存货净额Net bal of Inventory已完工尚未结算款Amount due from customer for contract work待摊费用Deferred Expense一年内到期的长期债权投资Long-term debt investment due within one year 一年内到期的应收融资租赁款Finance lease receivables due within one year 其他流动资产Other current assets流动资产合计Total current assets长期投资Long-term investment长期股权投资Long-term equity investment委托贷款Entrusted loan receivable长期债权投资Long-term debt investment长期投资合计Total for long-term investment减:长期股权投资减值准备Less: Impairment for long-term equity investment 减:长期债权投资减值准备Less: Impairment for long-term debt investment 减:委托贷款减值准备Less: Provision for entrusted loan receivable长期投资净额Net bal of long-term investment其中:合并价差Include: Goodwill (Negative goodwill)固定资产Fixed assets固定资产原值Cost减:累计折旧Less: Accumulated Depreciation固定资产净值Net bal减:固定资产减值准备Less: Impairment for fixed assets固定资产净额NBV of fixed assets工程物资Material holds for construction of fixed assets在建工程Construction in progress减:在建工程减值准备Less: Impairment for construction in progress在建工程净额Net bal of construction in progress固定资产清理Fixed assets to be disposed of固定资产合计Total fixed assets无形资产及其他资产Other assets & Intangible assets无形资产Intangible assets减:无形资产减值准备Less: Impairment for intangible assets无形资产净额Net bal of intangible assets长期待摊费用Long-term deferred expense融资租赁——未担保余值Finance lease – Unguaranteed residual values 融资租赁——应收融资租赁款Finance lease – Receivables其他长期资产Other non-current assets无形及其他长期资产合计Total other assets & intangible assets递延税项Deferred Tax递延税款借项Deferred Tax assets资产总计Total assets负债及所有者(或股东)权益Liability & Equity流动负债Current liability短期借款Short-term loans应付票据Notes payable应付账款Accounts payable已结算尚未完工款预收账款Advance from customers应付工资Payroll payable应付福利费Welfare payable应付股利Dividend payable应交税金Taxes payable其他应交款Other fees payable其他应付款Other payable预提费用Accrued Expense预计负债Provision递延收益Deferred Revenue一年内到期的长期负债Long-term liability due within one year 其他流动负债Other current liability流动负债合计Total current liability长期负债Long-term liability长期借款Long-term loans应付债券Bonds payable长期应付款Long-term payable专项应付款Grants & Subsidies received其他长期负债Other long-term liability长期负债合计Total long-term liability递延税项Deferred Tax递延税款贷项Deferred Tax liabilities负债合计Total liability少数股东权益Minority interests所有者权益(或股东权益) Owners’ Equity实收资本(或股本) Paid in capital减;已归还投资Less: Capital redemption实收资本(或股本)净额Net bal of Paid in capital 资本公积Capital Reserves盈余公积Surplus Reserves其中:法定公益金Include: Statutory reserves 未确认投资损失Unrealised investment losses 未分配利润Retained profits after appropriation 其中:本年利润Include: Profits for the year外币报表折算差额Translation reserve所有者(或股东)权益合计Total Equity负债及所有者(或股东)权益合计Total Liability & Equity三、利润及利润分配表Income statement and profit appropriation 一、主营业务收入Revenue减:主营业务成本Less: Cost of Sales主营业务税金及附加Sales Tax二、主营业务利润(亏损以“—”填列) Gross Profit ( - means loss)加:其他业务收入Add: Other operating income减:其他业务支出Less: Other operating expense减:营业费用Selling & Distribution expense管理费用G&A expense财务费用Finance expense三、营业利润(亏损以“—”填列) Profit from operation ( - means loss)加:投资收益(亏损以“—”填列) Add: Investment income补贴收入Subsidy Income营业外收入Non-operating income减:营业外支出Less: Non-operating expense四、利润总额(亏损总额以“—”填列) Profit before Tax减:所得税Less: Income tax少数股东损益Minority interest加:未确认投资损失Add: Unrealised investment losses五、净利润(净亏损以“—”填列) Net profit ( - means loss)加:年初未分配利润Add: Retained profits其他转入Other transfer-in六、可供分配的利润Profit available for distribution( - means loss)减:提取法定盈余公积Less: Appropriation of statutory surplus reserves提取法定公益金Appropriation of statutory welfare fund提取职工奖励及福利基金Appropriation of staff incentive and welfare fund提取储备基金Appropriation of reserve fund提取企业发展基金Appropriation of enterprise expansion fund利润归还投资Capital redemption七、可供投资者分配的利润Profit available for owners' distribution减:应付优先股股利Less: Appropriation of preference share's dividend提取任意盈余公积Appropriation of discretionary surplus reserve应付普通股股利Appropriation of ordinary share's dividend转作资本(或股本)的普通股股利Transfer from ordinary share's dividend to paid in capital八、未分配利润Retained profit after appropriation补充资料:Supplementary Information:1. 出售、处置部门或被投资单位收益Gains on disposal of operating divisions or investments2. 自然灾害发生损失Losses from natural disaster3. 会计政策变更增加(或减少)利润总额Increase (decrease) in profit due to changes in accounting policies4. 会计估计变更增加(或减少)利润总额Increase (decrease) in profit due to changes in accounting estimates。

