会计学英文实验

- 格式:doc

- 大小:48.50 KB

- 文档页数:3

会计专业英语作文Accounting Major。

Accounting is a crucial part of the business world. It is the process of recording, summarizing, analyzing, and reporting financial transactions. As an accounting major, I have gained a deep understanding of the principles and practices of accounting, and I am committed to pursuing a successful career in this field.One of the key skills that I have developed as an accounting major is the ability to analyze and interpret financial data. This involves understanding the various financial statements, such as the balance sheet, income statement, and cash flow statement, and being able to use this information to make informed decisions. I have also learned how to use accounting software and other tools to process and analyze financial data, which is essential for working in today's fast-paced business environment.In addition to technical skills, I have also honed my communication and teamwork abilities. As an accounting major, I have had the opportunity to work on group projects and case studies, which has allowed me to collaborate with my peers and develop my interpersonal skills. I have also learned how to effectively communicate financial information to non-financial professionals, which is an important skill for any accountant.Furthermore, I have gained a strong understanding of the ethical considerations in accounting. As an accounting major, I have studied the importance of integrity and honesty in financial reporting, and I am committed to upholding these principles in my future career. I believe that ethical behavior is essential for maintaining thetrust and confidence of stakeholders, and I am dedicated to conducting myself in a professional and ethical manner at all times.As I look to the future, I am excited about the opportunities that a career in accounting can offer. Whether it is working in public accounting, corporateaccounting, or another related field, I am confident that my education and experience as an accounting major have prepared me for success. I am eager to continue learning and growing in this field, and I am committed to making a positive impact through my work.In conclusion, being an accounting major has provided me with a strong foundation in accounting principles and practices, as well as valuable skills in analysis, communication, and ethics. I am confident that my education and experiences have prepared me for a successful career in accounting, and I am excited about the opportunities that lie ahead. I am committed to continuing to learn and grow in this field, and I am eager to make a positive impact through my work.。

会计单项实训作文英语英文回答:Accounting Single-Entry Bookkeeping。

Single-entry bookkeeping is a simplified method of accounting that records only the overall financial transactions of a business. It is most commonly used by small businesses and individuals with relatively simple financial operations.Advantages of Single-Entry Bookkeeping。

Simplicity: Single-entry bookkeeping is relatively easy to learn and implement, making it suitable for individuals with limited accounting knowledge.Cost-effective: Since it requires less time and resources to maintain, single-entry bookkeeping is a cost-effective option for small businesses.Transparency: All transactions are recorded in a single account, providing a clear overview of thebusiness's financial position.Disadvantages of Single-Entry Bookkeeping。

Limited financial information: Single-entry bookkeeping provides only basic financial information, making it difficult to assess the overall financial health of the business.Prone to errors: The simplicity of single-entry bookkeeping makes it more prone to errors, which can affect the accuracy of the financial records.Not accepted by auditors: Single-entry bookkeeping is not generally accepted by auditors for financial reporting purposes.Using Single-Entry Bookkeeping。

会计业务综合实训英文"Accounting Business Comprehensive Training" is a comprehensive practical training course that integrates various accounting business processes and skills. It aims to provide students or practitioners with hands-on experience and practical skills in handling accounting tasks and business operations.The "Accounting Business Comprehensive Training" covers a wide range of accounting knowledge and skills, including but not limited to the following aspects:1. Accounting Cycle: Understand and practice the entire accounting cycle, including recording transactions, posting to ledgers, preparing financial statements, and closing accounts.2. Bookkeeping: Learn how to accurately record transactions, including accounts payable, accounts receivable, inventory, and fixed assets.3. Financial Statement Preparation: Gain skills in preparing balance sheets, income statements, and cash flow statements, and analyzing financial ratios.4. Taxation: Understand tax regulations and calculate and file various taxes, such as value-added tax (VAT) and corporate income tax.5. Cost Accounting: Learn to calculate and analyze product costs, cost allocation methods, and budgeting.6. Audit and Internal Control: Understand the concepts and processes of auditing, internal control systems, and risk assessment.7. Accounting Software: Familiarize yourself with using accounting software to automate accounting processes and improve efficiency.The "Accounting Business Comprehensive Training" course usually includes theoretical lectures, case studies, practical exercises, and group discussions. Through this training, participants can gain a comprehensive understanding of accounting principles and practices, and develop practical skills and problem-solving abilities in accounting-related tasks.Whether you are a student majoring in accounting, a beginner in the accountingfield, or a professional looking to enhance your accounting skills, participating in "Accounting Business Comprehensive Training" can provide you with valuable learning and practical experience opportunities. It helps you build a solid foundation in accounting and prepares you for various accounting roles and challenges in the business world.。