四大财务报表中英文对照全文共四篇示例,供读者参考第一篇示例:四大财务报表是每家公司每年都要制作的重要财务文件,它们记录着公司在一定期间内的财务业绩和资产负债状况。

这四大财务报表分别是资产负债表(Balance Sheet)、损益表(Income Statement)、现金流量表(Cash Flow Statement)和股东权益变动表(Statement of Changes in Equity)。

下面将为您详细介绍这四大财务报表的中英文对照。

一、资产负债表(Balance Sheet)资产负债表是衡量公司财务状况的重要指标,它展示了公司在特定日期的资产、负债和所有者权益的情况。

资产负债表的中英文对照如下:中文:资产负债表英文:Balance Sheet资产(Assets):1. 流动资产(Current Assets)2. 非流动资产(Non-current Assets)负债和所有者权益(Liabilities and Equity):1. 流动负债(Current Liabilities)2. 非流动负债(Non-current Liabilities)3. 所有者权益(Equity)资产负债表将公司的资产按照流动性和长期性分类,并将公司的负债和所有者权益细分为流动负债、非流动负债和所有者权益,以展示公司的资产负债结构。

二、损益表(Income Statement)损益表是公司在一定期间内的收入、成本和利润情况的总结,展示了公司的盈利能力。

损益表的中英文对照如下:中文:损益表英文:Income Statement收入(Revenue):1. 销售收入(Sales Revenue)2. 其他收入(Other Revenue)成本(Expenses):1. 销售成本(Cost of Goods Sold)2. 营业费用(Operating Expenses)3. 税前利润(Profit Before Tax)利润(Profit):1. 税后利润(Net Profit)损益表记录了公司在一段时间内的总收入、总成本和净利润,帮助投资者和管理层了解公司的盈利能力。

中英文财务报表对照2中英文财务报表对照(2)三、利润及利润分配表 Income statement and profit appropriation一、主营业务收入 Revenue减:主营业务成本 Less: Cost of Sales主营业务税金及附加 Sales Tax二、主营业务利润(亏损以“—”填列) Gross Profit ( - means loss) 加:其他业务收入 Add: Other operating income减:其他业务支出 Less: Other operating expense减:营业费用 Selling & Distribution expense管理费用 G&A expense财务费用 Finance expense三、营业利润(亏损以“—”填列) Profit from operation ( - means loss) 加:投资收益(亏损以“—”填列) Add: Investment income 补贴收入Subsidy Income营业外收入 Non-operating income减:营业外支出 Less: Non-operating expense四、利润总额(亏损总额以“—”填列) Profit before Tax 减:所得税Less: Income tax少数股东损益 Minority interest加:未确认投资损失 Add: Unrealised investment losses五、净利润(净亏损以“—”填列) Net profit ( - means loss) 加:年初未分配利润 Add: Retained profits其他转入 Other transfer-in六、可供分配的利润 Profit available for distribution( - means loss)减:提取法定盈余公积 Less: Appropriation of statutory surplus reserves提取法定公益金 Appropriation of statutory welfare fund提取职工奖励及福利基金 Appropriation of staff incentive and welfare fund 提取储备基金 Appropriation of reserve fund提取企业发展基金 Appropriation of enterprise expansion fund利润归还投资 Capital redemption七、可供投资者分配的利润 Profit available for owners' distribution 减:应付优先股股利 Less: Appropriation of preference share's dividend 提取任意盈余公积 Appropriation of discretionary surplus reserve 应付普通股股利 Appropriation of ordinary share's dividend转作资本(或股本)的普通股股利 Transfer from ordinary share's dividend to paid in capital 八、未分配利润 Retained profit after appropriation补充资料: Supplementary Information:1.出售、处置部门或被投资单位收益 Gains on disposal of operating divisions or investments 2.自然灾害发生损失 Losses from natural disaster3.会计政策变更增加(或减少)利润总额 Increase (decrease) in profit due to changes inaccounting policies4.会计估计变更增加(或减少)利润总额 Increase (decrease) in profit due to changes inaccounting estimates5.债务重组损失 Losses from debt restructuring。

资产负债表Balance Sheet编制单位: _____ 年 ________ 月________ ____ 日单位: 元Prepared by: Month: D ate:Year Monetary unit:利润表Income Statement编制单位:_____ 年_____ 月_________ 日单位: 元Prepared by: Month: Date:Year Monetary unit: RMB Yuan资产减值准备明细表Statement of Provision for Impairment of Assets 编制单位:年度单位: 元注:根据财会[2003]10 号文件规定,此表已变动,请参见第404-407 页。

Note: This statement has been revised according to CaiKuai [2003] No. 10 by the Ministry of Finance. Please refer to page 404 to 407 for details.所有者权益(或股东权益)增减变动表Statement of Changes in Owner ' s (Stockholder ' s) Equity 编制单位:年度单位: 元应交增值税明细表VAT Payable Movement Table编制单位:年度单位: 元利润分配表Statement of Profit Distribution编制单位:年度单位: 元分部报表(业务分部)Business Segment Statement编制单位:年度单位: 元Prepared by: Period: ___________________________________________________ Monetary unit: RMB Y uan分部报表(地区分部)Geographical Segment Statement编制单位:年度单位: 元Prepared by: Period: ___________________________________________________ Monetary unit: RMB Y uan不可见预费contingencies 信用证死卷dead LCCover pool 担保池Pfandbrief 抵押债券提货担保shipping guarantee 押品小类collateral subdivision 准贷证approved loan letter 平息flat rate CAC Contributory asset charge:资产必要报酬CAPM Capital Asset Pricing Model:资本资产定价模型CU Currency unit:货币单位DCF Discounted cash flow:折现现金流EBIT Earnings before interest and tax:息税前利润EBITDA Earnings before interest, tax, depreciation and amortization:息税、折旧、摊销前利润GN Guidance Note:评估指南IFRS International Financial Reporting Standard:国际财务报告准则IPR&D In-process Research and Developmen:t 研发投入IVS International Valuation Standard:国际评估准则PFI Prospective financial information:预期财务信息US GAAP US Generally Accepted Accounting Principles:美国公认会计准则WACC Weighted average cost of capita:l 加权平均资本成本WARA Weighted average return on asse:ts 加权平均资产回报Compound Annual Growth Rate 年均复合增长率Cost of Goods Sold 已售商品成本Incremental-Cashflow 增量现金流量Multi-Period-Excess-Earnings 多期超额收益法Relief-from-Royalty 权利金节省法Net operating profit less adjusted tax 税后净营业利润。