会计实训英语English:During accounting practical training, students will have the opportunity to apply their theoretical knowledge in a real-world setting. They will learn how to record financial transactions, prepare financial statements, analyze financial information, and interpret accounting principles and regulations. Through hands-on experience, students will develop critical thinking and problem-solving skills, as well as enhance their attention to detail and accuracy in financial reporting. Accounting practical training also allows students to work collaboratively with peers, communicate effectively with clients and colleagues, and strengthen their time management and organizational abilities. Overall, this experiential learning opportunity provides students with valuable skills and insights that will prepare them for a successful career in accounting.中文翻译:在会计实训中,学生将有机会将他们的理论知识应用于真实世界的环境中。

会计学科英文作文英文回答:Accounting, a multifaceted discipline that serves as the backbone of financial reporting and analysis, plays a pivotal role in the corporate world and beyond. It encompasses a wide range of concepts, principles, and techniques that empower individuals to understand, interpret, and communicate financial information.One of the primary objectives of accounting is to provide transparency and accountability in financial reporting. By adhering to established standards and frameworks, accountants ensure that financial statements accurately reflect a company's financial performance and position. This information is invaluable for investors, creditors, shareholders, and other stakeholders who rely on it to make informed decisions.Beyond financial reporting, accounting also providesinsights into a company's operations, efficiency, and financial health. Through the use of various analytical tools, accountants can identify areas for improvement, optimize resource allocation, and enhance overall performance. Moreover, accounting contributes to effective financial planning and forecasting, enabling businesses to make informed strategic decisions.In today's rapidly evolving business landscape, accounting professionals are increasingly sought after for their specialized knowledge and analytical skills. They play a critical role in advising management, conducting audits, and ensuring compliance with regulatory requirements. As technology continues to transform the field, accountants are embracing data analytics, artificial intelligence, and blockchain technologies to enhance their efficiency and effectiveness.中文回答:会计是一门多方面的学科,是财务报告和分析的支柱,在企业界及其他领域发挥着至关重要的作用。

目录会计手工试验 (2)财务分析 (3)财务管理 (4)高级会计 (5)国际会计 (6)会计法规 (7)财务会计学 (8)成本会计学 (9)管理会计课程 (10)高级管理课程 (11)基础会计学 (12)审计 (13)外贸会计 (14)会计手工实验课程代码: 62283000课程名称:会计手工实验英文名称:Accounting Manual Experimental学分:1 开课学期:第2、3 学期授课对象:工商管理类专业本科学生,经济类专业本科生先修课程:基础会计学课程主任:孙素梅,副教授,硕士课程简介:会计手工实验是为了配合基础会计学而开设的一门实践性课程。