英文财务报表格式一、企业财务会计报表封面FINANCIAL REPORT COVER报表所属期间之期末时间点Period Ended所属月份Reporting Period报出日期Submit Date记账本位币币种Local Reporting Currency审核人Verifier填表人Preparer二、资产负债表Balance Sheet资产Assets流动资产Current Assets货币资金Bank and Cash短期投资Current Investment一年内到期委托贷款Entrusted loan receivable due within one year减:一年内到期委托贷款减值准备Less: Impairment for Entrusted loan receivable due within one year减:短期投资跌价准备Less: Impairment for current investment短期投资净额Net bal of current investment应收票据Notes receivable应收股利Dividend receivable应收利息Interest receivable应收账款Account receivable减:应收账款坏账准备Less: Bad debt provision for Account receivable应收账款净额Net bal of Account receivable其他应收款Other receivable减:其他应收款坏账准备Less: Bad debt provision for Other receivable其他应收款净额Net bal of Other receivable预付账款Prepayment应收补贴款Subsidy receivable存货Inventory减:存货跌价准备Less: Provision for Inventory存货净额Net bal of Inventory已完工尚未结算款Amount due from customer for contract work待摊费用Deferred Expense一年内到期的长期债权投资Long-term debt investment due within one year 一年内到期的应收融资租赁款Finance lease receivables due within one year 其他流动资产Other current assets流动资产合计Total current assets长期投资Long-term investment长期股权投资Long-term equity investment委托贷款Entrusted loan receivable长期债权投资Long-term debt investment长期投资合计Total for long-term investment减:长期股权投资减值准备Less: Impairment for long-term equity investment 减:长期债权投资减值准备Less: Impairment for long-term debt investment 减:委托贷款减值准备Less: Provision for entrusted loan receivable长期投资净额Net bal of long-term investment其中:合并价差Include: Goodwill (Negative goodwill)固定资产Fixed assets固定资产原值Cost减:累计折旧Less: Accumulated Depreciation固定资产净值Net bal减:固定资产减值准备Less: Impairment for fixed assets固定资产净额NBV of fixed assets工程物资Material holds for construction of fixed assets在建工程Construction in progress减:在建工程减值准备Less: Impairment for construction in progress在建工程净额Net bal of construction in progress固定资产清理Fixed assets to be disposed of固定资产合计Total fixed assets无形资产及其他资产Other assets & Intangible assets无形资产Intangible assets减:无形资产减值准备Less: Impairment for intangible assets无形资产净额Net bal of intangible assets长期待摊费用Long-term deferred expense融资租赁——未担保余值Finance lease – Unguaranteed residual values 融资租赁——应收融资租赁款Finance lease – Receivables其他长期资产Other non-current assets无形及其他长期资产合计Total other assets & intangible assets递延税项Deferred Tax递延税款借项Deferred Tax assets资产总计Total assets负债及所有者(或股东)权益Liability & Equity流动负债Current liability短期借款Short-term loans应付票据Notes payable应付账款Accounts payable已结算尚未完工款预收账款Advance from customers应付工资Payroll payable应付福利费Welfare payable应付股利Dividend payable应交税金Taxes payable其他应交款Other fees payable其他应付款Other payable预提费用Accrued Expense预计负债Provision递延收益Deferred Revenue一年内到期的长期负债Long-term liability due within one year 其他流动负债Other current liability流动负债合计Total current liability长期负债Long-term liability长期借款Long-term loans应付债券Bonds payable长期应付款Long-term payable专项应付款Grants & Subsidies received其他长期负债Other long-term liability长期负债合计Total long-term liability递延税项Deferred Tax递延税款贷项Deferred Tax liabilities负债合计Total liability少数股东权益Minority interests所有者权益(或股东权益) Owners’ Equity实收资本(或股本) Paid in capital减;已归还投资Less: Capital redemption实收资本(或股本)净额Net bal of Paid in capital 资本公积Capital Reserves盈余公积Surplus Reserves其中:法定公益金Include: Statutory reserves未确认投资损失Unrealised investment losses未分配利润Retained profits after appropriation其中:本年利润Include: Profits for the year外币报表折算差额Translation reserve所有者(或股东)权益合计Total Equity负债及所有者(或股东)权益合计Total Liability & Equity三、利润及利润分配表Income statement and profit appropriation 一、主营业务收入Revenue减:主营业务成本Less: Cost of Sales主营业务税金及附加Sales Tax二、主营业务利润(亏损以“—”填列) Gross Profit ( - means loss)加:其他业务收入Add: Other operating income减:其他业务支出Less: Other operating expense减:营业费用Selling & Distribution expense管理费用G&A expense财务费用Finance expense三、营业利润(亏损以“—”填列) Profit from operation ( - means loss)加:投资收益(亏损以“—”填列) Add: Investment income补贴收入Subsidy Income营业外收入Non-operating income减:营业外支出Less: Non-operating expense四、利润总额(亏损总额以“—”填列) Profit before Tax减:所得税Less: Income tax少数股东损益Minority interest加:未确认投资损失Add: Unrealised investment losses五、净利润(净亏损以“—”填列) Net profit ( - means loss)加:年初未分配利润Add: Retained profits其他转入Other transfer-in六、可供分配的利润Profit available for distribution( - means loss)减:提取法定盈余公积Less: Appropriation of statutory surplus reserves 提取法定公益金Appropriation of statutory welfare fund提取职工奖励及福利基金Appropriation of staff incentive and welfare fund 提取储备基金Appropriation of reserve fund提取企业发展基金Appropriation of enterprise expansion fund利润归还投资Capital redemption七、可供投资者分配的利润Profit available for owners' distribution 减:应付优先股股利Less: Appropriation of preference share's dividend 提取任意盈余公积Appropriation of discretionary surplus reserve应付普通股股利Appropriation of ordinary share's dividend转作资本(或股本)的普通股股利Transfer from ordinary share's dividend to paid in capital八、未分配利润Retained profit after appropriation补充资料:Supplementary Information:1. 出售、处置部门或被投资单位收益Gains on disposal of operating divisions or investments2. 自然灾害发生损失Losses from natural disaster3. 会计政策变更增加(或减少)利润总额Increase (decrease) in profit due to changes in accounting policies4. 会计估计变更增加(或减少)利润总额Increase (decrease) in profit due to changes in accounting estimates。