本课程的目的在于培养学生的实践和动手能力。

本课程包括会计凭证的填制和审核,会计账簿的设置和登记,以及会计报表的编制等项实验。

通过这门课程的实验,不仅能够使学生掌握会计的实际操作技巧,并且能够培养学生分析和解决问题的能力。

课程考核:本课程成绩由两部分组成:1、平时成绩:依据出勤和课堂表现,占20%2、期末成绩:依据所做的实验结果,占80%指定教材:孙素梅,于治.《会计手工实验》,自编实验材料.参考书目:[1]陈国辉,迟旭升.《基础会计》.大连:东北财经大学出版社,2007年.[2]朱小平, 肖镜元, 徐泓 . 《初级会计学》,北京:中国人民大学出版社,2007年.[3] 刘峰.《会计学基础》,北京:高等教育出版社,2002.财务分析课程编码: 62013000课程名称: 财务分析英文名称:Financiai analyse学分: 2 学期: 1学期授课对象: 会计系学生预备课程: 会计学授课老师:卢书泉课程介绍:这门课程提供了根据财务报表分析企业资产负债等状况,评估企业价值的基本理论及方法。

本课程从财务报表的基本框架入手,引入微观经济理论,阐述财务报表所能传达的信息的作用。

本课程以报表的项目分析为主线,以风险评估、价值评估、决策有用几个方面分别阐述财务分析的基本理论和方法,使学生能基本掌握财务分析的基本技巧。

英文会计学论文2500字_英文会计学毕业论文范文模板英文会计学论文2500字(一):中外合作办学项目中英文会计学基础课程教学法创新与实践论文摘要:中外合作办学各个项目中,商学院的合作重点且热门,在商学院的课程中,开设遵循一般会计准则(GAAP)的全英文会计授课非常普遍,如何在全英文授课模式下应对常见的语言和思维问题,会计学科中常见的学习问题成为教学法创新的一个重点。

本文结合实际实践阐述全英文授课模式下的中国本科生会计学基础课程教学法创新与实践。

关键词:会计学基础课;会计本科教学;中外合作办学留学热潮以来,商科一直是留学生和家长心目中的热门选择,商业全球化大趋势下,很多学生和家长会选择“1+3”“2+2”或“3+1”这种考虑长远的项目,以此开始自己的专业学习,而此类和各国高校合作的项目里,以美国大学的商学院为例,会计学科的学习是几乎所有商学专业的学生的基础必修课。

因此,全英文授课模式下的会计学基础课程也变得尤为重要,然而,相对于其他的商学专业,会计学科尤其是会计学基础(AccountingPrinciples),财务会计学(Financial Accounting),乃至会计学专业的专业课中级会计(IntermediaryAccounting),对于学生来说是较为枯燥且考察细节的,怎样提高学生的兴趣和学习动力,高效率地学习会计类基础课程,成为中美商学院合作项目中的重要创新研究对象。

一、一般会计准则(USGAAP)下的中国本科生全英文会计学基础课程的培养目标与中国特色(一)会计知识的储备和应用基础专业知识的学习对于任何专业都是极为重要的,对于会计学来说也不例外。

会计是商业的奠基石,是信息传递的重要媒介之一。

学生学习基础会计学,掌握财务信息,绘制财务报表,能更清晰地看到整个商业的运作,不管是不是从事财务工作,都能更好的创作更多的职业价值。

(二)中国公认会计准则(PRCGAAP),一般会计准则(USGAAP)和国际财务报告准则(IFRS)的学习齐头并进中美合作办学中的全英文会计基础课程选用的一般是遵循一般会计准则(US GAAP)的会计教材,在此类教材中,也会对相关内容做出一些一般会计准则(U SGAAP)和国际财务报告准则(IFRS)的比较教学,而通过对中国公认会计准则(PRCGAAP)的补充教学,可以让学生不管是毕业之后选择不同的国家继续攻读研究生教育,还是选择外企,考取不同的会计类证书,对不同的地区或证书遵循的不同的会计准则,都可以有一个较好的了解。

会计实习报告英文回答:Hello everyone, my name is [Your Name] and I am a [Your Year] accounting student at [Your University]. I am writing to express my interest in the accounting internshipposition at your company. I am very excited about the opportunity to learn from and contribute to your team.I have been involved in various accounting-related projects throughout my academic career. In my first year, I completed a project on the basics of financial accounting, which gave me a solid foundation in the principles of accounting. In my second year, I took a course on auditing, which introduced me to the concepts of internal control and financial statement analysis.In addition to my coursework, I have also gained practical experience through my involvement in the Accounting Club at my university. As a member of the club,I have had the opportunity to participate in various accounting competitions and workshops. I have also volunteered my time at a local non-profit organization, where I assisted with their financial reporting.I am confident that I have the skills and knowledge necessary to be successful in this internship. I am a highly motivated and results-oriented individual with a strong work ethic. I am also a team player and I am always willing to learn new things. I am confident that I can make a valuable contribution to your team and I am eager to learn from your experienced professionals.Thank you for your time and consideration. I look forward to hearing from you soon.Sincerely,。

第1篇一、实验目的1. 熟悉企业财务报表的基本结构和内容;2. 掌握财务报表分析的基本方法;3. 培养学生运用财务报表分析企业财务状况的能力;4. 提高学生解决实际问题的能力。

二、实验内容1. 企业财务报表的基本结构和内容;2. 财务报表分析的基本方法;3. 实际案例分析。

三、实验步骤1. 实验准备(1)查阅相关资料,了解企业财务报表的基本结构和内容;(2)熟悉财务报表分析的基本方法;(3)选择一家上市公司作为实验案例。

2. 实验实施(1)收集实验案例企业的财务报表数据,包括资产负债表、利润表和现金流量表;(2)分析资产负债表,计算流动比率、速动比率、资产负债率等指标,评估企业的偿债能力;(3)分析利润表,计算毛利率、净利率、净资产收益率等指标,评估企业的盈利能力;(4)分析现金流量表,计算经营活动现金流量净额、投资活动现金流量净额、筹资活动现金流量净额等指标,评估企业的现金流状况;(5)综合分析实验案例企业的财务状况,提出相应的改进建议。

3. 实验总结(1)总结实验过程中遇到的问题和解决方法;(2)总结实验案例企业的财务状况和存在的问题;(3)提出改进建议。

四、实验报告一、实验背景本次实验选取了某上市公司作为案例,旨在通过分析其财务报表,了解企业财务状况,为企业经营决策提供参考。

二、实验内容1. 实验案例企业的财务报表数据(1)资产负债表(2)利润表(3)现金流量表2. 财务报表分析(1)资产负债表分析流动比率:2.5速动比率:1.5资产负债率:50%(2)利润表分析毛利率:30%净利率:10%净资产收益率:5%(3)现金流量表分析经营活动现金流量净额:2000万元投资活动现金流量净额:-500万元筹资活动现金流量净额:-1000万元三、实验结果1. 实验案例企业的偿债能力较好,流动比率和速动比率均高于行业平均水平,资产负债率处于合理范围;2. 实验案例企业的盈利能力一般,毛利率和净利率低于行业平均水平,净资产收益率有待提高;3. 实验案例企业的现金流状况较好,经营活动现金流量净额为正,投资和筹资活动现金流量净额为负,但总体来看,企业现金流状况稳定。