英文财务报表(模板)现金流量附表: Supplementary Information:1.将净利润调节为经营活动的现金流量:Reconciliation of Net Profit to Cash Flow from Operating Activities:净利润Net Profit加:少数股东损益Add: Minority interest加:计提的资产减值准备Impairment losses on assets固定资产折旧Depreciation of fixed assets无形资产摊销Amortisation of intangible assets长期待摊费用摊销Amortisation of long-term deferred expenses待摊费用减少(减:增加)Decrease (increase) in deferred expenses预提费用增加(减:减少)Increase (decrease) in accrued expensesLosses (gains) on disposal of fixed assets, intangible assets and other long-term assets 处置固定资产、无形资产和其他长期资产的损失(减、固定资产报废损失Losses on write-off of fixed assets财务费用Finance expense (income)投资损失(减、收益)Losses (gains) arising from investments 递延税款贷款(减、借项)Deferred tax credit (debit)存货的减少(减、增加)Decrease (increase) in inventories经营性应收项目的减少(减、增加)Decrease (increase) in receivables under operating activities经营性应付项目的增加(减、减少)Increase (decrease) in payables under operating activities其他Others经营活动产生的现金流量净额Net cash flow from operatingactivities2.不涉及现金收支的投资和筹资活动:Investing and Financing Activities that do not Involve Cash Receipts and Payments: 债务转为资本Conversion of debt into capital一年内到期的可转换公司债券Reclassification of convertible bonds expiring within one year as current liability融资租入固定资产Fixed assets acquired under finance leases3.现金及现金等价物净增加情况:Net Increase in Cash and Cash Equivalents:现金的期末余额Cash at the end of the period减:现金的期初余额Less: cash at the beginning of the year加:现金等价物的期末余额Add: cash equivalents at the end of the period减:现金等价物的期初余额Less: cash equivalents at the beginning of the period现金及现金等价物净增加额Net increase in cash and cash equivalents。

英文财务报表(模板) Title: Financial StatementsI. Income Statement(in currency)Revenue: xxxCost of Goods Sold: xxxGross Profit: xxxOperating Expenses: xxxOperating Income: xxxNon-Operating Income: xxxNet Income: xxx1II. Balance Sheet(in currency)Assets:Current Assets:Cash: xxxAccounts Receivable: xxxInventory: xxxLong-term Assets:Property, Plant, and Equipment: xxx Intangible Assets: xxxTotal Assets: xxxLiabilities:Current Liabilities:2Accounts Payable: xxxShort-term Debt: xxxLong-term Liabilities:Long-term Debt: xxxTotal Liabilities: xxxEquity:Shareholder's Equity: xxxRetained Earnings: xxxTotal Equity: xxxIII. Cash Flow StatementOperating Activities:Cash Inflows:3Cash collections from customers: xxxInterest received: xxxCash Outflows:Payment to suppliers: xxxSalary and wages payments: xxxUtility and overhead payments: xxxNet Cash from Operating Activities: xxxInvesting Activities:Cash Inflows:Proceeds from sale of property, plant, and equipment: xxx Cash Outflows:Purchase of property, plant, and equipment: xxxNet Cash used in Investing Activities: xxx4Financing Activities:Cash Inflows:Proceeds from issuance of long-term debt: xxx Cash Outflows:Repayment of long-term debt: xxxNet Cash used in Financing Activities: xxxNet increase/(decrease) in Cash: xxxIV. Notes to financial statements- Explanation of significant accounting policies- Breakdown of revenue by product/service- Detailed list of property, plant, and equipment- Summary of long-term debt obligations5Note: This template serves as a starting point and can be customized based on the specific requirements and format preferences of your organization.6。