第1篇一、实验目的1. 熟悉会计凭证的填制和审核;2. 掌握会计账簿的登记方法;3. 了解会计报表的编制过程;4. 培养学生的实际操作能力和会计职业素养。

二、实验内容1. 会计凭证的填制和审核;2. 会计账簿的登记;3. 会计报表的编制。

三、实验过程1. 实验准备(1)实验教材:《会计学实验教程》;(2)实验材料:会计凭证、会计账簿、会计报表等;(3)实验环境:计算机、打印机等。

2. 实验步骤(1)会计凭证的填制和审核1)填制记账凭证:根据实验教材提供的业务数据,填制记账凭证。

要求凭证填写完整、准确,符合会计准则。

2)审核记账凭证:对照会计准则,检查记账凭证的合法性、完整性和准确性。

对不符合规定的凭证,予以退回修改。

(2)会计账簿的登记1)开设会计账簿:根据记账凭证,开设总账、明细账、日记账等会计账簿。

2)登记会计账簿:根据记账凭证,登记各会计账簿。

要求登记准确、及时。

3)对账:定期进行账账、账证、账实核对,确保会计账簿的准确性。

(3)会计报表的编制1)编制资产负债表:根据会计账簿,编制资产负债表。

要求资产负债表项目填写完整、准确。

2)编制利润表:根据会计账簿,编制利润表。

要求利润表项目填写完整、准确。

3)编制现金流量表:根据会计账簿,编制现金流量表。

要求现金流量表项目填写完整、准确。

4)编制会计报表附注:根据会计报表,编制会计报表附注。

要求附注内容完整、准确。

3. 实验总结通过本次实验,学生掌握了会计凭证的填制和审核、会计账簿的登记以及会计报表的编制等基本技能。

同时,提高了学生的实际操作能力和会计职业素养。

四、实验结果本次实验取得了圆满成功,达到了预期的教学目标。

学生在实验过程中,能够熟练运用会计凭证、会计账簿和会计报表等工具,完成了实验任务。

五、实验心得通过本次实验,我深刻认识到会计学在实践中的重要性。

会计凭证、会计账簿和会计报表等会计工具,是会计人员开展工作的基础。

在实际工作中,会计人员需要熟练掌握这些工具的使用方法,以确保会计信息的准确性和完整性。

会计实习过程英语作文English:During my accounting internship, I gained valuable hands-on experience in various aspects of financial management and reporting.I was tasked with reconciling accounts, preparing financial statements, and analyzing financial data to identify trends and discrepancies. This allowed me to apply the theoretical knowledge I gained in my academic studies to real-world scenarios, enhancing my understanding of accounting principles and practices. Furthermore, I had the opportunity to work closely with senior accountants and professionals, learning from their expertise and receiving constructive feedback on my work. Engaging in team projects and collaborating with colleagues provided me with insights into effective communication and teamwork within a professional setting. Additionally, I familiarized myself with accounting software and tools commonly used in the industry, improving my technical skills and adaptability to different software platforms. Overall, my accounting internship was an enriching experience that deepened my passion for the field and equipped me with practical skills essential for a career in accounting.Translated content:在我的会计实习期间,我获得了有价值的实践经验,涉及财务管理和报告的各个方面。

专业英语会计作文模板英文回答:Introduction。

Financial accounting is the process of recording, classifying, and summarizing financial transactions to provide information that is useful for decision-making. Accounting principles and standards are used to ensure that financial statements are prepared in a consistent and transparent manner.The Importance of Accounting。

Accounting is essential for businesses of all sizes. It provides information about a company's financial performance and position, which is used by investors, creditors, and other stakeholders to make informed decisions. Accounting also helps businesses to manage their finances and comply with legal and regulatory requirements.Accounting Principles。

The following are some of the key accounting principles:Accrual accounting: Transactions are recorded whenthey occur, regardless of when cash is received or paid.Going concern: A business is assumed to be a going concern, meaning that it will continue to operate in the foreseeable future.Matching principle: Expenses are matched to the revenues they generate.Materiality: Only material information is disclosed in financial statements.Accounting Standards。

会计学科英文作文英文:As an accounting student, I believe that this subjectis important because it provides a foundation for understanding the financial health of a business.Accounting is the language of business and it helps to communicate financial information to stakeholders. It also helps to make informed decisions about investments, budgeting, and financial planning.In addition, accounting provides a range of career opportunities. There are many different areas of accounting, including auditing, tax, financial accounting, and management accounting. Each area requires a different skill set and offers unique challenges and rewards.One of the things I enjoy most about studyingaccounting is the problem-solving aspect. Accounting problems often require creative thinking and analyticalskills. It can be challenging, but also very rewarding when you finally figure out a solution.Overall, I believe that accounting is a valuable subject to study and can lead to a fulfilling and rewarding career.中文:作为一名会计学生,我认为这门学科很重要,因为它提供了理解企业财务状况的基础。