XX Co., Ltd. Annual Audit Report YZXXZ () No. 2XX56XX Certified Public Accountants Co., Ltd.ContentI. Audit report Page 1-2II. Financial statements Page 3-6 (i) Balance Sheet Page 3 (ii) Income Statement Page 4 (iii) Cash Flow Statement Page 5 (iv) Change Statement of Owners’ Equity Page 6III. Explanatory notes of financial statements Page 7-23XX CERTIFIED PUBLIC ACCOUNTANTS CO., LTDAudit ReportYZXXZ () No. 2XX56XX Co., Ltd.,We have audited the accompanying financial statements of XX Co., Ltd. (hereinafter referred to as “your company”), including the balance sheet as at December 31, , the income statement, cash flow statement and change statement of owners’ equity of as well as explanatory notes of financial statements.I. Management’s responsibility for the financial statementsManagement of your company is responsible for the preparation and fair presentation of financial statements. This responsibility includes: (1) preparing the financial statements and reflecting fair representation in accordance with provisions of the Accounting Standards for Business Enterprises; (2) designing, implementing andmaintaining the necessary internal control in order to free financial statements from material misstatement, whether due to fraud or error.II. Auditor’s responsibilityOur responsibility is to express an opinion on these financial statements based on our audit. We conducted our audit in accordance with provisions of the Chinese Certified Public Accountants Auditing Standards. Those standards require that we comply with ethical requirements and plan and perform the audit to obtain reasonable assurance whether the financial statements are free from material misstatement.An audit involves performing procedures to obtain audit evidence about the amounts and disclosures in the financial statements. The procedures selected depend on the auditor’s judgment, including the assessment of the risks of material misstatement of the financial statements, whether due to fraud or error. In making those risk assessments, the certified public accountants consider the internal control relevant to the preparation and fair presentation of the financial statements in order to design audit procedures that area appropriate in the circumstances, but not for the purpose of expressing an opinion on the effectiveness of the internal control. An audit also includes evaluating the appropriateness of accounting policies used and the reasonableness of accounting estimates made by management, as well as evaluating the overall presentation of the financial statements.We believe that the audit evidence we have obtained is sufficient and appropriate to provide a basis for our audit opinion.III. Audit opinionIn our opinion, the financial statements of your company have been prepared in accordance with provisions of the Accounting Standards for Business Enterprises in all material aspects, and present fairly the financial position of your company as of December 31, and the results of its operations and cash flows of .XX Certified Public Accountants Co., Ltd. Chinese Certified Public Accountant: Guangdong, China Chinese Certified Public Accountant:February 29,Balance SheetDecember 31,KQ 01 Enterprise name: XX Co., Ltd.Unit: RMB YuanInterest receivable Employees’ compensationpayableDividend receivable Tax payableOther accounts receivable Interest payable Inventory Dividend payableAssets divided as availableassets for saleOther accounts payableNon-current assets due within 1 year Liabilities divided as available liabilities for saleOther current assets Non-current liabilities duewithin 1 yearTotal current assets Other current liabilitiesTotal current liabilitiesNon-current liabilities:Long-term borrowingsBonds payableIncluding: Preferred sharesPerpetual capital securitiesLong-term account payableLong-term employees’compensation payableNon-current assets: Special payablesAvailable for sale financialAccrued liabilitiesassetsHeld-to-maturity investments Deferred incomeLong-term account receivable Deferred tax liabilitiesLong-term equity investment Other non-current liabilities Investing real estate Total non-current liabilitiesFixed asset7Total liabilitiesProject in construction Owners’ equity (orshareholders’ equity)16 Engineering material Paid-in capital (or sharecapital)Fixed asset disposal Other equity instruments Production biological assets Including: Preferred sharesOil and gas assets Perpetual capital securities2Income StatementYear ofKQ 02 Enterprise name: XX Co., Ltd.Unit: RMB YuanPlus: Non-business income5 Including: Gain from non-current asset disposalMinus: Non-business expenditure6 Including: Loss from non-current asset disposalIII. Total profit (total loss with “-”)Minus: Income tax expense7 IV. Net profit (net loss with “-”)V. Net after-tax amount of other comprehensive incomes(i) Other comprehensive incomes not reclassified into profit andloss in future1. Changes for net liability or net asset of remeasured and resetbenefit plan2. Shares enjoyed in other comprehensive incomes not reclassifiedinto profit and loss by the invested unit(ii) Other comprehensive incomes reclassified into profit and lossin future1. Shares enjoyed in other comprehensive incomes reclassifiedinto profit and loss by the invested unit in future4Cash Flow StatementYear ofKQ 03 Enterprise name: XX Co., Ltd.Unit: RMB YuanII. Cash flow from investing activities:Cash flow from disposal of investmentsCash received from returns of investmentsCash received from incomes on investmentsNet cash received from disposal of fixed assets, intangible assets and other long-term assetsOther cash received relating to investing activitiesSub-total of cash inflows from investing activitiesCash paid to acquire fixed assets, intangible assets and other long-term assetsCash paid to acquire investmentsNet cash received from the subsidiary company and other business unitsOther cash payments relating to investing activitiesSub-total of cash outflows from investing activitiesNet cash flows from investing activitiesIII. Cash flows from financing activities:5。