会计模拟实验学习心得体会在进行会计模拟实验学习的过程中,我深深地感受到了其带给我诸多的收益和益处。

通过这次实验,我不仅理论知识得到了巩固和提高,更重要的是培养了实际应用能力、解决问题的能力和团队合作的能力。

下面是我做这个实验的心得体会。

首先,通过会计模拟实验,我对会计的相关知识有了更深入的理解。

在实际操作过程中,我亲身体会到了会计分录的编制、会计报表的填制等具体操作的流程,并将之前学过的理论知识应用于实际中。

通过这种实践操作,我对理论知识的消化和运用能力得到了提升。

其次,会计模拟实验让我深刻认识到了会计信息的重要性。

在实验中,我意识到会计信息对于企业的决策和管理具有重要的作用。

通过分析会计报表和财务数据,我们可以清晰地了解到企业的经营状况、财务状况以及盈利能力等重要信息,以便及时做出相应的决策和调整。

这种对会计信息的重视和认识将对我的日后工作和学习产生深远的影响。

再次,会计模拟实验培养了我解决问题的能力。

在实验中,我们遇到了一些困难和问题,如如何处理复杂的会计处理、如何填制合理的会计报表等。

面对这些问题,我积极主动地进行查找资料、请教他人,并结合自己的理解进行思考和分析,最终找到了解决问题的方法。

通过这个过程,我不仅解决了实际问题,也提高了自己的问题解决能力和思维能力。

最后,会计模拟实验锻炼了我的团队合作能力。

在实验中,我们需要组成团队协同工作,共同完成实验任务。

在这个过程中,我们需要相互配合、沟通协调、互相支持。

通过与团队成员的合作,我学到了如何与他人有效地合作,如何充分发挥每个人的优势,以及如何处理团队内部的冲突。

这对我今后进一步参与团队合作工作和项目管理能力的提升具有重要的意义。

总体来说,会计模拟实验是一次非常有收获的学习经历。

通过实践操作,我加深了对会计知识的理解和应用,提高了实际应用能力和问题解决能力,培养了团队合作意识和能力。

相信这些收获将对我的学习和工作产生长远的影响。

因此,我将会计模拟实验视为一次难忘且有意义的学习经历,将继续努力学习和运用这些知识和能力,不断提升自己。

会计专业实习报告结果## English.Executive Summary.My internship at [Company Name] was an incredibly valuable learning experience. I was able to apply theskills I learned in the classroom to real-world accounting scenarios, which has significantly enhanced my understanding of the field. I was also exposed to various aspects of accounting, including auditing, tax, and financial reporting. This broad exposure has helped me to develop a well-rounded perspective of the accounting profession.Specific tasks you performed, including any projects or assignments you completed.Examples of skills you developed or improved upon.How the internship has prepared you for a career in accounting.Conclusion.My internship at [Company Name] was a transformative experience that has prepared me well for a career in accounting. I am confident that the knowledge and skills I acquired during my time there will serve me well in myfuture endeavors.## 中文回答:摘要。

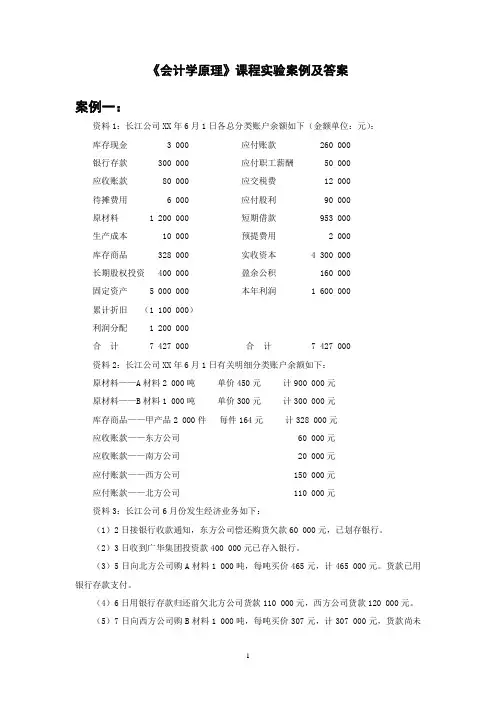

Business case for Manual Accounting

Haupt Consulting began its operations of consulting business on December 2010. The following transaction occurred and were completed on December.

Date Transactions

Dec 2 Received $10,000 cash from owner Carl Haupt

Dec 2 Paid monthly office rent, $500

Dec 3 Paid cash for a Dell computer, $2,000. This equipment is expected to remain in service for five years

Dec 4 Purchase office furniture on account, $3,600. The furniture should last for five years Dec 5 Purchased supplies on account, $300

Dec 9 Performed consulting service for a client on account, $1,700.

Dec 12 Paid utility expenses, $200.

Dec 18 Performed service for a client and received cash of $800.

Dec 21 Received $900 in advance for client service to be performed evenly over the next 30 days

Dec 21 Hire a secretary to be paid $ 1,500 on the 20th day of each month. The secretary begins work immediately.

Dec 26 Paid $300 on account

Dec 28 Collected $600 on account

Dec 30 Owner withdrew $1,600

Dec 31 The business gathers the following information for the adjusting entries:

a.Accrued service revenue, $400

b.Earned $300 of the service revenue collected in advance on December 21.

c.Supplies on hand, $100

d.Accrued $700 expense for secretary’s salary.

Dec 31 Depreciation enpense adjustment:

Haupt Consulting had purchased a Dell computer and office furniture on December

3 and 4, respectively. And these assets were expected to last five years. Assuming

both assets are using double-declining-balance depreciation, calculate and record the

amount of depreciation for each asset for the year ended December 31, 2010.

Haupt performs systems consulting. It has also begun selling accounting software. During January, Haupt Consulting completed the following transactions. The company uses LIFO perpetual

inventory system to determine Cost of Good Sold and the ending inventory. As for account receivables, Haupt uses the allowance method to estimate uncollectibles.

Date Transactions

Jan 1 Haupt believes the company will need $500,000 and plans to raise the capital by issuing 6%, 10 year bonds on January. The bonds pay interest semiannually on

January 1 and July 1. On January 1, the market rate of interest required by similar

bonds by investors is 8%. The first interest payment date is on July 1, 2011.

Jan 2 Completed a consulting engagement and received cash of $7,200

Jan 2 Prepaid three months office rent, $1,500

Jan 7 Purchased 100 units software inventory on account, $1,900, plus freight in, $100 Jan 16 Paid employee salary, $1,400

Jan 18 Sold 70 software units on account, $3,100

Jan 19 Consulted with a client for a fee of $900 on account

Jan 21 Paid on account, $2,000

Jan 22 Purchased 200 units software inventory on account,$4,600

Jan 24 Paid utilities, $300

Jan 28 Sold 100 units software for cash, $4,000

Jan 31 Recorded the following adjusting entries:

Accrued salary expense, $1,400

Expiration of prepaid rent, $500

Haupt uses the allowance method for receivables, estimationg uncollectibles to be

3% of credit sales.

Calculate and record Depreciation for January.

Accrued interest expense for bond

Required

1.Journalize the December transactions (Including adjusting entries)and post to the ledger .

2.Calculate the ending balance for each account, and prepare adjusted trial balance on

December 31

3.Journalize and post the closing entries on December 31.

4.Prepare the income statement for the month ended December 31, 2010, and prepare the

balance sheet at that date.

ing the same steps, accounting for transactions in January

Accounting cycle: journal---ledger---trial balance---adjusting—ledger---adjusted trial balance---closing----statement

Notes: the beginning balance for relevant account in January come from the ending balance in

December.。