【英文财务报表】资产负债表Balance Sheet项目ITEM货币资金Cash短期投资Short term investments应收票据Notes receivable应收股利Dividend receivable应收利息Interest receivable应收帐款Accounts receivable其他应收款Other receivables预付帐款Accounts prepaid期货保证金Future guarantee应收补贴款Allowance receivable应收出口退税Export drawback receivable存货Inventories其中:原材料Including:Raw materials产成品(库存商品) Finished goods待摊费用Prepaid and deferred expenses待处理流动资产净损失Unsettled G/L on current assets一年内到期的长期债权投资Long-term debenture investment falling due in a yaear 其他流动资产Other current assets流动资产合计Total current assets长期投资:Long-term investment:其中:长期股权投资Including long term equity investment长期债权投资Long term securities investment*合并价差Incorporating price difference长期投资合计Total long-term investment固定资产原价Fixed assets-cost减:累计折旧Less:Accumulated Dpreciation固定资产净值Fixed assets-net value减:固定资产减值准备Less:Impairment of fixed assets固定资产净额Net value of fixed assets固定资产清理Disposal of fixed assets工程物资Project material在建工程Construction in Progress待处理固定资产净损失Unsettled G/L on fixed assets固定资产合计Total tangible assets无形资产Intangible assets其中:土地使用权Including and use rights递延资产(长期待摊费用)Deferred assets其中:固定资产修理Including:Fixed assets repair固定资产改良支出Improvement expenditure of fixed assets其他长期资产Other long term assets其中:特准储备物资Among it:Specially approved reserving materials 无形及其他资产合计Total intangible assets and other assets递延税款借项Deferred assets debits资产总计Total Assets资产负债表(续表) Balance Sheet项目ITEM短期借款Short-term loans应付票款Notes payable应付帐款Accounts payab1e预收帐款Advances from customers应付工资Accrued payro1l应付福利费Welfare payable应付利润(股利) Profits payab1e应交税金Taxes payable其他应交款Other payable to government其他应付款Other creditors预提费用Provision for expenses预计负债Accrued liabilities一年内到期的长期负债Long term liabilities due within one year其他流动负债Other current liabilities流动负债合计Total current liabilities长期借款Long-term loans payable应付债券Bonds payable长期应付款long-term accounts payable专项应付款Special accounts payable其他长期负债Other long-term liabilities其中:特准储备资金Including:Special reserve fund长期负债合计Total long term liabilities递延税款贷项Deferred taxation credit负债合计Total liabilities* 少数股东权益Minority interests实收资本(股本) Subscribed Capital国家资本National capital集体资本Collective capital法人资本Legal person"s capital其中:国有法人资本Including:State-owned legal person"s capital集体法人资本Collective legal person"s capital个人资本Personal capital外商资本Foreign businessmen"s capital资本公积Capital surplus盈余公积surplus reserve其中:法定盈余公积Including:statutory surplus reserve公益金public welfare fund补充流动资本Supplermentary current capital* 未确认的投资损失(以“-”号填列)Unaffirmed investment loss未分配利润Retained earnings外币报表折算差额Converted difference in Foreign Currency Statements所有者权益合计Total shareholder"s equity负债及所有者权益总计Total Liabilities & Equity利润表INCOME STATEMENT项目ITEMS产品销售收入Sales of products其中:出口产品销售收入Including:Export sales减:销售折扣与折让Less:Sales discount and allowances产品销售净额Net sales of products减:产品销售税金Less:Sales tax产品销售成本Cost of sales其中:出口产品销售成本Including:Cost of export sales产品销售毛利Gross profit on sales减:销售费用Less:Selling expenses管理费用General and administrative expenses财务费用Financial expenses其中:利息支出(减利息收入) Including:Interest expenses (minusinterest ihcome) 汇兑损失(减汇兑收益)Exchange losses(minus exchange gains)产品销售利润Profit on sales加:其他业务利润Add:profit from other operations营业利润Operating profit加:投资收益Add:Income on investment加:营业外收入Add:Non-operating income减:营业外支出Less:Non-operating expenses加:以前年度损益调整Add:adjustment of loss and gain for previous years利润总额Total profit减:所得税Less:Income tax净利润Net profit现金流量表Cash Flows StatementPrepared by:Period: Unit:Items1.Cash Flows from Operating Activities:01)Cash received from sales of goods or rendering of services02)Rental receivedValue added tax on sales received and refunds of value03)added tax paid04)Refund of other taxes and levy other than value added tax07)Other cash received relating to operating activities08)Sub-total of cash inflows09)Cash paid for goods and services10)Cash paid for operating leases11)Cash paid to and on behalf of employees12)Value added tax on purchases paid13)Income tax paid14)Taxes paid other than value added tax and income tax17)Other cash paid relating to operating activities18)Sub-total of cash outflows19)Net cash flows from operating activities2.Cash Flows from Investing Activities:20)Cash received from return of investments21)Cash received from distribution of dividends or profits22)Cash received from bond interest incomeNet cash received from disposal of fixed assets,intangible 23)assets and other long-term assets26)Other cash received relating to investing activities27)Sub-total of cash inflowsCash paid to acquire fixed assets,intangible assets28)and other long-term assets29)Cash paid to acquire equity investments30)Cash paid to acquire debt investments33)Other cash paid relating to investing activities34)Sub-total of cash outflows35)Net cash flows from investing activities3.Cash Flows from Financing Activities:36)Proceeds from issuing shares37)Proceeds from issuing bonds38)Proceeds from borrowings41)Other proceeds relating to financing activities42)Sub-total of cash inflows43)Cash repayments of amounts borrowed44)Cash payments of expenses on any financing activities45)Cash payments for distribution of dividends or profits46)Cash payments of interest expenses47)Cash payments for finance leases48)Cash payments for reduction of registered capital51)Other cash payments relating to financing activities52)Sub-total of cash outflows53)Net cash flows from financing activities4.Effect of Foreign Exchange Rate Changes on Cash Increase in Cash and Cash EquivalentsSupplemental Information1.Investing and Financing Activities that do not Involve in Cash Receipts and Payments56)Repayment of debts by the transfer of fixed assets57)Repayment of debts by the transfer of investments58)Investments in the form of fixed assets59)Repayments of debts by the transfer of investories2.Reconciliation of Net Profit to Cash Flows from Operating Activities62)Net profit63)Add provision for bad debt or bad debt written off64)Depreciation of fixed assets65)Amortization of intangible assetsLosses on disposal of fixed assets,intangible assets66)and other long-term assets (or deduct:gains)67)Losses on scrapping of fixed assets68)Financial expenses69)Losses arising from investments (or deduct:gains)70)Defered tax credit (or deduct:debit)71)Decrease in inventories (or deduct:increase)72)Decrease in operating receivables (or deduct:increase)73)Increase in operating payables (or deduct:decrease)74)Net payment on value added tax (or deduct:net receipts75)Net cash flows from operating activities Increase in Cash and Cash Equivalents76)cash at the end of the period77)Less:cash at the beginning of the period78)Plus:cash equivalents at the end of the period79)Less:cash equivalents at the beginning of the period80)Net increase in cash and cash equivalents现金流量表的现金流量声明拟制人:时间:单位:项目1.cash流量从经营活动:01 )所收到的现金从销售货物或提供劳务02 )收到的租金增值税销售额收到退款的价值03 )增值税缴纳04 )退回的其他税收和征费以外的增值税07 )其他现金收到有关经营活动08 )分,总现金流入量09 )用现金支付的商品和服务10 )用现金支付经营租赁11 )用现金支付,并代表员工12 )增值税购货支付13 )所得税的缴纳14 )支付的税款以外的增值税和所得税17 )其他现金支付有关的经营活动18 )分,总的现金流出19 )净经营活动的现金流量2.cash流向与投资活动:20 )所收到的现金收回投资21 )所收到的现金从分配股利,利润22 )所收到的现金从国债利息收入现金净额收到的处置固定资产,无形资产23 )资产和其他长期资产26 )其他收到的现金与投资活动27 )小计的现金流入量用现金支付购建固定资产,无形资产28 )和其他长期资产29 )用现金支付,以获取股权投资30 )用现金支付收购债权投资33 )其他现金支付的有关投资活动34 )分,总的现金流出35 )的净现金流量,投资活动产生3.cash流量筹资活动:36 )的收益,从发行股票37 )的收益,由发行债券38 )的收益,由借款41 )其他收益有关的融资活动42 ),小计的现金流入量43 )的现金偿还债务所支付的44 )现金支付的费用,对任何融资活动45 )支付现金,分配股利或利润46 )以现金支付的利息费用47 )以现金支付,融资租赁48 )以现金支付,减少注册资本51 )其他现金收支有关的融资活动52 )分,总的现金流出53 )的净现金流量从融资活动4.effect的外汇汇率变动对现金增加现金和现金等价物补充资料1.investing活动和筹资活动,不参与现金收款和付款56 )偿还债务的转让固定资产57 )偿还债务的转移投资58 )投资在形成固定资产59 )偿还债务的转移库存量2.reconciliation净利润现金流量从经营活动62 )净利润63 )补充规定的坏帐或不良债务注销64 )固定资产折旧65 )无形资产摊销损失处置固定资产,无形资产66 )和其他长期资产(或减:收益)67 )损失固定资产报废68 )财务费用69 )引起的损失由投资管理(或减:收益)70 )defered税收抵免(或减:借记卡)71 )减少存货(或减:增加)72 )减少经营性应收(或减:增加)73 )增加的经营应付账款(或减:减少)74 )净支付的增值税(或减:收益净额75 )净经营活动的现金流量增加现金和现金等价物76 )的现金,在此期限结束77 )减:现金期开始78 )加:现金等价物在此期限结束79 )减:现金等价物期开始80 ),净增加现金和现金等价物。